CCUS: non-pipeline transport and cross-border CO2 networks - call for evidence

Updated 18 November 2024

General information

Rationale for calling for evidence

Carbon capture, usage and storage (CCUS) will be essential to meeting the UK’s 2050 net zero target, playing a vital role in levelling up the economy, supporting the low-carbon economic transformation of our industrial regions, and creating new high value jobs. The Climate Change Committee (CCC) has stated that CCUS is a ‘necessity, not an option’[footnote 1] for the transition to net zero.

In the ‘Carbon capture, usage and storage: a vision to establish a competitive market’[footnote 2] (CCUS Vision), government committed to publishing a call for evidence on how it envisages non-pipeline transport (NPT) being delivered in the UK.

NPT can have an important role to play in the development of CCUS, serving as a decarbonisation option in instances where a pipeline is technically and/or commercially unfeasible. NPT will allow capture projects outside of CCUS industrial clusters or in clusters without direct access to a pipeline to take their carbon dioxide (CO2) to an offshore store. NPT can help achieve decarbonisation across multiple regions and sectors of the economy, helping to meet our decarbonisation targets, net zero and energy security objectives. It will be important to demonstrate NPT technically and commercially in the near term to reduce future costs as the CCUS sector transitions toward becoming self-sustaining.

The CCUS Vision[footnote 2] also acknowledges the role that cross-border CO2 transport and storage (T&S) networks can play, maximising the opportunities presented by the UK’s potentially vast offshore storage capacity.

Through this call for evidence, we are now seeking evidence to better understand NPT and cross-border networks. The key areas are:

- NPT value chain data

- CCUS policy landscape

- Wider deployment considerations

Following the call for evidence closing on 16 July, government will look to assess the responses received and use the information gathered to inform policy development, to support the deployment of NPT in the UK and cross-border CO2 networks, as well as the role these networks can perform within the wider CCUS landscape.

Call for evidence details

Issued: 7 May 2024

Respond by: 16 July 2024

Enquiries to:

CO2 Non-pipeline Transport Policy Team

Carbon Capture, Usage and Storage Programme

Department for Energy Security and Net Zero

6th Floor

3-8 Whitehall Place

London

SW1A 2AW

Email: NPTandCrossBorderCO2@energysecurity.gov.uk

Call for evidence reference: Call for evidence on non-pipeline transport and cross-border CO2 networks

Audiences

The government welcomes responses from anyone with an interest in the CCUS policy area. We envisage that this call for evidence will be of particular interest to:

- Those developing and intending to use CO2 non-pipeline transport routes within the UK

- Those developing or intending to develop cross-border CO2 networks (via NPT or pipeline)

- UK CO2 transport and storage network developers and infrastructure providers

- Supply chain companies, trade bodies, academics, and prospective investors.

Territorial extent

Territorial extent is onshore in the United Kingdom and offshore including above or below the territorial sea adjacent to the United Kingdom and waters in a gas importation and storage zone (within the meaning given by Section 1 of the Energy Act 2008).

How to respond

Your response will be most useful if it is framed in direct response to the questions posed, and with supporting evidence wherever possible. Further comments and wider evidence are also welcome. When responding, please state whether you are responding as an individual or representing the views of an organisation. It is not necessary to answer every question.

However, responses in writing or via email will also be accepted. Should you wish to submit your main response via the e-consultation platform and provide supporting information via hard copy or email, please be clear that this is part of the same response to this call for evidence.

Respond online at: https://energygovuk.citizenspace.com/industrial-energy/non-pipeline-transportation-of-carbon-dioxide-cfe

or

Email to: NPTandCrossBorderCO2@energysecurity.gov.uk

We will conduct engagement while the call for evidence is open. If you want to be included in these engagement events, then please contact the department as soon as possible via email NPTandCrossBorderCO2@energysecurity.gov.uk.

Confidentiality and data protection

Information you provide in response to this call for evidence, including personal information, may be disclosed in accordance with UK legislation (the Freedom of Information Act 2000, the Data Protection Act 2018 and the Environmental Information Regulations 2004).

If you want the information that you provide to be treated as confidential, please tell us, but be aware that we cannot guarantee confidentiality in all circumstances. An automatic confidentiality disclaimer generated by your IT system will not be regarded by us as a confidentiality request.

We will process your personal data in accordance with all applicable data protection laws. See our privacy policy.

As part of this Call for Evidence, we are seeking to gather data on NPT costs and on the project pipeline. We may share relevant data within government and with our technical advisors to aid CCUS policy development. The NPT and Cross-border team may also reach out to clarify responses.

Quality assurance

This call for evidence has been carried out in accordance with the government’s consultation principles.

If you have any complaints about the way this call for evidence has been conducted, please email: bru@energysecurity.gov.uk.

Introduction

This call for evidence will set out a long-term vision for the non-pipeline transport (NPT) of carbon dioxide (CO2) as well as seek to improve the government’s understanding of both NPT value chains and cross-border CO2 T&S networks, the costs associated with them, and the potential barriers to deployment.

CCUS landscape

Carbon Capture, Usage and Storage (CCUS) is the process of capturing CO2 and permanently storing it deep underground where it cannot enter the atmosphere. CCUS will be essential to meeting the UK’s 2050 net zero target, playing a vital role in levelling up the economy, supporting the low-carbon economic transformation of our industrial regions, and creating new high value jobs. The Climate Change Committee (CCC) has stated that CCUS is a ‘necessity, not an option’[footnote 3] for the transition to net zero.

The Net Zero Strategy[footnote 4] and the Industrial Decarbonisation Strategy[footnote 5] set out the critical role of CCUS in delivering net zero by 2050. CCUS is important in the decarbonisation of industry (e.g. cement, chemicals, and refining) where in many cases, the process emissions mean that it is the only viable route to decarbonise at the scale required to meet our carbon budget and net zero targets. CCUS is also key to decarbonising the power sector by 2035, kick starting low carbon hydrogen production and engineered greenhouse gas removal (GGR) sectors by 2030.

The CCUS Vision[footnote 2] published in December 2023, set out an ambition to create a competitive market in CCUS by 2035. It aims to unlock investment and drive economic growth, potentially supporting up to 50,000 jobs by 2030 and adding up to £5 billion to our economy each year by 2050[footnote 6]. To achieve our objective of creating a self-sustaining CCUS sector that can reduce emissions and support thousands of jobs, we describe a 3-phase approach. These phases are:

- Market creation phase until 2030

- Market transition phase: 2030-2035

- Self-sustaining market phase: 2035 onwards

In Powering up Britain: Energy Security Plan, published in March 2023, government committed to deploying CCUS in two industrial clusters by the mid-2020s and 4 clusters by 2030, with the aim of capturing and storing 20-30 million tonnes of CO2 per year by 2030[footnote 7] in the market creation phase. In May 2021 government launched Track-1 Phase-1 of the CCUS cluster sequencing process. Its purpose was to identify at least two CO2 transport and storage companies (T&SCos), whose readiness suggested that they were most suited for deployment of a CO2 transport and storage (T&S) network in the mid-2020s. Track-1 was designed to deploy full chain piped T&S networks for simplicity and to support the deployment of CCUS at pace. The two Track-1 clusters selected were the East Coast Cluster and HyNet with 8 capture projects selected to proceed to negotiations in March 2023[footnote 8].

The second stage of CCUS deployment will look at Track-1 expansion (T1x), where additional capture projects connect to the Track-1 clusters, and Track-2, where two additional clusters were selected: Acorn and Viking. However, to ensure that multiple regions including those outside those 4 clusters can decarbonise, government recognises that there is a need to expand CO2 transportation capabilities by deploying NPT alongside piped solutions.

The CCUS Track-2 December 2023 Market Update[footnote 9] set out government’s proposed Track-2 approach of an ‘anchor’ and ‘buildout’ phase and high-level timelines. The anchor plans would need to credibly demonstrate connection via pipeline for an initial phase of capture, facilitating future phases of store and network expansion to enable both additional piped and NPT projects. As stated in the CCUS Vision[footnote 2], we anticipate NPT projects will be eligible to apply for emitter selection processes that open from 2025 onwards, to help meet the stated ambitions. Further details on future emitter selection processes will be provided in due course.

The CCUS Vision[footnote 2] also sets out how we envisage the market for CCUS developing between 2030 and 2035, with the emergence of a commercial and competitive market that moves towards a self-sustaining market. We will need to expand the CO2 transport network for both pipeline and non-pipeline solutions to facilitate decarbonisation across multiple regions and sectors of the economy, and to meet the evolving needs of users. During this period, we also assume that cross-border CO2 T&S networks would be enabled, unlocking additional economic opportunities.

NPT will allow for the deployment of CCUS in areas where a pipeline is technically and/or commercially unfeasible. This will be particularly important as roughly half of the industrial emissions in the UK sit outside industrial clusters[footnote 10], and not all clusters have access to a piped T&S solution (e.g. South Wales). Other sectors including power, residual waste management, CCUS-enabled hydrogen and some engineered GGR are also likely to require NPT solutions to achieve our net zero ambition. It is therefore important to demonstrate NPT technically and commercially in the near term to bring down costs in the future. By unlocking CCUS via NPT, it will be possible to secure high value jobs and investment in these areas throughout the UK for years to come.

The scale of NPT deployment is estimated in the Enabling Industry Pipeline Scenario[footnote 11] of Carbon Capture and Storage Association’s (CCSA’s) CCUS Delivery Plan 2035[footnote 12]. It is estimated that domestic capture projects using shipping and other NPT infrastructure could help capture a further ~15Mt CO2/yr by 2035.

NPT infrastructure can also unlock the potential for a new UK market in cross-border CO2 T&S. For example, by establishing CO2 shipping and associated receiving and send-out facilities, NPT can open cross-border CO2 transport networks to regional customers, providing access to our potentially vast offshore CO2 storage capacity [footnote 13] and supporting regional decarbonisation. The CCSA’s CCUS Delivery Plan 2035[footnote 12] estimates that the UK has sufficient storage to import a further ~20MtCO₂/yr by 2035 from neighbouring countries.

Unlocking the UK’s storage capacity for cross-border CO2 volumes also has the potential to mutually benefit the UK and its regional partners (e.g. EU Member States), our economies and our CCUS sectors.

Explanation of NPT

NPT in the CCUS context is the transportation of CO2 using road, rail, barge, and/or shipping. NPT will unlock CCUS as a potential decarbonisation route for capture projects outside the CCUS industrial clusters or in clusters without direct access to an offshore pipeline. Unlocking CCUS in these locations will be essential for the UK to reach its decarbonisation goals.

NPT solutions and piped T&S networks are likely to deploy in parallel and will be complimentary to one another. Although the piped network and NPT solutions may both be transporting CO2, there are some key differences which are described below.

In Track-1, CCUS will be delivered by two types of commercial entities: 1) capture projects utilising a pipeline (piped users) and 2) the T&SCo, where the T&SCo delivers the onshore pipeline, offshore pipeline, and offshore storage. Unlike piped solutions, the NPT user and its store are not physically connected, allowing the NPT user flexibility to connect to a number of different stores, as seen in Figure 1.

Figure 1: Comparison of Piped T&S Solution vs NPT Solution

Figure 1 description

Piped T&S Solution: Fixed Transportation of CO2 to Store:

1. Piped User

2. Onshore Pipeline

3. Offshore Pipeline

4. Offshore Storage

NPT Solution: Potential for Flexibility of CO2 to Store:

1. NPT User

2. Intermodal Facilities

3. NPT Transport Mode

Either

4. Intermodal Facility 1

5. Offshore Storage Site 1

Or

4a. Intermodal Facility 2

5a. Offshore Storage Site 2

Alongside increased flexibility, NPT value chains may have a greater degree of heterogeneity when compared to piped transportation due to the technical variability between different NPT value chains. Specifically, delivery through different modes of transport (road, rail, barge, ship), and the number of nodes[footnote 14] in the transportation chain (including the aforementioned transport modes, pipeline and intermodal facilities (e.g. liquefaction and temporary storage)).

NPT can be delivered via a single mode value chain, or a multi-modal value chain. As demonstrated in Figure 2, in a single mode NPT solution, one method of transportation would be utilised to transport CO2 from the user to the store. In a multi-modal NPT solution, multiple modes of transportation could be used at different stages of the CO2 transport process, also demonstrated in Figure 2. Multi-modal NPT solutions could be utilised in instances where it isn’t technically or economically viable to deliver CCUS via a pipeline or a single mode NPT chain.

Figure 2: Comparison of Single Mode and Multi-modal NPT Chain

Figure 2 description

Single Mode NPT Solution:

- NPT User

- Intermodal Facilities

- NPT Transport Mode

- Intermodal Facilities

- Offshore Storage

Multi-modal NPT Solution:

- NPT User

- Intermodal Facilities

- NPT Transport Mode

- Intermodal Facilities

- NPT Transport Mode

- Intermodal Facilities

- Offshore Storage

Vision for NPT

Set out below is a potential long-term vision for NPT that may exist during the self-sustaining market phase based upon the prospective benefits that can be realised through the delivery of NPT. We believe the long-term vision for NPT in this chapter will provide the sector with an understanding of the government’s aspirations for NPT, whilst the pathway to this long-term vision will be informed by the evidence gathered from this CfE.

Based on government’s current understanding of the NPT sector and its strengths, it may be possible to project a future outcome for NPT. As the evidence is collected from this call for evidence, our understanding of the NPT sector may change and with it the potential vision for the sector. It is understood that the vision below is one of multiple potential outcomes for the NPT sector and so the second part of this section will explain the rationale.

As set out in the CCUS Vision[footnote 2] our expectation for NPT deployment is during the market transition phase (2030-2035). In the following section we set out our proposal for a long-term vision of a mature NPT sector in the self-sustaining phase of CCUS deployment (e.g. after 2035) is as follows:

Variety of NPT chains

- NPT is expected to be delivered by all NPT transport modes (road, rail, barge and ship)

- NPT is expected to include multi-modal solutions to help realise CCUS decarbonisation in harder to access locations

- NPT will likely result in the creation of specialist service providers across the NPT value chain to facilitate NPT solutions

- different NPT value chains are likely to have a number of different commercial arrangements to best manage the chain’s NPT challenges, and NPT service providers’[footnote 15] expertise and risk appetite

Operational flexibility

- each CCUS cluster would have NPT connectivity, unlocking further flexibility between clusters, NPT users, and stores. This web of interconnected NPT users and stores could then connect with fixed piped T&S networks

- charging fee structures may develop for NPT users and cross-border users which react to storage market capacity to optimise store use

- third-party agents may be utilised to support a flexible service provision – potentially as risk taking intermediaries or brokers connecting NPT users, NPT service providers, and stores

Competition fuelling system growth

- NPT service providers are not expected to be economically regulated as it is anticipated there would be competition throughout the NPT service provider network in a self-sustaining market

- competition between NPT service providers should lower costs

- shipping may enable direct-to-wellhead CO2 injection, especially at stores without a local user base. This could potentially be favourable for cross-border users who could reduce costs and travel distances

- NPT users and cross-border users could incentivise storage exploration and appraisal activity

In the following section, we look to provide some additional rationale for this vision for NPT.

Rationale for vision

Allow NPT value chain to self-organise

Government considers that the market is best placed to effectively and efficiently resolve their specific NPT challenges. In Track-1, the full-chain approach of piped user and T&SCo meant that the CCUS regulatory regime (TRI Model, Network Code and user business models (BMs)) was designed to manage one specific organisational and commercial structure. It will be important to allow self-organisation across the NPT value chain without the CCUS policy landscape dictating particular organisational and commercial structures, delivering effective and efficient NPT solutions. As a result of this self-organisation, there is expected to be significant variation in the delivery models and commercial arrangements between different NPT value chains. NPT solutions will have technical variability including: scale, mode of transport (road, rail, barge and ship), temporary storage requirements at each node, and potentially be multi-modal. Allowing NPT value chains to self-organise will help to maximise delivery expertise, by matching technical expertise with the delivery of those elements of the NPT value chain.

Government understands there to be several different archetypes for the delivery of NPT. These can largely be explained through 3 lenses, as shown in Figure 3:

- Capture Led

- Intermediary Led

- Store Led

These archetypes each have different strengths and weaknesses making them suitable for different scenarios. As a result, a variety of archetypes may exist simultaneously, or the archetypes may change over time as the CCUS and NPT markets develop.

Figure 3: NPT Delivery Archetypes

Store Led

This may also be known as a collection model, with the store holding responsibility for the collection of CO2. Under a store led model, NPT and intermodal receiving/storage services act as an analogue of a pipeline within the piped T&S regime. Whilst mirroring the operation of the current T&S BM, this model may not allow the full flexibility of NPT solutions to be realised, but it is possible that prior to multiple clusters being NPT enabled this flexibility may not be required. This archetype may have a role in a transitionary capacity in the near term, but the other archetypes (capture led and intermediary led) may provide better flexibility as they do not link the NPT user to a specific store.

Capture Led

A capture led model is one where the capture project carries the responsibility for delivering the CO2 to the store. It is likely that a capture led model can provide greater flexibility of CO2 to store than a store led model, as a capture project is likely to have greater flexibility to select which store it connects with and can utilise alternative stores where necessary. Alongside this, a capture led model may align well with the current piped T&S regime, with the NPT user effectively delivering CO2 to a T&S delivery point within the piped T&S network.

Intermediary Led

Intermediary led models utilise third parties separate from the users and T&SCos to provide NPT solutions. Under this model, a third-party entity facilitates the connection between the capture project and T&SCo. The intermediary acts as a bridge, managing the coordination and efficient transfer of CO2. Government believes that this model may become more attractive as the NPT market matures and the risks attached to the emerging market become better understood. It could be envisaged that these models naturally evolve out of some of the capture led or store led models, which may look to subcontract some of the NPT value chain.

Operational flexibility

NPT solutions can deliver operational flexibility as the physical link between the capture project and the store does not exist as it does in piped T&S networks. This operational flexibility may create potential benefits of increased resilience[footnote 16] and T&S network utilisation[footnote 17]. These benefits may be provided by NPT users but would be reliant on numerous clusters being NPT enabled[footnote 18]. The more CCUS clusters that are NPT enabled, the greater the potential benefits.

NPT can provide resilience to the CCUS sector and improve security of sequestration. In the event of T&S unavailability within an NPT enabled cluster, NPT solutions could provide access to alternative stores for both piped users and NPT users (subject to capacity and interoperable infrastructure and CO2 specifications).

Operational flexibility has the potential to increase T&S utilisation across multiple T&S networks by matching excess storage capacity with CO2 volumes. Under-utilisation of the network may occur in different scenarios, including: the peaks and troughs of a user’s normal operational CO2 delivery to the piped T&S network; scheduled or unscheduled user downtime; or prolonged capture project underperformance leading to reduced CO2 delivery to the piped T&S network.

To optimise T&S utilisation, NPT service providers could be reactive to the T&S networks by delivering CO2 volumes to the T&S network when it is under-utilised. By increasing utilisation in this way, the T&S fees for all network users would be reduced by decreasing the need for mutualisation[footnote 19] and reducing reliance on revenue support as the CCUS sector transitions towards a self-sustaining market. In order for NPT users and cross-border users to play a role in improving T&S network utilisation rates, they may require a dynamic and responsive set of charging structures to incentivise NPT service providers to deliver CO2 to the store with most excess capacity. As the CCUS market becomes more dynamic, it may require third-party actors with this expertise to facilitate such a role, especially if the expertise does not reside with the NPT users, cross-border users, NPT service providers or storage operators.

Competition

The government response to the consultation on economic regulation[footnote 20] stated that it does not expect NPT service providers to be required to be economically regulated. This is unlike piped transportation which is expected, at least initially, to have monopolistic characteristics and therefore will be regulated through the economic licence. Government believes that NPT service providers are likely to be in competitive markets where they compete to provide a lower cost solution, leading to cost reductions. As NPT service providers begin to compete on price this will likely incentivise additional actors to enter the CCUS sector further reducing costs and supporting the transition towards a self-sustaining market.

As NPT and cross-border users deploy, this will create an increase in the volumes of CO2 that need to be permanently geologically stored. This increase in demand has the potential to be a catalyst for store appraisal. Store locations without a local user base could be made economically viable by NPT and cross-border users creating a demand for storage capacity that would otherwise have been unable to link storage capacity demand with CO2 supply. This is especially true through shipping solutions and is subject to the barriers of cross-border CO2 T&S networks being resolved. If additional stores are economically viable as a result, this will likely increase competition leading to cost reductions, as well as improve the probability of reaching our legally binding carbon budgets by improving resilience.

Call for evidence questions

We are calling for evidence to better understand the role that HMG will need to play within a new NPT sector deploying during the market transition phase, only intervening where it is necessary. To do this government needs to:

- increase our understanding of the costs associated with the deployment of potential NPT value chains to improve confidence in costs

- confirm our understanding of the technical and commercial variability that exists within potential NPT value chains to test and confirm our view that industry is best placed to manage that complexity without restrictions to self-organisation within the CCUS policy landscape

- understand the changes that may be required to the CCUS policy, legislative, and regulatory landscapes to allow for NPT and cross-border CO2 - understand the potential project funnel and deployment timelines for NPT and cross-border CO2 to inform future CCUS deployment

- understand if there are other factors that could influence NPT deployment timelines

This call for evidence is important to understand the views of all potential stakeholders and not just the views of the potential first movers. This is significant to ensure that the policy developed for first-of-a-kind (FOAK) deployment aligns with government’s long-term vision for a self-sustaining CCUS sector, whilst reducing the risk of locking into inefficient and less value for money FOAK NPT solutions.

To facilitate the aims of this call for evidence, in the following sections, we will ask questions in the following areas:

- respondent data

- views on the potential vision for the sector

- NPT value chain data

- CCUS policy landscape

- wider deployment considerations

Government understands that there are many questions in this call for evidence, and we are trying to gather evidence from a wide range of stakeholders. As a result, there may be questions within this call for evidence that are not relevant to all respondents. Therefore, there is no requirement to provide a response to all questions. To better manage the responses that are received, please make clear which question(s) a response is in relation to. Government thanks participants in advance for their cooperation as it will expedite the analysis of the data and responses provided by respondents.

Please note, that there is a sub-section within the ‘Wider deployment considerations’ section to add comments on areas that this call for evidence does not directly cover.

Please can participants provide the data for questions 6-10 and 13 in the template provided, to facilitate efficient analysis and future policy development.

Respondent data

We are collecting information on the respondent to better understand any trends that may exist from different stakeholder groups. Additionally, we are looking for permissions on how the data provided can be used for future analysis. Further analysis may be required from third-party contractors (who have the expertise to assess the data provided) to ensure robustness. The team may also reach out to clarify responses.

1. Who are you responding on behalf of, and what is your interest in this call for evidence?

2. If you consent to members of the team reaching out for clarifications on responses provided, please provide contact details.

3. Do you give permission for your anonymised evidence to be shared with external advisors for the purpose of technical analysis?

View on the potential vision for the NPT sector

In the section ‘Vision for NPT’

‘Vision for NPT’ government has set out a potential vision for a mature NPT sector during the self-sustaining market phase and the rationale behind that vision. Government also understands that NPT should unlock CCUS in regions and sectors of the economy that would have struggled to deploy CCUS via pipeline access, noting that some regions and sectors will rely more heavily on NPT solutions than others.

4. Please provide views on the potential long-term vision for the NPT sector.

5. Which regions and sectors of the economy will benefit most from NPT solutions unlocking CCUS? Which regions and sectors of the economy will continue to struggle to deploy CCUS? Should the government look to prioritise any particular regions or sectors of the economy for NPT?

NPT value chain data

In the following section government is keen to better understand NPT value chains, including:

- project data

- costs

- financing

Project data

Government is keen to understand the potential funnel of NPT projects and cross-border CO2 projects that exist, or have the potential to exist, and the deployment timelines for those projects. By providing this data, it will be possible for government to understand the potential demand for NPT solutions and cross-border transport of CO2 volumes and when that demand arises.

We are keen to see project development plans which highlight the rate determining step of project delivery. For example, if ship building takes 4-years then the NPT value chain cannot deploy quicker than 4-years.

Within the ‘Vision for NPTVision for NPT’ section, one of the key assumptions is that the NPT value chain is significantly more varied than a piped T&S value chain. This assumption has been arrived at after bilateral engagements with numerous potential projects. The following section is designed to obtain information about potential NPT projects with regard to their technical and commercial delivery. Government would like to understand the key technical elements within the NPT value chain and the variation between different NPT value chains, primarily in relation to infrastructure, equipment, and transport solutions.

Aside from technical variation, NPT value chains may vary in organisational and commercial terms. This may lead to the same technical NPT value chains being delivered differently organisationally and commercially. For piped user and T&SCo relationships, the two entities interact and transfer CO2 ownership where their infrastructure meets. For NPT, with the potential for additional entities and service providers within the NPT value chain, the transfer of CO2 ownership could become more complex.

As stated in the Vision for NPT section, there are several key archetypes that have been proposed to deliver NPT solutions by potential NPT sector participants. However, we understand that the simplified archetypes provided do not necessarily show the full extent of the complexity. Within each archetype, the way each element is owned and operated, as well as contractual payment flows, may vary. Government wants to understand the types of commercial arrangements that industry would set up to deliver NPT solutions, including the responsibilities that the different entities would have and the proposed contractual payment structures.

For instance, under a store led NPT archetype additional entities can be active within the NPT value chain, either as separate entities or subcontracted to another element of the NPT value chain. For example, in Figure 4, sub-option (b) demonstrates instances where the store would be the NPT service provider, despite subcontracting portions of the chain to third parties (such as transport in this instance). There could also be instances where the store contracts with a legally separate consolidator who collects the CO2 from multiple NPT users on their behalf (Figure 4 sub-option (c)).

Figure 4: Deep Dive on Store Led Archetype

There are also several different payment structures that could arise within an NPT value chain. In a full-chain piped T&S solution, the transfer of CO2 and the contractual payment are transactional (i.e. that the capture project pays the T&SCo for the CO2 it transfers). In a more complex NPT value chain, the transfer of CO2 and contractual payment may be decoupled. For example, payments could flow from NPT user to each participant in the NPT value chain, or from NPT user to the next entity within the NPT value chain only (for the receiving entity to then pass payment to the next entity in the chain and so on).

Alongside this, government is seeking information on NPT value chain operations and their interaction with the rationale for the technical design of NPT value chains. Government is specifically seeking information in relation to journey times, loading/un-loading times, managing operational risk, economies of scale, and future growth.

Government is keen to understand the net emissions that are stored from the total captured volume by the NPT user. When compared with piped transportation, the NPT value chain is more likely to have emissions associated with the transport mode and fugitive CO2 losses via leaks. It is important for government to understand the emissions that are associated with NPT value chains to ensure that the strategy for NPT delivery is accounted for within the overall approach to net zero.

6. Please provide details of your potential NPT or cross-border solution. Please provide any information on the timing of the project through the initial phase and into the future, and the minimum viable project.

7. Please provide the technical and operational considerations for the major pieces of infrastructure, equipment, and transportation. Considerations may include information on the sizes and numbers of the above, CO2 temperature and pressure conditions, loading/un-loading times and NPT journey lengths and duration. Please also provide the rationale for the technical and operational decisions.

8. For the above NPT chain, please provide information on the expected ownership/operatorship (e.g. leasing, owned, shared ownership, etc) and expected commercial/contractual arrangements. Please include when equipment is to be shared between multiple entities or for sole use.

9. Please provide information on the elements in the NPT chain with the longest lead times which could be rate determining in the deployment of the NPT chain. Please provide any information that you have on timelines for delivery of your NPT chain (e.g. project delivery Gantt charts).

10. What are the expected transport emissions and fugitive emissions expected within the NPT value chain? Please provide any information on how these emissions can be minimised.

Costs

NPT is expected to have far greater technical variation than pipelines. Government is keen to understand the variations in costs that may arise from delivering NPT via a number of different NPT solutions. Although there is some understanding of the costs associated with NPT (e.g. the CCS deployment at dispersed industrial sites report(2020)[footnote 21] and the Global CCS Institute Report (2021)[footnote 22], it will be important to understand the breakdown of costs in relation to developmental expenditure (devex), capital expenditure (capex) and operational expenditure (opex). Potential further disaggregation is requested in relation to fixed opex and variable opex given that we expect NPT will have relatively higher opex costs than piped transportation, making NPT solutions more susceptible to fluctuations in energy/fuel costs.

For Track-1 clusters which utilise a piped T&S network, the T&S fees are paid to the T&SCo by the capture project, who will pass the T&S fees through from the various capture business models (BMs). Deployment of NPT projects during the market transition phase may mean governmental involvement could also be required, however there will be a need for industry to minimise the costs of NPT to ensure value for money. It will be very challenging to support the deployment of NPT within the market transition phases without having increased confidence in the potential range and variability of NPT costs. It is therefore imperative that sufficient confidence is gained through the data collected from this section.

11. Could the costs associated with the full NPT value chain prevent investment and deployment of NPT solutions? If so, why?

12. If available, please provide any assessments that have been carried out to show an NPT solution is more economically viable than a piped solution for your NPT value chain, or that a piped solution is not technically viable.

13. Please provide evidence on the costs associated with NPT. Where possible disaggregated to the nodes delivered by NPT service providers (e.g. after capture plant and before delivery to the T&S network). Where possible, please provide information in relation to the devex, capex and opex of the operation. Please include the stage and Association for the Advancement of Cost Engineering (AACE) Cost Class at which this cost data has been generated, and please share the methodologies and assumptions that have been utilised to generate this data.

Below is a non-exhaustive list of cost categories (N.B. different archetypes will be made up of different combinations of these categories):

- any onshore pipeline required to the send-out facility

- liquefaction

- buffer storage

- loading/un-loading infrastructure

- transport mode (road, rail, barge, ship)

- pumping and heating

To help us analyse cost data across various returns, it would be helpful (but not essential) to also provide:

- undiscounted costs in 2024 prices

- total/absolute costs (e.g. £m) for the different cost categories

- the annual throughput of CO2

- a levelised (£/t) cost that includes devex, capex, fixed and variable opex

Financing

In the sections ‘Rationale for vision’ and ‘Project data’ we have outlined a non-exclusive selection of archetypes for the delivery of NPT. Government would be keen to understand the views of investors on the different delivery options, particularly in relation to the potential breaking of the full chain and the impact operational flexibility could have. It would be useful to have feedback on the key opportunities and financing risks of these proposals for all the entities within an NPT value chain.

14. What are the main financing risks with a disaggregated chain, and how do these differ to the full chain piped approach?

15. What are the main financing risks associated with operational flexibility, and how do these differ to the full chain piped approach?

16. Which archetype do you think would be most attractive to investors? Why?

17. What types of financing are best placed to deliver NPT value chains?

CCUS policy landscape

The current regulatory framework for T&S that has been developed for Track-1 clusters has been designed to support the initial deployment of a full-chain piped T&S network. As NPT is deployed into, and alongside piped T&S networks, changes to the current regulatory framework will be required.

In the following section we will ask questions on potential changes to:

- the TRI Model

- the CCS Network Code

- capture business models

- selection process

- cross-border CO2

- storage

TRI Model

For Track-1, T&SCos are going to deploy utilising the TRI Model (see Figure 5), which combines the Economic Licence, Government Support Package and Revenue Support Agreement. The TRI Model was specifically designed for the market conditions associated with Track-1 deployment.

Figure 5: TRI Model

In Track-1, the T&SCos are economically licensed due to CO₂ pipelines having monopolistic characteristics. In the government response to the consultation on economic regulation, it is stated that NPT does not share the same monopolistic characteristics as pipeline transportation, due to the potentially lower cost of entry for non-pipeline transportation and the ability for multiple assets to run in parallel suggests competitive regional markets should emerge. However, there remains the potential for market dominance, and were this to occur, this would be rationale for regulatory intervention. For example, some elements of the NPT value chain could have the potential to act as local monopolies, as it may not be feasible or realistic for a capture project located close to key hub infrastructure to access another key hub should fees increase. As such, we intend to keep this position under review should non-competitive behaviours emerge.

In the CCUS Vision[footnote 2], government stated a desire to transition from a market creation phase to a market transition phase, where we envisage an emerging commercial and competitive market. It is expected that NPT projects will be deployed during the market transition phase, where government’s involvement within the CCUS markets is also expected to reduce. The level of government involvement will reduce as the risks that government was providing protections against within the support agreements[footnote 23] also reduce and the market becomes self-sustaining. Government is keen to understand the ability of NPT value chains to manage the risks associated with connecting NPT users to existing CCUS clusters.

18. Do you agree the rationale for economically licensing NPT service providers does not exist? Or do you believe that some elements in the NPT value chain may still require some kind of economic licencing?

19. Considering the expected deployment timelines for potential NPT projects within the CCUS programme, can the risks associated with the deployment of an NPT value chain be effectively managed commercially between the different actors within the NPT value chain? If not, please provide evidence and rationale why these risks cannot be managed commercially.

CCS Network Code

The Energy Act (2023) enables government to grant economic licences to the UK’s first CO2 T&S network operators. The conditions of this licence will require licensees to maintain and administer a network code. The CCS Network Code (the ‘Code’) will set out the various commercial, operational, and technical arrangements which will apply between users and operators of T&S networks, together with governance arrangements. Its role is similar to that of the gas and electricity codes that govern arrangements between different actors in the gas and electricity markets respectively. It will therefore form a key component of the BM and regulatory regime currently being developed for the CCUS sector.

Government has worked closely with its advisors, regulatory partners and with industry to develop the Code. The immediate intention is to produce a form of the Code sufficient to support the deployment of the Track-1 clusters (the ‘Initial Code’). Accordingly, government and industry are targeting simplicity where possible, seeking to include those elements required by early networks whilst deferring development of other features until more has been learned from initial operations. Nonetheless the Initial Code seeks to establish some of the architecture which may be required to meet future needs in anticipation of the potential for a greater diversity of users and T&S operations in the future.

For example, Section D of the Code distinguishes between the onshore transportation system and the offshore transportation and storage system, which is itself made up of the offshore pipeline infrastructure and the storage complex. Recognising that in future it is possible the onshore and offshore components of the T&S network may be separately licensed and under separate ownership and control, this section includes a placeholder for provisions which may subsequently be added dealing with the interface between the onshore and offshore systems. Relatedly, the design of the charging structure under Section H of the Code splits out onshore and offshore charges in recognition of the possibility that some users, including NPT users, may not utilise the onshore components in future.

20. Please provide details on how you believe that the CCS Network Code[footnote 24] would need to be updated to facilitate NPT.

Capture business models

In Track-1, the capture business models (BMs) (industrial carbon capture (ICC)[footnote 25] – including waste ICC[footnote 26], Dispatchable Power Agreement (DPA)[footnote 27] and hydrogen production BM)[footnote 28] were designed on the basis of captured CO2 being transferred to the T&SCo at a piped delivery point. Additional BMs are also being developed to be available for T1x and Track-2 including the Power Bioenergy Carbon Capture and Storage (BECCS) BM and GGR BM[footnote 29].

During the market transition phases, capture BMs may be required to support the deployment of CCUS including NPT users. Therefore, the capture BMs are likely to be amended to accommodate NPT, or developed with NPT in mind for those capture BMs that are not deploying into Track-1 (e.g. power-BECCS and GGR). Some of these changes are likely to be inconsequential updates (e.g. updating definitions to remain relevant for NPT), other changes may be more significant relating to NPT solutions changing the initial policy rationale, or, that the relevance of a provision does not exist for an NPT user in the way that it does for a piped user.

We recognise that wider policy will also need to develop to enable NPT solutions, including the Low Carbon Hydrogen Standard[footnote 30] and GGR Standard and Methodologies.

21. What changes to the Track-1 capture BMs do you envisage being required to make the capture BMs work for NPT solutions? What considerations would be required for power-BECCS and GGR BMs when developing for NPT? Please flag in your response which of the capture BMs you are answering in reference to.

22. How important should consistency in approach between capture BMs be? How important is consistency between NPT users and piped users within a specific BM (e.g. ICC via pipeline and ICC via NPT)?

Future allocation processes

Another key area that needs to be considered is the assessment and selection of projects. The CCUS Vision set out the need for capture project funding allocation processes to transition towards more competition as the CCUS industry evolves.

In Track-1, the T&S networks were selected first in Phase-1, and then the piped users were selected in Phase-2. In Track 2, the T&S systems were selected and will initially choose their piped users for the ‘anchor phase’. In both cases, the assessment of the T&S solution was conducted separately of the piped user. For NPT projects the situation is different as the merits of the NPT user is reliant on the merits of their NPT solution. Also, for NPT, the infrastructure and commercial arrangements are far more varied (as described above) which will require consideration within the design of the assessment and selection process.

Consistent approaches are likely to be required to appropriately assess NPT users across capture BMs despite potentially different technical and commercial arrangements to ensure that comparisons are carried out on a like-for-like basis, especially as the CCUS programme moves towards increasingly competitive selection processes.

23. If NPT solutions are assessed against pipeline solutions, would this raise any concerns?

24. If government is to allow all archetypes of NPT, how should an assessment of an NPT value chain be considered to allow comparisons?

Cross-border CO2

As outlined in the CCUS Vision[footnote 2], not only can the development of the UK’s vast offshore CO₂ subsurface storage potential help to decarbonise key industrial sectors within the UK but it can also open up a new market for CO₂ storage services, bringing with it additional economic opportunities and an ability to support wider international decarbonisation efforts. Any transfer of CO₂ between the UK and a third-party nation would need to be compliant with our GHG emissions framework and future arrangements for carbon trading are under consideration.

The deployment of NPT networks within the UK, specifically those which are underpinned by CO2 shipping and dedicated port facilities, are likely to be crucial for international cross-border CO2 T&S networks which we envisage becoming operational during a market transition phase. Interoperable cross-border T&S networks, including potential cross-border pipelines, can facilitate CO2 imports from international customers but could also improve UK store resilience by providing the option to temporarily export CO₂ for storage in third countries in the event of problems with a store’s performance or with flows of CO₂ from domestic capture projects.

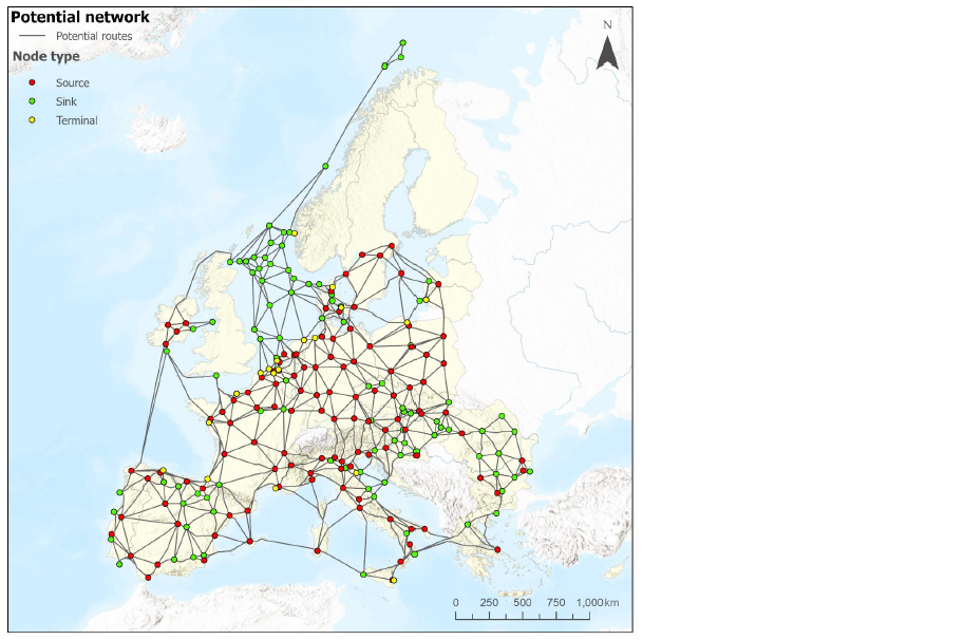

Cross-border CO2 T&S networks are likely to play an essential role in helping industrial operators who capture CO2 to decarbonise through access to CO2 storage sites, offering European emitters competitive optionality and resilience in transport routes and in storage site selection. It is anticipated that the growth of this market will initially focus on the European region and most likely in Northwestern Europe, where the UK is well placed both geographically and geologically to play a leading role. Figure 6 provides a visualisation of how expansive these networks could be within the region.

The European Union’s Industrial Carbon Management Strategy[footnote 31] shares the view that there are clear opportunities to cooperate across borders with regards to CO2 transport and storage. We are committed to exploring with the EU the conditions which are necessary to facilitate the cross-border movement of CO2 to enable the permanent, secure, and environmentally safe geological storage of captured CO2 and which lead to an overall reduction in emissions.

As the pace in which carbon capture is deployed across Europe increases, particularly in hard to abate industrial sectors, the demand for CO2 T&S capacity is likely to grow significantly. For example, within the EU it has been proposed that the EU develops at least 50 MtCO2 storage capacity by 2030[footnote 32]. By 2040, EU analysis suggests this demand for storage capacity will then grow to around 280 MtCO2[footnote 31]. A number of networks are already in development within Europe, the first of which is likely to be operational this year[footnote 33].

It is important that the UK has the right regulatory frameworks in place and a commercial landscape conducive to driving investment in CO2 storage appraisal and in the necessary supporting infrastructure. In this context, we are interested to understand stakeholders’ views on how the international CO2 market might develop, what the necessary conditions should be in the UK to support this network growth, and what steps both government and industry should take to realise this market opportunity.

Figure 6: Network map of potential routes between emissions sources and CO2 stores in Europe in 2040[footnote 34]

As outlined in the CCUS Vision[footnote 2] we are keen to understand what actions may be required from government to enable a new commercial framework to support international imports of CO2. This includes considering how the T&S BM might need to change to account for imports and whether any changes would be needed to support potential CO2 exports should this be desirable in future.

Our desired approach is to transition away from government support as the CCUS market evolves and as projects are deployed during the market transition phase. We expect government’s involvement to reduce as the risks against which we are currently providing protections through support agreements[footnote 23] diminish.

We would like to understand if there are any unique features of a future commercial framework that can specifically support the development and growth of cross-border CO2 T&S networks, underpinned by both NPT (i.e. CO2 shipping) or fixed pipeline connections to international CO2 markets.

Within this call for evidence, we have sought views on whether NPT service providers, or parts of the NPT chain, require economic licensing (see Question 18). We have also sought views on whether the risks associated with the deployment of an NPT value chain can be effectively managed commercially between the different actors within the NPT value chain (see Question 19).

The Energy Act 2023 provides for the Secretary of State, by regulations, to grant exemptions from the requirement to hold a CO2 T&S licence. In 2023, we launched a call for evidence on ‘Exemptions from the requirement to hold a CO2 transport and storage licence’[footnote 35] to inform policy development. Initial analysis has revealed that some stakeholders expressed a view that there should be an exemption from the requirement to hold a CO2 T&S economic licence for those T&SCos seeking to establish cross-border CO2 T&S networks. This view has also been expressed through engagement with some prospective CO2 T&S projects, who have also indicated that cross-border T&S networks could operate on a merchant basis. Government is currently considering responses received to the exemptions call for evidence and intends to consult on proposed terms of the exemptions regulations.

25. Please provide views on the potential vision for cross-border CO2 T&S networks in the UK.

26. With regard to Questions 18 and 19 and in the context of establishing cross-border CO2 T&S networks, do you have a view on:

i) whether an economic licensing framework for CO2 T&S might need to evolve to accommodate cross-border T&S networks?

ii) how cross-border CO2 volumes should be viewed within a commercial landscape currently designed for domestically captured CO2 volumes?

iii) how service providers could manage the risks on a commercial basis that would allow for a merchant delivery model?

iv) whether there are any specific changes needed to the current suite of capture business models if CO2 cross-border T&S networks are established?

For each answer please provide further explanation.

27. With regard to Question 20 do you think any changes will be required to the CCS Network Code to ensure cross-border CO2 T&S networks can be established?

Storage

NPT’s interaction with the stores is different from piped users. Whereas for piped users there is a fixed physical infrastructure link between piped users and stores which is typically reliant on relative proximity, NPT users and cross-border users have the potential to access any store that is enabled to receive their CO2. This has the potential to make stores that do not have a local user base viable by creating the demand for that storage capacity. NPT and cross-border CO2 T&S networks have the potential to be a catalyst for storage appraisal activity, and could potentially reduce the demand pressures for piped users and the linked stores.

The Norwegian Northern Lights CCS project[footnote 33] is reliant on shipping CO2 from capture plants, suggesting that it should be technically feasible to operate a store that is solely reliant on an NPT user base. In the UK context, government is keen to understand any technical complexities that could arise from a store that is reliant solely on NPT users when compared with stores reliant on either solely piped users or a mixture of piped users and NPT users. Government is also keen to understand the potential changes to the risk profile for stores who would operate solely utilising NPT users.

Floating production, storage and offloading is a practice that is performed by the oil and gas industry for hydrocarbon extraction. A similar approach can potentially be utilised for CCUS, shipping CO2 straight to the well head for subsequent CO2 injection. There may be a number of potential beneficial reasons for doing this, including reducing journey distances, avoiding potentially constrained piped infrastructure, and avoiding charges that might be associated with shipping and the use of portside facilities.

28. To what extent would enabling NPT users and cross-border users incentivise storage exploration and appraisal activity? If not, why doesn’t it?

29. Could a store which is solely reliant on NPT users be viable? What are the technical challenges to operating a store solely reliant on NPT users? How would this operating model impact the risk profile of the project?

30. Please provide evidence for the potential viability of shipping CO2 straight to the wellhead for CO2 injection. Please expand on the risks/barriers and benefits of straight to wellhead shipping.

Wider deployment considerations

In the following sections, this call for evidence is intended to gather further evidence on the wider deployment considerations that sit outside government’s understanding of NPT value chains and the potential changes required within the CCUS policy landscape. This section is split into:

- other regulatory controls (i.e. those outside the CCUS policy landscape)

- delivery

- further comments

Please utilise the questions in ‘Further Comments’ to flag any areas that have not been covered by specific areas within this call for evidence.

Other regulatory controls

The UK ETS allows for CCS deductions to be made for installations that are capturing and permanently storing CO2 transported via pipeline. In June 2023, in ‘Developing the UK Emissions Trading Scheme: Main Response’[footnote 36] it states that the ETS Authority will work with key regulatory partners to establish how NPT should best be integrated into the existing UK ETS framework. The intent and aim will be to enable UK ETS participants who use NPT for CO2 storage purposes to make deductions from their ETS obligation. The next step agreed by the ETS Authority is to explore options for how NPT emissions can be handled through the inclusion of NPT via an appropriate regulatory model. A consultation on their approach will be published in due course. Government appreciates that any proposals within that consultation could influence the commercial arrangements that could be required along the NPT value chain.

Government is keen to better understand the potential regulatory or legislative provisions that could impede or delay the potential deployment of NPT. It would be useful to understand any particular concerns about current regulations around the operations of the different transportation modes (road, rail, barge and shipping), temporary storage, and any transport infrastructure regulations that may need amending/considering.

Government wants to better understand the planning permission and environmental permitting challenges that may arise across the NPT value chain. NPT may be a solution where pipelines through areas of high population density are not feasible, and therefore the potential regulatory impacts of this should be reviewed. In particular, government is keen to understand the potential health and safety challenges which could influence both NPT value chain planning and permitting.

Once operational, NPT value chains will need to comply with health and safety regulations as CO2 is an asphyxiant and therefore a potentially hazardous substance in the event of a leakage event, either at intermodal facilities or in transit. This hazard may be particularly acute where the leak is catastrophic in nature resulting in large quantities of CO2 being released potentially endangering human health and the environment. Government would be keen to understand if particular transportation modes or temporary storage vessels are considered to be riskier in relation to the potential for acute leakage events.

A further consideration is how cross-border CO₂ T&S networks will be regulated and permitted. Sir Patrick Vallance’s Pro Innovation (Green Industries) Review acknowledges this, recommending that: ‘The government should work with international partners to remove regulatory barriers to the cross-border movement of CO₂ to help ensure that the UK can maximise the economic potential of providing CO₂ transport and storage services.’[footnote 37]

In our CCUS Vision[footnote 2], we have outlined some of the steps we are taking to address key regulatory barriers. This includes close engagement with European partners. As part of this call for evidence, we are also keen to improve our understanding from CCUS stakeholders of the key regulatory and permitting controls which must be considered to meet future deployment ambitions.

31. What regulations need to be considered or amended for NPT value chains to deploy (excluding those regulations which are covered in the CCUS policy landscape section)?

32. Do the current processes to comply with existing health and safety or environmental regulations or controls create barriers to NPT deployment when transporting CO2 via road, rail, barge, ship, or processing CO2 at intermodal facilities? If so, what are those barriers, and what would you suggest as an alternative?

33. Are there any specific changes to UK legislation, existing regulations or permitting processes which are necessary to support the development of cross-border CO2 T&S networks?

34. What do you see as the biggest regulatory barriers to the growth of cross-border CO2 T&S networks?

Delivery

Government is keen to understand any technical limitations or infrastructure considerations which may hinder the delivery and operation of domestic NPT and cross-border networks.

The growth of interconnected and interoperable domestic NPT and cross-border CO2 T&S networks require the right infrastructure to be in place, in the appropriate locations at the right time, and with sufficient alignment to other regional CO2 T&S networks being developed. The CCSA and Zero Emissions Platform (ZEP) recently published a comprehensive paper looking specifically at how a European market for CO2 transport by ship can be achieved[footnote 38]. The paper identifies a series of regulatory and policy steps that governments and policy makers should take to support the development of CO2 transport by ship as a credible and necessary component of carbon capture and storage and industrial decarbonisation. Standardisation is a key focus, where consistent CO2 specifications for shipping, liquefaction and onshore storage are recommended to ensure compatibility and consistency between CCUS projects across the region. The importance of CO2 transport conditions (low pressure, medium pressure, and high pressure) is also highlighted, as is the need for international standard methodologies for CO2 metering and calibration for mass-balance quantification.

Government is keen to understand the trade-offs between the CO2 specification being set to allow NPT users and service providers to deliver CO2 to any store (which could lead to higher operational costs across the NPT sector as higher technical standards could be required) vs being able to manage lower specification CO2 operationally, potentially through blending with higher specification CO2 in temporary storage.

To deliver resilience to clusters, the vision for NPT stated that this could be delivered through each cluster being NPT enabled. Within this, there is an assumption that it is technically and operationally feasible to become NPT enabled. However, government is keen to improve its understanding of any technical or operational limitations that would impede the development of NPT enabled clusters. There are also potential technical, access/capacity or operational limitations towards the use of fixed infrastructure that may exist (e.g. ports or railway line capacity) which could impede NPT solutions.

We note that NPT and temporary storage may be able to provide a network balancing effect to compliment the variable provision of CO2 volumes to the T&S network from some piped users, by providing CO2 volumes to the T&S network from the temporary storage during periods of lower network utilisation. We also recognise that there may be scope for a similar network balancing effect to be provided by piped users to increase network resilience, for example flexible or surge use of technologies such as direct air carbon capture and storage (DACCS).

Finally, delivery of NPT will be reliant on skilled workers delivering across the NPT value chain. The government response to the power CCUS call for evidence[footnote 39] highlighted a skills gap as a potential barrier to deployment. Government is keen to understand whether this skills gap also exists when considering NPT delivery. Developing a world leading NPT sector may also present opportunities for UK businesses, so it is useful to understand what areas the UK has a competitive advantage in when compared to other economies (outside of our vast storage potential).

35. What are your views on the best approach to creating interoperable CCUS networks?

36. How should the UK design the standards and specifications for CO2 T&S which offers network users sufficient flexibility in store choice but also provide sufficient protection to core T&S infrastructure? How can the UK ensure that its T&S network design does not impede access to an interconnected and interoperable European system?

37. Are there any technical or operational limitations that may exist that could be a barrier to domestic NPT or cross-border T&S network deployment? Please explain.

38. Is there any specific foundational infrastructure that must be operational in the UK before UK stores can offer storage to domestic NPT or international customers? If so, what should the UK prioritise?

39. Do you foresee any infrastructure innovations which could speed up the deployment of NPT and cross-border T&S networks and/or reduce associated costs? Please provide any supporting evidence.

40. What are your views on other flexible users of CCUS networks, e.g. flexible use of technologies such as DACCS? Do you foresee that NPT and buffer storage could be complimentary to operate alongside a flexible piped user (e.g. projects that could ramp up or ramp down CO2 output, potentially including technologies such as DACCS).

41. Does the UK have the relevant skills and capability to deliver NPT? Does the UK have a competitive advantage to deliver certain elements of the NPT value chain?

Further comments

In the above sections questions have been asked to help answer some of the key areas where we are looking to improve our understanding. This section is for respondents to flag areas that have not been covered in the above sections.

42. What other areas should government be considering for successful deployment of NPT?

43. Please respond with any other comments that are not contained in the above questions.

Next steps

After the call for evidence closes on 16 July, government will look to assess the responses received and use this to inform policy development. Following the policy development we intend to consult on government’s proposals for NPT deployment.

Glossary

| Terms | Definitions |

|---|---|

| Anchor phase | Initial projects connecting to the Transport and Storage (T&S) network. |

| BECCS | Bioenergy Carbon Capture and Storage |

| Buildout phase | Increasing the volume of captured, stored & abated CO2, filling spare Transport and Storage (T&S) capacity and enabling future phases of store and network expansion enabling additional projects. |

| Call for evidence | An information-gathering exercise that seeks expertise from people, organisations and stakeholders with knowledge of a particular issue. |

| Capture BM | A business model designed to overcome the barriers to CCUS deployment in a range of sectors supporting the capture and permanent storage of CO2. |

| Capture project | A facility with carbon capture installed for future utilisation or storage |

| Carbon budget | A carbon budget places a restriction on the total amount of greenhouse gases the UK can emit over a 5-year period. The UK is the first country to set legally binding carbon budgets. |

| CCC | Climate Change Committee |

| CCS | Carbon Capture and Storage |

| CCUS | Carbon Capture, Usage and Storage |

| CCUS cluster sequencing process | The process by which Carbon Capture, Usage and Storage (CCUS) industrial clusters are chosen, with two by the mid-2020s, and a further two clusters by 2030 as outlined in the Net Zero Strategy. |

| CCUS policy landscape | The policy instruments that have been developed, or will be developed, by UK Government, Devolved Administrations and relevant regulatory authorities to aide the deployment of CCUS across the UK. |

| CCUS value chain | Defined as the full range of activities, from start (e.g. capture) to finish (e.g. geological storage) which are required to provide the CCUS service. |

| CfD | A Contract for Difference is a private law contract between a low carbon electricity generator and the Low Carbon Contracts Company (LCCC), a government-owned company. |

| CO2 | Carbon dioxide |

| Consolidator | A consolidator refers to an entity that combines or aggregates multiple sources of CO2 emissions. |

| Cross-border CO2 T&S network | In this call for evidence, ‘cross-border CO2 T&S network’ should be taken to refer to a network which facilitates the transport and storage of CO2 and which traverses the territory of the UK and a third-party nation. Cross-border transport could be via NPT modes or pipeline. |

| Cross-border user | A capture project or intermediary which connects into a cross-border CO2 transport and storage network. |

| DACCS | Direct Air Carbon Capture and Storage |

| FOAK | First-of-a-kind |

| GGR | Engineered Greenhouse Gas Removal technology, e.g. Bioenergy Carbon Capture and Storage (BECCS) or Direct Air Carbon Capture and Storage (DACCS) |

| ICC Business Model | Designed to incentivise the deployment of carbon capture technology for industrial users, the ICC business model is a common law contract, similar to a CfD, that provides the emitter with a payment per tonne of captured CO₂. Projects looking to retrofit grey hydrogen production will be eligible for support through this scheme. |

| Intermodal facility | The equipment required to allow for the successful transfer of CO₂ from one mode of transport to another. |

| Market creation phase | Getting to 20 to 30 megatonnes per annum (Mtpa) CO₂ by 2030. |

| Market transition phase | Following the market creation phase, the emergence of a commercial and competitive market that efficiently accelerates deployment whilst driving costs reduction and reducing the degree of government support needed. |

| Mutualisation | The rebalancing of User charges to address any shortfall in regulated allowed revenue arising from network underutilisation. Underutilisation may arise from uncontracted network capacity and/or different load factors of Users like peaking power stations. The final rebalanced price for those Users that were originally below the carbon futures price before rebalancing is capped at the carbon futures price. |

| Network Code | The Carbon Capture and Storage Network Code is a key component of the business model and regulatory regime for CO₂ transport and storage. It sets out the commercial, operational, and technical arrangements between T&S Co and users, together with governance arrangements. |

| Net zero | A legally binding target set out in the Climate Change Act to reduce UK greenhouse gas emissions by at least 100% of 1990 levels (net zero) by 2050. |

| Net Zero Strategy | This strategy, published in October 2021, sets out policies and proposals for decarbonising all sectors of the UK economy to meet our net zero target by 2050. |

| Node | Node is derived from telecommunication network nodes and used in this context to mean something capable of creating, receiving or transporting CO2. |

| NPT | Non-Pipeline Transport – the transport of CO2 by road, rail, barge and ship. |

| NPT enabled | NPT enabled means that the cluster has the infrastructure (temporary storage, loading/unloading equipment and transport node infrastructure (e.g. jetty) to allow for transport of CO2 to occur in and out of that cluster. |

| NPT service provider | An NPT service provider is defined here as the entity delivering those services that are required specifically to deliver an NPT solution. In other words, any entity which provides a service in the transfer of CO2 from the NPT user following capture and before being delivered to the T&S network. |

| NPT solution | The delivery of an NPT value chain |

| NPT storage operator | A commercial operator storing CO2 which has been transported to the storage site by road, rail, barge or ship. |

| NPT transport mode | Road, rail, barge and / or shipping. |

| NPT user | A capture project which connects to a non-pipeline transport CO2 network |

| NPT value chain | NPT value chain is the full chain from CO2 capture via NPT service provider to the geological store. |

| Phase-1 | The cluster selection process used in Track-1. |

| Piped user | A capture project which connects to a CO2 transport network via a pipeline. |

| Receiving facility | A location where CO2 is unloaded from ships, barges, lorries, or railcars for injection into the piped T&S network. |

| Resilience | The ability to overcome a single point failure and continue to be operational. |

| Security of storage | The likelihood that any given unit of CO2 will be stored. |

| Send-out facility | A location where CO2 is loaded into ships, barges, lorries or railcars for onward transportation. |

| Storage operators | A company who is licensed by the relevant licensing authority to operate a CO2 store. |

| Store | A defined volume area within a geological formation used for the geological storage of CO2 |

| T&SCo | A company licensed to provide transport and storage services. |

| T&S fees | T&S fees under the TRI model refer to the charges paid by network users (such as power and industrial emitters) for the transport and geological storage of the CO₂ they produce. It follows a user-pays economic regulation approach. |

| T&S network | A transport and storage network means infrastructure and facilities for: (a) the disposal of carbon dioxide by way of geological storage (or injection for the purposes of geological storage) at a relevant site, or (b) the transportation of carbon dioxide to a relevant site for the purpose of such disposal.” (As defined in the Energy Act 2023 - section 1(9)) |

| T&S network user | Transport and storage network user means a person who is, or seeks to be, a party to arrangements for carbon dioxide to be transported to a relevant site for the purpose of disposal by way of geological storage. |

| Track-1 | The two industrial clusters targeting deployment by the mid-2020s. |

| Track-1 expansion (T1x) | Additional capture projects connecting to the Track-1 cluster. |

| Track-2 | The two additional industrial clusters targeting deployment by 2030. |

| Transport & Storage Regulatory Investment (TRI) Model | The Regulated Asset Base (RAB) model through which the Track 1 T&S companies were incentivised to deploy CCUS. It combines the Economic Licence, Government Support Package and Revenue Support Agreement. The TRI Model was specifically designed for the market conditions associated with Track-1 deployment. |

| UK | United Kingdom of Great Britain and Northern Ireland |

| UK Emissions Trading Scheme (UK ETS) | The UK Emissions Trading Scheme (UK ETS) is the UK’s cap-and-trade carbon pricing scheme. The UK ETS sets a cap on the total volume of greenhouse gases that sectors covered by the scheme (currently energy intensive industry, power generation, and aviation), can emit. Participating emitters purchase or receive emissions allowances at a price determined by the UK carbon market. The cap steadily decreases in line with the UK’s Net Zero trajectory, providing a long-term signal to decarbonise. |

-

The Climate Change Committee. ‘Net Zero - The UK’s contribution to stopping global warming’ 2019 ↩

-

Department for Energy Security and Net Zero. ‘Carbon capture, usage and storage: a vision to establish a competitive market’ 2023 ↩ ↩2 ↩3 ↩4 ↩5 ↩6 ↩7 ↩8 ↩9 ↩10

-

The Climate Change Committee. ‘Net Zero - The UK’s contribution to stopping global warming’ 2019 ↩

-

Department for Business, Energy and Industrial Strategy. ‘Net Zero Strategy: Build Back Greener’ 2021 ↩

-

Department for Business, Energy and Industrial Strategy. ‘Industrial Decarbonisation Strategy’ 2021 ↩

-

Department for Business, Energy and Industrial Strategy. ‘Energy Innovation Needs Assessment: Sub-theme Report: Carbon capture, utilisation, and storage’ 2019 ↩

-

Department for Energy Security and Net Zero. ‘Powering up Britain: Energy Security Plan’ 2023 ↩

-

Department for Energy Security and Net Zero. ‘Cluster sequencing Phase-2: Track-1 project negotiation list, March 2023’ 2023 ↩

-

Department for Energy Security and Net Zero. ‘CCUS Cluster Sequencing Track-2: Market update December 2023’ 2023 ↩

-