Disclosure Consultation: Summary of Responses

Updated 30 October 2024

Introduction

Background

Under previous governments, a commitment was made to disclose more information on business rates valuations in:

- the Business Rates Review: Final Report in October 2021

- the subsequent Technical Consultation that closed on 22 February 2022

The Valuation Office Agency (VOA) and GOV.UK provide information about business rates valuations on their websites.

The information already available includes the published rating lists, so anyone can find the rateable value[footnote 1] for a particular property that is assessed. For most properties (valued based on size and by rental comparison) the information is also available through the Find your business rates valuation service. This provides more information about individual valuations, including additional explanation and guidance.

Currently in England, specific information about the underlying evidence used to determine a rateable value can then be provided at the formal Challenge stage of the Check, Challenge, Appeal (CCA) process The VOA’s rating manual and over 200 practice notes, which set out how we value different types of properties, are also published on GOV.UK. Alongside this, the VOA runs social media campaigns, a GOV.UK blog, and partners with sector representatives to share information and guidance with their members.

A report by the Organisation for Economic Co-operation and Development (OECD) from 2014 found that the UK performed better than some of its European counterparts including Germany, Belgium, and Switzerland, on transparency in valuation data.

The greater transparency proposal (formerly referred to in published documents as Transparency Phase 2) is to ensure ratepayers can access:

- a fuller analysis of the evidence used to set their business rates assessment

- an explanation of how evidence has been used to arrive at the assessment

- further guidance.

It is anticipated that greater transparency will:

- help build trust and improve fairness, by helping ratepayers to better understand their rating assessment

- enable ratepayers to make swifter, more informed decisions about whether to challenge their business rates assessment

- enable access to information earlier than, and separately from, any evidence exchanged during the formal Challenge process

These changes will mean the UK is amongst the countries who provide a higher level of transparency.

Other changes to the business rates system asset out in the Business Rates Review: Final Report include a new duty for ratepayers to notify the VOA about information that underpins rating assessments. This will include when there are changes in occupation, changes to a lease or rent, or changes to a property, and to provide trade information if used for valuation purposes. There will also be a requirement to confirm annually that any changes have been reported.

This new duty will:

- increase the quantity and quality of evidence used to determine valuations

- ensure valuations are based on more comprehensive and up-to-date evidence

- support the implementation of more frequent revaluations (a key stakeholder ask)

- bring business rates more in line with other taxes

The duty will be formally implemented during the life of the 2026 rating lists and is an essential counterpart to greater transparency. It will ensure the information the VOA provides to ratepayers is more timely and complete.

The government wanted to explore if the type of information currently available, and changes made to increase the accessibility of this information to date, provided sufficient information for a ratepayer to feel they understand their rateable value and be confident that it is fair.

To help inform decisions, the VOA published the Business Rates: transparency and disclosure of information on business rates valuations consultation on 15 March 2023. This consultation ran until 7 June 2023.

The consultation aimed to:

- explain the disclosure proposals in more detail

- explain how it might work in practice, providing further background, options and examples

- understand any ratepayer concerns about certain data being disclosed

- gather stakeholder views, to ensure any final decisions were informed by extensive engagement with a wide range of stakeholders

Overview of the responses and stakeholder engagement

During the consultation extensive stakeholder engagement took place. The VOA met with over 100 stakeholders from a wide range of sectors and organisations. It received 64 written responses (either via the survey or by email) from a broad range of stakeholders. The breakdown of the representative groups is as follows:

- 26 ratepayers/businesses

- 13 business representative groups

- 10 rating agents

- 8 local authorities (LA)

- 1 local authority representative body

- 4 professional bodies[footnote 2]

- 2 landlords

The VOA is grateful to, and would like to thank, all the stakeholders that took the time to engage with the process and for providing invaluable feedback.

Geographical scope

This consultation was specific to England as business rates are devolved in Wales. The Non-Domestic Rating Act 2023 provides for enhanced disclosure to extend to both England and Wales. This will enable Welsh ratepayers to benefit from the same improvements to transparency of information about property valuations.

Chapter 1 - Executive summary

1.1 The government has closely reviewed the responses and views provided during consultation, including where stakeholders raised concerns. Responses to the consultation are summarised in Chapter 3.

1.2 Careful consideration has been and will need to continue to be given to what is technically and operationally feasible and affordable to deliver, as there are around 2.1 million assessments in the rating lists. While this document sets out the VOA’s intentions, the proposals are subject to ongoing work on feasibility.

1.3 As mentioned in the original consultation document, additional user research has also taken place. This was to ensure decisions could be made with the benefit of a broad range of external input, including views from those who have been less engaged to date.

1.4 Views differ about what information is needed to better understand rating assessments. For example:

-

Rating agents, who are typically rating surveyors, would prefer access to more detailed information.

-

When presented with rental information, and how this breaks down in valuation terms, ratepayers often found the content overwhelming and less easy to understand.

Some ratepayers preferred seeing which other properties are most comparable to their own (without rental information). They felt this enabled them to consider the fairness of their rating assessment, by comparing their rateable value to other similar or neighbouring ones.

1.5 The VOA will therefore take a phased approach to greater transparency. This will enable most ratepayers to see more accessible information in the 2026 rating lists, and additional information from 2029 and beyond.

1.6 More detail is set out below in Chapter 2. In brief the approach is expected to be:

-

Initially, for 2026, most ratepayers will be able to access details about properties most comparable to their own.

-

Disclosure will then be expanded for 2029 and will include more valuation information, including rental evidence.

1.7 The VOA would therefore start to be more transparent ahead of ratepayers proactively providing property information under the new duty (explained in the background section above), which will be fully implemented during the life of the 2026 lists. Transparency will then be expanded when changes are implemented to shorten the window for ratepayers making Challenges and remove Check as a separate process from the CCA system.

1.8 This phased approach will ensure the VOA successfully delivers a system based on the feedback received. As set out in the consultation document, the government’s decisions on the approach need to balance the desire for greater transparency from some stakeholders, alongside the concerns expressed by others about the confidentiality of their data.

1.9 The VOA will also continue to engage with stakeholders and users on the design and in respect to iterating the service further, and beyond 2029, as appropriate. It will also continue to gather input to ensure ratepayers, not expert in rating valuations, understand the information.

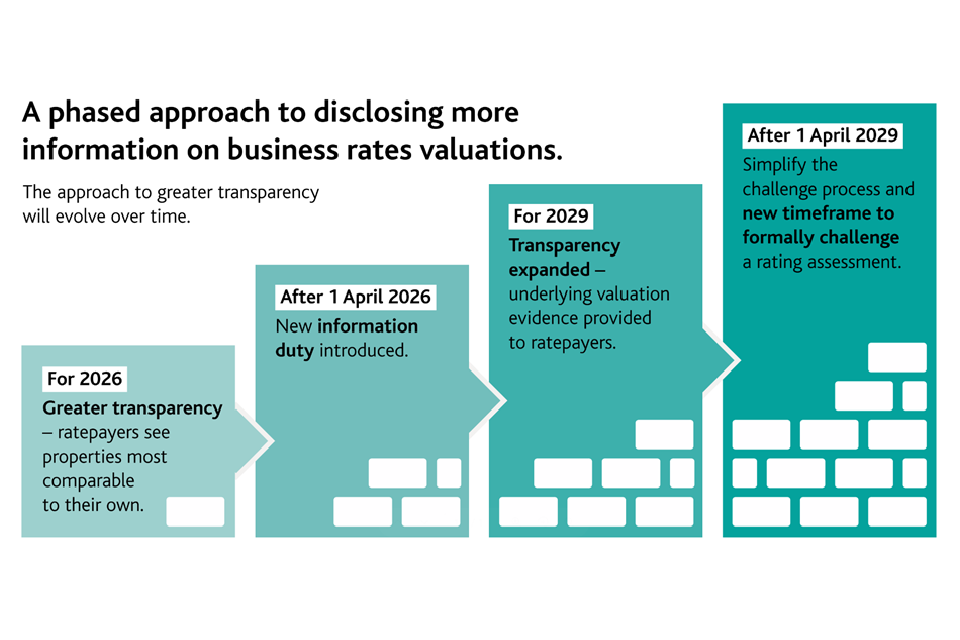

A phased approach to disclosing more information on business rates valuations

The approach to greater transparency will evolve over time.

From 2026, ahead of the VOA receiving more valuation evidence, most ratepayers will be able to see details about properties most comparable to their own. Some ratepayers have told us seeing this information is helpful and they would prefer not to be overwhelmed with detail.

After 1 April 2026, the new information duty will be introduced which, over time, aims to increase the quantity and quality of evidence the VOA receives to determine its valuations.

From 2029, and ahead of changes to shorten the timeframe to formally challenge a rating assessment with the VOA, more information will be disclosed. Ratepayers will still be able to see details about the most comparable properties and, in addition, some underlying valuation evidence will be provided.

The government recognises the value of stakeholder engagement in developing these changes and will continue to seek feedback to evolve the approach further as required.

Chapter 2 – Government response

Overview

2.1 As set out in the consultation document, the government’s decisions on the approach to disclosure need to balance the desire for greater transparency from some stakeholders, with the concerns being expressed by others about the confidentiality of their data. In addition, careful consideration must be given to what is technically and operationally feasible to deliver, as there are around 2.1 million assessments in the rating lists.

2.2 The government believes that the phased approach set out in this document strikes the right balance, especially given some conflicting views about what information might be helpful to different users, what is considered sensitive and what might be disclosed or withheld. Rating agents generally have a desire for more information to be disclosed, whereas ratepayers, landlords and some business representative organisations have concerns about certain types of data being included. Some ratepayers also prefer not to be overwhelmed with detail and only see basic information about properties most comparable to theirs.

2.3 The consultation highlighted, and some responses appreciated, that greater transparency could look different initially until the new duty for ratepayers to provide the VOA with property information is fully embedded.

Overarching detail

2.4 For 2026, access to more valuation information will be available to those with a valid property link via their Business rates valuation account. This will allow most ratepayers to see how their rating assessment compares to similar properties. Ratepayers can then make swifter and better-informed judgements about whether to make a Challenge or not.

2.5 As the approach to greater transparency evolves through to 2029, to include more sensitive information, access will be through VOA’s new digital service for ratepayers. This service will verify the ratepayer’s identity. Other parties, whether connected or not, will not have access to this information.

2.6 There are three main recognised valuation methods used for rating purposes (see also valuation methods and details from paragraph 1.8 of the original consultation). Properties also fall into ‘categories’ (for example, retail, offices, hospitality) because similarities exist in how the evidence is analysed and used in valuations. These ‘categories’ may require different approaches to providing more transparency and such approaches will protect data that is not appropriate for disclosure.

2.7 It is important to note that, if a valuation is challenged through the VOA’s formal process, the evidence provided by the VOA in response to that Challenge may be different to that provided through the transparency process. For example, there may be evidence that was not available at the original point of valuation or there may be different evidence that is more relevant to addressing the specific grounds of the Challenge.

2.8 The existing Find Your Business Rates online tool will not be removed as a result of the disclosure approaches set out below. Ratepayers have found this tool useful in finding their property’s rateable value and receiving help with the current valuation. The tool will remain, alongside the greater transparency approaches, to help build trust and improve fairness, by helping ratepayers to better understand their rating assessment.

Initial approach to Disclosure (2026)

Local valuation schemes

2.9 The VOA groups similar properties together in a valuation scheme, giving a range of values dependent upon property attributes. For example, a scheme might include all standard shops in a village or a district within a town.

2.10 Local valuation schemes cover the vast majority of properties in the rating lists (around 90%). This includes most shops, offices and industrial properties. These properties generally have underlying rental comparison evidence and are valued in comparison to other similar properties.

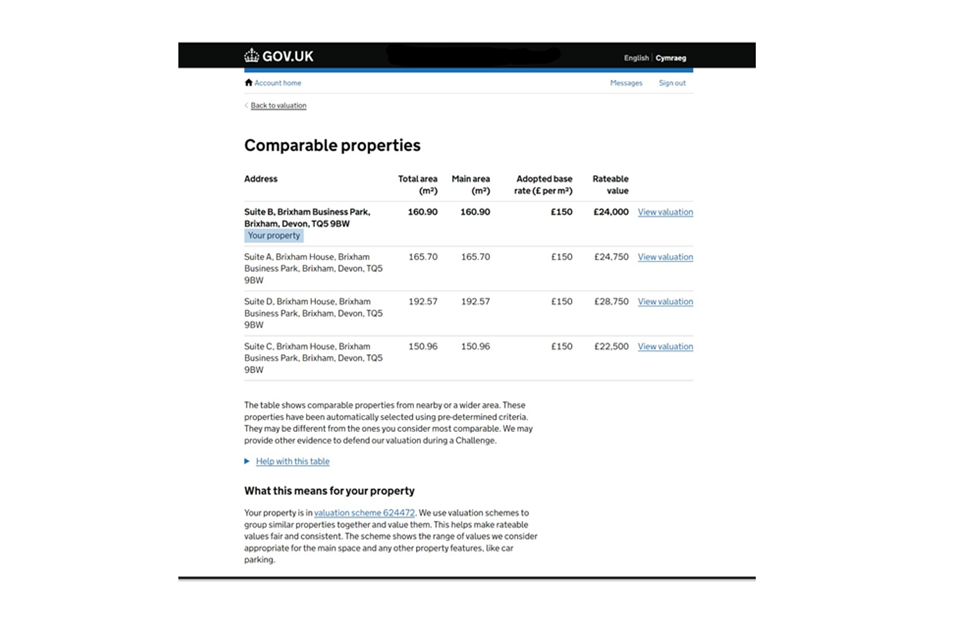

2.11 Ratepayers will be able to request information showing a selection of comparable assessments. They will be able to see the size, adopted value(s) applied, and the rateable value of these similar properties in the locality. This could be similar to Example 1 below.

Example 1

What is subsequently developed and provided for 2026 might not exactly replicate this example.

As the proposed approach would likely provide most ratepayers with access to tailored information about properties comparable to theirs, the number of entries could vary and at times could include fewer properties than shown in this example.

Example 1 is also available in table and word format in Appendix A.

2.12 The VOA expects supplying this information will be largely automated. The intention is to have the information available once a request is received. The number of the most comparable properties that could be provided may differ, as some property types or localities may have more than others.

2.13 There are a variety of property types valued on local schemes. While some are valued by reference to local rents, information may not be from the immediate locality. Some have a value per m2, and some, such as advertising rights, car parks and self-catering accommodation, may have a ‘unit’ value applied. These categories need further consideration and automation may not be possible for some. The VOA wants to ensure the information is meaningful and helpful to the ratepayer and expects to provide comparable valuation information for many of these assessments. Where this is not possible, it might provide general information about how the property is valued and the approach taken.

National valuation schemes

2.14 Some types of properties are valued on national, rather than local, valuation schemes. This is because the VOA reflects the national market approach to values. Some properties may be valued by the receipts and expenditure method[footnote 3] (examples include hotels and cinemas) or contractor’s basis[footnote 4] (examples include local authority schools, libraries, or hospitals). National schemes also include properties valued by reference to rents, and where ‘fair maintainable trade’ is used as comparison, rather than size (examples include public houses). Often national valuation schemes are subject to central discussions and, where possible, agreed with industry representative bodies or rating agents.

2.15 For 2026, ratepayers on a national valuation scheme will continue to make a request for a Detailed Valuation Report (DVR), which is not currently an automated service. The VOA has an ambition to bring together an overview of the valuation approach and include relevant links to the Rating Manual. This will provide a more accessible version of the information currently available.

Bespoke valuations

2.16 A very small number of bespoke valuations exist, and these are typically either a full receipts and expenditure or contractor’s basis valuation, specific to the individual property. For the 2026 rating list the CCA service will remain available, and the VOA has an ambition to provide additional explanation and more accessible guidance on valuation approaches where possible.

Approach to fuller Disclosure (2029 and onwards)

2.17 While some stakeholders welcomed improved accessibility and details about comparable properties, as proposed above, some thought it would be helpful if there was fuller disclosure and specific rental evidence provided, which is not currently publicly available from the VOA. Fuller disclosure will take place for the 2029 draft lists and, as mentioned at paragraph 1.9 above, the VOA may continue to iterate the service beyond 2029. In developing the approach to fuller disclosure, the VOA will continue to have regard to how to balance the desire for transparency with concerns about protecting sensitive information, and what is technically and operationally feasible to deliver.

Local valuation schemes

2.18 Details about comparable assessments, as for 2026 above, will continue to be provided with an additional summary of relevant supporting evidence. While there is still work to do to establish the appropriate operating principles and fully understand the level of sensitivity around some information that VOA might hold, it is expected that the following may be provided to summarise the rental evidence:

- address

- property description (e.g. office, shop)

- rent start date

- rent agreement type (e.g. lease renewal, new letting)

- either headline rent and adjusted rent[footnote 5], or adjusted rent with information that indicates the scale of adjustments made

- size of the property (in m2)

- analysed rent (£/m2)

- value adopted (£/m2)

- rateable value

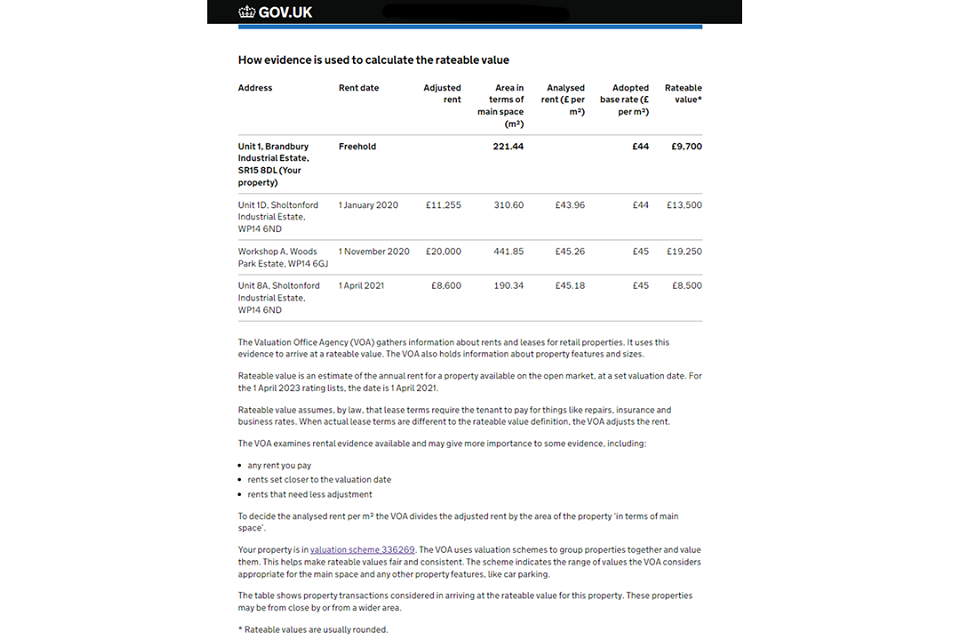

2.19 The VOA will also provide explanations about how it values properties and links to supporting information, for example, explanations or guidance specific to a sector or the published Rating Manual. While the exact detail that might be provided for 2029 is yet to be finalised and may also include aspects listed under paragraph 2.18 above, Example 2 below provides a visual of what this may look like. Examples like this were provided in the original consultation at Chapter 3 as an option for meeting the disclosure commitment with property transactions included.

Example 2

What is subsequently developed and provided for 2029 will not exactly replicate this example. See paragraph 2.17 above.

As this approach would provide actual property transactions as evidence, the number of entries could vary and at times could include fewer properties than the example.

Example 2 is also available in table and word format in Appendix A.

2.20 It is expected that the process will be largely automated so that the information is issued to the ratepayer once their identity has been confirmed at registration and they request the evidence.

2.21 For properties valued by reference to local rents (see paragraph 2.13 above), the VOA expects to provide rental evidence where it is appropriate to do so. As previously set out, the VOA is working through these categories to ensure the information provided is meaningful and helpful to the ratepayer to understand what underpins their rateable value.

2.22 Careful consideration needs to be given to balancing the level of detail provided so that all ratepayers can understand the information. Clear feedback from both the consultation and user research indicates some users find rating terminology and rating concepts hard to understand, especially when more detail is presented.

2.23 It has been decided, as stated in the original consultation at paragraph 4.17, that the VOA’s actual calculations undertaken, and any notes about the valuer’s judgements, when moving from headline to adjusted rent, would not be provided for 2029. This could in some cases reveal more sensitive information that needs to be protected.

2.24 Based on the stakeholder feedback, especially from rating agents, the VOA is considering how it might share more information than originally proposed in the consultation, for example how rents have been adjusted for rating valuation purposes. VOA will continue to engage with stakeholders as it works through the possible design.

National valuation schemes and bespoke valuations

2.25 For 2029, the VOA has an ambition to broaden the service to explain how the ratepayer’s own information, rather than a valuation approach, has been used to value their property. This is subject to ongoing work on what is technically feasible, to protect any sensitive underlying information, and what is operationally feasible and affordable to deliver, considering resource implications. The VOA will continue to engage with stakeholders as it works through the possible design.

Protecting data & onward data sharing

2.26 As mentioned above at paragraphs 2.4 and 2.5, access to the information will only be provided to the ratepayer after verifying their identity.

2.27 The legislation now in place to allow this greater sharing of information (The Non-Domestic Rating Act 2023, clause 10) sets out that the VOA should share what it “considers reasonable”. The legislation allows the VOA to disclose more information than it could previously, while ensuring it appropriately protects any data considered more sensitive and not suitable for disclosure. Commencement regulations will be required in due course.

2.28 As outlined in the consultation, once the information has been provided to a ratepayer or their appointed agent, it would be difficult, if not impossible, for the VOA to know if it had then been shared onwards. The VOA is continuing to consider whether it might require ratepayers (and their agents) to sign up to Terms and Conditions, restricting the use of the data and any onward sharing to third parties.

2.29 Ensuring compliance with GDPR to protect personal data and ensuring sensitive and commercially sensitive information is treated appropriately, and not disclosed, will be a core principle of the system design. Views from stakeholders will help inform the VOA’s operating principles around what is reasonable to disclose, what is sensitive and what will be protected. Responses to question 6 (summarised at 3.16 below) were helpful in setting out the types of information considered by ratepayers to be sensitive or commercially sensitive, noting that there was a wide range of views on the types of information that should be included and excluded.

Chapter 3 - Summary of responses

This summary is not intended to be a comprehensive account of all points of view expressed but instead provides a summary of key points and commonly expressed perspectives.

Question 1. Did you know the Find Your Business Rates online tools existed? If yes, have you used the tools to: see how a/your rateable value is calculated; access valuation scheme details; compare properties?

3.1 The majority of those that responded to this question knew the tools existed, found the tools useful and used the three functions highlighted.

3.2 A small number didn’t know the tools existed and almost all of these were individual ratepayers of micro or small businesses.

Question 2. In what ways does the information on Find Your Business Rates help you understand if the rateable value is fairly assessed? What specifically is helpful or what specifically could be improved?

3.3 Many respondents found the information on Find Your Business Rates (FYBR) helpful, as it enables users to view the property details recorded by VOA and to see a breakdown of most rateable value calculations.

3.4 While stakeholders said the information allows them to compare properties and see relative values, many felt it was limited in specifically helping them understand if a rateable value is fairly assessed. Some stakeholders said it was hard to navigate and find the most relevant comparable properties. The most common reason cited about its limitations was that FYBR contains no specific underlying evidence or information to help understand why that level of value had been decided. Responses of this nature came from all groups of stakeholders and businesses of all sizes.

3.5 Stakeholders said FYBR is beneficial and should be retained and will be, alongside the greater transparency approaches set out above.

Some suggested possible improvements. The most common being:

- understanding which assessments have been challenged and the result of any formal Challenge or Appeal

- including more information on assessments in sectors outside the main bulk classes (shops, offices and industrials)

- narrowing the value parameters in the valuation schemes, making comparisons easier

Question 3. Examples A and B show tables of similar or comparable properties, with the same adopted base rate. Would information like this help you understand if the rateable value is fairly assessed? What specifically is helpful or what specifically would improve the information?

3.6 Just over a third of the responses to this question said they would find information suggested in the examples helpful, especially for local scheme assessments. Some stakeholders felt a table of comparable properties could be helpful for smaller independent ratepayers or those not represented by an agent, but less so for rating agents. However, smaller businesses that responded were broadly split in terms of seeing the examples as being helpful.

3.7 This approach was seen as beneficial so users could have a list of the most comparable properties readily available, rather than having to research these.

Question 4. Examples C and D show more specific details on other properties, including adjusted annual rents, which have been used to determine the adopted value/ £ per m2. Would information like this help you understand if the rateable value is fairly assessed? What specifically is helpful or what specifically could/would improve the information?

3.8 Most that responded to the question thought the examples here were more helpful than examples A and B. A few respondents, mostly ratepayers, felt the examples weren’t helpful and expressed views around the information being too complex. Some had data concerns, saying this level of information was commercially sensitive or confidential and should not be shared.

3.9 There was a desire for even more information from some of those that were supportive. Generally rating agents and a few representative organisations provided extensive lists of data they thought would be needed in addition, such as headline rents and details about the adjustment made to those rents. Ratepayers, and some local authorities, had a desire for more information about property use and condition and knowing when the property was last inspected.

Question 5. What are your views around the examples E, F and G, regarding properties valued under a national scheme?

3.10 Almost all responses to the question indicated the examples were of some help or helpful and most recognised the data sharing sensitivities that can exist (and differ) in sectors valued under a national scheme. The remainder that expressed concerns, the majority of which were business representative groups (BROs), had concerns about commercially sensitive trading or turnover data being shared and ratepayers understanding what was being presented.

3.11 Some of those that were supportive felt the suggested approach would be an improvement over what is currently available to these sectors and would provide a better understanding. There was support for the principle, set out in the consultation, that a ratepayer would only access details and explanations about how their own turnover had been considered and the VOA would not include turnover information about other properties.

3.12 A range of supportive stakeholders, including rating agents, ratepayers, professional bodies and BROs, made suggestions for additional information, including:

- more clarity in terms of how a national scheme has been devised from evidence and applied to the property

- whether discussions with trade or representative bodies agreed the methodology / application of a scheme or involved discussions on scheme values, and which bodies had been involved in the discussions

- providing an indication of any weighting, adjustments, or considerations (for example for location) and why a specific percentage or range point might have been adopted

- for properties valued by the contractor’s basis, there was a desire for more detail about how costs are derived from evidence

Question 6. When it comes to business rates valuations what specific information do you consider to be sensitive or commercially sensitive and why?

3.13 The vast majority recognised the need to continue to protect some types of information from disclosure. While a number provided specific suggestions and some common themes emerged about information that might be considered sensitive or commercially sensitive, there were very differing views on what should be included or excluded.

3.14 A small number, almost wholly micro or small business ratepayers, had no suggestions or concerns to offer.

3.15 Many recognised that views would differ, advising some ratepayers and landlords will have different views to others on what is sensitive, and there would be different and specific sensitivities to consider in different sectors. As set out below, this seems to be the case.

3.16 The list below shows the types of information suggested as being the most sensitive or commercially sensitive. These were suggested in almost all the responses from landlords, professional bodies, BROs, rating agents and larger business ratepayers.

- turnover rents, which now feature particularly on retail premises

- trade or business performance information (including income, revenue, expenditure, turnover, profit, royalties paid on revenue, output or production)

- side letters or agreements – ancillary to the main lease, which can be personal to the tenant and can vary the lease terms

- transactions (or side letters) with related non-disclosure agreements or leases with confidentiality clauses

- details about some financial incentives, inducements or concessions to take a tenancy (which at times can be sensitive)

- costs of improvements, including fit out costs

3.17 Some rating agents, professional bodies and BROs felt that sensitivity and confidentiality decline with the passage of time, and the evidence used for rating valuations was generally historic.

3.18 In terms of those with larger property portfolios, including local authorities, there were concerns that greater transparency might reveal differences in arrangements between the landlord and tenants. For example, a landlord wishing to encourage regeneration in an area or where a tenant needs to be in a specific location for business purposes.

3.19 Some responses from micro or small business ratepayers reflected a more cautious view about what information was sensitive or commercially sensitive. Suggestions here included not wishing to have any detail disclosed about the rent paid and having nothing further than the rating assessment information already available (such as size and adopted value per m2 available on FYBR – see [x] above).

3.20 Both in the responses to the consultation and during the stakeholder meetings, it was suggested that a system might be devised where ratepayers/landlords flag any sensitivities when they provide the information to the VOA that they believe should not be disclosed and be given the opportunity to have these redacted.

Question 7. Do you have any specific data sharing concerns as a result of understanding the disclosure and transparency proposal set out in more detail in this consultation?

3.21 Around half of the responses had no real concerns they wished to express. A number recognised it was crucial to strike a balance on what would be disclosed, as there remain concerns around sharing data. Some respondents supported the suggested approaches set out in the consultation, which they felt sought to strike a balance and provided assurance that sensitive information would be protected.

3.22 Those that set out concerns were mainly ratepayers, landlords and representative organisations. Large ratepayers and landlords worried about other ratepayers or competitors seeing information and gaining a commercial advantage, and one felt that going further than the proposals in the consultation was a step too far. Small and micro businesses were concerned about their data being shared, wider disclosure and information becoming freely accessible.

Question 8. What, if anything, specifically concerns you about the risk of onward data sharing – where data might be put into the wider public domain by others?

3.23 Several respondents said terms and conditions on use should be put in place. Some suggested going further with legislative restrictions and/or penalties for onward disclosure. Many recognised that any onward data sharing would be difficult for the VOA to monitor, manage or police.

3.24 None of the respondents appeared to express severe concerns and again reiterated points they made in response to other questions.

3.25 The respondents that voiced more specific concerns, and this group were mainly ratepayers, landlords and local authorities, worried data might be commercially sold, misused or manipulated, used by cold calling companies looking to act as rating agents, or more generally used inappropriately.

Question 9. Which of these is more important to you and why? (a) Having more information about the underlying evidence used to assess a/your rateable value (b) protecting data from disclosure (and wider disclosure)?

3.26 Well over half the respondents said having more information about the underlying evidence was most important to them. The main reasons being so ratepayers can judge if an assessment is fair and this better understanding might lead to increased trust and less formal Challenges. Responses here came from across all groups. Rating agents said having more information enables them to better advise clients.

3.27 Just over a quarter said they felt both were equally important. They felt the two were not mutually exclusive; there was a need to protect certain data, but a system should be designed to take account of this. Several responses here were from representative organisations, rating agents and the professional bodies.

3.28 The remainder of respondents said protecting data from disclosure was most important to them. Responses here were from ratepayers of differing sizes and representative organisations of sectors where specific sensitivities exist.

3.29 Generally, it was recognised there was a balance to be struck and that this might be difficult.

Question 10. Do you have any views about how best to balance providing greater transparency with the concerns on disclosure?

3.30 Responses to this question almost wholly centred around the need to protect certain sensitive information from disclosure.

3.31 Some respondents made or repeated suggestions about how to design the system.

3.32 A small number – mostly ratepayers (both large and small) – felt there couldn’t be a balance and would prefer not to have information disclosed or the very minimum provided so ratepayers can make comparisons. Some said if a ratepayer decided to make a Challenge, then evidence would be provided at that stage, so greater transparency wasn’t required. There was also a comment that this might lead to people not providing information to the VOA, to ensure it wasn’t shared or disclosed.

Question 11. Are there any other views not covered in previous answers that you’d like to share about the transparency/disclosure proposal?

3.33 A number of respondents took the opportunity to reiterate points made on other questions. Other key points of note included:

- a desire to know more about how the VOA approached more specialist assessments or those valued by the contractor’s basis

- whether access might be broadened to include other interested parties

- if the intention was to provide transparency information at each revaluation and for these to be available over the Challenge period, or if the details would be updated or revised over the life of the rating lists

- concerns over the overall VOA resource and operational impact, with the amount of work that could be required to identify and protect more sensitive data

- that until the new duty was fully embedded, the VOA’s approach to greater transparency might need to develop over time

- concerns over the possible complexity; ensuring ratepayers could easily understand the information and ‘self-serve’, without having to make further enquiries or Challenges, was seen as key

- concern that this proposal could inadvertently lead to companies approaching ratepayers to offer assistance for a fee

Appendix A – Examples in alternative table and text format

Example 1

Summary of comparable properties

| Address | Total area (m2) | Area in terms of main space (m2) | Adopted base rate (£ per m2) | Rateable value* |

|---|---|---|---|---|

| Suite B, Brixham Business Park, Brixham, Devon, TQ5 9BW Your property |

160.90 | 160.90 | £150 | £24,000 |

| Suite A, Brixham House, Brixham Business Park, Brixham, Devon, TQ5 9BW | 165.70 | 165.70 | £150 | £24,750 |

| Suite D, Brixham House, Brixham Business Park, Brixham, Devon, TQ5 9BW | 192.57 | 192.57 | £150 | £28,750 |

| Suite C, Brixham House, Brixham Business Park, Brixham, Devon, TQ5 9BW | 150.96 | 150.96 | £150 | £22,500 |

The table shows comparable properties from nearby or a wider area. These properties have been automatically selected using pre-determined criteria. They may be different from the ones you consider most comparable. We may provide other evidence to defend our valuation during a Challenge.

What this means for your property

Your property is in valuation scheme 624472. We use valuation schemes to group similar properties together and value them. This helps make rateable values fair and consistent. The scheme shows the range of values we consider appropriate for the main space and any other property features, like car parking.

*Rateable values are usually rounded.

Example 2

How evidence is used to calculate the rateable value

| Address | Rent date | Adjusted rent | Area in terms of main space (m2) | Analysed rent (£ per m2) | Adopted base rate (£ per m2) | Rateable value* |

|---|---|---|---|---|---|---|

| Unit 1, Brandbury Industrial Estate, SR15 8DL (Your property) |

Freehold | - | 221.44 | - | £44 | £9,700 |

| Unit 1D, Sholtonford, Industrial Estate, WP14 6ND |

1 January 2022 | £11,255 | 310.60 | £43.96 | £44 | £13,500 |

| Workshop A, Woods Park Estate, WP14 6GJ |

1 November 2022 | £20,000 | 441.85 | £45.26 | £45 | £19,250 |

| Unit 8A, Sholtonford Industrial Estate, WP14 6ND |

1 April 2021 | £8,600 | 190.34 | £45.18 | £45 | £8,500 |

The Valuation Office Agency (VOA) gathers information about rents and leases for retail properties. It uses this evidence to arrive at a rateable value. The VOA also holds information about property features and sizes.

Rateable value is an estimate of the annual rent for a property available on the open market, at a set valuation date. For the 1 April 2023 rating lists, the date is 1 April 2021.

Rateable value assumes, by law, that lease terms require the tenant to pay for things like repairs, insurance and business rates. When actual lease terms are different to the rateable value definition, the VOA adjusts the rent.

The VOA examines rental evidence available and may give more importance to some evidence, including:

- any rent you pay

- rents set closer to the valuation date

- rents that need less adjustment

To decide the analysed rent per m2 the VOA divides the adjusted rent by the area of the property ‘in terms of main space’.

Your property is in valuation scheme 336269. The VOA uses valuation schemes to group properties together and value them. This helps make rateable values fair and consistent. The scheme indicates the range of values the VOA considers appropriate for the main space and any other property features, like car parking.

The table shows property transactions considered in arriving at the rateable value for this property. These properties may be from close by or from a wider area.

*Rateable values are usually rounded.

-

A rateable value is an estimation of the annual open market rental value that a property might achieve at a set valuation date. It is also based on a set of assumptions, including that the tenant is responsible for all outgoings, such as business rates, taxes, repairs and insurance. The valuation date is currently two years prior to the date the rating list is compiled. For example, for the 1 April 2023 rating lists, rateable values are based on estimated rental levels on 1 April 2021. ↩

-

Professional bodies: Royal Institution of Chartered Surveyors, Rating Surveyors’ Association, Institute of Revenues Rating and Valuation and the Chartered Institute of Taxation. ↩

-

The receipts and expenditure method is used for categories of property where there is no or very limited rental evidence and the property is occupied in pursuit of profit – this involves an analysis of income and costs to ascertain what a tenant might pay in rent (examples include hotels and cinemas). ↩

-

The contractor’s basis is used where there is no, or very limited, rental evidence and the property is not occupied with a view to generating profit – the value of land and cost of replacing the building is used to determine a notional annual rent (examples include schools, libraries and hospitals). ↩

-

Rating valuations follow the property market, by analysing evidence of the market rents being paid. The valuation stages are explained in more detail in the consultation document [hyperlink]. Rents are adjusted to bring them into line with the statutory definition of rateable value [(see footnote 1 above)]. This is because not all leases are agreed at, or close to, the set valuation date or the terms of a lease differ from those that must be assumed in assessing rateable value, so actual rental agreements don’t always precisely match the assumptions that need to be made [(as mentioned in footnote 1)]. The exact criteria of lease arrangements can vary in their complexity and terms. ↩