The Occupational and Personal Pension Schemes (General Levy) review 2019: public consultation

Updated 27 March 2020

Introduction

1. This consultation seeks views on proposed changes to the rates of the General Levy on occupational and personal pension schemes (“the levy”) from April 2020.

About this consultation

Who this consultation is aimed at

2. We would expect this consultation to be primarily of interest to those affected by the levy including occupational pension scheme trustees, personal pension providers and sponsoring employers of pension schemes. However, the government welcomes views from any interested parties.

Purpose of the consultation

3. The purpose of this consultation is to raise awareness of the Department for Work and Pension’s (DWP) proposal to raise the levy rates from April 2020 and to seek views on options for change.

Scope of the consultation

4. This consultation concerns the General Levy regulations which apply to England, Wales and Scotland. It is envisaged that Northern Ireland will make corresponding regulations.

Duration of the consultation

5. The consultation period begins on 18 October 2019 and runs until 29 November 2019. Please ensure your response reaches us by midday on 29 November 2019 as any replies received after this may not be taken into account.

How to respond to this consultation

6. Please send your consultation responses to:

General Levy Consultation Team

Department for Work and Pensions

ALB Partnership Division

1st Floor

Caxton House

London

SW1H 9NA

Or by email to generallevy.consultation@dwp.gov.uk.

Government response

7. We will aim to publish the government response to the consultation on GOV.UK. Where consultation is linked to a statutory instrument, as in this instance, responses should be published before or at the same time as any related instrument is laid. The report will summarise the responses and say what the government intends to do as a consequence.

How we consult

Consultation principles

8. This consultation is being conducted in line with the revised Cabinet Office consultation principles published in March 2018. These principles give clear guidance to government departments on conducting consultations.

Feedback on the consultation process

9. We value your feedback on how well we consult. If you have any comments about the consultation process (as opposed to comments about the issues which are the subject of the consultation), including if you feel that the consultation does not adhere to the values expressed in the consultation principles or that the process could be improved, please address them to:

DWP Consultation Coordinator

Legislative Strategy Team

4th Floor

Caxton House

Tothill Street

London

SW1H 9NA

Or by email to caxtonhouse.legislation@dwp.gov.uk.

Data protection and confidentiality

10. For this consultation, we will publish all responses except for those where the respondent indicates that they are an individual acting in a private capacity (for example, a member of the public). All responses from organisations and individuals responding in a professional capacity will be published. We will remove email addresses and telephone numbers from these responses; but apart from this, we will publish them in full.

11. For more information about what we do with personal data, you can read DWP’s Personal Information Charter.

Background

Structure of the levy

12. The General Levy on occupational and personal pension schemes (“the levy”) recovers the funding provided by the Department for Work and Pensions (DWP) in respect of the core activities of The Pensions Regulator (TPR), the activities of The Pensions Ombudsman (TPO) and part of the activities of the Money and Pensions Service (MaPS).

13. All 3 of these bodies receive grant-in-aid from DWP, which is reimbursed by levy income.

14. The levy is payable by the trustees of registrable occupational and personal pension schemes. The amount levied on individual schemes is calculated by reference to the number of scheme members.

15. The levy rates are set in regulations (the Occupational and Personal Pension Schemes (General Levy) Regulations 2005) (S.I. 2005 No. 626), as amended, and the levy is collected annually by TPR on behalf of the Secretary of State for Work and Pensions.

16. The levy rates are reviewed annually by DWP. Each review takes into account anticipated levy receipts; the agreed spending plans of the bodies listed in paragraph 14; and any surplus or deficit that may have accumulated.

17. The following table shows the current levy rates for the 2019 levy year:

Occupational schemes

| Number of members | Levy per member rate | Minimum charge per scheme |

|---|---|---|

| 2 to 11 | N/A | £29 |

| 12 to 99 | £2.88 | N/A |

| 100 to 999 | £2.08 | £290 |

| 1,000 to 4,999 | £1.62 | £2,080 |

| 5,000 to 9,999 | £1.23 | £8,100 |

| 10,000 to 499,999 | £0.86 | £12,300 |

| 500,000+ | £0.65 | £430,000 |

Personal or stakeholder schemes

| Number of members | Levy per member rate | Minimum charge per scheme |

|---|---|---|

| 2 to 11 | N/A | £12 |

| 12 to 99 | £1.15 | N/A |

| 100 to 999 | £0.81 | £120 |

| 1,000 to 4,999 | £0.69 | £810 |

| 5,000 to 9,999 | £0.46 | £3,450 |

| 10,000 to 499,999 | £0.35 | £4,600 |

| 500,000+ | £0.26 | £175,000 |

18. The levy rates were last increased in 2008 to 2009. The rates were then reduced by 13% in 2012 to 2013 and have remained at the same level for most pension schemes since then. A new, lower, levy rate for schemes with 500,000 members or more was introduced in 2017 to 2018.

19. The position in 2013 was that the levy was in surplus to the value of just over £24 million. During the subsequent period to 2018, the revenue collected in most years was slightly less than the expenditure incurred by the pension bodies, so that the cumulative surplus had by 2018 reduced to just over £2 million. Since 2018, the cumulative balance of the levy has moved from surplus to deficit, as annual expenditure has increased significantly relative to revenue. This has resulted in a cumulative deficit of over £16 million in 2019, and which is estimated to grow to over £50 million by 2020[footnote 1].

20. This change over time reflects levy rates not keeping up with inflation as well as growth in the levy-funded bodies due to:

- significant changes in the pensions industry and regulatory landscape

- the government’s commitment to strengthening the regulatory framework and TPR’s powers to better protect pension scheme members

- increased demand for pensions guidance and dispute resolution

Further details are set out in the next section.

21. A recent history of the position is summarised in the charts below (rounded to the nearest £0.1 million).

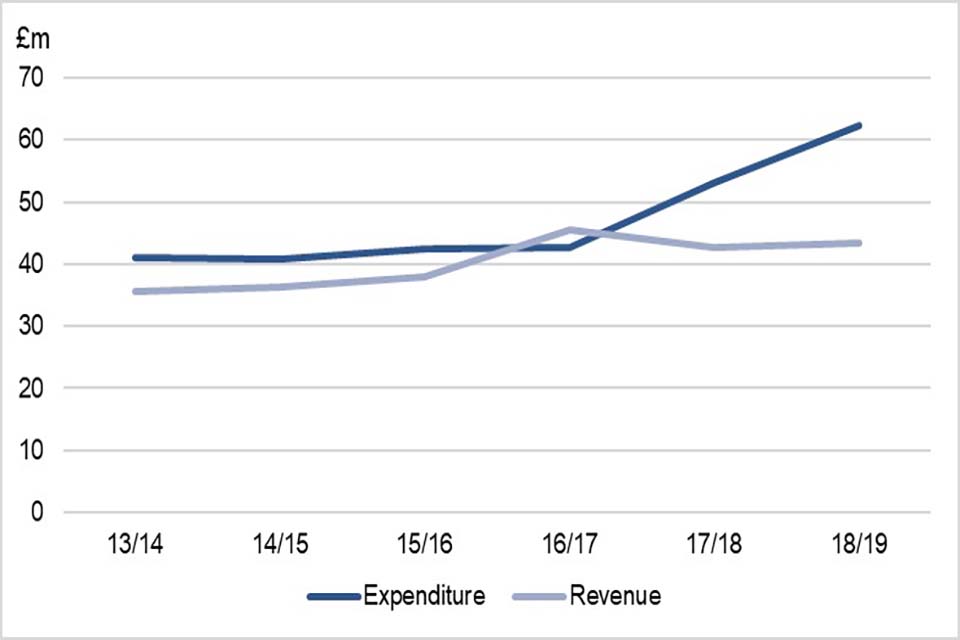

Figure 1: Levy revenue and expenditure 2013 to 2014 to 2018 to 2019[footnote 2]

The first chart is a line chart that shows the levy expenditure and levy revenue from financial year 2013 to 2014 to 2018 to 2019.

The expenditure line rises from around £40 million in 2013 to 2014 to over £60 million by 2018 to 2019.

The revenue line tracks lower than expenditure in all financial years except 2016 to 2017 when it is at around £3 million higher. The revenue is on average £5 million lower than expenditure in the 3-year period prior to 2016 to 2017 but the gap widens to broadly £20 million by 2018 to 2019.

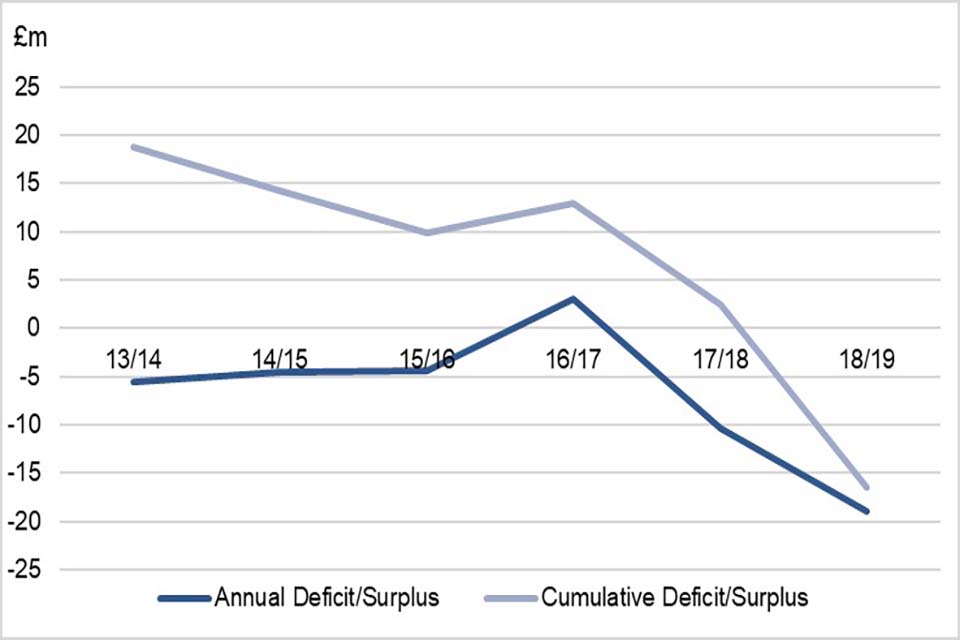

Figure 2: Annual and cumulative surplus/deficit 2013/14 to 2018/19[footnote 3]

The second line chart shows how both the annual surplus and the cumulative surplus has changed between 2013 to 2014 and 2018 to 2019.

The annual position reflects a small deficit position of about £5 million each year between 2013 to 2014 to 2016 to 2017, with this increasing to £20 million by 2018 to 2019.

The cumulative position shows the cumulative surplus of around £20 million in 2013 to 2014 falling to a cumulative deficit of just over £16 million by 2018 to 2019.

22. In conducting this year’s review, we have taken into account the current levy deficit, the spending plans of the bodies covered by the levy and the amount we expect to raise from eligible pension schemes over the 10 years from April 2020 if the levy rates remain unchanged. We are aware that there are a number of external factors that may affect these projections over time such as the projected growth in DC scheme membership and consolidation. We will therefore adjust any estimates as part of continuing yearly reviews. In a growing pensions market, led by the successful introduction of automatic enrolment into workplace pensions, it is prudent to make sure that the levy is adequate to allow government to deliver the strengthened regulatory framework put in place over recent years.

Pensions landscape

23. There have been significant changes in the pensions industry and the regulatory landscape since 2017. The government has taken steps to bolster the pension protection regime to ensure that confidence in pensions saving can be maintained and improved. This has included investing in stronger regulation, as well providing access to more comprehensive guidance and complaints services for members of the public.

24. As a result, the levy-funded pension bodies have seen continuing change and growth and, therefore, an increase in expenditure over recent years as well as in their forecast spending plans. The key areas include:

a) TPR, the largest funded body, continues to develop clearer, quicker and tougher interventions through its TPR Future programme, covering cultural, structural and procedural aspects of regulation, informed by its successful Automatic Enrolment operating model. The authorisation of master trusts, and ongoing work resulting from the Defined Benefit (DB) White Paper have created new and diverse challenges, not only for TPR, but for pension schemes and employers too. Some examples of the work undertaken by TPR include:

-

Proactively applying new regulatory initiatives to hundreds more schemes to influence their behaviours and improve outcomes for savers. From complex DB schemes and master trusts that TPR now authorise to smaller schemes, there is an increased focus on setting out the Regulator’s expectations for what effective compliance looks like, as a first step, when talking to individual schemes. TPR’s new supervision team is establishing one-to-one relationships with schemes of strategic importance upon whom millions of savers rely. TPR’s new range of regulatory tools and techniques, including high-volume targeted communications and broader thematic work, means that TPR can talk to an increased number of trustees, schemes, employers and other stakeholders about more aspects of their duties

-

Extending their regulatory grip to far more schemes than in the past, including smaller schemes with comparatively lower governance standards, engaging with these schemes if they cause concern and carrying out full investigations into those who persistently flout their duties. TPR’s increased breadth and volume of enforcement activity will act as a serious deterrent to those who consider doing wrong, thereby showing government’s resolve to protect the reputation of the pensions industry and safeguard millions of savers. TPR’s enforcement regime for automatic enrolment provides a clear example of this principle in action for workplace pensions, where new duties have been successfully implemented through a clear, consistent and tough regime, underpinned by an effective operational compliance framework.

-

Developing a consolidation plan for Defined Contribution (DC) schemes that have difficulties in meeting the standards expected. As part of this, guidance has been developed to assist trustees of DC schemes in understanding the key steps of the winding up process.

-

Communications-led initiatives such as the Trustee toolkit and 21st Century Trustee programme have helped to set clearer expectations of good governance. Phase 2 of the 21st Century Trustee programme will focus on the make-up of trustee boards and the impact of industry-developed competency standards and accreditation for professional trustees.

-

Working with the DWP, MaPS, the Pensions Dashboard Industry Delivery Group and the Financial Conduct Authority to develop the regulatory framework for effective consumer-facing dashboards.

-

Embarking on an upgrade of its old legacy IT systems to support the new operating model described above, as well as supporting reduce growing cyber and stability risks.

b) TPO is solely funded by the levy. TPO has undergone considerable transformation in recent years, including having its remit expanded to include an early resolution function and an increase in demand for its service. To support this, TPO is in the process of developing a more accessible, effective and streamlined customer journey by investing in core IT infrastructure, staffing and data processing. This initiative, together with its stronger stakeholder engagement programme, will enable TPO to deliver a quicker, more transparent customer journey as well as continue to work collaboratively with industry and other organisations to improve the pensions complaints process. As recommended by its recent tailored review[footnote 4], TPO is working with the DWP to introduce a new non-executive Board structure to strengthen its governance and support its existing Executive Team.

c) MaPS is partially funded by the levy covering the general pensions guidance side of its services previously provided by The Pensions Advisory Service. The government is succeeding in engaging savers encouraging them to seek guidance on their options to make good choices. This has led to a considerable increase in demand for pensions guidance which has more than trebled in the last five years since the introduction of pension freedoms.

The general levy also provides for a proportion of the development costs of the MaPS Pensions Dashboard and development costs of the supporting architecture elements that will enable dashboards to work.

25. While recognising the need to invest in these pension bodies to maintain and enhance the services they provide, the government also recognises the need to monitor performance actively and provide an effective challenge function in order to drive improvements. DWP maintains a regular dialogue with each body to ensure they are working to high standards and that their services are delivered efficiently and effectively in order to provide value for money by:

- satisfying itself that each body’s board is operating robustly and the board of the department is receiving regular updates and assurance on performance

- conducting independent tailored reviews which are designed to give regular assurance and challenge, and to ensure that all arm’s length bodies are providing good governance and operating efficiently

- providing financial challenge for each body through summer and winter planning rounds and the spending review process

Funding position

26. As set out above, as part of the levy review we have taken the opportunity to consider the increasing range of activities carried out by TPR, TPO and MaPS. These activities positively support government objectives, pensions schemes and savers. However, a natural consequence of increased activity is additional pressure on levy expenditure. Without an increase in the levy rates or a significant reduction in the activity of the levy-funded bodies, the amount by which the expected revenue from the levy falls short of forecast expenditure (the “deficit”) is likely to continue to grow significantly.

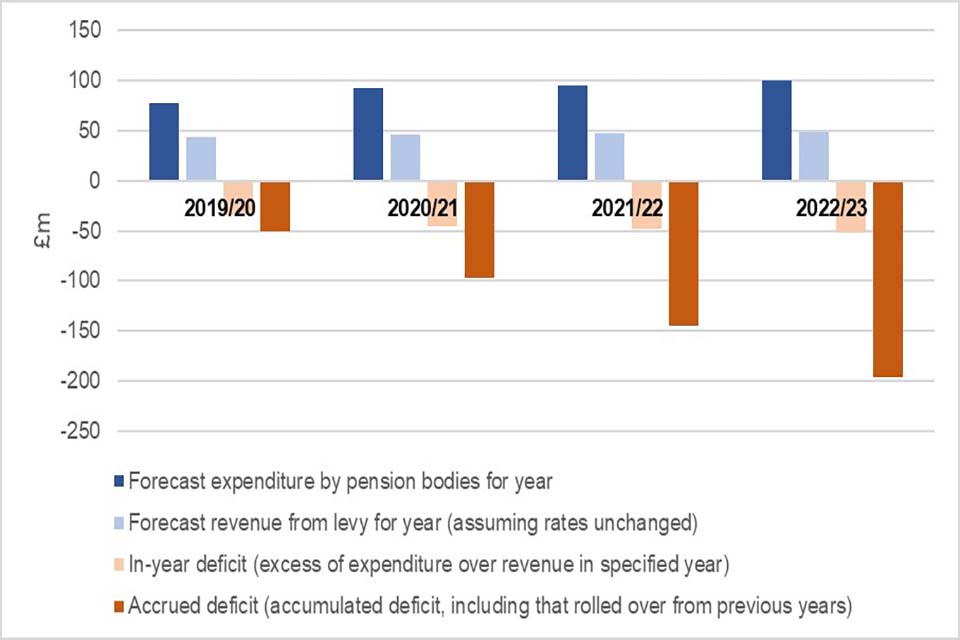

27. A chart showing the forecast position assuming no change in the levy rates over the next 4 years is shown below.

Figure 3: Forecast expenditure vs levy revenue[footnote 5]

The graph shows the financial forecasted revenue, expenditure, in-year deficit and accrued deficit for the financial years 2019 to 2020 to 2022 to 2023 if levy rates remain unchanged.

Forecast expenditure is expected to rise from around £78 million to £100 million over this period.

Forecasted revenue is expected to increase from approximately £43 million to £48 million.

In-year deficit is forecast to increase from £25 million to £50 million and the cumulative deficit is forecast to increase from £50 million to £200 million.

28. The government has sought to balance the need to fund the pension bodies at a level sufficient to deliver their core objectives of member protection and robust regulation, whilst at the same time keeping to a minimum the financial impact of the levy on the pensions schemes that fund it. In doing so the government was able to freeze the levy rates for a period of 7 years following the 2012 to 2013 reduction, thereby providing a period of significant stability in levy costs for schemes with less than 500,000 members.

29. Schemes with 500,000 members or more benefited from a reduction in their levy rate of 25% with effect from April 2017. This reduction was intended to increase fairness and make the operation of very large pension schemes more economic while avoiding the imposition of an additional burden on smaller schemes.

30. Whilst the government has protected the industry from increases in the levy over a number of years, it is committed to improved member education, proactive regulation, and strong protections for scheme member benefits. It believes that action to bring costs and the levy rates back into balance is now inescapable and is an appropriate and proportionate response to the levy deficit.

Increasing the levy rates

31. Following tailored reviews of both TPR[footnote 6] and TPO, the government is confident that these bodies are the right vehicles for ensuring that pension schemes are correctly regulated and that members and schemes are able to settle complaints and disputes when necessary. In setting up MaPS, the government has ensured that UK citizens can access the information that they require to make the right decisions about their pensions.

32. Ultimately, without an increase in levy rates, some of the core activities of the pension bodies would need to be stopped or curtailed. Under-investment could not only threaten the stability of systems but also impact the modernisation of services that the government requires and which schemes and their members are entitled to expect, undermining confidence in the pension system.

33. The government continues to work with the pension bodies to bear down on costs and realise sensible efficiencies in administration. However, it is clear that the growing responsibilities of these bodies has cost implications that can only realistically be addressed through an increase in the levy, once the smaller benefits of efficiency gains have been realised by the pension bodies. We believe that the levy increase will also allow for some future proofing of the regulatory regime, should new challenges in the industry emerge over the next decade.

34. The next section sets out the 4 options we have considered to address the current deficit as well as to realign the levy rates such that levy revenue is able to match ongoing expenditure in the longer term. We are keen to seek your views on all 4 options.

35. It should be noted that the proposed increases are based on the current forecast expenditure by the levy-funded bodies and our current understanding of relevant regulatory changes. Any future changes to planned expenditure to reflect new policy decisions would need to be identified and would inform future levy rates reviews. Such reviews will continue to be conducted on an annual basis in line with long-standing practice.

Options

Option 1: Holding increase of 10% of 2019 to 2020 rates on 1 April 2020, further increases from April 2021 informed by a wider review of the levy

36. This option would involve a moderate increase in the levy rates from April 2020 and would reduce the in-year deficit at the end of 2020 to 2021 by almost 10%, while allowing the government more time to consider longer-term options for changing the structure of the levy and to understand more fully the impacts that the industry and scheme members could be required to bear. The review would include engagement with the industry, for example through roundtables and an industry working group.

37. Following the conclusion of the review, the government would consult further on changes to levy rates from April 2021 onwards.

38. The government is attracted to this option. Whilst recognising that the levy deficit must be addressed, the government does not want to impose significant burdens on the industry at short notice. We have considered other options as set out below, but feel that a wider review could lead to more suitable solutions moving forward.

Option 2: Phased increase in the levy over the 3 years commencing 1 April 2020

39. The option would allow for a realignment in the required levy rates over a 3-year period ending in 2022 to 2023. It would involve an increase in the levy of 45%, 125% and 245% of the 2019 yo 2020 rates in each of the 3 years commencing 1 April 2020. The levy rates would be reviewed and set at a rate to cover ongoing costs from 2023 to 2024.

40. For a scheme paying £10,000 in 2019 to 2020, this means the levy would increase to the following amounts (assuming no change in membership levels):

| Year | Percentage increase of the 2019 to 2020 rate | Amount (£) |

|---|---|---|

| 2020 to 2021 | 45% | 14,500 |

| 2021 to 2022 | 125% | 22,500 |

| 2022 to 2023 | 245% | 34,500 |

41. The government is not attracted to this option. The increases required in years 2 and 3 in order to recover the levy deficit over such a short period are very substantial.

Option 3: Phased increase in the levy over approximately 10 years commencing 1 April 2020

42. This option would involve an increase in the levy rate of 25% with effect from 1 April 2020. The levy would then go up in 20% increments in each of the 8 years thereafter compared to the 2019 to 2020 base year. Subsequent alterations to the levy rates would follow the planned reviews described in paragraph 35 above.

43. As an illustration, for a scheme paying £10,000 in 2019 to 2020, this means the levy would increase to the amounts in the table below (assuming no change in membership levels) over the next 9 years. Rates for year 10 onwards would be determined nearer the time.

| Year | Percentage increase of the 2019 to 2020 rate | Amount (£) |

|---|---|---|

| 2020 to 2021 | 25% | 12,500 |

| 2021 to 2022 | 45% | 14,500 |

| 2022 to 2023 | 65% | 16,500 |

| 2023 to 2024 | 85% | 18,500 |

| 2024 to 2025 | 105% | 20,500 |

| 2025 to 2026 | 125% | 22,500 |

| 2026 to 2027 | 145% | 24,500 |

| 2027 to 2028 | 165% | 26,500 |

| 2028 to 2029 | 185% | 28,500 |

44. The option would allow for a more gradual realignment in the required levy rates and would broadly bring the levy back into balance if pension schemes would prefer to have a longer period in which to absorb the full impact of the increase in the levy rates that is required.

Option 4: Phased increase in levy over approximately 10 years commencing 1 April 2021

45. Similar to Option 3, this option also allows for a gradual increase in the levy rates but would defer the first increase in the levy rates by a year, to allow pension schemes time for preparation. It would involve an increase in the levy rate of 30% with effect from 1 April 2021. The levy would then go up in 25% increments in each of the 7 years thereafter compared to the 2019 to 2020 base rate year. Subsequent alterations to the levy rates would follow the planned reviews described in paragraph 35 above.

46. For a scheme paying £10,000 in 2019 to 2020, this means the levy would increase to the amounts in the table below (assuming no change in membership levels) over the next 9 years. Rates from year 10 onwards would be determined nearer the time.

| Year | Percentage increase of the 2019 to 2020 rate | Amount (£) |

|---|---|---|

| 2020 to 2021 | 0% | 10,000 |

| 2021 to 2022 | 30% | 13,000 |

| 2022 to 2023 | 55% | 15,500 |

| 2023 to 2024 | 80% | 18,000 |

| 2024 to 2025 | 105% | 20,500 |

| 2025 to 2026 | 130% | 23,000 |

| 2026 to 2027 | 155% | 25,500 |

| 2027 to 2028 | 180% | 28,000 |

| 2028 to 2029 | 205% | 30,500 |

47. Because of the deferred start date, this option produces slightly higher annual increases than the previous option but, as with Option 3, allows for a gradual realignment over a longer period. This offers a longer-term solution to bring the levy back into balance if pension schemes would prefer a longer notice period in advance of the first increase.

‘Band 1’ schemes - schemes with 2 to 11 members

48. In addition to the options above, we are proposing the following one-off increase to the annual levy contribution paid by schemes that have between 2 and 11 members as these have remained unchanged since 2000:

- for occupational pension schemes, from the current £29 pa to £75 pa per scheme

- for personal pension schemes, from the current £12 pa to £30 pa per scheme

Impact

49. As part of the selection of the preferred option, the government will consider the impact on employers, pension schemes and members.

50. We estimate that if levy rates were to remain unchanged, there would be a deficit of around £540 million at the end of 2029 to 2030. All options aim to recover the current accrued deficit and meet forecast expenditure, but differ in the timescales in which these objectives are met (some of which extend slightly beyond 2029 to 2030). For option 1, increases from 1 April 2021 would be informed by further consultation with industry.

51. The table below sets out our estimate of the additional aggregate impact of the increase in levy rates under each of the options. This includes impacts to both public and private sector schemes. The impacts for Options 2 to 4 are for the next 10 years (2020 to 2021 to 2029 to 2030). For Option 1 it covers 2020 to 2021 only.

52. The aggregate impact has been calculated by comparing each option to current levy rates.

Additional levy revenue by scheme type

| Option | Covers period to end of: | DB including Hybrid (£m) | Occupational DC (£m) | Personal/Stakeholder (£m) | Total |

|---|---|---|---|---|---|

| Option 1 | 2020 to 2021 | 2.6 | 1.3 | 0.7 | 4.6 |

| Option 2 | 2029 to 2030 | 278.7 | 182.1 | 82.3 | 543.1 |

| Option 3 | 2029 to 2030 | 268.5 | 188.5 | 80.7 | 537.6 |

| Option 4 | 2029 to 2030 | 267.2 | 190.5 | 80.6 | 538.3 |

53. For additional context the levy received was £43.5 million in 2018 to 2019.

54. The government is interested in understanding more about how pension schemes may absorb these costs or whether they may choose to pass on these costs to members of their scheme or to employers who enrol their employees into the scheme.

55. Responses on this issue should be included when answering questions 5 and 6 in paragraph 56.

Consultation questions

56. With regard to the 4 options set out above and changes to the rates for ‘Band 1’ schemes:

Question 1

Which option do you prefer?

Question 2

In respect of your answer to Question 1, why do you support your preferred option?

Question 3

Would you like to propose any alternative option(s) to those set out in this consultation which would eliminate the levy deficit? If so, please provide details.

Question 4

Do you agree/disagree that we should increase the fixed levy contribution for small schemes with 2 to 11 members? Please give your reasons.

Question 5

What is the impact to your scheme of raising the levy? How will your scheme respond to a levy increase? (For example: would it be absorbed by scheme, passed on to members, or employers?)

Question 6

If you were to consider passing on costs to employers to absorb the levy increase, what is the size composition of employers using your scheme? (For example: are they mainly small, with less than 50 employees or larger employers?)

Forward look

57. This consultation covers options for changes to the levy as it is currently structured.

58. The government will aim to introduce changes to the levy rates following this consultation exercise. Once consultation responses have been evaluated the government will invite interested parties to attend roundtables and/or join an industry working group. If subsequent proposals are developed that would result in further changes in the levy rates, the government will consult afresh.

59. The government is also open to hearing about the industry’s wider views on the structure of the levy for the longer term at this stage, albeit noting that these views will not formally form part of this consultation which is to address the immediate requirement to adjust the levy to meet the funding requirements of the bodies it supports.

-

Source: DWP internal modelling. This is based on a number of assumptions around membership growth and therefore is subject to change. ↩

-

Source: DWP ↩

-

Source: DWP internal analysis ↩

-

Source: DWP internal analysis, rounded to the nearest £0.1 million. The expenditure figures presented here are in nominal terms. All expenditure forecasts in this document take account of inflation. ↩