Membership

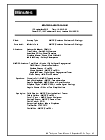

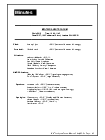

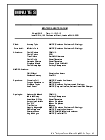

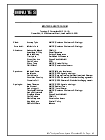

| Roles of HMRC members (names have been removed as this group is now closed - role-holders change and this page is not being updated) |

| Director, Indirect Tax |

| Deputy Director, Strategy for Business & Agents |

| Local Compliance (Mid-size Business) |

| Counter Avoidance |

| Deputy Director, Large Business |

| Deputy Director, Specialist Personal Tax |

| Deputy Director, Tax Administration Policy |

| Head of Agent Strategy |

| Head of Digital Agent Engagement |

| Organisation (names have been removed as this group is now closed and this page is not being updated) |

| BDO |

| Moore Stephens |

| RSM |

| Grant Thornton |

| Saffery Champness |

| Smith & Williamson |

| Mazars |

| Crowe Clark Whitehill |

Terms of reference

- Purpose

“Tax advisors play a vital role in all tax systems, helping their clients understand and comply with tax obligations” (OECD Study into the Role of Tax Intermediaries (2008)).

1.1. HMRC has a public commitment to consult with its customers on all major policy and operational issues, and to put the customer at the heart of everything it does. A core element of HMRC’s Customer- Centric Business Strategy is to improve customer experience.

1.2. Tax advisors play a vital role in the UK tax system. Mid-tier accountancy firms act on behalf of a significant proportion of taxpayers with complex affairs. HMRC is therefore looking to develop continually improving relationships with these advisors and to offer improved engagement opportunities.

1.3. The MTAF will foster a stronger relationship and greater understanding between HMRC and mid-tier agents.

1.4. The MTAF will sit alongside existing links between HMRC, its customers and representative bodies and will provide a direct channel between the operational and policy arms of HMRC and mid-tier tax advisors. It will offer a mechanism for those agents:

- to debate issues in an atmosphere of mutual trust

- to engage about administration of the tax system and implementation

of tax policy

- to improve the service provided by HMRC to customers

- to consult on proposed changes affecting customers

- to discuss operational aspects of the tax system with HMRC amongst

other initiatives

1.5. The forum will help the operational and tax policy arms of HMRC dealing with taxpayers with complex affairs to:

- understand the commercial environment better

- be more strongly aware of the interests of taxpayers and their agents

- draw on the knowledge and skills of subject matter experts

Framework

2.1. The private sector members of the MTAF will include the Heads of Tax or the Heads of Tax Policy of the mid-tier accountancy firms: those firms with more than £50 million in UK fee income, of which more than £10 million comes from tax work. To ensure continuity, appropriate challenge and that the agent community is properly represented, the forum will periodically consider updating its membership.

2.2. The MTAF will be chaired by a senior official of HMRC, the choice of chair will depend on the nature of the agenda. In the longer term, if members of the MTAF believe it would be of value, the forum will move to joint chairing by HMRC and private sector representatives.

2.3 Other HMRC attendees may include the directors from the business directorates dealing with taxpayers with complex affairs (Large Business (LB), Corporation Tax, International and Stamps (CTIS), Business Customer & Strategy (BC&S), VAT, Customs, Specialist Personal Tax and Specialist Investigations (SI). Other parties (including, but not restricted to the Treasury, BIS (Department for Business Innovation and Skills), other HMRC Directors, and other business representatives) may be invited to attend on an ‘as needed’ basis.

2.4. Secretariat support for the MTAF will be provided by HMRC with the secretariat shown as a point of contact on the HMRC website.

2.5. Agendas and related papers will be sent five working days in advance of meetings and members will be invited and encouraged to contribute between meetings.

2.6. Agendas and minutes will be posted on the HMRC website. Minutes of each meeting of the MTAF will be published on the HMRC website not later than 30 working days after each meeting.

2.7. The MTAF’s discussions will inform HMRC’s other lines of engagement with agents serving taxpayers with complex affairs. Issues will be progressed within three months of being raised, with exceptions being fully reported at the next MTAF meeting.

Review

3.1. These Terms of Reference will be reviewed by 30 June 2017.

Ministerial approval

4.1. Notwithstanding the above, actions falling to HMRC may be subject to Ministerial approval.

Meeting minutes

Meetings are held quarterly.

PDF, 235KB, 5 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a

version of this document in a more accessible format, please email

jeremy.tyler@hmrc.gsi.gov.uk.

Please tell us what format you need. It will help us if you say what assistive technology you use.

PDF, 227KB, 5 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a

version of this document in a more accessible format, please email

jeremy.tyler@hmrc.gsi.gov.uk.

Please tell us what format you need. It will help us if you say what assistive technology you use.

PDF, 102KB, 5 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a

version of this document in a more accessible format, please email

jeremy.tyler@hmrc.gsi.gov.uk.

Please tell us what format you need. It will help us if you say what assistive technology you use.

PDF, 116KB, 5 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a

version of this document in a more accessible format, please email

jeremy.tyler@hmrc.gsi.gov.uk.

Please tell us what format you need. It will help us if you say what assistive technology you use.

PDF, 100KB, 6 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a

version of this document in a more accessible format, please email

jeremy.tyler@hmrc.gsi.gov.uk.

Please tell us what format you need. It will help us if you say what assistive technology you use.

PDF, 246KB, 5 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a

version of this document in a more accessible format, please email

jeremy.tyler@hmrc.gsi.gov.uk.

Please tell us what format you need. It will help us if you say what assistive technology you use.

PDF, 252KB, 4 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a

version of this document in a more accessible format, please email

jeremy.tyler@hmrc.gsi.gov.uk.

Please tell us what format you need. It will help us if you say what assistive technology you use.

PDF, 293KB, 5 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a

version of this document in a more accessible format, please email

jeremy.tyler@hmrc.gsi.gov.uk.

Please tell us what format you need. It will help us if you say what assistive technology you use.

PDF, 192KB, 6 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a

version of this document in a more accessible format, please email

jeremy.tyler@hmrc.gsi.gov.uk.

Please tell us what format you need. It will help us if you say what assistive technology you use.

PDF, 302KB, 6 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a

version of this document in a more accessible format, please email

jeremy.tyler@hmrc.gsi.gov.uk.

Please tell us what format you need. It will help us if you say what assistive technology you use.

PDF, 200KB, 6 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a

version of this document in a more accessible format, please email

jeremy.tyler@hmrc.gsi.gov.uk.

Please tell us what format you need. It will help us if you say what assistive technology you use.

PDF, 161KB, 4 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a

version of this document in a more accessible format, please email

jeremy.tyler@hmrc.gsi.gov.uk.

Please tell us what format you need. It will help us if you say what assistive technology you use.

PDF, 38KB, 5 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a

version of this document in a more accessible format, please email

jeremy.tyler@hmrc.gsi.gov.uk.

Please tell us what format you need. It will help us if you say what assistive technology you use.

PDF, 33.2KB, 6 pages

This file may not be suitable for users of assistive technology.

Request an accessible format.

If you use assistive technology (such as a screen reader) and need a

version of this document in a more accessible format, please email

jeremy.tyler@hmrc.gsi.gov.uk.

Please tell us what format you need. It will help us if you say what assistive technology you use.

Please see the National Archives website for previous minutes.