Millions of parents to get help with childcare costs

New Tax-Free Childcare scheme to be increased up to £2,000 per child and extended to all children under 12 within the first year.

David Cameron and Nick Clegg on a childcare visit

A major new childcare package to help millions of parents will be unveiled by the Prime Minister and Deputy Prime Minister today (Tuesday 18 March).

The measures will help parents to go out to work if they want to and provide more security for their families, while directing extra support to those children from disadvantaged backgrounds.

The package includes:

Tax-Free Childcare for almost 2 million families

The scheme will be introduced far more quickly than previously announced so that all working parents with children under 12 will be covered within the first year from autumn 2015. This is significantly faster than initially proposed, where children under 12 would have gradually qualified for the scheme over a 7-year period.

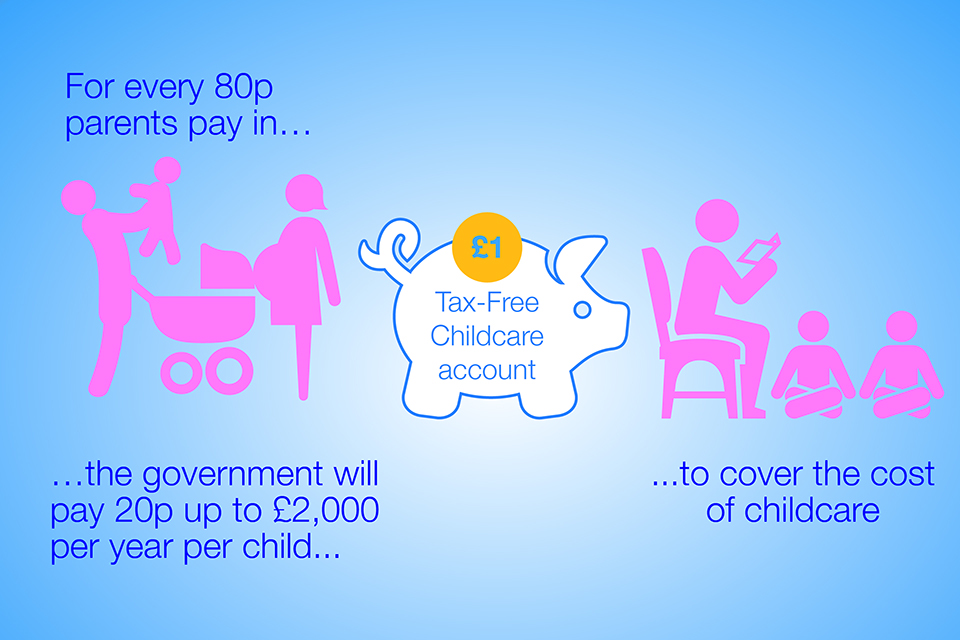

The government will provide 20% support on childcare costs up to £10,000 per year for each child via a new simple online system. The limit had previously been set at £6,000. This now means support of up to £2,000 per child per year.

Tax-Free Childcare will be open to more than twice as many families as currently use Employer Supported Childcare (ESC) vouchers and, unlike ESC, will not depend on employers offering it. In addition to giving support to the self-employed, the scheme has been adjusted to ensure those working part-time, earning £50 per week and above, those on maternity, paternity or adoption leave and those starting their own business who may not meet the minimum earning requirement will be included, giving them government help with childcare costs for the first time.

If you’re a parent and want to find out more about the new Tax-Free Childcare scheme, here’s 10 things you should know

David Cameron and Nick Clegg on a childcare visit

More help for disadvantaged 3 and 4 year olds

A new Early Years Pupil Premium will be introduced to help ensure children get the best possible start in life. £50 million will be invested in 2015 to 2016 giving early years providers more support to help those from the most disadvantaged backgrounds. This will help providers employ more highly qualified staff, for example, or to increase access to services such as speech and language specialists.

85% of childcare costs to be met under Universal Credit

To help more families move off of benefits and into employment, the government intends to increase the rate of childcare support in Universal Credit from 70% to 85%, so that 500,000 households get more out of the money they earn, making sure work pays.

Prime Minister David Cameron said:

Tax free childcare is an important part of our long-term economic plan. It will help millions of hard-pressed families with their childcare costs and provide financial security for the future.

Deputy Prime Minister, Nick Clegg said:

All children deserve the best start in life. As, together, we build a stronger economy for Britain, I’m committed to making sure that we create a fairer society too.

Today’s package of support will provide a childcare boost for millions of hardworking families, and a £50 million cash injection for early education providers to support those children who need extra help in their early years. We want to ensure that everyone can get on and succeed.

Further information

Tax-Free Childcare

The scheme will open in autumn 2015 and be available to around 1.9 million working families with children under 12 by the end of its first year of operation. The government’s consultation had originally proposed that eligibility for the scheme would build up more gradually and that it would take 7 years for all children under 12 to be eligible to receive support.

How Tax-Free Childcare will work

New online Tax-Free Childcare accounts will be run by HM Revenue & Customs (HMRC), in partnership with National Savings & Investments (NS&I). The accounts will make it easier for parents and providers, involve no fees and give parents security over their money, allowing them to build up credit for use when they need it most, for example during school holidays.

The scheme will also benefit childcare providers, who will be able to receive each child’s payment from a single account under Tax-Free Childcare, rather than keep track of multiple payments relating to a single child from different bank and voucher accounts.

For the first time, self-employed parents and those working for the vast majority of employers who do not offer the existing ESC scheme will be able to access the scheme. It will also be available to those working part time due to the low minimum earning threshold of £50 per week.

The rules will also be tailored to support entrepreneurs and those self-employed who do not at first meet the minimum earnings requirement to be eligible for the scheme in their first year.

All working families where the parents earn at least £50 per week will have access to government support with childcare costs, unless one of the parents earns over £150,000 or receives support from tax credits, Universal Credit or ESC.

Parents currently receiving childcare vouchers through ESC can continue to benefit from the scheme with their current employer should they wish to do so, but it will be closed to new entrants from autumn 2015. Workplace nurseries will be unaffected.

The changes follow the government’s consultation with parents, childcare providers, employers and other interested groups on the scheme’s implementation, the response to which has been published today.

Early Years Pupil Premium

The government has already prioritised investing in early education and childcare, in particular for the most disadvantaged families, by increasing the free entitlement from 12.5 to 15 hours a week of free early education and childcare for all 3 and 4 year olds; and extending this from September to the most disadvantaged 40% of 2 year olds.

The Early Years Pupil Premium will provide nurseries, schools and other providers of government funded early education with extra money for disadvantaged 3 and 4 year olds.

This will give our most disadvantaged children better access to early education and improve the quality of provision, which evidence shows can have a major impact on their school readiness. The Early Years Pupil Premium will be £50 million in 2015 to 2016 and the Department for Education will consult on the details of the programme shortly.

Universal Credit

Helping families move off benefits and into work is an important priority for the government and is central to Universal Credit, to help ensure it always pays to work.

Last year we consulted on a proposal to increase the rate of childcare support under Universal Credit for taxpayers. Today, the government announces that all families in Universal Credit will be able to receive 85% support on childcare costs, up from 70%.

This change will see 300,000 more working families getting more out of the money they earn, on top of the 200,000 taxpaying households already benefitting. More and more families will find that it pays to get a job, from taking the first few shifts back at work, right up to working full-time.

In line with the principles of the welfare cap, offsetting savings to fund this expansion will be found from within the Universal Credit programme. Further details will be set out at Autumn Statement.

Sign up for regular email updates from the Prime Minister’s Office.