More than 33,600 tax credits customers use HMRC app to renew

HMRC is encouraging more customers to use the highly-rated app as it is a quick and easy way to get tax credits renewals done ahead of the 31 July deadline.

More than 33,600 customers have successfully used the HMRC app to renew their tax credits claim so far this year, a 39% increase on last year, HM Revenue and Customs (HMRC) has revealed.

Tax credits help working families with targeted financial support, so it is important customers act now to renew before the quickly approaching 31 July deadline to ensure their payments don’t stop.

HMRC is encouraging more customers to use the highly-rated app as it is a quick and easy way to get this vital job done.

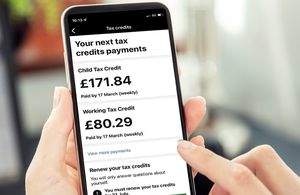

It is free and simple to use and allows direct access to tax credits at the touch of a button. There are many benefits of the fully secure app, which can be used on any smartphone or tablet, at any time, eliminating the need to call HMRC and helping customers to save time and money.

Customers using the HMRC app can:

- renew their tax credits

- make changes to their claim

- check their tax credits payments schedule, and

- find out how much they have earned for the year

There are nearly 259,000 tax credits app users, who have used the app more than 10 million times in the last year to do things like check their payment dates and amount.

Myrtle Lloyd, HMRC’s Director General for Customer Services, said:

Time is running out for our tax credits customers to renew their claims. It’s quick, easy and free to complete a renewal on the HMRC app – search ‘HMRC’ in your smartphone app store.

Customers can download the app at the App Store or Google Play. Online reviews at both indicate plenty of satisfaction with the app’s performance, as it currently holds a score of 4.5 stars on the App Store, and 4.7 on Google Play.

HMRC has released a video to explain how tax credits customers can use the HMRC app to view, manage and update their details.

Once signed into the app after initial download, there are options for users to set up and select facial recognition, a fingerprint or a 6-digit pin to get fast and fully secure access to their details.

Customers can also renew their tax credits and manage their claims online on GOV.UK. Customers can log into GOV.UK to check on the progress of their renewal, be reassured it’s being processed and know when they’ll hear back from HMRC.

The UK Government has recently announced a Cost of Living Payment of £650, payable in two separate lump sums of £326 and £324, for households receiving certain benefits or tax credits, to help with the cost of living. If receiving tax credits only, they are eligible for each payment. HMRC will contact them and issue payments automatically, with the first being made by the autumn. Customers do not need to contact HMRC or apply for the payment.

More information on the Cost of Living Payment, including eligibility, is available on GOV.UK.

Tax credits are ending and will be replaced by Universal Credit by the end of 2024. Many customers who move from tax credits to Universal Credit could be financially better off and can use an independent benefits calculator to check. If customers choose to apply sooner, it is important to get independent advice beforehand as they will not be able to go back to tax credits or any other benefits that Universal Credit replaces.

As the deadline for renewals approaches, customers hurrying to sort out their accounts could be more vulnerable to scammers. HMRC is warning people that if someone contacts them saying that they are from HMRC and wants the customer to transfer money urgently or give personal information, they should never let themselves be rushed. HMRC is also urging customers never to share their HMRC login details. Someone using them could steal from the customer or make a fraudulent claim in their name. The department urges people to take their time and check HMRC’s advice about scams on GOV.UK.

Further Information

Find out more about renewing tax credits claims.

Customers can download the HMRC app for free from their smartphone app store.

Find out more about Universal Credit replacing tax credits.

To sign into our tax credits service for the first time you’ll need to prove your identity using 2 evidence sources. We’ve recently added GB driving licences as an additional option to help more of our customers get online. You can find the full list of accepted forms of ID at Manage your tax credits.