New data shows regional and sectoral benefit of tax cut for businesses

Analysis shows businesses that will be taken out of paying employer National Insurance Contributions.

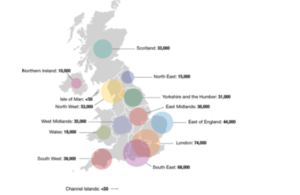

New data released today, 4 November 2013, will show for the first time an analytical breakdown of how the government’s new Employment Allowance will benefit the UK’s regions and trade sectors.

A tax cut worth up to two thousand pounds for every business and charity in the UK, the NICs Employment Allowance will see them benefit from a reduction in their employer National Insurance Contributions (NICs) bill – the tax that an employer pays on their employees.

Announced at Budget 2013 and taking effect from April 2014, the allowance will benefit up to 1.25 million businesses and charities in the UK.

The data published shows gives a breakdown by region and sector of the 450,000 businesses that will have their employer NICs bill completely wiped out.

Available every year, the allowance will be simple to claim and easy to administer. Businesses will just have to confirm their eligibility for the allowance through their regular payroll processes and up to £2,000 will be deducted from their employer NICs liability over the course of the year.