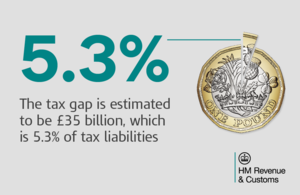

Tax gap remains low at 5.3%

The difference between the the total amount of tax expected to be paid and the total amount of tax paid for the 2019 to 2020 tax year is 5.3%.

The tax gap for the 2019 to 2020 tax year has remained low at 5.3% statistics published today by HM Revenue and Customs (HMRC) have revealed.

The annual Measuring Tax Gaps publication estimates the difference between the total amount of tax expected to be paid and the total amount of tax actually paid during the financial year. The majority of taxpayers pay the tax that is owed.

This year’s estimated tax gap at 5.3% represents £35 billion compared to 5% for the 2018 to 2019 tax year, which represents £33 billion in monetary terms.

Nearly 95% of the tax due was paid in the 2019 to 2020 tax year and HMRC has seen an increase in total revenue paid year on year. Taxpayers paid more than £633.4 billion in tax during the 2019 to 2020 tax year. This highlights how the vast majority of taxpayers are paying the correct amount of tax, which is essential to fund vital public services.

Jim Harra, HMRC’s Chief Executive and First Permanent Secretary, said:

It is encouraging to see such a large proportion of businesses and individuals meeting their tax obligations. We want to help everyone get their tax right, which will help fund our vital public services like the NHS and emergency services.

Findings from the Measuring Tax Gaps bulletin show:

- there has been a long-term reduction in the overall tax gap, falling from 7.5% in the 2005 to 2006 tax year to 5.3% in the 2019 to 2020 tax year, with the tax gap remaining low and fairly stable for the fourth year

- the total tax gap for Value Added Tax (VAT) is £12.3 billion. The statistics show there has been a long-term reduction for the VAT gap from 14.0% in the 2005 to 2006 tax year to 8.4% in the 2019 to 2020 tax year

- 43% (£15.1 billion) of the tax gap is attributed to small businesses, whereas wealthy customers and individuals account for the smallest share of the tax gap at 4% (£1.5 billion) and 7% (£2.6 billion) respectively

- the tax gap for wealthy individuals fell from £1.6 billion in the 2018 to 2019 tax year to £1.5 billion in the 2019 to 2020 tax year

- ‘failure to take reasonable care’ accounts for the largest proportion of the tax gap at 19% (£6.7 billion), whereas avoidance accounts for the smallest proportion of the tax gap at 4% (£1.5 billion)

- the Inheritance Tax gap has decreased from an estimated £425 million (7.4%) in 2018/19 to £350 million (6.3%) in the 2019 to 2020 tax year

These statistics show the tax gap for the 2019 to 2020 tax year. Any impact of the COVID-19 lockdown and economic downturn on the tax gap is likely to be first seen in the 2020 to 2021 tax year, which will be published in next year’s Measuring Tax Gaps publication.

HMRC publishes the tax gap because it believes it is important to be transparent in its work. HMRC is one of only two revenue authorities in the world that measures and publishes the tax gap, covering both direct and indirect taxes, every year. To improve transparency, HMRC has published an uncertainty rating for each component of the tax gap for the first time.

Each year, HMRC estimates the tax gap for direct and indirect taxes based on the latest available information. HMRC may revise previous years’ tax gaps as more data becomes available, in order to show the long-term trend.

Further information

The Measuring Tax Gaps 2021 edition was published today (16 September 2021).

The annual total revenue statistics.

HMRC’s tax gap estimates are official statistics produced in accordance with the Code of Practice for Statistics, which assures objectivity and integrity. Tax gap estimates are reviewed each year to reflect updated data and methodologies.

The VAT gap estimates are often revised because of both new and updated data, as well as methodological improvements. As the data changes, so do the estimates. The trend in the time series is considered a better indicator of the VAT gap rather than its year-on-year changes.