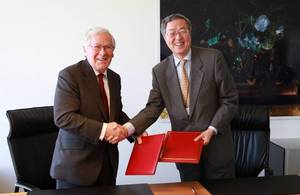

The UK and China sign Sterling/renminbi currency swap line

Governor Zhou Xiaochuan and Governor Mervyn King signed an agreement to establish a reciprocal 3 year, sterling/renminbi currency swap line.

Governor Zhou Xiaochuan and Governor Mervyn King signed an agreement to establish a reciprocal 3 year, sterling/renminbi currency swap line.

The maximum value of the swap is RMB 200 billion. The swap line may be used to promote bilateral trade between the two countries and to support domestic financial stability should market conditions warrant.

Commenting, the Governor of the Bank of England said:

It is a testament to the outstanding working relationships between the Bank of England and the People’s Bank of China (PBoC) that this swap line has now been signed. The establishment of a sterling/renminbi swap line will support UK domestic financial stability. In the unlikely event that a generalised shortage of offshore renminbi liquidity emerges, the Bank will have the capability to facilitate renminbi liquidity to eligible institutions in the UK. On behalf of the Bank, I am grateful to Governor Zhou and the staff at the PBoC, with whom it has been a pleasure to work.

Further information

This agreement follows the announcement of discussions between the Bank of England and the People’s Bank of China on 22 February 2013.

Offshore RMB, widely denoted as CNH, refers to any RMB used outside of mainland China which trades on a free-floating basis. Liquidity can move freely between a number of other offshore centres, including Hong Kong (the H in CNH), London, Singapore and Taiwan.

Further information on the City of London Corporation’s initiative to develop London as a centre of renminbi business