UK and Oman kickstart Sovereign Investment Partnership to boost investment links

The UK and Oman have signed a Sovereign Investment Partnership (SIP), agreeing to work closer together on increasing investment into both countries.

The UK and Oman have signed a Sovereign Investment Partnership (SIP), agreeing to work closer together on increasing high value investment into both countries.

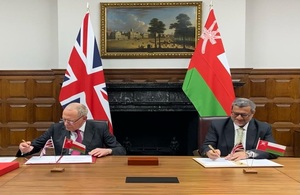

The Memorandum of Understanding between the UK’s Office for Investment (OFI) and the Oman Investment Authority (OIA) was signed in London by the UK’s Minister for Investment, Lord Gerry Grimstone, and President of the Oman Investment Authority, HE Abdulsalam Al Murshidi.

The new partnership will strengthen the economic ties between the UK and Oman and identify and support commercial investments in areas such as clean energy and technology, which are already an important part of our £1 billion-a year trading relationship.

Today’s signing follows Prime Minister Boris Johnson’s meeting with the Sultan of Oman, Haitham bin Tarik al Said, at Downing Street in December, where they discussed enhancing the bilateral relationship between the UK and Oman.

UK Minister for Investment Lord Grimstone said:

Oman is a long-standing and strategic partner in the Middle East and I am pleased that the UK is further deepening our investment relationship.

Our two countries share a vision for a sustainable and prosperous future. This Sovereign Investment Partnership ensures our respective private sectors and international investors are part of that journey.

Foreign Minister of Oman Sayyid Badr Albusaidi said:

The signing of the MOU is in line with the aspirations of both Oman and the UK as set in the Comprehensive Agreement on Enduring Friendship and Bilateral Cooperation.

We truly believe that by focusing our efforts on strategic joint investments, we will be able to reach further fruitful and tangible outcomes, in support of our mutual desire to continue developing a dynamic and stronger partnership.

President of Oman Investment Authority H.E Abdulsalam Al Murshidi said:

This partnership is a perfect embodiment of OIA’s mandate under Vision Oman 2040, especially for financial sustainability and attracting foreign investors who consider OIA their partner in potential investment

UK companies have a long history of investment in Oman, with Foreign Direct Investments from the UK accounting for nearly 50% of the foreign investment into Oman in recent years. (1)

As a sign of this growing partnership, UK waste-to-energy pioneer Green Fuels has formed Wakud, a joint venture with an Omani consortium which has invested over $2 million into its Oman-based operations since breaking ground in 2021.

Wakud’s first biorefinery at Khazaen Economic City in Oman can process up to 20 tonnes of used cooking oil per day which is collected from restaurants and food processing establishments and made into European standard biodiesel for local consumption and for export to the UK and EU. Later this year, the plant is set to become the first solar-powered biodiesel plant in the world. Wakud has already created new jobs in Oman and the company has plans to expand operations into the wider GCC region in 2022.

It comes as the UK and the Gulf Cooperation Council, of which Oman is a member, prepare to formally launch talks over a new Free Trade Agreement. Negotiations are expected to commence this year, with a future deal set to boost links in areas like investment and services.

The signing of the MoU today coincided with a meeting of the UK-Oman Strategic Advisory Group, chaired by Minister for Investment Gerry Grimstone.

Further information

- The UK businesses invested 7.9 billion Omani Rials of FDI stock in Oman. This was is equal to 49.6% of Omani FDI capital expenditure stock in 2020Q4. Source: Omani National Centre for Statistics and Information: Foreign Investment. (1)

- The UK and Oman shared a trading relationship worth nearly £979 million in the four quarters to the end of Q2 2021.