UK House Price Index for December 2017

The UK House Price Index (UK HPI) shows house price changes for England, Scotland, Wales and Northern Ireland.

The December data shows:

- on average, house prices have risen by 0.4% since November 2017

- an annual price rise of 5.2%, which takes the average property in the UK valued at £226,756

England

The data for England shows:

- house prices have risen by 0.4% since November 2017

- an annual price rise of 5% takes the average property value to £243,582

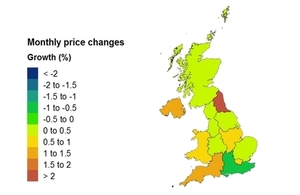

The regional data for England indicates that:

- the South West experienced the greatest rise in average property price over the last 12 months, up by 7.5%

- the North East experienced the greatest monthly price rise, up by 2.7%

- London saw the lowest annual price rise, up by 2.5%

- the South East saw the most significant monthly price fall, down by 0.5%

Price change by region for England

| Region | Average price December 2017 | Annual change % since December 2016 | Monthly change % since November 2017 |

|---|---|---|---|

| East Midlands | £185,694 | 6.3 | 0.6 |

| East of England | £290,341 | 5.2 | 0.2 |

| London | £484,173 | 2.5 | 0.8 |

| North East | £130,838 | 3.6 | 2.7 |

| North West | £158,370 | 5.9 | 0.2 |

| South East | £322,269 | 4.2 | -0.5 |

| South West | £254,081 | 7.5 | 1.0 |

| West Midlands | £191,050 | 6.3 | 0.1 |

| Yorkshire and the Humber | £156,781 | 2.8 | 0.2 |

Repossession sales by volume for England

The lowest number of repossession sales in October 2017 was in the East of England.

| Repossession sales | October 2017 |

|---|---|

| East Midlands | 48 |

| East of England | 17 |

| London | 40 |

| North East | 96 |

| North West | 140 |

| South East | 52 |

| South West | 35 |

| West Midlands | 57 |

| Yorkshire and the Humber | 101 |

| England | 586 |

Average price by property type for England

| Property type | December 2017 | December 2016 | Difference % |

|---|---|---|---|

| Detached | £364,919 | £349,408 | 4.4 |

| Semi-detached | £226,034 | £213,878 | 5.7 |

| Terraced | £196,410 | £186,867 | 5.1 |

| Flat/maisonette | £230,408 | £220,018 | 4.7 |

| All | £243,582 | £231,922 | 5.0 |

Funding and buyer status for England

| Transaction type | Average price December 2017 | Annual price change % since December 2016 | Monthly price change % since November 2017 |

|---|---|---|---|

| Cash | £229,209 | 5.0 | 0.4 |

| Mortgage | £250,824 | 5.0 | 0.4 |

| First-time buyer | £204,597 | 4.8 | 0.3 |

| Former owner occupier | £276,183 | 5.2 | 0.4 |

Building status for England

| Building status* | Average price October 2017 | Annual price change % since October 2016 | Monthly price change % since September 2017 |

|---|---|---|---|

| New build | £321,335 | 14.1 | 2.1 |

| Existing resold property | £238,634 | 5.4 | 0.1 |

*Figures for the two most recent months are not being published because there are not enough new build transactions to give a meaningful result.

Sales volumes for England

The most up-to-date HM Land Registry sales figures available for England show the number of completed house sales in October 2017 fell by 10.2% to 63,603 compared with 70,825 in October 2016.

| Month | Sales 2017 | Sales 2016 | Difference % |

|---|---|---|---|

| September | 67,983 | 76,114 | -10.7 |

| October | 63,603 | 70,825 | -10.2 |

London

The data for London shows:

- house prices have risen by 0.8% since November 2017

- an annual price rise of 2.5% takes the average property value to £484,173

Average price by property type for London

| Property type | December 2017 | December 2016 | Difference % |

|---|---|---|---|

| Detached | £896,260 | £887,005 | 1.0 |

| Semi-detached | £579,622 | £562,272 | 3.1 |

| Terraced | £497,236 | £483,479 | 2.8 |

| Flat/maisonette | £429,543 | £419,937 | 2.3 |

| All | £484,173 | £472,374 | 2.5 |

Funding and buyer status for London

| Transaction type | Average price December 2017 | Annual price change % since December 2016 | Monthly price change % since November 2017 |

|---|---|---|---|

| Cash | £508,917 | 1.8 | 0.6 |

| Mortgage | £476,480 | 2.7 | 0.8 |

| First-time buyer | £423,129 | 2.2 | 0.6 |

| Former owner occupier | £546,842 | 2.8 | 1.0 |

Building status for London

| Building status* | Average price October 2017 | Annual price change % since October 2016 | Monthly price change % since September 2017 |

|---|---|---|---|

| New build | £538,497 | 11.4 | 2.2 |

| Existing resold property | £481,656 | 2.5 | -0.4 |

*Figures for the two most recent months are not being published because there are not enough new build transactions to give a meaningful result.

Sales volumes for London

The most up-to-date HM Land Registry sales figures available for London show the number of completed house sales in October 2017 fell by 22.7% to 6,264 compared with 8,100 in October 2016.

| Month | Sales 2017 | Sales 2016 | Difference % |

|---|---|---|---|

| September | 6,991 | 8,275 | -15.5 |

| October | 6,264 | 8,100 | -22.7 |

Wales

The data for Wales shows:

- house prices have risen by 1% since November 2017

- an annual price rise of 5.4% takes the average property value to £154,398

Average price by property type for Wales

| Property type | December 2017 | December 2016 | Difference % |

|---|---|---|---|

| Detached | £231,947 | £221,813 | 4.6 |

| Semi-detached | £148,968 | £140,572 | 6.0 |

| Terraced | £119,490 | £113,104 | 5.6 |

| Flat/maisonette | £111,811 | £105,614 | 5.9 |

| All | £154,398 | £146,442 | 5.4 |

Funding and buyer status for Wales

| Transaction type | Average price December 2017 | Annual price change % since December 2016 | Monthly price change % since November 2017 |

|---|---|---|---|

| Cash | £150,562 | 5.4 | 1.0 |

| Mortgage | £156,678 | 5.5 | 1.0 |

| First-time buyer | £133,522 | 5.4 | 1.1 |

| Former owner occupier | £178,701 | 5.4 | 0.9 |

Building status for Wales

| Building status* | Average price October 2017 | Annual price change % since October 2016 | Monthly price change % since September 2017 |

|---|---|---|---|

| New build | £217,588 | 14.6 | 2.9 |

| Existing resold property | £151,322 | 5.0 | 1.1 |

*Figures for the two most recent months are not being published because there are not enough new build transactions to give a meaningful result.

Sales volumes for Wales

The most up-to-date HM Land Registry sales figures available for Wales show:

- the number of completed house sales in October 2017 fell by 3.8% to 3,805 compared with 3,957 in October 2016

- there were 64 repossession sales in October 2017

| Month | Sales 2017 | Sales 2016 | Difference % |

|---|---|---|---|

| September | 3,933 | 4,054 | -3.0 |

| October | 3,805 | 3,957 | -3.8 |

UK house prices grew by 5.2% in the year to December 2017, up from 5.0% in the year to November 2017.

The UK Property Transaction Statistics for December 2017 showed that the number of seasonally adjusted transactions on residential properties with a value of £40,000 or greater has decreased by 0.1% in the year to December 2017. Between November 2017 and December 2017, transactions decreased by 3.9%.

Looking at English regions, the largest annual price growth was recorded in the South West at 7.5%, up from 6.1% in the previous month. It was followed by the East and West Midlands, both growing at 6.3%. At 2.5%, London showed the slowest annual growth of all UK regions, though this is up from 2.0% in the previous month. This is the 13th consecutive month where the annual growth in London has remained below the UK average.

See the economic statement.

Notes to editors

-

The UK House Price Index (HPI) is currently published on the second or third Tuesday of each month with Northern Ireland figures updated quarterly. The January 2018 UK HPI will be published at 9.30am on 20 March 2018. See calendar of release dates.

-

From April 2018, publication of these figures will move from Tuesday to Wednesday; the new release dates are available.

-

We have made some changes to improve the accuracy of the UK HPI. We are not publishing average price and percentage change for new builds and existing resold property as done previously because there are not currently enough new build transactions to provide a reliable result. This means that in this month’s UK HPI reports, new builds and existing resold property are reported in line with the sales volumes currently available.

-

The UK HPI revision period has been extended to 13 months, following a review of the revision policy. This ensures the data used is more comprehensive.

-

Sales volume data is also available by property status (new build and existing property) and funding status (cash and mortgage) in our downloadable data tables. Transactions involving the creation of a new register, such as new builds, are more complex and require more time to process. Read revisions to the UK HPI data.

-

Revision tables have been introduced for England and Wales within the downloadable data. Tables will be available in csv format. See about the UK HPI for more information.

-

Data for the UK HPI is provided by HM Land Registry, Registers of Scotland, Land & Property Services/Northern Ireland Statistics and Research Agency and the Valuation Office Agency.

-

The UK HPI is calculated by the Office for National Statistics (ONS) and Land & Property Services/Northern Ireland Statistics and Research Agency. It applies a hedonic regression model that uses the various sources of data on property price, in particular, HM Land Registry’s Price Paid Dataset, and attributes to produce estimates of the change in house prices each month. Find out more about the methodology used from the ONS and Northern Ireland Statistics & Research Agency.

-

The UK Property Transaction statistics are taken from HM Revenue and Customs (HMRC) monthly estimates of the number of residential and non-residential property transactions in the UK and its constituent countries. The number of property transactions in the UK is highly seasonal, with more activity in the summer months and less in the winter. This regular annual pattern can sometimes mask the underlying movements and trends in the data series so HMRC also presents the UK aggregate transaction figures on a seasonally adjusted basis. Adjustments are made for both the time of year and the construction of the calendar, including corrections for the position of Easter and the number of trading days in a particular month.

-

UK HPI seasonally adjusted series are calculated at regional and national levels only. See data tables.

-

The first estimate for new build average price (April 2016 report) was based on a small sample which can cause volatility. A three-month moving average has been applied to the latest estimate to remove some of this volatility.

-

Work has been taking place since 2014 to develop a single, official HPI that reflects the final transaction price for sales of residential property in the UK. Using the geometric mean, it covers purchases at market value for owner-occupation and buy-to-let, excluding those purchases not at market value (such as re-mortgages), where the ‘price’ represents a valuation.

-

Information on residential property transactions for England and Wales, collected as part of the official registration process, is provided by HM Land Registry for properties that are sold for full market value.

-

The HM Land Registry dataset contains the sale price of the property, the date when the sale was completed, full address details, the type of property (detached, semi-detached, terraced or flat), if it is a newly built property or an established residential building and a variable to indicate if the property has been purchased as a financed transaction (using a mortgage) or as a non-financed transaction (cash purchase).

-

Repossession sales data is based on the number of transactions lodged with HM Land Registry by lenders exercising their power of sale.

-

For England, this is shown as volumes of repossession sales recorded by Government Office Region. For Wales, there is a headline figure for the number of repossession sales recorded in Wales.

-

The data can be downloaded as a .csv file. Repossession sales data prior to April 2016 is not available. Find out more information about repossession sales.

-

Background tables of the raw and cleansed aggregated data, in Excel and csv formats, are also published monthly although Northern Ireland is on a quarterly basis. They are available for free use and re-use under the Open Government Licence.

-

HM Land Registry’s mission is to guarantee and protect property rights in England and Wales.

-

HM Land Registry is a government department created in 1862. It operates as an executive agency and a trading fund and its running costs are covered by the fees paid by the users of its services. Its ambition is to become the world’s leading land registry for speed, simplicity and an open approach to data.

-

HM Land Registry safeguards land and property ownership worth in excess of £4 trillion, including around £1 trillion of mortgages. The Land Register contains more than 25 million titles showing evidence of ownership for some 85% of the land mass of England and Wales.

-

For further information about HM Land Registry visit www.gov.uk/land-registry.

-

Follow us on: Twitter @HMLandRegistry, our blog, LinkedIn and Facebook.

Contact

Press Office

Trafalgar House

1 Bedford Park

Croydon

CR0 2AQ

Email HMLRPressOffice@landregistry.gov.uk

Phone (Monday to Friday 8:30am to 5:30pm) 0300 006 3365

Mobile (5:30pm to 8:30am weekdays, all weekend and public holidays) 07864 689 344