Autumn Budget and Spending Review 2021 (HTML)

Updated 21 February 2023

Executive summary

Autumn Budget and Spending Review 2021 takes place as the country focuses on recovering from a period of unparalleled global economic uncertainty and challenge to move towards a more promising future. The successful vaccination programme and the government’s economic plan have led to faster than anticipated growth, and a strong recovery in employment across the country.

With the economic recovery underway and emergency support winding down, the Budget and SR sets out the government’s plans to build back better over the rest of the Parliament. It does so by investing in strong public services, driving economic growth, leading the transition to net zero, and supporting people and businesses.

At the heart of these plans is the government’s ambition to level up, reducing regional inequality so that no matter where in the UK someone lives, they can reach their full potential, find rewarding work and take pride in their local area.

Spending Review 2021 (SR21) sets departmental budgets up to 2024-25. Every department’s overall spending will increase in real terms as a result of SR21, and over this Parliament,[footnote 1] allowing for the additional provision that the government has set aside to take Official Development Assistance (ODA) to 0.7% of Gross National Income (GNI) in 2024-25. Total departmental spending is set to grow in real terms at 3.8% a year on average over this Parliament – a cash increase of £150 billion a year by 2024-25 (£90 billion in real terms). This is the largest real-terms increase in overall departmental spending for any Parliament this century. This includes taking forward plans to deliver over £600 billion of public sector gross investment over this Parliament.

Taxpayers’ money will be spent where it makes the most difference to people’s daily lives: creating high-wage and high-skilled jobs, reducing NHS waiting lists, putting more police on the streets, upgrading roads and railways, and building new homes, hospitals and schools.

The pandemic has demonstrated the risk of unforeseen shocks and there remains uncertainty around the path of the virus. The government is acting responsibly and ensuring the public finances are on a sustainable path, so these risks can continue to be managed into the future. The Budget and SR announces new fiscal rules that will allow the government to continue funding first-class public services and drive economic growth through record investment, while ensuring that debt falls over the medium term.

The economic context

Thanks to the government’s vaccine programme, the pandemic support provided to families and businesses, the underlying resilience of the economy, and the Plan for Jobs, the UK economy has seen faster than anticipated growth after the largest recession on record[footnote 2].

The government took unprecedented action to support jobs, public services and businesses throughout the pandemic. Overall, this government has provided £378 billion of direct support for the economy over the last year, including the Coronavirus Job Retention Scheme, which supported 11.7 million jobs in total.[footnote 3] Government action has led to a strong recovery in the labour market across every part of the UK, and the pandemic is now expected to have a smaller long-term effect on the economy than previously anticipated. Following the transition away from emergency economic support, the Budget and SR focuses on economic recovery.

At the same time, the easing of restrictions and the rapid return of economic activity globally has led to a substantial rise in commodity and raw material prices, as demand for inputs has outpaced production. The government is taking action to help firms tackle supply chain issues and labour market shortages, including by helping people into work and helping businesses get the skills they need through the Plan for Jobs.

Alongside these global supply issues, increases in transportation and energy costs have also pushed up inflation in many advanced economies, including in the UK, and the OBR expects inflation to remain elevated across 2022 and 2023. The government is committed to price stability and the Chancellor has re-affirmed the Bank of England’s 2% consumer price inflation target at the Budget. The strong recovery in the labour market has been accompanied by rising wages, which has helped to support household living standards in the face of price rises.

The public finances

The recovery and the action taken by the government over the past year means that the public finances are stronger than expected in the OBR’s March forecast.[footnote 4] However, while the costs of inaction would have been far greater, borrowing and debt remain at historically high levels.

This additional borrowing is currently affordable, but there are significant risks associated with elevated levels of debt – including the increased sensitivity of the public finances to changes in interest rates and inflation. The fiscal impact of a one percentage point rise in interest rates in the next year would be six times greater than it was just before the financial crisis, and almost twice what it was before the pandemic.[footnote 5] Taxpayer money spent servicing debt is money which could have been invested in public services.

That is why the government has taken early action to repair the public finances. This has included taking difficult but responsible decisions to raise taxes to ensure sustainable public finances and deliver the long-term funding needed for public services.

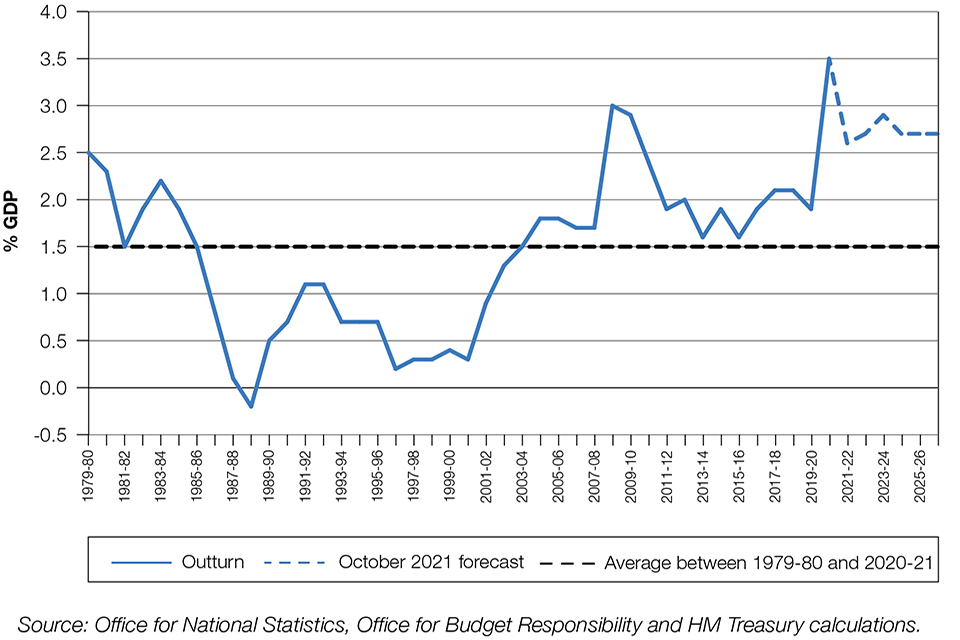

The government’s commitment to sustainable public finances over the medium term is underpinned by new fiscal rules. These ensure that the government’s spending plans are consistent with reducing debt from its historically high level. The OBR forecast confirms the fiscal mandate is met with debt as a proportion of GDP falling from 2024-25. In addition, the current budget is in surplus in 2024-25, public sector net investment averages 2.7% of GDP over the rolling forecast period, and the welfare cap is met.

To deliver the government’s priorities while meeting these fiscal rules, SR21 ensures that the government continues to spend taxpayers’ money well. Decisions have been based on how spending will contribute to the delivery of each department’s priority outcomes, underpinned by high-quality evidence. The government has also taken further action to drive out inefficiency; SR21 confirms savings of 5% against day-to-day central departmental budgets in 2024-25.

Strong and innovative public services

The Budget and SR invests in the recovery, reform and resilience of the public services that people rely on, to ensure they are fit for the future and to drive up standards across the country.

SR21 confirms the government’s historic investment in health and the NHS,[footnote 6] part-funded by the new Health and Social Care Levy. NHS England’s day-to-day budget is set to grow by 3.8% on average in real terms over the SR21 period, ensuring it can tackle the elective backlog, deliver the Long Term Plan and has the resources to fight COVID-19.

SR21 goes further to transform and improve healthcare outcomes for people, with the highest real-terms core capital budget for health since 2010.[footnote 7] This will drive a step-change in quality and efficiency of care through £2.3 billion for increased diagnostic capacity and £2.1 billion to support the innovative use of digital technology. This will help hospitals and other care organisations be as connected and efficient as possible, freeing up valuable NHS staff time and ensuring the best care for patients wherever they are. This will be supported by funding to continue building a bigger and better trained NHS workforce, and the largest ever cash uplift for health R&D, which will support the UK’s world-leading research to develop pioneering new treatments.

SR21 delivers significant support for pupils and teachers. It supports the government’s commitment to level up education with an additional £4.7 billion by 2024-25 for the core schools budget in England, over and above the Spending Round 2019 (SR19) settlement for schools in 2022-23. It also reaffirms and expands support to recover children and young people’s lost learning as a result of the pandemic, providing a new package of £1.8 billion over the SR21 period. This brings total investment specifically to support education recovery to £4.9 billion since academic year 2020/21.

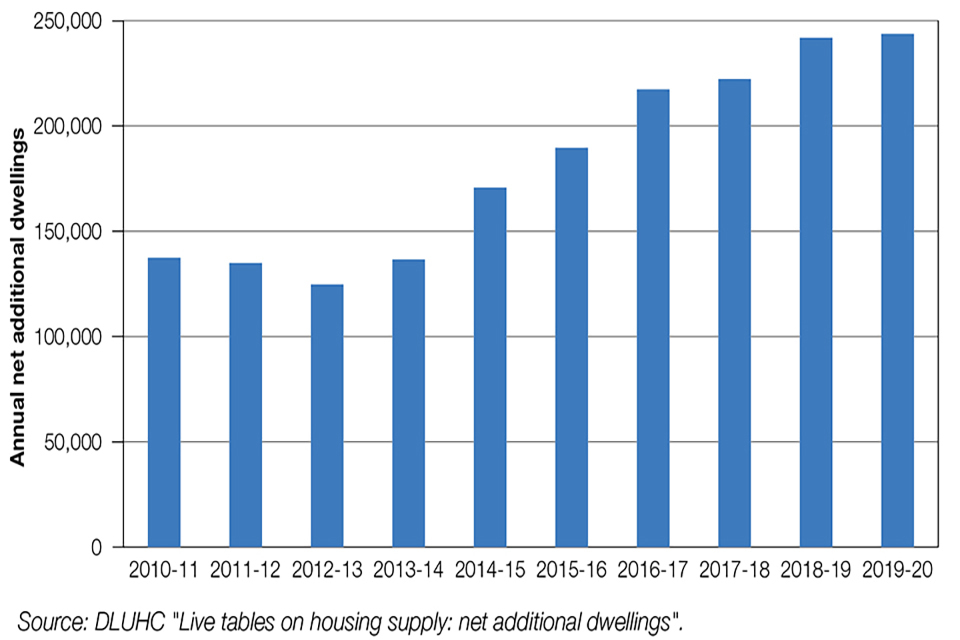

To turn Generation Rent into Generation Buy, the government is building on existing commitments by confirming a nearly £24 billion multi-year settlement for housing. This includes up to 180,000 affordable homes through investment of £11.5 billion in the Affordable Homes Programme – the largest cash investment in a decade, with 65% of funding for delivery outside London. The government is also helping people to feel safe in their homes by confirming the commitment to unprecedented grant funding of over £5 billion to remove unsafe cladding from the highest-risk buildings, supported by revenues raised from the new Residential Property Developer Tax.

The Budget and SR provides significant support for the criminal justice system. To keep local communities safe, it funds the recruitment of the final 8,000 police officers to reach the government’s commitment of recruiting 20,000 new officers by 2023. To ensure swift access to justice for victims, it provides almost £650 million additional funding by 2024-25 to manage the increased number of offenders being brought to justice by these officers; and almost £500 million over the next three years to address the courts backlog and start to reduce the waiting times caused by COVID-19.

Investing in growth

To deliver on the Prime Minister’s vision for a high-wage, high-skilled, high-productivity economy, the government is putting its Plan for Growth into action, with significant investment in innovation, infrastructure and skills.[footnote 8]

Investment in R&D and innovation will help drive economic growth and create the jobs of the future. At the Budget and SR, the government is increasing public R&D investment to record levels: £20 billion by 2024-25. This is an increase of around a quarter in real terms over the SR period, and makes significant progress towards the government’s ambition to spend £22 billion on R&D by 2026-27 and towards achieving the economy-wide target to invest 2.4% of GDP in R&D in 2027.

To help businesses access the funding they need to innovate and grow, in July the government launched the £375 million Future Fund: Breakthrough to increase the supply of growth-stage venture capital to UK-based R&D intensive companies. The government will consult on further changes to the regulatory charge cap for defined contribution pension schemes to unlock institutional investment to support some of the most innovative businesses.

In 2020, the government published the National Infrastructure Strategy.[footnote 9] Over the last year, through this strategy the government has already: overseen the launch of the UK Infrastructure Bank; confirmed a further 15 Towns Deals worth £335 million to revitalise towns across England; and provided £1.2 billion up to 2024-25 for gigabit broadband rollout across the UK. SR21 confirms a total of £100 billion of investment in economic infrastructure over the SR period.[footnote 10]

SR21 sets out plans to deliver infrastructure projects better, faster and greener. Connectivity across the country will be boosted through over £35 billion of rail investment over the next three years. Everyday journeys will be improved, through investing more than £5 billion over the Parliament in buses and cycling, and £5.7 billion of investment over five years in eight City Regions, including West Yorkshire, Greater Manchester, Liverpool City Region and the Tees Valley, through City Region Sustainable Transport Settlements.

To boost wages and prospects for all, total spending on skills will increase over the Parliament – by £3.8 billion by 2024-25 – equivalent to a cash increase of 42% (26% in real terms) compared to 2019-20. This funding will quadruple the number of places on Skills Bootcamps, expand the Lifetime Skills Guarantee on free Level 3 qualifications, and improve numeracy skills through the new Multiply programme. This is in addition to providing extra classroom hours for up to 100,000 T Level students. SR21 also confirms funding to open 20 Institutes of Technology and for upgrades to the Further Education college estate across England.

Apprenticeships funding will increase to £2.7 billion by 2024-25 – the first increase since 2019-20 – to support businesses to build the skilled workforce they need. Funding for the Help to Grow schemes will help SMEs improve their productivity through world-class management skills training and support for digital adoption.

Supporting people and businesses

The best way to help people to get on in life, and raise living standards across the UK, is to help people into work and to progress once in work. The Budget and SR builds on the success of the Plan for Jobs[footnote 11] by extending its most successful schemes, including: investment of over £900 million for each year of the SR on work coaches who will help jobseekers on Universal Credit move into work and progress once in work, and support for older workers via an enhanced 50+ offer.

To ensure that work always pays, the government is increasing the National Living Wage to £9.50 an hour from April 2022, and is reducing the taper rate in Universal Credit (UC) from 63% to 55%, as well as increasing work allowances in UC by £500 a year. The changes to UC represent an effective tax cut for low income working households in receipt of UC worth £2.2 billion in 2022-23. Freezing fuel duty and duty rates on alcohol will also help with the cost of living.

To help the most vulnerable families with the cost of living this winter, the government has introduced a £500 million Household Support Fund. The Budget and SR also invests significantly in early years and families to help everyone get the best start in life. This includes expanding the Supporting Families programme to help up to 300,000 families who face multiple issues, rolling out and improving Family Hubs in 75 Local Authorities across England, and increasing the rate to be paid to early years providers for the government’s free hours offers.

The Budget and SR provides significant backing for businesses to capitalise on the recovery, building on the support provided through the pandemic.

To support local high streets as they adapt and recover from the pandemic, the government is introducing a new temporary business rates relief in England for eligible retail, hospitality and leisure properties for 2022-23, worth almost £1.7 billion. Over 90% of retail, hospitality and leisure businesses will receive at least 50% off their business rates bills in 2022-23.

Reform of business rates will make the system fairer, more responsive and more supportive of investment. The proposals set out will collectively reduce the burden of business rates in England by over £7 billion over the next five years.

Reforms to R&D tax reliefs will ensure that they better support cutting-edge research methods and that the UK more effectively captures the benefits of R&D funded by the UK taxpayer through the reliefs. This will take combined public direct and indirect support for R&D to 1.1% of GDP in 2024-25 – well above the 2018 OECD average of 0.7%.[footnote 12]

In light of the upcoming increase in the main rate of Corporation Tax, the rate of the Bank Surcharge has been set at 3% from April 2023 to ensure that banks continue to pay their fair share of tax, while maintaining the UK’s financial services competitiveness and safeguarding British jobs and tax revenue.

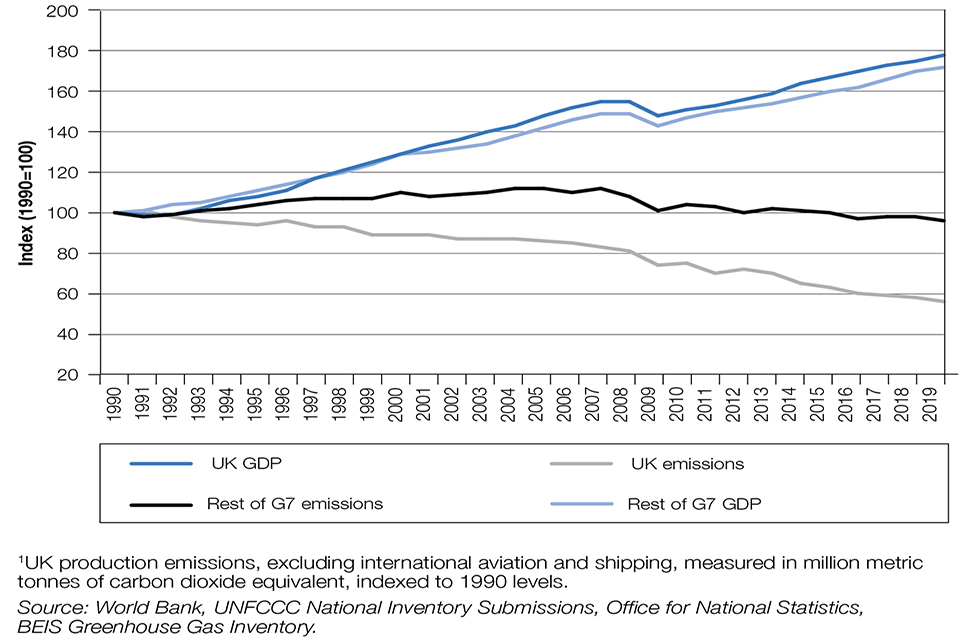

Building back greener

The UK has reduced emissions faster than any other country in the G20 and continues to have the most ambitious targets for 2030: a 46% reduction in emissions compared to 2018.[footnote 13] This is equivalent to achieving the same proportional fall in the next ten years as has been achieved in the last thirty.

The Net Zero Strategy confirmed £26 billion of public capital investment since the Ten Point Plan. Today, the Budget and SR confirms that since March 2021 the government will have committed a total of £30 billion of public investment for the green industrial revolution in the UK, fully supporting the delivery of all of the priorities in the Ten Point Plan and going further in several key areas.

This includes £620 million of new investment over the next three years to support the transition to electric vehicles and a significant increase in new funding to encourage more people to walk and cycle. To make buildings and homes warmer and more environmentally friendly, the Budget and SR provides £3.9 billion to decarbonise buildings, including £1.8 billion to support tens of thousands of low-income households to make the transition to net zero while reducing their energy bills.

Across the transition, the government’s priority is to ensure that changes are inclusive, fair, and sustainable for all, and work with the grain of consumer choice: no one will be required to rip out their existing boiler or scrap their current car.

As well as accelerating the decarbonisation of transport and buildings, the government is investing £1.5 billion in net zero innovation, and laying the foundations for the wider transition to a more resilient energy supply by investing in nuclear technologies and offshore wind. This includes £1.7 billion to enable a final investment decision for a large-scale nuclear project in this Parliament, and the government remains in active negotiations with EDF over the Sizewell C project.

To decarbonise industry and power the government is confirming £1 billion for Carbon Capture, Usage and Storage (CCUS), selecting Hynet and East Coast as the first CCUS clusters. In addition, the government is providing up to £140 million over the SR period to support hydrogen producers and heavy industry adopting CCUS through the Industrial Decarbonisation and Hydrogen Revenue Support scheme.

The government is expanding the Nature for Climate Fund to ensure total spending of more than £750 million by 2024-25 to help meet our commitment to plant at least 7,500 hectares of trees every year in England by 2025 and restore 35,000 hectares of peatland. This is in addition to significant public investment to support the government’s world-leading target to halt biodiversity loss by 2030.

Taken together, this spending package, along with bold action on regulation and green finance, will keep the UK on track for its carbon budgets and 2030 Nationally Determined Contribution,[footnote 14] and support the pathway to net zero by 2050. It does so in a way that creates green jobs across the country, attracts investment, and ensures energy security.

Levelling up

Delivering on the commitment to level up all of the UK underpins the choices made in the Budget and SR. The historic levels of investment confirmed through SR21 will improve living standards for people and places across the UK, helping ensure that people’s opportunities in life are not determined by where they live.

Investing in people will boost employment, wages and prospects. The Budget and SR launches the UK Shared Prosperity Fund (UKSPF), worth over £2.6 billion, to help people access new opportunities in places of need. Funding will rise to £1.5 billion a year by 2024-25. Alongside SR21’s wider investment in skills, the UKSPF will fund Multiply, a new UK-wide programme to equip hundreds of thousands of adults with functional numeracy skills to improve their employment prospects. To support young people, SR21 invests £560 million in youth services in England, including through the Youth Investment Fund and National Citizen Service.

To ensure that every community has access to reliable public services, SR21 provides enough funding for at least 100 new Community Diagnostics Centres in England over the next three years, making healthcare testing more accessible.

The government is also unleashing innovation and stimulating private investment to spread prosperity throughout the UK. Through the Budget and SR, the government will reinforce its efforts to ensure small and medium sized enterprises (SMEs) can access the finance they need, wherever they are across the UK. In addition, the £1.4 billion Global Britain Investment Fund will support some of the UK’s leading manufacturing sectors and stimulate regional growth across the UK.

Significant investment in high-quality transport infrastructure will bring communities across the country closer together and connect them to opportunity. This includes High Speed 2, rail enhancements and vital renewals to boost connectivity across the country – focusing on the Midlands and the North, dramatically reducing journey times. To spread digital connectivity and deliver 4G coverage across the UK, the government will provide £180 million over the SR period as part of the £1 billion deal with network operators for the Shared Rural Network.

To ensure that people across the UK can feel proud of where they live and being a part of their community, the Budget and SR sets out significant commitments on local growth and infrastructure. This includes £1.7 billion worth of projects to upgrade local infrastructure through the first bidding round of the £4.8 billion Levelling Up Fund, and announcing the first 21 projects to benefit from the £150 million Community Ownership Fund – which will help communities across the UK protect and manage their most treasured assets. This investment puts community priorities at its core and will improve the local infrastructure crucial to everyday life, such as transport and town centres. Tax reliefs for museums, galleries, theatres and orchestras will further support the cultural life of towns and cities across the UK.

SR21 also funds up to 8,000 multi-use community sports facilities and football pitches, as well as refurbishing more than 4,500 tennis courts. The £9 million Levelling Up Parks Fund will create over 100 new parks to ensure access to green space in urban areas.

The Levelling Up White Paper to be published later this year will set out further detail on the government’s plans in this area.

Advancing Global Britain

The Budget and SR builds on the government’s vision of Global Britain as a problem-solving and burden-sharing nation, globally competitive and firmly committed to an open and resilient international order.

In the coming years, the UK will continue to catalyse action from the international community to address the most pressing global issues, while defending its interests and demonstrating the government’s values. This will build on significant progress made under the UK’s G7 presidency – including an agreement to vaccinate the world by 2022 and a global tax agreement to ensure big international companies pay their fair share.

The Budget and SR ensures that the UK will remain a development superpower and one of the largest official development assistance (ODA) donors in the G7, spending the equivalent of 0.5% of its national income as overseas aid in 2022. In addition, as a result of the government’s careful stewardship of the public finances and the strength of the economic recovery, the ODA fiscal tests[footnote 15] are now forecast to be met in 2024-25, earlier than the OBR forecast in March. As such, SR21 also provisionally sets aside additional unallocated ODA funding in 2024-25, to the value of the difference between 0.5% and 0.7% of GNI. The ODA allocated to departments at SR21 will ensure that the UK continues to demonstrate leadership on the biggest challenges facing the world, including support for women and girls, global health, humanitarian response, and tackling climate change.

As the President of COP26, the UK will lead international efforts to agree coordinated action on climate change, and SR21 reconfirms the government’s commitment to double International Climate Finance from 2021. It also provides a significant increase in R&D funding, to help UK researchers and business push the frontiers of knowledge to find solutions to major international development challenges, including climate change.

The Budget and SR confirms the largest sustained increase in defence spending since the Cold War, to safeguard the UK’s cutting-edge military, underlining the UK’s commitment to NATO.

High-skilled migration boosts innovation, jobs and competitiveness. New Scale-up, High Potential Individual and Global Business Mobility visas will attract highly skilled people and support inward investment. The government is also creating a Global Talent Network – launching in the Bay Area and Boston in the US, and Bengaluru in India – to find and bring talented people to the UK to work in key science and technology sectors.

Seizing the opportunities of Brexit

The UK’s exit from the EU and the end of the transition period offer the chance to do things differently, with the government already proposing reforms to the UK’s data rights regime that will be more proportionate and less burdensome than the EU’s GDPR rules, and a science-based approach to the regulation of genetic technologies.[footnote 16],[footnote 17]

The Budget and SR will provide the resources to match the ambitions of the UK’s independent trade policy, in line with the government’s plan to secure deals covering 80% of trade.[footnote 18]

The government is also taking advantage of regulatory and legislative flexibilities after leaving the EU. The Alcohol Duty system will undergo a major simplification. Drinks will be taxed in proportion to their alcohol content, making the system fairer and more conducive to product innovation in response to evolving consumer tastes. Alongside this, a new relief that recognises the importance of pubs and supports responsible drinking will be introduced, with duty rates on draft beer and cider being cut by 5%.

The Budget also reduces the cost of Air Passenger Duty on domestic flights to support greater air connectivity within the UK. The government is also introducing reforms to modernise the UK’s Tonnage Tax regime, to ensure that the British shipping industry remains highly competitive. Furthermore, the government is designing a border which embraces innovation and simplifies processes for traders and travellers.

Delivering for all parts of the UK

The government will make levelling up a reality across Scotland, Wales and Northern Ireland by providing UK-wide support in critical areas, while also targeting action to meet local needs. SR21 provides an additional £8.7 billion per year on average to the devolved administrations over the SR21 period through the Barnett formula, on top of their annual £66 billion baseline. This will enable substantial investment into schools, housing, health and social care, and transport across Scotland, Wales and Northern Ireland.

The Budget and SR also funds specific initiatives tailored to the strengths and circumstances of Scotland, Wales and Northern Ireland. This includes: 38 successful projects funded through the Levelling Up and Community Ownership Funds; new British Business Bank funds in Scotland and Wales, alongside an expansion of the Northern Ireland fund; more funding to support union connectivity; and funding for trade and investment hubs in Cardiff, Belfast and Edinburgh. Funding allocations for farming and fisheries have also been confirmed, and the government is announcing new investment in hydrogen, wind and nuclear energy, which will benefit existing industry leaders across Scotland, Wales and Northern Ireland.

Economy and public finances

The achievements of the government’s vaccine programme to date, the support provided to families and businesses, and the Plan for Jobs have led to a stronger than previously anticipated recovery in economic activity and the labour market across the country. The strength of the recovery and the effectiveness of government policy mean the Office for Budget Responsibility (OBR) now judges that the pandemic will have a smaller long-term effect on the economy and public finances than previously expected.

Following the removal of restrictions to limit the spread of COVID-19, the transition away from emergency economic support and the economic recovery, the Budget and Spending Review focuses on building back better, while ensuring sustainable public finances. Through the plans set out here, the government is levelling up the country, investing in vital public services, driving economic growth, capitalising on opportunities from EU Exit and leading the transition to net zero.

As the global economy has reopened, inflation has risen around the world, including in the UK. This is due to demand for goods recovering more quickly than supply can immediately meet it, which has put pressure on global supply chains and led to higher prices for energy, raw materials and goods. The government is committed to working with international partners and businesses to ease these issues and has taken action to support those most acutely affected by increases in the cost of living.

The rebound in economic activity and the action the government has taken to repair the public finances mean that the fiscal outlook has improved since the OBR’s March forecast. However, as debt and borrowing remain elevated, the public finances are vulnerable to future shocks including changes in the interest rates paid on government debt and inflation. That is why the government has taken action over the past year to repair the public finances.

This action means that at SR21, the government is able to confirm that total departmental spending is set to grow in real terms at 3.8% a year on average over this Parliament – a cash increase of £150 billion a year by 2024-25 (£90 billion in real terms). This is the largest real-terms increase in overall departmental spending for any Parliament this century. The spending plans set out at the Budget and SR deliver the government’s commitment to continue to fund excellent public services while ensuring that the public finances are on a sustainable path over the medium term, in order to remain resilient to future challenges.

This approach is underpinned by the government’s new fiscal rules, which will guide fiscal policy for at least this Parliament. The fiscal mandate is met in the OBR’s forecast with public sector net debt excluding the Bank of England (underlying debt) as a proportion of GDP falling from 2024-25. In addition, the current budget is in surplus in 2024-25 and public sector net investment (PSNI) averages 2.7% of GDP over the rolling forecast period. Spending subject to the welfare cap is forecast to be £138.3 billion in 2024-25 and must remain below £141.1 billion to prevent a breach of the cap.[footnote 19]

Meeting these rules will reduce the risks associated with high debt, ensure that governments will be able to effectively support the economy in future crises, and prevents future generations from having to pay for current spending.

Economic Context

The government’s economic response to the pandemic has been praised internationally, with the IMF describing it as “one of the best examples of coordinated action globally – it has helped mitigate the damage, holding down unemployment and insolvencies.”[footnote 20] The measures taken by the government have supported millions of jobs and livelihoods, stopped businesses from going bankrupt and helped reduce economic scarring, while protecting the NHS.

The vaccine rollout allowed the government to re-open the economy safely and steadily as set out in the roadmap for England. As restrictions were lifted consumer activity increased, driving a rapid recovery across the economy. In April, the re-opening of non-essential retail and outdoor hospitality saw total consumer card spending increase by around a fifth between the week to 12 April and the week to 19 April.[footnote 21] The move to step three of the roadmap in May saw the re-opening of indoor hospitality, with the number of restaurant bookings increasing to 42% above 2019 levels and consumer confidence returning to its pre-pandemic level.[footnote 22],[footnote 23]

Business confidence recovered in Q2 2021, with uncertainty falling towards normal levels from the highs seen at the start of the pandemic.[footnote 24] Reflecting this, business investment has started to recover, supported by the super deduction announced in the Spring Budget. Investment grew by 4.5%† in Q2, compared to a decline of 9.3%† in Q1.[footnote 25] The Decision Maker Panel survey of firms by the Bank of England suggests that forward looking private sector investment intentions remain strong, with firms now reporting that investment is expected to be 2% higher in 2022 and beyond, compared to what it would have been without COVID-19.

As restrictions were lifted and consumer and business confidence returned, the economy outperformed expectations and grew by 5.5%† in the second quarter of 2021. There was a particularly strong recovery in sectors significantly affected by the pandemic and associated restrictions; with over half the total gross domestic product (GDP) growth in Q2 coming from those consumer facing sectors that were able to re-open during the roadmap. Output in the accommodation and food sector, for example, grew by 88%† in Q2. Whole economy output was only 3.3%† below its pre-crisis peak in Q2 compared to the 7.9% shortfall expected in the OBR’s March 2021 forecast.[footnote 26]

Box 1.A: International comparisons of GDP and Labour Markets

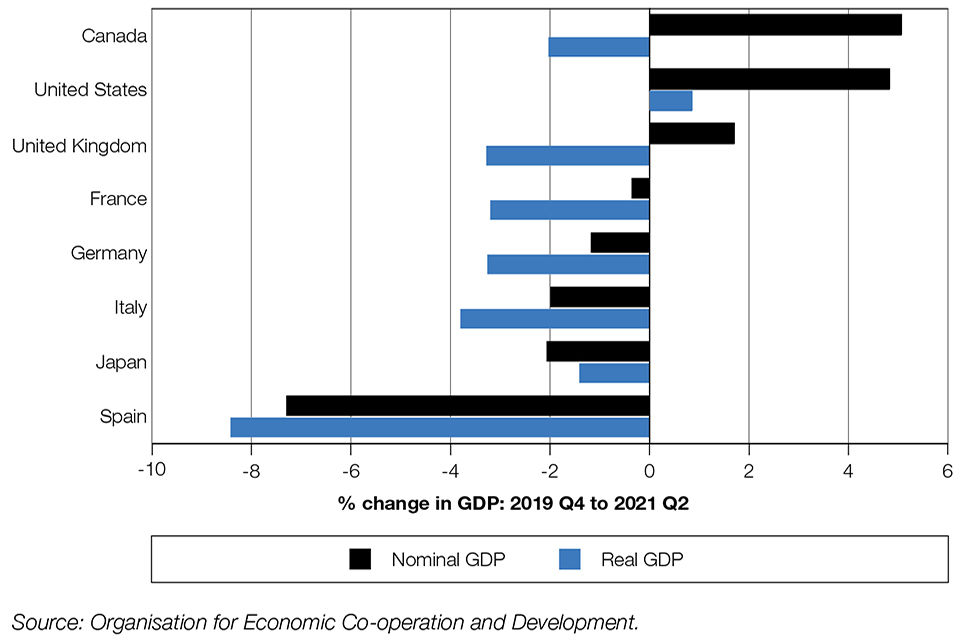

Like all major economies, the UK economy experienced a large fall in GDP in 2020. However, differences in how countries measure public services output contributed to a relatively larger fall in real UK GDP compared to other advanced economies.[a]

The independent Office for National Statistics (ONS) has said that during this period nominal GDP was a more internationally comparable measure as it was not affected by these public sector measurement issues.[b] On this measure, the 4.4%† fall in UK nominal GDP during 2020 was in line with other advanced economies.

As the economy recovers from the pandemic, the measurement issues that were partly driving the UK’s relative underperformance in real GDP during 2020 are unwinding. At the same time, the vaccine programme meant that restrictions on individuals and businesses could be lifted, resulting in a faster than expected recovery.[c] For instance, after having been 35% below its pre-pandemic level at its lowest point, output in the health and education sectors combined was 3% higher in August 2021. Similarly, after having fallen by 90%, output in the hospitality sector had recovered to be 2.6% up by August 2021.

As a result, the shortfall in real GDP for the UK is now in line with other advanced economies. In Q2 2021, real GDP was 3.3%† below where it was before the pandemic – in line with France and Germany and ahead of Italy and Spain. Looking ahead, the IMF expects the UK to have the fastest growth rate in the G7 in 2021 and the second fastest in 2022.

Chart 1.1: GDP shortfall to pre-pandemic levels: G7 nations and Spain

Chart 1.1 Bar chart showing a comparison of the change in real and nominal GDP of G7 nations and Spain compared to pre-pandemic levels (2019 Q4). The UK’s change in real GDP is in line with other advanced economies.

a. Spring Budget 2021, Box 1.A, HM Treasury, March 2021.

b. International comparisons of GDP during the Covid-19 Pandemic, ONS, 2021.

c. The OBR March 2021 forecast, which assumed some unwinding of the public sector measurement effects, predicted that GDP would still be 6% below pre-pandemic levels in June 2021. Thanks to a faster than expected recovery it was instead just 1.1% below.

UK labour market outcomes during the pandemic compare favourably to international peers. The UK unemployment rate peaked at 5.2% in the three months to December 2020. Compared to before the pandemic, this was a smaller increase in unemployment than the US, Canada, and Spain. The peak in UK unemployment was lower than for these countries, and France and Italy.

In their projections, the IMF expects the UK’s annual unemployment rate to remain below Canada, France, Italy and Spain in 2021 and 2022.

The easing of restrictions and rapid return of economic activity globally has affected the availability of certain commodities, components and raw materials. The recovery in demand for these inputs has outpaced their production and distribution, leading to significant prices rises and shortages. For example, microchip shortages have affected car production since the spring and the Bank of England’s agents report that firms face increased material costs as well as rising energy prices, which has increased inflation for goods around the world.[footnote 27]

These global supply issues have been compounded by disruptions to global shipping and shortages of goods vehicle drivers, which are affecting a number of countries.[footnote 28] Lost shipping hours, through disruptions in trading ports due to COVID-19 outbreaks and issues such as the temporary closure of the Suez canal in March, accompanied by robust demand for goods globally, have led to significant increases in shipping costs which currently stand around eight times higher through to September than their pre-pandemic levels.[footnote 29]

Energy prices have risen significantly as economies have reopened. Global oil prices fell to 20-year lows in April 2020 but have since increased, by 82% in the year up to September, and are at their highest level in three years.[footnote 30] A rise in industrial demand for natural gas globally, weather patterns in Europe and Asia, and low gas storage balances have resulted in wholesale natural gas prices rising by 471% and 422% in the year up to September in Europe and Asia, respectively.[footnote 31]

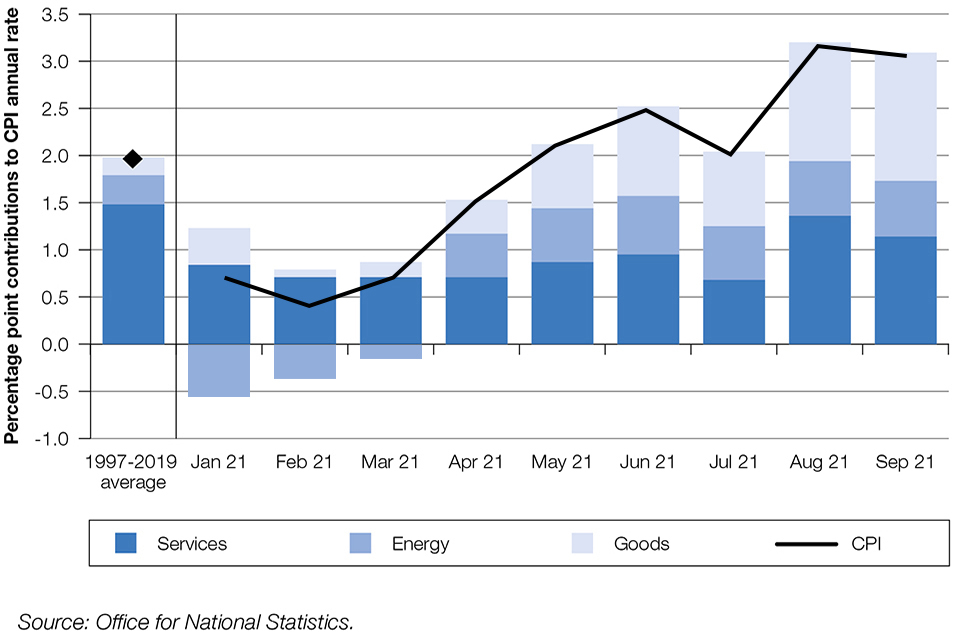

- These global factors explain the recent increase in inflation above its 2% target. The Consumer Prices Index (CPI) increased by 3.1% in the 12 months to September, compared to a low of 0.4% in February 2021. Of this, energy and goods contributed 1.9 percentage points to CPI inflation in September. This is above these components’ long-run average contributions to CPI inflation over 1997-2019, of 0.5 percentage points, and explains all of the rise in inflation above target. Services contributed 1.1 percentage points, below its average contribution over 1997-2019 of 1.5 percentage points (chart 1.2).

Chart 1.2: Contributions to CPI inflation

Chart 1.2 Bar chart showing contributions to the annual rate of CPI inflation over 2021 and on average from 1997-2019. The chart shows contributions from goods and energy have increased and are higher than their historic averages since 1997

Supply pressures alongside increased COVID-19 case numbers weighed on output in July, as firms faced higher prices for materials and workers were required to self-isolate, with monthly GDP falling by 0.1%†.

Growth returned in August, driven by the effect of the final step of the roadmap on consumer facing sectors, despite continued supply chain pressures and materials shortages. GDP grew by 0.4%† leaving the economy only 0.8%† below its pre-pandemic level. Strong growth in many consumer-facing sectors, such as hospitality and arts and entertainment, means that in contrast to the start of the year, they are close to or above their pre-COVID-19 peak levels of output. Output growth in other sectors, such as manufacturing and construction, stalled because of shortages and the global increase in the cost of energy.

The rebound in economic activity has driven a strong recovery in the labour market, supported by the government’s Plan for Jobs. The number of employees has grown for ten consecutive months, there are now more paid employees than before the pandemic, and vacancies are at a record high. At the same time, the number of employments furloughed fell to 1.3 million at the end of August, around 1.2 million fewer than the OBR expected in its March 2021 forecast.

This recovery in the labour market is seen across the UK. Eight of the nine regions in England and three of the four nations of the UK now have employee levels above pre-COVID-19 levels.[footnote 32] Northern Ireland (+1.6%) and the North West (+1.4%) have seen the largest increase compared to February 2020. More timely indicators suggest that demand for labour has remained strong through October with online job postings in all regions at least 17% above the level in February 2020 and strongest in the North East (+72%) and Northern Ireland (+71%).

The rapid recovery in the labour market has been accompanied by rising wages, helping to support household living standards. The headline figures for wages have been affected by some temporary distortions. These include a compositional effect, due to fewer lower paid workers in employment, and a base effect from comparing wages to last year when many workers were on furlough. In the three months to August the ONS estimates that underlying wage growth was between 4.1% and 5.6%. Cumulatively, despite inflation rising, real wages have grown by 3.4% since the three months to February 2020.

As set out in Box 1.B the policies and support put in place by the government and the faster than anticipated recovery mean the OBR now expects the pandemic to have a smaller lasting effect on the economy than previously forecast. The OBR has reduced its previous scarring estimate of 3% to 2%. Less scarring means a larger economy in the medium term with higher tax revenues, lower unemployment and higher wages.[footnote 33]

Box 1.B: Longer-term economic effect of COVID-19

Economic scarring refers to the tendency for the path of productive capacity of an economy to be persistently lower following a recession. Scarring can occur through reductions in the supply of labour, capital stock and total factor productivity, which measures how efficiently and intensively resources in the economy are working.

The OBR now judges that the COVID-19 pandemic will lead to scarring reducing GDP by 2% by the end of the forecast period compared to its pre-pandemic March 2020 forecast. This is smaller than its 3% estimate in March 2021. The OBR has said that ‘the Government’s pandemic support policies appear to have been largely effective in preserving viable jobs and businesses’ and that this support, alongside the vaccine rollout “has significantly reduced the collateral economic damage that could have resulted from the pandemic”.[a] Other major forecasters have also revised down their scarring estimates over the course of the pandemic. There are many factors that will affect scarring, and so there remains considerable uncertainty around forecasters’ estimates of the lasting effect of COVID-19 on the economy.

The OBR attributes just under half of the total 2% scarring to the labour market, comprised of 0.3 percentage points from reduced labour market participation, 0.4 percentage points from a reduced population level and 0.1 percentage points from a higher natural rate of unemployment. The total labour supply scarring estimate has been revised down from the OBR’s previous estimate, reflecting the strong recovery in jobs.

The Coronavirus Job Retention Scheme (CJRS) has played an important role in limiting labour market scarring, through supporting employer-employee matches in the most acute phase of the pandemic. This has helped to limit the rise in unemployment, which is projected to peak at 5.2%, compared to the OBR’s expectation of 12% in the July 2020 Fiscal Sustainability Report (FSR).

The CJRS was designed as a temporary measure to support businesses and households. As the economy has re-opened, the jobs market has recovered with 1.2 million vacancies in September, a record high. As such, the government has wound down its emergency pandemic support to focus on economic recovery, through continuing to support businesses to invest and supporting people into new jobs.

Just over half of the OBR’s 2% scarring estimate is accounted for by capital shallowing and reductions in total factor productivity. Capital shallowing occurs where the capital stock of the economy is lower than expected due to lower business investment or higher rates of scrapping or depreciation of productive capital. Investment has recovered quickly over recent months, supported by the new super-deduction which creates a strong incentive for companies to bring forward investment. The OBR forecasts business investment to return to its pre-pandemic level by late 2022. This is a quicker recovery than the average of four and a half years that business investment took to return to pre-recession levels following the 1979, 1990 and 2008 recessions.

Reductions in total factor productivity occur when resources across the economy are not being utilised as efficiently as they were previously. This can occur through lost investment in research and development (R&D) and inefficient reallocation of resources across firms and sectors. There is evidence of a smaller hit to R&D spending and of smaller impairments to the allocation of capital than in previous recessions, both of which will help to limit total factor productivity scarring.[b]

Evidence suggests private R&D spending in the short term has proven more resilient than other forms of business investment through the pandemic, and technology adoption has been faster and greater over the last 18 months, which has the potential to boost firm productivity in the medium term. The government is also providing further support, by increasing public investment in R&D to record levels of £20 billion by 2024-25 (including funding for EU programmes), and reforming R&D tax reliefs to better support cutting-edge research methods and refocus government support towards innovation in the UK.[c]

In some previous recessions weak bank lending has impaired the reallocation of capital between firms and sectors, but a strong financial sector and support schemes have mitigated such effects during the pandemic. The government introduced a range of business support, including loan schemes and grants, ensuring businesses could access the finance they needed through the pandemic.

Across the various loan schemes more than 1.5 million businesses accessed nearly £80 billion of finance, and business insolvencies have been lower than the pre-pandemic normal thanks to this support. The Bank of England estimates that there were at least 6,000 fewer insolvencies since the start of the pandemic, compared to pre-pandemic averages, supporting jobs and investment and reducing capital scrapping. Firm creation has also remained strong over the pandemic, further supporting jobs and helping the economy to adjust.

Policy measures put in place by the government such as the CJRS and business loan schemes have contributed to the survival of viable firms, mitigated the loss of firm-specific capital and jobs, and helped to reduce scarring. Without these measures, the level of scarring would likely have been considerably higher due to a misallocation of resources, capital shallowing and lower levels of employment.

With the removal of restrictions, it is important for the medium-term health of the economy and living standards that resources are able to reallocate across the economy to their most productive uses. With vacancies now at record highs, the adjustment of the labour market should be supported by the ending of temporary support measures such as the CJRS, together with active labour market policies.

a. ‘Economic and Fiscal Outlook’, OBR, October 2021.

b. Will the pandemic “scar” the economy?, Haskell, July 2021.

c. ‘The relationship between public and private R&D funding’, Oxford Economics, March 2020.

Supporting the economic recovery

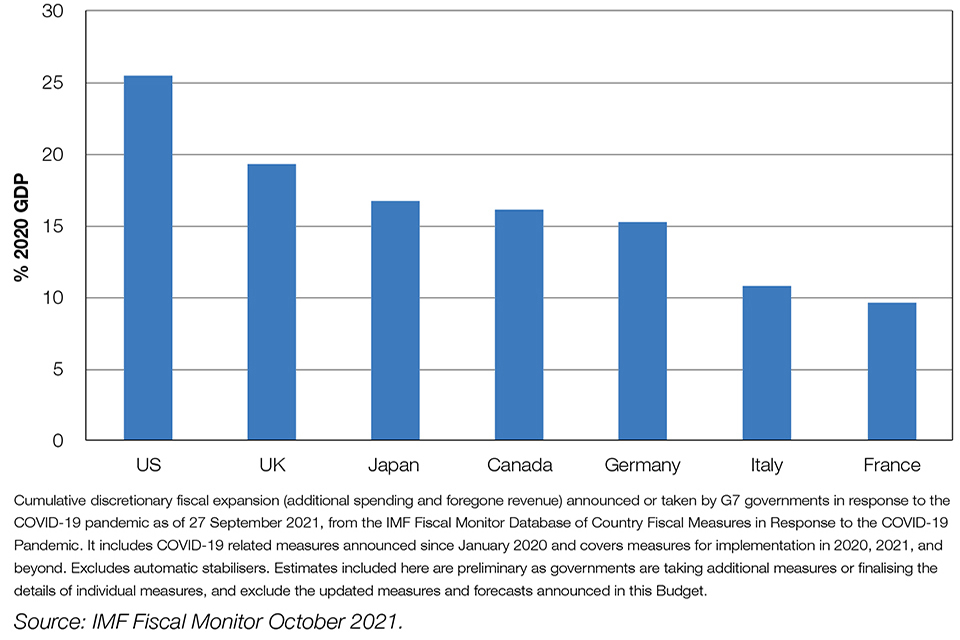

The government has taken unprecedented steps to support jobs, livelihoods, public services and businesses throughout the pandemic, having delivered a package of targeted, temporary support worth £323 billion over last year and this year. Accounting for Budget 2020, which included a step change in capital investment, decisions taken by this government have provided £378 billion of direct support to the economy this year and last year. Estimates from the IMF chart 1.3, show that the UK’s discretionary fiscal expansion in response to COVID-19 was one of the largest and most comprehensive fiscal support packages globally.

Chart 1.3: International Monetary Fund estimates of discretionary fiscal expansion in response to COVID-19 in G7 economies

Chart 1.3 A bar graph showing the UK is estimated to have had the second highest fiscal expansion in response to COVID-19 in the G7. The UK is second to the US and is preceded by Japan.

The furlough scheme has supported 11.7 million jobs across the whole of the UK, including 911,000 in Scotland, 470,000 in Wales and 287,000 in Northern Ireland, preserving the relationships between employers and employees through the pandemic. These interventions have helped to limit the short and long-run economic effects of the pandemic. As the OBR has said the “cost of inaction would certainly have been higher”.[footnote 34]

With the majority of the adult population fully vaccinated, the completion of the roadmap and the child vaccination and booster programmes running this autumn, the government has wound down much of the emergency pandemic support, allowing the focus to shift to economic recovery.

The government is mindful that risks remain from COVID-19, especially through the coming months. The government set out its plan A for the autumn and winter in September, focusing on vaccination as the main line of defence to control the spread of the virus, alongside treatments, testing and public health advice. The government has also outlined a plan B, should COVID-19 cause a rise in hospitalisations that would put unsustainable pressure on the NHS. These measures aim to control transmission of the virus while seeking to minimise economic and social impacts. The government is monitoring the data closely and will only introduce further measures if needed.

The Budget and SR sets out plans to build back better and support the economic recovery. At the heart of these plans is the government’s ambition to level up the country by tackling long standing regional inequalities, and ensure the economic recovery is felt across the UK. There are regional inequalities in wages, life satisfaction and productivity, as set out in Box 1.C. Within the nations and regions of the UK, London and the South East are the only two places with productivity above the UK average.

Box 1.C: Drivers of local disparities in economic outcomes

There is considerable variation in economic outcomes across the UK and narrowing these could have a significant positive impact on the UK economy. Increasing the productivity of the eight largest city regions outside of London and Edinburgh to match UK average productivity would increase UK GDP in aggregate by around 2%.[a]

A variety of frameworks have been used to understand local disparities in economic outcomes – with many of these based on a core set of ‘capitals’. The OECD Framework for Measuring Well-Being and Progress, for example, used natural capital, human capital, economic capital and social capital to understand outcomes.[b] Similarly, the New Zealand Treasury Living Standards Framework looks at natural capital, human capital, social capital and financial and physical capital alongside twelve domains of current wellbeing, while the Six Capitals research project at the Bennett Institute for Public Policy identifies physical, knowledge, social, human, natural and institutional capital.[c,d] There are complex interactions and interdependencies between these capitals which means that they can reinforce each other in improving local outcomes.

Empirical evidence points to the importance of capitals for local outcomes. For example:

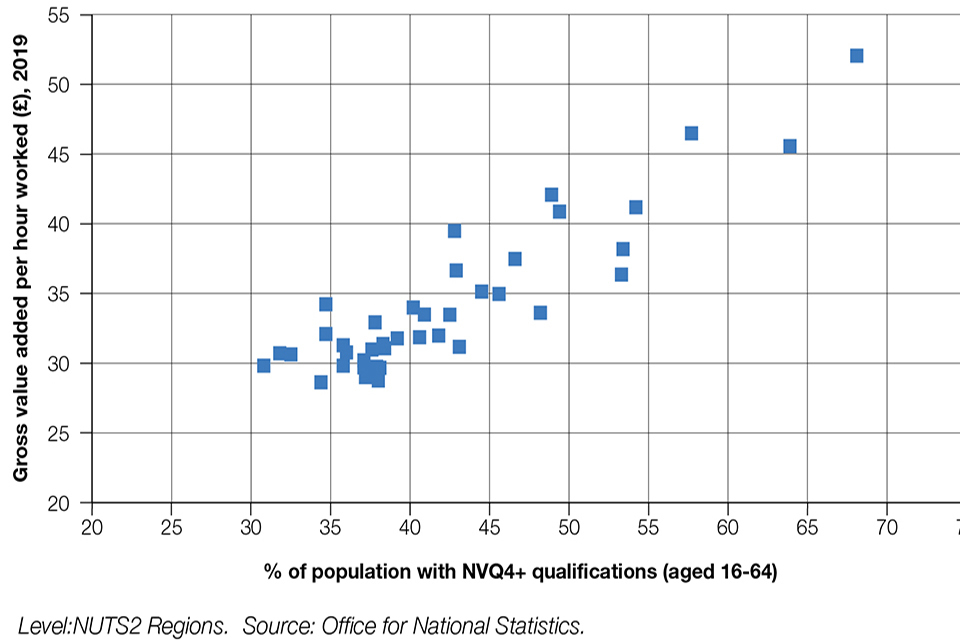

- Human capital – encompassing the level of education, skills and health of the people living in a region – is the largest measurable driver of regional disparities. Higher levels of human capital will create a more skilled and therefore productive workforce, which will in turn boost wages in the long term. London has the highest percentage of its working age population with NVQ4+ qualifications (qualifications equivalent to a degree), at 58.7% of the population aged 16-64, compared to 34.4% in the North East. Variations in the share of high skilled workers explain up to 90% of place-based disparities in wages in the UK.[e] Chart 1.4 for example shows a strong positive correlation between regional productivity and the level of skills. High skills in a region will reflect both participation in and the quality of the local educational system, as well as the attractiveness of an area as a place to live and commute from, which will in turn be shaped by other capitals.

The eight largest city regions outside of London and Edinburgh are:

a. Greater Manchester, West Midlands, West Yorkshire, Glasgow, Liverpool City Region, Sheffield City Region, West of England and Cardiff.

b. Measuring Well-being and Progress: Well-being Research, OECD, 2009.

c. The Living Standards Framework, New Zealand Treasury, 2019.

d. Building Forward: Investing in a Resilient Recovery, Bennett Institute, November 2020.

e. Area Disparities in Britain: Understanding the Contribution of People vs. Place Through Variance Decompositions - Gibbons et al. 2013.

Chart 1.4: Correlation between qualification level and productivity, by region

Chart 1.4 Scatter plot showing a strong positive correlation between NVQ4+ worker qualifications and value added per hour worked

-

High levels of firm capital – such as physical and intangible investment, and the degree of competition and innovation – mean that an area is more likely to attract skilled people and is more adept at taking advantage of technological change to improve living standards. Innovation is spatially concentrated both globally and within the UK, with only a handful of places in the UK producing ten or more patents per 1000 people.[e] Given its link with productivity this is likely responsible for some of the differences in regional productivity levels in the UK.

-

Higher social capital promotes a shared sense of belonging and connection within a local community. Trust in institutions and local government encourages people and local businesses to engage in public life and better shape decisions in the area in which they live – while helping to improve economic outcomes through lower transaction costs. The Community Life Survey shows that reported civil engagement for the least deprived quintile of small areas in England was nine percentage points higher than that for the most deprived quintile. Strong local institutions play a key role in strengthening civic participation, enabling communities to shape decisions that are most suited to their local area.

-

The public provision of infrastructure, amenities and environmental assets helps to drive both the attractiveness of an area to prospective firms and its attractiveness as a place to live, including by shaping quality of life through environmental factors and local biodiversity.[f] The National Infrastructure Commission highlighted the importance of local transport networks, particularly public transport, in supporting growth in England’s city regions.[g] Improving transport can help improve agglomeration economies and have a positive impact on both local productivity and wages.[h]

e. Exploring the micro-geography of innovation in England: Population density, accessibility and innovation revisited, Enterprise Research Centre, March 2021.

f. The Economics of Biodiversity: The Dasgupta Review, HM Treasury, 2021.

g. National Infrastructure Assessment, National Infrastructure Commission, 2018.

h. Transport evidence review, What works centre for local economic growth, 2015.

To help drive economic growth and level up the country, creating a higher wage, higher productivity economy, the government is continuing to invest in the three pillars of growth set out in the Plan for Growth at Spring Budget: infrastructure, skills and innovation. This includes significant investment in adult skills and transport networks, supporting clean energy projects to assist the transition to net zero, and doubling the number of AI scholarships to drive forward the economic recovery and help create high-skilled and high-paid jobs across the UK.

The government is committed to this economic recovery being green. The Net Zero Strategy sets out the steps the government will take to keep the UK on track for its carbon budgets and 2030 National Determined Contribution, and establishes the longer term pathway towards net zero by 2050. The Budget and SR sets out action to address the threat of climate change while driving growth and supporting the creation of green jobs across the country. The UK has already demonstrated that economic growth is compatible with reducing carbon emissions: between 1990 and 2019 the UK reduced its greenhouse gas emissions by 44% while GDP grew by 78%.

The Budget and SR provides funding to underpin the economic recovery and build back better. Although the OBR expect the output gap to be positive or closed across the forecast, they judge that the overall effect on inflation of the Budget and SR will be relatively small. Inflation is expected to peak at 4.4% in 2022 Q2, before the majority of departmental allocations at SR21 are spent.

As outlined in Box 1.D, the government has provided material support to the economy through the pandemic that tapers over time, meaning borrowing returns to sustainable levels and the government meets its fiscal rules in 2024-25. This is more than two years after the economy recovers to its pre-pandemic level and a time when unemployment is forecast to be 4.2%, close to its pre-pandemic rate. This represents a balanced approach of supporting the economy and public services during the recovery from the pandemic, while ensuring the public finances remain on a sustainable path.

Box 1.D: Measuring the impact of fiscal policy on the economy

There are multiple ways of estimating the extent to which fiscal policy is supporting the economy. A top-down approach uses the level of, and change over time in, the government’s budget balance. The budget balance is the difference between expenditure and revenues, and helps measure how fiscal policy is contributing directly to the level of GDP. Measures based on the budget balance can be called the ”fiscal stance”. The year-to-year change in that budget balance (the “fiscal impulse”) shows how the fiscal stance is changing over time and reflects how fiscal policy is contributing directly to GDP growth.

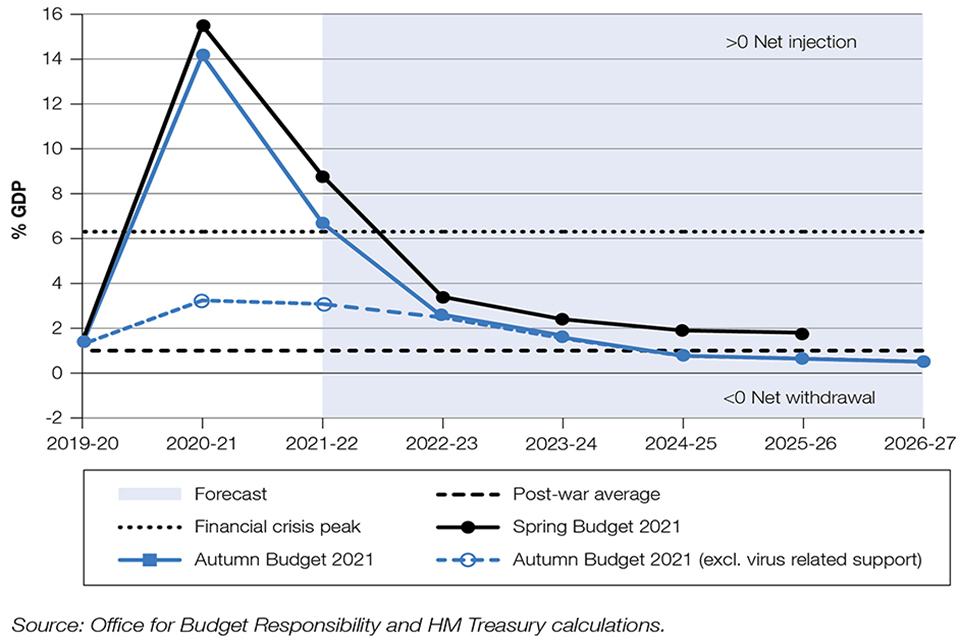

Chart 1.5 illustrates a top-down view of the fiscal position, as measured by the cyclically adjusted primary deficit (CAPD).[a,b] This shows that fiscal policy has provided exceptional levels of support over 2020-21 and 2021-22 in aggregate. The majority of this support has been emergency COVID-19 policy to address the immediate effects of the pandemic (shown by comparing CAPD with its value excluding COVID-19 related policy). Fiscal support is then withdrawn to more historically average levels from 2021-22, as restrictions end and the economy continues to recover. The fiscal stance excluding COVID-19 support is broadly stable over 2020-21 to 2022-23.

Chart 1.5: Fiscal stance as measured by the cyclically adjusted primary deficit

Chart 1.5 Line chart showing a high cyclically-adjusted primary deficit in 2020-21 but lowering towards the end of the forecast along with a line showing the cyclically adjusted primary deficit excluding virus-related support.

These top-down approaches rely on estimates of the output gap, which has been extremely difficult to assess through the COVID-19 crisis, and do not account for the composition of fiscal policy.

a. Exact definitions of stance and impulse vary. The IMF have noted that a number of metrics can be used as indicators of the fiscal stance. ‘Guidelines for Fiscal Adjustment’, International Monetary Fund.

b. One typical fiscal aggregate used is the Cyclically Adjusted Primary Deficit (CAPD). The primary deficit takes the difference between government expenditures, less net interest payments, and revenues. Interest payments are removed as these are largely pre-determined by past fiscal positions and are affected by interest rates which are outside a government’s direct control. Additionally, as a large portion of government debt is held outside the UK, changes in debt interest have less of a direct impact on the UK economy. Cyclically adjusting the deficit aims to isolate the actions of government by removing those parts of expenditure and revenue which move automatically with the economic cycle (automatic stabilisers). This process relies on correctly measuring the output gap.

It can be helpful to also look at a bottom-up view of the fiscal position. Table 1.6 sums the fiscal impact of individual policy decisions over time. Since the pandemic began, the government has provided £323 billion of COVID-19 support this year and last year. Once accounting for Budget 2020, which includes a step-change in capital investment, decisions taken by this government have provided £378 billion of direct support for the economy over this year and last year.

While the bottom-up approach highlights that the government is providing further fiscal support to underpin the recovery, the top-down approach indicates that fiscal policy is not significantly more expansionary than Spring Budget, due to underlying improvements in the economy and fiscal forecast.

Table 1.6: Total impact of policy decisions on borrowing 2020-21 to 2024-25 (1)

| £ billion | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 |

|---|---|---|---|---|---|

| (1) Budget 2020 | 17.9 | 36.4 | 38.5 | 41.2 | 41.9 |

| (2) Spending Review 2020(2) | 283.9 | 39.4 | -11.6 | -14.3 | -15.0 |

| (3) Spring Budget 2021(3) | 6.0 | 58.9 | 7.8 | -13.1 | -25.0 |

| (4) Re-costings of virus-related support measures(4) | -54.0 | -13.8 | 0.5 | 0.1 | -0.1 |

| (5) Autumn Budget 2021(5) | 0 | 3.0 | 25.3 | 21.9 | 9.8 |

| Total(6) | 253.8 | 123.8 | 60.6 | 35.7 | 11.6 |

| 1 Positive numbers represent net support to the economy, including for direct COVID-19 support and wider measures at successive events |

| 2 As published at the Spending Review 2020, before any adjustments made as a result of the OBR's recosting process |

| 3 As published at Spring Budget 2021, before any adjustments made as a result of the OBR's recosting process |

| 4 Total recostings of virus-related support measures, from the OBR's March 2021 Economic and Fiscal Outlook (Table A.5) and October 2021 Economic and Fiscal Outlook (Table [A.6]) |

| 5 Further details of policy decisions at the Autumn Budget 2021 are given in Table 5.1 |

| 6 Total policy decisions in 2020-21 and 2021-22 since the pandemic began is £323bn (rows 2-5), including Budget 2020 the total is £378bn |

| Source: Office for Budget Responsibility and HM Treasury calculations. |

Economic outlook

In its latest forecast the OBR expects the UK economy to grow by 6.5% in 2021, followed by growth of 6.0% and 2.1% in 2022 and 2023, respectively. The OBR now expects the economy to regain its pre-pandemic size around the turn of the year, earlier than mid-2022 previously expected. Following the end of the furlough scheme in September, the OBR expects unemployment to peak at 5.2% in Q4 2021, equivalent to around 2 million fewer people in unemployment than suggested in the central scenario published in its July 2020 FSR. The unemployment rate is then expected to fall to 4.2% in 2024 and remain there for the remainder of the forecast period. Inflation is expected to rise further to 4.4% in Q2 2022 before returning to target by the end of 2024.

Table 1.7: Summary of the OBR’s economic forecast (percentage change on year earlier, unless otherwise stated) (1)

| Forecast | |||||||

|---|---|---|---|---|---|---|---|

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | |

| GDP Growth | -9.8 | 6.5 | 6.0 | 2.1 | 1.3 | 1.6 | 1.7 |

| GDP Growth per capita | -10.2 | 6.3 | 5.6 | 1.7 | 1.0 | 1.3 | 1.4 |

| Main components of GDP | |||||||

| Household consumption (2) | -10.9 | 4.7 | 9.8 | 1.3 | 1.7 | 1.3 | 1.0 |

| General government consumption | -6.5 | 14.7 | 2.0 | 1.5 | 1.2 | 1.7 | 2.1 |

| Fixed investment | -8.8 | 5.7 | 8.9 | 3.3 | -0.7 | 3.2 | 3.9 |

| Business investment | -10.2 | -2.4 | 15.7 | 4.7 | -0.8 | 4.8 | 5.8 |

| General government investment | 3.5 | 14.7 | -2.1 | 6.5 | -1.0 | 1.1 | 1.8 |

| Private dwellings investment (3) | -13.1 | 16.3 | 4.6 | -1.4 | -0.5 | 1.4 | 1.5 |

| Change in inventories (4) | -0.5 | 0.1 | 0.2 | 0.0 | 0.0 | 0.0 | 0.0 |

| Net trade (4) | 0.8 | -0.8 | -2.5 | 0.3 | 0.1 | -0.1 | -0.2 |

| CPI Inflation | 0.9 | 2.3 | 4.0 | 2.6 | 2.1 | 2.0 | 2.0 |

| Employment (millions) | 32.5 | 32.3 | 32.6 | 33.0 | 33.2 | 33.3 | 33.4 |

| Unemployment (% rate) | 4.6 | 4.9 | 4.8 | 4.3 | 4.2 | 4.2 | 4.2 |

| Productivity per hour | 0.6 | 0.5 | 0.9 | 1.3 | 1.3 | 1.3 | 1.4 |

| 1 All figures in this table are rounded to the nearest decimal place. This is not intended to convey a degree of unwarranted accuracy. Components may not sum to total due to rounding and the statistical discrepancy. |

| 2 Includes households and non-profit institutions serving households |

| 3 Includes transfer costs of non-produced assets. |

| 4 Contribution to GDP growth, percentage points. |

| Source: Office for National Statistics and Office for Budget Responsibility. |

As the OBR notes in the Economic and Fiscal Outlook (EFO), ongoing global supply chain issues and labour market shortages are likely in the near term to act as a headwind to growth and push up inflation, presenting a risk to its forecast. The government is acting to help firms tackle supply chain issues and labour shortages.

Since 16 August in England, fully vaccinated individuals have not been subject to the requirement to self-isolate if they come into contact with someone who has tested positive for COVID-19. This has resulted in fewer workers self-isolating, helping to improve the availability of labour. The latest ONS survey data collected between 6 to 17 October show that 3% of adults had self-isolated in the previous seven days, compared to a high of 7% in July.

The rapid return of demand for labour has meant the ratio of unemployed workers to vacancies – a measure of the degree of slack in the labour market – is below pre-pandemic levels in some sectors. This is an indication of greater-than-usual labour shortages. The latest from the Recruitment and Employment Confederation Report on Jobs, showed reported staff availability has been declining for the past seven months with a record month on month decline in August.[footnote 35]

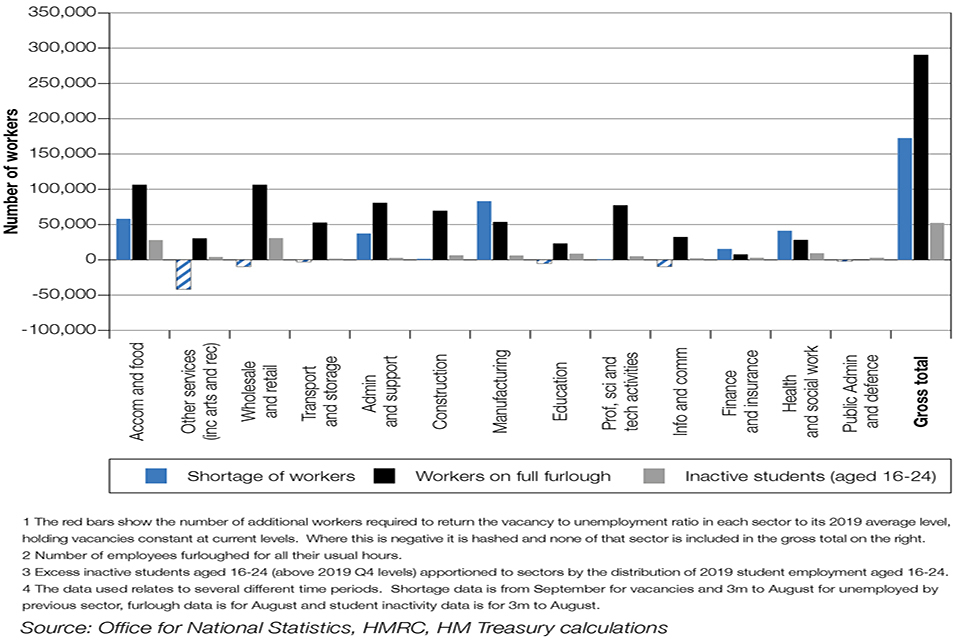

The speed and ease with which labour supply can adjust and recover to match demand will be a critical determinant of the next phase of the recovery. The closure of the CJRS and the return of inactive workers to employment should help to support this adjustment, while some reallocation between sectors is also likely to be required to help address some shortages (chart 1.8). The government is supporting the reallocation of labour and encouraging a high skill, higher productivity economy by taking action such as extending the £3,000 apprentice hiring incentive for employers until 31 January 2022 and expanding the Lifetime Skills Guarantee so more adults can access retraining opportunities.

Chart 1.8: Shortages of workers 1 relative to fully furloughed 2 and inactive students, 3 by sector, Q3 2021 4

Chart 1.8 Bar chart showing additional workers required to return to 2019 unemployed per vacancy ratios in each sector compared to how many fully furloughed workers and excess inactive students aged 16-24 there are in these sectors.

The government is working with international partners to monitor global pressures on supply chains and is taking action at home to ease pressures and support affected businesses. Transport pressures including in container shipping have not yet started to ease and prices for certain commodities, raw materials and components remain high. Where there are issues that are unique or acute in the UK, the government will continue to take appropriate action.

In the UK as in other countries, there is a shortage of Heavy Goods Vehicle (HGV) drivers. The number in the UK has fallen by 39,000 between June 2019 and June 2021.[footnote 36] Businesses have used the apprenticeship system to help train new drivers, and the government is also taking action to support the haulage industry, including:

-

investing £32.5 million in roadside facilities for HGV drivers on the road

-

investing in new skills bootcamps to train an additional 5,000 drivers

-

increasing the number of HGV driving tests available by up to 50,000 each year

-

freezing vehicle excise duty (VED) for HGVs and suspending the HGV road user levy for another 12 months from August 2022

-

relaxing cabotage rules temporarily for international HGV journeys within Great Britain to provide greater resilience for supply chains

-

issuing up to 5,000 short-term temporary visas for food and fuel haulage drivers to work in the UK

The OBR expects that inflation will remain elevated over 2022 and 2023, reflecting the lagged effects of recent increases in wholesale energy and other input prices. The Office of Gas and Electricity Markets (OFGEM) energy price cap has helped protect consumers by limiting the impact of recent wholesale price rises on energy bills over the winter. The Budget and SR also commits a total of £3.9 billion for England and Wales to ensure buildings are warmer and cheaper to heat. To reduce the UK’s reliance on gas, the Net Zero Strategy committed to decarbonising the power system by 2035, subject to security of supply. This includes £380 million for the world-leading offshore wind sector and significant investments in nuclear: up to £1.7 billion of direct government funding to enable a large-scale nuclear plant to achieve a final investment decision this Parliament; £385 million towards advanced nuclear R&D; and £120 million for a new Future Nuclear Enabling Fund to address barriers to entry.

It can be expected that global markets will adjust as supply responds to higher prices and demand conditions normalise. However, as the OBR acknowledges, more persistent supply and demand mismatches and further increases in energy costs are possible and pose an upside risk to inflation. The OBR has noted that developments since it closed its forecast would be “consistent with inflation peaking at close to 5 per cent”.[footnote 37]

These pressures will take time to ease, but the government is continuing to provide support with the cost of living. The government remains committed to raising the National Living Wage so that it reaches two-thirds of median earnings, helping the lowest paid in society. From 1 April 2022 the National Living Wage will rise to £9.50 per hour. Alongside this the government is making changes to Universal Credit to help those in work keep more of what they earn. The government is focused on investing in jobs and skills, particularly in new green industries, spreading better prospects and wages across the country. Further details of action taken at the Budget and SR to raise living standards and provide people with help towards the cost of living are set out in chapter 2.

The return of inflation to the 2% target is underpinned by the UK’s strong and credible macroeconomic framework which seeks to achieve strong, sustainable and balanced growth. Within this framework, the Bank of England is responsible for using monetary policy to achieve the inflation target set by government. The Bank’s Monetary Policy Committee (MPC) has operational independence to set monetary policy to meet its primary objective of price stability and, subject to that, to support the economic policy of the government, including its objectives for growth and employment.

Independent monetary policy is a critical element of the UK’s macroeconomic framework, alongside sustainable public finances and a resilient financial system. Low and stable inflation supports living standards and provides certainty for households and businesses, helping them make decisions about saving, investment and spending.

- The Chancellor is responsible for setting the MPC’s remit, which defines price stability and outlines the government’s economic policy objectives. Alongside the Budget and SR, the Chancellor is restating the MPC remit to reaffirm the symmetric inflation target of 2%, as measured by the 12-month increase in the CPI, which applies at all times. Within the remit the MPC’s primary objective of price stability has also been reaffirmed. The Chancellor also confirms that the Asset Purchase Facility (APF) will remain in place for the financial year 2022-23.

Fiscal context

The rebound in economic activity means that the public finances have performed better than expected in the OBR’s March forecast. Public sector net borrowing (PSNB) and public sector net debt (PSND) in 2021-22 are forecast to be, respectively, £50.9 billion and 9.2 percentage points of GDP lower than expected in March.[footnote 38] Jobs and businesses have been protected through the government’s Plan for Jobs, meaning that tax receipts have performed better than expected, while spending on support schemes has been lower than forecast.

These improvements mean that the government’s 2021-22 financing requirement has been revised materially downwards. The government’s revised financing plans for 2021-22 are summarised in Annex C.

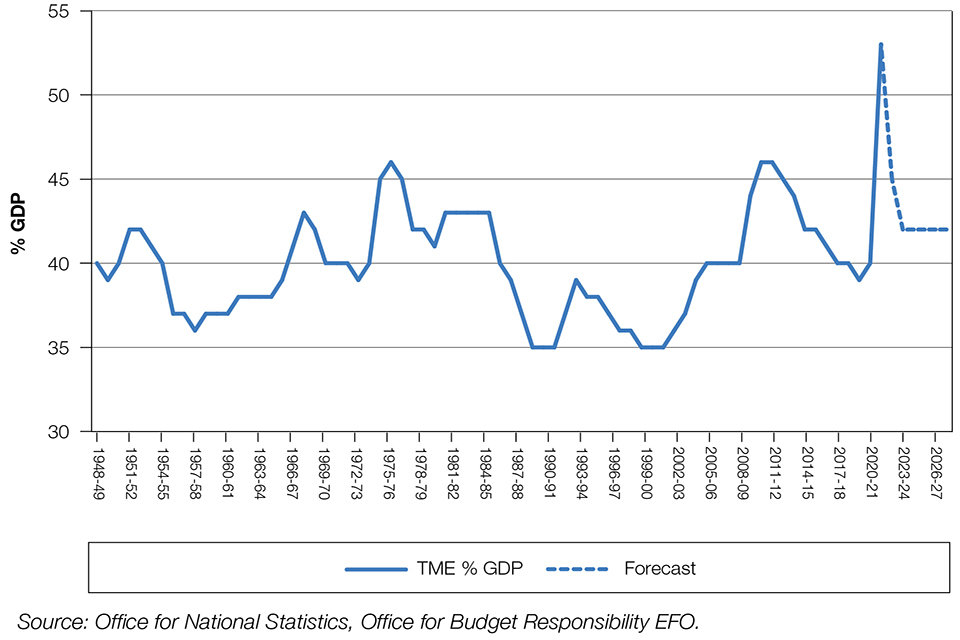

While the costs of inaction would have been far greater, the government’s package of unprecedented support for jobs and businesses has still placed significant burdens on the public finances. Although lower than previously forecast, borrowing and debt remain at historically high levels. PSNB reached £319.9 billion in 2020-21, the highest level since World War Two, and the OBR expects borrowing will remain high at £183.0 billion this year. PSND increased from 84.2% of GDP in 2019-20 to 96.6% of GDP in 2020-21, and is forecast to reach 98.2% of GDP this year.[footnote 39],[footnote 40]

This additional borrowing significantly increased the government’s financing requirement in the near term. Gilt issuance in 2020-21 was over two times its previous 2009-10 record and more than three times the original pre-pandemic plans for the year.[footnote 41] The government has successfully adapted its debt issuance strategy to help deliver these record levels of financing.

The use of innovative instruments has helped to support wider government policy objectives and has also contributed notably to government financing in 2021-22. The UK’s inaugural sovereign green bond (or “green gilt”) was launched in September 2021, and was followed by a second issuance in October 2021 as the UK begins to build out a ”green yield curve”.[footnote 42] National Saving and Investments (NS&I) retail Green Savings Bonds are the first sovereign green retail product of their kind in the world. These green financing instruments will help to finance important projects for tackling climate change and other environmental challenges. The government also successfully issued its second sovereign Sukuk in April 2021. The offering was more than double the size of the UK’s first Sukuk issuance and demonstrates the government’s ongoing commitment to Islamic finance in the UK.

While the higher level of borrowing is currently affordable as the interest rate the government pays on its debt remains close to historical lows, the public finances remain vulnerable to future shocks due to the government’s large stock of debt, as set out in Box 1.E. Taxpayer money spent servicing debt is money which could have been invested in public services, and a sustained one percentage point rise in interest rates and inflation is estimated to cost an extra £20.3 billion in 2024-25, rising to £22.8 billion in 2026-27.[footnote 43]

Box 1.E: Sensitivity of debt interest to changes in interest rates and inflation

The debt interest to revenue ratio has fallen significantly over the past century.[a] However, historically high levels of debt stock leave the public finances more vulnerable to future shocks.

Chart 1.9 shows the sensitivity of debt interest payments to changes in the interest rates paid on government debt and inflation in the final year of each forecast event since autumn 2014. Extensions of the APF have increased sensitivity to changes in the level of the interest rate set by the Bank of England. OBR analysis found that the first-year fiscal impact of a one percentage point rise in interest rates was six times greater than it was just before the financial crisis, and almost twice what it was before the pandemic.[b]

Sensitivity to gilt rates has also increased which reflects the higher stock of debt due to the pandemic. Currently, a one percentage point increase in gilt rates is estimated to increase debt interest spending by £7.1 billion in the final year of the forecast, compared to £4.2 billion in spring 2019.[c

The UK’s relatively large stock of inflation-linked debt means that the government’s debt interest sensitivity to inflationary pressures is high: a one percentage point increase in RPI inflation is estimated to increase spending on debt interest by £6.7 billion in 2026-27.[d] This sensitivity has remained largely stable in the past years, which in part reflects the government’s strategy in recent years to reduce inflation-linked debt as a share of total issuance.

Chart 1.9: Debt interest sensitivities in the final year of the forecast, by forecast event

Chart 1.9 A bar chart showing a 1 percentage point increase in short rates is increasingly risky for debt interest payments however this is expected to lower in the final year of this forecast.

a. Further detail can be found in Annex A.

b. ‘Fiscal risks report’, OBR, July 2021.

c. ‘Economic and Fiscal Outlook’, OBR, October 2021 and ‘Economic and Fiscal Outlook’, OBR, March 2019.

d. ‘Economic and Fiscal Outlook’, OBR, October 2021.

Medium-term fiscal strategy and outlook