Benefit sanctions statistics to April 2020

Updated 10 June 2021

The latest release of these statistics can be found in the benefit sanctions statistics collection.

This release of statistics on Benefit Sanctions includes data up to April 2020.

Statistics covered in this bulletin include data for sanction decisions during the initial period of the coronavirus (COVID-19) pandemic. Although legislative changes to temporarily disapply work-search and work availability requirements came into effect on 30 March 2020 (in response to the pandemic), some sanction decisions for these types of failures could have been made later than this date because decisions are often made and processed after the date that the claimant failure occurred. This means that it was possible for sanction decisions to be recorded after legislation changes came into effect, in instances where a claimant prior to 30 March 2020 has failed to meet the work requirements set out in their claimant commitment. Additionally, sanction decisions were also possible for some failures which occurred after this date, for example, for leaving a job voluntarily without good reason or for misconduct. This impacts data for Universal Credit (UC) and Jobseeker’s Allowance (JSA) sanctions.

The next release will be in November 2020.

We are seeking user feedback on this HTML version of the statistical bulletin which replaces the PDF version. Send comments to: stats-consultation@dwp.gov.uk.

There should be no comparisons made across benefits.

Whilst the same methodology has been used to produce these statistics, the benefits themselves are very different and require interpretation based on the rules of the specific benefit.

1. Main stories

On JSA, if a claimant fails to attend a Work-Focused Interview, their claim can be closed. However, because UC replaces a number of benefits, claims are not closed if a claimant fails to attend a Work-Focused Interview. In the period from February 2020 to April 2020, 90% of UC full service adverse decisions occurred due to failure to attend or participate in a Work-Focused Interview.

The statistics show:

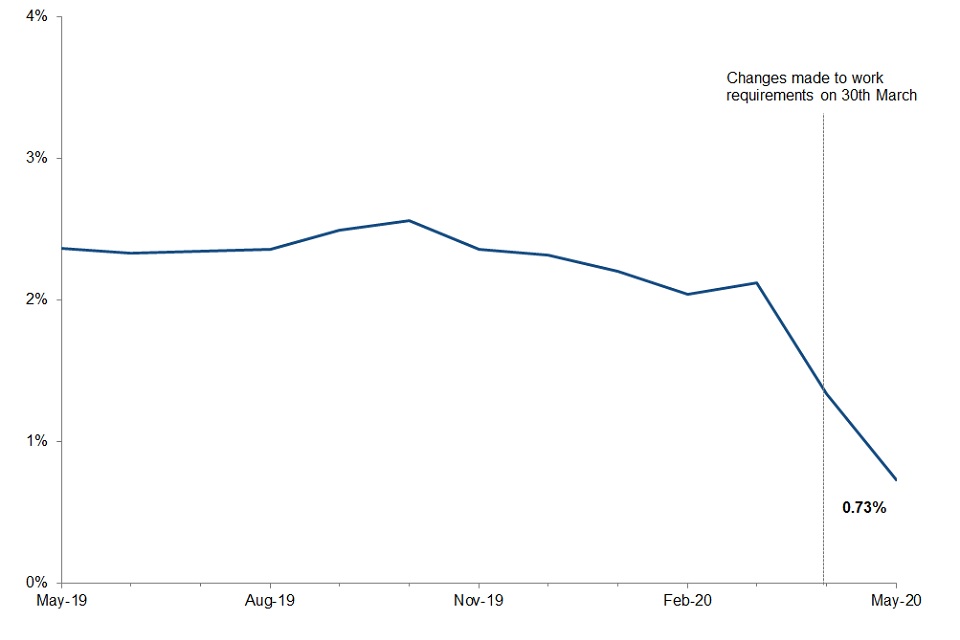

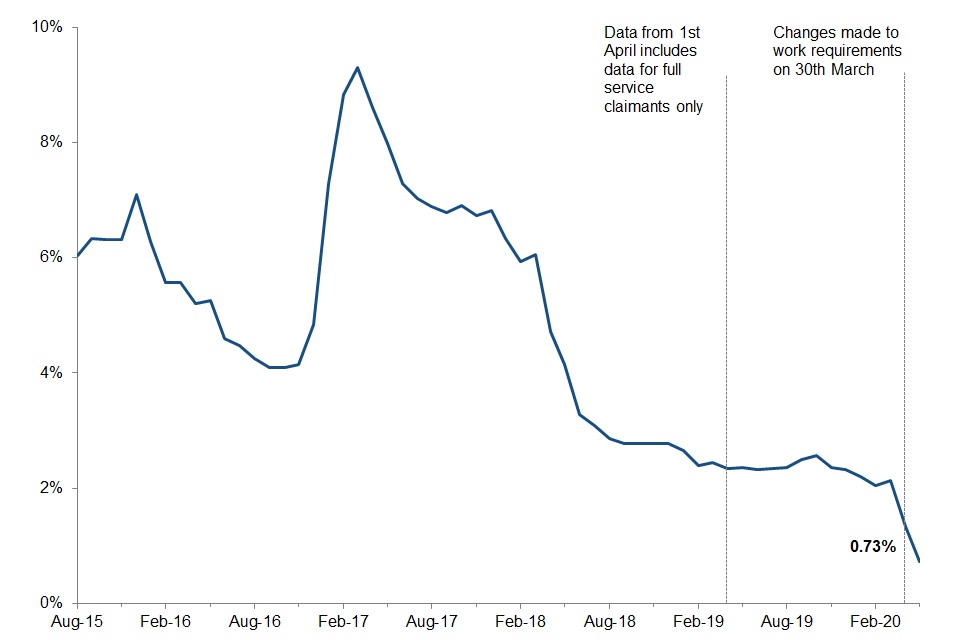

- prior to legislation changes made on 30 March 2020, 2.12% of UC full service claimants subject to conditionality at the point where the sanction was applied had a deduction taken from their UC full service award as a result of a sanction. In May 2020, this proportion was 0.73%. This is:

- down 1.32 percentage points from February 2020

- down 1.64 percentage points in the latest 12 months

- over the course of the roll-out of UC (live and full service), the balance of individuals in conditionality groups subject to sanction as a proportion of the caseload has changed.

- in May 2020, 67% of UC claimants were in the conditionality groups that could be subject to sanction. This proportion:

- has been trending downwards over the last year from 64% in May 2019, until April 2020. At this time there was a change in trend, which coincided with an increase to the UC caseload during the coronavirus (COVID-19) pandemic.

- has decreased from 81% in August 2015

- the average (median) UC (live and full service) sanction lasted 29 days

- for further information regarding how this is calculated, see the ‘’Sanction Rates’’ section of the background information and methodology document

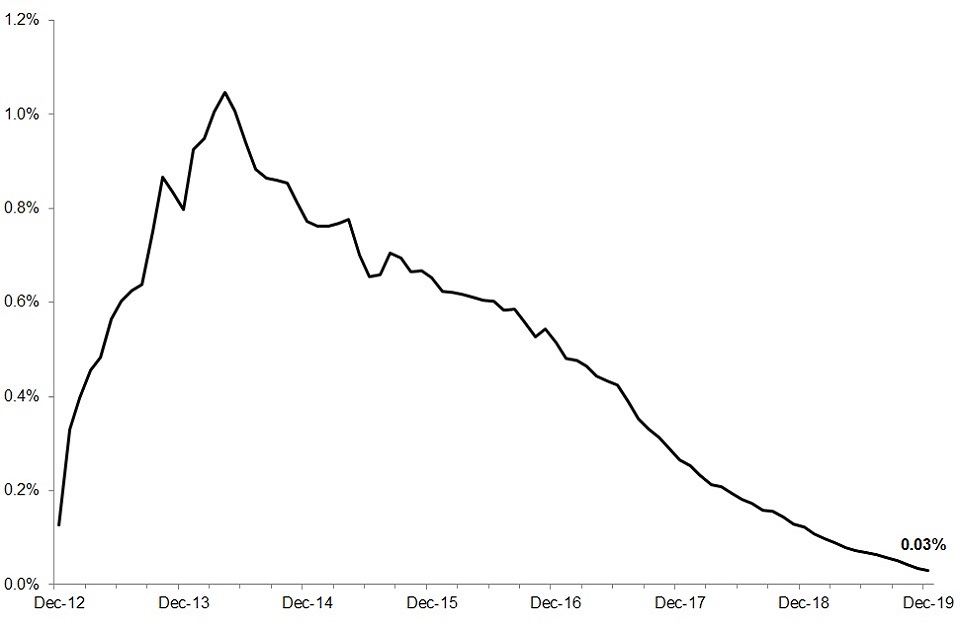

Figure 1: Experimental rate of UC full service claimants receiving less benefit due to a sanction

Figure 1 notes:

- Where this graph has previously shown an experimental rate of UC live and full service claimants, the data presented now relates to those on full service only. This is because UC live service systems were shut down by 1 April 2019, which is prior to the time period captured above.

- Analysis presented above contains information regarding sanctions that have already ended. See the background and methodology document for further information.

The data shows:

- numbers of claimants on JSA and Employment and Support Allowance (ESA) Work Related Activity Group (WRAG) have steadily reduced due to migration to UC (live and full service), and therefore the number of sanctions is now very low for JSA and ESA (WRAG)

- the percentage of JSA claimants with a drop in payment due to a sanction in December 2019 was 0.02%. This is:

- down 0.02 percentage points from September 2019

- down 0.11 percentage points in the latest 12 months

- the percentage of ESA (WRAG) claimants with a drop in payment due to a sanction in December 2019 was 0.03%. This is:

- down 0.02 percentage points from September 2019

- down 0.09 percentage points in the latest 12 months

2. What you need to know

If you do not meet one or more conditions of your benefit claim without good reason, your benefit could be stopped or reduced. This is a benefit sanction. However, not everyone that is initially referred for failing to meet the conditions of their claim will receive a sanction. Where a claimant’s benefit is reduced, the claimant may be eligible for a hardship payment.

Further information about the sanctions process, source of these statistics and the publication rounding policy can be found in the background information and methodology documents.

Statistics covered in this bulletin include data for sanction decisions during the initial period of the coronavirus (COVID-19) pandemic. Although legislative changes to temporarily disapply work-search and work availability requirements came into effect on 30 March 2020 (in response to the pandemic), some sanction decisions for these types of failures could have been made later than this date because decisions are often made and processed after the date that the claimant failure occurred. This means that it was possible for sanction decisions to be recorded after legislation changes came into effect, in instances where a claimant prior to 30 March 2020 has failed to meet the work requirements set out in their claimant commitment. Additionally, sanction decisions were also possible for some failures which occurred after this date, for example, for leaving a job voluntarily without good reason or for misconduct. This impacts data for UC and JSA sanctions.

Users can also:

- produce their own tables and access demographic breakdowns using Stat-Xplore

- access supporting tables

The data in this publication is the latest available for each of the following sets of statistics.

UC sanction statistics

The UC statistics in this release date from August 2015.

JSA sanction statistics

The JSA statistics in this release date from the regime change on 22 October 2012 when new rules were brought in.

Data from before the regime change (April 2000 to 21 October 2012) is available on Stat-Xplore and in the supporting tables.

Further information on the regime change can be found in the background information and methodology document.

ESA sanction statistics

The ESA statistics in this release date from the regime change on 3 December 2012 when new rules were brought in.

Data from before the regime change (October 2008 to 2 December 2012) is available on Stat-Xplore and in the supporting tables.

Further information on the regime change can be found in the background information and methodology document.

Income Support (IS) sanction statistics

These are not included in this publication, but are available on Stat-Xplore.

Migration of Claimants to UC Full Service

The move of legacy claimants onto full service will continue until migration is completed. As of April 2019, 100% of UC live service claimants have transferred onto full service and we are now including statistics relating to UC full service decisions in this publication.

Definitions

Sanction decisions

A claimant is referred to a sanction Decision Maker when they do not meet a condition of their benefit. The Decision Maker looks at the available information about the claimant and their referral and decides on an outcome. The decision made can be:

- Adverse – they decide to sanction the claimant

- Non-Adverse – they decide not to sanction the claimant

- Cancelled – they decide that the referral was not appropriate and cancel it

- Reserved – a decision to sanction the claimant cannot be made, since the claimant is not currently on benefit, so the sanction cannot be applied. The claimant will be re-referred to a Decision Maker if they begin to claim benefit again

Within this publication, we refer to all of these outcomes as decisions. Many sanction decisions can be made during the course of a claim where the claimant has failed to meet the conditions of their benefit claim more than once.

Sanction stages

Each JSA, ESA (WRAG) or IS sanction decision can have a maximum of four stages, beginning with the Original Decision made by a Decision Maker. If the claimant does not agree that their benefit should be reduced, they may request a Decision Review, Mandatory Reconsideration, and Appeal. UC has a maximum of three stages as there is no Decision Review.

In the statistics, only the latest decision is kept, meaning that any previous decisions for each sanction referral are updated with every publication.

Sanction durations

We count the length of time that a claimant is receiving less benefit because they were being sanctioned and calculate the median. The median is the middle number when all of the sanction lengths have been arranged from smallest to largest. Durations are counted up to and including the last month in which a deduction is taken. If someone has multiple sanctions which are served without a break in deductions, this will be counted as one sanction in the statistics. The underlying figures can be found in the supporting tables.

Sanction rates

We calculate the number of people who are receiving less benefit because they were sanctioned as a proportion of the total number of people in receipt of each benefit at a point in time (i.e. on a specific day of the month). These figures are calculated differently to the decisions figures, which are based on the number of decisions made in a full month. The underlying figures can be found in the supporting tables.

Destinations

We track what happens to claimants after they receive an original, adverse sanction decision. The figures show the amount of time spent on different working age benefits (UC, JSA, ESA (WRAG) and IS) in the 180-day period following the decision. In addition, we have developed statistics to show who has had a period of earnings after their sanction. Further information can be found in the destinations methodology document.

UC full service

At present, we only hold data on original, adverse sanction decisions for claimants on UC full service and cannot differentiate between non-adverse, reserved and cancelled outcomes. Prior to May 2016, UC full service was being implemented as a trial in a small area of the UK only (Sutton, Southwark, Croydon, Hounslow and Musselburgh) so data on original, adverse decisions is included from May 2016 onwards.

UC live service

New claims to UC live service ceased in January 2018, and since then the remaining live service cases have been gradually migrated to UC full service. This has resulted in a gradual decrease in the number of live service sanction decisions. By 1 April 2019, the systems that were used to administer live service cases were shut down. Due to this, data for any original UC live service sanction decisions has been frozen from this point.

3. Universal Credit Full Service

There should be no comparisons made across benefits.

Whilst the same methodology has been used to produce these statistics, the benefits themselves are very different and require interpretation based on the rules of the specific benefit.

Statistics in this section include data for sanction decisions during the initial period of the coronavirus (COVID-19) pandemic. Although legislative changes to temporarily disapply work-search and work availability requirements came into effect on 30 March 2020 (in response to the pandemic), some sanction decisions for these types of failures could have been made later than this date because decisions are often made and processed after the date that the claimant failure occurred. This means that it was possible for sanction decisions to be recorded after legislation changes came into effect, in instances where a claimant prior to 30 March 2020 has failed to meet the work requirements set out in their claimant commitment. Additionally, sanction decisions were also possible for some failures which occurred after this date, for example, for leaving a job voluntarily without good reason or for misconduct. This impacts data for UC and JSA sanctions.

These figures are for full service claimants only and do not include live service data; full service data and live service data come from different sources, which is why they have been reported separately for decisions. Note that rates are calculated in a manner that is not affected. For further information, see the UC background information and methodology document.

The migration to UC full service will continue until legacy benefits have ceased. As of April 2019, 100% of UC live service claimants have transferred onto full service and we are now including statistics relating to UC full service decisions in this publication.

Data for numbers of original adverse decisions has been included from May 2016, for UC full service. This is because prior to this time, UC full service was being implemented as a trial in a small area of the UK only (Sutton, Southwark, Croydon, Hounslow and Musselburgh). More information about this is available in our UC background information and methodology document.

It should be noted that references to full service adverse decisions describe original, adverse decisions only. We are currently unable to provide statistics on original non-adverse, reserved or cancelled decisions, as this information is not captured on the front end system. We are looking at ways of improving the way we collect sanctions information in UC full service.

3.1 UC full service: Sanction decisions and reasons – Experimental Statistics

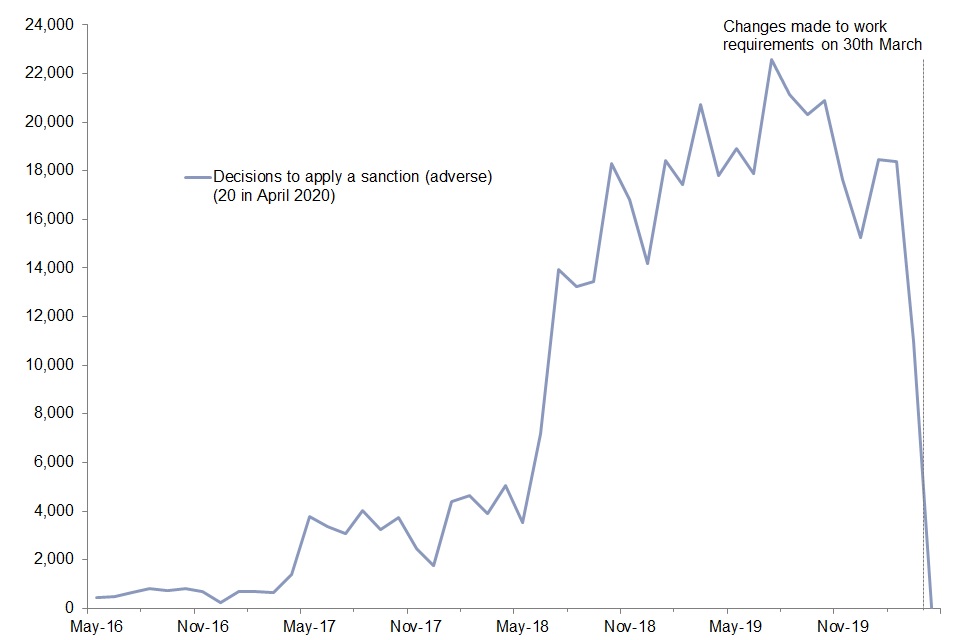

Figure 2: UC full service adverse sanction decisions by month, May 2016 to April 2020

Until changes were made to legislation on 30 March 2020 (in response to the coronavirus (COVID-19) pandemic), the numbers of adverse sanction decisions had been following an upward trend as UC full service continued to be rolled out and the UC caseload built up. In March 2020 there were 11,000 adverse decisions made, which occurred prior to the legislative changes to work requirements. There were 20 adverse decisions made in April 2020. These adverse decisions were due to failures to attend work-focused interviews that occurred prior to the decision to suspend the requirement to attend face-to-face appointments.

Figure 3: Summary of original UC full service adverse decision reasons from May 2019 to April 2020

| Original adverse decisions made by reason group | Latest Year (Thousands) | Latest Year (%) | Latest Quarter (Thousands) | Latest Quarter (%) |

| Work-Focused Interviews | 184.1 | 90.9 | 26.5 | 90.3 |

| Availability for Work | 11.7 | 5.8 | 1.8 | 6.0 |

| Employment Programmes | 4.0 | 2.0 | 0.7 | 2.2 |

| Reasons for Leaving Previous Employment | 2.2 | 1.1 | 0.4 | 1.2 |

| Other | 0.5 | 0.2 | 0.1 | 0.3 |

| Total | 202.5 | 100.0 | 29.4 | 100.0 |

Figure 3 notes:

- Note that these are original, adverse decisions, not all decisions as with other benefits.

- Disclosure control has been applied to this data for confidentiality purposes. Due to this, totals may not be the sum of the individual data breakdowns.

- For a full breakdown of the adverse decision reasons, see the methodology document

- A small proportion of sanctions (around 2%) have previously been categorised under the “Availability for Work’ reason group, where they should have been attributed to the “Work Focused Interviews” reason group. The methodology used to produce these statistics has now been improved, and the numbers provided above are correct. This had minimal impact on the statistics, and made no difference to the underlying trends and stories behind the data.

Failure to attend or participate in a Work-Focused Interview accounted for 91% of all adverse decisions in the last year. Availability for Work was the next most common sanction reason, accounting for 6% of adverse decisions in the last year.

4. Universal Credit Live Service

There should be no comparisons made across benefits.

Whilst the same methodology has been used to produce these statistics, the benefits themselves are very different and require interpretation based on the rules of the specific benefit.

100% of UC live service claimants were transferred onto UC full service by April 2019. There are no original decisions on UC live service past this point, hence any changes beyond this point refer to mandatory reconsiderations and appeals only.

4.1 UC live service: Sanction decisions and reasons – Experimental Statistics

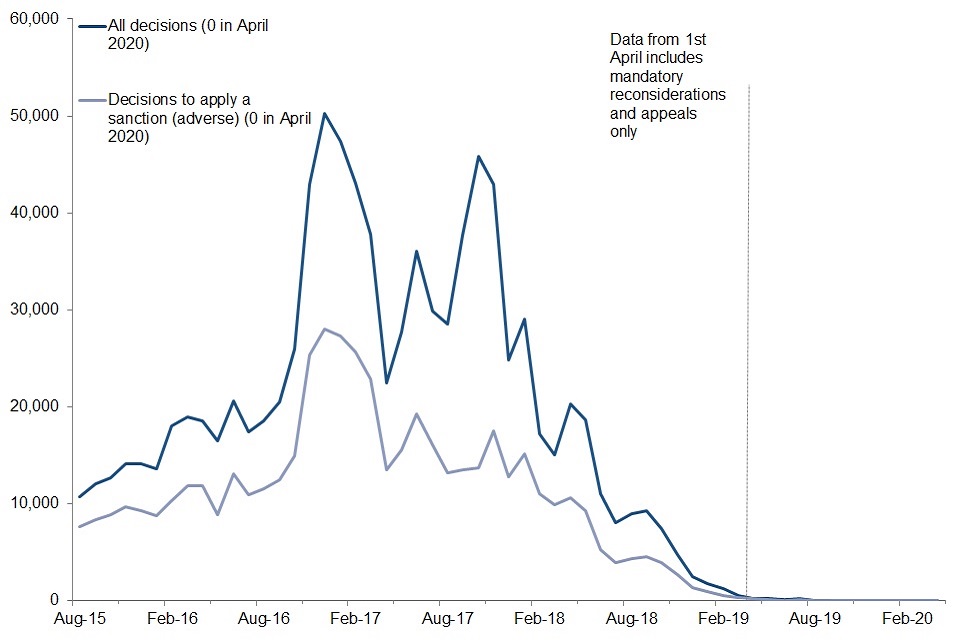

Figure 4: UC live service sanction decisions by month, August 2015 to April 2020

Figure 4 notes:

- Data from 1st April 2019 includes mandatory reconsiderations and appeals only.

The total number of monthly decisions has varied since August 2015, with peaks in December 2016 (50,000) and October 2017 (46,000) and falling to 0 in April 2020.

The volume of decisions processed has fallen based on the fact that UC live service has closed to new claims, and that the entire caseload has migrated to UC full service.

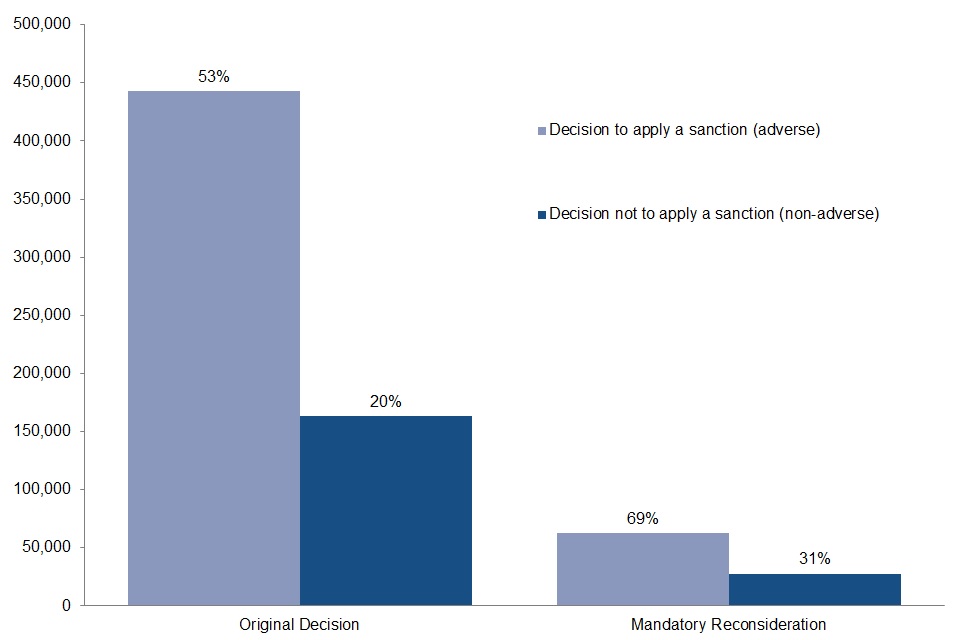

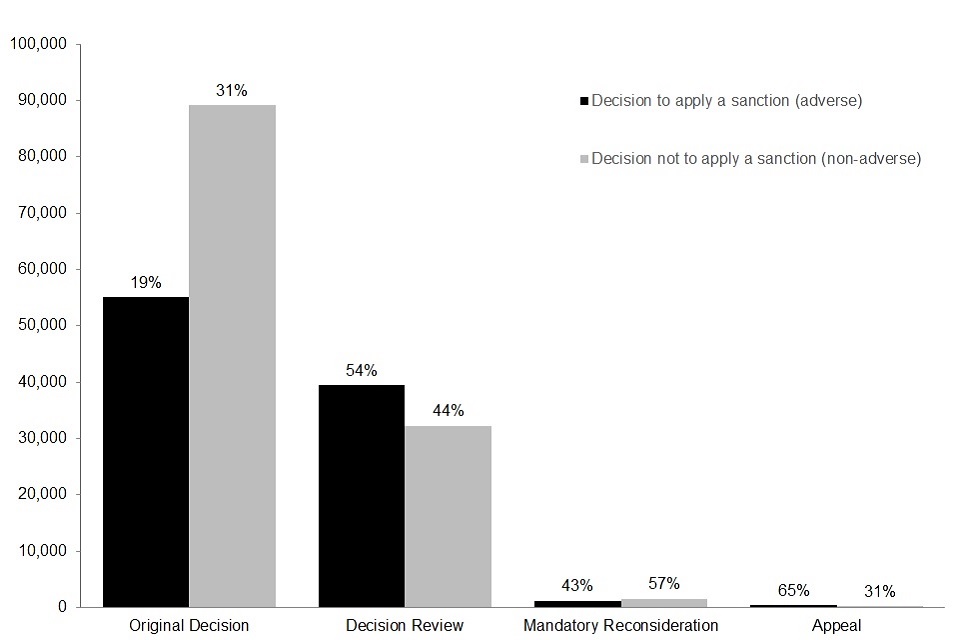

Figure 5: Summary of UC live service decision outcomes at each stage, August 2015 to April 2020

53% of original decisions have resulted in a sanction being applied and 69% of mandatory reconsiderations resulted in a sanction being upheld since August 2015.

Figure 6: Summary of UC live service decision reasons from May 2019 to April 2020

| All decisions made by reason group | Latest Year (Thousands) | Latest Year (%) | Latest Quarter (Thousands) |

| Work-Focused Interviews | 0.2 | 59.3 | 0.0 |

| Availability for Work | 0.0 | 12.0 | 0.0 |

| Employment Programmes | 0.1 | 28.5 | 0.0 |

| Reason for Leaving Previous Employment | 0.0 | 0.0 | 0.0 |

| Other | 0.0 | 0.0 | 0.0 |

| Total | 0.4 | 100.0 | 0.0 |

Figure 6 notes:

- Disclosure control has been applied to this data for confidentiality purposes. Due to this, totals may not be the sum of the individual data breakdowns.

- 100% of UC live service claimants were transferred onto UC full service by April 2019. There are no original decisions on UC live service past this point, hence any changes beyond this point refer to mandatory reconsiderations and appeals only.

- Proportions have been removed for the latest quarter, where the overall number of sanction decisions is low. This has been done because the disclosure control applied to the data could cause a misleading representation when calculating percentages.

- For a full breakdown of the adverse decision reasons see the methodology document.

Failure to attend or participate in a Work-Focused Interview accounted for 59% of all UC live service sanction decisions from May 2019 to April 2020.

4.2 UC live service: Destinations of claimants receiving a benefit sanction - Experimental Statistics

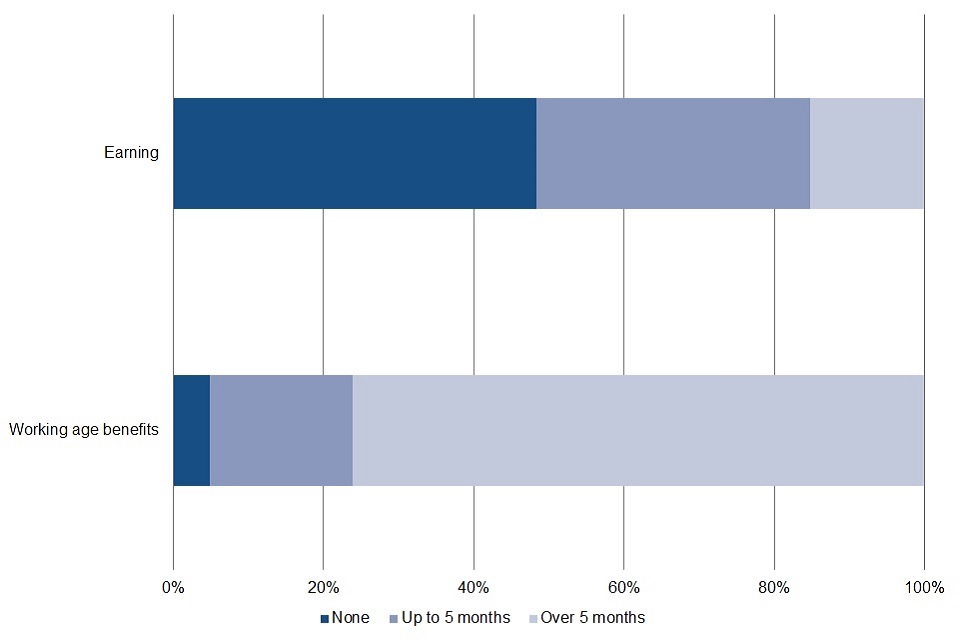

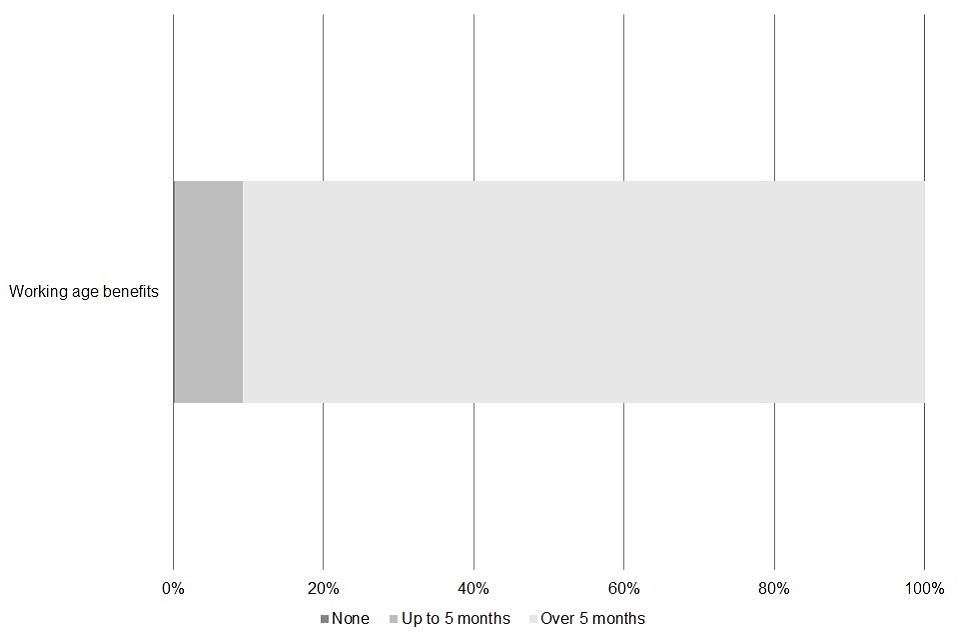

Figure 7: Distribution of number of months spent by UC claimants earning or on working age benefits in the 180 days (6 months) following a sanction decision

Figure 7 notes:

- Decisions made from 1st August 2015 to 30th September 2019 for UC live service are included.

After receiving a UC sanction decision, claimants spent an average (mean) of 153 days out of the following 180 days in receipt of benefit (UC, JSA, ESA (WRAG) or IS). On average (mean), only 2 of the 180 days were spent on a benefit that was not UC.

In the 180 days following a UC live service sanction decision, 4.9% of claimants were not in receipt of any of the tracked benefits (UC, JSA, ESA (WRAG) or IS). 76.2% of claimants spent over 150 days (5 months) in receipt of benefit and 70.3% of claimants spent the full 180 days in receipt of benefit.

After receiving a benefit sanction decision, UC live service claimants spent an average (mean) of 51 days out of the following 180 days earning, with 9.0% of claimants earning for the full 180 days after they had been sanctioned. See the methodology document for further information on how earnings are calculated.

5. Universal Credit Live and Full Service

There should be no comparisons made across benefits.

Whilst the same methodology has been used to produce these statistics, the benefits themselves are very different and require interpretation based on the rules of the specific benefit.

Statistics in this section include data for sanction decisions during the initial period of the coronavirus (COVID-19) pandemic. Although legislative changes to temporarily disapply work-search and work availability requirements came into effect on 30th March 2020 (in response to the pandemic), some sanction decisions for these types of failures could have been made later than this date because decisions are often made and processed after the date that the claimant failure occurred. This means that it was possible for sanction decisions to be recorded after legislation changes came into effect, in instances where a claimant prior to 30th March has failed to meet the work requirements set out in their claimant commitment. Additionally, sanction decisions were also possible for some failures which occurred after this date, for example, for leaving a job voluntarily without good reason or for misconduct. This impacts data for UC and JSA sanctions.

UC live service cases were shut down by 1st April 2019. Data shown here past this point is for full service claimants only.

5.1 UC live and full service: Benefit sanction rates – Experimental Statistics

The sanction rate is calculated as the proportion of people on each benefit at a point in time (meaning on the same day that the claimant count is recorded) with a deduction from their benefit due to a sanction. This is different to the data on sanction decisions, which uses the total number of decisions across a whole month.

Figure 8: All UC claimants (live and full service) with a sanction deduction, as a proportion of UC claimants, August 2015 to May 2020

Figure 8 notes:

- UC live service systems were shut down by 1st April 2019. Data shown here past this point is for full service only.

- Analysis presented above contains information regarding sanctions that have already ended. See the background and methodology document for further information.

Prior to legislation changes made on 30 March 2020, 2.12% of UC full service claimants subject to conditionality at the point where the sanction was applied had a deduction taken from their UC full service award as a result of a sanction. In May 2020, this proportion was 0.73%. It should be noted that the methodology used to calculate sanction rates only includes sanctions that have ended. The sanctions that appear in the April 2020 and May 2020 UC sanction rate were as a result of sanction decisions made prior to the legislation that was introduced on the 30 March 2020 in response to the coronavirus (COVID-19) pandemic and also for sanction decisions made after this date for failures which occurred previous to the legislation change.

The experimental monthly rate of UC claimants (both live and full service) with a sanction deduction showed a steady decrease from March 2017 to March 2019, and has since shown a gradual decline until April 2020. At this time there was a sharp downwards trend, which coincided with an increase to the UC caseload during the coronavirus (COVID-19) pandemic.

Over the course of the roll-out of UC, the balance of individuals subject to sanction as a proportion of the caseload has changed. In May 2020, 67% of the UC caseload were in the conditionality groups that could be subject to sanction, compared to 81% in August 2015.

5.2 UC live and full service: Benefit sanction durations – Experimental Statistics

The figures for benefit sanction durations are calculated based on sanctions that have ended, using the number of weeks that a claimant has a drop in their benefit payments to determine the length of the sanction. This means that if someone has multiple sanctions which are served without a break in deductions, this will be counted as one sanction in the statistics.

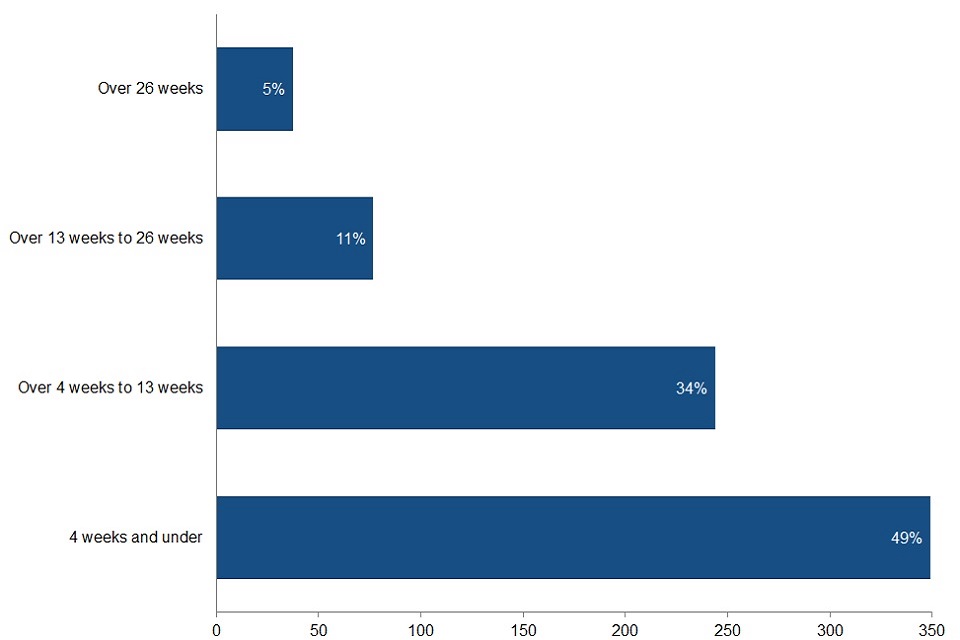

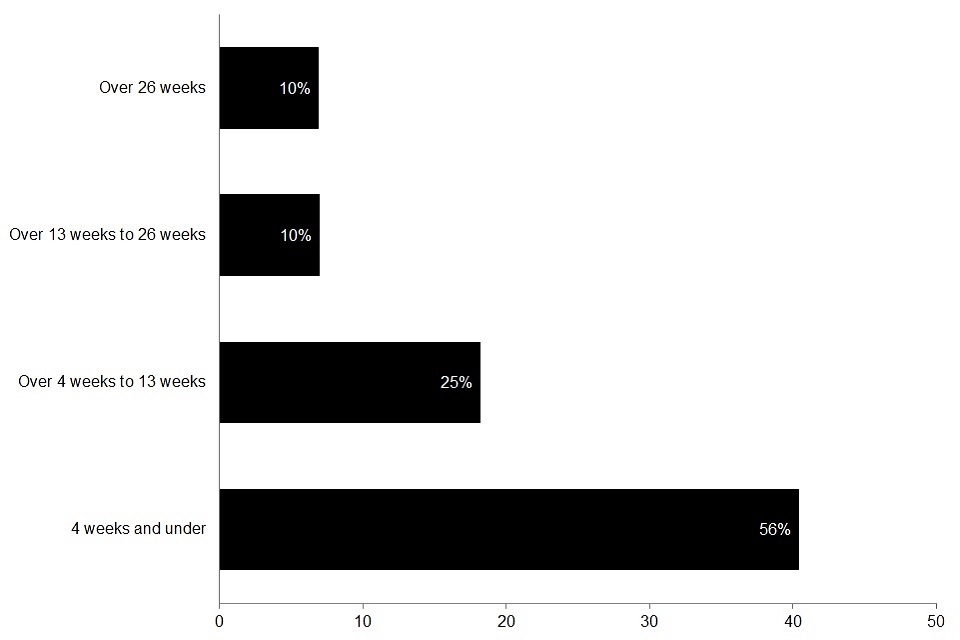

Figure 9: UC live and full service sanctions completed by length of sanction (thousands), August 2015 to May 2020

Figure 9 notes:

- Please note that percentages may not sum due to rounding.

- Analysis presented above contains information regarding sanctions that have already ended. See the background and methodology document for further information.

84% of ended UC sanctions lasted 13 weeks or less since August 2015. The average (median) UC sanction lasted 29 days. See the methodology document for further information on why a median has been used.

Since August 2015, 49% of all sanctions that ended lasted 4 weeks or less. 34% lasted between 5 and 13 weeks. 16% lasted over 13 weeks. Of all live service decisions between May 2019 and April 2020, 59% were made on the referral reason group “Work-Focused Interviews” (note that this includes Mandatory Reconsideration and Appeal Decisions only). For certain conditionality groups the sanction for this referral reason lasts until the claimant attends an interview, and then a sanction of between 7 and 28 days is applied. This helps to explain why such a large proportion of sanctions last 4 weeks or less.

6. Jobseeker’s Allowance

There should be no comparisons made across benefits.

Whilst the same methodology has been used to produce these statistics, the benefits themselves are very different and require interpretation based on the rules of the specific benefit.

6.1 JSA: Benefit sanction rates – Experimental Statistics

The sanction rate is calculated as the proportion of people on each benefit at a point in time (meaning on the same day that the claimant count is recorded) with a deduction from their benefit due to a sanction. This is different to the data on sanction decisions, which uses the total number of decisions across a whole month.

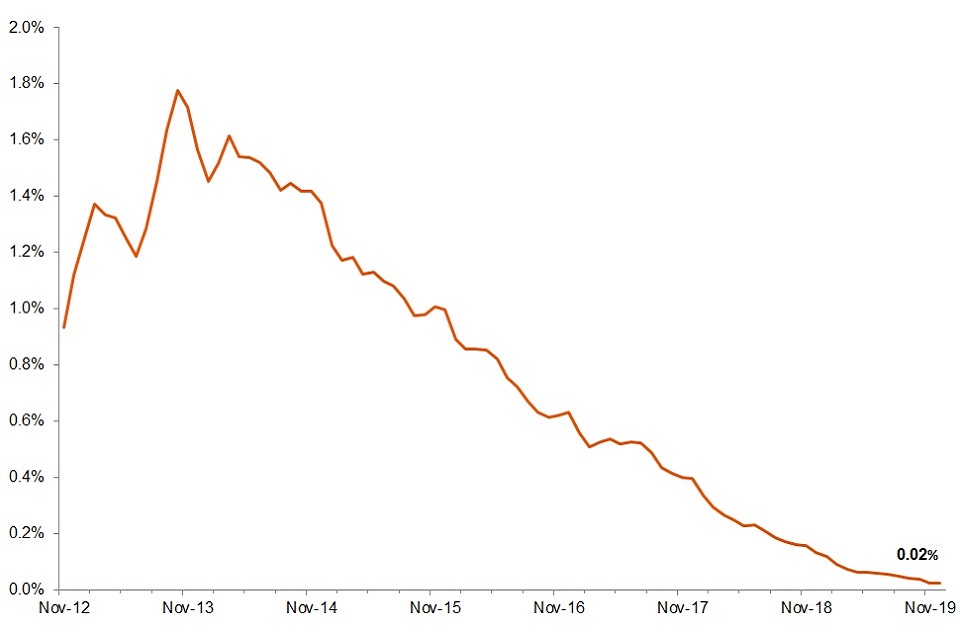

Figure 10: JSA claimants with a sanction deduction, as a proportion of JSA claimants, November 2012 to December 2019

Figure 10 notes:

- Analysis presented above contains information regarding sanctions that have already ended. See the background and methodology document for further information.

In December 2019, 0.02% of people on JSA had a deduction taken from their payment as a result of a sanction.

The experimental monthly rate of JSA claimants with a sanction deduction has decreased steadily over the past six years from a peak of 1.78% in October 2013, in line with the decrease in JSA sanction decisions.

6.2 JSA: Sanction decisions and reasons – Official Statistics

Statistics in this section include data for sanction decisions during the initial period of the coronavirus (COVID-19) pandemic. Although legislative changes to temporarily disapply work–search and work availability requirements came into effect on 30 March 2020 (in response to the pandemic), some sanction decisions for these types of failures could have been made later than this date because decisions are often made and processed after the date that the claimant failure occurred. This means that it was possible for sanction decisions to be recorded after legislation changes came into effect, in instances where a claimant prior to 30 March 2020 has failed to meet the work requirements set out in their claimant commitment. Additionally, sanction decisions were also possible for some failures which occurred after this date, for example, for leaving a job voluntarily without good reason or for misconduct. This impacts data for UC and JSA sanctions.

Over the course of 2019, some decisions were put on hold for Jobseeker’s Allowance (JSA) sanction referrals made under the reason of “failure to attend a place on a training scheme or employment programme without good reason”. This was to allow for changes to handling procedures to be developed. After developments had been implemented, these outstanding JSA sanction referrals were processed. This resulted in a temporary increase in JSA sanction decisions in the early months of 2020.

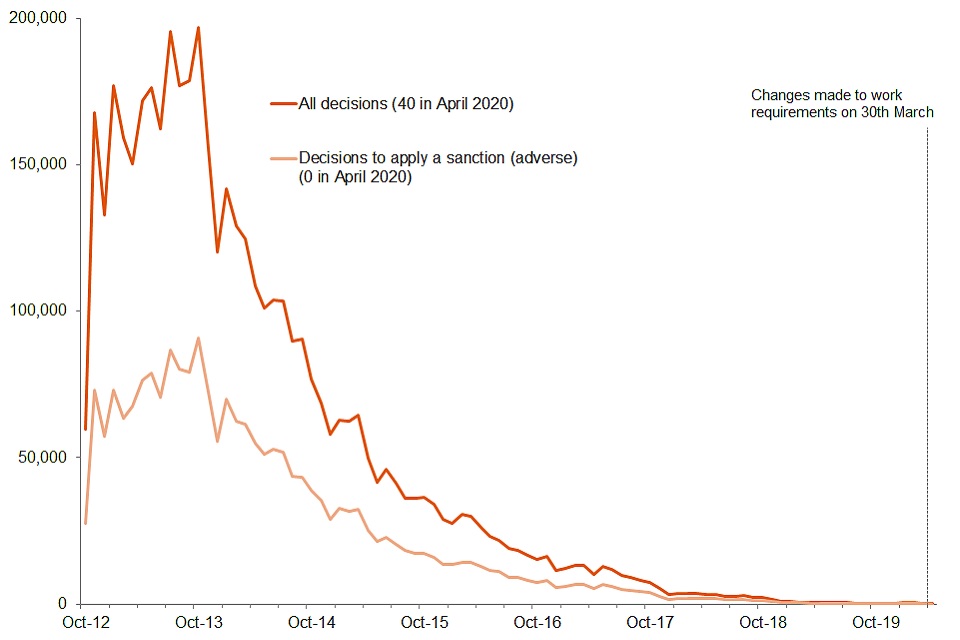

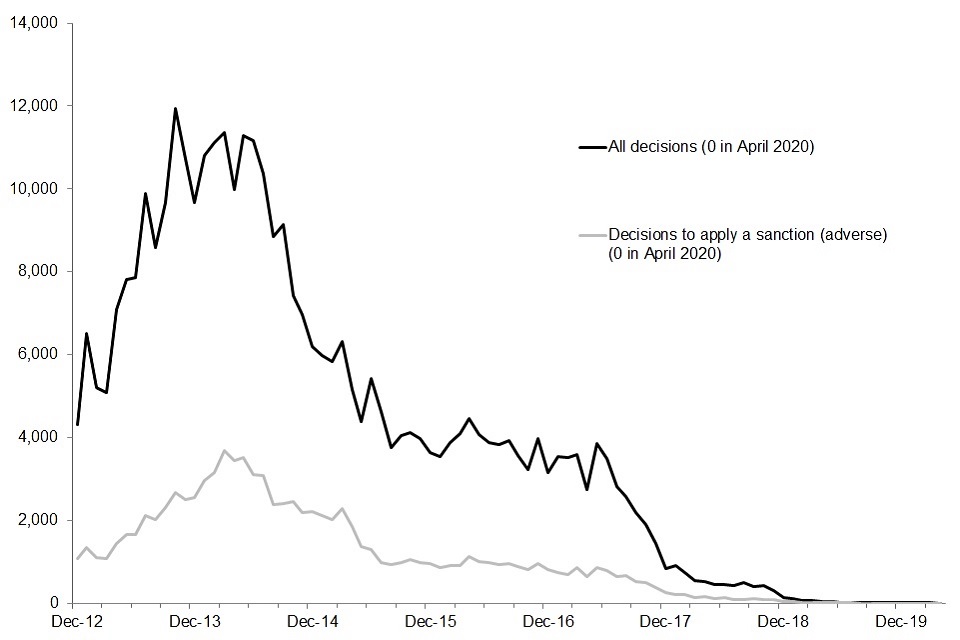

Figure 11: Sanctions decisions, October 2012 to April 2020

The fall in decisions is in part due to the fall in JSA claimants as more people move to UC. There was an increase in sanction decisions made in the earlier months of 2020, resulting from processing the backlog of sanction decisions mentioned above. Over the last 6 years, the total number of decisions per month has declined to 40 in April 2020.

Figure 12: Summary of decision outcomes at each stage, October 2012 to April 2020

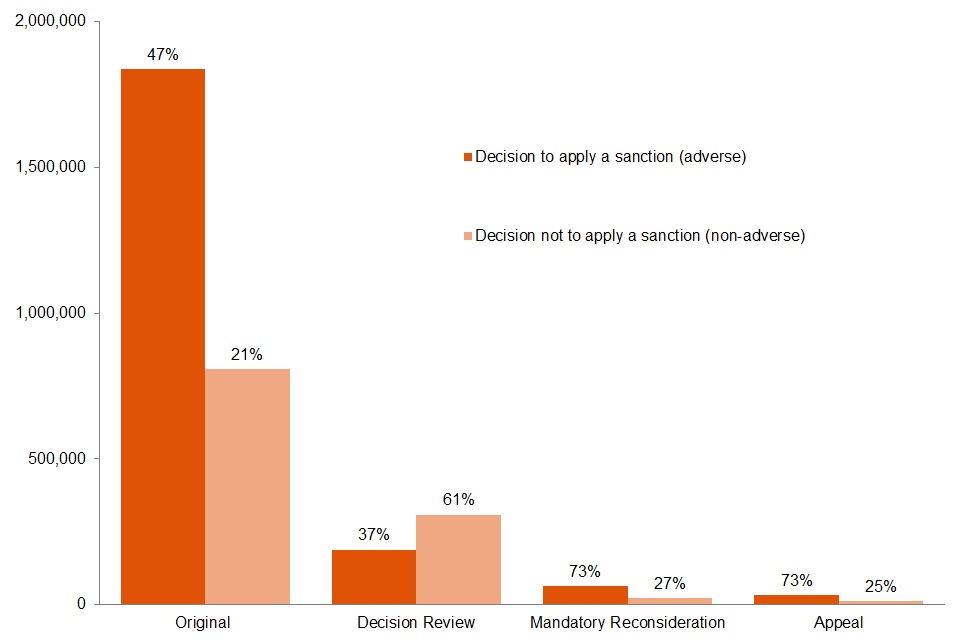

Original decisions currently account for 86% of all decisions made since October 2012. Since October 2012, 47% of original decisions have resulted in a sanction being applied. Since the introduction of the Mandatory Reconsideration in November 2013, Appeals have dropped from a peak of 4,600 in October 2013 to only 10 in the last year.

Figure 13: Summary of decision reasons, May 2019 to April 2020

| All decisions made by reason group | Latest Year (Thousands) | Latest Year (%) | Latest Quarter (Thousands) | Latest Quarter (%) |

| Work Programme | 0.0 | 0.3 | 0.0 | 1.9 |

| Work-Focused Interview | 1.0 | 26.2 | 0.1 | 11.7 |

| Availability for Work | 1.8 | 47.2 | 0.2 | 28.1 |

| Reason for Leaving Previous Employment | 0.0 | 0.6 | 0.0 | 0.0 |

| Other Employment Programmes | 1.0 | 25.5 | 0.4 | 59.6 |

| Other | 0.0 | 0.0 | 0.0 | 0.0 |

| Total | 3.8 | 100.0 | 0.7 | 100.0 |

Figure 13 notes:

- Disclosure control has been applied to this data for confidentiality purposes. Due to this, totals may not be the sum of the individual data breakdowns.

- For a full breakdown of the adverse decision reasons, see the methodology document.

The trend in JSA sanction decisions also coincides with the end of the Work Programme. Less than 1% of all JSA sanction decisions in the last year were due to Work Programme sanction referrals. These have been falling since October 2013, making the total number of JSA sanction decisions fall. Referrals to the Work Programme ended in March 2017.

47% of sanction decisions in the last year were due to Availability for Work referrals, followed by 26% of referrals for failing to attend or participate in a Work Focused Interview.

6.3 JSA: Benefit sanction durations – Experimental Statistics

The figures for benefit sanction durations are calculated based on sanctions that have ended, using the number of weeks that a claimant has a drop in their benefit payments to determine the length of the sanction. This means that if someone has multiple sanctions which are served without a break in deductions, this will be counted as one sanction in the statistics.

Figure 14: JSA sanctions completed by length of sanction (thousands), October 2012 to December 2019

Figure 14 notes:

- Please note that percentages may not sum due to rounding.

- Analysis presented above contains information regarding sanctions that have already ended. See the background and methodology document for further information.

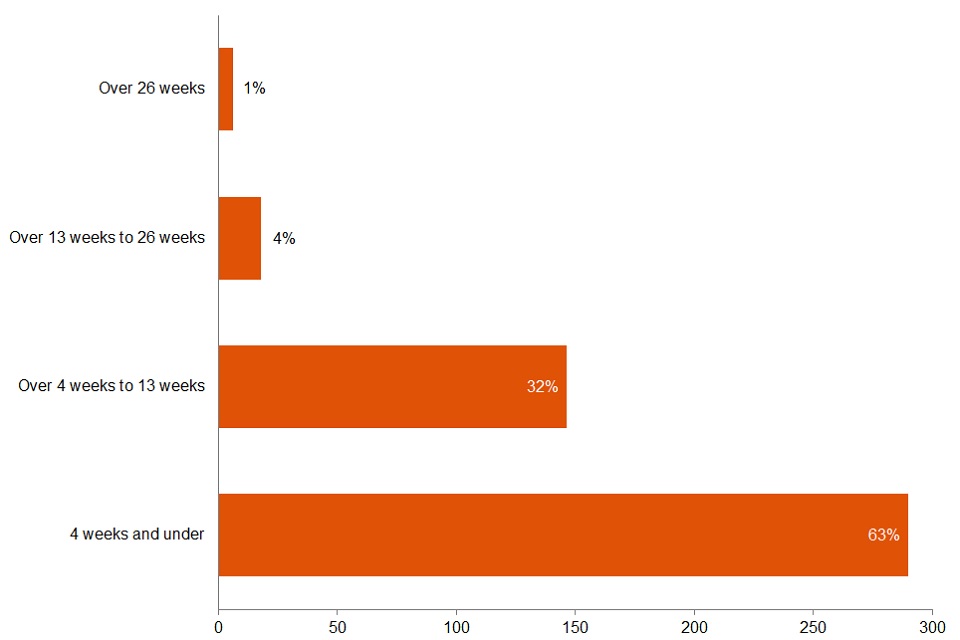

95% of ended JSA sanctions lasted 13 weeks or less since October 2012. The average (median) JSA sanction lasted 28 days. See the methodology document for further information on why a median has been used.

Since October 2012, 63% of all sanctions that ended lasted 4 weeks or less, a further 32% lasted between 5 and 13 weeks. 5% lasted over 13 weeks. In the period from May 2019 to April 2020, 47% of all decisions were made on the referral reason group Availability for Work. A further 26% of all decisions in the last three months were made on the referral reason group Work-Focused Interviews. For a first-time failure, sanctions issued under this referral reason last 4 weeks. This helps to explain why such a large proportion of sanctions last 4 weeks and under.

6.4 JSA: Destinations of claimants receiving a benefit sanction – Experimental Statistics

Figure 15: Distribution of number of months spent by JSA claimants on working age benefits or earning in the 180 days (6 months) following a sanction decision.

Figure 15 notes:

- Decisions made from 22nd October 2012 to 30th September 2019 for JSA are included.

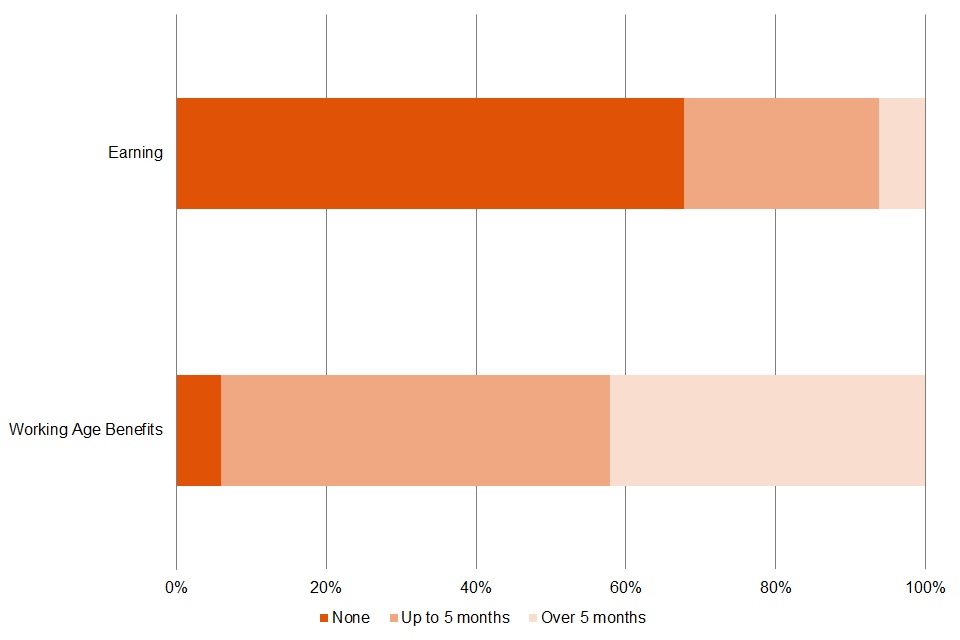

After receiving a JSA sanction decision, claimants spent an average (mean) of 111 days out of the following 180 days in receipt of benefit (JSA, UC, ESA (WRAG) or IS). On average (mean), 14 of the 180 days were spent on a benefit that was not JSA.

In the 180 days following a JSA sanction decision, 5.9% of claimants were not in receipt of any of the tracked benefits (JSA, UC, ESA (WRAG) or IS). 42.1% of claimants spent over 150 days (5 months) in receipt of benefit and 26.9% of claimants spent the full 180 days in receipt of benefit.

After receiving a benefit sanction decision, JSA claimants spent an average (mean) of 28 days out of the following 180 days earning, with 2.5% of JSA claimants earning for the full 180 days after they had been sanctioned. See the methodology document for further information on how earnings are calculated.

7. Employment and Support Allowance (Work Related Activity Group)

There should be no comparisons made across benefits.

Whilst the same methodology has been used to produce these statistics, the benefits themselves are very different and require interpretation based on the rules of the specific benefit.

As part of a claim to ESA, a Work Capability Assessment (WCA) is carried out. If the claimant’s capability for work is limited by their health condition or disability, and they are eligible to remain on ESA, the claimant is placed in one of two groups:

- the Work Related Activity Group (WRAG)

- the Support Group

Those in the Support Group do not have to attend interviews and are not subject to sanctions.

Those in the WRAG group may be expected to attend regular interviews with their work coach. They may also be expected to undertake Work Related Activity (WRA) to give them the best prospects of moving into work when they are able. Any WRA should be reasonable and appropriate for the claimant, based on their health condition or disability.

7.1 ESA (WRAG): Benefit sanction rates – Experimental Statistics

The sanction rate is calculated as the proportion of people on each benefit at a point in time (this means on the same day that the claimant count is recorded) with a deduction from their benefit due to a sanction. This is different to the data on sanction decisions, which uses the total number of decisions across a whole month.

Figure 16: ESA (WRAG) claimants with a sanction deduction, as a proportion of all ESA (WRAG) claimants, December 2012 to December 2019

Figure 16 notes:

- Analysis presented above contains information regarding sanctions that have already ended. See the background and methodology document for further information.

In December 2019, 0.03% of people in the ESA (WRAG) had a deduction taken from their personal allowance as a result of a sanction.

The experimental monthly rate of ESA (WRAG) claimants with a sanction deduction has fallen steadily from its peak of 1.05% in April 2014.

7.2 ESA (WRAG): Sanction decisions and reasons – Official Statistics

Figure 17: Sanction decisions, December 2012 to April 2020

The total number of ESA (WRAG) sanction decisions has continued to fall since May 2017, to 0 in April 2020. It is expected that as UC full service continues to roll out and claimants move from ESA (WRAG) to UC, the ESA (WRAG) sanctions will remain low (in-line with the fall in the number of ESA (WRAG) claimants).

ESA (WRAG) has a high proportion of decisions that are subsequently changed. As the data is overwritten by the latest decisions each quarter, the number of adverse decisions in the last month of the previous quarter can drop by over 30%.

Figure 18: Summary of decision outcomes at each stage, December 2012 to April 2020

19% of original decisions since December 2012 have resulted in a sanction being applied.

Figure 19: Summary of decision reasons, May 2019 to April 2020

| All decisions made by reason group | Latest Year (Thousands) | Latest Year (%) | Latest Quarter (Thousands) | Latest Quarter (%) |

| Failure to Participate in Work-Related Activity | 0.0 | 2.2 | 0.0 | 0.0 |

| Failure to Attend Mandatory Interview | 0.3 | 98.2 | 0.0 | 100.0 |

| Total | 0.3 | 100.0 | 0.0 | 100.0 |

Figure 19 notes:

- Disclosure control has been applied to this data for confidentiality purposes. Due to this, totals may not be the sum of the individual data breakdowns.

- Due to the low number of claimants remaining on this benefit and the disclosure controls applied, caution should be taken when considering percentages for the latest quarter.

- For a full breakdown of the adverse decision reasons, see the methodology document.

Trends are driven by work related activity sanction decisions. 92% of sanction decisions for ESA (WRAG) relate to failure to participate in work related activity since December 2012. There has been a change in this trend over time, as claimants have moved from ESA (WRAG) to UC following a change in circumstance or have been diverted to UC instead of ESA (WRAG). In the latest quarter, 100% of all sanction decisions were made due to failure to attend a mandatory interview. Due to the low number of claimants receiving a sanction decision and the disclosure controls applied, caution should be taken when considering percentages for the latest quarter.

7.3 ESA (WRAG): Benefit sanction durations – Experimental Statistics

The figures for benefit sanction durations are calculated based on sanctions that have ended, using the number of weeks that a claimant has a drop in their benefit payments to determine the length of the sanction. This means that if someone has multiple sanctions which are served without a break in deductions, this will be counted as one sanction in the statistics.

Figure 20: ESA sanctions completed by length of sanction (thousands), December 2012 to December 2019

Figure 20 notes:

- Please note that percentages may not sum due to rounding.

- Analysis presented above contains information regarding sanctions that have already ended. See the background and methodology document for further information.

81% of ended ESA (WRAG) sanctions lasted 13 weeks or less since December 2012. The average (median) ESA (WRAG) sanction lasted 28 days. See the methodology document for further information on why a median has been used.

Since December 2012, over half (56%) of all sanctions that ended lasted 4 weeks or less, a further 25% lasted between 5 and 13 weeks and 19% lasted over 13 weeks.

ESA (WRAG) sanctions are open-ended until the claimant complies with the interview requirement or work related activity that they failed to attend or participate in.

Once the claimant re-complies, a fixed-length sanction is imposed of 1, 2 or 4 weeks. This means that a sanction of longer than 4 weeks will be due to a claimant failing to re-comply, or where an individual has multiple sanctions which are served without a break in deductions.

7.4 ESA (WRAG): Destinations of claimants receiving a benefit sanction – Experimental Statistics

Figure 21: Distribution of number of months spent by ESA (WRAG) claimants on working age benefits in the 180 days (6 months) following a sanction decision

Figure 21 notes:

- Decisions made from 22nd October 2012 to 30th September 2019 for ESA (WRAG) are included.

After receiving an ESA (WRAG) sanction decision, claimants spent an average (mean) of 171 days out of the following 180 days in receipt of benefit (ESA (WRAG), UC, JSA or IS). On average (mean), only 5 of the 180 days were spent on a benefit that was not ESA (WRAG).

In the 180 days following an ESA (WRAG) sanction decision, 0.2% of claimants were not in receipt of any of the tracked benefits (ESA (WRAG), UC, JSA or IS). 90.8% of claimants spent over 150 days (5 months) in receipt of benefit and 85.0% of claimants spent the full 180 days in receipt of benefit.

8. About these statistics

The statistics in this publication are for Great Britain. We also publish a number of background and methodology documents.

Other National and Official Statistics

Read about other National and Official Statistics produced by the Department for Work and Pensions (DWP).

Users can also:

- produce their own tables and access demographic breakdowns using Stat-Xplore

- access supporting tables

- find further information about the sanctions process, source of these statistics and the publication rounding policy in the background information and methodology documents

Changes, revisions and known issues

The following information is about changes, revisions and known issues with the statistics.

Statistics covered in this bulletin include data for sanction decisions during the initial period of the coronavirus (COVID-19) pandemic. Although legislative changes to temporarily disapply work-search and work availability requirements came into effect on 30 March 2020 (in response to the pandemic), some sanction decisions for these types of failures could have been made later than this date because decisions are often made and processed after the date that the claimant failure occurred. This means that it was possible for sanction decisions to be recorded after legislation changes came into effect, in instances where a claimant prior to 30 March 2020 has failed to meet the work requirements set out in their claimant commitment. Additionally, sanction decisions were also possible for some failures which occurred after this date, for example, for leaving a job voluntarily without good reason or for misconduct. This impacts data for UC and JSA sanctions.

Increase in JSA sanction decisions

Over the course of 2019, some decisions were put on hold for Jobseeker’s Allowance (JSA) sanction referrals made under the reason of “failure to attend a place on a training scheme or employment programme without good reason”. This was to allow for changes to handling procedures to be developed. After developments had been implemented, these outstanding JSA sanction referrals were processed. This resulted in a temporary increase in JSA sanction decisions in the early months of 2020.

Breakdowns of sanction referral reasons for UC full service

A small proportion of UC full service sanctions (around 2%) have previously been categorised under the “Availability for Work’ reason group, where they should have been attributed to the “Work Focused Interviews” reason group. The methodology used to produce these statistics has now been improved, and the numbers provided above are correct. This had minimal impact on the statistics, and made no difference to the underlying trends and stories behind the data.

Migration from UC live service to UC full service

New claims to UC live service ceased in January 2018, and since then the remaining live service cases have been gradually migrated to UC full service. This has resulted in a gradual decrease in the number of live service sanction decisions. By 1 April 2019, the systems that were used to administer live service cases were shut down. Due to this, data for any original UC live service sanction decisions has been frozen from this point. Users should be mindful that this is also evident in the combined UC live and full service sanctions durations and rate data, and caution should be taken when comparing data before and after 1st April 2019. Work is currently underway to develop more data for UC full service, and the aim is to release this as and when it is available.

Migration of JSA and ESA claims to UC full service

In the May 2019 release, it was noted that JSA and ESA (WRAG) claims were closed when claimants were migrated to UC full service, resulting in both an increase in the number of claimants included in the JSA and ESA (WRAG) rate and retrospective changes to previously published rates.

Comparison across different benefits

Users should be aware that there are differences between sanctions policy across benefits that will affect comparisons. Whilst the same methodology has been used to produce these statistics the benefits themselves are very different and require interpretation based on the rules of the specific benefit. The sanctions process means that the outcome of a sanction is subject to retrospective changes which should be considered when using the decision data.

Interpretation of data and the sanction process

Care must be taken when interpreting the duration charts and figures as, for fair comparisons, sufficient time must have passed before longer duration categories can be achieved, for example, sanctions lasting 27 weeks or more starting in January 2016 would not begin to be cleared until July 2016. Deductions can end for a number of reasons, such as the claimant leaves benefit, transfers to a different conditionality group, or the claimant is earning enough on UC that they no longer have any standard allowance from which a deduction can be taken. These statistics include those sanctions which subsequently go on to be overturned. Claimants whose sanction is overturned will be repaid any deduction. When a claimant leaves benefit following a sanction start, but before the sanction is served, the claim end date is taken to be the sanction end date. In the cases where a sanction end date is the same date as the sanction start (the claimant serves zero days of sanction), the cases are not counted as a sanction served and are excluded from the data.

Contact information and feedback

For more information, please contact Tracy Hills at tracy.hills@dwp.gov.uk.

DWP would like to hear your views on our statistical publications. If you use any of our statistics publications, we would be interested in hearing what you use them for and how well they meet your requirements. Please email DWP at stats-consultation@dwp.gov.uk.

Users can also join the “Welfare and Benefit Statistics” community at: http://www.statsusernet.org.uk. DWP announces items of interest to users via this forum, as well as replying to users’ questions.

ISBN: 978-1-78659-190-6