Budget 2020

Updated 12 March 2020

- Presented to Parliament as a return to an order of the House of Commons

- Ordered by the House of Commons to be printed 11 March 2020

- HC number 121

- © Crown Copyright 2020

- ISBN 978-1-913635-01-5

Executive Summary

The Budget takes place against the backdrop of the global outbreak of COVID-19. The fundamentals of the UK economy are strong and the government is well prepared to protect people’s health and support their economic security throughout this period of temporary economic disruption. The Budget sets out a plan to support public services, individuals and businesses that may be affected by COVID-19.

While the economy continues to face challenges, the government’s careful management of the public finances means that it is able to support the economy in the short term, while investing in the future. The Budget announces investments in the roads, railways and digital networks that will underpin growth over the coming decade, as well as the world-class hospitals, schools, colleges and police forces that people rely on every day.

The Budget supports the government’s ambition for a fair and sustainable tax system that helps people and families with the cost of living, funds the first class public services they expect and creates an environment for business to succeed. The government will build on this across the Parliament, creating a tax system fit for the challenges and opportunities of the 21st century.

The Budget also sets out a plan to invest in research and development (R&D) and cutting-edge technologies. It provides support for people in every nation and region of the UK to gain the skills that they will need as the economy evolves, so that the nation can seize the opportunities of the next decade and fulfil its potential.

In the year that the UK hosts the COP26 UN climate summit, the Budget takes steps to decarbonise the economy and protect the UK’s natural habitats, ensuring that every part of the UK economy is ready for the challenges of decarbonisation, and ready to capitalise on the opportunities to become leaders in the green markets of the future.

This is the first Budget of a new government, the first of a new decade, and the first since the UK’s departure from the European Union (EU). It is a Budget that lays the foundations of the UK’s future prosperity and delivers on the government’s promises to the British people.

Economic context

The UK economy has many strengths. It has a globally competitive tax system, it is home to many highly innovative firms, has a world-beating science and research base, and has sound, independent macroeconomic institutions. Employment growth remains strong – the employment rate reached a record high in the three months to December 2019 – and earnings growth remains above inflation.

The recent COVID-19 outbreak is creating short-term uncertainty. The Office for Budget Responsibility’s (OBR) economy and fiscal forecast does not reflect the now global spread of COVID-19 nor an outbreak in the UK. The OBR notes that the spread and impact of a COVID-19 outbreak clearly represents a downside risk to the forecast, but the scale is highly uncertain and the economic impact is likely to be temporary.

Looking further ahead, the UK also faces challenges in the medium to long term. Productivity remains low compared to other countries and unevenly distributed across the country. And, in common with other advanced economies, the transition to a net zero emissions economy by 2050 will require radical changes in every sector. The Budget lays the foundations to address these challenges.

Outlook for the public finances

Over the past decade, the government has taken action to restore the public finances to health, reducing the deficit by four fifths. This, and the historically low cost of borrowing, mean that the government can support the economy in the short term, while providing significantly more investment in public services and infrastructure to support growth in the long term.

The Budget launches the Comprehensive Spending Review 2020 (CSR), setting out the overall level of public spending within which the CSR will be delivered. The CSR will conclude in July and will set out detailed spending plans for public services and investment, covering resource budgets for three years from 2021-22 to 2023-24 and capital budgets up to 2024-25.

The CSR will prioritise improving public services, levelling up economic opportunity across all nations and regions, strengthening the UK’s place in the world and supporting the government’s ambitions to reach net zero carbon emissions by 2050. It will focus on linking departments’ spending proposals to the real-world outcomes they seek to achieve, and delivering value for money for taxpayers.

The policy changes set out in the Budget, including the spending totals that have been set for the CSR, have been delivered while ensuring the current budget is in surplus, public sector net investment does not exceed 3% of GDP and debt is kept under control.

HM Treasury will review the fiscal framework ahead of Autumn Budget 2020 to ensure it remains appropriate for the macroeconomic context, while ensuring the sustainability of the public finances.

Responding to COVID-19

Public safety is the government’s top priority in its response to COVID-19 and it is taking firm and comprehensive action, consistent with the best scientific evidence.

As well as being focused on safety and the public health response to the outbreak, the government recognises that people will be concerned about the effect it will have on their livelihood, and business will be concerned about reduced demand, potential disruptions to supply chains and export markets, and to their workforce during this temporary period.

The Budget announces a £12 billion plan to provide support for public services, individuals and businesses, whose finances are affected by COVID-19. This includes a £5 billion COVID-19 response fund to ensure the NHS and other public services receive the funding they need to respond to the outbreak as the situation develops, and recover and return to normal afterwards.

For individuals it includes extending Statutory Sick Pay (SSP) for those advised to self-isolate, and those caring for others who self-isolate, and support through the welfare system for those who cannot claim SSP, as well as a hardship fund.

Finally, the government will support businesses that experience increased costs or disruptions to their cashflow. This includes expanded Business Rates reliefs, a Coronavirus Business Interruption Loan Scheme to support up to a further £1 billion lending to SMEs, a £2.2 billion grant scheme for small businesses, and a dedicated helpline for those who need a deferral period on their tax liabilities.

Tackling COVID-19 is a global challenge, and to complement our domestic response the Budget sets out steps the UK is taking to lead a swift and effective global response to deal with the impacts of the virus.

The measures set out in the Budget to support health and other public services, protect people and families and support businesses will be reflected in the public finances at Autumn Budget 2020.

Funding excellent public services

The people of the UK are rightly proud of its world-class public services. The NHS, schools and police provide the security and support that allow the British people to lead safe, prosperous and healthy lives. The government is committed to providing the funding that public services need and ensuring that excellent services are available in every nation and region of the UK.

Total departmental spending is set to grow twice as fast as the economy over the CSR period. Day-to-day departmental spending is set to grow at the fastest rate over a spending review period since Spending Review 2004.

Within this, the government will increase funding for its number one spending priority: the NHS. Compared to 2018-19, NHS England will receive a cash increase of £34 billion a year by 2024. In addition, the Budget commits over £6 billion of new funding over this Parliament, including to create 50 million more GP surgery appointments per year, ensure there are 50,000 more nurses, and fund wider commitments on hospital car parking and support for people with learning disabilities and autism. The Budget also sets out action to ensure that pensions tax rules do not deter doctors from taking on additional shifts.

The government will invest in the security of everyone in the UK with additional funding for counter-terrorism policing and the UK intelligence community. The government will keep people safe with strengthened community sentences and increased victim support.

Spending Round 2019 committed to a £7.1 billion cash increase in funding for schools by 2022-23. The Budget builds on this by providing £29 million per year by 2023-24 to support primary school PE teaching and help schools make the best use of their sports facilities, as well as £90 million per year to introduce an Arts Premium from September 2021 to help schools provide high-quality arts programmes and extracurricular activities for pupils.

Levelling up and getting Britain building

The government is committed to levelling up across the UK by raising productivity and growth in all nations and regions, creating opportunity for everyone, and addressing disparities in economic and social outcomes.

For too long the UK has under-invested in infrastructure, leaving many people stuck with delays and poor service.

By the end of the parliament, public sector net investment will be triple the average over the last 40 years in real terms. In total, around £640 billion of gross capital investment will be provided for roads, railways, communications, schools, hospitals and power networks across the UK by 2024-25. The government will publish a National Infrastructure Strategy later in the spring, and the CSR will provide full departmental spending plans. The Budget announces:

-

the largest ever investment in English strategic roads, with over £27 billion between 2020 and 2025, enough funding to fill in around 50 million potholes across the country, and unprecedented investment in urban transport, with £4.2 billion for five-year, integrated transport settlements for eight city regions on top of £1 billion allocated to shovel-ready transport schemes

-

funding for the Shared Rural Network agreement to radically improve mobile coverage in rural areas, and a record £5 billion investment in gigabit broadband rollout in the hardest-to-reach areas of England, Scotland, Wales and Northern Ireland

-

record funding of £5.2 billion for flood defences between 2021 and 2027, offering better protection from flooding for 336,000 homes and non-residential properties. Additional funding of £200 million will help communities most at risk of flooding recover faster in cases where they are affected by flood damage

-

a £10.9 billion increase in housing investment to support the commitment to build at least 1 million new homes by the end of the Parliament, and an average of 300,000 homes a year by the mid-2020s

-

the government will invest £1.5 billion (£1.8 billion including indicative Barnett consequentials) over five years in capital spending to refurbish further education colleges, and has committed to a new £2.5 billion National Skills Fund to improve adult skills (£3 billion including indicative Barnett consequentials). It will also boost science, technology, engineering and maths teaching with capital investment for up to eight new Institutes of Technology and 11 maths schools. The government is committed to giving everyone the opportunity to fulfil their potential, regardless of where they are from.

The government is also taking action to review the Green Book, which sets out how decisions on major investment programmes are appraised in order to make sure that government investment spreads opportunity across the UK.

The Budget reaffirms the government’s commitment to strengthening the ties that bind the Union. As well as taking action that will support people and businesses in every nation of the UK, and targeted support to each nation, it sets out the funding the government will make available through Barnett consequentials for the devolved administrations to fund public services, infrastructure and other priorities.

Supporting people and families

The government is committed to taking action to help with the cost of living for everyone across the UK and ensure that the most vulnerable in society get the support they need.

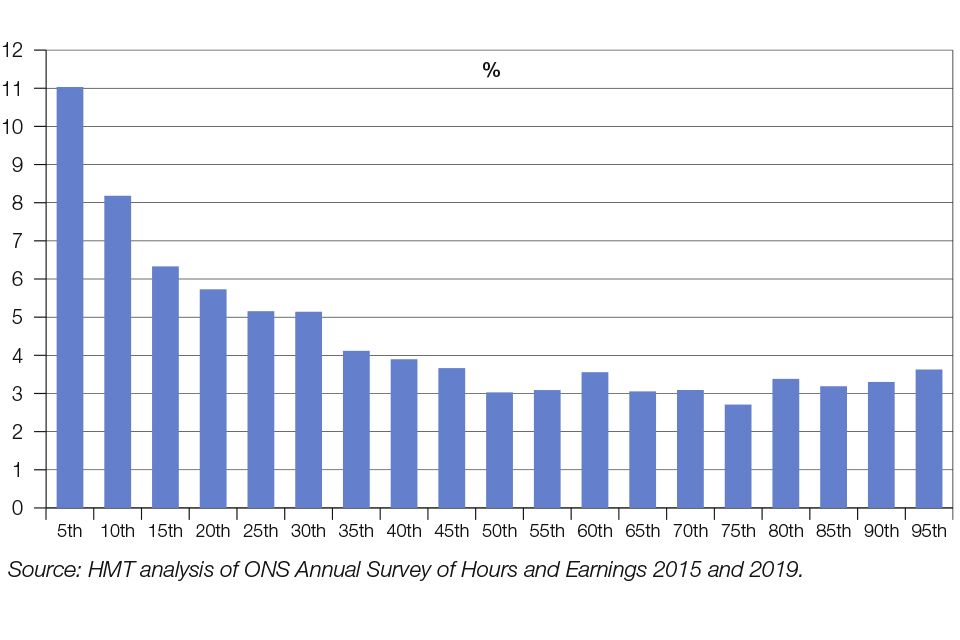

Alongside the Budget, the government is formally announcing a new, ambitious target for the National Living Wage (NLW) to reach two-thirds of median earnings and be extended to workers aged 21 and over by 2024, provided economic conditions allow. Based on the latest OBR forecast, this means the NLW is expected to be over £10.50 in 2024.

This builds on the 6.2% increase of the NLW to £8.72 an hour that takes effect from this April, meaning the government is on track to meet its current target of 60% of median earnings by 2020. Since the NLW’s introduction in 2016 real wages have grown fastest for the lowest paid full-time workers.

As people earn more, the government is committed to reducing taxes on their wages. The Budget confirms a tax cut for 31 million working people with the increase in the National Insurance contributions (NICs) thresholds for employees and the self-employed, saving the typical employee around £104 and a typical self-employed person around £78 in 2020-21. Taken together with increases to the NLW and to the Personal Allowance, an employee working full-time on the NLW anywhere in the UK will be over £5,200 better off compared to April 2010.

The government is investing a further £9.5 billion in the Affordable Homes Programme which in total will allocate £12.2 billion of grant funding from 2021-22 to support the creation of affordable homes across England.

The government is also helping people with the cost of living by freezing fuel duty for the tenth consecutive year, freezing all alcohol duties, applying a zero rate of VAT to e-publications, abolishing the tampon tax, and making it easier for parents of up to 500,000 school-age children to access Tax-Free Childcare.

The Budget confirms the end of the benefits freeze and continues the rollout of Universal Credit to support the most vulnerable in society, with extra help for parents of sick or premature babies, carers and victims of domestic violence.

The government will invest an additional £1 billion to remove unsafe cladding from residential buildings above 18 metres to ensure people feel safe in their homes.

The Budget also includes action to reduce rough sleeping, providing £643 million for accommodation and support services to help people off the streets.

Backing business

From the largest UK-headquartered multinationals to the smallest family-owned firm, businesses are the lifeblood of the UK economy. They have created 3 million new jobs since 2010, giving more people the chance to succeed in life and provide for their families.

The UK is one of the best places in the world to do business and the most attractive country for inward investment in Europe. The government is committed to unleashing businesses’ potential, and the Budget supports the development of the high-tech, high-skill jobs of the future.

The government wants to ensure that the United Kingdom continues to be attractive to investment and remains a dynamic environment to start and grow a business. To cut the cost of taking on staff the government is increasing the NICs Employment Allowance to £4,000, benefiting 510,000 businesses. At 19% the UK’s Corporation Tax rate remains the lowest in the G7 and G20. The government is reforming Entrepreneurs’ Relief, while continuing to support the vast majority of entrepreneurs and increasing tax incentives for businesses investing in structures and buildings, and R&D.

The Budget also announces the launch of a fundamental review of business rates, due to report in the autumn.

The Budget will help businesses to take advantage of opportunities for the UK outside the EU, for example through new financial support for British exporters and by investing in additional business support for SMEs through Growth Hubs. The government will also extend the Start-Up Loans Programme to ensure would-be entrepreneurs can access the finance they need.

To ensure that the UK remains a dynamic and competitive regulatory environment, the government is launching a Reforming Regulation Initiative to collect ideas for regulatory reform, as well as implementing the recommendations of the Furman Review of digital competition, publishing further detail on the Financial Services Bill which will ensure that the UK maintains its world-leading regulatory standards and openess to international markets.

Investing in innovation

The UK’s success in the global economy will be rooted in innovation and cutting-edge technology. By driving technological change, the government will create the high quality, highly paid jobs of the future, the Budget sets out plans to increase public R&D investment to £22 billion per year by 2024-25. The government will invest that money in the people, ideas and industries that will cement the UK’s world-leading position in science and technologies ranging from nuclear fusion to electric vehicles and life sciences.

This landmark investment is the largest and fastest ever expansion in support of researchers and innovative businesses, taking direct support for R&D to 0.8% of GDP and placing the UK among the top quarter of OECD nations – ahead of the USA, Japan, France and China.

Achieving the government’s ambitions on R&D will require investment from the private sector. To boost that investment the government will increase the rate of R&D tax credits and consult on widening the definition of qualifying expenditure to include data and cloud computing.

In life sciences, the government will provide the British Business Bank with additional resources to launch a dedicated £200 million investment programme which is expected to enable £600 million of investment, helping to ensure the UK remains a world leader in life sciences innovation.

Growing a greener economy

The UK has already cut carbon emissions by more than any other G7 country and in 2019 was the first major economy to legislate for a target of net zero greenhouse gas emissions by 2050. As the UK prepares to host this year’s COP26 UN climate summit, the Budget announces a range of policies to reduce emissions, ensure our environment is protected and resilient to climate change, and generate green economic opportunities across the nations and regions of the UK.

Increasing the UK’s use of clean energy is a vital part of reducing carbon emissions and putting the nation at the forefront of new innovative industries. The Budget announces a Carbon Capture and Storage (CCS) Infrastructure Fund to establish CCS in at least two UK sites, one by the mid-2020s, a second by 2030. To encourage more environmentally-friendly ways of heating homes and other buildings, the government will also introduce a Green Gas Levy to help fund the use of greener fuels, increase the Climate Change Levy that businesses pay on gas, and reopen and extend the Climate Change Agreement scheme by two years.

Road transport is responsible for 91% of domestic transport emissions, and around a fifth of overall UK emissions. To support drivers to move away from polluting vehicles, the Budget announces investment in electric vehicle charging infrastructure, which will ensure that drivers are never more than 30 miles from a rapid charging station, provides £532 million for consumer incentives for ultra-low emission vehicles, and reduces taxes on zero emission vehicles.

In addition, the government will promote air quality improvement by removing the entitlement to use red diesel except for agriculture, fish farming, rail and non-commercial heating. The government will tackle air pollution by providing £304 million to help local authorities reduce nitrogen dioxide emissions and improve air quality.

The government will also invest in the natural environment, planting enough trees to cover an area the size of Birmingham, restoring peatlands, and providing more funding to protect the UK’s unique plants and animals. The government will also go further to tackle the scourge of plastic waste by introducing a Plastic Packaging Tax, as well as providing further funding to encourage producers to make their packaging more recyclable.

Budget decisions

A summary of the fiscal impact of the Budget policy decisions is set out in Table 1. Chapter 2 provides further information on the fiscal impact of the Budget.

Table 1: Budget 2020 policy decisions (£ million) (1)

| 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | |

|---|---|---|---|---|---|---|

| Total spending policy decisions | -355 | -19,255 | -40,185 | -45,640 | -48,780 | -49,440 |

| Total tax policy decisions | +960 | +1,355 | +3,755 | +7,110 | +7,625 | +7,520 |

| Total policy decisions | +605 | -17,900 | -36,430 | -38,530 | -41,150 | -41,920 |

| 1 Costings reflect the OBR's latest economic and fiscal determinants. |

Government spending and revenue

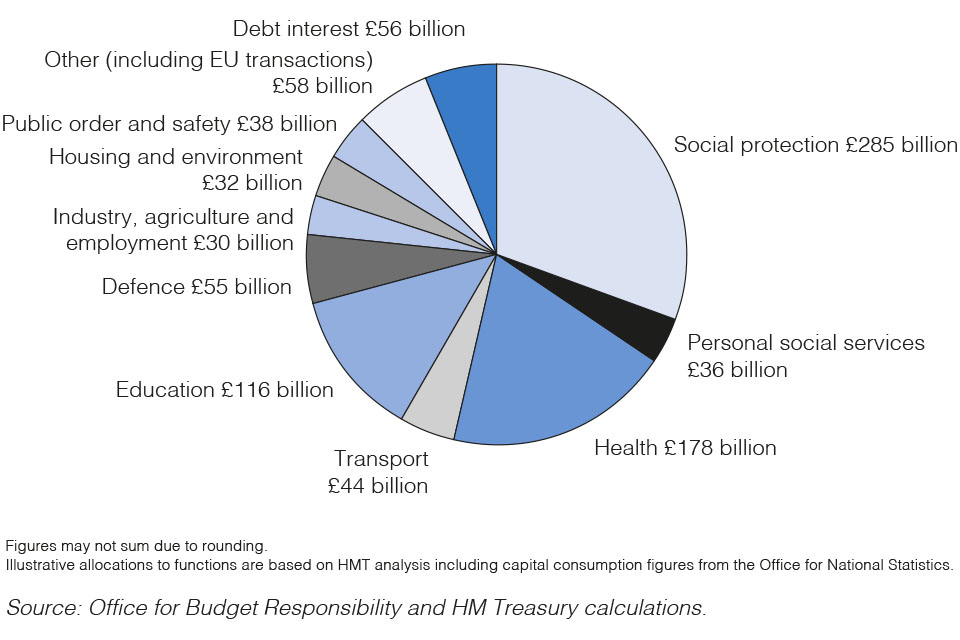

Chart 1 shows public spending by main function. Total Managed Expenditure (TME) is expected to be around £928 billion in 2020-2021.

Chart 1: Public sector spending 2020-21

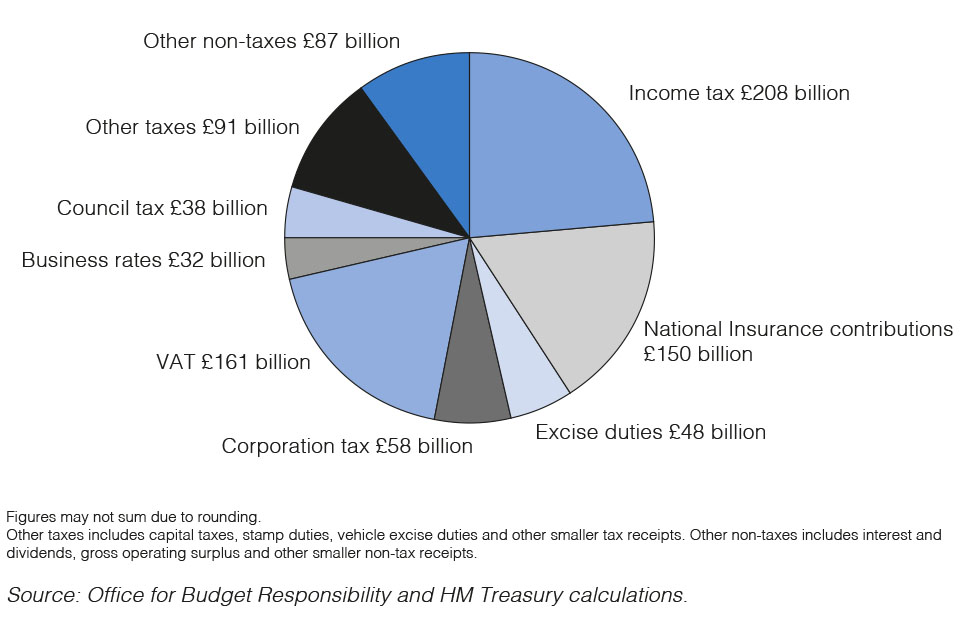

Chart 2 shows the different sources of government revenue. Public sector current receipts are expected to be about £873 billion in 2020-2021.

Chart 2: Public sector current receipts 2020-21

1. Budget Report

1.1 Economy and Public Finances

The UK economy has many strengths: a globally competitive tax system, some of the best universities in the world, is home to many highly innovative firms, and its economic prospects are underpinned by a strong macroeconomic framework. Since 2010, the economy has grown faster than France, Italy and Japan. Employment is at a record high and the unemployment rate is the joint-lowest since 1975. In common with other advanced economies, the UK faces economic challenges. In the near term, the outbreak of COVID-19 is expected to have a significant but temporary effect on the economic outlook. Productivity remains weak and is distributed unevenly across the country; and the transition to a net zero economy by 2050 will require radical changes in every sector.

The Budget announces a plan to support the economy over the short term in response to the COVID-19 outbreak. This includes measures to support public services, individuals and businesses.

The Budget builds on the UK’s economic strengths and takes steps to address the UK’s long-standing structural challenges. The government is committed to levelling up across the UK in order to raise productivity and growth in all nations and regions, creating opportunity for everyone and addressing disparities in economic and social outcomes.

Since 2010, the government has restored the public finances to health after inheriting debt that had nearly doubled in two years. The deficit has been reduced by four fifths from a post‑war peak of 10.2%[footnote 1] of GDP in 2009-10 to 1.8% of GDP in 2018-19.

With historically low borrowing costs and the public finances in a more secure position, the government can now increase borrowing for investment without compromising fiscal sustainability. The Budget provides significant levels of funding for public services to meet the economic challenges and priorities of today, and to address the long-term challenge of low productivity growth.

This increase in spending, which provides the envelope for the upcoming CSR, has been delivered while meeting a set of fiscal rules that ensures the government is only borrowing to invest over the medium term, with the current budget in surplus, and that limits public sector net investment to an average of 3% of GDP, to keep control of borrowing and debt. To ensure the fiscal framework remains appropriate for the current macroeconomic environment HM Treasury will undertake a review over the summer and announce any changes by Autumn Budget 2020.

1.2 Economic context

The OBR’s economy forecast was closed for new data when the spread of COVID-19 was at a much earlier stage. As such, the OBR’s forecast includes an estimate of the impact on global growth, based on the assumption that the spread of the virus would be relatively limited. The forecast does not reflect the now global spread of COVID-19 or an outbreak in the UK.

1.3 Global economy

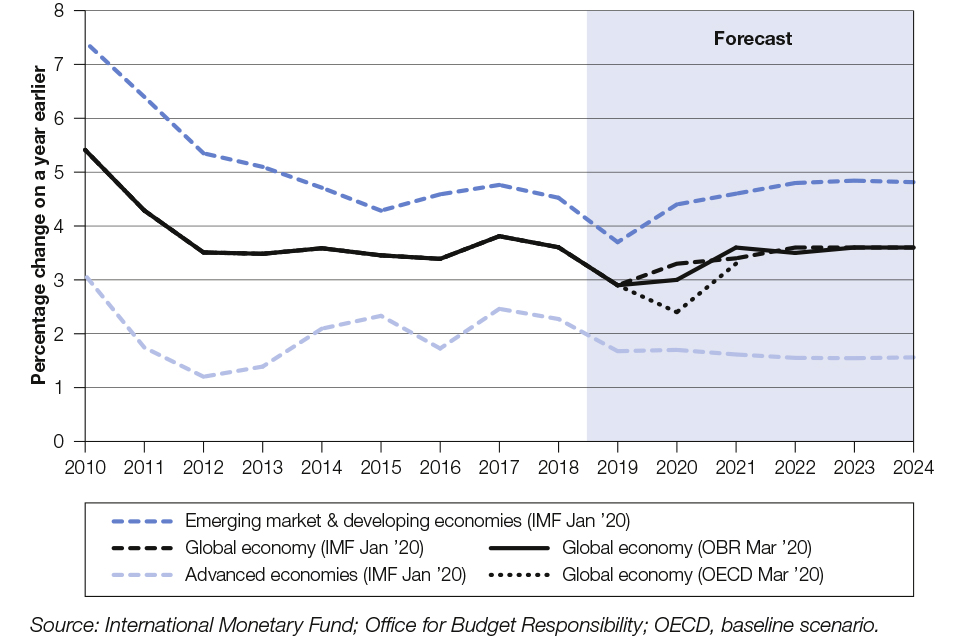

The International Monetary Fund (IMF) estimates that the global economy grew by 2.9% in 2019, down from 3.6% in 2018, and the slowest growth since the financial crisis (Chart 1). The COVID-19 outbreak is expected to reduce global growth this year. The OBR forecasts that annual global GDP growth will be 3.0% in 2020, down from 3.6% in its Spring Statement 2019 forecast. This includes an assumption that the outbreak would be “relatively limited” and its impact on the forecast “largely confined to a modestly weaker outlook for growth in world trade and the UK’s export markets.” The OBR notes that, since closing its global forecast to new data, “it has become clear that the spread of coronavirus will be far wider than assumed in our baseline forecast, pointing to a deeper – and possibly more prolonged – slowdown.”[footnote 2]

There have already been clear signs that activity in China, where the outbreak began, has slowed. In its most recent economic assessment published on 2 March 2020, the Organisation for Economic Co-operation and Development (OECD) downgraded its forecast for Chinese growth in 2020 by 0.8 percentage points, to 4.9%.

Highly integrated just-in-time manufacturing processes across the globe mean that disruption to Chinese output is likely to affect production globally. Lower Chinese growth will affect global demand. There will also be spillovers through financial markets and potential hits to business and consumer confidence.

The OECD has produced two scenarios. In the ‘baseline’ scenario it assumes the virus is contained largely in China and revised down expectations of global growth in 2020 from 2.9% to 2.4%. In a second scenario, assuming broader contagion, the OECD suggests that global growth could be reduced more significantly in 2020, to 1.5%.

Chart 1.1: Global GDP growth

1.4 UK economy

The OBR closed its forecast before the spread of COVID-19 in the UK, noting that this means “the precise forecasts for the economy … can no longer be regarded as central.”[footnote 3] As an open economy, the UK will be affected because of the wider impacts the outbreak is having on the global economy. The OBR’s estimate of the impact on global growth, based on the spread of the virus being relatively limited, reduces UK GDP growth by 0.1 percentage points this year.

The impact of a wider spread outbreak of COVID-19 on the UK economy is highly uncertain. The drivers of any economic impact are health-related factors, including how many people get infected, the persistence of an outbreak and measures put in place to protect public health and prevent the spread. There will likely be significant, temporary disruption to the economy. Disruption could include temporary absences from work and interruptions to global supply chains, both of which would constrain the UK’s productive capacity for a temporary period. In addition, the economy could be affected by a reduction in consumer spending and lower business investment, largely reflecting the response to measures to contain the outbreak, and weaker demand for UK exports.

1.5 Growth

The Office for National Statistics (ONS) estimates that the UK economy grew by 1.4% in 2019, 0.1 percentage points higher than in 2018. Delays to the UK’s departure from the EU affected the profile of economic activity throughout 2019, leading to volatility in quarterly growth over the year.

Growth is distributed unevenly across the UK. England has historically had the highest GDP growth, averaging 2.2% between 1998 and 2018. Over the same period, Wales grew at an average rate of 1.7%, while Scotland and Northern Ireland both grew at an average rate of 1.9%. Growth is also uneven at a regional level – London has seen the fastest growth of all regions, averaging 3.1% between 1998 and 2018, while the North East of England had an average growth rate of 1.5%, the slowest of all regions.

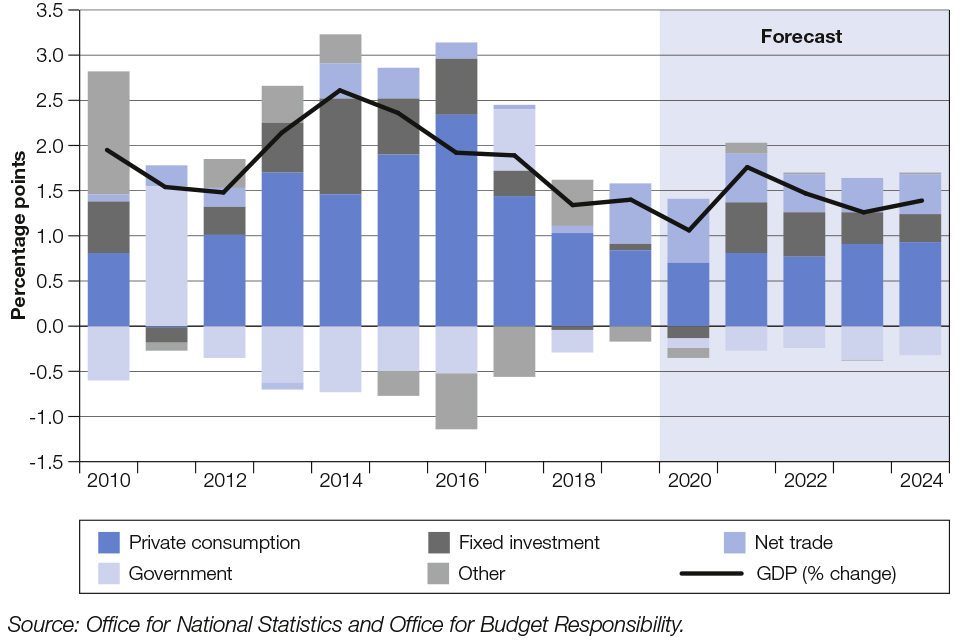

Over the forecast, the OBR has revised down its forecast for cumulative GDP growth by 0.5 percentage points, largely reflecting downward revisions to potential productivity and net migration. The OBR expects GDP growth of 1.1% in 2020, revised down from 1.4% in its Spring Statement 2019 forecast, with weaker contributions from both consumption and business investment growth. The OBR expects annual consumption growth to be 1.1% and for there to be no growth in business investment in 2020 (Chart 1.2). GDP growth is then expected to increase to 1.8% in 2021 before slowing slightly, reaching 1.4% in 2024.

Chart 1.2: UK GDP – contributions to annual GDP growth

1.6 The labour market and earnings

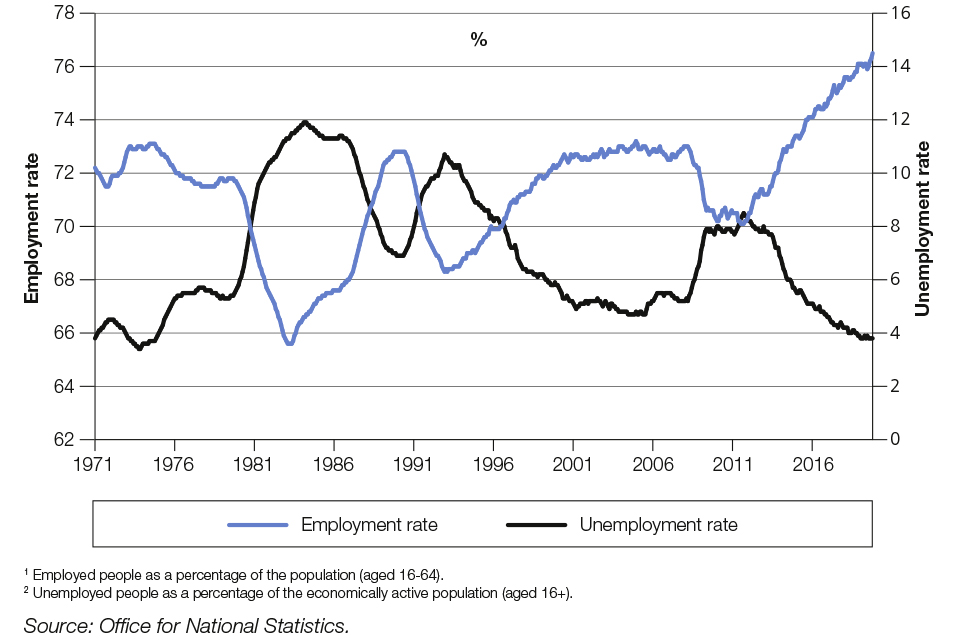

Employment is at a record high. The number of people aged 16 years and over in paid work was 32.8 million in 2019 and was at a record high of 32.9 million in the three months to December 2019. The employment rate – the proportion of people aged 16 to 64 who are in paid work – also reached a record high of 76.5% in the same period (Chart 1.3). The OBR expects the employment level to increase further over the forecast period, reaching 33.4 million in 2024.

Chart 1.3: UK employment and unemployment rates since 1971 (1,2)

The unemployment rate – the proportion of the economically active population (those in work plus those seeking and available to work) who are unemployed – was 3.8% in the three months to December 2019, the joint-lowest in over 40 years. The OBR expects the annual unemployment rate to remain at 3.8% in 2020 and 2021, before rising to 4.1% by 2024.

Every nation and region of the UK has higher employment and lower unemployment than in 2010. Wales has seen the largest reduction in its unemployment rate since 2010, of 5.6 percentage points. There are 3.9 million more people in work than in 2010, with over 60% of the increase taking place in UK nations and regions outside London and the South East. Table 1.1 gives national and regional labour market statistics for the three months to December 2019.

Earnings growth remains above inflation. Nominal wage growth (including bonuses) and regular nominal wage growth (excluding bonuses) were 2.9% and 3.2% respectively in the final quarter of 2019. Over the same period, real total pay growth was 1.4% and real regular pay growth was 1.8%. The OBR forecasts average earnings to grow by 3.3% in 2020 and rise to 3.6% in 2021.[footnote 4] It then expects growth to fall back to 3.1% by 2024.

Rising real wages have helped to support the growth of real household disposable income (RHDI) per head, a measure of living standards. RHDI per head grew by 0.3% in the year to Q3 2019, down from 1.0% in the year to Q2 2019. The OBR expects annual growth in RHDI per head of 0.6% in 2020, before reaching 1.1% by 2024.[footnote 5]

Table 1.1: National and regional employment and unemployment rates (3 months to December 2019)

| Employment rate | Unemployment rate | |||

|---|---|---|---|---|

| Actual (1) | Difference from UK average (3) | Actual (2) | Difference from UK average (3) | |

| North East | 71.1 | -5.4 | 6.1 | 2.3 |

| North West | 75.9 | -0.6 | 4.2 | 0.4 |

| Yorkshire & the Humber | 73.3 | -3.2 | 4.5 | 0.7 |

| East Midlands | 78.4 | 1.9 | 3.6 | -0.2 |

| West Midlands | 75.5 | -1.0 | 4.4 | 0.6 |

| East of England | 78.6 | 2.1 | 3.3 | -0.5 |

| London | 75.5 | -1.0 | 4.3 | 0.5 |

| South East | 80.0 | 3.5 | 3.1 | -0.7 |

| South West | 80.1 | 3.6 | 2.8 | -1.0 |

| Wales | 74.4 | -2.1 | 2.9 | -0.9 |

| Scotland | 75.0 | -1.5 | 3.5 | -0.3 |

| Northern Ireland | 72.4 | -4.1 | 2.4 | -1.4 |

| United Kingdom | 76.5 | 0.0 | 3.8 | 0.0 |

| 1 Employed people as a percentage of the population (aged 16-64). |

| 2 Unemployed people as a percentage of the economically active population (aged 16+). |

| 3 Percentage points. |

| Source: Office for National Statistics |

1.7 Productivity

UK labour productivity (measured as output per hour) did not grow at all in 2019, following subdued growth of 0.5% in 2018. This weakness has partly contributed to the OBR’s judgement to revise down potential productivity growth – the underlying rate that determines how quickly productivity can grow sustainably – by an average of 0.1 percentage points per year across the forecast.[footnote 6] The OBR does note that “the significant planned increase in public investment potentially boosts productivity by raising the public capital stock, but we have assumed that the effect is likely to be felt mainly beyond our forecast horizon.”[footnote 7]

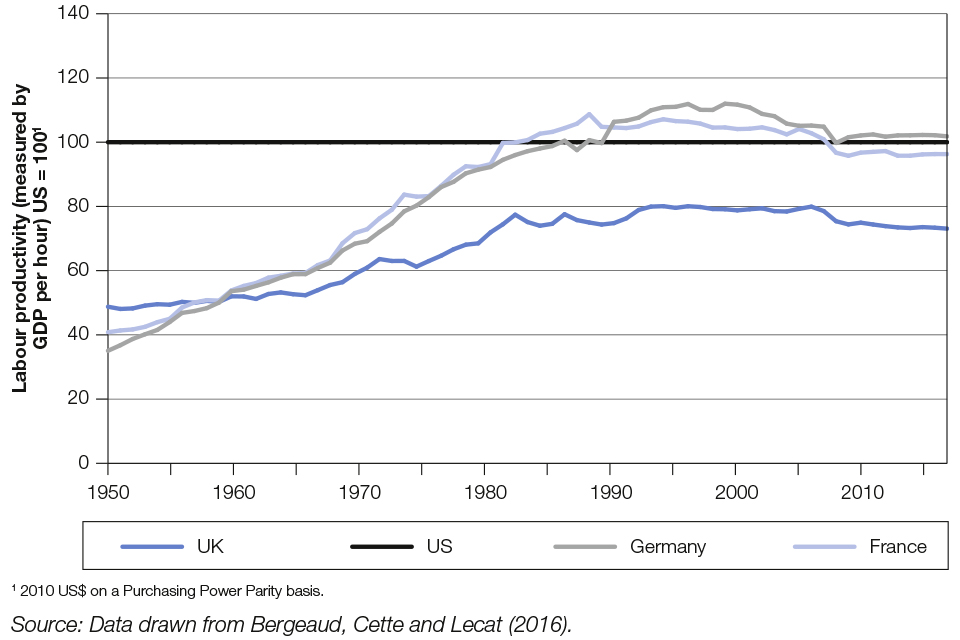

The UK’s level of productivity has been lower than that of other advanced economies since the 1960s. The UK’s level of productivity is more than 20% lower than other major advanced economies such as the US, France and Germany (Chart 1.4). In addition, UK productivity growth has slowed more since the financial crisis than other advanced economies. UK productivity growth has averaged 0.3% since 2008, slowing from 2.3% in the decade prior. By comparison, growth across the G7 has averaged 0.8% since 2008, compared to 1.9% in the decade prior.

Chart 1.4: Comparison of productivity levels relative to US

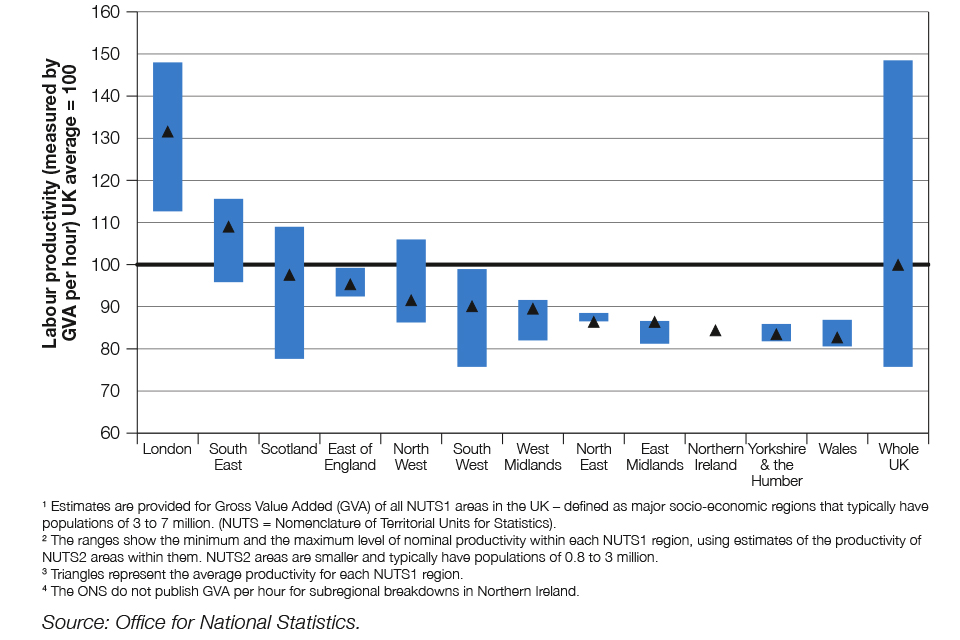

There is wide variation in productivity within the UK. As measured by output per hour, the only two areas with average levels of productivity above the UK average in 2018 were London (31.6% higher than the UK average) and the South East (9.1% higher than average). Productivity can vary significantly within each of the nations and regions as well as between them (Chart 1.5).

In the long term, higher productivity remains the only path to sustainable economic growth and rising living standards. Investing in skills and infrastructure to improve productivity across the UK permits growth by enabling firms to pay higher wages, offer goods and services at lower prices, and increase their profits. Productivity improvements, by enhancing economic growth, are also a fundamental source of long-run growth in tax receipts and the government’s ability to fund public services. A low average level of productivity – as well as significant variation between and within regions – are signs of untapped economic potential. The government is committed to levelling up investment across nations and regions to improve living standards nationally, as well as to address disparities in economic and social outcomes.

Chart 1.5: Spread of productivity across the UK, 2018 (1,2,3,4)

1.8 Prices

The annual rate of Consumer Prices Index (CPI) inflation was 1.8% in 2019, down from 2.5% in 2018. Inflation fell through much of 2019, reaching 1.4% in the final quarter of the year, before increasing to 1.8% in January 2020. The ONS’s headline measure of inflation, the Consumer Prices Index including owner occupiers’ housing costs (CPIH), was also 1.8% in January 2020.[footnote 8] The OBR forecasts CPI inflation to be 1.4% in 2020, gradually rising to 2.1% in 2022 and 2023, and settling at 2.0% by 2024.

Alongside the Budget, the government and UK Statistics Authority (UKSA) are launching a consultation, announced on 4 September 2019,[footnote 9] on UKSA’s proposal to address the shortcomings of the Retail Prices Index (RPI) measure of inflation. The consultation will cover, among other things, the issue of timing, including whether the UKSA’s proposal might be implemented at a date other than 2030, and if so, when between 2025 and 2030, and issues on technical matters concerning the implementation of its proposal. The consultation will be open for a period of six weeks, closing on 22 April 2020. The government and UKSA will respond to the consultation before the Parliamentary summer recess.

1.9 Current Account

The current account measures the flow of goods, services, income and transfers between the UK and the rest of the world. In 2018, the current account balance widened to a deficit of 3.9% of GDP from 3.5% in 2017. This was driven by a widening of both the trade and income deficits. The current account deficit averaged 4.7% of GDP in the first three quarters of 2019. The OBR expects the current account deficit for the whole of 2020 to be 3.8%. It is then forecast to remain close to 4.0% of GDP throughout the forecast period.

1.10 Monetary Policy

The Monetary Policy Committee (MPC) of the Bank of England has operational independence to set monetary policy to meet its primary objective of price stability and, subject to that, to support the economic policy of the government, including its objectives for growth and employment.

Independent monetary policy is a critical element of the UK’s macroeconomic framework, alongside sustainable public finances and a resilient financial system. Low and stable inflation supports living standards and provides certainty for households and businesses, helping them make decisions about saving, investment and spending.

The Chancellor is responsible for setting the MPC’s remit. In the Budget, the Chancellor reaffirms the symmetric inflation target of 2% for the 12-month increase in the CPI measure of inflation. This target applies at all times.[footnote 10] The Chancellor also confirms that the Asset Purchase Facility (APF) will remain in place for the financial year 2020-21.

Table 1.2: Summary of the OBR’s central economic forecast (percentage change on year earlier, unless otherwise stated) (1)

| Forecast | ||||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| GDP growth | 1.4 | 1.1 | 1.8 | 1.5 | 1.3 | 1.4 |

| GDP growth per capita | 0.8 | 0.5 | 1.3 | 1.1 | 0.9 | 1.1 |

| Main components of GDP | ||||||

| Household consumption (2) | 1.3 | 1.1 | 1.2 | 1.2 | 1.4 | 1.4 |

| General government consumption | 3.6 | 3.7 | 2.8 | 2.1 | 1.9 | 2.2 |

| Fixed investment | 0.4 | -0.8 | 3.4 | 2.9 | 2.0 | 1.8 |

| Business investment | 0.3 | 0.0 | 1.8 | 3.0 | 2.4 | 2.3 |

| General government | 2.1 | 1.9 | 10.9 | 4.6 | 1.8 | 1.2 |

| Private dwellings (3) | -0.3 | -4.2 | 1.5 | 1.6 | 1.3 | 1.2 |

| Change in inventories (4) | 0.1 | -0.1 | 0.1 | 0.0 | 0.0 | 0.0 |

| Net trade (4) | 0.0 | -0.1 | -0.3 | -0.2 | -0.4 | -0.3 |

| CPI inflation | 1.8 | 1.4 | 1.8 | 2.1 | 2.1 | 2.0 |

| Employment (millions) | 32.8 | 33.0 | 33.1 | 33.2 | 33.3 | 33.4 |

| Unemployment (% rate) | 3.8 | 3.8 | 3.8 | 3.9 | 4.0 | 4.1 |

| Productivity per hour | 0.0 | 0.9 | 1.2 | 1.2 | 1.1 | 1.2 |

| 1 All figures in this table are rounded to the nearest decimal place. This is not intended to convey a degree of unwarranted accuracy. Components may not sum to total due to rounding and the statistical discrepancy. |

| 2 Includes households and non-profit institutions serving households. |

| 3 Includes transfer costs of non-produced assets. |

| 4 Contribution to GDP growth, percentage points. |

| Source: Office for National Statistics and Office for Budget Responsibility. |

1.11 Public finances

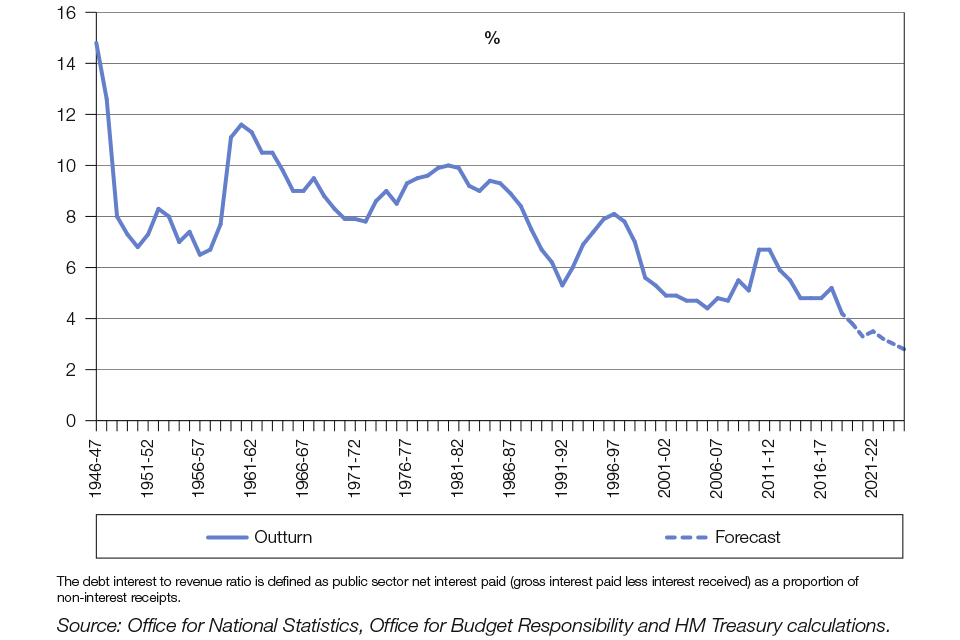

Since 2010, the government has restored the public finances to health after inheriting a deficit at a post-war high and debt that had nearly doubled in two years. The deficit has been reduced by four-fifths from a peak of 10.2% of GDP in 2009-10 to 1.8% of GDP in 2018-19.[footnote 11] As Chart 1.6 and 1.7 show the cost of government debt as a share of government revenues is now at a post-war low, due to historically low interest rates on government borrowing.

With low borrowing costs and the public finances in a more secure position, the government can support the economy and fund the response to COVID-19 in the short-term and take action over the medium-term to drive growth and improve public services, without compromising fiscal sustainability. In addition to short-term support for the COVID-19 response, the Budget provides for a significant medium-term increase in day-to-day spending on public services. With historically low borrowing costs, it is right that the government borrows to invest in the country’s future and address challenges. The government is therefore borrowing to fund a new set of growth-enhancing policies focused on delivering a step-change in infrastructure investment, which aims to raise the UK’s productivity growth in the long-run.

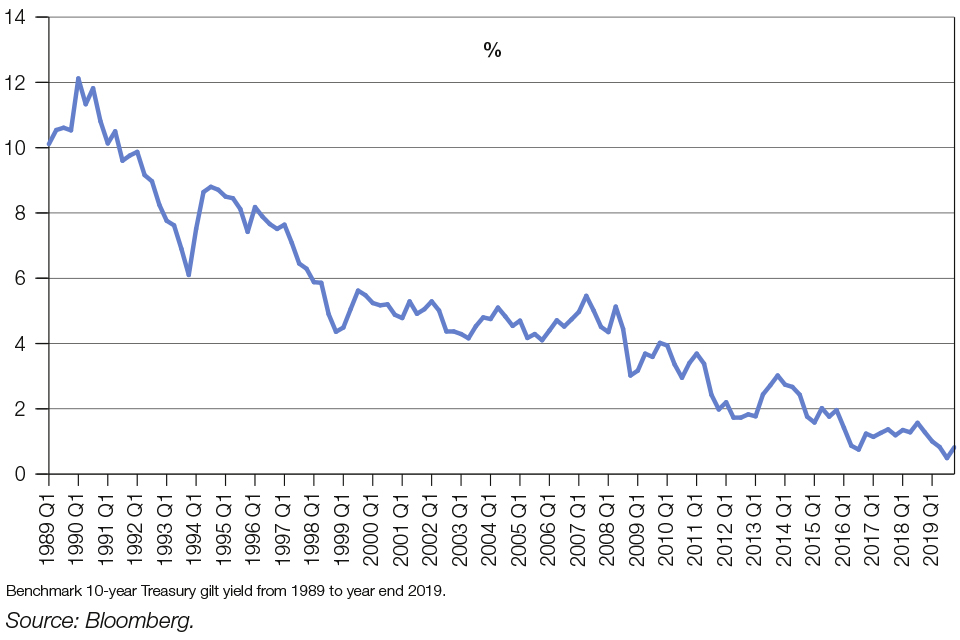

Chart 1.6: Debt interest to revenue ratio from 1946-47 to 2024-25

Chart 1.7: Historical quarterly 10-year gilt yields from 1989 to 2019

1.12 The fiscal framework

This Budget has been delivered to meet the following fiscal rules:

-

to have the current budget at least in balance by the third year of the rolling five-year forecast period

-

to ensure that public sector net investment (PSNI) does not exceed 3% of GDP on average over the rolling five-year forecast period

-

if the debt interest to revenue ratio is forecast to remain over 6% for a sustained period, the government will take action to ensure the debt-to-GDP ratio is falling

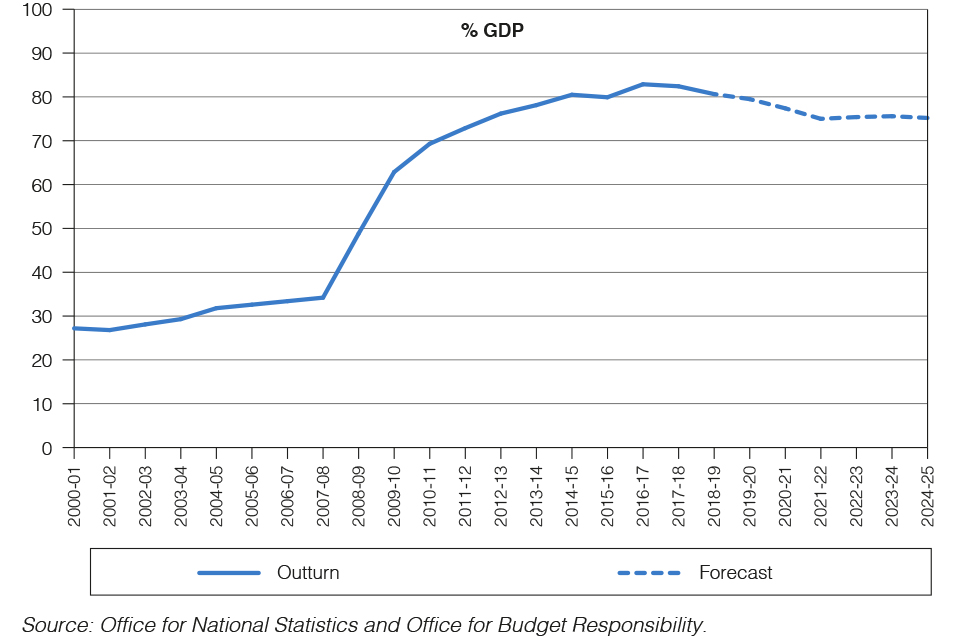

The Budget also sets the spending envelope for the upcoming CSR within these rules, which allow for significant investment in growth-enhancing infrastructure while maintaining control of day-to-day spending. They allow policy to meet the economic demands of today while ensuring that borrowing and debt remain under control. Chart 1.8 shows that public sector net debt has stabilised after the sharp rise driven by the financial crisis and is expected to be broadly stable across the forecast period. The rules also provide the flexibility to respond fully to near-term shocks to the economy and public finances such as from COVID-19.

Chart 1.8: Public sector net debt from 2000-01 to 2024-25

Interest rates are expected to remain at very low levels for an extended period. This has prompted an international debate around the implications of this environment for fiscal sustainability and the role of fiscal policy. In this context, the Chancellor has announced that HM Treasury will conduct a review of the UK’s fiscal framework, to:

-

ensure that it remains appropriate for the current macroeconomic environment

-

support the ambitious new policy agenda of the government to invest in and level up every part of the country

-

keep the United Kingdom at the leading edge of international best practice in macroeconomic policy

The review will report back by Autumn Budget 2020, to allow the government to confirm its fiscal objectives for the Parliament. It will be undertaken by HM Treasury and will involve broad consultation with external experts from across the UK and internationally. The review will be guided by the following principles:

-

fiscal policy should support the government’s economic objectives, while maintaining the sustainability of the public finances by keeping control over borrowing and debt

-

low and stable inflation should be supported, as an essential pre-requisite to deliver the government’s economic objectives

-

the UK’s existing institutional strengths in fiscal policy making – the independent Office for National Statistics (ONS) producing official economic and fiscal statistics, and the independent OBR producing the official economic and fiscal forecasts and assessing the government’s performance against its fiscal objectives – should be preserved and built on

The review will consider the following areas:

-

The low interest rate environment: It has been argued that, given persistently very low interest rates, there is further fiscal space to borrow for investment. This needs to be weighed against the risks posed by high levels of public debt, for example from rapid changes in economic conditions and from longer-term fiscal pressures. The review will look at how to balance the opportunities and risks within the fiscal framework.

-

Macroeconomic stabilisation: The review will consider the case for a more active role for fiscal policy in stabilising the economy, especially if there is reduced space for monetary policy due to low interest rates. This will be judged alongside consideration of the extent to which active fiscal policy can provide timely and effective demand management, and the implications for wider policy objectives and fiscal sustainability. The review will look at how to reflect these trade-offs within the fiscal framework.

-

Incentives for value for money prioritisation: The fiscal framework should support the prioritisation of public investments which most enhance growth. The review will consider whether some well-evidenced spending, beyond what the current international frameworks class as capital investment, is currently disincentivised. This will include an assessment of the practical challenges in evolving the framework: including measurement issues, consistency with internationally recognised statistical and accounting frameworks, how other countries have approached these issues, and the need to balance fiscal sustainability objectives.

-

Developments in the management and measurement of the balance sheet: Completion of HM Treasury’s Balance Sheet Review discussed in Box 1.A in the summer provides an opportunity to consider its conclusions and options to improve the management of loans, guarantees, contingent liabilities, and wider balance sheet transactions. The review will also consider the strengths and limitations of using broader balance sheet measures to assess fiscal sustainability.

-

Mitigating fiscal risks and pressures: The review will consider how to further support the effective management of fiscal pressures and risks, through a framework which can provide operationally-effective controls on the short and medium-term fiscal position, and can address and mitigate the challenge of longer-run pressures on fiscal sustainability, including from the ageing population and the actions needed to achieve net zero by 2050.

-

Building on the strength of the UK’s world class institutions: The review will consider options to support and strengthen the practices and institutions that deliver the UK’s fiscal framework, including the independent OBR and ONS, and advisory bodies such as the National Infrastructure Commission. The review will also consider the case for strengthening the legislative underpinning for the UK’s system of public financial management.

When the review is concluded, HM Treasury will lay before Parliament a new Charter for Budget Responsibility; the Autumn 2016 Charter therefore remains in force at the current time.[footnote 12] The Budget has been delivered within the fiscal rules set out above in section 1.12. The Chancellor wrote to the OBR ahead of the Budget to ask it to assess the government against these rules, in addition to those set out in the Autumn 2016 Charter.[footnote 13]

Box 1.A: Balance Sheet Review

The government manages assets worth £2 trillion alongside £4.6 trillion of liabilities on behalf of citizens.[footnote 14] The Balance Sheet Review (BSR) was launched in 2017 to identify opportunities to dispose of assets that no longer serve a policy purpose, improve returns on retained assets, and reduce the risk and cost of liabilities. This work aims to put the UK at the forefront of the international drive to reduce waste and deliver improvements in the cost-effective management of public wealth, as recognised by the IMF in its October 2018 Fiscal Monitor. The BSR will conclude and report at this year’s Comprehensive Spending Review.

Strengthening the assessment of balance sheet transactions

The BSR has highlighted the importance of considering the impacts on the government’s balance sheet, as well as on income flows over the longer term, when deciding to buy or sell assets and settle or incur liabilities. The government is therefore considering a new framework to evaluate the case for proceeding with significant balance sheet transactions. This will take into account impacts across a range of fiscal metrics, including Public Sector Net Debt (PSND), Public Sector Net Financial Liabilities (PSNFL) and Public Sector Net Worth (PSNW). The government will work with the ONS and OBR to further develop statistics and forecasts for PSNW and depreciation in the public sector finances, as well as assessing how these reconcile with the Whole of Government Accounts (WGA). This will inform the fiscal framework review set out in section 1.12.

Managing risk from contingent liabilities

The government is exposed to £192 billion of contingent liabilities, including guarantees and insurance provided to the private sector.[footnote 15] The BSR has developed proposals to improve the management of these liabilities and address a key balance sheet risk recognised by the OBR in its July 2019 Fiscal Risk Report.[footnote 16] The government is publishing a report alongside Budget: ‘Government as insurer of last resort’ providing more detail on the policy approach.

Knowledge assets

To improve social, economic and financial returns from its c.£150 billion[footnote 17] of knowledge assets in the public sector, and following publication of a report at Budget 2018,[footnote 18] the government will establish a new unit and fund to develop knowledge assets.

1.13 The fiscal outlook

Borrowing this year is forecast to be £47.4 billion, £0.2 billion lower than the OBR’s restated March 2019 forecast. Underlying receipts are forecast to be £4.9 billion higher, driven by a combination of stronger National Insurance contributions (NICs), capital gains tax and onshore corporation tax receipts. The strength in receipts is offset by higher spending, which is forecast to be £5.3 billion higher and is largely due to an increase in local and public corporations’ capital expenditure, an increase in company tax credits and lower than expected underspends by government departments. Policy decisions made by the government at Spending Round 2019 and at Budget, and described in Chapter 2, decrease borrowing by £0.6 billion in 2019-20.[footnote 19]

Across the rest of the forecast, compared to the OBR’s restated March 2019 forecast, the underlying forecast for borrowing is expected to be higher by £3.1 billion on average from 2020-21 onwards. The changes in the underlying fiscal outlook are due to a combination of the following factors:

-

A downward revision to underlying receipts from 2020-21 onwards that is predominantly driven by downward revisions to growth in GDP and its components. Excluding a fiscally neutral switch that means that customs duty revenues previously remitted to the EU are now recognised in both receipts and spending, receipts are lower by an average of £3.0 billion a year from 2020-21 onwards. Lower wage growth, consumer spending and profits, and an adjustment to fuel efficiency assumptions have downward effects on income tax and NICs, VAT, corporation tax and fuel duty receipts respectively. Lower interest rates reduce the interest received from government assets.

-

Underlying spending (excluding debt interest expenditure) is forecast to be higher in every year from 2020-21 onwards. Excluding the fiscally neutral change to the treatment of customs duties, non-interest spending is higher by an average of £7.4 billion. Higher expenditure on welfare, company tax credits, capital transfers associated with new student loans, and capital spending by local government are the main reasons for this increase.

-

However, underlying debt interest expenditure has been revised down by £7.4 billion on average from 2020-21 onwards. This is due to downward revisions in the forecasts for RPI inflation and interest rates.

The most significant changes to the forecast since restated March 2019 are the decisions taken by the government in the Budget and described in Chapter 2, which increase borrowing across the forecast. On average they increase borrowing by £21 billion from 2020-21 onwards. The direct cost of the measures is partly offset by the positive short-term impact on the fiscal position of the higher economic growth that is generated as a result of the Budget package. Higher growth in the short term, and a medium-term increase in nominal GDP leads to increased tax revenues. This is partly offset by the effect of higher borrowing, interest rates and inflation which increase debt interest and welfare spending.

In the usual way, the OBR have incorporated Budget policy decisions (set out in Table 2.1) into their final post-measures forecast. The government has not asked the OBR to incorporate the fiscal and economic impacts of the government’s plan to tackle the economic impact of COVID-19 into their final forecast. This reflects that the OBR’s baseline forecast does not incorporate the most recent estimate of the likely economic and fiscal impacts of a spread of COVID-19 and to do so would have introduced an inconsistency between the baseline forecast and the policy package. Moreover, given the fast-developing situation, the government will continue to adapt its policy to best respond to the latest circumstances. The OBR has said that, relative to their Budget forecast, COVID-19 is likely to put upward pressure on borrowing in the short term but expect limited impact over the medium and longer term.

The government will therefore reflect the costs of its response to COVID-19 at a future fiscal event alongside an updated OBR forecast. The current fiscal framework provides the near‑term flexibility to respond fully to the challenge of COVID-19, and the government has built headroom against the medium-term rules should it be needed.

Table 1.3: Changes to the OBRʼs forecast for public sector net borrowing since restated March 2019 forecast (£ billion)

| 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | |

|---|---|---|---|---|---|

| Restated March 2019 | 47.6 | 40.2 | 37.6 | 35.4 | 33.3 |

| Total underlying forecast changes since restated March 2019 (1) | 0.4 | 2.3 | 5.1 | 3.6 | 1.5 |

| of which | |||||

| Receipts forecast (2) | -4.9 | 1.0 | 3.5 | 4.1 | 3.5 |

| Debt interest forecast | -2.0 | -6.7 | -6.6 | -7.7 | -8.5 |

| Other spending forecast (2) | 7.3 | 7.9 | 8.2 | 7.1 | 6.5 |

| Total effect of government decisions since March 2019 (1) | -0.6 | 12.3 | 24.0 | 22.5 | 25.4 |

| of which | |||||

| Direct effects | -0.6 | 15.6 | 31.1 | 32.2 | 33.8 |

| Indirect effects | 0.0 | -3.3 | -7.1 | -9.7 | -8.4 |

| Total changes since restated March 2019 | -0.2 | 14.6 | 29.1 | 26.0 | 26.9 |

| Budget 2020 | 47.4 | 54.8 | 66.7 | 61.5 | 60.2 |

| Figures may not sum due to rounding. |

| 1 Equivalent to lines from Table 1.3 of the OBR (March 2020) ʽEconomic and fiscal outlookʼ; full references available in ʽBudget 2020 data sourcesʼ. |

| 2 Excludes a fiscally neutral change to the treatment of customs duty revenues previously remitted to the EU. |

| Source: Office for Budget Responsibility and HM Treasury calculations. |

Compared to the restated March 2019 forecast, borrowing is lower in 2019-20, but higher in every other year of the forecast. It rises over the forecast period from 2.1% of GDP in 2019-20 to 2.8% of GDP in 2021-22, before falling to 2.2% in 2024-25.

Table 1.4: Overview of the OBRʼs borrowing forecast as a percentage of GDP

| Outturn | Forecast | ||||||

|---|---|---|---|---|---|---|---|

| 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | |

| Public sector net borrowing | 1.8 | 2.1 | 2.4 | 2.8 | 2.5 | 2.4 | 2.2 |

| Cyclically-adjusted public sector net borrowing | 1.9 | 2.2 | 2.4 | 3.0 | 2.7 | 2.5 | 2.2 |

| General government net borrowing (1) | 1.8 | 2.2 | 2.5 | 3.1 | 2.6 | 2.4 | 2.4 |

| Memo: Output gap (2) | 0.3 | 0.0 | 0.1 | 0.4 | 0.4 | 0.1 | 0.0 |

| 1 Consistent with Manual on Government Deficit and Debt, Eurostat, 2019. |

| 2 Output gap measured as a percentage of potential GDP. |

| Source: Office for National Statistics and Office for Budget Responsibility. |

Compared with the restated March 2019 forecast, debt is lower in 2020-21, it is then higher in all the remaining years of the Budget forecast as a share of GDP, largely as a result of higher borrowing. Public sector net debt is expected to continue to fall over the forecast, from 79.5% in 2019-20, to a low of 75.0% in 2021-22 before rising slightly to 75.2% in 2024-25. Public sector net debt ex Bank of England is broadly stable across the forecast.

Table 1.5: Overview of the OBRʼs debt forecast as a percentage of GDP

| Outturn | Forecast | ||||||

|---|---|---|---|---|---|---|---|

| 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | |

| Public sector net debt (1) | 80.6 | 79.5 | 77.4 | 75.0 | 75.4 | 75.6 | 75.2 |

| Public sector net debt ex Bank of England (1) | 72.3 | 71.9 | 71.9 | 72.3 | 72.9 | 73.1 | 72.9 |

| Public sector net financial liabilities (1) | 67.4 | 66.7 | 65.9 | 65.3 | 64.9 | 64.5 | 63.4 |

| General government gross debt (2) | 84.1 | 83.2 | 82.9 | 83.2 | 83.3 | 83.3 | 83.0 |

| 1 Debt and liabilities at end of March; GDP centred on end of March. |

| 2 Consistent with Manual on Government Deficit and Debt, Eurostat, 2019. |

| Source: Office for National Statistics and Office for Budget Responsibility. |

Table 1.6: Changes to the OBRʼs forecast for public sector net debt since restated March 2019 forecast as a percentage of GDP

| 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | |

|---|---|---|---|---|---|

| Restated March 2019 | 81.3 | 78.2 | 74.3 | 73.6 | 72.7 |

| Total forecast changes since restated March 2019 (1) | -1.8 | -0.8 | 0.7 | 1.9 | 2.9 |

| of which | |||||

| Change in nominal GDP (2) | -1.0 | -1.1 | -1.2 | -1.0 | -0.9 |

| Change in cash level of net debt | -0.8 | 0.4 | 1.9 | 2.9 | 3.8 |

| Budget 2020 | 79.5 | 77.4 | 75.0 | 75.4 | 75.6 |

| Figures may not sum due to rounding |

| 1 Equivalent to lines from Table 3.34 of the OBR (March 2020) ʽEconomic and fiscal outlookʼ; full references available in ʽBudget 2020 data sourcesʼ. |

| 2 Non-seasonally adjusted GDP centred on end of March. |

| Source: Office for Budget Responsibility. |

The OBR’s ‘Economic and Fiscal Outlook’ shows that the government is forecast to meet the fiscal rules set out above in section 1.12. There is a current budget surplus of £11.7 billion in 2022-23, providing headroom against this rule. Net investment is expected to average 2.9% of GDP over 2020-21 to 2024-25 – below the 3% target – while the debt interest to revenue ratio remains below 6%.

Table 1.7: Metrics used for fiscal rules

| Forecast | ||||||

|---|---|---|---|---|---|---|

| 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | |

| Current budget deficit (% of GDP) | -0.1 | -0.2 | -0.1 | -0.5 | -0.7 | -0.8 |

| Public sector net investment (% of GDP) | 2.2 | 2.6 | 2.9 | 3.0 | 3.0 | 3.0 |

| Debt interest to revenue ratio (1) | 3.8 | 3.3 | 3.5 | 3.3 | 3.1 | 2.9 |

| 1 The debt interest to revenue ratio is defined as public sector net interest paid (gross interest paid less interest received) as a proportion of non-interest receipts. |

| Source: Office for Budget Responsibility. |

1.14 Public spending

The government’s significant progress in restoring the public finances to health over the last decade means it can now afford to support the economy in the short term while investing to support long-term growth. The new fiscal framework allows for a significant increase in growth-enhancing infrastructure investment, while maintaining control of day-to-day spending and the commitment to long-term fiscal sustainability.

At Spending Round 2019, the government increased departmental spending by 4.1% in real terms between 2019-20 and 2020-21, delivering the fastest planned growth in day-to-day departmental spending in 15 years.[footnote 20] Spending Round 2019 funded vital public services: high‑quality, readily accessible healthcare; schools and colleges that ensure every child receives a superb education; and action to cut crime and help keep our streets safe.

Individual budgets for all departments have been set until 2020-21 for both departmental capital totals (CDEL) and departmental resource totals (RDEL). Longer-term settlements have already been announced for the NHS and schools, which have confirmed budgets until 2023-24 and 2022-23 respectively.

Table 1.8: Departmental Capital Budgets in 2019-20 and 2020-21 (Capital DEL, in £ billion)

| 2019-20 | 2020-21 | ||

|---|---|---|---|

| Capital DEL | |||

| Health and Social Care | 7.1 | 8.2 | |

| Education | 4.6 | 4.5 | |

| Home Office | 0.7 | 0.8 | |

| Justice | 0.5 | 0.7 | |

| Law Officers' Departments | 0.0 | 0.0 | |

| Defence | 10.5 | 10.6 | |

| Single Intelligence Account | 0.6 | 0.8 | |

| Foreign and Commonwealth Office | 0.1 | 0.1 | |

| International Development (1) | 2.0 | 4.8 | |

| MHCLG Housing and Communities (2) | 8.4 | 13.1 | |

| MHCLG Local Government | 0.0 | 0.0 | |

| Transport (3) | 14.6 | 17.6 | |

| Business, Energy and Industrial Strategy (4) | 11.2 | 12.3 | |

| Digital, Culture, Media and Sport | 0.6 | 0.6 | |

| Environment, Food and Rural Affairs | 0.8 | 0.9 | |

| International Trade | 0.0 | 0.0 | |

| Work and Pensions | 0.1 | 0.2 | |

| HM Revenue and Customs | 0.3 | 0.4 | |

| HM Treasury | 0.1 | 0.0 | |

| Cabinet Office | 0.1 | 0.1 | |

| Scotland | 4.4 | 5.5 | |

| Wales (5) | 2.3 | 2.4 | |

| Northern Ireland (6) | 1.4 | 1.7 | |

| Small and Independent Bodies | 0.4 | 0.5 | |

| Reserves (7) | 0.0 | 3.4 | |

| Adjustment for Budget Exchange (8) | 0.0 | -0.6 | |

| Total Capital DEL | 71.1 | 88.5 | |

| Remove CDEL not in PSGI (9) | -11.2 | -13.3 | |

| Allowance for shortfall (10) | 0.0 | -3.9 | |

| Public Sector Gross Investment in CDEL | 59.9 | 71.2 | |

| 1 Figures for 2020-21 do not reflect all transfers which will be made from DfID to other government departments. |

| 2 MHCLG's CDEL budget in 2020-21 includes technical adjustments along with Budget announcements since Budget 2018. |

| 3 DfT's CDEL budget in 2020-21 includes a net reduction due to business rates retention pilots. |

| 4 BEIS and other government departments' CDEL budgets increased in 2020-21 to account for the reclassification of R&D in the National Accounts. |

| 5 This includes the 5% needs-based Barnett formula uplift. |

| 6 This includes the 2.5% VAT abatement. |

| 7 2020-21 adjusted to account for a change in the accounting treatment of leases. This money will be allocated to departments through the Estimates process. |

| 8 Departmental budgets in 2020-21 include amounts carried forward from 2019-20 through Budget Exchange, which will be voted at Main Estimates. These increases will be offset at Supplementary Estimates in future years so are excluded from spending totals. |

| 9 Capital DEL that does not form part of public sector gross investment, including financial transactions in Capital DEL. |

| 10 The OBR's forecast of underspends in Capital DEL budgets. |

Table 1.9: Departmental Resource Budgets in 2019-20 and 2020-21 (Resource DEL excluding depreciation, £ billion)

| 2019-20 | 2020-21 | ||

|---|---|---|---|

| Resource DEL excluding depreciation (1) | |||

| Health and Social Care | 133.3 | 139.8 | |

| of which: NHS England | 123.7 | 129.9 | |

| Education | 63.8 | 67.8 | |

| of which: Schools | 44.4 | 47.6 | |

| Home Office | 11.5 | 13.0 | |

| Justice | 7.8 | 8.3 | |

| Law Officers' Departments | 0.6 | 0.7 | |

| Defence | 29.5 | 30.8 | |

| Single Intelligence Account | 2.4 | 2.1 | |

| Foreign and Commonwealth Office (2) | 2.4 | 1.1 | |

| International Development (2) | 8.0 | 9.6 | |

| MHCLG Housing and Communities (3) | 2.6 | 1.7 | |

| MHCLG Local Government (3) | 5.2 | 8.2 | |

| Transport | 3.8 | 4.2 | |

| Business, Energy and Industrial Strategy | 2.5 | 2.5 | |

| Digital, Culture, Media and Sport | 1.6 | 1.7 | |

| Environment, Food and Rural Affairs (4) | 2.1 | 3.9 | |

| International Trade | 0.5 | 0.5 | |

| Work and Pensions | 5.7 | 5.8 | |

| HM Revenue and Customs | 4.0 | 3.9 | |

| HM Treasury | 0.4 | 0.2 | |

| Cabinet Office | 1.0 | 0.5 | |

| Scotland (5) | 16.9 | 21.1 | |

| Wales (5),(6) | 12.1 | 12.8 | |

| Northern Ireland (7) | 11.2 | 11.5 | |

| Small and Independent Bodies | 1.5 | 2.2 | |

| Reserves | 0.0 | 6.7 | |

| Adjustment for Budget Exchange (8) | 0.0 | -0.1 | |

| Total Resource DEL excluding depreciation | 330.4 | 360.6 | |

| OBR allowance for shortfall (9) | -0.5 | -3.2 | |

| OBR resource DEL excluding depreciation forecast | 329.9 | 357.3 | |

| 1 Resource DEL excluding depreciation is the Treasury's primary control total within resource budgets and the basis on which Spending Round settlements were made. |

| 2 Figures for 2020-21 do not reflect all transfers which will be made from DfID to FCO and other government departments. |

| 3 MHCLG Housing and Communities DEL in 2020-21 excludes the New Homes Bonus, reflecting a transfer to Local Government (LG) DEL. LG DEL increase in 2020/21 is also driven by the ending of the 2019/20 75% Business Rates Retention pilots. |

| 4 DEFRA's RDEL ex budget in 2020-21 increases due to the domestic replacement of Common Agricultural Policy spending. |

| 5 Block grant adjustments have been agreed with the Scottish Government for tax and welfare devolution and with the Welsh Government for tax devolution as part of their respective fiscal frameworks. |

| 6 This includes the 5% needs-based Barnett formula uplift. |

| 7 This includes the 2.5% VAT abatement. |

| 8 Departmental budgets in 2020-21 include amounts carried forward from 2019-20 through Budget Exchange, which will be voted at Main Estimates. These increases will be offset at Supplementary Estimates in future years so are excluded from spending totals. |

| 9 The OBR's forecast of underspends in Resource DEL budgets. |

1.15 The Spending Envelope and Comprehensive Spending Review 2020

The Budget marks the start of an ambitious programme of investment in communities across the country, many of whom feel left behind. The Budget launches the CSR, which will conclude in July.[footnote 21]

1.16 Path of Public Spending

1.17 The Comprehensive Spending Review envelope

The CSR will set Resource DEL budgets for three years to 2023-24 inclusive and Capital DEL funding for departments to 2024-25. The CSR will be delivered within the fiscal rules set out in section 1.12. The Budget sets the overall spending envelope for resource and capital spending within which the CSR will be delivered. Total departmental spending is set to grow twice as fast as the economy over the CSR period. Day-to-day departmental spending is set to grow at the fastest rate over a spending review period since Spending Review 2004.

Having left the EU, from 2021 the UK will no longer contribute to the EU budget as a Member State, leaving only payments due as part of Financial Settlement obligations. The government has accounted for this when setting its spending plans, allowing it to determine how an additional £14.6 billion[footnote 22] of spending by 2024-25 can be allocated to its domestic priorities, rather than be sent in contributions to the EU. The implementation period (IP) will end on 31 December 2020. The baseline scenario is that the UK will exit the IP at this time without a future relationship being agreed with the EU. HM Treasury will ensure that all necessary funding is made available to prepare for this outcome at the end of 2020.

Table 1.10: Total departmental budgets (Total DEL); Resource DEL excluding depreciation and Capital DEL from 2019-20 to 2024-25 (1), (2), (3) (£ billion, unless otherwise stated)

| 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | AARG 2019-20 to 2024-25 (4),(5),(6) | |

|---|---|---|---|---|---|---|---|

| Total Resource DEL excluding depreciation | 330.4 | 360.6 | 384.6 | 400.7 | 417.6 | 435.5 | 3.3% |

| OBR allowance for shortfall | -0.5 | -3.2 | -3.9 | -4.1 | -4.3 | -4.4 | |

| OBR resource DEL excluding depreciation forecast | 329.9 | 357.3 | 380.8 | 396.6 | 413.3 | 431.1 | |

| Total Capital DEL | 71.1 | 88.5 | 101.7 | 107.5 | 109.1 | 112.8 | 6.9% |

| OBR allowance for shortfall | 0.0 | -3.9 | -7.3 | -7.8 | -8.0 | -8.1 | |

| OBR capital DEL forecast | 71.2 | 84.6 | 94.3 | 99.6 | 101.1 | 104.7 | |

| Total departmental spending (Total DEL) | 401.5 | 449.0 | 486.3 | 508.1 | 526.8 | 548.3 | 4.0% |

| 1 Budgeting totals are shown including the Office for Budget Responsibility (OBR) forecast Allowance for Shortfall. |

| 2 Resource DEL excluding ring-fenced depreciation is the Treasury's primary control within resource budgets and is the basis on which departmental Spending Review settlements are agreed. The OBR publishes Public Sector Current Expenditure (PSCE) in DEL and AME. A reconciliation is published by the OBR. |

| 3 Capital DEL is the Treasury's primary control within capital budgets and is the basis on which departmental Spending Review settlements are agreed. The OBR publishes Public Sector Gross Investment (PSGI) in DEL and AME. A reconciliation is published by the OBR. |

| 4 DEL in 2019-20 and 2020-21 is reduced by Business Rates Retention pilots that switched spending into AME. To ensure consistency, growth rates for Resource DEL and Capital DEL have been adjusted to reverse this DEL-AME switch. |

| 5 Resource DEL from 2020-21 onwards is increased by the devolution of areas of welfare spending to the Scottish Government which has caused a decrease in the Block Grant Adjustment and subsequent increase in Resource DEL. To ensure consistency, growth rates for Resource DEL and Capital DEL have been adjusted to reverse this switch. |

| 6 Capital DEL from 2020-21 onwards includes a provision for the impact of the IFRS16 reclassification of leases on departmental capital budgets. To ensure consistency, growth rates have been adjusted to reverse this provision. |

1.18 Resource

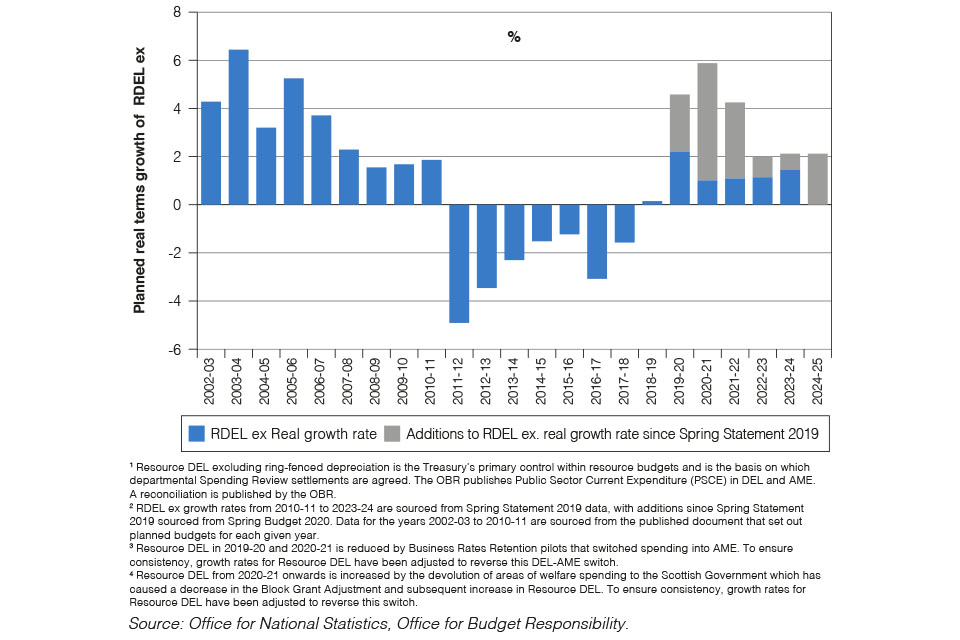

The CSR will see an increase in day-to-day spending from £360.6 billion in 2020-21 to £417.6 billion by 2023-24. Overall Resource DEL spending will increase by 2.8% per year on average in real terms over the CSR period. Over the Parliament, it will grow by 3.3% on average in real terms. Chart 1.9 shows the real terms growth in day-to-day departmental spending over the forecast period.

Chart 1.9: Resource DEL excluding depreciation growth from 2002-03 to 2024-25 (1,2,3,4)

1.19 Capital

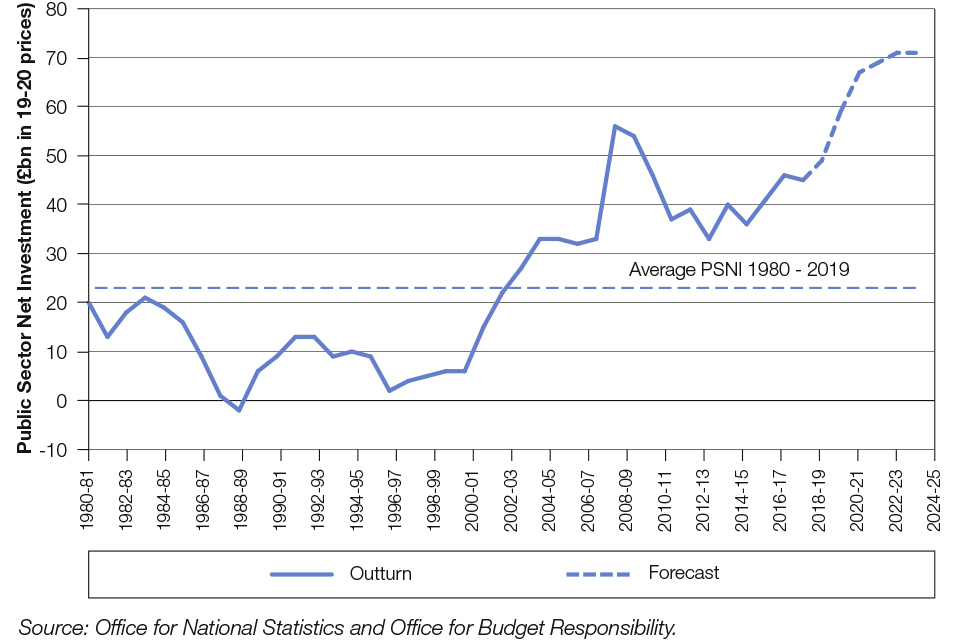

Over the next five years the public sector will invest £640 billion, as set out in Table 1.11. This significant increase in spending means that by 2024-25, public sector net investment will be triple the average investment over the last 40 years in real terms, as shown in Chart 1.9.

This spending will provide world-class infrastructure and public services, delivering value for money and focussing on efficient delivery. The CSR will allocate capital funding for projects across the UK to drive growth, level up economic opportunity, decarbonise the economy, and maintain and build high quality public infrastructure, including schools and hospitals. The Budget sets out plans to increase public R&D investment to £22 billion per year by 2024-25, taking public spending on R&D to 0.8% of GDP.

These allocations will be informed by early findings from the review of HM Treasury’s Green Book, which will consider how the design and use of project appraisal affects the ability of all areas to achieve their economic potential. The review will enhance the strategic development and assessment of projects, consider how to assess and present local impacts and look to develop new analytical methods for transformative or place-based interventions. It will also consider how project approval decisions are being made and provide clearer guidance and support to practitioners. The government will work with users, academics and others, and a revised Green Book will be published alongside the CSR.

Chart 1.10: Public sector net investment from 1980-81 to 2024-25

1.20 Total managed expenditure

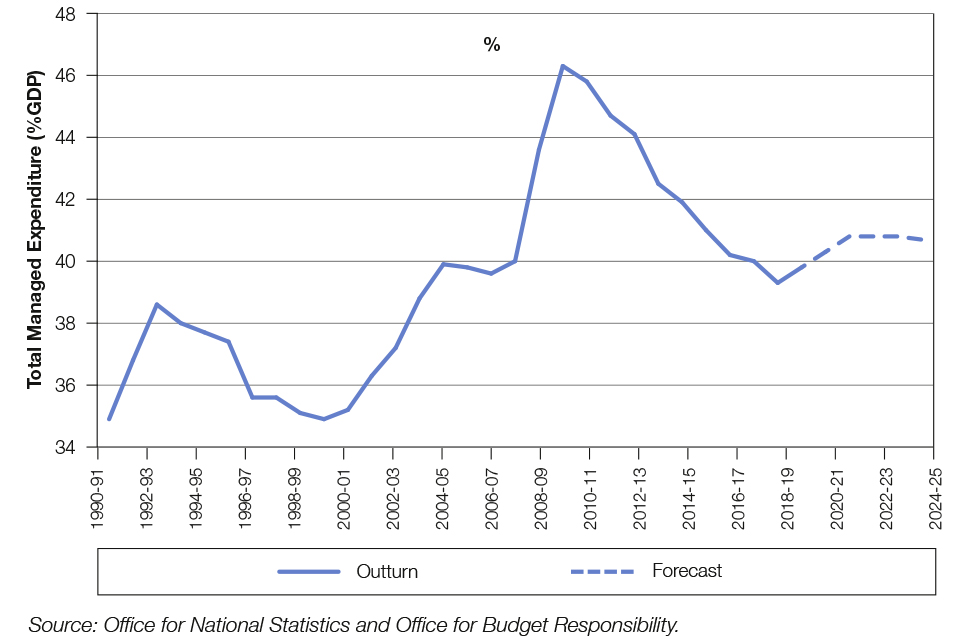

These firm decisions on the Departmental Expenditure Limits (DEL) envelope for the CSR mean that the average annual real growth of Total Managed Expenditure (TME), the total amount of money that the government spends through departments, local authorities, other public bodies and social security, will be 1.9% between 2019-20 and 2024-25. Table 1.11 sets out planned TME, public sector current expenditure (PSCE) and public sector gross investment (PSGI) up to 2024-25. Chart 1.11 which shows the change in government spending as a share of GDP over time, shows that tough decisions made in the aftermath of the financial crisis have restored the public finances to health and the government can now afford to invest more in public services and growing the economy.

Government spending is now set to be 40.7% of GDP in 2024-25. TME as a percentage of GDP has also increased because of classification and methodology changes that have impacted underlying spending, in particular those relating to student loans, public sector pensions and depreciation.[footnote 23] These are technical revisions that have been applied to the entire time series of data to ensure comparison to other years can be done on an equal basis.

Table 1.11: Total Managed Expenditure(1) from 2019-20 to 2024-25 (£ billion, unless otherwise stated)

| 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | |

|---|---|---|---|---|---|---|

| Current expenditure | ||||||

| Resource AME | 426.5 | 421.6 | 433.5 | 443.4 | 453.2 | 464.7 |

| Resource DEL excluding depreciation | 330.4 | 360.6 | 384.6 | 400.7 | 417.6 | 435.5 |

| Ring-fenced depreciation | 30.8 | 33.6 | 35.9 | 37.4 | 39.0 | 40.6 |

| Total public sector current expenditure | 787.7 | 815.8 | 854.1 | 881.5 | 909.9 | 940.8 |

| Capital expenditure | ||||||

| Capital AME | 33.6 | 30.4 | 26.6 | 26.9 | 28.5 | 29.2 |

| Capital DEL excluding financial transactions | 65.5 | 81.6 | 96.7 | 102.3 | 106.5 | 110.2 |

| Total public sector gross investment | 99.1 | 111.9 | 123.3 | 129.2 | 135.0 | 139.4 |

| Total managed expenditure | 886.8 | 927.7 | 977.4 | 1010.7 | 1044.9 | 1080.2 |

| Total managed expenditure % of GDP | 39.8% | 40.3% | 40.8% | 40.8% | 40.8% | 40.7% |

| 1 Budgeting totals are shown including the Office for Budget Responsibility (OBR) forecast Allowance for Shortfall. Resource DEL excluding ring-fenced depreciation is the Treasury's primary control within resource budgets and is the basis on which departmental Spending Review settlements are agreed. The OBR publishes Public Sector Current Expenditure (PSCE) in DEL and AME, and PSGI in DEL and AME. A reconciliation is published by the OBR. |

Chart 1.11: Total Managed Expenditure (% GDP) from 1990-91 to 2024-25

1.21 Allocations for the Comprehensive Spending Review

Chapter 2 of this document sets out further detail on the allocations made at the Budget. The overall allocations of total resource and capital funding over the CSR period will be determined at the CSR in July.

The CSR will prioritise:

-

levelling up economic opportunity across all nations and regions of the country by investing in infrastructure, innovation and people, to drive productivity and spread opportunity

-

improving outcomes in public services, including supporting the NHS and taking steps to cut crime and ensure every young person receives a superb education

-

strengthening the UK’s place in the world

-

reducing carbon emissions and improving the natural environment

All new spending will be accompanied by a rigorous new focus on outcomes. To support this the government is conducting an exercise across departments to identify savings and projects that do not provide value for money or support these priorities. The government will redirect this spending through the CSR to help achieve its priorities. The CSR will also set out plans to improve the use of data, science and technology across the public sector, and to ensure all programmes are supported by robust implementation and evaluation plans.

In conducting the CSR, the government will also build on the lessons of previous spending reviews and ensure that policy issues are considered across departmental boundaries to maximise the effectiveness and value for money of government spending. The Budget announces the first allocation from the Shared Outcomes Fund to pilot improved approaches to supporting adults with complex needs. This fund was established at Spending Round 2019 to pilot new programmes to build an evidence base and test new ways of working collaboratively across the public sector. Further details on this bid can be found in Chapter 2.

The CSR will be informed by the Integrated Security, Defence, Development and Diplomacy Review (Integrated Review). The government intends to publish the main conclusions of the Integrated Review alongside the CSR.

At the CSR the government will set out funding to meet commitments to replace the Common Agricultural Policy and EU structural funds. The government may also choose to participate in certain EU programmes, where it is in UK interests and the contributions are fair and appropriate.

1.22 Improving public services

1.23 Priority outcomes and evaluation