Build Back Better: our plan for growth (HTML)

Published 3 March 2021

Foreword

Boris Johnson - Prime Minister

With hundreds of thousands of needles going into arms every day, our fantastic NHS is shifting the odds in our favour, protecting the people we love and finally offering real hope for the future. These remarkable vaccines are giving us a realistic way forwards to restart our businesses and our lives. As we do so, we must grasp the historic opportunity before us: to learn the lessons of this awful pandemic and build back better, levelling up across our United Kingdom and fixing the problems that have held back too many people for too long.

I believe the formula for our success can be seen in the collaboration between industry, science and government that led to the production of the vaccines. Strong and active government investing massively in science and technology, coupled with a dynamic enterprise economy that embraces the instincts and know-how of the private sector. This formula has been central to our success since the industrial revolution, when our great cities built the modern world and the Victorian boom sparked new centres of civic pride, filled with industry and inspiration.

In that age of invention no one single place could lay claim to being the cradle of innovation – because brilliant minds were advancing the cause of humanity with their genius in every part of our country. A trail of invention and discovery can be traced across our land – from Richard Trevithick’s first steam powered rail journey in Merthyr Tydfil, to the electric carriage pioneered by Robert Anderson in Scotland; from the first man-made plastic by Alexander Parkes of Birmingham, to the first vaccine of Edward Jenner in Gloucestershire, whose institute today worked with AstraZeneca to produce Britain’s Covid vaccine. All proof, if any were ever needed, that brains and talent are uniformly distributed.

Yet in the post-industrial era the distribution of opportunity has failed to match that distribution of talent. While the UK has continued to punch well above its weight as the fifth biggest economy in the world, that punching – and with it jobs and opportunities – have been concentrated in London and the South East. Talent and resources have been sucked to the south so that for many people and places in Britain and Northern Ireland our economic model has just stopped working. People have been denied the opportunities to acquire the skills to work in new and dynamic industries, and there has been a chasm between invention and commercial application as too often “invented in Britain” has translated into “made elsewhere”.

This plan for growth is a call to arms to put this right. Our mission is to unleash the potential of our whole country and restore the energy and confidence of the Victorians themselves. Just as the government has done whatever it takes to support lives and livelihoods throughout the Covid crisis, so we will turn that same ambition and resolve to the task of our recovery. We will level up our country, so the map of our whole United Kingdom is lit up with competitive cities and vibrant towns that are centres of life – places people are proud to call home, with access to the services and the jobs they need to thrive.

We will back business large and small, including the millions of entrepreneurs and high street shops who have been hit hard by the pandemic and whose success will be pivotal to getting our economy moving again. Our Plan for Jobs will support new opportunities in every part of the country, while our Lifetime Skills Guarantee will enable anyone to acquire the skills to do those jobs, wherever they live and whatever their stage of life.

We will redress Britain’s historic underinvestment in infrastructure, with £600 billion of gross public sector investment over the next five years, so our United Kingdom becomes a truly connected kingdom. We will make our country a science and technology superpower and the best possible place to create green jobs with our Ten Point Plan for a Green Industrial Revolution.

And we will seize the new opportunities of a Global Britain outside the European Union to make our own regulations, to access global talent, and to forge new trade deals for Britain all around the world.

Above all, we will embrace the instincts and know-how of the wealth creators, those in the private sector who invest money and take risks on new ideas that lead to new jobs, new industry and some of the greatest advances humanity has ever known.

It is human genius and ingenuity that is beating Covid and it is by unlocking that genius and ingenuity across our whole county that we will build back better. In doing so, this plan for growth aspires to serve and support everyone in our United Kingdom, whoever you are and wherever you live.

Rishi Sunak - Chancellor of the Exchequer

In my first Budget nearly a year ago, I said that we would do whatever it took to support the economy in response to the COVID-19 crisis that was just beginning. Throughout, the government’s overriding goal has been to protect the lives and livelihoods of people across the UK.

We have put in place an unprecedented economic package to protect, support and create jobs. Through our Plan for Jobs, we have helped millions of people, with the furlough scheme, support for the self-employed, government backed loans, and grants for businesses forced to close. And where people have sadly lost their jobs, we have stepped in to provide further support to help them find work or retrain.

While the impact on the economy and people’s lives has been profound, the UK is well-placed to confront the challenges from the COVID-19 crisis. We are an open and dynamic economy, home to some of the best companies in the world.

We have an international reputation for science and world-class universities. And we have strengths across many sectors, from financial services to creative industries.

The single most important economic policy in the short term is rolling out the vaccine as quickly as possible, where thanks to our extraordinary NHS, we have already vaccinated over 20 million people across the UK.

But as restrictions ease we need to look ahead to the future sources of jobs and growth. Now that we have left the EU we have the opportunity to forge a new path as a fully sovereign trading nation, doing things differently, more nimbly and better.

As we Build Back Better, our plan for growth will focus on three pillars of investment to act as the foundation on which to build the economic recovery, uniting and levelling up the country:

-

High quality infrastructure is crucial for economic growth, boosting productivity and competitiveness. The UK has historically underinvested in infrastructure, but we are fixing that, starting with £100 billion of capital investment in 2021-22.

-

The best way to improve people’s life chances is to give them the skills to succeed. The UK has a strong foundation of advanced skills, but lags behind international comparators on technical and basic adult skills. The government is transforming Further Education, encouraging lifelong learning through the Lifetime Skills Guarantee, and building an apprenticeships revolution.

-

Innovation drives economic growth and creates jobs. The UK has a world-leading research base, which will be boosted by the government’s significant uplift in R&D investment and the creation of the Advanced Research & Invention Agency to fund high-risk, high-reward research. However, too few businesses are able to access the tools they need to translate new ideas into new products and services and to challenge established businesses. We will make the UK the best ecosystem in the world for starting and growing a business. That means having the best access to capital, skills and ideas, as well as a smart and stable regulatory framework.

In pursuing economic growth, this government will do things differently:

-

Our most important mission is to unite and level up the country: tackling geographic disparities; supporting struggling towns to regenerate; ensuring every region and nation of the UK has at least one globally competitive city; and above all, strengthening the Union.

-

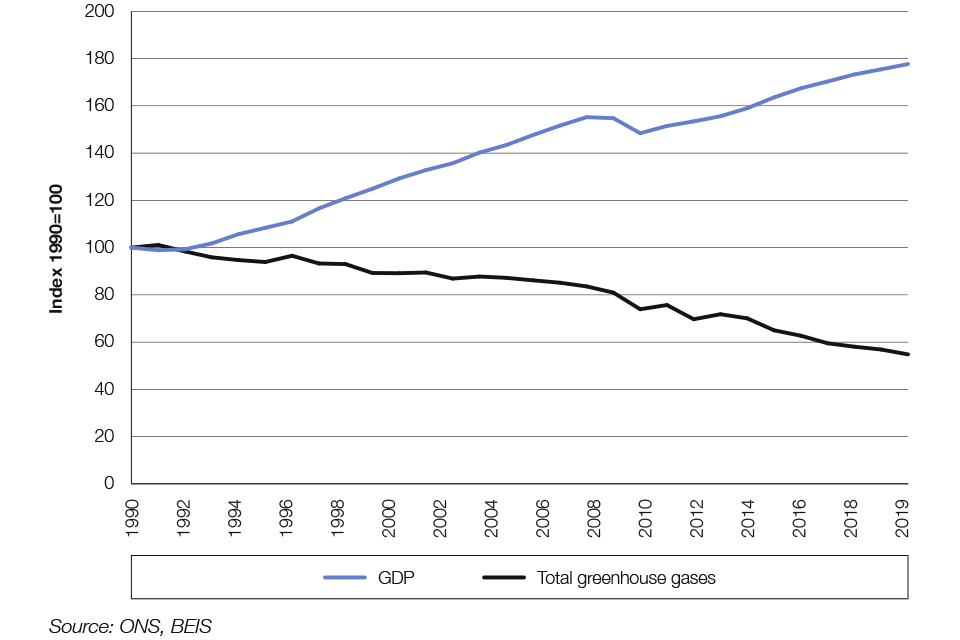

We will drive growth that is green: delivering our Ten Point Plan for a Green Industrial Revolution and taking action to fulfil our commitment to be the first generation to leave the natural environment in a better condition than we found it.

-

And our plan for growth will support our vision for Global Britain, taking advantage of the opportunities available to us now we have left the European Union.

Build Back Better: our plan for growth at a glance

Over the past year, we have faced substantial challenges, and the last few months have been amongst the most difficult yet. Businesses and schools have had to close, families and friends have been kept apart, and tragically, lives have been lost.

The UK Government has put in place an unprecedented economic package, providing businesses and individuals with support and certainty over the course of the pandemic, spending hundreds of billions to support people’s jobs, businesses, and public services across the UK. However, COVID-19 and the restrictions put in place to stop the spread of the virus caused the largest fall in annual GDP in 300 years.

But we are well placed to confront these challenges, rebounding to build back better: the UK’s departure from the European Union presents further opportunities for us to do things differently, opening up new ways to drive growth. The UK is one of the world’s largest economies, open and dynamic, with strong institutions and world-class universities.

The UK is a great place to start and grow a business, home to some of the world’s best companies. We have an international reputation for science: the development and manufacture of the Oxford/AstraZeneca vaccine demonstrated the strong partnerships that exist between universities and businesses in the UK. This strength extends to sectors such as aerospace, the creative industries, financial services, and emerging industries such as AI and fintech.

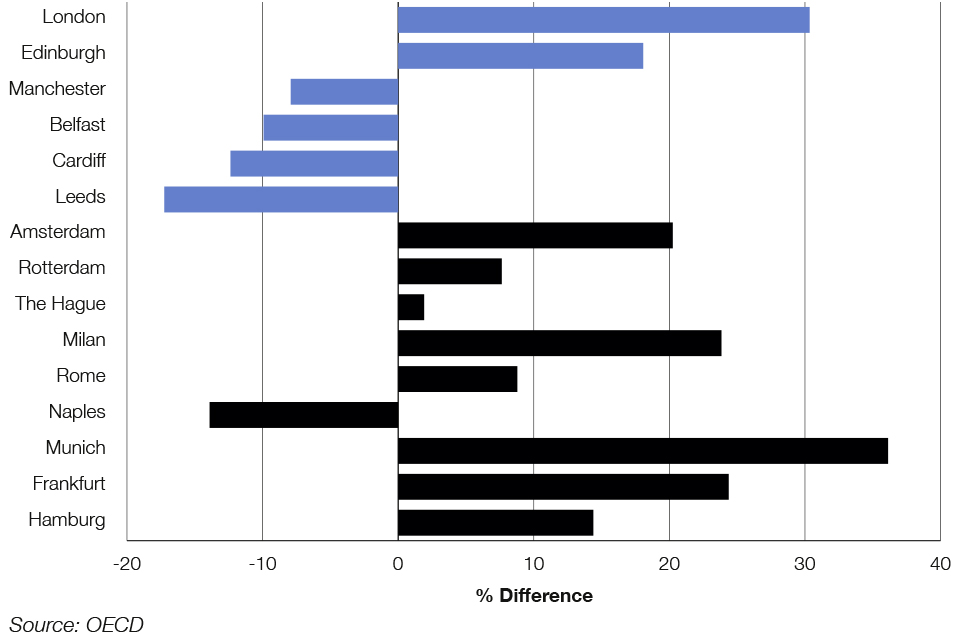

The last few decades have seen increased prosperity in London and the South East, but without commensurate improvements in the rest of the UK. The primary objective of this government is to change that, ensuring no region is left behind as we achieve greater economic prosperity. Our cities will be the engines for this growth, and our long-term vision is for every region and nation to have at least one internationally competitive city, driving the prosperity of the surrounding region and propelling forward the national economy. Our towns are crucial too - we will ensure that they are places that people are proud to live and raise their families, with good schools, vibrant high streets, and access to jobs that give everyone a fair chance to achieve their full potential.

Our plan to build back better takes a transformational approach, tackling long-term problems to deliver growth that creates high-quality jobs across the UK and makes the most of the strengths of the Union. We must retain our guiding focus on achieving the people’s priorities: levelling up the whole of the UK, supporting our transition to net zero, and supporting our vision for Global Britain.

We will do this by building on three core pillars of growth:

| We will... | |

|---|---|

| Infrastructure | Stimulate short-term economic activity and drive long-term productivity improvements via record investment in broadband, roads, rail and cities, as part of our capital spending plans worth £100 billion next year. Connect people to opportunity via the UK-wide Levelling Up Fund and UK Shared Prosperity Fund, as well as the Towns Fund and High Street Fund, to invest in local areas. Help achieve net zero via £12 billion of funding for projects through the Ten Point Plan for a Green Industrial Revolution. Support investment through the new UK Infrastructure Bank which will ‘crowd-in’ private investment to accelerate our progress to net zero, helping to level up the UK. This will invest in local authority and private sector infrastructure projects, as well as providing an advisory function to help with the development and delivery of projects. |

| Skills | Support productivity growth through high-quality skills and training: transforming Further Education through additional investment and reforming technical education to align the post-16 technical education system with employer demand. Introduce the Lifetime Skills Guarantee to enable lifelong learning through free fully funded Level 3 courses, rolling out employer-led skills bootcamps, and introducing the Lifelong Loan Entitlement. Continue to focus on the quality of apprenticeships and take steps to improve the apprenticeship system for employers, through enabling the transfer of unspent levy funds and allowing employers to front load apprenticeship training. |

| Innovation | Support and incentivise the development of the creative ideas and technologies that will shape the UK’s future high-growth, sustainable and secure economy. Support access to finance to help unleash innovation, including through reforms to address disincentives for pension funds to invest in high-growth companies, continued government support for start ups and scale ups through programmes such as British Patient Capital, and a new £375 million Future Fund: Breakthrough product to address the scale up gap for our most innovative businesses. Develop the regulatory system in a way that supports innovation. Attract the brightest and best people, boosting growth and driving the international competitiveness of the UK’s high-growth, innovative businesses. Support our small and medium-sized enterprises (SMEs) to grow through two new schemes to boost productivity: Help to Grow: Management, a new management training offer, and Help to Grow: Digital, a new scheme to help 100,000 SMEs save time and money by adopting productivity-enhancing software, transforming the way they do business. |

Not all growth is created equal. The growth we drive will:

| Level up the whole of the UK | Regenerate struggling towns in all parts of the UK viathe UK Shared Prosperity Fund and the UK-wide Levelling Up Fund. Realise our long-term vision for every region and nation to have at least one globally competitive city at its heart to help drive prosperity. This includes City and Growth Deals, £4.2 billion in intra-city transport settlements from 2022-23, and continued Transforming Cities Fund investment to 2022-23. Catalyse centres of excellence, supporting individuals across the country to access jobs and opportunities by ensuring digital and transport connectivity, by establishing a new UK Infrastructure Bank in the North of England and by relocating 22,000 Civil Service roles out of London. Strengthen the Union, creating Freeports across the country – including in Scotland, Wales and Northern Ireland – and delivering the Union Connectivity Review, reviewing options to improve our sea, air and land-links across the four nations. |

|---|---|

| Support the transition to Net Zero | Invest in net zero to create new opportunities for economic growth and jobs across the country, including supporting up to 60,000 jobs in the offshore wind sector, 50,000 jobs in carbon capture, usage and storage (CCUS) and up to 8,000 in hydrogen in our industrial clusters. Grow our current net zero industries and encourage new ones to emerge. This includes working with industry, aiming to generate 5GW of low carbon hydrogen production capacity and capture 10Mt CO2/year using CCUS by 2030, and ending the sale of new petrol and diesel cars and vans in 2030. |

| Support our vision for Global Britain | Cooperate with partners to inspire and shape international action on our domestic priorities, including through our G7 Presidency and COP26. Role-model openness to free and fair trade, working internationally to strengthen the multilateral system and the World Trade Organization and using preferential agreements and bilateral trade relationships to directly expand trading opportunities for UK businesses. Develop a new export strategy to align our support for exporters with our plan for growth and sectoral priorities, opening UK Government trade hubs in Scotland, Wales and Northern Ireland and increasing UK Export Finance lending capacity. |

We will carry this out with a relentless focus on delivery, using clear metrics to monitor progress and ensure success. Over the next twelve months, we will build on the strong foundation set out in this plan to make real progress.

By combining new approaches with our well-established strengths, we will deliver growth that benefits the whole of the United Kingdom, creates quality jobs, and ensures that we build back better.

Economic context

The challenges faced by the UK over the past twelve months have been substantial, and the last few months have been amongst the most difficult yet. Businesses and schools have had to close, families and friends have been kept apart, and tragically, lives have been lost.

COVID-19 and the restrictions put in place to stop the spread of the virus caused the largest fall in annual GDP in 300 years. The UK Government has put in place significant support measures to limit the rise in unemployment and insolvencies. This includes the furlough scheme, support for the self-employed, government backed loans, and grants for businesses forced to close. This support package, worth hundreds of billions, has helped all regions and nations of the UK.

As the economy starts to recover, we must confront the challenges created by COVID-19 and minimise the risk of lasting economic damage from this crisis across all corners of the UK. Jobs are the key economic priority. There will be a period of adjustment, as some jobs are lost, and people find new work in growing businesses or spot new opportunities to start their own. That is why through the Plan for Jobs the UK Government is focusing on delivering employment support, including work search or support with retraining, to those who need it most, from helping the recently unemployed to swiftly find new work, to offering greater support for people who will find that journey more difficult.

Plan for Jobs

The UK has one of the most successful labour markets, which pre-COVID-19 delivered record employment rates. The government has taken unprecedented action to protect jobs during the pandemic, most notably through the Coronavirus Job Retention Scheme (CJRS). However, the government is also supporting people who have unfortunately lost their jobs, helping them search for work or retrain, by:

-

Significantly expanding Department for Work and Pensions (DWP) Jobcentre support, including doubling the number of work coaches, additional investment into the Flexible Support Fund to provide direct support at a local level, and additional intensive support to those who have been unemployed for at least three months.

-

Introducing the £2 billion Kickstart scheme, which will provide young people at risk of long-term unemployment with fully-subsidised jobs to give them experience and skills.

-

Introducing the £2.9 billion Restart programme, which will provide regular, personalised support for those on Universal Credit who have been searching for work for over a year.

-

Supporting people to build the skills they need to get into work, with a substantial expansion of existing provision, providing funding to expand the number of traineeships and sector-based work academy placements, alongside further support for new apprentice hiring, which enables people to work while training.

These policies are important for the short-term recovery, helping to keep people close to the labour market and develop work experience and skills. They will help to ensure that the wider government labour market and skills offer also helps achieve long-term prosperity.

The scale of the challenge ahead is large. In December 2020 GDP was 6.3% below its February 2020 level; and business investment in the final quarter of last year was 19.2% lower than the year before. At its lowest point in November 2020, the number of employees had fallen by 882,000 (-3%) since February.

The COVID-19 shock has highlighted the great adaptability and resilience of UK businesses. Employers moved at speed to migrate services online, enabled their employees to work from home where possible, and adapted their premises to be COVID-secure. Over 60% of businesses have adopted new digital technologies during the pandemic[footnote 1].

That adaptability and resilience will prove vital in the months and years ahead, as the UK economy continues to transform. Technological innovations will change every sector of the economy, supporting higher earnings and shorter working days. New trading relationships will offer opportunities for our businesses to experience the benefits of exporting. The UK Government, alongside businesses and individuals, will harness the benefits of the transition to net zero, including an enhanced natural environment, cleaner air in our cities and new green jobs. Private sector investment will be a vital complement to planned public sector investment, and so it is crucial that we create the right conditions to unlock that investment and create jobs and growth.

The 2017 Industrial Strategy set out a cross-economy approach to boost productivity. But much has changed since 2017, so it is right that we create a new framework for how we will build back better. This document details our focus on infrastructure, skills and innovation. It reflects new opportunities available to us following our exit from the European Union, opening up new ways to drive growth and supporting our vision for Global Britain. This plan also demonstrates that we will not pursue growth at the expense of the government's wider objectives - instead we see real opportunities to boost our economic performance while levelling up across the UK and in a way that contributes to reaching net zero emissions.

Meeting modern challenges and thriving

The UK is well placed to meet both the challenges posed by COVID-19 disruption and to grasp the opportunities from our exit from the European Union, and from the social and economic adjustments due in the coming decades.

-

An open and dynamic economy – the UK has a flexible labour market that has generally seen lower unemployment than many of its European competitors over the last few decades. The UK has historically attracted international investment, with the largest stock of inward Foreign Direct Investment in Europe[footnote 2]. In 2019 our trade to GDP ratio was higher than the world average[footnote 3]. Our openness to trade and investment underpins our prosperity and drives opportunity across the UK.

-

World class knowledge and research – The UK has a high share of the adult population with tertiary education, over seven percentage points higher than the OECD average[footnote 4]. Four of the world’s top 20 universities are in the UK[footnote 5]. The UK punches above its weight on article downloads, citations and world’s most highly-cited articles. The UK is ranked 4th on the 2020 Global Innovation Index[footnote 6].

-

A stable framework for growth and strong institutions – The UK’s macroeconomic framework and institutions, for example through the commitment to low, stable inflation and financial stability through an independent central bank, enable the right conditions for the economy to succeed. Macroeconomic stability gives consumers, businesses and financial markets confidence to participate and invest in the real economy. The UK is committed to independent economic regulation and its institutions, such as its legal system, are respected around the world.

-

Leading innovative and high growth sectors – The UK has strengths in a diverse set of industries. An international reputation for science with strengths across sectors, including pharmaceuticals, aerospace, creatives, financial services, and professional and business services; and in emerging industries such as AI and fintech. The UK is home to some of the best businesses in the world and we are leading the way on the path to net zero.

-

A great place to start and grow a business – The UK is one of the best places in the world to start a business, with a stable regulatory environment and one of the highest birth rates of enterprises in the OECD. The UK has relatively deep capital markets that supports firms to grow. The UK has the lowest level of regulatory barriers to firm entry and competition in the OECD[footnote 7] and is ranked 8th on the 2020 World Bank Ease of Doing Business Index[footnote 8].

Creating an environment that enables the UK to succeed

Economic growth is driven by increasing employment and productivity. The UK must return to growing employment and take action to address weak productivity in order to secure a sustainable increase in growth.

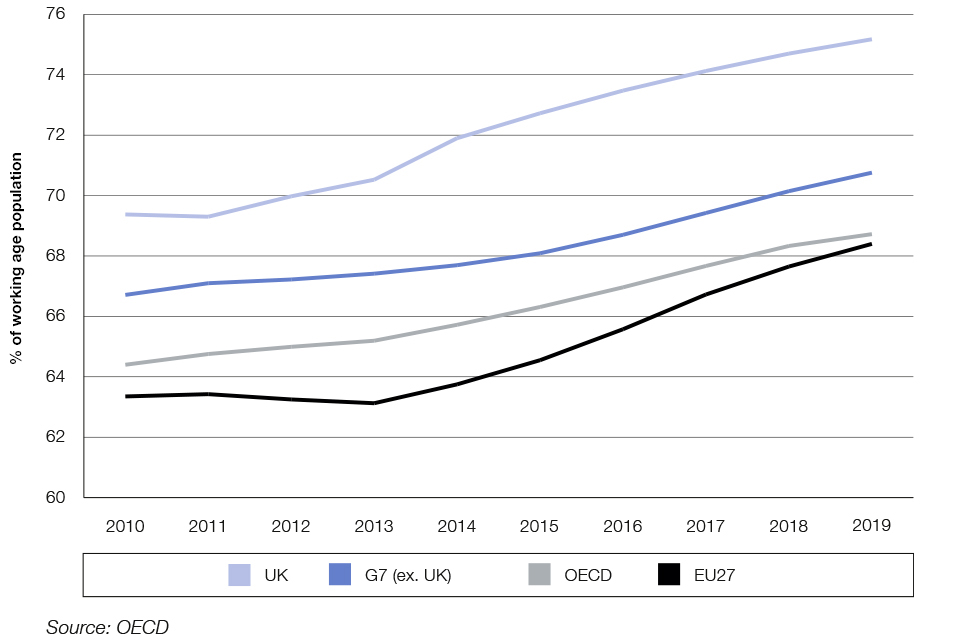

UK businesses have a good record in creating jobs, with the UK outperforming most other comparable OECD countries on employment. At the start of last year, the UK’s employment rate was at a record high (76.6% in the three months to February 2020), and 3.5 percentage points higher than its pre-financial crisis peak. This employment growth was led by the private sector. The plan for growth will help to build a business environment that gets UK hiring and investing again.

OECD employment rates, 2010-2019

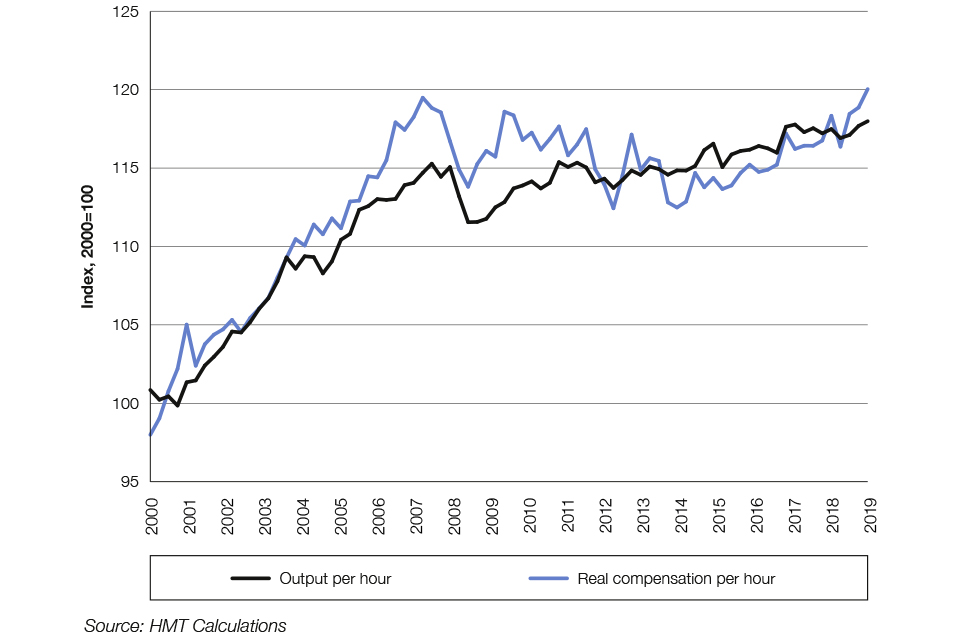

In the long run, productivity gains are the fundamental source of improvements in prosperity. Productivity is closely linked to incomes and living standards and supports employment. Improvements in productivity free up money to invest in jobs and support our ability to spend on public services.

UK productivity and total labour compensation, 2000-2019

Long-term investment in the country’s human and physical capital increases productivity. This means investing in people’s skills, the knowledge and capital within businesses, and the economic infrastructure that is the backbone of the economy, such as roads and broadband. We also need the right conditions to enable a dynamic economy that can encourage innovation and allow resources to be used most productively, which in practice means people being able to find high-quality work.

A long-term vision must be backed by action, and the plan for growth makes this possible by focusing on three pillars that are critical to supporting long-run growth and where UK action in the past has fallen short: infrastructure, skills and innovation.

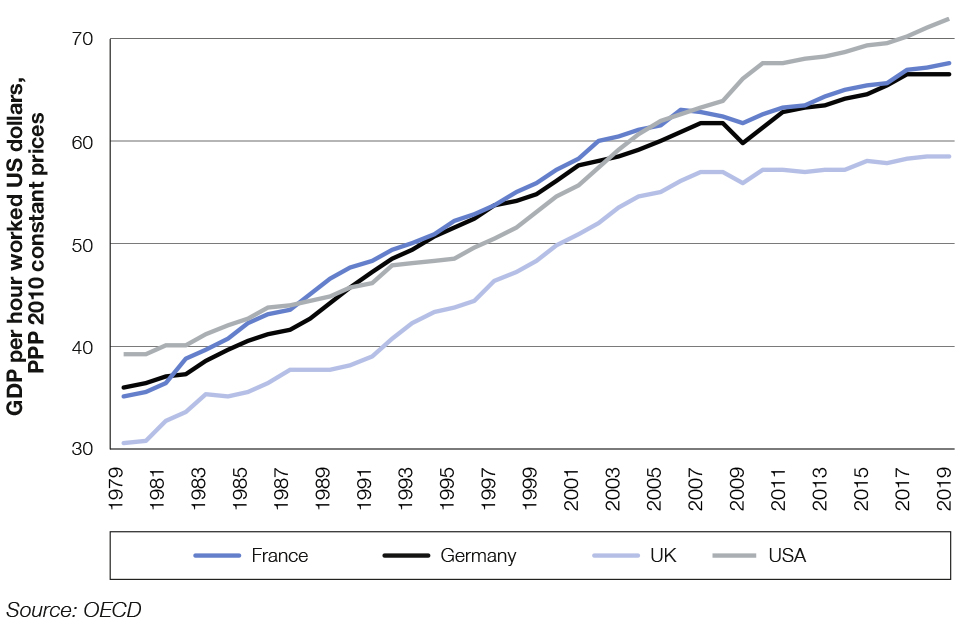

The UK has had a long-standing productivity gap to other major economies - in 2019, the gap in output per hour worked between the UK and France was one percentage point different to the gap 40 years before[footnote 9].

GDP per hour worked in selected countries, 1979–2019

Much of the reason for this gap lies in historic low levels of investment in physical capital - from underinvestment in infrastructure and weaker business investment compared to our peers - and lower levels of basic and technical skills. In the last 20 years, average investment as a percentage of GDP has been the lowest in the G7[footnote 10], and 18% of adults have a vocational qualification, compared to the OECD average of 27%[footnote 11].

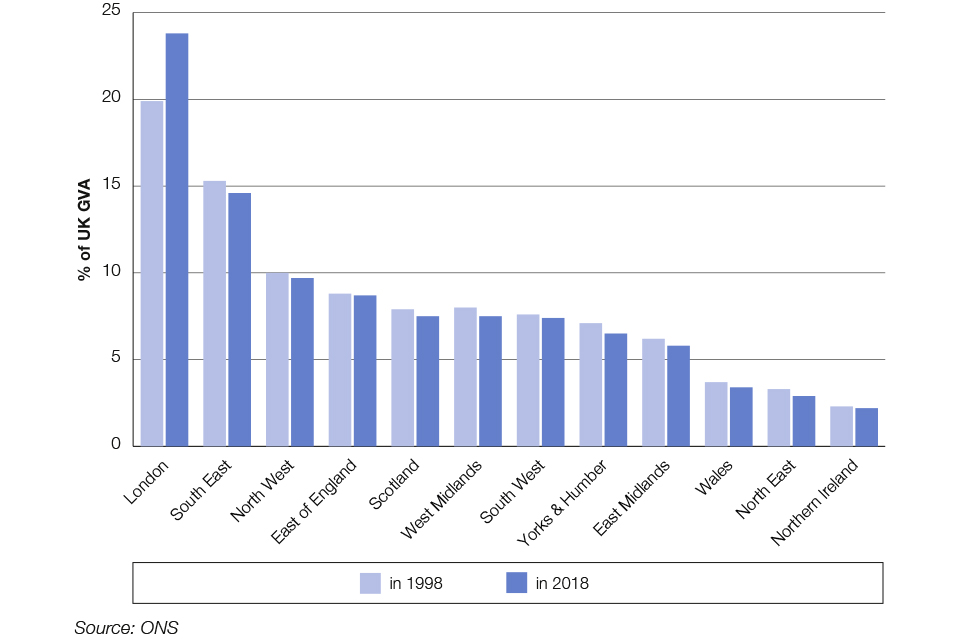

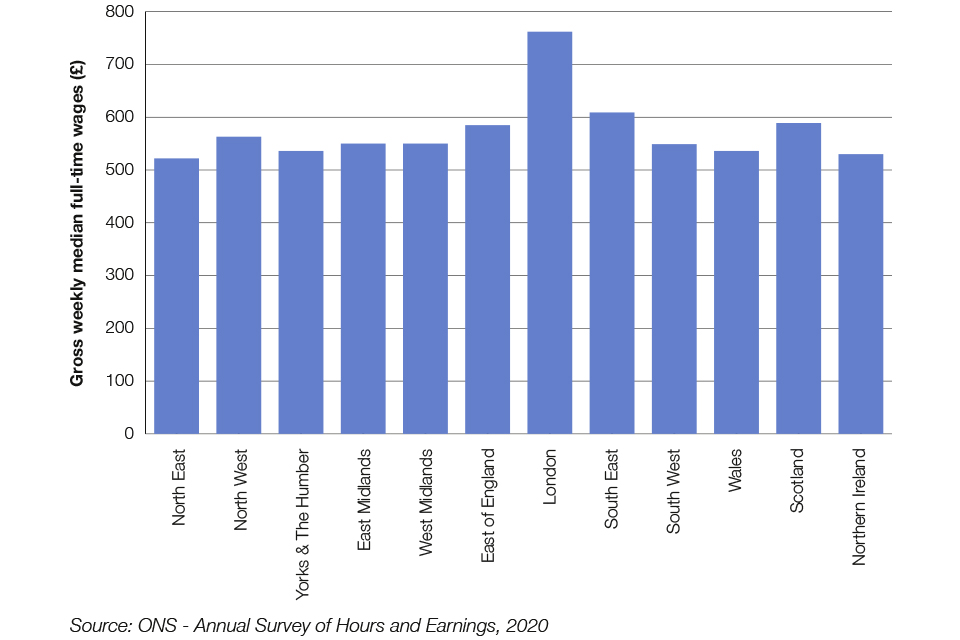

Within the UK itself, there are large disparities both across and within nations and regions, with only London and the South East with productivity above the UK average – this has implications for the relative prosperity of people living outside of those regions.

Our commitment to Levelling Up means tackling these disparities, which are some of the widest of any advanced economy and have been getting wider over time. In 1998, London accounted for 20% of UK GVA, but by 2018 this had risen to 24%. Important explanations for these differences are the distribution of skills between regions, and cities outside London not fully capturing the benefits of their size.

Relative contributions to national output of UK nations and regions

This is why a radical uplift in infrastructure investment and creating new skills training opportunities across the UK form two of the pillars of our plan for growth. Improving the UK’s performance in these areas would help to close the productivity gap between the UK and other countries, and close productivity gaps within the UK.

Productivity growth has also slowed since the financial crisis. While the UK ranks highly as one of the most dynamic economies amongst its competitors, there are signs dynamism has been reducing and played a part in the slowdown.

This is why the third pillar of the plan for growth is fostering the conditions to unleash innovation. This means maintaining a business environment where productive firms are able to scale up, barriers to business investment are removed and the constraints to new ideas and technology spreading through the economy are low.

Building on the pillars of growth

The quality of our infrastructure is lower than many other countries. The UK Government has already announced a record amount of capital and infrastructure investment at the Spending Review 2020 and in the National Infrastructure Strategy[footnote 12]. The plan for growth sets out how this investment will help the economy to recover, tackle our long-standing productivity gap, and lay the foundations for our long-term sustainable growth.

Skills play a crucial role in shaping people’s life chances. The UK has a strong foundation of advanced skills and a number of world-class universities, but lags behind international comparators on technical and basic adult skills. Improving skills opportunities will be important to productivity growth. The plan for growth sets out the range of interventions the UK Government is taking to drive improvements in skills.

Innovation, including cutting-edge research and how businesses adapt their products and processes, will be an important part of improving UK productivity growth. The UK has a world-leading research base, and while we have some of the best companies in the world, we also have a lower proportion of innovative firms overall than other advanced economies[footnote 13]. The plan for growth outlines measures that support and unlock innovative activity. These measures will support the high-growth businesses that make a significant contribution to employment and allow technology and best practice to diffuse through the economy to the benefit of all.

Delivering improved infrastructure, skills and innovation will be a joint endeavour between local authorities, combined authorities, the devolved administrations and the UK Government.

Growth that delivers the people’s priorities

The plan for growth is targeted at building on the UK’s strengths and addressing weaknesses in order to boost economic growth and employment. However, we recognise that not all types of growth are equal. The focus of this government is to ensure the benefits of growth are spread to all corners of the UK, driving growth that delivers the people’s priorities:

-

Levelling Up: the UK government’s most important mission is to unite and level up the country, improving everyday life for communities throughout the UK and ensuring everyone can succeed regardless of where they live. We will tackle geographic disparities in key services and outcomes, like health, education, and jobs; we will support struggling towns so they see social, economic and cultural regeneration; we want every region and nation of the UK to have at least one globally competitive city, acting as hotbeds of innovation and hubs of high value activity; and we will ensure that this plan builds on the strengths of the Union.

-

Net Zero: the UK will continue to be at the forefront of tackling climate change and is already a world leader in clean growth. We will deliver the Ten Point Plan for a Green Industrial Revolution, leveraging significant private sector investment and supporting up to 250,000 highly-skilled jobs; we will take action to fulfil our commitment to be the first generation to leave the natural environment in a better condition than we found it; and we will ensure the finance sector can play its role to support the transition to net zero.

-

Global Britain: the UK’s prosperity is built on our integration into the global economic and financial system. Following our exit from the European Union, we can also take advantage of the opportunities that come with our new status as a fully sovereign trading nation. We will role model free and fair trade, ensure the UK remains a leading destination for global investment, and support opportunities for trade and collaboration.

Infrastructure

High quality infrastructure is crucial for economic growth, boosting productivity and competitiveness. More than this, it is at the centre of our communities. Infrastructure helps connect people to each other, people to businesses, and businesses to markets, forming a foundation for economic activity and community prosperity. Well-developed transport networks allow businesses to grow and expand, enabling them to extend supply chains, deepen labour and product markets, collaborate, innovate and attract inward investment. Digital connectivity is unlocking new and previously unimaginable ways of working, and is now essential to facilitate public services, including healthcare and education.

The government is committed to transforming the UK’s infrastructure and increased investment is also a central part of economic recovery. The COVID-19 pandemic has introduced enormous short-term disruption and may have long-term effects on the way people live, for instance with less daily commuting. However, this does not undermine the long-term arguments for infrastructure. Instead, it requires the government to be flexible and adapt to the country’s changing needs. Investment in digital, transport and utilities networks is still required to underpin economic recovery and growth.

A 10% increase in the public capital stock – a measurement of the value of the UK’s current infrastructure networks – has been linked to a 1-2% increase in GDP, partly through productivity improvements[footnote 14].

Infrastructure can also support other UK Government policy objectives. For instance, it can improve skills and education through investment in digital technology and buildings, and health outcomes through investment in our health infrastructure. It is a key factor in determining where firms choose to locate and grow, and people’s ability to access resources. It unlocks development of housing. It can also support and enable our businesses to integrate into the international economy and trade goods and services across the world.

Last year, the UK Government published the National Infrastructure Strategy (NIS)[footnote 15], which brought together the government’s long-term infrastructure priorities with the short-term imperative to build back fairer, faster and greener following the COVID-19 pandemic. The NIS committed to:

-

Boosting growth and productivity across the whole of the UK, levelling up and strengthening the Union through investment in rural areas, towns and cities, from major national projects to local priorities.

-

Putting the UK on the path to meeting its net zero emissions target by 2050 by taking steps to decarbonise the UK’s power, heat and transport networks – which together account for over two-thirds of UK emissions – and take steps to adapt to the risks posed by climate change.

-

Supporting private investment by providing investors with clarity over the UK Government’s plans, so they can look to the UK with confidence and help deliver the upgrades and projects needed across the country.

-

Accelerating and improving delivery through wide-ranging Project Speed reforms including streamlining the planning system; improving the way projects are procured and delivered; and greater use of cutting-edge construction technology.

The National Infrastructure Strategy was just the first step of a multi-year process to transform the UK’s infrastructure networks and the UK Government is now focused on implementing this vision.

Delivering historic levels of infrastructure investment

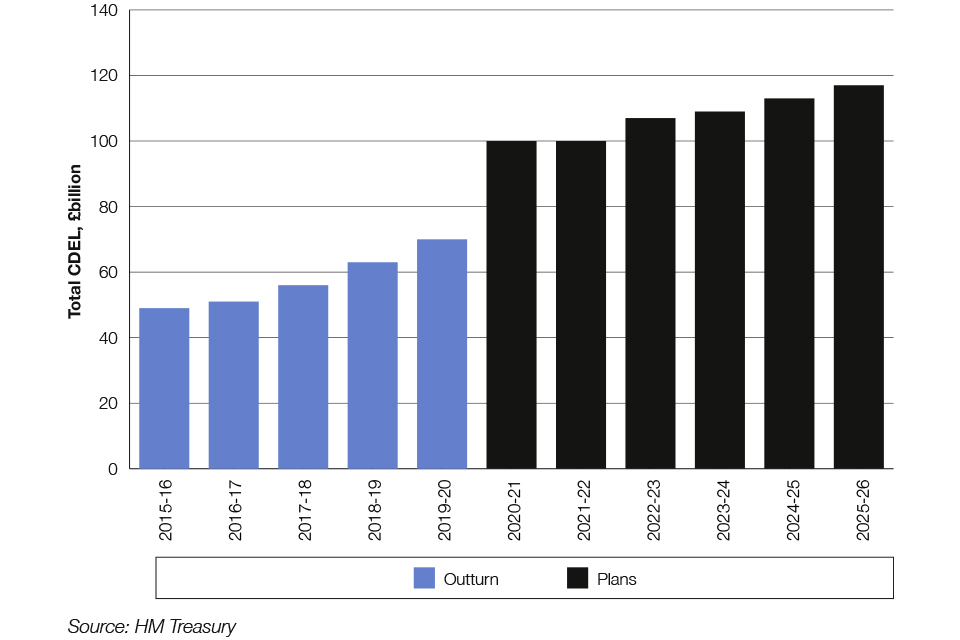

The UK has historically underinvested in infrastructure, with a smaller capital stock than comparable countries and ranking 11th globally for infrastructure quality, behind both France and Germany[footnote 16]. We are fixing that – Spending Review 2020 committed £100 billion of capital investment in 2021-22, a £30 billion cash increase compared to 2019-20. These plans make progress on delivering the UK Government’s objective of over £600 billion of gross public sector investment over the next five years.

The private sector also plays a vital role in achieving the UK’s infrastructure ambitions. Much of UK’s economic infrastructure is privately owned, with almost half of the UK’s future infrastructure pipeline forecast to be privately financed. Over the past decade alone, over £200 billion has been invested in the water and energy sectors. However, historic levels of investment will be required in UK infrastructure in the coming years, to maintain and upgrade networks to meet the UK Government’s objectives for economic growth and decarbonisation.

UK Government capital departmental expenditure limits (CDEL) outturn and plans, 2015-16 - 2025-26

Building back better, greener and faster

The UK Government needs to deliver infrastructure projects better, greener and faster. That means addressing longstanding challenges such as complex planning processes, slow decision-making, government capability and low productivity in the construction sector.

As set out in the Prime Minister’s Ten Point Plan for a Green Industrial Revolution, infrastructure investment is fundamental to delivering net zero emissions by 2050. The UK Government will unlock private sector investment to accelerate the deployment of existing technology, such as retrofitting the UK’s building stock and electrification of vehicles, while advancing newer technologies such as carbon capture and low carbon hydrogen. The UK Government’s approach will create jobs to support the recovery from COVID-19 and support the UK Government’s levelling-up agenda by ensuring key industrial areas are at the heart of the transition to net zero. As Glasgow hosts the UN Climate Change Conference COP26 next year, the UK will go even further to promote the importance of low carbon infrastructure and support its commitment to the Paris Agreement.

Our exit from the EU also provides a transformational opportunity to change how this government delivers infrastructure projects, using the flexibility the UK has as a sovereign country to do things differently. The government wants the UK to have the most efficient, technologically advanced and sustainable construction sector in the world. In June last year, the government set up Project Speed to review every part of the infrastructure project lifecycle and identify where improvements could be made, such as on procurement.

As a part of Project Speed, we will rigorously review the cost and delivery times of infrastructure projects. We will transform the way infrastructure is done in this country: it will be more efficiently delivered, driven by new technologies and less bureaucracy. It will be built better, with the construction of world-class schools and hospitals. Infrastructure will also be greener to align with our net zero ambitions.

These reforms will have a material impact on project timelines, bringing forward real benefits to local communities, business and the wider economy across the UK. The A66 Northern Trans-Pennine upgrade connecting the North East and North West of England will be accelerated through Project Speed and is expected to be delivered five years sooner through radical acceleration of the construction schedule. The Budget confirms £135 million development phase funding to get spades in the ground by 2024.

Similar rigorous Project Speed approaches and mindsets will be applied to other critical regional and national projects over this Parliament.

Project Speed Pathfinders

The Project Speed taskforce has focused on a number of high-profile “pathfinder projects” to identify reforms which could accelerate and improve delivery across the UK Government’s infrastructure portfolio. This is an evolving subset of projects, which is kept under review, but examples of current pathfinder projects include:

-

The Oxford-Cambridge Arc, led by the Ministry of Housing, Communities & Local Government (MHCLG)

-

The New Hospital Programme within the Health Infrastructure Plan, led by the Department of Health & Social Care (DHSC)

-

The A66 Northern Trans-Pennine upgrade, led by the Department for Transport (DfT)

-

The Northumberland Line, led by Northumberland County Council in partnership with DfT

Transforming journeys, communities and the environment

The UK Government is implementing the National Infrastructure Strategy and investing in infrastructure to transform delivery and support private investment. This includes:

-

over £22 billion for HS2, which will form the spine of the UK’s transport network by delivering essential North-South connectivity between some of the UK’s biggest and most productive cities;

-

£1.3 billion to accelerate the rollout of electric vehicle charging infrastructure, £5 billion for buses and cycling and our forthcoming National Bus Strategy.

-

£1 billion of UK-wide funding to support the establishment of carbon capture and storage in four industrial clusters;

-

£4.2 billion for intra-city transport settlements to support our largest city regions;

-

£5 billion to accelerate UK-wide gigabit broadband roll-out, a Shared Rural Network extending 4G mobile coverage to 95% of the UK and £250 million to ensure resilient and secure 5G networks and £50 million for the continuation of the 5G Testbeds and Trials Programme in 2021-22;

-

new UK-wide funds: the £4.8 billion Levelling Up Fund, and the £150 million Community Ownership Fund (over four years from 2020-21) that will invest in local infrastructure;

-

£5.2 billion by 2027 to better protect communities from flooding and coastal erosion;

-

record amounts of funding provided for national road and rail, including the Lower Thames Crossing – boosting capacity east of London by 90%

The Union Connectivity Review will assess how the quality and availability of transport infrastructure across the UK can support economic growth and quality of life across the whole of the UK. The review will deliver recommendations in Summer 2021 that set out how best to improve transport connectivity across the UK in the long-term, including bolstering existing connections. These recommendations will be consistent with the UK’s wider fiscal strategy. This will help us to consider future strategic investment to better connect our Union.

The UK Government is soon to publish a White Paper setting out the future of the railways. This will respond to the recommendations of The Williams Rail Review into rail industry reform.

While the UK Government will be investing record amounts in infrastructure, the private sector will continue to play a leading role. To facilitate this, the government is establishing a new UK Infrastructure Bank in the North of England to bring together public and private support for new infrastructure. The new UK Infrastructure Bank will provide financing and advisory support to local authority and private sector infrastructure projects across the United Kingdom to help meet government objectives on climate change and regional economic growth. It will be able to deploy £12 billion of equity and debt capital and be able to issue up to £10 billion of guarantees. Further details on the mandate and scope for the bank are set out in the UK Infrastructure Bank Policy Design document, published alongside Budget 2021.

Maintaining and building on the UK’s high-quality system of economic regulation will be crucial to attracting private investment. In the National Infrastructure Strategy, the government reaffirmed its belief in themodel of independent economic regulation and committed to refining it, to ensure that it provides a clear and enduring framework for investors and businesses and delivers the major investment needed in decades to come, whilst continuing to deliver fair outcomes for consumers. The UK Government will publish a policy paper on the system of economic regulation, focused on providing a clear and predictable framework which can rise to the challenges and opportunities of the 21st century. As part of this, the UK Government will consider regulator duties to ensure they are coherent, relevant and effective, as well as exploring the benefits of a cross-sector strategic policy statement.

Investing in places

The UK Government’s commitment to ensuring infrastructure investment delivers regional economic growth means we will be investing in:

-

City and Growth Deals for Scotland, Wales and Northern Ireland. To accelerate local economic priorities, £25.8 million will be brought forward over the next five years for three City and Growth Deals in Scotland (Ayrshire, Argyll & Bute, and Falkirk) and £58.7 million will be brought forward over the next five years for three City and Growth Deals in Wales (Swansea, north Wales and mid-Wales). The UK Government is also investing £617 million in four City and Growth Deals in Northern Ireland.

-

Intra-city transport settlements. Budget 2020 committed to invest £4.2 billion in these from 2022-23, through five-year consolidated funding settlements for eight city regions, including Greater Manchester, Liverpool City Region, West Midlands, West Yorkshire, Sheffield City Region, West of England and Tees Valley, subject to the creation of appropriate governance arrangements to agree and deliver funding. This Budget takes the first step toward delivering the government’s commitment - confirming capacity funding in 2021-22 to support those city regions with appropriate governance arrangements already in place to begin preparations for settlements, enabling them to develop integrated investment-ready transport plans that will deliver on local priorities such as tackling congestion and driving productivity.

-

The Oxford-Cambridge Arc, where a Spatial Framework, developed with community engagement at its core, will set the long-term, holistic strategy for infrastructure investment to support jobs, unlock clean growth, and achieve net zero alongside environmental sustainability; cultivating the Arc’s potential to become a global innovation powerhouse. Earlier this year the government confirmed funding for the next stage of East West Rail, which will connect communities and create jobs. We are also exploring up to four development corporations along its route which can help deliver sustainable, beautiful places to live and work for existing and future communities.

-

The Integrated Rail Plan for the Midlands and the North will ensure that Phase 2b of HS2, Northern Powerhouse Rail and other planned rail investments in the North and Midlands are scoped and delivered in an integrated way, bringing transformational rail improvements more quickly and to more places.

-

Freeports, where the UK Government is announcing that eight locations have been successful in the Freeports bidding process for England. Subject to the successful completion of their business case assessments, these Freeports will begin operations from later in 2021. Freeports will benefit the whole of the UK, not just England, and we are determined to deliver this as soon as possible. That is why we are continuing to work constructively with the devolved administrations in Scotland, Wales and Northern Ireland to establish at least one Freeport in each nation as soon as possible.

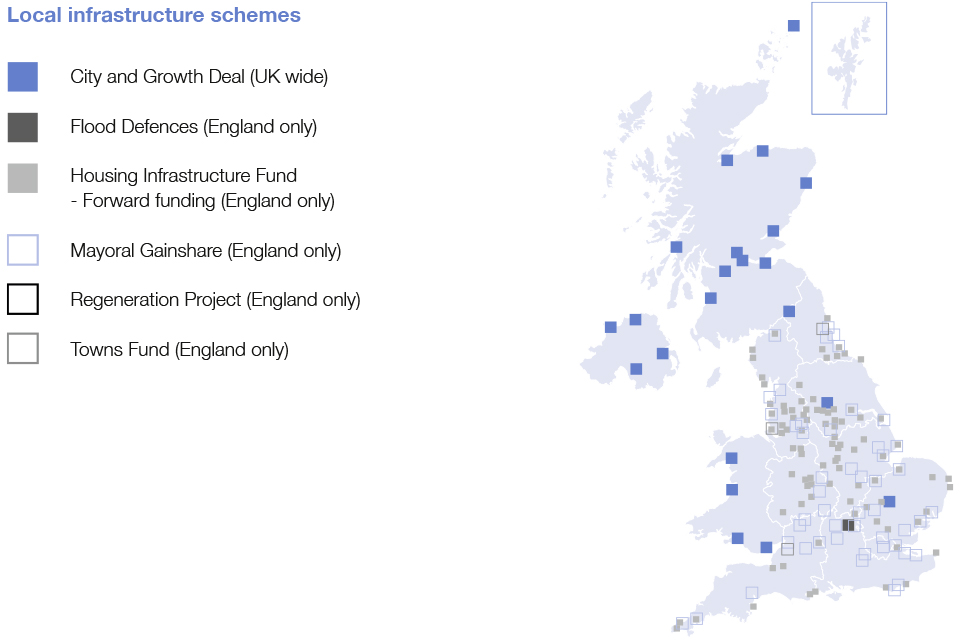

Local infrastructure schemes

Note: Where policy is reserved for the UK government – for example digital infrastructure – it is taking action to improve infrastructure across the whole of the UK. Where policy is devolved – for example substantial areas of transport – the UK government allocates funding to the devolved administrations through the Barnett formula. This map shows how investment by the UK government in a number of local infrastructure programmes will benefit different regions.

Our plan for infrastructure

| Why infrastructure is important | What this means | What we’re doing |

|---|---|---|

| Investing in infrastructure drives long term productivity improvements, and in the short term stimulates economic activity. | A 10% increase in the public capital stock has been linked to a 1-2% increase in GDP. | Record investment in broadband, flood defences, roads, rail and cities – as part of our capital plans worth £100 billion next year. Project Speed established to accelerate and improve delivery, delivering impacts by the end of the Parliament. £4.8 billion invested at Spending Review 2020 for infrastructure, land remediation and land assembly to unlock housing. |

| The private sector has a big role alongside the government in increasing investment and improving economic outcomes | Almost half of the UK’s future infrastructure pipeline is forecast to be privately financed. | A new UK Infrastructure Bank to ‘crowd-in’ investment and boost the pipeline of projects. |

| Boosting infrastructure investment in all parts of the country will help connect people to opportunity across the UK and help areas to level up. | People see tangible improvements in their local area, feel more pride in their communities and believe they can succeed wherever they live. | A new Levelling Up Fund, Shared Prosperity Fund, Towns Fund and High Street Fund to invest in local areas. |

| Infrastructure investment will be central to meeting our net zero objectives. | Over 80% of UK emissions come from infrastructure sectors: power, heat, heavy industry and transport networks. | £12 billion of funding for projects through the Prime Minister’s Ten Point Plan for a Green Industrial Revolution. |

Skills

High quality education and skills training play a vital role in sustaining productivity growth and our international competitiveness: improvements in skills accounted for 20% of the UK’s productivity growth before the financial crisis.[footnote 17]

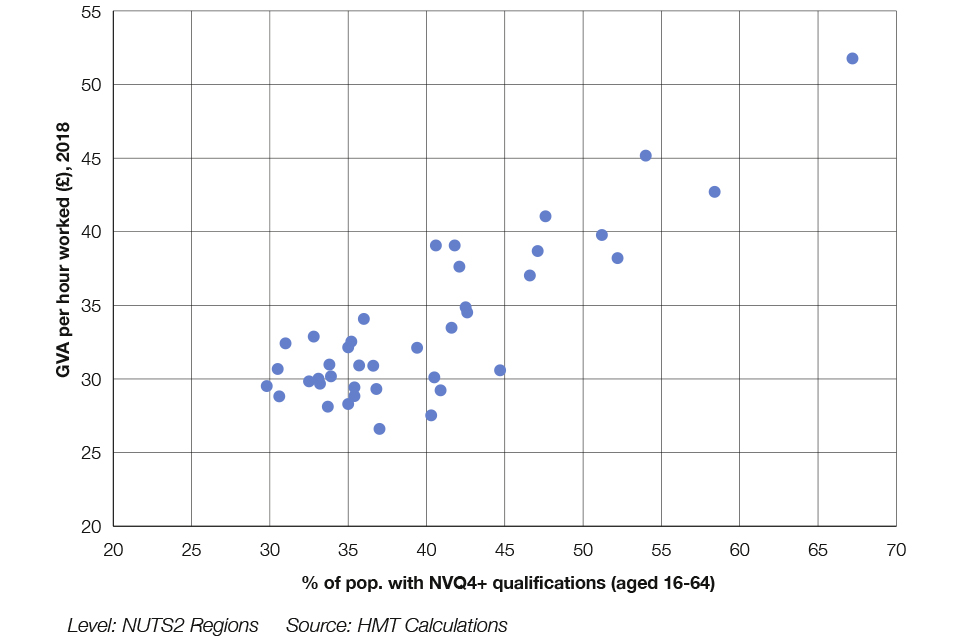

Creating opportunities to improve the skills of people in all regions is critical to the future success of the country and ensuring a strong recovery from the impacts of the COVID-19 pandemic, particularly for young people who have lost out on precious learning and employment opportunities. Improving our skills is also central to levelling up opportunity as differences in skill levels provide a key part of the explanation for differing output and wages across regions.

The UK skills system has many strengths:

-

Our university sector is world-leading: four of the world’s top twenty universities are in the UK[footnote 18]. This benefits our economy directly, with UK universities and their international students and visitors supporting over 940,000 jobs in 2014-15 alone[footnote 19].

-

52% of 25-34 year olds in the UK are educated to tertiary level, compared to an OECD average of 45%[footnote 20].

-

At school level there have been substantial improvements: between 2005-2017 the proportion of the cohort achieving Level 2 qualifications with English and Maths by age 19 rose from 46% to 69% in England[footnote 21].

Relationship between skills and productivity, by region

The contribution of skills to productivity growth, however, can largely be attributed to higher-skilled cohorts[footnote 22], and the UK’s skills system is less competitive internationally in areas such as technical skills and basic adult skills[footnote 23].

A particular challenge is the pipeline of technical skills: the UK has persistent technical skills shortages in key sectors such as construction and manufacturing. Only 4% of young people achieve a higher technical qualification by the age of 25, compared to 33% who get a degree or above[footnote 24] Since the 2000s, higher technical education as a whole has fallen in absolute terms[footnote 25].

On basic skills, more than a quarter of the working-age population in England have low literacy or numeracy skills. The Industrial Strategy Council forecast that five million workers could become acutely under-skilled in basic digital skills by 2030[footnote 26]. This holds back those people from employment, limits their ability to progress, reduces economic growth, and makes the UK a less attractive place to invest.

Combined, these factors mean that there are significant levels of mismatch between what the skills system provides and what employers need: the OECD found that the UK could improve its productivity by 5% or more if it reduced the level of skills mismatch to that of high performing international comparators[footnote 27]. Reforms to the technical skills system to support providers to respond to employer needs will play an important role in addressing these mismatches and driving growth at a national and regional level.

Overall, while there are notable strengths in the UK skills system, such as universities and apprenticeships, further reform is needed to address these challenges. The UK Government has put in place a package of immediate employment and skills support delivered through the Plan for Jobs, and is taking broader action to ensure people have the support they need to improve their skills over the longer term, as a key enabler of productivity growth.

Transforming Further Education

Recognising the importance of technical education, the UK Government has invested significant additional funding in Further Education (FE) in England, with an additional £691 million for core 16-19 education at the last two Spending Reviews, and a further £375 million to fund technical education for adults as the first step in a £2.5 billion investment in adult skills over the course of this Parliament through the National Skills Fund. The UK Government has also made significant capital commitments in post-16 education, with £1.5 billion over six years to raise the condition of the FE college estate, £270 million to establish 20 Institutes of Technology, £268 million across three waves to support the roll-out of T Levels with high quality equipment and facilities, and £83 million in 21/22 to ensure post-16 providers have sufficient places.

The UK Government is reforming technical education, making it a true alternative to a degree by delivering the training and education that employers want.

This includes aligning the substantial majority of post-16 technical education and training to employer-led standards, introducing new approved Higher Technical Qualifications as a high quality technical progression option, rolling out T Levels (see box below) and expanding the flagship Institutes of Technology programme to every part of the country by the end of this Parliament – to spearhead the increase in higher-level technical skills in Science, Technology, Engineering and Maths.

T Level rollout:

T Levels will be the option of choice in England for the majority of 16 to 19 year-olds who want to progress into high-skilled employment or onto higher levels of technical education at college or university. Students spend most of the course in classrooms and specialist training facilities, developing the knowledge, skills and behaviours that employers need for their chosen occupation. They also spend at least 45 days on a meaningful industry placement, putting the skills they have developed into practice and gaining first-hand experience of industry. Around 300 employers have been involved in designing content, and thousands more will be offering industry placements. Students across England started on the first ever T Levels in September 2020; from 2023, we expect that 24 T Levels covering 11 technical education routes will be available.

To ensure that skills provision is aligned to employer needs, the UK Government has published Skills for Jobs: Lifelong Learning for Opportunity and Growth which sets out how we will reform further education in England so it supports people to develop the skills throughout their lives, wherever they live in the country[footnote 28]. This reform will be delivered by putting employers at the heart of our skills system, supporting excellent teaching in further education, and reforming funding and accountability to ensure a focus on the needs of local labour markets, enabling flexible employer-led provision, and reducing unnecessary bureaucracy.

Encouraging lifelong learning

Recognising the vital role of training and retraining over the course of an adult’s lifetime, and as the Prime Minister set out in his speech in September 2020, the UK Government will help people get the skills they need at every stage in their lives through the Lifetime Skills Guarantee.

These reforms are backed by significant investment in adult skills. The UK Government has committed to a new £2.5 billion National Skills Fund over the course of this Parliament to improve the technical skills of adults in England. The UK Government will also introduce the UK Shared Prosperity Fund (UKSPF) to help to level up and create opportunity across the UK for people and places. A portion of the UKSPF will be targeted at bespoke employment and skills support tailored to local need.

Lifetime Skills Guarantee

The Prime Minister has introduced a Lifetime Skills Guarantee to give people access to the education and training they need throughout their lives.

Starting from April 2021, adults looking to achieve their first full advanced level (level 3) qualification, which is equivalent to an advanced technical certificate or diploma, or two full A levels, will be able to access a free, fully funded course as part of the Lifetime Skills Guarantee. These courses, in areas including business, engineering, health and social care, and digital, will improve people’s employment prospects and open up new opportunities.

Our employer-led skills bootcamps will also be rolled out across England from April as part of the Lifetime Skills Guarantee building on the successful digital bootcamps pilots. Skills bootcamps are 12 to 16-week training courses linked to guaranteed job interviews that support adults to retrain, top up skills, or gain new specialist skills in areas that are in-demand by employers in a bitesize and flexible way.

We will reform student finance to provide individuals with a flexible Lifelong Loan Entitlement from 2025, the equivalent of four years of post-18 education. The loan entitlement will be useable for both shorter modules and full years of study at higher technical and degree levels (levels 4-6), regardless of whether they are provided in colleges or universities, making it easier for people to study more flexibly throughout their lifetime.

Building on the apprenticeships revolution

The UK Government has transformed apprenticeships in England to ensure that they better meet the skills needs of employers across the country and provide people of all ages and backgrounds with the opportunity to benefit from a high-quality apprenticeship.

The Apprenticeship Levy is an important part of these changes as it encourages employers to make a long-term, sustainable and high-quality investment in apprenticeship training. As part of these changes, standards have helped make apprenticeships employer-led, and we have seen over 440,000 apprentices start on the new standards between the 2014/15 and 2018/19 academic years[footnote 29].

Building on these reforms, we will continue to focus on the quality of apprenticeships and take steps to improve the English apprenticeship system for employers. Spending Review 2020 announced the following:

-

From August 2021, employers who pay the Apprenticeships Levy will be able to transfer unspent levy funds in bulk to small and medium-sized enterprises (SMEs) with a new pledge function. We will build on good examples of this activity already in existence – for instance the West Midlands Levy Transfer Fund – by also introducing, from August 2021, a new online service to match levy payers with SMEs that share their business priorities.

-

From April 2021, the UK Government will allow English employers in construction, health and social care to front-load apprenticeship training, and will explore whether this offer can also be made available in other sectors.

Building on the measures the Government announced at Spending Review 2020 to improve the apprenticeship system for employers, the Budget outlines a £7 million fund from July 2021 to help employers in England set up and expand portable apprenticeships. This will enable people who need to work across multiple projects with different employers to benefit from the high-quality long-term training that doing an apprenticeship provides. Employers themselves will also benefit from access to a diverse apprenticeship talent pipeline.

The UK Government will also extend and increase the payments made to employers who hire new apprentices. Employers in England who hire a new apprentice between 1 April 2021 and 30 September 2021 will receive £3,000 per new hire, compared with £1,500 per new apprentice hire (or £2,000 for those aged 24 and under) under the previous scheme. This is in addition to the existing £1,000 payment the government provides for all new 16 to 18 year-old apprentices and those aged under 25 with an Education, Health and Care Plan, where that applies.

West Midlands Levy Transfer Fund:

Employers who pay the Apprenticeship Levy can transfer up to 25% of their unspent levy funds to small to medium-sized businesses who share their business priorities. The West Midlands Combined Authority (WMCA) set up a scheme in 2018 to facilitate these transfers and supercharge apprenticeships in the West Midlands. Employers like Lloyds Banking Group, BBC, National Express and the University of Birmingham have partnered with the WMCA to transfer their unspent levy to smaller employers who want to offer apprenticeships in key skills areas. The fund recently hit a £5 million milestone and has supported over 1,000 new apprenticeships at small to medium-sized businesses across the region.

Our plan for skills

| Why skills are important | What this means | What we’re doing |

|---|---|---|

| Skills and training is central to recovery from the COVID-19 pandemic by supporting people into work. Access to high quality training is vital to levelling up. |

Providing individuals affected by the crisis with the opportunity to build the skills they need to boost their job prospects. | Expanding traineeships and improving their quality and progression to apprenticeships; expanding sector-based work academies; incentivising new apprenticeship hires; and boosting the National Careers Service’s capacity. |

| High quality education and skills training play a vital role in sustaining productivity growth. | Boosting investment in technical education and adult skills, and reforms to better align the skills system with employer demand will support productivity growth. | Investing additional resource and capital funding in Further Education in England. Reforming technical education, including aligning the post-16 technical education system more closely with employer demand. Continuing to focus on the quality of apprenticeships and improving the apprenticeship system for employers. |

| 80% of the workforce of 2030 are already in work today, and we need to offer them the opportunity to upskill and reskill over their careers to progress and adapt to changes such as automation. | Providing adults with opportunities to upskill and reskill throughout their lifetime in a way that meets their needs (i.e. is flexible and provides line of sight to a job or career progression). | Improving the apprenticeship system for employers building on the all ages, all levels approach. Funding for adults without a Level 3 qualification (A levels or equivalent) to take courses in areas that will help boost their job prospects. Rolling out employer-led skills bootcamps across England for adults to upskill and reskill in a flexible, bitesize way. From 2025, delivering the Lifelong Loan Entitlement to make it easier for adults and young people to study more flexibly throughout their lifetime. In the interim, consulting on the scope and detail of the entitlement - and taking action to stimulate higher technical and modular provision and encourage more frequent credit transfer. Skills and Employment funding in the new UKSPF programme. |

Innovation

Innovation is a key driver of economic growth and improvements to living standards, through the development of new ideas, products and processes and their adoption and diffusion across the economy. This brings benefits for both citizens and society.

The UK is renowned for its science and innovation strengths, ranking 4th out of 131 economies in the Global Innovation Index[footnote 30]. We are home to world-leading research institutes and charities, with the UK ranking first in the G7 for field-weighted citation impact in the G7[footnote 31], as well as excellent universities – including four in the world’s top 20[footnote 32] – which work closely with businesses and international partners. This research ecosystem stimulates innovation through the exchange of ideas, knowledge and talent.

The UK also has the most mature venture capital market in Europe: at least £8.8 billion in 2020 was raised to start and grow innovative businesses, more than France and Germany combined[footnote 33]. However, UK companies can still struggle to access capital compared to their US counterparts, especially at later stages of their growth and larger deal sizes. There remains a largely untapped pool of capital from institutional investors, particularly Defined Contribution (DC) pension schemes. Investment also tends to be regionally concentrated in London and the South East, whilst women and entrepreneurs from BAME backgrounds disproportionately struggle to access the finance they need to start and grow their business.

To maximise the economic benefits of the UK Government’s significant investments in research and development (R&D) and build a more innovative and productive economy, the UK needs a regulatory system that is pro-innovation. Currently only 29% of businesses believe that the government’s approach to regulation supports them in bringing new products and services to market[footnote 34]. We are committed to regulatory reform to accommodate new processes, products and business models, and provide a supportive environment to dynamic entrepreneurial business.

The UK has a lower proportion of innovating firms overall than other advanced economies and weaker business investment[footnote 35],[footnote 36]. The diffusion of innovation through the economy requires businesses to update their business models and make investments that embody newer ideas. Our commitments to regulatory reform and a best in class competition regime will raise innovation and investment across the whole economy. Aligning skills provision to employer needs will also ensure that people are equipped to experience the benefits of innovation and help give firms the confidence to invest.

Relatedly, there is evidence that UK firms are relatively slow to adopt basic digital technologies, such as customer relationship and eCommerce tools that have been shown to have significant productivity benefits[footnote 37]. When it comes to digital intensity, we are ahead of some of our major European competitors, but lag behind international leaders like Denmark, Israel and Japan[footnote 38]. The UK Government is taking steps to help UK businesses significantly improve their adoption of digital technologies.

Supporting and incentivising the development of creative ideas and technologies

The UK Government is increasing its investment in R&D and will use it to boost R&D strengths across the UK. Next year alone we are investing £14.6 billion in research and innovation grants and facilities. This investment will back the priorities set out in the UK Government’s Research and Development Roadmap[footnote 39] and drive progress towards the target for total UK investment in R&D (public and private) to reach 2.4% of GDP by 2027.

Public investment in R&D crowds in private investment[footnote 40] at a ratio of around two pounds on average for each pound of government funding. Schemes such as the Biomedical Catalyst - a joint Medical Research Council and Innovate UK grant programme that accelerates innovations in the life sciences - have proven to be highly effective in driving business investment in R&D. The government will build on this, supporting new opportunities to strengthen the innovation ecosystem including through the public procurement reforms planned later this year, investing £800 million in the new Advanced Research and Invention Agency, and publishing an Innovation Strategy in Summer 2021.

Regional R&D intensity and selected R&D assets

UK R&D expenditure is currently concentrated in a relatively small number of large firms based in particular regions of the country[footnote 41]. The UK Government is committed to redressing this balance, by leveraging the capability of the UK’s geographically dispersed R&D assets, maximising the benefits of innovation for local economies and building on local strengths. Details of this will be set out in a UK-wide R&D Places Strategy this year, focusing on how R&D can contribute effectively to the government’s levelling up ambitions.

R&D tax reliefs support businesses to invest in R&D by allowing companies to claim an enhanced corporation tax deduction or payable credit on their R&D costs. In 2017-18, R&D tax reliefs of £5.1 billion supported £36.5 billion of R&D expenditure[footnote 42]. The government has now announced it will carry out a review of R&D tax reliefs, with a consultation published alongside the Budget. The government is also publishing at Budget 2021 the summary of responses from the consultation on the scope of qualifying expenditures for R&D Tax Credits. The decision on whether to bring data and cloud computing costs into scope of the reliefs will be made alongside the wider review[footnote 43].

Life Sciences across the Union

The UK is one of the best places in the world for life sciences. Over many decades the UK has established clusters of the most advanced scientific research facilities anywhere in the world, made possible by top class universities – including in Oxford, Cambridge, Edinburgh, Glasgow, Cardiff and Belfast - globally-renowned clinical research and a unique cradle to grave healthcare system in the NHS. The government has worked closely with industry and scientists to grow the life sciences sector through delivering the 2017 Life Sciences Industrial Strategy. This provided a roadmap for the UK to take the lead on cutting-edge, emerging industries such as genomics, early-stage diagnostics, advanced therapies and digital health. The strength of the life sciences sector in these areas and others provides economic opportunity in all parts of the UK:

-

in England it employs 224,000 people, with a turnover of £73.5 billion;

-

in Scotland it employs 15,000 people with a turnover of £3.8 billion;

-

in Wales it employs 12,000 people with a turnover of £2.4 billion;

-

in Northern Ireland it employs 6,000 people with a turnover of £1.0 billion

Source: OLS/BEIS/DHSC (2020), ‘Bioscience and health technology sector statistics 2019’, (https://www.gov.uk/government/statistics/bioscience-and-health-technology-sector-statistics-2019)

Backing the sectors and technologies that will shape the UK’s future

The pace of technological change and global competition means that we must consider how to support the sectors and technologies that will help shape the UK’s future. For example:

-

In life sciences we will build on our performance and leadership to date to create the most advanced genomic healthcare system in the world.

-

The digital and creative industry sectors are a major success story for the UK, and a critical driver of innovation and growth. We will work to ensure that these sectors can flourish by nurturing a safe, fair and open digital economy, growing more creative businesses around the country and building on our advantages in foundational technologies like AI, quantum computing and digital twins, including through the National Data Strategy and upcoming Digital Strategy.

-

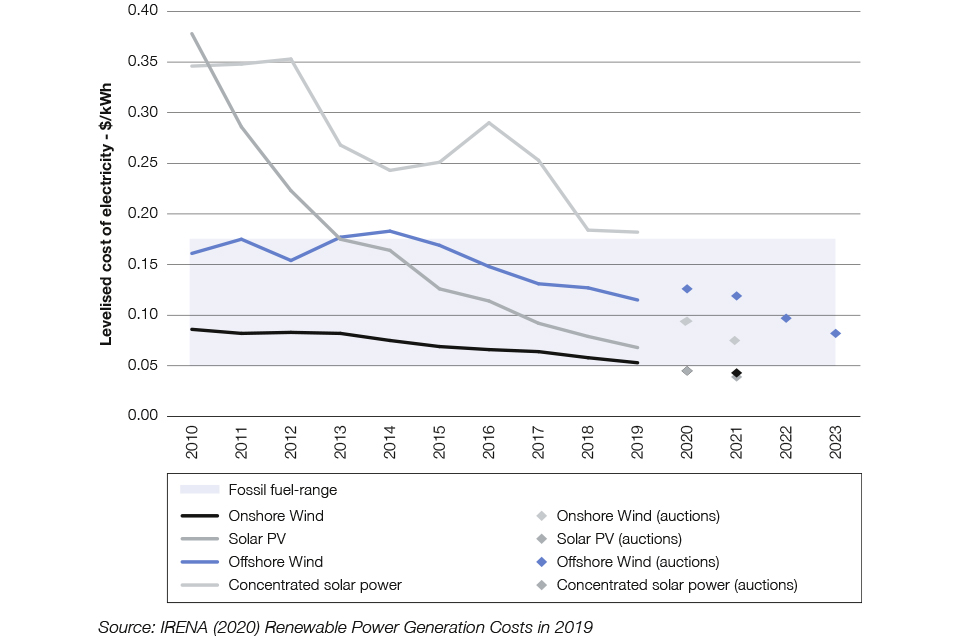

In clean energy, we will bring about a green industrial revolution, targeting investment in technologies like CCUS, hydrogen and offshore wind.

-

The fintech sector adds almost £11 billion to the UK economy and employs a workforce of almost 76,500. At Budget 2020, the Chancellor asked Ron Kalifa to lead an Independent Strategic Review of how government, regulators, and industry can maximise the future growth of the UK fintech sector. The Review published its final report The Kalifa Review of UK Fintech on 26 February 2021. It addressed a range of priorities for the sector and made recommendations on amendments to UK listing rules, improvement to tech visas, and a regulatory fintech ‘scalebox’. The government welcomes the report and is considering the Review’s recommendations.

-

The Ministry of Defence spends more than £20 billion each year with UK industry, supporting a total of over 200,000 jobs across the UK, and serving as one of the largest providers of apprenticeships. The MOD’s Defence and Security Accelerator has supported more than 750 innovations by finding and funding ideas. In the forthcoming Defence and Security Industrial Strategy, we will set out further actions we are taking to foster vibrant and innovative UK businesses

Over the coming year, the UK Government will publish an Innovation Strategy and set out a vision for high-growth sectors and technologies where we are well-placed to develop a globally competitive advantage.

Finance to unleash innovation

The UK Government has supported thousands of R&D intensive and innovative businesses from their early stages to scale and grow, through tax incentives, grants, loans and equity. The Seed Enterprise Investment Scheme (SEIS), the Enterprise Investment Scheme (EIS) and Venture Capital Trusts (VCTs) target market failures in SMEs’ access to growth finance, and together have supported over £31 billion of finance[footnote 44].

The British Business Bank’s lending and equity programmes are supporting nearly £8 billion of finance to almost 100,000 smaller businesses, excluding the COVID-19 support schemes. British Patient Capital, established in 2018 within the British Business Bank with £2.5 billion of investment, will crowd in an additional £5 billion of private investment over 10 years and increase the overall supply of funding for companies at later stages of their growth, where capital needs are higher.

The British Business Bank is tackling regional discrepancies in access to finance through the Regional Angels Programme and three regional funds: the Northern Powerhouse, Midlands Engine, and Cornwall and Isles of Scilly Investment Fund. The Bank has also taken concerted steps to address gender and ethnic diversity challenges, including through ensuring diversity in the recipients of its Start Up Loans and its associated mentoring programme.

British Business Bank support at every stage

| Start up | Scale up | Stay ahead |

|---|---|---|

|

Mentoring and funds to ‘be your own boss’ Start Up Loans |

Funds for higher growth potential businesses Regional Angels Programme Enterprise Capital Funds Managed Funds Programme British Patient Capital National Security Strategic Investment Fund |

More funding options and choice of provider Investment programme ENABLE programmes Enterprise Finance Guarantee |

Government and financial regulators have removed a range of regulatory barriers to ensure that pension savers can access the returns offered by venture capital and growth equity, as part of a balanced portfolio. Government will consult in the next month on whether certain costs affect DC pension schemes’ ability to invest in a broader range of assets. This is to ensure DC pension schemes are not discouraged from such investments and are able to offer the highest possible returns for savers. The Department for Work and Pensions will also come forward with draft regulations that will make it easier for schemes to take up such opportunities.

At this Budget, we will build on our progress to fill financing gaps for companies at all stages. Building on the Future Fund, the UK Government will commit £375 million to introduce Future Fund: Breakthrough, a new direct co-investment product to support the scale up of the most innovative, R&D-intensive businesses. The British Business Bank will take equity in larger funding rounds led by private investors to ensure these companies can access the capital they need to grow and deliver prosperity to communities across the UK.

Developing a regulatory system for an innovative economy

To maximise the economic benefits of the UK Government’s significant investments in R&D and build a more innovative and productive economy, a regulatory system for an innovative economy needs to accommodate new processes, products and business models, and provide a supportive environment to dynamic entrepreneurial business. Leaving the EU gives the UK an opportunity to capitalise on our global leadership in areas like clean energy technologies, life sciences, digital services and entertainment.

The UK Government will maximise new freedoms and ensure regulations support science and innovation, enable business to flourish, and boost growth whilst maintaining our high standards, by:

-

using regulation to unlock cutting-edge technologies such as drones and autonomous vehicles;

-

modernising our approach so that we deliver sophisticated policymaking that benefits citizens and the economy;

-

easing the regulatory compliance red tape burden on business;

-

hard-wiring competition principles into regulatory decision-making

UK approach to regulatory reform