Commercial rent code of practice following the COVID-19 pandemic

Published 7 April 2022

Ministerial foreword

From the outset of the COVID-19 pandemic, the government promised to do everything within its power to help struggling businesses weather the storm.

We provided an unprecedented package of support – £352 billion in total – bringing relief to thousands of small business owners as well as the hard-hit pubs, shops, cinemas and theatres who were badly affected during the lockdowns.

We stood by the nation’s employers too with business grants, the deferral of income tax payments and the Coronavirus Job Retention Scheme.

However, we also recognised that the road to recovery for some business owners would be a long one, especially high street stores dependent on footfall returning to pre-pandemic levels.

That is why we introduced a moratorium on commercial landlords evicting tenants struggling to pay their rent. We stopped landlords seizing stock owned by the tenant in lieu of rent, so that businesses in rent arrears were not forced to go to the wall by their landlord.

My department also worked together closely with businesses leaders to publish a voluntary Code of Practice.

This Code provided clarity for both tenants and landlords, encouraging them to work together on resolving unpaid rent.

We know that this Code was widely welcomed – and used – by businesses big and small who saw it as an invaluable guide to quickly resolving negotiations over unpaid rent.

The time has now come to update the Code in line with the Commercial Rent (Coronavirus) Act 2022.

This Act helps tenants still reeling from the effects of the pandemic to confront their debts, come to an agreement with their landlord on rent arrears and start to grow their business again.

To that end, the Act ringfences rent debt built up by businesses who were forced to close during the pandemic. It establishes a binding arbitration system which then decides what happens to that ringfenced debt.

This updated Commercial Rent Code of Practice sets out what the arbitration process looks like, the evidence that is considered, and the principles on which arbitration awards are made.

Just like the previous Code, there is clear guidance that balances the rights of both tenants and landlords in negotiations. The government continues to encourage negotiation between parties, including whilst arbitration is ongoing.

Where they can afford to do so, the Code states that a tenant should meet their obligations under their lease in full.

It makes clear that a tenant can’t keep the doors of their business open if it comes at the expense of the landlord’s solvency.

However, tenants should not have to take on more debt – or restructure their business – in order to pay their rent.

We hope this updated Code builds on its previous iteration as a helpful, go-to-guide for both landlords and tenants to consult when considering whether to apply for arbitration, or when negotiations are stalling.

It sets out what is expected of both landlords and tenants throughout arbitration, but it can be used by any business struggling with rent arrears - even if it falls outside scope of the Act’s scheme.

I am very grateful to those businesses who have continued to work with us on refining this Code and making sure that it remains a useful tool for any business owner struggling to keep their doors open.

Together with the Commercial Rent (Coronavirus) Act 2022, this Code will continue helping landlords and tenants to move from dispute to resolution together.

It will ensure that our local high streets and businesses of all shapes, sizes and sectors can leave the challenges of the past two years behind and fully share in the economic recovery that lies ahead.

Minister Neil O’Brien, Parliamentary Under Secretary for Levelling Up, the Union and Constitution

Minister Paul Scully, Parliamentary Under Secretary of State, Minister for Small Business, Consumers and Labour Markets

Introduction

1. This Code can be used in relation to all commercial leases held by businesses which have built up rent arrears, due to an inability to pay, as a result of the impact of the COVID-19 pandemic; whether, for example, in the hospitality, retail (including supply chains), leisure, manufacturing, industrial and logistics, ports, food and drink, or rural sectors. Businesses within the agricultural sector may also want to consider the principles included, whilst acknowledging the differing legal framework for agricultural tenancies.

2. This Code of Practice is issued in response to the impact of COVID-19 on landlords and tenants in the commercial property sector and replaces the ‘Code’ issued on 19 June 2020, updated on 6 April 2021, and subsequently revised on 9 November 2021.

3. This Code is therefore relevant for debts of unpaid commercial rent (including service charge, which itself includes insurance) accrued since March 2020 for premises in England and Wales, to assist with the terms of negotiation and to guide the small number of landlords and tenants who have been unable to reach agreement. The binding arbitration provisions do not apply in Scotland and Northern Ireland, but landlords and tenants are expected to follow the spirit of the Code when negotiating any changes to the terms and conditions contained in their leases.

4. This Code is comprised of three sections as follows:

i. Part One of this Code applies to all business tenancies and sets out the behaviours expected of landlords and tenants including when they are in negotiation. It is therefore designed for use by landlords and tenants within England, Wales, Scotland, and Northern Ireland.

ii. Part Two of this Code provides guidance on the Commercial Rent (Coronavirus) Act 2022 (“the Act”) including any applicable legal obligations. This section is therefore designed for use by Landlords and Tenants in England and Wales (where the Act applies) only.

iii. Part Three of this Code provides information on remedies and measures and is generally applicable to England and Wales only, with the exception of paragraph 119 which applies only to Scotland and 120 which applies only to Northern Ireland.

Background

5. COVID-19 and the associated closure measures have had a significant impact on the economy, particularly on the income of the hospitality, leisure and retail sectors and their supply chains. Whilst overall rent collection has increased, total rent arrears across the commercial sector remain significant.

6. In April 2021, government launched a call for evidence (across England) which invited landlords, tenants, and other interested parties to outline their experiences negotiating settlements of rent debt. Additionally, the call for evidence sought views on options for withdrawing or replacing the tenant protection measures that were then in place. These measures included a moratorium on forfeiture, restrictions on the use of the Commercial Rent Arrears Recovery (CRAR) process, and restrictions on issuing a winding-up petition on the basis of a statutory demand, for the non-payment of rent. See the results and analysis of the call for evidence.

7. In addition to this, government has continued to engage extensively with landlord and tenant groups, particularly small businesses, following the publication of the voluntary sector-led Code in June 2020. We are grateful to those involved for this engagement and for their feedback on this Code and in developing the arbitration process now set out in the Act.

8. The government’s policy aim is to preserve otherwise viable businesses and the millions of jobs that they support. In light of this and following analysis of responses to the Call for Evidence, government introduced legislation which came into force on 24 March 2022 to support the resolution of commercial rent debt (including service charges and insurance) accrued during the pandemic. Detail on the Act is set out in Part Two of this Code.

Purpose

9. As noted above; the government’s intention is that, where possible, rent debt accrued as a result of the COVID-19 pandemic should not force an otherwise viable business to cease operating. Contractual commitments should be respected as far as possible while achieving a proportionate balance between the interests of landlords and tenants.

10. This Code is therefore intended to assist landlords and tenants in resolving disputes relating to rent owed as a result of premises having been closed or having had business restricted during the COVID-19 pandemic. The Code seeks to do this by:

a. providing guidance on behaviours and negotiation aimed at assisting any business to resolve unpaid rent and to promote best practice within landlord and tenant relationships; and

b. providing guidance on the Act, including statutory guidance about how landlords and tenants are to make a reference to arbitration and explaining the modifications made by the Act to remedies for unpaid rent.

11. Although guidance on the Act will be of most relevance to landlords and tenants with disputes that are in scope of the Act, non-eligible landlords and tenants may find it useful to refer to the Act’s underlying principles when attempting to resolve unpaid rent debt via negotiations.

12. See guidance to assist arbitrators. The intent is that the arbitration process, including the paperwork required, is simple and streamlined, enabling cases to conclude rapidly and landlords and tenants to return to business as usual.

Government objectives for all commercial tenancies

13. It is in the interests of both landlords and tenants to enable otherwise viable businesses to continue operating following the end of COVID-related measures. As such, we encourage landlords and tenants to negotiate regardless of whether their rent debts fall within scope of the Act.

14. The legal position remains that tenants are liable for covenants and payment obligations contracted under the lease, unless this is renegotiated by agreement with landlords, or some relief is given as a result of the arbitration process explained within Part Two of this Code.

15. Our expectation therefore remains that tenants who are able to pay their rent debt in full should do so. However, we recognise the extreme impact closure requirements had on certain businesses, and we therefore encourage landlords and tenants to work together. Tenants who are or would be viable if not for rent debt, and who are unable to pay in full should, in the first instance, negotiate with their landlord in the expectation that the landlord will share the burden where they are able to do so and as set out within this Code. This will allow landlords to support those tenants who are in need and might otherwise be unable to continue trading.

16. Many parties have already reached agreements, including by using this Code and its predecessor; however, we recognise that there are also circumstances where parties have been, or will be, unable to reach agreement by themselves. We encourage parties to negotiate as far as possible using the advice in the ‘Negotiation’ section of this Code. For businesses in England and Wales who are in scope of the Act, and where negotiation has been exhausted, we have made binding arbitration available (see Part Two).

Existing agreements

17. As stated above, some landlords and tenants have already come to agreements in response to COVID-19 and have followed best practice in doing so. Any existing agreements should continue to be honoured, and neither this Code, nor the Act, change that.

18. We recommend that tenants make clear to landlords which periods any rent payments made relate to. Tenants who owe more than one instalment of rent have a right to specify the period a payment should be attributed to. Tenants are encouraged to communicate clearly to landlords which period of rent a payment is for, and to set this out in writing, even if the landlord agrees.

19. For parties in scope of the Act, if a tenant pays rent after the protected period (see Annex A) and either before or during the moratorium period, without appropriating it to a particular period, it must be used for unprotected rent before it can be used to cover protected rent (explained in Part Two).

Part One: Non-statutory guidance applicable to all tenancies

20. The following guidance on negotiation is non-statutory and can be used by parties both inside and outside of the arbitration system under the Act to facilitate constructive dialogue.

21. We recognise the difficulties that many landlords and tenants are facing, particularly those that were affected by the closures during lockdowns. Not all tenants will be in the same position as they previously were in terms of ability to pay rent and it may be in the interest of both landlord and tenant to reach new arrangements for unpaid rent (if they have not already done so). We hope this Code will help provide options for tenants and landlords to discuss, and that this will in particular help smaller businesses without access to significant legal or other resources.

22. Government encourages all landlords and tenants with outstanding rental debts owed following the pandemic to negotiate in the first instance. Should an application to arbitration be made under the Act they may continue to negotiate in parallel.

Behaviours to be exhibited by landlord and tenant for all tenancies

23. When negotiating rent arrears, or undertaking binding arbitration under the Act, the landlord and tenant should attempt to exhibit the following behaviours:

a. transparency and collaboration: landlords and tenants have a mutual interest in business continuity that reaches far beyond the extent of this pandemic. They are economic partners, not opponents. Therefore, in all dealings with each other, in relation to this Code and the COVID-19 pandemic, they should act reasonably, transparently and in good faith. This should not affect any requirements for reasonableness and commercial confidentiality which exist in any regulatory regime or in relation to legislation;

b. a unified approach: landlords and tenants should endeavour to help and support each other in all of their dealings with other stakeholders including governments, utility companies, banks, financial institutions, and others to achieve outcomes reflecting this code’s objectives, and to help manage the economic and social consequences of COVID-19;

c. act reasonably and responsibly: landlords and tenants should operate reasonably and responsibly, recognising the impact of COVID-19, in order to identify mutual solutions where they are most needed; and

d. a swift resolution: having regard to the above behaviours, and the future post-COVID-19 economy, landlords and tenants should act to avoid costly or burdensome processes by ensuring we resolve disagreement as quickly as possible whilst acknowledging that such haste should not unintendedly undermine the rights held by either party.

24. We recommend that parties adhere to these behaviours to assist during negotiations including, for example, where parties decide not to apply for arbitration or are not eligible to apply. Whilst these behaviours are non-statutory, we expect those parties who decide to apply for arbitration to also adhere to them during each stage of the process.

Negotiation (for all commercial tenancies)

25. We encourage all landlords and tenants to attempt negotiation regardless of whether the debts owed are in scope of the Act. If agreement is reached, we recommend that parties confirm this between themselves, formally and in writing. Where parties reach an agreement, the arbitration process will not override this.

26. Tenants experiencing temporary severe hardship because of the impact of COVID-19 should feel able to approach their landlords to discuss and negotiate rent owing or other support available to them. Landlords should consider a reasonable case put forward by a tenant in such distress and whether some temporary arrangement the landlord can reasonably offer might enable the tenant to survive.

27. Each relationship will need to respond to these circumstances differently. We encourage landlords and tenants to consider the principles, viability statements and evidential requirements of the Act (see Part Two below). We also recognise that there are many businesses including, for example, supply chain businesses that closed and others that may have found it uneconomical to open, that do not sit within the legislation but were impacted. Here we strongly support landlords and tenants coming together to use the principles and methods set out in the Act to negotiate and come to an agreement on outstanding rent arrears that protect the viability of the tenant business whilst not threatening the solvency of the landlord, thus benefitting the wider economy.

28. Tenants will need to show landlords sufficient evidence to substantiate their need for assistance with rent. The types of evidence that should help to substantiate the need for assistance are outlined in Annex B. Landlords may wish to make clear the impact of late or non-payment of rent on their own circumstances. Where the tenancy forms one of many such tenancies for landlord or tenant then this may be relevant to the discussions.

29. The relationship between landlord and tenant is defined by law and parties may wish to seek legal advice when agreeing payment arrangements.

30. We recognise there will be cases where landlords and tenants negotiate following the advice set out within this Code, but are, or have been, unable to reach a specific agreement. They might both feel that a negotiated outcome could still be achieved, and therefore they should consider alternative means of resolving their dispute, such as a third-party mediator who could be employed by mutual agreement of tenants and landlords to help facilitate negotiations (if the cost of this is proportionate and with the understanding both sides would bear their own costs).

31. Where either party chooses not to use alternative dispute resolution or the process used failed to resolve the dispute, the parties would not be prevented from applying for statutory arbitration (even if the alternative process was mandatory under the lease). See further information on alternative dispute resolution.

Part Two: The Commercial Rent (Coronavirus) Act 2022

32. The Act aims to support the resolution of commercial rent debt accrued during the pandemic by establishing a system of binding arbitration which has been specifically designed to meet government’s aims as expressed at the beginning of this Code.

33. The above legislation applies in relation to premises in England and Wales. It does not apply substantively in relation to premises in Scotland or Northern Ireland but use of and adherence to this Code as set out in the ‘Behaviours’ and ‘Negotiation’ sections in Part One is encouraged where appropriate.

34. Many landlords and tenants have already reached agreement on rental debts accrued during the pandemic and the government continues to encourage negotiation in respect of unresolved debts, as set out in the ‘Negotiation’ section of this Code. Where agreement cannot be reached the binding arbitration process provides a legal process for landlords and tenants, whose businesses are in scope (see section below entitled “Scope: how do I know if my dispute is eligible for arbitration?”), to have their case resolved by arbitration. Any award will be consistent with the principles set out in the Act, as detailed by this Code and consistent with the aims set out within the preceding sections. Further information on the process is set out below.

Scope: how do I know if my dispute is eligible for arbitration?

35. Under the Act, a dispute is eligible for arbitration where the tenant and the landlord under a “business tenancy” are “not in agreement” as to the resolution of “the matter of relief from payment” of a “protected rent debt.” A reference to arbitration should not be attempted if the dispute is not eligible for arbitration and a reference may be refused by an approved arbitration body if it is obviously ineligible. In addition, the Act requires an arbitrator to dismiss an ineligible reference.

36. In working out whether a dispute is eligible for arbitration, a party should check the following points before making any reference to arbitration:

a. am I party to a “business tenancy”?

b. is there unpaid rent in the form of “protected rent debt” in relation to that business tenancy?

c. is there a dispute in relation to the matter of relief from payment of that protected rent debt?

d. is the tenant the subject of a CVA, IVA, or compromise or arrangement?

37. The below is a high-level summary of the relevant concepts to help landlords and tenants answer these questions. For more detail, please see section 4 of the Statutory Guidance to Arbitrators.

What is a “business tenancy”?

38. A “business tenancy” is a tenancy to which Part II of the Landlord and Tenant Act 1954 (the “1954 Act”) applies, i.e. a tenancy comprised of property which is or includes premises that are occupied by the tenant for business purposes, or business and other purposes. A tenancy that has been contracted out of the security of tenure provisions of the 1954 Act is still a business tenancy for these purposes. The Act’s arbitration process is available between the landlord and tenant under the business tenancy.

39. What if my business tenancy is one of a chain of tenancies for the same premises (i.e. the business in occupation leases the premises from a landlord, who is themselves leasing from another landlord and so on)? Only the business tenancy under which the tenant occupies the premises is in scope. Government has taken this targeted approach to enable the arbitration system to return the commercial rent market to normal operations as quickly as possible. However, there are other provisions to be aware of:

a. the arbitrators’ principles (see section below on ‘Application of the Principles’) require that an award preserves the landlord’s solvency. To assess the landlord’s solvency, its liabilities under other tenancies must be taken into account as part of its financial position. Landlords can therefore raise their own obligations to pay rent, when demonstrating their ability to afford concessions; and

b. if a superior landlord (such as the landlord of the tenant’s landlord) enforces their right of forfeiture in relation to their superior tenancy during the moratorium period (see paragraph 125 below) and a tenant in scope of the Act applies for relief from forfeiture, any protected rent debt cannot count against them when the court decides whether to grant that relief.

What is “protected rent debt”?

40. “Protected rent debt” is a debt for “unpaid rent” under a “business tenancy” (see above) which was “adversely affected by coronavirus,” and where that rent is “attributable to occupation during a “protected period””.

41. “Rent” for the Act’s purposes means one or more of the following, payable by the tenant to the landlord (or person acting for the landlord):

a. an amount payable for possession and use of the premises to which the tenancy relates, whether or not that payment is described as ‘rent’ in the tenancy;

b. an amount payable as a service charge; and

c. interest due on any unpaid amount of (a) or (b) above.

42. VAT chargeable on any of the amounts in (a) to (c) above is included in the meaning of ‘rent.’

43. When was a business tenancy “adversely affected by coronavirus”? If the whole or part of the business carried on by the tenant at or from the premises comprised in the tenancy, or if the whole or part of the premises themselves, were subject to a “closure requirement” under coronavirus regulations during a “relevant period,” the business tenancy was adversely affected by coronavirus:

44. A “closure requirement” is a requirement specified in coronavirus regulations to close either premises (or parts of premises), or businesses (or parts of businesses) of a specified description. It does not matter if certain limited activities were allowed at the premises as an exception to the closure requirement. If businesses that were required to close their business or premises were still allowed by the regulations to do certain activities, these activities should be disregarded when determining whether a tenancy was adversely affected by coronavirus and so within scope of the arbitration process.

45. For example, certain retail businesses were required to close during some periods, but could make deliveries or respond to online, telephone or postal orders (without admitting customers). This is a closure requirement, despite the exception. Where regulations required specified business or premises, or parts of these, to be closed at particular times each day, this counts as a closure requirement.

46. A “relevant period” is a period within the time from 2pm on 21 March 2020 until 11.55pm on 18 July 2021 (for premises in England) or 6am on 7 August 2021 (for premises in Wales). This means that if a business was subject to a closure requirement for any period within these times and dates, the tenancy was adversely affected by coronavirus.

47. When is protected rent debt attributable to occupation during a “protected period”? The “protected period” began on 21 March 2020 and ends with the last day on which all or part of the tenant’s business carried on at or from the premises, or the premises itself (or part of the premises), was subject either to a “closure requirement” (see paragraph 44 above) or to a “specific coronavirus restriction” (note that for premises in England, the last day of the protected period cannot be later than 18 July 2021. For premises in Wales, the last day of the protected period cannot be later than 7 August 2021).

48. A “specific coronavirus restriction” is a restriction or requirement, other than a closure requirement (see above) which:

a. was imposed by coronavirus regulations; and

b. regulated the way in which a business of a specified description (or part of it) was to operate, or the way in which premises of a specified description (or part of it) were to be used.

49. Are general restrictions which apply more widely than to specific business premises “specific coronavirus restrictions”? No – an obligation to carry out a risk assessment at all places of work would not meet the test. In addition, a requirement to display or provide information on certain premises would also not amount to a specific coronavirus restriction.

50. What if only some of my rent can be attributed to a protected period? Only that rent which can be reasonably attributed to a ‘protected period’ will be protected rent for the purposes of the Act. For example, if a full quarter’s rent is outstanding but only part of that quarter is within the ‘protected period,’ then only the proportion of unpaid rent which is reasonably attributable to the protected period will be protected rent.

51. For a business for which the protected period ends on 18 July 2021, if rent due in June 2021 is unpaid and this rent relates to 3 months starting with the payment date, the amount attributable to the June quarter date to 18 July is protected and the amount attributable to 19 July onwards is not. If the lease makes provision for how to apportion rent, then that contractual method should be used to calculate the amount of protected rent in scope of the Act. Tenants can apply for arbitration for rent instalments which partially comprise protected rent, even if a lease requires instalments to be paid in full.

52. If a debt is attributable to a protected period, is the interest chargeable in relation to it also attributable to the protected period? Yes, for example, where the underlying debt is attributable to occupation within the protected period and is a ‘protected rent debt,’ any unpaid interest which has accrued in respect of that debt is also attributable to the protected period and is also ‘protected rent debt.’

53. When calculating the tenant’s period of occupation, does it matter what time of day occupation started or ended? No, for the purposes of calculating a tenant’s period of occupation, the whole of both the start and end dates are treated as included in full.

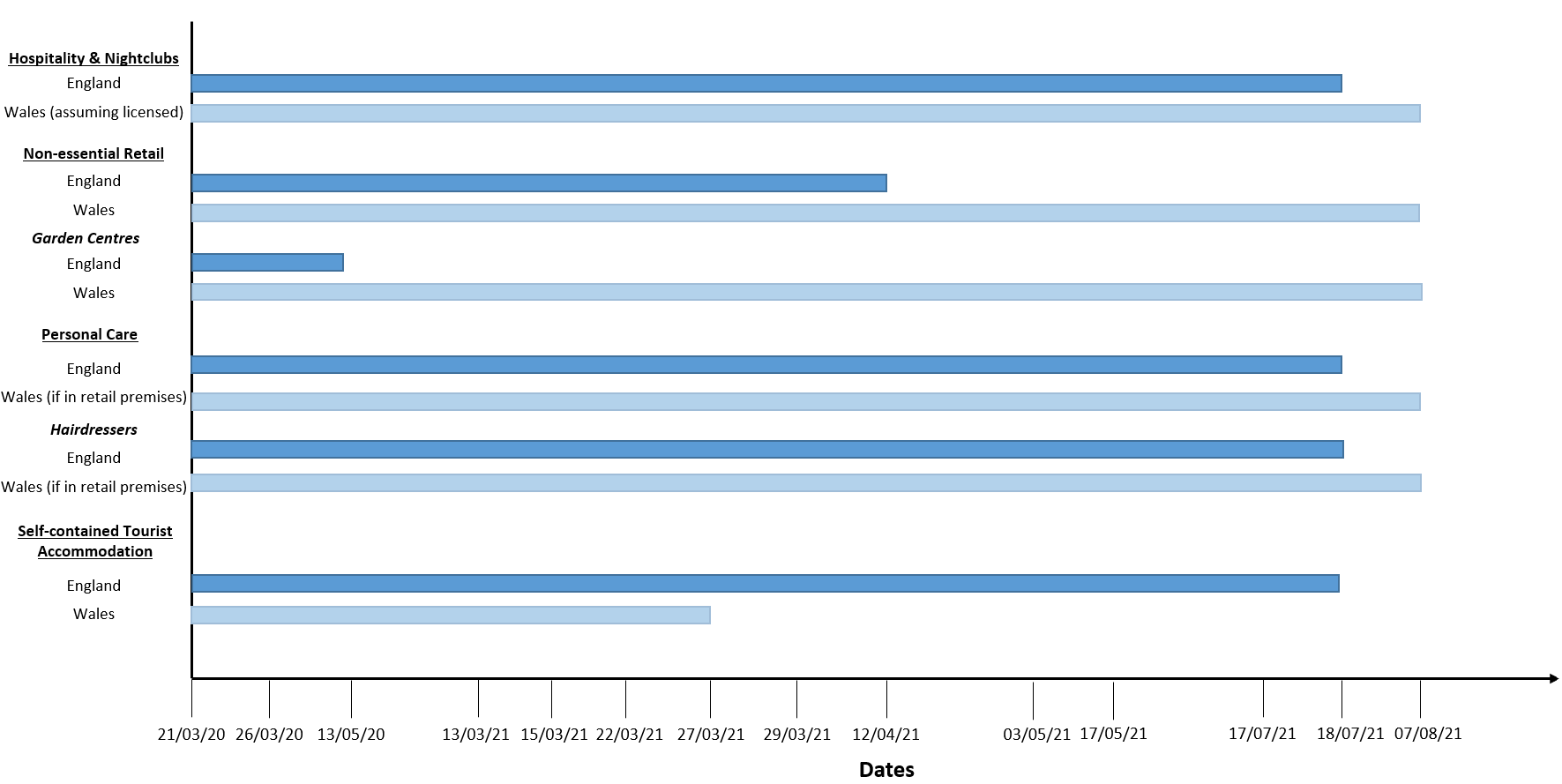

54. A summary of the protected periods for businesses affected can be found in Annex A to this Code. For example, for a clothing shop in England the protected period ran from 21 March 2020 to 12 April 2021 (when non-essential retail was allowed to re-open); and for a café in England the protected period ran from 21 March 2020 to 18 July 2021 (whilst they were able to open before, this was when restrictions ended on table booking size as did the requirement for customers to eat while seated). The protected period for similar businesses in Wales ran from 21 March 2020 to 7 August 2021 (if the restaurant is licensed), when restrictions on retail and licensed premises ended.

55. Are there particular circumstances or types of unpaid rent to be aware of? Yes:

a. if before 24 March 2022 a landlord drew down an amount from a tenancy deposit to meet all or part of a rent debt that would otherwise have been a protected rent debt, and the tenant has not made good any shortfall in the deposit, that rent is treated as unpaid, and the amount drawn down in respect of that debt is treated as a protected rent debt. This means that an arbitrator can consider and make an award about any part of a protected rent debt which the landlord has drawn down on the tenancy deposit to cover. Depending on the award, the tenant may be relieved from having to make good any shortfall in the deposit – this is because the Act treats making good the shortfall as paying, in respect of such rent. See paragraph 134 for explanation of the Act’s temporary moratorium on drawing down on, and topping up, tenancy deposits in certain circumstances; and

b. if judgment has been given in favour of the landlord before 24 March 2022, on a debt claim issued on or after 10 November 2021 for or including protected rent debt, then the part of the judgment debt relating to protected rent debt can be referred to arbitration. This is provided the judgment debt is unpaid. See paragraph 129 for further detail.

Is there a dispute in relation to the matter of relief from payment of a protected rent debt?

56. Assuming other eligibility requirements are met, there must also be a dispute between landlord and tenant where they cannot agree on whether the tenant should get relief from payment from a protected rent debt. Relief from payment can be one or more of:

a. writing off the debt (in whole or in part);

b. giving the tenant time to pay the debt (in whole or in part), including by way of instalments; and/or

c. reducing or writing off any interest payable by the tenant under the terms of the tenancy in relation to all or part of the debt.

57. There will be no dispute where the landlord and tenant have already reached an agreement on the matter of relief from payment. In line with the behaviours in this Code, we would expect and would recommend that whenever possible, landlords and tenants should reach an agreement since arbitration under the Act is intended to be a last resort.

58. To avoid unnecessary references to arbitration, we recommend the parties confirm any agreement reached, formally and in writing. The Act does not detail formalities for an agreement, as usual principles apply. If one party considers they have not reached an agreement so makes a reference to arbitration, but the other considers they have, then the arbitrator would assess whether there is an agreement, applying the usual tests for binding agreements.

59. Where agreement cannot be reached, the parties must carry out the pre-arbitration steps before a reference can be made to arbitration. These are described in the section below.

60. Note that if during the course of the arbitration the parties reach a settlement on the matter of relief from payment of protected rent debt, the arbitrator must record the settlement in an agreed award and then terminate the arbitration. That award has the same effect as any other award under the Act and is binding on the parties.

Is the tenant subject to a CVA, IVA, or compromise or arrangement?

61. A reference to arbitration may not be made where the tenant is subject to any of the following which relates to protected rent debt:

a. a company voluntary arrangement that has been approved under section 4 of the Insolvency Act 1986 (‘CVA’);

b. an individual voluntary arrangement that has been approved under section 258 of the Insolvency Act 1986 (‘IVA’); or

c. a compromise or arrangement that has been sanctioned under section 899 or 901F of the Companies Act 2006 (‘compromise or arrangement’).

62. If the tenant is a debtor under a CVA, IVA, or a ‘compromise or arrangement’ relating to any protected rent which has been proposed or applied for and is awaiting a decision, then the parties may refer a matter to arbitration. However, an arbitrator may not be appointed, no formal proposal may be made by the respondent, and neither party may make a revised formal proposal, whilst the decision is pending.

63. If the CVA, IVA, or ‘compromise or arrangement’ is approved or sanctioned, then the arbitration cannot progress, as an arbitrator may not be appointed and no formal proposals may be made by the respondent, or no revised formal proposal may be made by either party. If the CVA, IVA, or ‘compromise or arrangement’ is not approved or sanctioned then, once this decision has been made, an arbitrator can be appointed, and respondent can make a formal proposal and either party may make a revised formal proposal, so that the arbitration can proceed.

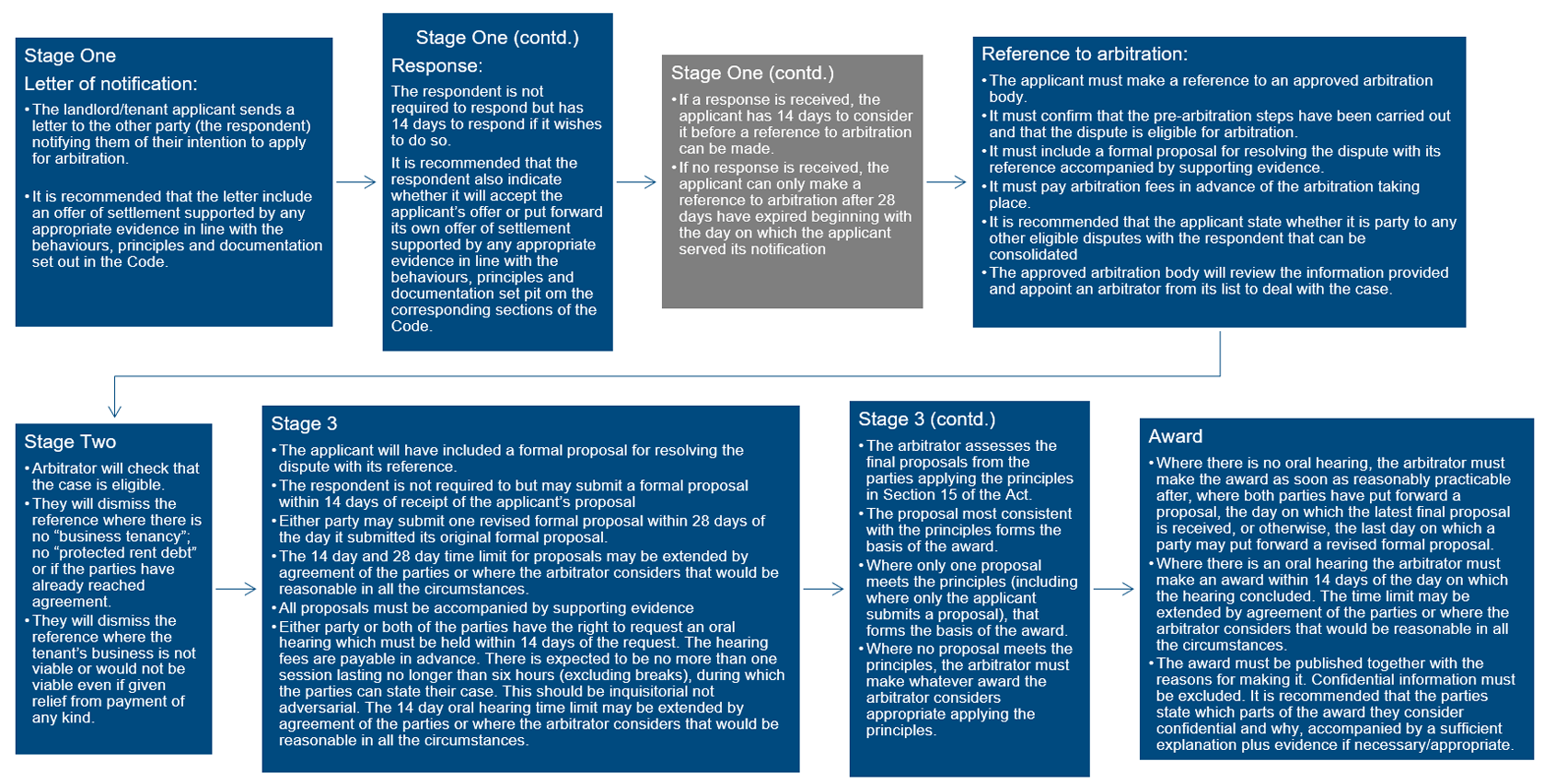

Stage 1: Statutory guidance on making a reference to arbitration at the pre-arbitration stage

64. Important: the information provided in this section regarding Stage 1 of the arbitration process is statutory guidance issued to landlords and tenants about making a reference to arbitration under the Secretary of State’s power in section 21(1)(b) of the Act.

65. It is open to either the landlord or tenant to make a reference to arbitration and they have until 23 September 2022 to do so (unless the Secretary of State extends the period for making a reference by regulations).

66. Before a reference can be made to arbitration, the Act requires the parties to carry out the pre-arbitration steps:

a. the party intending to make a reference (the applicant) notifies the other party (the respondent) of its intention to make a reference. Our recommendation is that this should be done via a letter of notification. We also recommend that the applicant use this as a final opportunity to settle the dispute and so the letter of notification should include an offer of settlement supported by any appropriate evidence in line with the behaviours, principles and documentation set out in the corresponding sections of this Code;

b. the respondent does not have to respond to the applicant’s notification but if it wishes to do so it has 14 days to submit a response. We recommend the respondent also uses the response as a final opportunity to settle the dispute so should either accept the applicant’s offer included with the notification or submit its own offer. If the respondent is submitting their own offer that should be supported by any appropriate evidence in line with the behaviours, principles and documentation set out in the corresponding sections of this Code; and

c. when the applicant can make the reference to arbitration will depend on whether the respondent has submitted a response. If the respondent has submitted a response, the reference can be made once 14 days (after the day on which the response was received) have expired. If the respondent has not submitted a response, a reference can be made after 28 days have expired beginning with the day on which the applicant served its notification.

67. Once the pre-arbitration steps have been carried out, the applicant can make a reference to arbitration. It does this by making a written application to an arbitration body approved by the Secretary of State requesting the appointment of an arbitrator. See a list of those bodies; applications will be able to be made online. An example of what the arbitration referral form may look like can be found at Annex D of this Code.

68. The approved arbitration body is required by the Act to maintain a list of arbitrators that are available and suitable by virtue of their qualifications or experience. It will appoint an arbitrator from that list to deal with the applicant’s case.

69. Arbitration fees: the applicant must pay the arbitration fees (the fees and expenses of the arbitration body and of the arbitrator) in advance (the expectation is those should be paid at the time the reference is made). Under the Act the parties have the right to request an oral hearing. Where one of the parties requests an oral hearing, that party must pay the hearing fees in advance. If both parties request an oral hearing, they are jointly and severally liable to pay the hearing fees in advance. Approved arbitration bodies will list their schedule of fees on their websites.

70. The applicant should be aware that the Act requires the reference to arbitration to include a formal proposal for resolving the dispute (see paragraph 96 below for further details).

71. Consolidation of arbitration proceedings: there may be situations in which the tenant and landlord are in dispute in relation to protected rent debts for multiple business tenancies. Our recommendation would be for the applicant (or respondent) to indicate to the approved arbitration body that there are multiple eligible disputes which could be consolidated into a single set of arbitration proceedings. This is because there may be significant advantages to consolidating proceedings, including a reduction in the cost of arbitration, an increase in the speed of resolution and a reduction in inconsistent arbitration awards.

72. Landlords and tied pub tenants in England and Wales may be within scope of the Act and at the same time within scope of the Pubs Code: The Pubs Code etc. Regulations 2016. The Act does not affect the provisions of the Pubs Code.

Stage 2: Arbitrator’s determination of eligibility (inc. viability of the tenant’s business)

73. Once an approved arbitration body has appointed an arbitrator, under Stage 2 of the process, the arbitrator is required to determine whether the dispute is eligible for arbitration (which is why it is important for the applicant to ensure that the dispute is eligible in the first place before making a reference).

74. Under the Act, the arbitrator is required to dismiss a reference to arbitration where:

a. the tenancy in question is not a “business tenancy;”

b. there is no “protected rent debt;” or

c. the parties have reached an agreement to resolve the matter of relief before the reference to arbitration was made.

75. A high-level summary of those concepts is in the section above entitled “Scope: how do I know if my dispute is eligible for arbitration?”

76. In addition, at Stage 2, as part of the consideration as to whether the dispute is eligible for arbitration, the arbitrator also assesses the viability of the tenant’s business. The arbitrator is required to dismiss the reference to arbitration if they determine that (at the time of the assessment) the tenant’s business is not viable, and also would not be viable even if the tenant were given relief from payment, of any kind. If they determine that the tenant’s business is or would be viable if given relief, then arbitration may proceed to Stage 3 (see below).

Background on viability

77. One of the aims of the Act is to ensure viable tenant businesses can continue to operate to facilitate a return to normal market operation. However, viable business models will differ from party to party and across sectors. For example, profit margins can vary significantly between industries and sectors.

78. As a result, viability is deliberately not specifically defined in the Act or in guidance, in order to account for the vast array of different business models both within and between sectors. Instead, the government has sought to provide helpful tools and suggested evidence to assist in the assessment of viability.

79. In making that assessment a key question is whether, protected rent debt aside, the tenant’s business has, or will in the foreseeable future have, the means and ability to meet its obligations and to continue trading.

80. That said, the concept of “viability” used in the Act is specifically for the purposes of the Act and is not intended to have broader application. For example, it is not an assessment as to whether the tenant’s business is solvent.

81. It is primarily for the tenant to demonstrate the viability of their business so tenants are advised to compile the necessary evidence and explanations in advance of arbitration proceedings, considering the below.

82. Note that the viability of the tenant’s business is considered again at Stage 3 of the arbitration process. However, at Stage 3 the key consideration is, having already established at Stage 2 that the tenant’s business is viable or would be viable (if given relief), how much can the tenant afford to pay and how quickly whilst preserving the solvency of the landlord. See below for further details.

Requirements in the Act for assessing viability

83. In assessing the viability of the business of the tenant, the arbitrator must, so far as known, have regard to the following:

a. the assets and liabilities of the tenant, including any other tenancies to which the tenant is a party;

b. the previous rental payments made under the business tenancy from the tenant to the landlord;

c. the impact of coronavirus on the business of the tenant; and

d. any other information relating to the financial position of the tenant that the arbitrator considers appropriate.

84. In making this assessment, the arbitrator must disregard the possibility of the tenant borrowing money or restructuring their business. The rationale is that if a business took on more debt to become viable for the purposes of arbitration under the Act, they would likely be delaying the problem and risking their long-term viability.

Indicators in guidance to arbitrators which may be used to determine viability

85. The statutory guidance to arbitrators contains a table of indicators plus categories of evidence to which the indicators can be applied which arbitrators may use to assess the viability of the tenant’s business. For ease of reference, that table is replicated in Annex E of this Code.

86. There is no one indicator that can be used to determine whether a business is viable and whether an indicator is relevant will depend on the circumstances of each case. In addition, no one indicator is more important than another.

87. The volume of evidence examined should be proportionate to the scale and complexity of the tenant’s business. A small business tenant should not be expected to supply a large volume of documentation or complex financial analysis. Arbitrators are aware that smaller businesses may find it challenging to provide predictions on their future profitability, detailed financial records, or liquidity or other ratios as compared to a larger business. It is not expected that tenants incur additional significant expense in obtaining evidence that is not readily available to them.

88. That said, both parties should be aware that the better the quality of the information provided, the more that it will assist the arbitrator. With that in mind, to the extent it is able to do so, the tenant may wish to consider producing some of the evidence listed in the table of indicators to help the arbitrator.

89. At the very minimum the tenant should provide at least the previous year’s full bank account information, including savings accounts, current accounts and loan accounts. Where the tenant’s business is not incorporated, it may be necessary to provide personal bank account information. Where these (and/or other records) show the tenant has a good track record of paying rent, and has no substantial new debts, that is likely to be strong evidence that the tenant is viable.

90. Other information where available will also be generally useful to the arbitrator, such as financial accounts for each financial year after March 2019 or management accounts for each financial month/year after March 2019.

91. The arbitrator may take into account whether information has been verified by a third party such as an auditor, but tenants are not required under the Act to produce audited records. However, where audited accounts are not available it would be useful for the tenant to provide the arbitrator with bank account information including any saving accounts, loan accounts and current accounts for each financial year after March 2019.

92. If the tenant is able to do so it would also assist the arbitrator to provide measures such as the net profit margin or gross profit margin prior to the protected period, compared to after closure requirements or specific restrictions ended for the business in question. The arbitrator also has the power to require evidence to be produced if where necessary.

93. If the arbitrator determines that the tenant’s business is viable or would be viable (and assuming the reference to arbitration has not been dismissed for other reasons relating to eligibility) then the arbitration will progress to Stage 3 which concerns whether the tenant should be given any relief from payment of protected rent debt and if so, what relief.

Stage 3: Consideration of proposals for resolving the dispute over protected rent debt

Introduction

94. If the arbitration process has progressed to Stage 3, the arbitrator will have already established that the dispute is eligible, and that the tenant’s business is viable or would be viable if given relief. The main concern at Stage 3 is whether the tenant should be given relief from payment of the protected rent debt, and if so, what relief.

95. Usually in arbitration the parties submit statements of claim and defence etc. which the arbitrator considers before coming to a judgment and making an award. However, under the Act there is a special process for resolving the dispute which deviates from this normal practice. The parties submit formal proposals which put forward what relief (if any) the tenant should get from payment of the protected rent debt applying the principles of section 15 of the Act and accompanied by supporting evidence. The arbitrator assesses the proposals against the principles in section 15 and that forms the basis of the arbitrator’s award. The process is set out below in more detail, with the principles as set out in the Act at paragraph 103.

Submission of formal proposals

96. Under the Act, a formal proposal is a proposal which is:

a. made on the assumption that the arbitrator is required to resolve the matter of relief from payment of a protected rent debt;

b. specified as made for the purposes of section 11 of the Act;

c. given to the other party and to the arbitrator;

d. accompanied by supporting evidence; (see suggested non-exhaustive list at Annex B); and

e. verified by a statement of truth.

97. It is worth bearing in mind that the stronger and more coherent the supporting evidence provided for a formal proposal the more persuasive that proposal will be to an arbitrator.

98. As mentioned in paragraph 70 above, the applicant must include its formal proposal with the reference.

99. The respondent has the option to (but is not required to) within 14 days (beginning with the day on which the applicant’s proposal is received), put forward its formal proposal. The parties may agree an extension to that 14-day time limit, or the arbitrator can extend if that would be reasonable in all the circumstances.

100. Either party may submit one revised proposal accompanied by further supporting evidence. A party has 28 days to do so beginning with the day on which it gave its original formal proposal to the other party. The parties may agree an extension to that 28-day time limit, or the arbitrator can extend if that would be reasonable in all the circumstances.

101. As stated in paragraphs 61 to 63 above:

a. if the tenant is a debtor under a CVA, IVA, or ‘compromise or arrangement’ relating to any protected rent which has been proposed or applied for and is awaiting a decision, then the parties are not prevented from making a reference to arbitration. However, an arbitrator may not be appointed, and no formal proposal may be made by the respondent or no revised formal proposal by either party, whilst the decision is pending; or

b. if the CVA, IVA, or ‘compromise or arrangement’ is approved or sanctioned, then the arbitration cannot progress, as an arbitrator may not be appointed, and those formal proposals set out in (a) above may not be made. If the CVA, IVA, or ‘compromise or arrangement’ is not approved or sanctioned then, once this decision has been made, an arbitrator can be appointed and the parties may make formal proposals as above, so that the arbitration can proceed.

Application of the principles

102. In determining what relief if any the tenant should receive, the arbitrator must consider the final proposal put forward by a party (a final proposal being a party’s revised formal proposal or if it hasn’t made a revised proposal, its original formal proposal).

103. The arbitrator must then apply the principles in section 15 of the Act to the final proposals. Those principles are that:

a. any award should be aimed at preserving or, as the case may be, restoring and preserving the viability of the business of the tenant, so far as that it consistent with preserving the landlord’s solvency; and

b. the tenant should, so far as it is consistent with the first principle to do so, be required to meet its obligations as regards the payment of protected rent in full and without delay.

104. Having already assessed whether the tenant’s business is or would be viable at Stage 2 of the process, the focus here at Stage 3 is on the extent to which a tenant can pay a protected rent debt considering, on the one hand, the viability of the tenant’s business, and on the other hand, the solvency of the landlord – so a balance between the parties is achieved.

105. The Act requires the arbitrator to consider certain factors when assessing the viability of the tenant’s business (whether at Stage 2 or Stage 3). See paragraph 83 above.

106. For the purpose of assessing the landlord’s solvency, a landlord is “solvent” unless the landlord is, or is likely to become, unable to pay their debts as they fall due. In assessing this, the arbitrator must, so far as known, have regard to:

a. the assets and liabilities of the landlord, including any other tenancies to which the landlord is a party; and

b. any other information relating to the financial position of the landlord that the arbitrator considers appropriate.

107. The parties should note that the arbitrator is not required to seek out information from them (although has the power to do so). As such, tenants should ensure they provide sufficient information to prove their viability. Landlords do not necessarily have to provide evidence of their solvency unless the landlord’s case is that the tenant’s proposal would affect its solvency, in which case, the landlord should provide evidence to back this up.

108. In making an award on the matter of relief from payment of protected rent debt, the arbitrator applies the principles in section 15 to the final proposal(s) as follows:

| Scenario | Consistency of proposal(s) with the principles | Award made on matter of relief from payment |

|---|---|---|

| Both parties submit final proposals | Both proposals are consistent | Award made in terms of the most consistent proposal |

| Both parties submit final proposals | Only one proposal is consistent | Award made in terms of that consistent proposal |

| Both parties submit final proposals | Neither final proposal is consistent | Whatever award the arbitrator considers appropriate applying the principles |

| One party submits a final proposal | That proposal is consistent | Award made in terms of that consistent proposal |

| One party submits a final proposal | That proposal is not consistent | Whatever award the arbitrator considers appropriate applying the principles |

109. The awards which the arbitrator may make are either to give the tenant relief from payment of the protected rent debt, or to state that the tenant is to be given no relief from payment.

110. Where the arbitrator’s award gives the tenant time to pay an amount (including an instalment), the payment date must be within a period of 24 months beginning with the day after the date of the award.

Publication of the award

111. The arbitrator must publish the award together with the reasons for making it. The award must exclude confidential information, unless the person to whom that information relates consents to its publication.

112. Confidential information means:

a. commercial information relating to a party or any other person which, if disclosed, would or might significantly harm the legitimate business interests of that person; or

b. information concerning an individual’s private affairs whose disclosure would or might significantly harm that individual’s interests.

113. In practice, the arbitrator will likely be reliant on the parties to state which parts of the award they think should be redacted or excluded on the basis that the information is confidential information and the reasons why that information is confidential. It is recommended that the parties provide a sufficient explanation accompanied by evidence if necessary or appropriate.

Effect of an award

114. An award made under the Act is final and binding. If an award gives relief from payment, it alters the terms of the tenancy in relation to the protected rent debt, so that the tenant no longer has an obligation to pay the original debt as under the tenancy but must pay in accordance with the award. A tenant that complies with an award under the Act will not be in breach of the tenancy on the grounds that they did not pay an amount written off by the award, nor that they paid later than the tenancy originally required.

115. If rent is ultimately paid by a guarantor or former tenant after an award is made giving relief from payment, the award affects their liability too, so they are not liable to pay any amount written off by the award, nor to pay an amount payable under the award until it becomes due under the award. This includes a guarantor who has indemnified the tenant.

116. The final and binding nature of an award does not affect the tenant’s right to challenge the award. Awards made under the Act may be challenged or appealed via sections 67 to 71 of the Arbitration Act 1996 (subject to the modifications made by the Act to section 68 of the Arbitration Act 1996).

Part three: Remedies and measures

Temporary moratorium on remedies and measures for debts not in scope of the Act

England and Wales

117. To provide the time to introduce and pass the Act, a moratorium on forfeiture and restrictions on the use of CRAR remained in place in England and Wales, ending on 24 March 2022. Restrictions on winding up petitions for inability to pay debts, including in relation to rent debts, applied until 31 March 2022. A temporary moratorium on other remedies and measures applies under the Act, for those in scope of the arbitration process.

118. For debts that are not in scope of the binding arbitration process, landlords are able to exercise their ordinary enforcement rights in the ways they did prior to the restrictions above. Action can be taken in respect of:

a. non-payment of rental arrears attributable to periods prior to 21 March 2020 and from the end of the protected period onwards;

b. tenants that fall outside the scope of the Act, for non-payment of rental arrears accrued at any time; and

c. interest on rent liabilities attributable to periods outside of the protected period.

Scotland

119. In Scotland, anti-irritancy measures for non-payment of rent expired on 30 March 2022. Evictions in Scotland have therefore returned to 14 days’ notice rather than the previous 14 weeks’ notice required by the anti-irritancy measures.

Northern Ireland

120. In Northern Ireland the moratorium on forfeiture expired on 25 March 2022. Landlords and tenants are encouraged to continue to use the Code of Practice to help resolve outstanding rent arrears and, if further assistance is needed, to access commercial rent mediation services. Enforcement rights under the Business Tenancies (Northern Ireland) Order 1996 will now apply as they did prior to the moratorium.

Remedies and measures for debts in scope of the Act

121. All remedies which are subject to the Act’s temporary moratorium are only restricted in relation to protected rent debt. The Act’s temporary moratorium on the remedies and measures described in the following paragraphs (except where another timing is indicated) runs from 24 March 2022 (when the Act was passed) until:

a. 23 September 2022, if neither party makes a reference to arbitration, subject to extension of this period by regulations; or

b. if either party makes a reference to arbitration, when the arbitration concludes.

This period is the “moratorium period.”

122. For situation b. above, an arbitration concludes at whichever of the following times is applicable:

i. when the proceedings are abandoned or withdrawn by the parties, which must be done by both parties together;

ii. if an award is made, when the time period for appeal expires without an appeal being brought – this includes an award dismissing the reference or stating that no relief is to be given; or

iii. if an appeal is made, when an appeal is finally determined, abandoned, or withdrawn.

If an agreement is negotiated once arbitration has started, this will be recorded in an award, and so the moratorium ends in line with (ii) or (iii) above.

123. For tenancies within scope of the Act, landlords may not during the moratorium period (as described at paragraph 121 above) enforce a right of forfeiture or re-entry for non-payment of protected rent debt. This prevents landlords from taking court action or other action such as re-entering the property or changing the locks. Landlords will not be considered to have waived their right of forfeiture or re-entry due to this or anything they do in the moratorium period, unless they give an express waiver in writing.

124. Landlords cannot use a tenant’s failure to pay protected rent debt during the moratorium period, to oppose an application for a new tenancy due to persistent delay in paying rent, under section 30(1)(b) of the Landlord and Tenant Act 1954. However, the Act does not affect delays in paying other rent that is not protected by the Act.

125. If a superior landlord enforces their right of forfeiture in relation to a superior tenancy in the chain during the moratorium period, then the failure of the occupying tenant (the tenant in scope of the Act) to pay protected rent debt on time cannot count against them if they apply for relief from forfeiture in respect of their interest (see paragraph 39 above in relation to tenancies in a chain).

126. Landlords are also prohibited from use of the Commercial Rent Arrears Recovery (CRAR) power in relation to protected rent debt, during the moratorium period. This prevents giving authorisation to an agent to exercise CRAR in relation to protected rent debt, the agent giving notice of enforcement to the tenant in relation to protected rent debt, and including protected rent debt in a calculation of net unpaid rent for the purposes of CRAR.

127. Landlords may not present a winding up petition – including in the Scottish courts – during the moratorium period on the ground that the tenant company or LLP which owes protected rent debt is unable to pay its debts, unless the tenant also owes the landlord a debt which is not a protected rent debt.

128. In addition, the Act makes provision about debt claims, use of a tenant’s deposit, appropriation and bankruptcy. There are also restrictions on CVAs and certain other restructuring arrangements, although these are for a different period to the moratorium period. The Act prevents landlords from issuing debt proceedings (for County Court or High Court Judgments) for protected rent debt during the moratorium period (as explained at paragraph 121).

129. If a debt claim includes protected rent debt and was issued on or after 10 November 2021 and before 24 March 2022 (when the Act came into force), either party may apply to court to stay the proceedings. If they do so, the Act requires the court to stay the proceedings, so that the dispute can be resolved by arbitration (or by other means). Protected rent debt covered by a judgement given in favour of the landlord before 24 March 2022, on a claim which was issued on or after 10 November 2021, may be considered in the arbitration process if it is unpaid.

130. The landlord may not enforce or rely on the judgment debt (or part of it) that relates to protected rent debt, nor any interest on it, whilst the arbitrator considers the matter during the Act’s moratorium period. Should an arbitrator award relief from payment, then the judgment debt relating to protected rent debt would be altered in accordance with that award – that is, the tenant would only owe the amount, and would only be required to pay within the time, specified in the arbitrator’s award. An agreement between the parties about relief from payment of the protected rent debt would have the same effect.

131. If a judgment relates only to protected rent debt and not any other debt and is given in favour of the landlord before 24 March 2022, on a claim which was issued on or after 10 November 2021, then the registration of the judgment may be cancelled if an award or agreement is made giving some relief from payment. This can be done once the moratorium period for the debt has ended (see paragraph 121 above). The landlord or tenant should notify the court that these conditions are met. See more information on applying to cancel a judgement. Applicants should state on the court form that the requirements of this Act are met in respect of the judgment debt.

132. The Act does not allow a bankruptcy petition to be presented against a tenant (such as a sole trader) for inability to pay a debt specified in a statutory demand or court judgment or order, where that demand was served, or the claim was issued, on or after 10 November 2021 and before the end of the moratorium period and relates to protected rent debt. If such a petition is presented, the court can make an order or give directions to restore the position to what it would have been without the petition. If a bankruptcy order was made against a tenant on or after 10 November 2021 but before 24 March 2022, on a creditor’s petition by the landlord, and the order would not have been made had the Act’s provisions on bankruptcy been in force then, the Act provides for the order to have no effect.

133. The Act’s provisions on debt claims and winding up or bankruptcy apply in relation to claims, petitions, proceedings, and orders against a tenant or against a guarantor (including where an indemnity has been given) or a former tenant (whether liable under an authorised guarantee agreement or due to privity of contract). This means guarantors and former tenants are protected from being pursued by these means for the protected rent debt owed by the tenant, for the periods when these provisions apply.

134. Landlords are also prevented, during the moratorium period, from drawing down on tenancy deposits to cover outstanding protected rent debt (see paragraph 55). In the case that a landlord has already drawn down on the deposit and used it to cover protected rent debt before the moratorium period started, the requirement for the tenant to top-up the deposit is suspended during the moratorium period. If the landlord has used money from the deposit to meet all or part of a protected rent debt and the tenant has not made good shortfall in the deposit, then this sum can be addressed in the arbitration system.

135. As mentioned in paragraph 18, on the appropriation of rent, it is recommended that tenants specify which period of rent is being paid for. If during the moratorium period, a payment is made without doing so and the tenant owes both protected rent and unprotected rent when the payment is made, then the landlord must use the payment to cover the unprotected rent debt before it can be used for any protected rent. An “unprotected rent” debt is a debt of rent which is not protected rent (as defined at paragraph 40), or interest on this.

136. If a rent payment was made after the protected period and before 24 March 2022, without the tenant communicating which period the rent relates to, then during the moratorium period the landlord can only use its right of appropriation to use the payment to cover unprotected rent debt before protected rent debt. If the landlord sought to appropriate the payment to the protected rent debt then this is undone, and the payment is treated as having been appropriated to the unprotected rent debt first.

137. By way of an example, assume a payment of £2000 was made on 1 March 2022, when there was a £1500 protected rent debt owed and also a £1500 unprotected rent debt. Under the Act, £1500 should pay off the unprotected rent debt first, leaving £500 to be removed from the protected rent debt, which reduces to £1000. But if the landlord has done the opposite (i.e. has instead sought to use it to pay off the protected debt first), the protected rent debt was purportedly paid first, so the unprotected debt would become £1000. The Act addresses this by providing that the allocation of £1500 to the protected debt is undone, and then treats this amount as having been applied to the unprotected debt, leaving £500 to reduce the protected debt.

138. There are certain restructuring processes available to businesses: for companies and limited liability partnerships, company voluntary arrangements (CVAs), schemes of arrangement under Part 26 of the Companies Act 2006 and restructuring plans under Part 26A; and for individuals such as sole traders, individual voluntary arrangements (IVAs). If parties enter the arbitration system and an arbitrator is appointed, a CVA, IVA, restructuring plan or scheme of arrangement which covers all or part of the protected rent debt may not be initiated for a period. This includes in Scotland (for CVAs, restructuring plans or schemes of arrangement) or Northern Ireland (for restructuring plans or schemes of arrangement).

139. The relevant period runs from the day on which the arbitrator is appointed until whichever of the following is applicable:

a. if an award is made either giving relief from payment or stating that no relief is to be given, the day 12 months after the day on which the award is made;

b. the day an award is made dismissing a reference;

c. the day a decision is made to set aside an award on appeal; or

d. the day of abandonment or withdrawal of proceedings.

140. To allow a tenant to include protected rent debt in a CVA or other arrangement immediately after a concession has been considered by an arbitrator would be inconsistent with the aims specified in this Code; however, government recognises that the commercial market is unpredictable, and businesses may be affected by many factors during the months that follow arbitration. It is for this reason that tenants may enter an arrangement after 12 months (rather than the 24 months which may be awarded as a maximum time to pay under an arbitrator’s award).

141. If a party takes action precluded by the moratorium, then it would be for the forum in which such action is brought to decide that the measure is unavailable during the applicable period. Should a claim be brought for a remedy covered by the moratorium, on the basis that the claimant landlord considers the Act’s arbitration process to be inapplicable, the tenant may choose to make a reference to arbitration if they consider the Act does apply. The arbitration timetable may be paused or extended whilst the other claim is considered.

Annex A: Timelines

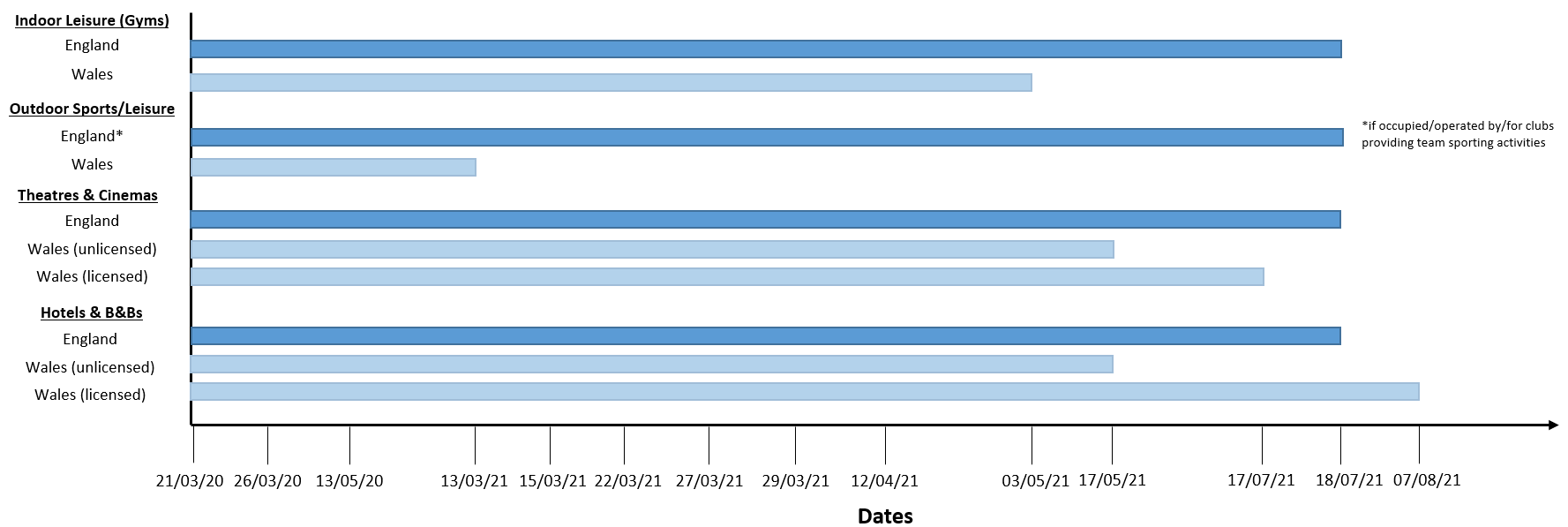

The protected period in the Act is the period from 21 March 2020, when the first requirements on businesses to close their premises or cease trading (in whole or in part, including with exceptions such as non-essential shops being allowed to open for collections) came into force under regulations made under section 45C of the Public Health (Control of Disease) Act 1984 to the date when specific restrictions (other than generally applicable restrictions such as displaying information about wearing face coverings) were last in place for the relevant sector.

For England the latest date is 18 July 2021 and for Wales 7 August 2021.

The below graph represents the protected period for differing sectors.

Please be aware that the graph is only a representation for illustrative purposes. The protected period should be considered on a business-by-business basis and tenants may not fit neatly into the sectors used for representation purposes in this annex.

Annex A: Illustration shows the start of the ‘protected period’ until the date that restrictions were generally lifted for that sector

Dates presented refer to the first date a sector was mandated to close (in full or in part), until the date relevant restrictions were lifted for that sector.

The below table sets out the dates when mandatory closures (in full or in part) were imposed during the period covered by the Act, alongside summaries of the sectors to which the requirements applied.

This table may help landlord and tenant to understand the periods a business was mandated to close or permitted to trade during the period covered by the Act. This table is not relevant for the scope of the Act; rather, it aims to help landlords and tenants understand periods during which businesses were mandated to open and close, to provide a better understanding of when tenants could be trading. Whilst landlords and tenants are expected to negotiate taking into account their particular respective circumstances, this information could assist with negotiations over unpaid rent.

For the purpose of the Act the protected period (relevant to each sector) remains as indicated in the graph above – although the circumstances of each business must be considered, as the graph is illustrative only.

| Date | Announcement/ Action | Region | Businesses affected |

|---|---|---|---|

| 21/03/20 and 26/03/20 | Mandated closure of businesses/premises with imposition of lockdown measures from 26/03 | England, Wales | Hospitality (pubs, bars, restaurants, cafes) for on-premises consumption; night-clubs; non-essential retailers; holiday accommodation, inc. Hotels and B&Bs; business including personal care, theatres, cinemas, gyms, leisure centres and outdoor sports facilities closed (some of these businesses were affected from 26/03, not 21/03) Note: All premises selling food or drink for consumption on the premises mandated to close. Retailers permitted to remain open included: food, supermarkets, hardware, homeware, convenience stores, off-licences, banks, post offices, laundrettes/dry cleaners, pharmacies, vets, pet shops, petrol stations, bicycle shops, taxi/vehicle hire, funeral directors, storage, building and agricultural suppliers, car parks |

| 21/04/20 | Some changes to businesses required to close | England | Outdoor swimming pools required to close; additional banking-related businesses, livestock auctions and markets excluded from closure requirements |

| 25/04/20 | Certain businesses, where allowed to open, required to take reasonable measures to ensure 2m distancing | Wales | Certain businesses required to open (including for limited purposes) |

| 11/05/20 | Minor amendments to restrictions | Wales | Garden centres and libraries reopen Subject to requirements to take reasonable measures to ensure 2m distancing |

| 13/05/20 | Limited relaxation of lockdown restrictions | England | Garden centres, outdoor sports courts allowed to reopen |

| 01/06/20 | Some changes to businesses required to close | England | Outdoor markets and showrooms removed from closure requirements; some closure requirements added, e.g. for social clubs, model villages, zoos |

| 15/06/20 | Restrictions further relaxed | England | Non-essential retail and certain outdoor attractions permitted to reopen |

| 22/06/20 | Some restrictions relaxed following review | Wales | Non-essential retail permitted to reopen Subject to requirements relating to physical distancing and customers having to stay local |

| 04/07/20 | Restrictions imposed on areas in and around Leicestershire; local restrictions for other areas followed | Parts of England | Similar to restrictions that had applied nationally from 26/03 (see above – less extensive in some other areas) |

| 04/07/20 | Restrictions further relaxed | England | Business including the following could open: hospitality (pubs, bars, restaurants, cafes); theme parks; cinemas; museums; hairdressers Businesses including gyms; live music venues; beauty salons and nightclubs remain closed |

| 06/07/20 | Clarification of requirement to close indoor visitor attractions (alongside some relaxation of rules for individuals) | Wales | Indoor visitor attractions required to close, outdoor visitor attractions allowed to open |

| 11/07/20 | Self-contained holiday accommodation allowed to reopen | Wales | Self-contained holiday accommodation |

| 11/07/20 | Further relaxing of restrictions | England | Outdoor swimming pools and water parks allowed to open |

| 13/07/20 | Further relaxing of restrictions | England | Businesses including beauty salons, tattoo and piercing, nail bars, tanning salons allowed to reopen |

| 13/07/20 | Phased reopening for hospitality and tourism | Wales | Bars, restaurants, and cafes with outdoor spaces; hairdressers; indoor visitor attractions (but not underground parts) allowed to reopen Subject to requirement to take protective measures |

| 20/07/20 | Further relaxing of restrictions | Wales | Funfairs, outdoor playgrounds and outdoor gyms allowed to reopen Subject to requirement to take protective measures |

| 25/07/20 | Further relaxing of restrictions | England | Indoor gyms, indoor pools, indoor fitness and dance studios allowed to reopen |

| 25/07/20 | Further relaxing of restrictions | Wales | Other tourist accommodation (including hotels) and underground visitor attractions allowed to reopen Subject to requirement to take protective measures |

| 27/07/20 | Further relaxing of restrictions | Wales | Businesses including beauty salons (personal care); indoor cinemas; museums allowed to reopen Subject to requirement to take protective measures |

| 03/08/20 | Further relaxing of restrictions | Wales | Indoor hospitality (bars, restaurants, cafes, pubs); bowling alleys; bingo halls; auction houses allowed to reopen Subject to requirement to take protective measures |

| 10/08/20 | Further relaxing of restrictions | Wales | Leisure centres; gyms; swimming pools; spas; indoor play areas; community centres allowed to reopen Subject to requirement to take protective measures |

| 15/08/20 | Further relaxing of restrictions | England | Casinos; bowling alleys; conference centres allowed to reopen |

| 28/08/20 | Further relaxing of restrictions | Wales | Casinos allowed to reopen Subject to requirement to take protective measures |

| 22/09/20 | Local coronavirus restrictions | Wales | Licensed businesses in Blaenau Gwent, Bridgend, Merthyr Tydfil, Newport and Caerphilly must close at 11pm - already applicable in Rhondda Cynon Taf Note: Hospitality affected. Restrictions on individuals also in place, and other areas were added for these purposes; however this table summarises restrictions on businesses |

| 24/09/20 | Restrictions on hospitality and licensed premises | England and Wales | Certain hospitality businesses to close at 10pm (in Wales, 10.20pm but no service after 10pm); if licensed, table service only Note: From 26/09, the same rules applied to “bring your own alcohol” premises in Wales |

| 03/10/20 | Further relaxing of restrictions | Wales | Skating rinks allowed to reopen (Subject to requirement to take protective measures) |

| 14/10/20 | Three-tiered lockdown system of alert levels introduced | England | Note that the areas within each tier changed over time, initial areas shown here. Tier 3 – Areas of/around Liverpool. Tier 2 – Areas of Cheshire, Derbyshire, Lancashire, West & South Yorkshire, Durham, Northumberland, Tyne & Wear, Tees Valley, West Midlands, Leicestershire, Nottinghamshire, Greater Manchester. Tier 1 – Rest of England Tier 1 - medium alert (rule of six, limited business closures, and 10pm-5am curfew and requirement for being seated/table service for hospitality sector) Tier 2 - high alert (no socialising outside household or bubble indoors, limited business closures, rule of six outside; 10pm-5am curfew and requirement for being seated/table service for hospitality sector) Tier 3 - very high alert (no indoor socialising; rule of six; some business closures; pubs can stay open if offering meals, plus curfew and seating/table service requirements; no overnight stays elsewhere; no travel outside your area) |

| 23/10/20 | 17-day ‘circuit break’ lockdown imposed | Wales | Hospitality; non-essential retail; holiday accommodation; businesses including nightclubs, personal care, cinemas, gyms, leisure centres closed Some limited exceptions, e.g. takeaways. Premises which could open were not allowed to sell alcohol 10pm-6am; and any open/accessible premises had to take protective measures |