The CMA's Digital Markets Strategy: February 2021 refresh

Updated 9 February 2021

1. Introduction

In 2019 the CMA published our first Digital Markets Strategy This recognised the profound changes taking place across the economy, and society more widely, as a result of the growth of digital markets. It set out the CMA’s priorities for its digital work to address these changes and ensure consumers continue to get good outcomes in those markets through competition and innovation.

Since that strategy was published much has changed. At the CMA we have completed many of the priority tasks we set ourselves. There have also been significant developments in the political and regulatory landscape for digital markets, both domestically and internationally, including notably the Government’s decision to establish a Digital Markets Unit (DMU) within the CMA. In light of these changes, we have taken this opportunity to refresh our strategy. This document sets out our aims and key priorities across our digital markets work as we work to establish the DMU.

Over the past eighteen months since our Digital Markets Strategy was published, the CMA has undertaken a significant amount of work.[footnote 1] In particular, we have:

- published the final report of our market study into online platforms and digital advertising, assessing the effectiveness of competition in the digital advertising market, including the role of advertising revenue in driving the business models of Google and Facebook, and making recommendations for a new regulatory framework

- published the advice of the Digital Markets Taskforce, putting forward proposals to Government on the design and implementation of a pro-competition regime for digital markets

- with Ofcom and the Information Commissioner’s Office (ICO) established the Digital Regulation Co-operation Forum (DRCF) to support cooperation and coordination on online regulatory matters, and enable coherent, informed and responsive regulation of the UK digital economy

- consulted on our revised Merger Assessment Guidelines (MAGs), to ensure that the way in which digital technologies have affected how goods and services are delivered to customers, and how businesses compete with each other, is properly reflected in assessing whether a merger could harm consumers

- continued to prioritise consumer enforcement work focused on increasing consumer trust in online markets, including projects on online reviews and disclosure of social media endorsements

- launched an antitrust case into Google’s proposed changes to its support for third party cookies in its Chrome browser and Chromium browser engine (the ‘Privacy Sandbox’)

- continued to use our merger assessment tools in sectors such as digital advertising services, business intelligence tools and restaurant and grocery delivery platforms;

- increased our data and behavioural science capabilities through the work of our DaTA unit, including launching an ‘Analysing Algorithms Programme’

- enhanced our international collaboration and hosted a major conference in March 2020 – ‘Understanding Digital Markets: Innovation, Investment and Competition’.

There have also been significant developments in the political and regulatory landscape for digital markets. In the March 2020 Budget, the Government accepted the strategic recommendations of the Furman Review and commissioned the Digital Markets Taskforce. In November 2020, the Government published its response to our online platforms and digital advertising market study and announced that it would set up a DMU to oversee a pro-competition regime for digital platforms. It announced that it would establish and resource the DMU from April 2021, housed in the CMA, to begin work to operationalise the key elements of the regime. The Government has also announced plans for an Online Safety Bill to put new responsibilities on online companies towards their users, with Ofcom to be responsible for implementing and overseeing the new framework.

Internationally, the consensus on the need for action to address the challenges posed by digital markets has grown stronger. Work to address these challenges is now underway around the world. In particular, the European Commission published its Digital Markets Act proposals in December 2020 which include ex ante rules covering large online platforms acting as gatekeepers. In addition, Germany has amended its competition act to enable it to better address the conduct of large digital companies. There have been regulatory proposals and developments in both Australia and Japan. And in the US, the House Judiciary Antitrust Subcommittee made a range of recommendations to restore competition in digital markets, and there has been a recent increase in antitrust enforcement activity.

In light of these developments, we have updated our Digital Markets Strategy, setting out a revised set of priorities across our digital work in light of this new context.

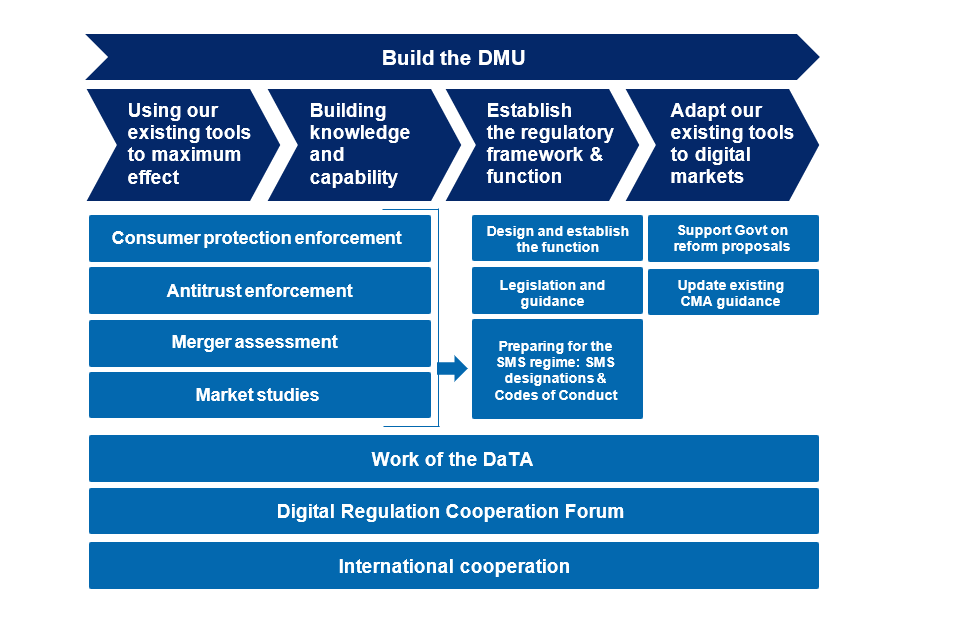

Whilst these build on the priorities set out in our 2019 Strategy, our overarching ambition - to build towards a proactive new pro-competition regulator for digital markets in the shape of the DMU – is altogether different and marks a step-up across our digital work as we build towards establishing this new function within the CMA.

2. Our strategic aims

The overarching ambition across our work in digital markets is now to support the establishment of the DMU within the CMA. In establishing the DMU we hope to deliver a step-change in the regulation and oversight of competition in digital markets and in turn drive dynamic innovation. Our ambition is to establish the DMU as a centre of expertise for digital markets, with the capability to understand the business models of digital firms, including the role of data and the incentives driving how these firms operate. Subject to final decisions by the Government, the DMU will oversee and enforce the new pro-competition regime for digital firms with Strategic Market Status (SMS). We have also recommended it should perform a monitoring role in relation to competition in digital markets more widely. The presence of a proactive regulator will prevent harm from occurring as well as enable swift action to be taken when problems do occur, better protecting consumers, and businesses who rely on digital firms as well as innovative competitors.

We will set-up the DMU within the CMA from April 2021 and will focus our work on establishing and operationalising the new function and regime. Any new powers for the DMU will be subject to legislation and Government has committed to introduce legislation as soon as parliamentary time allows. Therefore, in the interim, pending new powers, our work to establish the DMU will be focused around the four strategic aims set out below. In pursuing these we will work closely with Government, other regulators including Ofcom, the ICO and the Financial Conduct Authority (FCA) and the wide range of stakeholders who have an interest and expertise in these areas.

A. Using our existing tools to maximum effect

We will continue to use our existing tools effectively and efficiently to address problems in digital markets. This includes through antitrust and consumer protection law enforcement action, markets work, and merger assessment. The CMA’s operation of these tools will continue to play an important role in our digital markets work even once the DMU is established. Whilst enabling us to deliver outcomes for consumers and businesses, this work will also enable us to deepen our knowledge of digital markets and support us in considering where to prioritise focussing our new regulatory powers once they come into effect.

B. Building knowledge and capability

We will step up our work to build knowledge and skills to ensure we understand digital business models, and their opportunities and risks. This is an area the CMA has invested heavily in over the past few years, in particular through the work of our Data Technology and Analytics (DaTA) unit. Its work will take on an even more important role in supporting our preparedness to take on ex-ante regulatory functions, assisting us in developing a foundation of knowledge across all digital markets and technologies.

C. Establishing the regulatory framework and function

We will undertake work to establish the DMU within the CMA, including work on SMS designation and the development of codes of conduct. We will continue to support the Government in developing the regulatory framework for digital markets – including ensuring it is coherent with other regimes domestically, and with proposed digital regimes internationally.

D. Adapting our existing tools

Our existing tools will continue to play an important role in addressing problems in digital markets in the future, working alongside the new pro-competition regulatory regime. It therefore remains vital that these tools are adapted to meet the challenges of the digital economy. We will continue to work with Government to pursue reform of these tools as well as updating and developing our own guidance on how we deploy these tools to address problems in digital markets.

These strategic aims are supported by seven priority areas of work which are discussed further below.

3. Priority areas of focus

Priority 1: Establishing the pro-competition regulatory framework and function

Strategic aim: C

The Government announcement that it will fund a DMU to be housed in the CMA from April 2021 is a significant development and, as indicated by our overarching digital priority, is a major driver across our work. We will establish the DMU, building on the CMA’s existing wealth of experience in digital markets. In undertaking this work we will work closely with Government as well as with other regulators, in particular Ofcom, the ICO and FCA. This will encompass a range of activity including:

Designing and establishing the function

We will work closely with Government to consider and operationalise the organisational design for the DMU, including its funding, governance and decision-making structures, and how it will interact with existing CMA functions. Alongside this we will work to ensure its operational preparedness including staffing, skills, capability and, for instance, any specialist IT support needed.

Legislation and guidance

Following our advice to Government on the design and implementation of a new pro-competition regulatory regime for digital markets, we will continue to support Government as it considers this advice and in its work to develop the legislative framework. The Government has committed to consulting on proposals for the new pro-competition regime in 2021 and to legislating when parliamentary time allows.

Once there is more clarity on the proposed legislative framework for the new regime, we will also begin work to develop guidance on how the DMU will exercise its powers. In the advice of the Digital Markets Taskforce we set out several areas where there would be a need for guidance to provide further clarity on how the DMU would exercise its powers – for example procedural guidance on the DMU’s approach to code breach investigations and penalties. We will publish drafts of any such guidance for consultation, such that we are in a position to finalise it by the time the legislative framework comes into effect. This should help to provide stakeholders with greater clarity on how the DMU will operate the new pro-competition regulatory regime.

Preparing for the SMS regime

We will use work under our existing powers, where possible, to inform the evidence base with which to assess which firms should be designated with SMS and in relation to which activities, and to develop corresponding codes of conduct. Subject to our understanding of the proposed legislative tests for SMS designation and the purpose of the codes, we will do as much as we can with the evidence we gather to prepare for the new regime.

Priority 2: Using our existing tools

Strategic aim: A

We will continue to use our existing powers to the fullest extent possible in digital markets. Although we have expressed our desire for reforms to make our existing powers more effective, and, in addition, have set out proposals for new tools in the form of pro-competition digital regulation, it is important we continue to use our existing powers to the maximum extent. This includes using our consumer protection law enforcement powers to tackle fake online reviews and unfair roll-over contracts in subscriptions for online gaming and anti-virus software, assessing the impact of mergers in digital markets, using competition law to tackle potentially anti-competitive activity in digital markets, and using our markets powers, including the ability to make a Market Investigation Reference. We expect to be an increasingly active enforcer in relation to digital markets, in part due to the fact that we are now taking on digital enforcement cases and mergers which would previously have fallen under the jurisdiction of the European Commission. We continue to work closely with our international partners in this regard.

Priority 3: The work of the Data Technology and Analytics (DaTA) unit

Our DaTA unit is now fully operational and plays a crucial part across our digital work. The unit provides analytical and data management expertise to help the CMA deliver digital cases more efficiently and effectively. It also uses the latest in data engineering, machine learning and artificial intelligence techniques to help us understand how firms are using data, what their algorithms are doing, the consequences of these algorithms and, ultimately, what actions authorities need to take.[footnote 2] The team has also expanded to include behavioural scientists, to help us better understand the impact on consumer behaviour of some of the practices of digital firms, and Data and Technology Insight specialists to help us better understand digital technologies and how firms and businesses are using them.

The DaTA unit will continue to support our work, undertaking research and policy work alongside supporting on specific cases. Through this work they will also support us in understanding the data and analytical skills, and powers, that will be needed for the DMU.

Priority 4: Digital Regulation Cooperation Forum

Digital is not merely a sector of the economy – it transcends boundaries, and underpins almost all forms of economic activity. The activities of firms may be captured by different regulatory regimes, including the proposed new pro-competition framework for digital, the data protection and eprivacy regulation, and the new online harms regime. We will continue to work closely with Ofcom and the ICO through the Digital Regulation Cooperation Forum (DRCF) on digital work of mutual importance, as well as with other regulators with relevant responsibilities in relation to digital markets.[footnote 3] Such close cooperation is vital to delivering effective, efficient, coherent regulation across digital markets, for the benefit of both industry and consumers. The DRCF will shortly publish an ambitious workplan intended to deliver a step-change in cooperation across our work on digital markets. In particular the DRCF will work together on projects of common interest, such as algorithms, will continue to work with Government on what, if any, further measures may be needed to ensure regulatory coherence, and will consider mechanisms for working more effectively and efficiently together, including sharing and developing skills and expertise in relation to digital markets.

Priority 5: International cooperation

Many digital firms are active across international boundaries and regulators face many common challenges. It is therefore imperative that we work together, both to understand the issues and in devising solutions. We will continue to forge close relationships with other competition and consumer authorities in relation to their digital work. In particular, we will pursue work with the aim of better co-ordinating our actions and driving a coherent regulatory landscape internationally. This includes by working closely with international partners including through the Multilateral Mutual Assistance and Cooperation Framework,[footnote 4] as well as through the Organisation for Economic Cooperation and Development (OECD), International Competition Network (ICN) and the International Consumer Protection and Enforcement Network (ICPEN), and by pursuing work through the UK’s Presidency of the G7 in 2021. Strengthening our relationships with international partners will form a strong foundation for the DMU to build on.

Priority 6: Support Government on reform proposals of existing tools

Strategic aim: D

Our reform proposals [footnote 5] set out a number of reforms to the CMA’s existing competition, consumer, markets and mergers tools which will continue to be relevant to our work in digital markets. We supplemented these in the Taskforce advice with further reforms specific to digital markets. This included proposals to strengthen the markets tool, to establish a distinct merger control regime for firms with Strategic Market Status, to address online content which is economically harmful, to support informed consumer decision-making, and to strengthen enforcement of the Platform to Business Regulation.[footnote 6] We will continue to work with Government on these reforms, as well as to consider whether further reform is necessary to ensure our tools remain relevant as digital markets evolve.

Priority 7: Update existing CMA guidance

Strategic aim: D

We will continue to keep our guidance on how we operate our existing tools under regular review to ensure it best reflects our current operating environment and approach. We have recently consulted on the Merger Assessment Guidelines and will publish the revised guidance soon, taking into account the responses received.

4. Appendix: Examples of recent CMA digital markets work

Research and policy work:

(a) The advice of the Digital Markets Taskforce, led by the CMA, to provide advice to Government on the design and implementation of pro-competition measures in digital markets, as put forward in the Furman Review.

(b) Establishment and work of the DRCF.

(c) Research on algorithms showing how they can reduce competition in digital markets and harm consumers if they are misused.

(d) Our work to update the Merger Assessment Guidelines (MAGs), with consultation launched in November 2020.

Markets:

(a) The publication of the final report of the CMA’s market study into online platforms and digital advertising.

Enforcement of competition and consumer protection law enforcement:

(a) Launch of the Google Privacy Sandbox/Third Party Cookies Competition Act investigation.

(b) Price comparison websites and ‘most favoured nation’ clauses – We found that ComparetheMarket infringed competition law by using wide ‘most favoured nation’ clauses in contracts with some home insurance providers, and issued a fine of £17.9 million.

(c) Online reviews – This tackles the posting and trading of fake and misleading online reviews across many digital platforms.

(d) Social media endorsements – This tackles the lack of disclosure of incentivised endorsements on social media platforms.

(e) App store data collection and privacy – This work through ICPEN secures disclosure around the data collection and privacy terms of apps.

Mergers:[footnote 7]

(a) viagogo/StubHub (2021) – a transaction involving the supply of online secondary ticketing.

(b) Amazon/Deliveroo (2020) – a transaction involving online platforms that offer restaurant and grocery delivery services.

(c) Taboola/Outbrain (2020) - proposed acquisition (subsequently abandoned) involving the supply of digital advertising services (including content recommendation).

(d) Sabre/Farelogix (2020) – a transaction involving the supply of several software solutions which help airlines to sell flights via travel agents.

(e) Visa/Plaid (2020) – a transaction involving the supply of technology platforms that enable digital applications to connect with bank accounts.

(f) Google/Looker (2020) – a transaction involving the supply of business intelligence tools.

(g) Salesforce/Tableau (2019) – a transaction involving the supply of business intelligence tools.

-

A fuller list of our recent and current activities related to digital is in the Appendix. ↩

-

CMA’s Data, Technology and Analytics (DaTA) Unit Paper: Algorithms: How they can reduce competition and harm consumers (2021). ↩

-

The DRCF aims to support cooperation and coordination between the Competition and Markets Authority (CMA), the Information Commissioner’s Office (ICO) and Ofcom on online regulatory matters, and enable coherent, informed and responsive regulation of the UK digital economy which serves citizens and consumers and enhances the global impact and position of the UK. ↩

-

This comprises Australia, Canada, New Zealand and the United States. Press release: CMA to increase competition cooperation with international partners ↩

-

In February 2019, the CMA published a letter to the Secretary of State for Business Energy and Industrial Strategy, setting out proposals for a series of reforms to the CMA’s competition, consumer protection, markets and mergers tools. ↩

-

The EU platform-to-business relations (P2B regulation), which entered into force in July 2019, contains a set of rules intended to create a fair, transparent and predictable business environment for smaller businesses and traders on online platforms. ↩

-

Many of our recent merger assessments involve digital markets and this list is merely illustrative. A full list of our merger cases is available on our website, with links to specific case pages for more detailed information. ↩