Agreement holder's guide: Higher Tier for agreements starting on 1 January 2023

Published 29 June 2023

Applies to England

5 Scheme requirements and procedures

You must read and meet the requirements detailed in this section as these are mandatory for all Higher Tier Agreement Holders.

5.1 Entering into an agreement

If your application is successful, we will send you an agreement offer, by post (if you applied with an application pack) or using the Rural Payments portal (if you applied online). If you want to accept the agreement, return the signed acceptance declaration to us within 20 working days of the date on the letter.

All Higher Tier agreements start on 1 January 2023. For capital items you should not undertake work or incur costs for capital items before you have accepted your agreement offer, even if these form part of your agreement. The agreement must not include any work that has already been carried out or any financial commitment already made before 1 January 2023. If it does, the agreement may be terminated.

If you are successful in securing a place in one of the environmental land management schemes, you can terminate your Countryside Stewardship agreement early without penalty, at the end of an agreement year, so you can participate in the new environmental land management schemes.

5.1.1 Entering – and ending – an agreement: Option delivery and relationship to the cropping cycle

Any options that must be established and present in place in the spring/summer of year 1 (such as AB5 Nesting plots for lapwing (and in Higher Tier, stone curlew) and AB9 Winter bird food) must be established/in place during the management period to be eligible for payment. You do not need to destroy crops which are in the ground at the start of an agreement (1 January 2023) to establish a chosen option, you can manage and harvest them as normal farm crops.

However, some options may have restrictions on their management from 1 January 2023. For example, where the option requires that you do not use any fertiliser, pesticide sprays or other inputs. This will be detailed in your agreement.

Agreement options may involve work that can only take place at certain times of the year or under certain conditions, for example fencing to permit grazing, or creating beetle banks. In these cases, you must complete the work and meet any option requirements, during the first 12 months of the agreement.

Some options such as basic overwintered stubble (AB2 Basic overwinter stubble) require the stubble to be kept until 15 February in the year after it was established. However, it only needs to be retained until 31 December in the last year of the agreement.

5.2 General scheme requirements

Agreement Holder’ means the person (whether an individual, a company or other entity) who has entered into the Countryside Stewardship agreement as identified in the Agreement Document – read clause 1 of the Annex 1 Terms and Conditions.

You must deliver your capital item(s) and/or the Multi-Year Option(s) in accordance with the standards and requirements set out in your Agreement Document and this Manual (including any relevant time limits) and in the agreed location(s) as identified on the Agreement Map(s).

‘Agreement Land’ is the land parcels defined in the Agreement Document and identified on the Agreement Map(s), and any land parcels where rotational options are active in a particular year, as defined in clause 1 of the Annex 1 Terms and Conditions.

You, as the Agreement Holder, must follow all the general management requirements as set out below, on the Agreement Land throughout the period of the agreement unless:

-

specifically stated otherwise in another section of this manual

-

specifically permitted in the requirements of the option or capital item specification as part of the Countryside Stewardship Agreement Document, or

-

specifically required for organic management.

5.2.1 General management requirements

You must not:

-

allow Agreement Land to be levelled, infilled, or used for the storage or dumping of materials

-

light fires (including burning brash or cuttings) on the Agreement Land

-

allow field operations or stocking to cause any ground disturbance, wheel rutting, poaching or compaction on Agreement Land.

You can use Agreement Land to store muck heaps temporarily if you can continue to meet all the requirements in your agreement that apply to the area concerned.

5.2.2 Protecting historic features

These requirements apply to any features marked on the FER map and HEFER and also for any additional features of which we later write to tell you about.

You must not do any of the following:

-

cause ground disturbance, including poaching by livestock, on known archaeological features or areas of historic interest under grassland unless the ground disturbance is part of a programme of works intended to protect the historic or archaeological feature

-

sub-soil or de-stone on areas containing known archaeological features, unless these operations have been carried out as part of a routine in the past 5 years. You must have SM consent from the Secretary of State for the Department for Culture Media and Sport, as advised by Historic England to carry out sub-soiling on SMs

-

deliberately plough more deeply or undertake additional ground works or drainage on those areas already under cultivation that contain known archaeological features

-

allow free-range pigs on archaeological features

-

remove any useable building stone, walling stone or traditional roofing material (excluding materials produced from established quarries) from known archaeological features or areas of historic interest on the Agreement Land

-

damage, demolish or remove building material from substantially complete ruined traditional farm buildings, historic boundaries or from boundaries of parcels containing known archaeological features or areas of historic interest.

5.2.3 Hedgerows

In any one calendar year, you must not cut more than 50% of all hedges on or bordering Agreement Land. This includes all parcels under agreement, including land parcels which have been selected for rotational options but where rotational options are not sited during that year.

There is an exception for public safety, allowing road and trackside hedgerows to be cut annually or more frequently.

You must mark all hedges on or bordering Agreement Land on the FER map. You can find detailed guidance on the relevant hedges, and how to mark them on the FER map, with your application pack.

5.2.4 Grazing management

The following table lists Higher Tier multi-year options which limit grazing activity.

| Option code | Grazing management |

|---|---|

| AB1 | Nectar flower mix |

| AB6 | Enhanced overwinter stubble |

| AB7 | Whole crop cereals |

| BE4 | Management of traditional orchards |

| BE5 | Creation of traditional orchards |

| CT1 | Management of coastal sand dunes and vegetated shingle |

| CT2 | Creation of coastal sand dunes and vegetated shingle on arable land and improved grassland |

| CT3 | Management of coastal saltmarsh |

| CT4 | Creation of inter-tidal and saline habitat on arable land Woodland Management Plans where needed for woodland only applications, must be fully approved with any associated felling licence in place by this date |

| CT5 | Creation of inter-tidal and saline habitat by non-intervention |

| CT6 | Coastal vegetation management supplement |

| CT7 | Creation of inter-tidal and saline habitat on intensive grassland |

| GS1 | Take field corners out of management |

| GS3 | Ryegrass seed-set as winter food for birds |

| GS4 | Legume and herb-rich swards |

| GS6 | Management of species-rich grassland |

| GS7 | Restoration towards species-rich grassland |

| GS8 | Creation of species-rich grassland |

| GS9 | Management of wet grassland for breeding waders |

| GS10 | Management of wet grassland for wintering waders and wildfowl |

| GS11 | Creation of wet grassland for breeding waders |

| GS12 | Creation of wet grassland for wintering waders and wildfowl |

| GS13 | Management of grassland for target features |

| GS14 | Creation of grassland for target features |

| GS15 | Haymaking supplement |

| GS17 | Lenient grazing supplement |

| HS7 | Management of historic water meadows through traditional irrigation |

| LH1 | Management of lowland heathland |

| LH2 | Restoration of forestry and woodland to lowland heathland |

| LH3 | Creation of heathland from arable or improved grassland |

| OP1 | Overwintered stubble |

| SP1 | Difficult sites supplement |

| SP6 | Cattle grazing supplement |

| SP7 | Introduction of cattle grazing on the Isles of Scilly |

| SP8 | Native breeds at risk supplement |

| SW3 | In-field grass strips |

| SW4 | 12m to 24m watercourse or nitrogen sensitive terrestrial habitat buffer strip on cultivated land |

| SW7 | Arable reversion to grassland with low fertiliser input |

| SW8 | Management of intensive grassland adjacent to a watercourse |

| SW9 | Seasonal livestock removal on intensive grassland |

| SW10 | Seasonal livestock removal on grassland in Severely Disadvantaged Areas on land next to streams, rivers and lakes |

| SW12 | Making space for water |

| SW13 | Very low nitrogen inputs to ground waters |

| UP1 | Enclosed rough grazing |

| UP2 | Management of rough grazing for birds |

| UP3 | Management of moorland |

| UP6 | Upland livestock exclusion supplement |

| WD4 | Management of wood pasture and parkland |

| WD5 | Restoration of wood pasture and parkland |

| WD6 | Creation of wood pasture |

| WD7 | Management of successional areas and scrub |

| WD8 | Creation of successional areas and scrub |

| WD9 | Livestock exclusion supplement - scrub and successional areas |

| WT7 | Creation of reedbed |

| WT9 | Creation of fen |

| WT12 | Wetland grazing supplement |

If the agreement contains one or more of these options you must meet the following requirements.

-

Avoid over-grazing and under-grazing across the whole grazed area of the holding. Distribute stock across the grazed area of the holding to make sure this is the case.

-

Stock no more than the rates given in your Agreement Document on average over the year across all agricultural land on the farm or production unit where the agreement is located.

Under-grazing is where annual growth is not fully used, or where scrub or coarse vegetation is becoming evident, and this is damaging the environment of the site.

Over-grazing is where land is grazed by so many livestock that the growth, quality or diversity of vegetation is adversely affected, and this is detrimental to the environmental interests of the site.

Read Annex 8 for more information about record keeping, how to convert livestock numbers to livestock units and what to do when you take over additional land.

5.2.5 Nitrate Vulnerable Zones

If your Agreement Land is in a Nitrate Vulnerable Zone (NVZ), you must meet the requirements of both the relevant NVZ Action Programme and Countryside Stewardship. Where the rules overlap, you must meet those that are the strictest.

5.2.6 Farming Rules for Water

You must meet the requirements of the Farming Rules for Water on GOV.UK.

5.2.7 Maintaining capital items

You must maintain capital items funded under Countryside Stewardship on Agreement Land, in the condition and to the specification for which they were granted aid, for a set period of time.

For capital works which form part of a multi-year agreement this requirement lasts for the whole time that the land parcel where the capital item is located, is under agreement.

We may recover payments if you do not meet these requirements, or if your Agreement Land that the capital item is located on is taken out of the scheme before the end of the agreement.

5.2.8 Heather and grass burning

Where you have the legal right to carry out burning, and intend to do so, you must comply with all relevant legislation, which includes the Heather and Grass etc. Burning (England) Regulations 2007 and the Heather and Grass etc. Burning (England) Regulations 2021. You can find details of the requirements and information on when to apply for a licence at Heather and grass burning: rules and applying for a licence on GOV.UK.

You must also follow the Heather and Grass Burning Code (as may be amended).

If heather or grass burning is included in your Countryside Stewardship application, your Natural England adviser will discuss a restoration plan with you.

5.3 Cross Compliance: requirements

These requirements are updated annually and apply to that calendar year, regardless of when a Countryside Stewardship agreement started.

Cross compliance is a set of rules which applies to all farmers and land managers receiving payments from the Basic Payment Scheme, Countryside Stewardship Mid Tier and Higher Tier, Environmental Stewardship and other land based multi-annual schemes such as the England Woodland Grant Scheme.

If you have woodland parcels included in your agreement, cross compliance only applies to the woodland that you receive revenue payments for. It is only the Statutory Management Requirements (SMRs) that apply not the Good Agricultural and Environmental Conditions (GAECs) in most cases. GAECs only apply as well as SMRs if you are paid for WD1 and BPS.

Cross compliance requires you, as an Agreement Holder, to:

-

maintain your land in GAEC by meeting a range of standards that relate to water, the protection of soil and carbon stock, and landscape features, and

-

meet a range of SMRs relating to the environment, public and plant health, animal health and welfare, and livestock identification and tracing.

You must meet the cross compliance requirements across your whole holding for the whole calendar year, whether or not it is Agreement Land. For cross compliance purposes, a holding is all the production units and areas managed by you, as the Agreement Holder, situated within the UK. This includes land which is:

-

used for agricultural activities

-

used for forestry

-

other non-agricultural land (for example salt marsh) for which Rural Development payments for the schemes listed above are claimed, and

-

land declared for BPS (whether BPS is claimed on that land or not).

This is only a summary of the cross compliance requirements. You can find full details about the requirements that you must follow, in the latest version of The Guide to Cross Compliance in England on GOV.UK. We will publish any changes to the requirements and any replacement for cross compliance on GOV.UK.

5.4 Evidence: Record keeping and site visit requirements

You must obtain and keep evidence to show you have carried out all the requirements of your agreement to support your claim or to support a site visit.

You must keep evidence to show that:

-

you are eligible to apply for the scheme

-

capital works have been carried out to the required specification.

During Higher Tier site visits, we will assess how the environmental aims are delivered under the options you have in your agreement. We will also check that you have carried out any specific requirements set out in your agreement.

You must follow any requirements for management options and adhere to any specifications for capital items and retain any records that are required to support your claim. You can find more details of the steps you need to take to meet management options, capital items or supplements by using ‘Countryside Stewardship grants’ (known as the ‘grant finder’) on GOV.UK

Keeping appropriate records is an important part of an effective farm or woodland management system. Records will help demonstrate that you have carried out the activities in your agreement and that the funded activity is taking or has taken place. It also helps demonstrate that public money is being spent effectively and is delivering the intended results.

5.4.1 When is evidence required?

You must keep any required evidence and supporting documents and have them available on request.

You can find a list of evidence requirements for individual options and capital items at ‘Countryside Stewardship grants’ (known as the ‘grant finder’) on GOV.UK.

These records should demonstrate that you have done the required work. If you cannot provide evidence when asked, or the evidence you do provide is inaccurate or incomplete, we will treat this as a breach of your agreement and may apply reductions (read Section 6.4).

1. Evidence to support your application

You must keep evidence to show that you, your business, your land, multi-year management options or capital items are eligible as you may have to show this if you are chosen for a site visit.

2. During the agreement period

You may need to provide evidence to show that you have carried out the required actions. Evidence may be needed:

-

a) to support a claim, in particular capital item claims. More information is set out in Section 5.4.4, and where relevant further information will be sent with the claim form covering letter

-

b) during or after an environmental outcome site visit, for our administrative checks or other checks as described in Section 6.5.

3. After the agreement has ended

The Terms and Conditions explain that you must keep all invoices, receipts, accounts and other relevant documentation relating to the expenditure of the grant for at least 7 years from the end of the agreement.

5.4.2 Consents and permissions

It is your responsibility to obtain all consents, approvals or permissions that you may need due to your specific circumstances and to carry out the particular multi-year option or capital item (Section 4.11). These consents and permissions must remain effective – and records kept – for the duration of the agreement.

5.4.3 Organic certification

You must meet the organic standards on all your organic land for the entire duration of the organic option(s) in the agreement and keep records as evidence of organic farming practices.

This is an eligibility requirement and failure to comply could result in a breach of your agreement. This means a reduction may be applied or, in certain cases, this could lead to your agreement being suspended or terminated – read Section 6.4 for further details.

Record keeping requirements differ depending on whether land is certified as ‘organic’ or ‘in-conversion’. The organic schedule and certificate supplied by the Defra-approved Organic Certification Bodies (OCB) are legal proof of registration and provide verifiable evidence of the land status as ‘in-conversion’, or ‘fully organic’.

The evidence you need for organic support under Countryside Stewardship is listed below. The evidence must cover all land and enterprises entered for ongoing support under Countryside Stewardship organic options.

Fully organic

You must keep the following and have them available on request if we ask to see them:

-

a valid organic certificate and schedule issued by a Defra approved OCB

-

annual OCB inspection reports

-

evidence of continued OCB registration.

Organic Conversion payments

You must keep the following and have them available on request if we ask to see them:

-

your Conversion Plan approved by the OCB

-

a valid organic certificate and schedule.

New conversion

If you have not yet had an initial site visit and completed an OCB-approved conversion plan for the land in question (due to timing of conversion), you must have the following documents available on request if we ask to see them:

-

a fully completed Organic Viability Plan available on GOV.UK

-

a completed conversion plan approved by the OCB as well as a valid organic certificate and schedule.

5.4.4 Photographic evidence

For some multi-year management options and capital items you need to keep dated photographic evidence to support a claim or as part of the record-keeping requirements for an agreement. You must have this evidence available on request as we may ask to see it. You can use photographs with an automatic date stamp or write the date the photograph was taken on the reverse.

The need for dated photographic evidence depends on the multi-year option or capital item. Check the individual option or capital item requirements using ‘Countryside Stewardship grants’ (known as the ‘grant finder’) on GOV.UK. to see if this is the case.

For photographic evidence the following general principles apply.

Application stage

For some multi-year options and capital items, you need to take dated photographs and keep them to show where work or management will be undertaken on a particular feature or site.

Check the individual option or capital item requirements using ‘Countryside Stewardship grants’ (known as the ‘grant finder’) on GOV.UK. to see if this is the case.

During work stage

For the capital works listed below, you will need to keep and submit contracts, invoices, or other documents confirming that the technical specification for the completed works have been met.

If you are unable to provide this, you will need to keep and submit dated photographs of the site during the different stages of the construction or build to show that the minimum specification has been met.

If you have capital works that cannot be visually checked after the work has been completed, such as concreting or underground pipework, you will need to take photographs during construction.

| Code | Capital Item |

|---|---|

| LV3 | Hard bases for livestock drinkers |

| LV4 | Hard bases for livestock feeders |

| LV5 | Pasture pumps and associated pipework |

| LV6 | Ram pumps and associated pipework |

| LV8 | Pipework associated with livestock troughs |

| RP3 | Watercourse crossings |

| RP4 | Livestock and machinery hardcore tracks |

| RP6 | Installation of piped culverts in ditches |

| RP7 | Sediment ponds and traps |

| RP8 | Constructed wetlands for the treatment of pollution |

| RP9 | Earth banks and soil bunds |

| RP12 | Check dams |

| RP13 | Yard - underground drainage pipework |

| RP14 | Yard inspection pit |

| RP15 | Concrete yard renewal |

| RP24 | Lined biobed plus pesticide loading and washdown area |

| RP25 | Lined biobed with existing washdown area |

| RP26 | Biofilter |

| RP27 | Sprayer or applicator load and washdown area |

| WN3 | Ditch, dyke and rhine restoration |

| WN5 | Pond management (100 square metres or less) |

| WN6 | Pond management (more than 100 square metres) |

| WN8 | Timber sluice |

| WN10 | Construction of water penning structures |

Claim stage

For capital items, you may be required to submit dated photographs with your payment claim if you are unable to submit contracts, invoices or other documents that confirm the technical specification for the completed works.

Follow individual capital item guidance. It is your responsibility to retain sufficient evidence to show that the investment or required management has taken place.

5.4.5 Photographic evidence quality

All photographs must meet the following standards. Requirements apply equally to digital photographs or those supplied as paper photographs. We cannot accept data storage devices for security reasons, digital photos must be sent to us by email.

-

Quality – photographs must be in focus and clearly show the relevant option, capital item or environmental feature. If you send your images by email, send them as JPEG files attached to the email. Digital images should not be smaller than 600 x 400 pixels and ideally the image file size no larger than 400KB. Printed photographs must be no smaller than 15cm x 10cm. Photographs can be in either portrait or landscape.

-

Photograph to identify the environmental feature, land management option or capital item(s) concerned – it is your responsibility to have sufficient evidence that the investment or required management has taken place. For example, more than one photograph may be needed where the option, feature or capital item exceeds the frame or is not clearly evident from a single photograph.

-

Where possible include a significant feature to provide authenticity, for example, ditch, fence, farm building, road, telegraph pole.

-

Where possible mark the photographed feature location, and direction from which the photograph has been taken, with an ‘X’ and an arrow on a copy of a map (or map extract) of the agreement area.

-

Where scale or continuity is important include a feature, or introduce one. For example a quad bike or vehicle, or use a sighting pole (2m high with 50cm intervals marked in red and white) and take pictures consistently from the same spot for before and after photographs of the capital item or option.

5.4.6 Clearly label photographs

Use the Ordnance Survey (OS) map sheet reference and National Grid reference for the land parcel, followed by the relevant proposed or implemented option or capital item code and, if more than one image is required, the image number.

The OS map sheet reference and National Grid reference should relate to the land parcel on which the feature, multi-year management option or capital item is sited or for boundary features the adjacent land parcel. For example, if you need to take ‘before and after’ photographs to show evidence that work has taken place for Gateway relocation (RP2), the image should be labelled as XX12345678_ RP2_1 and XX12345678_RP2_2.

Save digital images under the label outlined above. Clearly write the label on the reverse of printed photographs detailing the OS map sheet reference and National Grid reference for the land parcel, the implemented capital item code, date, Agreement Holder name and SBI.

5.5 Keeping farm records

We strongly encourage you to keep appropriate records, as it is an important part of an effective farm or woodland management system. We recommend that you obtain and keep evidence to show that you have followed the requirements for options in your agreement, to support your claim or to support a site visit.

Records will help demonstrate that you have carried out the activities in your agreement and that the funded activity is taking or has taken place.

Where the option includes a requirement not to carry out certain activities during the year (for example no grazing, no pesticide application), you do not need to record the absence of these activities.

However, you will need to fill in a declaration on the annual claim form to confirm that you have met this requirement.

Where there is an existing statutory or farm assurance scheme requirement to maintain relevant records, these records can be used as evidence. For example, you can use:

-

plant protection product application records to prove the time of application and what products were applied

-

NVZ requirements for nitrogen planning and recording of nitrogen applications.

You can use existing farm records (those you already keep as part of your commercial farm activities and planning) where these already meet scheme requirements. This may include pesticide records, nutrient management plans, the use of manure and fertiliser, stock and grazing records.

Where the scheme requirements are not covered by existing farm records, you will need to keep an additional record. Examples include:

-

where the use of pesticides (including herbicides) is prohibited or restricted to dealing with a particular problem such as injurious weeds or to a particular method such as weed wiping or spot treatment. Check that appropriate information is included as part of your Pesticides Record under ‘other/additional information’

-

some option requirements restrict applications of manufactured fertiliser to specified levels of phosphate and potash. In these cases, if you are within an NVZ you would need to record the application of phosphate and potash in addition to the application of nitrogen.

5.5.1 Stocking records

If any of your options contain requirements relating to grazing management (including ‘do not graze’ or ‘exclude livestock’), you must keep livestock records as they may act as evidence to support your claim.

You can find more information about livestock record-keeping requirements in Annex 8. You can find templates that you can use to keep these records at Livestock record keeping on GOV.UK.

5.5.2 Nutrients

If any of options require you to keep a nutrient management plan, you should keep relevant records. Commercial nutrient recording systems for fertilisers and manures normally meet this requirement.

You must keep any required nutrient records on farm and make them available during site visits if we ask for them.

You must plan each application of manure or fertiliser on your land as set out under the Farming Rules for Water.

You can find more information at Rules for farmers and land managers to prevent water pollution on GOV.UK.

5.5.3 Recommended fertiliser management system

The following Countryside Stewardship options strongly recommend that you use a recommended fertiliser management system across the farm to achieve the environmental aims:

| Code | Option |

|---|---|

| GS4 | Legume and herb-rich swards |

| GS9 | Management of wet grassland for breeding waders |

| GS10 | Management of wet grassland for wintering waders and wildfowl |

| GS11 | Creation of wet grassland for breeding waders |

| GS12 | Creation of wet grassland for wintering waders and wildfowl |

| SW7 | Arable reversion to grassland with low fertiliser input |

| SW8 | Management of intensive grassland adjacent to a watercourse |

| SW12 | Making space for water |

| SW13 | Very low nitrogen inputs to groundwaters |

| SW14 | Nil fertiliser supplement |

| UP2 | Management of rough grazing for birds |

If you want to use such multi-year options you should do one of the following.

-

Demonstrate that you are using a recommended fertiliser management system across the farm.

-

Seek advice to adopt a recommended fertiliser management system within 18 months of the agreement start date.

-

Demonstrate that you qualify for exemption as a low intensity farmer. We explain below how 1, 2 and 3 are defined.

1) Demonstrate the use of a recommended fertiliser management system

You must hold sufficient farm records and documentation to demonstrate that you are using a recommended fertiliser management system and that nutrient management planning is taking place. Farm records must confirm that:

-

you plan any applications of nitrogen and phosphate fertiliser to each crop in each land parcel before applying it

-

you carry out periodic soil testing on relevant areas (every 5 years).

You must be able to show these records when we ask to see them or as part of a site visit. You can find more information about planning tools and advice for recommended fertiliser management systems in Note 1 below.

2) Seek advice to adopt a recommended fertiliser management system

If you cannot demonstrate that you are already following a recommended fertiliser management system, you will need to get advice, so that you can start one across your farm within 18 months of the start of the agreement.

You can get advice from the Farming Advice Service on GOV.UK.

You will need to demonstrate that you are actively carrying out a fertiliser management planning system throughout the life of the agreement and send us these records if we ask to see them or show them to us during a site visit.

You can ask for advice (at your own expense) but it must be from a suitably skilled agronomist or adviser. You can find more information about potential tools and advice in Note 1 below.

3) Demonstrate exemption as a low intensity farmer

You are exempt from this requirement if you can demonstrate that you are farming at a low intensity across your management or production unit or farm site. In these cases, you must meet all of the following requirements:

-

at least 80% of the land is grassland

-

you apply no more than 100kg N per hectare per calendar year as organic manure, including what is applied directly to the field by animals

-

you spread no more than 90kg N per hectare per calendar year as manufactured fertiliser and no organic manure is brought onto the farm site.

When calculating the fertiliser application rate, you must exclude any area of the farm site where you do not spread fertilisers or cultivate soil (for example rough grazing).

You need to keep adequate records on the farm site to show that you qualify as a low intensity farmer. You must send us these records if we ask to see them or show them to us at a site visit.

If you do not hold fertiliser records for each land parcel, you must have sufficient information recorded to show that you meet the above low intensity farmer criteria.

You can find more information on:

-

low intensity exemption applicants in Annex 1 Part A of the Nitrate Vulnerable Zones guidance – Guidance on areas designated as NVZs in England 2017 to 2020

-

how the use of nitrogen fertilisers and organic manures is restricted in NVZs by reading the Nitrate Vulnerable Zones guidance on GOV.UK.

Note 1: Guidance on using recommended fertiliser management systems and advice offered

There are several recommended fertiliser management systems available, as well as guidance and advice, such as:

-

RB209 (the Fertiliser Manual) which helps you assess the fertiliser required for the range of crops you plan to grow. Other sources of fertiliser nutrient advice are also available; and

-

the industry Tried and Tested Nutrient Management Plan.

There are a number of tools available to help you meet the requirement to plan farm nutrient use efficiently. These include:

-

PLANET: a software tool to help with field level nutrient management

-

MANNER NPK: a software tool that provides a quick estimate of crop available nitrogen, phosphate and potash from applications of organic manure.

-

ENCASH: a software tool that calculates the nitrogen in manure produced by different types of permanently housed pigs and poultry.

-

All 3 software tools are on the PLANET website.

-

There may be other packages providing a similar service.

-

There is also a wide range of advice available to help support you to improve nutrient management on farm:

-

FACTS-qualified advisers are qualified to give advice to promote farming systems that maximise crop nutrition and protect the quality of soil, water and air and farm biodiversity. The FACTS scheme is administered by Basis Registration Ltd, and a list of qualified persons is available from them on request at the Basis website.

5.5.4 Keeping woodland records

You need to keep certain records for all your woodland management options, for certain capital items and woodland supplements. You must send these with your grant claims when we request them. Typical activities that should be recorded include:

-

deer management and cull figures

-

squirrel management

-

red squirrel monitoring

-

open space

-

ride management

-

thinning, felling and coppicing

-

regeneration

-

any other general woodland management which could include Operational Site Assessments

You need to produce a monitoring report with your claim in years 3 and 5 of your agreement.

5.6 Soil sampling

If you’re applying manure or fertiliser to cultivated agricultural land (including grassland), you must plan the application of manure and fertiliser by using the results of soil tests.

The requirement for soil sampling is set out under the Farming Rules for Water. Read Rules for farmers and land managers to prevent water pollution and check ‘Countryside Stewardship grants’ (known as the ‘grant finder’) on GOV.UK. to see if this is the case.

Cultivated agricultural land is both or one of the following:

-

land you’ve ploughed, sowed or harvested at least once in the last year

-

land where you’ve applied organic manure or fertiliser at least once in the last 3 years.

The results of soil tests must show the pH and levels of:

-

nitrogen – you can estimate the soil nitrogen supply (SNS) index of a field by the Field Assessment Method described in the AHDB Nutrient Management Guide (RB209) on pages 20 to 25

-

phosphorus

-

potassium

-

magnesium.

Soil test results must be no more than 5 years old at the time of application. Contact the Environment Agency if you need more advice.

5.6.1 Soil Sampling on Scheduled Monuments

If land parcels contain an SM, you must avoid this when taking soil samples. If you cannot avoid this because the SM occupies a significant proportion of the land parcel, you must get consent from Historic England before taking soil samples.

Make sure you do this to avoid a potential offence under the 1979 Ancient Monuments and Archaeological Areas Act. In these situations use the Consent for soil sampling on scheduled monuments form on GOV.UK.

Fill this in and send it to Historic England in accordance with the guidance attached to the form, for their consideration. Do not carry out the sampling until consent has been given.

You must send the results of the soil analysis to us and a copy to Historic England. Details will be included in your s17 agreement (under section 17 of the Ancient Monuments and Archaeological Areas Act 1979).

If you find any archaeological artefacts during sampling or through sample analysis, you must send details to Historic England and the local Historic Environment Record (HER). This includes evidence of any artefacts discovered outside the Scheduled Area but within the wider land parcel containing the SM.

5.7 Specifications and cost quotations

A small number of payments for capital items are based on the actual cost and are paid as a % of the cost.

You need to get quotes for these particular capital items. You must get a minimum of 3 quotes in writing. You need to submit your quotes with your application. An adviser will discuss with you the RPA contribution towards the costs of the work and will confirm this in writing.

In exceptional circumstances involving highly specialised works fewer than 3 quotations may be accepted, but this must be agreed in writing by RPA in advance.

Actual cost works must be agreed with RPA and either Natural England or Forestry Commission before you include them in your application. In these cases the capital item may also require a bespoke specification to be developed for the work, for example when using capital item FM1 on geodiversity features.

Each specification will be tailored to the requirements for the individual option and capital item in discussion with the Natural England or Forestry Commission adviser. As a guide, the specifications are likely to include the following:

-

technical design drawings to illustrate the extent of the work or schedule of works to provide an itemised list of the component parts and/or process for implementation; and

-

describe the standards to which each category of work is to be carried out.

You can find out more information on capital item specifications using ‘Countryside Stewardship grants’ (known as the ‘grant finder’) on GOV.UK.

5.8 Measuring Countryside Stewardship option areas and widths

This section outlines how and where you should start to measure the areas and widths of Countryside Stewardship options, and where you can place them in the field parcel in relation to cross compliance requirements.

We will publish any changes on GOV.UK.

These requirements are updated annually and apply to that calendar year, regardless of when a Countryside Stewardship agreement started.

-

Countryside Stewardship options cannot be used to deliver mandatory requirements under BPS – Countryside Stewardship options must go beyond the requirements of cross compliance.

-

Cross compliance requirements apply to all Countryside Stewardship Agreement Holders whether or not you receive BPS payments. However cross compliance will not apply to agreements covering only stand-alone capital items where BPS is not claimed.

5.8.1 The relationship between Countryside Stewardship buffer strip options and Cross Compliance: examples of where to start measuring Countryside Stewardship options

This section applies to Countryside Stewardship buffer strip options SW1-4, WD3, and WT12 as listed below.

The general principle is that the Countryside Stewardship buffer strip may not overlap with the cross compliance strip.

Arable situations:

-

4m to 6m buffer strip on cultivated land (SW1)

-

In-field grass strips (SW3)

-

12m to 24m watercourse or nitrogen sensitive terrestrial habitat buffer strip on cultivated land (SW4)

-

Buffering in-field ponds and ditches on arable land (WT2)

-

Woodland edges on arable land (WD3)

Permanent grassland situations:

-

4m to 6m buffer strip on intensive grassland (SW2)

-

Buffering in-field ponds and ditches in improved grassland (WT1)

Countryside Stewardship options adjacent to a hedge

Diagram 1: Where to start measuring Countryside Stewardship options in relation to cross compliance requirements where the boundary feature is a HEDGE

In Arable and Permanent Grassland situations

NOTE: The 2m cross compliance strip, measured from the centre of the boundary, still applies where there is a fence adjacent to the hedge.

Where a fence is less than 2m from the centre of the hedge, the Countryside Stewardship option can still only start at 2m from the centre of the hedge (there will be a gap between the fence and the Countryside Stewardship option).

Where the fence is more than 2m from the centre of the hedge, the Countryside Stewardship option can start from the fence.

Countryside Stewardship arable options adjacent to a ditch

Diagram 2: Ditch measures 2m maximum width

Where to start measuring Countryside Stewardship options in relation to cross compliance requirements where the boundary feature is a DITCH and the distance from the centre to the top of the bank is 1m.

In this example the cross compliance strip would be 2m wide measured from the centre of the ditch.

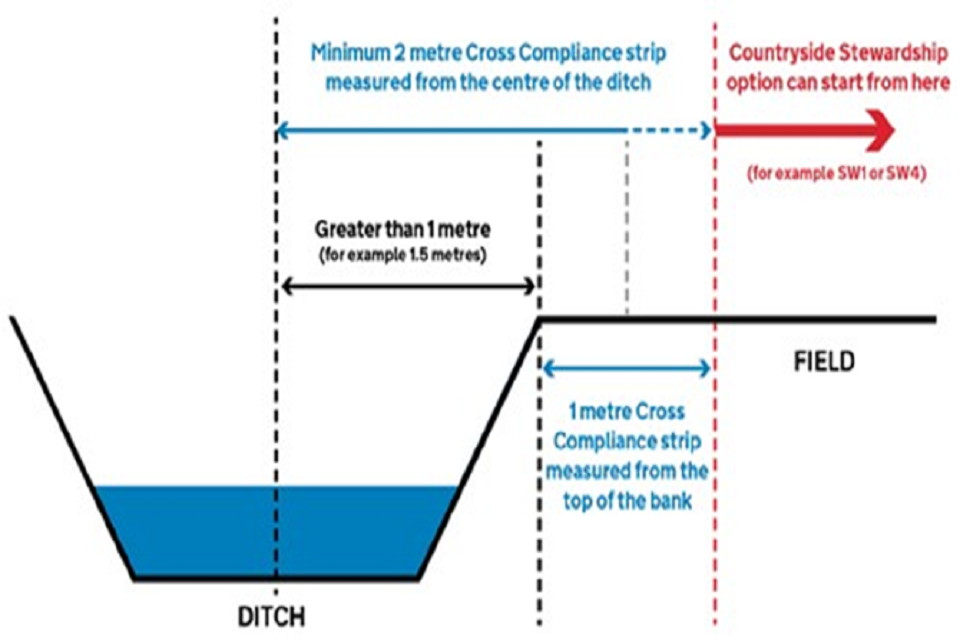

Diagram 2a: Ditch wider than 2m

Where to start measuring Countryside Stewardship options in relation to cross compliance requirements where the boundary feature is a WIDE DITCH and the distance from the centre to the top of the bank is more than 1m.

In this example the cross compliance strip would be 2.5m wide from the centre of the ditch.

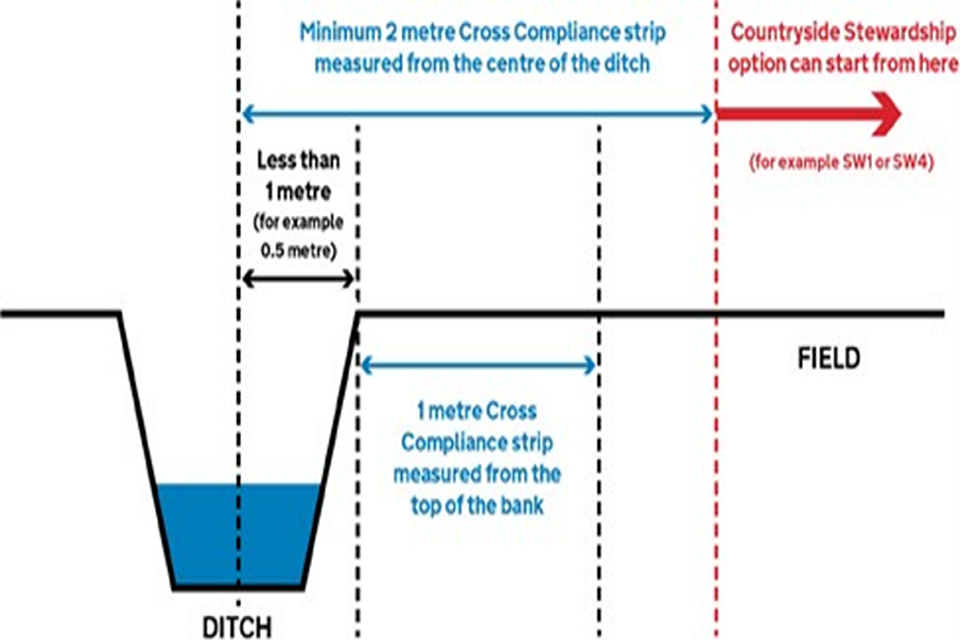

Diagram 2b: Ditch less than 2m

Where to start measuring Countryside Stewardship options in relation to cross compliance requirements where the boundary feature is a NARROW DITCH and the distance from the centre to the top of the bank is less than 1 metre.

In this example the cross compliance strip would be 2.0m wide from the centre of the ditch.

Countryside Stewardship options adjacent to a wall or fence

Diagram 3: Wall or fence where there is no cross compliance strip required

There are no cross compliance requirements where the boundary is a WALL or FENCE. In Arable and Permanent grassland situations:

Countryside Stewardship option can start immediately next to the wall or fence (but allowing access around the field as necessary).

NOTE: If there is a ditch on the field side of the wall, this becomes the cross compliance feature and diagram 2a/2b applies as appropriate.

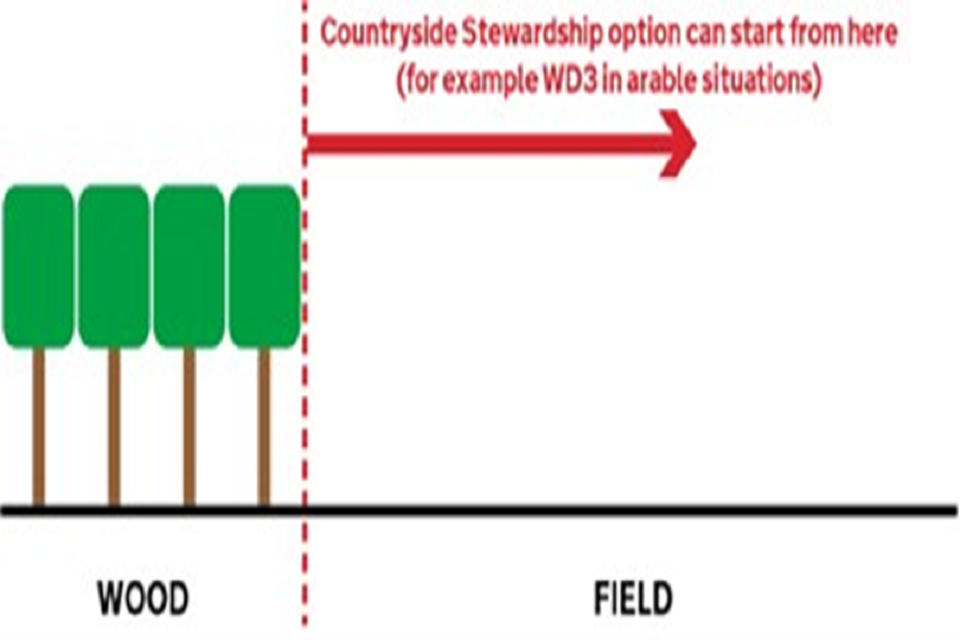

Countryside Stewardship options adjacent to a wood

Diagram 4: There are no cross compliance requirements where the boundary feature is a WOOD

In Arable and Permanent Grassland situations:

Countryside Stewardship option can start immediately next to the wood - WD3 is Woodland edges on arable land (6m).

NOTE: If there is a ditch on the field side of the wood, this becomes the cross compliance feature and diagram 2a/2b applies as appropriate.

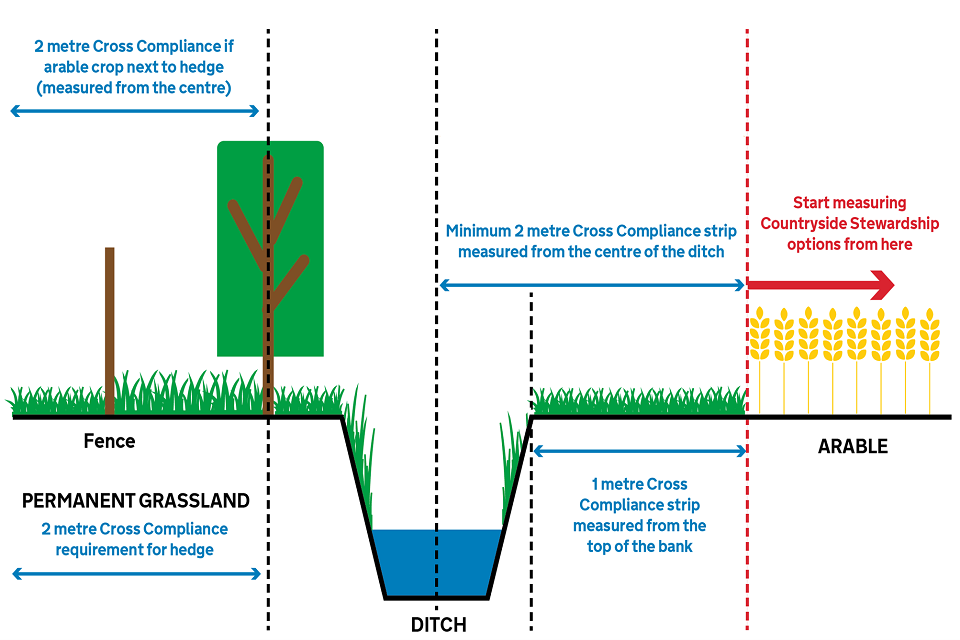

Real world example

Diagram 5: Cross compliance in an arable situation against a ditch and hedge

5.8.2 The relationship between Countryside Stewardship options and Cross Compliance: examples of where to start measuring Countryside Stewardship options

Countryside Stewardship buffer strips must not overlap with cross compliance requirements.

Countryside Stewardship options adjacent to a ditch

There must be no overlap of Countryside Stewardship options with the cross compliance strip (see diagram 2).

Countryside Stewardship options adjacent to a watercourse

A watercourse is defined under GAEC 1 as ‘all surface waters, including coastal water, estuaries, lakes, ponds, rivers, streams, canals and field ditches. It includes temporarily dry watercourses’.

5.8.3 The relationship between Countryside Stewardship options and Cross Compliance

For whole parcel Countryside Stewardship options, the required option management goes further and requires management in addition to any cross compliance requirements. This means you don’t need to reduce the areas of the option for cross compliance strips when claiming for whole parcel options.

For a part-parcel, CS options should not be on the same area as cross compliance strips. If a combination of part-parcel options covers the whole parcel, you need to make sure the cross compliance strip is not included in the area of any of the options.

Also, when a CS strip (for example an arable buffer strip, grass margin) is in the same parcel as a CS option applied on a part parcel, (such as basic overwinter stubble (AB2), you will need to deduct the cross compliance zone, the CS strip and any other ineligible areas, to work out the remaining parcel area.

5.9 Publicity requirements

The Terms and Conditions require you to comply with all instructions and guidance relating to acknowledging and publicising the support provided. This includes using any materials or templates which are provided for this purpose.

5.10 Metal detecting requirements

Metal detecting is not allowed on SMs, SSSIs and known archaeological sites on Agreement Land. These are identified on the FER, and the HEFER. We will write to tell you about any new sites that are discovered that will also be covered by these terms.

On all other Agreement Land, you must make sure that metal detecting does not conflict with the requirements of your agreement, in particular where proposed metal detecting may affect your ability to meet recommended management of an option.

For example, options supporting ground-nesting birds, priority habitats, or rare arable plants are incompatible with ground disturbance, and such activities may cause a breach of agreement and result in recovering monies already paid, withholding future payments, or interest payments – read Section 6.4.

Any metal detecting that you allow on Agreement Land should follow best practice as set out in the current Code of Practice for Responsible Metal Detecting in England and Wales (2017). You must report all finds to the Portable Antiquities Scheme .

5.11 Archaeological fieldwork requirements

If archaeological fieldwork (such as survey, test pitting or excavation) is proposed on Agreement Land that would cause, or may cause, ground disturbance or damage to any known archaeological sites or other environmental assets, you will need to request approval from us via a Minor and Temporary Adjustment - read Section 6.9.3.

Any proposed fieldwork must also have the written support of the local authority Historic Environment Service .

You will need written consent before any fieldwork can begin in the following circumstances:

-

any archaeological fieldwork involving ground disturbance on SMs - this requires scheduled monument consent from the Secretary of State for the Department for Digital, Culture Media and Sport, as advised by Historic England

-

On SMs - any geophysical survey requires a Section 42 licence from Historic England

-

Any archaeological fieldwork (including the use of ground-penetrating radar or remote sensing) on SSSIs requires written consent from Natural England.

5.12 Alternative fencing

Where traditional stock proof fencing is not appropriate on your holding due to landscape or access issues, and you are considering other methods, you should discuss this with your Natural England adviser.

5.13 Farm Environment Record, Historic Environment Farm Environment Record and Baseline Evaluation of Higher Tier Agreements

As set out at Section 4.6, it is a mandatory requirement to retain all the features identified in the FER, the HEFER and the BEHTA, and to protect them from damage or removal for the period of the agreement. An adviser from RPA, Natural England or Forestry Commission will explain these requirements to you.

Removal or damage to a feature identified on the FER, HEFER, or BEHTA is a breach of your agreement unless this is allowed by your agreement. An example where it is allowed is arable land (BEHTA code A01) is being managed to re-create a species-rich grassland. Read Section 6.4 for more information on agreement breaches.

5.14 How we will use and share Agreement Holder’s information

The Department for Environment, Food and Rural Affairs (Defra) is the data controller for personal data you give to the Rural Payments Agency (RPA).

For information on how we handle personal data search for Rural Payments Agency Personal Information Charter on GOV.UK.

5.15 Subsidy control rules

Countryside Stewardship Payments may be subject to subsidy control or equivalent rules. We will publish further information on GOV.UK.

6 Agreement Management: including how to claim, reductions and amending your agreement

Summary

You must read and meet the requirements detailed in this section as these are mandatory for all Higher Tier Agreement Holders.

A Countryside Stewardship agreement is made up of:

-

the Countryside Stewardship Annex 1 Terms and conditions

-

the Agreement Document (which sets out Agreement Holder-specific details)

-

the supplementary documents referred to in the Agreement Document.

6.1 Submitting a claim

You should sign into the Rural Payments service and submit a claim online.

You can find guidance on How to make a capital or revenue claim for Countryside Stewardship: on GOV.UK.

You must submit your claim in accordance with the instructions provided in this manual and on the claim form.

If you cannot make a claim online, contact us to ask for a claim form.

6.1.1 Submitting claims for multi-year management options

These are agreements that contain management options and last for 5, 10 or 20 years. The deadline for multi-year Countryside Stewardship payment claims (annual revenue claims) in 2023 is midnight on 15 May.

We must receive your claim by then. We must also receive any paperwork we ask for to support the management options part of the claim when you make the payment claim. If your agreement includes rotational options, and you are unable to include the location of these options on your claim, you must send us the location no later than 1 September.

It is your responsibility to make sure we receive your annual claim by the claim deadline. If you have any issues submitting your claim, either online or using a paper form, you must contact us and let us know before the claim deadline.

If you do not make a claim by midnight on 15 May your payment may be reduced. If you do not make a claim by midnight on 31 August, you will not receive a payment apart from in cases of good reasons for a breach.

Read Section 6.4 - Reductions and Section 6.9.4 - good reasons for a breach.

6.1.2 Multi-year claims from land managers with multiple agreements

If your business covers a number of farms and you manage it as a single unit, or you use a single vendor or SBI number, you can have more than one agreement for that SBI (read Section 3.1.3). If you have more than one multi-year agreement in place you must fill in separate Countryside Stewardship revenue claims for each agreement.

6.1.3 Capital items within multi-year agreements

A Higher Tier agreement can include a 2 year programme of capital works. You must complete all capital works within 2 years of the agreement start date, unless they are specifically identified to be completed in Year 1. You then have 3 months to submit any final claim.

You can submit a capital item claim for reimbursement at any time of the year. To do this, the approved work must have been completed in line with the agreement and you must have incurred the costs. This means you must be able to show that you have been charged or invoiced for the full payment, before you submit your capital item claim. If you cannot show that you have incurred the costs for works undertaken, your claim may be rejected.

If your claim is part of a multi-year agreement, you can make a claim in stages for certain capital items according to the schedule in your Agreement Document. The minimum value of any single claim is £500, except for the final claim, which can be less than £500.

Read your Agreement Document for details of ‘Claim-by’ dates.

6.1.4 Single claim water capital items

We cannot accept part claims for the water capital items listed below:

| Capital Item | Name |

|---|---|

| AQ1 | Automatic slurry scraper |

| AQ2 | Low ammonia emission flooring for livestock housing |

| RP4 | Livestock and machinery hardcore tracks |

| RP7 | Sediment ponds and traps |

| RP8 | Construction of wetland for the treatment of pollution |

| RP11 | Swales |

| RP13 | Yard – underground drainage pipework |

| RP15 | Concrete yard renewal |

| RP17 | Storage tanks underground |

| RP18 | Above ground tanks |

| RP22 | Sheep dip drainage aprons and sumps |

| RP24 | Lined biobed plus pesticide loading and washdown area |

| RP25 | Lined biobed with existing washdown area |

| RP27 | Sprayer or applicator load and wash-down area |

| RP28 | Roofing (sprayer washdown area, manure storage area, livestock gathering area, slurry stores, silage stores) |

| RP29 | Self-supporting covers for slurry and anaerobic digestate stores |

| RP30 | Floating covers for slurry and anaerobic digestate stores and lagoons |

6.2 Evidence required to support your claim

6.2.1 Using contractors for multi-year management options and capital works

You can employ contractors to carry out agricultural work on your Agreement Land, or to carry out work under the Countryside Stewardship multi-year management options and capital items.

You must tell the contractor about the agreement and its requirements. It is your responsibility to make sure that work carried out by contractors does not breach the terms of your agreement. If the contractor commits any breaches on the land, you will be responsible for any payment reductions.

You must keep records of the work carried out by contractors in either paper or electronic form, for the full period of the agreement and for at least 7 years after your agreement has ended. You must also produce these records if we ask you to.

6.2.2 Invoices for actual costs

You will need to provide invoices for some capital items. You can check this in your Agreement Document or in ‘Countryside Stewardship grants’ (known as the ‘grant finder’) on GOV.UK

Invoices and receipts must be dated and must relate to activities after the start date of the agreement and after you have received your agreement offer. We will reject your claim and you will not be paid, if we find that work was carried out before or after the period of your agreement.

If you are claiming for capital items based on actual costs you must send receipted invoices (that show payment for materials and contracted work) with the claim.

When we ask for invoices and receipts to support your claim, the following requirements apply.

-

Provide original receipted invoices for the purchase of every item claimed.

-

We can only treat invoices as receipted if they are annotated with some form of acknowledgement that the company or individual providing the goods or services involved has received the payment. The following are also acceptable evidence:

-

a till receipt from a retailer for purchases of standard, off-the-shelf items. These do not need to be separately receipted as paid because a receipt of this nature is only issued after payment

-

if receipted invoices are not available, a copy of a bank or credit card statement which shows the work has been paid for in full when supported by the invoice.

-

We can only accept an invoice if the document is an original, or a computerised carbon copy on an original letterhead, and bears the supplier’s official receipt (which could be a stamp, a signature or with the payment details shown on a computer printout of the invoice), confirming or annotating that the value of the invoice has been paid.

-

All costs must clearly relate to each individual claimed capital item.

-

Goods that are purchased second-hand (where the agreement specifies that second-hand items are acceptable) or that have been bought online also need to have receipted invoices provided for them, unless they are standard off-the-shelf items as described above, in which case the standard receipt for payment is considered adequate.

-

The invoice must not pre-date the agreement start date. If it does, we reserve the right to reject all or some of the claim.

-

Where you have used your own labour for construction, you must keep time sheets and send these with your claim.

You do not need to send invoices and time sheets when claiming for all other multi-year management options and capital items (that are based on fixed cost). But you must keep receipted invoices and time sheets and make them available to us when we ask to see them. This includes those for specific capital expenditure.

6.2.3 VAT for actual costs

If your Countryside Stewardship agreement includes actual cost capital items:

-

if you are registered with HM Revenue & Customs (HMRC) for Value Added Tax (VAT) - you cannot include the cost of the VAT charged on your capital items in your capital items claims

-

if you are not registered with HMRC for VAT and you can provide evidence of this, such as a statement from a registered accountant (for example, a chartered accountant or certified accountant) - then you can include the VAT charge in your actual cost claims.

If you submit a statement from an accountant, the accountant will need to provide a letter on headed paper which confirms the following:

-

they are a registered accountant

-

they act as the accountant for the agreement holder’s business

-

they can confirm that you as the agreement holder are not registered with HMRC for VAT.

6.2.4 Using your own or a farm employee’s labour for capital works

You can use your own labour or a farm employee’s labour for carrying out capital works. If you do so, you will need to prepare time sheets signed by the employee and employer showing all of the following:

-

the hourly rate for your labour or a farm employee’s labour

-

what work was carried out

-

the date the work was done

You must keep these records electronically or on paper for the full period of your agreement and for at least 7 years following the end of the agreement. You must also produce them if we ask you to.

You must tell the employee(s) about the agreement and its requirements. It is your responsibility to make sure that work carried out using your own labour or a farm employee’s labour, does not breach the terms of your agreement. If the employee commits any breaches, you will be responsible for any payment reductions.

6.2.5 Using your own machinery for capital works

You can use machinery and equipment owned by your business to carry out capital works. Or you can hire machinery or equipment, for example, a cement mixer.

You must keep any invoices and records of the machinery used, in either paper or electronic form, for the full period of the agreement and for at least 7 years after your agreement has ended. You must produce these records if we ask you to.

Your records must include:

-

dates and times the machinery was used

-

what it was used for

-

the rate applied to the usage and how this was arrived at

-

the name of the operator.

6.3 When will I get paid?

6.3.1 The impact of transfers on claims

If you are in the process of buying or selling land that is under an agreement, or entering and ending a tenancy arrangement on the land, you need to consider the rules on who should submit a claim. Read Section 6.8 of this manual if you are:

-

an Agreement Holder in the process of selling all or part of the land under agreement and transferring the agreement management obligations for this land to the purchaser

-

you are buying land from an Agreement Holder and taking on the agreement management obligations from the seller.

-

you are entering or ending a tenancy arrangement with an Agreement Holder.

Depending on whether the land transfer takes place before, on, or after 16 May 2022, may affect who should submit claims and who will receive payment.

For BPS, the payment is made to whoever submits the BPS application by 16 May.

For Countryside Stewardship any outstanding payments are made to the transferee (new owner/occupier) providing they take on the agreement and are eligible.

If you tell us about a transfer by 16 May, the transferee can claim BPS.

However, if you tell us after 16 May, we make:

-

the BPS payment to the transferor

-

the Countryside Stewardship payment to the transferee.

6.3.2 When will I get paid for multi-year management options?

For eligible revenue claims, we normally start making payments for multi-year management options in the December following the claim, up until June, once processing of your claim has been completed.

We check your claim to make sure that it is correct. We may visit you to review and assess delivery of the option or options in your agreement. If your claim is correct we will pay you. If we need to make reductions to your claim, then these will be applied to your payment. We normally make annual payments for multi-year management options in one instalment.

6.3.3 Payments for all agreements

We will make all payments directly into your nominated bank account.

6.4 Reductions

If you breach the terms of your agreement or you do not meet the relevant eligibility criteria on all or part of your Agreement Land, we may reduce or withhold future grant payments and may recover payments you have already received.

This section lists some examples when reductions may be applied and when payments may be withheld or recovered.

We can only pay you for work carried out according to your agreement and the scheme rules.

6.4.1 When reductions may apply

We can only pay you for work carried out according to your agreement and the scheme rules.

We will reduce the amount you have been or will be paid if you:

-

have given false or misleading information

-

have claimed payment on land which is not eligible or is not under your management control

-

have not met the aims of the options chosen

-

have over-claimed for capital works

-

have not followed the scheme rules

-

have not met the cross compliance rules where applicable

-

have submitted a multi-year agreement claim late

-

have submitted a change to a multi-year agreement claim late – this includes changes to supporting information/evidence.

This is not a complete list and there may be other examples of where we will apply reductions.

In cases of good reasons for a breach, obvious errors and notified errors, we will consider the facts on a case- by-case basis before deciding whether to pay or reduce a claim (read Section 6.9.4 for more information).

6.4.2 Late payment claims for multi-year agreements

You can make a late claim after 15 May up until midnight on 31 August but you will receive a reduction to your payment. Read the Important dates section of the How to complete a Countryside Stewardship revenue claim by email or post guidance.

You cannot make claims after midnight on 31 August apart from in cases of good reasons for a breach (read 6.9.4).

6.4.3 Changing a payment claim relating to a multi-year agreement after it has been submitted

You can change a claim up to midnight on 31 August without receiving a reduction to your payment, provided we received your original claim by 15 May.

You cannot change a claim after 31 August, apart from:

-

in cases of good reasons for a breach (read Section 6.9.4 for more information)

-

where you withdraw all or part of your claim (read Section 6.4.4 for more information)

-

obvious error (read Section 6.4.5 for more information)

6.4.4 Withdrawing all or part of a payment claim for a multi-year agreement

You can withdraw all or part of a payment claim at any time unless:

-

you have already been told about an error in the payment claim (or the relevant part of the payment claim)

-

you have had a site visit (or you receive advance warning of a site visit)

-

a visit reveals a breach of the rules

-

errors were found by us when we cross checked information against other relevant funding records for your land.

6.4.5 Obvious errors

Where you have made a straightforward mistake on a payment claim (and it is obvious from a simple administrative check of the claim), you can ask us to correct it. We may be able to do this without applying a reduction.

However, if you make the same mistake more than once, we may not accept it as an obvious error.

6.4.6 Notified errors

If you have made a mistake on your payment claim, you can notify us at any time in writing. However, this may affect the payment you receive, particularly if you have already been told of any non-compliances in your payment claim or you have received advance warning of a site visit.

6.4.7 Claiming on land that is not eligible or option not present

If you declare land that is not eligible (as set out in Section 3.1.2) or does not have the relevant option present on it in your payment claim, we will reduce your claim. We can only pay for the eligible land/options identified during administrative checks or site visits.

If we find that land is ineligible, you will not receive a payment for it. We may also recover previous payments if we find land was ineligible for payment in previous years. In certain cases, if we find significant breaches, your agreement may be terminated and all payments recovered.

If you have not met all of the option requirements, we may reduce or suspend your payment or we may recover the full amount of the payment.

6.4.8 Cross compliance

If we find a breach of cross compliance rules anywhere on your holding (including associated common land) by any of the following:

-

you

-

employees

-

workers and family members

then you will be held liable for their actions.

If we find a breach by any of the following:

-

agents

-

contractors

-

agronomists

then you might be held liable for their actions.

The cross compliance guide changes annually, so you need to read the latest version of the Guide to Cross Compliance in England to find out about cross compliance rules.

6.4.9 Delivering the aims of your options

If there is uncertainty about whether or not the aims of the options have been delivered, we will take into account any records or evidence you may have kept to demonstrate delivery of the aims of the options.

This includes any steps you’ve taken to follow the requirements of options, which you can find by ‘Countryside Stewardship grants’ (known as the ‘grant finder’) on GOV.UK. It is your responsibility to keep such records if you want to rely on these to support your claim.

In some cases we may write to tell you what you need to do to improve, and suspend your payments until you make the improvements. If appropriate, we may also offer you advice or guidance to help you meet the requirements of your agreement. Once you can demonstrate the improvements have been made, we will pay you.

If you do not fulfil your obligations under the agreement, we will reduce or withhold your payment or seek recovery. In some cases, we may terminate your agreement and/or refuse support for other Defra grant schemes for up to 2 years, for example, if we find intentional non-compliance or fraud.

The hectarage of rotational arable options you signed up to in your agreement is the hectarage to be delivered every year of the agreement term. It is part of your agreement to make sure that you do this. By making sure that you deliver the agreed hectarage, you will be able to claim the full amount under your agreement.

6.4.10 Breaches of agreement

If we find breaches during administrative checks or any site visits, we will write to tell you and you will have the opportunity to make written representations if you feel that our findings are incorrect. These representations will be taken into consideration before a decision is made on whether it is appropriate to apply reductions or withhold payments.

We will work out the level of reduction we need to apply by looking at the severity of the breach and whether it is an isolated or a repeat occurrence. We may apply a reduction to your current year’s claim and to previous years’ claims (under your agreement), unless you can demonstrate you were compliant in previous years.

We will assess what has happened due to the breach/non-compliance, consider the objectives of the agreement or options and the short or long-term impacts. For example, ploughing a priority habitat would be classed as a severe breach.

Factors considered and assessed for severity and level of reduction are:

-

circumstances, nature and consequences surrounding the breach

-

failure to cooperate with site visits, or further investigations

-

steps taken to report a change in circumstances

-

whether it is an isolated or a repeat occurrence

-

whether it was intentional,

-

whether it was because of reckless or negligent action

-

to what extent the breach can be rectified

-

issue a letter explaining that we’ve assessed the breach and what you have to do

-

amend your agreement.

If there’s a breach of your agreement or the regulations, we may ask you to correct the breach.

For more serious breaches, we may:

-

reduce the payments you get, or withhold part of them

-

reduce or withhold money from other schemes

-

recover money we’ve already paid

-

end your agreement

In exceptional circumstances where there is reasonable suspicion of a serious breach or fraud, then we may access land and your premises without notice, using powers of entry. In these circumstances, for example as part of a fraud investigation, we may access any computer that’s been used in connection with the evidence or these records.

6.4.11 Refusal or withdrawal of support claimed

In certain cases we may refuse, or withdraw in full, the support claimed and terminate your existing agreement. We will do this if we think any of the following has happened:

-

you have committed a serious non-compliance

-

you have provided false evidence

-

you have negligently failed to provide the necessary information (for instance, where we have asked for it repeatedly and there is no good reason why you have not provided it).

We will also take into account:

-

to what extent the breach can be rectified

-

the circumstances, nature and consequences surrounding the breach

-

any failure to cooperate with site visits, or further investigations

-

any steps taken to report a change in circumstances

-

whether it is an isolated or a repeat occurrence

-

whether it was intentional

-

whether it was because of reckless or negligent action.

If we have to withdraw support for these reasons, we will terminate the existing agreement and you will not be permitted to reapply for the agreement for two years. We may also refuse support for other Defra grant schemes for up to two years. If this is the case, we will tell you, and you will be able to appeal against this decision.

6.5 Scheme control: administrative checks and site visits

We are required to make sure that Countryside Stewardship is properly controlled, to protect public money. To support this we undertake administrative checks and site visits to monitor Agreement Holder compliance with the rules governing their agreements (and cross compliance on the whole holding) and the success of Countryside Stewardship overall.

We undertake 3 main checks:

-

administrative record checks

-

agreement monitoring visits

-

physical or virtual site visits.

You must allow RPA (or their authorised representatives or auditors) to access your land or premises to carry out Countryside Stewardship site visits. Other UK public authorities may also visit you to make sure you are meeting cross compliance requirements. Natural England, the Forestry Commission or Historic England may also visit your site to monitor environmental progress or check you are following specific management.

We will seek to agree a date and time for a site visit where possible. If not, you will be notified at least 48 hours in advance of the site visit unless we have reasons to suspect that you are in breach of your agreement.

You must help and co-operate with any person carrying out a site visit. Any refusal to do so or obstruction will be treated as a breach of the Countryside Stewardship terms and conditions, and you may face recovery, suspension or termination of your agreement. We may also refuse support for other Defra grant schemes for up to 2 years.

6.5.1 Administrative record checks

We will check all stages of the application and claim processes, including your application form, claim forms and, where appropriate, the nature and quality of any supporting evidence, such as receipts and farm records. This is to make sure that you meet eligibility requirements at the application stage, and that various forms and records match up during the whole agreement period.

If you do not provide records when asked, or there are discrepancies, we will treat this as a breach of your agreement. It is your responsibility to keep such records if you want to rely on this to support your claim.

6.5.3 Agreement monitoring visits

Advisers may visit sites to monitor environmental progress, discuss site reports, or if you ask us to visit.

During the period of your agreement, Historic England will visit your site if you have either of the following management options on a Scheduled Monument:

-

Scheduled Monuments which have reduced-depth, non-inversion cultivation on historic and archaeological features (HS3)

-

restricted depth crop establishment to protect archaeology under an arable rotation (HS9).

Results from these visits will be discussed with us and appropriate action taken.

6.5.4 Site visits

Each year, we will carry out site visits on a sample of agreements, to make sure environmental aims are being delivered and scheme aims or requirements have been met.

If we select you for a site visit, we will check that you are meeting the aims of the management options. We may also check some specific areas, for example your use of fertilisers and/or pesticides, seed mixes, or stocking levels on land.

If we can see that you have met the aims of management options, we’ll not ask you to provide additional evidence to show this.

Unless we have reasons to suspect that you are in breach of your agreement, we will seek to agree a date and time for a site visit where possible. If not, you will be notified at least 48 hours in advance of the site visit. If there is uncertainty about whether or not the aims of the options have been delivered, we will take into account any records or evidence you may have kept to demonstrate delivery of the aims of the option.

This includes any steps you’ve taken to follow the recommended management set out in ‘Countryside Stewardship grants’ (known as the ‘grant finder’) on GOV.UK.

We recommend that you obtain and keep evidence to show you have followed the recommended management of your agreement to support your claim or to support a site visit. Records will help demonstrate that you have carried out the activities in your agreement and that the funded activity is taking or has taken place.

It also helps demonstrate that public money is being spent effectively and is delivering the intended results.