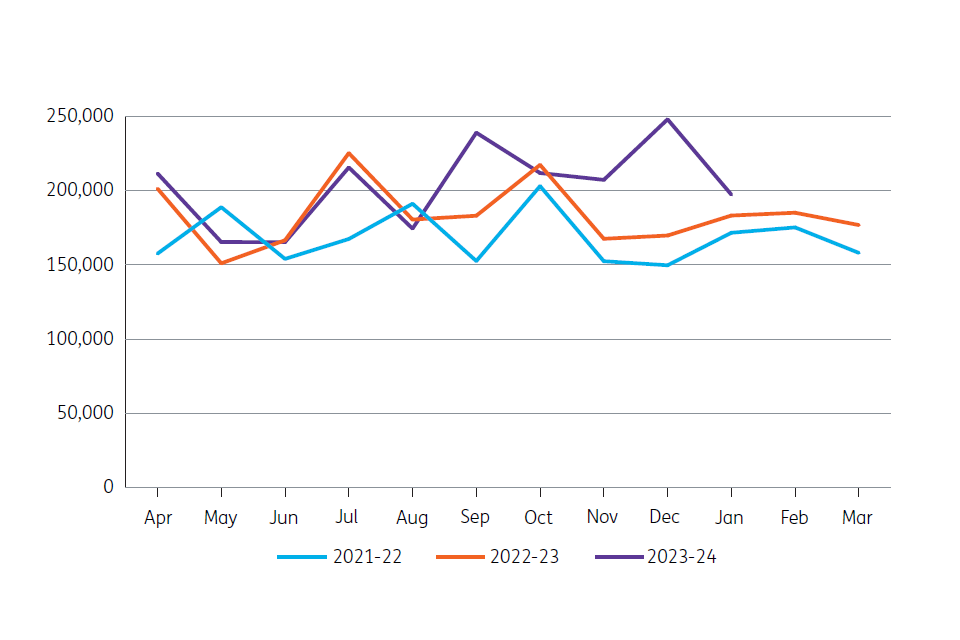

DWP annual report and accounts 2023 to 2024 (HTML)

Updated 13 November 2024

Annual Report and Accounts 2023 to 2024 for the year ended 31 March 2024

Accounts presented to the House of Commons pursuant to section 6 (4) of the Government Resources and Accounts Act 2000

Annual Report presented to the House of Commons by Command of His Majesty

Ordered by the House of Commons to be printed on 22 July 2024.

This is part of a series of departmental publications which, along with the Main Estimates 2024 to 2025 and the document Public Expenditure: Statistical Analyses 2024, present the government’s outturn for 2023 to 2024 and planned expenditure for 2024 to 2025.

This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit: www.nationalarchives.gov.uk/doc/open-government-licence/version/3/

Where the report identifies any third-party copyright information you will need to obtain permission from the copyright holders concerned.

This publication is available at: www.gov.uk/official-documents

Any enquiries regarding this publication should be sent to DWP at:

Finance Director General’s Office

5th Floor, Caxton House

6-12 Tothill Street

London SW1H 9NA

ISBN 978-1-5286-4660-4

HC 62

Printed on paper containing 40% recycled fibre content minimum.

Printed in the UK by HH Associates Ltd. on behalf of the Controller of His Majesty’s Stationery Office.

Corrections

Correction 1

Page 80: Due to the omission of a chart which would have shown the number of accepted IPRs by Primary Service Line 2023-2024. The narrative to be amended to reflect that the additional information is published separately.

Text currently reads:

Cases received for IPRs can cover more than one DWP service line as customers may have more than one benefit in payment, meaning the customer can have more than one primary service line recorded for the IPR. The chart below shows the primary service lines relating to the customers’ cases accepted to IPRs across 2023-24.

Text should read:

Cases received for IPRs can cover more than one DWP service line as customers may have more than one benefit in payment, meaning the customer can have more than one primary service line recorded for the IPR. Additional information is published separately.

Correction 2

Page 242: The Statement of Outturn against Parliamentary Supply Analysis of Resource Outturn by Estimate contains an administrative error within the 2022-23 outturn column relating to four benefit lines within the Total AME non-voted section. The prior year totals were correctly reported in the 2022-23 ARA (page 230) as well as correctly reported in the Core tables of this ARA (page 253). This error also had no effect on the 2022-23 control total as it was a transposition error across the four lines.

The four benefit lines are documented below.

| Non-voted | Error Outturn: total 2022 to 2023 £000 |

Correction Outturn: total 2022 to 2023 £000 |

|---|---|---|

| AE Social Fund: Winter Fuel | 11,759 | 4,565,822 |

| AF Incapacity Benefit | 4,527,025 | 11,759 |

| AG Social Fund: Other | 4,565,822 | 191,742 |

| AH Employment and Support Allowance (Contributory) | 191,742 | 4,527,025 |

Date of correction: 11 November 2024

Performance report: Permanent Secretary’s Overview

This Annual Report and Account sets out the activities of the Department for Work and Pensions (DWP) over the 2023 to 2024 financial year.

DWP’s role is to provide services to over 20 million people, paying benefits, pensions and helping people to move into and progress in work. Over the course of the last year, the Department has continued to deliver a number of labour market programmes, such as Restart, Sector-based Work Academy Programmes, the Youth Offer and 50+ Choices. These programmes have improved employment outcomes for jobseekers across the country.

DWP spent £265.9 billion in Resource AME, which covers benefits paid through the welfare system in 2023 to 2024, including support for people with a disability or health condition, Universal Credit, the State Pension and Cost of Living Payments.

The Department implemented Additional Jobcentre Support across 90 jobcentres, delivered over 90,000 starts through the Sector-based Work Academy Programme and over 160,000 customers participated in the Restart scheme.

On fraud and error in 2023 to 2024, £1.3 billion in AME savings were delivered and, overall, fraud and error stayed broadly constant. The State Pension Legal Entitlement and Administrative Practice (LEAP) exercise has now completed two of the three customer groups: the Cat BL and Cat D cases. DWP has also worked closely with HM Revenue and Customs on the Home Responsibilities Protection correction exercise, and have jointly established processes to take customers through the exercise. DWP has started making payments to people whose updated National Insurance records entitle them to an increased State Pension and arrears payments.

On Universal Credit, over 540,000 Migration Notices were delivered to relevant households to notify them to make the move from legacy benefits to Universal Credit. On the Health Transformation Programme, new Functional Health Assessment contracts were signed in September, ready for implementation in 2024 to 2025.

Our Values, We Deliver, We Adapt, We Care, We Value Everybody and We Work Together and guide how colleagues work with each other, customers, and others. I would like to thank all DWP’s 85,000 colleagues for their continued hard work for the benefit of those we serve.

Peter Schofield

Permanent Secretary and Accounting Officer

Performance Overview

This section provides a summary of the purpose, plans and performance of the Department for Work and Pensions. This includes an overview of our organisation, services and structure during the period 1 April 2023 to 31 March 2024. Any reference to government refers to the government in place at that time.

Our Vision, Our Role, Our Values

In 2023 to 2024 the aims of DWP aims to improve people’s day-to-day lives and help them build financial resilience and a more secure and prosperous future. The Department aimed to do this by helping people to move into work and supporting those already in work to progress, with the aim of increasing overall workforce participation. DWP helps people to plan and save for later life, while providing a safety net for those who need it now.

To achieve this aim during 2023 to 2024 DWP focused on delivering against the following Strategic Outcomes and cross cutting Delivery Objectives.

DWP’s people are its biggest asset, and ensuring they have the right skills and capability to deliver is essential to realising the Department’s vision. To deliver the vision DWP continues to focus on its 5 values. Everyone in DWP has a role to play in achieving them.

DWP values guide how colleagues work with each other, customers, and others. Understanding how colleagues live up to them helps us learn for the future.

- we care

- we deliver

- we adapt

- we work together

- we value everybody

Public Sector Equality Duty

DWP is committed to embedding and meeting the public sector equality duty (which covers the nine protected characteristics of; age, disability, gender reassignment, pregnancy and maternity, race, religion and belief, gender, marriage and civil partnerships and sexual orientation) in everything the Department does.

DWP Services

Services for maximising employment, reducing economic inactivity, and supporting the progression of those in work.

| Service | Description |

|---|---|

| Jobcentre Plus | Provides employment advice combined with detailed knowledge of local labour markets the aim being to match people to suitable job vacancies and to help those in low-paid work to progress and increase their earnings, through DWP’s network of jobcentres. |

| Restart | Supported people who have been unemployed for at least nine months. |

| DWP’s Sector-based Work Academy Programme (SWAP) | Placements offer training, work experience and a guaranteed job interview to those ready to start a job. Its aim is to enable people to learn the skills and behaviours that employers in particular industries look for. |

| Train and Progress | Supported Universal Credit customers to participate in full-time work-related training for up to 16 weeks, allowing jobseekers to access vocational courses, such as the Department for Education’s Skills Bootcamps, which offer targeted higher-level learning in sectors. |

| DWP Youth Offer | Provided individually tailored Work Coach support to 16 to 24 year olds in the Universal Credit Intensive Work Search group, offering access to vital skills, training and employment opportunities through the Youth Employment Programme, Youth Employability Coaches and Youth Hubs. From September 2023, the Youth Offer was expanded so additional 16 to 24 year old UC claimants can take advantage of the Work Coach support offered, including young parents and carers. |

| Universal Credit | Is available to people living in the UK aged 18 or over who are on a low income or need help with living costs. Claimants may be out of work, working (including self-employed or part-time) or unable to work (for example, due to a health condition). Support is withdrawn at a steady rate as claimants move into and progress in work. |

| 50PLUS employment support | Is provided through jobcentres, with Additional Work Coach Time for eligible 50PLUS jobseekers on Universal Credit delivering more intensive, tailored support during the first nine months of their claim. Work coaches and employers are supported by over 70 dedicated 50PLUS champions working out of every jobcentre across the UK. The Midlife MOT enables workers in their 40s, 50s and 60s take stock of their work, health and money, to give them access to career, health and financial guidance to help them plan for the future. All citizens can access the online Midlife MOT, which signposts to later life planning information and resources. |

| In Work Progression | Offers access to work coach support to people who are working and earning over the Administrative Earnings Threshold, the aim being to increase their earnings and progress in work. Support is offered across all jobcentres on a voluntary basis. |

Services to deliver financial support to people who are entitled to it.

| Service | Description |

|---|---|

| The Child Maintenance Service | Can arrange child maintenance on behalf of separated parents who may be unable to agree a child maintenance arrangement between themselves. |

| The Reducing Parental Conflict | Programme aims to decrease the number of children who have to live with damaging levels of parental conflict, by giving parents access to evidence-based support to increase collaboration, whether they are together or separated. |

Services to enable disabled people and people with health conditions to start, stay and succeed in work, and get financial support.

| Service | Description |

|---|---|

| The Work and Health Programme | Provides support on a voluntary basis to disabled people, disadvantaged groups and people with health conditions, taking a holistic approach to tackling barriers to employment by linking up with health and social care providers and other local services. |

| Universal Support | Aims to expand the availability of support to disabled people, people with health conditions and people with additional barriers to employment into sustained work. Work and Health Programme (WHP) Pioneer and Individual Placement and Support in Primary Care (IPSPC) form the first phase of delivering Universal Support, to those who are eligible for WHP and not in the Universal Credit Intensive Work Search regime or claiming Jobseeker’s Allowance at the point of referral. WHP Pioneer is delivered by WHP providers across England and Wales. |

| Intensive Personalised Employment Support | Provides personalised, intensive support for people who are disabled, have complex barriers to work and who the work coach considers to be more than 12 months from the labour market. The final participants for this programme started December 2023. |

| Access to Work | Aims to provide help to get or stay in work for those who have a physical or mental health condition or disability. The support provided depends on needs and can be: —- a grant to help for practical support with work —- support with managing mental health at work —- money to pay for communication support at job interviews |

| The Disability Confident employer scheme | Is a business-led scheme aiming to increase employment opportunities for disabled people by encouraging employers to think differently about disability and take action to improve how they attract, recruit and retain disabled employees. |

| Personal Independence Payment | Aims to help people between age 16 and pension age with the additional costs associated with a disability or long-term health condition. |

| Disability Living Allowance | For children under 16 helps with extra costs associated with mobility or long-term health condition. In Scotland Child Disability Payments are available for extra costs a disabled child might have. |

Services to support financial resilience in later life.

| State Pension | Is available for people who have reached State Pension age and have obtained the qualifying years on their National Insurance record by working, receiving credits or paying voluntary contributions. The amount of State Pension received depends on the number of qualifying years they have. |

| Pension Credit | Protects pensioners on a low income by topping up any income already received to a standard minimum amount, with higher amounts for pensioners with caring responsibilities, a severe disability or certain housing costs. |

For full details of DWP services, see Department for Work and Pensions – GOV.UK

DWP Structure

The Department is led by the Secretary of State for Work and Pensions and the Permanent Secretary, who is the most senior civil servant. The Permanent Secretary and Directors General form the Executive Team, the senior decision-making body, providing corporate leadership for the Department.

As of 31 March 2024, Director General-led groups were:

| Director General led groups | Areas of responsibility |

|---|---|

| Service Excellence Group | Child Maintenance services —- Retirement services —- Dispute resolution services —- Customer Experience —- Service Modernisation —- Deployment —- Service Delivery Optimisation |

| Work and Health Services | Operational delivery of Universal Credit, Disability Services, Working Age Operations, and Counter Fraud, Compliance and Debt with jobcentres and service centres across Great Britain and Northern Ireland —- Provision of all working-age face-to-face services through jobcentres, including the relationship with employers and other external partners |

| Change and Resilience Group | Major change projects and programmes —- Senior Responsible Owner for the Universal Credit Programme —- Business continuity, resilience and crisis management for the whole of the DWP —- Fraud and error |

| Policy Group | Advising ministers on policy and strategic decisions —- Leading the departmental Outcome Boards to support collaboration and deliver outcomes —- Looking ahead and developing proposals for change, including leading cross-government strategic challenges —- Managing the Department’s welfare spending |

| Finance Group | Strategic Finance —- Payments and financial controls —- Financial management and partnering —- Business strategy —- Commercial —- Contract Management and Partner Delivery —- Analysis —- Risk management —- Security and data protection |

| Digital Group | Providing information management and expert digital, data and business transformation services —- The running of the digital estate including telephony, on-site systems, and web solutions and applications —- Sharing of DWP data across government and representing DWP at cross-government Digital and Data forums —- The Department’s Digital Innovation capability and the delivery of the Artificial Intelligence strategy —- Senior Information Risk Owner |

| People and Capability | Providing expert HR services and business partnering —- Pay strategy and policy – SCS and Delegated —- Resourcing and capacity —- Strategic workforce planning —- HR Case Management —- Capability, Learning and Talent —- Performance systems —- People Strategy —- HR Policy —- Maintaining positive Trade Union and Employee Relations —- People Safety —- Embedding DWP values and creating an inclusive culture |

| Corporate Transformation | Internal major transformation programmes and projects such as Synergy, Workplace Transformation, and DWP Critical Estates Projects —- The departmental Environmental Sustainability Strategy and Sustainability Governance —- Transitioning to a smaller, more affordable, and adaptable estate whilst investing in improving DWP’s core critical assets —- Leading DWP on Government Reform, including Places for Growth and smarter working |

Strategic Outcomes during 2023 to 2024

This high-level overview is expanded upon in the Performance Analysis section of this report which includes further details of DWP activities and analysis of progress against performance indicators.

Strategic Outcome 1 – Maximise employment, reduce economic inactivity and support the progression of those in work

Summary

DWP continued to focus on supporting people back towards the labour market, into work, and to progress in work. The Department has tackled barriers to work by enhancing existing services and through the Back to Work Plan. DWP work collaboratively with other departments to support people furthest from the labour market and those from under-represented groups to improve their future ambitions.

Performance Metrics

Employment rate of 16 to 24 year olds

Employment rate of 16 to 64 year olds

Employment rate of 50 to 64 year olds

Unemployment rate of 16+ year olds

Unemployment rate of 16 to 64 year olds

Unemployment rate of 50 to 64 year olds

Employment rate gap between 35 to 49 and 50 to 64 year olds

Economic Inactivity Rate for 16 to 64 year olds

Number of children in workless households

UC households in receipt of childcare element

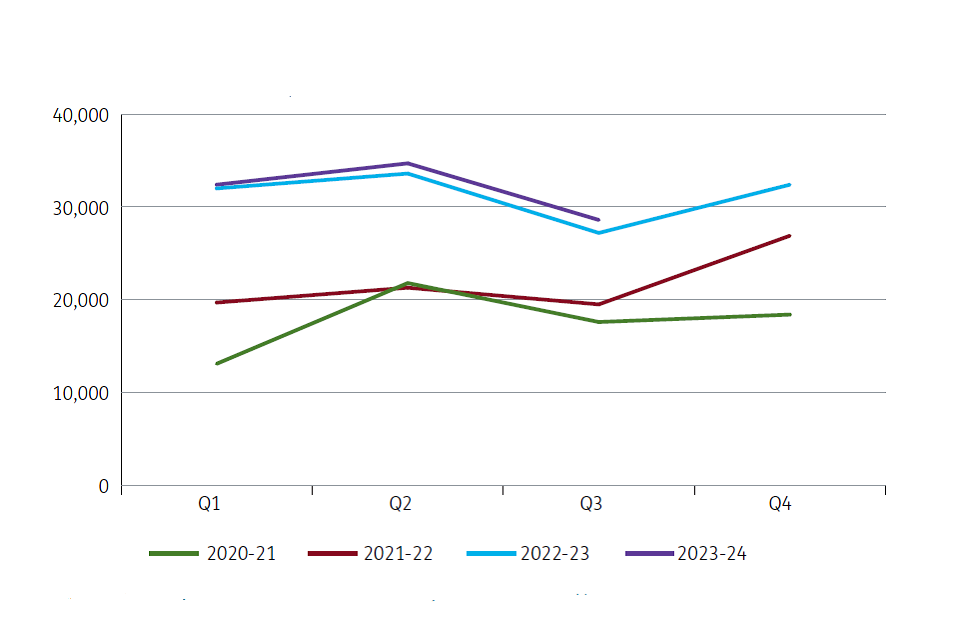

Starts on Restart

Outcomes from Restart

Starts on SWAPs

UN Sustainable Development Goals

SDG 1, 4, 8 and 10

Performance Analysis

See Performance Analysis section

Strategic Outcome 2 – Deliver financial support to people who are entitled to it

Summary

Throughout 2023 to 2024 DWP delivered 40.8 million Cost of Living Payments, recognising the challenges faced by those on low incomes and the most vulnerable in our society. From April 2023, benefit rates and State Pensions were uprated by 10.1%.

DWP has arranged and collected £1.3 billion in child maintenance payments in the 12 months to December 2023, by making it easier for customers to access the Online Application process, self-serve calculator and automated payment line.

The Department continued to provide housing support, with a spend of £31.8 billion of support in the 2023 to 2024 financial year through Housing Benefit and the housing element of Universal Credit.

Performance Metrics

Absolute low-income rate, after housing costs, for working-age adults.

Absolute low-income rate, after housing costs, for children.

Rate of unfulfilled eligibility, total, and for PIP, UC, DLA

Value of unfulfilled eligibility, total, and for PIP, UC, DLA

UN Sustainable Development Goals

SDG1, 5 and 10

Performance Analysis

See Performance Analysis section

Strategic Outcome 3 – Enable disabled people and people with health conditions to start, stay, and succeed in work, and get financial support

Summary

DWP has achieved the goal to see a million more disabled people in employment between 2017 and 2027 and aimed to build on that success in 2023 to 2024. To do this the Department has introduced Universal Support, a new supported employment programme, and broadened access to Additional Work Coach Support for disabled people.

DWP has published a Health and Disability White Paper which sets out changes to the benefits system to support disabled people and those with health conditions start, stay, and succeed in work and to live independently.

Performance Metrics

Disability Employment Rate Gap.

Absolute low income rate, after housing costs, for individuals in families where someone is disabled.

Rate of economic inactivity with long term sickness as the main reason

UN Sustainable Development Goals

SDG1, 4, 8 and 10

Performance Analysis

See Performance Analysis section

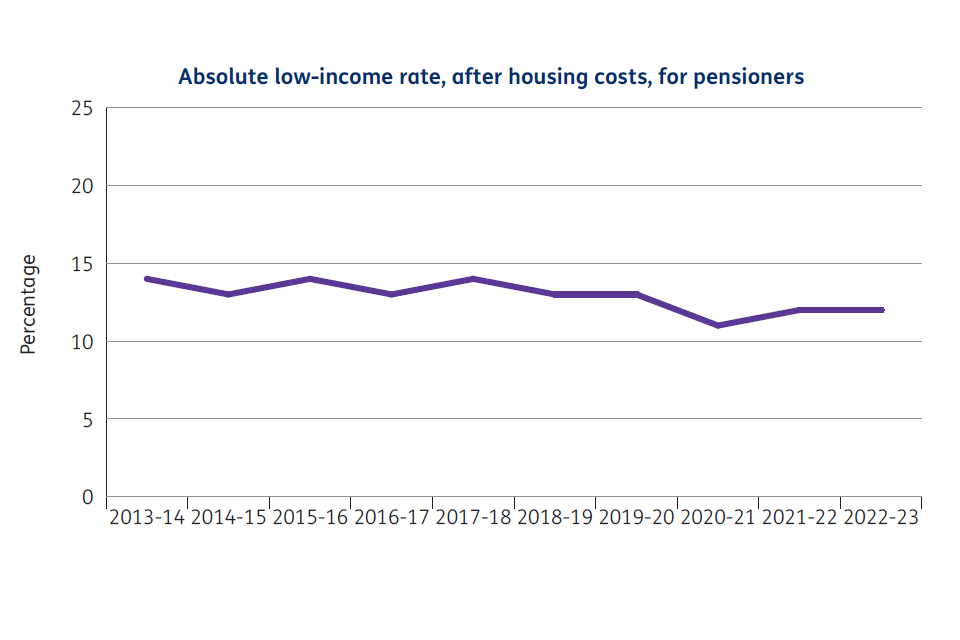

Strategic Outcome 4 – Support financial resilience in later life

Summary

DWP remains committed to supporting people to build financial resilience at all stages of their life. The State Pension continues to provide a foundation to support people’s financial wellbeing in retirement and for people on a low income and at risk of poverty, DWP provides additional support through Pension Credit.

Working through DWP’s arm’s length bodies, the Department encourages people to save towards their retirement through a private pension, supported by their employer.

The Department has continued to improve systems, for example by enabling some changes of circumstances to be reported online via the Get your State Pension service. This has simplified the process, reduced processing time and enabled more pensioners to access services digitally.

Performance Metrics

Percentage of pensioners in absolute low income, after housing costs.

Number of people automatically enrolled in workplace pensions.

Proportion of automatic enrolment-eligible employees participating in a workplace pension.

UN Sustainable Development Goals

SDG1, 5 and 10

Performance Analysis

See Performance Analysis section

Delivery Objectives

Deliver high quality services, modernising services and improving customers’ experience

Summary

DWP has continued to modernise the delivery of services to improve customer experience. DWP has simplified processes and made it easier for customers to self-serve, so that its people can provide additional support to customers with more complex needs. The Department has strengthened its complaints and appeals process, learning lessons to help improve customer satisfaction. DWP continued to make progress in clearing backlogs, despite increases in demand for many of its services.

DWP is delivering the Scottish Devolution Programme with the Scottish Government, to ensure the effective devolution of welfare support following the Scotland Act 2016.

Performance Metrics

Percentage of claimants satisfied with DWP services overall.

Percentage of claims processed within planned timescales.

Percentage of UC claims processed within planned timescales.

Performance Analysis

See Performance Analysis section

Improve services, tackle Fraud, Error and Debt and drive efficiencies.

Summary

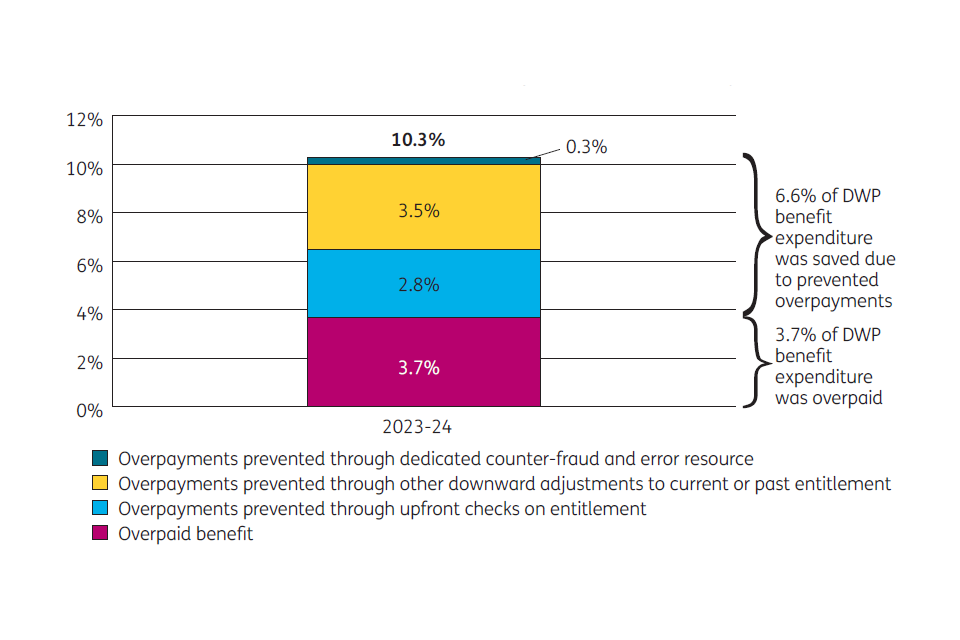

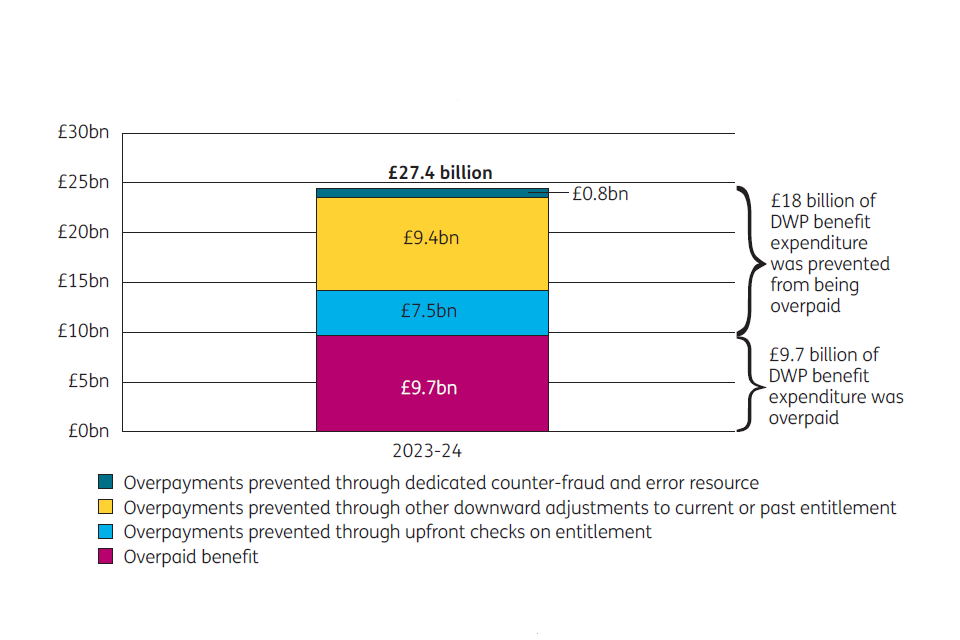

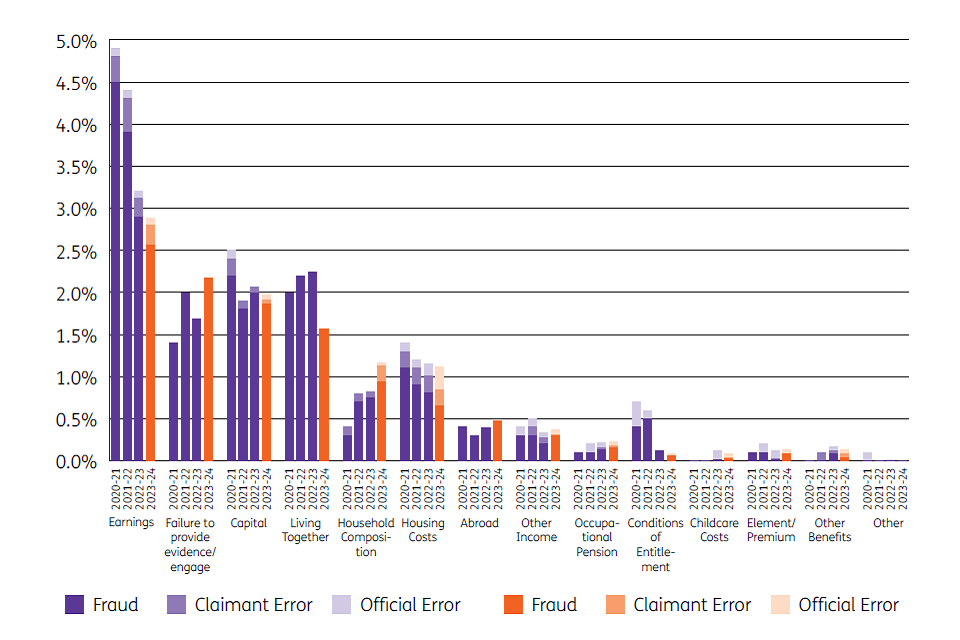

The Department is committed to tackling fraud and error in the benefits system and recovering debts owed. The Fraud, Error and Debt Report outlines what has been done to reduce overpayments and prevent loss, how underpayments are being corrected, and sets out how the Department has been managing debt recovery.

Performance Metrics

Annually Managed Expenditure (AME) savings made against DWP £1.3 billion AME savings target.

Fraud and error levels in the benefit system including both the rate and monetary value across the benefits measured in 2023 to 2024.

Performance Analysis

See Fraud Error and Debt report

Enabling the delivery of our services

Summary

Enabling functions remain an important driver of the Department’s ability to deliver on its Strategic Outcomes. These are key activities or operations that build capacity and capability, including:

- Workforce, Skills and Location

- Innovation Technology and Data

- Delivery, Evaluation, Collaboration

- Sustainability

UN Sustainable Development Goals

SDG 16

Performance Analysis

See Performance Analysis

Risks affecting the delivery of DWP’s objectives

Introduction

DWP continued to operate in a challenging external environment during 2023 to 2024, responding to global instability, cost of living pressures and uncertainty in the economy.

DWP’s risk management approach

Last year’s accounts set out the top three risk themes for 2023 to 2024:

1. Tackling fraud, error and debt

2. Building capacity in the labour market (tackling economic inactivity and improving workforce participation)

3. Resource capacity, delivering high quality services and driving efficiencies

The Executive Team has been focused on developing and delivering mitigations to the Department’s principal, top level risks, recognising the many links and complexities in the risk set.

The Department’s risk management plans need to focus on what can be influenced and ensure that decision making choices fully consider the impacts across linked risks to manage the total risk position across the Department. Key areas of focus include:

- managing increased demand for DWP services, which showed no signs of slowing in 2023 to 2024. The Department has flexed our resources to move people to work on areas of highest priority and recruited significant numbers of new colleagues.

- delivering the Department’s programme of change and transformation, which has been affected by capacity and capability challenges. Deliverability and affordability are being continuously reviewed and assessed.

- cyber-threats and the security of data have the Department’s full attention. Progress has been made on making DWP’s IT infrastructure more resilient and secure, increasing protection against cyber-attacks and other external threats, and improving data management controls.

- tackling levels of fraud and error by designing in fraud and error controls. Improving detection capability through targeted reviews, exploration of data analytics and machine learning.

- maintaining the focus on delivering a package of new measures to reduce economic inactivity which has risen from before the pandemic, expanding existing support measures while maintaining performance. During 2023 to 2024, the Risk Management Assessment (RMA) programme has continued to provide assurance on the effectiveness of risk management practices and internal control across the Department. The programme is being reviewed and enhanced to continue to ensure that DWP has a clear understanding of the risks that need to be managed, and carefully tested mitigation plans.

Chief Finance Officer Review

Introduction

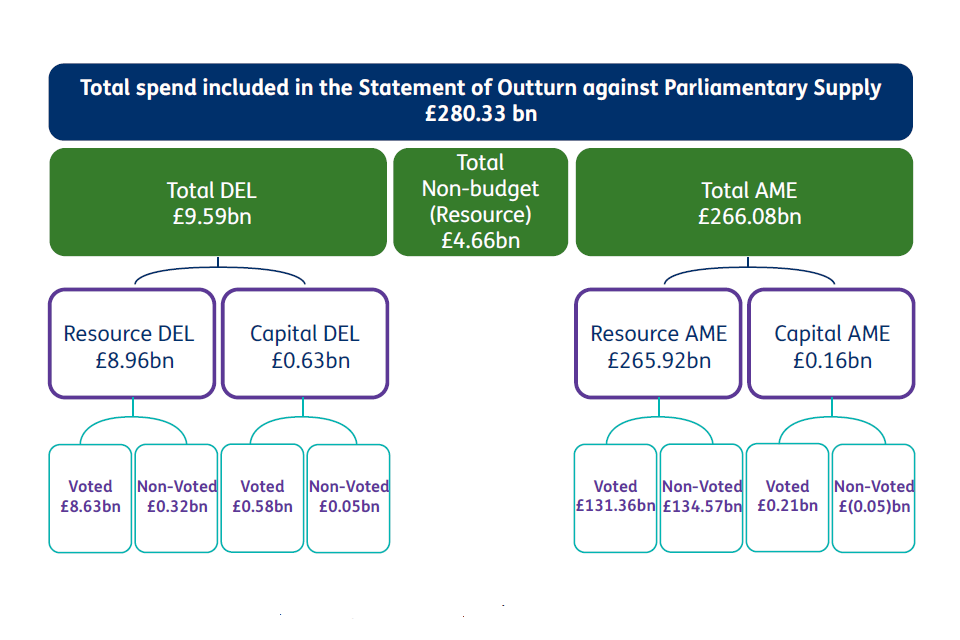

In 2023 to 2024 DWP provided £266.1 billion in financial support to around 20 million people. To deliver this, £9.6 billion was spent, against a departmental Expenditure Limit of £9.8 billion, administering pension and benefit payments. This was in addition to delivering services supporting people to move into and progress in work, supporting disabled people and those with long-term health conditions.

The economic environment has continued to be challenging throughout 2023 to 2024 with cost of living continuing to rise, although at a slower rate due to falling inflation. The Department has continued to prioritise delivery of essential services and financial support to customers.

Although recruitment continued throughout the year, there has been sustained high levels of demand for DWP services. In order to balance the running of existing core services with new measures introduced at Autumn Statement and Spring Budget, the Department focused resources on delivery of the Strategic Outcomes and Delivery Objectives.

The departmental budget and how it is set

The departmental budget is split into the following spend categories:

Annually Managed Expenditure (AME) for costs that may be unpredictable. Most welfare spending is classified as AME.

Departmental Expenditure Limit (DEL) for costs relating to running the Department. DEL costs are split between Programme and Administration.

Both DEL and AME are split into two further categories. Resource spending is money that is spent on day-to-day resources and administration costs. Capital spending is money that is spent on investment and things that will create growth in the future. For further explanation on spend categories, go to How to understand public sector spending – GOV.UK (www.gov.uk)

Annually Managed Expenditure forecasts

The Office for Budget Responsibility (OBR) forecasts welfare expenditure twice a year, at the Autumn Statement and the Spring Budget. The forecasts take account of any changes to OBR’s underlying assumptions about the economy, modelling changes, and tax and spending measures announced by the Chancellor. The OBR publishes the details of the forecasts in the Economic and fiscal outlook (EFO).

Welfare Cap

The welfare cap is a limit on the amount that government can spend on certain social security benefits and Tax Credits. 50% of welfare spending is subject to the welfare cap, which excludes the State Pension and payments to jobseekers.

At the Spring Budget 2024, the OBR estimated the breach of the welfare cap plus margin to be £7.4 billion in 2024 to 2025, down by £1.1 billion since Autumn Statement. This reduction is primarily driven by higher assumed earnings growth within the Universal Credit caseload which reduces UC expenditure, and an increase in the proportion of Tax Credit claims that are assumed to close rather than migrating to Universal Credit.

The next formal assessment of the welfare cap by OBR will be at the first fiscal event of the new Parliament, in 2024 to 2025. If the welfare forecast is above the welfare cap plus margin, the Department will breach the cap and the Secretary of State will need to either:

- Lay a paper before the House of Commons proposing government policy measures which will reduce welfare spending to within the level of the cap

- Explain to the House of Commons why a breach of the welfare cap is considered justified

Departmental Expenditure Limit budget

DWP’s 2023 to 2024 budget was initially set at Spending Review 21 (SR21) at £7.8 billion (excluding depreciation). As the economic environment evolved, HM Treasury made additional funding available, including to support those most in need via the Household Support Fund (£842 million). In 2022 to 2023, DWP secured agreement with HM Treasury to budget transfer (£212 million) from that year in return for a corresponding increase in 2023 to 2024 to enable delivery across the Spending Review settlement period. The Department also received additional funding to support the Workforce Participation and Target Case Review activity within Universal Credit (£407 million). Once depreciation is taken into account, DWP received total DEL funding in its Mains Estimate 2023 to 2024 of £9.8 billion. The Spring Budget 2023 also introduced a number of employment measures to support back-to-work schemes, with additional funding being provided at Supplementary Estimate. DWP returned funding against ring-fenced funding items of spend which could not be utilised elsewhere, meaning that the Department’s overall funding remained virtually unchanged at £9.8 billion.

Departmental budget vs actual spend in 2023 to 2024

The table below sets out the Department’s actual spend in 2023 to 2024 against budget

| Spend category | Budget £ billion | Actual £ billion | Variance |

|---|---|---|---|

| Resource AME | 273.3 | 265.9 | -7.4 |

| Capital AME | 0.4 | 0.2 | -0.2 |

| Total AME | 273.7 | 266.1 | -7.6 |

| DEL Administration | 1.0 | 1.0 | 0 |

| DEL Programme | 8.1 | 8.0 | -0.1 |

| Total Resource DEL | 9.1 | 9.0 | -0.1 |

| Total Capital DEL | 0.7 | 0.6 | -0.1 |

| Total Managed Budget vs Actual Spend | 283.5 | 275.7 | -7.8 |

For further details, including trends over the past five years, see the core tables.

Departmental spend in 2023 to 2024

Welfare spend in 2023 to 2024

| Welfare spend | Pension age benefits £ billion | Working age benefits £ billion | Totals |

|---|---|---|---|

| Support for children and working age disabled people and people with health conditions | – | £27.1 | |

| Support for pension age disabled people and people with health conditions | £13.1 | – | |

| Employment and Support Allowance | – | £12.4 | |

| Housing Benefit | – | £9.2 | |

| Cost of living payments | – | £7.8 | |

| Other pension and benefits | £7.7 | – | |

| Housing Benefits | £6.0 | – | |

| Other working age benefits | – | £4.2 | |

| Cost of living payments | £2.6 | – | |

| State Pension | £124.1 | – | |

| Universal Credit | – | £52.0 | |

| Other AME including capital AME | – | – | -£0.1 |

| AME | – | – | £266.1 |

Resource Annually Managed Expenditure

In 2023 to 2024, Resource AME was £265.9 billion, including Cost of Living Payments. This was around £36 billion (15%) more than in 2022 to 2023, largely due to the annual uprating of pensions and benefits of 10.1%, as well as the continued roll-out of Universal Credit, which includes payments formerly made through personal Tax Credits paid by HM Revenue and Customs.

58% of Resource AME expenditure was paid to pensioners, with the State Pension accounting for £124.1 billion and Pension Credit for £5.5 billion. The cost of the State Pension increased by £14.0 billion (13%) compared to 2022 to 2023.

Over £78 billion[footnote 1] of Resource AME (29%) supported people with a disability or health condition (including pensioners).

Around £58.4 billion of Resource AME (22%) was spent on a range of other benefits, with the majority going to working age people (73%). This includes £32.5 billion on Universal Credit (excluding payments to support those with either incapacity or caring responsibilities).

The Department provided £10.4 billion of additional support to customers who needed it the most through the Cost of Living Payments, an increase of £2.1 billion (25%) from 2022 to 2023. More than 7 million households on means-tested benefits and Tax Credits received up to £900, at a total cost of £6.8 billion. A further 6 million people who receive a qualifying disability benefit received a one-off £150, totalling £1 billion. Over 8 million pensioner households received £300 alongside their Winter Fuel Payment in November/December 2023, valued at £2.6 billion.

Capital Annually Managed Expenditure

The Department spent £157.1 million on Capital AME in 2023 to 2024, including £30.3 million on Support for Mortgage Interest payments, £129.2 million on Universal Credit Advances and £46.3 million on Estates Dilapidations, the costs incurred at the end of a lease to return a building to its original state. This was offset by £48.7 million of Social Fund loan net repayments.

See more detailed information on benefit expenditure outturn and forecasts in the DWP benefit expenditure tables on GOV.UK.

Departmental spend in 2023 to 2024

| Spend | Cost £ billion |

|---|---|

| Digital Group | £1.0 |

| Service Excellence | £0.8 |

| Change and Resilience | £0.7 |

| Policy Group | £0.2 |

| People and Capability | £0.2 |

| Health and Safety Executive | £0.2 |

| Money and pension Service | £0.2 |

| Finance Group | £0.1 |

| Other Corporate* | £0.0 |

| Work and Health Services | £2.6 |

| Contract Management and Partner Delivery | £2.2 |

| Corporate Transformation | £1.4 |

*includes spend for Central Analysis and Science, Communications and Private Office totalling £42.7 million

Departmental Expenditure Limit

While the Department started the year in a relatively balanced financial position, a number of challenges emerged. Through strong monthly financial management and collaborative working, the Department, has been able to meet all of these challenges and more, remaining within the funding allocation for the year. The main challenges across 2023 to 2024 were as follows:

- an uplift in colleague pay was 2.5% higher than the original HM Treasury Spending Review assumption. DWP defined a strong, sustainable set of efficiencies (see detail below) which were higher than original HM Treasury targets and sufficient to cover the pay pressure.

- there was a large increase in volumes of Personal Independent Payment assessments (£29 million) across the year, and in the second half of the year, significant rises in the number of Access to Work claims, added an additional pressure of £60 million. Those pressures were absorbed by the Department.

- increased costs in some Change Programmes caused additional funding pressure, which DWP was able to accommodate by reallocating funding across the portfolio.

- while recruitment plans for the year started strongly, higher than expected levels of internal appointments created further vacancies, in addition to people leaving the Department in the first half of the year. The overall impact meant that the Department did not make material increases in the headcount until the later part of the year.

Increasing efficiency

DWP carried out a cross departmental review of a number of activities to consider options for doing them differently or for less, meeting the Spending Review efficiency challenge and keeping in line with the Government Efficiency Framework’s efficiency drivers[footnote 2].

DWP delivered £343 million in cashable savings through our procurement activity and a further £128 million in non-cashable savings[footnote 3]. During 2023 to 2024, the Department saw the introduction of the Government Commercial Organisation Corporate Scorecard. This is a mechanism for defining and measuring the key metrics that will best represent the commercial function’s performance priorities for the year, and is agreed between the Chief Commercial Officer, Finance Director General, and the Head of the Government Commercial Function. Throughout the year the Department provides monthly updates on savings to the Head of the government Commercial Function.

Further information on efficiencies from the Workplace Transformation and Service Modernisation programmes, and investment in digital services, is set out in the Delivery Objectives sections.

Performance Analysis

This section expands on the Performance Overview and includes details of DWP activities and further analysis of progress against performance indicators covering the period 1 April 2023 to 31 March 2024. Any reference to government refers to the government in place at that time.

Strategic Outcomes

Strategic Outcome 1: Maximise employment, reduce economic inactivity, and support the progression of those in work

Maximising employment

Introduction

DWP jobcentres offered advice and support to those seeking employment, including face-to-face time with work coaches and interview assistance. The Department continued to deliver on major interventions and core regimes, such as Restart, Sector-based Work Academy Programmes, Youth Offer and 50+ Choices. Autumn Statement 2023 announced the Back to Work Plan.

Restart

The Restart scheme was established in response to the COVID-19 pandemic and forecast increases in unemployment, as part of the Plan for Jobs. First referrals to Restart were in July 2021. Restart was set up as a 3 year scheme originally due to close to new referrals in June 2024. To the end of April 2024, 610,000 people have started the scheme, with 230,000 of these having moved back into work whilst participating in the scheme[footnote 4].

The Department also published an evaluation of the scheme on 9 May 2024[footnote 5]. Survey data from Wave 2 of the evaluation suggested that participants were more likely to report being in work, approximately 12 months after referral, than non-participants (35% compared to 26%). This is based on self-reported data and a more robust assessment of the impact of Restart will be produced at the end of the Scheme.

Additional Jobcentre Support pilot

Additional Jobcentre Support is testing the impact that daily intensive support has on claimants’ movement into work and overall earnings. Additional Jobcentre Support Phase 1 rolled out from February 2023 in 60 jobcentres and tested two two-week interventions at weeks 13 and 26, with one week of employability support and one week of work search support each time.

Phase 2 expanded the Additional Jobcentre Support pilot to more jobcentres in October 2023 to test additional mandatory interventions with claimants as early as week 7 of their claim. Additional Jobcentre Support now intervenes at week 7 with a week of daily employability support, and then again at weeks 13 and 26 for two-week periods of daily work search support.

Sector-based Work Academy Programmes

Sector-based Work Academy Programmes (SWAPs) offer eligible jobseekers training, work experience and a guaranteed interview for a job or apprenticeship the aim being to help businesses with recruitment and enable customers to learn the skills and behaviours employers need. SWAPs are targeted at filling jobs in sectors such as construction, health and social care, logistics, hospitality, public sector and security. In 2023 to 2024, jobcentres delivered 98,710 SWAP starts, exceeding the ambition of 80,000.

DWP Train and Progress

Train and Progress was introduced in April 2021 to reinforce work coach engagement with jobseekers in identifying and addressing skills needs, so that customers are better equipped to take up job vacancies and achieve their career goals. The core element of DWP Train and Progress is to enable Universal Credit customers to participate in full-time work-related training for up to 16 weeks. This allows jobseekers to access vocational courses such as the Department for Education’s Skills Bootcamps, which offer targeted higher-level learning in sectors such as construction, engineering and logistics.

Youth Offer

The Youth Offer provides individually tailored work coach support to eligible young people aged 16 to 24 in the Universal Credit Intensive Work Search Regime. This includes the Youth Employment Programme, Youth Employability Coaches for young people with additional barriers to finding work, and Youth Hubs across Great Britain. From September 2023, the offer was expanded to young people in other regimes including young parents and carers.

The Youth Offer is a demand-led programme. As of 1 March 2024, over 1 million young people have accessed support through the Youth Offer.

Care leavers

DWP supports care leavers, who often face a difficult transition to adulthood, through a series of safeguards and easements to simplify and improve their interaction with the benefit system. The Department has continued to contribute to cross-government activity to support care leavers into sustainable independent living to help them thrive and fulfil their potential. Our pledges under the Care Leaver Covenant list the DWP offer to care leavers and is published on GOV.UK. Department for Work and Pensions: Care Leaver Covenant offer – GOV.UK (www.gov.uk)

Individual Placement and Support and Peer Mentoring

As part of the government’s 2021 drugs strategy, DWP committed to expanding Individual Placement and Support (IPS) for drug and alcohol dependency programmes across England by March 2025, and provide employment support for individuals with an addiction, including a peer mentoring programme.

As of March 2024, the programme is live in 90 local authority areas, providing up to 9 months of employment support and 4 months of in-work support, to those in clinical treatment.

The Department also launched a peer mentoring test in 2023 to 2024 across selected areas in London, Hampshire, Merseyside, Hull and North Wales. This supports individuals to disclose their dependency, access treatment and move closer to work.

Support for refugees and humanitarian visa groups

DWP provides a range of support to help those granted refugee or humanitarian protection status, as well as those on the Afghan Resettlement and Ukraine Schemes, to integrate in the community and find work. This includes access to DWP employment programmes such as Restart, Sector-based Work Academies and early access to the Work and Health Programme. Work coaches promote DLUHC’s STEP- Ukraine Programme and Home Office’s Refugee Employability Programme.

Prison work coaches

A network of 200 prison work coaches deliver employment and benefit support to prisoners and prison leavers. DWP has continued to test different approaches to helping customers prepare their Universal Credit claim and claimant commitment.

Supporting Families Employment Advisors

Through its network of around 300 Supporting Families Employment Advisors, who worked as part of the cross-government Supporting Families Programme, DWP has developed relationships with disadvantaged families, with the aim of supporting them on the path to work, financial stability, and continuous employment outcomes. The Department for Education-led Supporting Families Programme has funded local authorities to help almost 637,000 families make sustained improvements with the issues that led to them joining the programme. The most recent data suggests that Supporting Families Employment Advisors are assisting nearly 10,000 families, resulting in around 200 job starts every month.

Supporting ethnic minority claimants

DWP supports ethnic minority claimants to move into employment by providing access to mainstream services and bespoke programmes that are designed to be flexible to individual and local needs. The Department is also taking targeted action in 20 places with a high ethnic minority employment gap. At the end of March 2024, there were 5.4 million individuals from an ethnic minority background in employment, an increase of 378,000 on the year.

Sanctions

Under the Back to Work plan, claimants are expected to either take up a job, mandatory work placement or engage in a programme of intensive activity.

To ensure that claimants comply with specific work-related requirements, DWP toughened up the approach to conditionality and sanctions, including expectations around attending jobs fairs and job interviews. Compliance is monitored by work coaches, who have been given additional tools to help track attendance, leading to sanctions where necessary.

Where sanctions are applied, DWP is ensuring claimants re-engage and re-comply by applying claim examinations through Targeted Case Reviews.

Continuing the Move to Universal Credit

As of August 2023, there were around 2.1 million households on legacy benefits remaining in scope for moving to Universal Credit. The government’s commitment was to move all legacy benefit customers to Universal Credit by the end of the financial year 2024 to 2025 with the exception of customers on Employment and Support Allowance only, and customers claiming Employment and Support Allowance and Housing Benefit (ESA only and ESA and HB).

From 3 April 2023, DWP began increasing the numbers of Migration Notices issued and by the end of March 2024 had issued over 540,000 Migration Notices to households.

Between July 2022 and March 2024, 824,050 individuals in 540,070 households were sent Migration Notices. A total of 400,940 individuals living in 275,980 households have made a claim to Universal Credit so far.

DWP now has ‘Move to Universal Credit’ operating across all jobcentre districts within Great Britain.

Both the NAO and PAC recently examined whether DWP was making progress in implementing Universal Credit[footnote 6]. The NAO concluded DWP is on track with its plan to move claimants of legacy benefits over to Universal Credit. Both the NAO and PAC highlighted concerns with the proportion of Tax Credit claimants not transferring when invited to do so and made recommendations relating to continuing the support DWP provides to help claimants move to Universal Credit. PAC also recommended the Department continues to capture the learning from its current programme in order to migrate vulnerable claimants effectively.

DWP has carried out a range of research and monitoring to better understand why some Tax Credit customers are not claiming Universal Credit and have made enhancements to the Migration Notice and reminders, to improve engagement with Tax Credit customers.

There is a range of support available to individuals to help them make the move to Universal Credit, including a dedicated DWP telephone line, face-to-face support in the local jobcentre and independent support through Help to Claim, delivered by Citizens Advice and Citizens Advice Scotland. The Department has also developed and tested a new ‘enhanced support’ journey for ESA and Income Support customers who require more support to claim. This process is now in place for these customer groups and involves outbound telephony, system checks and home visits, dependent on individual support needs.

Reduce economic inactivity

Introduction

The workforce participation package of measures announced at the Spring Budget 2023 support people to enter work, increase their working hours, and extend their working lives. These measures focus on key groups who face additional barriers to work, including disabled people and those with health conditions, the over 50s, parents and carers.

Support for older workers

DWP continues to deliver the 50PLUS employment support offer to customers across the jobcentre network and doubled the number of 50PLUS champions in November 2023 to continue to raise awareness of the needs and value of older workers.

The Midlife MOT helps workers in their 40s, 50s and 60s take stock of their work, health and money, to give them access to the best possible career, health and financial guidance to be better prepared for the future. This year we launched a £5 million expansion of the Midlife MOT. All citizens can access the online Midlife MOT which signposts to later life planning information and resources. Work continued with the government-appointed Business Champion for Older Workers to engage employers and support businesses to better recruit and retain older workers. DWP is also piloting a private sector Midlife MOT, which went live in May 2023.

Lead carer conditionality

DWP introduced changes to conditionality for lead carers of children aged 1 to 12 on Universal Credit. These changes were designed to reduce inactivity and increase labour market participation. From July 2023 the Department increased the frequency of jobcentre appointments for lead carers of children aged 1 and 2. From October 2023, the maximum hours of work-related activity for lead carers of children aged 3 to 12 increased to 30 hours.

Support the progression of those in work

Introduction

DWP has extended the support jobcentres provide to people in work and on low incomes to help them increase their earnings and move into better paid quality jobs.

In Work Progression

Over 2023 to 2024 the Department continued to support those who were in work to progress and increase their earnings. Voluntary support remains available to all claimants in the light touch and working enough groups. Claimants earning above the Administrative Earnings Threshold (AET) but below the Conditionality Earnings Threshold (CET) are in the light touch group. Claimants working and earning the equivalent of CET at National Living Wage (or National Minimum Wage if under 23) are in the working enough group.

This support focuses on removing barriers to progression, such as considering skills gaps and identifying training opportunities which help people looking for progression opportunities in their current role or through a new one. Jobcentre colleagues are supported by a network of 37 District Progression Leads across Great Britain who work with partners to spearhead the scheme.

From spring 2024, the Administrative Earnings Threshold (AET) was increased to £892 per month (£1,437 per month for couples), bringing an additional 180,000 low earning claimants into regular contact with a work coach. For further information on the AET, see Administrative Earnings Threshold to rise for Universal Credit Jobseekers – GOV.UK (www.gov.uk)

New rules require 180,000 on Universal Credit to increase working hours – GOV.UK (www.gov.uk)

UC childcare costs

To support working parents to take on additional hours, in June 2023 DWP increased the monthly UC childcare costs ‘caps’ (or maximum amounts) by 47%, allowing parents to claim back more for the childcare they need. In the same month, measures were introduced to pay claimants’ initial childcare costs directly to the childcare provider and then pay 85% of those same costs to the parent, as if they had paid it themselves. This allows parents to pay the advance payment that childcare providers require, and have additional funds to pay their next month’s costs.

These measures ensure that parents looking to move into work or increase their hours are not prevented from doing so because of high childcare costs. In April 2024, the maximum UC childcare amounts increased further to £1,014.63 per month for a single child, and £1,739.37 per month for larger families.

DWP’s performance

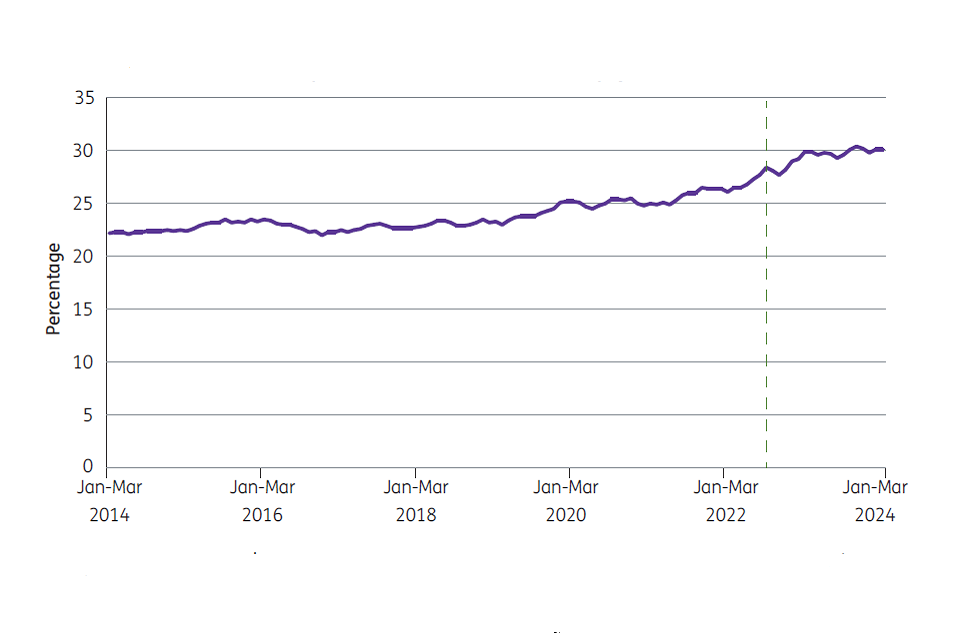

The following section provides the latest position on key metrics used to assess performance against this outcome. The labour market measures are drawn from the Labour Force Survey (LFS), which has experienced data quality problems as a result of low sample sizes.

The Office of National Statistics (ONS) notes that:

Due to increased volatility of LFS estimates, resulting from smaller achieved sample sizes, estimates of quarterly change should be treated with additional caution.

Employment rate by age

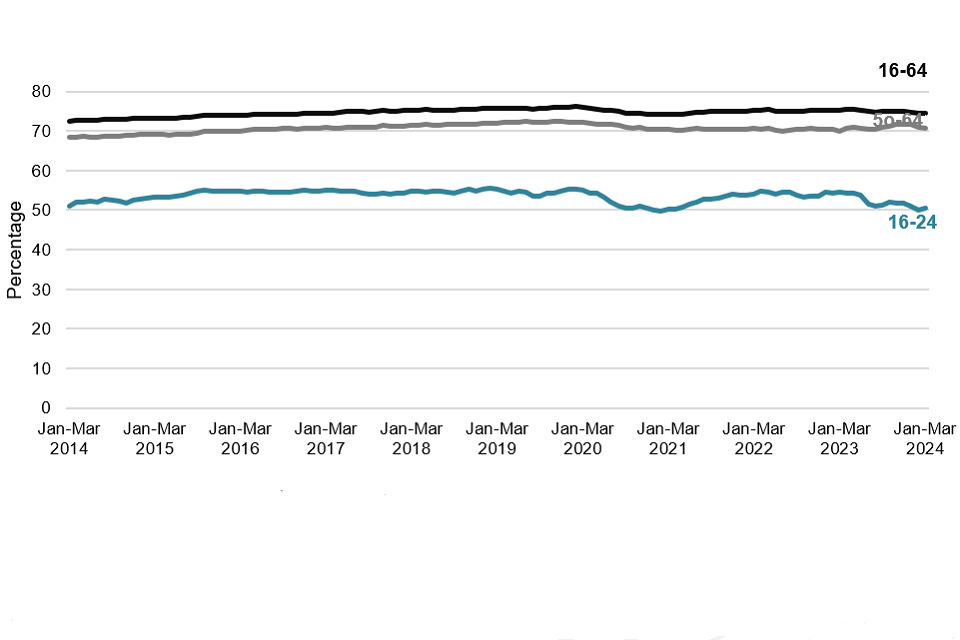

The latest available data, covering January to March 2024, shows the UK employment rate at 74.5% for people aged 16 to 64. The 16 to 64 employment rate is down 0.8 percentage points on the year, and down 1.7 percentage points on December to February 2020 (prior to the impact of COVID-19). The UK employment rate for young people (16 to 24) is 50.4% in January to March 2024. This is 24.0 percentage points lower than the UK employment rate for people aged 16 to 64. The 16 to 24 employment rate is down 4.1 percentage points on the year and down 4.9 percentage points on December to February 2020. The UK 50 to 64 employment rate is 70.8% in January to March 2024.

This is 3.7 percentage points lower than the UK employment rate for people aged 16 to 64. The 50 to 64 employment rate is up 0.7 percentage points on the year and down 1.5 percentage points on December to February 2020.

UK employment rate of 16 to 64, 16 to 24 and 50 to 64 year olds (Jan to Mar 2014 to Jan to mar 2024

UK figures are seasonally adjusted. Source: A01 Summary of labour market statistics: Labour market status by age group – Office for National Statistics – (ons.gov.uk)

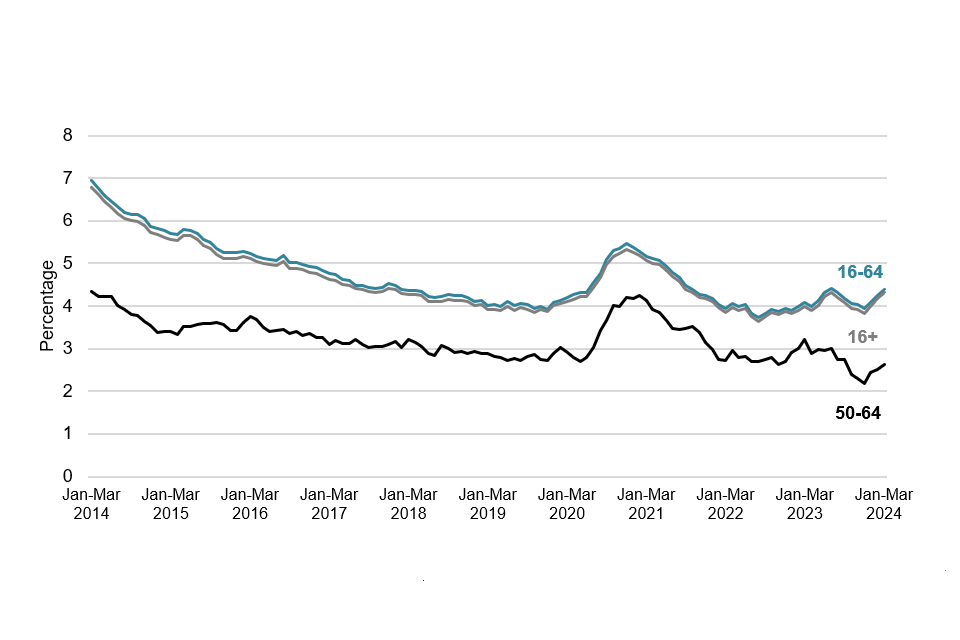

Unemployment rate by age

The latest available data covering January to March 2024, shows the UK unemployment rate at 4.3% for people aged 16+ (this is the headline measure of unemployment). The 16+ unemployment rate is up 0.3 percentage points on the year and up 0.2 percentage points on December to February 2020 (prior to the impact of COVID-19). The UK unemployment rate for people aged 50 to 64 is 2.6% in January to March 2024. The UK unemployment rate for people aged 50 to 64 in January to March 2024 is 1.7 percentage points lower than the UK unemployment rate for people aged 16+. The unemployment rate for people aged 50 to 64 is down 0.6 percentage points on the year and down 0.4 percentage points on December to February 2020.

The UK unemployment rate is at 4.4% for people aged 16 to 64 in January to March 2024. The 16 to 64 unemployment rate is up 0.3 percentage points on the year and up 0.2 percentage points on December to February 2020 (prior to the impact of COVID-19). The UK unemployment rate for people aged 50 to 64 in January to March 2024 is 1.7 percentage points lower than the UK unemployment rate for people aged 16 to 64.

UK unemployment rate of 16+, 16 to 64 and 50 to 64 year olds (Jan to Mar 2014 to Jan to Mar 2024)

UK figures are seasonally adjusted. Source: A01 Summary of labour market statistics: Labour market status by age group – Office for National Statistics (ons.gov.uk)

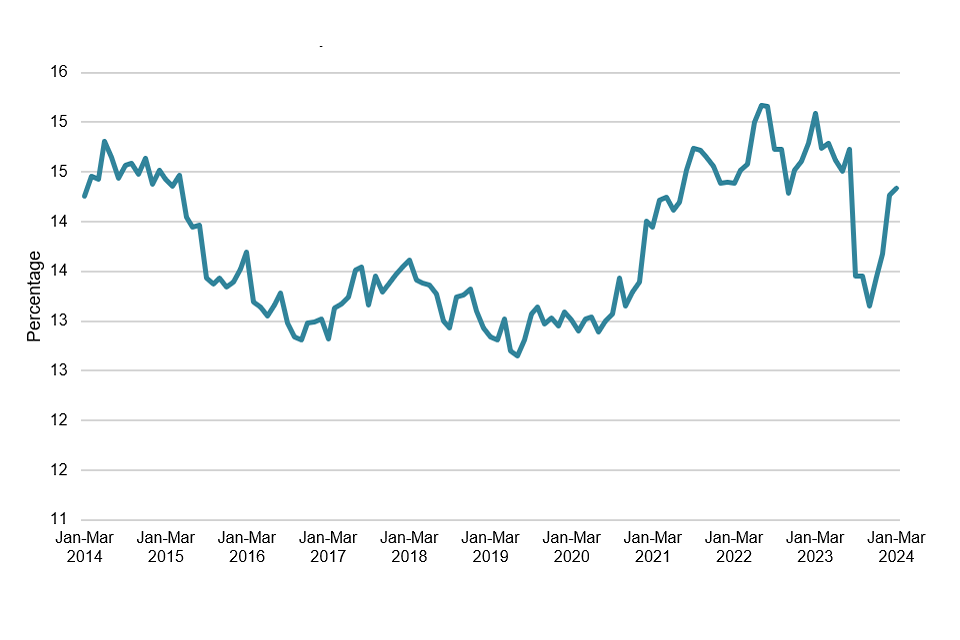

Employment rate gap between 35 to 49 and 50 to 64 year olds

The latest available data, covering January to March 2024, shows that the UK employment rate gap between 35 to 49 and 50 to 64 year olds is at 14.3 percentage points. The employment rate gap between 35 to 49 and 50 to 64 year olds is down 0.8 percentage points on the year, and is up 1.2 percentage points on December to February 2020.

UK employment rate gap between 35 to 49 and 50 to 64 year olds (Jan to Mar 2014 to Jan to Mar 2024)

UK figures are seasonally adjusted. Source: A01 Summary of labour market statistics: Labour market status by age group – Office for National Statistics – (ons.gov.uk)

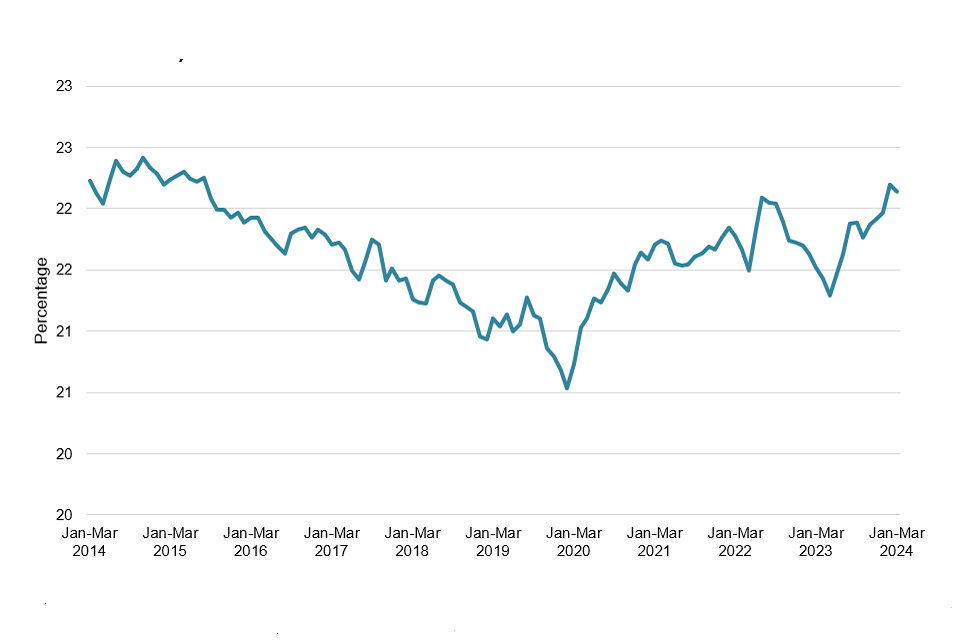

Economic inactivity rate

The latest available data, covering January to March 2024, shows that the UK economic inactivity rate for 16 to 64 year-olds is 22.1%. This is up 0.6 percentage points on the year, and up 1.6 percentage points on December to February 2020. See Strategic Outcome 3 for the rate of economic inactivity with long-term sickness as the main reason.

*UK figures are seasonally adjusted. Source: A01 Summary of labour market statistics: Labour market status by age group – Office for National Statistics (ons.gov.uk)

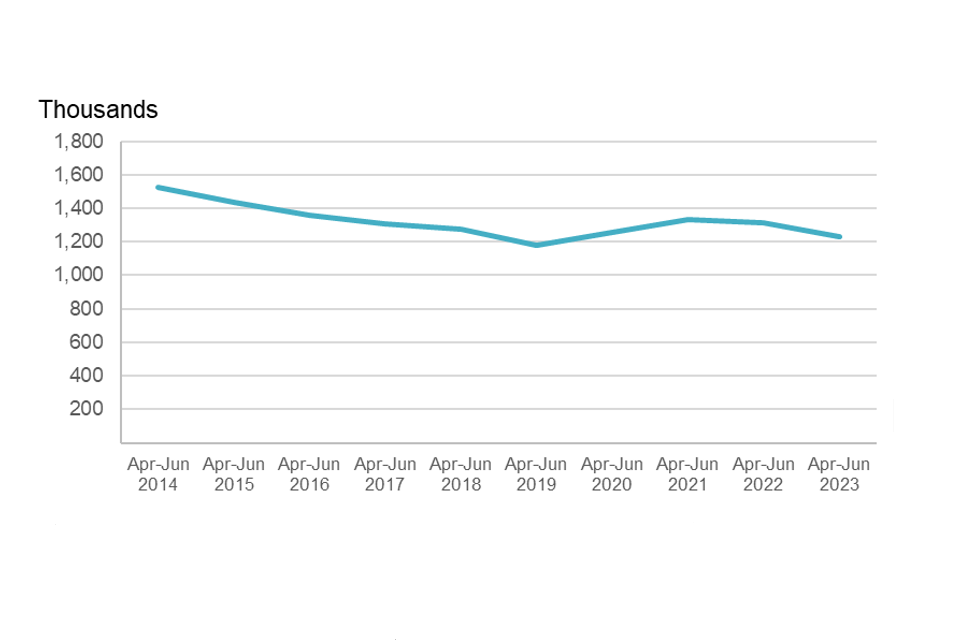

Number of children in workless households

The latest available data, for April to June 2023, shows that the number of children in workless households fell by 85,000 in the preceding year, to a total of 1.23 million.

UK children in workless households (2014 to 2023)

Source: table K children in households by combined economic activity status of household members – Office for National Statistics (ons.gov.uk)

ONS has suspended production of the household Labour Force Survey datasets used in these estimates. It is currently reviewing next steps for the release of children in workless households statistics. At present we do not know when the next update will be available.

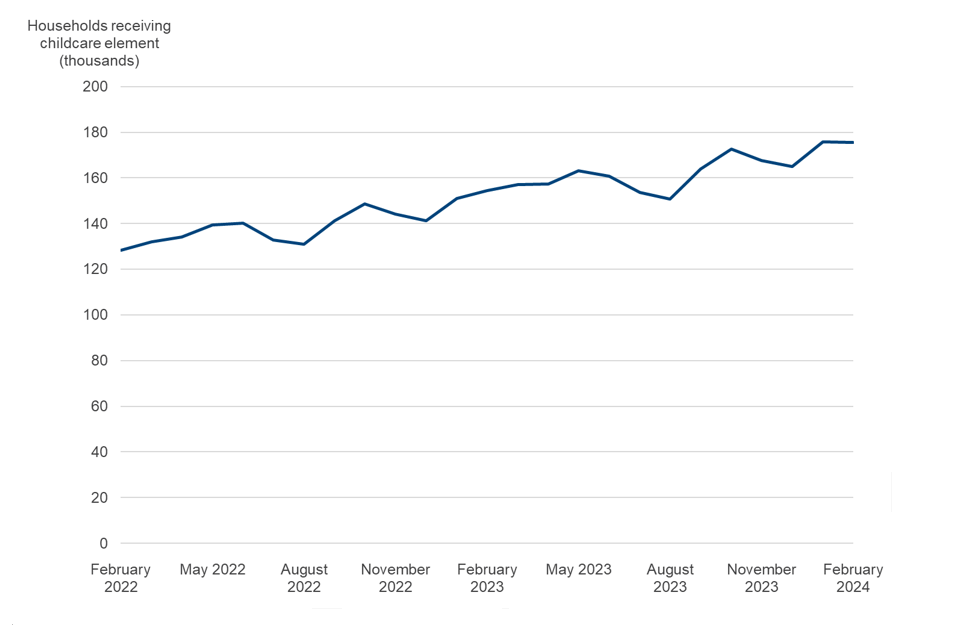

Households in receipt of Universal Credit childcare element

In February 2024, 176,000 households received the UC childcare element. This has increased by 21,000 (14%) since February 2023, reflecting the overall increase in the number of households on UC. In June, July and August 2023, and again in November and December 2023, the number of households receiving the UC childcare element fell slightly. This is in line with similar falls in previous years and is likely to be because households use childcare less during holiday periods.

Households counted by month of assessment period start date.

Source: Universal Credit administrative data, Universal Credit statistics, 29 April 2013 to 11 April 2024 – GOV.UK (www.gov.uk)

Strategic Outcome 2: Deliver financial support to people who are entitled to it

Introduction

The Department administers working-age, retirement, disability, and ill health benefits to around 20 million claimants across the United Kingdom.

In 2023 to 2024 DWP continued to provide additional cost of living support, both through its own Cost of Living Payments and by discretionary welfare assistance provided by local authorities. The Department also continued support children and families through the child maintenance system and through the Reducing Parental Conflict and Supporting Families Programmes.

This section details how the Department supported people with the cost of living and with meeting housing costs, and protected long-term outcomes from children in 2023 to 2024.

Delivering welfare and benefits to support people with the cost of living

Cost of Living Payments

While the rate of inflation reduced during 2023 to 2024, DWP recognised and sought to address the challenges and cost of living pressures faced by vulnerable customers and those on low incomes. On 17 November 2022, further Cost of Living Payments were announced worth a total of £10.4 billion. Legislation was laid so that the first payments were paid from April 2023, with a total of 40.8 million payments being paid:

- over 7 million households on eligible means-tested benefits received up to £900 in Cost of Living Payments, with a total value of £6.8 billion

- over 6 million people who qualified for an ‘extra costs’ disability benefit received a one-off £150 disability Cost of Living Payment, totalling £1 billion

- over 8 million pensioner households received a pensioner Cost of Living Payment of £300 as a top up to their Winter Fuel Payment from November 2023, at a total cost of £2.6 billion

The Work and Pensions Select Committee carried out an inquiry into the Cost of Living Payments and published a report on 14 November 2023. Full details of responses can be found here Cost of living support payments: government Response to the Committee’s First Report - Work and Pensions Committee – (parliament.uk).

Household Support Fund

In 2023 to 24 DWP provided £1 billion, including Barnett[footnote 7] impact, to enable the extension of the Household Support Fund. This meant that £842 million was available to local authorities in England to support those most in need, with the scheme running from 1 April 2023 to 31 March 2024. The Household Support Fund operates in England only. The Devolved Administrations receive Barnett Formula funding as a result of this, as usual, and it is for them to decide how to allocate their additional funding.

Supporting people to meet the costs of housing

Ensuring people have a safe, stable, and affordable place to live is vital to improving people’s financial and personal resilience, enabling them to access work and improving their quality of life. DWP continued to provide housing support, with a spend of £31.8 billion of support in the 2023 to 2024 financial year through Housing Benefit and the housing element of Universal Credit. The Department increased access to Support for Mortgage Interest from April 2023, by reducing the qualifying period and extending eligibility to Universal Credit claimants with earnings, meaning an additional 200,000 people could benefit.

Protecting long-term outcomes for children

Child Maintenance Service

DWP continued to deliver a Child Maintenance Service (CMS). In the 12 months up to December 2023, the CMS arranged around £1.3 billion in child maintenance payments, up £152 million on the previous 12 months.

Applications to CMS, increased by 7% in the year to December 2023. The CMS compliance has increased by 3 percentage points over the same 12 months, reaching 68%.

Vital child maintenance payments are reaching parents through improved enforcement processes, in the quarter ending December 2023 money per civil enforcement action was up 6% on the same period in 2022. DWP has introduced an online application process and automated payment line, and have expanded the changes that customers can make online. More information is in the Service Modernisation Programme section.

Reducing Parental Conflict Programme

DWP protects longer-term outcomes of children through the Reducing Parental Conflict Programme. In August 2023 we published an evaluation[footnote 8] into the effectiveness of 7 different parental relationship interventions. This showed that the interventions, which typically included a number of face-to-face or online sessions with a trained practitioner, have positive outcomes for children and their parents. Benefits included child mental health and wellbeing, and reduced parental conflict. The families involved sustained those positive outcomes throughout the 12 months that they were measured.

Supporting Families Programme

Employment Advisers played a key role in the Supporting Families Programme, helping families experiencing multiple disadvantages with the aim of achieving financial stability and long-term unemployment outcomes. Families supported included those who are workless, require support with their finances, and where a young person in the household is not in education, employment or training (NEET).

For more information on Universal Credit childcare costs, see Universal Credit childcare costs – GOV.UK (www.gov.uk)

Unfulfilled eligibility

Unfulfilled eligibility refers to cases where claimants are eligible for a higher award but have not provided the correct information needed to calculate that award. The claimant might have provided the wrong information or failed to inform and report about changes to their circumstances which would have resulted in a higher award.

In May 2024 DWP published estimates on unfulfilled eligibility, with further detail on the purpose of this statistical series outlined in the Fraud, Error and Debt report.

For information on how DWP continues to deliver key services to customers, simplify processes and provided additional support to customers with complex needs to support individuals to claim what they are entitled to see the Delivery Objectives. For information on how DWP has supported disabled people and those with health conditions see Strategic Objective 3. In the 2023 to 2024 Unfulfilled Eligibility estimates, Disability Living Allowance, Personal Independence Payment, and Universal Credit account for around three quarters of the total value of unfulfilled eligibility. In particular Disability Living Allowance and Personal Independence Payment account for the highest levels of unfulfilled eligibility in the benefits system and therefore these areas are focussed in further detail below.

Supporting people to claim what they are eligible for

DWP ensure people can access financial support when they need it and understand the importance of paying people their correct entitlement. Personal Independence Payment (PIP), Disability Living Allowance (DLA) and Attendance Allowance (AA) are all tax-free, non-contributory and non-means tested. Accessing financial support.

DWP has seen increasing numbers of Personal Independence Payment (PIP) claims. The Department has introduced a blend of phone, video and face-to-face assessments with the aim of delivering a more efficient and user-centred service. DWP has also increased the availability of health professionals who carry out the PIP assessments, and case managers who are responsible for making decisions on PIP awards.

PIP new claims almost doubled between 2020 and 2023 (470,000 to 850,000), and therefore careful management of all PIP assessments was required to ensure that new claimants received their decision as quickly as possible. For claimants already in receipt of PIP but awaiting a review of their award, case managers were able to make decisions on award reviews where there is sufficient and robust evidence, without referral to an assessment provider. DWP has also introduced processes to make sure that no claim goes out of payment while waiting for a review, using short term award extensions where appropriate.

Right from the outset for individuals making new claims to PIP DWP provides information to customers via gov.uk to support their understanding of the PIP eligibility criteria and evidence requirements for claiming that benefit. Instructions on reporting a change of circumstance are also available including how to contact the Disability Service Centre who manage PIP. DWP encourages all PIP claimants to inform it straightaway if their needs have changed for better or worse. Priority is given to claims where claimants report a change in their needs to ensure DWP is paying individuals the right amount. For more information on how the Department continues to deliver key services to customers, simplifying processes and provided additional support to customers with complex needs, see the Delivery Objectives.

For more information on Health Transformation Programme and other work that DWP does to support disabled people and people with health conditions - see Strategic Objective 3. DWP will continue to improve services across the Department, engaging with key stakeholder groups to ensure the right outcome for customers.

DWP performance

The following section provides the latest position on key metrics used to assess performance against this outcome.

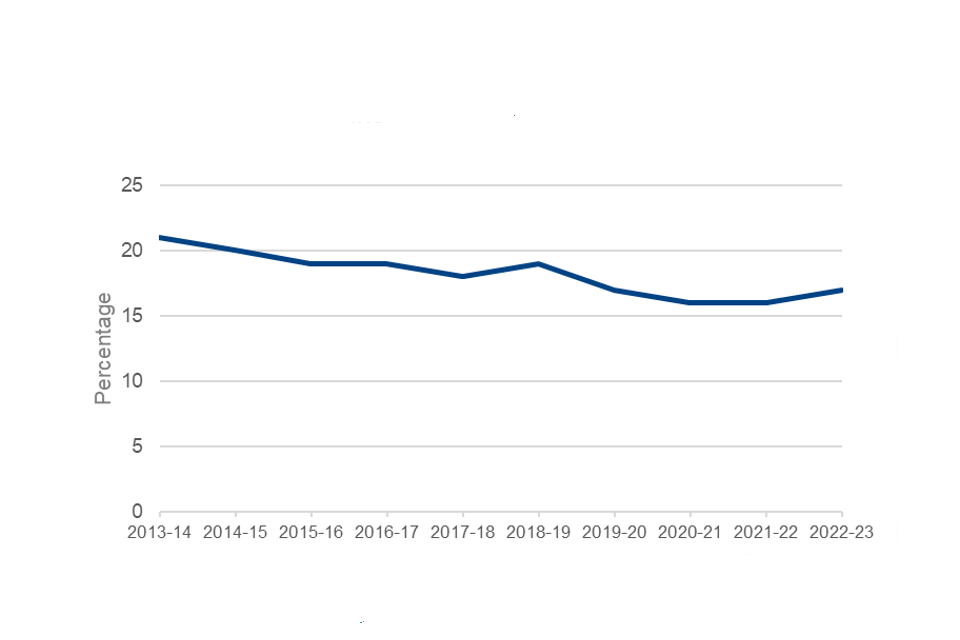

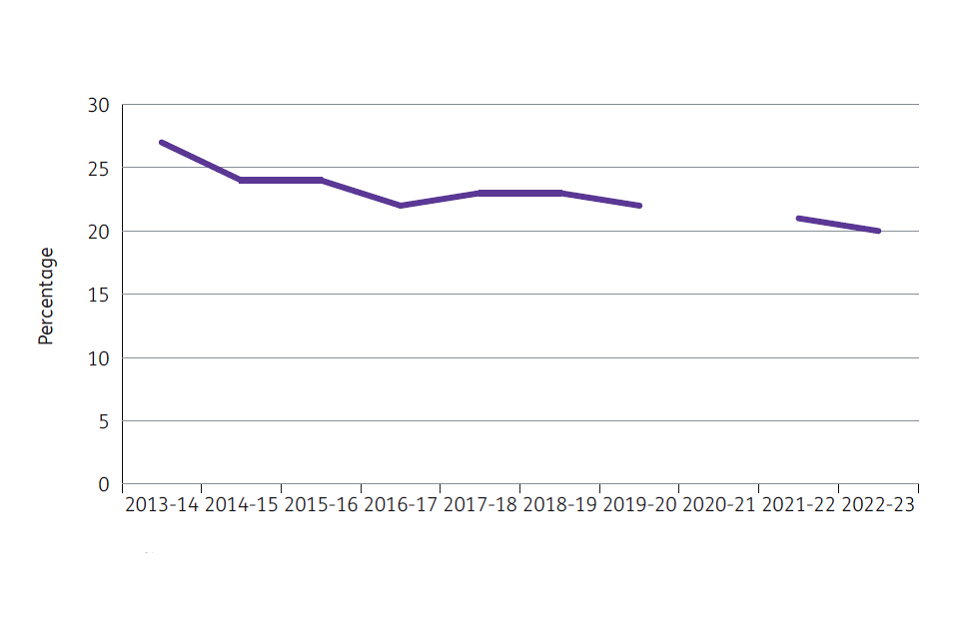

Absolute low-income rate, after housing costs, for working-age adults

Absolute low income refers to people living in households with income below a level set at 60% of median income in 2010 to 2011, adjusted for inflation.

In 2022 to 23, 17% of all working-age adults, 6.9 million, in the UK, were living in absolute low-income households after housing costs compared with 21%, or 8.0 million in 2013 to 2014.

Absolute low-income rate, after housing costs, for working age adults

*Source: Households below average income (HBAI) statistics – GOV.UK (www.gov.uk)

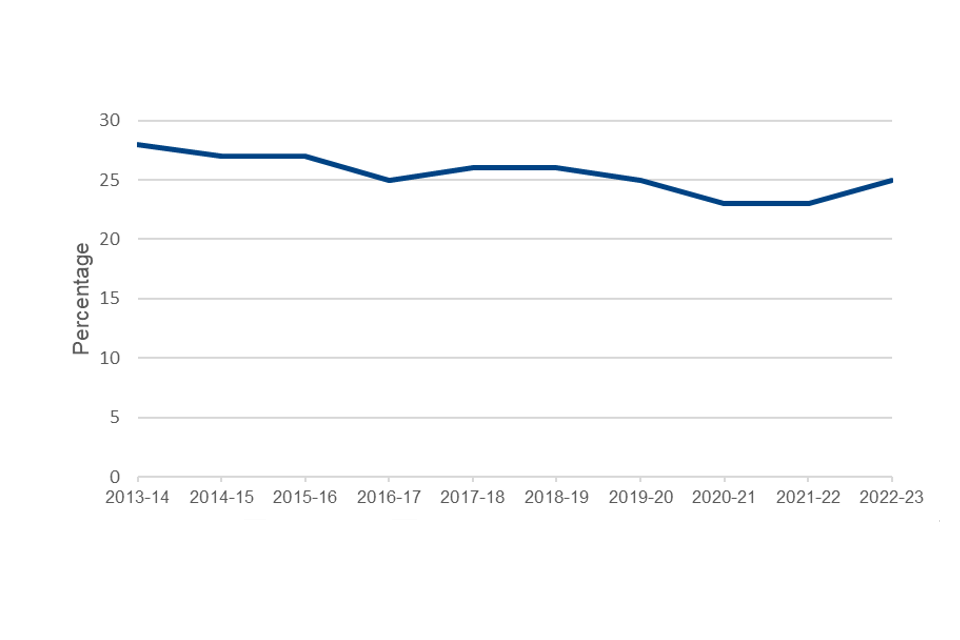

Absolute low-income rate, after housing costs, for children

In 2022 to 2023, 25% of all children, 3.6 million children in the UK, were living in absolute low-income households after housing costs compared with 28%, or 3.8 million in 2013 to 2014.

Source: Households below average income (HBAI) statistics – GOV.UK (www.gov.uk)

Unfulfilled Eligibility Estimates

DWP measures unfulfilled eligibility to understand the levels, trends, and reasons behind it – helping us identify what the Department can do to reduce the level of unfulfilled eligibility in the benefit system.

The total unfulfilled eligibility rate for 2023 to 2024 was 1.2% (£3.1 billion) compared to 1.0% (£2.3 billion) in 2022 to 2023.

The analysis showed for 2023 to 2024, Disability Living Allowance (DLA), Personal Independence Payment (PIP), and Universal Credit (UC) accounted for around three quarters of the total value of unfulfilled eligibility. The table below sets out the rate and financial value of unfulfilled eligibility for these benefits.

Unfulfilled eligibility in PIP, UC and DLA 2023 to 2024

| Benefit | 2023 to 2024 UE Value £ million | 2023 to 2024 UE rate % | 2022 to 23 UE value £ million | 2022 to 2023 UE rate % |

|---|---|---|---|---|

| Total | 3100 | 1.2 | 2300 | 1.0 |

| PIP | 870 | 4.0 | 850 | 4.8 |

| DLA | 750 | 11.1 | – | – |

| UC | 730 | 1.4 | 610 | 1.4 |

Universal Credit

The rate of unfulfilled eligibility remained at 1.4% in 2023 to 2024, the same as 2022 to 2023, with a financial value of £730 million, compared to £610 million the previous year. The largest source of unfulfilled eligibility in UC for 2023 to 2024 was for housing costs, due to claimants failing to report increases in their rent, and accounting for around 0.5%.

Personal Independence Payments

The rate of unfulfilled eligibility in PIP was 4.0% in 2023 to 2024, compared to 4.8% in 2022 to 2023. The financial value was £870 million - accounting for around a quarter of unfulfilled eligibility - compared to £850 million last year. All unfulfilled eligibility in PIP was due to claimants not informing the Department that they needed more help or that their conditions had deteriorated.

Disability Living Allowance

The rate of unfulfilled eligibility in DLA was 11.1% in 2023 to 2024. The financial value was £750 million, and all unfulfilled eligibility in DLA was due to claimants not informing the Department that they needed more help or that their conditions had deteriorated. The make-up of the DLA caseload has changed substantially since this benefit was last measured in 2004 to 2005 and therefore, DWP is unable to draw a comparison between the estimates. The reason for this change is because in 2004-05 DLA was primarily made up of working-age customers, but now, with the introduction of PIP, there are fewer working-age customers on DLA. The DLA sample for the 2023 to 2024 estimate was therefore made up purely of children and of adults over the age of 65.

Other

Other benefits account for much smaller amounts of total unfulfilled eligibility compared to PIP, DLA, and UC in 2023 to 2024. The drivers of this unfulfilled eligibility were largely housing costs (failing to report increases in rent) and capital.

Strategic Outcome 3: Enable disabled people and people with health conditions to start, stay and succeed in work, and get financial support

Introduction

Having met the goal to see a million more disabled people in employment between 2017 and 2027, the Department remained committed to helping as many disabled people and people with health conditions as possible to start, stay and succeed in work.

The working-age economic inactivity rate increased from 20.5% (8.55 million people) in December 2019 to February 2020, to 22.1% (9.38 million people) in January to March 2024: an increase of 832,000 people. During the same period, long-term sickness has also been rising and is now the is most common reason given for being economically inactive.

This section describes DWP’s activity to enable disabled people and people with health conditions to start, stay and succeed in work, and get financial support. It includes initiatives introduced following the announcements in the 2023 Spring Budget and Autumn statements, as well as information on the Health Transformation Programme (HTP).

Supporting claimants with timely and personalised support finding work

To support disabled people and people with long-term health conditions who are looking to return to work, DWP provides a range of support through the Jobcentre Plus network and through contracted employment provision. In this reporting period the Department has continued to expand support available within Jobcentre Plus, and designed new programmes specifically aimed at addressing the barriers to work experienced by disabled people and those with health conditions.

Disability Employment Advisor

Every jobcentre has access to one or more Disability Employment Advisors (DEA). DEAs offer advice and expertise on how best to help disabled people back into work and also directly support customers with a health condition or disability.

The Additional Work Coach Support (AWCS) pilot that was launched in summer 2022, continued throughout 2023 to 2024. AWCS provides disabled people and people with health conditions increased one-to-one personalised support from their work coach to help them move towards, and into, work. Over the last financial year, the number of jobcentres providing this support increased from one-third to two-thirds.

Work and Health Programme

The Work and Health Programme (WHP) provides personalised support to disabled people and disadvantaged groups who are motivated to work and expect to find it within 12 months. Participants receive up to 15 months of pre-employment support, with up to 6 months of light touch in-work support. All support is personalised to the needs of each participant, using expertise from private, public, voluntary and community sector providers.

WHP helps participants facing a wide range of barriers to work receive coordinated and holistic support. This includes support from agencies with expertise in working with ex-offenders, care leavers, refugees, drug and alcohol users, and veterans, among others.

Between November 2017 (when WHP began its roll-out across England and Wales) and February 2024, 320,000 people had started the programme, 130,000 people had started work and 85,000 people had achieved a sustained job outcome or 6 months of being in self-employment.

Universal Support

Universal support has been developed using the five stage Supported Employment model, which is based on the concept of ‘place, train and maintain. Work and Health Programme (WHP) Pioneer and Individual Placement and Support in Primary Care (IPSPC) form the first phase of Universal Support delivery and have already launched in England and Wales. WHP Pioneer opened for referrals in September 2023, offering support to an additional up to 25,000 ‘economically inactive’ people (defined as those who are eligible for WHP and not in the Universal Credit Intensive Work Search regime or Jobseeker’s Allowance at the point of referral). WHP Pioneer is delivered by WHP providers across England and Wales.

Since the launch of the first phase of Universal Support, latest data to the end of February 2024 shows there have been 5,600 starts on WHP Pioneer. Further details are available through the following link Work and Health Programme statistics – GOV.UK (www.gov.uk). Individual Placement and Support in Primary Care (IPSPC) provides support to disabled people out of work and those at risk of falling out of work due to health issues, and follows on from Health-led Trials in two locations. The Health-led Trials impact evaluation reports – GOV.UK (www.gov.uk) data was updated in April 2024.

DWP provided funding to 12 lead local authorities to deliver IPSPC services across 42 upper tier local authorities in England from April 2023.

IPSPC delivers through co-locating employment specialists across primary health care teams. These specialists work in partnership with clinicians, carers, and employers, encouraging the recognition of employment as an important driver of people’s holistic good health.

Intensive Personalised Employment Support

The voluntary Intensive Personalised Employment Support (IPES) programme supports unemployed and inactive disabled people with complex barriers to employment, who are motivated to work but are more than twelve months from the labour market. It’s aim is to empower them to find suitable employment or self-employment, or to develop the skills to do so.

IPES was launched in December 2019 in England and Wales to provide support for up to 10,000 people over a 4 year period. The Department increased capacity to meet extra demand, supporting a total number of disabled people on the programme of over 11,000 by the time referrals ended in December 2023.

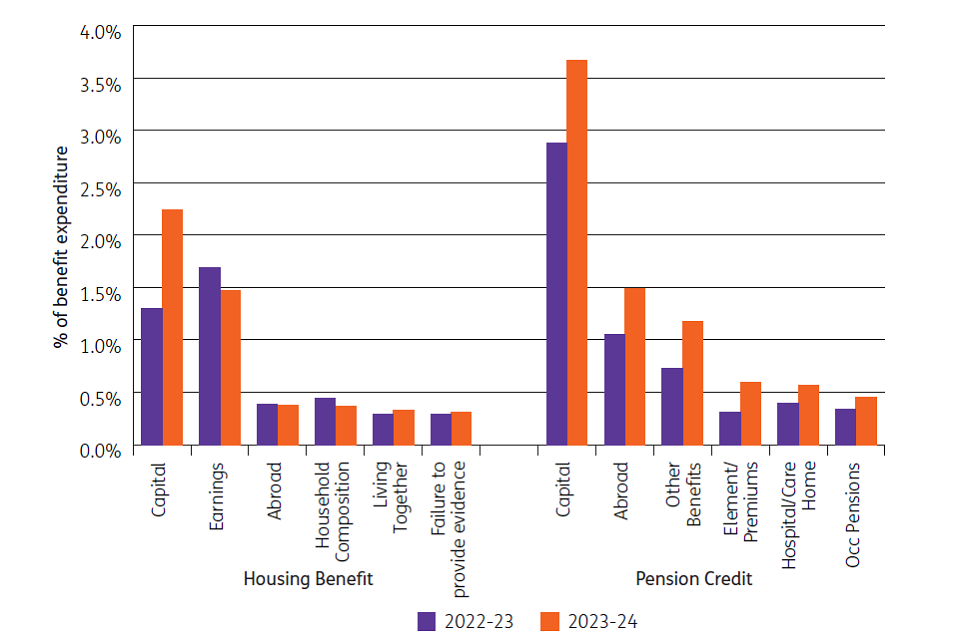

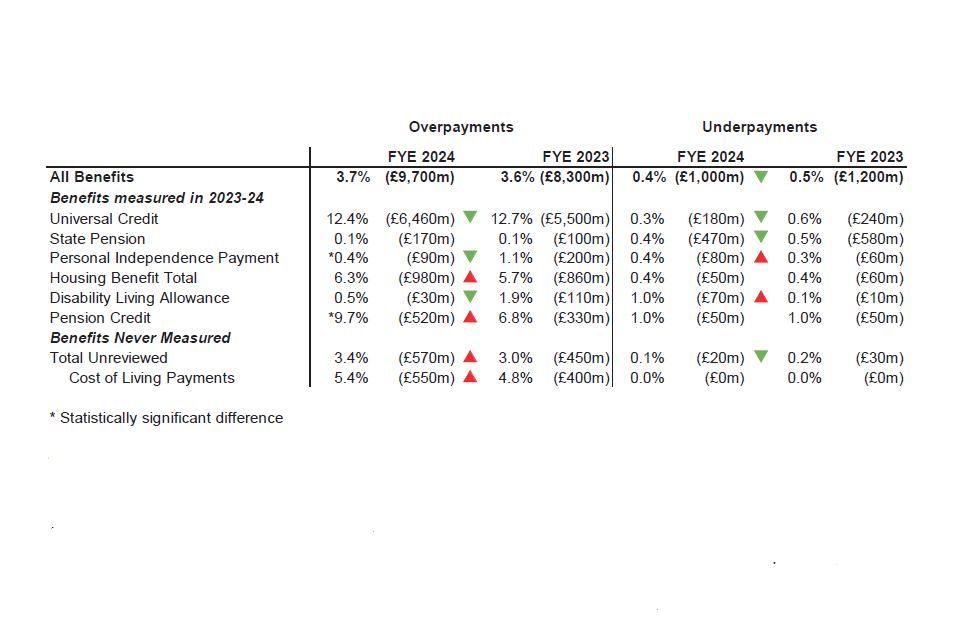

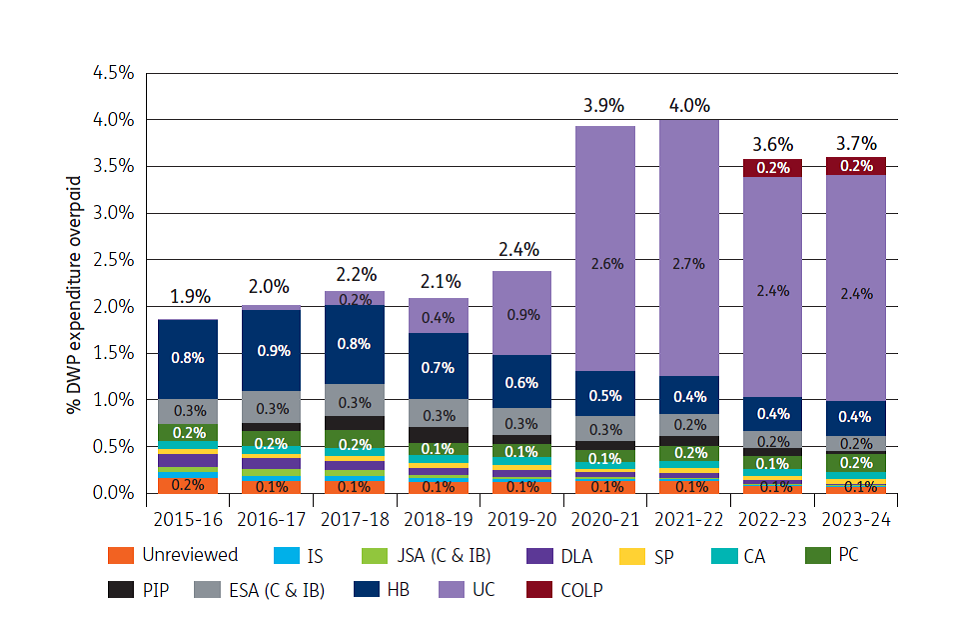

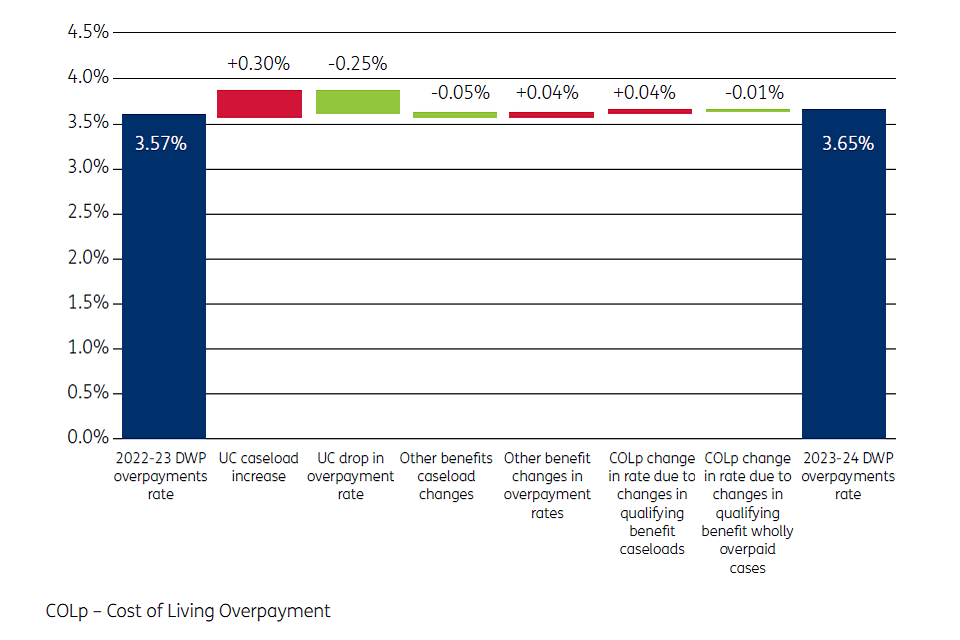

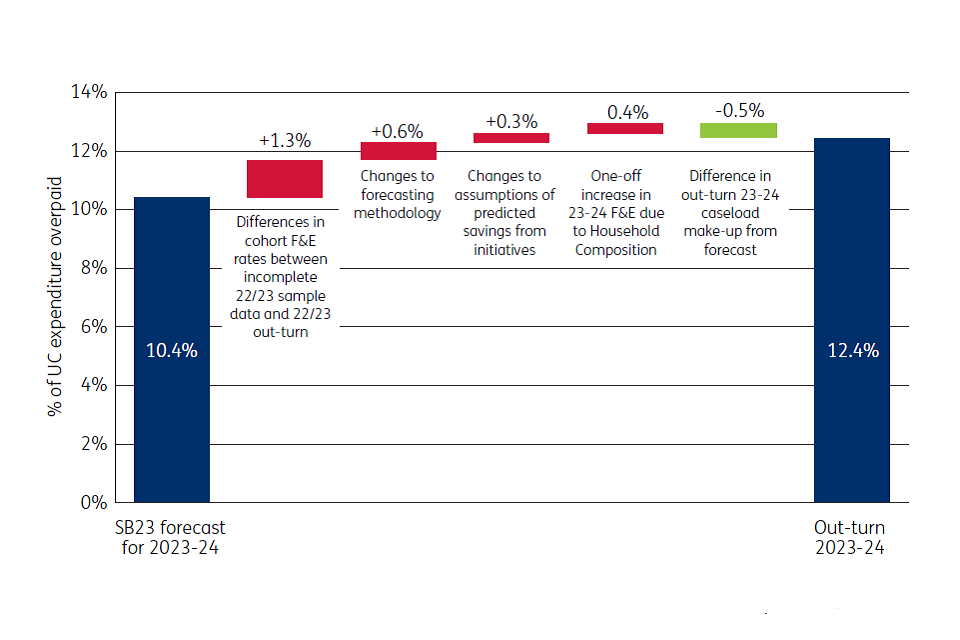

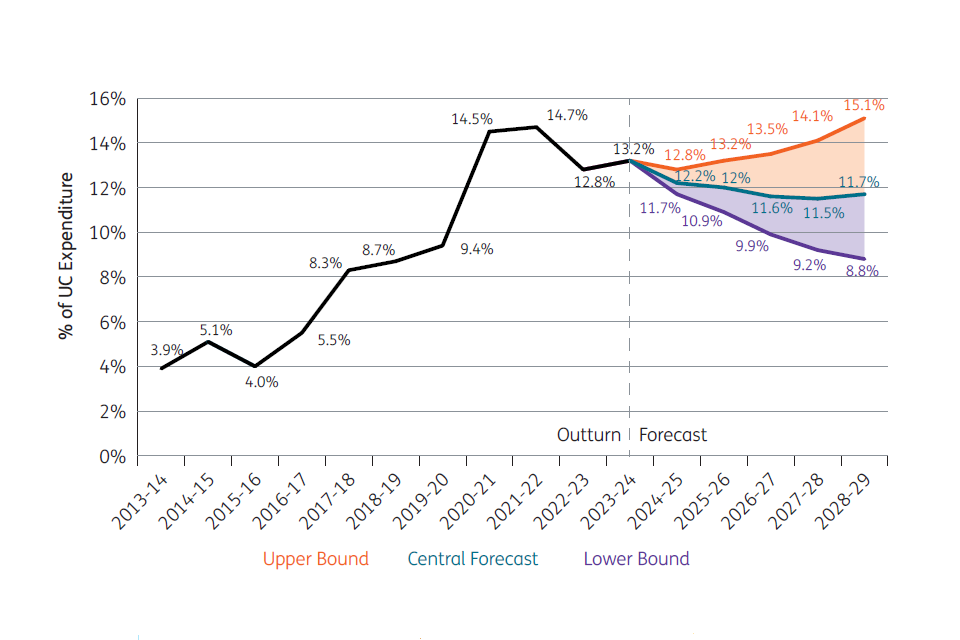

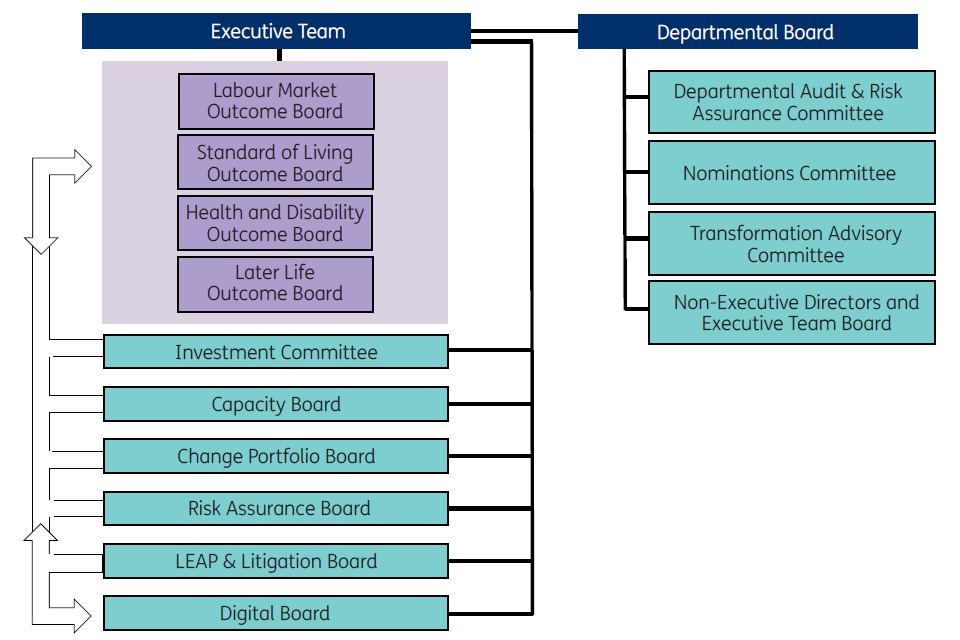

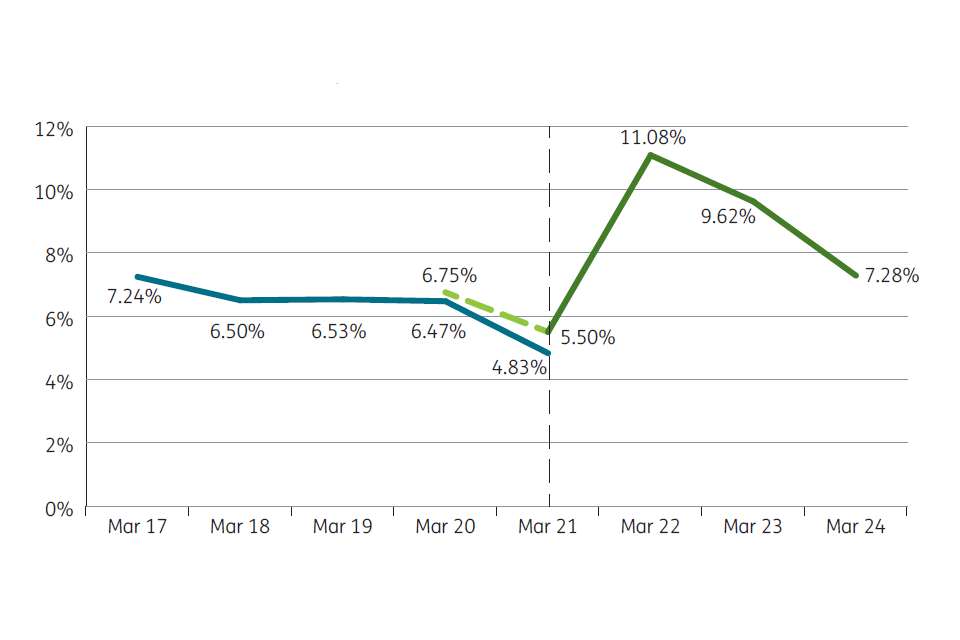

NHS Talking Therapies