Earnings adjustment statement (EAS) guidance: 2021 to 2022

Updated 13 April 2022

Applies to England

1. Introduction and purpose of the document

1. This document sets out how to submit data through the Earnings Adjustment Statement (EAS) data collection.

2. We may make changes to these principles and features during the funding year.

3. This document is designed for colleges, other training organisations and employers.

1.1 Understanding the terminology

4. The term ‘we’ refers to the Education and Skills Funding Agency. When we refer to ‘you’ or ‘providers’, this includes colleges, higher education institutions, training organisations, local authorities and employers that receive funding from us to deliver education and training.

5. The term ‘devolved authority’ refers to the mayoral combined authorities and the Greater London Authority that can fund AEB provision in the 2021 to 2022 funding year.

2. What is the EAS?

6. The EAS is a comma separated value (CSV) data collection. You can submit the EAS to Submit learner data to record some types of funding that you cannot report in the individualised learner record (ILR).

7. This guidance describes the format and content of the EAS.

8. Under most circumstances, you should not need to submit an EAS as you should record your learner data in the ILR. However, in some exceptional cases where you cannot record data in your ILR to receive your funding, you can use the EAS. In other cases, we will require you to use EAS.

9. We describe the circumstances when you may use the EAS, or are required to use the EAS, in this guidance.

10. For a complete understanding of how the funding system works in practice, please read this document along with the following documents:

- adult education budget (AEB) funding rules

- ESFA funding rates and formula documents

- each devolved authority’s funding rules

- each devolved authority’s funding rates and formula

- advanced learner loans funding rules

- apprenticeship funding rules (for starts from 1 May 2017)

- apprenticeships technical funding guide (for starts from 1 May 2017)

- funding rules (for apprenticeship starts before 1 May)

- individualised learner record (ILR) specification, validation rules and appendices

2.1 Changes from the 2020 to 2021 guidance

11. The main way you complete and submit the EAS has not changed from the 2020 to 2021 funding year.

12. We have added new ‘FundingLines’ to describe new procurements that have taken place for ESFA funded learning, and National Skills Fund funding lines for both ESFA and devolved funded provision – see the table in paragraph 48 for more information.

13. We have added new ‘AdjustmentTypes’ for learner support on some procured funding lines. In previous years, providers with procured contracts would be required to submit a funding claim just for these learner support elements, but this year that will no longer be required as the EAS must be used instead – see the table in paragraph 50 for more information.

14. We have added 2 new ‘Source of funding’ values for South Yorkshire Mayoral Combined Authority and West Yorkshire Combined Authority – see the table in paragraph 98 for more information.

3. Can I claim funding for our learners?

15. You can use the EAS to adjust your funding in the following scenarios. Please consult the corresponding funding rules for further details on the eligibility for this funding through EAS.

- you have learners that require ‘Excess Learning Support’ above the value of £150 a month of learning support which is generated by our calculations from ILR data

- you have learners that require ‘Learner Support’. This is split into a number of sub-categories of Learner Support within the EAS

- you have learners enrolled on learning aims within the ‘Prince’s Trust’ team programme

- you have traineeship learners who are eligible for a ‘Discretionary Bursary’ which institutions award to meet individual needs

- you have traineeship learners who are eligible for a ‘Vulnerable Bursary’ for defined vulnerable groups

- you have traineeship learners who are eligible for ‘Free Meals’ in further education

- we have written to you to give authorisation to make an ‘Authorised Claim’

- one of the devolved authorities has asked or allowed you to use EAS to make an ‘Authorised Claim’ for provision which they fund

16. The different types of learning you deliver, for example apprenticeships, or adult education from the AEB, have different eligibility for these scenarios. Paragraph 50 shows which types of EAS claims each different type of learning delivery is eligible for.

3.1 When must I use the EAS?

17. In exceptional cases, we may ask you to repay funding, for example following an audit. In these cases, you must enter a negative adjustment on your EAS.

18. If you are funded for devolved AEB, a devolved authority may also ask you to repay funding. In these cases, you must enter a negative adjustment on your EAS.

4. General guidance for creating your EAS

19. Under most circumstances, your EAS should only contain funding where you have recorded your ILR data correctly, but we have not been able to calculate all funding from that data. You may only use your EAS in cases where you have recorded your ILR data incorrectly if you have received written approval to do so from us or from the relevant devolved authority.

20. Your EAS is a cumulative return – each EAS you submit within a funding year must add to the contents of the previous file you submitted. If you do not include the contents that you previously submitted, we will recover the funding and only generate earnings for the contents of your current file.

21. Your EAS return is not learner based, so you do not need to return a row for each learner for whom you are claiming or repaying funding. You must aggregate the funding into different categories.

22. You must also ensure you have supporting evidence for each claim you make.

4.1 How do I submit data on my EAS?

23. Your submission must be a csv file, following the instructions in the next section. You must upload the CSV to the Submit Learner Data website.

24. Your file must use the format shown in the example file.

25. Please take care to use the exact field names you see in the file – otherwise we will reject your submission and you will not earn the funding from that file.

26. You must collect all your EAS data together to submit as a single file.

27. The adjustments in your EAS always represent activity at the point in time when they took place. The evidence you hold for the activity, including when it happened, should match the data you record in your EAS.

28. You only need to add rows to your file for the claims you are making in the CalendarMonth and CalendarYear when the activity took place. You do not need a row for each FundingLine, or each AdjustmentType each month.

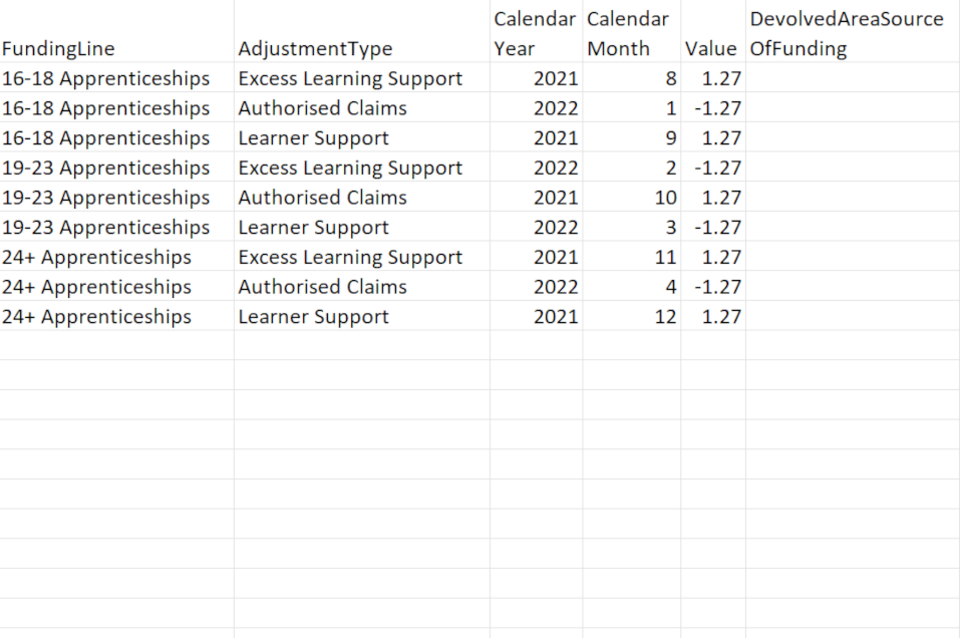

29. Each row in your CSV file you should use a unique combination of FundingLine, AdjustmentType, CalendarMonth, CalendarYear and DevolvedAreaSourceOfFunding as shown in the example below.

Diagram 1: Example EAS file showing valid data

30. When you add a new adjustment, you should create a separate row of data if any one of the 5 fields above is different for that adjustment compared to existing rows in your file. You only need to send a new file if there have been changes or additions since the last file you sent.

31. Each CSV file you submit will overwrite the last one you submitted; therefore, the file needs to include all the data you submit for your organisation for the current funding year – not just the period that you are submitting data in.

If you submit an EAS with a previous month’s data removed, we will recover any payments from you relating to that removed data.

You must continue to submit any data you previously submitted, as this is a year to date collection, unless you discover an error in that data, which you must delete or correct as appropriate.

Example 1: Deleting a single claim

You have submitted a row of data in your EAS for a ‘LearnerSupport’ adjustment in R03, but by R04 you discover the learner it was intended for had left prior to this claim, so you claimed the funding in error. In your R04 return, you would simply delete the row of data from your EAS and submit the file to delete that adjustment and repay the funding.

Example 2: Deleting all your claims

You have submitted several rows of data in your EAS for ‘LearnerSupport’ adjustments in R03 relating to a single learner, but your EAS contains no other data. By R04 you discover the learner it was intended for had never started their learning, so you claimed the funding in error. In your R04 return, you would simply delete all the rows of data from your file, submitting a file containing only the field headings to delete all your adjustments and repay the funding.

32. If you need to change or add EAS values for a previous calendar month, you would include these changes in your latest CSV file along with values for the latest month. For instance, the EAS files you submit at R04 could include rows with CalendarMonths from 8 to 11, representing August to November. At R05, your EAS could include rows with CalendarMonths from 8 to 12, representing August to December.

33. The validation rules will prevent you returning data for calendar months after the month relating to the current collection.

For example, the R06 collection in the 2021 to 2022 year is open until 4 February 2022, but the latest calendar month which may be returned in this file is calendar month 1 (January) in calendar year 2022.

34. You should only return records for delivery that has taken place within the associated funding year.

For example, you can submit an EAS for the 2021 to 2022 year any time up to the close of R14 in October 2022, but it must only relate to activity that took place in the 2021 to 2022 funding year between August 2021 and July 2022.

35. For technical queries about submitting the EAS, please contact the service desk using https://esfahelp.education.gov.uk/hc/en-gb/.

4.2 When to submit your EAS

36. The EAS operates within a funding year alongside the ILR. There are 14 ‘returns’ in a year where you can submit your EAS, which follow the ILR collection timetable:

- for collections R01 to R12, you must submit your EAS by the 4th working day of each month.

- for R13, you must submit your EAS by 14 September 2022

- for R14, you must submit your EAS by 20 October 2022

37. If you are a grant-funded provider (‘paid on profile’ for the AEB or the advanced learner loans bursary), your EAS claims will be included as part of your funding claims. You need to ensure your EAS claims are up to date by the ILR return date before the Funding Claim return dates in 2021 to 2022.

38. You need to submit all ILR and EAS data by the final R14 collection date so that we can calculate the correct amount to pay you for the year.

4.3 Naming your CSV file

39. Your file must follow these naming guidelines for our system to accept your EAS submission.

It must end with the .csv file extension and follow this format:

EASDATA-LLLLLLLL-yyyymmdd-hhnnss.csv where:

- L = UK provider reference number (UKPRN) – this must be 8 characters

- y = year at file creation

- m = month at file creation

- d = day at file creation

- h = hour at file creation

- n = minute at file creation

- s = second at file creation

4.4 EAS data validation

40. There are 3 stages in validating a file; file level, field definition and validation rules. For further information, please refer to the validation rules.

File level rules

41. If the file fails a file level error, then we will reject the whole file and we will report this on the EAS rule violation report. If this happens, then we will not produce the EAS funding report.

42. File level rules ensure the format of the file and the filename are correct.

Field definition rules

43. The fields within a file and the accepted characters in each field are shown in the following table:

| Field Name | Data Type | Mandatory Field | Accepted Data |

| FundingLine | Varchar | Y | Controlled value list – see below |

| AdjustmentType | Varchar | Y | Controlled value list – see below |

| CalendarYear | Integer | Y | 2021, 2022 |

| CalendarMonth | Integer | Y | 1 to 12 |

| Value | Decimal | Y | Made up of digits from 0-9, optionally one decimal point, and optionally a minus sign |

| DevolvedAreaSourceOfFunding | Integer | N | 110,111,112,113,114,115,116,117,118,119 or blank |

Table 1: EAS field definitions

Validation rules

44. If any part of a record fails the validation rules, we will reject the record with an error. We produce validation warnings where the data is unusual or where the data is allowed under certain circumstances. We load records that produce warnings into the national database, however you should check these records to ensure the data is correct.

45. A record within a file must be unique in order to pass the field definition rules. We identify this using the combination of these fields: FundingLine, AdjustmentType, CalendarYear, CalendarMonth and, for devolved AEB, DevolvedAreaSourceOfFunding.

46. You can access the validation rules on gov.uk.

5. Field-by-field guidance for completing your EAS submission

47. All fields are mandatory except DevolvedAreaSourceOfFunding.

48. Following the guidance from the field definition validation, you should start out constructing your file as a csv, with the first row of data containing each of the listed field names, as shown in the following example.

Diagram 2: An EAS file with headings, but no data

49. You should then fill out each subsequent row with data in each field that complies with each of the following sections.

5.1 FundingLine

50. The ‘FundingLine’ is a description of the type of learning delivery you have a contract to receive funding for. This is usually made up of an age group, a funding model and a contract type, for example, 16- 18 Apprenticeship Non-Levy Contract (procured). We validate this against the contracts you hold.

51. The table below shows all the FundingLines you can claim funding for as you should enter them in your EAS.

| FundingLine |

|---|

| 16-18 Apprenticeships |

| 19-23 Apprenticeships |

| 24+ Apprenticeships |

| 16-18 Trailblazer Apprenticeships |

| 19-23 Trailblazer Apprenticeships |

| 24+ Trailblazer Apprenticeships |

| 16-18 Apprenticeship (from May 2017) Non-Levy Contract (non-procured) |

| 19+ Apprenticeship (from May 2017) Non-Levy Contract (non-procured) |

| 16-18 Apprenticeship (Employer on App Service) Levy funding |

| 19+ Apprenticeship (Employer on App Service) Levy funding |

| 16-18 Apprenticeship (Employer on App Service) Non-Levy funding |

| 19+ Apprenticeship (Employer on App Service) Non-Levy funding |

| 16-18 Apprenticeship Non-Levy Contract (procured) |

| 19+ Apprenticeship Non-Levy Contract (procured) |

| ESFA AEB - Adult Skills (non-procured) |

| ESFA AEB - Adult Skills (procured from Aug 2021) |

| ESFA National Skills Fund (non-procured) |

| ESFA National Skills Fund (procured from Aug 2021) |

| Adult Education - Eligible for MCA/GLA funding (non-procured) |

| Adult Education - Eligible for MCA/GLA funding (procured) |

| National Skills Fund – Eligible for MCA/GLA funding (non-procured) |

| National Skills Fund – Eligible for MCA/GLA funding (procured) |

| Advanced Learner Loans Bursary |

| 16-18 Traineeships |

| 19-24 Traineeships (non-procured) |

| 19-24 Traineeships (2020 procurement) |

| Short Term Funding Initiative 1 |

| Short Term Funding Initiative 2 |

| Short Term Funding Initiative 3 |

| Short Term Funding Initiative 4 |

Table 2: Funding lines in the EAS

5.2 AdjustmentType

52. The ‘AdjustmentType’ is a description of the type of additional funding you want to claim through your EAS that cannot otherwise by claimed on your ILR.

53. The following table shows which AdjustmentTypes can be claimed for each FundingLine as you should enter them in your EAS. Where multiple similar FundingLines are eligible for the same AdjustmentTypes, we have clustered them together.

| FundingLines | Valid AdjustmentTypes |

|---|---|

| 16-18 Apprenticeships 19-23 Apprenticeships 24+ Apprenticeships |

Excess Learning Support Authorised Claims Learner Support |

| 16-18 Trailblazer Apprenticeships 19-23 Trailblazer Apprenticeships 24+ Trailblazer Apprenticeships |

Excess Learning Support Authorised Claims |

| 16-18 Apprenticeship (from May 2017) Non-Levy Contract (non-procured) 19+ Apprenticeship (from May 2017) Non-Levy Contract (non-procured) |

Excess Learning Support Authorised Claims - Training costs exc Maths/Eng Authorised Claims - Additional payments for provider Authorised Claims - Additional payments for employer Authorised Claims - Maths and English |

| 16-18 Apprenticeship (Employer on App Service) Levy Funding 19+ Apprenticeship (Employer on App Service) Levy Funding |

Excess Learning Support Authorised Claims - Training costs exc Maths/Eng Authorised Claims - Additional payments for provider Authorised Claims - Additional payments for employer Authorised Claims - Additional payments for apprentice Authorised Claims - Maths and English |

| 16-18 Apprenticeship (Employer on App Service) Non-Levy Funding 19+ Apprenticeship (Employer on App Service) Non-Levy Funding |

Excess Learning Support Authorised Claims - Training costs exc Maths/Eng Authorised Claims - Additional Payments for provider Authorised Claims - Additional payments for employer Authorised Claims - Additional Payments for apprentice Authorised Claims - Maths and English |

| 16-18 Apprenticeship Non-Levy Contract (procured) 19+ Apprenticeship Non-Levy Contract (procured) |

Excess Learning Support Authorised Claims - Training costs exc Maths/Eng Authorised Claims - Additional payments for provider Authorised Claims - Additional payments for employer Authorised Claims - Additional payments for apprentice Authorised Claims - Maths and English |

| Advanced Learner Loans Bursary | ALLB Excess Support Authorised Claims |

| 16-18 Traineeships | Excess Learning Support Authorised Claims Discretionary Bursary Vulnerable Bursary Free Meals |

| 19-24 Traineeships (non-procured) | Excess Learning Support Authorised Claims |

| 19-24 Traineeships (2020 procurement) | Excess Learning Support Authorised Claims Learner Support 19+ Hardship Learner Support 20+ Childcare Learner Support Residential Access Fund Learner Support COVID-19 Response Learner Support Administration Expenditure |

| ESFA AEB - Adult Skills (non-procured) | Excess Learning Support Authorised Claims Princes Trust |

| ESFA AEB - Adult Skills (procured from Aug 2021) | Excess Learning Support Authorised Claims Princes Trust Learner Support 19+ Hardship Learner Support 20+ Childcare Learner Support Residential Access Fund Learner Support COVID-19 Response Learner Support Administration Expenditure |

| ESFA National Skills Fund (non-procured) | Excess Learning Support Authorised Claims |

| ESFA National Skills Fund (procured from Aug 2021) | Excess Learning Support Authorised Claims Learner Support 19+ Hardship Learner Support 20+ Childcare Learner Support Residential Access Fund Learner Support COVID-19 Response Learner Support Administration Expenditure |

| Adult Education - Eligible for MCA/GLA funding (non-procured) Adult Education - Eligible for MCA/GLA funding (procured) |

Excess Learning Support Authorised Claims Princes Trust Learner Support 19+ Hardship Learner Support 20+ Childcare Learner Support Residential Access Fund Learner Support COVID-19 Response Learner Support Administration Expenditure MCA/GLA Defined Adjustment 1 MCA/GLA Defined Adjustment 2 MCA/GLA Defined Adjustment 3 MCA/GLA Defined Adjustment 4 MCA/GLA Defined Adjustment 5 MCA/GLA Defined Adjustment 6 |

| National Skills Fund - Eligible for MCA/GLA funding (non-procured) National Skills Fund - Eligible for MCA/GLA funding (procured) |

Excess Learning Support Authorised Claims Learner Support 19+ Hardship Learner Support 20+ Childcare Learner Support Residential Access Fund Learner Support COVID-19 Response Learner Support Administration Expenditure MCA/GLA Defined Adjustment 1 MCA/GLA Defined Adjustment 2 MCA/GLA Defined Adjustment 3 MCA/GLA Defined Adjustment 4 MCA/GLA Defined Adjustment 5 MCA/GLA Defined Adjustment 6 |

| Short Term Funding Initiative 1 Short Term Funding Initiative 2 Short Term Funding Initiative 3 Short Term Funding Initiative 4 |

Authorised Claims |

Table 3: Adjustment types that can be claimed for each funding line

Excess Learning Support

54. You can claim up to £150 of learning support a month through the ILR to support the delivery of a learning aim.

55. You can claim Excess Learning Support through the EAS to supplement this if the cost of reasonable adjustments to deliver a learning aim exceeds £150 a month.

For example, the monthly rate of £150 for learning support in the ILR is enough to cover reasonable adjustment costs for a learning aim for each delivery month, except September when there is an extra one-off cost of £100. To claim this excess, you record £100 of Excess Learning Support in your EAS for September.

56. There are some exceptions to this where you can claim the entire cost of the learning support through the EAS, instead of just the excess:

- if a learner is on a 16 to 18 traineeship not funded through a 16 to 19 contract

- if planned learning is less than one month

57. When you can claim enough learning support funding through the ILR, you should not use the EAS. We expect you to use the EAS only when there is no alternative method to claim the funding.

For example, a learner needs support for 2 months only; £100 in the first month and £200 in the second month equalling £300 in total. We expect you only to claim for 2 monthly payments of £150 in the ILR to cover the total cost; we do not expect you to claim £50 excess in the second month.

58. You can find further information on when you may claim learning support, and evidence requirements in the funding rules matching the learning delivery you are claiming for (see paragraph 10 for the hyperlinks to these documents).

Learner Support

59. You can use the EAS to claim Learner Support funding for apprenticeship frameworks that started before 1 May 2017 and any learning taking place on procured contracts.

60. For more information on Learner Support in apprenticeships that started before 1 May 2017, please see the funding rules.

61. Learner support for procured ESFA AEB and procured ESFA traineeships is split into the 5 following types:

- Learner Support 19+ Hardship

- Learner Support 20+ Childcare

- Learner Support Residential Access Fund

- Learner Support COVID-19 Response

- Learner Support Administration Expenditure

62. You should not use this adjustment type for learner support for the 16 to 19 traineeship bursary or the advanced learner loans bursary, as alternative adjustment types may be used instead.

ALLB Excess Support

63. You may use the adjustment type of ‘ALLB Excess Support’ to indicate eligible learner support and excess learning support for learners with advanced learner loans.

64. Contract-funded providers, and providers who only hold a loans facility conditions and bursary funding agreement with us, can claim additional learner and learning support funding for learners with advanced learner loans where the fixed monthly rate does not cover the full cost of the support provided.

65. The monthly rate depends upon the details entered in the ILR for code ALB1, ALB2 or ALB3. You must only claim the additional funding needed each month, and you must continue to claim the standard funding rate(s) using the ILR.

66. If you are funded by a procured contract for your ALLB delivery, the ‘ALLB Excess Support’ category may include a mixture of learner and learning support. You can find full details in the Advanced learner loans funding rules.

67. If you are a grant-funded provider, you should only use this funding line to claim excess learning support, and not learner support, through the EAS. To claim your learner support you will need to use the Funding Claim return directly, not your EAS.

68. If learning support for a single learner with an advanced learner loan is greater than £19,000 in a funding year, you must claim the excess over this amount as exceptional learning support through the exceptional learning support - cost form with prior agreement from us. You can only claim this funding when we have agreed that you can submit an exceptional learning support - cost form.

69. Where you claim the advanced learner loans bursary you must retain audit evidence for the overall cost of support provided, including funding earned using the ILR.

70. For further information on what you can claim, please read the Advanced learner loans funding rules.

Prince’s Trust

71. You can claim additional funding for Prince’s Trust qualifications above the qualification rate up to the value of the programme cost. For more information about the amounts you can claim, please refer to the relevant devolved or ESFA AEB Funding Rates and Formula.

72. The cost you can claim through the EAS is then calculated by subtracting the matrix funding rate for the aim from the maximum programme cost for the aim. This is shown as the ‘maximum additional funding for’ in the table above.

EAS adjustment amount = maximum programme cost – matrix funding rate

73. Where the table in the ESFA Funding Rates and Formula shows ‘N/A’, you cannot claim additional funding through the EAS for the aim, as the maximum programme cost is already greater than the matrix funding rate for the aim from the ILR.

74. For information on which learners are eligible, please refer to the relevant devolved or ESFA Adult education budget: funding and performance management rules.

16 to 19 bursary fund – discretionary bursary

75. The discretionary bursary can only be claimed for 16 to 19 traineeship learners not funded through a 16 to 19 contract. Please read the Adult education budget funding and performance management rules in conjunction with the 16 to 19 Bursary Fund guide when claiming for eligible students.

76. The discretionary bursary is 1 of 2 parts of the 16 to 19 bursary fund. You claim each of these elements separately.

77. The discretionary bursary is awarded by you to young people that best fit the needs and circumstances of their learners. However, all bursaries must be awarded based on actual student need, in line with the funding rules set out in the 16 to 19 bursary fund guide.

16 to 19 Bursary Fund – vulnerable bursary

78. The vulnerable bursary (also known as the bursary for defined vulnerable groups) can only be claimed for 16 to 19 traineeship learners not funded through a 16 to 19 contract. Please read the Adult education budget funding and performance management rules in conjunction with the 16 to 19 Bursary Fund guide when claiming for eligible students.

79. The vulnerable bursary is one of two parts of the 16 to 19 Bursary Fund. You claim each of these elements separately.

80. The vulnerable bursary is only available for learners who meet the criteria for the defined vulnerable groups in the 16 to 19 Bursary Fund guide and who have a financial need.

81. For the vulnerable bursary, you must first apply for the funding from the student bursary support service (SBSS) by filling in a funding claim form. You should access this through the SBSS online portal.

82. Once SBSS approves the funding claim, you can claim the funding using the EAS.

Free meals

83. Free meals in further education can only be claimed for 16 to 19 traineeship learners not funded through a 16 to 19 contract. Please read the Adult education budget funding and performance management rules in conjunction with the Free Meals in further education when claiming for eligible students.

84. You can claim free meals at a rate of £2.41 per eligible student per meal.

85. Free meals are available for students aged over 19 who are continuing the same study programme (19+ continuers) they started before they turned 19 or who have an education, health and care (EHC) plan.

Authorised Claims

86. An Authorised Claim is a generic adjustment to funding that you may request to make, or that you may be asked to make, where funding has not been correctly paid to you.

87. An Authorised Claim may only be recorded in your EAS with the prior approval of us or the relevant devolved authority that is providing the funding.

88. You may need to use this adjustment type if:

- we have asked you to repay funding to us following an audit. You must enter any repayments as a negative figure (-xxxx.xx)

- the devolved authority responsible for funding your provision asks you to use it

- the funding rules identify an exception where you can use this category

89. We will monitor the use of this adjustment type and may ask for the evidence of authorisation if we believe we have not authorised its use.

90. For apprenticeship starts from May 2017, we have separated Authorised Claims into these 5 adjustment types:

- Authorised Claims - training costs excluding maths and English - for claims relating to training costs, excluding training in maths and English

- Authorised Claims - additional payments for provider - for claims relating to the £1,000 additional payments we make to you for younger apprentices and eligible 19 to 23 year olds

- Authorised Claims - additional payments for employer - for claims relating to the £1,000 additional payments we make to you on behalf of the employer

- Authorised Claims - additional payments for apprentice - for claims relating to the £1,000 additional payments we make to you on behalf of the apprentice, for apprentices who are care leavers (aged up to 24 years old)

- Authorised Claims – maths and English - for claims relating to training costs in maths and English

5.3 CalendarYear

91. You must record the calendar year the adjustment has taken place. This could be different to the year you submit the data but must be within the current funding year. It should be 4 digits, for example 2019.

5.4 CalendarMonth

92. You must record the calendar month the adjustment has taken place. This could be different to the month you submit the data but must, in combination with the CalendarYear, be within the current funding year. It should be up to 2 digits long, for example 5 for May or 12 for December.

5.5 Value

93. You need to enter the value of the adjustment being claimed using numbers and a decimal point only. You can record a positive number, for example 45.24, or negative number, for example -12.79.

5.6 DevolvedAreaSourceOfFunding

94. You must record a value in this field if you have recorded a FundingLine of ‘Adult Education - Eligible for MCA/GLA funding (non-procured)’ or ‘Adult Education - Eligible for MCA/GLA funding (procured)’.

95. For any other FundingLine, you must leave this field blank.

96. You must record the source of funding (SOF) code of the devolved area for which you are recording an earnings adjustment, using the same definitions of SOF codes as we use in the ILR specification for 2021 to 2022.

For example, if you are claiming an Authorised Claim for a learner from Greater Manchester, then you would enter ‘110’ into this field.

97. For provision which we fund, you should not use the SOF code 105 which is used in the ILR to represent adult provision which we fund. Instead, you should leave this field blank and use one of the FundingLines which represent our funding.

98. Below is a list of valid SOF’s in this field, and the devolved area they represent.

| SOF Code | Devolved Authority |

|---|---|

| 110 | Greater Manchester Combined Authority |

| 111 | Liverpool City Region Combined Authority |

| 112 | West Midlands Combined Authority |

| 113 | West of England Combined Authority |

| 114 | Tees Valley Combined Authority |

| 115 | Cambridgeshire and Peterborough Combined Authority |

| 116 | Greater London Authority |

| 117 | North of Tyne Combined Authority |

| 118 | South Yorkshire Mayoral Combined Authority |

| 119 | West Yorkshire Combined Authority |

Table 4: SOF codes are the devolved authority they represent

6. When will you pay us?

99. We pay you monthly in arrears for all provision except devolved AEB. We will add the extra funding you claim through the EAS to your ILR earnings. We will pay you each month at a contract level. To understand how devolved authorities will pay you for your devolved AEB provision claimed through EAS, please consult their documentation.

100. We will make payments for R01 to R12 each month from September to August. We make R13 and R14 payments later in the year, depending on the FundingLine.

6.1 How much have I earned or repaid?

101. Once you submit a file successfully, we will generate 2 reports for you from R01:

- EAS Rule Violation Report (CSV) – this will show you any records with errors or warnings, for example, ‘The CalendarMonth must be in numbers, not letters’

- EAS Funding Report (CSV) – this will show you all rows in your report that have passed validation, and consequently you may receive funding for

102. We will produce a ‘Funding Summary Report’, a ‘Devolved Adult Education Funding Summary Report’ and an ‘Adult Funding Claim Report’ on the Submit learner data website. This shows you your earnings for each funding line based on your latest submitted ILR and EAS, from the ESFA and from devolved authorities respectively.

103. Initially we will generate these 3 reports on ILR submission only and later in the year we will generate them on EAS submission as well.

104. The Funding Summary Report shows the data from the EAS under the appropriate budget line. The titles of the funding lines start with the letters ‘EAS’ to distinguish them from the funding generated through the ILR. The Devolved Adult Education Funding Summary Report shows the equivalent data for your devolved adult education funding.

105. The funding in your Funding Summary Reports relates to when you earned the funding, not when we pay you for it.

106. In cases where a file level validation error is encountered that prevents us processing the file further, the EAS Rule Violation Report will be the only report we produce for that submission.

107. You will receive no funding for data in your EAS file that fails validation. You should make every effort to resolve the errors and warnings shown in your rule violation report so that you receive all the funding you are claiming.