Economic regulation policy paper (accessible webpage - HTML)

Updated 22 November 2023

Ministerial foreword

The UK’s system of strong independent economic regulation has provided a sound basis for success in our regulated utilities sectors. Since privatisation, over £450 billion of private sector investment has enhanced our energy, water, and digital infrastructure, benefitting consumers now and for years to come.

A key feature of this successful investment story has been the long-term certainty that politically independent regulators with sector-focused objectives and deep sectoral expertise, have brought to investors and to consumers. But another foundation of our approach has been to ensure our system evolves to meet new challenges and seize fresh opportunities. Following our departure from the EU, we now have the opportunity to design a regulatory settlement bespoke to the needs of UK businesses, consumers and investors. In the coming years, investment into upgrading our utilities infrastructure will be critical for the UK in meeting our target of net zero emissions by 2050, and in ensuring we build back better and greener from the COVID-19 pandemic. Our economic regulators have a central role in encouraging the green investment and innovation that will ensure we continue to lead the world in decarbonising our economy and in driving economic growth. The UK Regulators Network also have a critical role in facilitating greater collaboration between the economic regulators, ensuring consistency and transparency of approach across sectors.

This policy paper sets a course to build on the strengths of our system of economic regulation, while being clear on how it can further evolve to meet the challenges and opportunities of the 21st Century. Building on recommendations from the National Infrastructure Commission and in line with the commitment in our National Infrastructure Strategy, it sets out:

- how the government intends to ensure that the regulators’ duties will allow them to meet these systemic challenges in the years ahead

- how the government will provide strategic clarity on our long-term aims for the economy and these sectors specifically

- how competition for strategic investment opportunities can be enhanced for the long-term benefit of consumers and investors

- how transparency and consistency in key processes can be improved

The focus of this paper on the economically regulated utilities sectors, reflects their unique nature and the important role of regulators in setting conditions to encourage private sector involvement into natural monopolies for the benefit of consumers. However, there are links to other reforms being taken forward by the government including our proposed reforms to the UK’s approach to regulation across the economy set out in ‘Reforming the Framework for Better Regulation’. In ‘Reforming Competition and Consumer Policy’ we have also set out proposed reforms to boost our internationally recognised competition regime and to enhance consumers’ rights and how they are enforced. This policy paper should be considered alongside the forthcoming government responses to both consultations.

Similarly, the direction set by this paper also retains flexibility to take wider developments into account as our plan for economic regulation is refined over the months ahead. Most notably, we will continue to consider live developments in the energy retail market, where on 15 December 2021 I announced a review of how future government policy can best achieve the vision for the energy retail market. Lessons from recent market developments and the recent public debate about infrastructure in the water sector, will help to shape further policy ahead of a consultation later this year. Understanding customers’ experiences in these sectors and how they can be enhanced will be a particular focus.

Our vision for economic regulation will build on the strengths of our current system, position it to meet the challenges of the future, and continue to reinforce the UK as a prime global destination for investment into utilities sectors for the long-term benefit of consumers.

The Rt Hon Kwasi Kwarteng MP

Secretary of State for Business, Energy and Industrial Strategy

Introduction

The UK’s framework of strong, independent economic regulation has delivered significant benefits in the utilities sectors. Our regulatory model has been integral to driving higher standards for consumers and to attracting over £450 billion of private sector investment in the UK’s infrastructure networks since privatisation. [footnote 1]

An important foundation has been the government’s Principles for Economic Regulation (2011), [footnote 2] developed to maintain a focus on providing a stable, predictable, and transparent regulatory framework which facilitates efficient investment. [footnote 3]

The principles for economic regulation

Accountability – ensuring regulation takes place within a framework set by government, and that respective roles and responsibilities are enacted by the body that has the appropriate legitimacy, expertise and capability and are scrutinised accordingly.

Focus – ensuring economic regulators have clearly defined, articulated, and prioritised responsibilities, but adequate discretion to choose the appropriate means to best achieve desired outcomes.

Predictability – ensuring the framework for economic regulation is stable, allowing long-term investment to be supported with confidence and receive a reasonable return, subject to the normal risks inherent in markets.

Coherence – ensuring the framework for economic regulation forms a logical part of the government’s broader policy context, enabling cross-sector delivery of policy goals where appropriate.

Adaptability – ensuring the framework for economic regulation has the capacity to evolve to respond to changing circumstances and continue to be relevant and effective over time.

Efficiency – ensuring policy interventions are proportionate and cost-effective, whilst decision making is timely and robust.

These principles have guided the design and evolution of the framework of economic regulation. Today, the fundamentals of the principles and the framework they have supported remain sound and are not in need of significant reform.

However, the government agrees with the National Infrastructure Commission’s recommendation that, though the UK’s regulatory framework has delivered significant benefits, it needs updating and strengthening as it is increasingly facing emerging and long-term challenges it was not designed to address. [footnote 4] This includes reaching Net Zero [footnote 5], protecting and enhancing the environment, and increasing digitalisation. As a critical enabler of infrastructure investment, refreshing our approach to economic regulation will help the UK to build back fairer, faster, and greener, and help foster an enterprising and innovative economy which promotes growth.

Boosting investment will also help improve outcomes for present and future consumers. Consumers will directly benefit from improved delivery of utilities, including where opening up more strategic investment to competition will drive down prices. More widely, there is a need to balance immediate costs to consumers against long-term benefits and ensure that consumers are adequately protected from unfair practice.

Additionally, a key element to encouraging investment is providing a stable and predictable environment for investors and consumers. This paper highlights areas for improvement in the current system, such as having greater consistency in the price control process.

This publication indicates government’s intention to strengthen the existing framework for Ofwat, Ofgem and Ofcom (the ‘utilities regulators’). This publication’s remit is UK-wide, except where a devolved administration has jurisdiction over the sector in question.

Critically, a clear economic regulation framework is vital to delivering the government’s Net Zero Strategy, helping to attract and sustain investment in greener technology and empower regulators to balance key trade-offs and take decisions that will ensure the UK reaches its net zero targets. This is particularly relevant where investment in utilities infrastructure will have a direct impact on delivering net zero, but also where infrastructure investment will play more of an enabling role (such as digital infrastructure). Equally, the framework plays a vital role in achieving wider efforts to protect and enhance the environment, as set out in the government’s 25 Year Environment Plan.

We recognise the pressing need to address immediate challenges, particularly the recent exit of suppliers from the energy retail market and the ongoing efforts to reduce sewage discharges from storm overflows in the water sector. This includes ensuring sewage discharges from storm overflows become infrequent, and only in cases of unusually heavy rainfall. Focused work addressing these issues is already in progress and will be carried out in parallel to the work proposed in this paper.

Ofgem have published an open letter to industry [footnote 6] to set out the steps they are taking to protect the short and long-term interests of consumers. The government will continue to work closely with Ofgem to support a sustainable and competitive industry to support the sector’s transition that is fit for the future, especially as we transition towards green energy sources.

Earlier this year, the government published a new draft set of strategic priorities for the water industry’s economic regulator, Ofwat. Government set out its expectation that water companies must take steps to “significantly reduce the frequency and volume of sewage discharges from storm overflows.” [footnote 7] The Environment Act (2021) then placed this direction on a statutory footing, setting a duty for water companies to achieve a progressive reduction in the adverse impacts of discharges from Storm Overflows [footnote 8]. We expect Ofwat to challenge the water industry to meet these expectations and legal duties.

This publication focuses on 4 areas:

- Regulator duties: Duties are an important part of effective independent regulation. It is vital that utilities regulators have appropriate and coherent duties covering price, quality, resilience, the environment and net zero.

- Clear strategic direction: Effective economic regulation requires strategic leadership both from regulators and from government. In particular, the government is committed to providing more transparent strategic guidance and context to ensure all regulators can support effective long-term investment.

- Greater competition in strategic investment: Competition can lead to increased innovation, greener solutions, and provide savings to consumers by incentivising lower cost, more efficient business plans. For the design and delivery of infrastructure, all regulators should harness competition to unlock opportunities for strategic investment. As such, the government is supportive of removing strategic investments, including sustainable, nature-based solutions, from the standard price control process and opening them up for competition where appropriate. [footnote 9]

- Transparency and consistency: Economic regulation must provide a stable and predictable environment for investment to thrive, whilst protecting consumers in these markets. The government therefore supports promoting transparent and consistent experiences and processes to the benefit of investors and consumers, in particular, supporting the UKRN-led work to examine greater alignment of the price control methodologies employed by different regulators.

Updating the regulatory framework along these lines will reaffirm the importance of the Principles for Economic Regulation and position the system for the future. This will help to deliver the investment needed, increase innovation, promote growth, and build trust in these critical services to deliver better outcomes for consumers and investors.

This policy paper is the first step to updating our model of economic regulation. In 2022, we will be launching a consultation setting out more detail on a package of measures. This will be informed by close engagement with key stakeholders over the coming months. We will also take note of the proposals being taken forward as a result of the joint BEIS-Cabinet Office consultation on Reforming the framework for better regulation [footnote 10], whilst noting the distinct context of economic regulators.

Part 1: Regulators’ statutory duties

Economic regulators are established by statute and legally bound to execute their duties. Statutory duties are placed on the regulators through legislation. Regulators currently have a set of duties in primary and secondary legislation which they must fulfil in carrying out their core functions. The design of regulators’ duties is crucial to the conduct of both regulators and the regulated as they set objectives for the regulators to refer to in informing and guiding their decisions. At the time of privatisation, duties were used to provide a clearly defined role for economic regulators and have since been regarded as an important and stable part of the UK’s regulatory landscape.

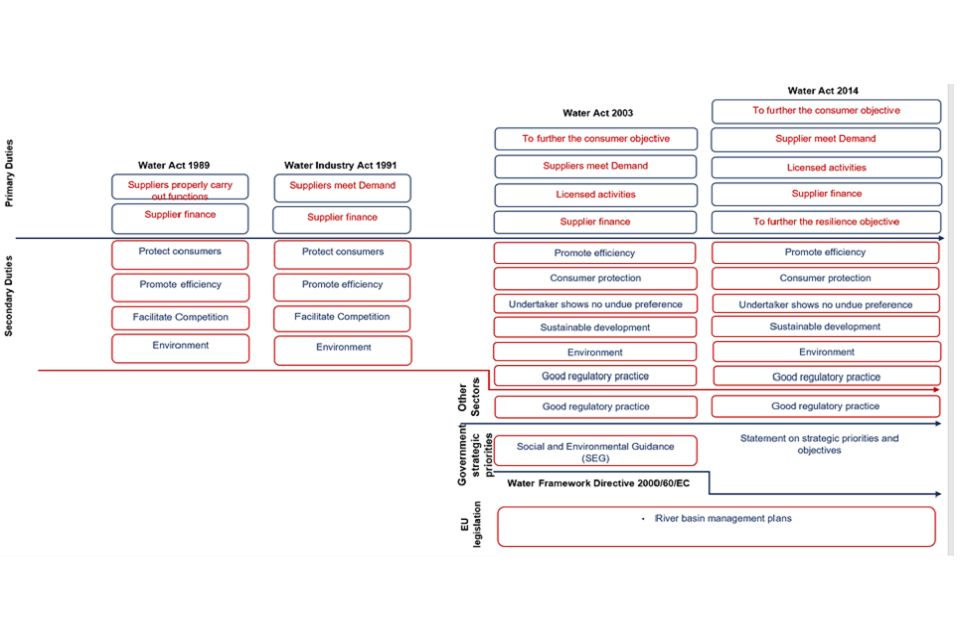

The utilities regulators’ statutory duties have grown in number significantly since privatisation. For instance, in the energy sector, since privatisation under the Gas Act 1986, the number of statutory duties has risen from 8 to 21. [footnote 11] A similar trajectory has been seen in the water sector (see Figure 1) and telecoms.

Figure 1: Ofwat’s Statutory Duties

Figure 1: Ofwat’s Statutory Duties - text version

| Water Act 1989 | Water Industry Act 1991 | Water Act 2003 | Water Act 2014 | |

|---|---|---|---|---|

| Primary Duties | - Suppliers properly carry out functions - Supplier finance |

- Suppliers meet demand - Supplier finance |

- To further the consumer objective - Suppliers meet demand - Licensed activities - Supplier finance |

- To further the consumer objective - Supplier meet demand - Licensed activities - Supplier finance - To further the resilience objective |

| Secondary duties | - Protect consumers - Promote efficiency - Facilitate competition - Environment |

- Protect consumers - Promote efficiency - Facilitate competition - Environment |

- Promote efficiency - Consumer protection - Undertaker shows no undue preference - Sustainable development - Environment - Good regulatory practice |

- Promote efficiency - Consumer protection - Undertaker shows no undue preference - Sustainable development - Environment - Good regulatory practice |

| Other sectors | - Good regulatory practice | - Good regulatory practice | ||

| Government strategic priorities | - Social and environmental guidance (SEG) | - Statement on strategic priorities and objectives | ||

| EU legislation | - Water Framework Directive 2000/60/EC - River basin management plans |

- River basin management plans |

Given the scale and nature of the challenges facing UK’s infrastructure over the coming decades, regulators will need to take effective decisions on strategic investments that will promote growth, foster sustainability, and deliver a fair deal for consumers. To enable this, the government recognises that regulators’ duties must provide the right degree of clarity, consistency, and relevance for the future.

Stakeholders have identified 3 major challenges posed by this growth in duties:

- the increasing complexity of existing duties risks both stifling regulatory decision making and limiting the effectiveness of new duties where they are introduced. [footnote 12] In turn, this is detrimental to the system’s ability to encourage long-term investment

- the transparency and predictability of the current framework could be improved. [footnote 13] Ensuring that duties are clear and coherent will enable regulators to assess and articulate the challenges associated with balancing their duties, promoting both greater transparency and consistency in decision-making, and providing greater clarity to stakeholders in turn

- the growth in duties as they have evolved has also been accompanied by divergence across the utilities sectors. Whilst a certain degree of variation in duties is necessary to account for the different dynamics in each sector, greater consistency between regulators’ duties would enable them to collaborate and support performance on vital common, long-term priorities, such as our net zero target and interim carbon budgets, investment in climate adaptation, and the environment, thereby helping to support predictable regulation over the long-term [footnote 14]

Therefore, the government will launch a review of utilities regulators’ statutory duties in 2022. This review will consider the National Infrastructure Commissions’ recommendation [footnote 15] that duties need to be coherent, covering price quality, resilience, and environment [footnote 16]. It also reflects the commitment in the government’s Principles for Economic Regulation that government will take opportunities to simplify and clarify regulators’ objectives.

The review will consider what changes, if any, might be necessary to reflect long-term, out-comes based objectives that address future challenges, support regulators to make transparent decisions which balance their respective duties, and support greater cross-sector collaboration. Transparent and predictable regulatory frameworks are vital to facilitating investment, protecting consumers, and delivering sustainable growth. The government will work closely with interested stakeholders in designing the review.

To inform this review, the government will commission an analytical study exploring: how regulators have been applying their duties in practice; how the introduction of new duties over time has been accommodated, and the subsequent impact their introduction has had on decision making; and how well duties can be functioning today as a result.

The government will consider the changes recommended by the review in due course.

Part 2: Clear strategic direction

Achieving the transformational infrastructure investment required over the coming decades needs strategic leadership both from regulators and government. The government has an important role to play in supporting regulators as they deliver this change, by setting strategic direction, while maintaining regulators’ independence.

Since 2013, strategy and policy statements have been introduced for some individual regulators. [footnote 17] These have become a successful part of the regulatory architecture, providing strategic priorities and signalling desired policy outcomes for the regulators to act in accordance with. They also enable consumers and industry to better understand the government’s ambitions for each sector. These statements can be updated as required to strike the balance between predictability and adaptability.

In the National Infrastructure Strategy, the government committed to assess the merits of a Cross-sector Strategic Policy Statement for the utilities regulators. At present, the government considers that:

- there is no effective mechanism which can situate the sector-specific statements within the context of government’s overarching ambition for economic regulation

- while regulators are tasked with, and must address, very different issues specific to the sectors they regulate, there are also cross-cutting issues, such as the need for long-term investment, the interaction between investment and household bills, and the need to address the climate challenge, which would benefit from more coordination and cooperation between regulators

The government sees merit in setting out high-level national policy objectives and reflecting these in a vision for the utilities sectors, including where the government expects greater collaboration between regulators.

Communicating these priorities will promote the systems’ transparency, predictability, and independence by ensuring that regulators receive consistent asks from government, thereby providing clear guidance on both national and sectoral level priorities.

Cross-sector guidance can also provide clear encouragement and incentives for regulators to understand and collaborate on matters of common regulatory interest. The UK Regulators’ Network (UKRN) aims to improve coordination across the regulators for the ultimate benefit of consumers and is well placed to explore and drive progress on cross-cutting issues [footnote 18]. The government highly values the work delivered via the UKRN and expects the UKRN to continue leading on the coordination of regulators to promote the transparency and coherence of the economically regulated sectors.

In parallel with this paper, the government has therefore published a letter of strategic guidance to the utilities regulators which situates their role as economic regulators within the government’s overarching priorities and highlights cross-sectoral opportunities for collaboration via the UKRN, where relevant to the pursuance of their statutory duties. [footnote 19] This letter is intended to complement existing sector specific guidance to regulators.

In addition to setting out an ambition for regulators to contribute to growth of the economy and foster sustainability, the letter highlights the need to deliver value for money and provide a fair deal for all consumers, particularly vulnerable consumers.

The letter highlights the government’s commitment to ensure the UK is the most efficiently regulated advanced economy in the world, championing our new regulatory principles focused on delivering growth and innovation.

The government will further consider whether it should issue future strategic guidance to the regulators to provide greater clarity and certainty on regulators’ status and role within the broader regulatory framework as statutory guidance to which the regulators must have regard.

Part 3: Greater use of competition

Competition provides incentives for firms to keep prices down and to keep quality and service standards up, to make their production and distribution more efficient, and to innovate [footnote 20]; in short, to win business by making the best offer possible to customers. [footnote 21] [footnote 22] Competition in the market, where firms simply compete for customers and market share, is difficult or sometimes impossible in natural monopoly markets [footnote 23].

This paper explores competition for the market, whereby competition is focused on a firm becoming the supplier of a product, service, or piece of infrastructure, rather than competing for market share. To manage the constraints of natural monopolies and encourage investment, sector regulators can open areas of the value chain (such as the delivery, management, and financing of infrastructure) to competition, rather than leaving it to the incumbent.

In the National Infrastructure Strategy, the government stated that competition in this form should be harnessed as the most reliable means of supporting innovation and delivering strategic investments and major projects. Going further, this paper commits to explore the potential approaches to increasing competition in strategic investments. This is in line with a recommendation from the National Infrastructure Commission for regulators to remove major strategic investments from price control processes, where appropriate, and opening them up to competition to support innovation.

Critically, increased competition in strategic investments could facilitate more efficient delivery of major projects to tackle long-term challenges; for example, the UK’s electricity system is decarbonised by 2035 [footnote 24], and increasing the UK’s resilience against volatile oil and gas prices and learning from Thames Tideway to deliver major water and wastewater infrastructure. [footnote 25]

More broadly, increased competition for investment opportunities has the potential to bring significant benefits to the current system, including for investors and consumers:

- incumbents will be incentivised to produce ambitious business plans at a lower cost

- Incumbents aren’t ordinarily equipped and experienced in the development and delivery of major infrastructure projects and new entrants can bring expertise and track record in this area

- third parties bidding will provide regulators with more information, for example on prices, to run price controls more accurately and deliver fairer returns for investors and prices for consumers

- separating the pricing, timescales, and project risks of major new investments from the lower risks of day-to-day running and maintenance of the network makes price regulation decisions less complex for regulators, firms and their investors, whilst ensuring all options for significant improvements and enhancements to infrastructure networks can be considered. It also allows regulators to have tailored conversations with stakeholders about the outcomes and outputs to be delivered, enabling different approaches to their assessment of expenditure. This in turn, can deliver savings to consumers [footnote 26]

- by planning for major projects to be offered on a competitive tender, this provides a platform for new entrants to the market and widens the pool of capital available to invest

- increased use of competition to determine and deliver solutions for tackling network constraints, could increase the opportunities for innovative green solutions to compete on an even footing. This could go hand in hand with a greater focus on coordinated network planning to create the right framework to support a transition away from grey infrastructure to greener solutions, where appropriate

The sector regulators have made encouraging progress in increasing competition for the market, primarily through opening up competitive projects in major infrastructure projects.

Ofgem introduced tenders in 2009 to grant licences to operate transmission assets for offshore wind. The regime has proved a success and has brought estimated savings for consumers in excess of £800 million since 2009. [footnote 27]

Going further, BEIS and Ofgem have recently published ambitious consultations to deliver greater competition in onshore energy networks:

- BEIS and Ofgem: Proposals for a Future System Operator role (FSO). The consultation outlines a proposal to establish an expert, impartial FSO to encompass all existing National Grid Electricity System Operator roles, as well its potential to take on a greater role in driving competition in energy networks amongst other roles. An independent FSO could deliver significant savings to energy consumers through better co-ordinated, strategic advice and facilitation of competition for third parties

- BEIS: Competition in onshore electricity networks. Opening up electricity network build, ownership, and operation to third parties will allow for innovative parties, with access to different sources of capital, to invest in Great Britain’s electricity network infrastructure. Economies of scale and competitive forces should drive efficiency in the operating and construction costs of assets and lower costs for consumers. Legislating to enable competition in electricity networks will include providing powers for the Secretary of State to appoint an appropriate tender body to run competitions

Ofwat used the Specified Infrastructure Projects Regulations (SIPR), which separates the risk and costs of financing and delivering major infrastructure projects, to provide for the tendering of the Thames Tideway in 2015. [footnote 28] This project will intercept at least 94% of the sewage overflows from London’s current system, and the use of a competitive tender process for its delivery is expected to have reduced the impact of the build on consumers’ annual bill from an estimated £70-80 down to a maximum of £20-25. [footnote 29], [footnote 30]

Ofwat have also introduced the Direct Procurement for Customers (DPC), developed from the experience of Thames Tideway. DPC involves a water or wastewater company competitively tendering for services in relation to the delivery of certain large infrastructure projects. Ofwat expects direct benefits through capital and operational cost savings as well as a reduction in financing costs, which will be passed directly to consumers through a reduction in bills.

The government encourages regulators to build on the benefits current initiatives have already provided. As part of this, the government would like to better understand the merits and impacts of potential approaches to increasing competition for new strategic investments in sectors beyond the energy sector and open up areas of the value chain to competition.

The government has therefore asked Ofwat to produce a bespoke review of competition for the provision of infrastructure in the water sector. The government welcomes Ofwat’s views on how they and government can seize opportunities for competitive strategic investments and address any barriers to doing so.

Ofcom has powers to undertake a formal market review process under the Communications Act (2003) [footnote 31], while BEIS and Ofgem are consulting on a range of ambitious measures to introduce greater competition to the onshore networks. However, in parallel, the government will work closely with these regulators in the coming months to identify possible opportunities where government action would facilitate enhanced competition for investment into strategic projects.

The government will assess the effectiveness of the competition review and will consider introducing a review mechanism as a regular tool for identifying key opportunities for competition across the utilities. We will also consider the merit of commissioning Ofgem to produce a review of competition with a view of driving strategic investment in the future.

Part 4: Promoting transparency and consistency

The government recognises the importance of maintaining and building public confidence in utility companies and regulators, to the long-term success of utility provision. The National Infrastructure Commission stressed the importance of a more transparent strategic framework to help regulators support investments, balancing the long-term priorities with the current needs of consumers.

There are 2 priority areas where the government believes that greater regulatory consistency may promote greater transparency for consumers, business and investors:

- the methodology that regulators use to control prices should be easy for companies to navigate, to create a fair and effective process that also balances the interests of investors and consumers. The sector regulators, via the UKRN, are taking forward work to align methodologies where viable and the government expects that this will quickly deliver greater consistency in approaches

- the process by which regulator decisions can be appealed should provide appropriate checks and balances to support the right outcome for consumers and the wider public interest. Whilst each sector has unique characteristics, we will explore whether greater alignment of these processes between sectors could reduce investor uncertainty and achieve better outcomes for consumers

Alongside these areas, we also expect the UKRN to continue playing a leading role in the coordination of regulators to deliver appropriate regulatory alignment and a coherent approach to improving outcomes for consumers and business.

Price control methodology

In the absence of competition, companies do not have the same incentives to be efficient or respond to consumers’ needs. Here, it is the economic regulators’ role to act as a proxy for competition, using price controls to provide companies with incentives to operate in an efficient, innovative, and consumer-focused manner whilst providing investors a fair return for their investments.

The regulators’ approach to setting price controls have stood at the heart of the UK’s system of economic regulation for over 30 years, yet that is not to say that the approach to price controls has or should remain static. Given the individual nature of each of the sectors, and the depth of technical sector-specific analysis conducted, some differences in the price control methodology are to be expected. However, the reasoning behind these differences may not always be clear to consumers, businesses, and investors. Some of these differences reflect the different regulatory frameworks, some relate to the individual building blocks of the price controls, the incentive mechanisms in place and the degree of risk-sharing between companies and customers.

In relation to the building blocks of the price control, it is the allowed return on the regulated assets which determines the base return for the regulated companies. This is typically set by reference to the Weighted Average Cost of Capital (WACC). While there are a number of similarities in how this assessment is made, in recent price controls, some differences remain with determining certain components of the Weighted Average Cost of Capital (WACC), such as the risk-free rate.

The economic regulators are working together to consider where there may be scope to achieve greater consensus on the approach to setting the WACC, via a taskforce supported by the UK Regulators Network (UKRN). The CMA have also agreed to provide input to this work. We welcome the collaborative input and expertise of the sector regulators, the CMA, and the UKRN in tackling the common challenges in setting the WACC.

The aim is to work towards greater consistency, and towards a common methodology, where appropriate, for the WACC when setting price controls. Ultimately, this will encourage greater confidence in the price control process across sectors for consumers, businesses, and investors, and in turn, to help encourage sustainable investment.

Broadly, the requirements are to identify those areas:

- where there is already close alignment of methodology on the cost of capital

- where there is scope for greater alignment

In doing so, the taskforce would be expected to consider:

- both methodology and sources of data

- the role of cross-checks and broader considerations which have a bearing on the determination of the allowed return in price controls

It is not expected that the outcomes of this taskforce will result in complete alignment on all aspects of the cost of capital by all regulators, as there are key sectoral differences that will require bespoke approaches from regulators.

The government expects the regulators, via the UKRN taskforce, to work towards alignment where clear benefits can be identified. This would include, where appropriate, consistency in 3 areas with regards to calculation of the WACC:

- where common components of WACC methodologies are not influenced by sector-specific variables, there is a strong case for alignment on methodologies, input data and, ultimately the output used in the WACC calculation itself

- where sectoral circumstances, e.g. sector-specific financial data, often lead to justified variation in outputs but where there may be greater scope for consistency in methodologies between sectors

- where different sector regulators include components in their WACC methodologies that are not used in other sectors, regulators could examine the case for greater alignment

This work has commenced and the relevant regulators will work towards publishing findings on price control methodology in 2022.

The government will support the regulators, the CMA and UKRN where appropriate, to act on the taskforce’s recommendations. Recognising the UKRN’s key enabling role, and the positive impact on consumers and investors of greater consistency and transparency across economic regulators, the proposed review of economic regulator duties will consider whether any changes to regulator’s duties could enhance cross-regulator collaboration.

Regulatory appeals

The UK’s economic regulation system enables parties to appeal [footnote 32] regulatory decisions to expert bodies with relevant experience to provide a substantive review, such as Competition and Markets Authority (CMA) and/or Competition Appeal Tribunal (CAT). An effective appeals process ensures that investors, companies, and consumers can be confident that regulatory decisions are made in line with the legal duties of the regulators. This promotes a fair, predictable and transparent process.

Each sector has its own legislation which sets out the roles and responsibilities of the economic regulator, the CMA, and in some cases the CAT. This means that, under the current system, the appeals processes differ by decision and by sector.

The CMA determines the outcome of price control appeals and redeterminations in the water, energy, and telecoms sectors. However, as the below table highlights, the CMA’s function in considering appeals against regulators’ price control decisions is inconsistent between sectors.

Table 1: Summary of CMA’s Regulatory References and Appeals Functions

| Overview of the Price Control Framework by Sector | Regulator | CMA Function | Appealing Party |

|---|---|---|---|

| Water & sewerage | Ofwat | Redetermination | Regulated Companies |

| Gas & Electricity | Ofgem; NIAUR | Appeal | Affected companies, including regulated companies, customers. competitors and statutory consumer bodies or consumers |

| Rail | ORR | Redetermination | Regulated Companies |

| Aviation licences | CAA | Appeal | Affected companies, including regulated companies, customers or competitors or consumers |

| Telecommunications | Ofcom | Review of price control on judicial review principles on reference from the CAT | Affected companies, including regulated companies, customers or competitors or consumers |

In the water and sewerage, and rail sectors, the CMA is required to conduct a full redetermination, regardless of the specific issues raised by the appellant. Whereas, in the energy, telecoms, and airport sectors, the CMA will consider only the specific issues raised by the appealing parties [footnote 33].

This lack of consistency has the potential to make it difficult for investors involved in multiple sectors to navigate the process. Moreover, differences are typically a by-product of sectoral policy development, rather than cross-sectoral design. Increasing consistency will likely make the UK a more attractive prospect for investment.

There are potential issues that need to be addressed with both approaches. In particular a re-determination process leads to increased uncertainty for all parties, including appellant companies and consumers, as the CMA may change the overall outcome of the decision, which could or could not align with the specific issues underpinning the appeal. This can be time consuming and delay investment. Additionally, the existing full redetermination process only allows for appeals by affected firms, preventing consumers or consumer groups appealing regulator decisions.

The appeals model, on the other hand, has been argued by some to lead to a ‘cherry picking’ approach and a greater number of appeals. The features of the appeal framework also make it difficult for smaller or less resourced parties, such as consumer bodies, to bring an appeal [footnote 34].

The government intends to develop proposals that will align the appeals processes between sectors [footnote 35] more closely and consider any wider issues with the current processes, following further discussions with investors, suppliers, consumers and consumer groups, and regulators. These proposals will focus on achieving an appeals system which delivers the best outcome for consumers and the wider public interest, appropriately checks and balances the decisions of sector regulator, addresses the uncertainty in the water sector caused by the full redetermination process for price controls, and specifically looks to align the processes in the water and energy sectors. They are unlikely to include proposals to fundamentally alter the CMA’s role in the appeals processes more widely or deviate from the current merit-based model.

Next steps

This policy paper is an essential step to improving the transparency and accountability of the UK’s model of economic of regulation. Below is a summary of its key proposals and next steps.

Strategic direction

Summary of commitment:

The government has published a letter of strategic guidance to the utilities regulators.

Next steps:

The government will consider whether putting future iterations of such a document on a statutory basis would provide greater clarity and certainty on its status and role within the broader regulatory framework.

Review of duties

Summary of commitment:

The government will launch a review of utilities regulators’ statutory duties in 2022.

Next steps:

Ahead of the review, the government will commission an analytical study into current regulation.

Competition

Summary of commitment:

This paper commits to explore the role of increased competition in strategic investments. This should facilitate major projects to tackle long-term challenges.

Next steps:

The government will work closely with regulators in the coming months to identify possible opportunities where government action could facilitate enhanced competition for investment into strategic priorities.

The government has asked Ofwat to produce a bespoke review of competition for the provision of infrastructure in the water sector.

Transparency and consistency

Summary of commitment:

The government will develop proposals that will align the appeals processes between sectors more closely and consider any wider issues with the current processes.

Next steps:

The government will work with investors, suppliers, consumers, consumer groups, regulators, and the CMA to develop these proposals.

Summary of commitment:

The economic regulators have agreed to work together to consider where there may be scope to achieve greater consensus on the approach to setting the WACC, via a taskforce supported by the (UKRN).

Next steps:

The UKRN-led taskforce will look to publish findings on price control methodology later in 2022.

The government will launch a consultation on economic regulation in 2022. The consultation will set out a coherent package of measures designed to ensure the UK model of economic regulation fits the needs of the modern age. In developing the consultation, we will also consider wider options to enhance the consumer experience and outcomes more generally. The government will work closely with key stakeholders over the coming months to develop the consultation.

-

Calculations using Office for National Statistics (2009) Multi-factor productivity estimates: Experimental estimates for October to December 2018. Industries used are Section D (Electricity, Gas, Steam and Air Conditioning Supply) and Section E (Water Supply; Sewerage, Waste Management and Remediation Activities). 2018 prices, using implied GFCG deflator. ↩

-

Department for Business, Innovation and Skills (BIS), The Principles for Economic Regulation, April 2011 ↩

-

The regulatory framework refers to the legislative, policy and strategic context which structures the relationship between the regulators and regulated and enables independent regulators take informed decisions. ↩

-

The National Infrastructure Commission concluded the current regulatory framework does not need to be completely reconfigured, but it was not designed to meet the coming challenges of achieving net zero, adapting to changing weather patterns, and increasing digitalisation and therefore must be updated. Similar conclusions have been shared by the Global Infrastructure Investor Association in ‘The Future of Regulation’ (2020), the Confederation of British Industry (CBI) in ‘Reimagining regulation: creating an economic framework fit for the future’ (2020) and Cathryn Ross in ‘Risk, Reward and Regulation’ (2021) commissioned by The Infrastructure Forum. ↩

-

The government has set out clear, ambitious, legislative targets to reach net zero by 2050 and halt biodiversity loss by 2030, as well as committing to be the first generation to leave the natural environment in a better condition than which it was found. ↩

-

Ofgem, Open letter to energy suppliers, 29th October 2021 ↩

-

Defra Press Office, 2021. ↩

-

Environment Act, 2021. ↩

-

Nature-based solutions involve protecting, restoring, and sustainably managing ecosystems to address a challenge. For instance, nature-based solutions for climate harness the power of nature to reduce greenhouse gas emissions. ↩

-

David Deller and Catherine Waddams Price, Fairness in Retail Energy Markets? Evidence from the UK (2018), p.35 ↩

-

The National Infrastructure Commission recommended updating statutory duties to support long-term investment and enable them to consider the environment, quality, and resilience alongside price. Similarly, the CBI recommended the introduction of duties for Net Zero and Innovation in ‘Reimaging Regulation: Creating a framework fit for the future’ (2020). ↩

-

The Global Infrastructure Investor Association recommended in ‘The Future of Regulation’ (2020) that regulators should be supported to make transparent trade-offs between their respective duties, noting that an expansion in regulators’ remits over the years has undermined the predictability and stability of the system. ↩

-

The National Infrastructure Commission identified the lack of consistency across some of regulators’ duties as a barrier to collaboration as the priorities for decision making can vary between the regulators. (Strategic Investment and Public Confidence, p.35) ↩

-

National Infrastructure Commission: Report on regulation ↩

-

The National Infrastructure Commission considers mitigation on climate change and the government’s legislated emissions reduction targets under the ‘environment’ category. ↩

-

The government published a statement for the water sector in 2017 and has just consulted on a new statement for the coming price control period. The government also set out its ambitions for the telecoms sector in a statement published in 2019. The government has committed to consult on a statement for the energy sector in 2022. ↩

-

The UKRN is a member organisation whose objective is to facilitate cooperation and communication between members to promote better outcomes for consumers and the economy. The UKRN currently works to coordinate across 13 regulators, including Ofgem, Ofwat and Ofcom, developing shared approaches to tackling common issues across all the sectors, such as vulnerable consumers, data sharing and cost of capital. ↩

-

Department for International Development, (2008) CMA Productivity and competition, a summary of the evidence (2015) ↩

-

In addition to the sector regulators, the Competition and Markets Authority (CMA) encourage government and regulators to promote better competition in UK markets for the benefit of consumers. Each of these regulators have statutory duties or objectives to promote effective competition in their sectors with a view to protecting the interests of consumers. ↩

-

The telecoms, energy, and water sectors contain natural monopoly features in their markets, due to the high fixed costs of entry and the potential inefficiency of duplicating provision, or involve essential facilities (e.g. a single owner of the distribution network). Subsequently, it is often more efficient for one firm to provide a good or service to the market, rather than multiple firms. ↩

-

Subject to the security of supply. ↩

-

In parallel, the Environment Act (2021) set a statutory duty for water companies to achieve a progressive reduction in the adverse impacts of discharges from Story Overflows. Environment Act, 2021. ↩

-

Cathryn Ross via the Infrastructure Forum: Risk, reward and regulated ↩

-

BEIS, Competition in onshore electricity networks consultation 2021 ↩

-

Thames Tideway Tunnel, a major infrastructure project consisting of a 25km combined sewer that will intercept at least 94% of the sewage that overflows from London’s current sewer system. ↩

-

Tideway, Our Delivery Partners ↩

-

Defra, Creating a River Thames fit for our future, 2015 ↩

-

Ofcom can undertake a review of the market to assess levels of competition with a view to opening up more competition where appropriate. The latest review, the Wholesale Fixed Telecoms Market Review (WFTMR) published in March 2021, set out Ofcom’s strategy to promote investment in gigabit-capable networks through network competition in suitable areas. Since the WFTMR, commercial ambition to roll out gigabit-capable networks has increased, building on the progress already made: 57% of total UK homes now have access to gigabit connection, up from 10% in November 2019. ↩

-

To note, the focus of this work is on reviewing the appeals process and not the appeals standard. ↩

-

Also, under provisions of the Environment Act, when brought in to force, for water and sewerage licence conditions. Environment Act, 2021 ↩

-

HM Government; Streamlining Regulatory and Competition Appeals (19 June 2013) ↩

-

This will consider the regulators set out in table 1 ↩