[Withdrawn] The Energy Bills Discount Scheme for non-standard cases in Great Britain and Northern Ireland: guidance

Updated 11 September 2023

This guidance document provides an outline of the Energy Bills Discount Scheme for Non-Standard Cases. Before making any application, the full scheme terms and related legislation should be reviewed and understood as they provide further information.

The guidance document for the Energy Bill Relief Scheme: Non-Standard Cases (Great Britain and Northern Ireland), is available on GOV.UK.

1. Objective of scheme and eligibility

This scheme is designed to provide support for certain non-domestic customers in Great Britain and Northern Ireland that consume gas (that is,natural gas or biomethane) or electricity supplied by wire or pipe from a license-exempt supplier, for which they pay a price that is pegged to wholesale energy prices (eligible energy). These non-domestic customers do not receive support under the standard Energy Bills Discount Scheme (EBDS), as that scheme is focused on providing support through licensed suppliers. Payments under this scheme will be applied to eligible energy provided between 1 April 2023 and 31 March 2024.

The non-standard customers to whom this scheme will be available, include:

- businesses

- voluntary sector organisations, such as charities

- public sector organisations such as schools, hospitals and care homes

who:

- Procure gas and/or electricity supplied by wire or pipe that has not come to them via a licensed gas / electricity supplier, either by participating directly in the wholesale market themselves (as Wholesale Market Customers) or from other providers which are not licensed energy suppliers (Qualifying Energy Providers (QEP). A QEP may be, for example, a generator whose output is distributed over a private electricity network (or a re-seller of the electricity produced by such a generator) or a re-seller of gas imported from the grid

and

- Pay a price for that energy that is linked directly to wholesale energy prices

This Scheme applies to non-domestic energy users operating in Great Britain and Northern Ireland.

1.1 Exclusions

The following are not eligible for direct support under the scheme:

- electricity that is produced mainly from the combustion of gas*

- electricity that is stored and then exported to the grid

- gas which is used to generate, and export back to the grid, electricity, including where this has been stored first. This is with the exception of Combined Heat and Power schemes that have an installed electrical generation capacity of 5MWe that could be eligible for discount on the amount sold to the grid as well

- any gas or electricity made available, or used to make heating, hot water or electricity available to end users in the Republic of Ireland

(* Defined as where the calorific input of gas into the production of electricity is 5% or greater of the total calorific input. ‘Gas’ here refers to natural gas or biomethane, for example as taken from the public gas grid. Electricity that is produced from biogas or landfill gases, for example through anaerobic digestion processes or landfill extraction, will be eligible for support, provided the other criteria are also met.)

2. The support you may be eligible to receive

The government will provide payments to ensure that non-standard customers (NSCs) receive relief in respect of what they paid for their wholesale energy during the relevant period.

The Non-Standard Cases (NSC) scheme, in alignment with the main EBDS is made up of 3 differing levels of support:

- The baseline discount will provide some support with energy bills for all eligible non-domestic customers in Great Britain and Northern Ireland.

- The Energy and Trade Intensive Industries (ETII) discount will provide a higher level of support to businesses and organisations in eligible sectors.

- The Heat Network discount will provide a higher level of support to heat networks with domestic end consumers.

In order to receive the higher levels of support available to ETIIs and heat networks, a customer must go through a separate process of certification under the Energy Bills Discount Scheme Regulations 2023 (in GB) or the Energy Bills Discount Scheme (Northern Ireland) Regulations 2023 (the Main Scheme Regulations) to show that it meets the applicable criteria.

No support at all is provided automatically under the NSC scheme. In each case, an application for registration, and subsequent claims must be made by the customer’s QEP, another provider in the customer’s energy supply chain, or the customer itself and accepted by DESNZ.

Under the NSC scheme, customers pay what their providers charge them and then receive a support payment that is claimed by the QEP, other provider or the customer itself, calculated in a way that is similar to the discounts under the Main Scheme Regulations, where licensed suppliers are required to discount their charges to customers and are then reimbursed by government.

2.1 Baseline discount

The government will provide payments to ensure that NSCs receive relief in respect of what they have paid for their eligible energy.

The scheme applies to eligible energy consumed during the 12-month period from 1 April 2023 to 31 March 2024. Support is only available when wholesale prices exceed a certain threshold, and is subject to a maximum rate.

For most non-domestic energy users (excluding eligible ETII and heat networks) in Great Britain and Northern Ireland the maximum rates have been set at:

- Electricity - £19.61 per megawatt hour (MWh) with a price threshold of £302 per MWh

- Gas - £6.97 per megawatt hour (MWh) with a price threshold of £107 per MWh

Support is calculated as the difference between the wholesale price associated with an energy contract (the Wholesale Related Price) and the price threshold. Support is phased in when the contract’s wholesale price exceeds the floor price, until the total discount per MWh reaches the maximum rate for that form of energy. Support is only applied to the wholesale element of the bill and therefore the final per unit price paid by non-domestic customers may differ (where other costs are included).

2.2 Categories of consumption

The way that the Wholesale Related Price is determined in order to calculate the amount of support a customer receives depends on the customer’s overall energy consumption. Eligible customers will be split into two categories:

A) Lower Consumption Customers

- Those who are expected to consume less than 10GWh electricity per annum and/or 30GWh per annum for gas (If a customer is eligible in respect of both electricity and gas, it will be a Lower Consumption Customer only for the type of energy where its consumption is below the threshold).

- For Lower Consumption Customers, the Wholesale Reference Price (WRP) is a value published by DESNZ that is used to deem the wholesale element of the NSC’s contract price (based on the kind of index used to fix the price under its contract).

- Lower Consumption Customers will be categorised into two groups: those whose contracts are linked to day-ahead rates and those on other index-linked rates.

We will publish a separate set of discount rates for electricity and gas, with two different rates: the day ahead discount rate and the other index linked discount rate for each month. The discount rate will then be applied to the relevant monthly consumption of the NSC to produce the discount value that they are entitled to. This information will be published in line with monthly claim windows opening.

B) Other customers:

- The Wholesale Related Price for customers whose consumption is expected to exceed the 10GWh and 30GWh thresholds will be calculated on an individual basis, based on “actual”, rather than “deemed” values, as set out in the scheme terms.

- Full details on how to apply the calculation will be published in due course.

2.3 The Energy and Trade Intensive Industries (ETII) Discount

Non-domestic customers operating primarily in sectors that have been identified as the most energy and trade intensive may receive a higher level of support. Eligible organisations will need to take action to receive this support. Your UK business or organisation should also be able to prove that at least 50% of its revenue is being generated from UK-based activity within eligible SIC code sectors.

Organisations will receive a discount reflecting the difference between the price threshold and the relevant wholesale price. The thresholds are:

- Electricity - £185 per MWh

- Gas - £99 per MWh

This discount will only apply to 70% of energy volumes and will be subject to a ‘maximum discount’ of £40.0/MWh for gas and £89/MWh for electricity. The baseline level of support will apply for the remaining 30% of energy volumes where the customers wholesale price meets the baseline eligibility criteria.

The customer itself will need to register to be entitled to this higher level of support and provide proof of eligibility to their energy provider. Customers with operations in both Northern Ireland and Great Britain will need to make a separate application for a certificate in each. If your NSC scheme application is being handled by your QEP or another energy provider, it is not part of their responsibility to deal with the process of getting you certified as an ETII operator. For more information on the Energy and Trade Intensive Industries Discount and how to register, please visit: https://www.gov.uk/guidance/energy-bills-discount-scheme-energy-and-trade-intensive-industries-support.

Non-standard customers who believe that they meet the criteria for ETII support and cannot see their energy provider listed should contact us at support@ebds.beis.gov.uk for us to consider your case further.

2.4 The Heat Network discount

A higher level of support will be available to heat networks with domestic end consumers.

This scheme aims to bring retail energy prices paid by heat suppliers down to a specific heat network Minimum Supply Price. This means there are no maximum discounts or wholesale price thresholds for heat networks. This is different to the approach taken for other parts of the Energy Bills Discount Scheme or the Energy Bill Relief Scheme.

The scheme will support the wholesale element of a heat network’s energy tariff, up to the point that the Minimum Supply Price is achieved. The Minimum Supply Prices will be set as:

- Electricity - £340 per MWh

- Gas - £78.3 per MWh

This should ensure that domestic customers on heat networks do not face disproportionately higher heat and hot water bills when compared to customers in equivalent households who are supported by the Energy Price Guarantee (EPG).

Heat networks will need to register to be entitled to this higher level of support. For more information on heat networks support, please visit: https://www.gov.uk/guidance/energy-bills-discount-scheme-heat-networks-support.

Non-standard customers who consider that, but for operating through an unlicensed supplier, they otherwise meet the criteria (set out in the guidance above) for heat network support should contact us at ebrs.nonstandardcases@beis.gov.uk for us to consider your case further.

2.5 Eligible energy

Energy is eligible energy (gas or electricity) in relation to an NSC where the following conditions are met:

- the energy is provided to the NSC by an entity other than the NSC itself

- the energy is not supplied to either the NSC, or to any other person, by a licensed supplier

- the energy is consumed by the NSC at the NSC’s premises, which are in the UK

- the energy price is set by reference to the Wholesale Market Price

- the energy is not gas used for the purpose of generating electricity, exporting it back to the grid and selling it on the wholesale market, or electricity that is stored and then re-exported to the grid

- the energy is lawfully provided to the customer

- the energy is not electricity produced mainly by the combustion of gas*

- The first, fourth, sixth and seventh of these conditions do not apply to a Wholesale Market Customer (that purchases its energy directly from the wholesale market)

(* Defined as where the calorific input of gas into the production of electricity is 5% or greater of the total calorific input. ‘Gas’ here refers to natural gas or biomethane, for example as taken from the public gas grid. Electricity that is produced from biogas or landfill gases, for example through anaerobic digestion processes or landfill extraction, will be eligible for support, provided the other criteria are also met.)

3. Applying for a relief payment

Eligible NSCs could be eligible for relief payment under this scheme, either the ‘Energy Cost Support’ or the ‘Pass-through Payment’ through an intermediary, depending on their role in the energy supply chain.

As a default position, the QEP should apply to DESNZ Energy Cost Support for the benefit of the NSC to which it provides energy. Where a NSC is procuring from the wholesale market and consuming the energy themselves (and there is no licensed supplier in the energy chain), they would make an application for relief themselves.

If a QEP applies to the Secretary of State for Energy Cost Support for the benefit of any of its NSCs, it must do so for the benefit of all of them unless a customer has explicitly opted out

If, for some reason, the QEP is not best placed to apply for the Energy Cost Support, by agreement between the QEP and the NSCs, another party in the chain of supply of energy may apply. This should be checked with DESNZ in advance of agreement to ensure it aligns with the scheme rules.

A NSC may opt out of the scheme if they wish to, by giving notice (Opt-out Notice) to the QEP that it will not be eligible for Energy Cost Support with effect from the date specified in the notice (which may be before, on or after, the date when the notice is given). Where an NSC has given an Opt-out Notice it may give a further notice to the Energy Provider withdrawing the Opt-out Notice with effect from the date specified in such further notice (which may not be before the date when the notice is given).

Where the appropriate QEP will not make an application for Energy Cost Support for the NSC, then the NSC may apply on its own behalf. They will need to have contacted their provider requesting they become part of the scheme and have also waited 15 business days for the provider to confirm participation or otherwise.

There may be scenarios where there are parties in the energy chain who may act as energy consumers as well as passing energy to their customers. Where their consumption of energy involves the production of another form of energy that is provided to their customers, these intermediaries will be required to pass on the benefit of support down the chain. An example would be an intermediary that consumes gas, but also supplies some of it to customers, some of whom it also supplies with steam.

NSCs who also act as QEPs will provide appropriate support for energy costs to subsequent NSCs.

3.1 Support calculations

As set out above, applicants will be split into two categories, depending on their energy consumption levels in relation to a de minimis threshold of 10 GWh per annum for electricity or 30 GWh per annum for gas. For Lower Consumption Customers, their Wholesale Related Price, for the purposes of support payment calculations, is derived from the appropriate index values published by DESNZ (based on whether the prices in their contracts are set on the basis of day-ahead or other index values). For other Customers, their Wholesale Related Price is based on their Wholesale-exposed Energy Price as below.

The WRP for Lower Consumption Customers therefore functions as a deemed price for the wholesale portion of the contract price that the NSC pays for their energy.

This means that relief for Lower Consumption Customers is not based on the actual prices paid, but a deemed discount rate. The discount rate would then be applied to the relevant monthly consumption of the end user to produce the discount value that they are entitled to.

The discount rate for the previous month will be published after a 0.5-month lag, in line with monthly claim windows opening and enabling the calculation to be undertaken. The WRP will be published after a two-month lag concerning the month it covers, which does not impact the calculation being done sooner, as it is the overall discount rate that is needed for this.

In calculating the relief for a Lower Consumption Customer, the applicant does not need to take into account the actual price charged for the energy in a given month (as long as the contract is tied to a wholesale price) nor specific customer elections or WAP.

3.2 The Wholesale-exposed Energy Price

This refers to the rate within the Energy Price charged by QEPs to NSCs above the consumption threshold that is linked explicitly to wholesale energy prices. This may be via either a wholesale market hedge or indexation to a published index such as the GB Day-Ahead Index (N2EX).

The Wholesale Related Price applicable to Eligible Energy consumed by a Wholesale Market Customer in any calendar month (M) is the volume-weighted average of the prices of the following transactions under which the customer bought and sold energy for delivery in month M:

- transactions accounted for in determining the customer’s imbalances under the BSC or UNC

- transactions for balancing services in respect of flows of energy to the customer at its premises

- transactions for settlement of the customer’s imbalances under the BSC or UNC

The Wholesale Related Price applicable to eligible energy consumed by a retail customer in any calendar month (M) is the volume-weighted average Wholesale-exposed Energy Price for that period, determined by reference to the quantities, periods and prices on the basis of which, in relation to periods in month M, the Wholesale-exposed Energy Price:

- is fixed (by the Customer or Energy Provider) under any mechanism in the Energy Pricing Arrangements

or

- in default of being so fixed, or in the absence of any such mechanism, is determined under the Energy Pricing Arrangements

NSCs with consumption above the threshold may have the option on a rolling basis to fix a wholesale price for a defined part of the volume to be provided, or to unfix it. These allow the NSC to gradually build up a blended price for energy, locking in prices for blocks of expected consumption over a period of time.

A unit rate for a given period (calendar month) will represent a blended rate in respect of the wholesale price of electricity or gas being determined by the provider for the energy consumed. The blended rate will reflect the dates of each fix or unfix and the associated wholesale electricity or gas volumes, based on a weighted average price (WAP) of all trades of the given period, WAP should be calculated on a MWh basis. This WAP calculation should consider all fixes and unfixes trades (baseload, peakload, index (like day ahead) and cash-out) that the NSC has made irrespective of when the trades occurred (that is, these fixes and unfixes could be made prior to 1 December 2021). The WAP calculation should consider the net value of fixes and unfixes for the given billing period, such as, any gains made from unfixing volumes should be reflected in a lower NSC WAP.

The WAP should not include any fees related to trading charges, volume tolerance breaches, premiums for shape/imbalance or similar. For clarity, where the QEP is assuming the market price risk then the trade should not be included in the WAP calculation (such as £/MWh fee applied to all volumes for shape), whereas if the NSC is assuming the market price risk (like day ahead settlement of residual volumes) then the trade should be included in the WAP calculation. Note the final relief calculated between the WAP and the Government Supported Discount Price (GSDP) should be applied to all NSCs actual consumption irrespective whether it was traded or covered by a shaping/imbalance fee.

The calculated WAP should be compared to the relevant GSDP to calculate the Energy Cost Support in the given period. The specific NSC relief will be subject to the maximum relief.

Where a QEP has offered to bill an NSC on a reference price or flattened customers’ prices (based on already executed trades) for cashflow purposes (such as over a quarter, season, year), the WAP calculation should be based on the underlying trades for each billing period not the agreed billing price.

NSCs with related financial instruments in place to manage risks outside of physical hedges (e.g., CPPAs, financial derivatives, weather hedges, etc.) are expected to declare these to QEPs who will in turn declare this information when submitting a claim and will have support adjusted to reflect the impact in the WAP of these products. QEPs are expected to communicate to NSCs that they should continue to manage their contracts and hedges in the same way they would have done had the scheme not been in place and should not make changes to intentionally manipulate the levels of government support they would otherwise have received.

3.3 Worked examples of non-standard EBDS relief application

The example site configurations below are intended to demonstrate how relief should be applied to NSCs given different scenarios.

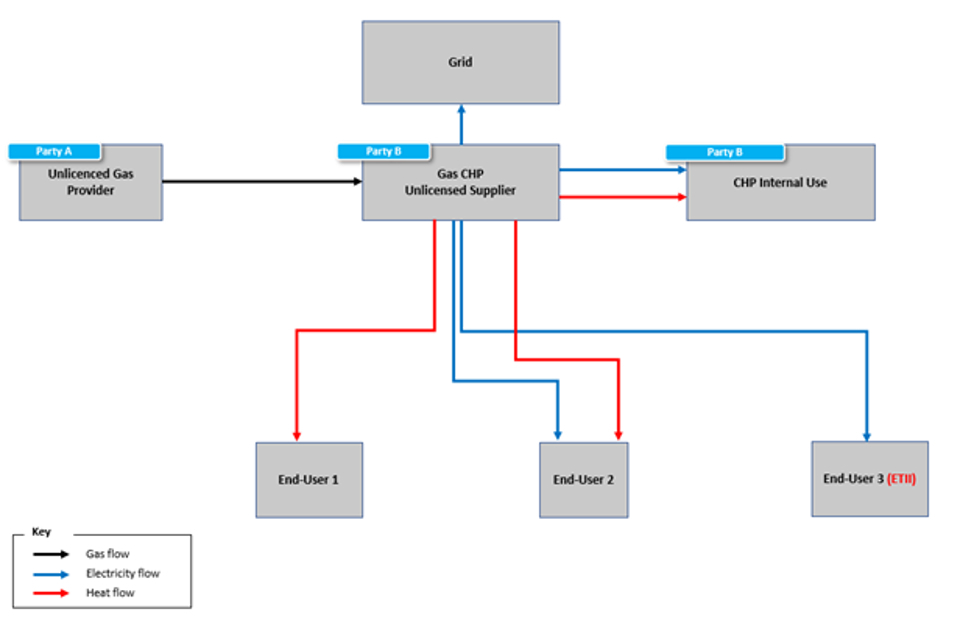

The example below shows a site in which gas is being supplied to an unlicensed thermal generator by an unlicensed provider via the main gas grid infrastructure. The description explains where and how relief under this scheme should be applied.

3.4 Illustrative example – gas-to-power and heat complex site

Illustrative example – gas-to-power and heat complex site

3.5 Who is eligible for support?

This diagram illustrates an example site whereby a gas-fired CHP (Party B) is procuring gas via a gas shipper (Party A) through a licence exempt supply agreement via the main gas grid at a price linked in some way to the wholesale price and is then using that gas for the following purposes:

- unlicensed generation and supply of electricity and heat to third-party customers

- generation of supply of heat and electricity for internal use

- generation of electricity for export to the main grid

The following parties are eligible for support under this scheme for the stated reasons:

| Party | Applicable support |

|---|---|

| Party B | Party B is considered an NSC for gas and is buying this gas from Party A, which is considered a QEP. Party B is eligible for a support payment under this scheme if the WAP for the gas it is procuring is above the GSP. Party A will adjust the support claim to take into account the gas used to generate electricity exported back to the grid as informed by Party B. Non-standard pass-through regulations will obligate Party B to pass through a proportion of this relief to customers to whom it is supplying heat and/or electricity. Party B will need to provide information on EU3 who is eligible for increased relief as an eligible ETII. The default position is that Party A as the QEP will claim on behalf of Party B. |

| EU1 | EU1 is eligible for passthrough relief via non-standard pass-through regulations as it is being supplied heat by Party B (an NSC for gas). This passthrough benefit is calculated by Party B. If EU1 is a Qualifying Heat Supplier (QHS), it is eligible for a higher level of relief as per the heat networks relief. They will need to provide their relevant certificate to Party B who should use this to calculate the higher level of relief. |

| EU2 | End-User 2 (EU2) is eligible for passthrough relief via non-standard pass-through regulations as it is being supplied both heat and electricity by Party B (an NSC for gas). The electricity supply is not directly supported as it is produced mainly from the combustion of gas. This pass-through benefit is calculated by Party B. |

| EU3 | End-User 3 (EU3) is eligible for passthrough relief via non-standard pass-through regulations as it is being supplied electricity by Party B (an NSC for gas). This pass-through benefit is calculated by Party B. EU3 is eligible for the higher level of relief as per the ETII relief, they will need to provide their relevant certificate to Party B who should use this to calculate the higher level of relief. |

Considering this example scenario, for each party to receive the correct relief payment, three steps should be followed:

- Party A claims Energy Cost Support on behalf of Party B via the Non-Standard EBDS

- Party A pays the support, once received from DESNZ, to Party B

- Once notified of the payment, Party B then passes through this benefit to customers based on pass-through benefit for the supply of heat and/or electricity to each End-User

3.6 Illustrative example – non-gas generator such as energy from waste-to-power

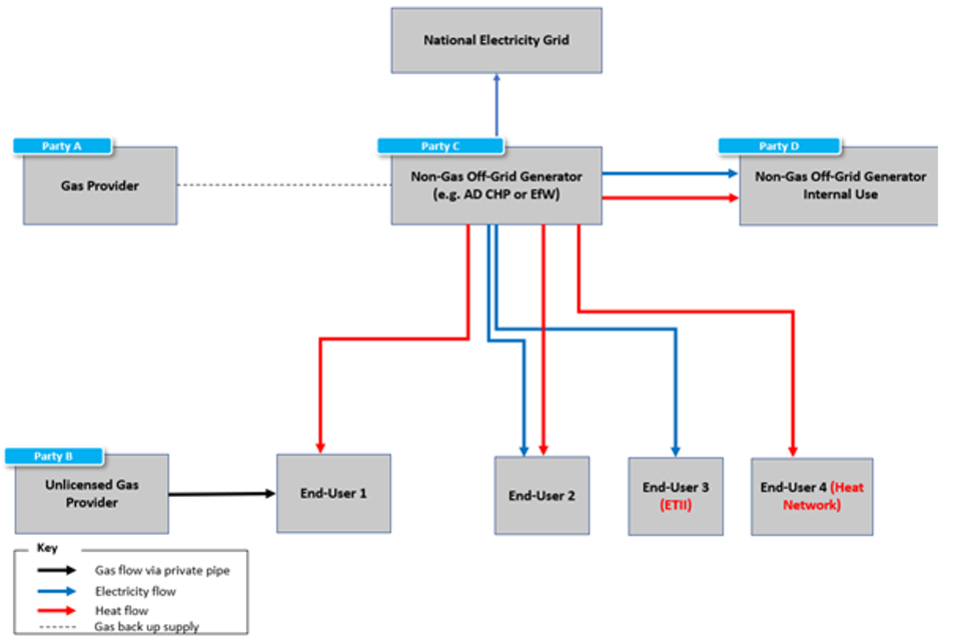

The example below shows a site in which an unlicensed non-gas generator (such as energy from waste) is supplying various end users with electricity and/or heat. The description explains where and how relief under this scheme should be applied.

Illustrative example – non-gas generator such as energy from waste-to-power

3.7 Who is eligible for support?

This diagram illustrates a scenario whereby a non-gas off-grid generator (such asenergy from waste) primarily uses waste or another non-gas input fuel to generate electricity and/or heat in order to supply end users at a price linked in some way to the wholesale price.

The generator uses waste or other non-gas fuel for the following purposes:

- generation and supply of electricity and heat to third-party customers

- generation of supply of heat and electricity for internal use

- generation of electricity for export to the main grid

The generator may also utilise a small proportion of gas as an input, for example as a boiler top-up or to assist in plant start up, as long as this is less than 5% by calorific value of all energy input.

The following parties can make claims under the scheme for the following reasons:

| Party | Applicable support |

|---|---|

| Party A | Party A may provide a small amount of gas to Party C, this gas should only be minimal volumes such as to start up an energy from waste plant. In the event this gas comes from the grid, it should be provided support under EBDS; or under the Non-Standard Cases scheme, in the event that it is provided by an unlicensed supplier. |

| Party B | Party B provides a private gas pipeline to EU1 with no grid connection. Party B should submit a claim for EU1 for the value of the gas used and provide the relief. |

| Party C | If Party C receives any pass-through from Party A for gas procured it should provide appropriate support to end users as pass-through. Heat supply to EU1 and EU4 may also be supported by any pass-through benefit on the gas procured from a licensed or unlicensed gas provider. No additional relief is provided on non-gas produced heat or steam. Party C can claim under the Non-Standard Cases scheme on behalf of EU2 and 3 relating to their electricity supply (assuming that supply price is linked to the wholesale price), as well as Party D as this is internal use for the generator. They should act as the QEP. It will need to adjust its claim for any electricity exported to the grid as this is not eligible for relief. |

| EU1 | EU1 is eligible for relief for the gas purchased from Party B as long as it is piped. EU1 is not eligible for relief on heat / steam beyond pass-through on any gas used. |

| EU2 | EU2 is eligible for relief on its energy provided by Party C; Party C should claim on their behalf as the QEP. EU2 is not eligible for relief on heat/ steam beyond pass-through on any gas used. |

| EU3 | EU 3 is eligible for the increased Energy and Trade Intensive Industry support (ETII): they will need to provide their relevant certificate to Party C who should use this to calculate the higher level of relief. |

| EU4 | EU4 is eligible for increased pass-through support on heat derived from gas as it is a Qualifying Heat Supplier (QHS). EU4 will have to apply for eligibility and provide certification to Party C. |

3.8 Large customers

In making application for a NSC the QEP must identify if it is classed as a large customer – that is, if it could be reasonably expected that:

- The quantity of Energy conveyed to the Customer at the Customer’s Premises in the 12-month period starting on 1 April 2023 will exceed 0.5 gigawatt hours, or

- The maximum rate at which Energy is conveyed to the customer at those premises at any time will exceed 0.5 megawatts.

If the QEP believes this applies to any of their NSCs, they must determine this prior to applying for registration and give notice to the customer and to DESNZ. Conditions around how large customers should be treated, as well as declarations, are set out in the Scheme Terms.

3.9 Application of ETII and QHS additional relief

As set out above, in some cases NSCs may be eligible for a higher level of support if they are an eligible ETII or Heat Network.

As with the standard EBDS the end user should apply directly to DESNZ as set out in the relevant guidance. The end customer should provide the relevant certification to their relevant energy provider and/or the entity making the application for relief from DESNZ. It will be the responsibility of the applicant to ensure they have correctly calculated and passed on the relief.

4. How providers will submit their registration application and registration information

Please note that this is a high-level description and is subject to change.

4.1 Application and registration

A QEP or any other registering party will be required to make a registration application, and to have had it accepted, before claiming for support for the first time. The application process will include the collection of general company information, information pertaining to eligibility for scheme support and information required for operational set-up, such as bank details. The applicant should also provide information on whether their customers are eligible ETII and heat networks.

The process is:

- QEP submits application for registration application and registration information. This must be accompanied by the Confirmation and Undertaking (if from a Higher Level Energy Provider).

- DESNZ make a decision on whether to accept an applicant for registration. This may require the applicant to submit further information or modify registration information.

- If DESNZ decides to accept the application for Registration, DESNZ invite the applicant to enter into a Scheme Agreement.

The application form and other relevant documents are available on gov.uk.

In the event that an existing QEP/ NSC registered to the scheme believe that they have additional energy that now falls within scope of this programme they should email ebrs.nonstandardcases@beis.gov.uk to discuss this in the first instance. They will not be expected to provide a new full application but will need to provide additional evidence to support their extension.

4.2 QEP claim submission

Please note that this is a high-level description and is subject to change.

- Providers will utilise the ebrs.nonstandardcases@beis.gov.uk to submit their claims.

- Providers will complete the claims form, including supporting evidence documentation, and the complete declaration template as part of their application and readiness information.

- Providers should place the completed forms into a compressed folder and mail the folder as a single attachment. The folder should be named [PROVIDER DATE GAS/ELECTRICITY/COMBINED (delete as appropriate)].

- All claims must be submitted by the claims window closure date within each month (set out below) in order for payments to be made in the next payment window.

- All claims must include the certificate of any eligible ETII or Heat Network for which the higher rate of support is claimed.

- Any late claims should be made in the following month however payment will be made in that month and cannot be brought forward.

- Pre-payment checks are carried out on data completeness, data quality, supplier details, relief application and consumption.

- If checks are not passed a notification will be sent back to providers highlighting reasons for not passing the checks.

If a registered QEP/ NSC is looking to claim for energy that they believe is now eligible under the extended eligibility criteria they should first speak to the team at ebrs.nonstandardcases@beis.gov.uk.

Claims windows are as follows, these are subject to change at DESNZ discretion and dependent on the complexity of claim, it may take longer to process payments than is indicated below.

Claims window 1

| Claims window opens | 17 May 2023 |

| Claims windows closes | 23 May 2023 |

Claims window 2

| Claims window opens | 14 June 2023 |

| Claims windows closes | 20 June 2023 |

Claims window 3

| Claims window opens | 14 July 2023 |

| Claims windows closes | 20 July 2023 |

Claims window 4

| Claims window opens | 14 August 2023 |

| Claims windows closes | 18 August 2023 |

Claims window 5

| Claims window opens | 14 September 2023 |

| Claims windows closes | 20 September 2023 |

Claims window 6

| Claims window opens | 13 October 2023 |

| Claims windows closes | 19 October 2023 |

Claims window 7

| Claims window opens | 14 November 2023 |

| Claims windows closes | 20 November 2023 |

Claims window 8

| Claims window opens | 14 December 2023 |

| Claims windows closes | 20 December 2023 |

Claims window 9

| Claims window opens | 15 January 2024 |

| Claims windows closes | 19 January 2024 |

Claims window 10

| Claims window opens | 14 February 2024 |

| Claims windows closes | 20 February 2024 |

Claims window 11

| Claims window opens | 14 March 2024 |

| Claims windows closes | 20 March 2024 |

Claims window 12

| Claims window opens | 15 April 2024 |

| Claims windows closes | 19 April 2024 |

Applications will close to new registrations on 31 March 2024.

4.3 Correcting a claim

If there is an error or a subsequent adjustment to a previous claim, a revised claim should be submitted for that claim period in the subsequent claim window. The difference between the original and revised claim will be netted off. The QEP may need to pay funds back to DESNZ in the event of an initial overpayment that cannot be reconciled through a deduction in a subsequent claim.

Payment

The frequency of payment is once per month and will be made up to 20 working days after a claim has been submitted.

Acceptance of claims and payment timings remain at the full discretion of DESNZ.

5. Providing Energy Cost Support to customers

QEPs are expected to provide to NSCs details of the Energy Cost Support calculations in a timely and transparent manner. The cost support payment applied to NSCs energy consumption does not have to be itemised on invoices but can be provided to customers as invoice backing information, or as a separate communication sent to customers.

VAT is only due on the amount providers actually charge to their customers, so the amount each customer is charged after the price adjustment is the amount on which VAT is due.

As actual metered volumes are settled through the electricity and gas settlement processes and systems, providers are expected to supply appropriate updates to customer detailing changes to the volumes relief has been applied to in each period. This should be reflected in the reconciliation on claims from government.

Any billing errors or errors in relief application should be highlighted to customers and corrected in a timely fashion. Any corresponding error in claims from government should also be corrected.

QEPs are expected to pay the amount to the customer as soon as reasonably practicable by bank transfer, cheque or other form of payment in cash.

With agreement in writing of the customer the QEP may instead pay the Energy Cost Support to the NSC by the following methods:

- application of a credit in the next bill provided by the energy provider to the customer

- adjusting the charges for energy in the next bill provided to the customer

- adjusting the amount of money taken pursuant to a direct debit or the amount of a standing order

- set off against an amount or part of an amount which was owed by the customer to the provider at the time the Energy Cost Support was paid to the provider

6. Audit

Given the scale of this scheme DESNZ reserves the right to audit the books, records, systems and process of the QEP and NSCs for the purposes of:

- ascertaining whether the Scheme Party is in compliance with the Scheme Terms

- ascertaining whether pursuant to the Scheme Terms any amount is payable by the Scheme Party to DESNZ

- otherwise ensuring the proper accounting for, tracing or control of public money under the scheme

7. Disputes and complaints

Processes and timelines for handling disputes and complaints are designed to ensure fair, impartial and discretionary handling by the contracting party (DESNZ).

Prior to a dispute being raised, DESNZ expects there to be a period of cooperative compliance which would ensue between themselves and the provider where discrepancies arise. The timeline for this cooperative compliance would be designated by DESNZ at their discretion but will endeavour to give providers every opportunity to fulfil the requirements either during the application process or following successful application but where a provider’s claims submission is considered unsatisfactory.

7.1 Dispute

Where cooperative compliance between DESNZ and the provider does not result in a satisfactory resolution, the provider will be informed and if desired, may raise a formal dispute. To ensure appropriate handling of the dispute, the provider will be required to raise this within 30 days. This applies to both:

a) Where an application is unsuccessful in the first instance

or

b) An unsuccessful application of claims submission

DESNZ will then have 45 days to handle the formal dispute and respond to the provider.

As part of the formal disputes process, both provider and DESNZ will be asked to nominate designated senior representatives, with the intention of resolving the outstanding dispute issue at senior level. Upon DESNZ dispute response, if the provider still deems the outcome unjust, then they may request a formal meeting, according to the terms of standard grant contracting. The formal meeting will require the designated senior DESNZ representative to meet with the providers Chief Executive (or suitable alternative) at the nearest opportunity.

7.2 Complaints

The provider has the opportunity to raise a complaint regarding operational considerations at any given time and DESNZ will endeavour to respond to the complaint as soon as possible within 45 days.