Frontier Economics Geospatial Data Market Study Report - Executive Summary

Published 24 November 2020

Context and background

The capabilities offered by geospatial data and location-based insights are no longer confined to the periphery of the UK economy. Geospatial data, otherwise known as location data, plays a significant role for businesses, individuals and the public sector and drives economic value. Geospatial data is increasingly being collected via a variety of means including location-aware devices and connected sensors. It has transformed the lens through which decision making is carried out and has enabled a new generation of consumer services that put location at the forefront of our lives. Consumers currently use a range of services that rely on geospatial data. These include fitness applications which track exercise activity, in-car navigation systems and insurance offerings that are informed by location data.

Frontier Economics was commissioned by the Geospatial Commission to carry out a detailed economic study of the size, features and characteristics of the UK geospatial data market. The Geospatial Commission was established within the Cabinet Office in 2018, as an independent, expert committee responsible for setting the UK’s Geospatial Strategy and coordinating public sector geospatial activity. The Geospatial Commission’s aim is to unlock the significant economic, social and environmental opportunities offered by location data. The UK’s Geospatial Strategy (2020) sets out how the UK can unlock the full power of location data and take advantage of the significant economic, social and environmental opportunities offered by location data.

This report sets out the results of our work, informed by an extensive data collection exercise and engagement with participants across the market. The report also builds on previous studies that have explored the value that some forms of geospatial data bring to specific sectors[footnote 1]. Our approach goes further by exploring the dynamics of the economic market for multiple types of location data and services, including how value is being generated from new sources of location data.

The findings and evidence presented throughout this report illustrate how the market has been transformed via an evolution in data collection mechanisms. Technology has enabled a substantial amount of value to be generated from non-traditional sources of location data, such as data gathered through crowdsourcing or as a by-product of company activity in other markets. Location-based services, powered through smartphone apps and other location-enabled devices, are now an integral part of the consumer experience. As technology continues to improve, and new forms of location data continue to be generated, this timely assessment of the geospatial market can help drive further economic growth by identifying opportunities for the UK that can be unlocked.

Market characteristics

During the course of our extensive research into the geospatial market, we observed three distinct characteristics of the geospatial data market (Figure 1). These three characteristics set the foundations for our conclusions on the economic dynamics of the market, which present an opportunity to generate additional value through informed policy-making.

Figure 1 outlines the three main characteristics of the geospatial market that are set out in the report. These are: geospatial activity takes place in an ecosystem and not a single market; traditional methods to measure geospatial commercial activity will not reveal it’s full value; and creating and using geospatial data leads to spillover benefits.

1. It is an ecosystem rather than a traditional market structure

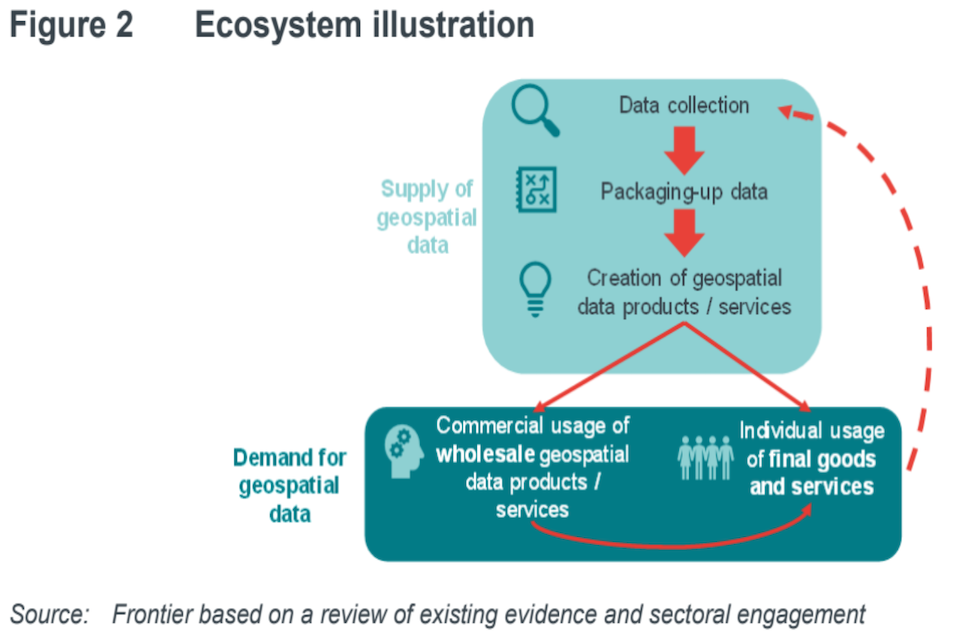

Given that geospatial firms offer a range of diverse products and services across multiple industries, it is not appropriate to view geospatial activity as taking place within a single economic market (Figure 2).

Activity is better visualised as a geospatial ecosystem containing individual submarkets, based on specific groups of products and services. We make a broad distinction between “supply” of geospatial data and “demand” within any specific geospatial market within the ecosystem.

Figure 2 outlines an illustration of any given submarket within the geospatial ecosystem. The supply-side involves data collection, packaging up data and creating geospatial data products and services. The demand-side involves the commercial usage of whole geospatial data products/services and individual usage of final goods and services. Data generated by these activities can be fed back to the data collection stage, and so give rise to a self-reinforcing feedback loop.

The supply side can be sub-divided into value-adding stages covering generation of data, transformation of that data and linking with other forms of information. Some supply-side organisations specialise in a niche within this value chain, while others span the entire spectrum of activities.

Geospatial products and services will also vary in terms of their granularity. In some cases, geospatial data will be aggregated. For example, transport authorities can learn about patterns of demand for public transport by examining information on aggregated user journeys. On the other hand, more targeted aggregation of geospatial data may be used to inform personalised advertising, which is informed by a person’s previous movements. These two data requirements will likely be served by different supply-side organisations and therefore occupy different positions within the overall data ecosystem.

Some goods and services are entirely geospatial in nature such as a database of addresses and associated locations. Other goods and services include a geospatial element in addition to many other components such as a transport planning smartphone application which relies on geospatial data as well as a range of other hardware and software.

We found evidence that the demand side of the ecosystem is not confined to one area of the economy. Widespread adoption of geospatial data products or services could contribute to higher levels of productivity via more efficient supply chains or more accurate resource allocation. A significant proportion of value from geospatial data will come from more widespread adoption of geospatial data products and services by firms across a large number of sectors. For example, in some instances the usage of products and services generates additional data that is fed back to the data collector. These can contribute to network effects, where the quality of the upstream supplier’s offering is related to the number of user, such as when a geospatial service relies on crowdsourced data, it becomes more accurate as the user base increases.

As we describe below in greater detail, evidence from the interviews suggest that some coordinated policy action may be needed to achieve more widespread adoption. This could include improving existing data infrastructure or addressing other specific barriers to adoption such as inflexible legacy IT systems. This is in keeping with previous analysis carried out by the Cabinet Office (2018) which illustrated how multiple sectors could derive value from greater adoption of geospatial data.

2.Current industry definitions do not adequately capture the geospatial market and several large firms span geospatial and other digital areas

Geospatial data forms a key part of the commercial activity for a wide range of companies that operate across multiple sectors in the economy. This makes it challenging to estimate the true value of geospatial data. This report has attempted to produce an estimate of the value of the UK geospatial market by capturing the turnover of a subset of the wider ecosystem. Namely, those companies for whom the supply and provision of geospatial data is a core part of their product or service offering. Major demand-side users of geospatial data, such as retailers and marketing companies, and large digital technology firms like Apple, Google and Amazon, are a key part of the broader geospatial ecosystem. However, the ecosystem characteristic of the geospatial market means that the activity and turnover of these companies overlap with multiple other markets. Taking an approach that focuses on where geospatial data is a core part of the company’s product or service offering provides a more robust estimation of value. This also demonstrates the difficulty in attempting to define a market which has activity that spans multiple sectors, as has been found in digital industries (House of Commons Business, Innovation and Skills Committee, 2016).

Under this framework, we were able to identify almost 2,000 such geospatial firms operating in the UK. The data suggests that this subset of geospatial firms are dispersed across many sectors and industries, reflecting the ongoing incorporation of geospatial insights across the economy as a general purpose technology. The technology, professional services and engineering sectors, in particular, contained the highest number of geospatial firms. This is in keeping with the private sector geospatial use cases identified previously by the Cabinet Office (2018).

We were able to explore multiple facets of these 2,000 firms. A conservative estimate of value suggests that geospatial accounted for over £6 billion of turnover in 2018.[footnote 2] This estimate excludes the large digital technology firms like Apple, Google and Amazon. For these firms, geospatial data underpins a significant amount of their activity but it is not possible to estimate the proportion of revenue that can be attributed to its use. To give a sense of scale for the value we have not included in our estimate, we looked at the total size of the digital technology market in the UK and apportion some of this to geospatial data. This is relevant given how cross-cutting and embedded geospatial data is throughout the economy, including the digital technology market. If even 5% of turnover in this market were attributed to geospatial data, this would correspond to £9.2 billion. [footnote 3]Furthermore, just 5% of the worldwide annual R&D spent by a small number of these large digital technology companies like Apple, Google and Amazon are estimated to be about £3 billion.

In addition, the figures quoted above do not represent the entire economic contribution of the geospatial ecosystem, as geospatial organisations will generate value for a range of other economic actors and individuals. This will include time saved by consumers who can make more informed decisions when they have access to geospatial data products and services. As a result, estimate likely represents a fraction of the total economic contribution of the geospatial ecosystem.

Our data shows that the ecosystem is growing as new firms continue to enter this space. We found that 55% of the geospatial firms that we identified were incorporated in the last ten years and that the average annual growth over this period has been 8%.[footnote 4]

These firms are also distributed geographically with the highest concentrations in London and the South East with emerging clusters of geospatial data activity in Edinburgh, Cambridge and Belfast. We were able to collect employment information for two-thirds of these firms which collectively employed over 115,000 staff. Employment rose on average by around 45% a year (from around 20,000 in 2009 to over 115,000 in 2019).[footnote 5]

The size of the ecosystem can also be captured through data on fundraisings and grants. Looking at the SME companies identified through the Beauhurst platform, we found that the number of fundraisings had an annual growth rate of over 20% over the past ten years and the growth rate of the value of these fundraisings was approximately 40%. Furthermore, for the geospatial projects identified in UK Research and Innovation (UKRI) data,[footnote 6] the number of grants per year grew by an average of over 90% from 2009 to 2019, and the value of grants grew from £2 million in 2009 to over £61 million in 2019.

The ecosystem is constantly developing and changing with new technology and our estimates should therefore be viewed as illustrative and indicative only.

3. The value of creating and using geospatial data spills over

Like many other forms of data, the value of geospatial data is not limited to the data creator or data user. Value from using geospatial data can be subdivided into several different categories, based on who the value accrues to:

Direct use value: where value accrues to users of geospatial data. This could include government using geospatial data to better manage public assets like roadways.

Indirect use value: where value is also derived by indirect beneficiaries who interact with direct users. This could include users of the public assets who benefit from better public service provision.

Spillover use value: value that accrues to others who are not a direct data user or indirect beneficiary. This could, for example, include lower levels of emissions due to improvement management of the road network by government. The benefits of lower emissions are felt by all of society even those who do not use the road network.

As the value from geospatial data does not always accrue to the direct user of the data, there is a risk of underinvestment in geospatial technology and services. Our £6 billion estimate of turnover for a subset of geospatial firms in 2018 does not take account of these wider economic benefits that “spill over” across the UK economy, and generate additional value. As such, the value that geospatial data delivers is likely to be significantly higher than we have estimated and is therefore an area for potential future investment.

Economic dynamics

The three characteristics set out above provide the foundations for our ten conclusions into the economic dynamics of the market. These findings present a detailed evidence base to inform the Geospatial Commission in its approach to supporting the market to generate additional value to society.

1.Certain emerging geospatial data segments may have relatively few suppliers and buyers (a “thin” market). This can make price setting difficult for suppliers if they cannot benchmark against other similar service offerings. It can also limit interest from potential users who lack information about a suitable price to pay. This is observed in multiple segments. For example, mobile phone and Global Positioning System (GPS) data can provide insights into aggregated mobility patterns. However, some potential buyers of this data can lack comparative information on prices paid for similar data or services. This can make it difficult for potential buyers to assess value for money and for sellers to stimulate more demand.

2.There are potential benefits from reuse of privately collected geospatial data that can accrue widely. For example, this type of data can inform the development of future infrastructure by providing insights into journey patterns. This data can be collected via non-traditional mechanisms, such as crowdsourced information from a large number of connected vehicles, or data generated as a by-product of activity in other markets, such as exercise tracking applications. Therefore, greater sharing of geospatial data can generate economic and social value. However, substantial investment is needed to collect certain types of data and the potential returns can be uncertain. As a result, commercial geospatial activity can follow the pattern of intellectual property business models. Even though the cost of providing access to this form of geospatial data may be low, the collector needs to be rewarded for making the risky investment, which may result in a unique market advantage. Incentives for data sharing that encourage sharing of commercially collected data will need to be created. This is beneficial for society while still allowing those private sector data holders to recoup their investments and incentivise ongoing data collection. In other cases, the commercial sensitivity of certain types of data may mean that providers are unwilling to share regardless of the price or incentive offered, especially if they view the recipient as a potential competitor.[footnote 7]

3. As the geospatial data market operates as an ecosystem across a number of different industries, conclusions about competition within the private sector will vary for different parts of the ecosystem. We were told by some market participants (such as developers of consumer-facing applications which incorporate a mapping interface) that end-user familiarity with established mapping platforms can be an important commercial advantage for some mapping providers. This may, in some cases, lead to the development of strong commercial positions amongst established mapping providers. Previous work has highlighted how the collection of location data via mapping services allows those providers to operate more effectively in other related digital markets, such as advertising.[footnote 8]

4.Public sector organisations that provide geospatial data and services also operate across multiple areas of the geospatial data ecosystem, and there are often clear economic rationales for their involvement. However, there is evidence that remits given to some public sector bodies may be crowding out private sector activity, for example where the public sector provides a downstream service underpinned by data which they have legitimately collected and which other organisations have difficulty accessing.

5.Geospatial data products and services that are currently available are not always being used even when they can add value. This is in part due to a lack of demand-side awareness of the value that geospatial data can bring. For example, we were told that, in some cases, policymakers were not incorporating available geospatial insights into their decision-making process as they were unaware of the value it could offer. In other cases, demand-side organisations are aware of the value of geospatial data but face barriers to successful implementation, such as inadequate data infrastructure or outdated IT systems.

6.Access to finance is not consistent across all segments of the ecosystem. For example, there appears to be more competition between funders for companies at early stages of funding compared to those that are more mature. Our analysis of comparable sectors suggests that this is not atypical and is broadly in keeping with the pattern we see in other firms classified within related sectors, where the vast majority of fundraising occurs at earlier stages of start-up development. However, there may still be value in broadening the supply of current geospatial funding sources. The observed patterns of funding may, in part, be due to wider trends in funders joining together and forming syndicates at later stages of start-up funding rather than competing with each other.

7.Providers are aware of their need to comply with privacy regulations in relation to geospatial data and of the ethical challenges in relation to the use of location data. These ethical challenges apply primarily in the context of information on the movement and location of people. They need careful consideration as certain forms of geospatial data can be used to identify individuals. In other cases, geospatial data is used to highlight aggregate movement patterns. For example, information on movement patterns can be collected via mobile network data when handsets interact with mobile masts or when GPS data is harvested via mobile phone applications. As with other forms of data, market participants would welcome further clarity around whether the collection method for certain types of location data (especially GPS data harvested from mobile phone applications) requires further safeguards to prevent any risks to privacy and maintain consumer confidence. A balance needs to be struck as excessive intervention in this area could have unintended consequences such as discouraging data usage and stifling innovation. It may be that development of a framework for the ethical usage of geospatial data could help to drive further usage.

8.Numerous stakeholders reported that geospatial skills are becoming essential components of a wider range of skill sets, particularly data science capability, of which there is a shortage. In particular, we were told that it is very difficult to find candidates with a combination of geospatial expertise, data science capability and non-technical/soft skills. Overcoming these shortages may require geospatial skills to be included in existing data education offerings and new data career pathways to be developed. These pathways could include dedicated geospatial apprenticeships, for example.

9.Commercial organisations want to access public sector geospatial data via flexible and modern mechanisms that allow them to pay according to the volume of usage and only access specific data attributes of interest. High upfront costs for buying and hosting geospatial data can be an access barrier. For example, we were told that users want to access data via machine-readable Application Programming Interfaces (APIs) that enable them to pay in line with the amount of data they use and also to hone in on specific data attributes of interest. Access to public sector data can also be limited when the organisations which have collected and hold such information are not set up or incentivised to provide commercial geospatial products. This can occur, for example, when valuable geospatial data is generated as a by-product of another administrative process such as payment of subsidies.

10.The quality of public sector data is generally high. However, the provision of local authority data can be inconsistent across certain areas. For example, we were told that different local authorities store data in a variety of different formats, and also have their own access arrangements in place. This can increase the time and effort required to examine local data.

-

For example, analysis of private sector geospatial use cases published by the Cabinet Office (2018) suggests government could unlock between £6 and £11 billion per year of economic value. Also, a UK space industry study (London Economics, 2019) explored geospatial services like earth observation, positioning and navigation, and Deloitte (2017) concluded that Transport for London (TfL) is generating up to £130 million a year in economic benefits and savings through its release of its open geospatial data. Other work has focused on the importance of geospatial data technologies, such as the Global Positioning System (GPS) and the Global Navigation Satellite System (GNSS). ↩

-

We use 2018 turnover data as 2019 data is less complete at the time of our analysis ↩

-

Size of the UK technology market taken from Technation EY report ↩

-

Incorporation dates have been used to identify when new companies are created. These statistics reflect the 86% of companies identified that we were able to match to administrative data. ↩

-

This is based on employment data drawn from multiple data sources, using headcounts. ↩

-

Which tracks grants awarded for R&D and innovation projects ↩

-

This reluctance to share data was also noted by the CMA’s (2020) conclusions as part of their online platforms and digital advertising market study. ↩

-

See for example CMA (2020): ↩