Enterprise Management Incentive scheme: technical note

Updated 26 March 2024

1. Changes to the 2022 to 2023 Employment Related Securities (ERS) templates

The changes which have been made to the 2022 to 2023 ERS templates are summarised by the relevant template:

-

EMI Adjustments

- Question 9 ― column title amended, validation amended and completion now mandatory

- Question 10 ― completion now mandatory

-

EMI Replaced

- Questions 6 ― column title amended, validation amended and completion now mandatory

- Question 7 ― Completion now mandatory

-

EMI RLC

- Questions 7 ― column title amended, validation amended and completion now mandatory

- Question 8 ― completion now mandatory

- Question 12 ― completion now mandatory

-

EMI Non-Taxable

- Question 5 — column title amended, validation amended and completion now mandatory

- Question 6 ― completion now mandatory

- Question 13 ― column title amended

-

EMI Taxable

- Questions 7 ― column title amended, validation amended and completion now mandatory

- Question 8 ― completion now mandatory

- Question 17 ― column title amended

1.1 Overview

This document is a guide for anybody who needs to report events as part of their ERS annual return and want to create their own ERS files to capture share related event information during the tax year. You’ll need to create your own file if you decide not to use the HMRC templates.

When creating your files, you’ll need to provide all the information that’s relevant to the particular ERS return that you’re making. If the column does not match the technical specification detailed in this guide, it will not be possible to submit the file successfully.

1.2 ERS file attachments

A file can only be accepted in the following formats:

- OpenDocument Spreadsheet (ODS) format (.ods template downloaded from hmrc.gov.uk)

- ODS format (.ods spreadsheet created by the user, but matching the HMRC template specification)

- Comma Separated Values (CSV) format (.csv file(s) created by the user, originating from the HMRC ODS downloaded templates

- CSV format (.csv files created by the user from scratch, must match the HMRC template specification)

The majority of spreadsheet software solutions can use ODS and CSV files. Office packages such as Microsoft Excel, Google Sheets and OpenOffice can convert their native formats into ODS and CSV files.

2. General information about the required format of ODS templates

If you choose to create your own version of an ODS template rather than download the HMRC ODS template, the specifications must meet HMRC requirements. The required formatting is detailed in this guide.

Each file consists of a number of sheets (sometimes called tabs). Each sheet will contain specific share event information for that scheme.

You cannot change the name of any ODS sheet name that you submit. Changing the name of a sheet will result in an error and you will not be able to successfully upload your file. For more detail on the specific sheet names read section 3,2.

2.1 ODS File names

File names must be less than 240 characters in length. For ODS templates, there are no other restrictions on the file name.

2.2 Template layout

The data in any user created ODS file must meet the required specifications of the HMRC ODS templates. All data must start in Cell A10, any data provided prior to this cell cannot be checked for formatting and will not be identified by HMRC and therefore will not be validated.

2.3 Table headings explained

Section 3 contains tables for each scheme type and name. There are six column headings on each table and you must follow the specifications detailed in this section to create your ODS template.

The following information explains the six column headings of the tables.

Column title

All column titles must match the required HMRC formatting detailed in section 3. You must make sure all punctuation and grammar match. If the column title does not accurately match the technical specification, it will not be possible to submit the file successfully.

Data Type

This details whether your response to the question in column 1 should be numbers, characters (that is letters), or a combination of numbers and characters, and also details the maximum amount of numbers and characters you can provide per cell.

Numbers will either be whole or decimal, the data type column in the section 3 tables show what format they should be in. The maximum size of the number is the whole number part plus any decimal.

For example, ‘NUM11V2’ means data can be up to 14 characters in length that is ‘NUM11 means you can have a maximum of 11 numbers, followed by the ‘V’ which represents the decimal place and the ‘2’ following the ‘V’ means you can have up to 2 numbers following the decimal place, for example (12345678910.12).

Characters (letters) are represented by the term CHAR followed by a number, for example ‘CHAR3’. The number shows the maximum number of characters (letters) a file can contain.

Formatting

If formatting is required and what the formatting should be. If this formatting does not match the technical specification this will result in errors and until corrected will prevent you from being able to successfully upload your ERS return.

Example data

This gives an example of the data format we require.

Mandatory, Conditional Mandatory or Optional

This shows if a response to the question (in column 1) is either Mandatory (M), Conditional Mandatory (CM) or Optional (O).

Mandatory means a response is always required regardless of any other information provided.

Conditional Mandatory means a response is only required if you have provided the relevant response on a previous question. For example, if a share option has been granted in a Company Share Option Plan (CSOP) then the ‘Date of Grant’ would need to be reported.

Optional means this field can be left blank but should be completed if you know the information requested.

CSV position

‘CSV position’ is only applicable for CSV files.

3. Table information to aid template creation

The following sections contain the information you need to create your own ODS templates.

3.1 Enterprise Management Incentives

Enterprise Management Incentives.

3.2 EMI ODS file downloads

If you choose to use the HMRC ODS template, you can download the template Enterprise Management Incentives: end of year template.

3.3 EMI Sheet titles

The EMI spreadsheet contains 5 sheets (sheet titles must be entered exactly as shown in the table).

| Sheet Number | Title |

|---|---|

| 1 | EMI40_Adjustments_V4 |

| 2 | EMI40_Replaced_V4 |

| 3 | EMI40_RLC_V4 |

| 4 | EMI40_NonTaxable_V4 |

| 5 | EMI40_Taxable_V4 |

3.4 Nature of disqualification event lookup

This table will help you complete the following sheets:

- EMI40_Adjustments question 4

- EMI40_RLC question 3

- EMI40_Taxable question 3

| ID | Description |

|---|---|

| 1 | Company has come under control of another company |

| 2 | Company has ceased to meet the trading activities requirements |

| 3 | The option holder has ceased to meet the working time requirement |

| 4 | Terms of option varied causing value of shares to be increased or option no longer a qualifying option |

| 5 | Variation of share capital which results in disqualifying event |

| 6 | Shares were converted into a different class of shares and this conversion did not happen to the whole class of shares |

| 7 | The option holder has been granted an option under a CSOP resulting in them holding EMI and CSOP options over shares with a UMV in excess of the maximum entitlement |

| 8 | The company has not started to carry on a qualifying trade within two years of the grant of the option or preparations to carryon a qualifying trade have ceased |

3.5 EMI Adjustment of options formatting guide (EMI40_Adjustments_V4)

This table details the information and the format in which it is required when creating your own ODS template. Although the questions in this table are shown vertically, when creating your ODS the questions should be entered horizontally with the relevant information entered under each question column and each row showing the data of each individual employee you are reporting on.

For example this sheet has 14 questions therefore the questions should be shown from cell A to N in row 9, and if you report changes to 3 employees this would require the information to be entered in 3 rows, from row 10 to row 13.

| Column Title | Data Type | Formatting | Example Data | Mandatory/ Conditional Mandatory or Optional | CSV Position |

|---|---|---|---|---|---|

| 1. Has there been any adjustment of options following a variation in the share capital of the company? (yes/no) | CHAR3 | YES/NO | YES | M | 1 |

| 2. Has there been a change to the description of the shares under option? (yes/no) | CHAR3 | YES/NO | YES | CM | 2 |

| 3. Is the adjustment a disqualifying event? (yes/no). If YES go to Question 4. If NO go to question 5. | CHAR3 | YES/NO | YES | CM | 3 |

| 4. If yes, enter a number from 1 to 8 depending on the nature of the disqualifying event. Follow the link at cell A7 for a list of disqualifying events | NUMBER | See ‘Nature of disqualification event’ table | 3 | CM | 4 |

| 5. Date option adjusted (yyyy-mm-dd) | DATE | yyyy-mm-dd | 20 August 2014 | M | 5 |

| 6. Employee first name | CHAR35 | John | M | 6 | |

| 7 . Employee second name (if applicable) | CHAR35 | S | O | 7 | |

| 8. Employee last name | CHAR35 | Smith | M | 8 | |

| 9. National Insurance number | CHAR9 | The NINO should be in the format AANNNNNNA, the last character should be alpha | QQ123456B | M | 9 |

| 10. PAYE reference of employing company | CHAR14 | 123/XZ55555555 | M | 10 | |

| 11. Exercise price per share under option before adjustment £ e.g. 10.1234 | NUM13V4 | 4 decimal places | 12.1201 | O | 11 |

| 12. Number of shares under the option after adjustment e.g. 100.00 | NUM11V2 | 2 decimal places | 25.25 | O | 12 |

| 13. Exercise price per share under option after the adjustment £ e.g. 10.1234 | NUM13V4 | 4 decimal places | 15.7845 | O | 13 |

| 14. Actual market value of a share at the date of grant £ e.g. 10.1234 | NUM13V4 | 4 decimal places | 16.1234 | O | 14 |

3.6 EMI Replaced formatting guide (EMI40_Replaced_V4)

This table details the information and the format in which it is required when creating your own ODS template. Although the questions in this table are shown vertically, when creating your ODS the questions should be entered horizontally with the relevant information entered under each question column and each row showing the data of each individual employee you are reporting on.

For example, this sheet has 17 questions therefore the questions should be shown from cell A to Q in row 9, and if you report changes to 3 employees this would require the information to be entered in 3 rows, from row 10 to row 13.

| Column Title | Data Type | Formatting | Example | Data Mandatory/ Conditional Mandatory or Optional | CSV Position |

|---|---|---|---|---|---|

| 1. Date of grant of old option (yyyy-mm-dd) | DATE | yyyy-mm-dd | 2013-10-28 | M | 1 |

| 2. Date of grant of new option (yyyy-mm-dd) | DATE | yyyy-mm-dd | 2014-03-20 | M | 2 |

| 3. Employee first name | CHAR35 | John | M | 3 | |

| 4. Employee second name (if applicable) | CHAR35 | S | O | 4 | |

| 5. Employee last name | CHAR35 | Smith | M | 5 | |

| 6. National Insurance number | CHAR9 | The NINO should be in the format AANNNNNNA, the last character should be alpha | QQ123456A | M | 6 |

| 7. PAYE reference of employing company | CHAR14 | 123/XZ55555555 | M | 7 | |

| 8. Actual market value of original shares at the date the option(s) were replaced £ e.g. 10.1234 | NUM13V4 | 4 decimal places | 250.1234 | O | 8 |

| 9. Name of the company whose shares are the subject of the new option | CHAR120 | Option text | M | 9 | |

| 10. Company address line 1 | CHAR27 | 1 Beth street | M | 10 | |

| 11. Company address line 2 | CHAR27 | Bucknall | O | 11 | |

| 12. Company address line 3 | CHAR27 | Stoke | O | 12 | |

| 13. Company address line 4 | CHAR18 | Staffordshire | O | 13 | |

| 14. Country | CHAR18 | United Kingdom | O | 14 | |

| 15. Postcode | CHAR8 | SE1 2AB | M | 15 | |

| 16. Corporation Tax reference (Unique Taxpayer Reference) | CHAR10 | 1234567890 | O | 16 | |

| 17. Company Reference Number (CRN) | CHAR10 | AC097609 | O | 17 |

3.7 EMI Released, lapsed or cancelled formatting guide (EMI40_RLC_V3)

This table details the information and the format in which it is required when creating your own ODS template. Although the questions in this table are shown vertically, when creating your ODS the questions should be entered horizontally with the relevant information entered under each question column and each row showing the data of each individual employee you are reporting on.

For example, this sheet has 12 questions therefore the questions should be shown from cell A to L in row 9, and if you report changes to 3 employees this would require the information to be entered in 3 rows, from row 10 to row 13.

| Column Title | Data Type | Formatting | Example | Data Mandatory/ Conditional Mandatory or Optional | CSV Position |

|---|---|---|---|---|---|

| 1. Date of event (yyyy-mm-dd) | DATE | yyyy-mm-dd | 2015-02-10 | M | 1 |

| 2. Is the release, lapse or cancellation the result of a disqualifying event? (yes/no) | CHAR3 | YES/NO | YES | M | 2 |

| 3. If yes, enter a number from 1 to 8 depending on the nature of the disqualifying event. Follow the link at cell A7 for a list of disqualifying events | NUMBER | See ‘Nature of disqualification event’ table | 5 | CM | 3 |

| 4. Employee first name | CHAR35 | John | M | 4 | |

| 5. Employee second name (if applicable) | CHAR35 | S | O | 5 | |

| 6. Employee last name | CHAR35 | Smith | M | 6 | |

| 7. National Insurance number | CHAR9 | The NINO should be in the format AANNNNNNA, the last character should be alpha | QQ123456B | M | 7 |

| 8. PAYE reference of employing company | CHAR14 | – | 123/XZ55555555 | M | 8 |

| 9. Number of shares subject to the option which have been released, lapsed or cancelled? e.g. 100.00 | NUM11v2 | 2 decimal places | 12.52 | O | 9 |

| 10. Was money or value received? (yes/no) If yes go to question 11, otherwise no more information is needed for this event. | CHAR3 | YES/NO | NO | M | 10 |

| 11. If yes enter the amount £ e.g. 10.1234 | NUM13v4 | 4 decimal places | 25.1234 | CM | 11 |

| 12. PAYE operated? (yes/no) | CHAR3 | YES/NO | YES | CM | 12 |

3.8 EMI Non-taxable exercise of options formatting guide (EMI40_NonTaxable_V4)

This table details the information and the format in which it is required when creating your own ODS template. Although the questions in this table are shown vertically, when creating your ODS the questions should be entered horizontally with the relevant information entered under each question column and each row showing the data of each individual employee you are reporting on.

For example this sheet has 15 questions therefore the questions should be shown from cell A to O in row 9, and if you report changes to 3 employees this would require the information to be entered in 3 rows, from row 10 to row 13.

| Column Title | Data Type | Formatting | Example | Data Mandatory/ Conditional Mandatory or Optional | CSV Position |

|---|---|---|---|---|---|

| 1. Date of option exercise (yyyy-mm-dd) | DATE | yyyy-mm-dd | 2014-05-15 | M | 1 |

| 2. Employee first name | CHAR35 | John | M | 2 | |

| 3. Employee second name (if applicable) | CHAR35 | S | O | 3 | |

| 4. Employee last name | CHAR35 | Smith | M | 4 | |

| 5. National Insurance number | CHAR9 | The NINO should be in the format AANNNNNNA, the last character should be alpha | QQ123456B | M | 5 |

| 6. PAYE reference of employing company | CHAR14 | 123/XZ55555555 | M | 6 | |

| 7. Total number of shares employee entitled to on exercise of the option before any cashless exercise or other adjustment e.g. 100.00 | NUM11V2 | 2 decimal places | 2500.23 | O | 7 |

| 8. Actual market value (AMV) of a share at the date of grant of the options exercised £ e.g. 10.1234 | NUM13V4 | 4 decimal places | 10.2567 | O | 8 |

| 9. Exercise price per share £ e.g. 10.1234 | NUM13V4 | 4 decimal places | 8.0055 | O | 9 |

| 10. AMV of a share at date of exercise £ e.g. 10.1234 | NUM13V4 | 4 decimal places | 11.5123 | O | 10 |

| 11. Are the shares subject to the option exercised listed on a recognised stock exchange? (yes/no) If yes go to question 14 If no go to next question 12 | CHAR3 | YES/NO | NO | M | 11 |

| 12. If no, was the market value agreed with HMRC? (yes/no) | CHAR3 | YES/NO | NO | CM | 12 |

| 13. If yes, enter the HMRC valuation reference given | CHAR 10 | 12345678 or qq123456 | CM | 13 | |

| 14. Total amount paid for shares £ e.g. 10.1234 | NUM13V4 | 4 decimal places | 5.1234 | O | 14 |

| 15. Were all shares resulting from the exercise sold? (yes/no). Answer yes if they were either sold on the same day as the exercise in connection with the exercise or sale instructions were given for all shares to be sold on exercise | CHAR3 | YES/NO | YES | M | 15 |

3.9 EMI Taxable exercise of options formatting guide (EMI40_Taxable_V4)

This table details the information and the format in which it is required when creating your own ODS template. Although the questions in this table are shown vertically, when creating your ODS the questions should be entered horizontally with the relevant information entered under each question column and each row showing the data of each individual employee you are reporting on.

For example this sheet has 20 questions therefore the questions should be shown from cell A to T in row 9, and if you report changes to 3 employees this would require the information to be entered in 3 rows, from row 10 to row 13.

| Column Title | Data Type | Formatting | Example | Data Mandatory/ Conditional Mandatory or Optional | CSV Position |

|---|---|---|---|---|---|

| 1. Date option exercised (yyyy-mm-dd) | DATE | yyyy-mm-dd | 25/09/2014 | M | 1 |

| 2. Is this as a result of a disqualifying event? (yes/no) | CHAR3 | YES/NO | YES | M | 2 |

| 3. If yes, enter a number from 1 to 8 depending on the nature of the disqualifying event. Follow the link at cell A7 for a list of disqualifying events | NUMBER | See ‘Nature of disqualification event’ table | 2 | CM | 3 |

| 4. Employee first name | CHAR35 | John | M | 4 | |

| 5. Employee second name (if applicable) | CHAR35 | S | O | 5 | |

| 6. Employee last name | CHAR35 | Smith | M | 6 | |

| 7. National Insurance number | CHAR9 | The NINO should be in the format AANNNNNNA, the last character should be alpha | QQ123456B | M | 7 |

| 8. PAYE reference | CHAR14 | 123/XZ55555555 | M | 8 | |

| 9. Total number of shares employee entitled to on exercise of the option before any cashless exercise or other adjustment e.g. 100.00 | NUM11V2 | 2 decimal places | 2500.12 | O | 9 |

| 10. Actual market value (AMV) of a share at date of grant £ e.g. 10.1234 | NUM13V4 | 4 decimal places | 72.2589 | O | 10 |

| 11. Exercise price per share £ e.g. 10.1234 | NUM13V4 | 4 decimal places | 15.1234 | O | 11 |

| 12. AMV of a share at date of exercise £ e.g. 10.1234 | NUM13V4 | 4 decimal places | 25.4321 | O | 12 |

| 13. Unrestricted market value of a share at date of exercise £ e.g. 10.1234 | NUM13V4 | 4 decimal places | 22.3456 | O | 13 |

| 14. Total amount paid for the shares £ e.g. 10.1234 | NUM13V4 | 4 decimal places | 5.8965 | O | 14 |

| 15. Is the company listed on a recognised stock exchange? (yes/no) If no go to question 16 If yes go to question 18 | CHAR3 | YES/NO | YES | M | 15 |

| 16. Has the market value been agreed with HMRC? (yes/no) | CHAR3 | YES/NO | YES | CM | 16 |

| 17. If yes, enter the HMRC valuation reference given | CHAR 10 | 12345678 or qq123456 | — | CM | 17 |

| 18. Has an election under Section 431(1) been made to disregard restrictions? (yes/ no) | CHAR3 | YES/NO | YES | M | 18 |

| 19. Has a National Insurance Contribution election or agreement been operated (yes/no) | CHAR3 | YES/NO | NO | M | 19 |

| 20. Amount subjected to PAYE £ e.g. 10.1234 | NUM13V4 | 4 decimal places | 12.5365 | O | 20 |

4. Creating CSV files

If you have a large amount of data or are a MAC user and you decide to create a CSV file, the following sections cover how to do this. Note if you are a MAC user you may find the ODS template is not compatible and therefore will have to create a CSV. You can read more about creating your own CSV in section 4.4.

If you are able to download the HMRC ODS template you can use this as the basis for your CSV. The advantages of producing your CSV from the HMRC ODS Downloaded template means all the formatting will be applied to the sheet.

Once you have created the CSV if you save and reopen it, the formatting may be lost.

4.1 Creating CSV files for your annual return from the HMRC ODS Template

When creating CSV files from the HMRC ODS Template, you first must download the relevant HMRC ODS template.

When you create a CSV you’ll need to produce one CSV file per ‘sheet’ that you’ll be using in a return. When starting with the downloaded ODS template only complete one sheet at a time, before saving as a CSV and moving on to complete a different sheet (if applicable).

For example, the ODS template for scheme type ‘ SIP’ contains 2 separate sheets, if you need to complete more than one of these sheets, you must complete one sheet at a time and save it before re-opening the ODS template to populate the subsequent sheets.

Each sheet you make entries within and save must be saved using the relevant file and sheet name. The system will ask you to upload all the CSV files for each registered scheme at the same time.

4.2 CSV sheet and File names

CSV file names must consist of the name of the sheet being submitted, followed by ‘.csv’. For example EMI40_Adjustments_V4.

You can read about all relevant file names in section 3.2. The sheet name will be displayed when you open the HMRC ODS Template, this is case sensitive and must be used on your CSV sheet name as well as the CSV file name. This will be a different sheet and file name for each sheet you submit.

4.3 Saving as a CSV file

Save each CSV file that you create within a local drive or on your desktop. As you will need to upload this file as part of your annual return.

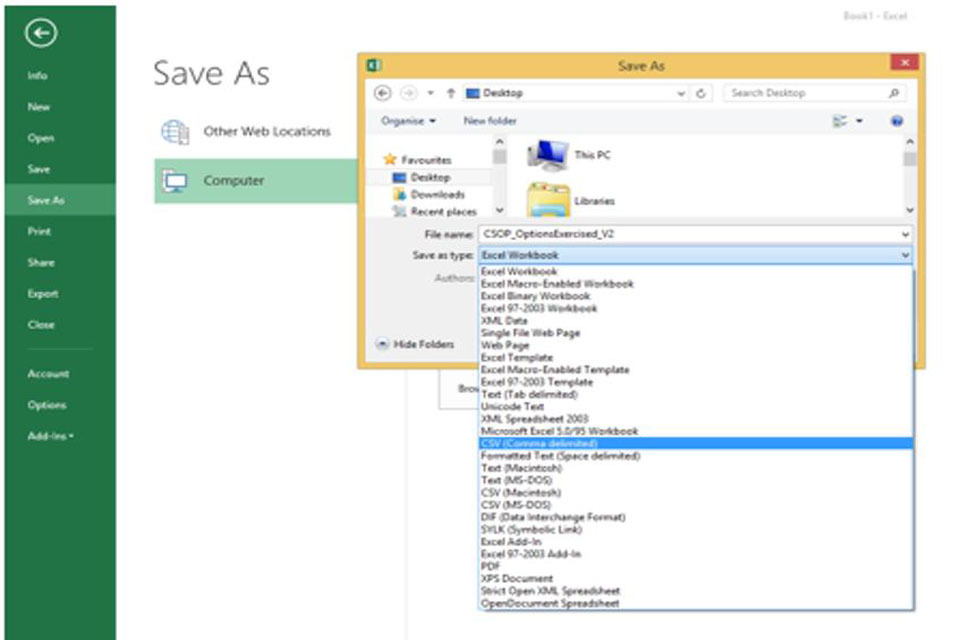

To change your ODS template into a CSV, this is done at the point of saving the document. To save the file as a .csv file:

- select ‘file’ and ‘saved as’

- input the file name as described in the above links, ensuring you put .csv at the end of the file name example ‘EMI40_Adjustments_V4’.

Select ‘CSV (Comma delimited)’from the ‘Save as type’ dropdown menu as shown in the below screen shot, then click ‘Save’.

Image showing how to save a CSV file

4.4 Creating your own CSV from scratch

If you are unable to download or open the ODS you will need to create your own CSV. When creating CSV files to use in your upload, you’ll need to produce one CSV file per ‘sheet’ that you’ll be using. The system will allow you to upload all the CSVs for each registered scheme at the same time. For example, an EMI scheme could include up to 5 separate CSV files. When using the system you’ll be prompted to upload all the files that you’ve completed.

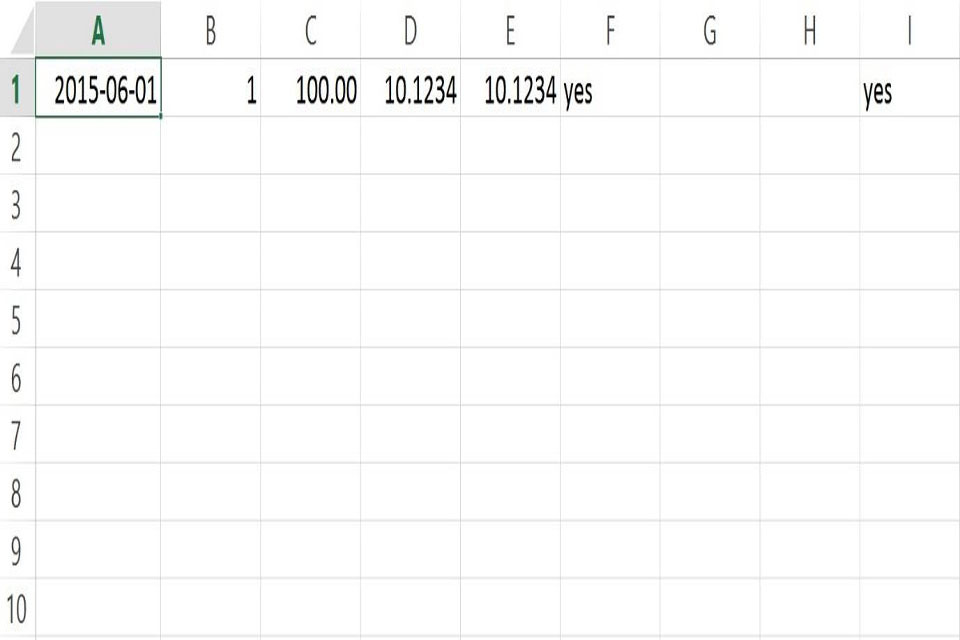

When creating a CSV file from the ODS template, you need to delete all the prefilled information from the first 9 rows (the guidance and headers). If you’re using excel to create your CSV, your data must start from cell A1 and must follow the expected sequence and formatting relative to the type of return you’re making. The remainder of data required in the CSV must follow the expected sequence and formatting depending on the type of return you are making.

This screenshot gives an example of what a CSV document will look like when created in excel (you can also create this in Libre office). Once you have populated all relevant cells you need to save this as a CSV file.

CSV filenames must consist of the name of the sheet being submitted, followed by ‘.csv’. For example, ‘EMI40_Adjustments_V4.csv’, note this is case sensitive.

This image shows an example CSV document created in Excel.

Tables describing the format of each column (by scheme type and by sheet name) can be found in the tables from section 3.4. The last column in each table shows the position where each specific column must appear in each specified CSV file.

4.5 Formatting the files

As commas are being used to separate the data, you must not include extra commas within a cell, for example an address that contained a comma would be rejected would denote an extra field of data when saved as a CSV, this would result in a error message being generated and you being unable to successfully upload your ERS submission. If you need to include data that contains extra commas in it (for example, in the name of a company) then you must enclose that piece of data within double quotes.

4.6 Group schemes

Your return may include other companies who share in the benefits of that scheme. The way that we refer to these will depend on the type of security that you’re using.

For EMI, they’re referred to as ‘qualifying subsidiaries’.

The ERS returns service gives you 2 methods for providing this information. You can upload it in a CSV file or enter it manually. You have a maximum limit of 150 rows of data you can include for group schemes.

You’ll need to read section 4.7 if you’re using a CSV file to provide the information.

4.7 Submitting group company information as a CSV

The following table shows the information that a CSV upload of group company information can contain.

| Position | Name | Format |

|---|---|---|

| 1 | Company Name | Text (120) |

| 2 | Address Line 1 | Text (27) |

| 3 | Address Line 2 | Text (27) |

| 4 | Address Line 3 | Text (27) |

| 5 | Address Line 4 | Text (18) |

| 6 | Zip/Postcode | Text (8) |

| 7 | Country | Text (18) |

| 8 | Company Reference Number | Text (10) |

| 9 | Company Tax Reference | Text (10) |