NCA evidence to the NCA Remuneration Review Body, 2019 to 2020 (accessible version)

Published 2 May 2019

February 2019

Executive Summary

1. The National Crime Agency[footnote 1] (NCA) is a law enforcement agency with global reach, tackling some of the most complex and high risk serious and organised crime (SOC) threats. Our mission is ‘Leading the UK’s fight to cut serious and organised crime’. As at end December 2018, we have 4,113 officers with an additional 210 secondees, agency staff and contractors. 1,844 (44%) officers (FTE)[footnote 2] hold powers. The agency budget for 2019/20 is £520m RDEL[footnote 3] of which c. £247m is used for pay.

2. The SOC threat is continually changing as criminals exploit developing technologies and vulnerabilities. We protect the public by developing intelligence; deploying against the highest threats and harm and developing specialist capabilities, both for the NCA and wider law enforcement system.

3. Responding to this level of complexity requires increasing pace and agility. The agency is driving a significant programme of change. We are adopting a capability led intelligence enabled approach to respond to the dynamic nature of SOC. The agency is transforming its investigative and intelligence processes and working with external partners to deliver a multi-agency approach to SOC threats.

4. In last year’s submission, we provided a detailed examination of the agency’s challenges as a result of uncompetitive pay and reward. Since then, we have made significant progress, but we are aware we still have a long way to go. Our existing pay scales remain too long, impeding the rate that officers progress through the ranges, and we remain behind our core competitor markets for investigations and intelligence officers. We also need to do more to become a more attractive employer for niche and specialist capabilities (Digital, Data, Technology and Cyber). This is impacting attractiveness as an employer and, more broadly, our culture. Attitudes towards building new skills and taking on new roles are constraining, rather than encouraging, operational flexibility.

5. The NCA is in the third year of its pay reform programme and has invested significantly in pay and reward. This was achieved through the delivery of c£89m of efficiencies over 2015-19 Spending Review period (which represents a 23% saving of core-funded baseline). This allowed us to invest an additional £6.9m to introduce a differentiated pay strategy aimed at roles where it would have maximum impact, shorten pay ranges, improve the position on equal pay and revise our recruitment and retention allowances.

6. The agency invested 3% in the pay bill in 2017/18 and is projecting to have invested a further 3% increase in 2018/19. Since our last submission:

- Over 800 officers have moved onto the new ‘Spot Rate’ pay framework out of c. 1,600[footnote 4];

- New Recruitment and Retention Allowances have benefitted over 350 officers;

- Our median gender pay gap has reduced by c. 40%; and

- A Remuneration Committee chaired by a Director and local pay reform engagement groups have been established

7. These reforms have allowed us to narrow gaps significantly however, the agency remains behind key comparators.[footnote 5] The effects are exacerbated by our commitment to partnership working, as NCA officers work side by side with colleagues from across policing and the intelligence communities for significantly less remuneration. Our unique role in the law enforcement environment, working in close partnership with policing and UK delivery of niche capabilities means that we continue to struggle to recruit and retain to the right levels.

8. This submission provides the pay review body with the following:

- Section 1: An overview of the agency’s strategic context: In this section, we set out the UK’s SOC strategy, how the NCA is ensuring it meets the expectations placed upon it, and explain how pay and reward is a vital part of the agency’s approach to building capabilities. We also provide details of our investment in our recommended pay proposals.

- Section 2: The agency’s organisational context: This section a) addresses how the agency is supporting and developing workforce capability by building workforce engagement, strengthening leadership capability and development of a comprehensive people offer; and b) provides an analysis on agency workforce trends specifically around recruitment & retention and diversity & inclusion.

- Section 3: Our workforce: In this section, we provide information about the workforce composition. We explain our workforce planning process, describe the recruitment and retention challenge and our talent pipelines. We demonstrate how our approach to pay and reward is enabling our ambition to be a more diverse, skilled and engaged workforce.

- Section 4: Our Core Comparators: In this section we provide evidence to a) demonstrate our position in relation to comparator markets; b) support our continued differentiated pay strategy; and c) illustrate the importance of maintaining the momentum behind our pay reform plans.

- Section 5: Progress on pay reform to date and proposals for the 2019/20 pay award: The section details the proposals for the 2019/20 award. We are seeking to incorporate reforms to include a new approach to flexibility, (including a formal shift review), and proposals to respond to increasing recruitment and retention challenges in our highly prized niche capabilities. We demonstrate the impact on both individuals and our pay policy position resulting from the recommendations with a focus on the spread of awards across the workforce and the equality impact.

- Section 6: Looking ahead: The agency recognises that it remains behind its comparator market. In this section, we outline our three year reward strategy. We plan to bring the next stage of our pay reform journey to the pay review body in our 2020/21 submission.

9. Our 2019/20 pay proposals are:

- Increase spot rates by 2% for Grade 4 and Grade 5 Investigations and Intelligence Officers.

- Increase the grade minima of Grades 1 to Grade 4 by 2% with no changes to the maxima across all officers (i.e. powers and not);

- Increase the grade minima of Grade 5 and Grade 6 by 4.25% and 4.50% respectively, with no changes to the grade maxima – to further compress the pay range lengths across all officers;

- Increase London Weighting Allowance by 1%, taking it from £3,258 to £3,291 per annum across all officers; and

- Increase the pensionable shift allowance of 12.5% paid to officers working in our Control Centre to 15%

10. In proposing these recommendations, we have carefully considered affordability and ensured that they are in line with guidance and approvals issued by HM Treasury. These recommendations have Home Office sponsorship, and have been subject to appropriate internal governance overseen by the NCA Remuneration Committee and NCA Board.

11. The proposals are fully costed within the 1.7% Increase in Remuneration Cost (IRC) agreed with HM Treasury, and will be funded through the agency’s existing budgets.

12. By endorsing these recommendations, the pay review body will support the NCA in:

- Increasing our ability to recruit, retain and develop the capabilities we need to lead the UK’s fight against SOC, and making a difference to the thousands of lives blighted by the effects of SOC every day.

- Further reducing the gender pay gap and increasing the morale of our officers by further compressing the pay ranges, in order to reduce the variance between the highest and lowest paid in the organisation.

- Ensuring that the agency is able to deliver best value for money in return for the investment it places into developing capabilities, by increasing rates of retention. This is particularly in areas of niche capability and a reduced reliance on alternative capability resources (i.e. contingent labour).

- Delivering the UK Government’s increasing investment in tackling SOC nationally and internationally, by allowing the agency to maintain its ambitious agenda on pay reform.

13. SOC is one of the gravest threats to the UK’s national security. It takes more lives than terrorism and road deaths combined, and costs the UK at least £37bn every year. It is important that the NCA is able to attract and retain the right calibre of workforce to combat it.

Section One Strategic Context

In this section, we set out the UK’s SOC strategy, how the NCA is ensuring it meets the expectations placed upon it, and explain how pay and reward is a vital part of the agency’s approach to building capabilities. We also provide details of our investment in our recommended pay proposals.

14. In November 2018, the Government launched a revised SOC strategy. This aims to protect UK citizens and UK prosperity by tackling SOC as a national security threat, leaving no safe space for serious and organised criminals to operate within the UK and overseas, online and offline.

15. The SOC strategy sets out four objectives to drive forward the system wide changes needed:

- Relentless disruption and targeted action against the highest harm serious and organised criminals and networks, using all available powers and levers;

- Building the highest levels of defence and resilience in vulnerable people, communities, business and systems;

- Stopping the problem at source, developing and using preventative methods and education to divert more young people from engaging in criminality and reduce reoffending; and

- Establishing a single, whole-system approach, aligning collective efforts to respond at local, regional, national and international levels; expanding global reach and influence; and pooling skills, expertise and resource with the private sector.

16. The ability of the NCA to successfully tackle this breadth of SOC relies on two key factors: (a) Leading effective partnership working across the SOC landscape (policing, third sector, private sector, wider intelligence community, other government departments, and increasingly on a global scale) and (b) Transforming its investigative and intelligence processes at pace; to keep up with the changing threat, and leading the development of new capabilities across SOC and to address the gaps and duplication in capability across policing.

17. The NCA’s Five-Year Strategy supports the delivery of the SOC strategy through its key priorities. The graphic at Figure 1 summarises the NCA strategy under 4 headings: intelligence, response, capabilities and enablers. It illustrates how we focus effort on the most serious criminals and the greatest risks, whilst at the same time being alert to changing priorities.

18. In 2017-18 alone the NCA:

- Safeguarded more than 2,000 children, many of whom were victims of the most despicable sexual abuse;

- Took away what matters most to the criminals – their money. £302 million in criminal assets were restrained last year;

- Seized 123 tonnes of cocaine, 5.1 tonnes of heroin and 793 firearms;

- Achieved 1,880 disruptions (100 major, 413 moderate, & 1,367 minor); and;

- Made over 1,000 arrests in the UK, achieving a 94% conviction rate. In addition, NCA activity led to a further 975 arrests overseas.

19. Going forward, the NCA Change Portfolio has been constructed to enable the agency to continue to support the SOC strategy by:

- Delivering a new operating model that ensures the right capabilities are built to deliver the agency’s mission, and which can adapt and flex as threats and demand change;

- Significantly boosting the agency’s ability to fight crime in the digital age, enhancing intelligence and investigative capabilities;

- Establishing the NCA as the pinnacle of law enforcement in order to attract and retain the best talent;

- Equipping officers with the right skills, workplaces and technology to lead the UK’s response to SOC;

-

Ensuring sophisticated and specialist capabilities are built or enhanced which are capable of being deployed nationally and across the law enforcement community; and

- Driving down cost base to build a sustainable and affordable agency for the future.

20. The initiatives listed above have resulted in the agency being on course to deliver c. £89m of efficiencies over the 2015-19 Spending Review period. And this, in turn, has allowed us to invest in a wide ranging transformation portfolio which includes funding pay reforms and structural changes (such as spot rates) from the cashable savings achieved.

Costs & Affordability

21. The agency budget for 2019/20 is £520m RDEL. This comprises £440m of core budget and an additional c. £80m of external funding.[footnote 6] As at end December 2018, we have 4,113 officers with an additional 210 secondees, agency staff and contractors. 672 officers are paid for through external funding sources (see section three for more detail about the agency workforce).

22. The 2017/18 and 2018/19 pay awards cost £4.95m and £4.58m[footnote 7] respectively, which came from within existing agency budgets. To make the previous pay awards over and above 1%, the agency used funds realised through c. £40m of wider savings achieved in the 2017/18 and 2018/19 financial years. These savings came from the agency’s transformation programme which includes the estates rationalisation, IT cost reduction and workforce efficiencies.

23. Our current cash position and agreed pay flexibility envelope agreed with HM Treasury, means that we can propose a pay award of 1.7% for the 2019/20 pay year at a cost of £3.18m. In addition, we have allocated £0.08m from the non- consolidated pot for one-off payments made to underpin 1% pay awards paid to officers who are close to, or at the top of the pay range. As in previous years, this pay award comes from within existing agency budgets.

24. The agency recognises that it remains behind its comparator market. In section six, we outline our three year reward strategy. We plan to bring the next stage of our pay reform journey to the pay review body in our next submission.

25. The forecast baseline pay bill for 2019/20 is £186.58m. This is higher than in previous years due to the inclusion of overtime, on-call and additional hours for the first time.

Table 1: Composition of the 2019/20 paybill

| 2019/20 £m | |

|---|---|

| August 2019 Baseline Pay Bill (forecast) | 154.80 |

| FTE including net of churn (MTFP alignment)[footnote 8] | 12.27 |

| London Weighting Allowance | 5.72 |

| Shift Allowance (Pensionable) | 0.13 |

| Overtime / On-Call / Additional Hour | 13.65 |

| Baseline Remuneration Cost | 186.58 |

26. The table below sets out the forecast costs for the 2019/20 pay award

Table 2: Summary of costs / Cost profile

| 2019/20 | Costs (£m) |

|---|---|

| Baseline pay bill (including overtime) | 186.58 |

| IRC of 1.7% | 3.18 |

| Comprising: | |

| Spot Rate increase | 0.96 |

| Pay Range compression | 2.13 |

| London Weighting increase | 0.06 |

| Shift Allowance increase | 0.03 |

| Total cost of pay award | 3.18 |

*These costs are net and exclude pension and Employer National Insurance costs.

27. Overtime and On-call payments are made at an hourly rate. Following the pay award, the hourly cost of the same amount of overtime/on-call is expected to increase by an estimated cost of £220k.

28. The agency manages predominantly proactive work, and is able to tightly control the overtime/on-call budgets which it does through:

- The re-prioritisation of tasking;

- The move to the Spot Rate structure which has moved officers to a 40 hour week and reduced reliance on discretionary overtime; and

- Increased recruitment to reduce reliance on overtime to cover vacant posts.

29. There is also an on-going programme of work to reduce spend in this area and regularise further our use of overtime through our Spring review of agency flexibility requirements (shift review) due to conclude in 2019.

30. In the 2019/20 pay year, the overtime budget will remain static and absorb the hourly rate increase. The net financial impact will be a nil increase to the IRC. For officers, this means that fewer hours of overtime will be available. We have therefore excluded this impact from the IRC calculation.

Table 3: Composition of overtime, additional hours and on-call including 2018/19 uplift

| 2019/20 £m | |

|---|---|

| Additional Hours | 0.10 |

| On-Call Allowance | 2.09 |

| Overtime | 11.46 |

| Total | 13.65 |

| Impact of hourly rate increase in 19/20 | 0.22 |

| Overtime/On-call budget reconciliation | -0.22 |

| Total | 13.65 Nil impact to IRC |

31. The NCA also has a role in developing capabilities across the law enforcement/security system. This requires multi agency teams to regularly work alongside one another. Without a competitive and modern pay offer, our ability to achieve this element of the strategy will be severely impacted. Since its establishment in 2013, the NCA has fallen behind its key competitors in terms of pay, particularly at operational Grade 4 and 5 roles and certain specialist areas (such as Digital, Data, Cyber and Technology). This means we are continually struggling to recruit and retain at the levels required to ensure operational effectiveness and build sustainable capabilities (see section four for further detail on our pay comparators, and section three, from paragraph 95 for further detail on recruitment and retention issues).

32. The pay reforms made over the past two years have started to narrow disparities and encourage the flexibility the SOC strategy requires (see section four). As the agency continues to change, it is important that we continue with our pay reform journey so gaps close further rather than start to re-open. We say more about future plans in section six.

Section Two Organisational Context

This section a) addresses how the agency is supporting and developing workforce capability by building workforce engagement, strengthening leadership capability and development of a comprehensive people offer; and b) provides an analysis on agency workforce trends specifically around recruitment and retention, and diversity and inclusion.

33. The agency is very aware that it needs to invest in a comprehensive employee offer as well as continue with pay reforms. As part of a ‘Brilliant Civil Service’, the NCA Board is committed to making the agency a great place to work, attracting the brightest and best talent. This section provides analysis on our workforce trends, specifically around recruitment and retention, and also, equally important, diversity and wellbeing.

34. The agency is undertaking a programme of work to strengthen leadership capability and develop a compelling people offer.

35. Our People Strategy is changing the way we recruit, develop and retain the best talent. The purpose of this section is to demonstrate how our approach to pay and reward underpins the People Strategy and how these measures will:

- Develop a people offer that supports, motivates and engages the workforce;

- Build a talent pipeline to ensure the agency can operate effectively;

- Build the capability of its existing and recently recruited workforce; and

- Sponsor flexibility and agility so the agency can respond to the changing SOC threat.

People Engagement

36. The spot rate element of our reforms have resulted in targeted investment for key operational roles, compressing the non-spot rate structures, and new recruitment and retention allowances. The Spot Rate structure received the largest investment, targeted in this way, in part, to respond to very low engagement scores within intelligence and investigations roles across the agency and higher differentiation with our competitor markets. In the 2016 People Survey,[footnote 9] some intelligence and investigations teams scored as low as 11% satisfaction with pay and benefits.

37. In the previous report, the pay review body raised concerns about the impact on morale of applying a differentiated pay strategy, particularly for officers who were at the top of the pay ranges and those not benefitting from the new Spot Rate pay structure. We continue to work hard on how we manage both the communication and the impact of the reward strategy with our workforce.

38. The 2018 People Survey results demonstrated a significant increase in satisfaction with pay and benefits across the whole workforce – 9 points up to 23%. However, pay and reward continues to be one of the lowest scoring areas across the People Survey, and further improvements are required. We recognise, based on feedback from our officers both through the staff survey and wider engagement, that the differentiated approach to pay is not supported by all our officers.

39. We are working with our staff groups to better understand the their views. The feedback to the pay strategy generally focusses on a desire to have a more generous pay award evenly spread across the workforce and a return to public sector pay progression which was experienced by some of our officers at different stages of their careers.

40. However, we are also assessing indicators that the impact of the compression for non-spot rated roles had a positive impact in terms of morale for those at the bottom of the pay ranges. For example, a G5 officer on the pay range minimum received over 6% pay award in 2017/18 and 2018/19. It has also had a demonstrably positive impact on gender pay (section two, paragraph 58).

Table 4: Demonstration of People Survey scores in 2018

| Command | Pay & Benefits 2018 | Shift from 2017 |

|---|---|---|

| CEOP | 24% | +10% (14%) |

| Intelligence | 20% | +10% (10%) |

| Investigations | 20% | +8% (12%) |

| Safety & Security | 21% | +1% (20%) |

| Vulnerabilities | 22% | +10% (12%) |

| Commodities | 17% | +12 (5%) |

| Strategy | 40% | +14% (26%) |

| Capabilities | 32% | +7% (25%) |

| Human Resources | 32% | + 5% (26%) |

41. The table above evidences the increase in satisfaction scores across the Commands in response to pay and benefits. Improved scores have not been limited to the areas of the agency where spot rates have been implemented and supports our contention that a targeted approach has positively impacted a significant proportion officers across the whole organisation, albeit in different ways.

42. The agency’s overall engagement score[footnote 10] decreased by 3%. Questions which generated a high percentage of negative responses included:

Table 5: Negative scoring responses from 2018 and 2017 People Survey

| Questions | 2018 | 2017 | Change |

|---|---|---|---|

| I feel that change is managed well within the NCA | 10% | 12% | -2% |

| Compared to people doing a similar job in other organisations I feel my pay is reasonable | 21% | 13% | +8% |

| I feel that my pay adequately reflects my performance | 25% | 15% | +10% |

| I am satisfied with the total benefits package | 21% | 13% | +8 |

| I have the opportunity to contribute my views before decisions are made that affect me | 20% | 21% | -1% |

43. It was encouraging to see that the survey responses demonstrated strong positive indicators. The most consistent and highest rating theme related to questions involving team working, i.e. reliance, collaboration and improving, with a positive score of 75%.

Table 6: High scoring responses from the 2018 and 2017 People Survey

| Questions | 2018 | 2017 | Change |

|---|---|---|---|

| I understand the values of the NCA and the behaviours expected of me | 89% | 91% | -2% |

| I am interested in my work | 85% | 87% | -2% |

| I am trusted to carry out my job effectively | 83% | 85% | -2% |

| My team have regular meetings (at least once a quarter) | 83% | 85% | -2% |

| The people in my team can be relied upon to help when things get difficult in my job | 82% | 81% | +1% |

44. The table above demonstrates that, despite some small reductions in engagement, the same themes continue to score highly.

45. The first phase of pay reform constituted a significant change to the agency’s pay strategy. It was a complex pay deal to explain to officers and required rigour and process to ensure implementation was fair and defendable. We implemented the new pay frameworks at pace to ensure we could provision the pay award before year end. We recognise we had a number of lessons to learn, particular on how we communicated to officers throughout the process. We have conducted a review of the process and our implementation which highlighted that we needed to improve the consistency and quality of our communications and the resources we had available to support the process.

46. As a response to the lessons learned, we set up a Pay Reform Engagement Group (PREG), which continues to take place. The group is chaired by a Deputy Director. The purpose of the PREG is to share communications and gather insight from the workforce to enable the agency to better shape its responses on pay issues.

47. The PREG is one part of a comprehensive engagement strategy that included blogs from senior leaders, the creation of pay calculators and pay reform engagement sub-groups in each business area.

48. To oversee the agency’s strategic approach to pay, and the implementation of the new structures, we also created a Remuneration Committee (RC). The RC is chaired by a Director and has senior representatives from all Commands, our Trade Unions, and one of the Non-Executive Directors. Whilst it provides a governance function primarily, it provides reassurance to officers that decisions on pay are transparent and accountable through a formal structure. The PREG is also represented at the RC. The RC reports to our Investment Committee, with the Pay Strategy continuing to be set by the NCA Board.

NCA People Strategy, Wellbeing and Diversity

49. In previous submissions, we have discussed NCA transformation and the need to enhance our human capabilities in order to deal with SOC more effectively. As part of this programme, we introduced the People Strategy in 2018 which will underpin a five year transformation for the agency. The programme has four pillars: Engage, Employ, Enable and Empower. These pillars represent the areas the NCA will focus on to recruit talent and build the required flexibility to meet the changing threat from Serious and Organised Crime.

50. In the last 12 months the People Strategy has introduced:

- Key changes to help officers take control of their own career through the lateral moves process. The agency successfully rotated 160 (FTE) officers on a skills based and anonymous posting process which will be repeated on a periodic basis;

- The NCA is changing the recruitment process to a pipeline model[footnote 11] that will make it much quicker to fill vacancies in the future as well as introducing a new on-boarding process that seeks to create a sense of one NCA;

- We have re-set leadership expectations at G1 and conducted a comprehensive assessment exercise. All G1 leaders now have personal development plans. We are recruiting for 29 new G1 leaders (both through internal promotion and external recruitment). It is anticipated that the new recruits will commence on-boarding from June 2019. As part of this exercise, we will be monitoring the competitiveness of our pay offer at our most senior grades. The agency is designing a review of Grade 2 leaders in 2019/20;

- The agency has refreshed and re-launched strategies for Diversity & Inclusion and Health & Wellbeing. We have launched a Workplace Support Officer network ensuring officers are supported when they need it most;

- The NCA has also responded to increasing demand for learning and development, investing a further £1.1m in the budget to address the gap for this year, and also developing a new model of learning to take the agency forward for the future. More detail on training is at section two, from paragraph 59.

51. The People Programme has engaged diversity groups, trade unions and other officer networks, and a large number of officers. Officer wellbeing has been identified as an important area through this engagement.

52. Protecting the public drives every decision made by NCA officers. To ensure that this duty is being met, officers must have the strength, support and resilience to make those decisions effectively. Supporting NCA officers with an integrated and effective wellbeing offer is critical to delivering the NCA mission.

53. Our Wellbeing Strategy involves:

- Appointing Senior NCA Health & Wellbeing Champions to promote the health and wellbeing agenda;

- Supporting officers by promoting health and wellbeing in the workplace and providing guidance to all the services we provide.

- Equipping managers to recognise and address stress in the workplace, and encouraging them to talk to officers about mental health issues and access help and support at the earliest stage.

- Promoting a work environment that encourages physical activity, healthy lifestyles and develops tailored interventions.

54. The NCA wellbeing strategy is based on a number of design principles used in the Blue Light “Oscar Kilo” Wellbeing Framework from the police. This framework is being used to self-assess and ensure Wellbeing interventions are based on evidence, both of need and outcome. The framework is intended to facilitate a change in behaviours and attitudes towards wellbeing, and support the NCA to improve wellbeing provision.

55. The agency’s Diversity & Inclusion strategy is another important element in enabling the NCA to attract and retain a workforce that reflects the community in which it operates, in addition to addressing the gender pay gap and meeting its obligations under the Public Sector Equality Duty (PSED).[footnote 12] The NCA operates in Northern Ireland (NI) which places additional obligations under Section 75 of the NI act 1998 (Equality Scheme) and Section 49 A & B of the Disability Discrimination Act (as amended).

56. The NCA workforce is 38% female and 62% male; only at the lowest grade (Grade 6) is the proportion of female officers higher at 65%. At the core operational grade (grade 5), the representation of male officers is 15% higher than female. This increases to 25% at first line manager grade 4. These figures have improved slightly in the past 12 months. The early evidence is suggesting that our new Spot Rate structure is not only attracting mores candidates, but candidates from a more a diverse background, and as such, we may start to see increased numbers of female officers at Grades 4 and 5.[footnote 13]

57. We are particularly keen to increase the proportion of officers that identify themselves from an ethnic background other than white. The number of NCA officers declaring their ethnicity as BAME (Black, Asian and Minority Ethnic) currently stands at 7.3%, but this is below the Civil Service average of 12%. The NCA figure has improved by 0.4% in the past 12 months. The highest BAME representation within the NCA continues to be at Grade 6 (15.1%) which is predominately an administrative grade, with the lowest being 3.9% at Grade 3. The Grade 6 rate also compares favourably with the Civil Service grade AA/AO which is 12.1%. Out of the 111 successful external candidates for the recent IOTP campaign, 20 or 18% identified as BAME. These officers will be appointed to Grade 5 investigations roles, and onto the Spot Rate pay structure.

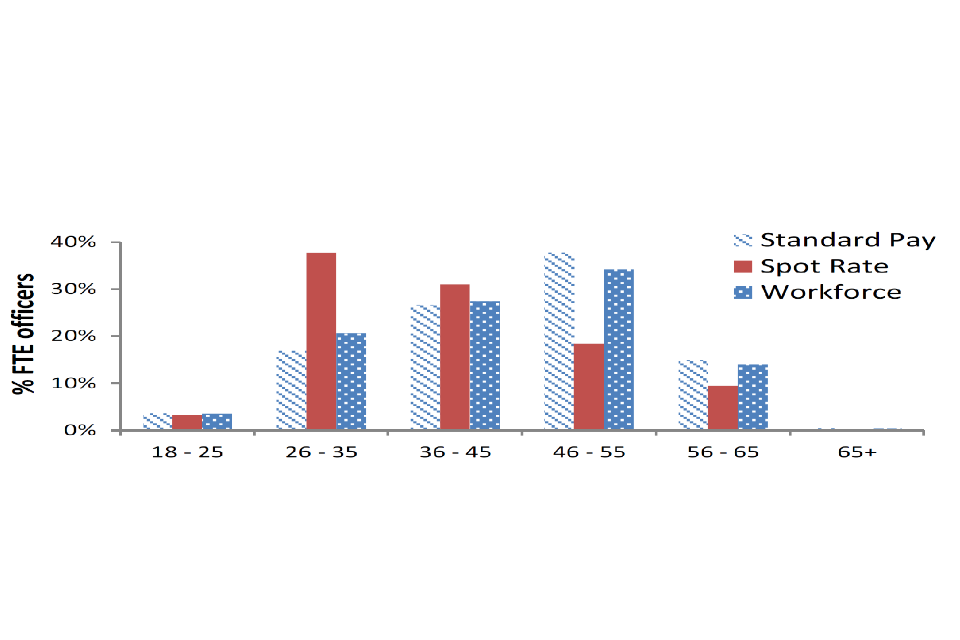

58. Our diversity profile reflects the legacy of uncompetitive pay, and as a result, an over reliance on recruiting experienced investigations and intelligence officers from the police, who are often embarking on second careers being in receipt of a first pension. The agency’s reliance on retaining existing officers post pensionable age has also contributed significantly to the aging workforce profile. Currently 17.5% of the workforce could reasonably be considering retirement (over 55), and of those, 67% are in investigations and intelligence roles. The agency still seeks to recruit officers with experience, however, with the introduction of spot rate pay it is now in a more competitive position to attract new entrants, and those at mid-career. Whilst the majority of the workforce (64%) is aged under 50, just over a third of officers are aged 50+ (36%). Currently, 43.1% of investigations officers are aged 50 or over and in the last recruitment campaign for experienced Grade 5 investigation officers, 42.3% of applicants that were shortlisted were aged 50 or over.

59. Declaration rates of LGBT+ officers and officers with a disability are very low, which makes it difficult to provide detailed analysis of the workforce makeup. Current evidence demonstrates that:

- 2.32% of the workforce declares as LGBT+. In the Civil Service 3.1% identify as gay/lesbian, 1% as bisexual and 0.5% as other. The Civil Service also have low recording rates for sexual orientation; and

- 4.23% of the workforce declares as having a disability, compared to 10% of Civil Service.

60. The reliability of our data is hampered by low declaration rates and therefore impacts on the statistical significance of any conclusions the agency can draw from existing data. To address this, we have run awareness campaigns to encourage officers to declare, and in doing so, challenge established misconceptions. We are also making changes to the declaration platform to improve the usability, with implementation scheduled in the spring. This will help us to continue to test how to shape our people and pay strategy to support inclusion.

61. One of the fundamental principles of our pay strategy is to attract a more diverse workforce and continue to reduce the gaps between the lowest and highest paid. The recently published gender pay gap report demonstrates that our pay reforms have started to make a positive impact on younger and female officers. The median ordinary gender pay gap has reduced by 6.6 percentage points from 16.2% to 9.6% (see Annexe F for the 2018 Gender Pay Gap report).

62. More specifically, the introduction of spot rate pay has had a significant impact on gender pay within the eligible population (median pay gap 0.89%). The spread of female officers across the Spot Rates is consistent with the opt in rates, and the proportion of female officers in proficient roles (81%) is comparable to that of male officers (84%).

63. Nevertheless, challenges continue to exist. The mean gender pay gap for 2018 increased marginally by 0.08% to 11.66% from 11.58% in 2017. This is due to the number of highly paid male officers acting as outliers and the high numbers of male officers in spot rate roles, making it challenging for the agency to reduce this existing trajectory.

64. The agency is committed to tackling the gender pay gap and we will continue to keep equality at the heart of our pay strategy. Ensuring compliance with the PSED must be a common thread throughout everything the agency does, so that, in realising the benefits of diversity and inclusion, it will achieve its strategic ambition to cut and reduce the impact of SOC.

Learning & Development

65. In response to the staff survey scores relating to learning and development, and as part of the People Programme, we are investing in the development of a new model for learning. In 2017/18, over 15,300 learning opportunities were delivered to NCA officers, both internally and externally.

66. We know professional development is an important attraction tool. The agency currently offers two primary routes into achieving professional accreditation in investigations and intelligence: Initial Operating Training Programme (IOTP) and Apprenticeships.

67. The IOTP is an attractive proposition to new officers who wish to join the agency from a non-accredited law enforcement background, or for those officers from within who wish to develop as investigations or intelligence officers. Investigations officers will graduate from the programme with the PIP2[footnote 14] accreditation.[footnote 15]

68. To ensure the NCA can position itself as a strong competitor in the market, trainees recruited onto the IOTP programme are offered a starting salary of £22,407 (plus £3,226 London weighting). This compares favourably to the starting salary for a first entry police constable which is c. £20-23k.

69. If IOTPs successfully pass the National Investigators Exam (NIE) and NCA Specific Powers Exam (SPE) at the 6-9 month mark and are deemed to be operationally independent, they move to SR1 (Developing), currently £30,154. After successfully completing the 2 year programme and completing their PIP2 accreditation, they move to SR2 (accredited), currently £31,410.

70. Participants are appointed to an investigations post. The agency currently has 9 cohorts undertaking the IOTP, equating to 161 officers. 24% of the cohort intake is formed of new starters to the agency (38 trainee officers), with the remainder having been selected for training from within the agency.

71. The NCA cohorts perform highly in terms of pass rates for the NIE and SPE (See Annexe C). Anecdotal evidence suggests that limited salary progression on achieving occupational competence has contributed to post graduation attrition. One of the key drivers for implementing spot rate pay was to improve the rate of progression and close the pay gap between the highest and lowest paid in the core operational Grade 5 to provide a career path linked to skills based pay progression. We are monitoring the impact of spot rates on retention and officer engagement over time.

72. The NCA is currently designing and implementing a new model for learning that will support specific skills transfer and encourage a culture of development. The aim is to create a more agile approach to the agency’s key learning requirements, starting with leadership and then embracing systems training, cyber training and our IOTP. The NCA training programmes are well respected across policing but are very traditional in design. They rely on lengthy classroom courses. Our new model involves delivering training completely differently – smaller modules, closer to the workplace, closer to the time of need. It will then require a shift in the way we present materials to ensure that they reflect our approach to diversity, e.g. content contains gender neutral language and learning channels are accessible for people with disabilities or different learning requirements.

73. The agency is currently reviewing the IOTP programme as an early and important part of our new model for learning. The new pilot for the redesigned IOTP will commence in early 2019. We have also implemented a successful apprenticeship programme encompassing key operational areas, including intelligence analysis, criminal investigations and digital forensics.

74. Apprenticeships are open to existing officers who can complete these programmes whilst undertaking their current role. The NCA has been set an annual target of 92 new apprenticeship starts. Since 2016, 186 apprenticeships have commenced in:

- L4 Intelligence Analyst;

- L3 Electronic and Engineering;

- L5 Criminal Investigations;

- L4 Cyber Technologist; and

- L4 Digital Forensics.

75. It is anticipated the NCA will exceed the government target by at least 25%.

76. To support the agency’s apprenticeship ambitions and demonstrate support to embedding new career pathways through apprenticeships, we have developed two new operational apprenticeship standards and End Point Assessments: Serious and Complex Crime Investigator Apprenticeship[footnote 16] and an Intelligence Analyst Apprenticeship, both starting in 2019.

77. In designing a new NCA operational career pathway using apprenticeships, the agency is strengthening its plans to grow its own talent and increase social mobility, alongside professionalising and up skilling our existing workforce. The agency is aligning the Spot Rate structure to this programme in the same way that it currently does to the IOTP programme, ensuring that these schemes remain affordable and sustainable.

78. This also reflects a culture where officers have the opportunity to join the agency and develop a broad range of skills and pursue diverse career paths. For example, we have officers who have joined the agency in non-powered roles, and been recruited to the IOTP internally. Some of these officers are now grade 3 intelligence officers in areas such as Modern Slavery & Human Trafficking. In addition, we have recruited officers to the IOTP externally who have been successful in achieving promotion and are now in grade 4 investigator roles in, for example, the National Cyber Crime Unit. These examples reinforce our need for an integrated yet differentiated pay model.

79. The success of our IOTP and apprenticeships programmes show the agency is attractive to newcomers/direct entrants. Our challenge is to retain experienced officers and attract those in their mid-career from other law enforcement organisations. It is particularly important that our reward offer is competitive for these officers.

Section Three: Our Workforce

In this section, we will provide information about the workforce composition. We explain our workforce planning process, describe the recruitment and retention challenge and our talent pipelines. We will demonstrate how our approach to pay and reward is enabling our ambition to be a more diverse, skilled and engaged workforce.

Workforce Composition

80. The remit of the pay review body is to cover officers with powers, but this submission provides a broader view of our pay strategy and recommendations. We have developed a very integrated pay strategy. This is because officers who have powers have an opportunity to undertake a variety of roles in the organisation. It is a strength of the agency that we can offer this breadth and flexibility, while at the same time supporting the development of our officers and their teams. We also recognise that the delivery of an effective operational response relies on a range of skills and will involve officers who may not have powers. Nevertheless their contribution to our operational success is crucial and we must have a strategy to attract and retain these skills in what can also be a competitive market.

81. The NCA has a layered workforce, comprising directly employed officers, seconded officers, fixed term employees and contingent labour staff (paid at a daily rate).

82. As at end December 2018, we have 4,113 officers. The budgeted FTE by the end of this financial year is projected to be 4,465. This number increases to 4,752 if additional employment sources are factored in (secondments, contingent labour etc.).

83. The use of contingent labour is kept under constant review and is closely managed. As at end December 2018, the agency has c. 160 contingent labour hires, 90 of which are covering unfilled vacancies.[footnote 17]

84. Table 4 shows a summary of officers with powers by grade. 1,844 (44%) officers (FTE) have powers[footnote 18] and 2,348 (56%) do not (at December 2018). Figures 9 and 10 in Annexe A provide more detailed analysis by command, gender, grade and working pattern.

Table 7: Breakdown of the NCA showing officers with/without powers.[footnote 19]

| Grade | Powers (No.) | No Powers (No.) | Powers (%) | No Powers (%) |

|---|---|---|---|---|

| SCS | 7 | 18 | 0.4% | 0.8% |

| NCA Grade 1 | 28 | 52 | 1.5% | 2.2% |

| NCA Grade 2 | 85 | 124 | 4.6% | 5.3% |

| NCA Grade 3 | 306 | 269 | 16.6% | 11.4% |

| NCA Grade 4 | 565 | 555 | 30.7% | 23.6% |

| NCA Grade 5 | 850 | 1,047 | 46.1% | 44.6% |

| NCA Grade 6 | 3 | 283 | 0.1% | 12.1% |

| Total | 1,844 | 2,348 | 100.00% | 100.00% |

85. The agency also receives a number of additional funding streams, which affect the way that it manages its workforce planning. For the purposes of the pay award, we refer to the FTE on NCA payroll. However, we utilise a mixed workforce including secondments, contingent labour and contractors.

Turnover

86. Annualised turnover, i.e. officers leaving the agency for the 12 months to 31 August 2018, currently stands at 9.3%, an increase of just under 1% from last year’s submission (8.36%). Resignations account for 43% of leavers (largest reason), compared to 18% transferring to another Civil Service department, 16% retirements, and 23% planned (i.e. end of Fixed term contracts, attachment, etc.). Grades with higher turnover than the agency’s rate of 9.3% are Grade 2 (14.9%), followed by Grade 1 (14.6%) and then Grade 6 (13.4%).

87. Tables 1 and 2 in Annexe B provide information on leavers by grade, command and business area within the Intelligence and Investigations command and the reasons for leaving.

88. The majority of leavers in terms of headcount are from the core operational areas (Investigations and Intelligence), although proportionately the turnover rate of 7.8% is lower than the agency’s overall rate of 9.3%.

89. Exit survey responses are a snapshot of the leaver population. However, the data demonstrates that for those respondents leaving for job related reasons (i.e. excluding personal/retirement etc.), the most frequently cited reason is change of job/career (21%). Only 12% cited pay directly as a reason for leaving. Whilst the most common reasons cited are career based, the agency recognises they will most likely have pay drivers (i.e. promotion and progression). Anecdotally, managers are saying that officers are leaving for higher pay. We are currently in the process of making improvements to our exit data.

90. As part of the People Programme, the agency has longer term plans to create an alumni network to recognise that officers will want to develop their skills and careers in the wider Civil Service, law enforcement community or the private sector, and in the future may wish to return to the NCA.

Building a talent pipeline

91. The NCA has introduced a Workforce Planning Committee (WPC) and is adopting Government best practice processes to responsibly manage its workforce establishment. The WPC is chaired by a Director General and meets monthly to monitor joiners, leavers and movers. The WPC sets business priorities and oversees flows through the recruitment pipeline, to ensure we have the right resources in the right place at the right time. Now that the basic process is becoming embedded, we are planning to extend the process by incorporating future skills requirements.

92. As part of its people strategy, the agency is moving to a new model of recruitment. The ‘pipeline’ model is based on recruiting to a profession, or job, fairly, rather than to an individual role. This will allow us to recruit at scale, in anticipation of need, thereby reducing the number of individual campaigns being run at short notice. The agency has also introduced a new process for internal postings to streamline the way officers move around the agency. This encourages more flexibility, develops their skills and demonstrates potential for promotion. In 2018, 156 officers took up a post through this new process which also enables the agency to ensure priority roles are filled.

93. During the summer of 2018, the agency undertook its first large scale recruitment campaign using the new model of recruitment across Grades 2 - 6. At December 2018, 1,200 external candidates are at a pre-selection stage; and a further 600 external candidates, are undergoing final clearances, with 240 of the external candidates expected to be on-boarded by the end of the financial year. We continue to encounter challenges around the speed with which we can provide security clearance for successful candidates, and our pipeline approach will ease this pressure.

94. We are in the process of selecting a further 120 trainees to join our flagship Initial Operational Training Programme (IOTP). These officers are expected to be on-boarded from April 2019, and fully operational in approximately 2 years. This is part of our deliberate strategy, underpinned by our approach to pay, to develop our capability in a number of ways including growing our own.

95. Whilst we are still in the early stages of conducting large scale and ongoing recruitment campaigns since the implementation of the Spot Rate structure for intelligence and investigations roles, we are starting to see some positive indicators:

- Our recent campaigns seeking experienced investigators[footnote 20] for spot rated roles have seen a 70% increase in terms of numbers of applications received per campaign. This is despite the fact that we remain behind the police in terms of total package (see section four, from paragraph 100 for further detail).

- Non spot rated roles have seen a 0.3% drop in applications per campaign. From this we can infer that the spot rates have had a positive impact – however, we will need to monitor this through to campaign completion before we can provide solid evidence.

- The latest pool of candidates for the IOTP has demonstrated an improvement across all protected characteristics.[footnote 21] Whilst this cannot be solely attributed to pay, we expect to see these trends continuing across other campaigns as they reach conclusion.

- We also expect to be more successful in recruiting to PIP1[footnote 22] candidates, who are more likely to benefit financially from the career pathway accompanying the Spot Rate structure.

- We recognise that recruiting people early on in their career will require significant investment to build the necessary capability, and developing a comprehensive people offer to ensure retention cannot be our only approach to diversifying our workforce.

96. Over the past 12 months, 229 candidates have withdrawn applications whilst going through the recruitment process. Whilst we cannot attribute this solely to the breakdown in salary negotiations, we have feedback that for 75 candidates, pay was the primary reason. We are continuing to improve our data collection through the recruitment process so that we can better capture the candidate experience.

97. In 2018, we conducted a leadership review of all our G1 officers. As a result of this review, we conducted a lateral moves exercise and created 29 vacancies. This campaign is due to complete in Spring 2019. We expect a mix of internal and external candidates to be successful. We will use the data resulting from this exercise to inform our position on pay for the more senior grades (1-2) in the next pay round and with this insight, we will be able to compete more effectively in the market.

98. There are areas where it has proved difficult to recruit officers with the right level of skill and experience, particularly in parts of the workforce where spot rates do not apply. For example, we have struggled to recruit managers at G3 and above with the requisite investigatory experience from other agencies (incl. Border Force, Policing and HMRC). Conversely, NCA trained staff are attractive to other law enforcement, Civil Service and, for officers with specialist skills, the private sector in Banking, Insurance and IT.

99. We are also experiencing high turnover infrastructure and software engineers to private sector for higher salaries.[footnote 23] Digital, Data, Technology and Cyber roles: these skills are highly prized, particularly in London and the South East which has a strong contingent labour market. Whilst we cannot attribute low applications directly to salary – it is highly likely that this is the case, and we are developing this evidence. Some examples of recent campaigns include:

- G2 Data Architect: Three unsuccessful campaigns completed – 0 candidates appointed.

- G2 and G3 Security Architects: 4 applicants – 0 shortlisted.

- G3 Service Transition Manager: Two campaigns completed – 0 candidates appointed.

- G4 & G5 IT Security Officers – Three campaigns completed to fill 5 posts – 2 candidates appointed (one internal).

100. We will provide further information on our market comparators in the next section. In summary, whilst we have made progress in relation to recruiting to investigations and intelligence posts, we must not lose the momentum in our longer term pay strategy to extend pay reform to leaders and specialist niche roles.

Section Four: Our Pay Comparators

In this section we will provide evidence to demonstrate our position in relation to out comparator markets to support our continued differentiated pay strategy and demonstrate the importance of maintaining the momentum behind our pay reform strategy.

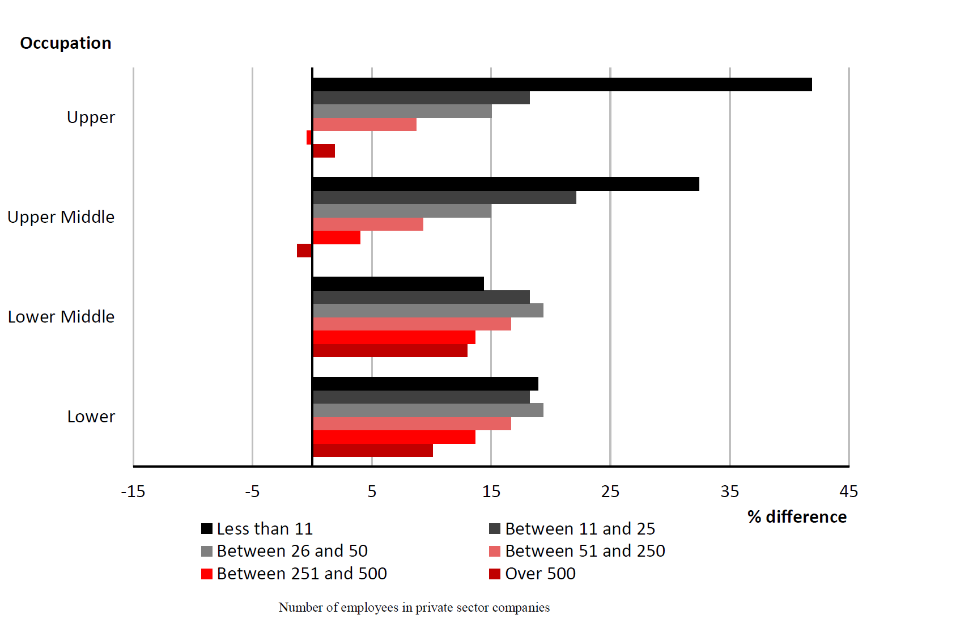

101. The NCA’s pay strategy is differentiated due to the complexities of our workforce profile and the blend of skills and capabilities that we require. We are keen to set out that across some markets, we continue to fall significantly behind. This predominantly affects roles across intelligence, investigations and where we have niche and specialist capabilities. In other areas, we tend to compete more effectively, particularly across the Civil Service and public sector, with some exceptions.[footnote 24] The approach we have taken to date, to differentiate our pay offer, is the first step along our journey to ensure that we are able to respond in the right way to recruitment and retention challenges created from very different types of comparator markets.

Police Pay

102. The agency occupies a leadership role across the law enforcement landscape in response to serious and organised crime. Many of the skills that the agency relies on are found within policing – however, the nature of the work differs. The agency is predominantly a proactive workforce, working at the high end of high risk. The totality of the police pay and rewards package includes both the skills and more reactive nature of the work. The NCA therefore needs to compete effectively for talent, without necessarily being able to match police pay exactly.

103. The agency aims to keep its pay in line with its primary comparators because this is essential to ensure sustainable operational delivery. However there are constraints in terms of the agency’s budget and the affordability of pay reform, as all increases must be delivered within the flat rate settlement allocated in the last government spending round. We also have to balance the allocation of the award to remain within the HM Treasury approved IRC agreed in our three year pay submission. However, we cannot allow the gap to widen any further. The below table provides a comparison of NCA and police salaries for G5/Constable and G4/Sergeant. This demonstrates our current position.

104. By making a 2% award to spot rates, the table below demonstrates that we are able to maintain our current salary position in relation to policing. We will need to monitor this position very closely as part of our submission for the 2020/21 pay award.

105. Unlike policing, the NCA pay scales do not contain incremental pay progression, meaning that officers cannot move through the pay scales from minimum to maximum in a defined period of time. In the tables below, we have used the top of the police pay bands to compare to NCA proficient rates of pay. We have done this because we require PIP2 accreditation for our roles, which is only normally achieved by experienced detectives, who would normally be at the top of their respective pay range.

Table 8: NCA pay comparison with police pay (Constable)

| 2016/17 | 2018/19 | 2019/20 | |

|---|---|---|---|

| Police pay for PIP2 accredited investigators | £38,001 | £39,150 | NCARRB will be considering the Police pay award proposals concurrently with this submission. The NCA seeks to ensure relative pay parity with policing in key roles to maintain our workforce and skills. |

| NCA rate for PIP2 accredited investigators | £24,965 | £33,504 (G5 Spot Rate 3 Proficient) | NCARRB will be considering the Police pay award proposals concurrently with this submission. The NCA seeks to ensure relative pay parity with policing in key roles to maintain our workforce and skills. |

| NCA pay as a percentage of police pay. | 65.7% | 86% | NCARRB will be considering the Police pay award proposals concurrently with this submission. The NCA seeks to ensure relative pay parity with policing in key roles to maintain our workforce and skills. |

Table 9: NCA pay comparison with police pay (Sergeant)

| 2016/17 | 2018/19 | 2019/20 | |

|---|---|---|---|

| Police pay for PIP2 accredited investigators | £42,285 | £43,998 | NCARRB will be considering the Police pay award proposals concurrently with this submission. The NCA seeks to ensure relative pay parity with policing in key roles to maintain our workforce and skills. |

| NCA rate for PIP2 accredited investigators | £33,286 | £40,800 (G4 Spot Rate Proficient) | NCARRB will be considering the Police pay award proposals concurrently with this submission. The NCA seeks to ensure relative pay parity with policing in key roles to maintain our workforce and skills. |

| NCA pay as a percentage of police pay. | 78.7% | 93% | NCARRB will be considering the Police pay award proposals concurrently with this submission. The NCA seeks to ensure relative pay parity with policing in key roles to maintain our workforce and skills. |

Figure 3: The position of an NCA Grade 5 PIP2 accredited officer compared to current police pay rates.

2018 Police Officer Pay Scale (Constable)*

| Pay Point | Annual Salary |

|---|---|

| 0 | £20,370 |

| 1 | £23,586 |

| 2 | £24,654 |

| 3 | £25,728 |

| 4 | £26,802 |

| 5 | £28,947 |

| 6 | £33,267 |

| 7 | £39,150 |

*Appointed after 1 April 2013

PIP 2 Accredited

NCA Spot Rate 3: £33,504 (-16.85%)

Figure 4: The position of an NCA Grade 4 PIP2 accredited officer compared to current police pay rates.

2018 Police Officer Pay Scale (Sergeant)

| Pay Point | Annual Salary |

|---|---|

| 1 | £40,480 |

| 2 | £41,847 |

| 3 | £42,738 |

| 4 | £43,998 |

PIP 2 Accredited

NCA Spot Rate 2: £40,800 (-7.8%)

106. This demonstrates that NCA salaries for investigations officers working at the high end of high risk still remain significantly below the police comparator. It is of critical importance that we continue to invest in our spot rate structure as we seek parity with police pay for key roles. It is important to maintain the NCA as an attractive employer, therefore we have started to evidence trends in our ability to recruit and retain skills from this market.

107. Our spot rate pay award is for 2%. Whilst we cannot predict the pay award that policing will receive in the 19/20 pay year, we are preparing for the possibility that the 2019/20 police pay award is greater than 2%. Any further widening of the gap between NCA and Police pay would negatively impact on our ability to realise the benefits of the significant investment in pay that we have made to date. Therefore, in the event that police pay exceeds 2%, we have modelled the following spot rate increases if we were to increase the spot rate in line with police pay and the impact on our IRC[footnote 25].

Table 10

| Pay Year 2019/20 | 2.0% | 3.50% | 4.0% | 4.25% | 4.50% |

|---|---|---|---|---|---|

| Total Baseline Remuneration Cost | £186.58m | £186.58m | £186.58m | £186.58m | £186.58m |

| Cost to meet Spot Rate Increase | £0.91m | £1.77m | £1.98m | £2.13m | £2.26m |

| Cost of current proposed awards | £2.27m | £2.27m | £2.27m | £2.27m | £2.27m |

| Subtotal | £3.18m | £4.04m | £4.25m | £4.40m | £4.54m |

| Total increase | £189.76m | £190.61m | £190.83m | £190.97m | £191.11m |

| % Increase Overall | 1.70% | 2.16% | 2.28% | 2.36% | 2.43% |

| Cost increase | 0m | £0.86m | £1.07m | £1.22m | £1.35m |

108. The PRB should consider relationship between the NCA and Police pay when making their recommendations. In the event of a recommendation that would widen the gap between police and NCA pay, the NCA will consult with the Home Office and Treasury about how to keep pace, including for the 19/20 pay award. We acknowledge this would require the agency to assess affordability and priorities for the budget. However, we would consult at speed on costed proposals as we consider the risk of the pay gap widening to be so serious for recruitment and retention that it could impact on our ability to deliver the agency’s mission.

109. We have provided evidence of the challenges posed by the salaries of our primary comparator market, policing. We continue to face additional pressures from additional comparators, including the private sector, Civil Service and wider intelligence community. We have included below additional comparators, demonstrating that we continue to fall behind our other comparator markets.

Table 11: NCA pay comparison with wider Law Enforcement and Public Protection employers

Grade 5

| Cyber Specialist | Financial Investigator | Child Protection Advisor (CPA) | |

|---|---|---|---|

| NCA | £32,691^ | £33,504* | £33,504* |

| Comparator[footnote 26] | £42,286 | £45,758 | £40,000 |

| Diff £ | -£9,595 | -£12,254 | -£6,496 |

| Diff % | -29% | -37% | -19% |

*Spot Rate 3 – Proficient 2018/19

[^] NCA Grade 5 median 2018/19 excluding officers on Spot Rate pay.

Pay comparison with the Civil Service, public and private sectors

110. 80% of our workforce remains paid on our standard pay range. We recognise that this does not suitably differentiate between the specialist, niche and professional communities included in this cadre. We need to do further work in this area and we will provide more detail on our future pay strategy in section six.

111. For many of our roles contained within the standard pay range, we have applied comparators from across the private and public sector including the civil service.

112. When compared with Civil Service salaries, NCA base pay tends to perform well (see Annexe H). Median salaries across all six NCA grades exceed civil service medians, including when taking into account London based pay. However, we need to do further work to understand the effect of allowances and other pay elements present in other government departments (e.g. enhanced overtime). We have feedback to suggest that our grading for some niche and specialist roles falls behind equivalent grades in other departments. For example, we are in the process of evaluating our digital, data and technology roles against the cross government capability framework to ensure we are consistent.

113. When compared across the private and wider public sector, according to recent Korn Ferry benchmarking (contained at Annexe H), we are now competing favourably at grades 5 and 4. However, at grades 1 to 3 and 6, we remain behind the market. This submission seeks to ensure we do not move backwards at grades 5 and 4. We intend to address our grade 1s, 3s and 6s in our proposals for 2020-23.

London Weighting Allowance (LWA)

114. Enhanced pay for London or a geographical definition of London is delegated to departments. Our assessment demonstrated that most departments have moved to London pay scales. Where departments still pay LWA, rather than London pay scales, the average is £3,868 pa.

115. Other Civil Service employers offer market supplements alongside LWA to recognise specific recruitment and retention issues, similar to the RRAs used by the NCA.

116. Police officers in the London region receive up to £6,782 pa location based allowances. The current value of the London allowances are made up of the London weighting (£2,444 pa, pensionable), London allowance 1 (£1,011 pa, non-pensionable) and London allowance 2 (£3,327 pa, non-pensionable). The total value equates to £6,782 and is paid to all officers working in London employed after 1994.

117. Police officers in the South East receive an allowance of up to £3,000 pa for Essex, Hertfordshire, Kent, Surrey and Thames Valley and up £2,000 pa for Bedfordshire, Hampshire and Sussex. The allowances offer a way of compensating officers who live in areas generally viewed as having the most expensive living costs.

118. The private sector tends to favour a fixed amount allowance and a 2016 Loughborough University study estimated the average LWA to be under £4,000 pa. Benchmarking shows amounts differ widely between sectors and companies, ranging from £300 to £7,000 pa.

119. The assessment demonstrated recruitment and retention issues are not driven by London locations or commutes to these locations. The majority of officers (1176 / 75%) receiving LWA are currently based in Spring Gardens with the remaining (395 /25%) based in locations within and beyond the M25 boundary. These locations are Heathrow Airport (61), Gatwick Airport (45), Slough (39), Tolworth (74), Crawley (67) and Gillingham (109). Moving away from a LWA focus (for recruitment and retention) and more towards a wider array of reward strategies may be more effective in enabling the agency to achieve its long term strategic goals. There is however a need for an enhanced pay mechanism to retain the officers needed in the London area but the LWA does not address all recruitment and retention issues and the agency will continue to deploy recruitment and retention allowances to target specialist skills and skills shortages regardless of location. (See Annexe G for all locations currently in scope for the LWA and the number of officers currently receiving this allowance).

Section Five: Progress on pay reform to date Proposals for the 2019/20 pay award

This section details our 5 pay recommendations for the 2019/20 pay award, our Northern Ireland allowance and use of the non-consolidated pot.

This year we are seeking to incorporate reforms which include a new approach to flexibility, (including a formal shift review), and proposals to respond to increasing recruitment and retention challenges in our highly prized niche capabilities.

The NCA Pay Implementation Journey 2017-19

120. In Spring 2018, the agency secured final approvals for the implementation of a new pay structure in the NCA.

121. The NCA was totally committed to making a pay award using the new structures in the 2017/18 financial year and ran internal preparation in parallel with securing external approvals. In doing so, the NCA created four products to support the engagement and implementation process:

- A new Remuneration Committee (RC), chaired by an operational Director and attended by Deputy Director representatives from across the organisation;

- A pay calculator for every individual officer to be able to calculate their exact pay award (and arrears) for both the 2017/18 and 2018/19 pay awards;

- Pay reform engagement groups representing each Command to ensure that officers’ views were considered in the future; and

- A skills matrix underpinning the skills levels required for each rate of pay within the Spot Rate pay framework.

122. In preparation for the Spot Rate pay framework, the RC oversaw the evaluation of the individual skills of each eligible officer and conducted a thorough review and appeals process to ensure that the assignment of officers to Spot Rates was fair and transparent.

123. The RC has on-going oversight of this process and keeps the skills matrix and capability framework under regular review working with our Occupational Standards and Capability Assessment Unit (OSCAU) to ensure alignment with agreed National Occupational Standards (NOS) and the agency’s developing capability requirements.

124. In determining the final offer made to officers in March 2018, we sought to achieve agreement from the Trade Unions to automatically move all eligible officers to the Spot Rate structure unless they actively opted out. Following negotiations and a staff ballot, we reached agreement with the Public and Commercial Services Union (PCS), National Crime Officers Association (NCOA) and Association of First Division Civil Servants (FDA) that, whilst they could not accept the deal, they would not obstruct the offering of new terms and conditions directly to officers in scope for the new pay structure. As a result, c. 800 officers elected to move onto the new Spot Rate pay in March 2018 and onto new terms and conditions of employment.

125. The RC has also led work across the agency to further develop the skills matrix and capability framework increasing the number of roles that are now in scope for the Spot Rate pay structure. In November 2018, the RC agreed to amend the skills matrix and offer all posts in intelligence at Grade 4 & Grade 5 currently requiring IPP[footnote 27] or PIP2 Spot Rate terms and conditions.

126. It was also agreed to expand the scope of the Spot Rate structure and extend eligible roles to those requiring professional qualifications such as Financial Investigators, Undercover Officers Advanced (UCA) and Undercover Officers Online (UCOL). These roles require specialist and niche skills that need sustained investment by the agency to develop capability. It is anecdotal that in adopting spot rate pay, attracting candidates to these posts will improve.

127. The agency anticipates a further 170 out of 350 eligible officers will opt into the Spot Rate pay structure in February 2019. This offer will be backdated to August 2018 and is forecast to result in c. 1,000 officers on Spot Rate terms and conditions (out of 1,900 eligible officers).

128. The agency developed a communications strategy that seeks to explain to the workforce in a transparent way the rationale and benefits of the agency’s approach to pay (section two, paragraph 43).

Pay Award Recommendations for 2019/20

129. Having implemented significant reforms to our pay structures in the 2017/18 and 2018/19 pay years, we are now in the third and final year a year of pay flexibility agreed with HM Treasury. Despite the positive work to date, we recognise that there is still a significant way to go. We are therefore already developing a further three year pay strategy for the years 2020/21 – 2022/23.

130. In section six, we will provide further detail on our longer term approach to pay; we have significant work planned to continue our reform agenda over the next three years. Our approach for 2019/20 is to consolidate the implementation of reform agreed to date. We have taken this approach based on affordability and the feasibility of implementing further reform this year.

131. In section four, we have outlined our position in relation to our comparator markets, and highlighted the challenge that we will continue to face as police pay also increases. We recognise that as we currently stand, we have the approval from HMT and the financial provision with the NCA, to make a pay award of 1.7% only and therefore have made recommendation in line with this position.

132. The NCARRB is therefore asked to make recommendations on how to apply the pay award for the 2019/20 year only. In the remainder of this section, we will outline the rationale and impacts, on both officers individually and our pay strategy.

- Recommendation 1: Increase Spot Rates by 2% for Grade 4 and Grade 5 Investigations and Intelligence Officers.

- Recommendation 2: Increase the pay range minima for Grades 1 – 4 by 2% with no corresponding increase to the pay range maxima.

- Recommendation 3: Increase the pay range minima for Grades 4 and 5 by 4.25% and 4.50% respectively with no corresponding increase to the pay range maxima.

- Recommendation 4: Increase London Weighting Allowance by 1% taking it from £3,258 to £3,291 per annum.

- Recommendation 5: Increase the pensionable shift allowance paid to the control centre from 12.5% to 15%. We will then remove the non-pensionable top-up of 2.5%

Recommendation 1: Increase Spot Rates by 2% for Grade 4 and Grade 5 Investigations and Intelligence Officers.

133. Spot Rates (SRs) apply to eligible posts within Intelligence and Investigations at both Grade 5 and Grade 4. We have three SRs at Grade 4 and four at Grade 5. The SRs correspond to increasing levels of skills and capability outlined in the underpinning skills matrix, albeit we have not yet implemented the highest SR which is reserved for ‘expert’ levels. We continue to monitor this position.

134. By increasing each SR by 2%, all c. 1,000[footnote 28] officers on SR terms and conditions will receive a consolidated 2% pay award.

135. The following tables demonstrate the proposed 2019/20 values of the SR pay framework.

Table 12: Proposed increase to Spot rates for Grade 5 Intelligence and Investigations Officers.

| 2018/19 | 2019/20 | |

|---|---|---|

| G5 Spot Rate 1 - Developing | £30,154 | £30,757 |

| G5 Spot Rate 2 - Developing | £31,410 | £32,038 |

| G5 Spot Rate 3 - Proficient | £33,504 | £34,174 |

| G5 Spot Rate 4 - Expert | £34,900 | £35,598 |

Table 13: Proposed increase to Spot rates for Grade 4 Intelligence and Investigations Officers.

| 2018/19 | 2019/20 | |

|---|---|---|

| G4 Spot Rate 1 - Developing | £37,536 | £38,287 |

| G4 Spot Rate 2 - Proficient | £40,800 | £41,616 |

| G4 Spot rate 3 - Expert | £42,500 | £43,350 |

136. Through increasing the value of the SRs, we expect a further 47 officers to accept SR terms and conditions and move across to this pay framework. We continue to offer SR terms and conditions for officers to accept if it is the right decision for them, taking into account the requirement to work 40 hours per week. This forecast increase of 47 SR officers has been included in our cost profiling.

137. The below tables, demonstrate the numbers of officers benefitting from increases to SRs, and the 47 officers who are likely to opt into the SR structures by as a result of the 2019/20 increases. These officers may receive an award of larger than 2% based on their current salary – but they will need to balance this with the additional requirement to increase their hours.

Table 14: Grade 5 officers benefitting from increase to Spot Rates

| Existing SR officers receiving a 2% increase to SRs | Officers expected to opt into SRs[footnote 29] in July 2019. | Expected Total of officers on SRs 2019/20 | |

|---|---|---|---|

| G5 Spot Rate 1 | 106 | 7 | 113 |

| G5 Spot Rate 2 | 82 | 3 | 85 |

| G5 Spot Rate 3 | 471 | 21 | 492 |

| G5 Spot Rate 4 | 0 | 0 | 0 |

| Total | 659 | 31 | 690 |

Table 15: Grade 4 officers benefitting from increase to Spot Rates

| Existing SR officers receiving a 2% increase to SRs | Officers expected to opt into SRs in July 2019. | Expected Total of officers on SRs 2019/20 | |

|---|---|---|---|

| G4 Spot Rate 1 | 29 | 0 | 29 |

| G4 Spot Rate 2 | 298 | 16 | 314 |

| G4 Spot Rate 3 | 0 | 0 | 0 |

| Total | 327 | 16 | 343 |

138. By continuing to make the Spot Rates an attractive proposition, we will grow the proportion of eligible officers that choose to adopt SR and begin to harmonise terms and conditions across investigations and intelligence. At present, December 2018, 51% of eligible officers had accepted SRs.

139. Spot Rate pay continues to sit within the same salary range as the Standard Pay Range. The table below demonstrates the comparison between both pay frameworks.

Graph 1: Shows the positioning of SRs against the standard pay range for Grade 5

| G5 Spot Rate | 2018/19 | 2019/20 |

|---|---|---|

| G5 SR1 | 35% | 38% |

| G5 SR2 | 48% | 48% |

| G5 SR3 | 68% | 71% |

| G5 SR4 | 81% | 87% |

Graph 2: Shows the positioning of SRs against the standard pay range for Grade 4

| G4 Spot Rate | 2018/19 | 2019/20 |

|---|---|---|

| G4 SR1 | 29% | 32% |

| G4 SR2 | 66% | 73% |

| G4 SR3 | 85% | 94% |

140. The two pay frameworks operate independently of each other, which means that over time, the value of the spot rates may begin to exceed the pay range maximums of the standard pay range.

141. Graphs 1 and 2, demonstrate that for some eligible officers who were previously paid at the lower end of the pay range, the spot rate structure provides a mechanism to increase their salary within the same grade. By continuing to invest in the spot rate structure, we will seek to grow the proportion of officers who have opted in. We do recognise that officers who are currently paid in excess of the SR value on a 37 hour contract are unlikely to move across.

142. A core part of our pay strategy design has been to reduce inequities in our pay structures. Our implementation journey to date has demonstrated that although the spot rate eligible workforce tends to be less diverse than the overall workforce, we have seen positive trends in the profile of officers who have opted into SRs. We have seen increased numbers of female, non- Christian and younger officers opting in. This reflects the fact that these groups of officers are more likely to have been at the lower end of the standard pay range and found spot rates a more attractive proposition. But continuing to invest in this element of our pay framework, we can continue to close the pay gaps in our operational roles.

143. This is also demonstrated in our 2018 gender pay gap report. Within the SR workforce, we have reduced the mean gap to 2.36%, compared to an overall mean gap of 11.66%.

144. New recruits to SR roles, are automatically offered only SR terms and conditions, which over time will continue to increase the proportion of officers on SRs. In section four we have provided context on our market rate comparisons, and the challenges of maintaining our position vis-à-vis police pay as well as other market groups. By continuing to invest in our spot rate structure, we continue to send the message to potential recruits that the NCA offers an improving reward offer.

- Recommendation 2: Increase the pay range minima for Grades 1 – 4 by 2% with no corresponding increase to the pay range maxima.

- Recommendation 3: Increase the pay range minima for Grades 5 and 6 by 4.25% and 4.50% respectively with no corresponding increase to the pay range maxima.

Officers who are already at, or who will reach, the pay range maximum will receive the balance of their 1% pay award as a one-off non-consolidated payment.