Free meals in further education funded institutions

Published 30 March 2022

Applies to England

1. Free meals: a summary

The 1996 Education Act requires maintained schools and academy sixth forms to provide free meals to disadvantaged students who are aged over 16. In the 2014 to 2015 academic year the requirement was extended to disadvantaged students following further education (FE) courses at the range of FE funded institutions. Funding agreements place a legal duty on institutions to comply with the requirement.

Institutions must make a free meal available for all eligible students for each day the student attends their study programme, where this is appropriate.

Institutions receive funding at a rate equivalent to £2.41 per student per meal.

Students aged over 19 who are continuing on the same study programme (19+ continuers) they started before they turned 19 or who have an Education Health and Care Plan (EHCP) are eligible for a free meal where they meet the criteria.

Where institutions receive funding for both free meals in further education and 16 to 19 Bursary Fund discretionary bursary, they may use the funding as a single allocation.

Transitional protections continue to apply. The protection means that all students already receiving free meals on or after 1 April 2018 continue to be eligible to receive free meals whilst Universal Credit (UC) continues to roll out. This also applies to students who were eligible for free school meals (FSM) prior to moving into further education provision.

2. Eligibility for free meals

2.1 Institution eligibility

Students must be enrolled in FE provision funded via ESFA to be eligible for a free meal. Eligible institutions are:

- general further education colleges, including specialist colleges

- sixth-form colleges

- independent learning providers

- higher education institutions (HEIs) with ESFA 16 to 19 funding

- specialist post-16 institutions (SPIs)

- local authorities (LAs) and FE institutions directly funded for 16 to 19

- 16 to 18 traineeship providers

- European Social Fund (ESF) only institutions

- 16 to 19 only academies and free schools

- 16 to 19 only maintained schools

2.2 Student eligibility

Age

A student must be aged 16 or over but under 19 on 31 August 2022 to be eligible to receive a free meal. Students aged 19 or over are only eligible to receive a free meal if they are continuing on a study programme they began aged 16 to 18 (‘19+ continuers’) or have an EHCP.

These 2 groups of aged 19 plus students can receive a free meal while they continue to attend education (in the case of a 19+ continuer, this must be the same programme they started before they turned 19), as long as their eligibility continues.

The following groups of students are not eligible for free meals in further education:

- students aged between 14 and 16 (these students are already covered by FSM provision)

- students aged 19 or over at the start of their study programme, unless they have an EHCP or are a 19+ continuer

- apprentices, including those with an EHCP

Eligible benefits

Free meals are targeted at disadvantaged students. Free meals in further education defines disadvantage as students being in receipt of, or having parents who are in receipt of, one or more of the following benefits:

- Income Support

- income-based Jobseekers Allowance

- income-related Employment and Support Allowance (ESA)

- support under part VI of the Immigration and Asylum Act 1999

- the guarantee element of State Pension Credit

- Child Tax Credit (provided they are not entitled to Working Tax Credit and have an annual gross income of no more than £16,190, as assessed by HM Revenue and Customs (HMRC))

- Working Tax Credit run-on – paid for 4 weeks after someone stops qualifying for Working Tax Credit

- UC with net earnings not exceeding the equivalent of £7,400 for each year (after tax and not including any benefits they get)

A student is only eligible to receive a free meal when they, or a responsible adult on their behalf, have made a successful application to the institution where they are enrolled.

It is important that institutions ensure they understand that a parent or student must be in receipt of one of the qualifying benefits set out above to be eligible.

Working Tax Credit is not a qualifying benefit for free meals, and a parent or student in receipt of Working Tax Credits is not entitled to a free meal (this is a common question sent to ESFA). Qualifying benefits do include the Working Tax Credit run-on which is paid for 4 weeks after you stop qualifying for Working Tax Credit.

From 1 April 2018, any student who is in receipt of, or has parents who are in receipt of, UC must have a net earned annual income of no more than £7,400 to be eligible for free meals.

Students must also satisfy the residency criteria set out in our funding regulations guidance.

3. Verification of student eligibility

Institutions are responsible for assessing applications for free meals. All students applying for a free meal for the first time in the 2022 to 2023 academic year must submit an application (either by the student or by a responsible adult on their behalf) to the institution where they are enrolled. Some institutions may use a paper application form; others may operate an on-line application.

Institutions will be aware that the Department for Education (DfE) provides an electronic Eligibility Checking System (ECS) that enables local authorities to check FSM eligibility on behalf of institutions.

It is important that institutions and local authorities understand that the legal gateway (section 110 of the Education Act 2005) that enables the department to obtain benefit information held by DWP and HRMC for checking eligibility is limited to FSM. Information from the ECS cannot currently be used to check entitlement for free meals for post-16 students.

As part of the application, institutions must ask the student (or their parent/guardian) to provide evidence of the award of the qualifying benefits. This might be an award notice or letter from DWP or HMRC. Institutions may want to consider using a combined application form and process for free meals and the 16 to 19 Bursary Fund.

4. Universal Credit

For new applicants, institutions must verify the eligibility of students, or their parents, who are in receipt of UC, by asking for a copy of their UC award notice that includes their monthly earnings. Institutions will need to assess the information given to obtain an accurate proxy of the individual’s current earned annual income. Monthly earnings are after tax and do not include any benefits the individual receives.

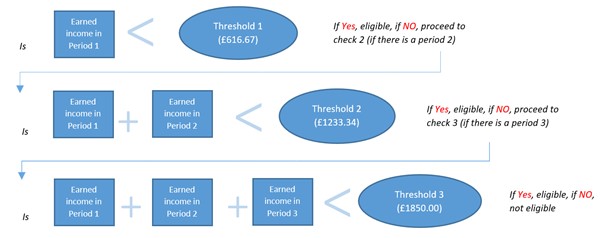

Institutions should check eligibility using the following assessment process:

Threshold 1

The student or their parents provide a UC award statement from their most recent complete assessment period, showing that their earnings in that period do not exceed £616.67 (this is a twelfth of an equivalent annual income of £7,400). If their earnings do not exceed £616.67, they are eligible for free meals. If their earnings do exceed £616.67, the check must move on to the next step.

Threshold 2

The student or their parents provides UC award statements from their two most recent complete assessment periods, showing that their earnings in that period do not exceed £1,233.34 (this is a sixth of an equivalent annual income of £7,400). If their earnings do not exceed £1,233.34, they are eligible for free meals. If their earnings do exceed £1,233.34, the check must move on to the next step.

Threshold 3

The student or their parents provides UC award statements from their three most recent complete assessment periods, showing that their earnings in that period do not exceed £1,850.00 (this is a quarter of an equivalent annual income of £7,400). If their earnings do not exceed £1,850.00, they are eligible for free meals. If their earnings do exceed £1,850.00, the student is not eligible for free meals.

A manual check will be required to determine eligibility for those students or their parents who are self-employed and in receipt of UC. Parents will need to provide evidence that:

- they are in receipt of UC by providing their UC award letter

- they are self-employed by providing a copy of their company registration or tax return form

- their monthly net earnings do not exceed the threshold as set out in steps 1, 2 and 3. Institutions should request that self-employed parents complete the self-declaration form and, once satisfied that they are eligible, provide the student with a free meal

The diagram below also shows the assessment process.

5. Transitional protection arrangements

Eligibility criteria introduced under UC from 1 April 2018 will result in some households becoming eligible for free meals and others falling outside of the eligibility criteria. DfE has put transitional protection arrangements in place to provide certainty for families and ensure they do not experience a sudden loss of free meals.

The protection arrangements apply as follows:

-

all students already receiving free meals from 1 April 2018 will continue to receive free meals whilst UC is rolled out until March 2023 and then until the end of the course they are enrolled on at this point. This will apply even if their household earnings rise above the new threshold during that time

-

any student who becomes eligible for free meals after the threshold has been introduced will also continue to receive free meals during the UC rollout until March 2023 and then until the end of the course they are enrolled on. This will apply even if they subsequently become ineligible during this period because their household earnings rise above the new threshold

Institutions do not need to carry out any further eligibility checks for these protected families during this period. They may wish to note the students as ‘protected’ in their free meals auditable records.

Institutions should seek to identify students who are eligible to receive free meals under the transitional protection. If a student transferring in from a school falls under the transitional protection rules, we recommend the institution, where possible, obtain evidence of FSM eligibility from the previous school or local authority. If a student is transferring in from a previous further education funded institution, we recommend the institution obtains evidence from that provider where possible. Institutions should retain appropriate evidence of eligibility for audit purposes. The department is also exploring options for providing historical FSM information to help institutions identify students who are protected and should continue to receive a free meal.

Where institutions are unable to verify previous eligibility for free meals using the approaches above, they may wish to consider seeking evidence from the student/their parent, for example, by requesting a copy of previous entitlement letters.

A student who has not previously claimed free meals is only eligible to receive one when they, or a responsible adult on their behalf, have made a successful application to the institution where they are enrolled. Once UC is fully rolled out, any students receiving free meals who no longer meet the eligibility criteria at that point (because they are earning above the threshold) will continue to receive protection until they complete their 16 to 19 funded education. 19+ continuers and students aged 19 and over with EHCPs will continue to receive protection until the end of their current programme of study.

Students who make a first application in the 2022 to 2023 academic year and who have household earnings above the threshold will not be eligible for free meals.

6. Allocations and payments

Where possible, we have based 2022 to 2023 academic year free meals funding for further education institutions on their 2020 to 2021 full academic year data and their funded student number for the 2022 to 2023 academic year. We have used the number of students assessed as eligible for, and in receipt of, free meals in the 2020 to 2021 academic year as a percentage of the total number of reported students aged 16 to 19 in that year. This establishes the number of students we might reasonably expect to be eligible for free meals support in the 2022 to 2023 academic year.

If 2020 to 2021 full academic year information is not available or not appropriate, we will use alternative approaches to generate the allocation. We strongly advise institutions to make data returns for the number of students assessed as eligible for and in receipt of free meals on an ongoing basis.

We apportion the number of fundable free meals students across the funding bands, using the same methodology as for mainstream allocations. Band 5, Band 4 and Band 1 FTEs are full-time students. Band 3 and Band 2 are part-time students. Two funding rates apply, one for full-time students and one for part-time students, equivalent to £2.41 per student per meal.

As in previous years, we have made an adjustment for historic double funding between free meals and the 16 to 19 Bursary Fund. We calculate each institution’s share (percentage) of the total number of students supported with free meals who informed the 2022 to 2023 free meals allocations. We use this percentage to calculate the amount to be subtracted from each institution’s discretionary bursary allocation.

Further information about the allocations methodology is set out in funding statements issued to institutions in February and March 2022.

6.1 Payment of allocations

We will pay free meals allocations to institutions in 2 parts: approximately two-thirds in August and one third in April. The first payment for eligible academies is September, reflecting the general academies payment schedule.

If any institution given an allocation of free meals funding determines they do not have eligible students during 2022 to 2023, they should contact us to return their allocation.

6.2 Administrative contribution

Institutions are permitted to use up to 5% of their allocation for administrative costs.

Institutions that receive allocations for both the 16 to 19 Bursary Fund and free meals in further education schemes are permitted to use up to 5% of the combined allocation for administration. Institutions must ensure they do not take a sum that is greater than 5% of the single allocation total.

7. Rules on unspent free meals funds

We permit institutions to carry unspent free meals funds over to the next academic year. Any funds carried forward must continue to be used to support students. They cannot be added to general institution funds.

Where institutions are given a single overall allocation that includes funding for both free meals and the discretionary bursary, they can carry forward funds from both schemes. The funding may be used for either free meals or discretionary bursary payments in the new academic year.

Institutions must fully utilise any unspent funds for either free meals or discretionary bursary before using their new academic year allocation.

Institutions cannot carry forward funding for free meals and/or discretionary bursary meals funding for more than one year and must inform us of the total amount of any unspent funds (not previously reported) from any year up to and including the 2020 to 2021 academic year.

Institutions must report unspent funding using our online enquiry form. We encourage institutions to do this as soon as they are aware, however they must report it no later than 31 March each year. We will recover the unspent funds.

8. The provision of free meals to students

Institutions must make provision for free meals to eligible students (those who are in receipt of the qualifying benefits and who make a successful application for free meals) for each day the student attends their study programme, where this is appropriate.

For example, if a student attends for 5 days a week, 9am to 3pm, for part of their course, the institution should provide 5 free meals. If a student has 2 days a week when they only attend from 9am to 10am, then the institution does not have to provide meals on those days.

Institutions are responsible for encouraging and supporting students in making healthy food choices. Many caterers will be able to advise on suitable healthy options to offer students. Institutions should also offer hot food options where practical.

Institutions should provide a meal free of charge to eligible students or fund the free meal via an electronic credit or voucher that can be redeemed on-site or off-site where institutions have arrangements with nearby food outlets. Electronic credits and vouchers must be worth a minimum value of £2.41.

If an institution determines it is necessary to enhance the £2.41 free meals funding rate, in other words, to provide a meal with a greater value, from the single funding allocation or other sources, they have discretion to do so. Institutions must consider the value for money and reasonableness of an enhancement to the £2.41 rate and must be able to justify this at audit, particularly if they choose to make a significant variation from this amount.

The cost of meals is sometimes included as part of the package of support for high needs students that is agreed with local authorities. In these instances, institutions should consider the issue of potential double funding for meals when assessing the need to support. This might be by deducting the appropriate amount of funding from the total costs of the package for those students who will be eligible for a free meal, enabling local authorities to use those funds elsewhere.

The majority of students will require a free meal at lunchtime to fit in with usual study and attendance patterns. However, institutions may exceptionally choose to make provision for a free meal at an alternative time, for example, breakfast, depending on the study pattern of individual students.

Institutions must make free meals provision for students on days when they are off-site as part of their study programme, for instance attending a work placement, work experience or industry placement. Wherever possible, institutions should provide the student with a voucher they can use at nearby food outlets or arrange with the work experience or placement provider to provide a meal.

We expect that a meal, voucher, or credit will be provided to eligible students. However, this may not be practical in some situations and institutions are permitted to make cash payments to students in the following exceptional circumstances:

Students attending institutions that meet all the following criteria:

- fewer than 50 students in total on roll

- no catering or kitchen facilities on site

- no suitable food outlets locally that will agree to take part in a credit or voucher scheme

Students who are off-site on work placement or work experience as part of their study programme whose host organisation is unable or unwilling to provide a meal, and who have no access to a suitable food outlet that will accept a voucher. Examples include work placements in rural areas or on industrial sites.

Institutions with more than 50 students in total on roll but which have sites away from their main campus that:

- have no on-site catering facilities

- are too far away for students to travel back to facilities on the main campus

If institutions identify particular and exceptional circumstances that fall outside these parameters, they have discretion to make cash payments if they believe that failing to do so will prevent an eligible student from being provided with a meal. Institutions must ensure they record any such decisions as part of their auditable records.

8.1 Catering for students with special dietary requirements

Institutions are best placed to make decisions in the case of students who have special dietary requirements, considering local circumstances. Institutions are expected to make reasonable adjustments for students with these requirements.

The School Food Plan’s UIFSM toolkit was developed to help schools implement universal FSM for infant pupils, but it contains advice on how to cater for pupils with special dietary requirements, which may be helpful to institutions.

9. Free meals and the 16 to 19 Bursary Fund

There is no ring fence between the free meals in further education allocation and the 16 to 19 Bursary Fund discretionary bursary allocation to give institutions flexibility in using the funding. Institutions must manage the single allocation appropriately to ensure all students eligible for a free meal receive one in line with this guide.

Prior to the introduction of additional funding for free meals, institutions had supported the cost of meals for students who needed them from discretionary bursaries. We adjust discretionary allocations to take account of this double funding for those institutions also in receipt of an allocation for free meals.

Institutions have discretion to manage the single allocation as they decide most appropriate to best provide support to eligible students for both schemes. Free meals in further education remains an entitlement and institutions must manage the single allocation appropriately to ensure that all students entitled to a free meal are provided with one.

If an institution determines it is necessary to enhance the £2.41 free meals funding rate and provide a meal with a greater value, whether from their single allocation or other sources, they have the discretion to do so. However, where institutions choose to do this, they must ensure that funding for discretionary bursaries continues to provide sufficient help to students facing the range of barriers to participation and should not enhance free meals funding to the detriment of other needs.

Institutions can give additional support to students eligible for a free meal from the 16 to 19 Bursary Fund, if the institution assesses they meet the criteria for bursary for vulnerable groups or the discretionary bursary.

Institutions should ensure they consider the provision of a free meal, or the funding provided to the student for the free meal, when they assess their overall need for support.

10. Raising awareness of free meals

Institutions are responsible for ensuring students are aware of the eligibility criteria for free meals. They should also encourage students who may meet the criteria to make an application for a free meal.

Institutions should clearly set out their free meal provision for students and parents. This might be by publishing a statement on their website, promoting, and providing information about free meals at induction and enrolment days, sending letters home to parents, for example.

Students do better in their studies when they have access to proper, regular, nutritional meals. We encourage institutions to support students to make healthy food choices by raising awareness of relevant information and guidance.

11. Data returns, including the individualised learner record (ILR) and school census

Institutions must complete the free meal field in the ILR to provide information on the number of young people eligible for free meals in further education. This is code FME2.

Institutions must ensure they only record students who are eligible and have taken up the free meal in the free meal field. Students assessed as eligible but who do not take up a meal should not be recorded under code FME2.

Students who receive funding for meals from the discretionary 16 to 19 Bursary Fund must not be recorded under code FME2 nor should students who receive FSM, for example, 4 to 15 year olds.

The ILR states that code FME2 should be used if the student is eligible for, and has taken up, free meals at any point during the academic year. If the student stops taking free meals FME2 should be retained and not removed until the start of the following academic year. Similarly, if a student becomes ineligible during the year, the transitional protections mean that FME2 should be retained until the student’s programme of study ends.

This code should be recorded for eligible students who are ESFA funded students aged 16 or over and under 19, 19 to 24 year-old students who are subject to an EHCP, ESF funded students aged between 16 and 18 and 19+ continuers.

Institutions that do not complete the ILR but instead complete the school census should complete the 2 free school meals fields.

We operate an in-year growth process for free meals in further education based on ILR or census data. This is part of the in-year growth process for 16 to 19 programme funding which will release additional funding to institutions where data indicates it is needed. Any growth or additional funding is subject to affordability.

12. Audit and assurance

Free meals in further education is subject to normal assurance arrangements for 16 to 19 education and training.

Institutions must maintain accurate and up to date records that evidence which students receive free meals funding; confirm student eligibility for funding, including where transitional protections apply, and demonstrate appropriate use of funds, including the rationale for any enhancement to the £2.41 free meals rate. They must also be able to confirm, during any audit, the amount of any unspent funds that have been carried forward to the current academic year.

Institutions are responsible for deciding what evidence they accept for free meals and how recent it is. However, they must ensure they can evidence that only students who meet the eligibility criteria for free meals in each academic year receive them. Where institutions have used their discretion to make cash payments that are outside the specified criteria set out in this document, they must ensure these are recorded.

Institutions should note that, following an audit, we might recover funding where free meals payments are found to have been made to ineligible students.

13. Further information

Information about healthy eating, including recipes, is available at healthier families and NHS.