Delivering financial support for heat networks: England and Wales

Updated 16 October 2018

Applies to England and Wales

This delivery plan is intended to send a message that HNIP is now ready to work with project sponsors, developers and investors - put simply we are open for business.

Foreword

Heat Networks have been proven around the world as a reliable, cost-effective and low carbon means of providing heat, yet in the UK just 2% of buildings are heated in this way[footnote 1].

The government has rightly identified this opportunity and is seeking a transformation to support the development of a sustainable heat network market. The Clean Growth Strategy’s illustrative 2050 pathways suggest that around 1 in 5 buildings will have the potential to access a largely low carbon district heat network by 2050[footnote 2].

As a representative of Triple Point Heat Networks Investment Management, I am delighted that we have been appointed as Delivery Partner for the government’s Heat Networks Investment Project (HNIP). Over the next 3 years we will deliver £320m of government support to individual projects across England and Wales as part of the HNIP main scheme, leveraging around £1bn of private and other capital in order to provide much needed scale to this market.

A heat network is defined as a system for distributing heat generated in a centralised location, via a network of underground pipes, however a successful heat network project is capable of much more than this.

The impact of this funding should be felt across the UK. Heat network construction in towns and cities will support jobs in engineering, construction, energy management and design. At the same time, many projects will be integrated into broader urban renewal and redevelopment – contributing not just sustainable heat and power but also to an understanding of place and pride in the local environment.

Large scale commercial investment is critical to the development of this market and this will be a major area of focus for the Delivery Partner team as we seek to create the right conditions and connections between project sponsors, developers and investors from the UK and around the world who may be able to support them.

Guidance will soon be published that will provide project sponsors with the detail necessary to submit a successful application. Until then, this document reflects the most up to date information on our approach, timescales and requirements.

From the outset we are clear on the need to ensure that projects are well-designed, commercially viable and beneficial for consumers.

We are committed to a vision, shared with the Department for Business, Energy and Industrial Strategy (BEIS), to create a transformed, selfsustaining and trusted market which offers affordable and reliable low carbon heat. This will be delivered through projects which are investable, strategic, future proofed, transparent and in the right place at the right time.

There is much to do, and we look forward to working with you.

Ken Hunnisett

on behalf of Triple Point Heat

Networks Investment Management

Introduction

Heat networks offer a substantial opportunity to assist the UK in achieving a clean and cost-effective transition towards a low carbon economy.

In addition to the installation of new infrastructure, heat networks offer an investment opportunity to renew vital infrastructure and support the economic renewal of towns, cities and rural areas.

The Heat Networks (Metering and Billing) Regulations 2014 [footnote 3] [footnote 4] state that district heat network means ‘the distribution of thermal energy in the form of steam, hot water or chilled liquids from a central source of production through a network to multiple buildings or sites for the use of space or process heating, cooling or hot water’. Varying in size, scope, and heat source; a heat network could service the heat requirement of just 2 buildings or an entire city. By supplying multiple buildings with heat from the same centralised source, heat networks avoid the need for individual boilers or electric heaters in every building. Heat network pipe infrastructure is heat source and fuel agnostic.

Heat networks, leveraging economies of scale, serve to reduce the amount of energy wasted, balance the supply of heat and can offer bill savings to households and businesses alike.

The government is committed to developing a self-sustaining heat networks market in the UK that can operate in the long-term without direct government subsidy. The Department for Business, Energy and Industrial Strategy (BEIS) is delighted to launch the Heat Networks Investment Project (HNIP) - a major government project which will invest £320m of capital funding in heat network projects. HNIP will ensure that schemes of the highest quality – delivering both carbon savings and consumer benefits – will be incentivised to progress. This investment is offered as ‘gap funding’ through a combination of grants and loans which will be offered to eligible projects from April 2019. The scheme will be open for applications for a period of up to 3 years[reference i].

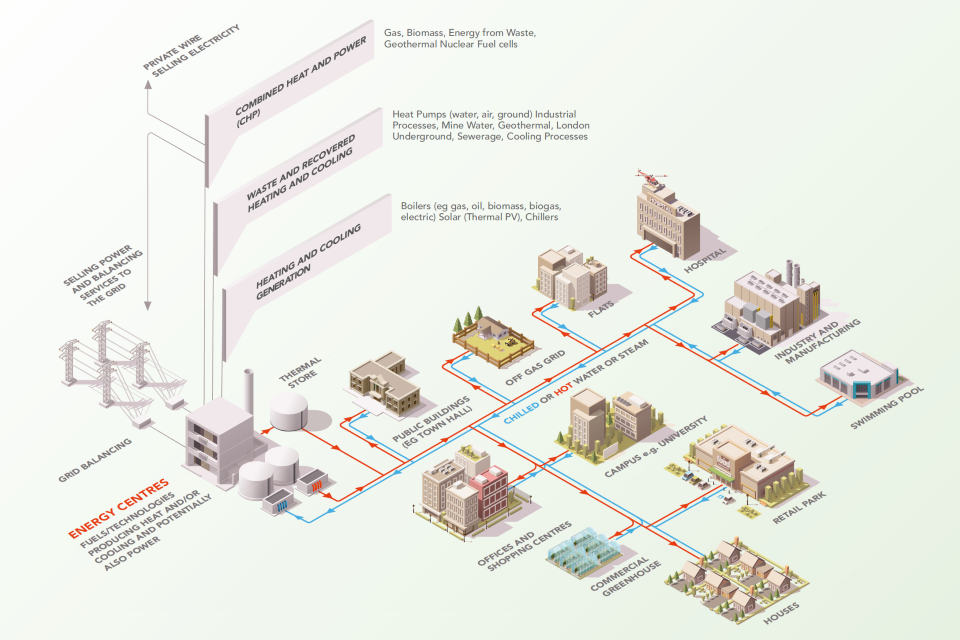

An example of how a local heat network operates

Source: BEIS (2018) What is a Heat network?

Funding offered through HNIP seeks to leverage around £1bn of private sector and other investment to support the commercialisation and construction of heat networks. This together with the government’s investment will deliver a step change in the development of the heat networks market. The aims are to deliver carbon savings, drive down infrastructure costs, reduce consumers’ energy bills, improve skills and capability and demonstrate to the investment community that heat networks are a viable investment proposition in the UK.

BEIS is proud to announce the appointment of Triple Point Heat Networks Investment Management as its HNIP Delivery Partner.

This document introduces the Delivery Partner team and the crucial role that it will play in delivering HNIP. It provides a high-level overview of the application and assessment process which will be of interest to project sponsors and potential applicants to the scheme.

Finally, this document details a timeline of key milestones including when the scheme is expected to open for first applications.

Policy Context

How our homes and buildings are heated in the future will be critical to achieving the government’s ambitions for clean growth in the UK. Heat is a major part of our economy accounting for approximately a third of UK carbon emissions and almost half our energy usage.[footnote 5]

80% The legally binding target by which the United Kingdom is to reduce greenhouse gas emissions by 2050

57% The target by which the United Kingdom is to reduce greenhouse gas emissions in 2028-2032

17% Heat networks could provide 17% of heat demand in homes by 2050

24% Up to 24% of heat demand from non-industrial business and public sector buildings could be provided by heat networks in 2050

The UK has legally binding targets to reduce greenhouse gas emissions by at least 80% by 2050 from 1990 levels, and by 57% over the 2028-2032 period (the fifth carbon budget). Doing so will rely on a significant contribution from decarbonising heat [footnote 6]. Installing efficient heat networks in areas of high heat demand is a low-regrets way to reduce emissions while we determine how best to move the rest of our heating away from fossil fuels and towards low carbon energy sources.

In the Clean Growth Strategy[footnote 7], the government set out 3 illustrative pathways for meeting the UK’s 2050 target. Each envisaged a significant role for heat networks, for instance, providing 17% of heat demand in homes and up to 24% of heat demand in the non-industrial business and public sector buildings. This will require a significant increase in current growth rates and investment in heat networks.

Benefits of a heat network

Heat networks can deliver a wide variety of benefits to the environment, consumers and the wider economy:

- They are particularly attractive in high-density built-up areas and positively integrate with new build developments and campuses but may also service the heating requirements of rural off-gas grid communities.

- Heat networks enable the use of cheaper, low carbon heat sources that can only be used at scale, e.g. recoverable heat from industry and energy from waste incineration.

- On average heat network consumers are as satisfied overall with their heating system as non-heat network consumers[footnote 8]. In addition, they are likely to pay lower bills than non-heat network consumers[footnote 9].

- Carbon savings can also be delivered more cost effectively than individual building solutions.

- Use of heat storage and electric heat (e.g. from heat pumps) offers significant electricity system balancing opportunities.

- Support for devolution and local growth through Local Authority-led schemes that are optimised to support economic regeneration and local user needs.

Aims and objectives of HNIP

The aim of HNIP is to create the conditions for a self-sustaining heat networks market that contributes to the decarbonisation of the UK energy system at the lowest cost to the economy by 2050.

The long-term objective of HNIP is to help create a self-sustaining heat networks market that does not require direct government subsidy by:

- Increasing the volume of strategic, optimised and low-carbon heat networks built by providing central government funding which will draw in significant additional investment.

- Improving the quality of heat networks that meet local infrastructure and consumer needs.

- Building the capability of project sponsors and the supply chain to develop systems of the right type and quality.

Triple Point Heat Networks Investment Management is working with BEIS to deliver affordable and dependable low-carbon heat across the country. Using a mix of government and private sector funding, our approach will build a self-sustaining and transformative heat energy market for the future.

We define a self-sustaining market as a market in which a sufficient volume of strategic, optimised and low-carbon heat networks is economically attractive without direct government subsidy and are operated with no consumer detriment.

The launch of HNIP builds on the government’s strong track record in supporting heat networks growth across the country. In 2013, the government set up the Heat Networks Delivery Unit (HNDU) to support Local Authorities in England and Wales developing heat network projects. Through HNDU’s support the government has invested over £17m in grant funding to more than 200 projects across 140 Local Authorities catalysing the building of a thriving market.[footnote 10]

During 2016/17, BEIS ran a pilot HNIP scheme for public sector participants only, providing £18.5m of funding for 8 local authority projects[footnote 11]. An evaluation research into the administration, delivery and influence of the HNIP pilot scheme was produced and a summary of learning from the HNIP pilot process was developed[footnote 12]. The lessons from the pilot are being used to improve the design of the main HNIP scheme.

Standards and consumer protection

Government has supported industry in driving up standards in the heat networks market and protecting consumers. Measures that have already been introduced include:

- the Heat Trust[footnote 13]; an independent customer protection scheme designed for heat network customers.

- a voluntary Code of Practice[footnote 14], which establishes minimum standards for design, installation and operation of schemes.

Projects being supported through government funding must meet these, or equivalent standards, as a minimum. Projects must also meet Heat Network (Metering and Billing) Regulations 2014[footnote 15],[footnote 16], ensuring that consumers connected to a heat network are billed based on metered consumption data.

Definitions

Strategic

Future proofed networks that play an appropriate part in the energy system (heating, cooling, power, grid balancing) and can expand and interconnect over time to facilitate neighbourhood-wide networks and enable commercial aggregation. A strategically important heat network is therefore one that can be proven to combine the characteristics of scale, expandability, replicability or innovation.

Optimised

A heat network that achieves the most cost effective or highest achievable performance across its lifetime given constraints. A heat network should be optimised technically, contractually, commercially and financially. This includes understanding its integration into wider energy systems and ensuring there is no consumer detriment in comparison to alternative heating solutions.

Low carbon

Lower carbon than the counterfactual heating solution, and the capability to further decarbonise in the future.

No consumer detriment

HNIP funded heat networks should operate to elicit consumer benefits and cause no customer detriment in comparison to the likely alternative heat supply – a key project aim and characteristic of a sustainable market.

Delivery Partner

Who is the Delivery Partner?

BEIS has appointed Triple Point Heat Networks Investment Management to the role of Delivery Partner[reference ii]. Comprised of a number of professional firms with a demonstrable track record of engaging with investors and supporting project developers to deliver a wide range of infrastructure projects, Triple Point Heat Networks Investment Management includes the following organisations:

AECOM:

Technical Analysis & Assessment

GEMSERV:

Application Support

BDO:

Financial & Commercial Assessment

ECUITY:

Stakeholder Enagement

AMBERSIDE:

Investor Relations

LUX NOVA:

Legal Assessment

Parties Involved

Whilst they may be drawn from the same organisations, the individuals carrying out scoring and assessment and participating in funding decisions will be separate from the business development managers whose function is to provide support through the process. Scoring assessment and financial decisions must be carried out in a fair and transparent way by individuals who are not conflicted.

| Stage | Role | Lead | Support |

|---|---|---|---|

| Pre-Application and Support | Business Development Managers* | Triple Point | - AECOM - Amberside |

| Scoring and Assessment | Assessors | AECOM | - BDO - Lux Nova |

| Funding Decision | Investment Committee |

BEIS Triple Point |

|

| Completion | Legal, Technical & Financial | Triple Point | - AECOM - Lux Nova |

| Monitoring and Reporting | Contracts & System Performance | Triple Point | - AECOM - Gemserv |

*Business Development Managers provide support through the process.

Triple Point

(Investment Management)

Triple Point has a long track record of working with the public sector and helping investors access new asset classes. With more than £1 billion under management, invested across energy and infrastructure, real estate, direct lending and venture capital, it is ideally placed to help accelerate deployment in this emerging sector.

Founded in 2004, Triple Point provides funding to a wide range of businesses and organisations in both the public and private sectors, including the NHS, Local Authorities, housing associations, infrastructure developers and small and medium-sized businesses. Triple Point managed funds have invested in multiple energy infrastructure projects including heat networks and distributed energy projects.

The Triple Point team will be facilitating and leading the HNIP Investment Committee, the body responsible for deploying funding in line with the HNIP investment mandate.

BEIS Heat Networks Team

The BEIS Heat Networks team is responsible for overseeing the delivery of HNIP and developing policy to support a selfsustaining heat networks market. The team also includes the Heat Networks Delivery Unit (HNDU) which was established in 2013 to address the capacity and capability challenges which Local Authorities identified as barriers to heat network deployment in the UK. The Unit provides funding and specialist guidance to Local Authorities who are developing heat network projects. The heat networks team will work closely with Triple Point Heat Networks Investment Management to ensure the smooth and successful delivery of HNIP.

AECOM

(Technical Analysis and Assessment)

AECOM[footnote 17] is a global network of experts working with clients, communities and colleagues to develop and implement innovative solutions to the world’s most complex challenges. The company has around 87,000 employees worldwide and operates in more than 150 countries. It is ranked number 1 in Transportation and General Building in Engineering New- Record’s 2018 “Top 500 Design Firms” and has been named one of Fortune magazine’s “World’s Most Admired Companies” for the past 4 years. The company had revenue of approximately US$18.2 bn of revenue during fiscal year 2017.

Part of the services the company delivers in the UK is a leading district heating consultancy. This team has undertaken numerous feasibility appraisals for decentralised energy and heating and cooling networks over the last 30 years. They have delivered projects for central and local government, universities, property developers, housing associations, industrial clients and Energy Service Companies (ESCos). In recent years, the team has delivered feasibility studies for around 40 district heating network schemes, and heat mapping for around 30 Local Authorities. This work includes a number of HNDU funded studies. Using the team’s extensive technical expertise, AECOM will be leading on the application scoring and assessment.

Amberside Advisors Ltd

(Investor Relations)

Amberside Advisors is an independent financial consultancy practice, advising almost all the principal energy/infrastructure investment funds on raising debt and equity capital for large scale energy and infrastructure projects. The Amberside team bring a strong combination of energy infrastructure advisory, debt and equity raising and investment management expertise with a focus on successfully professionalising immature markets to lever in institutional investment alongside earlier forms of capital such as crowdfunded debt and equity. Amberside Advisors will draw on the expertise of other members of the Amberside group to benefit the project at investment stage, using its FCA regulated fund manager, Amberside Capital, and in the operational stage, using its technical consultancy practice, Amberside Energy and its financial management practice, Amberside Accounting.

BDO Ltd

(Financial and Commercial Assessment)

BDO is the world’s fifth largest accountancy network. The UK firm operates from 17 offices, covering all major UK business centres, employing 3,600 people offering tax, audit and assurance advice, and a wide range of consulting and advisory services. Internationally, BDO operates in 162 countries with 74,000 staff in 1,500 offices, generating revenues of $8.1bn.

BDO is a leading advisor on corporate sustainability and commercialisation of clean technology. BDO specialises in feasibility studies, project funding, financial modelling, due diligence, valuation, tax, audit, strategic advisory work, business case development, accounting treatment, procurement support and due diligence. BDO works with the public and private sectors, giving the firm a wellrounded insight and market understanding. BDO will focus on the financial and commercial aspects of project applications, using its range of highly specialised tax, accountancy and other financial advisers as appropriate.

Ecuity Consulting LLP

(Stakeholder Engagement)

Ecuity is a specialist consultancy focused on sustainable energy policy. They are experts in stakeholder engagement and communication operating at the intersection of business, regulation and economics. Operating nationally and internationally, Ecuity has supported over 100 organisations across the past 5 years, assisting with understanding of the energy policy landscape and shaping of messages to key stakeholders.

Ecuity’s team has experience of the heat network sector, working with both industry and policymakers to deliver events and engage key stakeholders over multiple projects. Ecuity will organise and facilitate stakeholder events across the country and disseminate scheme information into the marketplace.

Gemserv

(Application Support)

Gemserv is an expert provider of professional services enabling the energy market transformation and data revolution. They administer numerous programmes and projects within the energy, renewables and smart space for both the private and public sector and support central market codes across the energy and smart meter environment. Using this experience, Gemserv will apply its expertise managing the applications for funding, including the processing and handling of sensitive project qualitative and quantitative data.

Lux Nova Partners Ltd

(Legal Assessment)

Lux Nova Partners is a boutique law firm focussed exclusively on the clean energy sector. The team has advised on numerous district heating and decentralised energy projects over many years, including many of the largest in the UK. They will provide input on the legal aspects of the main scheme including in relation to heat network structuring, procurement and contracts, state aid, due diligence, funding agreements and regulatory issues.

Main Scheme

HNIP funding is available to support the commercialisation and construction stages of a project.

Eligibility

The HNIP main scheme will be open to all applicant types - public, private and third sector[reference iii] in England and/or Wales. In order to be eligible, the heat network must meet the definition set out in the Heat Networks (Metering and Billing) Regulations 2014 [footnote 18] [footnote 19].

The regulations state that district heat network means ‘the distribution of thermal energy in the form of steam, hot water or chilled liquids from a central source of production through a network to multiple buildings or sites for the use of space or process heating, cooling or hot water’.

HNIP funding is available to support the commercialisation and construction stages of a project.

If you are a local authority and your project is in the early stages of project development, it may be worth considering HNDU support. Local authorities can access support from HNDU for heat mapping and master planning, feasibility studies, detailed project development and commercialisation (see detail on page 16 ‘Heat network project development stages supported by HNDU’).

Both HNDU and HNIP offer support for local authorities in the commercialisation phase, however the appropriateness of HNDU and HNIP support will depend on the project. If you are a local authority entering into the commercialisation phase it is recommended that you contact HNDU[reference iv] to discuss the most suitable route and the support available.

Triple Point Heat Networks Investment Management will work with HNDU to ensure a seamless transition between the 2 schemes. For example, where support is being provided to the project by the HNDU, Triple Point Heat Networks Investment Management will be introduced to the project team if, and when, the project becomes sufficiently mature to consider HNIP funding.

Further information about the type of support available from the Triple Point Heat Networks Investment Management is provided on page 20 ‘Applicant support’.

Heat network project development stages supported by HNDU

| Project | Stage detail |

|---|---|

| Heat mapping and planning | - Area-wide exploration, identification and prioritisation of heat network project opportunities. |

| Feasibility study | - Technical feasibility and options appraisal - scheme definition and concept design - detailed techno-economic modelling - development of financial model - initial scheme specific business model/commercial structures options identification & evaluation - delivery programme |

| Detailed project development | - Development of business/commercial model and financing options. - development of outline business case (for public sector this is typically green book compliant depending on scheme size). - development of detailed financial model. - development of procurement strategy. - further scheme design including development of proposed network route, network sizes, and customer connections, development of proposed energy centre solution and location. - costing reviews to improve cost certainty; initial scoping and development of commercial agreements. - soft market testing. |

| Commercialisation | - Reasonable legal costs such as in relation to developing customer commercial agreements, heat supply contracts, necessary land purchase, land access arrangements, etc. - further development of tariff structure for customer contracts. - further development of financial model and business case and associated commercial advice costs where necessary. - Potential for preparatory works depending on scheme needs, assessed on a case by case basis. |

The decision tree below outlines outlines the support available for project sponsors and partners (consultants, contractors, suppliers and investors) throughout a heat network project.

1. Are you the project sponsor?

If yes, contact your Delivery Partner to register your interest and go to step 2.

If no, register as a project partner (consultants, contractors, suppliers and investors) by contacting enquiries@tp-heatnetworks.org. Advice, guidance and networking opportunities are available.

2. Which project phase are you in?

If the project has not started, is in mapping and masterplanning, feasibility study or detailed project development, you may be eligible for HNDU support. Go to step 3.

If the project has reached the stage of commercialisation, you may be eligible for HNIP support. Go to step 4

If the project has reached the construction stage, you may be eligible for HNIP support. Go to step 5.

3. Are you a Local Authority?

If yes, HNDU support is available. Apply for HNDU funding.

If no, HNDU support is not available. You can fund your own early stage project or work with local authority to see if access to HNDU funding is possible.

4. Which sector are you in?

If you’re in the public sector, private sector or third sector, HNIP Commercialisation funding support is available. Go to step 6.

5. Which sector are you in?

If you’re in the public sector, private sector or third sector, HNIP Construction funding support is available. Go to step 6.

6. Carefully read the application guidance materials and work with Triple Point to prepare your application for funding.

Go to step 7.

7. Apply for HNIP funding when the project is ready.

If unsucessful, feedback will be provided and applicants are encouraged to participate in a future funding round.

Once the detailed project development (as outlined above) has been completed, the project has entered commercialisation and may apply for HNIP funding. Investment costs eligible for support under the HNIP scheme include, but are not limited to:

- The building of new heat networks (generation, distribution and customer supply).

- Development of existing heat networks including expansions, refurbishment or the interconnection of existing networks where additional carbon savings can be demonstrated.

- Commercialisation phase and construction costs.

- Building connections (unless these fail the additionality test i.e. planning conditions would have already required the works).

- Works to access recoverable heat[footnote 20].

Applicants can apply for HNIP and combine funding with other government or EU funding schemes if this is allowable under the relevant scheme rules and is compliant with State Aid obligations. HNIP funding cannot be used to fund costs for energy generation plants supported through the Renewables Obligation (RO), a Contract for Difference (CfD) or the Renewable Heat Incentive (RHI). The funding can however be utilised to pay for heat network infrastructure connected to a generation plant.

In order to receive funding, projects must demonstrate that they:

- are viable

- financially (taking account of HNIP funding),

- technically

- commercially

- offer sufficient economic and social benefit

- contribute to the HNIP wider goals for transforming the market

- are a deliverable project

- will deliver genuine carbon savings relative to a counterfactual scheme option

- have a future-proofed design to ensure that expansion and/or carbon savings can continue to be made during their expected lifetime

Please note that details on the above are to be defined in the full guidance that will be published in November.

State Aid

All projects receiving HNIP funding must comply with the rules on State Aid, so funding will not be provided to any project which is not compliant[footnote 21].

Applicants will be required to submit information demonstrating State Aid compliance as part of the application process. Funding awards will be conditional on ongoing compliance with State Aid rules. Guidance will be made available to help applicants check that any State Aid they receive (from HNIP or elsewhere) is used in their projects in a compliant manner, but applicants will remain responsible for ensuring their own compliance throughout the life of their project and so will be expected to be taking appropriate advice, as necessary.

Future Proofed

A future proofed network is one that can play an appropriate part in the energy system and can expand and interconnect over time to facilitate neighbourhood-wide networks and enable commercial aggregation.

If the heat network is not supplied by a near zero carbon heat source, the network should be designed to enable a simple transition to a near zero carbon heat source in the future. A future proofed scheme will take into account future carbon emissions and potential changes in heat source e.g. to a lower carbon technology and expansion opportunities.

Projects will also need to satisfy the minimum eligibility criteria including, but not limited to:

- The heat network is of an eligible type (i.e. heat generated from 75% gas CHP or from 50% renewable, recovered heat or a combination).

- The heat network meets the technical and customer requirements (for example CIBSE ADE Code of Practice CP1:2015[footnote 22], Heat Trust[footnote 23] or equivalent, and metering and billing regulations[footnote 24]).

- Only eligible investment costs are included.

- The heat network demonstrates carbon savings and the heat price will be no more than the counterfactual.

- Evidence is provided of a funding gap at full application and projects pass at least one of the ‘additionality’ tests:

- Economic/financial additionality route (for new networks): The sponsor could not raise the capital, and/or the project financials (i.e. internal rate of return), whilst positive, are not attractive enough to enable funding on the open market or through other available means alone.

- Technical/commercial additionality route (for existing networks and networks directed through planning requirements): Funding for additional technical or commercial features where capital cost is currently a barrier to deployment and for additional features not required through planning obligations.

Applicant Support

Experienced Business Development Managers (“BDMs”) will be on hand to provide guidance throughout the application process. It is envisaged that each applicant will benefit from technical, operational and financial BDM expertise.

Applicants will have access to information that will enable them to submit high quality, robust applications.

BDM support will be available to:

- help projects to understand the scheme’s due diligence, evidence and eligibility requirements

- help ensure project documentation is aligned with HNIP requirements including helping applicants identify any gaps and additional information and work that they may need to address

- help applicants identify gaps or risks associated with the quality and deliverability of the project in advance of an application

- direct applicants to additional sources of funding

- help applicants understand the type of HNIP funding on offer and how it could contribute to the project finance.

- help applicants understand the requirements of the scheme to enable them to make decisions to optimise the commercial structure; and

- support projects exploring other funding opportunities

Applications which meet the eligibility criteria (on page 19 ‘minimum eligibility criteria’) will progress through to assessment. As noted previously, the eligibility criteria will be explained in more detail in the Application Guidance which will be published in November.

Applications which fail to meet the eligibility criteria will be rejected. Explanation will be provided as to why your application was rejected but we will not seek to rectify deficiencies. If the explanation provided is heeded and the deficiencies are addressed, the applicant is actively encouraged to re-submit. Triple Point Heat Networks Investment Management and the BEIS Heat Networks Team are keen to make sure that projects apply when they are ready to do so and that they seek support prior toapplication to avoid disappointment due to insufficient information or duplicated efforts.

In addition to the support from the BDM’s, the BEIS Heat Networks Team, including HNDU, have developed a number of guidance documents to help project developers establish credible and deliverable heat network opportunities. The key documents are summarised at the end of this document.

Applicant Process

Triple Point Heat Networks Investment Management in collaboration with the BEIS Heat Networks Team is in the process of finalising the application process for the main scheme.

It is anticipated that this will:

- allow for applications to be submitted at any time while HNIP funding is still available

- include an initial check or ‘pre-application’ stage to check projects against the minimum eligibility criteria

- determine attractiveness of the project for third party funding

- allow applicants to apply for funding for more than one year, as far as possible, as commercialisation and construction could span multiple financial years; and

- provide constructive feedback to unsuccessful applicants

The assessment process will be run as transparently and objectively as possible. Expert judgements will be made within an agreed framework and all assessments will be subject to internal quality assurance.

While applications are encouraged at any time, the Investment Committee will convene quarterly to appraise and consider applications received in the preceding period ensuring competition. It is a government requirement that the HNIP fund is allocated on a competitive basis to maximise value for money. As such even if your application meets all the eligibility criteria and scores well, there is no guarantee of a funding award.

All applications submitted in a given period that meet all of the eligibility criteria will be assessed. Each application will be scored against the assessment criteria (scoring is discussed in more detail on page 25 ‘Application scoring’). The applications will then be ranked. The ranked applications will be considered by the Investment Committee. Applications that are successful will be notified accordingly. Applications that are unsuccessful will be informed and will receive feedback.

HNIP seeks to fund good projects that require financial support. If your application is unsuccessful we would urge you to consider working to improve your project and your application to participate in a future competition. You should carefully consider how you could improve uponyour original application to meet the eligibility criteria (where your application was rejected) or how to achieve a higher score (where your application was deemed eligible but was not awarded funding). We will provide clear feedback so that you can work further with BDMs on an improved application to submit in a future funding round.

Overview of the proposed HNIP main scheme application process

As noted the application process is being finalised however, the graphic below provides an indication of the potential stages.

Stages in the applications process. Project Sponsor actions are indicated with (PS). Application Assessment are indicated with (AA).

1. Review Application Guidance (PS)

2. Prepare pre-application (PS)

3. Submit pre-application (PS)

4. Assess pre-application including eligibility (AA)

If successful, go to step 5.

If unsuccessful, return to step 2.

5. Development of full application (PS)

6. Submit full application (PS)

7. Score project against assessment criteria (AA)

Determine attractiveness for third party funding (timed project development).

8. Rank applications (AA)

9. Funding decision made by Investment Committee (AA)

If successful, go to step 11.

If unsuccessful, go to step 10.

10. Receive feedback, opportunity to reapply at a later date (PS)

Return to step 5.

11. Issue of offer letters and draft agreements (AA)

12. Review and sign funding agreements (PS)

Steps 1-7: Application support from Business Development Managers prior to and during the application.

Steps 8-12: Business Development Managers support applicant in developing an improved submission based on feedback.

(Please note that the application process is under development and further more detailed guidance will be published shortly. As the funding rounds progress, Triple Point Heat Networks Investment Management will look to continuously approve the process.)

Over the period from October 2016 to May 2017, BEIS ran the HNIP pilot scheme. The primary objective of the HNIP Pilot was to provide learning to be used to maximise the smooth running, impact and value-for-money of the planned main scheme.[footnote 25] The pilot scheme was only open to the public sector. The HNIP pilot policy design and development process took place within compressed timescales which had implications for the application and assessment process. The learnings from the pilot are being used to inform the main scheme. Some of the key lessons from the pilot scheme and things to consider when making an application to HNIP are shown below:

Do

- Read the application guidance & scheme requirements carefully.

- Ensure that it’s the right scheme for your project and that you’re eligible to apply.

- Bear in mind that, if successful, the amount and type of financial support you are offered may differ from those for which you applied.

- Take the time to get your application right. Make sure it addresses the requirements of the scheme.

- Ensure that you are able to provide as much solid technical, financial and commercial data in support of your application as possible and that the bases and assumptions for all projections and e.g. financial models are clearly set out.

- Set out all sources of funding – confirmed and potential – in your application. If you have been offered funding or have documented evidence of e.g. potential loads or private wire deals, then these should be clearly identified.

- Refer to the pilot results presentation on the Salix website, which has examples of evidence and evidence gaps in pilot applications, set against the requirements.

Don’t

- Apply with a project that just isn’t ready. There are rolling funding rounds in HNIP so you will have the time to develop your project to a more mature state before you apply.

- Assume that evidence produced for another purpose answers all of the requirements for HNIP. Information provided e.g. for an internal approval or for an application to another funding stream might meet the requirements but check against the HNIP guidance and provide additional information if needed.

- Forget to include important information e.g. financial data, milestone dates, confirmation of other sources of funding, or contracts/heads of terms.

- Forget to take all public-sector funding for your project into account when you apply. If you have other public funding e.g. from the local authority, ERDF, RHI, these all count towards the State Aids threshold and may impact on your ability to take HNIP funding.

Learning from the HNIP Pilot. Source: BEIS (2018)[footnote 26]

Application Scoring

Once a project has demonstrated that it meets the above eligibility criteria, the application will be scored by Triple Point Heat Networks Investment Management. The key aspects which will be used to score projects are:

- volume of heat delivered

- project carbon savings

- lifetime carbon savings

- deliverability

Evaluation of the HNIP pilot indicated applicants struggled to produce detailed, comparable data on the counterfactualscenario. This made making a consistent comparison across projects more difficult. As part of the assessment process we are therefore intending touse a deemed counterfactual. This means using standard values for the costs and performance of gas boilers and other counterfactual heating technologies. More information will be provided on this as part of the detailed guidance.

The total score will be calculated and divided by the amount of funding support required (Gross Grant Equivalent) so that the process will favour schemes that make the largest impact for the smallest investment of public money.

Scoring criteria

Volume of heat delivered

The volume of heat delivered is the increase in heat supplied over a 15-year period from the planned date for the completion of construction and start of operation of the defined ‘project’. For an extension to an existing heat network, the increase in heat delivered will be the difference between that which would have been delivered by the existing network and that delivered by the extended network. For a new heat network, the delivered heat could be all the heat delivered by the new network to consumers.

Project carbon savings

Projects will be assessed based on their predicted carbon emission savings compared to the counterfactual heating system, over the first 15 years of operation.

Future Decarbonisation and Expansion

Future Decarbonisation and Expansion is the predicted carbon savings over the longer term that the project is aiming to deliver. Such savings could come about through extending the network to connect to more customers and/or a future switch to a different heat generating technology beyond the life of the first technology. As part of this assessment we will expect to see projects providing robust evidence to demonstrate that there is reasonable confidence that these saving will occur.

Deliverability

Deliverability is the likelihood of a project being able to deliver the benefits it is claiming it will within the proposed project timescales. It includes the level of preparation of a scheme across a range of stakeholder, design and business development issues. A deliverable scheme is expected to be more likely to be completed on time and on budget and to have secure future income.

(The details of how the above will be calculated and assessed will be provided in the Assessment Guidance that will be published in November).

Triple Point Heat Networks Investment Management and the Investment Committee will in their absolute and sole discretion assess, score and rank projects when considering eligibility for funding and making funding decisions. BEIS will be a voting member of the Committee and any funding awarded will be subject to the delegated authority set out in the Investment Mandate. The Investment Mandate establishes the parameters on which Triple Point Heat Networks Investment Management has delegated authority to act on behalf of BEIS to award HNIP funding. These parameters are outlined below:

1. Any HNIP award per project must be within the following limits:

a) Grants between £0 and £5 million.

b) Loans between £25,000 and £10 million; and

c) If a combination of grant and loan is awarded as well as complying with points 1(a) and 1(b) the total award must also not exceed a Gross Grant Equivalency of £5million.

2. HNIP awards must be less than 50% of the capital expenditure to be incurred for the construction of the project.

3. Forecast investor returns must be limited as follows:

- Any individual investor return, in any form, may not exceed the HNIP Internal Rate of Return (IRR) Ceiling.

- All other things being equal where alternative financing structures are proposed for an Application, the HNIP Investment Committee must choose the structure that leads to the lowest Gross Grant Equivalent contribution by HNIP.

4. The Delivery Partner cannot provide an award where the Project Social Net Present Value plus the project’s contribution towards the Portfolio Social Net Present Value is less than Zero[reference v].

5. For local authority-controlled projects where the project capex is greater than £2.4m the project must be off the National Accounts, such as through the use of a special purpose vehicle (SPV).

6. No award can be made for transactions which are novel or contentious[footnote 27].

The full list of supporting documentation required to underpin applications is likely to be similar to the pilot and will be developed by BEIS and Triple Point Heat Networks Investment Management. The requirements applicable to the first funding round will be developed and published as part of the scheme guidance in the November. To register for updates, contact: enquiries@tp-heatnetworks.org.

Funding Products

A mix of grant and loans will be available, and it is important to note that applicants may not receive the combination or level requested if it is deemed excessive or an alternative offer presents better value for money for the taxpayer. There are 3 funding mechanisms available; grants, corporate loans, and project loans.

Grants

- There will be a competitive element to the application process, which could influence the grant level.

Loans (Corporate and Project)

- Lending to a credit worthy project sponsor organisation.

- The life of the project concession minus 2 years, up to a maximum of 25 years.

- Below market rates (see the following section on interest rates).

- Fixed rate annuity repayment.

- Principal Repayment starts when the project becomes operational.

- Ranked equally with other lenders.

In addition to the above, Project loans have the following additional features:

- Secured lending direct to a project company without recourse.

- Project Loans will include a Connection Delay feature.

- In the event key customers fail to materialise for reasons beyond the operator’s control – and project cash flows suffer, the borrower may annually request an interest and repayment Grace period up to a maximum 3 years. A project Debt Service Cover Ratio (DSCR) test of 1.4x will apply.

- If the Connection Delay feature is used then repayments are recalculated to recover the money owed, but over the remaining loan life.

- This Connection Delay feature can only be triggered within the first 10 years of the loan.

HNIP Loan Interest Rates

The interest rate applicable on the loans is regulated by EU State Aid rules and guidance. HNIP is a State Aid program designed to provide an economic benefit to the recipients of these loans.

The terms of the corporate loan and the project loan will be more favourable than those generally available in the market. This generates a State Aid benefit and is designed to enhance the financial viability of the applicant’s scheme.

The corporate loan interest rate is 0.25% as at 1 October 2018, and this will periodically change over time in line with movements in the EU published Base Rate[footnote 28] for the UK (which is 1.00% as of 1 October 2018), and in line with any changes in the BEIS applied interest rate discount. Neither loan rate will fall below 0.01%. The project loan interest rate is 4.00% as at 1 October 2018.

This interest rate might also change with movements in the EU published Base Rate and with the BEIS applied discount.

Revisions to the interest rates will be published and notified to applicants.

Other Loan Terms

The economic benefit provided through a loan is aproximately 20% of that provided by an equivalent sized grant but obviously depends on individual circumstances and will be calculated and reported to the EU on a case by case basis. The interest rate on all loans is fixed on the date the loan is drawn (funds transferred) and is fixed for the life of the loan, which is up to 25 years.

Guidance documents

The BEIS Heat Networks Team has developed a series of guidance documents for potential project sponsors.

A repository of these documents can be found in the link below: www.gov.uk/government/collections/heat-networks-guidance-for-developers-and-the-supply-chain

The key documents are summarised below:

| Title | Summary description |

|---|---|

| Heat Networks detailed project development[footnote 29] | This is a set of 4 core guidance documents designed to help develop an HMT Green Book compliant Outline Business Case. It looks at Strategic, Commercial, Economic and Financial cases, as well as exploring high level public sector procurement law considerations and State Aid. It also provides some high level template Heads of Terms of core contracts that will often need to be entered into to develop a heat network. |

| Stakeholder engagement in heat networks: a guide for project managers[footnote 30] | This document provides a road map, for Local Authority led schemes, on how, when and with whom to engage as a project is developed. Stakeholder engagement (both internal and external) if done well can be the difference between a successful and unsuccessful scheme. Knowing how and when to engage with a variety of stakeholders is an important part of project development. |

| Heat Network Electricity Revenues and Licencing[footnote 31] | This document provides a detailed analysis of the electricity sector and the way in which embedded CHP generation can be enhanced to access wider revenue streams. It sets out the routes to market for this technology as well as the potential costs, risks and rewards associated with different approaches. |

| Heat Networks: Procuring Finance[footnote 32] | Legal advisers Womble Bond Dickinson were commissioned to explore the public sector procurement law considerations relevant for engaging with private sector investors. To the extent that third party investment is being considered and either the project sponsor is a public sector body or proposed anchor customers are public sector, this guidance provides insights into the procurement exercises that will be needed. This should better enable procurement planning to be embedded in the project’s development reducing the likelihood of unforeseen delays arising through procurement law. |

| Financing Heat Networks in the UK: guidebook[footnote 33] | This guidebook has been developed by Grant Thornton and builds on the financial case work explored in the DPD guidance. It considers: delivery structures (including risk/ reward allocation), funding sources, tax, accounting and relevant case studies in both the public and private sectors. |

| Optimisation of heat networks: issues for project sponsors to consider[footnote 34] | This guidance is for project sponsors or owner-operators who are developing a heat network scheme and may be thinking about taking their project to market or applying for HNIP funding. It considers some of the appropriate evidence that is required to give projects the best chance of success. |

Glossary

Definitions are provided in order of appearance.

Carbon savings: a reduction in Carbon Dioxide (CO2) emissions. Carbon savings can be elicited through using lower or zero carbon emitting heating sources or more efficient processes.

Capital Funding: money that lenders provide to a business. With relation to the Heat Networks Investment Project, capital funding is being provided by BEIS to successful applicants in order to support the commercialisation and construction of heat networks.

Gap funding (sometimes referred to as gap financing): the provision of an interim loan or grant to finance the difference between the available project finance and what is required in order for a project to go ahead.

Project sponsors: Entities initiating development of a heat network and/or providing a source of funding. Includes property developers, Local Authorities, universities, business park owners, leisure centres, schools, commercial/social landlords, community organisations, charities etc.

Clean growth: a means to achieve economic growth, using clean technology, and allowing sustainable development. Clean growth aims to increase standards of living and Gross Domestic Profit (GDP) whilst simultaneously reducing emissions and mitigating environmental impacts or economic growth.

Investment mandate: statement of aims and investment policy, including without limitation, any applicable limits on investment that may be made by the HNIP Investment Committee. This is outlined in more detail in the Scoring and Ranking chapter.

Commercialisation: a project development stage in which the project sponsor contractually secures investment and future revenues. A partner is procured and appointed (where required) and relevant permissions and permit are obtained. Following financial and contractual negotiations, any technical changes are made, in order to develop a full business case for the Project. This may include detailed design, if delivery were to be contracted as a build (and operate).

Construction: construction begins at the earlier of the following points: 1) When work has begun on site; or 2) Funding is committed for products or services related to the deliver of the project.

Outline Business Case: sets out the preliminary thoughts regarding a proposed project (including envisaged outcomes, benefits and potential risks associated with the proposal). As such, it typically contains the information needed to help decide whether or not to adopt or pursue the project.

Renewables Obligation (RO): places an obligation on UK electricity suppliers to source an increasing proportion of the electricity they supply from renewable sources.

Renewable Heat Incentive (RHI): UK Government scheme set up to encourage uptake of renewable heat technologies amongst householders, communities and businesses through financial incentives.

Counterfactual: a counterfactual heating solution refers to the default heating system that would be installed for householders or businesses without any policy intervention.

Additionality: an impact arising from government intervention in the market is additional if it would not have occurred in the absence of the intervention. HNIP projects will only be funded where they can demonstrate that the support would be additional, because the predicted returns on investment would fall below a reasonable threshold level.

Due diligence: an investigation or audit of a potential investment or product to confirm all facts and assess risks, such as reviewing all financial records, plus anything else deemed material.

Gross Grant Equivalent: For loans, this is calculated as the equivalent amount in £ to a grant, for state aid reporting and value for money assessment purposes.

Internal rate of return (IRR): the rate of growth a project is expected to generate, serving as a metric used in budgeting to estimate the profitability of potential investments.

Social Net Present Value (social NPV): the value of a heat network project to society as a whole by quantifying a wide range of benefits and costs.

Connection Delay: delays in connecting customers or businesses connecting to the heat networks, resulting in them being without power.

Debt Service Cover Ratio (DSCR): A measure of the cash flow available to pay current debt obligations.

Key milestones

-

Delivery Partner appointed (September 2018)

– Mobilisation period -

Scheme Launch (October 2018)

– Development of guidance documents

– Register interest in applying -

Publication of guidance materials (November 2018)

– Project sponsors can seek support from BDMs

– Engagement with investor community -

Application process launch (January 2019)

– Projects can apply (open process)

– Regional application workshops -

First funding decision (April 2019)

– Investment Committee will meet quarterly -

Application process continuously open

– Projects to apply when they are ready -

HNIP application period closed (December 2021)

– Applications will no longer be considered -

Close of HNIP main scheme (March 2022)

– Last potential allocation of funding

Further information

To register for updates from Triple Point Heat Networks Investment Management and to join the HNIP mailing list contact: enquiries@tp-heatnetworks.org

For more information about Triple Point Heat Networks Investment Management visit: www.tp-heatnetworks.org

Throughout the main scheme, Triple Point Heat Networks Investment Management will be hosting a series of stakeholder events and application workshops across England and Wales. To register your interest in one of our events contact: enquiries@tp-heatnetworks.org

BEIS guidance and scheme background information:

Key contacts:

- Triple Point Heat Networks Investment Management: enquiries@tp-heatnetworks.org

- Heat Networks Delivery Unit: hndu@beis.gov.uk

- BEIS Heat Networks Team: heatnetworks@beis.gov.uk

References

i. A HNIP pilot scheme has already offered £18.5m of funding support to 8 projects. ↩

ii. Between 19 April and 11 June 2018, the government conducted an Invitation to Tender to procure a Delivery Partner to deliver the main HNIP scheme. ↩

iii. Note that HNIP is not available for central government departments ↩

iv. Contact HNDU at hndu@beis.gov.uk ↩

v. As HNIP is seeking to transform the heat networks market the benefits from the project are wider than those of individual projects. These wider benefits (for example, the benefit of reducing costs through learning by doing) will be estimated using an established methodology. Projects will be apportioned an element of these wider benefits based on their volume heat demand served. ↩

Footnotes

-

The Association for Decentralised Energy (2018) Bringing Energy Together, Market Report: Heat Networks in the UK. ↩

-

Department for Business, Energy and Industrial Strategy (2017) Clean Growth Strategy. ↩

-

Department for Business, Energy and Industrial Strategy (2018) Heat network metering and billing regulations: compliance and guidance. ↩

-

UK Government (2017) Final UK greenhouse gas emissions national statistics, 1990-2015. ↩

-

Department for Business, Energy and Industrial Strategy (2017) Clean Growth Strategy. ↩

-

Department for Business, Energy and Industrial Strategy (2017) Clean Growth Strategy. ↩

-

Competition and Markets Authority (2017) Heat Networks Market Study. ↩

-

Department for Business, Energy and Industrial Strategy (2017) Heat Networks Consumer Survey. ↩

-

Department for Business, Energy and Industrial Strategy (2017) Clean Growth Strategy: Heat networks delivery unit. ↩

-

Department for Business, Energy and Industrial Strategy (2017) Heat Networks Investment Project. ↩

-

Department for Business, Energy and Industrial Strategy (2018) Evaluation of the Heat Networks Investment Project pilot scheme. ↩

-

The Association for Decentralised Energy & CIBSE (2016) Code of practice for Heat Networks. ↩

-

Department for Business, Energy and Industrial Strategy (2018) Heat network metering and billing regulations: compliance and guidance. ↩

-

UK Government (2014) The Heat Network (Metering and Billing) Regulations ↩

-

Department for Business, Energy and Industrial Strategy (2018) Heat network metering and billing regulations: compliance and guidance ↩

-

UK Government (2014) The Heat Network (Metering and Billing) Regulations. ↩

-

Department of Energy and Climate Change (2014) The potential for recovering and using surplus heat from industry. ↩

-

Department for Business, Energy and Industrial Strategy, UK Government, and Salix. (2016) Heat Networks Investment Project Pilot: Application guidance’ October 2016; Section 6.3 and Annex C ↩

-

The Association for Decentralised Energy & CIBSE (2016) Code of practice for Heat Networks. ↩

-

Department for Business, Energy and Industrial Strategy (2018) Heat network metering and billing regulations: compliance and guidance ↩

-

Department for Business, Energy and Industrial Strategy (2018) Heat Networks Investment Project Evaluation. Pilot Process Evaluation Report. ↩

-

Department for Business, Energy and Industrial Strategy (2018) Learning from the pilot. ↩

-

UK Government (2012) Managing public money. ↩

-

European Commission (2018) State Aid: Published Base Rate. ↩

-

Department for Business, Energy and Industrial Strategy (2018) Heat network detailed project development. ↩

-

Department for Business, Energy and Industrial Strategy and Carbon Trust (2018) Stakeholder engagement in Heat Networks. ↩

-

Cornwall and Lux Nova Partners (2018) Heat Network electricity revenues and licencing. ↩

-

Womble Bond Dickinson (2018) Heat Networks: procuring finance. ↩

-

Grant Thornton (2018) Financing heat networks in the UK: guidebook ↩

-

Department for Business, Energy and Industrial Strategy and Ecuity Consulting LLP (2018) Optimisation of heat networks: issues for project sponsors to consider. ↩