Accountability report

Published 18 July 2023

Applies to England and Wales

Corporate governance report

Directors’ report

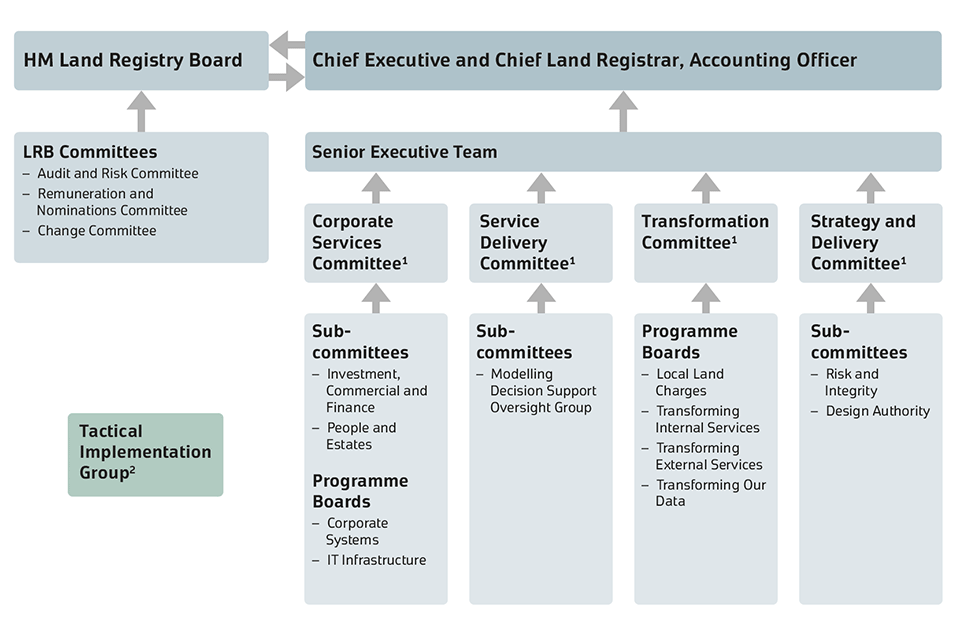

This section sets out the membership of our key directing boards and committees and explains their responsibilities.

Our governance structure

HM Land Registry has a two-layered system of governance. During 2022-23 HM Land Registry made some changes to both of these layers:

- HM Land Registry Board (composed of non-executive board members and executive directors). Supported by: Audit and Risk Committee

- Remuneration and Nominations Committee

-

Change Committee (established in January 2023)

- HM Land Registry Senior Executive Committees (set up in 2023 to replace a single Executive Board, members of the Senior Executive Committees comprise the Senior Executive Team). Corporate Services Senior Executive Committee

- Service Delivery Senior Executive Committee

- Strategy and Delivery Senior Executive Committee

- Transformation Senior Executive Committee

In addition the Tactical Implementation Group (TIG) is a separate body which will plan and implement events or activities that require cross-organisation coordination and cooperation beyond that which is readily achievable via normal management arrangements. The TIG is brought into action at the direction of a Senior Executive Committee (SEC) or the Senior Executive Team (SET).

This structure enables non-executive board members to provide appropriate challenge to the SET while enabling the SET to make effective decisions on the day-to-day running of HM Land Registry.

- Members of the Senior Executive Committees form part of the Senior Executive Team.

- The Senior Executive Team can also call into action the Tactical Implementation Group if required.

HM Land Registry Board

The role and responsibilities of the HM Land Registry Board (LRB/the Board)) are set out in the Framework agreed with the Department for Business, Energy and Industrial Strategy (BEIS). (The Department for Business, Energy and Industrial Strategy was HM Land Registry’s sponsoring department until Machinery of Government changes took place in February 2023.) The Framework will be reviewed as part of the further Machinery of Government change that made HM Land Registry a partner organisation of the Department for Levelling Up Housing and Communities from 1 June 2023.

The purpose of the Board is to support, constructively challenge and provide advice and guidance to the Chief Executive and Chief Land Registrar (CE&CLR) and their supporting SET. LRB supports senior management in setting the strategic vision of HM Land Registry and in ensuring the activities that contribute towards that vision. Its main objectives are to:

- advise and agree on the long-term vision, the medium-term business strategy, the annual budget and key performance indicators (KPIs);

- review financial and operational performance;

- monitor market developments for opportunities and consider any strategic risks faced by the organisation, ensuring adequate systems and controls are in place;

- ensure compliance with all statutory requirements;

- ensure the organisation employs best practice in respect of corporate governance; and

- ensure that effective relationships are maintained with shareholders, customers, suppliers, employees and government departments.

LRB is supported by its Audit and Risk Committee, Remuneration and Nominations Committee and Change Committee. Further details about these Committees can be found on the following pages.

LRB contains a mix of executive directors and non-executive board members. The non-executive board members of LRB are highly skilled, with appropriate experience in relevant fields to support and challenge the Executive Board. Following an open recruitment process a new Chair was appointed to the Board in September 2022.

The non-executive board members are independent of management. All board members are required to sign an annual statement recording any potential conflict of interests and declare any new interests in the interim. A central ‘Register of Interests’ record is retained and is shared annually with the Audit and Risk Committee. See note 17 to the accounts on page 119 for related party disclosures.

Between February-June 2022, LRB underwent an independent external assessment of its effectiveness. The final report was published in July 2022 and the Board had a special meeting to discuss the recommendations and actions in September 2022. The report concluded that overall LRB displayed the attributes of an effective Board including a Board that was agile and responsive, open and transparent and focused on continual improvement of governance arrangements. A number of recommendations were made and many have been implemented over the course of the year. Progress against these recommendations continues to be monitored. LRB will undergo an internal effectiveness evaluation in June and July 2023 which will follow up on the external evaluation.

Neil Sachdev, Non-executive Chair

Neil joined the Board in September 2022. He is also currently Chair of the East West Railway Company (EWR Co), overseeing the delivery of a new direct rail link between Oxford and Cambridge, as well as Chairman of the Defence Infrastructure Organisation Board for the Ministry of Defence. He is also a Non- Executive Director of Network Rail Property Limited.

Neil has also previously held a variety of senior leadership positions in the energy, property and retail sectors.

Simon Hayes , Chief Executive and Chief Land Registrar

Simon joined in November 2019. Previously Simon held several senior positions at the Home Office, including the UK Border Agency’s first Regional Director for the Americas, the UK Visas and Immigration (UKVI)’s International Director and finally the Director of Visas & Citizenship at UKVI. Simon’s responsibilities included setting up the EU Settlement Scheme for European citizens residing in the UK.

Angela Morrison, Non-executive Board Member

Angela is Chief Operating Officer at Cancer Research UK (CRUK) where she is responsible for Finance, HR, Technology and Corporate Services. Prior to joining CRUK Angela was Retail, Supply Chain and Technology Director at Debenhams as well as holding roles at J Sainsbury plc, Direct Line Group and ASDA Walmart.

Jeremy Pee, Non-executive Board Member

Jeremy is the Chief Digital Officer at Marks & Spencer. Previously he was the Senior Vice President of Loblaw Digital, the digital unit of Canada’s leading retailer. Jeremy has a Master’s in Business Administration (MBA) from Harvard Business School and a degree in engineering from University of Waterloo.

Ann Henshaw, Non-executive Board Member and Chair of the Remuneration and Nominations Committee

Ann has extensive experience in human resources (HR), having worked at several major companies across a variety of sectors, including property, both in the UK and internationally. She was HR Director at British Land before retiring in May 2022. Other roles include serving as Group HR Director at Clear Channel International and HR Director at EDF Energy.

Katy Baldwin, Non-executive Board Member, UKGI (nominated representative of the BEIS Secretary of State)

Katy joined the Board in 2021 as an Executive Director at UK Government Investments (UKGI), the Government’s centre of excellence in corporate finance and corporate governance. She is a civil servant, previously with the Department for Levelling Up, Housing and Communities, with significant experience of public spending, local government finance and housing and planning policy.

Elliot Jordan, Non-executive Board Member and Chair of Audit and Risk Committee

Elliot is Chief Financial Officer and member of the Executive Board of Farfetch, the leading global platform for luxury fashion. He is responsible for the finance, legal, strategy and human resource teams across the global operation. He is also the executive sponsor of Diversity and Inclusion. Prior to joining Farfetch, Elliot held positions at ASOS plc, J Sainsbury plc, Credit Suisse and KPMG.

Kirsty Cooper, Non-executive Board Member and Senior Independent Board Member

Kirsty is General Counsel and Company Secretary for Aviva. She established Aviva’s first global leadership team and has responsibility for public policy and corporate responsibility. Kirsty is on the General Counsel Legal 500 Powerlist and is also a trustee of the Royal Opera House.

Iain Banfield, Chief Financial Officer

Iain joined in February 2019. Prior to this he spent two and a half years in the Department for International Trade, first as Deputy Director for Strategic Finance and then acting Finance Director. Previously Iain has been the Finance Director for UK Trade & Investment and held roles in the Shareholder Executive and the Department for Business, Innovation and Skills.

Mike Harlow, General Counsel, Deputy Chief Executive and Deputy Chief Land Registrar

Mike joined in February 2018. He graduated from Imperial College in mechanical engineering before converting to law. He then worked as a solicitor in London for 15 years, acting for commercial property clients, and 11 years at English Heritage as its Legal Director and Corporate Secretary. He gained board-level experience of organisational change and heritage law and policy reform.

| LRB membership | |

|---|---|

| Non-executive | |

| Neil Sachdev | Non-executive Chair |

| Katy Baldwin | Non-executive Board Member, UK Government Investments (nominated representative of the BEIS Secretary of State) (from 6 October 2021) |

| Kirsty Cooper | Non-executive Board Member and Senior Independent Board Member, Interim Chair of Remunerations and Nominations Committee (RemCo) (to 31 May 2021) |

| Ann Henshaw | Non-executive Board Member (from 1 June 2021) |

| Elliot Jordan | Non-executive Board Member and Chair of Audit and Risk Committee |

| Angela Morrison | Non-executive Board Member |

| Jeremy Pee | Non-executive Board Member (from 1 June 2021) |

| Executive | |

| Simon Hayes | Chief Executive and Chief Land Registrar |

| Iain Banfield | Chief Financial Officer |

| Mike Harlow | Deputy Chief Executive and Director of Customer and Strategy |

A year in focus

During 2022-23 matters covered by the LRB included:

- business planning, budget and performance framework, including revision of priorities throughout the reporting year, strategic oversight of the Spending Review and annual business planning;

- service delivery improvement and performance;

- transformation progress, prioritisation and planning;

- the ongoing transferrals of local land charges registers from local authorities to HM Land Registry;

- consideration of HM Land Registry’s risk appetite;

- the launch and implementation of an ambitious new business strategy published in August 2022;

- HM Land Registry’s approach to environmental, social and governance including Net Zero;

- Civil Service People Survey 2022 results, evaluation of the culture and ways of working across the organisation, consideration of talent development within the organisation; and

- internal governance arrangements.

Board meetings

LRB met seven times in 2022-23. Meetings took place in-person, virtually and in hybrid setting with participants meeting in person and online. LRB has returned to its pre-pandemic practice of visiting different office locations which allows for wider staff engagement. In September 2022 the Board decided to change the nature of its meetings to allow more time for strategic discussions that better inform formal decision-making. The Board now holds a formal governance meeting every other month, and on the months in between the Board holds a strategic discussion session. No decision-making takes place at the strategic sessions.

Engaging with stakeholders

Engaging with stakeholders is a key part of ensuring LRB are well informed.

- The Chair engaged regularly with the Geospatial Commission and Board members meet regularly with the six core Geospatial Commission partner bodies.

- The Chair and Chief Executive and Chief Land Registrar regularly engage with the Minister of their sponsoring department. This was the Department for Business, Energy and Industrial Strategy until Machinery of Government changes established the Department for Business and Trade.

- Quarterly meetings took place between the Chair, Chief Executive and Chief Land Registrar and Chief Financial Officer with UK Government Investments (UKGI), including informal meetings in between, to discuss governance, financial performance and other relevant matters as set out in the Framework.

- Members of the Board engaged with their counterparts at other government departments such as HM Treasury and the Department for Levelling Up, Housing and Communities as required.

- Members of the Board regularly met market stakeholders who are members of the Land Registry Advisory Council and Industry Forum and drew upon their knowledge and expertise, tested ideas, shared information and discussed land and property-related issues.

Committees of the HM Land Registry Board

Audit and Risk Committee

The Audit and Risk Committee met four times in 2022- 23. The Audit and Risk Committee supports LRB and the CE&CLR by monitoring and reviewing the effectiveness of HM Land Registry’s risk, assurance and audit activity. The Audit and Risk Committee updates the Board on progress of the committee’s work and escalates any issues that require the Board’s attention.

At every meeting, the Audit and Risk Committee sees an overall risk report incorporating the risk register and detailed reporting on issues like cyber security. At each meeting the committee also receives a more detailed risk management report of at least two Principal Risks, so that over time all the Principal Risks are given a detailed review.

During 2022-23 matters covered by the Audit and Risk Committee included:

- oversight and input into the development of the risk and assurance framework, maturity plans, risk taxonomy and the risk appetite statement;

- monitoring and challenge of HM Land Registry’s Principal Risks;

- oversight and input into the development and monitoring of a three-year internal audit plan, refreshed annually;

- oversight of and challenge to internal governance structures;

- oversight of and challenge to data and register quality;

- oversight of and challenge to the indemnity fund provision;

- monitoring and challenging fraud controls and the counter fraud strategy;

- consideration and challenge of key financial judgements; and

- review of the Independent Complaints’ Reviewer Annual Report for HM Land Registry, and HM Land Registry’s response to the report.

| Audit and Risk Committee membership | |

|---|---|

| Elliot Jordan | Non-executive Board Member and Chair of Audit and Risk Committee |

| Katy Baldwin | Non-executive Board Member, UK Government Investments (nominated representative of the BEIS Secretary of State) |

| Angela Morrison | Non-executive Board Member |

| Attendees | |

| Iain Banfield | Chief Financial Officer |

| Harnaik Dhillon | Head of Internal Audit |

| Mike Harlow | Deputy Chief Executive and Director of Customer and Strategy |

| Simon Hayes | Chief Executive and Chief Land Registrar |

| Joanna Horrocks- Potts |

Deputy Director, Risk and Assurance |

| Representative of the National Audit Office |

National Audit Office |

Remuneration and Nominations Committee

The Remuneration and Nominations Committee met three times in 2022-23. The committee ensures that remuneration and nomination arrangements support HM Land Registry’s aims and oversees the recruitment, retention and performance of the executive directors and other Senior Civil Servants in line with Civil Service pay policies. The Remuneration and Nominations Committee provides an update to the Board after every meeting.

During 2022-23 the main matters covered by the Remuneration and Nominations Committee included:

- performance of the Chief Executive and Chief Land Registrar;

- Senior Civil Service performance and pay;

- senior leadership structure, development and succession planning; and

- gender and other pay gap reporting.

| Remuneration and Nominations Committee membership |

|

|---|---|

| Ann Henshaw | Chair of the Remuneration and Nominations Committee and Nonexecutive Board Member |

| Katy Baldwin | Non-executive Board Member, UK Government Investments (nominated representative of the BEIS Secretary of State) |

| Kirsty Cooper | Interim Chair of the Remuneration and Nominations Committee (from 8 January 2021) Non-executive Board member |

| Simon Hayes | Chief Executive and Chief Land Registrar |

| Simon Morris | Director of Human Resources |

Change Committee

The Change Committee was commissioned by LRB at the end of 2022 and met for the first time in January 2023. The Committee supports the Board in ensuring that HM Land Registry’s transformation plans remain aligned to its strategic ambitions and can be delivered effectively.

In 2023 the Change Committee reviewed:

- HM Land Registry’s overarching transformation programme;

- HM Land Registry’s approach to transforming internal services, external services, and HM Land Registry’s data; and

- the Committee’s objectives and goals.

| Change Committee membership | |

|---|---|

| Jeremy Pee | Chair of the Change Committee and Non-executive Board member |

| Katy Baldwin | Non-executive Board Member, UK Government Investments (nominated representative of the BEIS Secretary of State) |

| Iain Banfield | Chief Financial Officer |

| Simon Hayes | Chief Executive and Chief Land Registrar |

| Angela Morrison | Non-executive Board Member |

| Jon Parry | Director of Technology and Digital Services |

Attendance schedule for LRB, Audit and Risk Committee, and Remuneration and Nominations Committee

| Name | Title | Period* | Board LRB |

Committee | ||

|---|---|---|---|---|---|---|

| Audit | Remuneration | Change | ||||

| Non-executive board members |

||||||

| Neil Sachdev | Non-executive Chair | From September 2022 | 5/5 | - | - | - |

| Michael Mire | Non-executive Chair | Until August 2022 | 2/2 | - | - | - |

| Katy Baldwin | Non-executive Board Member, UKGI representative |

6/7 | 3/3 | 3/3 | 1/1 | |

| Kirsty Cooper | Non-executive Board Member and Senior Independent Board Member |

6/7 | - | 3/3 | - | |

| Ann Henshaw | Non-executive Board Member and Chair of Audit and Risk Committee |

7/7 | - | 3/3 | - | |

| Elliot Jordan | Non-executive Board Member and Chair of Audit and Risk Committee |

5/7 | 4/4 | - | - | |

| Angela Morrison | Non-executive Board Member | 7/7 | 4/4 | - | 1/1 | |

| Jeremy Pee | Non-executive Board Member and Chair of Audit and Risk Committee |

7/7 | - | - | 1/1 | |

| Executive directors | ||||||

| Simon Hayes | Chief Executive and Chief Land Registrar |

7/7 | 4/4 | 3/3 | 1/1 | |

| Iain Banfield | Chief Financial Officer | 5/7 | 3/4 | - | 1/1 | |

| Mike Harlow | General Counsel, Deputy Chief Executive and Deputy Chief Land Registrar |

6/7 | 4/4 | - | 1/1 | |

| Chris Pope | Chief Operations Officer | To November 2022 | 4/5 | - | - | 1/1 |

| Simon Morris | Director of Human Resources | - | - | 3/3 | 1/1 | |

| Jon Parry | Director of Technology and Digital Services |

- | - | - | 1/1 | |

*appointment relates to the whole of the reporting year unless otherwise specified.

Senior Executive Committees and the Senior Executive Team

HM Land Registry’s internal governance structures were transformed during 2022-23. The structure changed from a single Executive Board (EXB) to four Senior Executive Committees (SEC):

- Corporate Services Senior Executive Committee

- Service Delivery Senior Executive Committee

- Strategy and Delivery Senior Executive Committee

- Transformation Senior Executive Committee

The Chief Executive and Chief Land Registrar chairs all of the Senior Executive Committees. While EXB comprised of Executive Directors only, the SECs are comprised of a broader Senior Executive Team (SET) as detailed below. Through the mechanism of individual letters of delegation, members of the Senior Executive Team handle the day-to-day running of HM Land Registry. Until the end of December 2022 the EXB met twice a week. Since January 2023 each SEC meets once a month. The SET meets monthly to discuss challenges and share opportunities and updates outside of the governance structure. Most SEC and SET meetings have taken place in person with hybrid participation enabling virtual attendance when required. SEC and SET meetings have taken place at HM Land Registry offices across the country.

The Corporate Services SEC oversees corporate services performance delivery and takes decisions on services and organisation design specific to corporate services, ensuring alignment with Business Plan and Strategy, including pay awards and pay strategy, workplace strategy, commercial strategy, HR policies, stewardship of the Heads of Profession and Government Functions coordination, technology services and strategies, and Environment, Social and Governance planning.

The Service Delivery SEC has responsibility for overseeing and taking decisions on service performance delivery, including casework, and takes decisions on services and organisation design specific to performance and service delivery. Service Delivery SEC identifies and resolves issues affecting HM Land Registry’s ability to meet published key performance indicators.

The Strategy and Delivery SEC provides strategic direction for HM Land Registry including long-term fees and charging strategy and strategic workforce plan.

This committee is responsible for leading and managing the delivery of HM Land Registry’s approved Business Strategy and its impact on the economy, customers and stakeholders. On a quarterly basis Strategy and Delivery SEC reviews the principal risks of the organisation. The outcomes of these discussions are then reported to and considered by the Audit and Risk Committee of the HM Land Registry Board.

Transformation SEC oversees the transformation portfolio performance delivery and takes decisions on services and organisation design specific to transformation. The purpose of these meetings is to oversee the delivery of operational and digital change within the organisation through oversight of delivery programmes and projects, their strategic alignment, benefits, risks and finance.

The Tactical Implementation Group (TIG) plans and implements, events or activities that require cross-organisation coordination and cooperation beyond that which is readily achievable via normal management arrangements. The TIG is brought into action at the direction of an SEC or the SET.

The Senior Executive Team has continued to work with the wider ‘Leadership Group’ to develop a broader leadership team by establishing weekly performance discussions and ‘lunch and learn’ sessions to pick up specific topics.

| HM Land Registry Senior Executive Team | Corporate Services Senior Executive Committee |

Service Delivery Senior Executive Committee |

Strategy and Delivery Senior Executive Committee |

Transformation Senior Executive Committee |

|

|---|---|---|---|---|---|

| Simon Hayes | Chief Executive and Chief Land Registrar |

Chair | Chair | Chair | Chair |

| Stephen Aynsley-Smith | Deputy Chief Financial Officer | Member | – | – | – |

| Iain Banfield | Chief Financial Officer | Member | Member | Member | Member |

| Angie Clarkson | Director of Service Delivery | – | Member | – | – |

| Emily d’Albuquerque | General Counsel and Interim Director of Data & Register Integrity Group |

Regular Attendee |

Member | Member | Regular Attendee |

| Eddie Davies | Deputy Director of Digital Services | – | – | – | Member |

| Clare Delaney | Deputy Director of the Design Hub and Transforming External Services Programme Senior Responsible Officer |

– | Member | – | Member |

| Kirsty Eales | Digital and Data Programme Director |

– | – | – | Member |

| Francis Gough | Director of Service Delivery | – | Member | – | Member |

| Mike Harlow | Deputy Chief Executive and Deputy Chief Land Registrar and Director of Customer and Strategy Group |

Member | Member | Member | Member |

| Joanna Horrocks-Potts | Deputy Director for Risk and Assurance |

Regular Attendee |

Regular Attendee |

Regular Attendee |

Regular Attendee |

| Cathy Jenkins | Chief of Staff | Regular Attendee |

Regular Attendee |

Regular Attendee |

Regular Attendee |

| Mark Kelso | Programme Director of Local Land Charges |

– | – | – | Member |

| Gemma McNally | Deputy Director of Strategic Planning and Performance |

Regular Attendee |

Regular Attendee |

Regular Attendee |

Regular Attendee |

| Simon Morris | Director of Human Resources | Member | – | – | – |

| Lynne Nicholson | Lead Product Manager - Data | – | – | – | – |

| Jon Parry | Interim Director of Technology and Digital Services |

Member | – | Member | Member |

| Ronal Patel | Head of Corporate Communications |

Regular Attendee |

Regular Attendee |

Regular Attendee |

Regular Attendee |

| Steve Philips | Deputy Directory of Technology | Member | – | – | – |

| Terry Robertson | Deputy Director of Strategy | – | – | Member | – |

| Andrew Trigg | Chief Geospatial and Data Officer and Transforming our Data Programme senior Responsible Officer |

– | – | – | Member |

| Annie Wareham | Deputy Director of Portfolio Delivery | – | – | – | Member |

| Caley Zappacosta | Director of the Delivery Unit | – | Member | Member | Member |

Other executive committees and panels

Three committees, six programme boards, one group and one authority report into the Senior Executive Committees. These were reviewed and refreshed during 2022-23 to bring them in line with best practice, to ensure clear accountability and to better meet the needs of the Senior Executive Team. They now comprise:

- Corporate Services Senior Executive Committee Investment, Commercial and Finance Committee

- People and Estates Committee

- Corporate Systems Programme Board

-

IT Infrastructure Programme Board

-

Service Delivery Senior Executive Committee Modelling Decision Support Oversight Group

- Strategy and Delivery Senior Executive Committee Risk and Integrity Committee

-

Design Authority

- Transformation Senior Executive Committee Local Land Charges Programme Board

- Transforming Internal Services Programme Board

- Transforming External Services Programme Board

- Transforming Our Data Programme Board

The bodies listed above meet regularly throughout the year and report back to their respective Senior Executive Committee after every meeting. Membership of these bodies is composed of senior leaders from across the organisation. These bodies are further supported by a number of working groups on specific items such as diversity and inclusion, health and safety, counter-fraud and security and resilience.

In addition to the Senior Executive Committee and other governance bodies detailed above, HM Land Registry also has a Tactical Implementation Group. This group meets as required, at the Senior Executive Team’s direction, to plan and implement events/activities that require cross-organisation coordination beyond that which is readily achievable via normal management arrangements. The group were not required to meet in 2022-23.

Security incidents

Security is overseen by the Security team. There were 17 physical security incidents during the year and none of those were for significant (Class 1) incidents. Class 1 incidents cover matters such as injury to a staff member or third party, major property damage, major theft or breach of system. There were 67 minor cyber security incidents during the year and of those, none were significant (class 1) incidents. Security team provides a quarterly Security Assurance Report to the Risk and Integrity Committee (RIC) and Audit and Risk Committee to update senior managers on security risk and controls.

Personal data-related incidents

There were three data-related incidents reported to the Information Commissioner’s Office (ICO) during this reporting period. The ICO determined that no further action was required by them in relation to the incidents reported.

Statement of Accounting Officer’s responsibilities

Resource Accounts

Under the Government Resource and Accounts Act 2000, HM Treasury has directed HM Land Registry to prepare, for each financial year, resource accounts detailing the resources acquired, held or disposed of during the year and the use of resources by the department during the year. The accounts are prepared on an accruals basis and must give a true and fair view of the state of affairs of the department and of its income and expenditure, Statement of Financial Position and cash flows for the financial year.

In preparing the accounts, the Accounting Officer is required to comply with the requirements of the Government Financial Reporting Manual and in particular to:

- observe the Accounts Direction issued by HM Treasury, including the relevant accounting and disclosure requirement, and apply suitable accounting policies on a consistent basis;

- make judgements and estimates on a reasonable basis;

- state whether applicable accounting standards as set out in the Government Financial Reporting Manual have been followed, and disclose and explain any material departures in the accounts;

- prepare the accounts on a going-concern basis; and

- confirm that the Annual Report and Accounts as a whole is fair, balanced and understandable and take personal responsibility for the Annual Report and Accounts and the judgments required for determining that it is fair, balanced and understandable.

HM Treasury has appointed the Chief Executive and Chief Land Registrar as Accounting Officer of HM Land Registry. The responsibilities of an Accounting Officer, including responsibilities for the propriety and regularity of the public finances for which the Accounting Officer is answerable, for keeping proper records, and for safeguarding HM Land Registry’s assets, are set out in Managing Public Money published by HM Treasury.

As the Accounting Officer, I have taken all the steps that I ought to have to make myself aware of any relevant audit information and to establish that HM Land Registry’s auditors are aware of that information. So far as I am aware, there is no relevant audit information of which the auditors are unaware.

Governance statement

Scope of responsibility

As the Accounting Officer for HM Land Registry I have responsibility for maintaining corporate governance structures that support the achievement of HM Land Registry’s aims, objectives and targets, while safeguarding public funds and HM Land Registry’s assets.

I was appointed Chief Executive and Chief Land Registrar from 11 November 2019. I have received a ministerial letter of appointment pursuant to the Land Registration Act 2002 and a letter from the Permanent Secretary to HM Treasury, appointing me as Accounting Officer.

HM Land Registry became a Non-Ministerial Department on 1 April 2020. My duties as Accounting Officer are set out in Managing Public Money, which are to ensure public money is safeguarded, properly accounted for and used economically, efficiently and effectively.

The main statutory duties relating to maintaining the registers HM Land Registry holds are found in the Land Registration Act 2002, the Land Charges Act 1972 and the Local Land Charges Act 1975.

Purpose of the governance framework

HM Land Registry’s relationship with other government bodies is set out in a Framework which was agreed with Ministers of its then sponsor, the Department for Business, Energy and Industrial Strategy in November 2020 and published on gov.uk on 8 January 2021. The framework will be reviewed as part of the Machinery of Government change that made HM Land Registry a partner organisation of the Department for Levelling Up, Housing and Communities from 1 June 2023. The governance framework is designed to give assurance that HM Land Registry carried out its duties in a manner that fulfils the appropriate standards of effective internal control and risk management. The framework is based on processes designed to identify and prioritise the opportunities and risks to the delivery of HM Land Registry’s strategy, its strategic objectives and performance targets. The framework aligns with our statutory duties and is designed to support the governance and strategic aims of HM Land Registry’s sponsor department. Our approach to governance is in line with HM Treasury’s Corporate Governance in Central Government Departments: Code of Good Practice. HM Land Registry’s governance team attended BEIS Partners Governance Network meetings to share and learn from best practice.

Central controls

My role as Chief Land Registrar is referred to in the Land Registration Act 2002, the Land Charges Act 1972, the Agricultural Credits Act 1928 and the Local Land Charges Act 1975. The Chief Executive and Chief Land Registrar is responsible for keeping those registers established for the purposes of those Acts and has all the power, responsibilities and duties conferred and imposed on the Registrar by those Acts and by the rules and other secondary legislation made under them. In carrying out those specific statutory functions, the Chief Executive and Chief Land Registrar is not subject to any ministerial control or direction. Those functions are subject to supervision by the court.

In managing its business more generally, HM Land Registry operates within Cabinet Office spend controls, which are part of the wider government financial delegations and approvals process, with specific delegations authorised by officials at HM Land Registry’s sponsor department and HM Treasury and the Framework.

The Framework sets out the relationship HM Land Registry has with the Geospatial Commission. Separately, there is also a requirement to work with the Government Digital Service to ensure that product releases conform to standards in terms of security, effectiveness and consistency.

Government functional standards guide people working for and with the UK Government and promote consistent and coherent ways of working. HM Land Registry has embedded relevant Government functional standards and introduced a system to monitor compliance and continuous improvement.

Risk management and assurance

Our approach to risk management To deliver our strategic objectives, it is vital we manage risks throughout HM Land Registry, from decision making on individual cases through to delivering large-scale change and strategic policy making. Everyone in HM Land Registry, from board level down, has a clear role to play in capturing and managing risks and this year we have embedded our new digital risk tool which has enabled greater analysis, collaboration and transparency of risks and controls across HM Land Registry.

There are two types of risk that we manage:

-

Principal risks: these are risks to the management of HM Land Registry and the delivery of our strategic objectives. We manage these risks across all levels of HM Land Registry, from decision making on individual cases through to delivering large-scale change and strategic policy-making. Assurance on the effectiveness of the management of each risk and their controls is provided by the Second Line of Defence and reported to our governance bodies.

-

Organisational risks: these are risks to the efficient operation of our processes. We have enhanced our approach to effective process management by putting in place controls to manage those risks. Assurance on the effectiveness of the controls is provided by the Second Line of Defence.

We manage these risks through a risk and assurance framework and through an integrated data analysis process with our performance and strategic objectives. Principal risks are reviewed regularly through the appropriate Senior Executive Committee and sub-committees. Reporting also takes place to Audit and Risk Committee and LRB. Organisational risks are primarily reviewed by each directorate but escalated when necessary.

The Audit and Risk Committee provides independent assurance to the board and Accounting Officer on the integrity of financial statements and the comprehensiveness and reliability of assurances across HM Land Registry on governance, risk management and the control environment. Information on the risk and assurance framework is readily available in HM Land Registry, enabling a culture of integrated governance and continual improvement.

Our sub-committees scrutinise and assure our risk and assurance processes. Information on the risk and assurance framework is readily available in HM Land Registry, enabling a culture of integrated governance and continual improvement.

HM Land Registry also has a robust whistleblowing policy in place and remains committed to the highest standards of public service. HM Land Registry refers to its whistleblowing policy as ‘Speak up: raising a concern’. The Speak up policy has a number of nominated officers, clearly accessible to all HM Land Registry colleagues, that are there to champion the policy and to offer assistance, advice and support for any colleagues who have any concerns. There were no new cases of whistleblowing during the reporting period.

HM Land Registry’s risk and assurance framework At HM Land Registry we align our risk and assurance framework to the Orange Book. This is published by HM Government and provides guidance to departments on improving risk management and embedding it as a routine part of how they operate. By closely aligning our risk and assurance framework to the Orange Book we demonstrate that we are following best practice in government and support its goal of consistency among departments.

We continually take steps to improve the way we are managing risk so we can understand and improve the effectiveness of our controls and activities. To help us deliver our strategic objectives and manage both strategic and organisational risks, we take an integrated approach through our control framework which is based on the application of the ‘3 Lines Model’ for providing assurance. The model seeks to outline the different roles people have and the types of activities you might see in the management of risks. Our governing bodies also take assurance from a range of activities across the organisation that HM Land Registry is able to deliver on its overall strategy and objectives.

HM Land Registry’s assurance model

| First Line | Second Line | Third Line |

|---|---|---|

| Controls in place to mitigate risks to strategic objectives and business processes | Assure and report on the effectiveness of controls in the First Line | Independently assure control effectiveness, risk management and assurance processes |

The risk and assurance framework then brings together the tools and standards that allow us to manage our business better, make better decisions, stop things going wrong and make things easier for HM Land Registry. It also makes sure that we are doing this in a safe environment with sensible, proportionate controls in place. The risk and assurance framework covers:

- governance: ensuring that authorities and accountabilities are clear and that our success in operating the framework is reflected in the annual governance statements;

- process management: taking the necessary action to ensure our processes are defined and effective, efficient and well-controlled;

- risk management: identifying, assessing, managing and reporting the risks to the delivery of our strategic objectives and activities;

- controls: embedding effective controls in our business processes to ensure HM Land Registry’s objectives are met, and any risks reduced;

- management assurance: assuring the controls in place are sufficient and operating as intended, and taking the necessary action to address any weaknesses;

- independent assurance: internal and external audit to challenge or confirm the findings of assurance provided by the First and Second Line; and

- data: ensuring that the data on which our business relies is secure and accurate.

Managing risks to our delivery

In order to protect public money, optimise performance and deliver on our strategic objectives, we identify and manage closely our suite of principal risks. This suite is regularly reviewed to ensure we keep pace with our delivery of a modern land registration system and identify and respond to the risks now and in the future.

We ensure we have mitigating controls to manage our risk within appetite and to target levels. The impacts continue to be assessed, new ones identified, and our risks adjusted to ensure an effective strategic portfolio.

Each risk is linked to our strategic objectives and key performance indicators, ensuring the mitigating activity is focused efficiently on securing the achievement of objectives. Where sub-optimal performance within those objectives is indicated, the risks are adjusted to regain the appropriate mitigating focus.

Below is a summary of each of our 11 principal risks, with each sponsored by a member of the Senior Executive Team. These principal risks are underpinned by associated group, programme and team risks, all of which are regularly reviewed by senior leaders.

Our appetite for risk

Our risk appetite statement sets out how we balance risk and opportunity in pursuit of achieving our objectives and desired outcomes. It forms a key element of our governance and reporting framework and is reviewed annually.

Our first concern is the availability, security and accuracy of the register information we hold. We have a low appetite for any risks that may impact upon those primary objectives.

Provided risk to those primary objectives is not heightened, we have a medium appetite for risks arising from developing new ways to deliver existing services and from devising new services and a high appetite for risks from releasing value out of the data we hold.

Our principal risks

We have managed 11 principal risks to the delivery of our strategy and objectives throughout the year. Our risks and the links to our strategic pillars and organisation are provided below.

The risk appetite assessment reflects the position at the end of the reporting period. Those outside of appetite require further controls and actions to be delivered to bring them to a level of risk that we are willing to accept in pursuit of our objectives. Those within appetite mean that the risk is within an acceptable range but there are additional controls and actions we want to take to mitigate the risk further.

| Strategic pillars | |||||

|---|---|---|---|---|---|

| 1. Providing secure and efficient land registration |

2. Enabling property to be bought and sold digitally |

3. Providing near real-time property information |

4. Providing accessible digital register data |

5. Leading research and accelerating change with property market partners |

6. Our organisation |

| Risk | Detail | Appetite | Pillar/s |

|---|---|---|---|

| Reducing the backlog |

Key mitigations over the year have focused on improving our operational capacity, capability and efficiency and managing customer expectations. Several initiatives have helped improve output for our customers by focusing on reducing the number and age of applications in the backlog and improving our output and throughput of both substantive applications and information service applications. |

Outside | 1, 2, 3, 6 |

| Integrity of the registers |

Providing secure and efficient land registration remains a core deliverable in our Strategy and this risk helps to protect that objective. Throughout the year, we have closely monitored changes in the accuracy of the registers and strengthened the control framework to now include all registers and automated services. |

Inside | 1, 2, 3, 6 |

| People and culture | One of the key themes of our People Strategy is to modernise the way we work. To support this, we are committed to collaborative hybrid working, maturing our inclusive culture and involving our people in change, while strengthening a high-performance culture that puts our customers at the heart of everything we do. We have revised the control framework this year to align to the lenses in our culture model which was developed with extensive collaboration with our people. It focuses on the things we need in HM Land Registry to enable our ongoing transformation and to ensure we can deliver effectively for our customers and that that our people are key in being able to achieve this. |

Inside | 6 |

| System performance & resilience |

Technology underpins almost every aspect of HM Land Registry’s performance and is critical to the success of the organisation. Recent years have offered unprecedented challenges to our technology estate as we move to a hybrid working model. This has not only changed where we work, but how we work with far more flexibility over the hours that people use our technology estate. |

Inside | 1, 2, 3 |

| Transformation outcomes |

The internal efficiency/productivity benefits released by transforming our services have taken longer to materialise than anticipated and have impacted delivery plans for non-automated casework and several of the other principal risks. Developing a new resourcing plan and a plan to address internal culture and engagement around change management are key mitigations for this risk. |

Outside | 1, 2, 3, 6 |

| Changing market | We have taken a number of steps to improve the overall customer experience and HM Land Registry has become more outward facing and plugged in to various means of listening to, and testing approaches with, the various segments of the market. Further work is being undertaken on horizon scanning and to engage with stakeholders on change. |

Inside | 5 |

| Manual capability & capacity in Service Delivery |

Increasing caseworker numbers and their skills and capabilities has been and continues to be a major challenge. The skills and experience lost to the organisation each year are not easily or quickly replaced. The Land Registration Academy continues to provide a structured consistent approach to training and development of our people. |

Outside | 1, 2, 4, 6 |

| Delivery of Local Land Charges Programme |

Full delivery of the Local Land Charges Programme by the end of 2024/25 remains challenging and is reliant upon local authority engagement, delivery capability and supplier performance. The main priorities of the programme have changed from delivering it within the originally envisaged timeframe to completing it at a reasonable pace and realisation of its benefits. |

Inside | 4 |

| Cyber threat/attack | The control framework for the risk has been strengthened over the year against advanced, persistent or state-sponsored attacks, and new threat vectors by recruiting additional cyber security expertise and development of a new Security Control Library. |

Outside | 1, 3, 4 |

| Medium-term capacity & capability within the organisation |

The key mitigation for this risk has been developing a sustainable strategic workforce plan that articulates the broad capability and capacity requirements HM Land Registry needs beyond the current spending review period including the impacts, outcomes & benefits of our transformation activities and the subsequent impact on the capacity and capability of our people. |

Outside | 1, 6 |

| Geopolitical and/ or macroeconomic uncertainty |

This risk was raised following the escalation of conflict in Europe and the resulting geopolitical tensions, threat of retaliation to sanctions being imposed and general volatility with the UK economy. The controls include horizon scanning of our external operating environment and scenario planning beyond our current financial/ economic position. |

Inside | 6 |

Performance reporting

I receive monthly financial reports from the Chief Financial Officer. In addition, I also receive information on organisational performance, which is submitted monthly to the Service Delivery SEC (previously to the EXB) for review. As laid out in the Performance section of the Annual Report, our performance framework includes eight key performance indicators providing a balanced scorecard across operational, financial, people and customer impacts of what we do.

HM Land Registry has a dedicated analysis team which quality assures the management information in use throughout the organisation. On a monthly basis, the Service Delivery Senior Executive Committee receives near real-time data on service delivery alongside business-critical management information. Appropriate levels of management information (MI) are also provided to other key committees and to managers throughout the organisation.

HM Land Registry operates a number of models critical to its core business. A dedicated Modelling and Decision Support Oversight Group, which reports to the Service Delivery Senior Executive Committee, provides oversight and relevant challenge to our business-critical models. We have implemented Aqua Book compliant ownership structures and quality assurance documentation. Similarly, our appraisal of projects and delivery options is consistent with Green Book guidance, and we are developing monitoring and evaluation approaches consistent with the Magenta Book.

Financial performance is monitored and reported monthly to the Corporate Service Senior Executive Committee. There is a procedure for setting annual budgets and reviewing financial performance and full-year forecasts. Quarterly forecast reviews are in operation and give the Service Delivery Senior Executive Committee and LRB appropriate oversight and assurance. LRB reviews finance and performance progress at every Board meeting.

Alongside other members of the Senior Executive Team I have visited a number of HM Land Registry offices this year. In addition we have carried out virtual ‘office’ and ‘national’ question and answer (Q&A) sessions and written blogs covering key messaging throughout the year. The combinations of visits, Q&As and blogs have all provided vital opportunities to engage with staff at all levels of the organisation.

Over the last 12 months, I have held frequent one-to-one meetings with the Chair of LRB. I have also met with a wide range of external stakeholders through regular meetings and formal stakeholder engagement groups to understand their concerns and operational context. These meetings with the Chair and other stakeholders have taken place virtually and in person.

I have reported to ministers on a regularly basis and held regular meetings throughout the year to discuss HM Land Registry’s progress against strategic objectives and other areas of concern.

Procurement assurance

I am assured by the Chief Financial Officer, regarding specific procurements, that procurement activities are conducted in line with procurement regulations and Cabinet Office and HM Treasury guidance, and that senior managers have complied with these and HM Land Registry-specific procurement guidelines.

The Investment, Commercial & Finance Committee (ICFC) holds responsibility for approval of contracts over £1m and advises on approvals of investment cases for contracts over £10m. HM Land Registry has had zero legal challenges to procurement exercises in 2022-23.

Every contract has a Senior Responsible Owner (SRO), whose delegations are formally set out each year along with the responsibilities of their contract managers. We continue to operate supplier financial stability monitoring for our most business-critical contracts. As part of our organisational assurance, we operate a rolling programme of Contract Health checks on our most business-critical contracts. ICFC also oversees the findings from these Contract Health check Reviews.

We assess and benchmark our commercial practices against good practice using the Cabinet Office Continuous Commercial Improvement Assessment Framework (CCIAF) which encompasses all of the Government Commercial Functional Standards (GovS 008). Our score of 67.3% places us in the “Good” Maturity Rating. We report our progress against the standards to the Cabinet Office on an annual basis and have a Continuous Improvement Plan to increase our maturity against the key themes. We continue to participate in the Cabinet Office Contract Management accreditation programmes and have over 120 staff that have completed the Contract Management Foundation accreditation.

Internal Audit and opinion

HM Land Registry has an adequate and effective framework for risk management, governance, and internal controls to support the satisfactory achievement of its business objectives and enable key risks to be effectively managed. While our work found some control issues during its audits there were no notable trends in control failings.

Transformation continues to a more digital and automated business. However enhancements to the risk management, assurance and internal audit processes continue to evolve to meet the changing needs. The overall rating remains unchanged from the prior year.

Ongoing assurance

I can confirm that the internal controls referenced throughout this Governance Statement remain in place. Controls are regularly reviewed, to make sure they align with Government best practice, as part of the assurance exercises that take place throughout the year.

Simon Hayes

Chief Executive and Chief Land Registrar

12 July 2023

Parliamentary accountability report

1. Remuneration report

Policy for senior civil servants

The remuneration of senior civil servants (SCS) is set by the Prime Minister following independent advice from the Senior Salaries Review Body.

In reaching its recommendations, the Review Body has regard to:

- the need to recruit, retain and motivate suitably able and qualified individuals to exercise their different responsibilities;

- regional/local variations in labour markets and their effects on the recruitment and retention of employees;

- Government policies for improving the public services including the requirement on departments to meet the output targets for the delivery of departmental services;

- the funds available to departments as set out in the Government’s departmental expenditure limits; and

- the Government’s inflation target.

The Review Body takes account of the evidence it receives about wider economic considerations and the affordability of its recommendations.

The salary of the Chief Land Registrar and Chief Executive is set by the sponsoring Ministerial department. The HM Land Registry Remuneration and Nominations Committee, acting on the authority of the HM Land Registry Board and in consultation with the Board’s chair, considers pay recommendations and agrees the annual pay strategy (including base pay, pay awards, pay gaps and performance pay) for the executive team and other SCS staff within HM Land Registry.

Both base pay and non-consolidated performance related awards are dependent on performance, which is assessed through an annual appraisal system for senior civil servants, more details of which can be found at https:// www.gov.uk/government/publications/senior-civil-service-performance-management.

During the year the members of the Remuneration Committee were non-executive board members Kirsty Cooper, Ann Henshaw and Katy Baldwin, and Simon Hayes as Chief Executive and Chief Land Registrar, and Simon Morris, Director of Human Resources and Organisation & Employee Development.

Detail of any paid or otherwise remunerated outside employment, held by members of HM Land Registry’s SCS, that has been agreed through the process for the declaration and management of outside interests is published on gov.uk and can be access at https://www. gov.uk/government/publications/hm-land-registry-scs-secondary-paid-employment-details-2022-to-2023/scs-secondary-paid-employment-details-2022-to-2023.

Policy for other civil servants

Pay for HM Land Registry employees who are not in SCS grades is determined each year following negotiation and consultation between HM Land Registry and the recognised unions and is subject to approval by the Secretary of State, taking into account guidance issued by HM Treasury.

Service contracts

The Constitutional Reform and Governance Act 2010 requires Civil Service appointments to be made on merit on the basis of fair and open competition.

The Recruitment Principles published by the Civil Service Commission specify the circumstances when appointments may be made otherwise.

Unless otherwise specified, all the directors covered by this report hold appointments that are open-ended and are subject to a notice period of three months. Early termination for the directors on open-ended service contracts, other than for misconduct, would result in the individual receiving compensation as set out in the Civil Service Compensation Scheme.

Further information about the work of the Civil Service Commission can be found at www.civilservicecommission.org.uk

Off-payroll disclosures

Off-payroll engagements as at 31 March 2023, for more than £245 per day and that last for longer than six months:

| Existing engagements as of 31 March 2023 | 2022-23 109 |

2021-22 37 |

|---|---|---|

| Of which existing: — for less than one year at time of reporting |

76 |

29 |

| — for between one and two years at time of reporting | 29 | 7 |

| — for between two and three years at time of reporting | 4 | 1 |

| — for between three and four years at time of reporting | – | – |

| — for four or more years at time of reporting | – | – |

New off-payroll engagements, or those that reached six months in duration, between 1 April 2022 and 31 March 2023, for more than £245 per day and that last for longer than six months.

| New engagements, or those that reached six months in duration, between 1 April 2022 and 31 March 2023 |

102 | 35 |

|---|---|---|

| Of which: — have been assessed as within IR35 |

102 |

35 |

| — have been assessed as outside IR35 | – | – |

| — have been terminated as a result of assurance not being received | – | – |

| Number engaged directly (via Public Sector Contract to department) and are on the departmental payroll |

– | – |

| Number of engagements reassessed for consistency/assurance purposes during the year | 109 | 35 |

| Number of engagements that saw a change to IR35 status following the consistency review | – | – |

| Off-payroll engagements of board members and/or senior officials with significant financial responsibility between 1 April 2022 and 31 March 2023 |

||

| Number of off-payroll engagements of board members and/or senior officials with significant financial responsibility, during the financial year |

– | – |

| Total number of individuals on payroll and off payroll that have been deemed ‘board members, and/or, senior officials with significant financial responsibility’, during the financial year. This figure includes both off-payroll and on-payroll engagements |

5 | 7 |

Expenditure on consultancy

| 2022-23 £’000 |

2021-22 £'000 |

|

|---|---|---|

| Cost of consultancy | 773 | 1,804 |

| Total | 773 | 1,804 |

Salary and performance pay – executive directors(1) 2022-23

| Salary £'000 |

Performance pay £’000 |

Benefits in kind To nearest £100 |

Pension benefits(2) £ |

Total £’000 |

|

|---|---|---|---|---|---|

| Simon Hayes Chief Executive and Chief Land Registrar |

135 – 140 | – | – | 2,000 | 140 – 145 |

| Mike Harlow General Counsel, Deputy Chief Executive and Deputy Chief Land Registrar |

125 – 130 | – | – | 10,000 | 135 – 140 |

| Jon Parry(3) Interim Director of Digital, Data and Technology |

375 – 380 | – | – | – | 375 – 380 |

| Simon Morris Director of Human Resources and Organisation & Employee Development |

115 – 120 | – | – | 46,000 | 160 – 165 |

| Iain Banfield Chief Financial Officer |

115 – 120 | – | – | 10,000 | 125 – 130 |

| Chris Pope(4) Chief Operations Officer Annual Equivalent |

90 – 95 (130 – 135) |

– | – | 25,000 | 115 – 120 (130 – 135) |

| Karina Singh(5) Director of Transformation Annual Equivalent |

25 – 30 (110 – 115) |

– | – | 20,000 – |

45 – 50 (110 – 115) |

-

Audited.

-

The value of pension benefits accrued during the year is calculated as (the real increase in pension multiplied by 20) plus (the real increase in any lump sum) less (the contributions made by the individual). The real increases exclude increases due to inflation or any increases or decreases due to a transfer of pension rights.

-

Jon Parry’s appointment as Interim Director of Digital, Data and Technology commenced on 2 August 2021. The disclosed amounts above relate to the period of 1 April 2022 to 31 March 2023.

-

Chris Pope’s appointment as Chief Operations Officer ended on 30 November 2022. He received an exit package of 85-90 during the period in addition to the remuneration shown above, giving a total remuneration received during the period of 200-205.

-

Karina Singh’s appointment as Director of Transformation ended on 30 June 2022.

Salary

‘Salary’ includes gross salary, reserved rights to London weighting or London allowances, recruitment and retention allowances and any other allowance to the extent that it is subject to UK taxation. The tables on pages 76 to 78 are based on accrued payments made by HM Land Registry and thus recorded in these accounts.

Benefits in kind

The monetary value of benefits in kind covers any benefits provided by HM Land Registry and treated by HM Revenue and Customs as a taxable emolument.

Performance awards

Awards are based on performance levels attained and are made as part of the performance review process as discussed and noted at the Remuneration Committee in August 2022. The awards reported relate to the performance in the year in which they were paid to the individual. There were no performance payments made in 2022-23. The awards reported in 2022-23 relate to performance in 2021-22.

Remuneration – non-executive Board Members(1)

| 2022-23 £'000 |

2021-22 £'000 |

|

|---|---|---|

| Michael Mire (2) Non-executive Chair (Annual equivalent) |

15 – 20 (55 – 60) |

55 – 60 – |

| Neil Sachdev (3) Non-executive Chair (Annual equivalent) |

30 – 35 (55 – 60) |

– – |

| Katy Baldwin (4) Non-executive Director |

– | – |

| Kirsty Cooper Non-executive Director |

20 – 25 | 20 – 25 |

| Angela Morrison Non-executive Director |

20 – 25 | 20 – 25 |

| Elliot Jordan Non-executive Director |

20 – 25 | 20 – 25 |

| Ann Henshaw Non-executive Director (Annual equivalent) |

20 – 25 – |

15 – 20 (20 – 25) |

| Jeremy Pee Non-executive Director (Annual equivalent) |

20 – 25 – |

15 – 20 (20 – 25) |

-

Audited.

-

Michael Mire’s appointment as Non-executive Chair ended on 7 August 2022

-

Neil Sachdev’s appointment as Non-executive Chair started on 2 September 2022

-

Katy Baldwin from UK Government Investments’ (UKGI) HM Land Registry sponsor team represented the interest of BEIS Ministers on the Board and does not receive any remuneration from HM Land Registry.

Pension benefits(1)

| Real increase in pension and lump sum at 60 |

Total accrued at March 2023 |

Cash equivalent transfer value (CETV) at 31 March |

Real increase in CETV after adjustment for inflation and changes in investment factors |

||||

|---|---|---|---|---|---|---|---|

| Pension £’000 |

Lump sum £’000 |

Pension £’000 |

Lump sum £’000 |

2023 £’000 |

2022 £’000 |

£’000 |

|

| Simon Hayes Chief Executive and Chief Land Registrar |

0 – 2.5 | 0 | 50 – 55 | 85 – 90 | 833 | 759 | -16 |

| Mike Harlow General Counsel, Deputy Chief Executive and Deputy Chief Land Registrar |

0 – 2.5 | 0 | 35 – 40 | 0 | 618 | 562 | -7 |

| Jon Parry Interim Director of Digital, Data and Technology |

– | – | – | – | – | – | – |

| Simon Morris Director of Human Resources and Organisation & Employee Development |

2.5 – 5 | 0 | 5 – 10 | 0 | 91 | 56 | 23 |

| Iain Banfield Chief Financial Officer |

0 – 2.5 | 0 | 35 – 40 | 55 – 60 | 526 | 477 | -8 |

| Chris Pope Chief Operations Officer |

0 – 2.5 | 0 | 20 – 25 | 0 | 389 | 344 | 19 |

| Karina Singh Director of Transformation |

0 – 2.5 | 0 – 2.5 | 55 – 60 | 50 – 55 | 1,009 | 973 | 14 |

- Audited

Civil Service pensions

Pension benefits are provided through the Civil Service pension arrangements. From 1 April 2015 a new pension scheme for civil servants was introduced – the Civil Servants and Others Pension Scheme or alpha, which provides benefits on a career average basis with a normal pension age equal to the member’s State Pension Age (or 65 if higher). From that date all newly appointed civil servants and the majority of those already in service joined alpha. Prior to that date, civil servants participated in the Principal Civil Service Pension Scheme (PCSPS). The PCSPS has four sections: 3 providing benefits on a final salary basis (classic, premium or classic plus) with a normal pension age of 60; and one providing benefits on a whole career basis (nuvos) with a normal pension age of 65.

These statutory arrangements are unfunded with the cost of benefits met by monies voted by Parliament each year. Pensions payable under classic, premium, classic plus, nuvos and alpha are increased annually in line with Pensions Increase legislation. Existing members of the PCSPS who were within 10 years of their normal pension age on 1 April 2012 remained in the PCSPS after 1 April 2015. Those who were between 10 years and 13 years and 5 months from their normal pension age on 1 April 2012 will switch into alpha sometime between 1 June 2015 and 1 February 2022. All members who switch to alpha have their PCSPS benefits ‘banked’, with those with earlier benefits in one of the final salary sections of the PCSPS having those benefits based on their final salary when they leave alpha. (The pension figures quoted for officials show pension earned in PCSPS or alpha – as appropriate. Where the official has benefits in both the PCSPS and alpha the figure quoted is the combined value of their benefits in the two schemes.) Members joining from October 2002 may opt for either the appropriate defined benefit arrangement or a ‘money purchase’ stakeholder pension with an employer contribution (partnership pension account).

Employee contributions are salary-related and range between 4.6% and 8.05% for members of classic, premium, classic plus, nuvos and alpha. Benefits in classic accrue at the rate of 1/80th of final pensionable earnings for each year of service. In addition, a lump sum equivalent to three years initial pension is payable on retirement. For premium, benefits accrue at the rate of 1/60th of final pensionable earnings for each year of service. Unlike classic, there is no automatic lump sum. classic plus is essentially a hybrid with benefits for service before 1 October 2002 calculated broadly as per classic and benefits for service from October 2002 worked out as in premium. In nuvos a member builds up a pension based on his pensionable earnings during their period of scheme membership. At the end of the scheme year (31 March) the member’s earned pension account is credited with 2.3% of their pensionable earnings in that scheme year and the accrued pension is uprated in line with Pensions Increase legislation. Benefits in alpha build up in a similar way to nuvos, except that the accrual rate in 2.32%. In all cases members may opt to give up (commute) pension for a lump sum up to the limits set by the Finance Act 2004.

The partnership pension account is a stakeholder pension arrangement. The employer makes a basic contribution of between 8% and 14.75% (depending on the age of the member) into a stakeholder pension product chosen by the employee from a panel of providers. The employee does not have to contribute, but where they do make contributions, the employer will match these up to a limit of 3% of pensionable salary (in addition to the employer’s basic contribution). Employers also contribute a further 0.5% of pensionable salary to cover the cost of centrally-provided risk benefit cover (death in service and ill health retirement).

The accrued pension quoted is the pension the member is entitled to receive when they reach pension age, or immediately on ceasing to be an active member of the scheme if they are already at or over pension age. Pension age is 60 for members of classic, premium and classic plus, 65 for members of nuvos, and the higher of 65 or State Pension Age for members of alpha. (The pension figures quoted for officials show pension earned in PCSPS or alpha – as appropriate. Where the official has benefits in both the PCSPS and alpha the figure quoted is the combined value of their benefits in the two schemes, but note that part of that pension may be payable from different ages.)

Further details about the Civil Service pension arrangements can be found at the website www. civilservicepensionscheme.org.uk

Cash equivalent transfer values

A Cash Equivalent Transfer Value (CETV) is the actuarially assessed capitalised value of the pension scheme benefits accrued by a member at a particular point in time. The benefits valued are the member’s accrued benefits and any contingent spouse’s pension payable from the scheme. A CETV is a payment made by a pension scheme or arrangement to secure pension benefits in another pension scheme or arrangement when the member leaves a scheme and chooses to transfer the benefits accrued in their former scheme. The pension figures shown relate to the benefits that the individual has accrued as a consequence of their total membership of the pension scheme, not just their service in a senior capacity to which disclosure applies.

The figures include the value of any pension benefit in another scheme or arrangement which the member has transferred to the Civil Service pension arrangements. They also include any additional pension benefit accrued to the member as a result of their buying additional pension benefits at their own cost. CETVs are worked out in accordance with The Occupational Pension Schemes (Transfer Values) (Amendment) Regulations 2008 and do not take account of any actual or potential reduction to benefits resulting from Lifetime Allowance Tax which may be due when pension benefits are taken. CETV figures are calculated using the guidance on discount rates for calculating unfunded public service pension contribution rates that was extant at 31 March 2023. HM Treasury published updated guidance on 27 April 2023; this guidance will be used in the calculation of 2023-24 CETV figures.

Real increase in CETV

This reflects the increase in CETV that is funded by the employer. It does not include the increase in accrued pension due to inflation, contributions paid by the employee (including the value of any benefits transferred from another pension scheme or arrangement) and uses common market

Reporting of Civil Service and other compensation schemes – exit packages(1)

| Exit package cost band | Number of compulsory redundancies |

Number of other departures agreed |

Total number of exit packages by cost band |

|||

|---|---|---|---|---|---|---|

| 2022-23 | 2021-22 | 2022-23 | 2021-22 | 2022-23 | 2021-22 | |

| £0–£10,000 | – | – | 3 | 4 | 3 | 4 |

| £10,001–£25,000 | – | – | 1 | 1 | 1 | 1 |

| £25,001–£50,000 | – | – | 1 | 1 | 1 | 1 |

| £50,001–£100,000 | – | 3 | 2 | 3 | 2 | |

| £100,001–£150,000 | – | – | – | – | – | – |

| £150,001–£200,000 | – | – | – | – | – | – |

| >£200,000 | – | – | – | – | – | – |

| Total number of exit packages |

– | – | 8 | 8 | 8 | 8 |

| Total cost | – | – | £225,190 | £184,641 | £225,190 | £184,641 |

- Audited.

There were eight ex-gratia payments in 2022-23 totalling £225,190 (2021-22: 8, £184,641).

Compensation for loss of office

Redundancy and other departure costs have been paid in accordance with the provisions of the Civil Service Compensation Scheme, a statutory scheme made under the Superannuation Act 1972. Exit costs are accounted for in full in the year of contractual agreement to depart. Where applicable, the additional costs of buy-out of reduced pension benefit are met by HM Land Registry and not by the Civil Service pension scheme. Ill health retirement costs are met by the pension scheme and are not included in the table.

Pay multiples(1)

Reporting bodies are required to disclose the relationship between the remuneration of the highest paid director in their organisation for the lower quartile, median and upper quartile remuneration of the organisation’s workforce.

Total remuneration includes salary, allowances, overtime, non-consolidated performance-related payments and benefits in kind. It does not include employer pension contributions and the cash equivalent transfer value of pensions payments.

| 2022-23 | 2021-22 | |

|---|---|---|

| Band of highest paid director’s total remuneration (£’000) | 375 – 380(2) | 380 – 385 |

| Median (£) Median (remuneration ratio) |

32,390 11.6 |

31,149 12.3 |

| Lower quartile (£) Lower quartile (remuneration ratio) |

28,080 13.4 |

27,130 14.1 |

| Upper quartile (£) Upper quartile (remuneration ratio) |

40,020 9.4 |

39,152 9.8 |

| Salary and allowances |

Performance pay and bonuses |

|

|---|---|---|

| Percentage change between 2021-22 and 2022-23 for highest paid director |

48% | -1% |

| Percentage change between 2021-22 and 2022-23 for remaining employees |

4.26% | 6.44% |

- Audited.

The tables below show the results if the calculations had been made against the highest paid permanent director:

| 2022-23 | 2021-22 | |

|---|---|---|

| Band of highest paid permanent director’s total remuneration (£’000) |

135 – 140 | 135 – 140 |

| Median (£) | 32,390 | 31,149 |

| Median (remuneration ratio) | 4.3 | 4.4 |

| Lower quartile (£) | 28,080 | 27,130 |

| Lower quartile (remuneration ratio) | 5.0 | 5.0 |

| Upper quartile (£) | 40,020 | 39,152 |

| Upper quartile (remuneration ratio) | 3.5 | 3.5 |

| Salary and allowances |

Performance pay and bonuses |

|

|---|---|---|

| Percentage change between 2021-22 and 2022-23 for highest paid permanent director |

2% | 0% |

| Percentage change between 2021-22 and 2022-23 for remaining employees |

4.59% | 6.44% |

The table below shows the comparative pay ranges for staff remuneration (excludes pension benefits).

| 2022-23 | 2021-22 | |

|---|---|---|

| Lowest remuneration (£’000) | 20 – 25 | 15 – 20 |

| Highest remuneration (£’000) |

375 – 380 | 380 – 385 |

The percentage changes for remaining employees have been calculated using the values of active employees as at 31 March for each respective year. The percentage change increase in salary and allowances for remaining staff is mainly due to the increase in employee headcount in 2022-23 when compared with 2021-22.

The 6.4% increase in performance pay and bonuses is due to the increase in performance payments made in 2022-23 when compared with the payments in 2021-22.

2. Staff report

Staff costs for 2022-23(1)

| Permanent staff £’000 |

Apprentices £’000 |

Others £’000 |

Total £’000 |

|

|---|---|---|---|---|

| Salaries | 210,221 | 527 | 471 | 211,219 |

| Social security costs | 22,752 | 34 | 42 | 22,828 |

| Other pension costs | 52,581 | 86 | 46 | 52,713 |

| Total staff costs | 285,554 | 647 | 559 | 286,760 |

- Audited

Staff report as at 31 March 2023

| 2022-23 | 2021-22 | |

|---|---|---|

| Number of permanent employees (including fixed-term appointments) | 6,814 | 6,677 |

| Permanent full-time equivalents on 31 March1 | 6,189 | 6,077 |

| Number of apprentices on 31 March | 79 | 75 |

| Number of temporary/contract staff on 31 March1 | 237 | 70 |

| Average sickness days per employee | 8.9 | 8.1 |

| Average number of training days per employee | 6.1 | 6.5 |

| Training days per apprentice | 52.0 | 51.9 |

| Training spend as percentage of salary bill | 0.4% | 0.25 |

| Female employees | 60.7% | 60.6% |

| Employees working part-time | 31.1% | 30.7% |

| Employees from ethnic minorities | 5.7% | 5.9% |

| Employees who report they have a disability | 10.2% | 6.7% |

| Staff turnover | 6.8% | 5.7% |

| Staff engagement scores | 65% | 71% |

Gender analysis at 31 March 2023

| Male | Female | Total | |

|---|---|---|---|

| Non-executive directors | 3 | 3 | 6 |

| Executive directors(1) | 5 | 0 | 5 |

| Senior Civil Service – band 2(1) | 4 | 0 | 4 |

| Senior Civil Service – band 1(1) | 10 | 15 | 25 |

| Permanent employees (not including Senior Civil Service)(2) | 2,641 | 4,118 | 6,759 |

| Apprentices(2) | 41 | 38 | 79 |