Industrial decarbonisation strategy (accessible webpage)

Updated 7 April 2021

Ministerial foreword

The UK is the world’s first major economy to present a net zero Industrial Decarbonisation Strategy. This strategy comes at a time when the UK is striving forward with environmental progress, with economic recovery from the COVID-19 global pandemic, and towards a healthy future for generations to come.

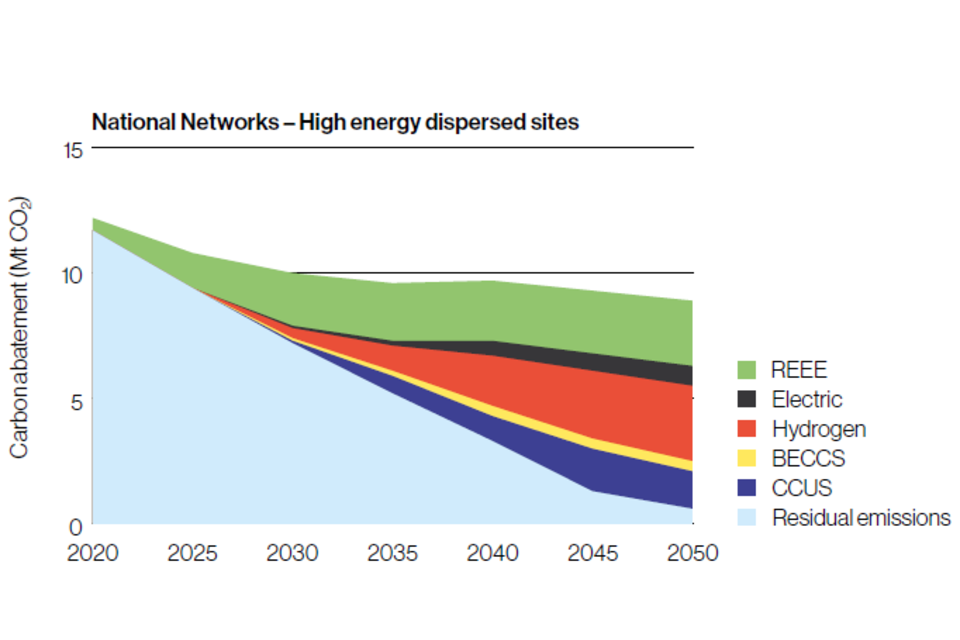

The UK was also the first major economy to legislate an ambitious net zero target and we are taking a leading role globally in the fight against climate change. Domestically, this is a pioneering agenda, and this government will continue to seek ambitious targets and collaboration from other countries. We will do this most imminently through the UK’s presidency of COP26, the United Nations’ climate conference held in November 2021. I am committed to ensuring our leadership encourages all countries to pledge to a more viable path for our industries’ futures.

Decarbonising UK industry is a core part of the government’s ambitious plan for the green industrial revolution. Timing is critical and we must continue to propel forwards towards our 2050 net zero target with fervour, innovation, and commitment. We will use the actions set out in this strategy to accelerate the green transformation in industry: aiming high with our ambition, as we expect that emissions need to fall by around two thirds by 2035; and ensuring UK businesses expand into new and growing markets in a low carbon world, while broader competitiveness is protected.

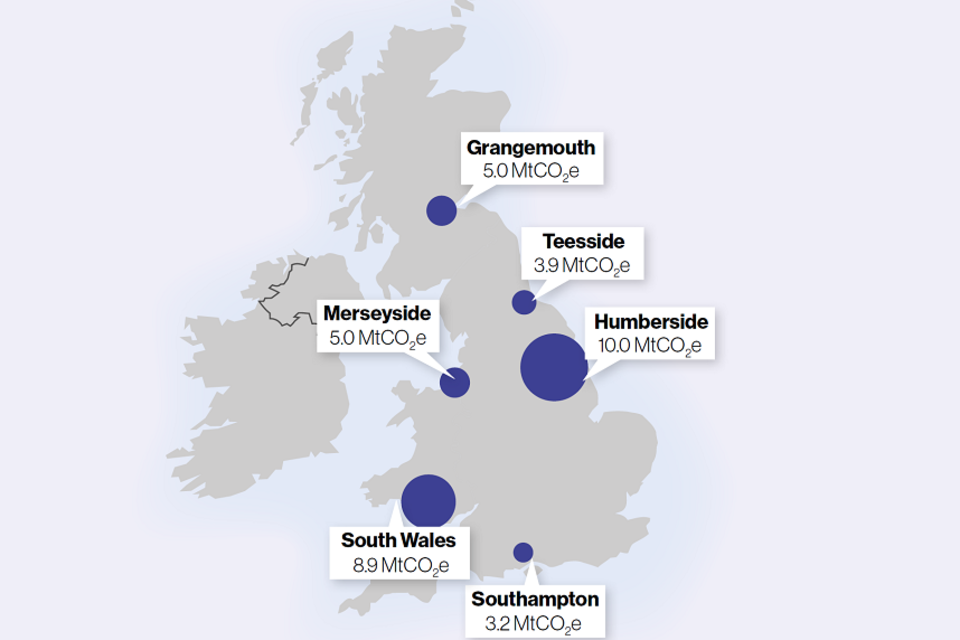

From the UK’s ceramic cluster in the West Midlands, to the Teesside chemical plants in North East England, the UK’s industrial heartlands are vitally important to our economy, contributing £170 billion each year and providing 2.6 million jobs (ONS, Annual Business Survey, 2020). As the UK leads the race to net zero, we will ensure that decarbonisation works for everybody and every region. In line with our policy priorities, we will use our efforts on decarbonisation to transform geographic disparities. Industrial clusters play a monumental role in achieving our goal: we have set ourselves the target of ensuring that there will be at least four low carbon clusters by 2030 and at least one net zero cluster by 2040.

The 2020s will be crucial for us to lay the bedrock for industrial decarbonisation. Over the next decade we will begin the journey of switching away from fossil fuel combustion to low carbon alternatives such as hydrogen and electrification, deploying key technologies such as carbon capture, usage and storage, and supporting industrial sites to maximise their energy and resource efficiency to reduce costs for businesses. In parallel, we will continue to help industry overcome barriers and work with our international partners, both old and new, to kick-start the demand for low carbon industrial products. The work we do in the next decade will be essential to ensure industry can flourish during its transition to net zero, without moving emissions and businesses abroad.

As the movement against climate change grows, the UK will continue to set global precedents towards a fairer, greener society. We are leading the way, and I look forward to working with industry sectors, businesses, and governments from across the world to ensure these challenges are met.

The Rt Hon Anne-Marie Trevelyan MP

Minister of State for Business, Energy and Clean Growth

Executive summary

The UK is a world leader in the fight against climate change. In 2019 we became the first major economy in the world to pass laws to end its contribution to global warming by 2050. Reaching this target will require extensive, systematic change across all sectors, including industry. We must get this change right as the products made by industry are vital to life in the UK, and the sector supports local economies across the country.

This strategy covers the full range of UK industry sectors: metals and minerals, chemicals, food and drink, paper and pulp, ceramics, glass, oil refineries and less energy‑intensive manufacturing[footnote 1]. These businesses account for around one sixth of UK emissions, and transformation of their manufacturing processes is key if we are to meet our emissions targets over the coming decades (BEIS, Final UK greenhouse gas emissions from national statistics: 1990 to 2018: Supplementary tables, 2020).

The aim of this strategy is to show how the UK can have a thriving industrial sector aligned with the net zero target, without pushing emissions and business abroad, and how government will act to support this. An indicative roadmap to net zero for UK industry based on the content in this strategy is set out at the end of this summary. This strategy is part of a series of publications from government, which combined show how the net zero transition will take place across the whole UK economy.

Part 1: Foundations to deliver net zero for industry

Chapter 1: Why we need a strategy and our approach

We want to provide a clear signal to industry, setting out how we expect decarbonisation will happen through the sector, and the role government will take in supporting and enabling this transition. By doing so, we will support industrial development decisions, improve investor confidence, and provide the greater certainty needed to enable industrial businesses to begin the journey to net zero.

This chapter sets out:

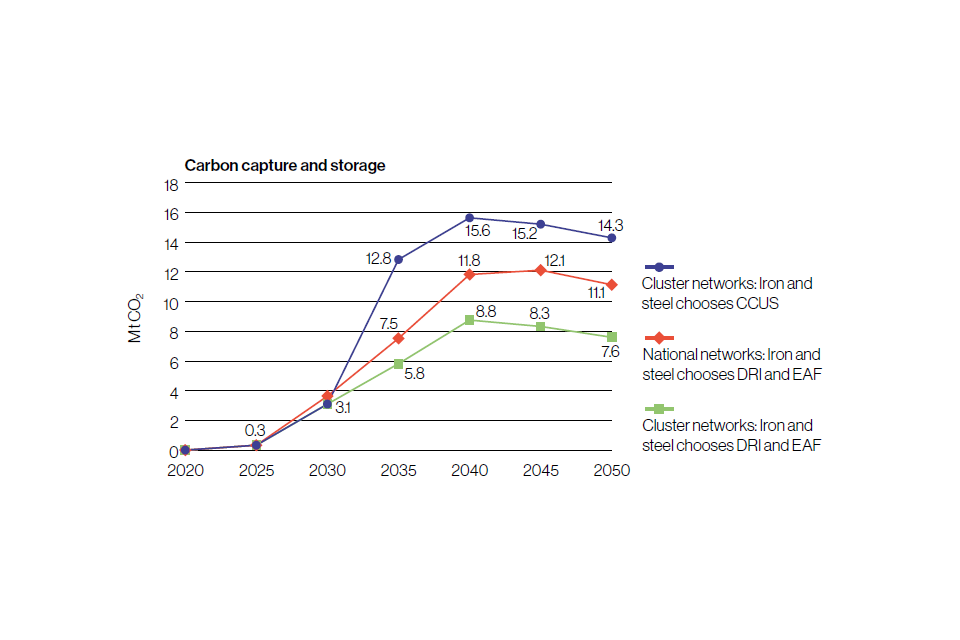

- our ambition for decarbonising industry in line with net zero: our expectation is emissions will need to reduce by at least two-thirds by 2035 and by at least 90% by 2050, with 3 MtCO2[footnote 2] captured through Carbon Capture, Usage and Storage (CCUS) and around 20 TWh switching to low carbon fuels by 2030

- our policy principles to drive industrial decarbonisation via addressing barriers, mitigating carbon leakage risks, and playing a key role in the delivery of large infrastructure projects

- our priorities in the 2020s, which focus on aligning existing policy with net zero and putting in place new incentives to fill any policy gaps

- the policy framework that will be used to drive decarbonisation through the 2030s and 2040s, combining incentives to reduce emissions, carbon leakage mitigation, and supporting policy frameworks to address outstanding barriers to decarbonisation

- how we will position ourselves as a climate leader whilst ensuring UK industry retains its competitive advantage, by working with industry to enable decarbonisation utilising a range of policy approaches, and mitigating against the risk of carbon leakage through levers that grow the market for low carbon products and reduce differences in climate policy between trading partners

Chapter 2: Getting investors to choose low carbon

We want to support existing industry to decarbonise, and encourage the growth of new, low carbon sectors in the UK. In the long run we believe that markets will be best placed to determine the most cost-effective pathways to decarbonisation. Throughout the next decade government will need to help overcome the barriers that currently prevent industry from securing investment to start the low carbon transition.

This chapter sets out how we will:

- use carbon pricing as a tool to send a clear market signal, providing certainty over our net zero ambition for industrial sectors

- put in place funding mechanisms to support deployment and use of CCUS and low carbon hydrogen infrastructure

- establish the right policy framework to ensure uptake of fuel switching

- take initial steps to create a market for negative emissions technologies

- establish a targeted approach to mitigating carbon leakage

- work with stakeholders to understand how an EU Carbon Border Adjustment Mechanism (CBAM) could affect the UK

Chapter 3: Getting consumers to choose low carbon

Without a clear demand for low carbon industrial products, industry risk being undercut by cheaper, high carbon alternatives after decarbonising. Government can take action to support low carbon manufacturers by creating demand and developing the market for low carbon industrial products, without significantly impacting end-consumers financially.

This chapter sets out how we will:

- develop proposals to improve data transparency

- develop proposals for new product standards

- develop proposals for product labelling

- use public procurement to drive change

- support businesses to make greener choices

Part 2: Transforming industrial processes

Chapter 4: Adopting low-regret technologies and building infrastructure

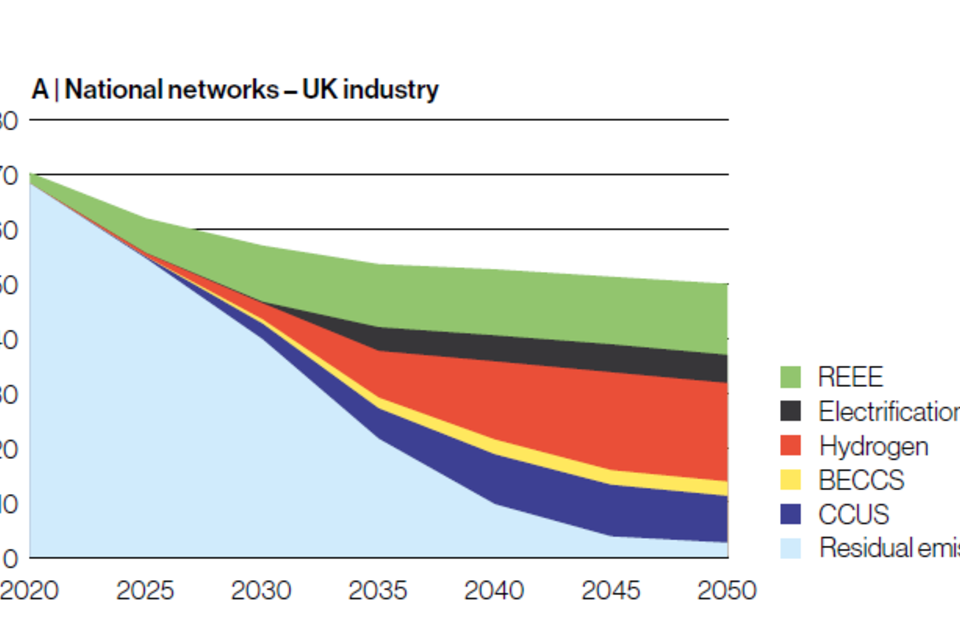

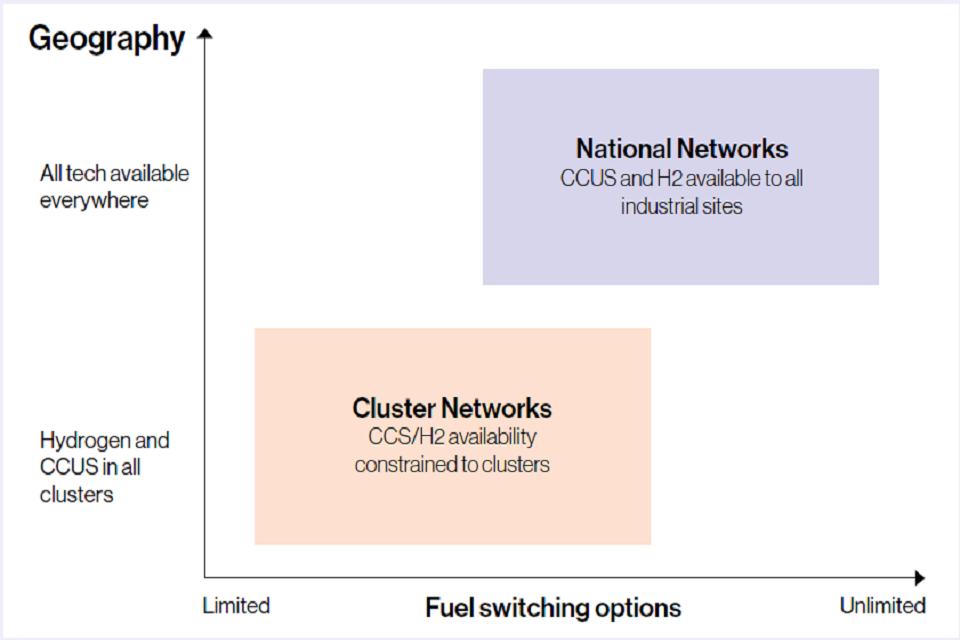

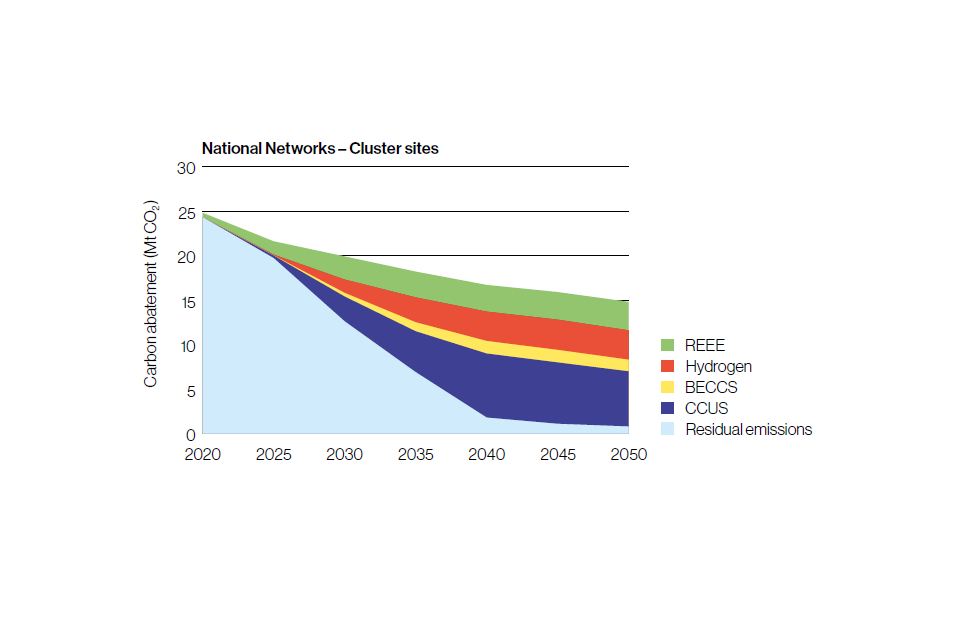

The diversity of industry means that decarbonisation of the sector will be achieved through a combination of different technologies and measures. We will use our industrial decarbonisation pathways modelling to focus on low-regret deployment of key technologies such hydrogen and CCUS, which is robust to future uncertainties such as industrial demand, technical challenges and fuel prices.

This chapter sets out how we will:

- support deployment of CCUS on industrial sites in clusters to capture and store around 3 MtCO2 per year by 2030

- support increasing amounts of fuel switching to low carbon hydrogen during the 2020s

- support low-regret fuel switching to electrification in industry during the 2020s

- review the most appropriate use of bioenergy in industry to provide evidence for the Bioenergy Strategy (2022)

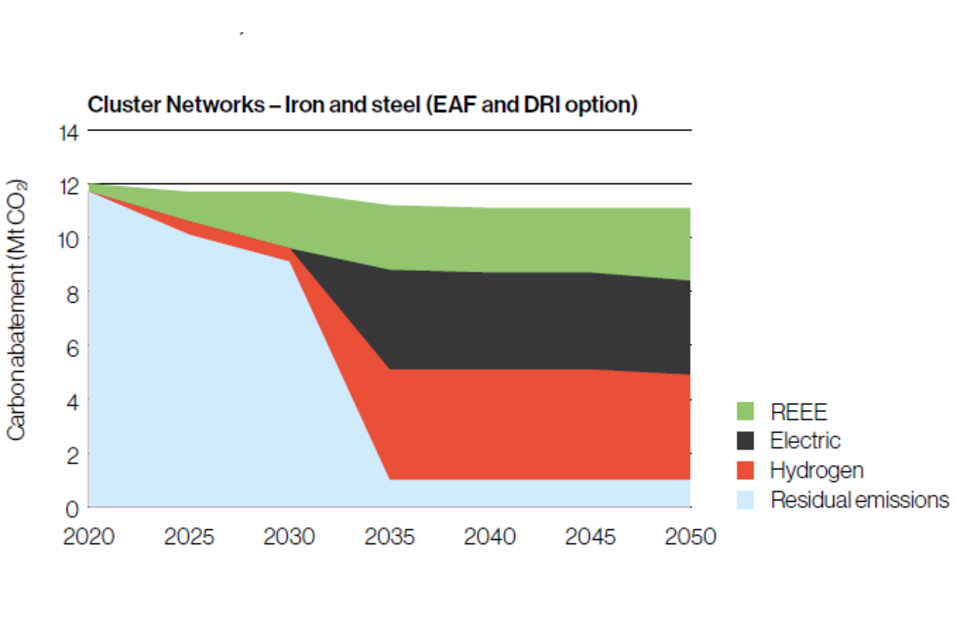

- consider the implications of the recommendation of the Climate Change Committee to set targets for ore-based steelmaking to reach near-zero emissions by 2035

- work with industry to understand what is required to make sites retrofit-ready

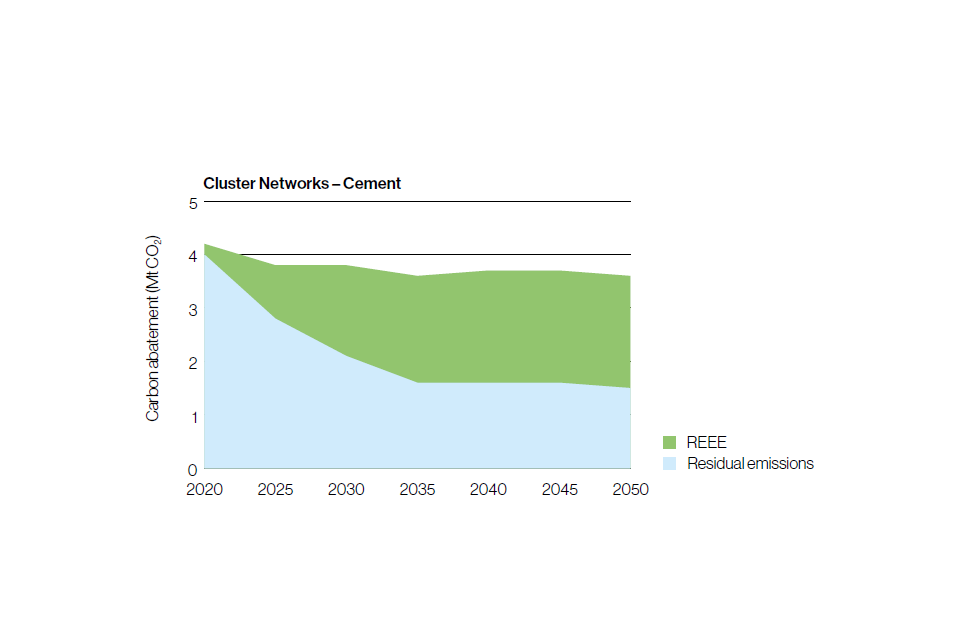

- work with the cement sector to explore options to decarbonise sites in dispersed locations

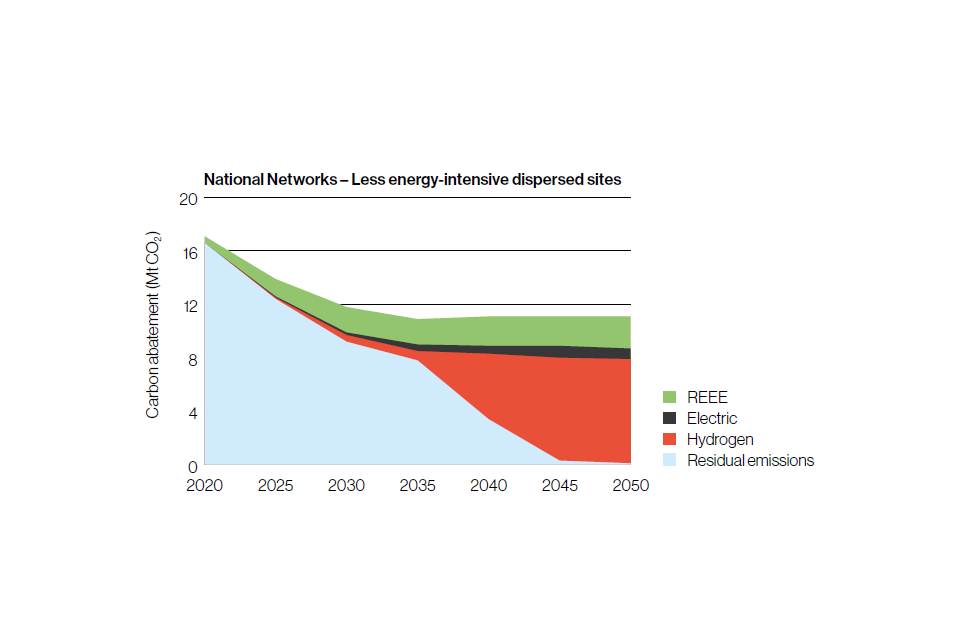

- review policies to address specific barriers faced by less energy‑intensive, dispersed industrial sites

- use Project Speed to ensure the land planning regime is fit for building low carbon infrastructure

- improve co-ordination between decarbonisation and environmental policies to meet a common sustainability agenda

Chapter 5: Improving efficiency

Energy and resource efficiency measures, which reduce the level of energy and materials used in producing industrial goods, will be crucial to getting industry to net zero. Improvements in energy and resource efficiency will play a particularly significant role in reducing industrial emissions in the 2020s, leading the way in widespread emissions reductions while infrastructure for the deep decarbonisation options is built up throughout the decade.

This chapter sets out how we will:

- support sites to install energy management systems

- improve heat recovery and reuse across sites, particularly in sites with high operational temperatures

- help less energy‑intensive, dispersed industrial sites improve energy efficiency through the adoption of technologies available in the market with low payback times

- develop a communications plan to make industry aware of the support that is already available to increase energy efficiency

- support increased resource efficiency and material substitution within industry, by driving the transition towards a circular economy model and increasing reuse, repair and remanufacturing

Chapter 6: Accelerating innovation of low carbon technologies

The low carbon technologies that are needed to decarbonise industry are at various stages of development. We need to continue to innovate and develop a broad range of low carbon technologies to put us in the best position to reduce the cost of decarbonisation and maintain the competitiveness of industry throughout the net zero transition.

This chapter sets out how we will:

- support innovation in fuel switching technologies, including low carbon electricity, biomass and hydrogen

- support first-of-a-kind demonstration of carbon capture utilisation and storage from a range of industrial sources

- support the development of industrial digital technologies to maximise efficiency improvements

- support research into advanced technologies

- support advancements in product innovation

Part 3: Maximising the UK’s potential

Chapter 7: Net zero in a global market

Decarbonising industry is a global challenge. Industrial products are bought and sold in every country in the world, and the sector accounts for around 24% of global carbon dioxide emissions (IEA, Tracking Industry 2020, 2018). By leading and advocating for stronger international collaboration with others, we will develop new technologies faster, increase production, and bring down the costs of industrial decarbonisation more quickly.

This chapter sets out how we will:

- work with our partners to create a coalition of countries committed to shared approaches to developing the market for low carbon products

- lead global innovation efforts, through the UK’s leading role in Mission Innovation, to reduce the costs of supplying low carbon industrial products

- support industrial decarbonisation through trade policy

- capitalise on the export opportunities of having a world-leading net zero industry

- continue to work with key international organisations, countries and initiatives to encourage industrial decarbonisation in developing countries

Chapter 8: Levelling up

The manufacturing sector is a crucial part of local economies across the UK, often providing well-paid jobs in areas where salaries fall below the UK average, and it is vital that this sector thrives now and in the future. We will use the opportunity of net zero to transform the UK’s industrial regions, attracting inward investment, future proofing businesses and securing the long-term viability of jobs.

This chapter sets out how we will:

- unlock new job opportunities through deployment of low carbon infrastructure in industrial areas

- support the skills transition so that the current and future workforce benefit from the creation of new jobs

- create incentives for new industrial sectors to base themselves in the UK’s industrial hubs and promote opportunities to attract foreign investment

- work with devolved governments across England, Scotland, Wales and Northern Ireland to unlock barriers to decarbonisation

Chapter 9: Tracking progress

Industrial decarbonisation is a complex process and it is imperative that we take action now to reach our 2050 goals. In this strategy, we are setting out new ambitions for a thriving low carbon industrial sector, and we need new indicators to measure our progress. For example, we need to track the deployment of new infrastructure that will enable widespread capture and storage of carbon dioxide, as well as monitoring the growth of green jobs in industry.

This chapter sets out how we will:

- take a strategic, effective, proportionate, flexible and responsive approach to track our progress on meeting our strategy goals

- use government’s annual response to the Climate Change Committee’s progress report on decarbonising the UK economy to inform the public on progress in delivering the strategy, and undertake a full review of strategy actions every five years

- use a range of metrics to update on our progress, including UK industry emissions and volume of carbon dioxide captured and stored, and hydrogen used in industry

Part 1: Foundations to deliver net zero for industry

Chapter 1: Why we need a strategy and our approach

Factory turbines

The UK was the first major economy in the world to pass laws to end its contribution to global warming with our 2050 net zero target. With the publication of this strategy, we become the first to show how we can have a thriving industrial sector aligned to net zero. We will work in partnership with industry, its workforce, customers and communities, sharing the costs and opportunities of this green industrial revolution.

This strategy builds on the ambition and actions set out in the Industrial Decarbonisation and Energy Efficiency Roadmaps to 2050 project: updating the pathways analysis and adapting actions to reflect our net zero target, considering fully the role of hydrogen and resource efficiency, and expanding to consider all of UK industry.

This strategy reflects advice and feedback from trade associations, businesses, environmental groups, academics and the Climate Change Committee (CCC). Workshops explored themes such as incentives to adopt low carbon technologies, carbon leakage risks and the importance of a clear policy and funding landscape. The role of government, industry and the consumer in the net zero transition were discussed at a Confederation of British Industry roundtable with over 40 industry representatives, as well as the BEIS Industrial Energy and Energy Intensive Industry stakeholder forums. Finally, the pathways analysis in Annex 4 was tested with a group of academic experts. We look forward to continued partnership with our stakeholders, so that we can deliver the ambition of this strategy together over the coming years.

The decarbonisation challenge

Industrial products are vital to life in the UK, from the fabric of our buildings to the materials we use in our daily life. Without manufacturing industry, there would be no cars, no COVID-19 vaccine, no food or the packaging it goes in. UK industries combine high end technology and highly skilled workers with ingenuity to make products that are traded all over the world.

Industry plays an essential role in society, contributing £170 billion to the overall economy. It is a high value area of employment, directly accounting for 9% of the UK’s GDP and providing 2.6 million direct jobs (ONS, Annual Business Survey, 2020) as well as over 5 million jobs across the value chain (UK in a Changing Europe, Manufacturing and Brexit, 2020). These businesses are disproportionately important to regions outside the South East, providing well paid jobs in areas such as the North West, Yorkshire and South Wales.

This strategy covers the full range of UK industry sectors: metals and minerals, chemicals, food and drink, paper and pulp, ceramics, glass, oil refineries and less energy‑intensive manufacturing[footnote 1]. It also covers the new emerging industries, which will be the hallmarks of the net zero transition, including low carbon hydrogen and carbon capture, usage and storage.

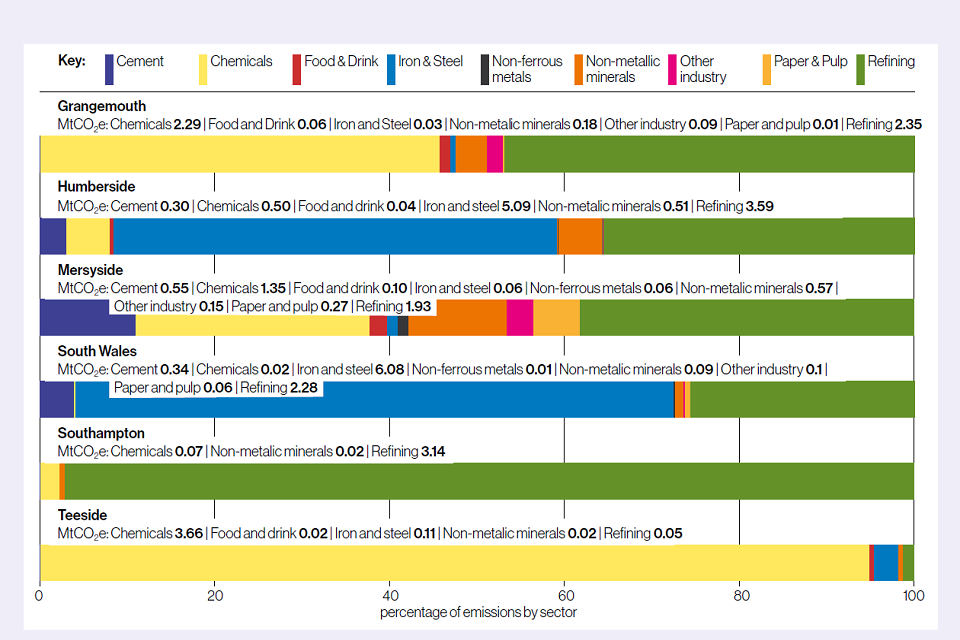

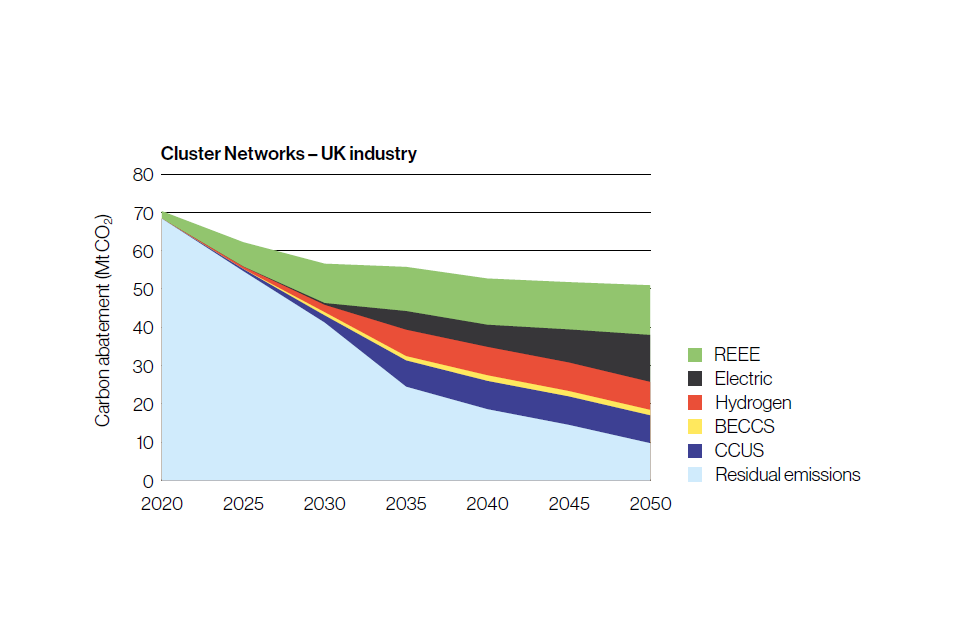

Today our sectors are highly emitting, and combined produce 16% (72 Mt CO2e) of UK emissions (BEIS, Final UK greenhouse gas emissions from national statistics: 1990 to 2018: Supplementary tables, 2020)[footnote 3]. Around half of these emissions are concentrated in industrial clusters (BEIS, 2020 - BEIS analysis of the NZIP model, see Annex 4).

Figure 1.1: Breakdown of current UK industry as considered in this strategy[footnote 4]

- Clustered sites - total 37.6 MtCO2e

- Non-iron and steel industry - 25.6 MtCO2e

- Iron and steel - 12.0 MtCO2e

- Dispersed sites - total 33.6 MtCO2e

- Dispersed cement sites - 4.2 MtCO2e

- Energy intensive (excluding cement) - 12.3 MtCO2e

- Less energy intensive - 17.1 MtCO2e

This strategy comes at a time of substantial economic challenge and decreased ability of companies to invest. COVID-19 has resulted in a fall in production output, exports, and turnover growth across many of our industries. In the short term, industry has been able to access a range of cross economy government support, and in the longer term we are pursuing a green response to this crisis, including through the actions detailed in this strategy.

At the same time, there are significant positive changes taking place in the global fight against climate change, which will support industry’s net zero transition. In November 2021, the UK will host the 26th UN Climate Change Conference of Parties (COP26), through which we are committed to reaching a constructive, negotiated outcome that drives forward collective climate action globally in line with the temperature goal of the Paris Agreement. The UK is also implementing and negotiating new free trade agreements following our exit from the EU, growing our decarbonisation export and collaboration opportunities in turn.

Supporting the sectors to reach net zero carbon emissions by 2050 will provide new opportunities to level up the economy across all nations and regions of the country. Enabling investment in decarbonised technologies can drive job creation and new inward investment in the UK, and create new markets for our manufacturers.

Decarbonisation also creates challenges for industry. Many essential low carbon[footnote 5] technologies are in earlier stages of development, and not yet deployed regularly at a commercial level. Low carbon manufacturing will also be more expensive for some sectors, leading to an increase in their costs, and therefore risking a reduction in their competitiveness. This creates a risk of “carbon leakage” (Chapter 2), which could impact both our domestic and global climate goals. We need to work with industry to overcome these barriers in the coming decades. Any action taken will need to be consistent with our international obligations, both under the Paris Agreement and wider international trade rules.

To meet net zero, our modelling shows industrial emissions will need to fall by at least 90% by 2050 (Chapter 4), equivalent to taking all the cars off the roads today. Any remaining emissions will need to be offset by separate methods, such as planting trees and capturing carbon from the air. All industrial sectors will need to act to meet this challenge. We need to transform how industry uses energy and makes products, and rethink the way consumers buy industrial products.

Our objectives

Through this strategy, we are aiming to:

- show how the UK can have a thriving industrial sector aligned with the net zero target, without pushing emissions and business abroad

- show how and when government will act to support this, while sharing the costs and risks fairly between industry, its customers and the taxpayer

- start a conversation with industry, its workforce, customers and communities about the future of industry in a net zero world

Every part of the UK has an important role to play in decarbonising industry. There are unique challenges to reaching net zero in each of the devolved nations, and some of the ambition set out within this strategy may require devolved powers to deliver. We look forward to continuing to work collaboratively with the devolved administrations to ensure that industry decarbonises across all nations.

Our ambition

To keep industry on the journey to net zero, and meet our carbon budgets and nationally determined contribution under the Paris Agreement, we expect that emissions need to fall by around two thirds by 2035, delivering this in a way that capitalises on clean growth opportunities. Annex 4 sets out the modelling and analysis that has informed this. Our current expectation is that to meet this we need:

- four of our major industrial regions linked up to the necessary decarbonisation infrastructure by 2030

- around 3 MtCO2 of industry emissions captured each year by 2030, the same as planting over 500 million trees

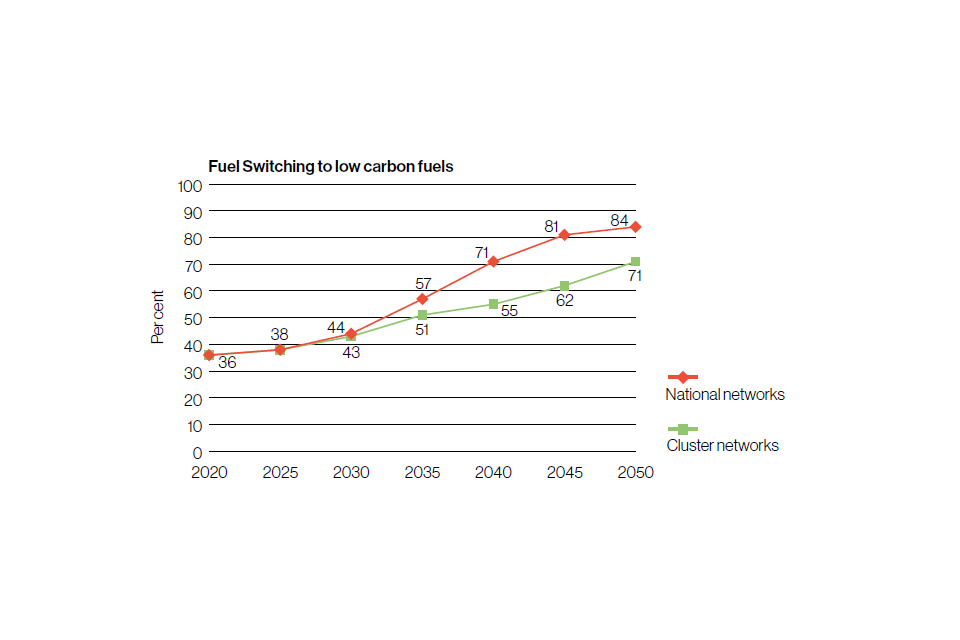

- low carbon fuels such as hydrogen, electricity and bioenergy replacing fossil fuels, unless combined with carbon capture. To be on track to deliver net zero, we expect that the minimum, in all future scenarios, is 20 TWh per year of fossil fuel use replaced with low carbon alternatives in 2030

- maximum energy, resource and material efficiency within industry, including the adoption of circular economy measures, particularly through the 2020s

- development of a thriving market for low carbon materials

- established approaches to equip workers and local residents to take advantage of new opportunities of decarbonising industry

- cooperation with other leading nations and support to the developing world to ensure that industrial decarbonisation is happening across the globe

We will revisit these expectations as part of the analysis for the Net Zero Strategy later this year, and as relative costs evolve over time. Additionally, in collaboration with the Steel Council we will consider the implications of the recommendation of the Climate Change Committee to ‘set targets for ore-based steelmaking to reach near-zero emissions by 2035’ and the business environment necessary to support the transition.

Our principles

Over the long run, we believe carbon markets are best placed to determine the most cost‑effective pathways to decarbonisation. But industry faces a range of well documented barriers to clean growth, and government efforts so far have not provided the framework needed to make decarbonisation viable. We will change the policy landscape to overcome these issues, through actions driven by the following principles:

- government intervention should focus on addressing market failures or barriers to decarbonisation. Intervention should be technology neutral, and fairly share the cost and risk between industry, consumers and taxpayers (Chapter 2 and 3)

- where decarbonisation leads to significant costs that creates carbon leakage risk, it should be supported by targeted intervention to mitigate this risk (Chapter 2)

- government should play a key role in delivery of large infrastructure projects for key technologies (for example CCUS and hydrogen networks) where there is a shared benefit and the risk or cost is too great for the private sector (Chapter 4)

- government should intervene to deliver specific strategic outcomes in line with wider priorities set out in Build Back Better: our plan for growth (Chapters 6 and 8)

These principles inform the commitments in this strategy, and will be the basis for our interventions through the 2020s and beyond. Annex 1 collects the full range of delivery commitments made in this strategy and Annex 3 sets out how we will deliver our goal of achieving four low carbon clusters by 2030 and at least one fully net zero cluster by 2040.

Our approach

Action in the 2020s

We are entering a crucial decade where we will lay the policy and infrastructure foundations to enable deep decarbonisation and ensure businesses do not lock in high carbon technologies. We also hear the feedback that current policies are complicated and overlapping. Our actions in the 2020s will focus on aligning existing policy with net zero and putting in place new incentives to fill any policy gaps, to create a clear set of incentives that stands the test of time. Through these changes we will create the conditions for the first industrial businesses to deeply decarbonise, forging a path for other companies to follow. At the same time we will continue to incentivise energy efficiency improvements across industry, to ensure emissions targets are met.

For our funding approach, this means having the right schemes in place to support the deployment of low carbon technologies. And it means investing in the critical shared infrastructure required to deploy these technologies.

For our approach to carbon pricing, this means ensuring the UK Emissions Trading Scheme (ETS) sets a cap in line with our emissions targets, and that our policy provides the right long-term signals to incentivise abatement across industry. It also means ensuring appropriate mitigations for competitiveness are in place that accurately reflect carbon leakage risks and do not disincentivise abatement.

For regulation, this means introducing new incentives to address other market failures. This includes measures to support the development of the market for low carbon products.

Frameworks for the 2030s and 2040s

In the 2030s and 2040s, deep decarbonisation will set in across industry, building on the concrete steps taken in the 2020s. As decarbonisation becomes more widespread, government’s role will change. Certainty about the impact and cost of technologies will improve, gradually reducing the need for government funding to support deployment. Essential foundations such as building infrastructure and maturation of the low carbon product market will be completed, further reducing the need for government intervention.

Government will continue to play a role in reducing emissions. We see emissions trading and product regulation policies continuing to form the core levers used to drive deployment of low emissions technology through to 2050. Long term, we need to address the competitiveness risks arising from such policies that give rise to carbon leakage. This will include ensuring that both global and local incentives to decarbonise endure by seeking to reduce differences in climate policy between trading partners. For example, by closing differentials in global carbon prices as the cap of the UK ETS tightens and fewer emission allowances are given for free. As set out in the Net Zero Review Interim Report, this could be achieved through a range of policy approaches including climate diplomacy and treating imports in ways that seek to compensate for the competitiveness impacts of any asymmetries between trading partners’ climate policies.

Figure 1.2: Industrial decarbonisation policy in the 2020s, with costs.

Measures to improve productivity could also be implemented to mitigate competitiveness pressures. These options are discussed in the Net Zero Review Interim Report. Figure 1.3 sets out the framework of policy options that could drive abatement in industry by 2050, building on work undertaken in the 2020s.

Figure 1.3: Possible industrial emissions policy approaches by 2050

1. Primary sector decarbonisation incentive (essential)

Gets existing and new industries to keep emissions low so we can meet net zero

Options:

- Carbon pricing

- Product standards

2. Carbon leakage mitigation mechanism (necessary if other countries decarbonise more slowly)

Appropriately addresses risks of carbon leakage as a result of differences in climate policies

Options:

- Climate diplomacy

- Improving productivity

- Treatment of imports

3. Wider supporting policy framework (beneficial to support net zero transition)

Enables transition across sector and addresses any final barriers

Options:

- Skills transition

- Energy / resource efficiency regulation

- Targeted assistance for innovation and complex sites

Direct government funding for new abatement projects in industry will decrease in the 2030s and into the 2040s as, in line with our principles, we increasingly see the market driving investment in reducing industrial emissions. Government at a national or local level will play a role supporting any necessary training of the workforce as companies evolve in the transition to net zero, to ensure we have the skills needed for a low carbon industrial sector.

Figure 1.4: Strategy interrelation with other relevant UK government publications

| Previous publications that informed the Strategy | Current strategy publications and beyond that inform and were informed by the Strategy | Current strategy publications and beyond that will be informed by the Strategy | |

|---|---|---|---|

| Overarching strategy | Clean Growth Strategy (BEIS 2017) | Net Zero Srategy (BEIS 2021) Build Back Better: our plan for growth (HMT 2021) The ten point plan for a green industrial revolution (HMG 2020) Net Zero Review (HMT 2021) |

Future Spending Reviews (HMT) |

| Industrial Decarbonisation Policy | Industry roadmaps (DECC 2015) Future of UK carbon pricing consultation (BEIS 2019) CCUS business models consultation (BEIS 2020) Industrial Energy Transformation Fund consultation (BEIS 2019) |

Industrial Decarbonisation Strategy (HMG 2021) | Call for evidence on market for low carbon industrial products (BEIS) UK Emissions Trading Scheme reforms (BEIS) Industrial Decarbonisation Strategy implementation (BEIS) |

| Wider System change | Resources and waste strategy for England (Defra 2018) Hy4Heat (BEIS 2018) |

Transport Decarbonisation Plan Consultation (DfT 2020) Hydrogen Strategy (BEIS 2021) National Infrastructure Strategy (HMT 2020) Construction Playbook (Cabinet Office 2020) Procurement Green Paper (Cabinet Office 2020) Energy White Paper (BEIS 2020) Net Zero Heat & Buildings Strategy (BEIS 2021) |

Future UK Free Trade Agreements (DIT) Transforming Infrastructure Performance: Roadmap to 2030 (IPA) National Policy Statement for Energy (BEIS) |

Progress so far and next steps

Total industry emissions have more than halved over the past 30 years (BEIS, Final UK greenhouse gas emissions national statistics: 1990 to 2018: Supplementary tables, 2020). Analysis by the CCC suggests this can be explained by a combination of the changing structure of the UK’s manufacturing sector, improved energy efficiency, and a shift to lower-carbon fuels. However, emissions reductions in industry are slowing, and more action is needed if we are going to meet our net zero commitments.

We have a good policy foundation that can help us meet this challenge. Energy‑intensive industry has been covered by a cap-and-trade policy in the UK since 2005. In 2015, we published the Industrial Decarbonisation and Energy Efficiency Roadmaps to 2050, which set out a series of pathways for emissions reductions for energy-intensive sectors. Alongside the 2017 Clean Growth Strategy, we published action plans that identified how government and industry should work together to enable decarbonisation in line with our previous 80% emissions reduction target.

More recently, we have set out to have the world’s first net zero industrial cluster by 2040, launched the new UK Emission Trading Scheme and the Industrial Energy Transformation Fund, consulted on commercial support for carbon capture, and announced a £1 billion Carbon Capture and Storage Infrastructure Fund and a £240 million Net Zero Hydrogen Fund. Annex 2 details the full set of extant UK government policies that support industrial decarbonisation.

Industry is greatly interconnected with the UK’s energy system, and delivering net zero in the sectors will have a wide range of interactions with our wider economy as it too decarbonises. This strategy builds on commitments in previous government strategies and policy consultations, including the 2020 Ten Point Plan or a Green Industrial Revolution (Ten Point Plan). It sits in a wider system of strategies that set out how net zero will be achieved for the UK as a whole.

We are setting our policy framework for the 2020s now, and will implement this over the rest of the decade; driving deep decarbonisation of first movers, energy efficiency improvements across sectors, and setting the incentives to ensure a smooth transition to net zero for all of industry, taking advantage of the innovation opportunities available and retaining competitiveness as we reduce emissions.

This is the start of the journey. We need to stay focused on our overarching net zero 2050 goal, but respond to feedback and evolve how we get there. We will track emissions and other indicators and update on our progress annually. We will build on this strategy, updating our actions every five years. (Chapter 9)

| Phase 1. Establishing and developing policy framework to kick-start industry net zero transition | Phase 2. Developing and finalising our policy framework to support wider industrial decarbonisation | Phase 3. Long-term steady deep decarbonisation ongoing across all industry sectors | |

|---|---|---|---|

| State of emissions in industry | – First businesses begin deep decarbonisation – Building of transport and storage networks for CCUS and hydrogen commenced |

– More UK businesses begin deep decarbonisation process, majority developing net zero aligned plans – Low-carbon industrial clusters begin to come online |

– All UK businesses completed, undertaking or fully planned deep decarbonisation process in line with net zero – First net-zero industrial clusters begin to come online, businesses outside of clusters access shared hydrogen and CCUS infrastructure |

| Business case for decarbonisation | – Business model of capital funding and revenue support contract – Energy efficiency measures undertaken funded in part by the Industrial Energy Transformation Fund (IETF) |

– Competitively allocated business model contracts, phase-out of upfront funding – ETS cap tightening with reformed leakage mechanism, and cost of technology reducing – Implementation of demand-side policies to support consumer decision making |

– ETS cap and/or product standards limit emissions, with leakage mechanism established in Phase 2 – Wider demand-side policies in place to support consumer decision making |

| Wider government policy development | – ETS cap and trajectory set to deliver net zero in traded sector – free allocation mitigates against leakage risk – Other funding streams support technology innovation – Development of policies to enable fuel switching to hydrogen and electrification |

– IETF and other funding streams supporting additional abatement begin to phase out – More comprehensive smaller policy interventions remain to mitigate other barriers (e.g. retrofit ready) |

– Policy interventions to support net zero transition across economy (e.g. skills transition support) |

Chapter 2: Getting investors to choose low carbon

Man working at plant

Reducing industrial emissions to net zero is a commercial challenge. In many cases, the financial cost of making low carbon industrial products will be higher than the carbon intensive production methods used now. In all cases, the costs associated with decarbonising industry are uncertain and will be influenced by factors such as fuel prices, costs of new equipment and the proximity of industrial sites to shared infrastructure or other industrial users. We want to support existing industry and encourage the growth of new, low carbon sectors in the UK. To achieve this, we need to help make low carbon investments become a viable option for industry, meeting industry’s need for short term pay back on investment. Aligning with the principles set out in the government’s Net Zero Review Interim Report, we need to consider how costs of net zero can be shared fairly between the taxpayer, industry and its customers.

In the long run, markets will be best placed to determine the most cost-effective pathways to decarbonisation. Throughout the next decade, government will need to help overcome a number of different market failures and barriers to entry that prevent industry from securing investment needed to start the low carbon transition. Three levers will be key to any policy framework designed to unlock investment in the technologies we need to decarbonise industry – as set out in Figure 2.1. An ambitious UK Emissions Trading Scheme (UK ETS) cap will send a clear signal to the market that this government is committed to reaching net zero. While risks associated with low carbon investments remain high, or if the carbon price is low, targeted government funding mechanisms will pull through investment from the private sector for the deployment of technologies. A reformed approach to mitigating carbon leakage, adapting over time to reflect a tighter ETS cap alongside increased deployment of low carbon technologies, will ensure our global and domestic climate goals are met, while supporting the growth of low carbon manufacturing in the UK.

Figure 2.1: A framework to unlock investment in low carbon industry

– An effective carbon pricing mechanism sends a clear market signal

plus

– Funding mechanisms overcome barriers to securing private sector investment

plus

– Policy reform mitigates risk of carbon leakage for specific sectors

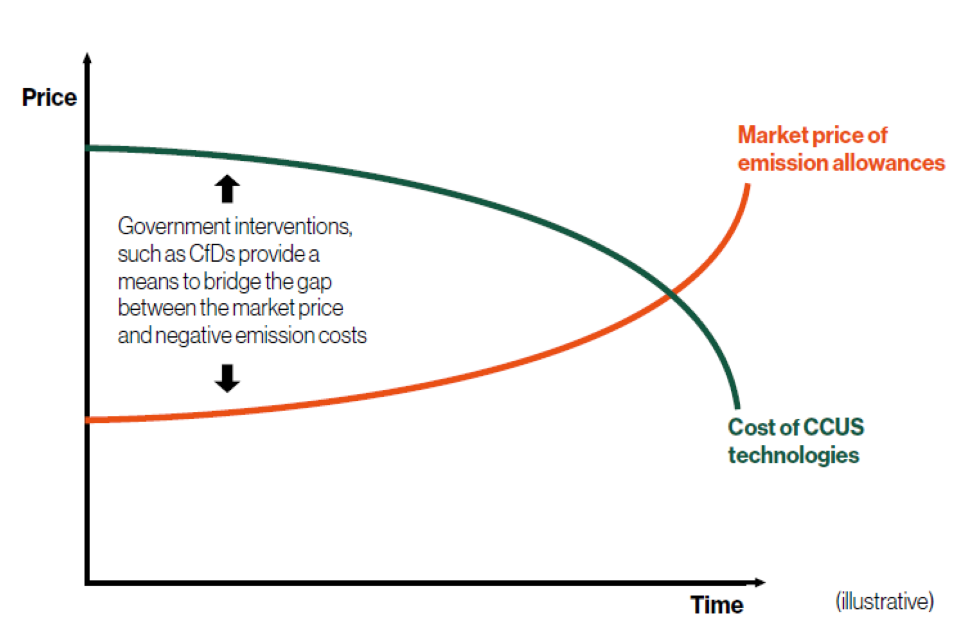

Over time, we expect that costs of deploying new technologies for industry will fall. This reflects experience in the offshore wind sector, where the government’s Contracts for Difference scheme for low carbon electricity delivered investment and significant cost reductions, with costs of offshore wind falling by two-thirds in the past five years (HM Government, Ten Point Plan, 2020). Other barriers faced by industry, associated with risk, or coordination, will also be addressed, reducing the need for direct government support.

The policies set out in this chapter will adapt in a way that reflects changes in the market, to ensure that any government support guarantees value for money for the taxpayer, while industry and its customers pay a fair price for their emissions.

To help drive investment in low carbon industry, government will:

Action 2.1: Use carbon pricing as a tool to send a clear market signal, providing certainty over our net zero ambition for industrial sectors

Carbon pricing is a cost-effective and technology-neutral tool for getting industry to take account of its emissions in business decisions. Pricing policies like the Carbon Price Support and EU Emissions Trading System (EU ETS) have helped drive a switch from coal to gas generation in the power sector, and the UK ETS will be a key part of the framework to reduce emissions from industry.

In January 2021, we established a UK ETS to replace the UK’s participation in the EU ETS. To reflect our ambition on carbon pricing, the cap on allowances – which represents the overall limit of emissions allowed in the system – will be aligned with the UK’s net zero ambition by January 2024. In 2021, we will carry out a review of the UK ETS. This will include consulting on a net zero consistent emissions cap; reviewing the long-term role of free allowances; exploring expanding the scope of the scheme to cover more sectors of the economy and linking with other schemes internationally; and considering the case for a supply adjustment mechanism.

Some industrial businesses, or facilities within an installation, will remain out of scope of the UK ETS at this time. For those businesses, we expect the Climate Change Levy (CCL) and action agreed through the Climate Change Agreements (CCA) scheme to act as a driver for energy efficiency improvements and decarbonisation. The CCA scheme has recently been extended by two years, providing significantly reduced CCL rates until March 2025 for participants who meet their targets. We intend to undertake further assessment of the purpose and targeting of a long-term scheme following the extension, informed by the responses to last year’s consultation.

Action 2.2: Put in place funding mechanisms to support deployment and use of CCUS and low carbon hydrogen infrastructure

CCUS will be crucial to reaching net zero, and low carbon hydrogen has the potential to play a key role in enabling the economic transformation of the UK’s industrial regions. With both technologies at early stages of development, government will need to play an active role in overcoming market failures; sharing the risk and costs of scaling up deployment of both CCUS and low carbon hydrogen.

Throughout the early 2020s, we will support the engineering and technical design elements of decarbonisation projects across the UK’s industrial clusters through UK Research and Innovation’s (UKRI) Industrial Decarbonisation Challenge. Throughout the 2020s and 2030s, further support to develop markets for these technologies will be necessary. We have already committed to a £1 billion CCS Infrastructure Fund to provide industry with certainty required to deploy CCUS at pace and scale, alongside a £240 million Net Zero Hydrogen Fund. Later this year, we will bring forward further details of the revenue mechanism that will support business models for both industrial carbon capture and low carbon hydrogen projects.

Industrial carbon capture

We are already working with industry to develop an industrial carbon capture contract. In December 2020, we set out our ‘minded-to’ position on the commercial business model designed to incentivise deployment of carbon capture technology for industry. For first of a kind projects, we expect the model to cover operational costs, transport and storage fees and a rate of return on capital investment, with an element of capital co-funding for initial projects. The model will be based on the Contract for Difference model with, for initial projects, a pre-defined, fixed trajectory for the reference price, coupled with a bilaterally negotiated strike price that is intended to reflect the actual costs of capture. As carbon capture is established and the low carbon market matures, it is intended that the reference price would evolve to the market-driven carbon price. We plan to finalise the industrial carbon capture business model in 2021 and to implement it in 2022.

Figure 2.2: Illustrative example: CCUS costs fall over time

Transport and storage

Carbon dioxide transport and storage networks are fundamental to supporting efficient and cost-effective decarbonisation of industry. They also offer a pathway for negative emissions through Bio-Energy CCUS (BECCS) and Direct Air Capture with Carbon Sequestration (DACCS). In our December 2020 update on CCUS business models, we set out plans to publish a carbon dioxide Transport and Storage Regulatory Investment business model. The regulatory framework will support a stable, predictable and indexlinked model which will underpin investment returns so that carbon capture can play a role in the UK’s economy, supported, where needed, by appropriate levels of government intervention (BEIS, CCUS: an update on Business Models, 2020).

Low carbon hydrogen

The government’s Ten Point Plan confirmed that a £240 million Net Zero Hydrogen Fund will provide capital co-investment for early low carbon hydrogen production projects. The December 2020 update on CCUS business models also included an update on our work on hydrogen business models and summarised our approach to developing business models that aim to overcome the cost gap between low carbon hydrogen and higher carbon fuels, such as natural gas. We have committed to a consultation on preferred low carbon hydrogen business models in Q2 2021, with a final model to be agreed in 2022. We have also committed to setting out further details on the revenue mechanism to fund our hydrogen business model later in 2021.

Alongside work on business models, we are considering the role that fuel standards can play in helping industry invest in low carbon alternatives. We are gathering evidence on the emissions associated with different hydrogen production technologies and will work with industry to develop a UK standard that defines low carbon hydrogen. Further details will be provided in the UK Hydrogen Strategy.

Action 2.3: Establish the right policy framework to ensure uptake of fuel switching

While CCUS will be critical to achieving net zero, fossil fuels (gas, coal and oil) will also need to be replaced with low carbon alternatives such as low carbon hydrogen, electricity or biomass (primarily with CCUS). Industry face barriers to fuel switching (set out in detail in Chapter 4) and we acknowledge that there may be a role for government to support uptake of fuel switching, beyond the business models for low carbon hydrogen set out in the previous section. During 2021, we will review the existing policy landscape and assess the impact that barriers have on business decisions about investing in electrification and biomass (primarily with CCUS) technologies. We will also consider how industry can make use of smart technologies, such as storage and demand side response, to provide flexibility to the system, helping industrial consumers use energy when it is cheapest and cleanest.

By the end of 2021, we will set out any initial steps that the government will take to support the uptake of electrification and biomass (primarily with CCUS) for industry.

Energy costs

We recognise that the UK’s industrial electricity costs are currently higher than those of some of our competitors, which partly reflects how the costs of the electricity system are distributed across household and industrial customers. We have taken steps to reduce the cumulative impact of energy and climate change policies on industrial electricity prices for eligible sectors. The total package of compensation and exemptions from electricity policy costs was worth over £470 million in 2019, through compensation for indirect costs of the EU ETS and Carbon Price Support, as well as exemptions for Contracts for Difference, Renewables Obligation and small-scale feed-in-tariffs. The UK’s industrial gas prices are competitive; gas prices for medium industrial users were the fourth lowest in the EU15 in the second half of 2019.

As set out in the Energy White Paper, fairness sits at the heart of our approach to decarbonising the energy system. We want households and businesses to be confident that all energy users are fairly sharing in the benefits and costs of the UK’s transition to net zero. To help make this happen, we will publish a call for evidence by April 2021 and begin a strategic dialogue between government, consumers and industry on affordability and fairness in our energy system.

Action 2.4: Take initial steps to create a market for negative emissions technologies

Our pathways modelling demonstrates that there will be a small amount of residual emissions (about 6 Mt CO2e) that will need to be offset through a combination of different greenhouse gas removal (GGR) measures. GGR technologies include afforestation as well as innovative technologies including DACCS and BECCS.

In June 2020, the government announced up to £100 million of new research and development funding to help develop direct air capture technologies in the UK. This will support the development of GGR technologies to help them achieve commercialisation. In December 2020, we launched a call for evidence on GGRs, to strengthen the government’s evidence base on the viability of different GGRs in the UK and the role of government in addressing market barriers and stimulating the development and deployment of GGRs. We will use responses from this call for evidence to inform the government’s future policy in this area, including considering how the UK ETS could be developed to incentivise deployment of GGRs.

Case study: Chemicals sector decarbonisation

The chemicals sector will be a vital part of the net zero economy. A large proportion of the manufacturing sector uses chemicals to make products such as batteries, wind turbine blades and solar panels, lightweight materials for transport and fuels such as hydrogen. In 2020, the Chemical Industries Association published their report ‘Accelerating Britain’s Net Zero Economy’, setting out how the sector can provide a direct and indirect contribution to reaching net zero. Working closely with government, the chemicals sector can benefit from policy designed to deploy new technologies in industrial clusters across Scotland, Wales and the North of England, as well as the demand‑side mechanisms we discuss in Chapter 3.

Action 2.5: Establish a targeted approach to mitigating carbon leakage

Managing the trade-off between driving change as we seek to meet our domestic and global climate goals and keeping businesses competitive is key to achieving a successful transition to low carbon industry.

As the UK transitions to net zero, there will be implications for the competitiveness of UK businesses. Some businesses will benefit from new export opportunities (Chapter 7), but others could face competitiveness concerns if other countries do not decarbonise as quickly as the UK. These changes could lead to carbon leakage.

Carbon leakage is when policies achieve their goal of lowering emissions in one jurisdiction but drive some companies to move production or reallocate investment to other countries with less ambitious greenhouse gas emissions reduction policies. This could lead to an increase in overall global emissions, and a worse outcome for climate change. The risk of carbon leakage depends on several factors, including each sector’s costs of decarbonising, how many emissions they produce, how much a sector trades internationally, and climate and business environment policies in other countries.

Carbon leakage can arise through several channels. In the context of industrial decarbonisation, we are particularly concerned with:

- domestic producers losing market share to higher carbon imports as a result of higher domestic carbon costs than those faced by international competitors

- diversion of investment from countries with more ambitious carbon constraints to those with less ambitious ones, leading to increased emissions

Leakage is first and foremost an environmental issue, but it is also an obstacle to a fair and level global playing field for businesses. Industry should not wrongly lose their competitiveness because of their exposure to more stringent emissions targets than their global competitors.

Beyond immediate climate policy, there are wider circumstances that affect the competitiveness of UK industry, and can also lead to investment moving abroad. ‘Build Back Better: our plan for growth’ sets out the government’s plans to support growth across the economy through significant investment in infrastructure, skills and innovation, in a way that enables net zero. As cited above, we will publish a call for evidence later this year on affordability and fairness in our energy system. Net zero is a shared commitment across all of government and a consideration of climate change impact will need to be embedded across all future policy making.

Current approaches to mitigating leakage

Historically, the UK’s approach to mitigating carbon leakage risk has been through issuing free allowances under the EU ETS and providing energy-intensive sectors with compensation for increased energy costs. We recognise this approach may overcompensate for the risk of leakage, and as we further develop our policy framework, we want to ensure that carbon leakage policies are better targeted.

Under the UK ETS, a proportion of allowances are also allocated for free, with the initial approach similar to that of the EU ETS (Phase IV). The UK ETS 2021 review will include considering the role that free allowances play in mitigating carbon leakage as we move towards net zero.

Developing an evidence base

Research undertaken for government in 2020 found limited empirical evidence of carbon leakage to date. These results can in part be attributed to historically low carbon prices in many jurisdictions, as well as the proactive use of measures to limit the leakage risk and competitiveness impacts, as described above (BEIS, UK Business Competitiveness and the Role of Carbon Pricing, 2020).

As UK policy becomes more ambitious and world-leading in line with our emissions reduction targets, the risk of leakage may increase, particularly for high emissions intensive and trade exposed sectors. Long term we envisage that as costs of decarbonisation technologies go down, our key global trading partners will also take action to reduce domestic emissions, and through that the risk of UK industry leakage will decrease.

We have developed a framework to assess the competitiveness of UK sectors and the impact of carbon pricing (BEIS, UK Business Competitiveness and the Role of Carbon Pricing, 2020). We will build on and apply this framework to better understand the impact that government policy, including on carbon pricing, compensation schemes and other measures has on the competitiveness of different industrial sectors.

Considering a range of carbon mitigation policies

There are a range of levers available to government to mitigate the risk of carbon leakage. Some policies we are pursuing will provide some leakage mitigation alongside their primary objective, for example funding policies that reduce the cost of decarbonisation, or demand‑side policies that enable greater passthrough of costs to consumers (Chapter 3).

In the immediate future, government’s preferred method for mitigating the risk of carbon leakage will continue to be free allocation of UK ETS emissions allowances, which will be decreasing throughout the 2020s. We are exploring the impacts of a net zero consistent cap trajectory and the most appropriate way to mitigate the risk of carbon leakage and adverse effects on UK industrial competitiveness as part of the review into free allocations. We have opened a call for evidence on how our use of free allocation can better incentivise decarbonisation and mitigate the risk of carbon leakage for energy‑intensive, trade-exposed industries.

The UK will continue to holistically consider the full set of policies, both in existence and in development, as part of our future trade and carbon leakage mitigations policy development. In the longer term, particularly in the 2030s and 2040s, a range of wider measures could be deployed to address leakage risks for industry, primarily falling into the categories of:

- climate diplomacy: continuing work with other countries and multilateral bodies to align our approaches and minimise the differentials that create a leakage risk

- treatment of imports: seeking to mitigate the competitiveness impacts of any asymmetry in domestic and international emissions mitigations policies

- improving productivity: boosting the competitiveness of UK sectors and making them more resilient

We will analyse options and impacts over the next few years, alongside the government’s Net Zero Review, which will build on the analysis of the risks of carbon leakage and competitiveness that could arise from the transition to net zero.

In considering carbon mitigation policies, the UK will also take account of their wider effects on international trade and investment. The UK is committed to promoting free and fair trade and ensuring that its policies are consistent with our international trade obligations, including at the World Trade Organization (WTO) and our international trade agreements.

Action 2.6: Work with stakeholders to understand how an EU Carbon Border Adjustment Mechanism could affect the UK

As part of the EU Green Deal, the EU’s Carbon Border Adjustment Mechanism (CBAM) proposal is expected in June 2021. Little detail has been provided on what the mechanism would look like in practice, although options considered in the consultation included a tax on imports; extension of the EU ETS to non-EU operators; and a new consumption-level tax. The EU plans to discuss carbon leakage with WTO members, including the UK, with a view to agreeing a ministerial statement at the WTO Ministerial in December. We will work with business, academic and government stakeholders in the EU and UK to understand how such a policy would affect UK industry, and are committed to ensuring our businesses do not face any unreasonable barriers to trade, given the UK and EU’s shared high levels of climate ambition.

Chapter 3: Getting consumers to choose low carbon

Pipes

A key barrier to reaching net zero is fairly distributing the costs of decarbonisation between the taxpayer, industry and consumers of industrial products. Deploying low carbon technologies will likely mean that the resulting low carbon products will be more expensive to manufacture, unless supported by government fiscal interventions such as carbon pricing. Since cheaper, carbon intensive products will continue to be available at least in the short-term, action needs to be taken to support the development of a market for low carbon products. This will complement fiscal action to reduce the risk of carbon leakage set out in Chapter 2.

Analysis suggests the cost increase in consumer products from the switch to using low carbon industrial materials and components will be relatively low (Energy Transitions Commission, Mission Possible, 2018). Government can support low carbon manufacturers by implementing policies that aim to increase overall demand for low carbon products (“demand-side” policies), without significantly impacting the cost to end consumers. There are two key obstacles which can be addressed through new government action:

- first, there is a lack of information about the carbon intensity of industrial products. There may be consumers who are willing to pay more for low carbon products, but are not currently able to identify them. Consumers need a simple way to recognise low carbon products, and a better understanding of how they can use their purchasing power to support the transition to net zero

- second, carbon-intensive products are currently cheaper than low carbon alternatives. In the long-term, demand-side policy can play a key role in making low carbon products competitive, helping the development of the market and mitigating the risk of carbon leakage

By putting measures in place to address these barriers, government can help to develop a market and boost demand for low carbon industrial products. Over time the market for low carbon products can become self-sustaining, becoming a driver of decarbonisation in and of itself.

Design principles for demand-side measures

We want to use demand-side measures to increase industry confidence in the profitability of decarbonisation and to support consumers to make low carbon choices. To be successful, the measures we introduce should:

- support industry to share the cost of decarbonisation with consumers

- create incentives for emissions reductions which are balanced across industry

- apply equally to domestically produced and imported products to ensure a level playing field

- be adaptable according to the needs of different sectors

- be technology-neutral to allow for the possibility of future innovation

- work in harmony with other policies, such as carbon pricing, energy efficiency and business models for low carbon technologies

- be suited to a joint approach between the UK and other countries pursuing similar goals

Scope for demand-side measures

Industrial products cover a huge range of goods, from intermediary products manufactured from raw materials such as steel and cement, through to final consumer products such as vehicles and appliances. Focusing our policies at the right point in this complex chain will be essential to effect the change we want to see. We will focus on two crucial parts of the supply chain:

-

intermediary product manufacturer: government will support the decarbonisation of intermediary industrial products, so that the supply chain is gradually supplied with green materials that trickle down to make up greener final products.

-

end-product consumer: government will encourage consumers to make informed choices about the environmental impact of products, creating pressure feeding upwards to encourage greener purchases throughout the supply chain.

Defining low carbon products

A shared definition of what is meant by a “low carbon” industrial product is essential for the development of demand-side policies and will help industry know what to aim for when reducing emissions in their manufacturing processes. There has been significant progress on this issue already, and a range of voluntary definitions and standards have been developed by industrial groups and academia, particularly in the construction sector. However, take up of these definitions is generally limited, and there are few examples where they have become standardised across a sector.

For the purposes of this strategy, when we talk about low carbon industrial products, we mean products manufactured producing fewer, or even zero emissions. However, further work will be needed define low carbon products in a way that is measurable and comparable, for the implementation of demand-side measures.

In developing this definition, we will be looking at the embodied emissions of products. But we are also interested in the entire lifecycle of these products and their impact on the environment – whether they are made of recycled material, their recyclability or repairability, and emissions they produce during the in-use phase. Any definition of a low carbon product will need to take these, and other relevant factors, into account.

To help support the development of a market for low carbon industrial products, government will:

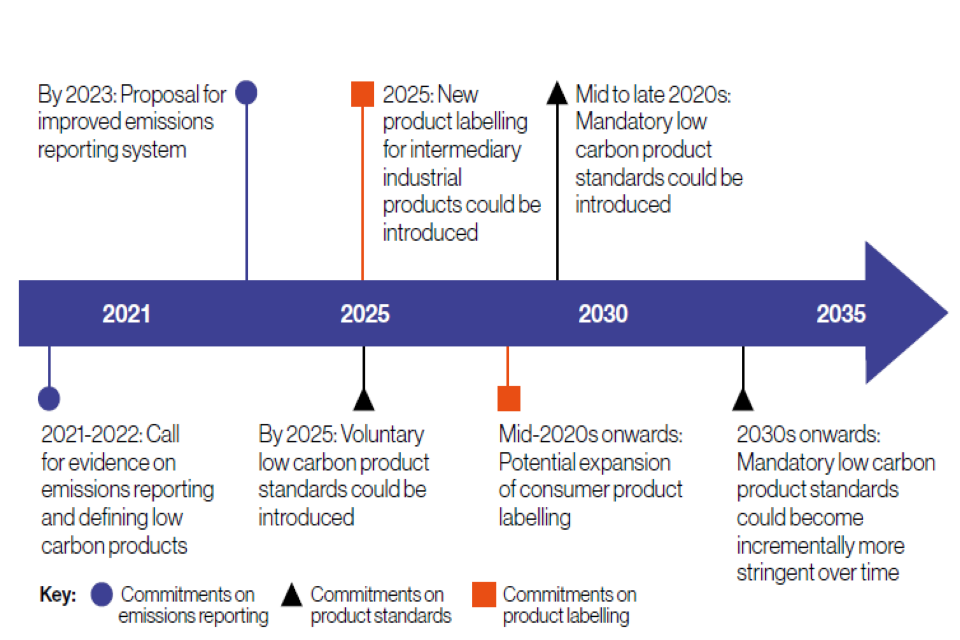

Action 3.1: Develop proposals to improve data transparency

To develop the market for low carbon products, we need increased data transparency so that the embodied carbon in industrial products can be accurately determined. This is a complex task; UK businesses already have to meet a range of emissions reporting requirements, most notably through compliance with the UK ETS and Streamlined Energy and Carbon Reporting, as well as forthcoming regulations government is proposing to require climate-related financial disclosures.

However, current systems were not designed to provide information to calculate the emissions associated with individual products. More or better data may be needed in order to introduce demand-side policies. To understand how this can be achieved with minimal additional burden to industry, we will launch a call for evidence on low carbon industrial products within the next year, which will cover data collection for the development and delivery of demand-side policies.

Based on the results of this call for evidence, we will develop a proposal by 2023 for how any necessary reporting could best be achieved. This system would form the bedrock of the demand-side measures we will introduce later this decade. We are committed to ensuring that this system is streamlined, is user-friendly and places the least possible additional burden on industry.

Action 3.2: Develop proposals for new product standards

Our review of data reporting will inform our understanding of the embodied carbon in industrial products across the market. Our upcoming call for evidence will also consider how we can define low carbon products.

Definitions of low carbon products could be used to develop a voluntary product standards system for key intermediary industrial products. Under this system, manufacturers meeting the standards set by government would receive accreditation certifying their products as lower carbon than the norm in the market. This would enable manufacturers to clearly distinguish their products from high carbon competitors and could provide an opportunity for organisations who have already laid the groundwork on sectoral definitions of low carbon products to gain government endorsement of their work. We will consider the benefits of a voluntary product standards system following the results of the call for evidence, with a view to their potential introduction by 2025.

If a voluntary standards regime is pursued, we will work with industry in the coming years to agree definitions, ensuring standards are tailored to the product and how it is manufactured, without compromising the safety or suitability of materials used in construction and infrastructure.

Beyond voluntary product standards

The use of mandatory standards is one medium-term mechanism which could be used to drive reductions in industrial emissions. Mandatory standards can be used differently to voluntary standards to set an upper limit on the emissions associated with industrial products, as opposed to recognising the best performing manufacturers in the market.

If government chooses to pursue a mandatory standards regime, and potential legal and trade barriers can be overcome, mandatory standards could be introduced in some sectors over the course of the mid to late 2020s. Initially this would be aimed at intermediate industrial products, but the potential for expanding product standards to other stages in the supply chain will be explored. Out to 2050, mandatory product standards could become incrementally more stringent as the definition of a low carbon product narrows, supporting our carbon pricing policy in driving industrial decarbonisation. Further research and analysis, as well as public consultation would be required before this policy could be introduced.

Action 3.3: Develop proposals for product labelling

Low carbon industrial products are often identical to carbon-intensive alternatives; for example, a low carbon glass bottle will perform the same function as a glass bottle produced with high emissions. The ability to assess the embodied emissions of products will provide a new opportunity to give consumers greater detail on the climate impact of their purchases.

We will develop a proposal for a new labelling system for intermediary industrial products reflecting their impact on the environment, which could be implemented in the mid-2020s. In developing this proposal, we will consider whether existing certification systems such as Environmental Product Declarations, could be used or made mandatory. We will also consider which sectors are most suitable to be covered by a labelling system, and how the sectoral scope could broaden over time. This will be subject to further research and analysis on the impact and benefits of such a system, which government will undertake over the next year.

We will also consider expanding existing labelling for consumer products, such as vehicles and appliances, to include an assessment of embodied emissions from the mid-2020s onwards. We will test different methods of doing this, including examining the use of lifecycle assessments. Any label on a final product will need to be easily understood and used by consumers, building on existing labelling approaches such as energy efficiency labels currently required for energy-related products such as fridges and dishwashers. We will also consider ongoing work on resource efficiency labelling, for which powers are being obtained under the Environment Bill.

Figure 3.1: Timeline of commitments

Case study: Construction materials: Increased circularity and resource efficiency

The construction sector is one of the biggest purchasers of industrial products, using significant quantities of energy‑intensive materials such as steel and concrete to build the buildings and infrastructure of a modern society. A range of initiatives have been developed by the sector to reduce emissions, including the adoption of a standard to manage carbon in infrastructure projects (PAS 2080), as well as new tools aimed at influencing procurement decisions away from lowest cost such as the Construction Leadership Council’s Procurement for Value work. One example of a project using energy and resource efficiency measures is the Thames Tideway Tunnel, which is currently under construction. Through resource efficient design and the use of waste materials in construction, the project is predicted to be completed at reduced cost and with a lower level of embodied carbon. The measures are projected to save 2,000 tonnes of material, equivalent to 31% of the original design, with 1,379 tonnes of CO2e being saved as a result (Business in the Community, Advancing Circular Construction, 2020).

Action 3.4: Use public procurement to drive change

Government spent a total of £292 billion on procurement in 2018/19 (HM Treasury, Public Expenditure Statistical Analyses 2019, 2019). In 2018/19, government spent at least £81 million on procuring UK-made steel (BEIS, Steel public procurement, 2020). As a significant buyer of industrial products for construction and defence, government can directly increase demand for low carbon products.

Procuring low carbon materials for public projects will likely be more expensive, at least initially, compared to the high carbon alternatives, but should not lead to significant increases in end-product cost. For example, using green steel in the manufacture of a car has been estimated to add less than 0.5% to the final cost of the vehicle, (Rootzén and Johnsson, Paying the full price of steel, 2016) and using deep-decarbonised cement is estimated to increase the cost of a residential building by a maximum of 1% (Rootzén and Johnsson, Managing the costs of CO2 abatement in the cement industry, 2016).

Ahead of COP26, the UK is developing a new initiative under the Clean Energy Ministerial, supported by the United Nations Industrial Development Organisation and several leading countries. This initiative will explore the role of coordinated action on public procurement to create demand for green industrial products. We want to bring together a coalition of willing countries to set out a collective intention to use public procurement to drive the adoption of green practices, underpinned by a common plan and timetable to collaborate and coordinate our actions.

By acting together, countries can increase the demand pull for low carbon products, helping to achieve economies of scale and drive down costs for all, reducing the risk of carbon leakage and allowing a broader market to develop. International collaboration will support our work to deliver our net zero target. Changes in public procurement behaviour offer an important opportunity to accelerate the adoption of low carbon products in the coming decades.

There are existing measures in place to allow us to consider broader environmental and societal impacts within the commercial process in the UK. This includes Social Value, Balanced Scorecard and the Greening Government Commitments. These measures will be strengthened by forthcoming definitions of low carbon products, and the development and implementation of low carbon product standards and labelling (see Actions 3.1, 3.2 and 3.3). This will ensure a systematic approach is taken to achieving net zero by 2050.

Ongoing procurement reform

Government is in the process of reforming public procurement policy to reflect our values and respond to national priorities.

Green Paper on procurement reform

The end of the transition period provides a golden opportunity to reform the UK’s public procurement regulations, to make public procurement simpler and better able to meet the needs of this country, while still complying with our international obligations. Our aim is for bold reforms that improve commercial outcomes, deliver simplification and flexibility, reduce administrative burdens, drive innovation, get small and medium enterprises winning public sector business and provide more transparency. On 15 December 2020, Cabinet Office published a Green Paper consultation on Transforming Public Procurement ahead of bringing forward primary legislation in the summer. The Green Paper includes a number of proposals to enable procurement to better deliver government policy and maximise societal benefits, such as amending the basis on which contracts are awarded from most economically advantageous tender (MEAT) to most advantageous tender (MAT) and retaining the requirement for criteria to be linked to the “subject matter of the contract” but allowing specific exceptions set by government.

National Procurement Policy Statement

The government will publish a National Procurement Policy Statement setting out national priorities of strategic importance in public procurement, including tackling climate change. The government intends to legislate to require all contracting authorities to have regard to these priorities in their procurement and commercial activities.

Action 3.5: Support businesses to make greener choices

Alongside government, the private sector can create demand for low carbon industrial products. We want to ensure that businesses have the knowledge and resources available to make greener choices as low carbon products become more widely available.

We want to help private companies combine their purchasing power by facilitating the formation of voluntary buyers’ alliances. By acting together through buyers alliances, businesses could benefit from economies of scale while supporting demand for low carbon products. We will engage closely with stakeholders to understand how government can bring businesses together to achieve this outcome.

International cooperation

Efforts to create a market for low carbon products can benefit significantly from global collaboration. A joint green procurement approach would increase and consolidate demand for low carbon products, improving investors’ confidence in decarbonisation. Shared definitions of low carbon products and common product standards can simplify processes for industry and make international trade between countries smoother.

The UK intends to be a key player in a coalition of progressive countries leading the way for the rest of the world in seeking a joint approach on creating demand for low carbon products. We will use key upcoming international meetings, including COP26, to seek joint commitments on these issues. More information on our approach is set out in Chapter 7.

Part 2: Transforming industrial processes

Chapter 4: Adopting low-regret technologies and building infrastructure

Refinery

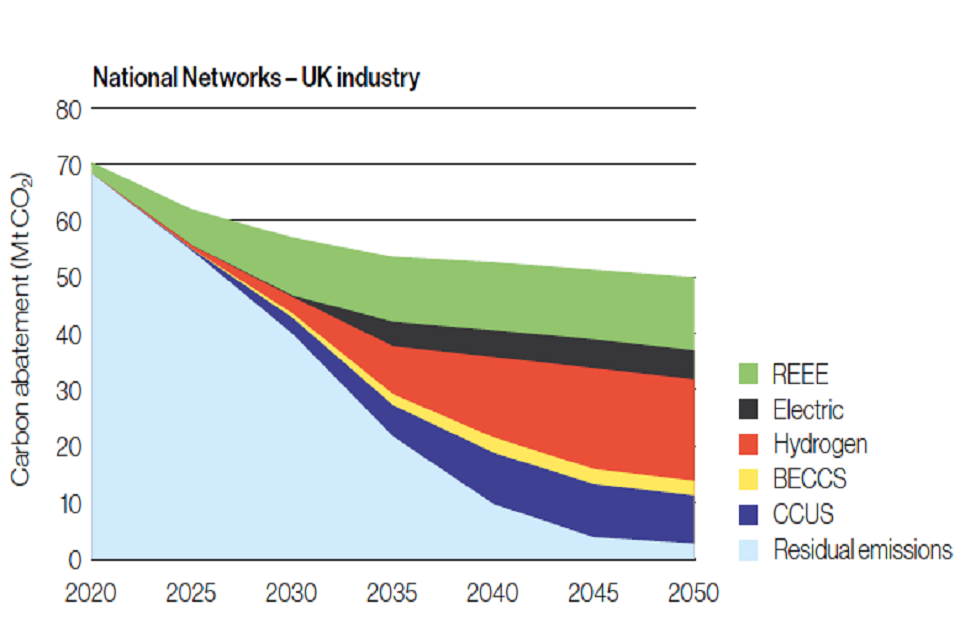

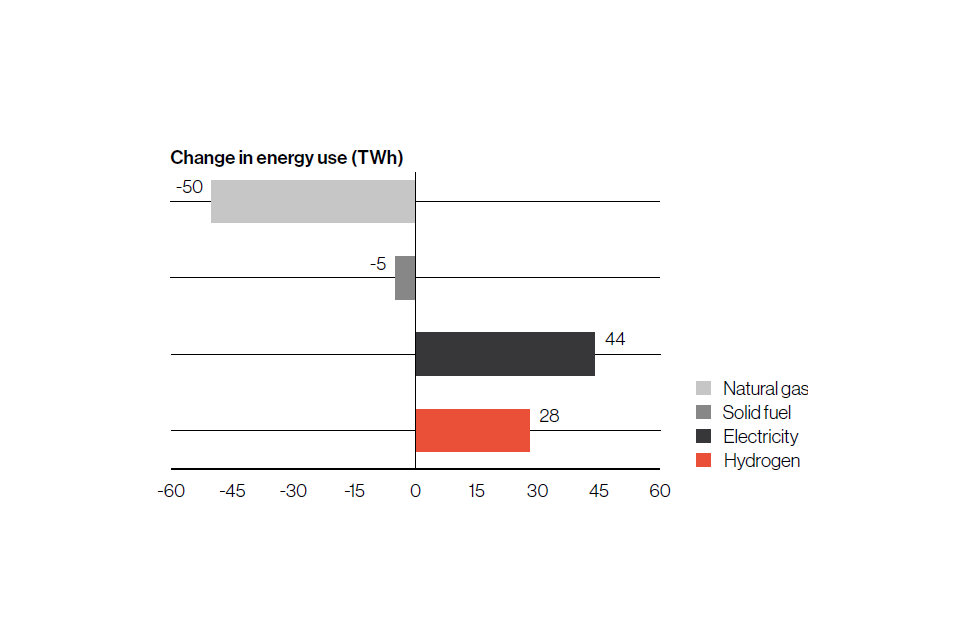

A net zero target requires a major change in how industry makes goods and consumes energy. This transformation is unprecedented in terms of scale, pace and cost. Based on what we know today, our analysis shows that net zero for industry is likely to mean:

- Overall, we expect that emissions need to fall by about two thirds by 2035 and by at least 90% by 2050, compared to today’s level[footnote 6]. The remaining emissions will need to be offset by GGR technologies

- Efficiency maximised to make best use of energy and materials, including how materials are used, repaired and recycled (Chapter 5)

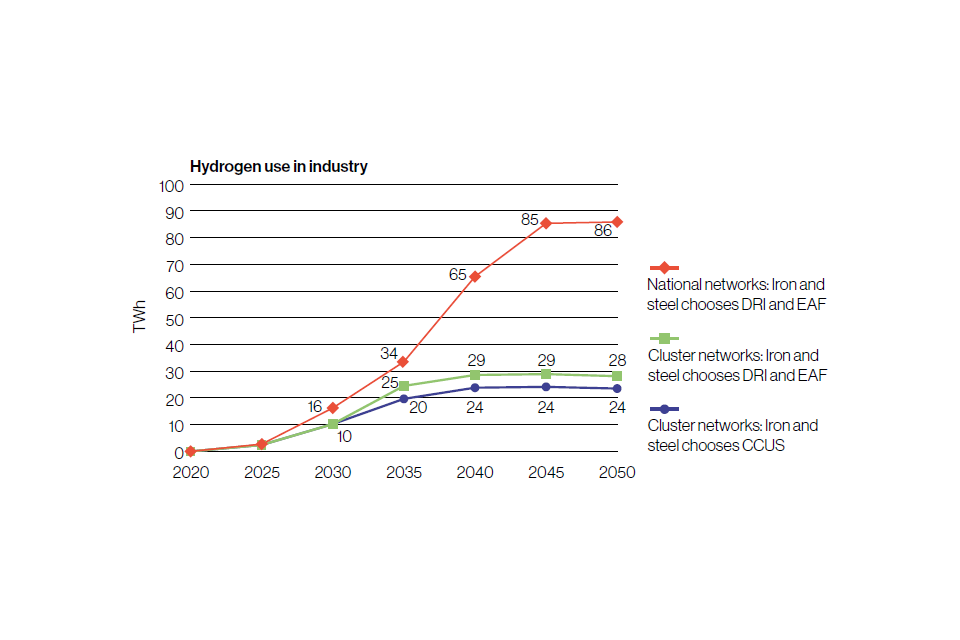

- Carbon capture usage and storage playing a vital role. We expect that, in all future scenarios, around 3 MtCO2 is the level of capture required in industry by 2030 to be on track to deliver net zero

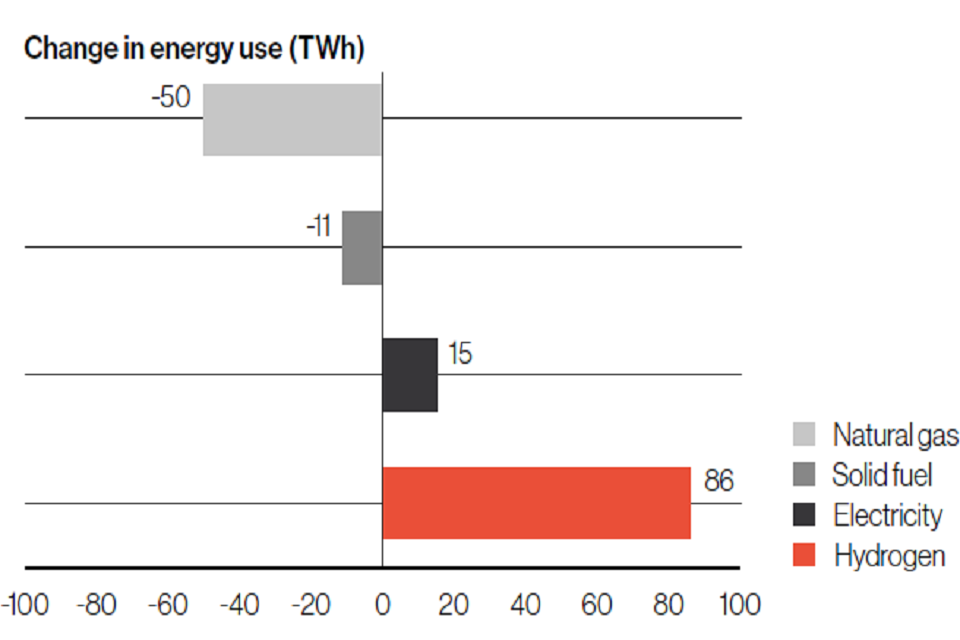

- Low carbon fuels such electricity, hydrogen and bioenergy replacing fossil fuels, unless combined with carbon capture. To be on track to deliver net zero, we expect that the minimum, in all future scenarios, is 20 TWh per year of fossil fuel use replaced with low carbon alternatives in 2030.

This is our expectation with current information, and we will revisit this as part of the analysis for the Net Zero Strategy later this year and as relative costs evolve over time.