LA Welfare Direct 4/2023

Updated 12 December 2023

Contact

If you have queries about the:

-

technical content of this bulletin then contact details are given at the end of each article

-

general content and distribution of this bulletin, contact lawelfare.correspondence@dwp.gov.uk

Who should read

All Housing Benefit staff

Action

For information

Editorial

Welcome to the April 2023 edition of the Local Authority Welfare Direct (LAWD) bulletin. I last wrote this Editorial for the September 2022 edition, seven months ago. With everything that has happened subsequently, it feels like much more than seven months!

In this month’s edition, as well as a number of other articles, you’ll see one about the upcoming improvement to the Universal Credit Local Council Tax Reduction (UC-LCTR) data share, to include nine new deduction reasons/amounts. This is the first significant improvement to this data share since it was introduced over six years ago.

Making changes to UC systems is very difficult, as technical development capacity in the Department for Work and Pensions (DWP) is rightly focused on higher priority UC developments. But I’m delighted that we’ve been able to persuade DWP colleagues of the importance of developments that support local authorities (LAs); the upcoming changes being one of the highest priorities that LAs in our Working Group told us about.

The collaborative working from the LAs attending the Working Group has been vital in helping us make the case for further developments to our UC data sharing with LAs. We are confident that, during 2023, further improvements to the UC-LCTR data share will be made, plus improvements to the UC data available on Searchlight.

My team can’t make all the changes LAs want us to make to our data shares as quickly as you would all want us to in a perfect world. However, equally, I think you all realise that making such changes to IT systems is complicated and does take time. We continue to listen to all the feedback you give us, and hopefully you can all see the steady stream of improvements that we have delivered over the seven years I have now been in my current post. There are many more improvements to come!

Finally, April is one of my very favourite months of the year, with all the green leaves budding out on the trees, it always feels like a month of new hope. Hope you all get a chance to enjoy this April like I know I will do.

Paul Selby

Deputy Divisional Manager

Local Authority Partnership, Engagement and Delivery division

Reminder: Deadline for the submission of Housing Benefit pre-audit final claims and Discretionary Housing Payment claims

1. Pre-audit final claims for Housing Benefit (HB) subsidy and Discretionary Housing Payments (DHP) claims (England and Wales only) are normally provided to the Department for Work and Pensions (DWP) by 30 April each year.

2. The pre-audit final claim forms were issued to all local authorities (LAs) on 14 March 2023 and the DHP claim forms were issued to LAs on 17 March 2023.

3. LAs must ensure all reasonable efforts are made to submit their claims by 30 April 2023 for the financial year ending March 2023. Whilst we appreciate this is a tight deadline, it is a legislative requirement that it is achieved.

4. If for any reason you have not received either claim form or you need any further information then contact us at lawelfare.lapaymentsandsubsidy@dwp.gov.uk

Additional Universal Credit deductions reasons and amounts to be added to Local Council Tax Reduction data share

5. We told you in March’s LAWD that nine new additional Universal Credit (UC) deduction reasons were to be added to the Local Council Tax Reduction (LCTR) data feed.

6. We can now confirm that all LA software suppliers have confirmed that the test file we issued has successfully passed their system acceptance testing and so all LA systems are ready to receive the additional data.

7. We have agreed with UC that the extra data can be “switched on” from Wednesday 5 April 2023 and we have informed LA suppliers of this.

8. So, from 5 April, where relevant, changes of circumstances notifications will include the following deductions reasons and corresponding amounts:

-

mortgage interest

-

owner-occupier service charges

-

rent or service charges

-

gas arrears

-

electricity arrears

-

Council Tax

-

Fines

-

water arrears

-

child maintenance

9. Local Government Data Sharing Transformation (LGDST) is aiming to add many more additional data items for the LCTR data feed and for Searchlight over the next financial year.

10. LGDST will continue to provide progress updates on the LCTR data share and Searchlight enhancements in future LAWD articles. In the meantime, if you would like to join LA colleagues in helping to shape these future enhancements, do get in touch with the team at lawelfare.datasharingtransformation@dwp.gov.uk

Supported housing research

11. The Department for Levelling Up, Housing and Communities (DLUHC) and DWP have commissioned research from the Centre for Regional Economic and Social Research (at Sheffield Hallam University) to assess the size, cost and demand of the supported housing sector. It will cover supported housing across England, Scotland and Wales.

12. This research will update and build on the 2016 supported accommodation review. This is vital research to ensure government has the best available data for making decisions on the future direction of supported housing policy, to ensure residents in supported housing receive good quality support and accommodation which represents value for money.

13. The research will take a mixed method approach and includes an analysis of secondary data as well as surveys of local authority HB teams, supported housing commissioners and supported housing providers. There will also be a series of in-depth case studies with supported housing providers, LAs and county councils.

14. The research team at Sheffield Hallam University are keen to encourage all Revenues and Benefit teams as well as those involved in commissioning supported housing services to take part in the research.

Housing Benefit Team survey and Supported Housing Commissioner survey

15. On 22 March 2023, links to both the Housing Benefit Team survey and Supported Housing Commissioner survey were sent directly to LAs’ single inboxes for appropriate cascade.

16. If you are not aware of the survey but think that you or another member of the team is the most appropriate person to complete the survey for your organisation then please contact Dave Leather at d.leather@shu.ac.uk (part of the Sheffield Hallam University research team) and he will be able to forward the details for the survey directly to you.

17. The research team also want to speak to those involved in the commissioning of supported housing in more depth. This could be via a discussion with a member of the team or by taking part in a case study. This would give you a chance to give your perspective on the factors affecting supported housing provision in your area and how this varies across client groups. All information collected as part of the study will only be seen by the research team and all data collected will be anonymised and not attributed to any individual or organisation in reporting.

18. If you are interested in learning more about the research or to discuss what is involved in taking part the research as a case study area or via in-depth interview, then please contact Christina Beatty at C.Beatty@shu.ac.uk

19. The Sheffield Hallam research team is extremely grateful for the time given by respondents to complete the survey, to take part in the case studies research, or to take part in the in-depth interviews. It will really make a difference to the overall research and robustness of the findings, which are expected to be published by the end of 2023.

Frequently asked questions: Supported housing and temporary accommodation caseload review

20. Thank you to those that attended the all LA online meeting held on 13 March 2023 to discuss and ask questions on the content of circular HB A3/2023.The questions that arose during the call have been summarised as frequently asked questions (FAQs) which can be found at Annex A. The FAQs can also be found on Glasscubes.

21. We hope you find them helpful, however, should you have any questions do contact housing.policyenquiries@dwp.gov.uk

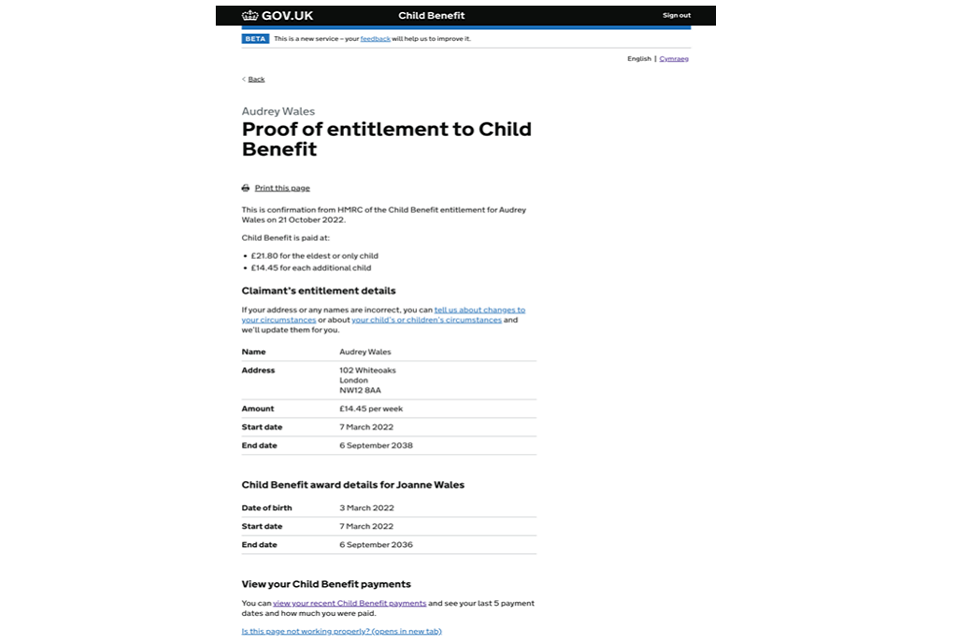

Reminder: New online service for parents and carers to prove they are entitled to Child Benefit

22. HMRC has launched a new online service so it’s quicker and easier for parents and carers to prove they claim Child Benefit.

23. They often need to obtain this proof for HB, Council Tax and other services and previously it’s involved the need to call or write to HMRC. Now it can be done within minutes at a time convenient to them.

24. From 28 February 2023, parents or carers have been able to access this information through the HMRC app (which can be downloaded) or online through www.gov.uk, then print or save as a document to use as proof of entitlement.

25. An example copy of online proof of entitlement is provided at Annex B for information. This notification from HMRC provides proof that the customer is entitled or has a valid claim to Child Benefit.

Further extension to the Household Support Fund

26. On 17 November 2022, as part of the Chancellor’s Autumn Statement, the government announced an additional £1 billion to help with the cost of household essentials, for the financial year ending 2024. This is on top of what has already been provided since October 2021 and brings the total funding for this support to £2.5 billion.

27. In England, the funding is an extension to the Household Support Fund and will run from 1 April 2023 to 31 March 2024. An additional £842 million has been allocated to English councils, who will then use it to support those most in need in their local area with the significantly rising cost of living.

28. In line with previous grants the Barnett formula will apply in the usual way for funding for the devolved administrations. It will be for the devolved administrations to decide how to allocate this additional funding.

29. Guidance and individual LA allocations can now be found on www.gov.uk.

UC expanded to more Tax Credit claimants

30. From April 2023, more Tax Credit claimants will be asked to claim UC in order to continue to receive the benefit they are entitled to. This change is part of plans to streamline and simplify the benefits system, with legacy benefit claimants moving onto the modern benefit system.

31. Households that receive Tax Credits only, will be the first to be asked to make the move to UC. Those affected will receive a letter from DWP, notifying them of the action they need to take and the support available to help them.

32. In most cases, individuals will be better off following a move from legacy benefits to UC. However, where an individual’s entitlement to UC would be lower than their legacy benefits entitlement, they may be entitled to a top-up payment known as Transitional Protection. This means that their UC entitlement will be the same as their legacy benefit entitlement at the point they move.

33. Our commitment to LA’s as we expand is to keep you informed of our progress and notify LA’s by sending a letter to the appropriate LA Chief Executive Officer before we expand into the LA area to provide sufficient time to prepare.

34. From April we will be expanding to Avon, Somerset and Gloucester. We will expand further in May, bringing onboard East London and Cheshire.

35. For more information see Universal Credit expanded to benefit more Tax Credit claimants on www.gov.uk.

DWP’s continuation of Help to Claim support

36. As announced on 20 March 2023, the current Help to Claim support arrangements in England, Scotland and Wales have been extended to 31 March 2024.

37. Citizens Advice and Citizens Advice Scotland will continue to independently provide support through telephony and digital (for example, webchat) channels for people making and managing a new claim to UC, up to receiving their first correct payment.

Practitioners’ Operational Group and LA Welfare Steering Group

38. The LA Welfare Steering Group meeting took place on 23 March 2023. Agenda items included LA Welfare issues Highlight Report, update on Move to UC, Supported Housing Bill and consultation and an update on LA Funding Group.

39. Both groups’ meetings are held bi-monthly (and alternately), so the next Practitioners’ Operational Group meeting is scheduled to take place on 20 April 2023.

40. If you have any questions regarding topics raised at these consultation groups, you can email lawelfare.correspondence@dwp.gov.uk

HB decisions by the Upper Tribunal

41. Decision Making and Appeals (DMA) Leeds is aware of the following HB cases that have been decided by the Upper Tribunal (UT):

-

UA-2021-000446-HB: Beneficial ownership of bank account. Remitted. More evidence needed.

-

UA-2021-001073-HB: Issue on whether HB was payable from the earlier date of the start of the Severe Disability Gateway given that a retrospective award of ESA including SDP was reinstated - Appeal dismissed – The relevant HB legislation restricted payment to a backdating of one month from the date the claim was made.

42. A selection of decisions of the UT are published on their website. Do be aware that there is an undefined time lapse between decisions being issued and their appearance on the website.

43. If you have any queries about cases before the UT Judges or courts, please contact us by email at quarryhouse.dmaleedscustomersupportservices@dwp.gov.uk

New Legislation

44. The following Statutory Instruments (SIs) have been laid:

-

2023 No. 404 The Treasure (Designation) (Amendment) Order 2023, made on 30 March 2023

-

2023 No. 403 The Judicial Pensions (Fee-Paid Judges) (Amendment) Regulations 2023, made on 28 March 2023

-

2023 No. 401 The Air Navigation (Restriction of Flying) (Coventry) Regulations 2023, made on 31 March 2023

-

2023 No. 400 The Wireless Telegraphy (Licence Charges) (Amendment) Regulations 2023, made on 22 March 2023

-

2023 No. 320 The Gas Safety (Management) (Amendment) (No. 2) Regulations 2023

45. The following Statutory Rules of Northern Ireland have been laid:

-

2023 No. 61 The Road Races (Craigantlet Hill Climb) Order (Northern Ireland) 2023 made on 31 March 2023

-

2023 No. 60 The Road Races (Cookstown 100 Motor Cycle Road Race) Order (Northern Ireland) 2023 made on 31 March 2023

46. Copies of SIs can now be downloaded from legislation.gov.uk

What’s new on our HB pages on www.gov.uk

47. The following items can be found on the website:

| Document Type | Subject | Link |

|---|---|---|

| LAWD3/2023 | Editorial, State Pension underpayments, Cryptoassets and HB Update: Increase in benefit cap levels and the impact on LAs, Updated MGP1 LA form, Extension to statutory deadline for final tested claims (for the financial year ending 2023) Additional Deductions reasons and amounts to be added to Local Council Tax, Reduction data feed, Reminder of help needed: LA monitoring of Searchlight activity to help support the case for more UC claimant data, Supported housing and temporary accommodation caseload review and all LA online meeting, Advice for LAs telephoning Debt Management to discuss a claimant’s HB debt, HB Accuracy Award Initiative (Year 4) launch and all LA conference call, New Verify Earnings and Pensions User Interface survey HB Overpayments Guide for LAs, Invitation to the next Data sharing and IT consultation and engagement forum, HB Debt Recovery statistics, Publication of HB Speed of Processing statistics for July to September 2022, Update: Move to UC Practitioners’ Operational Group and LA Welfare Steering Group, Secondment opportunities in the LA-PED division, HB Cases decided by the Upper Tribunal, New Legislation, What’s new on our HB pages on www.gov.uk | LAWD3/2023 |

| Circular HB S3/2023 | Additional New Burdens funding to meet the costs of action required to improve the quality of supported housing and temporary accommodation management information | Circular HB S3/2023 |

| Circular HB S4/2023 | Rent Rebate Subsidy Limitation information for financial year ending March 2024 (Wales only) | Circular HB S4/2023 |

| Circular HB A4/2023 | Housing Benefit Award Accuracy Initiative for financial year ending March 2024 | Circular HB A4/2023 |

Annex A: Frequently asked questions: Supported housing and temporary accommodation Single Housing Benefit Extract management information for caseload review

Introduction

The Department for Work and Pensions’ (DWPs’) circular HB A3/2023 (published on 28 February 2023) provides details regarding the supported housing and temporary accommodation caseload review.

This document contains the frequently asked questions (FAQs) that arose from the all local authority (LA) call held on 13 March 2023.

Any questions not covered by this document or relating to the technical content of the circular should be sent to housing.policyenquiries@dwp.gov.uk

Private Members Bill

Q1. Why is the quest for driving up quality and providing value for money just coming from Housing Benefit (HB) data and what is the point in this exercise?

A1. Following a consultation on funding options for supported housing in August 2018, the government announced that it would continue to fund supported housing through the Welfare System. Alongside this, the government also announced it would work with stakeholders to develop a new oversight regime to ensure quality and value for money across the supported housing sector.

Therefore, as part of DWP’s effort to improve quality and value for money on supported housing, it is essential we understand more about the HB expenditure to inform policy development.

The new management information will allow us to do this.

Q2. What measures will the Private Members Bill cover? Will it look at the costs of all supported accommodation, or will there be transitional measures for existing providers?

A2. The Department for Level Up Housing and Communities is working through the detailed design of the licensing regime, including when it will be introduced and will be consulting with stakeholders, including LAs, later this year after the Bill becomes law. DWP will continue to explore the issues with subsidy.

Process

Q3. Do LAs have to check all Local Housing Allowance cases?

A3. Yes. Funding is provided for LAs to carry out a desk-based review of their whole HB live caseload to determine if claimants are living in supported housing (specified accommodation), temporary accommodation or neither; recording as such on their systems.

Q4. How will you know a claim has been checked?

A4. When an LA reviews each case, they will either set the marker to be Supported Housing, Temporary Accommodation or Neither. LAs will need to manage the process to ensure that all claims have been checked.

Q5. The temporary accommodation caseloads are constantly changing so should LAs just pick a date and review their caseload ‘on that date’?

A5. As detailed in circular HB A3/2023, once the marker is set correctly, it is then the LA’s responsibility to keep it updated and correct, as the case details change.

Q6. Is this review for live HB cases only?

A6. Yes, all live HB cases, and to keep this information updated going forward for all new cases, as LAs have been required to do since the new IT was implemented between April and June 2022.

Q7. How can we review our HB caseload and make a decision whether an existing claim is exempt without new information from the claimant and landlord? Some claims have been running for years with little recent documentation.

A7. Most LAs tell us they are on top of their caseloads and review supported accommodation cases annually at a minimum. That means a simple desk-based review of existing information already on systems would be sufficient, in order for the new markers to be set correctly. However, there will always be the odd case where more information may be required. The funding we’ve allocated takes into account these odd cases that may take more time.

Q8. Are you asking us to go back through all our caseload and set a marker for all existing supported housing/temporary accommodation cases as we have done with new claims this year?

A8. Yes. In April 2022, we asked you to do this for all new cases. Now we’ve secured the funding to pay you to do this for all older live cases too.

Q9. Does this exercise include Pension Age cases as well?

A9. Yes, funding is provided for LAs to carry out a desk-based review of their whole HB live caseload which includes Pension Age cases.

Q10. Is this exercise being carried out on the Universal Credit (UC) Housing cost caseload?

A10. This exercise only relates to HB.

Q11. Is this exercise for the person or the property?

A11. All HB cases need the marker correctly set as Supported Housing, Temporary Accommodation or Neither and it needs to be accurately done for each case.

Q12. If information on Care Support and Supervision is not held, do we need to change existing claims?

A12. A fully desk-based review of all live HB cases must be carried out and all cases must be marked as either Supported Housing, Temporary Accommodation or Neither. All HB cases must be reviewed.

Q13. If we find a case we want to re-classify, is there a date of change you want us to work towards, in other words, from 1 April 2023 or from the start of the claim?

A13. For the markers themselves, the date of change doesn’t matter. If other aspects of the case change too, for example the payment amount, then existing business as usual processes should be followed for the date of change.

Q14. Will the marker prevent these cases from being migrated to UC Housing costs?

A14. Yes. That is why it is important to set the new markers correctly as this will prevent some cases from being migrated to UC incorrectly.

Q15. We have Housing Associations that provide supported homeless accommodation and obviously LA homeless accommodation, so there are implications particularly on the benefit cap for those cases with both characteristics. How should LAs mark these types of cases?

A15. We are clear that cases cannot be both supported housing and temporary accommodation and that they should be recorded as either one or the other.

If individual cases have characteristics of both, only one should be chosen. LAs must select the marker that is the most suitable, except in cases where the ‘exempt’ criteria is met which should then take precedence.

It is understood there may be claims where the accommodation could meet both supported housing and temporary accommodation. However, it is important to note the policy rules between the two accommodation types are different. LAs must use their discretion to select the appropriate marker and ensure this is aligned using the same classification used to claim subsidy.

For clarity, sheltered or extra care accommodation claims should only be recorded if they meet the definition for specified accommodation, for example, supported exempt as set out in HB regulations. If the definition for supported exempt/specified accommodation has not been met, then the LA should record this as ‘not specified’.

Q16. Is marking claims as Supported Housing, Temporary Accommodation and Neither, different to marking as non-specified?

A16. A review of stock cases must be carried out and all cases must be marked as either Supported Housing, Temporary Accommodation or Neither. IT software supplier guidance (which can be found on Glasscubes) makes it clear how this should be recorded.

For cases that does not meet Specified or Temporary Accommodation, we would expect these to be marked as ‘Neither’.

Q17. As referenced at paragraphs 12-14 circular HB A3/2023, do we have to list all of the ineligible service charges or not, or can we list under one code, in other words, General Services deductions?

A17. LAs are encouraged to continue recording the amount of ineligible service charges in relation to the care, support and supervision for new supported housing claims. In line with the Housing Benefits 2006 Regulations, LAs are required to identify ineligible service charges such as ‘personal care or general support/counselling services’ when calculating the eligible rent and must be satisfied that the cost of providing care, support and supervision is funded from a source outside of HB.

However, where the information is not available, LAs should leave the field blank.

Q18. If a claim is not supported housing or temporary accommodation, does it need to be added to the property register?

A18. The property register is optional, but most LAs tell us this is really useful.

The use of the property register should more easily allow LAs to classify cases as Supported Housing, Temporary Accommodation or Neither.

Single Housing Benefit Extract

Q19. Can you provide details of what Single Housing Benefit Extract (SHBE) is currently picking up?

A19. Since the new software was delivered in April 2022, SHBE is currently picking up all the supported housing and temporary accommodation markers set by LAs on the new cases classified this way.

Q20. Will any changes at case level be picked up by the real time SHBE process that’s being introduced later this year (2023)?

A20. The new real time SHBE data share will pick up exactly the same data as the existing SHBE data share.

Q21. Can you give up-to-date details of our caseload reported on SHBE?

A21. Caseload data is available on stat xplore. Further information is available on Stat-Xplore.

IT software

Q22. Will IT software suppliers be providing an automated solution to accurately record the cases that LAs know are definitely not supported housing or temporary accommodation?

A22. LAs need to go into every case and carry out the actions outlined in the circular HB A3/2023. We cannot provide an automated solution as LAs have been recording things differently on their own systems. So what might work for one LA would incorrectly record markers for others.

Q23. The current marker on NEC IT Software only picks up new claims and not those that have been in receipt for HB prior to when the reports were run and are still current claims. How do we pick up current claims that have been in payment for a while?

A23. Funding is provided for LAs to carry out a desk-based review of their whole HB live caseload to determine if claimants are living in supported housing (specified accommodation), temporary accommodation or neither; recording as such on their systems. This includes claims that have been in payment for a while.

Q24. Have you reviewed the IT software from all of the suppliers?

A24. Yes. IT software suppliers are addressing fixes needed to their IT systems. When these are released, they will advise on any changes on how to record Supported Housing, Temporary Accommodation or Neither.

LAs should contact their IT software suppliers directly for further information.

Timing

Q25. What if we get to 31 March 2024 and we have not met the deadline?

A25. The Local Authority Partnership, Engagement and Delivery division will be tracking LA progress throughout the year and will be supporting LAs to ensure the deadline is met.

Annex B: Example of online proof of entitlement to Child Benefit