Cabinet Office Mains Estimate Memorandum 24-25 (HTML)

Published 30 July 2024

1. Overview

1.1 Objectives

The Cabinet Office objectives are as follows:

- Seize the opportunities of EU Exit, through creating the world’s most effective border to increase UK prosperity and enhance security

- Secure a safe, prosperous and resilient UK by coordinating national security and crisis response, realising strategic advantage through science and technology, and the implementation of the Integrated Review

- Advance equality of opportunity across the UK

- Increase the efficiency, effectiveness and accountability of government through modernising and reforming the work of the Government Functions

- Support the design and implementation of Government’s and Prime Minister’s priorities

1.2 Spending controls

Cabinet Office spending is categorised into several different spending totals, for which Parliament’s approval is sought. The spending totals which Parliament votes are:

- Resource Departmental Expenditure Limit (Resource DEL) - day to day running costs;

- Capital Departmental Expenditure Limit (Capital DEL) - investment in capital equipment including property and IT;

- Resource Annually Managed Expenditure (Resource AME) - provisions for early departures, dilapidations and onerous contracts, revaluation of assets, depreciation charge on donated assets and impairments; and

- Capital Annually Managed Expenditure (Capital AME) - required to cover Capital depreciation as a result of IFRS16 implementation.

In addition, Parliament votes on a net cash requirement, designed to cover the elements of the above budgets which require Cabinet Office to pay cash in year.

1.3 Main areas of spending

The graphic below shows the main components of the Cabinet Office’s proposed budget for the current year, included in the latest Main Estimate, and the proportions of funds spent on its main activities.

Main Estimate 2024-25 RDEL sought (£m)

- A. Seize the Opportunities of EU exit (£6.794m)

- B. Secure a Safe, Prosperous and Resilient UK (£49.833m)

- C. Advance Equality of Opportunity Across the UK (£15.616m)

- D. Increase the Efficiency, Effectiveness and Accountability of Government (£510.696m)

- E. Support the Government’s and Prime Minister’s Priorities (£264.168m)

- F. Government Property Agency - Executive Agency (£68.568m)

- G. Arm’s Length Bodies (Net) (£45.708m)

Main Estimate 2024-25 CDEL sought (£m)

- B. Secure a Safe, Prosperous and Resilient UK (£18.805m)

- D. Increase the Efficiency, Effectiveness and Accountability of Government (£62.169m)

- E. Support the Government’s and Prime Minister’s Priorities (£25.282m)

- F. Government Property Agency - Executive Agency (£261.046)

1.4 Comparison of spending totals sought

The table below shows how the totals sought for the Cabinet Office in its Main Estimate compare with last year:

2024-25 Main Estimate budget sought £m

| Category | £m |

| Resource DEL | 961.383 |

| Capital DEL | 395.252 |

| Resource AME | 216.300 |

| Capital AME | 30.000 |

Change from Supplementary Estimate 2023-24 £m

| Category | £m | % |

| Resource DEL | -133.721 | -12.21% |

| Capital DEL | -252.763 | -39.01% |

| Resource AME | -80.668 | -27.16% |

| Capital AME | -0.050 | -0.17% |

Change from Original Budget Last Year (Main Estimate 2023-24) £m

| Category | £m | % |

| Resource DEL | 11.551 | 1.22% |

| Capital DEL | 29.416 | 8.04% |

| Resource AME | -54.168 | -20.03% |

| Capital AME | 30.000 | - |

1.5 Key drivers of spending changes since last year

The main causes of the overall net decrease in Resource DEL of £133.721 million to since the 2023-24 Supplementary Estimate include the below, full details can be found in section 2.1:

Increases due to:

- £25.062 million increase of Reserve funding for Public Inquiries;

- £27.444 million of Reserve funding for the Team designing the Infected Blood compensation scheme and setup costs of the new Infected Blood Compensation Authority; and

- £4.250 million increase of Office for Veterans’ Affairs funding received as part of Budget announcements.

Decrease due to:

- £40.300 million decrease due to one-off Reserve funding in 2023-24 for 1 Victoria Street dilapidations, settlement of Civil Service pension claims and Joint Venture sale proceeds;

- A decrease of One Login programme spend in 2024-25 of £13.690 million when compared with 2023-24;

- £12.920 million decrease in Reserve funding for the Government Property Agency from £40.220 million received in 2023-24 to £27.300 million to cover the costs of VAT on PFI contracts received in 2024-25;

- £10.895 million decrease in Budget Cover Transfers primarily in the transfer of the Single Trade Window to HM Revenue and Customs in 2023-24;

- £101.203 million decrease of depreciation and IFRS16 depreciation charges in 2024-25 when compared with 2023-24; and

- £5.265 million decrease of SR21 funding settlement from £551.086 million received in 2023-24 to £545.821 million received in 20245-25.

The main causes of the overall net decrease in Capital DEL of £252.763 million include the below, full details can be found in section 2.1:

Increase due to:

- £27.450 million increase in Reserve funding for setup costs of the new Infected Blood Compensation Authority;

- £6.000 million increase in funding for the Office of Veterans’ Affairs from Budget announcements; and

- £21.339 million increase in SR21 funding settlement of £21.339 million from £464.310 million received in 2023-24 to £485.649 million received in 2024-25.

Decrease due to:

- A decrease in One Login funding programme spend in 2024-25 of £17.180 million when compared with 2023-24;

- £2.543 million decrease in Reserve funding for the Covid-19 Public Inquiry;

- £10.188 million decrease in Budget Cover Transfers primarily in the transfer of the Single Trade Window to HM Revenue and Customs in 2023-24;

- £10.943 million decrease in funding due to prior year Machinery of Government transfer primarily driven by the transfer of Geospatial Commission to the Department of Science, Innovation and Technology. £134.657 million was transferred in 2023-24 to £142.600 million in 2024-25; and

- £254.910 million decrease in IFRS16 charges in 2024-25.

Resource AME is required to cover property impairments, legal provisions, dilapidations and doubtful debts. The main causes of the overall net decrease in RAME of £80.668 million in 2024-25 when compared to 2023-24 is due to:

- £62.000 million decrease for dilapidations and impairments in the Government Property Agency and £2.709 million in the Cabinet Office and Equalities and Human Rights Commission;

- £19.259 million decrease in doubtful debt and legal provision in the Cabinet Office and Equalities and Human Rights Commission;

- £5.000 million increase in doubtful debt and legal provision in the Government Property Agency;

- £3.200 million decrease for provision of pensions for Members of the Europeans Parliament which will be requested as part of the Supplementary Estimate; and

- £1.500 million increase in the Government Property Agency for IFRS16 depreciation relating to the charge on peppercorn leases.

1.6 New policies and programmes and ambit changes

The ambit has been updated to reflect the establishment of the new Infected Blood Inquiry Compensation Authority. There are no other changes to the Ambit this year.

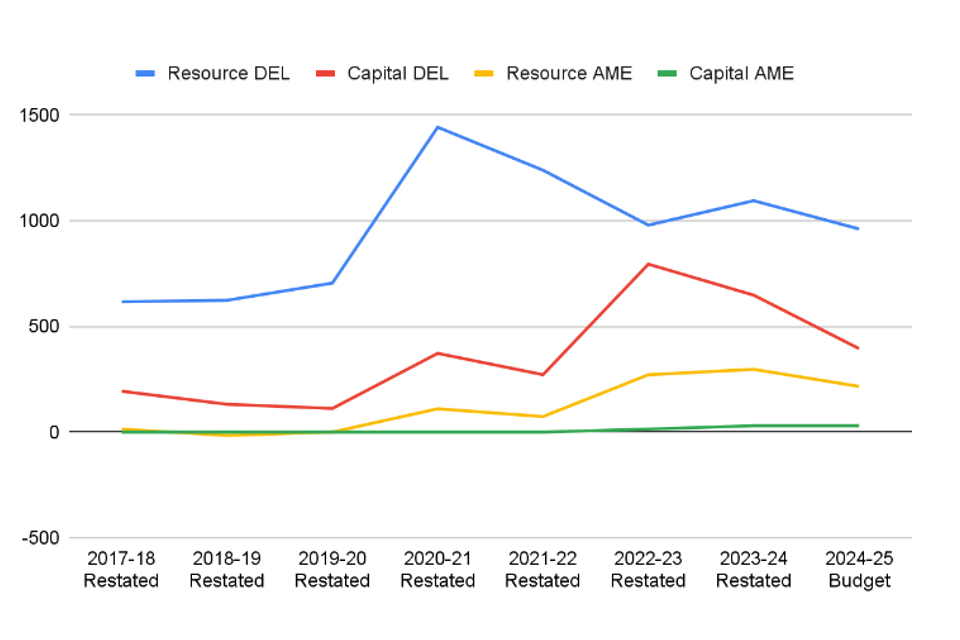

1.7 Spending trends

The chart below shows overall spending trends for the last five years and the budget in 2023-24. Prior years’ outturn has been restated for machinery of government transfers.

1.8 Funding: Spending Review and Budgets

The levels of DEL funding for the Cabinet Office for 2024-25 are based on plans published in the 2021 Spending Review. Since then, the Cabinet Office has made a number of changes to the Department’s 2024-25 Spending Plans. Details of funding changes are set out in the Annex at Table B.

The main causes of the overall net increase in Resource DEL of £415.562 million from the 2021 Spending Review total of £545.821 million to the amount now sought of £961.383 million are set out below.

- £99.000 million in Reserve funding to support the delivery of the Covid-19 Public Inquiry;

- £4.709 million of Reserve funding to support the delivery of the Grenfell Tower Inquiry;

- £27.444 million increase of Reserve funding for the setup costs of the Infected Blood Compensation Authority to administrator the Infected Blood Compensation Scheme and to fund the team delivering the design of the Compensation scheme;

- £71.000 million in Reserve funding to recognise the surrender of the CCS dividends;

- £67.910 million increase in spending on the One Login programme;

- £36.500 million of Reserve funding to recognise joint venture sales proceeds to fund productivity measures;

- £27.300 million in Reserve funding to cover the costs of PFI contracts transferred to the Government Property Agency;

- £20.295 million of funding confirmed in Budgets including 11.020 million for the Public Sector Fraud Authority and £13.525 million for the Office for Veterans’ Affairs;

- A budget exchange from 2023-24 into 2024-25 of £1.006 million to continue delivery of the Health Innovation Fund programme;

- The surrender of £5.374 million of funding in support of increased National Insurance costs;

- Incoming Budget Cover Transfers totalling £67.657 million including £35.700 million from the Ministry of Defence in support of national security and crisis management, £14.875 million of UK Integrated Security Fund transfers from the Foreign, Commonwealth and Development Office in support of Cyber and other programmes, and £2.311 million from HM Treasury for the Infected Blood Inquiry;

- Outgoing Budget Cover Transfers sent totalling £63.115 million including £59.500 million to HM Revenue and Customs for the development of the Single Trade Window and £3.365 million for the department’s contribution for the Osaka Expo 2025;

- Machinery of Government transfers of £5.351 million received for the transfer of National Cyber Security programmes from Security and Intelligence Agency;

- £80.700 million of depreciation funding; and

- Adjustments to the initial SR21 settlement totalling £29.257 million baseline funding transferred due to prior year Machinery of Governments transfers. The key drivers include the transfer of £12.377 million for Geospatial Commission to the Department of Science, Innovation and Technology and £12.727 for Constitution Group to the Department for Levelling Up, Housing and Communities.

The main cause of the overall net decrease in Capital DEL of £90.397 million from the 2021 Spending Review total £485.649 million to the amount now sought of £395.252 million is due to:

- Adjustments to the initial SR21 settlement totalling £142.600 million baseline funding transferred out of the department due to prior year Machinery of Governments transfer. The key drivers are a transfer of £143.000 million for the Geospatial Commission to the Department of Science, Innovation and Technology offset by a transfer in of £0.400 million for the Investment and Security Unit from from the Department for Business, Energy and Industrial Strategy;

- £27.450 million additional Reserve funding for the setup costs of the Infected Blood Compensation Authority to administrator the Infected Blood Compensation Scheme;

- £26.110 million of Reserve funding for the One Login Programme;

- £1.500 million of Reserve funding to recognise Joint Venture sales proceeds to fund productivity measures;

- £0.479 million of Reserve funding for the Covid- 19 Public Inquiry;

- £8.000 million of funding for the Office of Veterans’ Affairs announced within the Budget;

- Incoming Budget Cover Transfers received totalling £19.014 million including £17.199 million from various departments for the ROSA Renewal Programme and £1.815 million from the Ministry of Defence for the development of the Spotlight Confidential software; and

- Outgoing Budget Cover Transfers sent totalling £30.350 million primarily £30.000 million to HM Revenue and Customs for development of the Single Trade Window.

The causes of the increase in Resource AME of £216.300 million in 2024-25 from the 2021 Spending Review is due to:

- £203.000 million increase for dilapidations, impairments and provisions in the Government Property Agency;

- £10.000 million increase in doubtful debt provisions for Government Property Agency;

- £3.000 million increase in the Government Property Agency for IFRS16 depreciation relating to the charge on leases; and

- An increase in £0.300 million for legal and pension provisions within the Equalities and Human Rights Commission.

The increase in Capital AME of £30.000 million is due to Government Property Agency dilapidation provisions on right of use assets under IFRS16.

2. Spending detail

2.1 Explanations of changes in spending

Explanations of changes in spending - Resource DEL

The table below shows how spending plans for Resource DEL compare with 2023-24 Supplementary Estimate plans. Resource DEL spending has reduced by £133.721 million (12.2%).

| Description | 2024-25 Main Estimate budget sought £m | 2023-24 Supplementary Estimate budget approved £m | Change from Supplementary Estimate 2023-24 £m | Change from Supplementary Estimate 2023-24 % | See note ref |

|---|---|---|---|---|---|

| A. Seize the Opportunities of EU exit | 6.794 | 18.603 | -11.809 | -63.5% | A |

| B. Secure a Safe, Prosperous and Resilient UK | 49.833 | 41.241 | 8.592 | 20.8% | |

| C. Advance Equality of Opportunity Across the UK | 15.616 | 19.167 | -3.551 | -18.5% | |

| D. Increase the Efficiency, Effectiveness and Accountability of Government | 510.696 | 405.971 | 104.725 | 25.8% | D |

| E. Support the Government’s and Prime Minister’s Priorities | 264.168 | 405.514 | -141.346 | -34.9% | E |

| F. Government Property Agency – Executive Agency | 68.568 | 184.037 | -115.469 | -62.7% | F |

| G. Arm’s Length Bodies (Net) | 45.708 | 20.571 | 25.137 | 122.2% | G |

| Total | 961.383 | 1,095.104 | -133.721 | -12.2% |

Differences of either more than 10% and £10 million, or more than 5% and £200 million are explained below. Numbers relate to the relevant row in the table above. Further detail of spending within these totals is given in the Annex at Table A.

(A) Seize the opportunities of EU Exit, through creating the world’s most effective border to increase UK prosperity and enhance security

A decrease of £11.809 million consisting of:

- £10.061 million decrease due to the net increase in outgoing Budget Cover Transfer to HM Revenue and Customs for the Single Trade Window; and

- £1.370 million decrease in incoming Budget Cover Transfers for contributions for the Border Flow Service from the Department for Food and Rural Affairs and the Department for Transport.

(D) Increase the Efficiency, Effectiveness and Accountability of Government

An increase of £104.725 million consisting of:

- £21.439 million increase in Reserve funding for the surrender of Joint Venture sale proceeds to fund acceleration of shared services and productivity measures;

- £4.100 million increase in Reserve funding for the surrender of the CCS dividend;

- £13.690 million decrease of One Login programme funding;

- £3.000 million increase in budget confirmed as part of Budget announcements for the Public Sector Fraud Authority from £8.020 million received in 2023-24 to £11.020 million received in 2024-25;

- £9.411 million decrease in incoming Budget Cover Transfers including reduced GREAT campaign contributions from various other government departments £6.099 million, Shared Service programme costs from Department for Science, Innovation and Technology £2.533 million and Local Authority PFI costs from the Department for Levelling Up, Housing and Communities £2.000 million;

- £24.128 million increase from lower outgoing Budget Cover Transfers mostly due to an GREAT campaign contributions to various other government departments of £24.872 million;

- A decrease of £3.450 million due to the downward trajectory of SR21 baseline funding and prior year Machinery of Government transfers; and

- An increase of £78.373 million due to the reclassification of IFRS16 and depreciation charges from strategic objective E to strategic objective D.

(E) Support the Government’s and Prime Minister’s Priorities

A decrease of £141.346 million consisting of:

- £25.062 million increase of Reserve funding for the Public Inquiries, mainly costs of the Covid-19 Inquiry £25.267 million;

- £2.644 million increase in Reserve funding for the Infected Blood Inquiry Response Team delivering the design of the compensation scheme;

- £7.750 million decrease of Reserve funding for the one-off settlement of Civil Service pensions claims in 2023-24;

- £5.634 million decrease of Reserve funding for His Majesty’s the King Official Portraits received in 2023-24;

- £2.100 million decrease of Reserve funding received from the surrender of CCS dividend income;

- £1.802 million decrease in Reserve funding for non-consolidated payment to staff in 2023-24;

- £1.000 million decrease in Reserve funding to fund the Infected Blood Inquiry Compensation Team Expert Panel costs;

- £1.250 million increase of funding confirmed from Budget announcements for the Office of Veterans’ Affairs;

- £17.033 million decrease in funding from incoming Budget Cover Transfers including £9.009 million of funding received from the Department for Health and Social Care for the Infected Blood Inquiry, and reclassification of £10.500 million funding received from the Ministry of Defence in support of national security and crisis management now reflected in strategic objective B;

- £3.841 million increase in funding due to lower outgoing Budget Cover Transfers mainly due to £2.397 million of funding to the Department for Science, Innovation and Technology for Emergency Alert funding and £1.500 million sent to Ministry of Defence for contributions to Veterans Digital ID cards; and

- A decrease of £138.848 million due to reclassification of funding between strategic objectives including the reclassification of IFRS16 and depreciation charges from strategic objective E to strategic objective D.

(F) Government Property Agency – Executive Agency

A decrease of £115.469 million consisting of:

- £25.500 million decrease of Reserve funding to cover the one-off dilapidation costs for 1 Victoria Street property in 2023-24;

- £15.229 million decrease of Reserve funding to cover the costs of PFI contracts transferred to the Government Property Agency;

- £8.809 million decrease of Reserve funding to cover freehold rebates on freehold accommodation;

- £3.380 million decrease in funding due to a switch from Capital to Resource for the Private Finance Initiative unitary contract costs which was only received in 2023-24;

- £30.900 million decrease in depreciation charges in 2024-25 compared with 2023-24; and

- £31.831 million decrease due to transfer between strategic objectives D and F and decrease IFRS16 charges and depreciation in 2024-25 compared with 2023-24.

(G) Arm’s Length Bodies

An increase of £25.137 million consisting mainly of £24.800 million increase of Reserve funding for the setup costs of the Infected Blood Compensation Authority to administer the Infected Blood Compensation Scheme.

Explanations of changes in spending - Capital DEL

The table below shows how spending plans for Capital DEL compare with Supplementary Estimate 2022-23. Capital DEL spending has reduced by £252.763 million (39.0%).

| Description | 2024-25 Main Estimate budget sought £m | 2023-24 Supplementary Estimate budget approved £m | Change from Supplementary Estimate 2023-24 £m | Change from Supplementary Estimate 2023-24 % | See note ref |

|---|---|---|---|---|---|

| A. Seize the Opportunities of EU exit | 0.000 | 0.000 | 0.000 | 0.0% | |

| B. Secure a Safe, Prosperous and Resilient UK | 18.805 | 20.468 | -1.663 | -8.1% | |

| C. Advance Equality of Opportunity Across the UK | 0.000 | 0.000 | 0.000 | 0.0% | |

| D. Increase the Efficiency, Effectiveness and Accountability of Government | 62.169 | 85.338 | -23.169 | -27.1% | D |

| E. Support the Government’s and Prime Minister’s Priorities | 25.282 | 18.199 | 7.083 | 38.9% | |

| F. Government Property Agency – Executive Agency | 261.046 | 523.210 | -262.164 | -50.1% | F |

| G. Arm’s Length Bodies (Net) | 27.950 | 0.800 | 27.150 | G | |

| Total | 395.252 | 648.015 | -252.763 | -39.0% |

Differences of either more than 10% and £10 million, or more than 5% and £200 million are explained below. Numbers relate to the relevant row in the table above. Further detail of spending within these totals is given in the Annex at Table A.

(D) Increase the Efficiency, Effectiveness and Accountability of Government

A decrease of £23.169 million due to:

- A decrease in One Login programme costs of £17.180 million;

- £1.675 million reduction in Reserve funding for the development of the Find a Grant platform;

- £1.500 million increase in Reserve funding to progress productivity measures;

- £1.815 million increase in funding received from incoming Budget Cover Transfers from the Ministry of Defence for the development of Spotlight Confidential;

- £0.784 million increase in funding due to lower outgoing Budget Cover Transfers for the Evaluation Accelerator Fund to various other government departments;

- £8.403 million decrease due to funding transferred for prior year Machinery of Government transfers. The key driver is due to an increase of £8.343 million funding transferred for the Geospatial Commission to the Department of Science, Innovation and Technology.

(F) Government Property Agency – Executive Agency

A decrease of £262.164 million is due to:

- £254.600 million decrease in IFRS16 charges;

- £4.780 million net decrease in Budget Cover Transfers for capital project contributions from various other government departments. £3.648 was transferred to the Home Office to account for the disposal of Aragon Court offset by an increase of £5.050 million received from the Department for Science, Innovation and Technology for 22-26 Whitehall and £3.378 million received from the Department for Energy Security and Net Zero for 2-8 and 55 Whitehall;

- £3.380 million increase in funding due to a switch from Capital to Resource for the Private Initiative unitary contract costs which was only received in 2023-24; and

- £6.164 million decrease due to transfer between strategic objectives E and F.

(G) Arm’s Length Bodies (Net)

An increase of £27.150 million is mostly due to an increase of Reserve funding of £27.450 million for the setup costs of the Infected Blood Compensation Authority to administer the Infected Blood Compensation Scheme.

Explanations of changes in spending - Resource AME

The table below shows how spending plans for Resource AME compares with Supplementary Estimate 2023-24. Resource AME funding has been reduced by £80.668 million (-27.2%).

| Description | 2024-25 Main Estimate budget sought £m | 2023-24 Supplementary Estimate budget approved £m | Change from Supplementary Estimate 2023-24 £m | Change from Supplementary Estimate 2023-24 % | See note ref |

|---|---|---|---|---|---|

| Cabinet Office | 0.300 | 25.468 | -25.168 | -98.8% | A |

| Government Property Agency – Executive Agency | 216.000 | 271.500 | -55.500 | -20.4% | B |

| Total | 216.300 | 296.968 | -80.668 | -27.2% |

A: Cabinet Office and Equalities and Human Rights Commission

A decrease of £25.168 million due to:

- £2.709 million decrease in dilapidation and impairments costs;

- £19.259 million decrease in doubtful debts and legal provisions; and

- £3.200 million decrease provision of pensions for Members of the European Parliament which will be requested as part of the Supplementary Estimate.

B: Government Property Agency – Executive Agency

A decrease of £55.500 million due to:

- £62.000 million decrease for dilapidations, impairments;

- £5.000 million increase in doubtful debt provisions; and

- £1.500 million increase for IFRS16 depreciation relating to the charge on peppercorn leases.

2.2 Ring fenced budgets

Within the totals, the following elements are ring fenced i.e. savings in these budgets may not be used to fund pressures on other budgets.

| Resource DEL | 2024-25 Main Estimate budget sought £m | Change from Supplementary Estimate 2023-24 £m | Change from Supplementary Estimate 2023-24 % | Change from Original Budget Last Year (Main Estimate 2023-24) £m | Change from Original Budget Last Year (Main Estimate 2023-24) % |

|---|---|---|---|---|---|

| Depreciation | 80.700 | -101.203 | -56% | -104.861 | -57% |

| One Login and Data Exchange Programmes | 65.110 | -51.620 | -44% | -35.870 | -36% |

| Grenfell Public Inquiry | 4.709 | -0.205 | -4% | -10.091 | -68% |

| Covid Public Inquiry | 99.000 | 25.110 | 34% | 37.536 | 61% |

| Infected Blood Inquiry Compensation Team Expert Panel | 2.644 | 2.644 | - | 2.644 | - |

| Fraud Measures | 11.020 | 3.000 | 37% | 3.000 | 37% |

| Veterans’ initiatives | 14.531 | 2.256 | 18% | 2.256 | 18% |

| Funding for the official portraits of His Majesty the King | 0.662 | -4.972 | -88% | 0.662 | - |

| GPA PFI VAT | 27.300 | 2.300 | 9% | 2.300 | 9% |

| GPA PFI unitary charges | 24.800 | 9.580 | 63% | 24.800 | - |

| GPA freehold rebates | 12.530 | 6.030 | 93% | 6.030 | 93% |

| GPA property voids | 9.300 | 9.300 | - | 9.300 | - |

| Capital DEL | |||||

| One Login and Data Exchange Programmes | 26.110 | -17.050 | -40% | -11.050 | -30% |

| Veterans’ Affairs | 8.000 | 6.000 | 300% | 6.000 | 300% |

| Covid Public Inquiry | 0.479 | -2.543 | -84% | 0.479 | - |

2.3 Changes to contingent liabilities

All of the contingent liabilities present at the 2022-23 Supplementary Estimate still apply.

3. Priorities and performance

3.1 Major projects

The Major Projects Authority reports on the delivery of major projects annually. Its latest report

4. Accounting Officer approval

This memorandum has been prepared according to the requirements and guidance set out by the House of Common Scrutiny Unit, available on the Scrutiny Unit website.

The information in this Estimates Memorandum has been approved by myself as Departmental Accounting Officer.

Catherine Little CB

Permanent Secretary of the Cabinet Office and Civil Service Chief Operating Officer

July 2024