Financial relationship between HM Treasury and the Bank of England: memorandum of understanding 2025 (accessible)

Published 13 February 2025

Memorandum of Understanding on the financial relationship between HM Treasury and the Bank of England

ISBN 978-1-917151-83-2

PU 3490

1. Introduction

A. Aim of the Memorandum of Understanding and Key Areas Covered

This Memorandum of Understanding (MOU) describes the key responsibilities of the Bank of England (‘the Bank’) in managing its Financial Framework and documents current practical arrangements and the day-to-day working relationship with HM Treasury (‘the Treasury’) in its role as sole shareholder and customer. This MOU supersedes the 1972 MOU, the 2001 update, and the 2018 MOU.

This MOU is structured as follows:

- Introduction

- Framework for determining the Bank’s capital

- Financial framework

- The Bank of England Levy

- Bank’s financial accounts and annual report

- Payments in lieu of dividend

- Provision of agency services by the Bank to the Treasury

- Asset Purchase Facility costs

- Note Issue

It also contains a calendar of key meetings between the Bank and the Treasury throughout the Financial Year (see Annex A: Key Milestones).

B. Information Sharing and Cooperation between the Bank and the Treasury

Officials from the Bank and the Treasury liaise on a range of issues in relation to the financial relationship between the Bank and the Treasury. Depending on the interaction, the Treasury will be acting in its role as sole shareholder of the Bank, as departmental sponsor or as a customer.

The Bank and the Treasury have agreed that information-sharing arrangements should be in place to allow transparency and cooperation between the Bank and the Treasury (acting in its capacity as sole shareholder of the Bank, as departmental sponsor or as a customer), which will ensure that there is a common understanding of the Bank’s income, expenditure, dividend, and capital position and as context for any changes being proposed to the funding of the Bank. These arrangements will also ensure that the Treasury is able to meet its accountability obligations to Parliament in respect of the public finances and any contingent liability arising in its role as sole shareholder of the Bank. This MOU sets out those information-sharing arrangements between the Bank and the Treasury. The Bank will continue to be accountable to Parliament in respect of the Bank’s finances and budget in a variety of ways, including but not limited to: its Annual Report, regular public appearances by Governors and members of Court before the Treasury Select Committee (as well as pre-appointment hearings) and the National Audit Office (NAO) value for money reviews.

The MOU also respects the role of the Bank’s Court of Directors (Court) in managing the Bank’s affairs, including setting the Bank’s objectives and strategy and managing the Bank’s finances in accordance with Section 2 of the Bank of England Act 1998.

This MOU may be updated or amended from time to time to reflect changes to the financial arrangements between the Bank and the Treasury.

2. Framework for determining the Bank’s capital

The objective of the capital framework is to provide a robust and transparent process to ensure that the Bank has the financial resources needed to undertake the financial operations necessary to deliver its objectives even under severe but plausible stress scenarios.

Subject to meeting the Bank’s statutory policy objectives, the Bank seeks to implement its policy decisions through balance sheet operations that ensure value for money by minimising financial costs and risks to its capital and any future contingent capital exposure, whether that risk is borne by the Bank or indemnified by HMT, thus protecting public funds.

A. Capital principles

This section sets out the mutual understanding between the Treasury and the Bank on the types of operation that would be backed by the Bank’s own capital, and the types of operation for which the Bank may request an indemnity from the Treasury. Further detail on the operation of the capital principles will be agreed separately between the Bank and the Treasury.

Principle 1 – Purpose of Bank capital: Operations that lie within the Bank’s objectives of maintaining monetary and financial stability should be backed by its own capital, unless those operations bear a level of risk beyond the tolerance approved by Governors and Court.

Principle 2 – Nature of operations backed by capital: Consistent with Principle 1 above, the following types of operations should be backed by capital:

- secured lending in line with the Bank’s published frameworks, including against eligible collateral

- asset purchase operations to support conventional monetary policy implementation, the Bank’s official customer business or the funding of the Bank

Principle 3 – Size of operations backed by capital: The actual level of the Bank’s loss-absorbing capital at any point in time should allow it to continue to undertake the operations under Principle 2, both in normal market and liquidity conditions and under a set of severe but plausible stress scenarios, without falling below the capital floor. These scenarios are approved by Governors and Court.

Principle 4 – Other Operations: The financial backing for other operations, including those covered under the ‘Memorandum of Understanding on resolution planning and financial crisis management’, unconventional monetary policy asset purchases and Market Maker of Last Resort operations should be assessed on a case-by-case basis. The presumption is that such operations would only be backed by the Bank’s capital where the resultant exposures do not exceed the Bank’s loss-absorbing capital, when (i) evaluated according to the set of severe but plausible stress scenarios agreed by Governors and Court and (ii) added to the Bank’s existing commitments described in Principles 1-3

B. Contingent Capital Framework

- The parameters of the Bank’s capital framework (as set out below) will be formally reviewed by the Bank and the Treasury at least every five years, alongside reviews of the Bank of England Levy, and agreed in writing. However, in circumstances where the risk environment or the risk profile of the Bank’s balance sheet changes materially, intermediate arrangements to review these parameters may be warranted.

Parameters of the capital framework

-

Capital requirements will be set considering both the Bank’s current balance sheet and its contingent commitments to provide liquidity insurance to the financial system. Other factors, such as potential future changes to Bank facilities that the Bank indicates may be necessary to enable it to achieve its objectives, will also be considered. The Bank and the Treasury would expect to discuss changes to Bank facilities, or the introduction of new facilities, that go materially beyond the principles in Section 2(A) before such changes take effect. The following will not be used to fund the Bank’s current expenditure: injections to the Bank’s capital base; income generated from injections to the capital base; and, any additional capital that may be accreted through an excess of income over interest and expenses associated with operating the Bank’s facilities.

-

The metric to which the capital framework applies is the loss-absorbing capital (LAC) of the Bank. LAC is defined as the Bank’s total capital less any capital components that cannot absorb losses, which include (net of deferred tax): intangible assets; net pension scheme assets and property revaluation reserves; and illiquid investments.

-

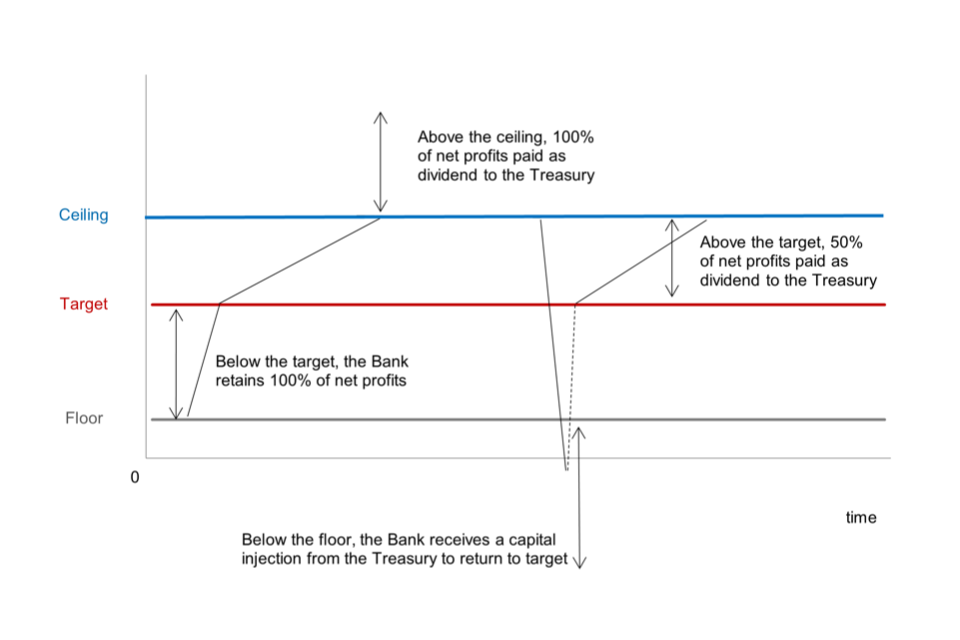

The parameters of the capital framework include a target, a floor, and a ceiling, as illustrated in Chart 1. These parameters, as well as any additional funding for capital, will be discussed and agreed between the Bank and the Treasury as part of the periodic review outlined in paragraph 11. In those reviews, the Bank will put forward its assessment of the values of those parameters it judges necessary to deliver on its objectives of maintaining monetary and financial stability, using the principles set out below. The Treasury will also have regard for the implications to the public finances.

Chart 1: Bank capital and income sharing framework

Target

- The central anchor of the framework is a target level for the Bank’s capital.

- The target will be calculated using a forward-looking, scenario-based approach to assess potential losses in a set of severe but plausible events, for activities that are backed by the Bank’s capital, as described in Section 2(A). Scenarios are reviewed annually, and material changes are approved by Governors and Court to reflect the risks to which the Bank is exposed in delivering its objectives of maintaining monetary and financial stability and discussed with the Treasury.

- When the Bank’s capital is below the target, whether above or below the floor, the Bank will not make payments in lieu of dividends to the Treasury until such time as the target is reached.

Floor

- The floor will be set as the level below which the credibility of the Bank’s ability to deliver its mission would be in sufficient jeopardy to warrant timely action.

- Should the Bank’s capital fall below that floor, it will be important to take rapid and decisive steps to restore the Bank’s capital to underpin confidence in the Bank. That will be achieved through activation of the process set out in section 2(D) below. The level to which capital would be restored would normally be the current estimate of the target, subject to reasonable allowance for any anticipated near-term growth in the Bank’s net profits.

Ceiling

- The ceiling will be set at a level that enables the Bank’s capital to withstand substantial losses without falling below the target by the end of the five-year period. For example, the distance between the ceiling and the target could be calibrated as a proportion of the distance between the target and floor. Once the Bank’s capital is above the ceiling, no further income is retained, and 100% of net profits for the financial year in which the ceiling is exceeded and for any future years that it is exceeded, will be paid in lieu of dividend by the Bank to the Treasury.

- If the Bank’s capital is above the target, but below the ceiling, the Bank will pay 50% of net profits for the financial year in which the capital target is exceeded and for any future years that it is exceeded, in lieu of dividend to the Treasury.

Regular Reporting Arrangements

Court is responsible for approval of the Bank’s Financial Framework, the Bank’s risk tolerance statement and its framework for monitoring and managing risk within the Bank and receives regular reports on the Bank’s capital adequacy, financial risks, and key drivers of risk. Alongside Court’s review of this information, the Treasury will be provided with an update on the level of capital, the risks borne by it and, where appropriate, notes explaining the key drivers. Both the Bank and the Treasury will respond reasonably to any ad hoc requests for discussion or further information from the other.

C. Capital Conservation

The Bank routinely employs a range of measures to conserve capital. These include:

- limiting access to its lending facilities to firms that the Bank is satisfied are appropriately supervised and taking into account the relevant threshold conditions

- use of collateral, wherever possible pre-positioned with the Bank, and hence subject to detailed due diligence, to provide further protection should counterparties fail

- applying conservative collateral haircuts, set to protect against changes in collateral value under severely stressed market conditions

In the event of a material loss from balance sheet operations that reduces capital below the target, further options to conserve capital would be considered including whether cost reduction would be feasible and have any material impact, but only in ways that allow the Bank to continue its mission of monetary and financial stability. The Bank should notify the Treasury of such measures, and the resultant impact on capital, in a timely manner. Where the loss takes capital below the floor, the measures outlined in Section D apply in addition.

D. Recapitalisation process

Loss reporting

Should the Bank experience (or expect to experience) a material loss from its balance sheet operations that reduces LAC to a level significantly below the capital target, the Bank will report to the Treasury on the events that have caused the loss (or expected loss) to occur in a timely manner.

This report might include: information on the counterparties causing the loss (or expected loss), the operations through which it was (or is expected to be) incurred, and the collateral or market movements involved. The details of the reporting shall be decided at the time, giving consideration to any issues and sensitivities in relation to this, including statutory prohibitions on disclosure.

The provision of Paragraph 15 for additional information sharing also applies in this case.

Process to restore capital

To ensure that the Bank’s ability to achieve its objectives is maintained, it is important that a process to restore the Bank’s capital takes place rapidly. To achieve this, the recapitalisation process will include, among others, notification by the Bank to the Treasury that the Bank’s capital is likely to breach the floor (or has breached it), evaluation by the Treasury’s Accounting Officer of the case for capital injection and how that should be undertaken, disclosure by the Treasury to Parliament, financing by the UK Debt Management Office, and payment by the Treasury to the Bank from the Consolidated Fund.

3. Financial Framework

A. The Bank’s Annual Budget

In February of each year, Court sets an expenditure budget for the year ahead in the context of the Bank’s medium-term objectives.

Ahead of this, but subsequent to Court’s December meeting, the Bank will provide the Treasury with a high-level overview of the Bank’s budget. This written summary will include:

- high level details of the Bank’s budget and medium-term spending plan, including a projection of spending of no less than three years

- the principles and assumptions on which the budget is based

- formal estimates in respect of Exchange Equalisation Account (EEA) Agency Services in respect of the input costs of each major service for each of the three financial years ahead, as set out in Section 7

The Bank’s Finance Director (or nominated alternate) will then discuss the high-level overview of the budget with the Treasury’s Fiscal Director (or nominated alternate). This discussion will focus on (i) the Bank’s budget and medium-term spending plan, (ii) the principles and assumptions on which the budget is based, and (iii) formal estimates in respect of the EEA Agency Services.

The Treasury’s Fiscal Director (or nominated alternate) may provide comments, at a working level, to the Bank’s Finance Director. Such comments should be provided as soon as possible and, in any event, in line with Court’s timetable. This process is designed to allow the Treasury the opportunity to provide comments on the draft budget, which the Bank’s Finance Director will consider and communicate to Court when presenting the final budget at Court. Court manages the financial affairs of the Bank as set out in Section 2 of the Bank of England Act 1998.

Following Court’s approval of the Bank’s finances in February, the Bank’s Finance Director (or nominated alternate) and the Treasury’s Fiscal Director (or nominated alternate) will meet as soon as possible, usually later in the same month, to discuss Court’s conclusions and the background to them. This meeting will cover:

- the budget as approved by Court

- the Bank’s medium term spending plan as agreed by Court

- the background to Court’s decision

Ahead of this meeting, the Bank’s Finance Director (or nominated alternate) will provide the Treasury’s Fiscal Director (or nominated alternate) with copies of the relevant background written financial information provided to the Court in reaching its judgements, but for the avoidance of doubt, not internal commentary and analysis.

B. The Exchange of Letters

The Governor of the Bank will then write to the Chief Secretary to the Treasury within a reasonable time after the Court meeting (in line with the key milestones calendar in Annex A) setting out the consequences of Court’s review. A Treasury Minister, customarily the Chief Secretary, will reply to the Governor.

C. Bank’s Performance Against Budget & Financial Risk Reporting

Every quarter, the Bank will share an update with the Treasury on the Bank’s performance against the budget and any supporting narrative, following Court’s review. This update will include a revised forecast outturn in respect of EEA Agency Services provided by the Bank to the Treasury as set out in Section 7 below.

Every six months, the Bank will share an update with the Treasury on the level of the Bank’s capital, the risks borne by it and, where appropriate, notes explaining the key drivers (see paragraph 15 above).

D. The Prudential Regulation Authority’s (PRA) Annual Budget

The PRA’s annual budget and the provision of financial information in respect of it are subject to different procedures from those of the rest of the Bank and are not covered by this MOU.

The PRA’s annual budget is adopted by the Prudential Regulation Committee (PRC) with the approval of Court before the start of the financial year to which it relates and the Bank must publish it in whatever way it thinks appropriate (pursuant to paragraph 18 of Schedule 6A of the Bank of England Act 1998). The PRA’s Annual Report is prepared annually and presented to Parliament (pursuant to paragraph 19 of Schedule 1ZB of the Financial Services and Markets Act 2000). For each financial year, a statement of accounts of the PRA is included in the Bank’s accounts pursuant to section 7(2A) of the Bank of England Act 1998.

Given this, the procedure set out in Section 3(A) of this MOU, which provides that the Treasury may provide comments on the Bank’s annual budget before it is agreed by Court, does not apply to the PRA’s budget.

This reflects the fact that the PRA’s sources of funding are separate from those of the rest of the Bank, and that the Treasury does not assume any contingent liabilities with respect to the PRA. Furthermore, the PRA is subject to Basel Core Principles, which require, among other things, that there is “no government or industry interference that compromises the operational independence of the supervisor”.

Existing established processes between the Bank and the Treasury are set out in the calendar for reference only with respect to the PRA’s report and accounts.

4. The Bank of England Levy

The Bank of England Levy (Levy) replaced the Cash Ratio Deposit (CRD) scheme on 1 March 2024 as a means of funding the functions exercised by the Bank in pursuit of its financial stability and monetary policy objectives. In 2021, the Treasury ran a consultation which proposed the Levy as an alternative funding arrangement to the CRD scheme, in order to deliver a more reliable and stable funding scheme for the Bank’s policy functions.

The amount that Levy payers will be liable to pay is determined by the Bank in accordance with primary legislation and regulations made by the Treasury. The Levy is applied on a proportional basis, which means that the Bank allocates the policy costs to be recovered by the Levy in proportion to an eligible institution’s eligible liability base. This is a continuation of how the CRD scheme operated.

The Treasury and the Bank have committed to review the Levy. Five years after 1 March 2024, the Treasury will undertake a review and commit to further reviews taking place every five years after the first review.

In advance of each Levy review, the Treasury and the Bank will meet at a working level to discuss the following aspects of the review (this list is indicative and the Bank and the Treasury may include additional topics):

- the operation and suitability of the Levy, looking at overall purpose of the scheme, including framework, thresholds, and definitions

- changes in the Bank’s expenditure on its policy functions since the last review

- the Bank’s forecast income from the Levy over the period covered by the review, including a model that considers a different threshold for eligible liabilities and the definition of an eligible institution

- the resultant impact of the Levy on the Treasury’s dividend and on the Bank’s reserves.

At the beginning of any Levy review, the Treasury and the Bank will meet to agree a timetable of key actions and meetings for the review period.

5. The Bank’s financial accounts and annual report

The Bank’s financial year end is 28 February. The Bank of England Act 1998 sets out the accounting standards that govern the Bank’s published accounts and permits Court to modify these where it deems this to be appropriate. The reasons for any deviations from agreed accounting standards are set out in the published notes to the accounts. The present approach was agreed between the Bank and the Treasury at the time of the Bank of England Act 1998. In accordance with section 7(7) of the Bank of England Act 1998, the Treasury may by notice in writing require the Bank to publish in such manner as it thinks fit, such additional information relating to the accounts as the Treasury may specify in the notice.

The Bank will publish in its Annual Report details of the Financial Framework, in particular the budget and the costs of functions, in order to provide accountability and transparency to the taxpayer without prejudicing the lower level of disclosure in the statutory accounts.

6. The payments in lieu of dividend

Section 1(4) of the Bank of England Act 1946 provides that 50% (or such other sum as agreed between the Bank and the Treasury) of the Bank’s net profits are to be paid by the Bank to the Treasury as shareholder.

Normally two payments will be made each year by the Bank to the Treasury in lieu of dividend, and charged to the Bank’s accounts. A first (“interim”) payment on 5 April will be based on such information as the Bank can reasonably provide to the Treasury about the profits for the financial year just ended. The final dividend payment, calculated to conform with the final audited accounts, will be paid on 5 October. Both the interim and final dividends will be agreed between the Bank and the Treasury by exchange of letters. Please refer to Section 2(B) above for details on how the payments in lieu of dividend by the Bank to the Treasury will change depending on the Bank’s capital position.

7. Provision of Agency Services by the Bank to the Treasury

The Exchange Equalisation Account (EEA) holds the United Kingdom’s reserves of gold, foreign currency assets and International Monetary Fund Special Drawing Rights. The EEA is under the control of the Treasury, whose prime objective in managing the EEA on behalf of the government is to ensure that the reserves are fit for purpose in order to meet current policy objectives and any potential future changes in policy.

The Treasury has appointed the Bank to act as its agent in the day-to-day management of the EEA. The Treasury acts as a customer of the Bank for the management of the EEA, rather than as the Bank’s shareholder.

The basis upon which the Bank will provide agency services to the Treasury for management of the EEA will be agreed separately, before the start of the Treasury’s financial year. This will include the strategy, investment objectives and parameters within which the Bank is to manage the reserves.

The EEA is regarded by the Bank as a remunerated function. The general principle governing charges for the Bank’s remunerated functions is ‘full and fair’ cost recovery, including from the Treasury for the agency services provided. On occasion, the Bank and the Treasury may choose, by mutual agreement, not to apply the principle of full cost recovery for a limited period.

The Bank will provide sufficient information to the Treasury to be able to satisfy itself that the charge is reasonable and accords with the parameters agreed between the Bank and the Treasury, and to allow the Treasury to meet the requirements assigned to it in accordance with the “Managing Public Money” principles. In providing information, the Bank will allow reasonable time for discussions to take place and to enable the Treasury to consider the fee proposals before decisions on costs and associated fees are made. Further details of funding and information provision arrangements for the EEA will be agreed separately between the Bank and the Treasury.

8. Asset Purchase Facility Costs

In January 2009, the Chancellor of the Exchequer authorised the Bank to set up the Asset Purchase Facility (APF). The aim of the APF is to boost economic activity and return inflation to target, including via the purchase of financial assets such as gilts and corporate bonds. These transactions are carried out through the APF, and financed by creating central bank reserves. Transactions are undertaken by a subsidiary of the Bank, the Bank of England Asset Purchase Facility Fund Limited (BEAPFF). Further details of funding arrangements for the APF management fee are set out in the APF Annual report published by the Bank.

9. Note Issue

A. Note Issue Expenses

The Bank will continue to manage the design, production, issue and distribution of bank notes. Notes Issue expenses are agreed separately between the Bank and the Treasury. They will be deducted from the income of the Issue Department as follows:

- One-twelfth of the approved estimate of note expenditure costs for the year ended 28 February will be charged each calendar month to profits of the Issue Department, before those are paid over to the Treasury monthly on the last business day of each month.

- In March the amount charged will be based solely on the initial estimate for the year. From April to February costs charged in the month will consist of the cost estimate for the month and a true up based on the actual note expenditure cost in the prior month.

- The April charge will be adjusted by 50% of the previous year’s final estimated difference. The July charge will be adjusted by the remainder of the previous year’s difference, based on the final audited statement of costs.

- The cost estimate will be reviewed quarterly and the amount charged may be adjusted on the basis of the latest forecast for the current year, which takes into account the actual expenditure incurred by the Bank from the beginning of the financial year.

Any adjustment proposed to the schedule of payments set out above during the year shall only be made by agreement between the Treasury and the Bank.

B. Note Issue Income

Any excess income net of expenses will be transferred as profits by the Bank from the Note Issue Income account (NII) to the National Loans Fund (NLF). Normal practice shall be for the profits to be paid over monthly, on the last business day of each month, subject to a buffer retained on the NII set by the Bank every month in order for the Issue Department to meet its projected expenses in the following month.

The Treasury and the Bank shall review these arrangements from time to time, at the request of the Treasury or the Bank.

C. Coordination

As noted above, the Bank will continue to manage the design, production, issue and distribution of bank notes. The Treasury may approve the denomination of bank notes pursuant to Section 1 of the Currency and Bank Notes Act 1954, but the Bank will take all other decisions in relation to bank notes, including without limitation, the choice of substrate, design, characters, security features and choice of suppliers.

In order to support the Treasury’s understanding of the forthcoming bank note expenditure and in recognition of the unique nature of the Issue Department, the Bank will liaise with the Treasury in advance of any significant decision regarding expenditure in relation to the production of bank notes that the Bank considers could have a material effect on the Bank’s budget. To provide guidance as to the appropriate materiality threshold for such consultation with the Treasury, in 2013-14 the Bank consulted with the Treasury during the process of purchasing new printing equipment at the Debden printing works. The Bank also consulted with the Treasury in relation to moving to polymer bank notes.

Further information can also be found in the Service Level Agreement between the Bank and the Exchequer Funds and Accounts team at the Treasury, which is reviewed annually.

Annex A: Key milestones

For guidance, these calendars set out the key milestones and meetings between the Treasury, the Bank and the PRA in relation to the Financial Framework every year. These calendars are indicative and do not preclude additional informal meetings between the Treasury and the Bank and/or PRA if these are required. The Chair of Court and the Permanent Secretary to the Treasury will usually meet at least twice a year, and otherwise, as and when required.

Bank

| December – January | Working level meetings and information sharing with the Treasury following December Court between the Bank’s Finance Director and the Treasury’s Fiscal Director to discuss a high-level overview of the Bank’s budget (as set out in Section 3(A) of this MOU). |

| February | Court sets the Bank’s budget for coming year. |

| Officials from the Bank and the Treasury meet to discuss the budget and interim dividend. | |

| Letter from the Governor to the Chief Secretary to the Treasury and subsequent reply. | |

| March | Court approves the interim dividend. Note that references to the dividend here are subject to Section 2(B) of this MOU and payments in lieu of dividend may change depending on the Bank’s capital position. |

| The Bank’s Finance Director writes to the Permanent Secretary to the Treasury confirming the interim dividend. | |

| The Permanent Secretary to the Treasury replies noting the interim dividend. | |

| April | 5 April – interim dividend paid by the Bank to the Treasury. |

| May | The Bank’s Finance team writes to the Treasury’s Debt & Reserves Management team, proposing a final dividend. |

| If content, the Treasury replies agreeing the final dividend. | |

| The Bank sends a copy of the draft Annual Accounts to the Treasury. | |

| Court approves the Bank’s Annual Report, to send to the Chief Secretary to the Treasury. | |

| Court approves the final dividend. | |

| The Chief Secretary to the Treasury lays the Bank’s Annual Report before Parliament. | |

| The Bank’s Finance Director writes to the Permanent Secretary to the Treasury confirming the final dividend. | |

| The Permanent Secretary to the Treasury replies noting the final dividend. | |

| July | The final balance of end of year difference on Notes Issue costs recharges is settled. |

| October | 5 October – final dividend paid by the Bank to the Treasury. |

PRA

The PRA’s budgeting process is different to the Bank’s. This is because Schedule 6A Section 18 of the Bank of England Act 1998 requires that the Prudential Regulation Committee must have a budget agreed before the start of the financial year to which it relates.

- Annual Accounts of the PRA and the Treasury’s power of direction

In accordance with Section 7 (2A) Bank of England Act 1998 (accounts) the PRA must prepare a statement of accounts for each financial year.

In preparing the annual accounts, in accordance with Section 7(3) Bank of England Act 1998, the Bank must comply with any directions given by the Treasury as to:

(a) The information to be contained in the statement and the manner in which it is to be presented, and

(b) the methods and principles according to which the statement is to be prepared.

- Annual Reports – in accordance with Schedule 6A Section 19 Bank of England Act 1998, at least once a year the PRC must make a report to the Chancellor of the Exchequer on:

(i) Adequacy of Resources – the adequacy of resources allocated, in the period to which the report relates, to the Bank’s functions as the Prudential Regulation Authority; and

(ii) Independence – the extent to which the exercise of the Bank’s functions as the Prudential Regulation Authority is independent of the exercise of its other functions.

| February | The Treasury provides direction on the format, the basis of preparation and disclosures for the PRA section of the Bank’s Annual Report. |

| The Treasury answer any questions from the Bank related to the direction. | |

| May | At working level, the Bank send a draft copy of the Bank’s Annual Report and Accounts to the Treasury (which will include a separate PRA section). The Treasury reviews the narrative of the Report and provide any informal comments to the Bank as necessary. |

| May – July | Bank officials share a final draft of the Bank’s Annual Report and Accounts (which will include a separate PRA section) with officials at the Treasury. Officials at the Treasury seek approval from the relevant Minister to lay the documents before Parliament. |

| In line with the Financial Services and Markets Act (2000), the Bank (PRA Chief Operating Officer) delivers the Bank’s Annual Report and Accounts (which will include a separate PRA section) to the Treasury to lay before Parliament (statutory requirement). |