National Security and Investment Act 2021: Annual Report 2023-24 (HTML)

Updated 7 October 2024

Executive Summary

1. This report is a statutory requirement, laid before Parliament under Section 61 of the National Security and Investment Act 2021 (“the Act”). It covers the year from 1 April 2023 to 31 March 2024 (the “reporting period”), containing all the information that is required by the Act and additional information to aid understanding and transparency.

2. The Government is committed to ensuring the Act protects our national security, and does so as effectively, efficiently, and transparently as possible - giving investors the certainty they need to kickstart growth across the UK.

Overview of this report’s content

3. In this report, the term ‘the Government’ is used to refer to the decision maker, who for this time period was the Secretary of State in the Cabinet Office and the Chancellor of the Duchy of Lancaster. The term ‘the Government’ is also used, in a few instances, to refer to the Investment Security Unit (ISU) which can exercise the powers on behalf of the decision maker under the Act. The ISU also administers the operation of the NSI Act.

4. This is the third annual report on the operation of the Act and the second to cover a whole year. For the first time the report includes year-on-year comparisons with the previous reporting period and an accompanying spreadsheet containing all data published since the commencement of the Act. Comparisons are included throughout the report using data included in this report and data published in the previous reporting period. Some figures from the previous reporting period have been updated for improved accuracy. The revised figures can be found in the accompanying spreadsheet.

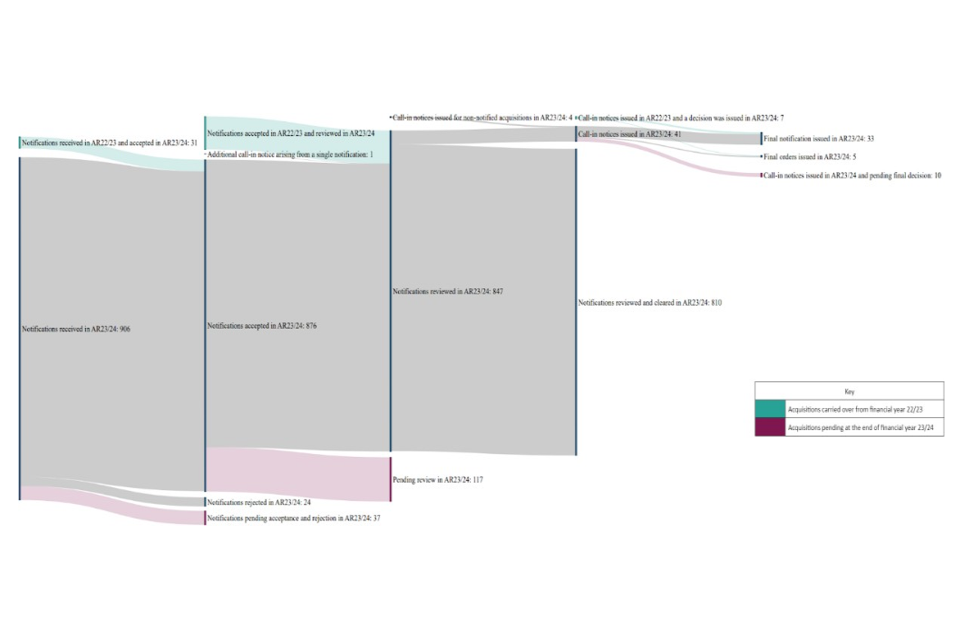

5. The Act requires each annual report to contain specific details on the operation of the Act. In addition, this report contains information and comparisons that go beyond the statutory minimum. This includes information that was included in previous annual reports (such as the total number of notifications received organised by notification type and month and the number of call-in notices organised by origin of investment) and new categories of information not previously published (such as the number of withdrawals from a called in acquisition by area of the economy, and the average number of calendar working days it took to issue a final order).

Notifications Received

6. In this reporting period the Government received 906 notifications[footnote 1], an increase from 865 notifications received in the previous reporting period[footnote 2]. Of the 906 notifications received, 753 were mandatory notifications, 120 were voluntary notifications, and 33 were retrospective validation applications[footnote 3].

7. Of the 906 notifications received, the Government accepted 876 notifications (an increase from 806 in the previous reporting period) and rejected 24 notifications during the reporting period, a decrease from 42 notifications in the previous reporting period[footnote 4]. The 876 accepted notifications comprised 728 mandatory notifications, 116 voluntary notifications, and 32 retrospective validation applications.

8. Annex D contains a diagram which breaks down the total number of notifications received, and the overlap where notifications were received in the last reporting period but accepted during this reporting period.

Call-in notices, withdrawals, final notifications, and final orders issued

9. During the reporting period, the Government reviewed 847 notifications. Of the 847 notifications reviewed, 4.4% (37) were called in, and 95.6% (810) were notified that there would be no further action. For comparison, during the previous reporting period, 7.2% of notified acquisitions[footnote 5] were called in and 92.8% were notified that there would be no further action.

10. In addition to the 37 notified acquisitions called in during the reporting period, 4 non-notified acquisitions were issued with a call-in notice[footnote 6]. Therefore, the Government issued a total of 41 call-in notices in this reporting period, a decrease from 65 in the previous reporting period.

11. Of the 41 call-in notices issued during this reporting period, 22 related to a mandatory notification, 15 related to a voluntary notification, and 4 were in relation to non-notified acquisitions. No call-in notices were issued in connection with a retrospective validation application.

12. The Government issued 33 final notifications[footnote 7] (which includes 10 withdrawn notifications) and 5 final orders[footnote 8], and also varied 3 other final orders during this reporting period. For comparison, the Government issued 57 final notifications and 15 final orders during the previous reporting period.

13. Of the 33 final notifications, 18 were following a mandatory notification, 12 were following a voluntary notification, and 3 were following non-notified acquisitions[footnote 9].

14. There were 10 instances where parties withdrew from a called in acquisition, a decrease from 11 in the previous reporting period. Of the 10 withdrawals, 3 were following a mandatory notification, 5 were following a voluntary notification, and 2 were following non-notified acquisitions.

15. Of the 5 final orders, 3 were following a mandatory notification, 1 following a voluntary notification, and another was an non-notified acquisition.

Notifications and acquisitions, by area of the economy

Note 1: Acquisitions can be associated with more than one area of the economy. Therefore the number of notifications, call-in notices, final notifications, withdrawals, and final orders issued broken down by area of the economy may add up to more than the total number of notifications, call-in notices, final notifications, withdrawals, and final orders.

16. In this reporting period, the highest proportion of all accepted and rejected notifications related to the defence area of the economy (48% of notifications). This is followed by critical suppliers to government with 19% and military and dual-use with 17%.

17. Of the 41 acquisitions called in, the highest proportion (34%) were associated with the defence area of the economy and 29% with military and dual-use. Acquisitions in the areas of academic research and development in higher education, advanced materials, and communications each accounted for 24% of call-in notices. For comparison, the highest proportion of call-in notices issued in the previous reporting period related to the military and dual-use (37%) area of the economy.

18. 30% of the final notifications issued during this reporting period were associated with acquisitions in the defence area of the economy, with academic research and development in higher education, advanced materials and military and dual-use areas of the economy each accounting for 24% of final notifications. For comparison, the highest proportion of final notifications in the previous reporting period were associated with the military and dual-use (44%) area of the economy.

19. Of the 10 occasions on which parties withdrew from a called in acquisition, 5 withdrawals related to the professional, scientific and technical activities area of the economy, 5 related to academic research and development in higher education, and 4 related to information and communication areas of economy.

20. Of the 5 final orders made during this reporting period, 4 were associated with acquisitions in the defence area of the economy, 2 related to military and dual use, and 2 related to communications. For comparison, the largest number of final orders issued in the previous reporting period were associated with the military and dual-use area of the economy (5).

Notifications and acquisitions, by origin of investment

Note 2: The number of notifications, call-in notices, final notifications, withdrawals, and final orders issued when broken down by origin of investment may differ because a single acquisition can be associated with more than one origin of investment. This is because there can be more than one acquirer per acquisition, so one acquisition may be associated with multiple origins of investment.

21. In this reporting period, 61% of accepted notifications related to acquirers associated with the United Kingdom (UK) and 26% with acquirers associated with the United States of America (USA). Acquirers associated with France, Germany, and Luxembourg each accounted for 4% of notifications. The UK was also associated with the highest proportion of accepted notifications (57%) in the previous reporting period.

22. Of the 41 acquisitions called in, 41% related to acquisitions involving acquirers associated with China, 39% with acquirers associated with the United Kingdom, and 22% with the USA. China was also associated with the highest proportion of call-in notices issued (42%) during the previous reporting period.

23. Of the 33 final notifications issued, 48% involved acquirers associated with China, 42% with the UK, and 21% with the USA. China was also associated with the highest proportion of final notifications issued (40%) during the previous reporting period.

24. Of the 10 withdrawals, 8 were associated with China, 7 were associated with the UK and 2 were associated with the USA.

25. Of the 5 final orders issued, 2 were associated with the UK and 2 with the USA. Acquirers associated with Canada, France, and the United Arab Emirates accounted for 1 final order each.

Notifications and acquisitions, by the time taken

Note 3: The use of an information notice or attendance notice in the assessment period[footnote 10] affects how working days are calculated. The calendar working days count includes the number of working days in the assessment period during which an information or attendance notice is in place, whereas the statutory working days count excludes the time during which an information notice or attendance notice is in place. Both counts exclude bank holidays. An information notice does not affect the number of working days during the review period[footnote 11].

All average timings in the executive summary are displayed as median values to minimise the impact of outliers (large or small numbers) compared to the mean values.

26. All accepted notifications were either called in or cleared within the statutory time limit of 30 working days during the review period. For notifications that were called in, it took on average 29 statutory working days to issue a call-in notice once a mandatory or voluntary notification was accepted. For comparison, it took on average 28 statutory working days to issue a call-in notice after accepting a mandatory notification and 27 statutory working days to issue a call-in notice after accepting a voluntary notification in the previous reporting period.

27. On average, it took 26 statutory working days or 48 calendar days to issue a final notification from the point an acquisition was called in during the assessment period. In the previous reporting period, the average number of statutory working days between calling in an acquisition and issuing a Final Notification was 26 working days[footnote 12].

28. The additional period was used 12 times, a decrease from 29 times in the previous reporting period. Of the 12 times the additional period was used, 4 were related to mandatory notifications, 4 were related to voluntary notifications, and 4 were related to non-notified acquisitions.

29. The voluntary period was used 4 times, a decrease from 10 times in the previous reporting period. Of the 4 times the voluntary period was used, 2 were related to mandatory notifications, 1 related to voluntary notifications, and 1 was related to non-notified acquisitions.

30. Of the 12 acquisitions that used the additional period, 7 were subsequently issued with a Final Notification and 3 were subsequently issued with a Final Order, with the remaining 2 acquisitions not finalised during this reporting period. Of the 4 acquisitions that used the voluntary period, 2 were subsequently issued with a Final Notification and 2 were issued with a Final Order.

31. On average, it took 34 statutory working days or 53 calendar days to issue a final order from the point an acquisition was called in. For comparison, it took an average of 81 statutory working days to issue a final order from the point an acquisition was called in during the previous reporting period. Given the small number of final orders (5) issued in this reporting period, no conclusions should be drawn about any trends in the time taken between calling in an acquisition and issuing a final order.

Enforcement and assistance

32. No financial assistance was given during this reporting period. No penalties were issued, nor any criminal prosecutions concluded. Where offences were identified but the decision was made not to impose a penalty, parties were asked to provide reassurance to the Government that steps had been taken to prevent any recurrence.

Purpose of the NSI system

1. The NSI Act came into full effect on 4 January 2022 and grants the Government powers to scrutinise and intervene in certain acquisitions of control (“acquisitions”) to safeguard the UK’s national security. These powers ensure that investment in the UK can continue with predictability and transparency while protecting the UK’s national security.

2. The UK continues to encourage investment and is committed to remaining a free and open economy. The NSI Act focuses solely on national security, meaning it will not be used to interfere unnecessarily with investment or to support any other objectives. Most acquisitions will not raise national security concerns and so will be unaffected by the NSI Act. This ensures the system is effective but light-touch, helping businesses and investors to continue with certainty. These powers are in line with many similar systems across the world.

How the NSI system works

3. The NSI Act allows the Government to review certain acquisitions that meet legal tests set out in the NSI Act and which may give rise to a risk to national security.

4. While the powers cover all areas of the economy, certain acquisitions involving entities that carry out particularly sensitive activities in 17 areas of the economy[footnote 13] (such as in defence, civil nuclear, and quantum technologies) must be notified to the Government in the form of a “mandatory notification” and receive approval before completion. Such acquisitions are called “notifiable acquisitions”.

5. Acquisitions which are not covered by mandatory notification must be submitted through a “voluntary notification” and if a notifiable acquisition has been completed without approval, the acquisition is void but parties will be able to submit a “retrospective validation application”.

Reviewing a notification

6. When the Government receives a notification of an acquisition, it must ‘accept’ or ‘reject’ that notification. If a notification is rejected, the notifying party or parties will be contacted by officials to explain why the notification has been rejected. Parties may resubmit the notification after addressing the feedback, and the notification may then be accepted.

7. Once the Government has accepted a notification, it has 30 working days to decide whether to call in the acquisition for a more detailed assessment or to clear it. This is known as the “review period”.

Identifying acquisitions which have not been notified

8. In addition to receiving mandatory notifications, voluntary notifications, and retrospective validation applications, the Government can also investigate acquisitions that have not been notified. If a notifiable acquisition has taken place without the Government’s approval, it is void in law, but it may be approved retrospectively.

9. The Investment Security Unit (ISU) conducts market monitoring to identify non-notified qualifying acquisitions which are of potential national security concern. Acquisitions are identified in a number of different ways, including using commercial tools, departmental referrals, and open-source information from online reporting.

10. Where the Government becomes aware of an acquisition that took place on or after 12 November 2020 (the day after the NSI Act was introduced to Parliament), any call-in notice must be issued within six months of the Government becoming aware of the acquisition, and cannot be issued more than five years after the acquisition took place.

Scrutinising acquisitions

11. The Government may ‘call in’ acquisitions for further scrutiny. The statement for the purposes of Section 3 of the NSI Act, published on GOV.UK, sets out how the Government expects to exercise the power to call in acquisitions and the factors taken into account.

12. During the assessment period, the Government can impose interim orders, for example requiring the acquisition to halt until the assessment is complete.

13. If an acquisition is called in, it proceeds to the “assessment period”. The Government then has 30 statutory working days to assess the acquisition (the “initial period”). This count of statutory working days is paused in the event that transaction parties are asked to respond to an information notice or an attendance notice and does not include bank holidays in any part of the United Kingdom. The Government can extend this period by 45 statutory working days (the “additional period”), and can mutually agree to further voluntary extensions (the “voluntary period”) with the acquirer.

14. At the end of the assessment period the Government will either clear the acquisition through a final notification or, if it believes on the balance of probabilities that a risk to national security has arisen or would arise as a result of a qualifying acquisition, impose a final order. If the Government considers this to be necessary and proportionate, this may include imposing conditions on acquisitions, preventing them from being completed, or, if the acquisition has already taken place, requiring parties to unwind the acquisition.

Complying with the NSI Act

15. Non-compliance with the requirements of the NSI Act may attract civil or criminal penalties. Decisions made by the Government under the NSI Act may be challenged by applying for judicial review within 28 days, beginning with the day after the day on which the grounds to make the claim first arose (unless the court considers that exceptional circumstances apply).

Further guidance

16. The Government has published extensive guidance on gov.uk which provides further details on the operation of the NSI Act, including the process for submitting notifications.

SECTION ONE: Notifications

1. This section contains information about the notifications the Government received during this reporting period. Notifications by area of the economy are on page 20, and notifications by origin of investment are on page 24.

2. Notifications are the means by which a person gives notice to the Government about acquisitions that meet the legal tests set out in the NSI Act. The vast majority of activity in the UK economy in any given year will not need to be notified to the Government.

3. Parties to acquisitions can make three types of notification under the NSI Act:

a. Mandatory notifications are those received in relation to ‘notifiable acquisitions’, which are certain acquisitions of entities carrying out certain activities in the 17 sensitive areas of the UK economy specified in the Notifiable Acquisition (Specification of Qualifying Entities) Regulations 2021.

b. Voluntary notifications are those received in relation to acquisitions of assets and of entities which are not covered by mandatory notification requirements. Parties may submit notifications voluntarily to achieve business certainty.

c. Retrospective validation applications are applications for notifiable acquisitions to be recognised retrospectively as being valid in law after they have been completed without approval.

4. In this report, “notifications” refers collectively to mandatory notifications, voluntary notifications, and retrospective validation applications.

Notifications received

5. Once a notification is received, the Government must either accept the notification (meaning it can be reviewed) or reject the notification. Reasons for rejecting a notification are outlined in Figure 5 on page 16.

Table 1

| ID | Information | Number |

|---|---|---|

| A | The total number of notifications received | 906 |

| B | The number of mandatory notifications received | 753 |

| C | The number of voluntary notifications received | 120 |

| D | The number of retrospective validation applications received | 33 |

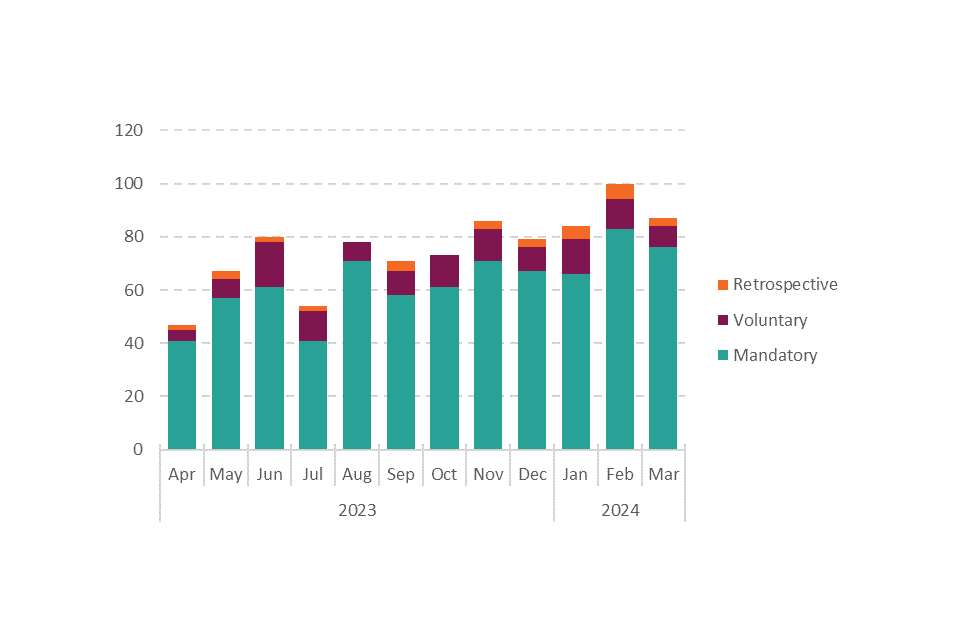

Figure 1 - Notifications received, by notification type and month

6. Figure 1 shows the total number of notifications received, broken down by notification type and in each month of the reporting period, which totalled 906. This is an increase from 865 notifications[footnote 14] received in the previous reporting period. The most notifications (100) were received in February 2024, and the fewest (47) were received in April 2023. More than six times as many mandatory notifications were received as voluntary notifications.

Notifications accepted and rejected

7. This section includes notifications that were accepted and rejected during the reporting period. Some of the notifications received towards the end of this reporting period will have been accepted or rejected after the reporting period closed. In addition, some of the notifications received in the previous reporting period will have been accepted or rejected in this reporting period. This means that there may be some difference between the total number of notifications received and the total number of notifications accepted and rejected.

Table 2

| ID | Information | Number |

|---|---|---|

| E | The total number of notifications accepted and rejected | 900 |

| F | The total number of notifications accepted | 876 |

| G | The total number of notifications rejected | 24 |

| H | The number of mandatory notifications accepted | 728 |

| I | The number of mandatory notifications rejected | 13 |

| J | The number of voluntary notifications accepted | 116 |

| K | The number of voluntary notifications rejected | 9 |

| L | The number of retrospective validation applications accepted | 32 |

| M | The number of retrospective validation applications rejected | 2 |

| N | The number of notifications pending acceptance and rejection at the end of the reporting | 37 |

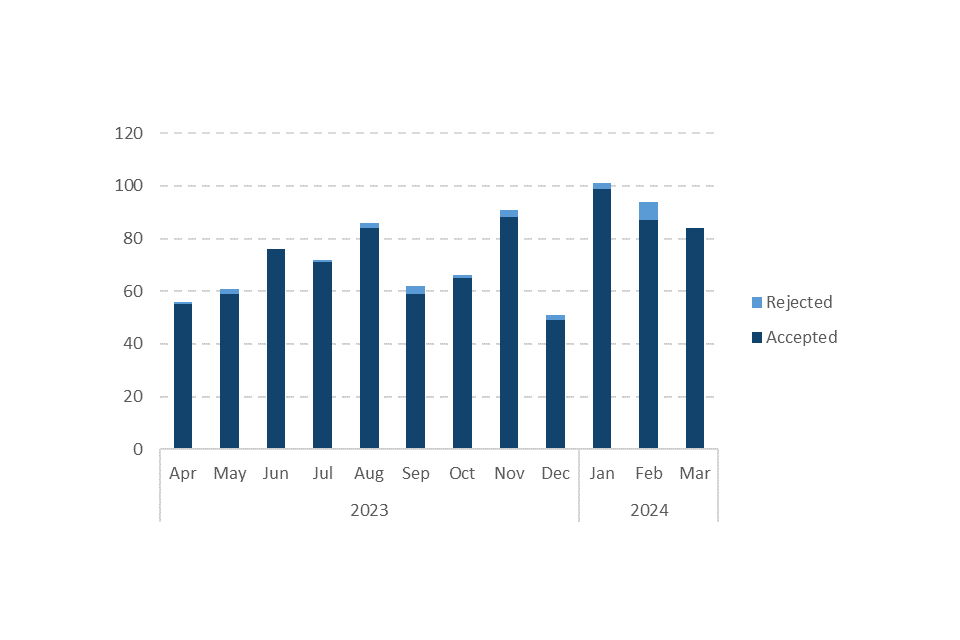

Figure 2 - Notifications accepted and rejected, by month

8. Figure 2 shows the number of notifications which were accepted or rejected during each month of the reporting period. The large majority of notifications received were accepted (97%), with only a small minority being rejected (3%). Figure 5 provides a detailed breakdown of the reasons why the Government has rejected notifications.

9. The total number of accepted notifications has increased from 806 in the previous reporting period to 876. Meanwhile, the total number of notifications rejected has decreased from 42 to 24.

Figure 3 - Notifications accepted, by notification type and month

10. Figure 3 shows the number of accepted notifications by notification type in each month of the reporting period. The chart illustrates that December 2023 had the lowest (49) number of notifications accepted, while January 2024 had the highest (99) number of accepted notifications.

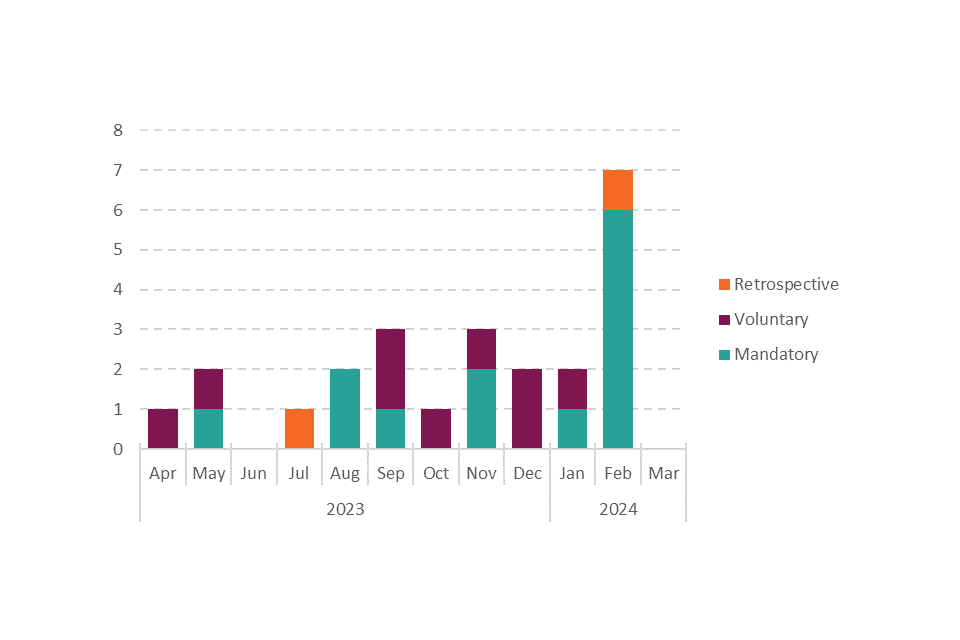

Figure 4 - Notifications rejected, by notification type and month

11. Figure 4 shows a breakdown of the number of rejected notifications by notification type in each month of the reporting period. Mandatory notifications made up the biggest proportion of rejected notifications with 13 (54.2%), followed by voluntary notifications with 9 (37.5%) and retrospective validation applications with 2 (8.3%).

Figure 5 - Notifications rejected, by the reason why they were rejected

12. Figure 5 provides a detailed breakdown of the reasons why the Government has rejected a notification. The most common reason for rejecting a notification was that the acquisition should have been notified under a different notification type (10 notifications rejected out of 24 in total). When the ISU rejects a notification, officials contact parties to explain why the notification was rejected.

SECTION TWO: Call-in notices

1. This section contains information about notified and non-notified acquisitions that have been reviewed during this reporting period. This is different from notifications that have been received and accepted or rejected because not all acquisitions called in were notified, and the Government may have received or accepted a notification in a previous reporting period but reviewed the notification in this reporting period.

2. The Government can only call in an acquisition for further scrutiny if it reasonably suspects a qualifying acquisition may give rise to a risk to national security. Call-in notices may be issued concerning any qualifying acquisition, whether or not it has been notified.

3. The number of call-in notices issued by area of the economy is on page 21, and the number of call-in notices issued by origin of investment is on page 25.

Notifications reviewed & call-in notices issued

Table 3

| ID | Information | Number |

|---|---|---|

| A | The total number of notified acquisitions reviewed | 847 |

| B | The number of acquisitions reviewed following a mandatory notification | 704 |

| C | The number of acquisitions reviewed following a voluntary notification | 117 |

| D | The number of acquisitions reviewed following a retrospective validation application | 26 |

| E | The total number of call-in notices issued | 41 |

| F | The number of call-in notices issued following a mandatory notification | 22 |

| G | The number of call-in notices issued following a voluntary notification | 15 |

| H | The number of call-in notices issued following a retrospective validation application | 0 |

| I | The number of call-in notices issued for non-notified acquisitions | 4 |

4. Table 3 shows that the total number of notified acquisitions reviewed was 847. This is an increase from 757 acquisitions reviewed in the previous reporting period[footnote 15].

5. Of the 847 notified acquisitions reviewed, 95.6% (810) were cleared to proceed. This is an increase from 92.8% (706) in the previous reporting period.

6. 4.4% (37) of the 847 notified acquisitions reviewed were issued with a call-in notice. This is a decrease from 7.2% (55) of notified acquisitions issued with a call-in notice during the previous reporting period.

7. 4 non-notified acquisitions reviewed by the Government in this reporting period were issued with a call-in notice, giving a total of 41 call-in notices. This is a decrease on the 65 call-in notices issued during the previous reporting period and shows that the large majority of notified acquisitions were able to proceed without being called in.

Figure 6 - Call-in notices, by notification type and month

8. Figure 6 shows the number of call-in notices by notification type in each month of the reporting period. The chart illustrates that the largest proportion of call-in notices issued was following a mandatory notification, with 53.7%. This is followed by voluntary notifications with 36.6%, and non-notified acquisitions with 9.8%.

SECTION THREE: Final notifications

1. This section contains information about the final notifications the Government issued during this reporting period. The number of final notifications issued by area of the economy can be found on page 22, and the number of final notifications issued by origin of investment can be found on page 27.

2. Following a call-in and subsequent assessment period, the Government may clear an acquisition with no further action by issuing a final notification. In these circumstances, the Government cannot take any further action unless they were given materially false or misleading information.

3. The number of call-in notices issued in this reporting period is different to the total number of final notifications and final orders issued post call-in in this reporting period. This is because some of the acquisitions called in during this period will not receive a final decision until the next reporting period.

Final notifications issued

Table 4

| ID | Information | Number |

|---|---|---|

| A | The total number of final notifications issued | 33 |

| B | The number of final notifications issued following a mandatory notification | 18 |

| C | The number of final notifications issued following a voluntary notification | 12 |

| D | The number of final notifications issued following a retrospective validation application | 0 |

| E | The number of final notifications issued for non-notified acquisitions | 3 |

4. There were 38 called in acquisitions on which the Government made a decision on whether to issue a final notification or make a final order in this reporting period. This is a decrease from 72 in the previous reporting period. Of the 38 called in acquisitions on which the Government made a decision, 86.8% (33) were cleared resulting in a final notification.

Withdrawals from a called in acquisition

5. Parties may withdraw from acquisitions at any time. Where an acquisition has already been called in and the parties have withdrawn the acquisition, the Government issues a final notification to end the assessment period.

6. The total number of final notifications issued includes the total number of withdrawals from a called in acquisition.

Table 5

| ID | Information | Number |

|---|---|---|

| F | The total number of withdrawals from a called in acquisition | 10 |

| G | The number of withdrawals from a called in acquisition following a mandatory notification | 3 |

| H | The number of withdrawals from a called in acquisition following a voluntary notification | 5 |

| I | The number of withdrawals from a called in acquisition following a retrospective validation application | 0 |

| J | The number of withdrawals from a called in acquisition for non-notified acquisitions | 2 |

7. The total number of withdrawals post call in has decreased to 10, compared to 11 in the previous reporting period.

SECTION FOUR: Final orders

1. This section contains information about the final orders the Government issued during this reporting period. The number of final orders issued by area of the economy is on page 23, and the number of final orders issued by origin of investment is on page 27.

2. The Government may make a final order to mitigate risks to national security arising from an acquisition. This may include imposing certain conditions, preventing an acquisition from taking place or ordering an acquirer to unwind the acquisition.

3. Some final orders issued in this reporting period may relate to acquisitions that were called in during the previous reporting period, and some acquisitions called in during this reporting period had not reached a conclusion by the end of this reporting period.

Final orders issued

Table 6

| ID | Information | Number |

|---|---|---|

| A | The total number of final orders issued | 5 |

| B | The number of final orders issued following a mandatory notification | 3 |

| C | The number of final orders issued following a voluntary notification | 1 |

| D | The number of final orders issued following a retrospective validation application | 0 |

| E | The number of final orders issued for non-notified acquisitions | 1 |

| F | The number of acquisitions blocked or subject to an order to unwind the acquisition | 0 |

4. Of the 38 called in acquisitions on which the Government made a decision as to whether to issue the parties a final notification or a final order in this reporting period, 5 (13.2%) resulted in a final order. This is a decrease from 15 final orders issued in the previous reporting period. No acquisitions were blocked or were subject to an order to unwind by the Government.

5. The Government must keep each final order under review and may vary or revoke them. A person required to comply with a final order may request that the Government vary or revoke an order but the Government is not required to consider such a request if there has been no material change in circumstances since the final order was issued or last varied or the last request for variation was received. During the reporting period 3 final orders were varied and none were revoked.

Table 7

| ID | Information | Number |

|---|---|---|

| G | The number of final orders varied | 3 |

| H | The number of final orders revoked | 0 |

6. A summary of each final order, variation, and revocation from the current and subsequent reporting periods is published on the NSI Collection page on GOV.UK.

SECTION FIVE: Areas of the economy

1. This section breaks down the number of accepted notifications, call-in notices, final notifications issued, withdrawals from a called in acquisition and final orders issued by area of the economy.

2. Acquisitions can be associated with more than one area of the economy. The percentages in the charts in this section therefore add up to more than 100%. Notifications may also appear more than once, as a notification can be rejected and then resubmitted and accepted.

Notifications accepted and rejected by area of the economy

3. Notifications are associated with areas of the economy when they are accepted or rejected. Figure 7 therefore only includes data on the notifications that were accepted or rejected within this reporting period, not all notifications that were received in this reporting period.

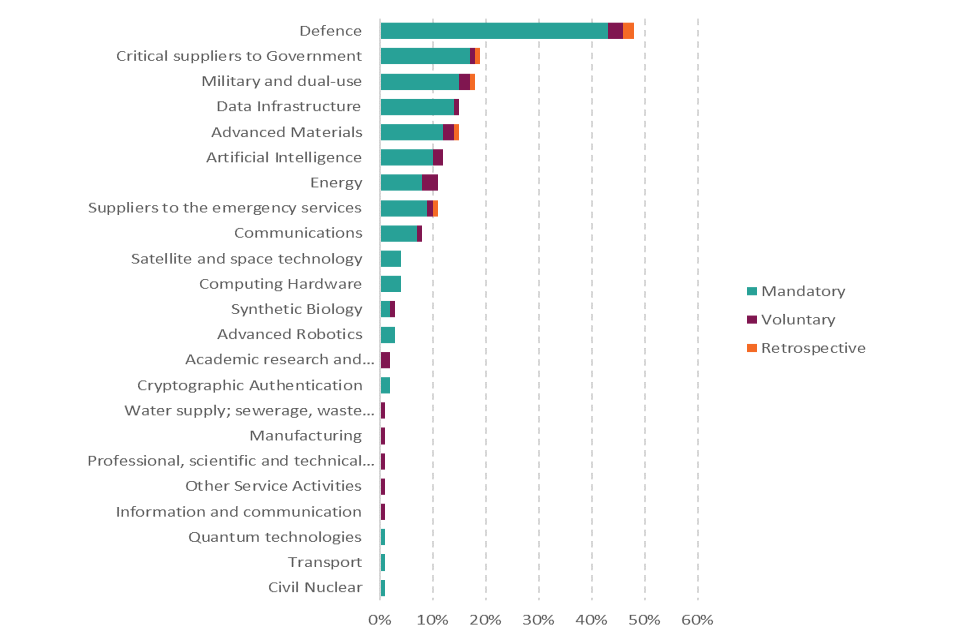

Figure 7 - Notifications accepted and rejected, by notification type and area of the economy

4. The largest percentage of notifications accepted or rejected during the reporting period was associated with the defence (48%) area of the economy. Critical suppliers to government (19%) and military and dual-use (17%) areas of the economy were the next largest proportions.

5. The 24 rejected notifications in Figure 7 were associated with 14 different areas of the economy[footnote 16].

Call-in notices issued by area of the economy

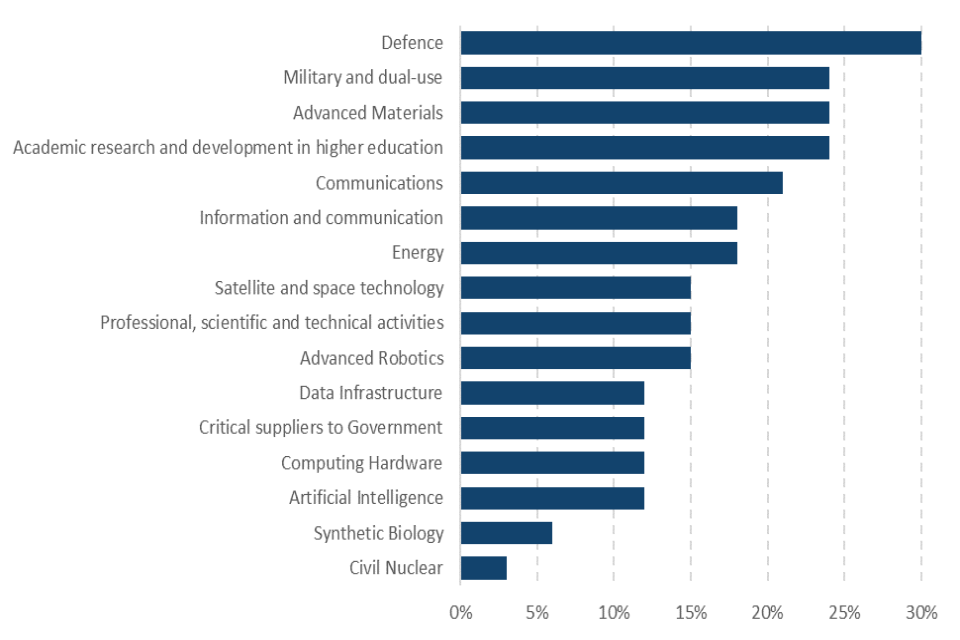

Figure 8 - Call-in notices, by area of the economy

6. Figure 8 shows the percentage of call-in notices issued by area of the economy. The areas of the economy associated with the largest proportion of call-in notices were defence (34%) and military and dual-use (29%). It is important to note that this means 34% of called in acquisitions were associated with defence, not that 34% of defence acquisitions were called in. Acquisitions in the academic research and development in higher education, communications and advanced materials areas of the economy all accounted for 24% of all call-in notices. For comparison, the largest proportion of call-in notices during the previous reporting period was associated with the military and dual-use (37%) area of the economy.

7. Call-in notices were issued in connection with acquisitions in 16 of the 17 areas of the economy subject to mandatory notification, as well as a small number of other areas of the economy such as manufacturing and academic research and development in higher education. No call-in notices were associated with the transport area of the economy.

Final notifications issued by area of the economy

Figure 9 - Final notification, by area of the economy

8. Figure 9 shows final notifications split by area of the economy. Of the 33 final notifications issued during this reporting period, 30% of final notifications were issued to acquisitions associated with the defence area of the economy, 24% with military and dual-use, 24% with advanced materials, and 24% with academic research and development in higher education. For comparison, the largest proportion of final notifications during the previous reporting period was associated with the military and dual-use (44%) area of the economy.

Withdrawals from a called in acquisition by area of the economy

Figure 10 - Withdrawals from a called in acquisition, by area of the economy

9. Figure 10 shows the largest number of withdrawals from a called in acquisition were in relation to the professional, scientific and technical activities (5) and academic research and development in higher education (5) areas of the economy. The next largest was information and communication with 4 withdrawals.

Final orders issued by area of the economy

Figure 11 - Final Orders, by area of the economy

10. Figure 11 shows that 15 areas of the economy were represented in the 5 final orders issued in the reporting period.

11. The largest number of final orders issued by area of the economy during this reporting period was associated with the defence area of the economy (4). For comparison, the largest number of final orders issued in the previous reporting period was associated with the military and dual-use area of the economy (5).

SECTION SIX: Origin of investment

1. This section breaks down the number of accepted notifications, call-in notices issued, final notifications issued, withdrawals from a called in acquisition and final orders issued by origin of investment.

2. For the purposes of these statistics, the origin of investment includes several factors such as the location of the immediate acquirer’s headquarters or the headquarters of its ultimate beneficial owner. The Act applies to all acquirers, regardless of origin of investment.

3. Acquirers can be associated with more than one origin of investment, and there can be more than one acquirer per acquisition, so one acquisition may be associated with multiple origins of investment. The percentages in the charts can therefore add up to more than 100%. The charts which display information on acquisitions that were called in include notified acquisitions and non-notified acquisitions.

Notifications accepted by origin of investment

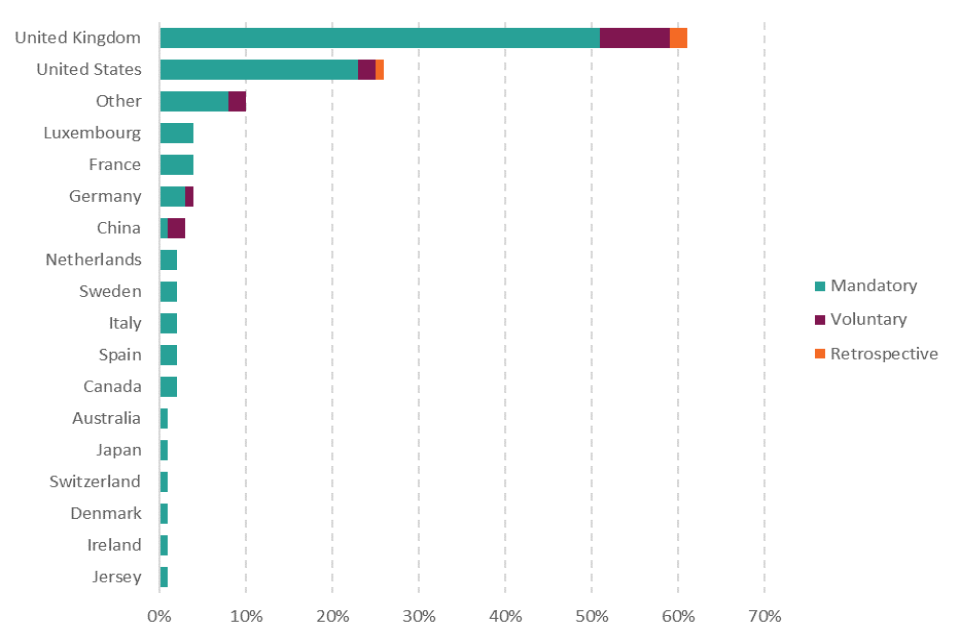

Figure 12 - Notifications accepted, by notification type and origin of investment

4. Figure 12 shows the percentage of accepted notifications by origin of investment. 61% of accepted notifications related to acquirers associated with the United Kingdom, 26% with the United States of America, and 4% each with Luxembourg, France and Germany. 10% were also associated with Others. The origins of investment included in the ‘Other’ category are listed in Annex C.

Call-in notices issued by origin of investment

Figure 13 - Call-in notices, by origin of investment

5. Figure 13 shows the breakdown of called in acquisitions by origin of investment. The chart shows that 41% of call-in notices related to acquirers associated with China, 39% with the United Kingdom and 22% with the United States of America. It is important to note that 41% of called in acquisitions were associated with China, not that 41% of notifications or acquisitions associated with China were called in.

6. For comparison, the largest proportion of called in acquisitions by origin of investment during the previous reporting period was associated with China (42%).

Final notifications issued by origin of investment

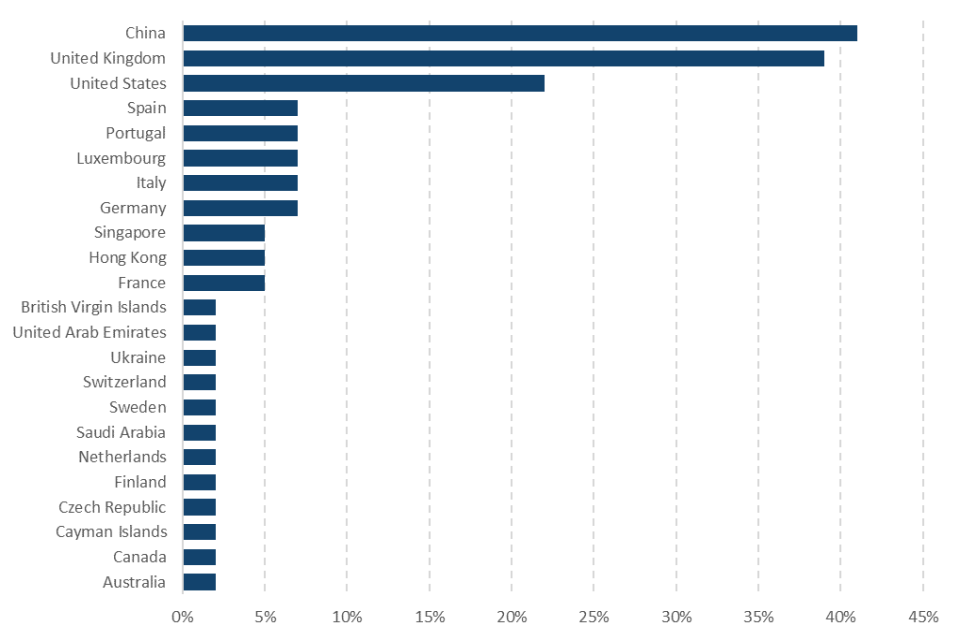

Figure 14 - Final notifications, by origin of investment

7. Figure 14 shows that acquirers associated with China accounted for the largest proportion of final notifications, with 48%. The United Kingdom was second in this list with 42% and the United States of America was third with 21%.

8. For comparison, the largest proportion of final notifications by origin of investment in the previous reporting period was associated with China (40%).

Withdrawals from a called in acquisition by origin of investment

Figure 15 - Withdrawals from a called in acquisition, by origin of investment

9. Figure 15 shows the number of withdrawals from an acquisition post call-in, broken down by origin of investment. The origin of investment associated with the most withdrawals was China, with 8. The United Kingdom was second in this list with 7, and the United States of America was third with 2.

Final orders issued by origin of investment

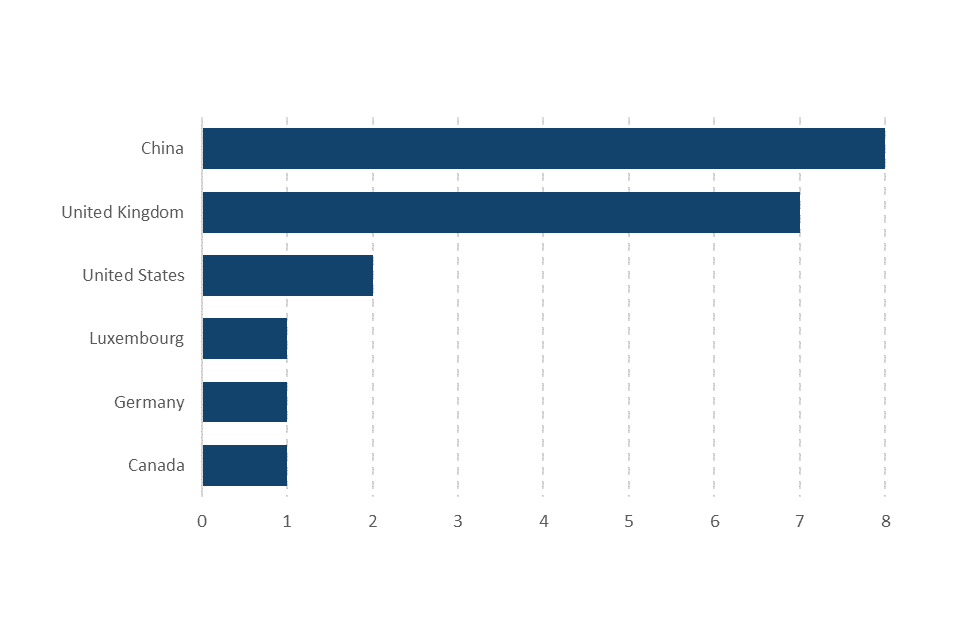

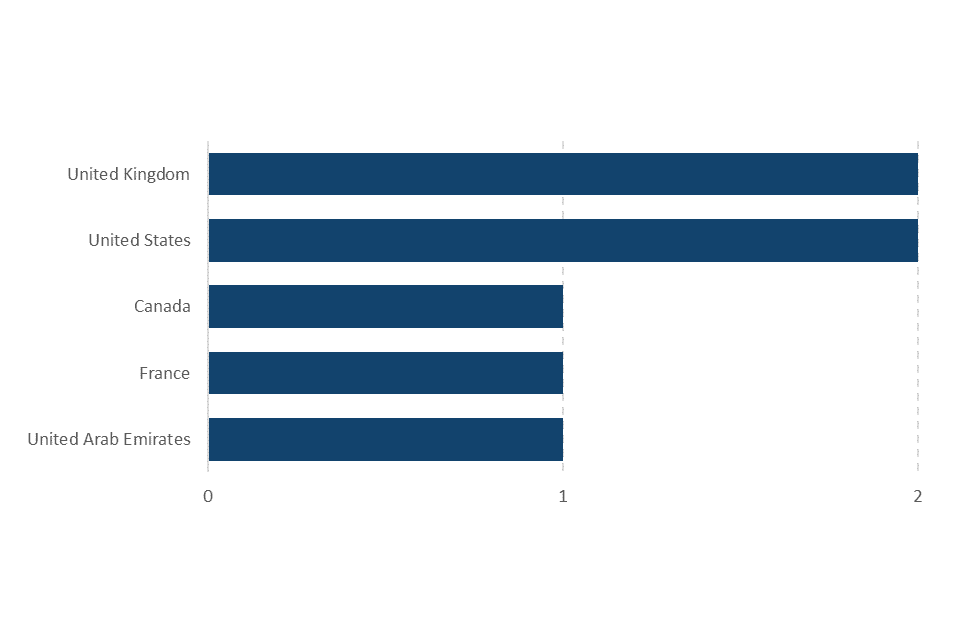

Figure 16 - Final orders, by origin of investment

10. Figure 16 shows the number of final orders issued broken down by the associated origin of investment. This includes both notified acquisitions and non-notified acquisitions.

11. Acquisitions by entities associated with the United Kingdom and United States of America were the origins of investment with the largest number of final orders with 2 each, followed by the United Arab Emirates, France and Canada with 1 final order each. For comparison, acquisitions by entities associated with China had the largest number of final orders (8) in the previous reporting period.

SECTION SEVEN: Time taken to screen acquisitions

1. This section sets out the time taken to accept or reject notifications, call in acquisitions, issue final notifications and final orders, and acquisitions which used the additional period and voluntary period.

2. When a notification has been submitted, the Government must accept or reject the notification. If the Government decides to accept the notification, it has 30 statutory working days to decide whether to call in the acquisition for a more detailed assessment or to clear it. This is known as the “review period”.

3. If an acquisition is called in, the Government then has 30 statutory working days to assess whether any remedies are needed to address national security risks (the “initial period”). If required, it can extend this period by 45 statutory working days (the “additional period”), and the Government and the acquirer can mutually agree to further voluntary extensions (the “voluntary period”).

4. Some of the tables below describe the number of working days by “statutory working days” and “calendar working days”. The calendar working days count includes the number of working days in the assessment period during which an information or attendance notice is in place, whereas the statutory working days count excludes the time during which an information notice or attendance notice is in place. Both counts exclude bank holidays.

Calendar working days to accept or reject a notification

Table 8

The average number of calendar working days from receipt of a…

| ID | Information | Median working days | Mean working days |

|---|---|---|---|

| A | …mandatory notification to notification of a decision to accept that notification | 6 | 7 |

| B | …mandatory notification to giving written reasons for a decision to reject that notification | 13 | 18 |

| C | …voluntary notification to notification of a decision to accept that notification | 8 | 10 |

| D | …voluntary notification to giving written reasons for a decision to reject that notification | 15 | 16 |

| E | … retrospective validation application to notification of a decision to accept that application | 7 | 8 |

| F | … retrospective validation application to giving reasons for a decision to reject that application | 13 | 13 |

5. Table 8 shows the number of calendar working days it took to accept or reject notifications. The statutory screening period starts from when a notification has been accepted and activates the review period.

6. On average it took 6 calendar working days to accept a mandatory notification and 8 calendar working days to accept a voluntary notification. For comparison, in the previous reporting period it took on average 4 calendar working days to accept a mandatory notification and 4 calendar working days to accept a voluntary notification.

7. On average it took 13 calendar working days to reject a mandatory notification and 15 calendar working days to reject a voluntary notification. For comparison, in the previous reporting period it took on average 10 calendar working days to reject a mandatory notification and 7 calendar working days to reject a voluntary notification[footnote 17].

Statutory working days to call in notifications

Table 9

The average number of statutory working days to decide to call in…

| ID | Information | Median working days | Mean working days |

|---|---|---|---|

| G | … a mandatory notification once accepted | 29 | 28 |

| H | … a voluntary notification once accepted | 29 | 29 |

8. On average it took 29 statutory (median) working days to decide to call in a mandatory notification and a voluntary notification once accepted. No retrospective validation applications were called in during this reporting period.

Called in acquisitions that used the additional and voluntary period

9. Tables 10, 11 and 12 show how many called in acquisitions used the additional period and voluntary period. The full lifecycle of an acquisition may cover more than one reporting period. This means that the additional and voluntary periods may be in different reporting periods from either the reporting period for call in, or the reporting period for the conclusion of the acquisition.

Table 10

| ID | Information | Number |

|---|---|---|

| I | The number of times an additional period notice was issued in this reporting period for acquisitions that were called in during this or a previous reporting period | 12 |

| J | The number of times an additional period notice was issued in this reporting period for acquisitions that were called in during this or a previous reporting period following a mandatory notification | 4 |

| K | The number of times an additional period notice was issued in this reporting period for acquisitions that were called in during this or a previous reporting period following a voluntary notification | 4 |

| L | The number of times an additional period notice was issued in this reporting period for acquisitions that were called in during this or a previous reporting period following a retrospective validation application | 0 |

| M | The number of times an additional period notice was issued in this reporting period for acquisitions that were called in during this or a previous reporting period for non-notified acquisitions | 4 |

10. Table 10 shows that 12 called in acquisitions went to the additional period during this reporting period, of which 4 originated from mandatory notifications, 4 from voluntary notifications and 4 following non-notified acquisitions. None of these acquisitions came from retrospective validation applications. For comparison, the total number of called in acquisitions that went to the additional period in the previous reporting period was 29.

Table 11

| ID | Information | Number |

|---|---|---|

| N | The number of times a voluntary period notice was agreed in this reporting period for acquisitions that were called in during this or a previous reporting period | 4 |

| O | The number of times a voluntary period notice was agreed in this reporting period for acquisitions that were called in during this or a previous reporting period following a mandatory notification | 2 |

| P | The number of times a voluntary period notice was agreed in this reporting period for acquisitions that were called in during this or a previous reporting period following a voluntary notification | 1 |

| Q | The number of times a voluntary period notice was agreed in this reporting period for acquisitions that were called in during this or a previous reporting period following a retrospective validation application | 0 |

| R | The number of times a voluntary period notice was agreed that were called in during this or a previous reporting period for non-notified acquisitions | 1 |

11. Table 11 shows that 4 called in acquisitions went to the voluntary period, of which 2 originated from mandatory notifications, 1 was following a voluntary notification and another was following a non-notified acquisition. None of these acquisitions involved a retrospective validation application. For comparison, the total number of called in acquisitions that went to the voluntary period in the previous reporting period was 10.

Table 12

| ID | Information | Number |

|---|---|---|

| S | The number of times the additional period was used for acquisitions that were called in during this or a previous reporting period and subsequently issued a final notification in this reporting period | 7 |

| T | The number of times the voluntary period was agreed for acquisitions that were called in during this or a previous reporting period and subsequently issued a final notification in this reporting period | 2 |

| U | The number of times the additional period was used for acquisitions that were called in during this or a previous reporting period and subsequently issued a final order in this reporting period | 3 |

| V | The number of times the voluntary period was agreed for acquisitions that were called in during this or a previous reporting period and subsequently issued a final order in this reporting period | 2 |

12. Table 12 shows, for acquisitions that received final orders or final notifications in the reporting period, how many times the additional period had been used and the voluntary period had been agreed.

13. The number of times the additional period was used and subsequently issued a final notification in this reporting period is 7. For comparison, the number of times the additional period was used and subsequently issued a final notification in the previous reporting period was 12. Meanwhile, the number of times the voluntary period was agreed for acquisitions that were subsequently issued a final notification is 2, which is the same as in the previous reporting period[footnote 18].

14. The two times the voluntary period was agreed for acquisitions that were called in and subsequently issued a final notification were as a result of withdrawals.

Calendar and statutory working days to issue a final notification

15. Table 13 provides the average number of calendar and statutory working days to issue a final notification for notified acquisitions which were called in during this or a previous reporting period. These statistics only refer to the number of acquisitions in which the Government received and accepted the notification and called in the acquisition during this or a previous reporting period, then subsequently issued a final notification in this reporting period.

Table 13

The average number of days between…

| ID | Information | Statutory working days - Median | Statutory working days - Mean | Calendar working days - Median | Calendar working days - Mean |

|---|---|---|---|---|---|

| W | … receiving a notification and issuing a final notification | 60 | 63 | 87 | 92 |

| X | … accepting a notification and issuing a final notification | 52 | 55 | 76 | 85 |

| Y | … calling in a notified acquisition and issuing a final notification | 26 | 28 | 48 | 57 |

16. Table 14 provides the average number of statutory and calendar working days to issue a final notification for all acquisitions (notified and non-notified).

The average number of days between…

| ID | Information | Statutory working days - Median | Statutory working days - Mean | Calendar working days - Median | Calendar working days - Mean |

|---|---|---|---|---|---|

| Z | The average number of days between calling in an acquisition and issuing a final notification | 26 | 31 | 48 | 61 |

17. In this reporting period, it took on average 26 statutory (median) working days and 31 statutory (mean) working days between calling in an acquisition (including non-notified acquisitions) and issuing a final notification. The number of statutory working days is the same when compared to the previous reporting period.[footnote 19]

Calendar and statutory working days to issue a final order

18. Table 15 provides the average number of statutory and calendar working days to issue a final order for notified acquisitions. These statistics show acquisitions from when the Government received and accepted the notification or from calling in the acquisition during this or a previous reporting period, and subsequently issuing a final order in this reporting period.

Table 15

The average number of days between…

| Number | Information | Statutory working days - Median | Statutory working days - Mean | Calendar working days - Median | Calendar working days - Mean |

|---|---|---|---|---|---|

| AA | … receiving a notification and issuing a final order | 86 | 83 | 105 | 113 |

| AB | … accepting a notification and issuing a final order | 84 | 81 | 102 | 111 |

| AC | … calling in a notified acquisition and issuing a final order | 56 | 56 | 79 | 86 |

19. In this reporting period, it took on average 86 statutory (median) working days and 83 statutory (mean) working days between receiving a notification and issuing a final order.

20. Table 16 provides the average number of statutory working days to issue a final order for all acquisitions (notified and non-notified).

Table 16

| Number | Information | Statutory working days - Median | Statutory working days - Mean | Calendar working days - Median | Calendar working days - Mean |

|---|---|---|---|---|---|

| AD | The average number of days between calling in an acquisition and issuing a final order | 34 | 51 | 53 | 75 |

21. In this reporting period, it took on average 34 statutory (median) working days and 51 statutory (mean) working days between calling in an acquisition (including non-notified acquisitions) and issuing a final order. In comparison, in the previous reporting period it took on average 81 statutory (median) working days and 77 statutory (mean) working days between calling in an acquisition and issuing a final order.

22. Given the small number of final orders (5) issued in this reporting period, no conclusions should be drawn about any trends in the time taken between calling in an acquisition and issuing a final order.

SECTION EIGHT: Financial assistance

1. The Government may give financial assistance to or in respect of an entity in consequence of making a final order. This may be any form of financial assistance (actual or contingent) including loans, guarantees or indemnities. Such assistance must be made with the consent of HM Treasury.

2. No financial assistance has been given during this reporting period. There are therefore no liabilities in respect of financial assistance.

SECTION NINE: Appeals, Compliance, and Enforcement

1. The NSI Act specifies that offences may be committed in respect of:

a. completing a notifiable acquisition without approval;

b. failing to comply with an interim or final order;

c. failing to comply with an information notice or attendance notice, and various associated offences; and,

d. using or disclosing information in contravention of the Act’s provisions regarding the disclosure of information.

2. For this reporting period the Government did not issue any penalties, and consequently, there were no appeals against penalties or costs. There were no criminal prosecutions concluded during this time period.

3. During the reporting period, the Government identified 34 offences of completing a notifiable acquisition without approval. Penalties were not imposed in these cases but parties were contacted to request that steps were taken to prevent any recurrence.

Contacting the Investment Security Unit

1. You can contact the Investment Security Unit (ISU) through its mailbox at investment.screening@cabinetoffice.gov.uk with any questions regarding the operation of the NSI Act, or this publication.

2. Please visit National Security and Investment Act for full details of the operation of the NSI Act, including comprehensive guidance.

Annex A: Summary of statistics and figures in this report

1. The following tables summarise the statistics and figures contained in this report. The accompanying spreadsheet containing all the data published since commencement of the NSI Act can be found on GOV.UK.

2. The table below summarises the statistics in this reporting period (1 April 2023 – 31 March 2024).

Statistics included in this report

Section One: Notifications

| ID | Information | Number |

|---|---|---|

| A | The total number of notifications received | 906 |

| B | The number of mandatory notifications received | 753 |

| C | The number of voluntary notifications received | 120 |

| D | The number of retrospective validation applications received | 33 |

| E | The total number of notifications accepted and rejected | 900 |

| F | The total number of notifications accepted | 876 |

| G | The total number of notifications rejected | 24 |

| H | The number of mandatory notifications accepted | 728 |

| I | The number of mandatory notifications rejected | 13 |

| J | The number of voluntary notifications accepted | 116 |

| K | The number of voluntary notifications rejected | 9 |

| L | The number of retrospective validation applications accepted | 32 |

| M | The number of retrospective validation applications rejected | 2 |

| N | The number of notifications pending acceptance and rejection at the end of the reporting period | 37 |

Section Two: Call-in notices

| ID | Information | Number |

|---|---|---|

| A | The total number of notified acquisitions reviewed | 847 |

| B | The number of acquisitions reviewed following a mandatory notification | 704 |

| C | The number of acquisitions reviewed following a voluntary notification | 117 |

| D | The number of acquisitions reviewed following a retrospective validation application | 26 |

| E | The total number of call-in notices issued | 41 |

| F | The number of call-in notices issued following a mandatory notification | 22 |

| G | The number of call-in notices issued following a voluntary notification | 15 |

| H | The number of call-in notices issued following a retrospective validation application | 0 |

| I | The number of call-in notices issued for non-notified acquisitions | 4 |

Section Three: Final notifications

| ID | Information | Number |

|---|---|---|

| A | The total number of final notifications issued | 33 |

| B | The number of final notifications issued following a mandatory notification | 18 |

| C | The number of final notifications issued following a voluntary notification | 12 |

| D | The number of final notifications issued following a retrospective validation application | 0 |

| E | The number of final notifications issued for non-notified acquisition | 3 |

| F | The total number of withdrawals from a called in acquisition | 10 |

| G | The number of withdrawals from a called in acquisition following a mandatory notification | 3 |

| H | The number of withdrawals from a called in acquisition following a voluntary notification | 5 |

| I | The number of withdrawals from a called in acquisition following a retrospective validation application | 0 |

| J | The number of withdrawals from a called in acquisition for non-notified acquisitions | 2 |

Section Four: Final orders

| ID | Information | Number |

|---|---|---|

| A | The number of final orders issued | 5 |

| B | The number of final orders issued following a mandatory notification | 3 |

| C | The number of final orders issued following a voluntary notification | 1 |

| D | The number of final orders issued following a retrospective validation application | 0 |

| E | The number of final orders issued for non-notified acquisitions | 1 |

| F | The number of acquisitions blocked or subject to an order to unwind the acquisition | 0 |

| G | The number of final orders varied | 3 |

| H | The number of final orders revoked | 0 |

Section Seven: Time taken to screen acquisitions

| ID | Information | Number - Median | Number - Mean |

|---|---|---|---|

| A | The average number of calendar working days from receipt of a mandatory notification to notification of a decision to accept that notification | 6 | 7 |

| B | The average number of calendar working days from receipt of a mandatory notification to giving written reasons for a decision to reject that notification | 13 | 18 |

| C | The average number of calendar working days from receipt of a voluntary notification to notification of a decision to accept that notification | 8 | 10 |

| D | The average number of calendar working days from receipt of a voluntary notification to giving written reasons for a decision to reject that notification | 15 | 16 |

| E | The average number of calendar working days from receipt of a retrospective validation application to notification of a decision to accept that application | 7 | 8 |

| F | The average number of calendar working days from receipt of a retrospective validation application to giving written reasons for a decision to reject that application | 13 | 13 |

| G | The average number of statutory working days to decide to call in a mandatory notification once accepted | 29 | 28 |

| H | The average number of statutory working days to decide to call in a voluntary notification once accepted | 29 | 29 |

| ID | Information | Number |

|---|---|---|

| I | The total number of times an additional period notice was issued in this reporting period for acquisitions that were called in during this or a previous reporting period | 12 |

| J | The number of times an additional period notice was issued in this reporting period for acquisitions that were called in during this or a previous reporting period following a mandatory notification | 4 |

| K | The number of times an additional period notice was issued in this reporting period for acquisitions that were called in during this or a previous reporting period following a voluntary notification | 4 |

| L | The number of times an additional period notice was issued in this reporting period for acquisitions that were called in during this or a previous reporting period following a retrospective validation application | 0 |

| M | The number of times an additional period notice was issued in this reporting period for acquisitions that were called in during this or a previous reporting period for non-notified acquisitions | 4 |

| N | The total number of times a voluntary period notice was agreed in this reporting period for acquisitions that were called in during this or a previous reporting period | 4 |

| O | The number of times a voluntary period notice was agreed in this reporting period for acquisitions that were called in during this or a previous reporting period following a mandatory notification | 2 |

| P | The number of times a voluntary period notice was agreed in this reporting period for acquisitions that were called in during this or a previous reporting period following a voluntary notification | 1 |

| Q | The number of times a voluntary period notice was agreed in this reporting period for acquisitions that were called in during this or a previous reporting period following a retrospective validation application | 0 |

| R | The number of times a voluntary period notice was agreed in this reporting period for acquisitions that were called in during this or a previous reporting period for non-notified acquisitions | 1 |

| S | The number of times the additional period was issued for acquisitions that were called in during this or a previous reporting period and subsequently issued a final notification in this reporting period | 7 |

| T | The number of times the voluntary period was agreed for acquisitions that were called in during this or a previous reporting period and subsequently issued a final notification in this reporting period | 2 |

| U | The number of times the additional period was issued for acquisitions that were called in during this or a previous reporting period and subsequently issued a final order in this reporting period | 3 |

| V | The number of times the voluntary period was agreed for acquisitions that were called in during this or a previous reporting period and subsequently issued a final order in this reporting period | 2 |

| ID | Information | Number - Median | Number - Mean |

|---|---|---|---|

| W | The average number of statutory working days between receiving a notification and issuing a final notification | Median 60 | Mean 63 |

| W | The average number of calendar working days between receiving a notification and issuing a final notification | Median 87 | Mean 92 |

| X | The average number of statutory working days between accepting a notification and issuing a final notification | Median 52 | Mean 55 |

| X | The average number of calendar working days between accepting a notification and issuing a final notification | Median 76 | Mean 85 |

| Y | The average number of statutory working days between calling in a notified acquisition and issuing a final notification | Median 26 | Mean 28 |

| Y | The average number of calendar working days between calling in a notified acquisition and issuing a final notification | Median 48 | Mean 57 |

| Z | The average number of statutory working days between calling in a notified or non-notified acquisition and issuing a final notification | Median 26 | Mean 31 |

| Z | The average number of calendar working days between calling in a notified or non-notified acquisition and issuing a final notification | Median 48 | Mean 61 |

| AA | The average number of statutory working days between receiving a notification and issuing a final order | Median 86 | Mean 83 |

| AA | The average number of calendar working days between receiving a notification and issuing a final order | Median 105 | Mean 113 |

| AB | The average number of statutory working days between accepting a notification and issuing a final order | Median 84 | Mean 81 |

| AB | The average number of calendar working days between accepting a notification and issuing a final order | Median 102 | Mean 111 |

| AC | The average number of statutory working days between calling in a notified acquisition and issuing a final order | Median 56 | Mean 56 |

| AC | The average number of calendar working days between calling in a notified acquisition and issuing a final order | Median 79 | Mean 86 |

| AD | The average number of statutory working days between calling in a notified or non-notified acquisition and issuing a final order | Median 34 | Mean 51 |

| AD | The average number of calendar working days between calling in a notified or non-notified acquisition and issuing a final order | Median 53 | Mean 75 |

Figures included in this report

Section One: Notifications

| Information | Figure |

|---|---|

| The number of notifications received, by notification type and month | Fig 1 |

| The number of notifications accepted and rejected, by month | Fig 2 |

| The number of notifications accepted, by notification type and month | Fig 3 |

| The number of notifications rejected, by notification type and month | Fig 4 |

| The number of notifications rejected, by the reason why they were rejected | Fig 5 |

Section Two: Call-in notices

| Information | Figure |

|---|---|

| The number of call-in notices issued, by notification type and month | Fig 6 |

Section Five: Areas of the economy

| Information | Figure |

|---|---|

| The breakdown of notifications accepted and rejected, by notification type and area of the economy | Fig 7 |

| The breakdown of call-in notices issued, by area of the economy | Fig 8 |

| The breakdown of final notifications issued, by area of the economy | Fig 9 |

| The number of withdrawals from a called in acquisition, by area of the economy | Fig 10 |

| The number of final orders issued, by area of the economy | Fig 11 |

Section Six: Origin of Investment

| Information | Figure |

|---|---|

| The breakdown of notifications accepted, by notification type and origin of investment | Fig 12 |

| The breakdown of call-in notices issued, by origin of investment | Fig 13 |

| The breakdown of final notifications issued, by origin of investment | Fig 14 |

| The number of withdrawals from a called in acquisition, by origin of investment | Fig 15 |

| The number of final orders issued, by origin of investment | Fig 16 |

Annex B: Information contained in this report

1. The National Security and Investment Act 2021 specifies information that must be included in each Annual Report. The Government includes additional information to assist stakeholders in their understanding of the operation of the NSI Act and to maintain high standards of transparency.

Statutory information included in this report

| Information | Page number |

|---|---|

| The number of mandatory notifications accepted | 16 |

| The number of mandatory notifications rejected | 16 |

| The number of voluntary notifications accepted | 16 |

| The number of voluntary notifications rejected | 16 |

| The total number of call-in notices issued | 19 |

| The total number of final notifications issued | 21 |

| The number of final orders issued | 23 |

| The number of final orders varied | 24 |

| The number of final orders revoked | 24 |

| The breakdown of notifications accepted and rejected, by notification type and area of the economy | 25 |

| The breakdown of call-in notices issued, by area of the economy | 26 |

| The average number of calendar working days from receipt of a mandatory notification to notification of a decision to accept that notification | 34 |

| The average number of calendar working days from receipt of a mandatory notification to giving written reasons for a decision to reject that notification | 34 |

| The average number of calendar working days from receipt of a voluntary notification to notification of a decision to accept that notification | 34 |

| The average number of calendar working days from receipt of a voluntary notification to giving written reasons for a decision to reject that notification | 34 |

| The expenditure incurred by the Government in giving, or in connection with giving, financial assistance falling within Section 30 | 40 |

| The amount of the actual or contingent liabilities of the Government at the end of the relevant period in respect of such financial assistance | 40 |

Additional information included from previous reports

| Information | Page number |

|---|---|

| The total number of notifications received | 14 |

| The number of mandatory notifications received | 14 |

| The number of voluntary notifications received | 14 |

| The number of retrospective validation applications received | 14 |

| The number of notifications received, by notification type and month | 14 |

| The total number of notifications accepted and rejected | 16 |

| The total number of notifications accepted | 16 |

| The total number of notifications rejected | 16 |

| The number of retrospective validation applications accepted | 16 |

| The number of retrospective validation applications rejected | 16 |

| The number of notifications pending acceptance and rejection at the end of the reporting period | 16 |

| The number of notifications accepted and rejected, by month | 16 |

| The number of notifications accepted, by notification type and month | 17 |

| The number of notifications rejected, by notification type and month | 17 |

| The number of notifications rejected, by the reason why they were rejected | 18 |

| The total number of notified acquisitions reviewed | 19 |

| The number of acquisitions reviewed following a mandatory notification | 19 |

| The number of acquisitions reviewed following a voluntary notification | 19 |

| The number of acquisitions reviewed following a retrospective validation application | 19 |

| The number of call-in notices issued following a mandatory notification | 19 |

| The number of call-in notices issued following a voluntary notification | 19 |

| The number of call-in notices issued following a retrospective validation application | 19 |

| The number of call-in notices issued for non-notified acquisitions | 19 |

| The number of call-in notices issued, by notification type and month | 20 |

| The total number of withdrawals from a called in acquisition | 22 |

| The number of acquisitions blocked or subject to an order to unwind the acquisition | 23 |

| The breakdown of final notifications issued, by area of the economy | 27 |

| The number of final orders issued, by area of the economy | 28 |

| The breakdown of notifications accepted, by notification type and origin of investment | 29 |

| The breakdown of call-in notices issued, by origin of investment | 30 |

| The breakdown of final notifications issued, by origin of investment | 31 |

| The number of final orders issued, by origin of investment | 32 |

| The average number of statutory working days to decide to call in a mandatory notification once accepted | 35 |

| The average number of statutory working days to decide to call in a voluntary notification once accepted | 35 |

| The total number of times an additional period notice was issued in this reporting period for acquisitions that were called in during this or a previous reporting period | 35 |

| The number of times an additional period notice was issued in this reporting period for acquisitions that were called in during this or a previous reporting period following a mandatory notification | 35 |

| The number of times an additional period notice was issued in this reporting period for acquisitions that were called in during this or a previous reporting period following a voluntary notification | 35 |

| The number of times an additional period notice was issued in this reporting period for acquisitions that were called in during this or a previous reporting period following a retrospective validation application | 35 |

| The number of times an additional period notice was issued in this reporting period for acquisitions that were called in during this or a previous reporting period for non-notified acquisitions | 35 |

| The total number of times a voluntary period notice was agreed in this reporting period for acquisitions that were called in during this or a previous reporting period | 36 |

| The number of times the additional period was issued for acquisitions that were called in during this or a previous reporting period and subsequently issued a final notification in this reporting period | 37 |

| The number of times the voluntary period was agreed for acquisitions that were called in during this or a previous reporting period and subsequently issued a final notification in this reporting period | 37 |

| The average number of statutory working days between calling in a notified or non-notified acquisition and issuing a final notification | 38 |

| The average number of statutory working days between calling in a notified or non-notified acquisition and issuing a final order | 39 |

| Commentary on compliance and enforcement | 41 |

Additional information included for the first time in this report

| Information | Page number |

|---|---|

| The number of final notifications issued following a mandatory notification | 21 |

| The number of final notifications issued following a voluntary notification | 21 |

| The number of final notifications issued following a retrospective validation application | 21 |

| The number of final notifications issued for non-notified acquisitions | 21 |

| The number of withdrawals from a called in acquisition following a mandatory notification | 22 |

| The number of withdrawals from a called in acquisition following a voluntary notification | 22 |

| The number of withdrawals from a called in acquisition following a retrospective validation application | 22 |

| The number of withdrawals from a called in acquisition for non-notified acquisitions | 22 |

| The number of final orders issued following a mandatory notification | 23 |

| The number of final orders issued following a voluntary notification | 23 |

| The number of final orders issued following a retrospective validation application | 23 |

| The number of final orders issued for non-notified acquisitions | 23 |

| The number of withdrawals from a called in acquisition, by area of the economy | 27 |

| The number of withdrawals from a called in acquisition, by origin of investment | 31 |

| The average number of calendar working days from receipt of a retrospective validation application to notification of a decision to accept that application | 34 |

| The average number of calendar working days from receipt of a retrospective validation application to giving written reasons for a decision to reject that application | 34 |

| The number of times a voluntary period notice was agreed in this reporting period for acquisitions that were called in during this or a previous reporting period following a mandatory notification | 36 |

| The number of times a voluntary period notice was agreed in this reporting period for acquisitions that were called in during this or a previous reporting period following a voluntary notification | 36 |

| The number of times a voluntary period notice was agreed in this reporting period for acquisitions that were called in during this or a previous reporting period following a retrospective validation application | 36 |

| The number of times a voluntary period notice was agreed in this reporting period for acquisitions that were called in during this or a previous reporting period for non-notified acquisitions | 36 |