Review of the Aggregates Levy: discussion paper

Updated 21 July 2020

1. Introduction

The Aggregates Levy ‘the levy’ is an environmental tax that was introduced in 2002 to reduce the extraction of fresh aggregate (rock, sand and gravel used as bulk fill in construction) and encourage recycling and use of by-products from other industrial processes. It has not been reviewed since its introduction, but following the conclusion of litigation on the legality of the levy in February this year, the government announced a comprehensive review of the levy, and confirmed its commitment to devolving the levy to the Scottish Parliament.

This paper sets out the rationale for the review, the terms of reference and scope of the review, and how to engage with this process.

1.1 Key terms of reference

This review will look at the objectives and the impact of the levy, how effective the current design of the levy is, and the environmental and business context of the production and supply of all kinds of aggregate and the extraction of other construction materials. The review will consider potential reforms that could be made to the Aggregates Levy.

The review begins in spring 2019 and the government will engage widely with stakeholders throughout the review; written representations are welcomed by 5 July 2019. The government will report back and announce any next steps from the review by the end of the year.

The review will be led by HM Treasury and it will report to the Chancellor of the Exchequer. It will work closely with HMRC, other relevant government departments and agencies, and the devolved administrations.

The government will consider all aspects of the Aggregates Levy, considering new and existing evidence on the impact of the levy (including its environmental impact), and the nature of the wider industry. The government is:

- publishing this discussion document, outlining why the government is reviewing the levy, what the government is asking for evidence on, and how stakeholders can engage with the review process

- engaging widely with stakeholders during the review period

- gathering, analysing and summarising the representations made during the review, whether in person or by written response

- using existing evidence from previous policy development

- conducting further analysis where necessary

There will also be an expert working group made up of representatives of industry and other relevant organisations. At the point of publication, the confirmed members of the working group are:

- British Geological Survey

- Mineral Products Association (England and Wales)

- Mineral Products Association Northern Ireland

- Mineral Products Association Scotland

- British Aggregates Association

- British Ceramics Confederation

- CBI Minerals Group

- Environmental Services Association

- Civil Engineering Contractors Association

- Construction Employers Federation

- Royal Society for the Protection of Birds

- Wales Environment Link

- Northern Ireland Environment Link

Further members may be invited to join the working group and we welcome expressions of interest. Its role will be to provide expert input, advice and challenge to the HM Treasury review team. Members of the working group will share their findings with the Exchequer Secretary to the Treasury.

When considering possible changes to the Aggregates Levy, the government will bear in mind:

- the policy objectives in the light of the latest evidence on the environmental impacts of aggregates extraction, considering also the environmental impacts of other methods of aggregate production and of the extraction of other construction materials

- the current design of the tax and its effectiveness in meeting its policy objectives and its impact on business decisions

- the impact of the current levy and any potential reforms on business, including the administrative burden

- the interaction of any potential reforms with the planned devolution of the tax to the Scottish Parliament

- the fiscal impact of any potential reforms

The findings from the expert working group meetings will not be binding on the government. Any proposals from the working group will be considered alongside other representations on the levy. All executive decisions concerning the review will be the responsibility of HM Treasury.

2. Why we are reviewing the levy

2.1 Overview of the levy

The levy was introduced in 2002, as a UK-wide environmental tax on commercially exploited virgin aggregate (i.e. rock, sand and gravel). This includes aggregate that has been dug from the ground, dredged from the sea in UK waters or imported.

The rate has been £2.00 per tonne since 2009.

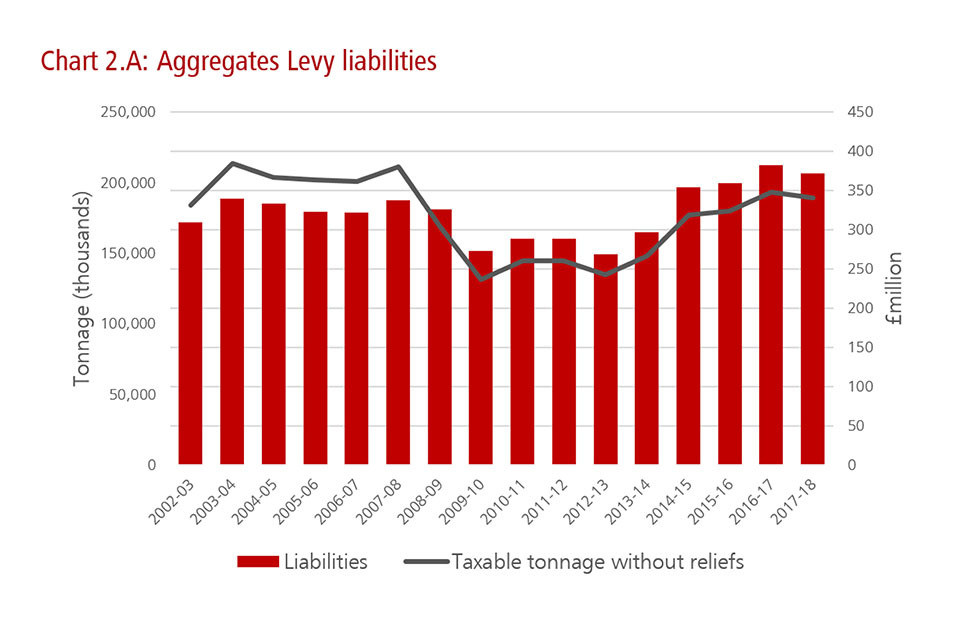

Chart illustrating Aggregates Levy liabilities

Chart illustrating Aggregates Levy liabilities

The levy has historically brought in between £240 and £410 million of annual revenue. In recent years, receipts from the levy can be apportioned as follows: 67% for England, 15% for Scotland, 10% for Wales and 8% for Northern Ireland.

A significant proportion of revenue comes from larger, multi-site operators. Because the tax is charged on the first commercial exploitation, taxpayers are concentrated in areas with significant aggregate quarrying activity.

The cost of the tax can be passed through to the construction industry; it generally makes up a small proportion of construction costs. Due to construction activity slowing down during the financial crisis, revenue from the levy also declined during this period.

2.2 Changes to date

The levy has been subject to minimal changes since its introduction; the changes made have been:

-

to increase the rate in 2008 and 2009

-

the introduction of the Aggregates Levy Credit Scheme (ALCS) in 2004, replacing a relief scheme on aggregate used in processed products in Northern Ireland

-

the introduction of an exemption for railway excavation in 2007

-

the abolition of the ALCS

-

the introduction in 2015 of the Special Tax Credit Scheme covering importations into Northern Ireland between 2004 and 2010

-

to the liability of shale

When introduced, the rate was set at £1.60 per tonne, which was increased to £1.95 per tonne in 2008 and £2.00 per tonne in 2009. The rate has remained frozen since 2009. Budget 2018 confirmed a further freeze in the rate of the levy, bringing the cumulative saving to quarries to 72p per tonne of aggregate in real terms since 2009, compared to uprating with inflation.

The levy has been subject to various litigation. In 2002, the European Commission (‘Commission’) found that the levy as a whole did not contain state aid. This decision was challenged which resulted in the European General Court annulling the Commission’s decision. In 2012, the Court ruled that the Commission needed to make a new state aid decision. The Commission investigated the levy on state aid grounds, and found the levy exemptions to be lawful, apart from the exemption for shale used in construction, which constituted an unlawful aid. As a result, the government removed the exemption for shale in 2015 and was obliged to pursue the collection of historical aid. There is no ongoing litigation in the European General Court.

The government introduced the ALCS to Northern Ireland in 2004, which allowed quarries there to pay a lower rate of the levy if they met certain environmental requirements. This replaced a scheme in Northern Ireland introduced alongside the tax in 2002 which relieved aggregate in processed products. The ALCS ran until 2010. With effect from 1 April 2015, businesses which had imported aggregate into Northern Ireland from another EU member state between 2004 and 2010 and paid Aggregates Levy at the full rate were able to claim a retrospective credit.

In 2007, the government also added an exemption for aggregate extracted in the construction, or improvement of works to railways, tramways or monorails. This was consistent with comparable exemptions for highways and waterways.

As well as making changes to the levy itself, the government ended the Aggregates Levy Sustainability Fund (ALSF) in the 2010 spending review in light of a very tight spending context and the need to reduce the deficit. The ALSF directly allocated a proportion of levy revenue to local communities and conservation efforts around quarries. As environmental spending is devolved, the fund was administered separately in each administration. In England, the ALSF was administered by Defra and delivered by 28 Delivery Partners (including 18 local authorities). It delivered £20m-£30 million each year.

Other than the changes cited above, the only key changes made to the levy were temporary (when the government was obliged to suspend certain exemptions pending state aid investigations). For the most part the levy has remained unchanged.

2.3 The case for reviewing

The levy has not been comprehensively reviewed since its introduction. Reviewing the efficacy and impact of policies is good practice, and the government is keen to do so given that litigation on the legality of the levy has now ended. There is now an opportunity to consider whether the policy context, the industry and its regulatory environment have evolved, the impact of the levy and whether its design could be amended in line with the principles of tax design, such as fairness, simplicity and clarity.

In 2011, the Office for Tax Simplification’s Review of Tax Reliefs highlighted the levy’s many exemptions, and asked whether the levy could be simplified.

In 2014, the government committed to devolve the levy to the Scottish Parliament once litigation had been concluded and the government remains committed to devolution. Following the Silk Commission, the government said it would keep the devolution of the levy to the Welsh Assembly under review, with the intention of devolving in the future subject to state aid issues and any cross-border market distortions having been worked through in full.

This review of the Aggregates Levy offers the opportunity to consider whether the design of the levy is optimal for devolution.

3. Scope of the review

The government welcomes representations that comment on the current levy, identifying the features that work well and those that might be improved. The government is particularly interested in thoughts on:

-

the environmental context and impact of the levy

-

the effect of the levy on the supply and demand of all kinds of aggregate

-

the effect of the levy on the supply and demand of all construction products

-

the nature of cross-border trade of aggregate and other construction products, both across external UK borders, and internal borders

-

the suitability of the current tax design for devolution

-

the suitability, clarity and simplicity of current legislation and HMRC guidance

-

the operation of the tax

This chapter outlines the main features of the design of the current levy, and highlights key issues to consider in more depth.

3.1 Objectives of the Aggregates Levy

The levy was designed with various exemptions to encourage the use of less environmentally damaging sources of aggregate. The extraction of fresh aggregate can cause noise, dust, visual intrusion, loss of amenity and damage to biodiversity. When it was introduced, the objectives of the levy were described as being: to address, by taxation, the environmental costs associated with quarrying operations in line with the government’s statement of intent on environmental taxation at the time; to cut demand for virgin aggregates; and encourage the use of alternative materials where possible.

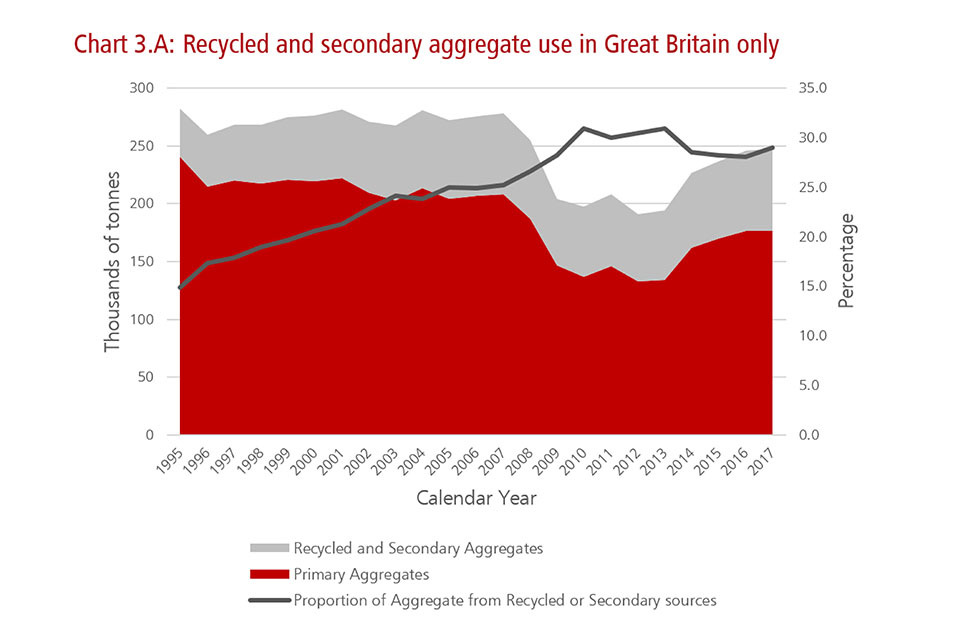

Over the years, the use of recycled aggregate has increased as a proportion of overall aggregate consumption, although this growth has recently plateaued.

Chart illustrating recycled and secondary aggregate use in Great Britain only

Chart illustrating recycled and secondary aggregate use in Great Britain only

In aggregates markets, recycled and secondary materials are estimated to represent nearly 30% of the market in Great Britain. For comparison, the average across the rest of Europe stands at around 10%.

The tax operates within a broader context of regulations that affect the extraction and production of aggregates and other construction products.

The disposal of construction waste is also subject to the lower rate (inert or inactive waste) of Landfill Tax to encourage use of waste construction materials, although this is very small, at £2.90/tonne (from 1 April 2019), compared to £91.35/tonne for standard rated waste. Although the standard rate of Landfill Tax was escalated significantly (in 1996, it was charged at £7/tonne), the lower rate has only been uprated slightly.

The government welcomes evidence on the environmental impact of the extraction and processing of aggregates, and the extraction and processing of other construction materials, and on the environmental impact of the levy. Given the time that has passed since the introduction of the levy, we welcome up-to-date evidence relating to the levy’s current objectives, as well as the efficacy of the current design in meeting them. The government will also consider the fiscal impact of any options.

3.2 Chargeable aggregate

The levy is charged on aggregate that is subject to commercial exploitation, although there are non-chargeable forms of aggregate, exempt processes and reliefs available, which are outlined below for context.

The government will review the scope of material liable to the levy.

The Office for Tax Simplification referred to the Aggregates Levy in its 2011 Review of Tax Reliefs, highlighting the fact that the levy contains 28 exemptions:

‘the question was raised whether this was the most appropriate method of legislating, i.e. should the tax be based on defining what is caught rather than what is excluded (although in practice we understand that this can be difficult)?’

The government will review the definitions and design of the levy and evidence is welcome on the impact of the design, and any issues associated with the structure of the charge and the definitions associated with it.

Any tax design will seek to ensure that the scope of the tax is clear and unambiguous, but will incorporate reliefs and exemptions to prevent perverse or unintended consequences. Recommendations will be considered, taking account of whether they help to simplify the tax as well as the administrative burden on business and any potential effects on business decisions.

3.3 Commercial exploitation

The levy applies to any aggregate that is subjected to commercial exploitation, which is when any of the following applies:

-

it’s removed from

-

its originating site

-

a connected site which is registered under the same name as the originating site

-

a site where it had been intended to apply an exempt process to it, but this process was not applied

-

it’s subject to an agreement to supply. Examples of this include when a contract is made, or when the goods change hands and a document is raised

-

it’s used for ‘construction purposes’, which is defined as being:

-

used as material or support in the construction or improvement of any structure

-

mixed with anything as part of a process of producing mortar, concrete, tarmacadam, coated roadstone or any similar construction material

-

it’s mixed with anything other than water. Examples of this include when it’s used to make concrete, when it’s mixed with levy-paid aggregate or when it’s mixed with non-taxable material.

Overburden is the material, which could include aggregate, on or near the surface. It needs to be removed in order to extract the material beneath which is the primary product. Any overburden arising from the extraction of any of these materials or from the extraction of any industrial minerals is taxable unless it is itself a specifically exempt material.

Interburden is a layer of material beneath the surface which needs to be removed to extract the primary product. Interburden from china clay and ball clay extraction isn’t taxable.

The levy isn’t due on any aggregate which hasn’t been subject to commercial exploitation, or which isn’t ‘taxable aggregate’. This includes aggregate which:

-

is moved between sites under the same registration

-

is removed to a registered site to have an exempt process applied to it

-

is removed to any premises where china clay or ball clay will be extracted from the aggregate

-

has previously been used for construction purposes

-

is being returned to the land at the site from which it was won provided that it’s not mixed with any material other than water

-

is won by an agricultural or forestry business from its own site and used in an unmixed state for the purpose of that business, on that same site or on land occupied with that site

3.4 Import

Imported aggregate is treated in exactly the same way as aggregate originating in the UK, except that there is no UK originating site.

‘The UK’ includes UK waters and any aggregate dredged from outside UK waters is treated as an import on arrival in the UK. Incoming aggregate from the Isle of Man or the Channel Islands is treated as an import for Aggregates Levy purposes.

The levy isn’t due when imports arrive in the UK. It becomes due when they are commercially exploited in the UK.

A quantity of aggregate is only considered to be commercially exploited when it’s in the UK, so when an agreement is made to supply aggregate in the UK, but the aggregate in question isn’t in the UK at the time the agreement is made, this does not constitute commercial exploitation.

Anyone in the UK who imports aggregate and, in the course or furtherance of their business, uses it for construction purposes, owns it when it’s mixed with anything other than water or enters into an agreement to supply it onwards, is responsible for commercially exploiting that aggregate.

Where more than one person is responsible for importing for commercial exploitation, their liabilities are joint and several, although only one business should register and account for the levy. This is normally the importer.

Imported processed products containing aggregate, for example, concrete and concrete products, are not subject to the levy since these products are no longer aggregate by the time they reach the UK.

3.5 Exempt aggregate

Any material, more than half of which consists of the following substances is exempt from the levy:

- clay, soil, vegetable or other organic matter

- coal, lignite and slate

- all spoil, waste or other by-products from any industrial combustion process or the smelting or refining of metal - for example, industrial slag, pulverised fuel ash and used foundry sand

- drill cuttings from oil exploration in UK waters, and from land drilling in the UK

- material arising from utility works, for example, laying gas or water pipes and phone lines in Northern Ireland.

Anything that consists completely of the following substances is exempt from the levy:

-

china clay waste and ball clay waste (not including the overburden)

-

processing waste resulting from the separation of coal, lignite or slate from other aggregate after extraction (but not any other aggregate which was extracted at the same time)

-

spoil from the processing after extraction of the industrial minerals (see Annex A)

-

aggregate arising from the ground on the site of any building or proposed building, which is lawfully removed, exclusively for the purpose of laying its foundations, pipes or cables.

-

aggregate necessarily arising from navigation dredging, if dredged exclusively for the purpose of creating, restoring, improving or maintaining that watercourse

-

aggregate necessarily arising from the ground in the course of excavations to improve, maintain or construct a highway or a proposed highway

-

aggregate necessarily arising from the ground in the course of excavations to improve, maintain or construct a railway, monorail or tramway

3.6 Exempt processes

The intended product of an ‘exempt process’ isn’t liable to Aggregates Levy, but the spoil, waste, off-cuts and other by-products resulting from the application of that exempt process are taxable. The exception to this is processing waste from extracting industrial minerals, which is an exempt material in itself.

The following processes are exempt:

-

creating dimension stone, building stone, or any other type of flat stone, by intentionally cutting or otherwise shaping stone to produce one or more flat surfaces. Offcuts are taxable unless subsequently shaped into a dimensioned product

-

extracting certain industrial minerals, such as:

-

ball and china clay

-

potash

-

sodium chloride

-

producing lime or cement from limestone, or from limestone and anything else, including shale

-

using shale for a purpose other than construction purposes

If an exempt process takes place after the levy has been paid on an amount of material, the tax can be reclaimed by the person who paid it.

3.7 Reliefs

A relief is a credit or repayment of levy that can be claimed under certain circumstances after the levy has become due.

Aggregate may be relieved from the levy if it’s:

-

exported from the UK in the form of aggregate

-

used in an exempt process after the levy has been brought to account

-

used in a prescribed industrial or agricultural process, such as use in:

-

manufacturing metals, glass, plastics, fertiliser and pesticides

-

treating drinking water, oil, air or sewage

-

manufacture of animal feeds or animal bedding material

-

adding to soil or growing media

-

returned to its originating site unprocessed

-

removed to landfill

-

used for beach replenishment

The levy is a specific one stage non-deductible tax.

3.8 Impact on Northern Ireland

Northern Ireland (NI) has a different aggregates market to the rest of the UK, mainly because it shares a land border with the Republic of Ireland (RoI), where there is no similar levy paid by quarries.

In 2004, the government introduced a Northern Irish Aggregates Levy Credit Scheme (ALCS), which allowed Northern Irish businesses to temporarily pay a lower rate of the levy if they met certain environmental requirements.

The ALCS was designed to address cross-border competition issues that Northern Irish quarries faced with the RoI, and was approved by the Commission as allowable aid in 2004.

It allowed for an 80% relief from the full rate of the levy for aggregate extracted and commercially exploited in Northern Ireland between 1 April 2004 and 30 November 2010. Any aggregates business in NI wishing to benefit from relief was required to agree to sign a negotiated agreement with the Department of Environment Northern Ireland and to meet the targets set out in that agreement, covering improvement in environmental performance of quarrying operations. Each agreement was individually tailored to the circumstances of the quarry in question, taking into account, for example, current standards and scope for improvement. Compliance with the scheme resulted in the issue of a certificate used by the operators to claim a levy credit from HMRC.

The scheme was suspended on 1 December 2010 while the European Commission undertook a State aid investigation into the scheme and has not been reintroduced.

In November 2014 the Commission concluded that the scheme complied with prevailing State aid rules in all but one respect: this was that aggregate imported into Northern Ireland from another EU member state had not been eligible for the relief. The government, therefore, introduced the Special Tax Credit Scheme on 1 April 2015 to allow those who had been disadvantaged in this respect to claim a 80% tax credit. This credit could be claimed on levy paid at the full rate on aggregate imported into Northern Ireland from another EU member state and then commercially exploited during the time that the ALCS was in operation. The claimant must satisfy the NI Department of Environment that it obtained the aggregate from a quarry that met specified environmental standards. Applications for credit from those eligible remain open until 31 March 2019.

The government will consider how the levy impacts businesses in all parts of the UK, including Northern Ireland, and taking account of the specific context for NI.

The government will consider any cross-border trade issues, alongside other policy issues, including the fiscal impact of any options.

3.9 Suitability for devolution

Following the recommendations of the Smith Commission in 2014, the government committed to devolve the levy to the Scottish Parliament. This was legislated for in the Scotland Act 2016 (Article 18), although due to the litigation then ongoing, the Scottish and UK governments agreed that devolution should take place after the resolution of litigation, at ‘such a date as the Treasury appoint in regulations made by statutory instrument’.

Now that litigation on the legality of the levy has concluded, the UK government is working with the Scottish government to set a timetable for devolution to the Scottish Parliament.

In light of this commitments, the government must consider what adjustments are needed in advance of devolution. If devolved in the current design, the risk of double taxation exists, if material moved across the border is taxed in both jurisdictions. The government must consider how it might minimise that risk and any risk of unintended consequences, such as distorting the market around the border.

The Silk Commission also recommended that the Aggregates Levy should be devolved to the Welsh Assembly, subject to the outcome of discussions between the UK Government and the EU Commission on state aid issues. In its response the government said it would keep the devolution of the levy under review with the intention of devolving in the future subject to state aid issues and any ’cross-border’ market distortions having been worked through in full.

3.10 Operations and compliance

Liable businesses must register for the levy and calculate the weight of aggregate that they commercially exploit, according to the guidance for calculations given by HMRC. Businesses submit a return, normally covering a 3-month period.

Businesses are expected to keep a range of records:

-

Aggregates Levy account: the periodic summary of total Aggregates Levy due, detailing any credits of levy and any adjustments

-

Aggregates Levy tax credits account: the evidence needed to substantiate claims for credits for exports and other reliefs

-

Aggregates Levy bad debt account (if claiming bad debt relief)

-

record of exempt aggregate: the evidence needed to substantiate exempt aggregate

-

invoices: copies of all invoices and other accounting documents that you issue or receive

-

specified records in authorisations to calculate levy liability using a special scheme for mixes, or for sites not using a weighbridge

-

Special Tax Credit Scheme: all evidence used in support of a claim under this scheme

Records should be kept for six years and made available to HMRC.

HMRC has various compliance powers, including to charge penalties (either fixed-cost, interest and/or penalty interest) for failure to:

-

to register, deregister or notify

-

to keep or produce records

-

to render returns or full payment on time

-

to make correct declarations

Businesses can be subject to a penalty or criminal sanctions for evading the tax.

Any potential reforms to the levy must be considered in light of the likely implications for compliance, in order to ensure a fair and level playing field.

Similarly, the government would also consider any reforms to improve compliance, but would have to consider the impact on business and the fiscal impact of any options.

4. How to engage with the review

The government welcomes all views on the levy and will engage widely with relevant stakeholders to gather evidence and recommendations. This will happen through three main forms of engagement: a working group, regional visits and written representations.

4.1 Working group

The government will convene an expert working group made up of representatives from industry and other relevant organisations.

This working group will meet three times throughout the review process, to offer expertise and experience to the government. Its role will be to provide input, advice and challenge to HM Treasury. The working group can also ensure from across the sector and help us to engage widely.

The working group will share its findings with the Exchequer Secretary.

4.2 Regional visits

There will be various opportunities for businesses, trade associations, charities and other organisations to engage with this process in person.

Over April, May and June, the HM Treasury review team will make a series of regional visits. These visits will offer the opportunity to discuss the effect of the levy on the regional industry and to discuss key features of the levy as well as to make recommendations on the future of the levy.

4.3 Written representations

The government welcomes written representations, including representations making recommendations for specific reforms or changes. Those representations may be on the subject of any relevant issues, but the government is particularly interested in receiving representations that address:

-

the environmental context and impact of the levy

-

the effect of the levy on the supply and demand of all kinds of aggregate

-

the effect of the levy on the supply and demand of all construction products

-

the nature of cross-border trade of aggregate and other construction products, both across external UK borders, and internal borders

-

the suitability of the current tax design for devolution

-

the suitability, clarity and simplicity of current legislation and HMRC guidance

-

the operation of the tax

The government especially welcomes representations that include good evidence and hard data and specific examples to support the arguments made.

Businesses and industry organisations across the construction products, quarrying and dredging sectors are invited to engage with this process, whether affected directly or indirectly by the levy.

Representations can be sent by email to ETTanswers@hmtreasury.gov.uk with the subject line ‘Aggregates Levy review representation’. If any attachments are included, please ensure that it is possible to open them in Microsoft Word or in Microsoft Excel.

Representation by mail can be sent to:

Aggregates Levy review

Energy and Transport Tax team

HM Treasury

1 Horse Guards Road

London

SW1A 2HQ

All responses will be acknowledged, but it will not be possible to give substantive replies to individual representations.

The deadline for formal representations in this review is 5 July 2019.

Information provided in response to this consultation may be published or disclosed in accordance with the Freedom of Information Act 200. If we receive a request for disclosure of the information we cannot give an assurance that confidentiality can be maintained in all circumstances, although we will take full account of any explanations for why you consider information to be confidential. For more information on the processing of data, see Annex C.

4.4 Next steps

Written representations are welcomed by 5 July 2019, after which the HM Treasury review team will consider all the evidence provided and representations made about the future role of the Aggregates Levy. The government will report back and announce any next steps from the review by the end of the year.

5. Annex A

Full list of exempt industrial minerals

-

anhydrite

-

ball clay

-

barytes

-

china clay

-

feldspar

-

fireclay

-

fluorspar

-

fullers earth

-

gems and semi-precious stones

-

gypsum

-

metal ore

-

muscovite

-

perlite

-

potash

-

pumice

-

rock phosphate

-

sodium chloride

-

talc

-

vermiculite

6. Annex B

6.1 Full list of industrial and agricultural reliefs

Industrial reliefs:

-

iron, steel and non-ferrous metal manufacture and smelting processing including foundry processes, investment casting, sinter plants and wire drawing

-

alloying

-

emission abatement for air, land and water

-

drinking water, air and oil filtration and purification

-

sewage treatment

-

production of energy

-

ceramic processes

-

refractory processes

-

manufacture of glass and glass products

-

manufacture of fibre glass

-

man-made fibres

-

production and processing of food and drink

-

manufacture of plastics, rubber and pvc

-

chemical manufacturing for example soda ash, sea water magnesia, alumina, silica

-

manufacture of precipitated calcium carbonate

-

manufacture of pharmaceuticals, bleaches, toiletries and detergents

-

aerating processes

-

manufacture of fillers for coating, sealants, adhesives, paints, grouts, mastics, putties and other binding or modifying media

-

manufacture of pigments, varnishes and inks

-

production of growing media and line markings for sports pitches and other leisure facilities

-

incineration

-

manufacture of dessicant

-

manufacture of carpet backing, underlay and foam

-

resin processes

-

manufacture of lubricant additives

-

leather tanning

-

paper manufacture

-

production of art materials

-

production of play sand

-

clay pigeon manufacture

-

abrasive processes: specialist sand blasting, iron free grinding (pebble mills) and sandpaper manufacture

-

use as propping agent in oil exploration (or production), for example, fracture sands and drilling fluids

-

flue gas desulphurisation and flue gas scrubbing

-

manufacture of mine suppressant

-

manufacture of fire extinguishers

-

manufacture of materials used for fireproofing

-

acid neutralisation

-

manufacture of friction materials for example automotive parts.

Agricultural reliefs:

-

manufacture of additives to soil

-

manufacture of animal feeds

-

production of animal bedding material

-

production of fertiliser

-

manufacture of pesticides and herbicides

-

production of growing media, including compost, for agricultural and horticultural use only

-

soil treatment, including mineral enrichment and reduction of acidity

7. Annex C

7.1 Processing of personal data

This notice sets out how HM Treasury will use your personal data for the purposes of this consultation and explains your rights under the General Data Protection Regulation (GDPR) and the Data Protection Act 2018 (DPA).

7.2 Your data (Data Subject Categories)

The personal information relates to you as either a member of the public, parliamentarian, or representatives of an organisation or company.

7.3 The data we collect (Data Categories)

Information may include your name, address, email address, job title, and employer of the correspondent, as well as your opinions. It is possible that you will volunteer additional identifying information about yourself or third parties.

7.4 Legal basis of processing

The processing is necessary for the performance of a task carried out in the public interest or in the exercise of official authority vested in HM Treasury. For the purpose of this consultation the task is consulting on departmental policies or proposals or obtaining opinion data in order to develop good effective government policies.

7.5 Special categories data

Any of the categories of special category data may be processed if such data is volunteered by you.

7.6 Legal basis for processing special category data

Where special category data is volunteered by you (the data subject), the legal basis relied upon for processing it is: the processing is necessary for reasons of substantial public interest for the exercise of a function of the Crown, a Minister of the Crown, or a government department.

This function is consulting on departmental policies or proposals, or obtaining opinion data, to develop good effective policies.

7.7 Purpose

The personal information is processed for the purpose of obtaining the opinions of members of the public and representatives of organisations and companies, about departmental policies, proposals, or generally to obtain public opinion data on an issue of public interest.

7.8 Who we share your responses with

Information provided in response to this review may be published or disclosed in accordance with the access to information regimes. These are primarily the Freedom of Information Act 2000 (FOIA), the Data Protection Act 2018 (DPA) and the Environmental Information Regulations 2004 (EIR).

If you want the information that you provide to be treated as confidential, please be aware that, under the FOIA, there is a statutory Code of Practice with which public authorities must comply and which deals with, amongst other things, obligations of confidence.

In view of this it would be helpful if you could explain to us why you regard the information you have provided as confidential. If we receive a request for disclosure of the information we will take full account of your explanation, but we cannot give an assurance that confidentiality can be maintained in all circumstances. An automatic confidentiality disclaimer generated by your IT system will not, of itself, be regarded as binding on HM Treasury.

Where someone submits special category personal data or personal data about third parties, we will endeavour to delete that data before publication takes place.

Where information about respondents is not published, it may be shared with officials within other public bodies involved in this consultation process to assist us in developing the policies to which it relates. Examples of these public bodies appear at: https://www.gov.uk/government/organisations. In this case, HM Treasury may share relevant responses with HMRC, Defra, the Environment Agency and the devolved administrations.

As the personal information is stored on our IT infrastructure, it will be accessible to our IT contractor, NTT. NTT will only process this data for our purposes and in fulfilment with the contractual obligations they have with us.

7.9 How long we will hold your data (Retention)

Personal information in representations that is published and will be therefore retained indefinitely as a historic record under the Public Records Act 1958.

Personal information in representations that is not published will be retained for three calendar years after the review has concluded.

7.10 Your rights

You have the right to request information about how your personal data are processed and to request a copy of that personal data.

You have the right to request that any inaccuracies in your personal data are rectified without delay.

You have the right to request that your personal data are erased if there is no longer a justification for them to be processed.

You have the right, in certain circumstances (for example, where accuracy is contested), to request that the processing of your personal data is restricted.

You have the right to object to the processing of your personal data where it is processed for direct marketing purposes.

You have the right to data portability, which allows your data to be copied or transferred from one IT environment to another.

7.11 How to submit a Data Subject Access Request (DSAR)

To request access to personal data that HM Treasury holds about you, contact:

HM Treasury Data Protection Unit

G11 Orange

1 Horse Guards Road

London

SW1A 2HQ

7.12 Complaints

If you have any concerns about the use of your personal data, please contact us via this mailbox: privacy@hmtreasury.gov.uk

If we are unable to address your concerns to your satisfaction, you can make a complaint to the Information Commissioner, the UK’s independent regulator for data protection. The Information Commissioner can be contacted at:

Information Commissioner’s Office

Wycliffe House

Water Lane

Wilmslow

Cheshire

SK9 5AF

0303 123 1113

Any complaint to the Information Commissioner is without prejudice to your right to seek redress through the courts.

7.13 Contact details

The data controller for any personal data collected as part of this review is HM Treasury, the contact details for which are:

HM Treasury

1 Horse Guards Road

London

SW1A 2HQ

020 7270 5000

public.enquiries@hmtreasury.gov.uk

The contact details for HM Treasury’s Data Protection Officer (DPO) are:

The Data Protection Officer

Corporate Governance and Risk Assurance Team

Area 2/15

1 Horse Guards Road

London

SW1A 2HQ