Spring Budget 2023 Media Factsheet: Cutting & Simplifying Tax for Businesses to Invest and Grow

Published 15 March 2023

At Spring Budget 2023, the Chancellor Jeremy Hunt set out his vision to ensure that the UK’s tax system fosters the right conditions for enterprise by being one of the most competitive in the world.

To do this, the Chancellor transformed capital allowances to boost investment, increased support for R&D, and simplified the tax system for SMEs.

Two major capital allowances

- The UK has the lowest corporation tax rate in the G7, even after April’s rate rise.

- With the super-deduction coming to an end on 31 March 2023, the Chancellor announced a policy package at Spring Budget 2023 that goes further and ensures the UK’s capital allowances regime continues to be the joint most competitive in the G7 and OECD.

- Capital allowances let businesses write off the cost of certain capital spending against taxable profits, thus cutting their overall tax bill.

- The Spring Budget 2023 confirmed two major capital allowances, together worth £27 billion over the next three years. An effective £9 billion a year corporation tax cut for UK businesses.

Full expensing (FE)

- This lets taxpayers deduct 100% of the cost of certain plant and machinery from their profits before tax. It is effective from 1 April 2023 to 31 March 2026.

- It applies to spending on main rate equipment, which includes but is not limited to, warehousing equipment such as forklift trucks, tools such as ladders and drills, construction equipment such as bulldozers and excavators, machines such as computers and printers, vehicles such as tractors, lorries and vans, office equipment such as chairs and desks, and some fixtures such as kitchen and bathroom fittings and fire alarm systems.

- FE means that companies can deduct 100% of the cost from their profits straight away – rather than more slowly over the life of the asset.

- Similar to the super-deduction, FE also results in a 25p tax saving for every £1 invested (19% x 130% super-deduction rate = 25%).

- Before the super-deduction and with the 19% Corporation Tax rate, companies investing £10 million in main rate assets received a £342,000 tax saving in year 1. Under full expensing, on a £10 million investment, a company will receive a £2.5 million tax saving in year 1.

- As part of his commitment to maintain a stable economy, the Chancellor’s long-term ambition is to make full expensing permanent.

The 50% first-year allowance (FYA)

- This lets taxpayers deduct 50% of the cost of other plant and machinery, known as special rate assets, from their profits during the year of purchase. This includes long life assets such as solar panels and thermal insulation on buildings.

- The 50% FYA was introduced alongside the super-deduction and was due to end on 31 March 2023. We are extending it by three years to 31 March 2026. For each year following the first year, 6% of the remaining cost will be written off via Writing Down Allowances (WDAs).

- 50% FYA allows for faster relief than under the default WDAs-only regime, which is worth 6% each year, including year one.

- As part of his commitment to maintain a stable economy, the Chancellor’s long-term ambition is to make 50% FYA permanent.

Research & Development

- At Spring Budget 2023, the Chancellor announced a new R&D scheme for 20,000 SMEs in the UK - coming in from 1 April 2023 and worth around £500 million per year.

- These changes are a key part of the Chancellor’s plan to get the economy growing and make the UK the best place in the world to start and grow a business by promoting the conditions for enterprise to succeed.

- At Autumn Statement 2022, as part of the review into the R&D tax reliefs, the Chancellor committed to considering the case for further support for R&D intensive SMEs. Following engagement with industry, the Chancellor is now acting to provide that support.

- The scheme is targeted specifically at loss making R&D intensive SMEs. Focusing support towards those most impacted by the rate changes introduced at Autumn Statement 2022.

- A company is considered R&D intensive where its qualifying R&D expenditure is worth 40% or more of its total expenditure.

- Eligible loss-making companies will be able to claim £27 from HMRC for every £100 of R&D investment, instead of £18.60 for non R&D intensive loss makers.

- Around 1,000 claiming companies will come from the pharmaceutical and life sciences industry. This will support the development of life saving medicines.

- Around 4,000 digital SMEs will be from the computer programming, consultancy, and related activities sector. This will support the development of AI, machine learning and other digital based technologies.

- Around 3,000 other manufacturing firms, and another 3,000 professional, scientific, and technical activities firms will also qualify for the enhanced support.

- This builds on previously announced changes to support modern research methods by expanding the scope of qualifying expenditure for R&D reliefs to include data & cloud computing costs.

- The permanent increase from 13% to 20% for the R&D Expenditure Credit rate announced at Autumn Statement 2022 also means the UK now has the joint highest uncapped headline rate of tax relief in the G7 for large companies.

- Combining the government’s spending on R&D with the support from tax reliefs, total UK R&D support as a proportion of GDP is forecast to increase to approximately 1.0% in 2024/25, up from approximately 0.9% in 2019. The latest 2019 OECD average is 0.7% of GDP.

A Simpler Tax System for Small Businesses

- At Spring Budget 2023, the Chancellor announced a series of admin changes to the simplify the tax system to make it easier for small businesses to interact with.

- A simpler tax system frees up time and money for the UK’s 5.5 million small businesses to grow. With an estimated turnover of £2.3 trillion, they make up 52% of the private sector.

- The simplification package includes:

- Changes to the Enterprise Management Incentives (EMI) scheme from April 2023 to simplify the process to grant options and reduce the administrative burden on participating companies. This includes, from 6 April 2023, removing requirements to signs a working time declaration and setting out details of share restrictions in option agreements.

- Delivery of IT systems to enable tax agents to payroll benefits in kind on behalf of their clients – allowing agents to better support their clients and reducing burdens on employers.

- Consulting to the Help to Save scheme.

- Measures to simplify the customs import and export processes, including improvements to the Simplified Customs Declaration Process, and the Modernising Authorisations project.

- The Chancellor also announced a number of consultations to pave the way for future reform, including:

- A commitment from HMRC to deliver a systematic review of guidance and forms for small businesses.

- A consultation to simplify calculating income tax for smaller, growing sole traders.

- This Budget package marks the first stage of a continuous programme of work on tax simplification. Officials will continue to engage businesses directly and prioritise this as part of all tax policymaking.

Further information:

- Both full expensing and 50% FYA are on top of the permanent £1 million threshold for the Annual Investment Allowance (AIA), which amounts to full expensing for 99% of businesses by providing 100% first-year relief for plant and machinery investments up to £1 million. The AIA is available to all businesses, including unincorporated businesses and most partnerships.

- The long-term ambition is to make full expensing and the 50% first year allowance a permanent feature of the UK’s corporate tax system. However economic stability, underpinned by public debt falling, is the foundation of growth. It is through confidence in the UK economy that businesses will invest. The measure will be made permanent when the Chancellor is confident it is consistent with keeping debt on a sustainable path with prudent headroom.

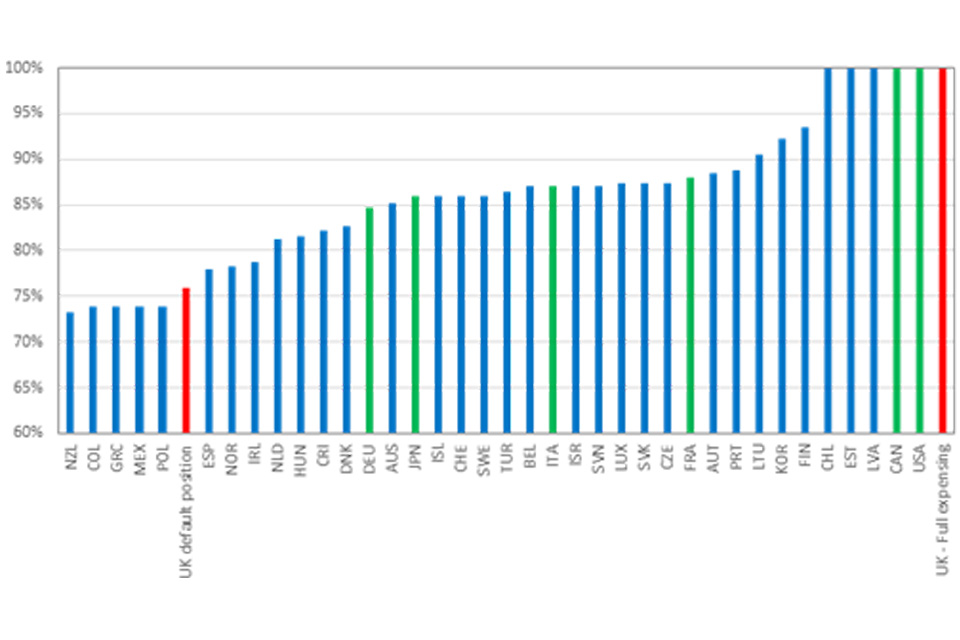

- Under full expensing, the UK will have the joint highest Net Present Value for capital allowances in the OECD[1]:

[1] Net Present Value is a measure of how valuable a capital allowance is to a business. £1 today is better than £1 tomorrow. Full expensing has an NPV of 100% and means we are letting companies claim that £1 today rather than over time so that they can invest in their business and the UK economy now.