The Universal Credit (Transitional Provisions) Amendment Regulations 2022: report by SSAC and statement by the Secretary of State for Work and Pensions

Published 4 July 2022

Applies to England, Scotland and Wales

After the passing of the Welfare Reform Act in 2012 that introduced Universal Credit to replace six legacy benefits and tax credits, these regulations will help complete the move to Universal Credit including revoking provisions that have been superseded or identified as no longer necessary.

The Universal Credit (Transitional Provisions) Amendment Regulations 2022 improve the existing legislative framework that sets out how claimants are notified of their move to Universal Credit (UC) - managed migration - and protections for claimants as they migrate (transitional protection). This legislative framework supports the migration of legacy claimants and underpins both the 2019 Harrogate pilot (suspended in March 2020) and the recent resumption of managed migration in the Jobcentre Plus districts of Bolton and Medway in May 2022.

The Department thanks Social Security Advisory Committee for its consideration of the regulations and report. The Department welcomes the Committee’s focus on the regulation regarding the removal of the 10,000 limit on the number of claimants who can be sent a managed migration notice. This regulation has been proposed as this previous regulatory constraint no longer reflects how we wish to test and learn our approach for a responsible and safe transition for claimants to UC. We note that the committee has not made any recommendations regarding the draft regulations; therefore, we have not made any amendments to them, apart from some minor technical and drafting changes, ahead of laying them in Parliament.

The committee did make recommendations focusing on programme governance, operational matters, and engagement with stakeholders, particularly Parliament. The Department would like to formally note all the recommendations.

We already have comprehensive governance arrangements in place for Move to UC, including through the Programme Board, the regular review of the Permanent Secretary, and the oversight of Ministers. The Department already engages with the Work and Pensions Select Committee regularly.

The Department fully understands the importance of ensuring that the move from legacy benefits to UC is as smooth as possible. As part of our learning during the Discovery phase, we will test and validate our approach on what additional support may be required for people to make their claim to UC.

The Department has a clear focus on ensuring that we support the most vulnerable claimants. Without seeking to undermine the approach being tested for the first group of claimants in this initial phase of Discovery, the Department has agreed a process to proactively work with those claimants who do not make a claim within the three month period given, unless they have informed the Department already that they do not intend to make a claim.

The Department already has a comprehensive stakeholder engagement strategy in place. As we started to look again at Move to UC during 2021, we re-commenced engagement with a broad and diverse range of stakeholders, starting with a large stakeholder event in March 2021. Regular monthly stakeholder meetings were put in place across three themes:

(1) health and disability

(2) welfare, poverty, and children

(3) research and finance institutions

We have continued these into 2022 and use them to provide regular updates and gain valuable feedback on both voluntary and managed migration. In addition to these smaller, focused events, we have held further large, stakeholder events – with Ministerial and SRO attendance – in both November 2021 and May 2022, providing key updates regarding our Move to UC plans and responding to stakeholders’ questions and concerns. The progress being made with our stakeholder engagement was illustrated at a recent Work and Pensions Select Committee meeting, where one witness stated:

there has been a lot of consultation in the last year or two. There are a lot of meetings. They have been getting together and talking with us on Universal Credit meetings and different forums and it is all very welcome.

The Department is committed to continuing our engagement. As we progress through the Discovery phase, we will be seeking views and feedback to inform our approach.

The Department has a clear focus on the successful delivery and completion of Move to UC by the end of 2024; we therefore keep the resourcing of the programme, including continuity plans in relation to the SRO, under regular review.

Following the conclusion of the Committee’s formal referral of the regulations, we are now bringing these regulations forward.

Letter to Secretary of State from Social Security Advisory Committee

The Rt. Hon Thérèse Coffey MP

Secretary of State

Department for Work and Pensions

Caxton House

6-12 Tothill Street

London

SW1H 9NA

26 May 2022

Dear Secretary of State,

The Universal Credit (Transitional Provisions) (Managed Migration) Amendment Regulations 2022 The draft regulations were presented to the Social Security Advisory Committee (SSAC) for statutory scrutiny at its meeting on 8 December.[footnote 1]

The Government has committed to completing the transition of claimants in receipt of a working age income-related benefits onto Universal Credit (UC) by the end of 2024, as set out in the Department for Work and Pensions’ (DWP’s) policy paper Completing the move to Universal Credit.[footnote 2]

These regulations will form the legislative basis for delivering that commitment. This Committee recognises the need to complete the transfer of remaining legacy benefit claimants across to UC and is supportive of the Department’s ambition in this respect.

The process of moving around 1.7 million households onto UC from legacy benefits creates a significant risk both for those who are reliant on these benefits and for DWP operationally. The core challenge of Move to UC has been set out by the Department as follows:

Managed migration is a significant undertaking and requires the department to design and build an end-to-end service that safely supports claimants to make the Move to UC. This includes being able to confidently identify and contact eligible claimants, appropriately support claimants through their claim and accurately calculate transitional protection for eligible claimants, to ensure their entitlement on UC at the point of managed transition is not below that of legacy benefits.

During its statutory scrutiny of these proposals, the Committee concluded that one aspect of the proposals in particular required closer examination. This related to draft regulation 9, which has the effect of removing the cap on the number of migration notices (10,000) that could be issued to existing claimants on legacy benefits, and the associated commitment by former Secretary of State, the Rt Hon Amber Rudd, to report back to Parliament before proceeding further.[footnote 4]

We need to reach out to claimants – so the onus should be on us to deliver managed migration in a way that meets everyone’s needs. So I am going to change the current regulations, removing the powers government previously planned to migrate all legacy claimants onto the new system. Instead, I’m only going to seek powers for a pilot: the chance to support 10,000 people through the process. This is an opportunity to learn how we can best facilitate the transition – before returning to Parliament with the legislation which we will need for future managed migration.

The Rt Hon Amber Rudd

11 January 2019

The commitment to pause and report to Parliament served to provide assurance, transparency, and oversight of ‘Move to UC’, as well as strengthening public confidence in UC as it moved to its next phase.

My letter of 13 January set out the Committee’s concerns, along with some suggestions for mitigation.[footnote 5]

I was grateful for the Minister for Welfare Delivery’s subsequent offer to meet on a quarterly basis to update the Committee on progress and share key findings up to the end of discovery phase, however it was the Committee’s view that such an approach alone would not be able to deliver the robust independent oversight and assurance that we consider to be necessary.[footnote 6]

Therefore, after careful consideration of these issues, the Committee decided to take the regulations on formal reference in accordance with sections 172(1) and 174(1) of the Social Security Administration Act 1992.

This report focusses on the impact of draft regulation 9 and its removal of the 10,000 migration notice limit and the related parliamentary consent for proceeding, and investigates the method by which the ‘Move to UC’ programme can deliver the necessary assurance, transparency and oversight, thereby building public confidence in Universal Credit and the Move to UC Programme in particular.

Mindful of the Government’s desire to make progress following a prolonged pause enforced by the COVID-19 pandemic, we sought to gather evidence from the Department, experts in the field of ‘agile’ project management and others in an appropriately expedited timescale.

The Committee made a conscious decision not to look again at issues that were addressed in its earlier report, The Universal Credit (Transitional Provisions) (Managed Migration) Amendment Regulations 2018 but have drawn on our original findings for the purpose of this report.

The implementation of a project that directly impacts on so many households – many of which will be in vulnerable situations – is a significant risk. Success in this venture is dependent on ensuring there is a smooth claimant experience, especially around clarity of process, timing, handling of transitional protection and any debt from legacy benefits. Public trust in this approach will also be important – as it feeds into claimant perceptions and confidence in engaging in the process.

So how can DWP provide assurance, and build confidence in, the large-scale high-profile UC Programme in a way that would obviate the prior requirement to report to Parliament after 10,000 claimants? We look at this in more detail below.

Move to UC as an agile process

The ‘Move to UC’ programme is based on agile principles. After an initial very small-scale exercise in Harrogate (paused during the COVID-19 pandemic) it has recommenced with a test-and-learn period, called the ‘discovery’ phase. This will involve issuing migration notices to small batches of claimants and finding out the reasons underpinning any reluctance or difficulty in taking that migration journey. The first batch will involve 500 claimants from Bolton and Medway. A dozen UC case managers will be focussing on supporting these 500 claimants through the process – a significantly lower claimant to case manager ratio than is ordinarily the case. The teams involved in analysing the information that materialises from these tests are multi-disciplinary, claimant-focussed, specialist teams. The findings and data from this first batch will feed into the next step of the discovery process, and so on, in an iterative manner. The discovery phase is scheduled to last until the end of this calendar year.

As more is learned, more processes and IT infrastructure will be developed accordingly, and the numbers of transfers will steadily scale up. This gradual scaling phase will remain relatively small-scale in comparison to the total number of claimants who ultimately need to migrate, and it will continue to follow the test-and-learn iterative approach. Before moving on to each subsequent phase, the programme considers a wide range of exit criteria, such as ensuring there are adequate resources to manage the caseload, that products are fit for purpose, and that robust monitoring of processes is in place.

However, in order to move the large remaining legacy benefit caseload across to UC by the Department’s 2024 deadline, there will need to be a dramatic increase of the rate of claimants migrating, and that level of escalation is not expected until late 2023, or possibly 2024. The success of a very large uptick in the number of transfers at the end of the scaling phase will be dependent on a significant degree of learning and getting the process right in the earlier phases. This significant scaling up of numbers will be a critical moment in the programme. If necessary, there would be scope to enter into a second discovery phase to solve issues affecting certain groups of claimants while the migration rate is scaled up for others.

We have been told that the programme has very experienced staff versed in agile delivery, who understand how to manage this step-by-step approach and make good use of the information and learnings produced. We heard that there is an established track record within the Department of managing comparable large-scale programmes, for example the roll-out of UC to Jobcentres nationwide, and the impressive response to the COVID-19 pandemic where the system was able to handle a doubling of the number of people on UC from three million on 12 March 2020 (the last count date before the coronavirus pandemic) to six million on 11 March 2021.[footnote 7]

People on Universal Credit, Great Britain, July 2016 to July 2021

The Committee was also told by an independent source that there was a good culture within the Programme, in terms of being able to report back to the SRO when things are not working well and know that they will be listened to. By way of evidence of this approach we were told that the Department had paused roll-out in some cases, for example in 2016 when a member of the senior leadership team identified that a higher than anticipated number of cases required the Habitual Residence Test to be applied. We were told that the Department remained committed do so again in future where risks to claimants are identified, and that the SRO would always put claimants first. We welcome that positive culture, but we were less clear about the extent to which it was encouraged below senior grades, and whether a defined process existed for escalating specific concerns from outside of the Programme team itself.

The ‘agile’ process and governance

Universal Credit has been a pioneering agile programme within government in terms of its scale, as will be the ‘Move to UC’ component. This means that, rather than delivering an entire project in a one-off ‘waterfall’ approach, the project develops and moves forward in small, incremental steps, building up in size gradually as the project tests and learns the optimal way to proceed. Because agile implementation initially develops slowly and iteratively it does not lend itself to being managed in a traditional, target-based, framework. Just as the development of UC in an agile manner has required a step-change in the approach to implementation, so also has it required a commensurate adjustment to standard governance approaches.

In order to improve our own understanding of the distinct challenges around the governance of agile projects, and to ensure our evidence is as well-informed as possible, the Committee spoke to a small number of experts with experience of the management of large-scale agile projects both in and outside of government. In particular, we were keen to understand best practice in terms of governance, monitoring, and scrutiny within this environment.

The Committee is very grateful to those who provided evidence and answered our questions.[footnote 8]

We were advised that, while agile projects need strong and effective governance, inflexible control can be detrimental. There needs to be a level of freedom of action, to pursue new threads of development as they arise, and to enable the learning to happen as the evidence emerges. None of this is possible if a very detailed framework and project plan is established in advance.

It was also emphasised to us that, within an agile process, some things will not work, and this should be expected. After all, the purpose of an extended phase of testing and learning is to understand quickly what works and what does not, before implementation scales up – an approach, when executed appropriately, that we welcome. Inevitably, testing will reveal which elements of the programme do not work or could be done better. The crucial thing is that learnings – both positive and negative - are managed in a controlled way by being quickly identified and rectified.

Specific numerical performance targets to be met within specified timescales are not always helpful in an agile context and risk derailing the important focus on learning, especially in the early stages. However, this should not mean there is no reasonable expectation of reporting, oversight, and scrutiny. Instead, this is more likely to be meaningful if it is associated with a specific milestone, for example when the project is moving to a new phase, rather than a pre-determined date or number of transactions. There may also be some success criteria that could be applied in a periodical review to ensure a satisfactory rate of learning. For example, it may be as simple as outlining what has been learnt since the last update to show that there is progress in discovering more about what works or what does not, and what new questions and issues have arisen.

Governance and oversight of Move to UC

During our scrutiny of these regulations, we heard – from both the Department and independent contributors – many examples of where the governance and management of the UC Programme was working well. The Department provided some strong evidence about the governance of the UC Programme, and indeed one external expert told us that some of his peers in non-government organisations consider the programme to be leading the field.

The UC programme is classified as one of the Government’s Major Portfolio Projects. Because of this, in addition to the Secretary of State’s oversight, its Senior Responsible Officer (SRO) is accountable to Parliament, as well as to DWP’s Accounting Officer, for the successful implementation of the UC migration process.[footnote 9] This is set out in his SRO letter:

You are directly accountable to the DWP Accounting Officer (AO), under the oversight of the Secretary of State…. As SRO you are personally responsible for delivering the Programme. You are held accountable for delivering its objectives, benefits and policy intent, for securing and protecting its vision, for ensuring it is governed responsibly, reported honestly, escalated appropriately and for influencing constructively the context, culture and operating environment of UC.

In addition to your internal accountabilities, you should also be aware that SROs of Government Major Portfolio Projects (GMPPs) programmes and projects are held personally accountable to Parliamentary Select Committees. You will be expected to account for, and explain, decisions and actions you have taken to deliver the programme or specific milestones within the delivery plan. It is important to be clear that your accountability relates only to implementation. It will remain for the Minister to account for the relevant policy decisions and development.

In addition to the SRO’s accountability to Parliament through the Work and Pensions Select Committee, oversight is provided by the Public Accounts Committee which examines the value for money of government programmes and service delivery. Drawing on the work of the National Audit Office, they hold the SRO to account for the economy, efficiency and effectiveness of public spending.

The letter makes clear that the Department’s Secretary of State has “oversight” of the programme and remains responsible for all policy decisions relating to it. The Government’s Osmotherly Rules also notes that the Permanent Secretary, as DWP’s Accounting Officer, “is ultimately accountable for the performance of all the business under their control, including major projects for which an individual SRO has direct accountability and responsibility”.[footnote 10]

The tripartite responsibilities set out in the SRO letter provides some assurance that appropriate oversight of the UC Programme is in place. However, our discussions with the Department and others have suggested that the balance between the powers invested in those with oversight roles and the levers held by the SRO were weighted towards the latter.

The SRO is responsible for critical decisions and the management of risks relating to the implementation. The SRO is “expected to account to Parliament, for the decisions and actions they have taken to deliver the projects for which they have personal responsibility”.[footnote 11]

The UC Programme Board provides “advice and support” to the SRO. The UC Programme Board is chaired by John McGlynn, who is also a non-executive member of DWP’s Departmental Board.[footnote 12] However, the Chair “does not have individual decision-making authority or accountability”.[footnote 13] The Board examines the actions of the SRO for all aspects of UC, with a particular focus on issues of the migration. It provides independent advice, support and challenge to the SRO and the Permanent Secretary. The Board meetings are minuted, but these are not published until two years have elapsed. While the exit criteria for each phase are agreed jointly by the SRO and the UC Programme Board, the Board does not have any authority to pause the rollout or make any specific demands of the SRO.

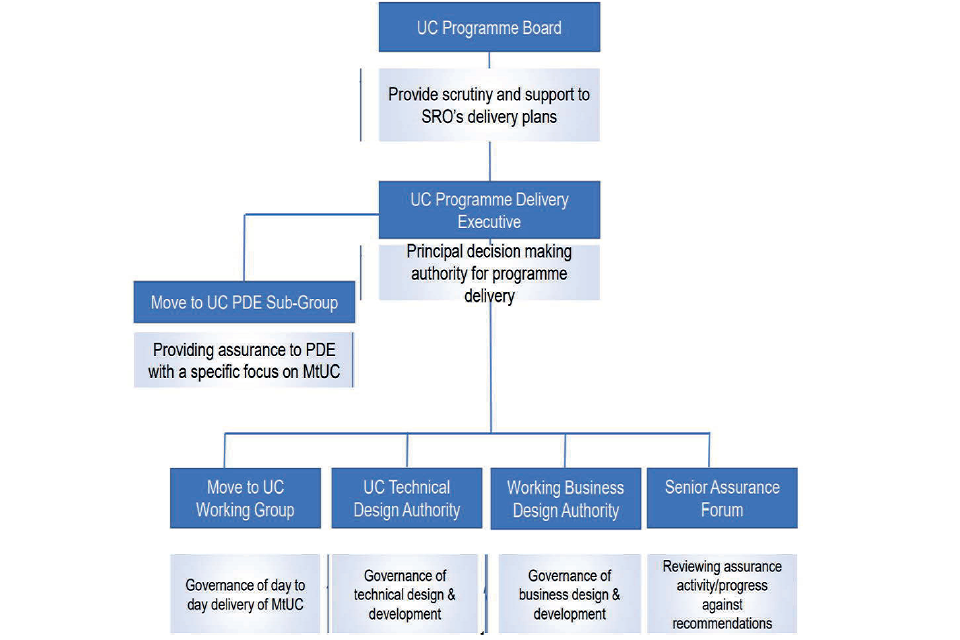

The SRO is also supported by six other sub-Board level fora, including the UC Programme Delivery Executive, which meets weekly and is chaired by the UC Programme Director. This is described as the “principal decision-making body accountable for the successful delivery of the UC Programme”.

We were told that the UC Programme has fortnightly internal stand-up sessions to share plans, assess progress and to identify risk. These are supplemented by monthly “show and tell” sessions with a group of ‘external’ stakeholders, including Her Majesty’s Revenue and Customs and devolved administrations.

The full DWP governance structure for the UC Programme can be found at annex A.

Outside of the Department, the Infrastructure and Projects Authority (IPA), which reports to Cabinet Office and HM Treasury, has a role in ensuring that large-scale projects are delivered well. At certain key points throughout the life of a major programme, it will be subject to an assurance review by the IPA. For the UC Programme, the next assurance review (gate zero) is scheduled to commence later this year. It is accepted practice that reports from such reviews are not published as doing so may inhibit the candour of those providing evidence. The reports are presented to Departmental Accounting Officers.

Could the Department strengthen its governance arrangements?

Having conducted this review, the Committee continues to have concerns about the consequences of the removal from existing legislation of the pilot which would limit the number of migration notices issued to 10,000, and the associated removal of the commitment by a recent Secretary of State to return to Parliament “with the legislation which we will need for future managed migration”.[footnote 14] In the absence of such a stage-gate, we are not convinced that the governance arrangements currently in place are sufficiently robust to safeguard against, or put strong mitigations in place for, those risks which have the potential to impact adversely upon up to 1.7million households and to affect public confidence in the programme.

We are also conscious that constraining agile projects with too many layers of governance could be a risk in itself, and that care needs to be taken in reaching an appropriate balance. While we are mindful of that risk, the proposals expose other significant risks – both to claimants and to the Department’s staff who are responsible for delivering ‘Move to UC’.

Hence, we believe a number of areas can be addressed in a way that provides greater assurance without unduly burdening the programme. These involve ensuring that there is:

- clarity of the tripartite accountabilities that exist within the Department, in addition to those that exist to Parliament

- an assessment of performance which helps ensure key risks are identified and addressed

- an independent external perspective to identify knowledge gaps and to capture wider claimant experience that can supplement the Department’s own data

- greater transparency of the process and progress to increase public confidence in the Programme

- greater oversight and assurance of the Department’s readiness at the point of scaling up

- a clear understanding of the leadership risks that are associated with large programmes of this nature, and that steps are taken to ensure that such risks are mitigated

For each of these issues, the Committee has identified recommendations that it considers appropriate to address the related risks.

Accountability within DWP

As outlined earlier in this report, we have heard that the SRO of the UC Programme, Neil Couling, has a significant amount of authority invested in him to deliver the Programme and manage the associated risks. As is the case for all SROs of the Government’s Major Portfolio Projects, he is required to account to Parliament for the decisions he takes. This is in addition to his accountabilities within DWP. It was clear from those that we spoke to, including Neil himself, that these accountabilities are taken very seriously. The SRO is supported in his role by the Department’s UC Programme Board which provides “advice and support to the SRO”, but we were told that the SRO remains accountable for all decisions relating to the implementation of the Programme.[footnote 15]

The Department’s Accounting Officer is ultimately accountable for the performance of the Programme, and the primary governance mechanism within the Department is the SRO letter issued by the Accounting Officer, which provides a framework within which the SRO can deliver.

Given the potential impact on 1.7 million households, and especially because of the agile nature of the programme, we consider it appropriate to undertake a review of the framework and mandate of the SRO as the programme enters significant new phases. It will be important at each stage to achieve a balance of responsibilities that enables the SRO to make progress, while ensuring appropriate mitigation of significant risks. Such reviews will need to ensure that any action taken does not cut across appropriate SRO accountabilities to Parliament as set out in the Ministerial Code.

Recommendation 1

The Secretary of State and Accounting Officer should direct the SRO to undertake a review of the current governance arrangements and accountabilities for the UC Programme to ensure that they are appropriately transparent and robust, with internal mechanisms in place to ensure that concerns can be escalated and acted upon, that decisions can be challenged and tested, or an aspect of the programme can be slowed down or scaled back because of emerging risks. Upon completion, the SRO should present his recommendations to the Accounting Officer for consideration, and they should jointly report their conclusions to the Chair of the Work and Pensions Select Committee.

Recommendation 2

In advance of any further scaling up of the migration of claimants, the Accounting Officer should issue a revised SRO letter that reflects the outcomes of the governance review and learnings from the initial phase.

Assessing performance

We have been told that the UC Programme has established its own internal performance metrics and specific criteria that inform decisions about scaling up or moving on to a new phase of implementation. The Programme is also responsible for assessing how it measures up against those criteria. This information is shared with the UC Programme Board, but not published, making it difficult for interested parties to understand the progress being made or for Parliament to hold the SRO properly to account. In our view, this amounts to the UC Programme setting and marking its own homework.

We are conscious that there is a two-year lag on the publication of UC Programme Board minutes, but we are of the strong view that issues relating to exit criteria should be published contemporaneously. We believe that doing so would strengthen the SRO’s internal and external accountabilities. In particular, this would strengthen Parliament’s ability to hold the current and future SROs to account for decisions they have taken.

Recommendation 3

We recommend that:

(a) the current criteria for moving to the next phase are published before summer recess, and subsequently within one month of amendments being agreed by the UC Programme Board, to ensure that there is transparency about the Programme’s intentions; and that

(b) at a point when decisions about implementation or scaling up are taken, a letter from the SRO should be submitted to the Secretary of State and Permanent Secretary setting out the factors that have informed that decision. This should be supplemented by an assessment from the Chair of the UC Programme Board on the readiness of the Department to take that step. To fully discharge his accountabilities, the SRO should additionally share this letter with the Chair of the Work and Pensions Select Committee.

Recommendation 4

In line with his accountability to the Work and Pensions Select Committee, the SRO should provide periodic reports on performance, including timely updates on progress against key milestones and lessons learned, to the Chair of that Committee. This should be placed in the House of Commons Library.

Independent perspective

One very clear risk of an approach that lacks healthy independent challenge is that the Programme may be focussed too much on the Department’s high-level implementation priorities, potentially excluding criteria or metrics that would provide valuable insight on the impact on claimants in a range of different circumstances and work coaches. The sole reliance on DWP data exacerbates the risk. In our discussion with the UC Programme Board Chair, we asked whether it would be useful to establish targeted external engagement to provide assurance that internal management is complete and accurate to avoid important data being overlooked. We were told that, while nothing was currently in place, engagement with the charity and advice sectors would be valuable and was being actively considered by the Programme Board.

Introducing a greater degree of independent perspective and voice within the programme would help access the claimant perspective and subjective experience as it refines its migration plans, ensuring that a richer understanding of the potential impacts and risks can be reflected in the SRO’s decisions. We understand that trusted external experts have previously been seconded to the Programme, and that the insight they were able to bring to this work was invaluable.

Recommendation 5

The Department should introduce secondments of trusted experts with considerable claimant insight into the Programme team. An update on such secondments attached to the Programme team should be included in the regular performance reports to the Chair of the Work and Pensions Select Committee.

More substantively, we believe there is an opportunity to reflect on how the Programme might make effective use of a small number of trusted stakeholders who may be in a position to provide feedback on progress to date and also constructive advice on emerging challenges.

A ‘star chamber’ style of stakeholder scrutiny challenge (with both expert and claimant representation) may help overcome any gaps in data collected, identify success criteria that may not have been considered, provide additional experience and/or insight that may be lacking on the Programme team (including claimants’ subjective experience), and to guard against the risks of ‘group think’. We have been told that the Programme’s primary concern is supporting the claimant through this process, and therefore bringing in external voices with direct experience will improve their ability to deliver a system that achieves that.

We have been told that the Programme’s primary concern is supporting the claimant through this process, and therefore bringing in external voices with direct experience will improve their ability to deliver a system that achieves that. This could be achieved through the extension of the membership of the monthly ‘show and tell’ sessions as recommended below.

We understand that this Committee will be invited to send a representative to future monthly stakeholder meetings to provide an opportunity to identify and examine any emerging concerns and provide advice to the Secretary of State in line with our statutory responsibilities. We welcome that opportunity but wonder if there is an opportunity to go further still?

Recommendation 6

The Department should review the membership of the monthly external ‘show and tell’ sessions and consider whether a limited extension of the membership to trusted stakeholders and partners would strengthen existing accountabilities and/or provide access to expertise and insight, particularly on the experience of claimants in a range of different circumstances, which perhaps does not exist within the Programme.

Recommendation 7

The Department should supplement its own performance data with an element of external assurance (from expert and claimant representation) of the programme to help overcome any gaps in data collected, identify success criteria that may not have been considered, provide additional experience and/or insight that may be lacking on the Programme team, and guard against the risks of ‘group think’.

Transparency and building public confidence

While we have been given positive feedback about the Department’s performance, there is no publicly available evidence to support those claims. One external expert we interviewed likened the UC Programme to an aircraft’s ‘black box’, with little real-time visibility from the outside of how any of the Programme’s decisions are made, or of its performance and milestones achieved. This was perceived to be a missed opportunity by some of the experts that we spoke to, and there was a clear view that greater transparency about developments and performance would help to build much-needed public confidence in the system and enable Parliament to hold the SRO to account in a more meaningful and timely way.

Some of our earlier recommendations already propose greater transparency in specific aspects of the Programme’s work. We understand that transparency about objectives, progress and learnings have helped grow public confidence of major government programmes. We were told that transparency need not be a formal publication but could be something as simple as a monthly blog.

An example of where informal transparency has worked particularly well was the HM Courts and Tribunals Service’s Reform Programme which has an information webpage providing information “including how to engage with the programme, get involved in projects and stay updated on progress and developments”.[footnote 16] The material available on that webpage includes a summary of progress, monthly newsletters, blogs, information on stakeholder events and how to engage with the Programme, as well as a summary of progress against their commitments to improving engagement.

In addition to the increased transparency proposed in some of our other specific recommendations, the Committee considers there is a strong case for strengthening the proactive transparency of the UC Programme without adding administrative burdens, for example by publishing information that already exists. Such steps may enable the Department to take greater control of the narrative about the Programme and ensure that external reporting and debate reflects the position more accurately.

Recommendation 8

(a) The Department should actively consider introducing greater transparency and reporting of the Programme’s progress to help build public confidence in Universal Credit. Consideration should be given to providing assurance about the controlled management of such learnings, both positive and negative.

(b) The Programme should also confirm when it has passed gate zero following the IPA assurance review.

Scaling up

The volume of migrating claimants will rise relatively slowly during the discovery phase, with the numbers starting at a very low level (initially 500), with a high number of case managers supporting them through the process. Initially there will be a ratio of 12 staff supporting 500 claimants. That ratio will change as migration steadily scales up, with the numbers of staff providing support to claimants proportionately decreasing over time. It will be important to keep monitoring the impact of that falling staff-to-claimant ratio to check that it is not detrimental to claimants’ ability to transfer successfully to UC.

There will be a critical moment in time when the UC Programme has ended both the discovery phase and the gradual scaling phase and starts the steep scaling phase. We are told that this is likely to happen in the second half of 2023, and it can best be visualised by comparing it to the upwards trajectory implied by the handle of a hockey stick. There is no question that this presents the most significant risk in the programme by far. Any oversights or missteps could be to the detriment of very large numbers of claimants. We understand that there is no particular mechanism in place to identify the optimal point in time for that steep scaling phase to begin, nor any currently defined criteria to determine whether or not the UC Programme is ready to make that significant step.

The point at the end of the gradual scaling phase, just before the steep scaling phase begins is probably the most critical moment of the Department’s plans for completing the move to UC. This presents an important opportunity to reflect on what has been learned and enable appropriate scrutiny to take place to ensure that the Programme is ready to take that momentous step with robust mitigations in place for all identified risks. It is essential that strong scrutiny and assurance is applied before the steep scaling phase.

The SRO’s accountability to Parliament for this Programme will never have been more important than at this significant moment, therefore it seems an appropriate and respectful step to report to Parliament as an alternative to the prior commitment in regulation 9. We take it as read that the Secretary of State will be consulted in accordance with her oversight role.

Recommendation 9

We recommend that the SRO presents the scaling-up proposals to the Work and Pensions Select Committee for scrutiny and assurance before proceeding.

Recommendation 10

The declining ratio of staff to claimants needs to be closely monitored by the SRO and the Director General for Work and Health, to ensure that there is a sufficient number of case managers to deal with claimants in a wide range of different circumstances through each phase and that neither the migration plan – nor the experience of claimants – is put at risk.

Leadership risk

Finally, the Programme’s SRO, Neil Couling, is a long-standing senior civil servant with considerable experience in both policy and operational roles. Even so we consider that a single person having responsibility for all decision-making relating to the implementation of a project that directly impacts on so many households – many of which will be in vulnerable situations – is a significant risk. Our concern is exacerbated by the fact we have been told that there is no deputy in place who would be able to step in at short notice in the event that Neil was unable to continue with his duties for any given period, and no succession arrangements in place.

‘Move to UC’ will affect the lives of millions of claimants, many of whom will be living in vulnerable situations, and it is essential that the leadership of the UC Programme is resilient, and that the Department is able to respond rapidly and effectively to unexpected absences or changes in personnel. This needs to be addressed as a matter of priority.

Recommendation 11

The Accounting Officer, with oversight from the Secretary of State, should ensure that clear contingency plans are in place for this important and high-profile SRO role, along with other key posts in the Programme.

Conclusion

This report has considered the impact of draft regulation 9, which removes the 10,000-migration notice limit and the related parliamentary consent for proceeding and has recommended alternative methods by which the ‘Move to UC’ programme can deliver the necessary assurance, transparency and oversight.

The Committee commends the iterative test-and-learn approach being applied to this Programme. We acknowledge the extensive governance arrangements already in place, and that this programme, in the words of one interviewee, is sui generis. The scale of the programme, the necessarily ground-breaking approach, and the vulnerability of many of those claimants who will be engaged means that the governance of the programme in the interests of all also needs to be fit for purpose, so that the public at large can be appropriately confident in the quality of delivery of this important exercise. Nonetheless it is important to ensure that any framework put in place strikes a balance that both avoids stifling the practices that make agile effective and also ensures there is scrutiny, transparency and an openness of culture that encourages concerns from outside of the Programme to be escalated and addressed, and thereby enhance public confidence.

When considering such a balance, the Committee observed that a lack of public confidence in Universal Credit is one of the main barriers to people migrating to the service. Therefore,such scrutiny and transparency should not be seen as a hurdle to overcome but an opportunity to instil that confidence. It is in this spirit that we have developed these recommendations.

I would be happy to discuss any aspect of this report with you if that would be helpful.

Dr Stephen Brien

SSAC Chair

Annex A: Governance Structure for the UC Programme

UC Programme Board

Purpose

The main purpose of the UC Programme Board (UCPB) is to provide advice and support to the SRO (the Change and Resilience Director General), who is accountable for the delivery of Universal Credit.

Key responsibilities

The Board has collective responsibility to:

- maintain an overview of the plan to deliver UC including the scope (the requirement), financials (budget and approvals) and the approach and activities to ensure the plan is delivered

- maintain an overview of the systems of programme control and governance including change control, risk management and stakeholder engagement

- take receipt of agreed programme reporting which provides visibility of achieved and predicted progress against the plan, including all work strands, and satisfy themselves of its accuracy and robustness

DWP Change Portfolio Board

Membership

Chair - John McGlynn

Change and Resilience Director General and UC Senior Responsible owner - Neil Couling

DWP Work and Health Director General - Karen Gosden

UC Programme Director - Ian Wright

DWP IT Director General, Chief Information Officer - Simon McKinnon

DWP Finance Director General (Tax Credits and RTI) - Myrtle Lloyd

London Borough of Hillington Chief Executive - TBC

DWP People and Capability Director - Deb Walton

HMT Director Personal Tax, Welfare and Pensions - Chris Drane

Cabinet Office, Operations Lead - David Magee

Deputy Secretary for Work and Health DFC Northern Ireland - Paddy Rooney

Special Adviser to the Secretary of State - Ed Winfield

Meetings are held monthly.

UC Programme Delivery Executive

Purpose

The Universal Credit Programme Delivery Executive (PDE) is the principal decision making body that is accountable for the successful delivery of the Universal Credit Programme. The PDE will be accountable for delivering the strategic intent of Universal Credit and the transformation of the Department, welfare system and labour market securely.

UC Programme Board

Membership

UC Programme Director (Chair)

Change Director General and UC SRO

Work and Health Director General

UC Digital Delivery Director

HMRC UC Programme Director

Finance Business Partner

Commercial Business Partner

HR Director, Change and Resilience Group

Counter Fraud, Compliance and Debt

UC Product Director

UC Engagement and Planning Director

Working Age, UC Policy Division

Meetings are held weekly.

Move to UC PDE Sub-group

Purpose

The PDE MtUC sub-group will provide additional assurance to UC Programme Delivery Executive (PDE), with specific focus on Move to UC. The PDE MtUC sub-group will provide PDE with aforum to defer certain issues/themes which need to be explored in more detail, or which UC PDE doesn’t have sufficient time to consider.

The forum will also:

- provide a single focus on Move to UC to complement UC PDE

- provide oversight of the standing items (see para 9)

- ensuring that the right links are made between the respective phases and workstreams of the programme

Membership

External Affairs, Strategic Design and Planning

UC Product

DWP Legal Services

HMRC

Policy and Analysis

Design and Transformation

UC Digital

Strategic comminications

People and Capability

Finance

CFCD

Operations

Commercial

Department for communities

GIAA

Meetings are held fortnightly.

UC Technical Design Authority

Purpose

The Universal Credit Technical Design Authority (UC TDA) establishes and maintains the UC Technical Architecture and any interim architectures, makes key technical design decisions, manages programme level technical design risk, and provides a channel for the various technical design leads to share information. The UC TDA addresses all technical matters for the end-to-end UC service.

Membership

UC Head of Dependent Systems

UC Head of Secure Design

UC Tech Lead (Leeds)

UC Head of Architecture

UC Head of Software Engineering

UC Head of Platforms

DWP Digital Design Authority

UC Delivery Management

DWP Digital Design Authority

UC Technical Architect

UC Infrastructure Architect

Meetings are held fortnightly.

Senior Assurance Forum

Purpose

The purpose of the forum is:

‘…to bring together the lead colleagues from disparate assurance authorities across government who are responsible for UC programme/project, corporate, independent assurance, and audit relationships and activities to ensure there is a co-ordinated, coherent and consistent approach aligned to the Integrated Assurance and Approvals Plan (IAAP)’.

The Senior Assurance Forum will take an overview of UC 3rd line assurance activity, Programme-wide, and will help to enable the effective facilitation of forthcoming reviews and monitoring and managing relevant recommendations by sharing information about Programme developments.

The Chair of SAF is a member of the HMT/UC Assurance group and is responsible for ensuring that messages are communicated and where appropriate that assurance activities are co-ordinated between the two forums.

Membership

DWP Departmental Change Portfolio Office

DWP Strategy and Governance Directorate

Government Internal Audit Agency

Infrastructure and Projects Authority

UC Programme Assurance Team

Meetings are held weekly.

Move to UC Working group

Purpose

The Universal Credit Move to UC (M2UC) Working Group is a key decision forum that will provide assurance and act collectively to identify and agree the necessary project activities, to implement and deliver the intended outcomes to meet the M2UC departmental objectives. The outputs and expected outcomes from the Working Group will be used to report up into the PDE (and Delivery and Oversight Board). The Working Group is comprised of representatives from the Directorates and Programme across the Department with the relevant knowledge and skills. Each member represents their sponsor on the Delivery Board.

Membership

External Affairs

DWP Legal Services

HMRC

Policy and Analysis

Local Authority Partnership, Engagement and Delivery

Service Planning and Delivery

Department for Communities, Northern Ireland

Strategic communications

Working Age - National Operations

CFCD

Product Design

UC Transformation and Delivery

Meetings are held weekly.

Working Business Design Authority

Purpose

WBDA agrees cross portfolio design decisions, and provides:

- cross product team working group to discuss emerging designs or design thinking

- agree and, where needed, harmonise new trials, POC, and A/B tests

- provide awareness and inform the group of wider departmental initiatives for example ARA, HTP

Any paper impacting on design/service due to go to PDE to come to this governance group first

Topics in scope as required:

- any make vs buy decision

- any design that impacts a non-UC system (dependant systems)

- any changes or proposed changes to the UC IA

- any significant UC design proposals (typically that impact multiple themes or portfolios)

- any proposals for resolution of significant design or technical debt items

- any changes or proposed changes to the UC service breakdown (after we have settled with portfolios)

- any proposed trials and or experiments impacting the service

- where appropriate, PDE papers ahead of PDE discussion

- MOVE considerations

Membership

All UC lead product managers

All UC heads of practice (including technology)

Service Design and Transformation

Secure Design

Policy

Business Analysts

Meetings are held weekly

Annex B: Letter of continued appointment as Senior Responsible Officer for the Universal Credit Programme

To: Neil Couling, Director General and Senior

Responsible Owner for Universal Credit Programme

Date: 16 November 2018

From: Peter Schofield CB, Permanent Secretary

Department for Work and Pensions

Tony Meggs, Chief Executive, Infrastructure and Projects Authority

Appointment as Senior Responsible Owner for Universal Credit Programme

We are writing to confirm your continued appointment as the Senior Responsible Owner (SRO) of Universal Credit Programme (UC), which took effect from 1 October 2014.

You are directly accountable to the DWP Accounting Officer (AO), under the oversight of the Secretary of State. This will be a full time role. As SRO you are personally responsible for delivering the Programme. You are held accountable for delivering its objectives, benefits and policy intent, for securing and protecting its vision, for ensuring it is governed responsibly, reported honestly, escalated appropriately and for influencing constructively the context, culture and operating environment of UC.

In addition to your internal accountabilities, you should also be aware that SROs of Government Major Portfolio Projects (GMPP) programmes and projects are held personally accountable to Parliamentary Select Committees. You will be expected to account for, and explain, decisions and actions you have taken to deliver the programme or specific milestones within the delivery plan.

It is important to be clear that your accountability relates only to implementation. It will remain for the Minister to account for the relevant policy decisions and development.

Tenure of Position

You will be expected to remain in this role until the end of the programme, ensuring the safe and secure delivery of UC in the future. The current end date is planned for 31 December 2023.

Objectives and Performance Criteria

UC is a major reform, which, at a strategic level, is transforming the welfare state in Britain for the better. UC introduces a welfare service designed to encourage those not in work to take up work, and those in work to seek to earn more and become financially independent. It changes the way benefits are assessed, administered and delivered and impacts a range of stakeholders including claimants, DWP staff, landlords and delivery partners including HMRC, Local Authorities and other public, private and third sector organisations.

UC introduces fundamental changes to the way that citizens interact with the welfare system. It seeks to tackle worklessness through a combination of incentives and new forms of support for those seeking work and those in work who are in a position to take on more hours. In summary, the main changes include:

- Stronger financial incentives

- Stronger support and conditionality

- Integrating out of work benefits and tax credits into one single Universal Credit

UC will deliver wider transformation for:

- Claimants – the approach puts claimants at the centre of the development, with work outcomes influencing the entire design and build

- Taxpayers – by designing a service which builds in security at every level and by doing so , reduces the risk of Fraud and Error

- Staff – the single system will be coherent and intuitive, based on a “Test and Learn” approach throughout the build and ahead of rollout

- Employers – the dynamic effects of UC increase demand of employers for labour supply

- Government – by reforming the Welfare State, providing fit for future technology, focussed on getting people into work and earning more.

The objectives of UC, working with a range of delivery partners, is to deliver:

- Full employment – increasing participation in the Labour Market

- Reducing and preventing fraud and error

- Controlling welfare cost

- Providing a safety net - UC will allow the Department to tailor our offer to those who need it most, with extra assistance for those with disabilities and those who require support with childcare costs

- Increasing efficiency through automation.

In addition, the delivery of UC has a transformational effect on the Department’s future business model, culture and ways of working through the development of digital services that meet both the Programme’s needs and provide enablers for the wider Department, these include:

- Use of Real Time Information

- Digital verification services

- Digital Service centres

UC will ensure a smooth transition and migration from Legacy Benefits and the roll out of Universal Credit in a safe and secure manner.

Since your original appointment in October 2014, the scope of the programme has changed through the passage of the Work and Welfare Act 2016, the Scotland Act 2016 and the Northern Ireland Welfare Reform Act 2015. In result of the policy changes announced through Budget 2017 and Budget 2018, the timetable for delivery has been changed, on your advice to Ministers, to accommodate these changes in scope.

You will continue to develop ongoing plans for implementation in line with the Full Business Case agreed in spring 2018. Using the strategic planning assumptions in that Business Case, and subsequent outcomes from Budget 2017 and Budget 2018, you will develop plans for delivery, reflecting emerging evidence, operating experience and responding to the agile design and build of the UC Full Service. Future revisions to plans will be subject to Ministerial agreement and you are accountable for ensuring formal approval for delivery of UC throughout this Parliament and longer-term.

Future proposed changes to the programme scope that impact on government policy, digital transformation or the benefits your programme has been set up to deliver must be authorised by the AO, who may delegate their decision-making authority to DWP’s Investment Committee (IC) and may be subject to further levels of approval. You are also responsible for recommending to the AO or IC, the need to either pause or terminate the programme where necessary and in a timely manner.

As you know, the Department is transforming the way it delivers its business by introducing digitally-based, user-centred services to better meet customer needs and deliver increased efficiency. As SRO, you have responsibility to be sighted on and aligned with Departmental Strategy and the Single Departmental Plan and attend appropriate governance fora to provide assurance that the programme deliverables are aligned with DWP’s strategic direction and processes.

Programme Status

The Programme status is reflected in the latest quarterly return to the Infrastructure and Projects Authority (IPA), where the most recent assessment of deliverability was an Amber rating. The whole life cost budget for this programme is as per the latest approved Business Case; see Annex 1. Detailed guidance on SRO roles and responsibilities is attached at Annex 2. You should follow that guidance and also ensure that you understand the guidance ‘Giving Evidence to Select Committees – Guidance for Civil Servants[footnote 17] and make yourself aware of the Infrastructure and Projects Authority guidance on the management of major projects.[footnote 18]

Extent and Limit of Accountability

HM Treasury (HMT) spending controls will apply, as set out within the HMT Delegated Spending Authority letter. Where your programme exceeds the delegated authority set by HMT, the Treasury Approval Point process will apply and the details of each approval process must be agreed with the DWP’s HMT spending team.

You should note, in particular, that where expenditure is considered novel, contentious, repercussive or likely to result in costs to other parts of the public sector, HMT approval will be required regardless of whether the project exceeds the delegated authority set by HMT.

Following recommendation from the Public Accounts Committee (PAC), from April 2017 an Accounting Officer Assessment should always be produced for projects or programmes which form part of the GMPP at the Outline Business Case (OBC) stage (or at the point when it enters the GMPP if this is later).

As the UC Programme is beyond the OBC stage, there is no mandate to undertake an assessment. You should note an Accounting Officer Assessment should be prepared at subsequent stages of the programme if it departs from the four standards (regularity, propriety, value for money and feasibility), or the agreed plan – including any contingency – in terms of costs, benefits, timescales, or level of risk.

It is for you, as the SRO, to decide whether or not an Accounting Officer Assessment should be prepared at any other stage of the programme. You should be prepared to defend your decisions to Parliament if challenged, for example, if called to give evidence to the Public Accounts Committee.

You should ensure that you operate at all times within the rules set out in Managing Public Money.[footnote 19]

In addition, you must be mindful of and act in accordance with the specific Treasury Delegated limits and Cabinet Office controls relevant to projects. Information on these controls can be found here.[footnote 20]

Major Projects Leadership Academy (MPLA)

As the SRO of a GMPP programme, you are required to attend the Major Projects Leadership Academy (MPLA). You attended this as part of Cohort 10.

As a graduate of MPLA, we will both expect and support you to continue your on-going professional development and will encourage you to take an active part in MPLA alumni activities. You are a recognised, accredited IPA reviewer and as such will be expected to lead or participate in such reviews for other Government Departments, the wider public sector and other areas of the Department for Work and Pensions as appropriate.

You will be required to participate in such reviews at least once every 12 months to maintain your accreditation.

We would like to take this opportunity to wish you success in your role as SRO for the Universal Credit Programme.

Yours sincerely,

Peter Schofield CB, Permanent Secretary Department for Work and Pensions

Tony Meggs, Chief Executive, Infrastructure and Projects Authority

I confirm that I accept the appointment including my personal accountability for implementation of the programme detailed in the letter above.

Name of SRO:

Signature of SRO:

Date:

Annex 1: Programme Budget

The latest planning allocation assumptions are as follows:

| 2018/19 Budget (£m) | Whole Life Cost (£m) |

|---|---|

| 836.7 | 12,716.95 |

The programme SR15 allocation(5) is as follows:

| Category | 2016/17: £m | 2017/18: £m | 2018/19: £m | 2019/20 (indicative): £m | Total: £m |

|---|---|---|---|---|---|

| Investment | 175.409 | 181.484 | 174.832 | 119.739 | 651.464 |

| Consequences (Held in Change) | 35.605 | 54.731 | 28.165 | 310.366 | 428.867 |

| Total | 211.014 | 236.215 | 202.997 | 430.106 | 1080.332 |

(5) Sources: 2018/19 – 2019/20 Budget Allocations from DWP RAM dated 24 Oct 2018 2017/18 Budget Allocations from DWP RAM dated 22 March 2018 2016/17 Budget Allocation from DWP RAM dated 10 February 2017

Annex 2: Senior Responsible Owner Role and Accountabilities

The role of the SRO

You are personally accountable for ensuring the on-going delivery of the programme. You are responsible for ensuring the related implementation and transition activities will deliver the agreed objectives and the benefits stated in the Business Case.

You must ensure the effectiveness of the governance, assurance and programme management arrangements and maintain them through the life of the programme.

You should adopt best practice and be prepared to justify any deviation from it, in line with guidance published by the Cabinet Office.

An SRO will:

- be a visible, engaged and active programme leader, not a figurehead

- deliver the agreed outcomes and benefits

- create an open, honest and positive culture committed to delivering at pace

- challenge senior officers and Ministers when appropriate and escalate quickly

- provide appropriate support, steer and strategic focus to the Programme Director and ensure they have a clear and current letter of appointment; and

- have sufficient time, experience and the right skills to carry the full responsibilities of the role

Specific SRO accountabilities

Set up the programme for success:

- ensure the programme is set-up to make an unambiguous and demonstrable link to strategic policy

- translate the policy intent into clear deliverables which are established and agreed with senior stakeholders

- carry out robust and commercially viable options appraisal, which balances the risk with opportunity, as part of initial programme feasibility

- establish a firm Business Case for the programme during the initiation/definition phase and ensure any planned changes continue to be aligned with the business

- Identify and secure the necessary investment for the Business Case (this includes both budget and operational resource)

- design and implement robust, appropriate and transparent programme governance

- build strong and effective relationships with key stakeholders, justifying their trust and retaining their confidence, and obtain commitment to benefits realisation

Meet the programme objectives and deliver the projected benefits:

- gain agreement to the programme objectives and the benefits to be delivered amongst stakeholders, including Ministers where appropriate

- understand the broader government perspective and its impact on the programme

- ensure the strategic fit of the programme objectives and the stated benefits

- agree a clear and simple approach to performance management and monitor delivery of the objectives and benefits taking appropriate action where necessary to ensure their successful delivery

Develop the programme organisation and plan:

- design and implement a coherent organisation structure and an appropriately detailed programme plan

- build the right team, securing necessary resources and skills and providing clear lines of accountability

- provide appropriate support, steer and strategic focus to the Programme Director

Monitor and take control of progress:

- monitor and control the progress of the programme at a strategic level, being honest and frank about project progress, risk and issues

- monitor benefits and ensure that any changes to the agreed programme stated benefits are flagged appropriately within programme governance and the Business Case is updated accordingly (throughout the programme life-cycle)

- maintain the integrity of the programme and speak truth to power

- communicate effectively with senior stakeholders about programme progress and provide clear, appropriate and delivery-focused decisions and advice to the Programme Director

Effective and appropriate problem resolution and referral processes:

- identify, understand and drive the successful mitigation of programme risks

- escalate serious issues quickly and with confidence to senior management and/or Ministers

- Develop strong and effective engagement between project teams and its stakeholders and sponsors

- ensure the communication processes are effective and that the programme’s objectives and deliverables continue to be consistent with the organisation’s strategic direction

Ensure the programme is subject to review at appropriate stages

- recognise the value of robust programme review and ensure it occurs at key points in the programme lifecycle, particularly at the pre-initiation (feasibility) and initiation stages

- make certain that any recommendations or concerns from reviews are met or addressed in a timely manner

- in the event of a “red” or “amber-red” review, ensure the Permanent Secretary has been made aware of the situation and briefed accordingly

Manage formal programme closure:

- formally close the programme documenting lessons learned with the final evaluation report and disseminate to stakeholders

- put plans in place for a post implementation review, agreeing this with your Programme Board and other relevant stakeholders

- agree a plan for both long term benefits realisation and on-going sustainability with key stakeholders as part of the process of moving to business as usual

Annex C: Role of UC Programme Board Non-Executive Chairperson

The appointment is as a Non-Executive Board Member and will chair the DWP Universal:

Credit Programme Board. The key responsibilities of the role are to:

- provide external advice, expertise and challenge, alongside independence of thought, to inform the decision making process for the delivery of the Universal Credit programme

- Lead and facilitate discussions at Programme Board meetings ensuring decisions are brokered appropriately

- Work with the Universal Credit Senior Responsible Officer and Programme Board Secretariat to ensure that agendas and papers submitted to the Board are of high quality and enable the Board to make decisions effectively

- give advice on the operational/delivery implications of Universal Credit policy and plans proposals

- Provide constructive, independent support, guidance and robust challenge to the Board on the progress and implementation of the Programme plan, facilitating decisions following discussion where required

- provide management advice to the Permanent Secretary and Universal Credit SRO

- satisfy yourself on the integrity of financial information and that financial controls and systems and risk management are robust and defensible

- the chairperson does not have individual decision-making authority or accountability

Person specification:

- extensive experience of delivering major transformation programmes at a senior level within Government

- previous non-executive director experience within the public sector

- recognised by the Cabinet Office Infrastructure & Projects Authority as an exemplar in their field

- Knowledge and experience of applying Agile principles to deliver major public sector transformation

- ability to handle, analyse and understand complex planning, financial and performance data to inform Board discussions and decision making

- experience of providing independent but informed constructive challenge to senior leaders

Annex D: List of individuals who provided evidence to this project

The Committee is grateful for the valuable input provided by the following, who gave their time to advise us and provide evidence during the course of this project:

Tom Loosemore: Public Digital

Dave Magee: Infrastructure and Projects Authority

John McGlynn: Non-executive Chair of the DWP’s Universal Credit Programme Board

Sir John Oldham

We are also grateful to the Secretary of State for Work and Pensions, the Minister for Welfare Delivery, Neil Couling and other DWP officials who responded to our questions and requests for further information throughout our examination of these proposals.

Annex E: Extract of minutes from SSAC meeting on 8 December 2021

3. The Universal Credit (Transitional Provisions) Regulations 2022, and The Universal Credit (Transitional Provisions) Regulations (Northern Ireland) 2022.[footnote 21] and [footnote 22]

3.1. The Chair welcomed Neil Couling (Director General, DWP Change and Resilience), Graeme Connor (Deputy Director, UC Analysis and UC Policy), Dave Higlett (G6, UC Policy), James Calverley (G7, UC Policy), to the meeting. He proposed that the meeting be broken into three parts:

- a review of actions since the SSAC Managed Migration report of 2018, in particular: the feedback at that stage, what the Department have taken on board, and the learnings to date

- the specific proposals in the draft regulations

- plans going forward given the proposed removal of the regulation limiting the number of migration notices to 10,000, the roll out, milestones, checkpoints, review and oversight

3.2. Neil Couling introduced the regulations by stating that whilst certain things from that previous report have been considered other things have not as yet, as work on this stopped abruptly when Covid occurred. However, these will continue to feature in the next phase of UC – a learning phase titled the ‘discovery phase’. In this discovery phase there will be work undertaken with claimants, advisors and external stakeholders and partners before the volumes are increased. For this phase there are not pre-determined data and numbers, rather it is a space to explore, learn and construct, allowing volumes to be adjusted based on learning.

3.3. Committee members asked the following questions:

SSAC’s earlier advice: an update on developments

(a) There were a number of useful conversations about the earlier recommendations by SSAC, such as about what was considered a safe transfer, about the state of readiness to roll out, the impacts on different cohorts, and implicit and explicit consent. What has (and what has not) happened following the SSAC recommendations?

The COVID interruption was immediate, so some aspects of ongoing work at that time were lost. Some aspects have changed, including the volume of cases to move. In the Harrogate pilot there were not many cases that needed transitional protection (TP), however that may have been do with the cohorts moving. In terms of the Committee’s previous recommendations a number were accepted, such as the two week run-on of DWP income-related benefits, whilst others were met with promises to explore further as we developed and tested UC. Where there was an agreement to explore things, such as with operational readiness, that will be picked up in the future plan and other issues raised, around transferring data across from legacy systems, explicit consent, and how to work with third parties will be looked at in the discovery phase.

(b) Previously the Department were following a step by step iterative approach – does that original philosophy still hold?

Yes. The Department is determined to go at a pace that allows us to learn to transition to different phases properly. The pace in the discovery phase will be careful and considered, as with small volumes one can slow down, stop, and correct. [Redacted].

(c) How does the gradual, iterative approach work with the political pressure to get through the massive transitional caseload?

If there was a way to go faster whilst still making sure the system works that would be the approach. [Redacted]. The Senior Responsible Officer’s (SRO’s) view is that 2024 is still a reasonable target. The SRO would be content to regularly update SSAC during this process.

(d) What are the key lessons learned from the Harrogate trial?

There was originally a three-phase plan – first Jobseeker’s Allowance cases (JSA), then Housing Association (HA), then Tax Credit cases. The JSA cases were underway, and the HA were about to start when lockdown happened. The main learning from the JSA cohort was that claimants are anxious about moving to UC.

Personal contact helped address negative preconceptions and informed claimants when payments would fall in the calendar which helped claimants understand when best to make their UC claim within the period they are required. There were very few TP cases, but the people in this cohort were less likely to have a lower entitlement on UC. It is not possible to move individuals across to UC or set up a gateway to identify them by using data from the legacy systems. It would take years of system development and would still be unreliable. People need to participate, and clean data is essential. Also, whilst it may be perceived that the JSA cohort are simpler on paper, they often had complex lives and the cases contained much complexity.

(e) Are the learnings from the huge pandemic claimant increase and the Harrogate pilot transferable to the ESA and Tax Credit cohorts?

The experience so far is that tax credit claimants are reluctant to engage with UC and DWP, they don’t like the brand, they see it as a jobcentre experience. The issue therefore is how can it not be like a jobcentre experience? More must be done on communications, to build confidence with current legacy benefit claimants. The changes to the taper rate and work allowances introduced after the Budget will help as they do mean that a large majority of tax credit claimants will be better off on UC.

(f) A particular concern of SSAC in 2018 was that the risk of a failed transition was borne by the claimant. With that in mind is the 2024 a target or a commitment?

It doesn’t help running all the different legacy benefit and IT systems, so the sooner we can complete the move to UC the better [Redacted]. It is a Manifesto commitment to complete the UC move. Initiating all transfers by the end of 2024 is a valid target, subject to not being impacted by other policy priorities or external events.

(g) One of the commitments in 2018 was to explore automatic transfers of claims – has DWP explored any options since?

Automatic transfer is not impossible, but it is very hard. One area where there is some possibility is on tax credits – aspects of HMRC tax credit claims may be able to be used to build UC claims. We had previously planned to test this before the pilot was paused. We want to explore with HMRC if there is scope for certain information to be ported across.

(h) Another 2018 commitment was to seek evidence on the group whose earnings exceed the UC threshold for four months – did that happen?

At present UC claimants who are no longer entitled to UC due to earnings will have their earnings monitored for six months to see if they might (within this period) re–establish entitlement for UC. This might inform that four-month issue.

(i) The gradual, iterative process is welcomed, but why therefore remove the failsafe of reporting at a particular point? Is there not wisdom in retaining that pilot point?

The 10,000 limit is a threshold chosen previously, based on the concept of a pilot, to provide assurances that without a limit the intention was to move significant numbers of claimants in one go. [Redacted].

Specific regulations

(j) On regulation 4 - could the purpose of that be explained?

This change clarifies what happens in practice anyway. There is an inconsistency here, the legislation removes the inconsistency, and brings it into line with practice.

(k) How does this interact with people in temporary accommodation?

An award of housing benefit for those in temporary accommodation (and specified accommodation) does not terminate on claiming UC. Paragraph 3 of article 7 of UC Commencement Order No. 23 ensures claimants in temporary accommodation are not prevented from claiming housing benefit. This saving will be maintained in the commencement order meaning there is no interaction between the revocation of regulation 8(1)(b) and the availability of housing benefit to claimants in temporary accommodation.

(l) On regulation 5 – could the purpose of that be explained?

This aligns the approach to termination of legacy benefits for couples issued with a migration notice who separate, so it is the same as that in the case of natural migration. Existing Regulation 47(2) provides that if one member of the couple makes a claim for UC all legacy benefits to both members of the couple are stopped.

That is revoked by these regulations. So, instead now it will be the case that the member claiming for the couple stays on legacy benefits if their ex-partner claims UC.

(m) The migration notice gives them three months to apply – is there a danger that applicants will not report changes in the circumstances of their benefit unit during that period?