Retailer’s checklist for purchases made on or before 31 December 2020 (VAT407 notes)

Updated 31 December 2020

1. Check that your customer is eligible to buy goods under the VAT Retail Export Scheme

Customers are eligible if they’re:

- visiting the UK and live outside of the UK or EU

- UK or EU residents and are leaving the UK or EU for more than 12 months

Eligible customers can only claim back VAT charged on goods when they leave the UK or EU, and only for goods purchased in the 3 months before leaving the UK or EU.

Full details are in Retail Export Scheme (VAT Notice 704).

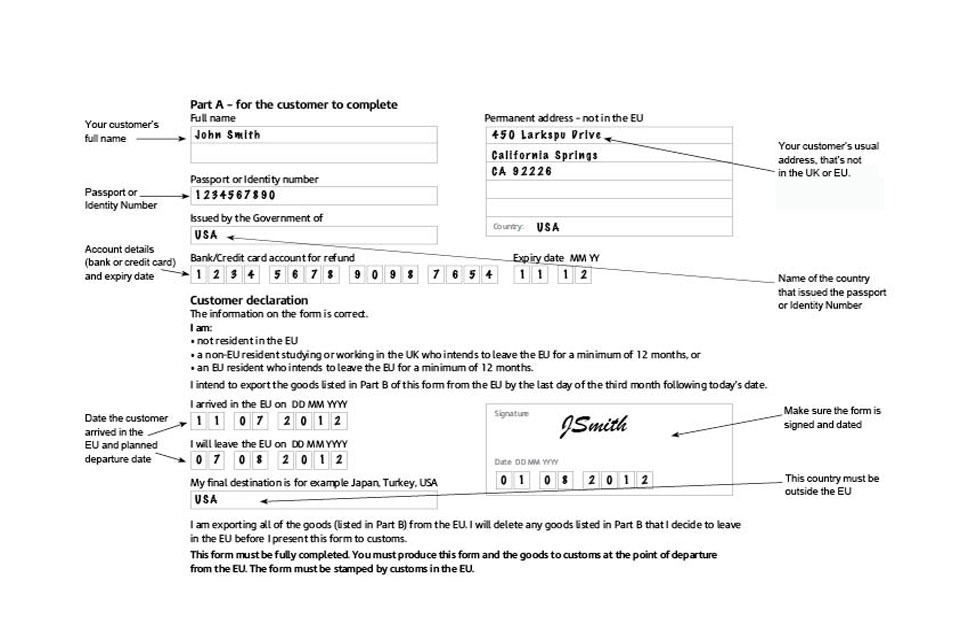

2. Make sure your customer has filled in form VAT407 (or authorised equivalent)

Your customer must complete the form and include:

- their full name

- their permanent address outside the UK or EU - see the list of non-UK and non-EU territories

- their passport or identity number

- the name of the country that issued their passport or identity number

- details of a bank or credit card account - for their refund

- the date they arrived in the UK or EU

- the date they plan to leave the UK or EU

They must also sign and date the form.

Image shows an example of form VAT407.

3. Fill in the form and stamp the till receipt

Complete the retailer’s section of the form, and:

- give a full and accurate description of the goods, price, administration charge and the refund due

- sign and date the form

- mark the till receipt to show that the goods have been included on a VAT refund form, for example, stamp the form ‘VAT export’

Then give your customer a pre-paid envelope to return the refund form.

Your customer can find out about how to claim VAT back on tax-free shopping in the UK (VAT Notice 704/1).

Remind your customer that when they leave the UK or EU, they’ll need to show customs their:

- goods

- receipt

- VAT refund form

You can contact HMRC if you need help with the VAT Retail Export Scheme.

4. VAT: UK and EU countries

Tax-free shopping cannot be used when goods are removed to the countries shown below:

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus (including the British Sovereign base areas of Akrotiri and Dhekelia)

- see section 5 for exceptions - Czech Republic

- Denmark

- Estonia

- Finland

- France (including Monaco)

- Germany

- Greece

- Hungary

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal (including the Azores and Madeira)

- Romania

- Slovakia

- Slovenia

- Spain (including Majorca, Menorca, Ibiza and Formentera)

- Sweden

- United Kingdom (including the Isle of Man)

5. VAT: non-UK and non- EU territories

Your customer can use tax-free shopping when goods are removed to:

- Andorra

- The Canary Islands:

- El Hierro

- Gran Canaria

- Fuerteventura

- La Gomera

- La Palma

- Lanzarote

- Tenerife

The Channel Islands: - Alderney

- Guernsey

- Herm

- Jersey

- Sark

- The United Nations buffer zone in Cyprus and the part of Cyprus to the north of the UN buffer zone, where the Republic of Cyprus does not exercise effective control

- The Danish territories of:

- the Faroe Islands

- Greenland

- The Finnish territory of the Aland Islands

- The French territories of:

- French Guiana

- Guadeloupe

- Martinique

- Miquelon

- Reunion

- St Pierre

- The German territories of:

- Busingen

- the Isle of Heligoland

- Gibraltar

- The Italian territories of:

- Campione d’Italia

- Livigno

- the Italian waters of Lake Lugano

- Liechtenstein

- Mount Athos

- San Marino

- The Spanish territories of:

- Ceuta

- Melilla

- The Vatican City

All other countries not separately listed, for example:

- Australia

- China

- Japan

- Turkey

- USA

6. Export timetable

This table shows you the latest date your customer must leave the UK or EU with the goods, if they want to claim back the VAT.

| Goods bought in | Must be exported by |

|---|---|

| January | 30 April |

| February | 31 May |

| March | 30 June |

| April | 31 July |

| May | 31 August |

| June | 30 September |

| July | 31 October |

| August | 30 November |

| September | 31 December |

| October | 31 January |

| November | 28 or 29 February |

| December | 31 March |