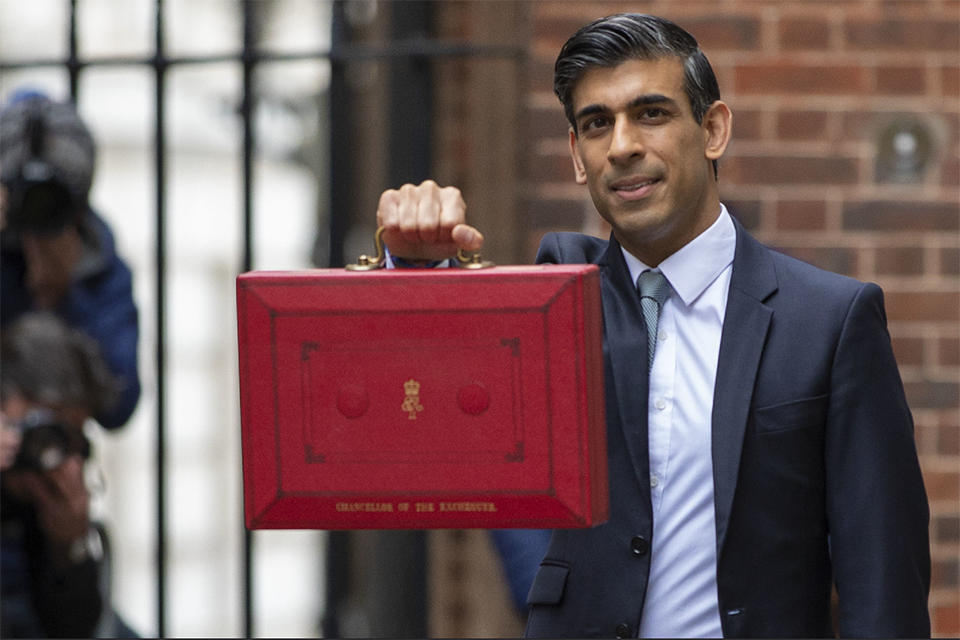

Autumn Budget and Spending Review 2021 Speech

Autumn Budget and Spending Review 2021 speech as delivered by Chancellor Rishi Sunak.

Madam Deputy Speaker,

Employment is up.

Investment is growing.

Public services are improving.

The public finances are stabilising.

And wages are rising.

Today’s Budget delivers a stronger economy for the British people:

Stronger growth, with the UK recovering faster than our major competitors.

Stronger public finances, with our debt under control.

Stronger employment, with fewer people out of work and more people in work.

Growth up, jobs up, and debt down:

Let there be no doubt – our plan is working.

Madam Deputy Speaker,

This Budget is about what this Government is about.

Investment in a more innovative, high-skilled economy.

Because that is the only sustainable path to individual prosperity.

World class public services.

Because these are the common goods from which we all benefit.

Backing business.

Because our future cannot be built by government alone but must come from the imagination and drive of our entrepreneurs.

Help for working families with the cost of living.

Because we will always give people the support they need and the tools to build a better life for themselves. And levelling up.

Because for too long, far too long, the location of your birth has determined too much of your future.

Because the awesome power of opportunity shouldn’t be available only to a wealthy few…

…but be the birth right of every child in an independent and prosperous United Kingdom.

Madam Deputy Speaker,

Today’s Budget does not draw a line under Covid; we have challenging months ahead.

And let me encourage everyone eligible to get their booster jabs as soon as possible.

But today’s Budget does begin the work of preparing for a new economy post Covid.

The Prime Minister’s economy of higher wages, higher skills, and rising productivity.

Of strong public services, vibrant communities and safer streets.

An economy fit for a new age of optimism.

Where the only limit to our potential is the effort we are prepared to put in and the sacrifices we are prepared to make.

That is the stronger economy of the future.

And this Budget is the foundation.

Inflation

Madam Deputy Speaker,

The House will recognise the challenging backdrop of rising inflation.

Let me begin by carefully explaining what is happening in our economy and why.

Inflation in September was 3.1% and is likely to rise further – with the OBR expecting CPI to average 4% over next year.

The majority of this rise in inflation can be explained by two global forces.

First, as economies around the world reopen, demand for goods has increased more quickly than supply chains can meet.

Having been shut down for almost a year, it takes time for factories to scale up production…

…for container ships to move goods to where demand is, for businesses to hire the people they need.

And second, global demand for energy has surged…

…at a time when supplies have already been disrupted, putting strain on prices:

In the year to September, the global wholesale price of oil, coal and gas combined, has more than doubled.

The pressures caused by supply chains and energy prices will take months to ease.

It would be irresponsible for anyone to pretend that we can solve this overnight.

I am in regular communication with finance ministers around the world…

…and it’s clear these are shared global problems…

…neither unique to the UK, nor possible for us to address on our own.

But where the Government can ease these pressures, we will act:

To address the driver shortage, the Transport Secretary is introducing temporary visas…

…tackling testing backlogs, changing cabotage requirements…

…and is today announcing new funding to improve lorry park facilities.

We’ve already suspended the HGV levy until August and I can do more today…

…extending it for a further year until 2023, and freezing Vehicle Excise Duty for heavy goods vehicles.

To help with the cost of living, we’ve introduced a new £500m Household Support Fund…

…and today’s Budget will further support working families.

And in terms of our fiscal policy, we are going to meet our commitments on public services and capital investment…

…but we are going to do so, keeping in mind the need to control inflation.

And, finally, I have written to the Governor of the Bank of England today to reaffirm their remit to achieve low and stable inflation.

And people should be reassured: they have a strong track record in doing so.

I understand people are concerned about global inflation – but they have a Government here at home ready and willing to act.

Growth and Labour Markets

And, Madam Deputy Speaker,

In a period of global uncertainty, you need to work hard to maintain a strong economy and be responsible with the public finances – and that is what we’re doing.

I’m grateful to the OBR for their work, and I’m pleased to say they now expect our recovery to be quicker.

Thanks to this Government’s actions, they forecast the economy to return to its pre-covid level at the turn of the year – earlier than they thought in March.

Growth this year is revised up from 4% to 6.5%. The OBR then expect the economy to grow by 6% in 2022, and 2.1%, 1.3% and 1.6% over the next three years.

In July last year, at the height of the pandemic, unemployment was expected to peak at 12%.

Today, the OBR expect unemployment to peak at 5.2%.

That means over 2 million fewer people out of work than previously feared.

And wages are rising: Compared to February 2020, they have grown in real terms by almost three and a half per cent.

I can confirm for the House that the OBR’s forecast for business investment has been revised up over the next five years.

And because of the actions we took to support our economy…

…we have been more successful than previously feared in preventing the long-term economic damage of covid.

The OBR have today revised down their scarring assumption from 3% to 2%.

In the depths of the worst economic crisis on record we set out a Plan for Jobs.

A plan that was backed by business groups and trade bodies.

A plan that has helped millions of people and saved millions of jobs.

A plan that the OBR have today described as: “remarkably successful”.

Madam Deputy Speaker,

Today’s forecasts confirm beyond doubt…our Plan for Jobs is working.

Public Finances

And, Madam Deputy Speaker,

Disruption in the global economy highlights the importance of strong public finances.

Coronavirus left us with borrowing higher than at any time since the Second World War.

As the Prime Minister reminded us in his conference speech:

Higher borrowing today is just higher interest rates and even higher taxes tomorrow.

So we need to strengthen our public finances so that when the next crisis comes, we have the fiscal space to act. Today I am publishing a new Charter for Budget Responsibility.

The Charter sets out two fiscal rules which will keep this government on the path of discipline and responsibility. First, underlying public sector net debt…

…excluding the impact of the Bank of England…

…must, as a percentage of GDP, be falling.

Second, in normal times the state should only borrow to invest in our future growth and prosperity.

Everyday spending must be paid for through taxation.

Both rules must be met by the third year of every forecast period…

…giving us the flexibility to respond to crises while credibly keeping our public finances under control.

These rules are supplemented by targets to spend up to 3% of GDP on capital investment…

…and keep welfare spending on a sustainable path.

Madam Deputy Speaker,

The House will be asked to vote on our Charter, giving Members a simple choice.

To abandon our fiscal anchor and leave our economy adrift with reckless unfunded pledges.

Or to vote for what we on this side of the House know is the right course:

Sound public finances and a stronger economy for the British people.

Madam Deputy Speaker,

Important as the Charter is, our credibility comes as much from what we do as what we say.

So I’m pleased to tell the House that because our plan is delivering a stronger economy…

…and because we’ve taken tough but responsible decisions on public finances…

…the OBR report today that all our fiscal rules have been met.

Underlying debt is forecast to be 85.2% of GDP this year, then 85.4% in 2022-23, before peaking at 85.7% in 2023-24.

It then falls in the final three years of the forecast from 85.1% to 83.3%.

Borrowing as a percentage of GDP is forecast to fall in every single year.

From 7.9% this year to 3.3% next, then 2.4%, 1.7%, 1.7% and 1.5% in the following years.

Borrowing down, debt down; proving once again it is the Conservatives – and only the Conservatives - who can be trusted with taxpayers’ money.

Fiscal Strategy

Madam Deputy Speaker,

I have made four fiscal judgements in this Budget.

First, we will meet our fiscal rules with a margin to protect ourselves against economic risks.

That is the responsible decision at a time of increasing global economic uncertainty…

…when our public finances are twice as sensitive to changes in interest rates as they were before the pandemic….

…and six times as sensitive as they were before the financial crisis.

Just a one percentage point increase in inflation and interest rates would cost us around £23bn.

My second judgement today is to continue supporting working families…

Third, as well as helping people at home, our improving fiscal position means we will meet our obligations to the world’s poorest.

I told the House that when we met our fiscal tests, we would return to spending 0.7 per cent of our national income on overseas aid.

Some people said this was a trick or a device.

I told this House – it was no such thing.

And based on the tests I set out, today’s forecasts show that we are, in fact…

…scheduled to return to 0.7 in 2024-25 – before the end of the Parliament.

And Madam Deputy Speaker, my fourth fiscal judgement is this:

Today’s Budget increases total departmental spending over this Parliament by £150bn.

That’s the largest increase this century, with spending growing by 3.8% a year in real terms.

As a result of this Spending Review, and contrary to speculation…

…there will be a real terms rise in overall spending for every single department.

And public sector net investment as a share of GDP will be at the highest sustained level for nearly half a century. If anyone still doubts it, today’s Budget confirms:

The Conservatives are the real party of public services.

Public Services

Madam Deputy Speaker,

Our stronger economy lays the foundation for everything we want to achieve in today’s Budget:

World-class public services and more investment in our future growth.

Before I turn to the details, I’d like to thank My RHF the Chief Secretary.

Completing the Spending Review in such challenging circumstances was a tall order – and thankfully we had just the man for the job.

Madam Deputy Speaker,

At the start of this Parliament, resource spending on healthcare was £133bn.

Today’s Spending Review confirms that by the end of this Parliament, it will increase by £44bn to over £177bn.

And the extra revenue we’re now forecast to raise from the Health and Social Care Levy is going direct to the NHS and social care as promised.

The health capital budget will be the largest since 2010.

Record investment in health R&D, including better new-born screening…

…as campaigned for by the Member for the Cities of London and Westminster.

40 new hospitals.

70 hospital upgrades.

More operating theatres to tackle the backlog.

And 100 community diagnostic centres.

All staffed by a bigger, better-trained workforce, with 50,000 more nurses and 50 million more primary care appointments.

As well as funding to deliver the Prime Minister’s historic reforms to social care…

…we’re providing local government with new grant funding over the next three years of £4.8bn…

…the largest increase in core funding for over a decade.

And we’re investing more in housing and home ownership, too.

With a multi-year housing settlement totalling nearly £24bn.

£11.5bn to build up to 180,000 new affordable homes – the largest cash investment in a decade, 20% larger than the previous programme.

And we’re investing an extra £1.8 billion:

Enough to bring 1,500 hectares of Brownfield land into use…

…meet our commitment to invest £10bn in new housing…

…and unlock 1 million new homes…

We’re also confirming £5bn to remove unsafe cladding from the highest risk buildings…

…partly funded by the Residential Property Developers Tax, which I can confirm will be levied on developers with profits over £25m at a rate of 4%.

And we’ve also already reduced rough sleeping by over a third, but we will go further…

…with £640m a year for rough sleeping and homelessness…

…an 85% increase in funding compared to 2019.

Madam Deputy Speaker,

Today’s Budget funds our ambition to recruit 20,000 new police officers;

Provides an extra £2.2bn for courts, prisons and probation services, including £0.5bn to reduce the courts backlogs…

Pays for programmes to tackle neighbourhood crime, reoffending, County Lines…

…violence against women and girls, victims’ services, and improved responses to rape cases.

And over the next three years, commits £3.8bn to the largest prison-building programme in a generation.

Madam Deputy Speaker,

All governments should aspire to provide greater life chances for future generations.

But few governments can match our ambition.

So let me now turn to what this Budget does to support children.

The evidence is compelling that the first 1,001 days of a child’s life are the most important.

My Right Honourable Friend, the Member for South Northamptonshire has recognised this with her inspirational report.

And we are responding today with £300m for:

A Start for Life offer for families;

High-quality parenting programmes;

Tailored services to help with perinatal mental health;

And, I’m pleased to tell the Member for Congleton, funding to create a network of Family Hubs around the country too.

To improve the quality of childcare, we’re going to pay providers more – with today’s Spending Review providing an extra £170m by 2024-25.

We’re confirming £150m to support training and development for the entire early years workforce.

To help up to 300,000 more families facing multiple needs, we’re investing an extra £200m in the Supporting Families programme.

And we will provide over £200m a year to continue the holiday activity and food programme.

Today’s Spending Review also delivers our commitment to schools, with an extra £4.7bn by 2024-25.

Which combined with the ambitious plans we announced at Spending Review 2019…

…will restore per pupil funding to 2010 levels in real terms…

…equivalent to a cash increase for every pupil of more than £1,500.

And for children with special educational needs and disabilities…

…we are more than tripling the amount we invest to create 30,000 new school places.

And we know that the pandemic caused significant disruption to children’s learning.

We’ve already announced £3.1bn to help education recovery.

Today, as promised by the Prime Minister and Education Secretary, we will go further – with just under £2bn of new funding to help schools and colleges.

Bringing this Government’s total support for education recovery to almost £5bn.

Levelling Up

Madam Deputy Speaker,

As we level up public services, we’re also levelling up communities - restoring the pride people feel in the places they call home.

To do that, we’re providing £560m for youth services, enough to fund up to 300 youth clubs across the country.

Over £200m to build or transform up to 8,000 state-of-the-art community football pitches across the UK.

Funding to turn over 100 areas of derelict land into new ‘pocket parks’.

And I’m allocating the first round of bids from the Levelling Up Fund…

…£1.7bn to invest in the infrastructure of everyday life in over 100 local areas.

With £170m in Scotland, £120m in Wales, and £50m in Northern Ireland…

…more than their Barnett shares…

…this will benefit the whole United Kingdom.

We’re backing projects in:

Aberdeen.

Bury.

Burnley.

Lewes. Clwyd South.

And not one, not two, but three successful projects for the great city of Stoke-on-Trent.

But that’s not all.

We’re also going to fund projects in Ashton under Lyne, South Leicester, Sunderland, Doncaster, and West Leeds. Madam Deputy Speaker,

We’re so committed to levelling up – we’re even levelling up the Opposition front bench.

Creative Industries

Madam Deputy Speaker,

Levelling up is also about protecting our unique culture and heritage.

The British Museum; Tate Liverpool; the York Railway Museum…

…we’re investing £850m to protect museums, galleries, libraries, and local culture.

And thanks to the Culture Secretary, over 100 regional museums and libraries will be renovated, restored and revived.

And she’s secured up to £2m to start work on a new Beatles attraction on the Liverpool waterfront.

We’re also going to review our museum freedoms.

And make our creative tax reliefs more generous.

On current plans, the tax relief for museums and galleries is due to end in March next year…

…just as exhibitions are starting to tour again – so I’ve decided to extend it, for two years, to March 2024.

And to support theatres, orchestras, museums and galleries to recover from covid…

…the tax reliefs for all those sectors – from today until April 2023 – will be doubled.

And they won’t return to the normal rate until April 2024.

That’s a tax relief for culture worth almost quarter of a billion pounds.

Union

And Madam Deputy Speaker, this is a Budget for the whole United Kingdom.

Through the Barnett formula, today’s decisions increase Scottish Government funding, in each year…

…by an average of £4.6bn, Welsh Government funding by £2.5bn, and £1.6bn for the Northern Ireland Executive.

This delivers, in real terms, the largest block grants for the devolved administrations since the devolution settlements of 1998.

The whole of the United Kingdom will benefit from the UK Shared Prosperity Fund, and over time we will ramp up funding…

…so that total domestic UK-wide funding will match EU receipts, averaging around £1.5bn a year.

And we will fund projects across the UK, including:

Funding for the Extreme E race in Scotland – the 2022 Hebrides X-Prix.

Accelerating funding for the Cardiff City Region Deal in Wales.

And funding in Northern Ireland for community cohesion.

And whilst today demonstrates the indisputable fiscal benefit of being part of the United Kingdom.

This is and always will be secondary to the simple truth that we are bound together by more than transactional benefit.

It is our collective history, our culture and our security.

We are, and always will be, one family.

One United Kingdom.

Outcomes/ Value for Money

Madam Deputy Speaker,

Whilst today’s Budget delivers historically high levels of public spending.

Its success will be measured not by the billions we spend but by the outcomes we achieve and the difference we make to people’s lives.

The budgets are set; the plans are in place; the task is clear.

Now we must deliver – because this isn’t the government’s money, it’s taxpayers’ money.

Investment in Growth and Productivity

Madam Deputy Speaker,

Our stronger economy allows us to fund world class public services - the people’s priority.

But over the long-term the only way to pay for higher spending is economic growth.

And if we want to see higher growth, we’ve got to tackle the problem that’s been holding this country back for far too long:

Our uneven economic geography.

As we come out of the worst economic shock we’ve ever seen, we’ve got a choice.

To retrench - or to invest.

This Government chooses to invest:

To invest in our economic infrastructure.

To invest in innovation.

To invest in skills.

To invest in a Plan for Growth that builds a stronger economy for the future.

That’s what this Budget is about and that’s what this Government is about.

Infrastructure

Madam Deputy Speaker,

Infrastructure connects our country, drives productivity and levels up.

That’s why our National Infrastructure Strategy invests, in economic infrastructure like roads, railways, broadband and mobile, over £130bn.

To connect our towns and cities, we’re investing £21bn on roads and £46bn on railways.

Our Integrated Rail Plan will be published soon, dramatically improving journey times between our towns and cities.

But today, we’re providing £5.7bn for London-style transport settlements in:

Greater Manchester. Liverpool City Region. The Tees Valley. South Yorkshire. West Yorkshire. West Midlands. And the West of England.

And we’re helping local transport, everywhere:

With £2.6bn for a long-term pipeline of over 50 local roads upgrades…

Over £5bn for local roads maintenance, enough to fill 1 million more potholes a year…

And funding for buses, cycling and walking totalling more than £5bn.

The Prime Minister promised an infrastructure revolution – this Budget delivers an infrastructure revolution.

Innovation and Ideas

Madam Deputy Speaker,

Investment in our infrastructure is just the first step.

We need to do what the people of this country have always done…

…invent, discover, and create the ideas and technologies that will change the world.

So we will also invest more in innovation.

The UK is already a world-leader.

With less than 1% of the world’s population, we have 4 of the world’s top 20 universities;

14% of the world’s most impactful research;

And the second most Nobel Laureates.

We want to go further.

I can confirm we will maintain our target to increase R&D investment to £22bn.

But in order to get there, and deliver on our other priorities, we’ll reach the target in 2026-27…

…spending, by the end of this Parliament, £20bn a year on R&D.

That’s a cash increase of 50%.

The fastest increase ever.

And I can confirm for the House that this £20bn is in addition to the cost of our R&D tax reliefs.

Combined with those tax reliefs, total public investment in R&D is increasing…

…from 0.7% of GDP in 2018 to 1.1% of GDP by the end of the Parliament.

How does 1.1% compare internationally?

Well, the latest available data shows an OECD average of just 0.7%.

Germany, investing 0.9%.

France, 1%.

And the United States, just 0.7%.

This unprecedented funding will:

Increase core science funding to £5.9bn per year by 2024-25, a cash increase of 37%.

Meet the full costs of associating with Horizon Europe;

Establish the new Advanced Research and Invention Agency with £800m by 2025-26.

And strengthen our focus on late-stage innovation, increasing Innovate UK’s annual core budget to £1bn…

…double what it was at the start of the Parliament.

Net Zero

Madam Deputy Speaker,

There’s more to becoming a science superpower than just what the Government spends on R&D.

Our ambitious Net Zero strategy is also an innovation strategy, investing £30bn to create the new, green industries of the future.

We’ve just issued our second Green Bond, making us the third-largest issuer of sovereign green bonds anywhere in the world.

London last week was named the best place in the world for green finance.

And on Monday, the new UK Infrastructure Bank announced its first ever investment:

£107m to support offshore wind in Teesside.

And to build on this work, one week today I’ll be hosting global finance ministers and businesses at COP26.

Enterprise

And, Madam Deputy Speaker,

Innovation comes from the imagination, drive and risk-taking of business.

That’s why we’ve launched Help to Grow, to turbocharge SME productivity.

Started a new co-investment venture capital fund - Future Fund: Breakthrough.

It’s why I’m announcing today that we will consult on further changes to the regulatory charge cap for pensions schemes…

…unlocking institutional investment while protecting savers.

Its why we’re introducing a new £1.4bn Global Britain Investment Fund…

…supporting transformative economic activity, in our world-leading sectors like Life Sciences.

And it’s why today’s Budget increases the British Business Banks regional financing programmes to £1.6bn…

…expanding their coverage and helping innovative businesses get access to the finance they need, across the whole United Kingdom.

Migration

Madam Deputy Speaker,

A third of our science Nobel Laureates have been immigrants.

Half of our fastest growing companies have a foreign-born founder.

So, an economy built on innovation must be open and attractive to the best and brightest minds.

Thanks to our brilliant Home Secretary, today’s Budget confirms the eligibility criteria for our new Scale-Up Visa…

…making it quicker and easier for fast-growing businesses to bring in highly skilled individuals.

And the Trade Secretary’s new Global Talent Network, launching initially in the Bay Area, Boston and Bangalore…

…will identify, attract and relocate the best global talent in key science and tech sectors.

All part of our plan to make our visa system for international talent the most competitive in the world.

R&D Tax Credits

Madam Deputy Speaker,

If we want greater private sector innovation, we need to make our research and development tax reliefs fit for purpose.

The latest figures show the UK has the second highest spending on R&D tax reliefs in the OECD.

Yet it’s not working as well as it should: UK business investment in R&D is less than half the OECD average.

We’ve reviewed the reliefs and identified two issues we’re solving today.

First, the reliefs need to reflect how businesses conduct research in the modern world.

So, as many businesses have called for, I’m expanding the scope of the reliefs to include cloud computing and data costs.

The second problem is this:

Companies claimed UK tax relief on £48bn of R&D spending.

Yet UK business investment was around half of that, at just £26bn.

We’re subsidising billions of pounds of R&D that isn’t even happening here in the United Kingdom.

That’s unfair on British taxpayers.

And it puts us out of step with places like Australia, Canada, Hong Kong, Singapore, Switzerland and the USA…

…who have all focused their R&D tax reliefs on domestic activity.

So from April 2023, we’re going to do the same, and incentivise greater investment here at home.

So, Madam Deputy Speaker:

£22bn investment in R&D.

The Net Zero strategy.

The Future Fund.

Help to Grow.

More regional finance.

Unlocking institutional capital.

A more competitive visa system.

And a modernised R&D tax credits regime . Enough action to prove the hypothesis:

We are making this country a science and technology superpower.

Skills

And, Madam Deputy Speaker,

As well as investing in infrastructure and innovation, there is one further part of our plan for growth that is crucial:

Providing a world-class education to all our people.

Higher skills lead to higher regional productivity.

And higher productivity leads to higher wages.

With 80% of the UK’s 2030 workforce already in work, our future success depends not just on the schooling we give our children but the lifelong learning we offer to adults.

We’ve already done a lot.

Our Plan for Jobs invested in apprenticeships, traineeships, and the Kickstart scheme.

But we need to go further.

Today’s Budget invests in the most wide-ranging skills agenda this country has seen in decades.

We’re increasing skills spending, over the Parliament by £3.8bn - an increase of 42%.

We’re expanding T Levels.

Building Institutes of Technology.

Rolling out the Prime Minister’s lifetime skills guarantee.

Upgrading our FE college estate.

Quadrupling the number of places on our skills bootcamps.

And significantly increasing funding for apprenticeships.

We’re also going to tackle a tragic fact:

Millions of adults in England have numeracy skills lower than those expected of a nine-year-old.

According to the leading charity National Numeracy…

…this costs individuals with poor numeracy up to £1,600 a year in lost earnings.

People with poor numeracy skills are more than twice as likely to be unemployed as their peers.

So, today I can announce a new, UK-wide numeracy programme: Multiply.

With £560m, Multiply will improve basic maths skills…

…and help to change people’s lives across the whole United Kingdom.

So, Madam Deputy Speaker,

We’re building our infrastructure with new roads, railways and broadband…

Cementing our status as a science and technology superpower…

And strengthening the skills of our people, the country’s greatest asset.

That’s a real plan for growth;

That’s how this Government is building a stronger economy for the British people.

Tax reforms for investment

Madam Deputy Speaker,

World class public services are the people’s priority.

Investment in infrastructure, innovation and skills will create the growth we need to pay for them.

But as Conservatives, we know that Government action alone won’t be enough to create a stronger economy.

We want this country to be the most exciting and dynamic place in the world for business.

And now that we’re left the EU, we have the freedom to do things differently and deliver a simpler, fairer tax system.

Tonnage Tax

I want to begin with one of our smallest taxes – but a tax which plays an important role in one of our pre-eminent industries: shipping.

Now that we’ve left the EU, today we start reforming our Tonnage Tax regime to make it simpler and more competitive.

And we’re also making it fairer for UK taxpayers.

When we were in the old EU system, ships in Tonnage Tax regime were required to fly the flag of an EU state. But that doesn’t make sense for an independent nation.

So I can announce today that our Tonnage Tax will – for the first time ever…

…reward companies for adopting the UK’s merchant shipping flag, the Red Ensign.

That is entirely fitting for a country with such a proud maritime history as ours.

Air Passenger Duty

Let me turn now to Air Passenger Duty.

Right now, people pay more for return flights within and between the four nations of the United Kingdom than they do when flying home from abroad.

We used to have a return-leg exemption for domestic flights but were required to remove it in 2001.

But today I can announce that flights between airports in England, Scotland, Wales and Northern Ireland will…

…from April 2023, be subject to a new lower rate of Air Passenger Duty.

This will help cut the cost of living, with 9 million passengers seeing their duty cut by half.

It will bring people together across the UK.

And because they tend to have a greater proportion of domestic passengers…

…it is a boost to regional airports like Aberdeen, Belfast, Inverness and Southampton.

Airports are major regional employers – so to help them get through the winter…

…I’m also extending our support for English airports for a further six months.

We’re also making changes to reduce carbon emissions from aviation.

Most emissions come from international rather than domestic aviation.

So I’m introducing, from April 2023, a new ultra long haul band in Air Passenger Duty…

…covering flights of over 5,500 miles, with an economy rate of £91.

Less than 5% of passengers will pay more; but those who fly furthest will pay the most.

Corporation Tax

Madam Deputy Speaker,

Our approach to corporate taxation strikes a responsible balance between funding public services and encouraging the investment we need for a stronger economy.

At the March Budget, we took the difficult but necessary decision to increase the rate of Corporation Tax to 25% from 2023…

…still the lowest rate in the G7 and the fifth lowest rate in the G20.

Alongside, I introduced the new Super Deduction - the biggest business tax cut in modern British history.

And extended, to the end of this year, the Annual Investment Allowance at its higher level of £1m.

Now is not the time to remove tax breaks on investment.

So I can confirm today that the £1m Annual Investment Allowance will not end in December as planned… …it will be extended all the way to March 2023.

I also said in March that I would review the Bank Surcharge within Corporation Tax, to maintain the competitiveness of our financial services.

We will retain a surcharge of 3%.

The overall for corporation tax rate on banks will, in 2023, increase from 27% to 28%.

And will remain higher than the rate paid by other companies.

Small challenger banks are improving banking competition, which is good for the sector and good for consumers. So to help them, I will also raise the annual allowance to £100m.

Business Rates

Madam Deputy Speaker,

Our manifesto promised to review business rates.

We’re publishing our conclusions today.

Before I set out our plans, let me say this:

We on this side of the House are clear that reckless, unfunded promises to abolish a tax which raises £25bn every year are completely irresponsible.

It would be wrong to find £25bn in extra borrowing, cuts to public services, or tax rises elsewhere, so we will retain business rates.

But with key reforms to ease the burden and create stronger high streets.

First, we will make the business rates system fairer and timelier with more frequent revaluations every three years. The new revaluation cycle will be delivered from 2023.

Second, as called for by the Federation of Small Businesses and the British Property Federation…

…we’re introducing a new investment relief to encourage businesses to adopt green technologies like solar panels.

And I’m announcing today that we’ll accept the CBI and the British Retail Consortium’s recommendation… …to introduce a new ‘business rates improvement relief’.

From 2023, every single business will be able to make property improvements – and, for 12 months, pay no extra business rates.

That means a hotel adding extra rooms;

A manufacturer expanding their factory;

An office adding new air conditioning, CCTV or bike shelters;

Will all pay no extra rates.

Together with the new green investment relief, we’re introducing investment incentives totalling £750m.

This will make a difference, but without action millions of businesses would see their tax bills going up next year because of inflation.

I want to help those business right now, so our third step, is that next year’s planned increase in the multiplier will be cancelled.

That’s a tax cut for business worth, over the next five years, £4.6bn.

And I have one final measure to help those businesses hardest hit by the pandemic.

I’m announcing today, for one year, a new 50% business rates discount for businesses in the retail, hospitality, and leisure sectors.

Pubs, music venues, cinemas, restaurants, hotels, theatres, and gyms.

Any eligible business can claim a discount on their bills of 50%, up to a maximum of £110,000.

That is a business tax cut worth almost £1.7bn.

Together with Small Business Rates Relief, this means that over 90% of all retail, hospitality and leisure businesses will see a discount of at least 50%.

Apart from the Covid reliefs, this is the biggest single-year tax cut to business rates in 30 years.

Madam Deputy Speaker, taken together, today’s Budget cuts business rates by £7bn.

Madam Deputy Speaker,

We’re unleashing the dynamism and creativity of British businesses with a simpler, fairer, more competitive tax system.

The biggest business tax cut in modern British history.

The biggest single-year cut to business rates for 30 years.

A £1m investment allowance.

Tonnage tax – reformed. Air passenger duty – cut.

That is the way to back business and build a stronger economy.

Alcohol Duties

Madam Deputy Speaker,

Let me turn now to alcohol duties.

First introduced in 1643 to help pay for the Civil War, our alcohol duty system is outdated, complex and full of historical anomalies.

The Institute of Fiscal Studies have called it, in their words: “a mess”.

The Institute of Economic Affairs said it: “defies common sense”.

And the World Health Organisation have warned that countries like the UK which follow the EU rules are, and I quote:

“Unable to implement tax systems that are optimal from the perspective of public health”.

So, Madam Deputy Speaker,

Today, we are taking advantage of leaving the EU to announce the most radical simplification of alcohol duties for over 140 years.

We’re taking five steps today to create a system that is simpler, fairer, and healthier.

First, to radically simplify the system, we are slashing the number of main duty rates from fifteen to just six.

Our new system will be designed around a common-sense principle: the stronger the drink, the higher the rate.

This means that some drinks, like stronger red wines, fortified wines, or high-strength ‘white ciders’…

…will see a small increase in their rates because they are currently undertaxed given their strength.

That’s the right thing to do, and it will help end the era of cheap, high-strength drinks which can harm public health and enable problem drinking.

And because this is a more rational system, the converse is also true:

Many lower alcohol drinks are currently overtaxed - and have been for many decades.

Rosé, fruit ciders, liqueurs, lower strength beers and wines – today’s changes mean they will pay less.

The second step I’m taking today will encourage small, innovative craft producers:

I’m announcing proposals for a new Small Producer Relief.

This will extend the principle of the Small Brewers Relief to include – for the first time ever…

…small cidermakers and other producers making alcoholic drinks of less than 8.5% ABV.

Third, I’m going to modernise the system to reflect the way that people drink today.

Over the last decade, consumption of sparkling wines like prosecco has doubled.

English sparkling wine alone has increased almost tenfold.

It’s clear they are no longer the preserve of wealthy elites.

And they’re no stronger than still wines.

So I’m going to end the irrational duty premium of 28% that they currently pay.

Sparkling wines – wherever they are produced – will now pay the same duty as still wines of equivalent strength.

And because growing conditions in the UK typically favour lower strength and sparkling wines…

…this means English and Welsh wines, compared with stronger imported wines, will now pay less.

Sales of fruit cider have increased from one in a thousand ciders sold in 2005 to one in four today.

But they can pay two or three times as much duty as cider that is made with apples or pears.

So I’m cutting duty on them too.

The fourth step I’m taking today will directly support the home of British community life for centuries: our pubs.

Even before the pandemic, pubs were struggling: between 2000 and 2019, consumption in the on-trade fell by 40%.

And many public health bodies recognise that pubs are often safer drinking environments than being at home.

So, as the Members for Dudley South and North West Durham will agree, a fairer, healthier system supports pubs.

So, I can announce today: Draught Relief.

Draught Relief will apply a new, lower rate of duty on draught beer and cider.

It will apply to drinks served from draught containers over 40 litres.

It will particularly benefit community pubs who do 75% of their trade on draught.

And let me tell the House the new rate: Draught Relief will cut duty by 5%.

That is the biggest cut to cider duty since 1923.

The biggest cut to fruit ciders in a generation.

The biggest cut to beer duty for 50 years.

This is not temporary…

It’s a long-term investment in British pubs of £100m a year.

And a permanent cut in the cost of a pint of 3p.

Madam Deputy Speaker,

These much-needed reforms will come into effect in February 2023.

But I want to help the hospitality industry right now.

So for my final announcement on alcohol duty today, I can confirm that the planned increase in duty…

…on spirits like Scotch Whisky, wine, cider and beer, will all, from midnight tonight, be cancelled.

That’s a tax cut worth £3bn.

Madam Deputy Speaker,

Our reforms make the alcohol duty system simpler, fairer and healthier;

They help with the cost of living while tackling problem drinking;

They support innovative entrepreneurs and craft producers;

They back pubs and public health;

And they are only possible because we’ve left the EU.

Helping Families with the Cost of Living

Madam Deputy Speaker,

World class public services.

Investment in infrastructure, innovation, and skills.

Simpler, fairer taxes to support businesses and consumers.

All built on the foundation of a stronger economy and responsible public finances.

That is our vision for the future and that is what this Budget delivers.

And this Budget also supports working families.

Fuel Duty

Madam Deputy Speaker,

With fuel prices at the highest level in 8 years…

I’m not prepared to add to the squeeze on families and small businesses.

So I can confirm today: the planned rise in fuel duty will be cancelled.

That’s a saving over the next five years of nearly £8bn.

Compared to pre-2010 plans, today’s freeze means the average tank of fuel will cost…

…around £15 less per car; £30 less for vans; £130 less for HGVs.

After 12 consecutive years of frozen rates, the average car driver will now save a total of £1,900.

Pay

Madam Deputy Speaker,

I can announce today that public sector workers will see fair and affordable pay rises across the whole Spending Review period…

…as we return to the normal, independent pay-setting process.

And I can take action to help the lowest paid as well.

It was a Conservative government that introduced the National Living Wage in 2016.

A Conservative government that, according to statistics published just yesterday…

…has overseen the proportion of people in low-paid work falling to its lowest level since 1997.

And it is a Conservative government that is increasing the wage floor again today.

The independent Low Pay Commission brings together economists, business groups, and trade unions.

The Government is accepting their recommendation to increase the National Living Wage next year by 6.6%, to £9.50 an hour.

For a full-time worker, that’s a pay rise worth over £1,000.

It will benefit over 2m of the lowest-paid workers in the country.

It’s broadly consistent with previous increases and keeps us on track for our target of two thirds of median earnings by 2024.

And it is a major commitment to the high-wage, high-skill, high-productivity economy of the future.

Peroration/ UC Taper

Madam Deputy Speaker,

As we build this stronger economy, we’re doing so at the end of an extraordinary 18 months.

Covid wasn’t just a public health challenge.

It wasn’t just an economic challenge.

It was a moral challenge too.

We had to show we could pull together as a country, and we did.

We had to put aside questions of ideology and orthodoxy to do whatever it took to care for our people and each other, and we did.

There’s a different kind of moral dimension to the economic challenge we face now.

Last year, the state grew to be over half the size of the total economy.

Taxes are rising to their highest level as a % of GDP since the 1950s.

I don’t like it, but I cannot apologise for it – it’s the result of the unprecedented crisis we faced and the extraordinary action we took in response.

But now, we have a choice.

Do we want to live in a country where the response to every question is: “what is the government going to do about it”?

Where every time prices rise, every time a company gets in trouble, every time some new challenge emerges, the answer is always: the taxpayer must pay?

Or do we choose to recognise that Government has limits. That Government should have limits.

If this seems a controversial statement to make… then I’m all the more glad for saying it… because that means it needed saying… and it is what we believe.

There’s a reason we talk about the importance of family, community, and personal responsibility.

Not because these are an alternative to the market or the state…it’s because they are more important than the market or the state.

The moments that make life worth living aren’t created by government, aren’t announced by government, aren’t granted by government.

They come from us as people… our choices… our sacrifices… our efforts…

And, we believe people should keep more of the rewards of those efforts.

Yes, we’ve taken some corrective action to fund the NHS and get our debt under control.

But as we look towards the future, I want to say this simple thing to the House and the British people:

My goal is to reduce taxes.

By the end of this Parliament, I want taxes to be going down not up.

I want this to be a society that rewards energy, ingenuity and inventiveness.

A society that rewards work.

That is what we believe on this side of the House.

That is my mission over the remainder of this Parliament.

And the final announcement in today’s Budget takes a first step.

Madam Deputy Speaker,

For many of the lowest-paid in society, there is a hidden tax on work.

The Universal Credit Taper withdraws support as people work more hours.

The rate is currently 63%, so for every extra £1 someone earns, their Universal Credit is reduced by 63p.

Let us be in no doubt: this is a tax on work.

And a high rate of tax at that.

Organisations as varied as the Trades Union Congress, the Joseph Rowntree Foundation…

…the Resolution Foundation, the Centre for Policy Studies…

…and the Centre for Social Justice have all said it’s too high.

So, to make sure work pays, and help some of the lowest income families in the country keep more of their hard-earned money…

…I have decided to cut this Rate, not by 1%, not by 2% - but by 8%.

This is a tax on working people – and I’m cutting it from 63 to 55%.

The rate originally envisaged by My Right Honourable Friend the Member for Chingford.

And because I’m also increasing the Work Allowances by £500…

…this is a tax cut next year worth over £2bn.

Nearly 2 million families will keep, on average, an extra £1,000 a year.

Changes like this normally take effect at the start of the new tax year in April.

But we want to help people right now.

So we’ll introduce this within weeks, and no later than December 1st.

Let me tell the House what these changes mean:

A single mother of two, renting, and working full-time on the National Living Wage will be better off by around £1,200.

And a couple, renting a home with their two children…

…one working full-time, the other working part-time…

…will be better off, every single year, by £1,800.

This is a £2bn tax cut for the lowest-paid workers in the country.

It supports working families.

It helps with the cost of living.

And it rewards work.

So, Madam Deputy Speaker,

Fuel duty – cut.

Air passenger duty – cut.

Alcohol duty – cut.

The biggest cut to business rates in 30 years.

Growth up.

Jobs up.

Wages up.

Public finances back in a better place.

More investment in infrastructure, innovation and skills.

A pay rise for over 2 million people.

And a £2bn tax cut for the lowest paid.

This Budget helps with the cost of living.

This Budget levels up to a higher-wage, higher-skill, higher-productivity economy.

This Budget builds a stronger economy for the British people.

And I commend it to the House.