Asset recovery annual statistical bulletin: background information note

Published 8 September 2022

Applies to England, Northern Ireland and Wales

This note provides useful legislative background and definitions to enhance the statistics published in the Annual Statistical Bulletin for Asset Recovery.

This report is regularly reviewed and updated annually to reflect additions, and changes that are relevant to the statistics.

Statistical information on the Bulletin can be found in the accompanying Methodology and Quality Data Report and Background Quality Report.

1. Legislation on asset recovery

An overview of the statutory powers used by law enforcement agencies under the two main systems for asset recovery are outlined below.

1.1 Legislative background on the Proceeds of Crime Act

The Proceeds of Crime Act (POCA) contains the statutory framework used to deprive from criminals the benefit of their criminal conduct, and to recover property obtained by, or intended for use in, unlawful conduct.

1.2 Main systems for asset recovery

The asset recovery powers in POCA to deprive and recover the proceeds of crime or other property connected to criminal activity can be applied through criminal confiscation, forfeiture, civil recovery, and taxation.

Part 2 (and Part 3 for Northern Ireland) of POCA makes provision for the confiscation of a person’s benefit from criminal conduct, following a criminal conviction. If the relevant statutory conditions are satisfied, the court must decide the recoverable amount for that person and make an order (a Confiscation Order) requiring him or her to pay that amount.

Part 2 (and likewise Part 3 for Northern Ireland) also contains a number of powers to restrain, and/or to seize and detain property. These powers are available to prevent a suspect or defendant making certain property unavailable for satisfying a confiscation that has been, or may be, made against him or her.

Civil Powers

-

Part 5 of POCA contains powers that enable the seizure, detention and forfeiture of cash or certain listed assets, as well as powers for the freezing and forfeiture of monies in relevant accounts, which are determined to be or to represent property obtained through unlawful conduct or property intended for use by any person in unlawful conduct

-

Part 5 also contains Civil Recovery Order powers to enable an enforcement authority to recover property which is determined to be or to represent property obtained through unlawful conduct. Applications are made in civil proceedings before the High Court

-

The National Crime Agency (NCA) and HM Revenue and Customs (HMRC), have powers to tax income using revenue powers, where there are reasonable grounds to suspect that the income is the proceeds of crime

1.3 Changes introduced under the Criminal Finances Act (CFA) 2017

Legislative changes introduced to amend the POCA legislation include the provisions described below.

The Criminal Finances Act 2017 (CFA) amended POCA, most notably introducing two new forfeiture powers and an investigative tool to give Law Enforcement (LE) and partners new powers for tracing and recovering: the proceeds of crime; property obtained through unlawful conduct; or property intended for use in unlawful conduct. The prominent powers which came into force from 31 January 2018 include Unexplained Wealth Orders (UWOs) and Account Freezing Orders (AFOs) in England and Wales, with these powers in force from 28 June 2021 in Northern Ireland. They improve significantly LE’s ability to tackle economic crime.

Descriptions of the different civil and criminal powers can be found below.

2. Descriptions of POCA Powers

Descriptions of the POCA legislative powers are outlined below. An illustrative example of the proceedings system is given in the supplementary figures for the Asset Recovery Process by criminal confiscation powers and civil powers in Appendices A to D.

2.1 Criminal Confiscation Powers

Restraint Orders

Restraint Orders are part of the criminal confiscation powers in POCA, which grant the prosecutor the ability to apply to the court for an order freezing “realisable property” so that it may be used to settle a potential Confiscation Order at a later date. A Restraint Order prevents a defendant from disposing of their property.

A Restraint Order can be sought in respect of realisable property by the prosecutor once a criminal investigation has started so long as the statutory conditions for the making of an order are fulfilled.

There is no limit on the value of property that can be restrained, but the value will usually be equal to the amount by which a defendant has been or may potentially be determined to have benefitted from his or her crimes.

Confiscation Orders

A Confiscation Order is an order made against a convicted defendant. When the relevant statutory conditions for the making of a Confiscation Order are met, and an order is made, the defendant will be liable to pay the full amount by a date set by the court. This payment may come from proceeds of crime restrained using a Restraint Order, or from other assets, whether determined to be the proceeds of crime or not. If a Restraint Order was in place, this will not end when a Confiscation Order is granted but will instead end when the full amount has been paid by the defendant.

2.2 Civil Powers

Cash seizures

The cash seizure powers in POCA enable the seizure of cash with a minimum value of £1,000, which can then be followed by a civil process in the magistrates’ court, for the further detention and forfeiture of that property. This does not require a criminal prosecution or conviction. As a result, the cash seizure, detention and forfeiture provisions effectively prohibit anyone from accessing or using cash during the period up to the completion of the application to forfeit on the basis that there are reasonable grounds to suspect that the cash is recoverable property or property that is intended for use in unlawful conduct.

Any cash which is seized can initially be detained for a 48-hour period, but this detention period can be extended to up to six months, if authorised by the magistrates’ court. The maximum amount of time for which cash can be detained is two years.

Account Freezing Orders

Account Freezing Orders are part of the CFA 2017 amendments to POCA powers. They provide that senior HMRC officers, constables, SFO officers and accredited Financial Investigators have the power to apply to the court for the freezing of money in a relevant account with a minimum value of £1,000. As for cash, this is a civil process, which does not require criminal prosecution or conviction. And also, as is the case for cash, this prevents any persons from accessing or otherwise using the money in the account during the period up to the completion of the application to forfeit, on the basis that there are reasonable grounds to suspect that the cash is recoverable property or property that is intended for use in unlawful conduct.

Non-senior enforcement officers can exercise this power with prior approval from a judicial office, or a senior officer. Account Freezing Order applications can be made without giving the affected parties notice if notice of the application would prejudice any steps to secure forfeiture of money. The order can remain in place for a maximum of two years.

Listed Asset Orders

Listed Asset Orders are part of the CFA 2017 amendment to POCA powers. A Listed Asset Order grants HMRC officers, constables, SFO officers or accredited Financial Investigators the power to seize personal property, such as precious metals and precious stones, watches, artistic works, face-value vouchers and postage stamps worth a minimum value of £1,000. Property can be seized if there are reasonable ground to suspect that it is recoverable property or intended for use in unlawful conduct.

Any seized property can initially be detained for a 6-hour period, but this detention period can be extended by a further 42 hours with the approval of a Senior Officer. Following an order by a magistrates’ court the property may be detained for up to six months, extended for a maximum period of up to two years.

Forfeiture Orders

A Forfeiture Order can be made by a magistrate’s court following an application by HMRC officers, constables, SFO officers or accredited Financial Investigators for the forfeiture of cash, monies held in a relevant account or certain listed assets that have been seized and detained under POCA.

Unexplained Wealth Order

An Unexplained Wealth Order (UWO) is an investigative power that was introduced as part of the CFA 2017 amendments to POCA powers. UWOs can be granted only on an application by the following agencies: the NCA, the Crown Prosecution Service (CPS), the Financial Conduct Authority (FCA), the Serious Fraud Office (SFO), and HMRC. This order requires an individual or company to provide an explanation on the origin of assets in cases where the value of these assets appear disproportionate to their known income. The legislation provides that a UWO can only be made in respect of assets which have a value greater than £50,000.

UWOs may be granted in respect of individuals or companies suspected of being involved in or having links with serious crime. This power can also be applied to foreign politicians or officials from a state outside the European Economic Area (EEA), their family members or close associates, as such people may pose a particularly high corruption risk. A UWO made in relation to a non-EEA Politically Exposed Persons (PEP) does not also require suspicion of serious criminality. This power can only be exercised pursuant to an order of the High Court. If an individual or company subject to a UWO does not provide the information sought, without a reasonable excuse, then there is a statutory presumption that the property in question is recoverable property, and it could result in the applicant for the UWO proceedings obtaining a Civil Recovery Order if they make an application for that.

An Interim Freezing Order can also be applied for alongside a UWO to prevent property being dissipated during the UWO proceedings.

Civil Recovery Order

In England and Wales or Northern Ireland, proceedings for Civil Recovery Orders may be taken by the enforcement authority in the High Court against any person who the authority thinks holds recoverable property. This is done through a civil process and requires no criminal prosecution or conviction. Recoverable property is defined as property obtained through unlawful conduct.

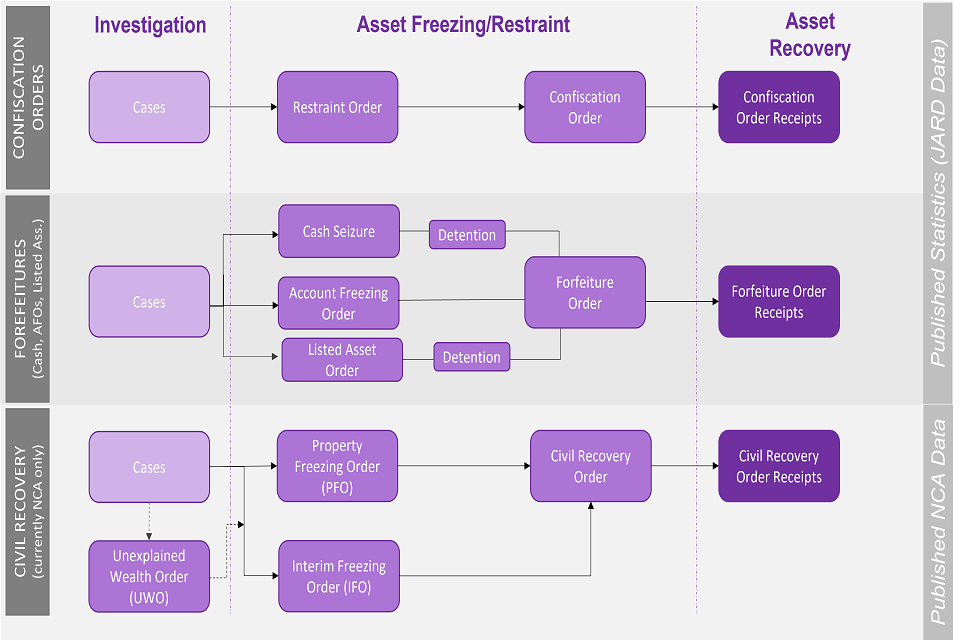

Figure 19: Appendix A: overview of the process of the asset recovery system for Proceeds of Crime under POCA

The chart in Figure 19 shows an overview of the process of the asset recovery system for the proceeds of crime under POCA using the criminal confiscation system and the civil system.

Notes

-

Money held in accounts maintained with relevant financial institutions can be frozen; it cannot be detained.

-

The asset recovery options following an UWO would not necessarily just be a Civil Recovery Order, they could be any of the other Part 5 forfeiture powers. (The statutory presumption would only apply for civil recovery applications).

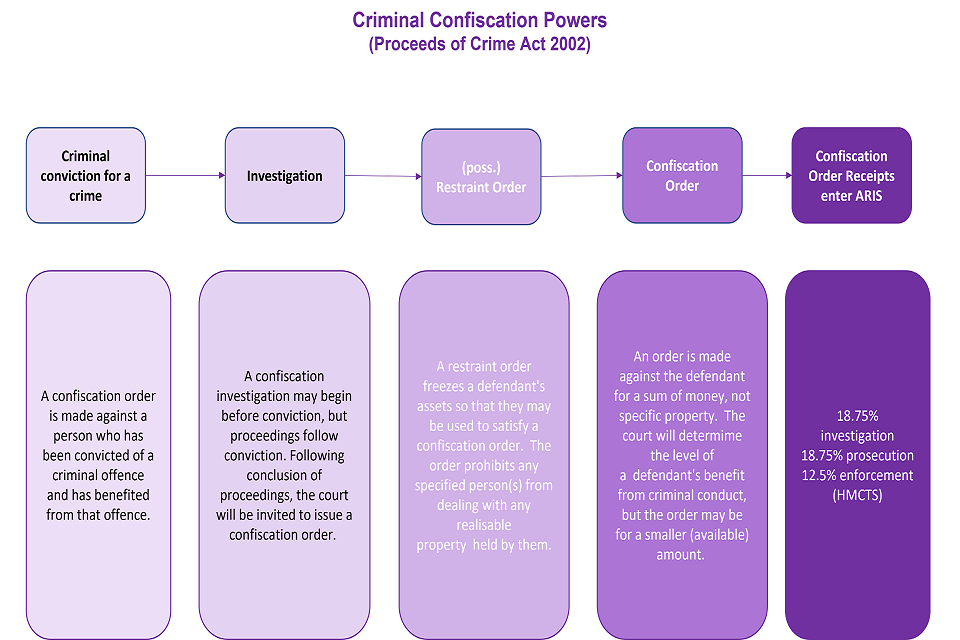

Figure 20: Appendix B: overview of the criminal confiscation system process for Proceeds of Crime under POCA

Notes

- The process is not necessarily as linear. The illustration provided is to provide an overview of the criminal confiscation system.

The chart in Figure 20 shows an overview of the criminal confiscation system process of the asset recovery system for the proceeds of crime under POCA.

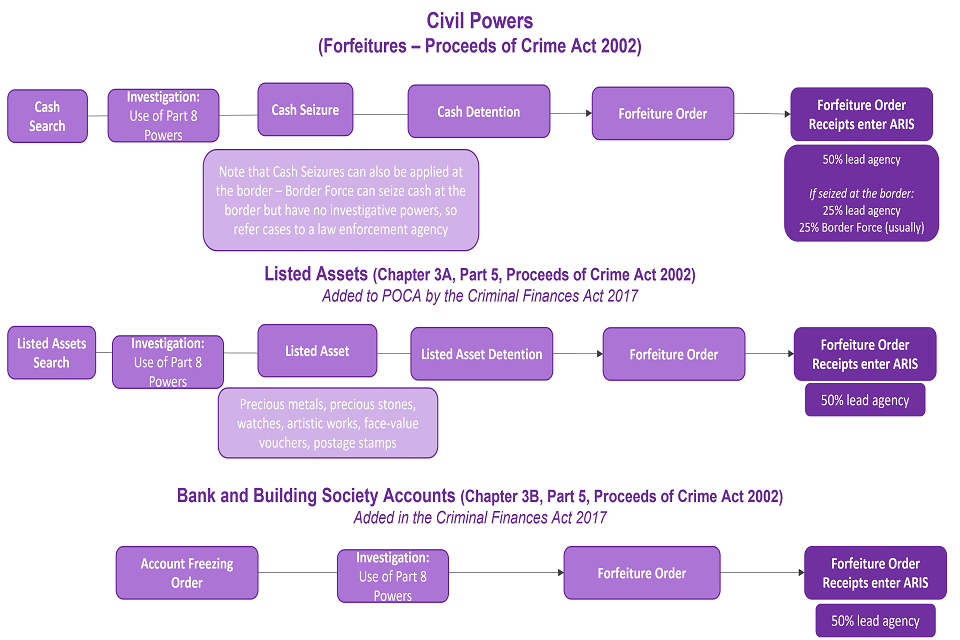

Figure 21: Appendix C: overview of the civil system process for Proceeds of Crime – Forfeitures under POCA

The chart in Figure 21 shows an overview of the civil system process of the asset recovery system for the proceeds of crime under POCA using Forfeiture powers.

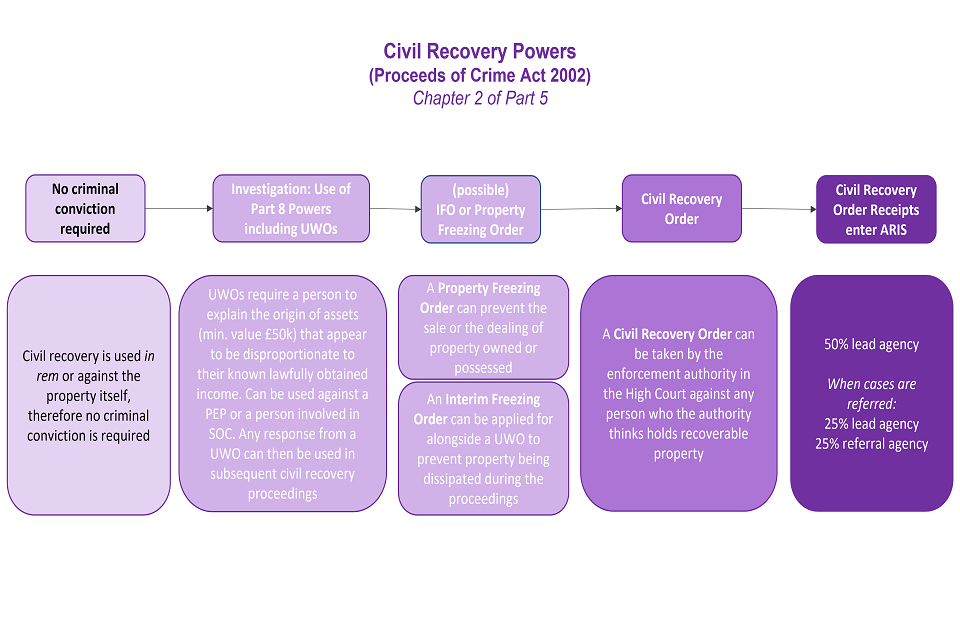

Figure 22: Appendix D: overview of the civil system process for Proceeds of Crime – Civil Recovery under POCA

The chart in Figure 22 shows an overview of the civil system process of the asset recovery system for the proceeds of crime under POCA using Civil Recovery powers.