Council Tax: challenges and changes statistical summary

Published 17 August 2023

About this release

This release includes statistics on challenges against and changes made to the England and Wales Council Tax valuation lists between 1 April 1993 and 31 March 2023.

Responsible statistician

Sarah Windass

Statistical enquiries

Date of next publication

Summer 2024

1. Headline facts and figures – 1 April 2022 to 31 March 2023

Challenges against and changes made to the Council Tax valuation lists for England (1993) and Wales (2005) in 2022 to 2023:

- The number of received challenges in 2022 to 2023 was 51,080 up from 50,300 in 2021 to 2022

- The number of resolved challenges in 2022 to 2023 was 56,820 up from 46,430 in 2021 to 2022

- The number of outstanding challenges as at 31 March 2023 was 9,720 down from 15,460 as at 31 March 2022

- The percentage of challenges resulting in no change to the Council Tax band in 2022 to 2023 was 66% up from 63% in 2021 to 2022

- The number of amendments to the Council Tax lists in 2022 to 2023 was 86,600 up from 74,860 in 2021 to 2022

2. About these statistics

The statistics in this publication relate to England and Wales only. Property valuations are not carried out by the Valuation Office Agency (VOA) in Scotland and Northern Ireland, where the valuation law and practice differ from England and Wales.

The statistics are available at national, regional and billing authority level.

This publication is released to bring greater transparency to VOA functions. The data are also used to inform government policy and conduct analyses to support the operations of the VOA.

3. Challenges against the Council Tax valuation lists for England (1993) and Wales (2005)

These are challenges against the entries in the Council Tax valuation lists for England (1993) and Wales (2005). For England before 1 April 2008 and for Wales, this consists of band reviews and appeals. For England from 1 April 2008, this consists of band reviews, proposals and, of these proposals, the number which were sent to the Valuation Tribunal Service for appeal, referred to as appeals.

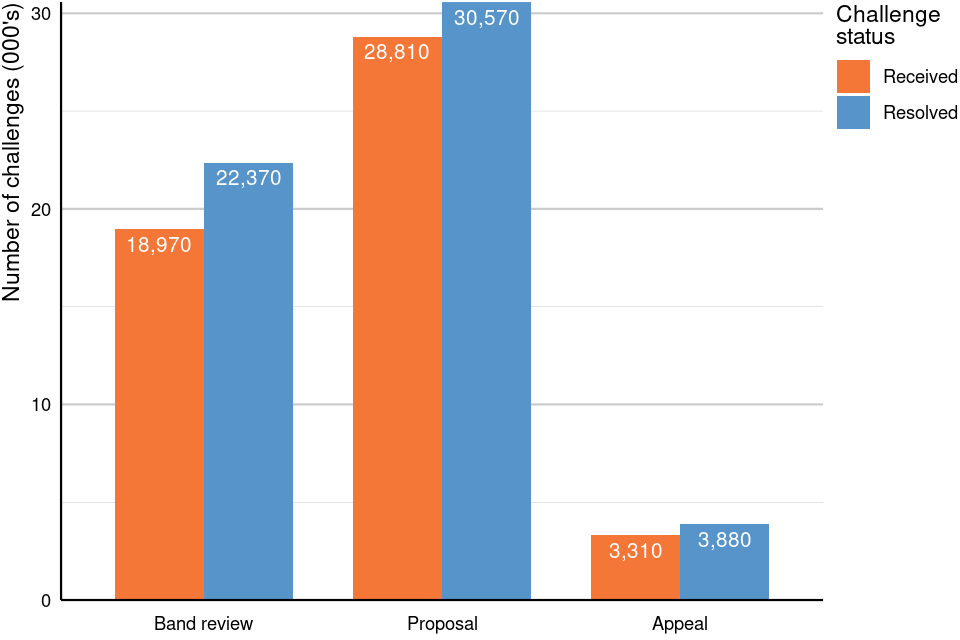

Figure 1: Number of challenges received and resolved in England and Wales, 1 April 2022 to 31 March 2023

Source: Tables CTCAC1.2 to CTCAC1.4

The number of challenges received and resolved between 1 April 2022 and 31 March 2023 are shown in Figure 1.

Of the 51,080 challenges received by the VOA in 2022 to 2023, there were:

- 28,810 (56%) proposals

- 18,970 (37%) band reviews

- 3,310 (6%) appeals

Of the 56,820 challenges resolved by VOA in 2022 to 2023, there were:

- 30,570 (54%) proposals

- 22,370 (39%) band reviews

- 3,880 (7%) appeals

Of these:

- 66% resulted in no change to the Council Tax band

- 28% resulted in a reduction to the Council Tax band

- less than 1% resulted in an increase to the Council Tax band

- 3% resulted in a property being deleted from the Council Tax list

- 1% resulted in a new entry to the list

- 1% resulted in either a property being split or multiple properties being merged

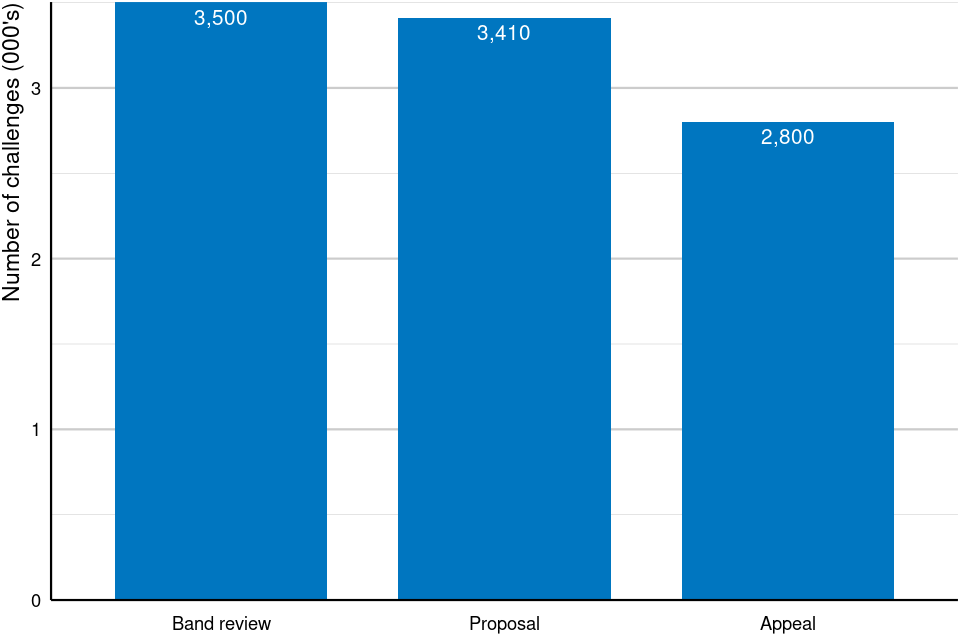

Figure 2: Number of challenges outstanding in England and Wales, 31 March 2023

Source: Tables CTCAC1.2 to CTCAC1.4

The number of challenges outstanding at 31 March 2023 is shown in Figure 2.

Of the 9,720 challenges outstanding at 31 March 2023, there were:

- 3,500 (36%) band reviews

- 3,410 (35%) proposals

- 2,800 (29%) appeals

4. Band reviews

Band reviews were introduced in the 2004 to 2005 financial year. A band review is carried out when the taxpayer brings a potential inaccuracy to the attention of the VOA. The taxpayer must provide sufficient evidence to the VOA to show why they consider their Council Tax band to be incorrect. The VOA will investigate the matter and inform the taxpayer of the outcome. The taxpayer does not have the right to appeal the outcome of a band review.

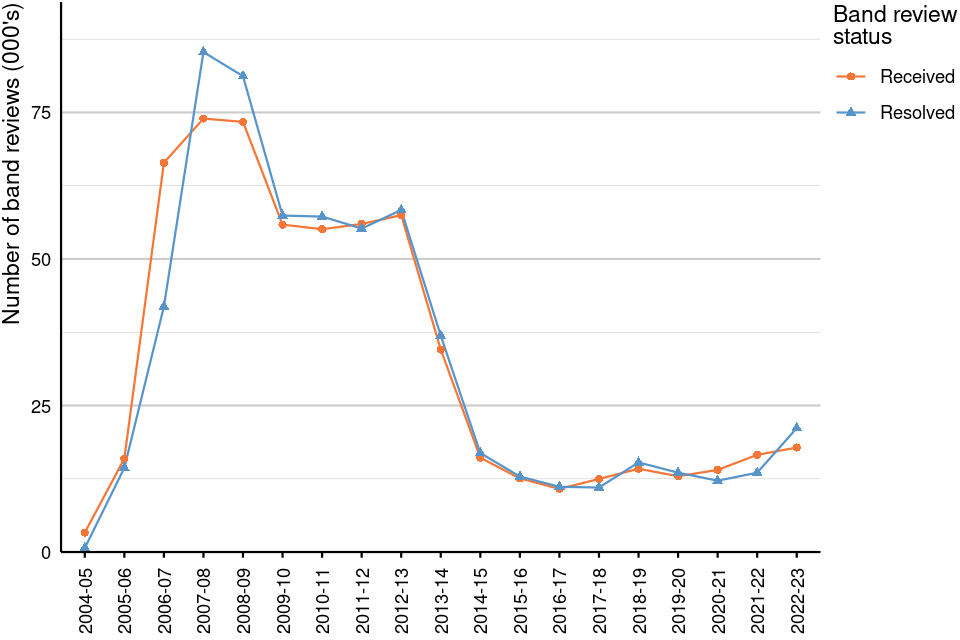

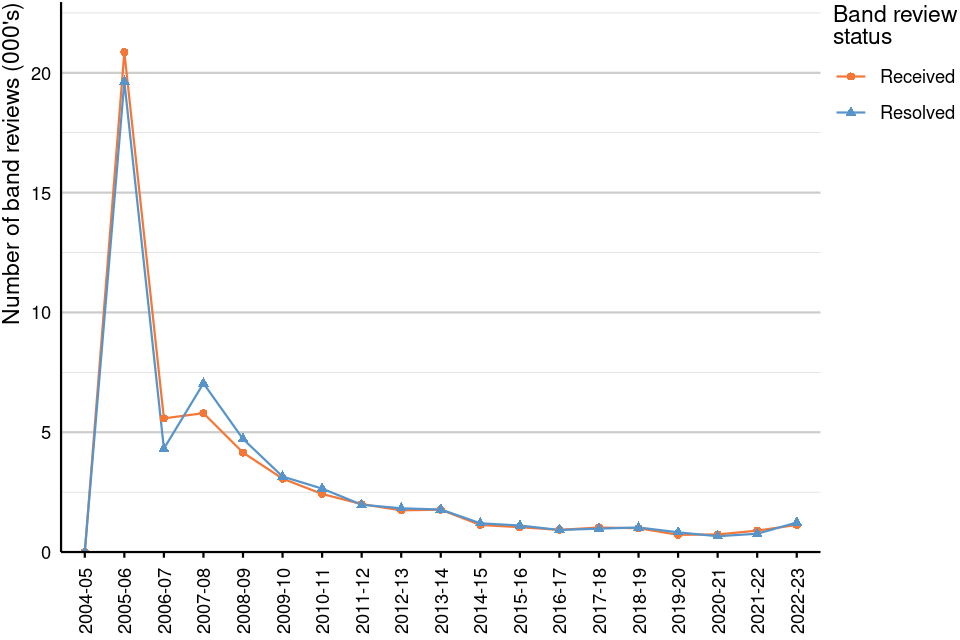

Figures 3 and 4 show the number of band reviews received between 1 April 2004 and 31 March 2023.

Following the introduction of a new Council Tax list on 1 April 2005 in Wales, there was an increase in the number of band reviews received for Welsh properties. This increase constituted most of the total band reviews received in 2005 to 2006. Media campaigns began in early 2007 which drew public attention to the process of taxpayers challenging their Council Tax band. As a result, the number of band reviews increased.

From October 2015, a change in VOA standard practice to only raise band reviews when sufficient evidence is brought to its attention likely contributed to the reduction in band reviews. Between October 2015 and January 2022 the number of band reviews received and resolved was relatively stable.

On 3 February 2022, the government announced that households in Council Tax bands A to D in England would receive a £150 rebate on their Council Tax bills. Following this announcement, the VOA received an increase in band reviews as taxpayers challenged their Council Tax band.

Figure 3: Number of band reviews received and resolved in England, 1 April 2004 to 31 March 2023

Source: Tables CTCAC4.1 & CTCAC4.2

Figure 4: Number of band reviews received and resolved in Wales, 1 April 2004 to 31 March 2023

Source: Tables CTCAC4.1 & CTCAC4.2

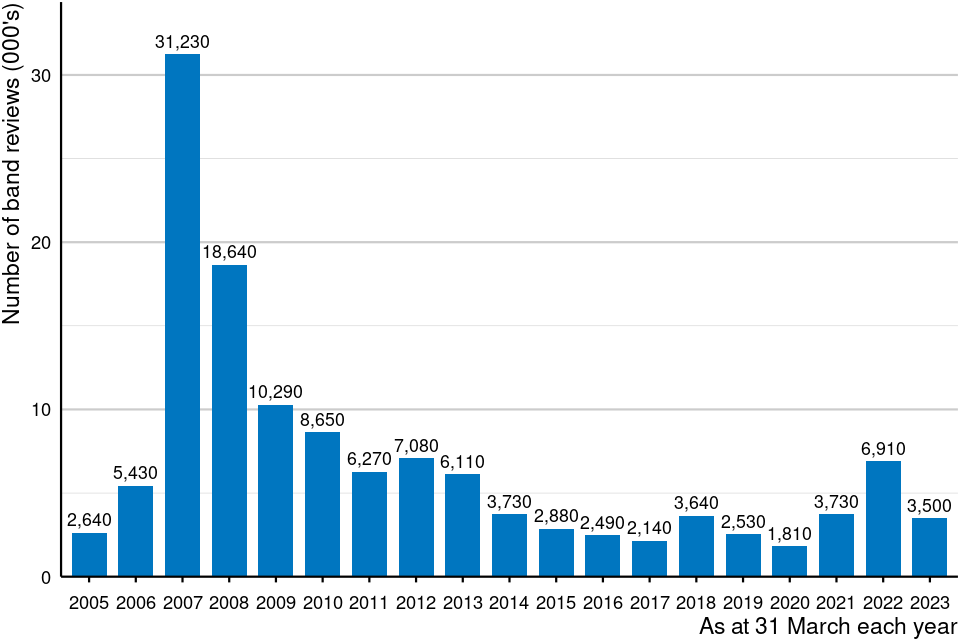

4.1 Outstanding band reviews

The number of outstanding band reviews spiked following their introduction in the 2004 to 2005 financial year until 2007, but since 2007 the number outstanding reduced steadily.

The number of outstanding band reviews started to increase between 31 March 2020 and 31 March 2022 (figure 5). The increase in band reviews received in 2021 to 2022 resulting from the £150 Council Tax rebate led to an increase in the number outstanding that year.

In 2022 to 2023 band reviews received increased by 9% with 18,970 in 2022 to 2023 compared with 17,480 in 2021 to 2022. The number of resolved band reviews has also increased by 56% with 22,370 resolved in 2022 to 2023 and 14,300 resolved in 2021 to 2022.

Figure 5: Number of band reviews outstanding in England and Wales, 31 March 2005 to 31 March 2023

Source: Table CTCAC4.3

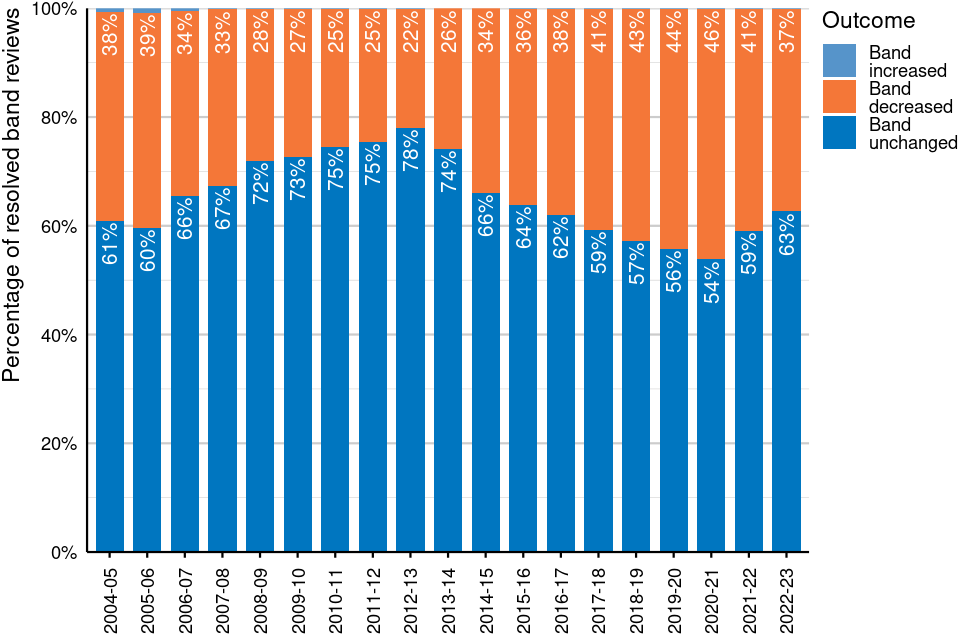

4.2 Outcomes of band reviews

Band reviews can either result in a Council Tax band increase, a Council Tax band decrease or no change to the Council Tax band.

Between 1 April 2022 and 31 March 2023:

- 14,010 (63%) resolved band reviews resulted in no change to the Council Tax Band

- 8,340 (37%) resolved band reviews resulted in a reduction to the band

- 10 (less than 1%) resolved band reviews resulted in an increase to the band

In 2021 to 2022:

- 8,440 (59%) resolved band reviews resulted in no change to the Council Tax Band

- 5,840 (41%) resolved band reviews resulted in a reduction to the band

- 20 (less than 1%) resolved band reviews resulted in an increase to the band

Figure 6: Outcomes of band reviews resolved in England and Wales, 1 April 2004 to 31 March 2023

Source: Table CTCAC4.2

Figure notes:

Please note that the percentage labels are displayed for the outcomes of ‘Band decreased’ and ‘Band unchanged’ only; therefore, the percentages will not sum to 100 per cent for each year. The band increase percentage for all years is less than 1 per cent.

5. Proposals in England since 1 April 2008

A proposal is a formal challenge to a Council Tax list entry. There are limited circumstances under which a proposal can be accepted; for example, a new occupier can make a proposal within the first six months of becoming the taxpayer for their home. If the taxpayer has a statutory right to make a proposal, they do not need to provide evidence upfront that the banding is wrong unlike band reviews. In England since 1 April 2008, the VOA will review the proposal and provide the taxpayer with a written decision, usually within two months. The taxpayer then has up to three months to appeal to a Valuation Tribunal. In Wales, and in England before 1 April 2008, the VOA transmits all proposals to the Valuation Tribunal Service for appeal within 30 days of receiving them. Therefore, only proposals in England since 1 April 2008 are included in these statistics.

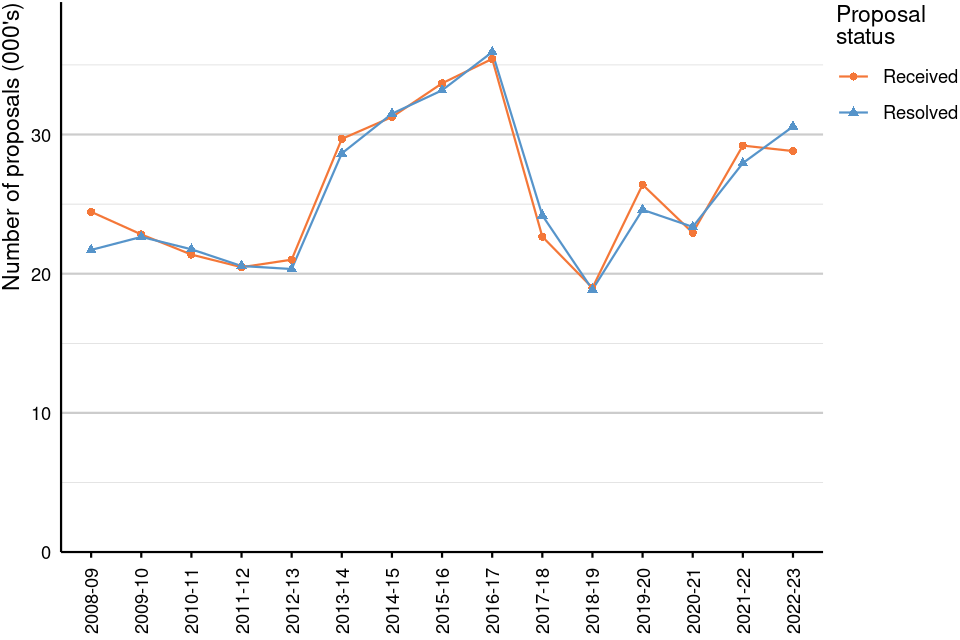

The numbers of proposals received and resolved in each year track each other consistently, though there has been considerable fluctuation in the number of proposals received over the years. Numbers started to increase in 2012 to 2013, but since 2016 to 2017 there has been a general decline, except for an uptick in 2019 to 2020 and then again in 2021 to 2022. Figure 7 shows the number of proposals received between 1 April 2008 and 31 March 2023.

Figure 7: Number of proposals received and resolved in England, 1 April 2008 to 31 March 2023

Source: Tables CTCAC5.1 & CTCAC5.2

5.1 Outstanding proposals

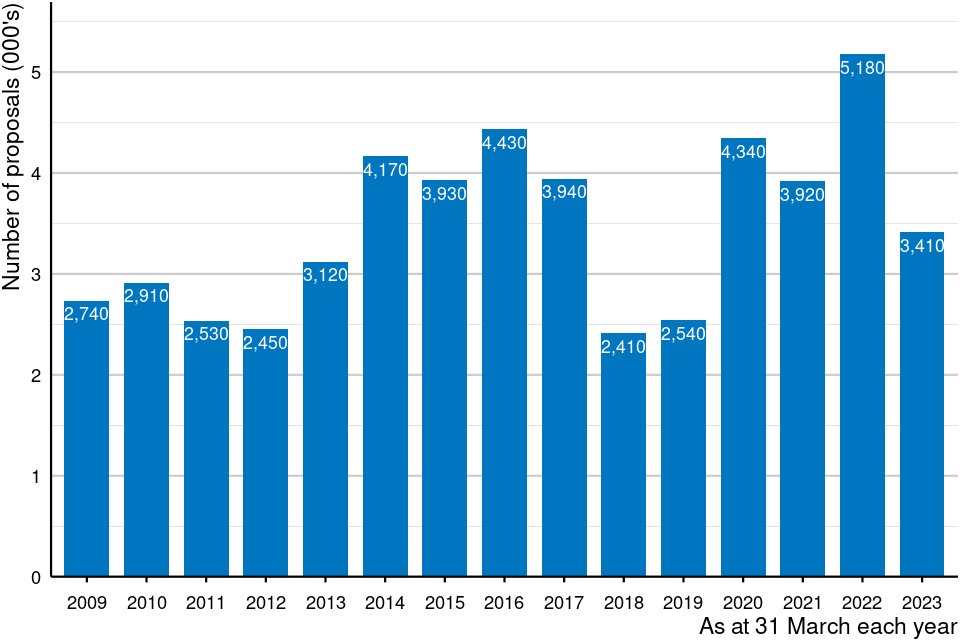

Figure 8: Number of proposals outstanding in England, 31 March 2009 to 31 March 2023

Source: Table CTCAC5.3

Figure 8 shows the number of proposals outstanding at 31 March each year from 2009 to 2023. Over the years, these numbers generally follow the same pattern as the number of proposals received and resolved. There were 3,410 proposals outstanding at 31 March 2023; this is 34% lower than the 5,180 outstanding at 31 March 2022, this decrease is largely attributable to a reduction in proposals received compared with 2021 to 2022.

5.2 Outcomes of proposals

Proposals can result in a Council Tax band increase, a Council Tax band decrease, no change to the Council Tax band, a new entry to the Council Tax list, a deleted entry from the list or a property on the list being either split or merged.

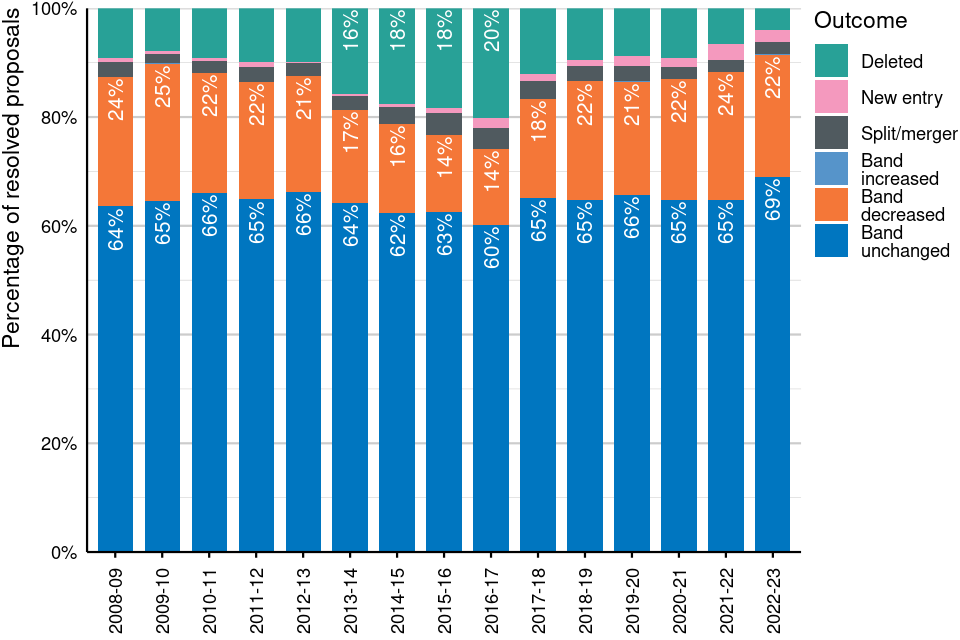

Figure 9: Outcomes of proposals resolved in England, 1 April 2008 to 31 March 2023

Source: Table CTCAC5.2

Figure notes:

Please note that the percentage labels are only displayed for the outcomes of ‘Band decreased’ and ‘Band unchanged’, as well as for any other outcome that accounts for at least 15 per cent of the total in the year. Therefore, the percentages will not sum to 100 per cent for each year.

Figure 9 shows that the percentage of proposals resulting in each outcome in 2022 to 2023 has remained similar to figures from previous years. In 2022 to 2023, 21,090 (69%) of proposals resulted in no change to the band and 6,870(22%) resulted in a band decrease. In 2021 to 2022, these figures were 18,090 (65%) and 6,570 (24%) respectively.

6. Appeals in England from 1 April 2008

In England since 1 April 2008, the VOA will review a proposal and provide the taxpayer with a written decision, usually within two months. The taxpayer then has up to three months to appeal this decision to an independent Valuation Tribunal. In order to demonstrate the connection between proposals and appeals, appeals are recorded using the date that their associated proposal was resolved.

Currently, the appeal process at the Valuation Tribunal Service takes about nine months, from submission of an appeal form to final decision. Due to the time taken to complete the appeals process 1,810, proposals resolved in 2022 to 2023 that were subsequently appealed are sitting in the appeal process at the Valuation Tribunal Service. Therefore the resolution of proposals in 2022 to 2023 represents an interim position as many cases proceed to Valuation Tribunal which means they are settled later.

Over the years, percentages of proposals resolved that were subsequently appealed have remained fairly steady. With percentages of proposal decision appealed ranging from 7% to 11%in the last five years. Of the 30,570 proposals resolved in 2022 to 2023, 7% were subsequently appealed. This is consistent with the 8% in 2021 to 2022.

6.1 Outcomes of appeals in England from 1 April 2008

Appeals are often withdrawn or settled before reaching the Valuation Tribunal.

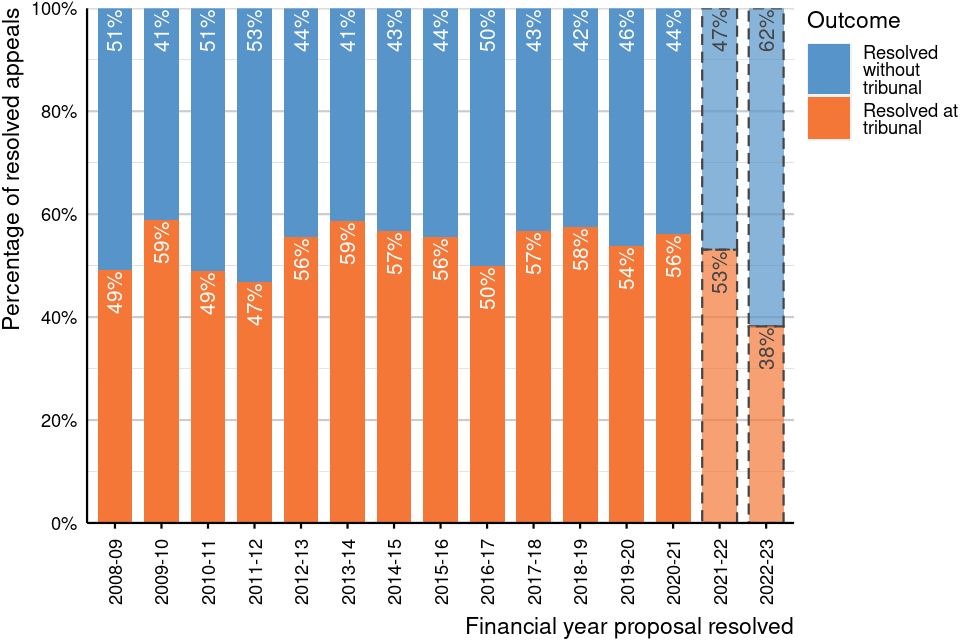

Figure 10: Percentage of appeals resolved without a Valuation Tribunal and resolved at Valuation Tribunal in England, 1 April 2008 to 31 March 2023

Source: Table CTCAC5.2

Figure notes:

The bars outlined with a dashed line represent the interim position that will be revised in next year’s release as appealed cases proceed to Valuation Tribunal and the VOA is notified of the outcome.

Figure 10 shows the percentage of appeals resolved without a Valuation Tribunal and at Valuation Tribunal, by the year that the associated proposal was resolved. In the ‘Council Tax Challenges and Changes in England and Wales, March 2022’ release, we reported that 17% of appeals were resolved at tribunal where the associated proposal was resolved in 2021 to 2022. This has now increased to 53%. In 2022 to 2023 the percentage of appeals resolved at tribunal is 38%. The VOA expects this figure to increase as the proposals resolved in 2021 to 2022 which have been subsequently appealed are resolved at tribunal and the VOA notified of the outcome.

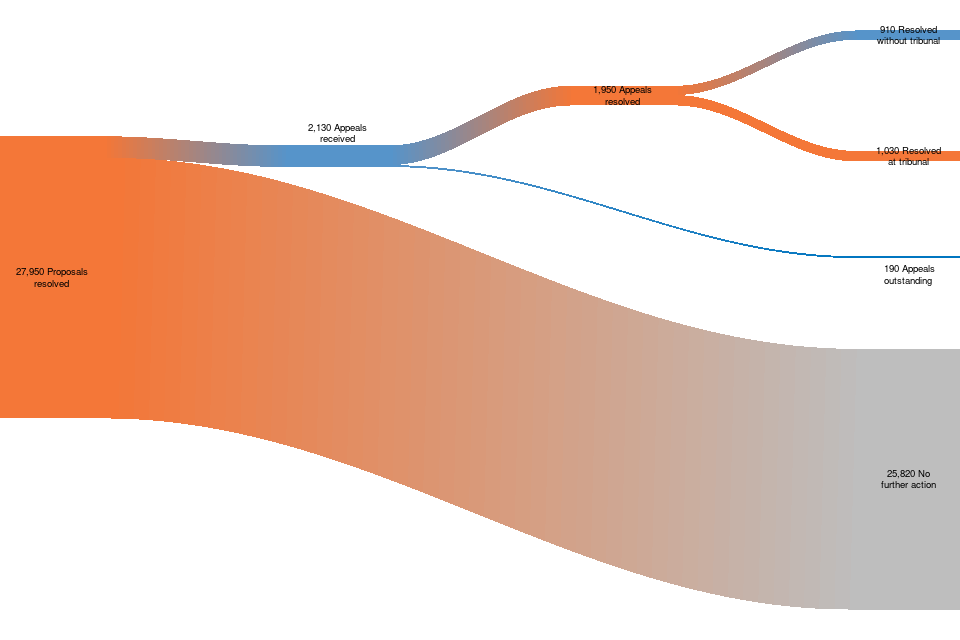

Figure 11: Proposals resolved in England from 1 April 2021 to 31 March 2022 with the action taken by the taxpayer following the issuing of the decision notice

Source: Table CTCAC5.2

In 2021 to 2022, 27,950 proposals were resolved (figures 7 and 11) and 2,130 (8%) of those proposals were subsequently appealed (figures 11). Of the proposals that were subsequently appealed:

- 1,950 were resolved as at 31 March 2023 (figure 11)

- 910 (47%) of them were resolved without a tribunal

- 1,030 (53%) required a tribunal (figures 10 and 11)

In 2022 to 2023, 30,570 proposals were resolved (figure 7) and 2,230 (7%) of those proposals were subsequently appealed. Of the proposals that were subsequently appealed, 420 were resolved at 31 March 2023. These figures will be revised in next year’s release.

Appeals, like proposals, can result in a Council Tax band increase, a Council Tax band decrease, no change to the Council Tax band, a new entry to the Council Tax list, a deleted entry from the list, or a property on the list being either split or merged.

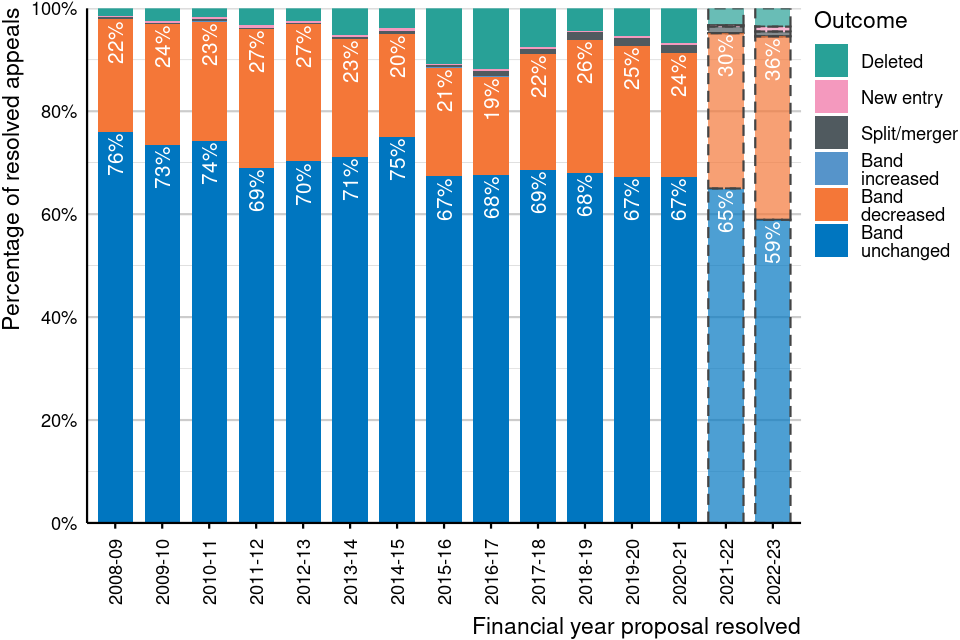

Figure 12: Outcomes of resolved appeals in England, 1 April 2008 to 31 March 2023

Source: Table CTCAC5.2

Figure notes:

The bars outlined with a dashed line represent the interim position that will be revised in next year’s release as appealed cases proceed to Tribunal and the VOA are notified of the outcome.

Please note that the percentage labels are displayed for the outcomes of ‘Band decreased’ and ‘Band unchanged’ only. Therefore, the percentages will not sum to 100 per cent for each year.

Figure 12 shows the outcomes of resolved appeals since 1 April 2008, by the year that the associated proposal was resolved. Of the resolved appeals where the associated proposal was resolved in 2022 to 2023, 36% of proposals resulted in a band decrease, 59% resulted in no change to the band and 4% resulted in a deletion. These figures will be revised in next year’s release. In 2021 to 2022, these figures were 30%, 65% and 3% respectively.

6.2 Outstanding appeals

Currently, the appeal process at the Valuation Tribunal Service takes about nine months, from submission of an appeal form to final decision, resulting in a high number of outstanding appeals as at 31 March 2023, where 2,060 were outstanding in England. Of these, 1,810 (88%) were from proposals resolved in 2022 to 2023 and 190 (9%) were from proposals resolved in 2021 to 2022. A small number of complex cases remain outstanding from earlier years.

7. Appeals in Wales

The proposal system in Wales differs from the system in England that was introduced on 1 April 2008. All proposals received in Wales, if unresolved, are automatically transmitted as appeals to Valuation Tribunal Service (VTS) within 30 days of receiving them.

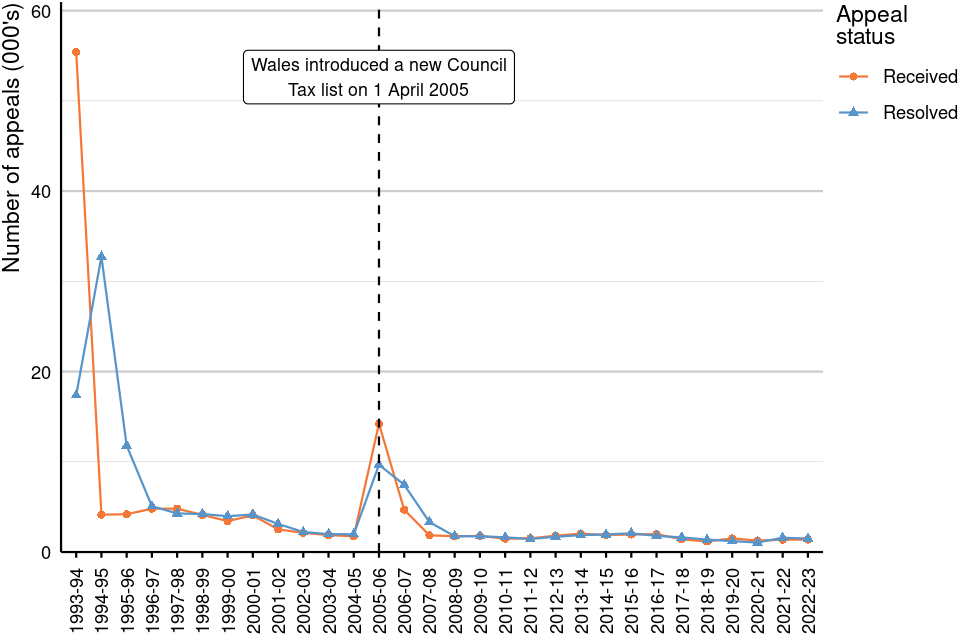

Figure 13: Number of appeals received and resolved in Wales, 1 April 1993 to 31 March 2023

Source: Table CTCAC6.2

Figure 13 shows the spike of appeals that were submitted in 2005 to 2006. This was due to the new Council Tax list that was introduced in Wales on 1 April 2005.

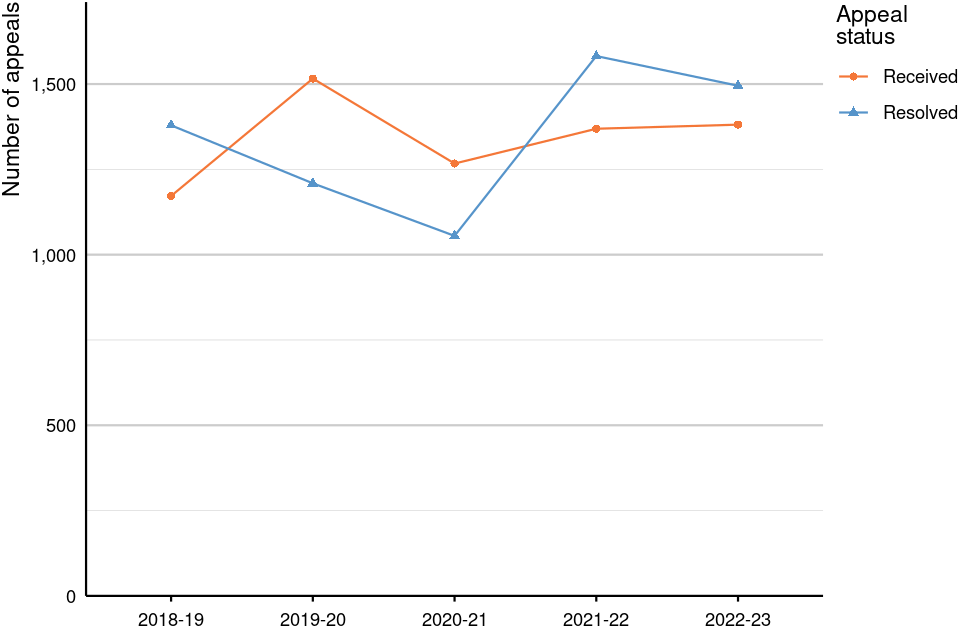

Figure 14: Number of appeals received and resolved in Wales, 1 April 2018 to 31 March 2023

Source: Table CTCAC6.2

Figure 14 shows the number of appeals received and resolved between 1 April 2017 and 31 March 2023. These numbers have been decreasing over the years, however, there was an increase in the number of appeals received in 2019 to 2020. This could be attributed to the implementation of changes in Wales where empty or second homes may be charged a Council Tax premium of up to 100%.

7.1 Outcomes of appeals in Wales

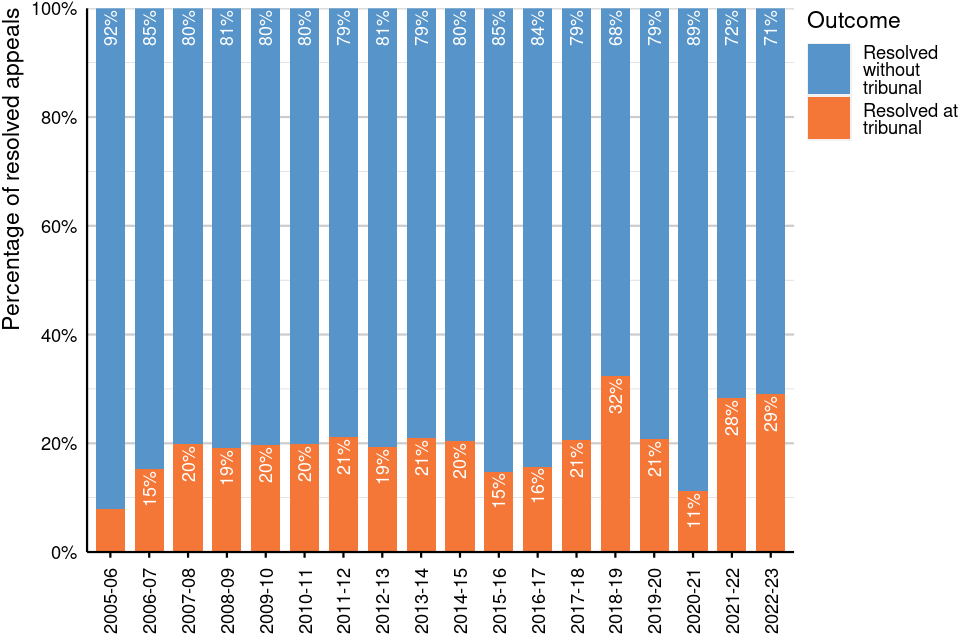

Figure 15: Percentage of appeals resolved without a tribunal and resolved at tribunal in Wales, 1 April 2005 to 31 March 2023

Source: Table CTCAC6.2

Figure notes:

Please note that in years where the outcome of ‘Resolved at tribunal’ accounts for less than 10 per cent of the total, the percentage labels are displayed for the outcome of ‘No tribunal required’ only. Therefore, the percentages will not sum to 100 per cent for these years.

Figure 15 shows the percentage of appeals resolved without a tribunal and resolved at tribunal in Wales from 1 April 2005 to 31 March 2023. In each year, the percentage of appeals resolved without a tribunal is significantly higher than the percentage resolved at tribunal, ranging from 68% to 92%. The year with the highest percentage of appeals that were resolved at tribunal was 2018 to 2019, with 32%. Of the 1,500 appeals resolved in 2022 to 2023 in Wales, 71% were resolved without a tribunal and 29% required a tribunal. In 2021 to 2022, 450 (28%) appeals were resolved at tribunal.

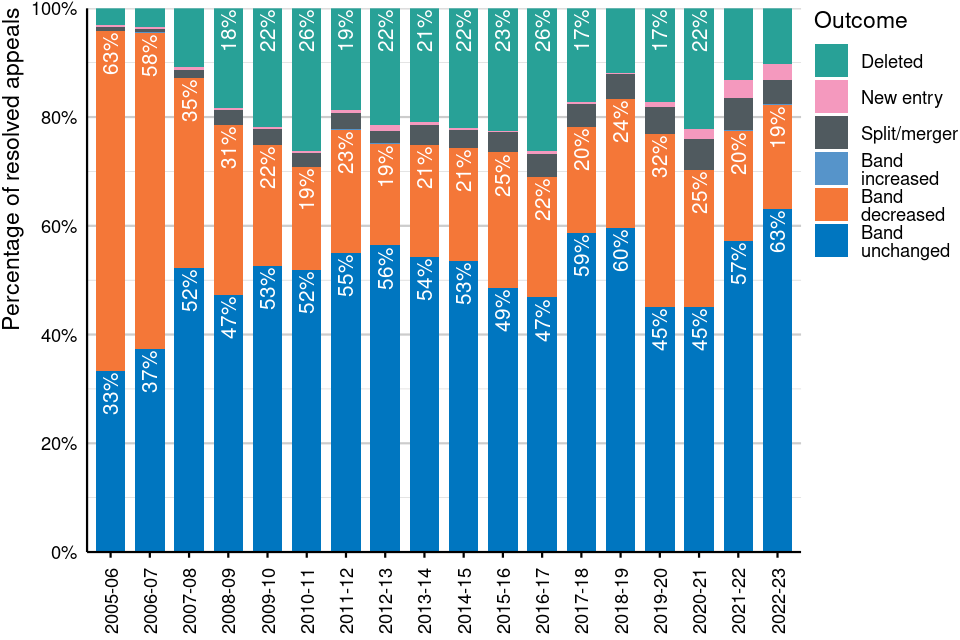

Figure 16: Outcomes of appeals resolved in Wales, 1 April 2005 to 31 March 2023

Source: Table CTCAC6.2

Figure notes:

Please note that the percentage labels are only displayed for the outcomes of ‘Band decreased’ and ‘Band unchanged’, as well as for any other outcome that accounts for at least 15 per cent of the total in the year. Therefore, the percentages will not sum to 100 per cent for each year.

Figure 16 shows the outcomes of resolved appeals in Wales from 1 April 2005 to 31 March 2023. Due to the relatively small number of appeals resolved each year, the percentages of appeals resulting in each outcome vary significantly over the years. In 2022 to 2023, 940 (63%) of appeals resulted in no change to the band and 290 (19%) resulted in a band decrease. In 2021 to 2022, these figures were 910 (57%) and 320 (20%) respectively.

7.2 Appeals outstanding in Wales

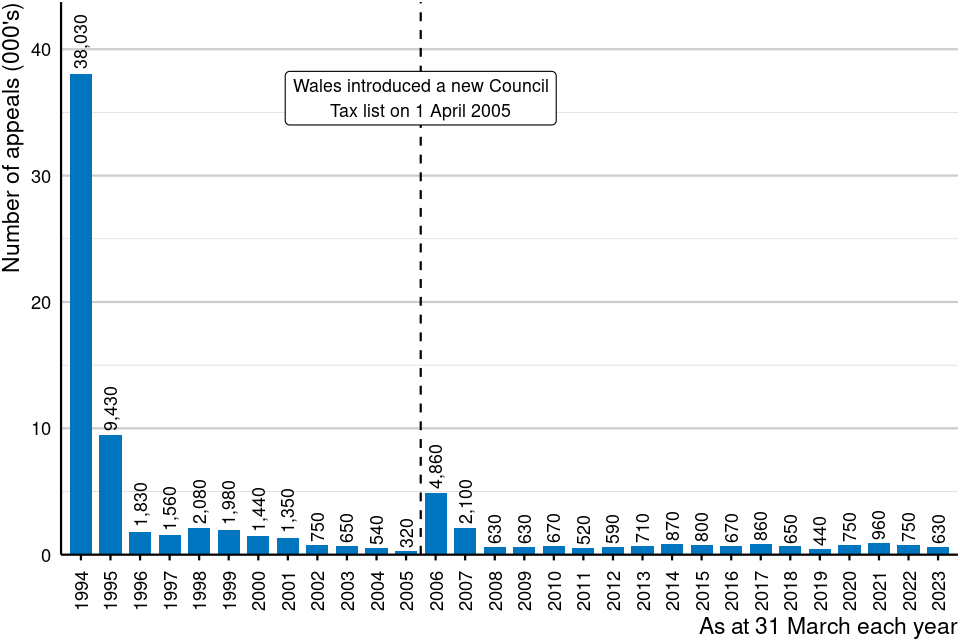

Figure 17: Number of appeals outstanding in Wales, 31 March 1994 to 31 March 2023

Source: Table CTCAC6.2

Figure 17 shows the appeals outstanding in Wales from 1994 to 31 March 2023. There was a brief spike in outstanding appeals after the introduction of the new Council Tax list on 1 April 2005.The number of appeals outstanding has fluctuated over these years. There were 630 appeals outstanding at 31 March 2023, which is 15% lower than the 750 outstanding at 31 March 2022.

8. Amendments to the Council Tax valuation lists for England (1993) and Wales (2005)

Amendments are changes that have been made as a result of either a challenge or a report. A report happens when the VOA has been made aware of a change to the property that warrants a change in the valuation list entry (for example, when a house is extended and subsequently sold). This may result in a band increase, band decrease or no change to the Council Tax band. Even when the band is unchanged, property attribute details (for example number of bedrooms) may have been updated on the VOA’s administrative system.

In this publication, amendments do not include properties that have been deleted from the Council Tax valuation lists, inserted to the Council Tax valuation lists or properties amended on the Council Tax valuation lists as a result of being split or merged. These are reported in our Council Tax Stock of Properties release, published on 15 June 2023.

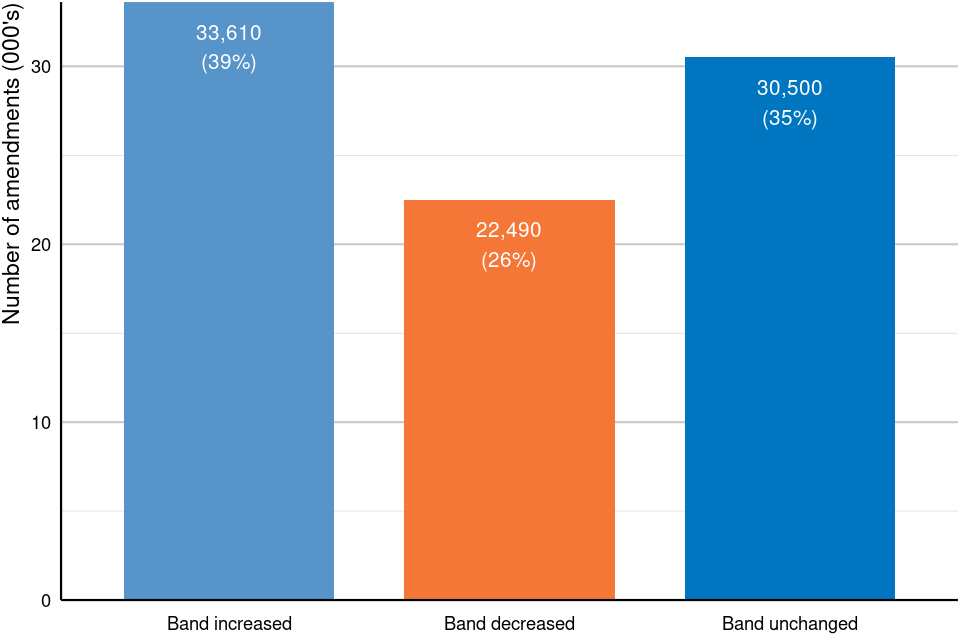

Figure 18: Number of amendments to Council Tax valuation lists in England and Wales, 1 April 2022 to 31 March 2023

Source: Table CTCAC2.1

Figure 18 shows the amendments made to the Council Tax valuation lists between 1 April 2022 and 31 March 2023 as a result of both challenges and reports. Of the 86,600 amendments:

- 39% resulted in an increased Council Tax band

- 26% resulted in a reduction to the Council Tax band

- 35% resulted in no change to the Council Tax band

Between 1 April 2021 and 31 March 2022, there were 74,860 amendments made to the Council Tax valuation lists as a result of both challenges and reports. These consisted of:

- 39% with an increased Council Tax band

- 25% with a reduction to the Council Tax band

- 36% with no change to the Council Tax band

A number of factors have led to an increase in the number of amendments this year. This includes the increased number of resolved band reviews linked to £150 Council Tax rebate discussed above and other work within the VOA to update Council Tax information and resolve outstanding reports.

9. Further information

Further information about the data and methodology presented in this summary can be found in the Background information.

GOV.UK has more information on:

- how domestic properties are assessed for Council Tax bands

- how to check your Council Tax band

- how to challenge your Council Tax band

Timings of future releases are regularly placed on the VOA research and statistics calendar.