DCMS Sectors Economic Estimates 2019: Regional GVA – Technical and quality assurance report

Published 26 August 2021

This document covers the following topics:

- an overview of the content covered in the statistical release ‘DCMS Economic Estimates 2019: Regional GVA’

- an overview of DCMS Sectors, how they are defined, and limitations of these definitions

- the methodology underlying the statistical release, including data sources

- the processes used to check that the estimates have been produced correctly

- other sources of information for the DCMS sectors

- further information, including contact details for DCMS statisticians

1. Overview of release

The statistics release ‘DCMS Economic Estimates 2019: Regional GVA’ provides an estimate of the contribution of DCMS Sectors to each region in the UK, measured by GVA (gross value added). GVA measures the contribution to the economy of each individual producer, industry or sector in the UK. It is used in the estimation of gross domestic product:

GVA + Taxes on Products − Subsidies on Products = GDP

Estimates of taxes and subsidies are not available at an industry level and therefore GVA is used as the headline economic measure at an industry level.

The release reports GVA expressed in both:

- current basic prices (‘nominal GVA’), which give the best ‘instantaneous’ measure of the value to the economy, but are not adjusted for the effect of inflation

- chained volume measures (‘real terms GVA’), where the effect of inflation is removed

Other organisations, including some of DCMS’ arm’s length bodies, produce alternative GVA measures of DCMS sectors. These alternative measures can be found in Section 5.

The estimates in the publication are consistent with national (UK) estimates, published by the Office for National Statistics (ONS).

1.1 Code of Practice for Statistics

In June 2019, the DCMS Sector Economic Estimates: Regional GVA were badged as National Statistics. This affirms that the statistics have met the requirements of the Code of Practice for Statistics.

This followed a report by the Office for Statistics Regulation in December 2018, which stated that the series could be designated as National Statistics subject to meeting certain requirements. Since the report, we have striven to improve our publications by providing summaries of other notable sources of data, more detail on the nature and extent of the overlap between the sectors, and further information on the quality and limitations of the data. We will continue to improve the series in the future, in line with the recommendations of the report. We encourage our users to engage with us so that we can improve our statistics and identify gaps in the statistics that we produce.

1.2 Users

The users of these statistics fall into five broad categories:

- Ministers and other political figures

- Policy and other professionals in DCMS and other Government departments

- Industries and their representative bodies

- Charitable organisations

- Academics

The primary use of these statistics is to monitor the performance of the industries in the DCMS sectors, helping to understand how current and future policy interventions can be most effective.

2. Sector definitions

2.1 Overview of DCMS Sectors

Main sector definitions

The sectors for which DCMS has responsibility are:

- Civil Society

- Creative Industries

- Cultural Sector

- Digital Sector

- Gambling

- Sport

- Telecoms

- Tourism

However, DCMS Sector Economic Estimates: Regional GVA does not include Civil Society or Tourism, as regional GVA estimates are currently not available for these sectors.

In order to measure the size of the economy it is important to be able to define it. DCMS uses a range of definitions based on internal or UK agreed definitions. All definitions are based on the Standard Industrial Classification 2007 (SIC) codes. This means nationally consistent sources of data can be used and enables international comparisons.

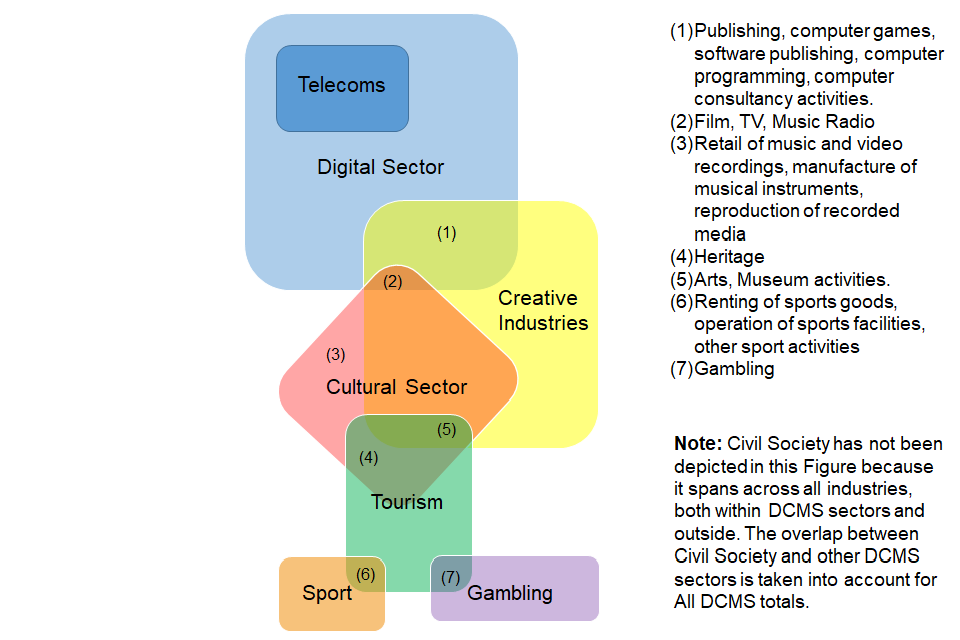

Individual sector definitions were developed in isolation as the department’s remit expanded. This has led to overlap between DCMS sectors. For example, the Cultural Sector is defined using SIC codes that are nearly all within the Creative Industries, whilst the Telecoms Sector is completely within the Digital Sector.

Figure 1 below visually shows the overlap between DCMS Sectors in terms of SIC codes. Users should note that this does not give an indication of the magnitude of the value of overlap. For this, users should consult the main report. A list of SIC codes appearing in each sector and subsector can be found in the tables accompanying the release.

Figure 1. Overlap of SIC codes within DCMS Sectors

Other sector definitions

Additional analysis is presented in the Regional GVA release for the Audio Visual sector and the Computer Games sector.

The definition of the Audio Visual sector (see below) is intended to reflect the sectors covered by the EU Audio Visual Media Services Directive.

- 59.11 - Motion picture, video and television programme production activities

- 59.12 - Motion picture, video and television programme post-production activities

- 59.13 - Motion picture, video and television programme distribution activities

- 59.2 - Sound recording and music publishing activities

- 60.1 - Radio broadcasting

- 60.2 - Television programming and broadcasting activities

- 63.91 - News agency activities

- 63.99 - Other information service activities n.e.c.

- 77.22 - Renting of video tapes and disks

- 77.4 - Leasing of intellectual property and similar products, except copyrighted works

The Computer Games sector combines the 4-digit SIC code 58.21 (Publishing of Computer Games) and 62.01/1 (Ready-made interactive leisure and entertainment software development).

A number of software programming companies in 62.01 – ‘Computer programming activities’ may also contribute to the output of computer games, as part of a range of programming activities. This is not included in these computer games estimates, but will have been implicitly included in the ‘IT, software and computer services’ group in the main estimates.

2.2 Details and limitations of sector definitions

This section looks at sector definitions in more detail, and provides an overview of limitations. There are substantial limitations to the underlying classifications. As the balance and make-up of the economy changes, the SIC, finalised in 2007, is less able to provide the detail for important elements of the UK economy related to DCMS Sectors. The SIC codes used to produce these estimates are a ‘best fit’, subject to the limitations described in the following section.

Creative Industries

The Creative Industries were defined in the Government’s 2001 Creative Industries Mapping Document as “those industries which have their origin in individual creativity, skill and talent and which have a potential for wealth and job creation through the generation and exploitation of intellectual property”.

To allow the Creative Industries to be measured, DCMS worked with others to develop a statistical definition of the Creative Industries which reflects this definition. DCMS uses a “Creative Intensity” to determine which industries (at 4 digit SIC) are Creative. The Creative Intensity is the proportion of occupations in an industry that are creative and, if the intensity is above a set threshold, that industry is typically defined as Creative. More information can be found in the 2016 methodology document.

The definition used for the Creative Industries in this release does not allow consideration of the value added of “creative” to the wider economy, such as Creative Occupations outside the Creative Industries. DCMS policy responsibility is for creative industries across the economy and therefore this is a significant weakness in the current approach.

Cultural Sector

There are significant limitations to the DCMS measurement of the cultural sector arising from the lack of detailed disaggregation possible using the standard industrial classifications. There are many cases where culture forms a small part of an industry classification and therefore cannot be separately identified and assigned as culture using standard data sources. DCMS consulted on the definition of Culture and published a response in April 2017.

It is recognised that, due to the limitations associated with SIC codes, the SIC code used in past publications as a proxy for the Heritage sector (91.03 - Operation of historical sites and building and similar visitor attractions) is likely to be an underestimate of this sector’s value. We have changed the name of the Heritage sector to ‘Operation for historical sites and similar visitor attractions’ to reflect this.

Digital Sector

The definition of the Digital sector used by DCMS is based on the OECD definition of the ‘information society’. This is a combination of the OECD definition for the “ICT sector” as well as including the definition of the “content and media sector”. An overview of the SIC codes included in each of these sectors is available in the OECD Guide to Measuring the Information Society 2011 (see Box 7.A1.2 on page 159 and Box 7.A1.3 on page 164).

The definition used for the Digital Sector does not allow consideration of the value added of “digital” to the wider economy e.g. in health care or construction. DCMS policy responsibility is for digital across the economy and therefore this is a significant weakness in the current approach.

Sport

The definition of sport used in the release is based on the EU agreed core/statistical Vilnius definition, which includes only SIC codes which are predominately sport. In our release of national estimates of GVA, we also include estimates of Sport GVA based on the Sport Satellite Account. These estimates are based on the broad Vilnius definition, which is a more wide-ranging measure of sport that considers the contribution of sport across a range of industries, for example sport advertising, and sport-related construction. Caution should be made when using the Sport Satellite Account, as proportions have not been updated since 2016 and results are not comparable to those of other sectors. Sport GVA in the Sport Satellite Account is calculated by estimating the proportion of the SIC code that applies to sport, and then applying this proportion to the total GVA for each industry, finally summing to produce total sport GVA for each year.

3. Methodology

This chapter summarises the methodology used to produce regional GVA estimates, both in current prices and chained volume measures.

3.1 GVA - current prices

This first section presents the methodology for estimates of regional GVA expressed in current prices (i.e. not taking into account inflation).

Data sources (current prices)

The following data sources were used in the production of regional GVA (current prices) for DCMS sectors:

- ONS Regional Gross Value Added balanced tables (published 26 May 2021) – containing data up to 2019.

- Unsuppressed Annual Business Survey (ABS) approximate GVA estimates at the lowest level available

Method (current prices)

The most reliable estimate of regional GVA comes from the Regional gross value added (balanced) tables produced annually by ONS. These estimates are consistent with the UK National Accounts. National aggregates for the components of GVA are allocated to regions using the most appropriate regional indicator available. The Regional Accounts Methodology Guide contains more information about the construction of the regional accounts.

The balanced GVA tables report GVA at division level (2 digit SIC codes), but DCMS sectors are defined at industry level (3 or 4 digit SIC codes). This means a method for breaking down the GVA to industry level must be applied.

This is achieved by using approximate Gross Value Added (aGVA) regional data from the UK non-financial business economy (Annual Business Survey), by:

- extracting aGVA from the ABS at industry level (e.g. SIC 32.12) for each region

- calculating aGVA from the ABS at division level (e.g. SIC 32, by aggregating industries in the division) for each region

- calculating the proportion of the division aGVA that each industry accounts for (e.g. aGVA for SIC 32.12 as a proportion of SIC 32) for each region

- applying the proportion for each industry to the division GVA in the balanced regional GVA tables, to get a National Accounts consistent estimate of regional GVA for each industry.

This method, using the National Accounts consistent GVA, is preferable to only using aGVA from the ABS. There are differences between the two measures of gross value added in the SUT and ABS in terms of coverage. For example, GVA covers the whole of the UK economy while aGVA covers the UK Non-Financial Business Economy, a subset of the whole economy that excludes large parts of agriculture, all of public administration and defence, publicly provided health care and education, and the financial sector.

There are also conceptual differences between the two measures of gross value added. For example, some production activities such as illegal smuggling of goods must be included in the National Accounts but are outside the scope of the ABS. In addition, the national accounts data have gone through the Supply and Use balancing process, which reconciles all three estimates of GDP. Using balanced GVA makes comparison with the wider UK economy more straightforward, and ensures that non-market production is included in the DCMS estimates. More information on the differences between National Accounts GVA and Approximate GVA can be found in the article, ‘A Comparison between Annual Business Survey and National Accounts Measures of Value Added’.

Regional GVA figures for 2010 to 2018 have been revised since the last DCMS Economic Estimates: Regional GVA publication in May 2020. These revisions take into account the latest balancing of the National Accounts and finalisation of the Annual Business Survey data. Regional Accounts GVA is open to revisions back to 1997 each year. These are planned revisions and an integral part of the balancing process.

Method limitations

Estimates from the Annual Business Survey (ABS) are subject to various sources of error, with sampling errors published at a 4-digit SIC level. While these data provide the best available source of information there is often volatility, especially at the 4 digit SIC level which is used to produce estimates for DCMS sectors. Further information on the quality of the ABS data is published by the Office for National Statistics.

There have also been two survey design changes in recent years (expanding the ABS population in 2015 and re-optimising the sample in 2016), but as the survey outputs are used only to provide a proportion of the SUT, these changes should have a minimal impact on the estimates of DCMS sector GVA.

Method for SIC 91: Libraries, archives, museums and other cultural activities

A different approach is used to break down the SUT matrix to 4 digit level for SIC 91. In the ABS data, the aGVA for aspects of SIC 91 can be negative (this is due to under coverage in the ABS and high levels of funding from local authorities). For this reason, turnover data from the ABS is used instead of aGVA to allocate SIC 91 at the 4-digit level. This is the only SIC where this approach has been used.

Accounting for sector overlap

As mentioned in the sector definitions chapter, there is an overlap between DCMS sector definitions. This overlap must be estimated in order to avoid double counting and produce a robust estimate for all DCMS sectors.

The overlap is estimated by looking at which SIC codes appear in multiple sectors. All unique SICs can then be aggregated to give a total figure with no overlap.

Constraining sector and subsector totals

We use different versions of ABS data in our national and regional GVA publications. The national GVA publication, usually published in December, uses provisional ABS data for the latest year. The regional GVA publication, usually published in Spring/Summer, uses revised ABS results for the latest year. This means that the sum of regional GVA for each DCMS sector would not usually match the national GVA totals published in December. We therefore constrain the current price regional GVA figures for each sector to the national totals published in December.

There are minimal differences when the individual regional data for a sector is summed together compared to the UK total for that sector. This is because the UK totals presented are constrained to the totals that we published in December 2020 for total GVA for each sector.

3.2 GVA - chained volume measure

This second section presents the methodology for estimates of regional gross value added (GVA) for DCMS sectors, expressed in chained volume measures (i.e. taking into account inflation).

In Chained Volume Measures (CVMs), inflation is taken into account. CVMs are different to constant prices. Constant prices are simply the current price data deflated using a price from one base period, which is updated every 5 years. For CVMs, the base period is updated each year (for the latest publication, this is 2018). CVMs are created by linking together series with different base years. In this analysis we use the CVM price series to calculate volume in terms of previous year prices and current year prices.

Data sources

The following data sources were used in the production of GVA (chained volume measures) for DCMS sectors:

- Current prices data (see previous chapter, GVA - current prices, for data sources and methodology).

- Experimental national industry level deflators

Method (chained volume measure)

The current price data is broken down by industry for each of the aggregated industries included within the DCMS remit.

In order to derive a Chain Volume Measure (CVM) we make use of the relationship

value = volume x price

Current price estimates are the ‘value’ component of this equation.

The ‘price’ component comes from experimental industry level deflators, published on the ONS website (Industry Level Deflators).

These are the same deflators used to produce national chained volume measure estimates of DCMS GVA. National deflators are used because no regional price indices are currently available. The Eurostat Manual on regional accounts methods (PDF, 1.26MB) recommends that in the absence of regional prices, the use of national deflators is acceptable. The availability of a greater level of industrial detail allows the deflation to take account of regional variation in industrial composition and hence the composition of products and services produced in each region.

The industry deflators used in this release are a mixture of product and implied industry (division) level deflators. These are not consistent with the deflators used in the national accounts, or the implied regional deflators published alongside the regional accounts. The industry deflators used to derive chained volume measures in this release are consistent with the deflators used in the national DCMS GVA releases. These deflators are preferred due to maintaining a closer relationship between current price and chained volume measures.

We advise users not to make comparisons to previous publications of DCMS Economic Estimates: Regional GVA, as the chained volume measures GVA will not be consistent. This change in methodology brings the current release in line with the national GVA estimates published in DCMS Sectors Economic Estimates 2019: GVA.

Experimental industry level deflators are not available for all of the SIC codes in DCMS sectors, therefore deflators are used which match as closely as possible to each industry. All were in the form of a price index with 2010 = 100.

For each 3 or 4 digit SIC code in DCMS sectors, the ‘volume’ series is obtained by dividing the current price series by the deflator (price) series.

volume = value/price

To create a chained volume measure, the value series in previous year’s and current year’s prices is calculated (PYP and CYP respectively). The CYP series is simply the current price (‘value’) series.

CYPt = volumet x pricet= valuet

where t is time (year).

The PYP series is given by

PYPt = volumet x pricet-1

The PYP series and CYP series are then summed across relevant SIC codes to give a PYP and CYP aggregate for each DCMS sector and subsector, and the DCMS Sector total, for each UK region.

These are used to obtain scaling factors at sector and subsector level. When t ≥ base year, the scaling factor is 1. In this analysis, the base year is 2018 to remain in line with National Accounts data published by ONS. When t < base year, the scaling factor is given by

SFt = (CYPt+1 / PYPt+1) x SFt+1

The CVM is then calculated for each sector and subsector. When t ≤ base year, CVM is

CVMt = SFt x CYPt

When t > base year, CVM is given by

CVMt = SFt x PYPt

The output is a CVM series for each region from 2010 to 2019 for each sector and subsector, and the DCMS Sector total.

Users should note that the methodology for chained volume measures means they are not additive prior to the base year. This means the sum of subsector values will not equal sector values prior to 2018. This caveat does not affect summing of sector values to form the All DCMS total, as the All DCMS total is lower than the sum of the individual sectors due to overlap between sectors.

Constraining sector totals

Similarly to the current price estimates, we constrain the regional CVM series to the national CVM series used in the national GVA release in December.

3.3 Summary of data sources

In summary, the data presented in this report on regional GVA

- are based on official statistics data sources

- are based on internationally-harmonised codes

- are based on survey data (Annual Business Survey and National Accounts) and, as with all data from surveys, there will be an associated error margin surrounding these estimates[footnote 1]

This means the estimates are:

- comparable at both a national and international level.

- comparable over time, allowing trends to be measured and monitored

However, this also means the estimates are subject to limitations of the underlying classifications of the make-up of the UK economy. For example, the standard industrial classification (SIC) codes were developed in 2007 and have not been revised since. Emerging sectors, such as Artificial Intelligence, are therefore hard to capture and may be excluded or mis-coded.

4. Validation, accuracy, and quality assurance processes

This chapter summarises the validation, accuracy and quality assurance processes applied during the production of the DCMS Economic Estimates 2019: Regional GVA statistics. This includes a detailed account of the quality assurance processes and the data checks carried out by our data providers (Office for National Statistics, ONS) as well as by DCMS.

4.1 Validation, accuracy and quality assurance processes at ONS

Quality assurance at ONS takes place at a number of stages. The validation and accuracy of the source data, as well as the various processes in place to ensure quality for the data sources used in the regional GVA publication, are outlined in the relevant links below.

Regional balanced GVA tables

Section 6 of the Regional gross value added QMI details how ONS collects the data for the regional balanced GVA tables, the main data sources, and the validation and accuracy of the estimates.

Annual Business Survey (ABS)

For more information on quality assurance processes used during the production and analysis of ABS, as well as validation and accuracy of the estimates, see the Annual Business Survey QMI and the Annual Business Survey technical report: August 2018.

4.2 Quality assurance processes at DCMS

The majority of quality assurance of the data underpinning the DCMS Sectors Economic Estimates: Regional GVA release takes place at ONS, through the processes described above. However, further quality assurance checks are carried out within DCMS.

Production of the report is typically carried out by one member of staff, whilst quality assurance is completed by at least one other, to ensure an independent evaluation of the work.

Data requirements and data delivery

For the ABS data, DCMS discussed our data requirements with ONS and these are formalised as a Data Access Agreement (DAA). The DAA covers which data are required, the purpose of the data, and the conditions under which ONS provide the data. Discussions of requirements and purpose with ONS improved the understanding of the data at DCMS, helping us to ensure we receive the correct data and use it appropriately.

DCMS checks that the data delivered by ONS match what is listed in the Data Access Agreement (DAA). For this particular release we check that:

- we have received all regional data at the 4 digit SIC code level, which is required for us to aggregate up to produce estimates for our sectors and sub-sectors

- data at the 4 digit SIC code has not been rounded unexpectedly. This would cause rounding errors when aggregating up to produce estimates for our sectors and subsectors

Data Analysis quality assurance checks

At the analysis stage, data are aggregated to produce information about DCMS sectors and sub-sectors. The GVA statistics lead checks whether:

- the GVA proportions are similar to last year, and if not, whether this is because of changes to the methodology

- there is any missing data

- the percentage changes each year look similar

- the updated Regional Accounts data has been used, including the revised back series data

- the correct SIC codes have been aggregated together to form DCMS sector and sub-sector estimates

Publication quality assurance checks

Finalised figures are disseminated within OpenDocument Format tables and a written headline report, published on GOV.UK. These are produced by the GVA statistics lead. Before publishing, a quality assurer checks the data tables as well as the report to ensure minimal errors. This is checked against a QA log where comments can be fed back and actioned accordingly. The quality assurer also makes sure any statements made about the figures (e.g. regarding trends) are correct according to the analysis and checks for spelling or grammatical errors.

Proofreading and publication checks are done at the final stage, including:

- checking the figures in the publication match the published tables

- checking the footnote numbering is correct

- making sure hyperlinks work

- checking chart/table numbers are in the correct order

- ensuring the publication is signed off by DCMS Head of Profession for Statistics and DCMS Chief Economist

- contacting press office to ensure they are aware of the release date

- checking the published GOV.UK page again after publishing

Post publication

Once the publication is released, DCMS reviews the processes and procedures followed via a wash up meeting. This occurs usually a week after the publication release date and discusses:

- what went well and what issues were encountered

- what improvements can be made for next time

- what feedback have we received from engaging with users

5. External Data Sources

It is recognised that there are always different ways to define sectors, but their relevance depends on what they are needed for. Government generally favours classification systems which are

- rigorously measured

- internationally comparable

- nationally consistent

- ideally applicable to specific policy interventions

These are the main reasons for DCMS constructing sector classifications from Standard Industrial Classification (SIC) codes. However, DCMS accepts that there are limitations with this approach and alternative definitions can be useful where a policy-relevant grouping of businesses crosses existing Standard Industrial Classification (SIC) codes. DCMS is aware of other estimates of DCMS Sectors. These estimates use various methods and data sources, and can be useful for serving several purposes, e.g. monitoring progress under specific policy themes such as community health or the environment, or measuring activities subsumed across a range of SICs.

Table 1 shows different sources of analysis measuring the economic contribution of different DCMS policy areas from our arm’s-length bodies. It is recognised that there will be many other sources of evidence from industry bodies, for example, which have not been included in this table. This will be developed over time to capture a wider spectrum of stakeholder’s releases. We encourage statistics producers within DCMS sectors who are not represented in the table to contact the economic estimates team at evidence@dcms.gov.uk.

Table 1. Alternative data sources measuring economic contribution of DCMS sectors

| Sector | Sub-sector | Organisation | Summary of use |

|---|---|---|---|

| Civil Society | Civil Society | ONS | ONS publishes a household satellite account which includes an estimate for volunteering for 2015 and 2016. This is based on the DCMS Community Life Survey and multiplying participation by the median earnings. However these figures should not be included in the GVA figure for the economy due to volunteering being part of the informal economy, and therefore not captured in the ONS’s methodology for calculating GVA. The latest year for which data is available is currently 2016. |

| Creative Industries and Cultural Sector | Arts | Arts Council England (ACE) | ACE provides a value of GVA and employment accountable by the Arts and Culture industry. They use similar SIC codes to DCMS’ Economic Estimates, but rather than using the supply and use tables and then the Annual Business Survey to inform the proportions to use, ACE use only the Annual Business Survey and therefore an approximate measure of GVA. |

| Creative Industries and Cultural Sector | Film, TV, video, radio and photography; IT, software and computer services | British Film Institute (BFI) | BFI provides a value of GVA and FTE employment accountable by the Screen sector. The analysis uses a bespoke economic impact model developed for this study, reflecting current best practice in economic impact modelling, aligning the study with current government evaluation methodology (HM Treasury Green Book 2018). |

| Creative Industries and Cultural Sector | Museums, Galleries and Libraries; Museums and Galleries | Arts Council England (ACE) | ACE commissioned a report on the economic impact of museums in England in 2013. This methodology is very different to that of the DCMS Sector Economic Estimates, in particular the definition of museums was much wider. ACE have identified the limitations with using SIC codes for museums, namely that to be included in the official statistical surveys, the museum needs to be registered for PAYE or VAT, which means some of the small museums would not be included in these official sources. The same applies to local authority delivered museum services which would be coded under the Public Administration SIC code. As a result ACE have used a bottom-up approach of developing a database of museums in England then using various sources to identify the economic measures for each museum. This is for England and was produced in 2013. |

| Cultural Sector | Heritage | Historic England | Historic England provides a value of GVA and employment accountable by the Heritage sector. Historic England use a satellite account approach to measure the heritage sector. Satellite accounts measure a sector by aggregating shares of other SICs, estimated using Standard Occupational Classification (SOC) codes primarily and additional information. They can serve several purposes, e.g. monitoring progress under specific policy theme. While potentially useful, the quality of the data depends on that of the evidence used to estimate the appropriate share of existing SICs. These figures are useful in building the sectoral narrative, and in advocacy work (e.g. in speeches, alongside our sector estimates). However the scope of the industries included is much wider than for DCMS’ estimates. |

| Gambling | Gambling | Gambling Commission | The Gambling Commission produces industry statistics twice a year on gross gambling yield, employment and number of businesses. The methods are different to DCMS’ Economic Estimates to reflect the different data sources available to the Gambling Commission and their policy needs. The Gambling Commission derive their estimates from the operators. As it is a license requirement for operators to submit returns the data collection is essentially a census. This has benefits compared to using a sample survey. DCMS define the gambling sector as SIC 92; however it is likely that there will be companies outside of SIC 92 included in the Gambling Commission statistics. For example, some working men’s clubs may hold a license but would not be classified under SIC 92 by virtue of their other primary activities. Finally, Gambling Commission do not produce an estimate of GVA; instead they provide Gross Gambling Yield (GGY), which is the amount retained by gambling operators after the payment of winnings but before the deduction of operation costs, excluding the national lottery. This is because this measure is understood by the sector as a whole and is internationally comparable. This means the Gambling Commission can compare historically and internationally, but it does mean it is not comparable against other sectors. |

| Sport | Sport | Sport England | Sport England produces an estimate of the GVA and number of FTE jobs generated by sport and sport-related activity. This was updated in 2017/18 and covers England only. GVA is split by participation and consumption. The definition is wider than the statistical definition used by DCMS, but is similar to the sport satellite account approach based on the Vilnius definition. This means elements such as sport broadcasting are included. While potentially useful, the quality of the data depends on that of the evidence used to estimate the appropriate share of existing SICs. |

| Sport | Sport | UK Sport | UK Sport has produced estimates of the contribution of the Olympic and Paralympic sports. Whilst this is not fully comparable with DCMS’ estimates due to its much narrower scope, it uses a similar methodology to the DCMS Sport satellite account. Please note that this Sport satellite account is not currently part of the DCMS Sector Economic Estimates so there will be further differences in methodology and scope of industries. UK Sport use a satellite account approach for a portfolio of sports. They produce a GVA and employment estimates, using a range of sources: ABS/ASHE, 2014 Input-Output tables, Participation data and company accounts. Whilst these are not the exact same data sources as DCMS uses, or the most up to date, they do enable a comparison to DCMS statistics. They are therefore a robust estimate if the user is looking for specific Olympic and Paralympic sports. However, as with all satellite accounts, the quality of the data depends on that of the evidence used to estimate the appropriate share of existing SICs. |

| Tourism | Tourism | VisitBritain | VisitBritain have commissioned a report to value the number of jobs and economic contribution in the Tourism industry. This is based on a bespoke model, but the direct tourism industry figures have consistency with the Tourism Satellite Account methodology, which DCMS uses for its Tourism estimates. It is based on 2008 to 2011, so is more outdated than DCMS estimates. |

| Computer Games | Computer Games | UKIE and NESTA | UKIE has a website dedicated to statistics and other useful information about the UK games industry. This includes statistics on GVA (national and regional), employment, exports and imports, number of businesses, and investment, which are based on their latest official publications. In partnership with UKIE, NESTA has produced national and regional estimates of the economic contribution of the computer games industry, including number of businesses and GVA. This is based on a ‘big data’ modelling approach where researchers identified games companies through their digital footprint, rather than using official industrial (SIC) codes or surveys. The latest estimate is for 2014, so is more outdated than DCMS estimates. |

6. Further information

For enquiries on this release, please email evidence@dcms.gov.uk.

For general enquiries contact: Department for Digital, Culture, Media and Sport 100 Parliament Street London SW1A 2BQ Telephone: 020 7211 6000

DCMS statisticians can be followed on Twitter via @DCMSInsight.

The Economic Estimates of DCMS Sectors release is an Official Statistics publication and has been produced to the standards set out in the Code of Practice for Statistics. For more information, see https://www.statisticsauthority.gov.uk/code-of-practice/.

-

Sampling error is the error caused by observing a sample (as in a survey) instead of the whole population (as in a census). While each sample is designed to produce the “best” estimate of the true population value, a number of equal-sized samples covering the population would generally produce varying population estimates. This means we cannot say an estimate of, for example, 20% is very accurate for the whole population. Our best estimates, from the survey sample, suggest that the figure is 20%, but due to the degree of error, the true population figure could perhaps be 18% or 22%. This is not an issue with the quality of the data or analysis; rather it is an inherent principle when using survey data to inform estimates. ↩