Benefit Combinations to February 2023

Published 15 August 2023

Applies to England, Scotland and Wales

A person in Great Britain may be eligible to claim several benefits, administered by or on behalf of the Department for Work and Pensions, at the same time. The Benefit Combination statistics offer a picture of the number of individuals claiming at least one benefit as well as the number of claimants for each combination of benefits, as at the end of each quarter, for the period February 2013 to February 2023. Figures are presented separately for England and Wales and for Scotland due to the devolution of certain benefits to the Scottish Government. For detailed commentary on individual benefits see the DWP benefits statistics.

The Benefit Combination statistics cover:

- Attendance Allowance (AA)

- Bereavement Benefit (BB)

- Bereavement Support Payment (BSP)

- Carer’s Allowance (CA)

- Disability Living Allowance (DLA) for both adults and children

- Employment and Support Allowance (ESA)

- Housing Benefit (HB)

- Incapacity Benefit (IB)

- Income Support (IS)

- Industrial Injuries Disablement Benefit (IIDB)

- Jobseeker’s Allowance (JSA)

- Pension Credit (PC)

- Personal Independence Payment (PIP)

- Severe Disablement Allowance (SDA)

- State Pension (SP)

- Universal Credit (UC)

- Widow’s Benefit (WB)

Within the statistics, certain benefits are grouped together, where more than one benefit could be claimed to meet a particular need. The groupings used are:

- INCAP, which comprises ESA, IB and SDA (and IS where IB is claimed at the same time), to help with living costs if a claimant is unable to work due to a disability or health condition

- PIP/DLA (including AA for those over State Pension Age) for help with some of the extra costs caused by long-term disability, ill-health or terminal ill-health

Please note that for consistency, all of the figures in the Benefit Combinations release are aligned to a common time point: February 2023. More up-to-date figures have been published for:

1. Total benefit claimants

22.4 million people claimed some combination of DWP benefits in February 2023 (of the 17 benefits included in these statistics). Of these:

- 12.8 million were of State Pension Age (including those in receipt of their State Pension)

- 9.2 million were of Working Age

- 620,000 were under 16 (and in receipt of Disability Living Allowance as a child)

In England and Wales there were 20.8 million people (this includes unknown and abroad cases):

- 11.8 million were of State Pension Age (including those in receipt of their State Pension), 29% of whom were claiming more than one benefit

- 8.4 million were of Working Age, 35% of whom were claiming more than one benefit

- 620,000 were under the age of 16 (and in receipt of Disability Living Allowance as a child)

In Scotland there were 1.8 million people:

- 1.0 million were of State Pension Age (including those in receipt of their State Pension), 34% of whom were claiming more than one benefit

- 790,000 were of Working Age, 41% of whom were claiming more than one benefit

- 2,700 were under the age of 16 (and in receipt of Disability Living Allowance as a child)

The total number of benefit claimants in Great Britain remained relatively stable between February 2013 and February 2020, between 20 and 21 million, but subsequently rose due to the economic disruption caused by the coronavirus (COVID-19) pandemic, peaking at 23 million in February 2021. This then decreased to 22.4 million in February 2022 and currently remains at a similar level in February 2023.

2. Working Age combinations in England and Wales

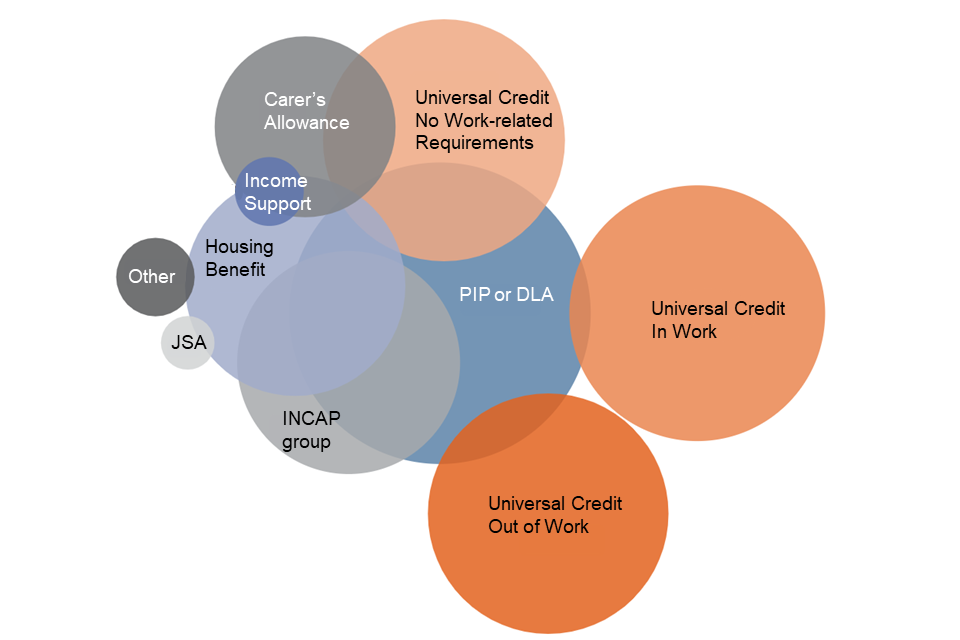

DWP Benefit Combinations, Working Age, February 2023

Note: This illustration uses overlapping circles, where larger circles and overlaps show more people claiming a particular combination of benefits. It is included to demonstrate the complexity of the situation for many claimants. Only the most common combinations are shown and other combinations do occur. It is not always possible for the areas to be exactly proportional to the number of cases for each combination.

Source: Benefit Combination Statistics to February 2023, Stat-Xplore

The most common benefit or combination of benefits claimed by Working Age (WA) individuals in England and Wales is Universal Credit (UC) on its own. Of all WA claimants in February 2023:

- 47% claimed UC and no other benefit

- 17% claimed UC in combination with some other benefit(s)

WA individuals may claim PIP or DLA if they need help with some of the extra costs caused by long-term disability, ill-health or when approaching the end of life due to a progressive disease. Of all WA claimants in February 2023:

- 7% claimed PIP or DLA and no other benefit

- 24% claimed PIP or DLA in combination with some other benefit(s)

WA individuals may claim Carer’s Allowance if they spend at least 35 hours per week caring for somebody and meet the required eligibility criteria. Of all WA claimants in February 2023:

- 4% claimed Carer’s Allowance and no other benefit

- 8% claimed Carer’s Allowance in combination with some other benefit(s)

The combinations of benefit that people claim are varied. Nearly one in five WA claimants (17% in February 2023) claim some combination other than the top 10 most common possibilities. This can include benefits that appear in the top 10, but in combination with other benefits at the same time. For example, somebody claiming INCAP on its own falls into the 11th most common combination (2% of all WA claimants in February 2023) whilst somebody claiming INCAP, PIP/DLA and Housing Benefit would be in the 5th most common combination (6% of all WA claimants in February 2023).

Top 10 Working Age benefit combinations, England and Wales, February 2023

| Benefits Claimed | Thousands | Percentage |

|---|---|---|

| UC In Work only | 1,817 | 22% |

| UC Out of Work only | 1,407 | 17% |

| UC No Work Requirements only | 711 | 8% |

| PIP/DLA only | 619 | 7% |

| INCAP, PIP/DLA and Housing Benefit | 534 | 6% |

| UC No Work Requirements and PIP/DLA | 505 | 6% |

| INCAP and PIP/DLA | 441 | 5% |

| Carer’s Allowance only | 308 | 4% |

| UC No Work Requirements and Carer’s Allowance | 291 | 3% |

| Housing Benefit only | 289 | 3% |

| Any other combination | 1,449 | 17% |

Source: Benefit Combination Statistics to February 2023, Stat-Xplore

Further combinations of benefits, and breakdowns by age, gender, geography, and individual benefits are available from Stat-Xplore.

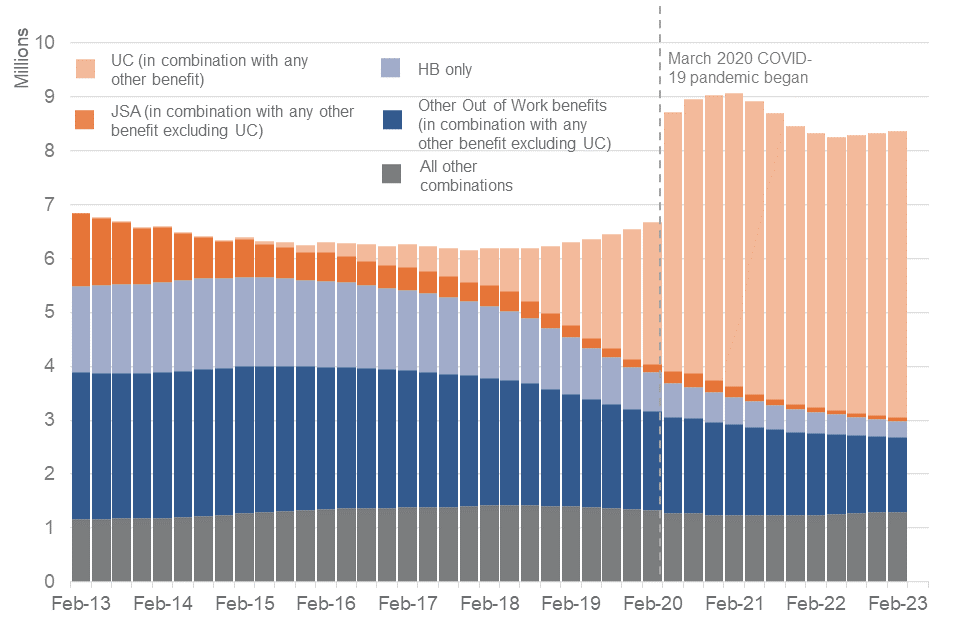

Working Age DWP Benefit Claimants, England and Wales, February 2013 to February 2023

Source: Benefit Combination Statistics to February 2023, Stat-Xplore

Since the introduction of Universal Credit in 2013 the picture of who claims which combination of benefits has been gradually changing, with more people claiming UC and fewer people claiming other benefits. In particular, there have been reductions in the numbers claiming JSA and other “Out of Work” benefits which comprise ESA, IB, SDA, IS (where CA not also in payment) or PC (where CA not also in payment), as well as reductions in HB.

The economic disruption caused by the coronavirus (COVID-19) pandemic caused UC claims to double, with 2.7 million claiming UC in February 2020, and 5.4 million in February 2021. This then gradually decreased to 5.1 million by February 2022, before rising again to 5.3 million by February 2023. The remainder of the WA benefit claiming population reduced by 24% from 4.0 million (February 2020) to 3.1 million (February 2023), in part because some people on other benefits but not claiming UC in February 2020 have started new UC claims by February 2023.

3. State Pension Age combinations in England and Wales

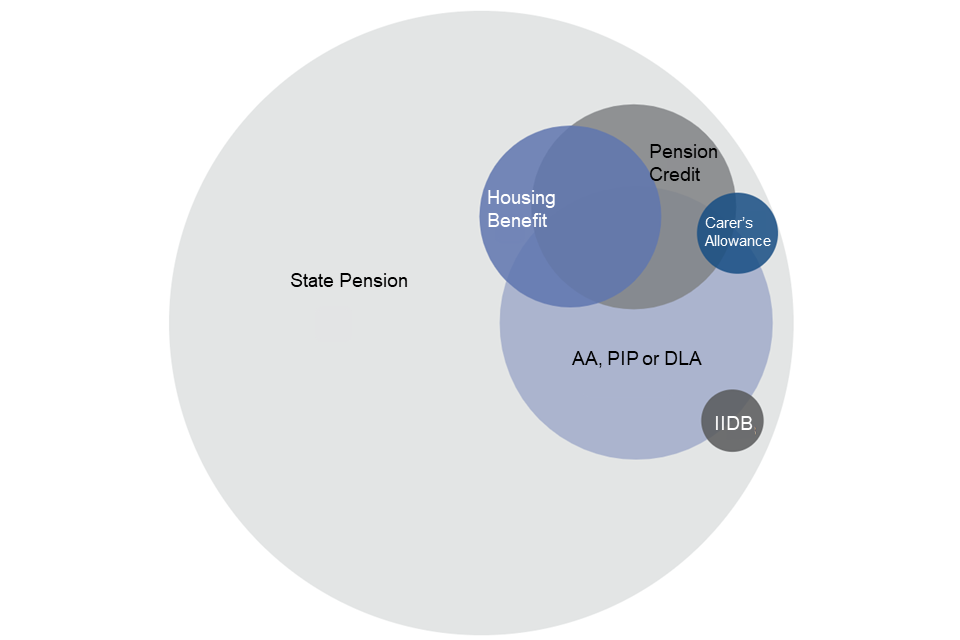

DWP Benefit Combinations, State Pension Age, February 2023

Note: This illustration uses overlapping circles, where larger circles and overlaps show more people claiming a particular combination of benefits. It is included to demonstrate the complexity of the situation for many claimants. Only the most common combinations are shown and other combinations do occur. It is not always possible for the areas to be exactly proportional to the number of cases for each combination.

Source: Benefit Combination Statistics to February 2023, Stat-Xplore

The most common benefit or combination of benefits claimed by State Pension Age (SPA) individuals in England and Wales is State Pension (SP) on its own. Of all SPA claimants in February 2023:

- 71% claimed their State Pension and no other benefit

- 28% claimed their State Pension in combination with some other benefit(s)

SPA individuals may claim AA, PIP or DLA if they need help with some of the extra costs caused by long-term disability, ill-health or terminal ill-health. Of all SPA claimants in February 2023:

- 11% claimed AA, PIP or DLA and their State Pension but no other benefit

- 8% claimed AA, PIP or DLA in any other combination

SPA individuals may claim Pension Credit and/or Housing Benefit (via their own or a partner’s claim) if they have a low income and need help with living or accommodation costs. Of all SPA claimants in February 2023:

- 6% claimed one or both of Pension Credit and Housing Benefit, as well as their State Pension, but no other benefit

- 9% claimed one or both of Pension Credit and Housing Benefit, in any other combination

Top 10 State Pension Age benefit combinations, England and Wales, February 2023

| Benefits Claimed | Thousands | Percentage |

|---|---|---|

| State Pension (SP) only | 8,342 | 71% |

| AA/PIP/DLA & SP | 1,335 | 11% |

| AA/PIP/DLA, Pension Credit, Housing Benefit & SP | 335 | 3% |

| Pension Credit, AA/PIP/DLA & SP | 277 | 2% |

| Pension Credit, Housing Benefit & SP | 274 | 2% |

| Pension Credit & SP | 269 | 2% |

| Housing Benefit & SP | 220 | 2% |

| AA/PIP/DLA, Housing Benefit & SP | 139 | 1% |

| Carer’s Allowance & SP | 113 | 1% |

| IIDB & SP | 62 | 1% |

| Any other combination | 417 | 4% |

Source: Benefit Combination Statistics to February 2023, Stat-Xplore

Since 2013, the trends in benefit claims amongst those of State Pension age have remained relatively stable, aside from a gradual reduction in Pension Credit claims (due to the introduction of the New State Pension in April 2016, among other factors). Whilst the retirement age has risen (a gradual increase for women from 60 in April 2010 to 65 in November 2018, and for both men and women to 66 by October 2020) the England and Wales population has also aged.

Further explanation and commentary on the statistics for State Pension and Pension Credit can be found in the benefits statistics summary release.

4. Benefit Combinations in Scotland

The Scotland Act 2016 gives Scottish Parliament powers over a number of social security benefits which had been administered to Scottish clients by the Department for Work and Pensions. From 1st April 2020, executive competency for DLA, PIP, AA, SDA and IIDB transferred from DWP to Social Security Scotland, the executive agency of Scottish Government which is responsible for delivering social security benefits for Scotland. Claims continued to be administered by DWP on Social Security Scotland’s behalf during an interim transitional period.

Carer’s Allowance became the first benefit for which executive competence transferred to the Scottish Government in 2018. DWP is administering Carer’s Allowance on behalf of Scottish Ministers until the introduction of Carer’s Assistance, which will replace it. However, Social Security Scotland is delivering Carer’s Allowance Supplement for which recipients of Carer’s Allowance who are resident in Scotland are eligible. Benefit Combination statistics in this release do not include data on Carer’s Allowance Supplement.

Child Disability Payment (CDP) has been introduced in Scotland to replace DLA for those aged under 16. New claims for CDP began in certain areas of Scotland in July 2021 and for the whole of Scotland from November 2021. The process of transferring existing claimants who live in Scotland from child DLA to CDP is a gradual and automatic. It began in Autumn 2021 and is expected to finish in Spring 2023.

Adult Disability Payment (ADP) has been introduced in Scotland to replace PIP and DLA for those aged between 16 and state pension age. New claims for ADP began in certain areas of Scotland in March 2022 and gradually extended to the whole of Scotland by 29th August 2022. For existing PIP and DLA claimants who live in Scotland, Social Security Scotland began to move clients to ADP from Summer 2022.

In the future, there are plans to replace AA with Pension Age Disability Payment and CA with Carer’s Assistance in Scotland.

For Benefit Combinations, this means:

- the caseload for those under the age of 16 (and in receipt of DLA as a child) in Scotland has reduced by 94% to 2,700 between August 2021 and February 2023, and will continue to fall

- the caseload for Working Age adults in Scotland claiming PIP or DLA has reduced by 6% to 290,000 between August 2022 and February 2023 and will continue to fall in future releases, which will in turn affect the volumes for any combination of benefits including PIP or DLA for individuals living in Scotland

The most common benefit or combination of benefits administered by DWP claimed by Working Age (WA) individuals in Scotland is Universal Credit (UC) on its own. Of all WA claimants in February 2023:

- 43% claimed UC and no other benefit

- 17% claimed UC in combination with some other benefit(s)

Top 10 Working Age combinations of benefits administered by DWP, Scotland, February 2023

| Benefits Claimed | Thousands | Percentage |

|---|---|---|

| UC In Work only | 142 | 18% |

| UC Out of Work only | 117 | 15% |

| UC No Work Requirements only | 79 | 10% |

| INCAP, PIP/DLA and Housing Benefit | 74 | 9% |

| UC No Work Requirements and PIP/DLA | 54 | 7% |

| PIP/DLA only | 53 | 7% |

| INCAP and PIP/DLA | 50 | 6% |

| UC No Work Requirements and Carer’s Allowance | 28 | 4% |

| Carer’s Allowance Only | 26 | 3% |

| INCAP only | 21 | 3% |

| Any other combination | 144 | 18% |

Source: Benefit Combination Statistics to February 2023, Stat-Xplore

The most common benefit or combination of benefits claimed by State Pension Age (SPA) individuals in Scotland is State Pension (SP) on its own. Of all SPA claimants in February 2023:

- 65% claimed their State Pension and no other benefit

- 34% claimed their State Pension in combination with some other benefit(s)

Top 10 State Pension Age combinations of benefits administered by DWP, Scotland, February 2023

| Benefits Claimed | Thousands | Percentage |

|---|---|---|

| State Pension (SP) only | 667 | 65% |

| AA/PIP/DLA & SP | 137 | 13% |

| AA/PIP/DLA, Pension Credit, Housing Benefit & SP | 44 | 4% |

| Pension Credit, AA/PIP/DLA & SP | 29 | 3% |

| Pension Credit, Housing Benefit & SP | 25 | 2% |

| Housing Benefit & SP | 21 | 2% |

| Pension Credit & SP | 21 | 2% |

| AA/PIP/DLA, Housing Benefit & SP | 18 | 2% |

| Carer’s Allowance & SP | 12 | 1% |

| IIDB & SP | 7 | 1% |

| Any other combination | 41 | 4% |

Source: Benefit Combination Statistics to February 2023, Stat-Xplore

The introduction of Adult Disability Payment is reducing the caseload of those Working Age individuals in Scotland who are claiming PIP or DLA (or combinations that include PIP or DLA). However, devolution changes are not currently impacting the State Pension Age caseloads of any benefits since Pension Age Disability Payment is yet to launch.

5. About these statistics

Methodology

There are methodological differences between individual benefit series and the combined benefit series, which in some cases give rise to differences in the figures themselves. Further information on methodology, and detail on uses and limitations of the series can be found in the background methodology note. For official statistics on each individual benefit please see the DWP benefits statistics collection.

Data Quality Statement

In Spring 2023, the Chief Statistician for DWP led an internal review of all experimental official statistics produced by DWP. This is in line with the Code of Practice for Official Statistics. The review found that it was appropriate to remove the experimental label from this publication because it was concluded that the statistics are suitable and of public value. As of 15 August 2023, these statistics are now classed as ‘official statistics’.

Known Issues

- During 2019, a new DWP computer system called “Get Your State Pension” (GYSP) came online to handle new State Pension claims. It is not yet possible to include the full GYSP data within published figures, but the number of cases on the new system is now too high to continue to publish State Pension data without including them. The Benefit Combinations State Pension caseload from February 2021 therefore includes an estimate of GYSP cases created using payment data, in line with the published State Pension figures (for this quarter, please note that these are being released as data tables and will not be released on Stat-Xplore).

- Between October 2020 and July 2021, Hackney Borough Council was not able to supply any Housing Benefit (HB) data to DWP. The published HB figures for this period were therefore modified by using the last complete data return from Hackney (October 2020) as an approximation and then using other trusted data sources (such as removing cases where the claimant is claiming the housing element of Universal Credit or has died) to amend or “clean” Hackney’s data. These modified HB data were used for Benefit Combinations during this interruption period to ensure continuity. A further interruption occurred in the supply of data from Gloucester City Council starting from December 2021 onwards. The HB statistics that cover Gloucester will be derived from earlier data using the same approach that was adopted for Hackney.

- The source IIDB data used for Benefit Combination statistics shows IIDB claimants at a point five months previous to the last day of the Benefit Combinations calendar month. To adjust for this lag, data from the Customer Information System (CIS) has been used to remove cases for individuals known to have died between the IIDB time point and the Benefit Combinations time point, giving an estimate of the IIDB caseload at the Benefit Combinations time point.

- Prior to December 2022, payments for abroad cases of IIDB were managed on a separate system which was not linked to published statistics. All abroad cases were migrated to the payment system that handles the rest of the IIDB caseload in November 2022. The official IIDB caseload statistics from December 2022 published on Stat-Xplore include a complete breakdown for abroad cases. The February 2023 Benefit Combination statistics (published in August 2023) use September 2022 IIDB data, and hence do not contain all abroad cases. A direct comparison therefore cannot be carried out between the official IIDB statistics and IIDB within the Benefit Combinations statistics at this time point. At the next publication date (November 2023), Benefit Combinations source IIDB data will be from December 2022, and hence will include the complete breakdown for abroad cases and will match the official IIDB caseload statistics.

The background methodology note gives detail and impact for each of these changes.

Benefits not included in this Benefit Combinations release

Maternity Allowance is not currently included in the series.

Current Benefit Combinations statistics do not include the HMRC administered benefits (Child Tax Credit, Working Tax Credit and Child Benefit). Since the introduction of Universal Credit in 2013, most Tax Credits are being gradually replaced by Universal Credit and so individuals who would formerly have claimed tax credits and not appeared in these statistics are now more likely to appear as Universal Credit claimants. DWP and HMRC analysts are working towards a joint annual publication of benefit combination statistics that would include Tax Credits and Child Benefit, and this is intended to be published at some point in the future.

Current Benefit Combinations statistics also do not include scottish benefits:

- Carer’s Allowance Supplement

- Child Disability Payment

- Adult Disability Payment

Expected future changes

At some point in the future, further devolution will affect claims from people residing in Scotland for AA, SDA, IIDB and CA. Caseloads for these benefits (and combinations including them) will reduce when they are replaced by new Scottish benefits.

Where to find out more

Read a background methodology note for more detail on derivation of Benefit Combination statistics.

Build your own data tables using Stat-Xplore.