Housing Benefit Debt Recoveries statistics: April to September 2022

Published 1 March 2023

The latest release of these statistics can be found in the collection of Housing Benefit Debt Recoveries statistics.

Housing Benefit (HB) is an income-related benefit that is intended to help meet housing costs for rented accommodation.

This publication updates statistics on the amount of HB that local authorities (LAs) identified had been overpaid to claimants, the amount recovered, and the amount written off, with data for the first two quarters of FYE 2023 (April 2022 to September 2022).

1. Main stories

During the first two quarters of FYE 2023:

-

LAs identified £206 million overpaid HB – £2 million less than the first two quarters of FYE 2022

-

LAs recovered £198 million overpaid HB – £18 million less than the first two quarters of FYE 2022

-

LAs wrote off £32 million overpaid HB – £5 million more than the first two quarters of FYE 2022

-

at the start of Q2 of FYE 2023, there was £1.73 billion outstanding overpaid HB – £107 million less than at the start of Q2 of FYE 2022

2. What you need to know

This summary contains statistics on the amount of overpaid HB identified, recovered and written-off by LAs. The statistics are based on the Housing Benefit Debt Recovery (HBDR) returns, collected from LAs each quarter.

The statistics are published twice a year, in March and September. The March publication contains data for the first two quarters of the financial year (April to September). The September publication contains finalised data for the whole of the financial year.

Data tables containing data that underpin the charts and figures featured in this statistical summary are available. As well as the regional and GB totals shown in this statistical summary, the data tables show figures for individual LAs.

Some LAs do not send data returns every quarter or cannot supply data for all fields. In early years of the HBDR collection, estimates were made of missing data. These were added to the data that LAs did return to produce estimates of GB totals.

In the charts in this summary, GB figures up to Quarter 2 of FYE 2017 are “imputed” totals, based on estimates of missing LA data. From Quarter 3 of FYE 2017, figures shown are those actually returned by LAs, with no estimates being made for missing data. However, the amount of missing data excluded from the figures is small – for Q1 and Q2 FYE 2023, returns were received covering 99.5% of HB claimants in GB. Please see section 8 for more information about this.

Since the end of 2018, most new working-age claimants have claimed the housing element of Universal Credit (UC) rather than HB. The number of people claiming HB has been steadily decreasing and will continue to fall as existing HB claims transfer to UC. This has had an impact, both on the amount of overpaid HB identified by LAs, and the amount of overpaid HB that they recover.

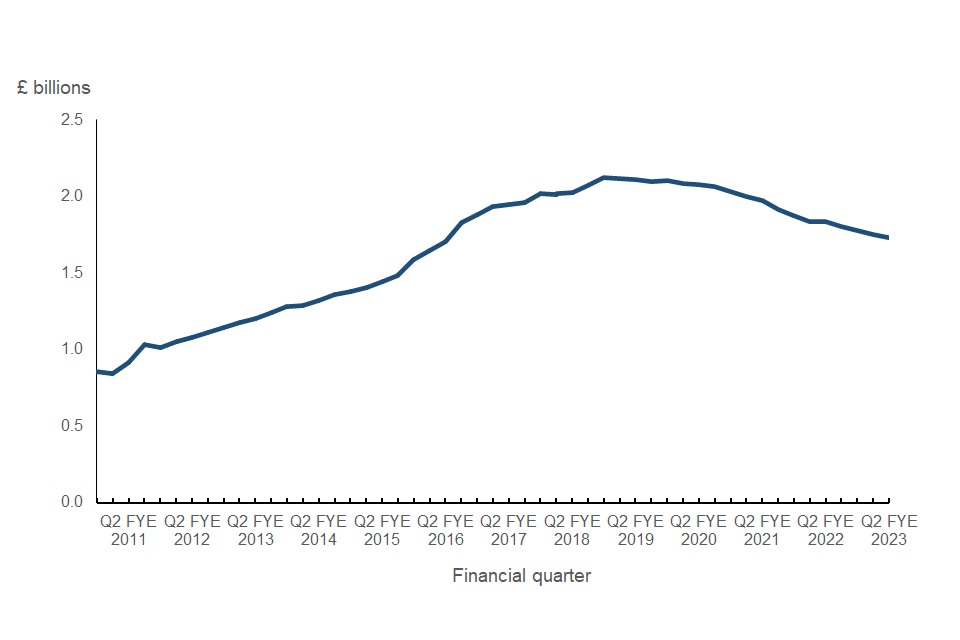

3. Total outstanding HB overpayments

Total outstanding HB overpayments in Great Britain from Q1 FYE 2010 to Q2 FYE 2023 (£ billions)

Source: HBDR data tables

At the start of Q2 of FYE 2023, total outstanding HB overpayments stood at £1.73 billion. This was £107 million (6%) less than at the start of Q2 of FYE 2022.

The value of outstanding overpayments followed a generally increasing trend from £554 million in Q2 FYE 2009, until it reached a peak of £2.12 billion in Q4 of the FYE 2018 and has gradually declined since. During the first two quarters of the FYE 2023, the total value of outstanding overpayments continued to follow a decreasing trend and was £1.75 billion in Q1 and £1.73 billion in Q2.

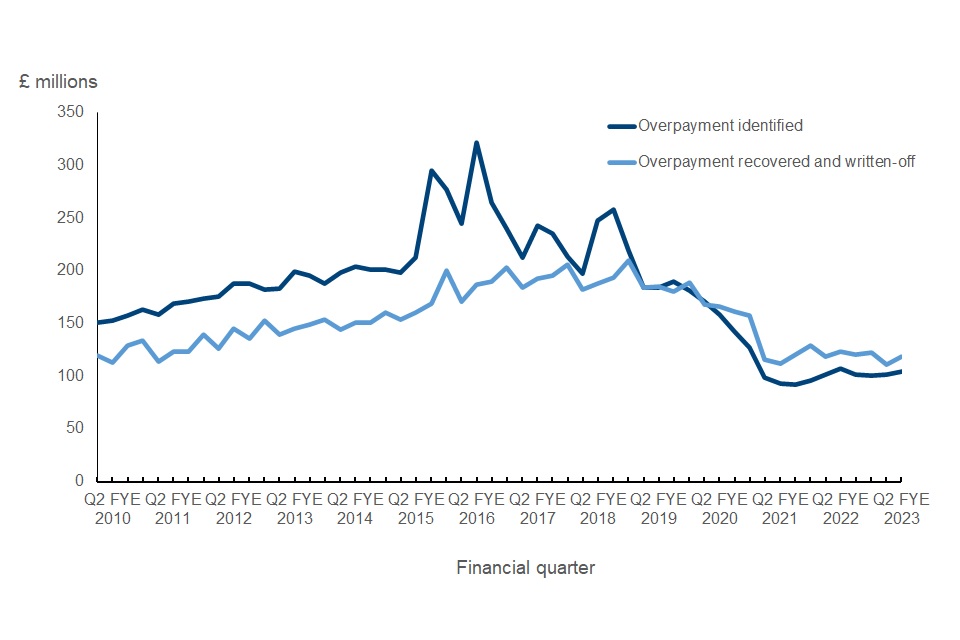

Amount of overpaid HB identified / recovered and written-off by LAs from Q1 FYE 2010 to Q2 FYE 2023 (£ millions)

Source: HBDR data tables

Prior to end of FYE 2018 the amount of overpaid HB identified was always greater than the amount recovered or written off, but since then the total amount of overpaid HB outstanding has been falling because LAs are recovering or writing-off more HB overpayments than they newly identify. In Q2 of FYE 2023, LA’s identified £104 million overpaid HB, but recovered £100 million and wrote-off £18 million.

Total outstanding HB overpayments by region, at the start of Q2 of FYE 2023

| Region | Total outstanding HB overpayments (£ millions) | % of GB total |

|---|---|---|

| Great Britain | 1,730 | 100% |

| North East | 57 | 3% |

| North West | 170 | 10% |

| Yorkshire and The Humber | 91 | 5% |

| East Midlands | 80 | 5% |

| West Midlands | 153 | 9% |

| East | 117 | 7% |

| London | 596 | 34% |

| South East | 191 | 11% |

| South West | 93 | 5% |

| Wales | 46 | 3% |

| Scotland | 136 | 8% |

Source: HBDR data tables

At the start of Q2 of FYE 2023, London LAs reported £596 million outstanding overpaid HB, just over a third (34%) of the GB total. At the start of Q2 of FYE 2023, 89% of the outstanding overpaid HB in GB were in LAs in England, 3% in Wales and 8% in Scotland.

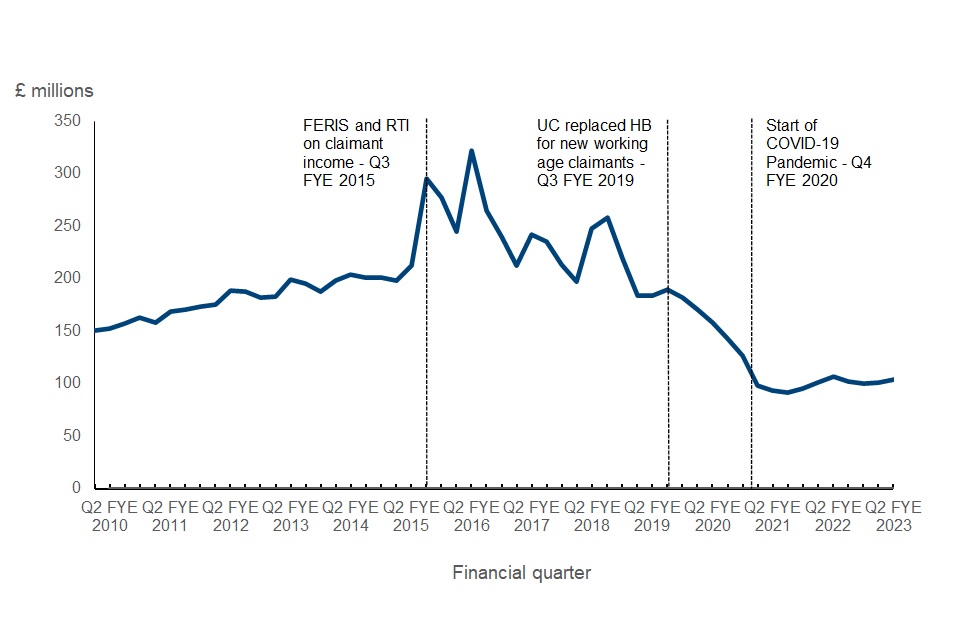

4. HB overpayments identified by LAs

HB overpayments identified in Great Britain, from Q1 of FYE 2010 to Q2 of FYE 2023 (£ millions)

Source: HBDR data tables

Historically there was an increasing trend in the amount of identified overpayments from Q1 of FYE 2009 to Q2 of FYE 2016 where the amount identified reached a high of £322 million. After this, the amount of HB debt identified has fluctuated but generally followed a downward trend to a low of £92 million in Q3 of FYE 2021. Since then, the quarterly amount of overpaid HB that LAs identified has increased, with £102 million being identified in Q1 of FYE 2023 and £104 million in the latest quarter (Q2 of FYE 2023).

Factors influencing the amount of HB overpayment identified by LAs include:

-

the Fraud and Error Reduction Incentive Scheme (FERIS) was introduced in Q3 of FYE 2015 to help LAs to identify and prevent HB overpayment. Around the same time, real-time information (RTI) on claimant’s incomes became available to LAs. The income that claimants reported on their HB claims was checked against RTI on claimants’ actual income from HMRC. These checks led to undeclared income, and consequently overpaid HB, being identified by LAs

-

UC rollout – most new working-age claimants have claimed the housing element of UC rather than HB

-

during the COVID-19 lockdowns in Q4 FYE 2020 and FYE 2021, many LAs redeployed staff away from processing and debt recovery to other frontline activities and restricted face-to-face meetings between staff and claimants

Total HB overpayments identified by LAs, by region, Q1 and Q2 FYE 2023

| Region | Total HB overpayments identified (£ millions) | % of GB total |

|---|---|---|

| Great Britain | 206 | 100% |

| North East | 6 | 3% |

| North West | 17 | 8% |

| Yorkshire and The Humber | 11 | 5% |

| East Midlands | 10 | 5% |

| West Midlands | 26 | 13% |

| East | 13 | 6% |

| London | 68 | 33% |

| South East | 24 | 12% |

| South West | 13 | 6% |

| Wales | 7 | 3% |

| Scotland | 11 | 5% |

Source: HBDR data tables

The amount of overpaid HB identified by LAs in the first two quarters of FYE 2023 ranged from £6 million in the North East (3% of the GB total) to £68 million (33% of the GB total) in London. Of the overpaid HB identified in GB, 91% were identified by LAs in England, 3% in Wales and 5% in Scotland.

Average HB overpayment identified per claimant per month, by region, Q1 and Q2 FYE 2023

| Region | Average HB overpayment newly identified per claimant per month |

|---|---|

| Great Britain | £13.43 |

| England | £14.51 |

| North East | £7.59 |

| North West | £9.23 |

| Yorkshire and The Humber | £8.70 |

| East Midlands | £10.52 |

| West Midlands | £18.18 |

| East | £11.46 |

| London | £24.55 |

| South East | £14.57 |

| South West | £11.73 |

| Wales | £8.11 |

| Scotland | £7.11 |

Source: HBDR data tables and HB Caseload Statistics

During Q1 and Q2 of FYE 2023, LAs identified overpaid HB equivalent to £13.43 per claimant per month. LAs in London identified the highest amount of overpaid HB, equivalent to £24.55 per claimant per month. LAs in England identified overpaid HB equivalent to £14.51 per claimant per month, compared with £8.11 in Wales and £7.11 in Scotland.

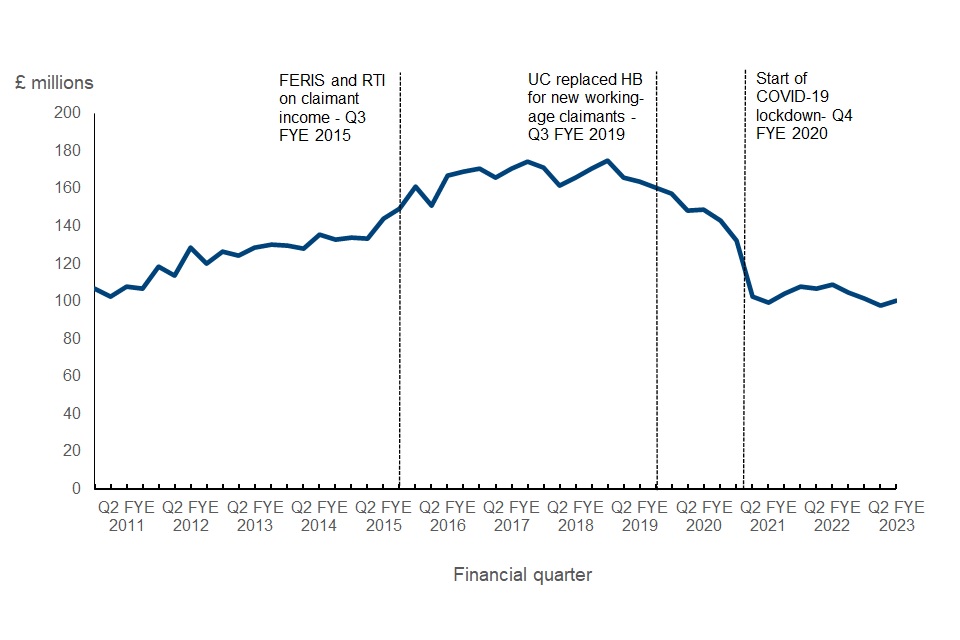

5. HB overpayments recovered

HB overpayments recovered in Great Britain from Q1 of FYE 2010 to Q2 of FYE 2023 (£ millions)

Source: HBDR data tables

Historically, the total value of overpayments recovered has tended to vary seasonally between quarters. Overall, from Q4 FYE 2010, it has followed an upwards trend, reaching a high of £175 million in Q4 of FYE 2018.

The FYE 2019 was the first where the amount of overpayments recovered saw a decreasing trend. This decrease continued to the first two quarters of the FYE 2021, with the decrease from Q4 of the FYE 2020 to Q1 of the FYE 2021 being the greatest decrease observed between consecutive quarters, within the time series (£30 million). This decrease should be seen in context with the effects of the COVID-19 pandemic, which resulted in the majority of debt recovery staff not being in post for several months.

The amount of HB that LAs recovered in the latest two quarters was £98 million in Q1 and 100 million in Q2 of FYE 2023. In Q1 of FYE 2023, the amount of overpaid HB that LAs recovered was the lowest seen since Q4 of FYE 2009 (when it was £91 million).

Total HB overpayments recovered, by region, Q1 and Q2 FYE 2023

| Region | Total HB overpayments recovered (£ millions) | % of GB total |

|---|---|---|

| Great Britain | 198 | 100% |

| North East | 7 | 3% |

| North West | 19 | 10% |

| Yorkshire and The Humber | 11 | 6% |

| East Midlands | 11 | 5% |

| West Midlands | 26 | 13% |

| East | 15 | 8% |

| London | 56 | 28% |

| South East | 25 | 12% |

| South West | 13 | 6% |

| Wales | 6 | 3% |

| Scotland | 10 | 5% |

Source: HBDR data tables

The total amount of overpaid HB that LAs recovered in the latest two quarters of FYE 2023 was £198 million. In the first two quarters of FYE 2023, LAs in London reported 28% of the total amount of HB overpayments recovered in GB. Of the total HB overpayments recovered in GB, 92% were recovered by LAs in England, 3% by LAs in Wales and 5% by LAs in Scotland.

6. HB overpayments written off

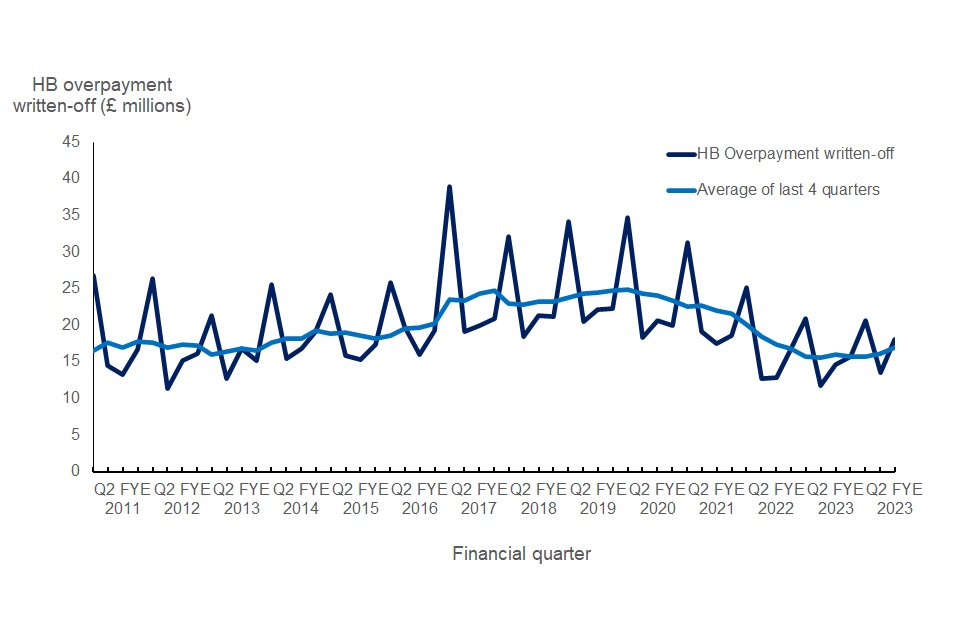

HB overpayments written off in Great Britain, from Q4 of FYE 2010 to Q2 of FYE 2023 (£ millions)

Source: HBDR data tables

The amount of overpaid HB that LAs wrote-off in the first two quarters of FYE 2023 was £32 million. This was an increase of 5 million when compared to the first two quarters of FYE 2022.

The amount of overpayments written off changes throughout the year. It is generally highest in Q4 (January-March) of each financial year, followed by a sharp decrease during Q1 of the following year. To smooth out seasonality a rolling quarterly average is used in the statistics.

Historically, using the quarterly rolling average figures, the amount of overpayments written off gradually increased from Q4 of FYE 2011 to Q4 of FYE 2018. From Q1 of FYE 2019, the quarterly rolling average figures have gradually decreased to Q4 of FYE 2022. For the most recent two quarters (Q1 and Q2 of FYE 2023), the quarterly rolling average figures have slightly increased.

Taking the financial year as a whole, FYE 2018 saw the highest amount of overpaid HB written off at £100 million. In Q1 of FYE 2023, LAs wrote-off £14 million overpaid HB, which increased to £18 million in Q2 of FYE 2023.

Total HB overpayments written off, by region, Q1 and Q2 FYE 2023

| Region | Total HB overpayments written-off (£ millions) | % of GB total |

|---|---|---|

| Great Britain | 31.6 | 100% |

| North East | 1.6 | 5% |

| North West | 3.3 | 10% |

| Yorkshire and The Humber | 2.0 | 6% |

| East Midlands | 1.5 | 5% |

| West Midlands | 1.7 | 5% |

| East | 2.1 | 7% |

| London | 12.7 | 40% |

| South East | 2.8 | 9% |

| South West | 1.6 | 5% |

| Wales | 0.7 | 2% |

| Scotland | 1.6 | 5% |

Source: HBDR data tables

The amount of overpaid HB written-off by LAs in the first two quarters of FYE 2023 ranged from £0.7 million (2% of the GB total) in Wales to £12.7 million (40% of the GB total) in London. 93% of overpaid HB written-off were made by LAs in England, 2% by LAs in Wales and 5% by LAs in Scotland.

7. About these statistics

This summary contains statistics on the amount of overpaid HB identified, recovered and written-off by LAs. The statistics are based on the Housing Benefit Debt Recovery (HBDR) returns, collected from LAs each quarter.

Publication schedule

The statistics are published twice a year, in March and September. The March publication contains data for the first two quarters of the financial year (April to September). The September publication updates the statistics with data for the whole of the financial year. Where LAs notified us of changes to their first two quarters’ data, or provided a late Quarter 1 or Quarter 2 return after the deadline for the March 2023 publication, these will be incorporated into the September 2023 publication.

Supplementary statistics

Data tables containing data that underpin the charts and figures featured in this statistical summary are available. As well as the regional and GB totals shown in this statistical summary, the data tables show figures for individual LAs.

LAs are asked to provide a breakdown between overpaid “Rent Allowance” (HB paid to LA tenants) and “Rent Rebate” (HB paid to housing association and private sector tenants). This breakdown is shown in the supplementary tables, in those LAs for which it is available.

Data completeness

Some LAs do not send data returns every quarter or cannot supply data for all fields. This produces missing data in the returns. The table at the end of this summary shows the scale of missing data, each year since the HBDR collection began.

In the first year of the HBDR collection (FYE 2009) LAs that returned data accounted for less than 75% of all HB claimants. In view of the scale of missing returns in FYE 2009, data for FYE 2009 have been excluded from the charts in this summary.

After the first year, response rates improved. In FYE 2010, responses were received covering approximately 96.5% of all HB claimants and from FYE 2014, over 99% of HB claimants were covered by the returns.

Up to Q2 of FYE 2017, when an LA did not send a return, its figures were estimated. These estimates were added to the returns that LAs did submit, to produce an “imputed” GB total. Information on how these estimates were calculated is available in the background information document.

During FYE 2017, the methodology for treating missing LA data was reviewed. It was decided that, in recent years, the amount of data missing from the HBDR return had reduced to the point that estimates were unnecessary. Therefore, in this statistical summary, while “imputed” GB totals are shown for earlier years, all of the figures from Q3 of FYE 2017 onwards are based on the data actually returned by LAs. Overall, for Q1 and Q2 of FYE 2023, returns were received covering 99.5% of HB claimants in GB. We continue to work with LAs to reduce the number of missing returns and will review our policy for treating missing data should the number of missing returns increase.

Comparability

As well as missing data, the background information document describes a number of other factors that need to be considered when comparing data. These include:

-

it is not possible to make direct comparisons between the amount of HB overpayments that LAs identify during a particular period and the amount of overpayment that they recover in that period. Firstly, because overpayments are not necessarily identified in the same period that they occurred. Secondly, because overpayments are not necessarily recovered in the same period that they are identified

-

the number of people claiming HB has been decreasing and will continue to fall as Universal Credit (UC) replaces HB for working age claimants

-

the Fraud and Error Reduction Incentive Scheme (FERIS) provided LAs with tools to help them identify and prevent overpaid HB. Real-time information (RTI) on claimants’ income became available to LAs at around the same time (Q3 of FYE 2015). This allowed LAs to identify income that claimants had failed to report on their HB claims, which in turn led to an increase in the amount of overpaid HB that LAs were able to identify

-

at the start of the COVID-19 pandemic, many LAs redeployed staff away from debt recovery to frontline activities and restricted face-to-face meetings between staff and claimants

-

LAs sometimes identify an amount by which a HB claimant has been overpaid, but then revise this amount at a later date. In some cases, for instance, “underlying entitlement” might be retrospectively applied to an overpayment, reducing the amount that the claimant was originally thought to owe. Conversely, an LA might retrospectively reverse their decision to write-off an overpayment. These revisions lead to a discrepancy between figures for one quarter and the next

The total amount of HB overpayment at the start of a quarter should, in theory, equal the total amount of overpayment at the start of the previous quarter, plus the amount of overpayment newly identified during the previous quarter, minus the amount of overpayment recovered and written-off during the previous quarter. However, this is not the case in all LAs.

Nationally, the total amount of outstanding HB overpayment that LAs reported at the start of Q2 of FYE 2023 was 0.64% less than the figures reported in Q1 suggested it would be. This difference was a result of revisions made in Q4 to overpayments that LAs first identified in previous quarters. The background information document describes this issue in more detail.

Local authority mergers

There have recently been a number of local authority mergers. Four LAs in Buckinghamshire, for instance, merged to form a single LA. Although the LAs officially merged in 2020, their IT systems merged later.

Average HB overpayment identified per claimant per month

This summary includes a table showing the equivalent amount of overpaid HB, per claimant per month. This is calculated by dividing the total amount of overpaid HB identified by LAs in Q1 and Q2 of FYE 2023, by the sum of the HB caseload in each month of Q1 and Q2 FYE 2023. Data on the number of HB claimants was taken from Stat-Xplore.

This is not an exact measure because, although LAs might report during a particular quarter that they had identified an amount of overpaid HB, this overpayment might have occurred in a previous quarter or financial year and the claimant whose HB was overpaid may no longer have been receiving HB when the overpayment was identified.

Rounding policy

Percentage figures presented in this document are rounded to the nearest 1%. In some cases, figures may not add up to 100% due to rounding.

Data presented in the tables within this summary have been rounded to the nearest whole number (in millions) except for regional data of HB overpayments written off in Q1 and Q2 FYE 2023. These have been rounded to one decimal place (in millions) to represent a clearer picture of the data as overpayments written off are typically smaller than the other metrics covered in this release.

In the supplementary tables, raw data provided by LAs have been added to generate regional and national totals, before being rounded to the nearest £1,000. As a result of this rounding, the sum of the LA figures shown in the tables may be slightly different to the regional and national totals.

Related statistics

These statistics show the amount of HB overpayment that is identified and subsequently recovered by LAs. DWP carry out a sampling exercise to estimate overall levels of fraud and error in HB, including overpayment not identified by LAs. According to the latest estimate, published in May 2022, there was approximately £860 million overpaid HB in FYE 2022. An estimated £540 million was overpaid due to fraud, £260 million due to claimant error and £70 million due to official error.

8. HBDR data: collection processes and accuracy

Data collection

The table below details the list of questions asked to LAs as part of the data collection process.

| Field | Overpayment Questions |

|---|---|

| 1 | Total value of HB overpayments outstanding at the start of the quarter |

| 2 | Total value of HB overpayments identified during the quarter |

| 3 | Total value of HB overpayments recovered during the quarter |

| 4 | Total value of HB overpayments written off during the quarter |

LAs are asked to provide a breakdown between overpaid “Rent Allowance” (HB paid to LA tenants) and “Rent Rebate” (HB paid to housing association and private sector tenants). Where this breakdown is available it is shown in the “supplementary tables”.

Average data return rates

| Collection Period | Percentage of HB caseload covered by the HBDR returns |

|---|---|

| FYE 2009 | 74.0% |

| FYE 2010 | 96.5% |

| FYE 2011 | 96.3% |

| FYE 2012 | 97.9% |

| FYE 2013 | 98.7 % |

| FYE 2014 | 99.1% |

| FYE 2015 | 99.3% |

| FYE 2016 | 99.9% |

| FYE 2017 | 99.3% |

| FYE 2018 | 100.0% |

| FYE 2019 | 100.0% |

| FYE 2020 | 99.9% |

| FYE 2021 | 99.3% |

| FYE 2022 | 99.2% |

| Q1 and Q2 FYE 2023 | 99.5% |

9. Further information

Our background information document provides further information on the HBDR statistics, including some of the processes involved in developing and releasing these statistics.

Data tables containing data that underpin the charts and figures featured in this statistical summary are also published.

National Statistics status

The UK Statistics Authority has designated these statistics as National Statistics, at June 2012, in accordance with the Statistics and Registration Service Act 2007 and signifying compliance with the Code of Practice for Statistics.

National Statistics status means that our statistics meet the highest standards of:

-

trustworthiness

-

quality

-

public value

Once statistics have been designated as National Statistics it is our responsibility to maintain compliance with these standards. In order to assess the quality of the HBDR statistics, in July 2021, LAs were sent a survey, asking them a number of questions about how they complete their returns. Information collected on this survey has been incorporated into the background information document.

Other National and Official Statistics

See the schedule of statistical releases over the next 12 months and a list of the most recent releases.

Feedback

Specific HBDR statistics feedback can be submitted via our HBDR user questionnaire.

Completed questionnaires can be returned by email to: cbm.stats@dwp.gov.uk

Users can also join the “Welfare and Benefit Statistics” community. DWP announces items of interest to users via this forum, as well as replying to users’ questions.

Lead Statistician: James Gray cbm.stats@dwp.gov.uk

Statistical Producer: Nikoleta Ivanova

DWP Press Office: 0115 965 8781

ISBN: 978-1-78659-495-2