Income Dynamics: Background information and methodology

Published 21 March 2024

Section 1: Purpose and context of the statistics

Income Dynamics (ID) contains analysis of income movements and the persistence of low income for various population groups.

Reporting on the percentage of children in the United Kingdom who live in households whose income has been less than 60% of median equivalised net household income, in at least three of the last four survey periods, is required under section 4 of the Welfare Reform and Work Act 2016, and, regarding Scotland, the Child Poverty (Scotland) Act 2017. Definitions for relevant key terms in these Acts are consistent with those given in the Glossary of this document. Data for reporting against the other three measures are available in the Households Below Average Income (HBAI) publication.

ID has been published annually alongside the HBAI series since 2017. While HBAI is the UK’s official source of poverty estimates, its statistics are cross-sectional. ID statistics are longitudinal, and thereby provide a complementary perspective on poverty.

Longitudinal analysis allows us to identify:

- what percentage of people stay in low income for longer periods of time, and who is most and least likely to do so

- what percentage of people move into and out of low income each year, and who is most and least likely to do so

- how different household changes are associated with moving into and out of low income, e.g. what is the role of a change in employment status or household demographics

- how much longer-term income mobility there is

Potential users include:

- policy and analytical teams within the DWP

- the Devolved Administrations and other government departments

- local authorities

- Parliament

- Academics

- Journalists

- and the voluntary sector

The Department for Work and Pensions’ (DWP) responsibilities include understanding and dealing with the causes of poverty rather than its symptoms, encouraging people to work and making work pay, encouraging disabled people and those with ill health to work and be independent, and providing a decent income for people of pension age and promoting saving for retirement. The extent of progress towards these responsibilities will affect these statistics.

Context relevant to this publication

ID uses data from the Understanding Society survey. ‘Understanding Society’ (referred to from now on as ‘USoc’) is a longitudinal survey, run by the University of Essex. Data collection is continuous and takes place via survey ‘waves’, each of which is carried out across two calendar years. For its annual publication, ID uses the most recent USoc data release, which includes data from the most recent survey ‘wave’: this is Wave 13 for this publication, which covers calendar years 2021 and 2022.

The coronavirus (COVID-19) pandemic

The coronavirus (COVID-19) pandemic and subsequent policy announcements affected USoc fieldwork, data collection and processing in waves 11, 12 and 13. These changes have been documented by the USoc team (see references below this section), but some key points relevant to this ID publication are noted here:

- The first national lockdown due to the coronavirus pandemic began in March 2020, while waves 11 and 12 were in the field. At this point in time, around two-thirds of USoc data collection was web-based, with around a third completed via face-to-face interview and about 1% conducted via telephone.

- Following lockdown, data collection for all respondents was swiftly moved online in the first instance (a ‘web-first’ approach), with telephone follow-up used if necessary. Response rates were largely protected over the course of these adjustments. Small changes in the sample profile occurred as some groups were less likely to respond. Weights were adjusted accordingly.

- USoc maintained the web-first approach throughout the rest of waves 11 and 12, and for the first fifteen months of Wave 13. From April 2022, face-to-face interviewing was resumed for a small part of the sample: between April and December 2022, 13% of households were issued as face-to-face interviews, while the remaining 87% of household continued as web-first.

- For waves 11, 12 and 13, the USoc questionnaire was adjusted to gather information on participation in the Coronavirus Job Retention Scheme for employees and receipt of grants via the Self-Employment Income Support Scheme (SEISS) for the self-employed.

Section 3 discusses the implications of these changes for ID statistics. For further information on USoc changes linked to the pandemic, please refer to:

- the USoc Main Survey Data and documentation, including technical reports for each wave.

- USoc (2022) Understanding Society Main Study Changes due to the COVID-19 Pandemic (Wave 13 release); and

- Alvarez, Burton & Lynn (2021) Covid-19 and Mode Selection Effects in Understanding Society

Section 2: Source of the statistics

These statistics are derived from the Understanding Society (USoc) survey. USoc is an initiative funded by the Economic and Social Research Council and various Government Departments, with scientific leadership by the Institute for Social and Economic Research at the University of Essex, and survey delivery by NatCen Social Research and Kantar Public. The research data are distributed by the UK Data Service.

We have used the following dataset:

University of Essex, Institute for Social and Economic Research. (2022). Understanding Society: Waves 1-13, 2009-2022 and Harmonised BHPS: Waves 1-18, 1991-2009: Special Licence Access. [data collection]. 17th Edition. UK Data Service. SN: 6931, DOI: 10.5255/UKDA-SN-6931-16

We do not publish the dataset that we derive to produce ID statistics. Please contact us if you require further information about how we process and analyse USoc data.

We would like to thank Paul Fisher and Raj Patel at the University of Essex for ongoing advice and assistance.

DWP bears sole responsibility for the analysis or interpretation presented here.

The USoc sample

USoc is a UK household panel survey, which has been running since 2009. Individuals in households recruited at the first round of data collection are visited each year to collect information on changes to their household and individual circumstances. These individuals and their descendants form the core sample. Household members aged 16 or older are eligible for a full adult interview each year, allowing measurement of change. Household members not part of the core sample are also eligible provided they are living with at least one core sample member.

The USoc main sample is made up of four subsamples:

| Subsample | Explanation |

|---|---|

| General Population Sample (GPS) | This is the largest of the four subsamples and has been part of the survey since Wave 1 was launched in 2009. The England, Scotland and Wales sample in this data release is based upon an initial sample of 47,520 addresses. In Northern Ireland, 2,395 addresses were selected in a single stage from the list of domestic addresses. |

| Ethnic Minority Boost Sample (EMBS) | The EMBS has also been part of the survey since Wave 1. It was designed to provide at least 1,000 adult interviews from each of five groups: Indian, Pakistani, Bangladeshi, Black Caribbean, and Black African, and did so by sampling postal sectors with relatively high proportions of relevant ethnic minority groups, based upon 2001 Census data and more recent Annual Population Survey data. It screened in individuals living in households with at least one person who considered themselves, or a parent or grandparent to be an ethnic minority. |

| The former British Household Panel Survey (BHPS) sample | The BHPS ended in 2009. Active members of the BHPS were then invited to join USoc in Wave 2 (2010). It should be noted that the BHPS sample contains different subsamples, including the original sample (first selected in 1991), boost samples in Scotland and Wales (first selected in 1999), and a Northern Ireland sample (selected in 2001). |

| Immigrant and Ethnic Minority Boost (IEMB) | This sample was introduced at Wave 6 of USoc and introduced around 2,900 new households to the survey. Data from the IEMB was included in ID for the first time in the 2010 to 2021 publication. The target population groups for the IEMB were either people born outside of the UK, or people who considered themselves, their parents or grandparents to be of Indian, Pakistani, Bangladeshi, Black Caribbean or Black African origin. Individuals with minority group origins of other than the five groups mentioned above were also screened in if they lived in the sampled areas. |

Representativeness of the USoc survey

USoc was initially designed as a representative sample. Detailed ‘following rules’ (see the next section) set out how the sample is allowed to change over time, as sample members’ circumstances change. These rules aim to ensure that the survey remains representative of the UK population, although they do not enable it to capture the effect of immigration to the UK.

To help address this gap and improve the representativeness of the survey, the Immigrant and Ethnic Minority Boost (IEMB) sample was introduced at Wave 6 (2014 and 2015). It resulted in an additional 2,900 households being added to the survey. The target population groups for the IEMB were either individuals born outside of the UK, or individuals who considered themselves or their parents or grandparents to be of Indian, Pakistani, Bangladeshi, Black Caribbean or Black African origin (the five largest established minority ethnic groups in the UK). In addition, those with minority group origins other than those of the five groups were also screened for eligibility if they lived in the sampled areas.

The initial USoc sample only included private households living in the UK. This meant that it excluded individuals living in institutions such as nursing or retirement homes, hostels for homeless people, or prison/young offender’s institutions. As a result, analysis for particular age bands, such as older people or younger people, may not be completely representative of all individuals in those age bands where the characteristics of people who live in private households (and who are included), differ in a fundamental way from those living in institutional settings (who are not included).

USoc does collect information on the reasons why household members may be currently absent, which includes being in a range of institutions. A person who moves into an institution (except prison) is still an eligible sample member and so if they do not complete the survey online, they are followed up by an interviewer by phone where feasible. USoc is collecting more information about people who go into care homes to facilitate follow-up, and now asks participants to nominate a proxy if they are unable to be interviewed because of ill-health or being away from home for a long period.

For further discussion on the representativeness of the USoc sample, including information on hard to reach groups and plans to improve sub-group coverage, please refer to:

- Benzeval, Bollinger, Burton, Crossley & Lynn (2020) The Representativeness of Understanding Society, and

- Borkowska (2019) Improving population and sub-group coverage: who is missing and what can be done about it?

Sample status and “following rules”

This section sets out the three different sample ‘statuses’ as well as the ‘following rules’ that are applied when there are specific changes to individual or household circumstances.

The three sample statuses are:

Original Sample Members (OSMs)

All members of USoc GPS households enumerated at Wave 1 - including absent household members and those living in institutions who would otherwise be resident - are Original Sample Members (OSMs). All ethnic minority members of an enumerated household eligible for inclusion in the EMBS are OSMs. Any child born to an OSM mother after Wave 1 and observed to be co-resident with the mother at the survey wave following the child’s birth is an OSM. In the former BHPS sample, OSMs are those who were enumerated at the first wave of the sample from which they come (Wave 1 for the original sample, Wave 9 for the Scotland and Wales boost samples, Wave 11 for Northern Ireland) or who were subsequently born to an OSM mother or father (or both). Following the incorporation into USoc from Wave 2 onward, for those in the former BHPS sample, as for all other USoc samples, only children born to an OSM mother will themselves become an OSM.

OSMs, of all ages, are followed for interview and remain eligible as long as they are resident within the UK. They remain potentially eligible sample members for the life of the survey. The case may arise where the only OSM in the household is a child. Provided they are co-resident with the child, other household members are then Temporary Sample Members (see below) and therefore eligible for interview, even if the OSM child is not yet old enough to be eligible for a youth or adult interview. If the OSM child moves house, they are followed to their new address and those living with the OSM child are eligible for interview. If the OSM child moves into an institution, where normally just the OSM/Permanent Sample Member (PSM) would be interviewed and not co-residents, a split-off household is created containing only the OSM child and the household enumeration grid completed. The child OSM is an eligible sample member, even if they are not eligible for interview because of their age.

Temporary Sample Members (TSMs)

Any members of an enumerated household eligible for inclusion in the EMBS at Wave 1 who are not from a qualifying ethnic minority are Temporary Sample Members (TSMs) at Wave 1. This was the only category of TSM at Wave 1. In all other samples, any new person found to be co-resident with at least one OSM or PSM after Wave 1 is a TSM. This would include any child born to an OSM father after Wave 1 but not an OSM mother and observed to be co-resident with the father (or any other OSM) at the survey wave following the child’s birth. TSMs remain eligible for interview as long as co-resident in an OSM/PSM household. TSMs who are not co-resident with at least one OSM/PSM are not followed and become ineligible for interview. TSMs are identified as re-joiners if they are subsequently found to be living with at least one OSM/PSM, and then become eligible for interview.

Permanent Sample Members (PSMs)

Any TSM father of an OSM child born after Wave 1 and observed to be co-resident with the child at the survey wave following the child’s birth is a PSM. PSMs remain potentially eligible for interview for the life of the survey.

Only OSMs have positive longitudinal weights (see the Weighting section, below), and they form the basis of the analysis included here. Account is also taken of the inevitable changes of address or location that some interviewees experience; as noted above, the survey follows OSMs if they move to a new household. This is to ensure that the household or family history is not lost, and that there is no significant fall off in interview numbers.

For further information on the survey, see the USoc homepage, especially the Main Survey User Guide.

Mode of data collection

USoc interviews were initially typically carried out face-to-face in respondents’ homes. Mixed-mode data collection introduced in Wave 8 (2016 and 2017) resulted in increasing numbers of interviews being completed online. Following the implementation of nationwide ‘lockdown’ measures in March 2020, USoc adopted a web-first approach for Wave 11 (2019 and 2020) and Wave 12 (2020 and 2021), with a telephone interview available for online non-responders. This approach remained in place for much of Wave 13 (2021 and 2022). From April 2022, face-to-face interviewing resumed for a minority of households.

Survey periods

USoc fieldwork is conducted over a two-calendar-year wave, with each individual being interviewed on a yearly basis. Note that these waves overlap, and that individual respondents are interviewed around the same time each year.

For the purposes of this publication, persistent low income analysis is based on datasets which comprise four overlapping survey periods. For example, the period 2010 and 2011 to 2013 and 2014 uses individuals present in all of the following four waves: 2010 and 2011, 2011 and 2012, 2012 and 2013, and 2013 and 2014, together with all children born to Original Sample Members before their 2010 and 2011 interview.

Usoc survey waves and samples

| Survey Wave | Calendar Year | Sample Used |

|---|---|---|

| Wave 1 | 2009 to 2010 | GPS and EMB |

| Wave 2 | 2010 to 2011 | BHPS, GPS and EMB |

| Wave 3 | 2011 to 2012 | BHPS, GPS and EMB |

| Wave 4 | 2012 to 2013 | BHPS, GPS and EMB |

| Wave 5 | 2013 to 2014 | BHPS, GPS and EMB |

| Wave 6 | 2014 to 2015 | BHPS, GPS, EMB and IEMB |

| Wave 7 | 2015 to 2016 | BHPS, GPS, EMB and IEMB |

| Wave 8 | 2016 to 2017 | BHPS, GPS, EMB and IEMB |

| Wave 9 | 2017 to 2018 | BHPS, GPS, EMB and IEMB |

| Wave 10 | 2018 to 2019 | BHPS, GPS, EMB and IEMB |

| Wave 11 | 2019 to 2020 | BHPS, GPS, EMB and IEMB |

| Wave 12 | 2020 to 2021 | BHPS, GPS, EMB and IEMB |

| Wave 13 | 2021 to 2022 | BHPS, GPS, EMB and IEMB |

Wave 1 ran in 2009 and 2010 and used the GPS and EMB sample.

Wave 2 (2010 and 2011), Wave 3 (2011 and 2012), Wave 4 (2012 and 2013) and Wave 5 (2013 and 2014) all used the BHPS, GPS and EMB sample.

Wave 6 (2014 and 2015) used the BHPS, GPS, EMB samples and also the IEMB sample, which was introduced in that wave. Wave 7 (2015 and 2016), Wave 8 (2016 and 2017), Wave 9 (2017 and 2018), Wave 10 (2018 and 2019), Wave 11 (2019 and 2020), Wave 12 (2020 and 2021) and Wave 13 (2021 and 2022) all used the same samples as Wave 6.

Sample size, attrition and quality

Please note that although the Immigrant and Ethnic Minority Boost (IEMB) sample was introduced by USoc in Wave 6 (2014 and 2015), the first few publications of ID did not include these sample members, because there was not four years’ worth of data on these individuals to allow them to be included in persistent low income estimates. USoc’s Immigrant and Ethnic Minority Boost (IEMB) sample was first included in ID 2010 to 2021. Full details on how this was implemented and the implications for ID statistics can be found in the associated Background information and methodology report.

Table M.1b shows how many individuals were available for longitudinal analysis in each wave. These are Original Sample Member cases with positive longitudinal weights, except where noted.

Table M.1b - Single-wave cases available for longitudinal analysis

| Wave | GPS+EMB cases | BHPS cases | All cases |

|---|---|---|---|

| 2009-2010 (not used: see Section 4) | 76,240 | Not included | 76,240 |

| 2010-2011 (cross-sectional weights) | 60,474 | 16,572 | 77,046 |

| 2011-2012 | 48,873 | 11,554 | 60,427 |

| 2012-2013 | 43,101 | 10,383 | 53,484 |

| 2013-2014 | 39,112 | 9,499 | 48,611 |

| 2014-2015 | 34,175 | 8,517 | 42,692 |

| GPS+EMB+IEMB [footnote 1] | |||

| 2015-2016 [footnote 1] | 38,954 | 8,352 | 47,306 |

| 2016-2017 | 34,409 | 7,698 | 42,107 |

| 2017-2018 | 30,532 | 7,166 | 37,698 |

| 2018-2019 | 27,833 | 6,667 | 34,500 |

| 2019-2020 | 25,118 | 6,178 | 31,296 |

| 2020-2021 | 22,477 | 5,616 | 28,093 |

| 2021-2022 | 20,489 | 5,177 | 25,666 |

Source: Understanding Society 2010 to 2022

As with most longitudinal surveys, attrition reduces the USoc sample size over time. Attrition tends to affect some groups more than others. Recently published analysis explored attrition in the GPS and IEMB samples of USoc up to and including Wave 11. It considered how various factors including age, employment status, health status, and income level, affect attrition. The findings reinforced those of an earlier study on the same topic, concluding that attrition is more likely to affect those at the lower end of the income distribution. It also reported that the IEMB experienced a greater rate of attrition than the GPS. One of the roles of survey weights is to address the effects of attrition by taking into account how it affects some groups more than others. The recent study assessed the efficacy of USoc survey weights, finding that they effectively mitigate the effects of differential attrition.

Tables M.8 and M.9 in the 2010 to 2022 ID Publication methodology tables compare ID income and income distribution measures for each wave of the USoc survey with the cross-sectional measures produced by HBAI. For a more detailed assessment of how USoc measures compare to HBAI statistics, please refer to Understanding Society and its income data.

Persistent low income analysis in ID is based on individuals with positive longitudinal weights in the final wave of each four-wave period. Any individuals who are not in the survey for all four relevant waves are excluded.

Table M.2 - Four-wave cases available for analysis of persistent low income

| Wave | All cases | Cases present for fewer than four waves [footnote 2] | Cases available for analysis |

|---|---|---|---|

| 2010-2011 to 2013-2014 | 48,611 | 1,537 | 47,074 |

| 2011-2012 to 2014-2015 | 42,692 | 1,190 | 41,502 |

| 2012-2013 to 2015-2016 | 47,306 | 8,710 | 38,596 |

| 2013-2014 to 2016-2017 | 42,107 | 5,976 | 36,131 |

| 2014-2015 to 2017-2018 | 37,698 | 895 | 36,803 |

| 2015-2016 to 2018-2019 | 34,500 | 710 | 33,790 |

| 2016-2017 to 2019-2020 | 31,296 | 569 | 30,727 |

| 2017-2018 to 2020-2021 | 28,093 | 447 | 27,646 |

| 2018-2019 to 2021-2022 | 25,666 | 382 | 25,284 |

Source: Understanding Society 2010-2022

Missing information

As well as attrition reducing the available sample, some of the variables used in analysis for ID have missing values. These may be due to item non-response or partial responses. We exclude individuals with missing data from relevant analysis.

Missing income information is imputed in the USoc dataset where possible. Table M.3 below shows the extent of missing data for the longitudinal analysis of incomes for individuals in each four-wave sample. The most common reason for not having income information is having individual responses but no household questionnaire. The percentage of individuals for whom this is the case has risen since the start of the survey, most noticeably in the period 2014 and 2015 to 2017 and 2018. This may be linked to several factors, including a change in fieldwork procedures and the introduction of mixed-mode data collection (online reporting) from Wave 8 (2016 and 2017). For further information, see the Understanding Society Main Survey User Guide (Waves 1-13), and ‘Understanding Society and its income data’.

Other reasons for missing income data include missing equivalisation factors and missing interview dates (which means we are unable to deflate incomes).

Table M.3 - Missing income data in the four-wave sample

| Four-wave periods for persistent low income analysis | Missing equivalised income |

|---|---|

| 2010-2011 to 2013-2014 | 29 cases (<1%) out of 47,074 |

| 2011-2012 to 2014-2015 | 779 cases (2%) out of 41,502 |

| 2012-2013 to 2015-2016 | 1,016 cases (3%) out of 38,596 |

| 2013-2014 to 2016-2017 | 1,551 cases (4%) out of 36,131 |

| 2014-2015 to 2017-2018 | 2,943 cases (8%) out of 36,803 |

| 2015-2016 to 2018-2019 | 2,778 cases (8%) out of 33,790 |

| 2016-2017 to 2019-2020 | 2,750 cases (9%) out of 30,727 |

| 2017-2018 to 2020-2021 | 2,643 cases (10%) out of 27,646 |

| 2018-2019 to 2021-2022 | 2,355 cases (9%) out of 25,284 |

Source: Understanding Society 2010 to 2022

Table M.4 in the 2010 to 2022 ID methodology tables shows the extent that information is missing for classificatory variables. In many cases less than 1% of cases have missing values. For highest qualification, only those completing an individual questionnaire are included, so non-responding individuals in partially responding households will have missing values for this variable. For highest qualification, there is also a known issue in feeding forward information collected on the BHPS (i.e. pre-populating the question with what the respondent said previously) or asking individuals turning 16 about their qualifications.

In the four-wave period (from 2014 and 2015 to 2017 and 2018) there was an unusually large number of missing values for the ID derived variable which identifies whether an individual was up-to-date with their bills. This was due to missing data on the USoc variable ‘problems paying council tax’, in Wave 6 (2014 and 2015). This variable is one of the three variables used by ID to identify whether a household is behind with their bills. From Wave 7 (2015 and 2016), the amount of missing data for this variable decreased back to levels observed during previous four-wave periods.

Weighting

USoc data is designed to be used with weights. Weights are used to ensure that any analysis removes known bias and is as representative of the population as possible, based upon what is known about the survey design (particularly how this affects selection probability) as well as non-response. Longitudinal weights also take into account differential attrition probability, as mentioned above. USoc provides cross-sectional weights (for when only one wave of the survey is being analysed), and longitudinal weights (for any analysis using data - or measures based on data - from more than one wave, such as change in income).

ID uses weights which are produced by the University of Essex for analysing the combined GPS, EMBS, BHPS and, after Wave 6, the IEMB sample, and for producing population estimates by adjusting for unequal selection probabilities, differential non-response, and potential sampling error. Weighted analysis will adjust for the higher sampling fraction in Northern Ireland and for different probabilities of selection in the EMB and IEMB samples, as well as for response rate differences between subgroups of the sample. USoc produces weighting factors rather than grossing factors, so we do not produce estimates of numbers of individuals in low income. Instead we focus on percentages of the population.

USoc provides detailed information on weighting in specific weighting guidance and in its User Guide.

Section 3: Definitions and terminology within the statistics

ID includes analysis of low income as well as movements within the overall income distribution. This section sets out how income measures are calculated in ID.

How is income measured in ID?

ID bases its income measure on a monthly net household income variable provided in the USoc dataset. The income measure used in ID is total weekly net (disposable) equivalised household income. This comprises total income from all sources after tax, national insurance and other deductions in the latest period before the interview. It comprises income from all household members, including dependants.

The components of the income measure used in ID are:

| Term | Definition |

|---|---|

| Labour income | Includes usual pay and self-employment earnings. This also includes income from second jobs. |

| State support | Include tax credits and all state benefits, including State Pension. |

| Pension income | Includes occupational pensions income. |

| Investment income | Includes private pensions/annuities, rents received, income from savings and investments. |

| Private benefit income | Includes trade union/friendly society payments, maintenance or alimony and sickness or accident insurance. From Wave 12, it also included income from Student and/or Tuition Fee Loans (see below). |

| Miscellaneous income | Includes educational grants, payments from family members and any other regular payment. |

Income is net of the following items:

- income tax payments

- National Insurance contributions

- Pension contributions

- council tax (note domestic rates in Northern Ireland are not deducted)

Recent changes to income sources

As noted above, ID derives its income measure from a monthly net household income variable produced by USoc. Over the four most recent survey waves, there have been several relevant changes to income sources which have had implications for data collection, as well as a measurement change regarding income from Student and Tuition Fee loans:

Support received by employees via the Coronavirus Job Retention Scheme (CJRS)

This scheme was announced by the government in March 2020, in response to the coronavirus (COVID-19) pandemic. Employers who were unable to maintain their workforce because of the coronavirus pandemic could put their employees on ‘furlough’ and apply for a grant. Government and employer contributions varied during the scheme to ensure that an employee received at least 80% of their monthly wage up to £2,500 a month, including National Insurance and pension contributions. The scheme was in place until the end of September 2021, affecting incomes during waves 11, 12 and 13.

Information on income received via the CJRS was gathered by the USoc questionnaire as part of ascertaining employee pay (amount received via employee paycheque). No additional response options or questions were included to establish whether employee pay was linked to being on furlough, and any income received via the scheme was therefore included as labour earnings.

USoc introduced a new response option to the economic status variable ‘jbstat’, from the end of July 2020, which enabled respondents to identify if they were on furlough. This variable is used in ID’s analysis of events associated with low income entry and exit.

Support received by self-employed individuals via the Self-Employment Income Support Scheme (SEISS)

The government introduced the Self-Employment Income Support Scheme (SEISS) to assist self-employed people whose income was affected by the coronavirus pandemic. SEISS grants were available over the period from March 2020 until April 2021.

It is understood that income from these grants was reported via existing questions which are used to calculate income from self-employment based on the reporting of profits over an earlier timeframe, usually the previous financial year. Nevertheless, USoc introduced new questions across waves 11 to 13 to capture more precise data on SEISS grants, including amounts received and timeframes covered.

Detailed information on changes relating to the coronavirus pandemic has been published by USoc.

Universal Credit and Working Tax Credit uplifts

From April 2020, the government temporarily increased the standard allowance in Universal Credit (UC) by £1,040.04 per year and the basic element in Working Tax Credit by £1,045 per year. This meant that new and existing UC claimants, and existing Working Tax Credit claimants received an additional £20 per week on top of annual uprating. The temporary £20 per week UC uplift continued until 6 October 2021, while for working households receiving Tax Credits, a one-off payment of £500 was paid in April 2021, replacing the weekly uplift.

One-off payments are routinely captured by the USoc survey which establishes, for each source of unearned income and state benefit, what amounts were received and what period of time they covered. Additional imputation was run during this period to improve the accuracy of any imputed amounts where income data was missing.

Cost of Living payments

Some households will have received one or more lump sum payments over this period, which have been designed to provide support with the cost of living.

In 2022, DWP made three types of Cost of Living Payments to households on means-tested benefits in order to help them meet the rising cost of living:

- a Cost of Living Payment for households on qualifying low-income benefits or tax credits

- a Disability Cost of Living Payment for households on a qualifying disability benefit

- a Pensioner Cost of Living Payment for households entitled to a Winter Fuel Payment

In addition, the Household Support Fund, which was initially set up in 2021, was extended throughout 2022. The fund is administered by local authorities and aims to ensure that vulnerable households can meet the cost of daily needs such as food, clothing, and utilities.

The previous section explains how one-off payments are captured by the USoc survey.

Income from student and/or tuition fee loans

Income from Student and/or Tuition Fee loans was gathered and recorded as part of Private Benefit income for the first time in Wave 12.

Measuring income before and after housing costs

ID presents analyses on both a BHC and AHC basis. Income After Housing Costs (AHC) is derived by deducting housing costs from BHC income.

Housing costs in ID include the following:

- rent (gross of housing benefit)

- water rates, community water charges and council water charges

- mortgage interest payments (net of tax relief)

- ground rent and service charges

In the case of renters, these housing costs will include service and water charges because this is how the information is requested on the USoc questionnaire. For owner-occupiers, these amounts will not be included.

The main difference between HBAI and ID in terms of housing costs data is that, for owner-occupiers, HBAI includes structural insurance payments, whereas ID does not: no information is collected on structural insurance payments in USoc.

For Northern Ireland households, water provision is funded from taxation and there are no direct water charges. Therefore, it is already taken into account in the Before Housing Costs measure.

Adjusting for inflation

Incomes are adjusted for inflation, so they are in real terms corresponding to the middle January of the latest USoc wave (for Wave 13, this is January 2022). Like HBAI, ID uses a bespoke variant of the Consumer Price Index (CPI) to adjust for inflation.

Equivalisation

An adjustment called ‘equivalisation’ is used to make income comparable across households of different size and composition. ID uses net disposable weekly household income, after adjusting for the household size and composition, as an assessment for material living standards - the level of consumption of goods and services that people could attain given the net income of the household in which they live. In order to allow comparisons of the living standards of different types of households, income is adjusted to take into account variations in the size and composition of the households in a process known as equivalisation. ID assumes that all individuals in the household benefit equally from the combined income of the household. Thus, all members of any one household will appear at the same point in the income distribution

Figure 1. How household income is equivalised

Equivalence scales conventionally take an adult couple without children as the reference point, with an equivalence value of one. The process then increases relatively the income of single person households (since their incomes are divided by a value of less than one) and reduces relatively the incomes of households with three or more persons, which have an equivalence value of greater than one.

The main equivalence scales used in ID are the modified OECD scales, which take the values shown in Table M.5 below. These are in line with those used in HBAI. The equivalent values used by the McClements equivalence scales are also shown for comparison alongside modified OECD values. The McClements scales were used for the main estimates in the predecessor Low Income Dynamics publication with results based on the modified OECD equivalence scales published in an Appendix. In the modified OECD and McClements versions two separate scales are used, one for income BHC and one for income AHC.

Table M.5 – Comparison of modified OECD and McClements equivalence scales

| Equivalence scales | ||||

|---|---|---|---|---|

| Modified OECD to equivalise BHC results rescaled to couple without children=1[footnote 3] | OECD ‘companion’ Scale to equivalise AHC results | McClements BHC | McClements AHC | |

| First Adult | 0.67 | 0.58 | 0.61 | 0.55 |

| Spouse | 0.33 | 0.42 | 0.39 | 0.45 |

| Other Second Adult[footnote 4] | 0.33 | 0.42 | 0.46 | 0.45 |

| Third Adult | 0.33 | 0.42 | 0.42 | 0.45 |

| Subsequent Adults | 0.33 | 0.42 | 0.36 | 0.40 |

| Children aged under 14yrs[footnote 5] | 0.20 | 0.20 | 0.20 | 0.20 |

| Children aged 14yrs and over[footnote 5] | 0.33 | 0.42 | 0.32 | 0.34 |

The construction of household equivalence values from these scales is quite straightforward. Consider a single person, a couple with no children, and a couple with two children aged twelve and ten, all having unadjusted weekly household incomes of £300 (BHC). The process of equivalisation, as conducted in ID, gives an equivalised income of £448 to the single person, £300 to the couple with no children, but only £214 to the couple with children.

Income measurements used in ID

Relative low income

Low income can be defined in various ways. ID uses a measure of relative low income. Relative low income measurements identify which individuals have income which falls below a certain threshold based upon the income distribution. In ID, we set this threshold as 60% of median income.

ID tables also include information on individuals with household incomes below 70% of median income.

Figure 2. Calculating the low income threshold

Changes in rates of relative low income can be driven by changes in single year relative low income estimates or by individuals spending a longer or shorter time in relative low income.

The percentage of individuals in relative low income will increase if:

- the average income stays the same, or rises, and individuals with the lowest incomes see their income fall, or rise less, than average income; or

- the average income falls and individuals with the lowest incomes see their income fall more than the average income

The percentage of individuals in relative low income will decrease if:

- the average income stays the same, or rises, and individuals with the lowest incomes see their income rise more than average income; or

- the average income falls and individuals with the lowest incomes see their income rise, or fall less, than average income, or see no change in their income

Persistent low income

An individual is classified as being in persistent low income if they live in a household in relative low income for at least three of their last four consecutive interviews. It is therefore possible that some of those classed as being in persistent low income were not in relative low income at the time of their most recent interview. However, they will have experienced low income in each of the previous three years and, as a result, their long-term living standards are not anticipated to be different to other individuals in persistent low income who were in low income in the most recent interview.

This issue is relevant because the income distribution is particularly dense around the 60% and 70% of median income thresholds. In addition, some short periods of recorded high income may be due to measurement error and not reflect any real improvement in living standards.

Low income entries and exits

The methodology used here is the same as in the predecessor Low Income Dynamics publication. This analysis looks at individuals moving into and out of relative low income across a two-wave period, and uses a measure of equivalised household income consistent with that used elsewhere in ID.

When analysing transitions into and out of low income, the threshold used is the standard 60% of median income. Analysis of transitions between one wave and the next only includes what are defined as ‘clear’ transitions. For example, for an exit or entry to occur, household incomes must change such that they cross the threshold and are at least 10% higher or lower than 60% median income in the following wave. This requirement is put in place because all survey estimates - including household incomes and measures based on them such as the low income threshold - are subject to sampling and measurement error.

Using low income exits as an example, the exit rate for individuals is calculated as the number of individuals in low income in one wave who exited low income in the following wave, expressed as a percentage of all those who were in low income. Roughly equal numbers of individuals move into as move out of low income across each two-wave period. Rates of entry are, however, much lower than rates of exit, because entry rates are expressed as a percentage of those who were not in low income in the first of the two waves under consideration. Exit rates are expressed as a percentage of those who were in low income in the first of the two waves under consideration, which is a much smaller number than those not in low income.

The unit of analysis is the individual. However, as individuals live in households and we assume that all members of the household benefit equally from the household’s income, they will be affected by changes at the household level. This could come about either through changes in income levels, or by change in the household composition which affects incomes through the equivalisation process.

For the publication tables containing detailed breakdowns we have presented the rates as an average over three, two-wave periods as this will, to some extent, remove instability that can be associated with smaller sample sizes, and help to create a more robust and stable series.

Events associated with low income entry and exit

This analysis is based on the same individuals included in low income entry and exit analysis (above). It aims to help us understand how certain events are linked to these low income entries and exits by considering changes to income sources (including earned and non-earned income), changes in employment, and demographic changes. For AHC analysis only, we also look at changes in tenure and housing costs.

The method used is based on an approach used on the British Household Panel Survey (BHPS) previously (for example, Jenkins S.P and Rigg J.A with the assistance of Devicienti, F. (2001) ‘The dynamics of poverty in Britain’, DWP Research Report No. 157); and also in Low Income Dynamics, the predecessor of ID, based on the BHPS.

ID includes findings on the following events.

| Event | Definition |

|---|---|

| Earnings | A change in monthly household earnings of at least 20% and a minimum of £10. No change in the number of workers in the household. |

| Benefit Income | A change in monthly household benefit income of at least 20% and a minimum of £10. No change in household size. |

| Investment Income | A change in monthly household income from investment of at least 20% and a minimum of £10. No change in household size. |

| Occupational pension income | A change in monthly household occupational pension income of at least 20% and a minimum of £10. No change in household size. |

| Other Income | A change in monthly household ‘other’ income of at least 20% and a minimum of £10. No change in household size. This event was affected by the addition of income from Student and/or Tuition Fee Loans in Wave 12 (see below for discussion). |

| Number of Workers | A change in the number of workers in a household. This is considered both for where there is an accompanying household size change and where there is no change in household size. |

| Number of Full-Time Workers | A change in the number of full-time workers in a household. This is considered both for where there is an accompanying household size change and where there is no change in household size. Full-time work is defined as 30 or more hours per week. |

| Changing the number of hours worked | A change from full-time to part-time work, or the other way around. Part-time work is defined as less than 30 hours per week. |

| Working or Workless households | A household changing from having at least one adult in work (working) to having no adult in work (workless), or the other way around. |

| Household Type | A change in household type. |

| Lone Parent Household | A change in lone parent status – either becoming a lone parent (low income entries) or changing from being a lone parent (low income exits). |

| Couple to Single Person Household | A change from living in a couple household to single person status – no children in either case. |

| Single Person to Couple Household | A change from single person status to living in a couple household – no children in either case. |

| Number of Children | A change in the number of children – an increase for low income entry or a decrease for low income exit. |

| Tenure | AHC only, a change in tenure across the four tenure types (outright ownership; buying with a mortgage; social renting or private renting). |

| Housing Costs | AHC only, an increase (low income entries) or decrease (low income exits) in monthly housing costs of at least 20% and a minimum of £10. |

For a change in monthly income or housing costs to be considered an event, it must have changed by at least 20% and a minimum of £10. This requirement aims to ensure that only meaningful changes in income components are included. To be included in analysis of low income exits, income components must have increased, and to be included in analysis of low income entries, income components must have decreased.

Certain employment and demographic changes are controlled for when examining income and housing costs events. This is to try and remove the effect of major changes that are likely to have a bearing on the event being considered. For example, changes in household earnings are only included if the number of workers stays the same. For all other income events, the number of people in the household must not change.

For each event, we present three statistics in our ID publication tables across all two-wave periods since 2010 to 2011. To help explain the three measures, statistics from the most recent two-wave period presented in Table 9.1n, are used as an example:

| Prevalence (%) | Entry rate (%) | Share of entries (%) | |

|---|---|---|---|

| Fall in earnings | 13 | 26 | 38 |

A prevalence statistic – this tells us how common an event is among the population at risk of either entering or exiting low income. When considering the relationship between a fall in earnings and low income entry, for example, the prevalence statistic tells us what percentage of those who were not in low income in the first wave experienced a fall in earnings between the two waves. Table 9.1n tells us that over the most recent two-wave period, this was 13%.

A statistic expressing the rate of entry or exit if an individual experienced this event – the extract above shows us that 26% of those who were not in low income in 2020 to 2021 and who experienced a decrease in earnings, entered low income in 2021 to 2022.

A share statistic, indicating how common an event was among all low income entries or exits – Table 9.1n shows that 38% of all those who entered low income experienced a fall in earnings.

Because those in low income are a smaller group than those who are not, and are, by definition, closer to the low income threshold, they have a greater chance of exiting low income if they experience a particular event than those not in low income have of entering low income if they experience the same event. This explains why exit rates tend to be higher than entry rates.

While we have aimed to rule out major confounding events, this analysis does not rule out all factors which may have a bearing upon low income entry or exit, and should not be interpreted as implying causality.

Variables used for sub-group analysis

When longitudinal analysis is carried out on particular sub-groups, we allocate individuals to sub-groups according to their status in the first wave being considered, and use weights in the final wave being considered. This means that their status in any intervening waves may change, and have a bearing upon what is being measured in the final wave, but will not be taken into account.

For example, if looking at persistent low income over a four-wave period, consider a single working-age adult living alone who was working in the first interview of the period being considered and not in relative low income, but then was not working for the next three interviews and was in relative low income for each of those waves. This individual would be identified as in persistent low income, but would also be classified as in a family where all adults are working despite not having worked for the past three waves.

Age and pensioner status

All age-related derived variables in ID use the USoc age variable ‘age_dv’. USoc check the variable ‘age_dv’ for consistency, and make imputations when errors are found in order to improve its accuracy.

An individual is classified as a pensioner if they are of State Pension age at the time of interview. We use the USoc variable ‘pensioner_dv’ to identify if an individual is of State Pension age (SPa). ‘Pensioner_dv’ is derived using a respondent’s full date of birth (via ‘age_dv’). This allows precision in determining SPa.

The State Pension age is rising. Detailed information about how these rises are being phased in is available in the State Pension age timetable. As a consequence of the recent increase in State Pension age, we are seeing fewer numbers of pensioners in the ‘Under 65’ age bracket and, in the most recent four-wave period (2018 and 2019 to 2021 and 2022), the statistics for this group have been suppressed due to the small sample size Table 5.15p. Alongside this change, we are also seeing small numbers of working-age adults who are 65. ID analysis currently sets the top age-band for working-age adults at 55 to 64. In the most recent four-wave period, there were too few working-age adults who were aged 65 to justify producing a new age band, but the size of this group will be monitored and a new category introduced as and when numbers and data quality allow.

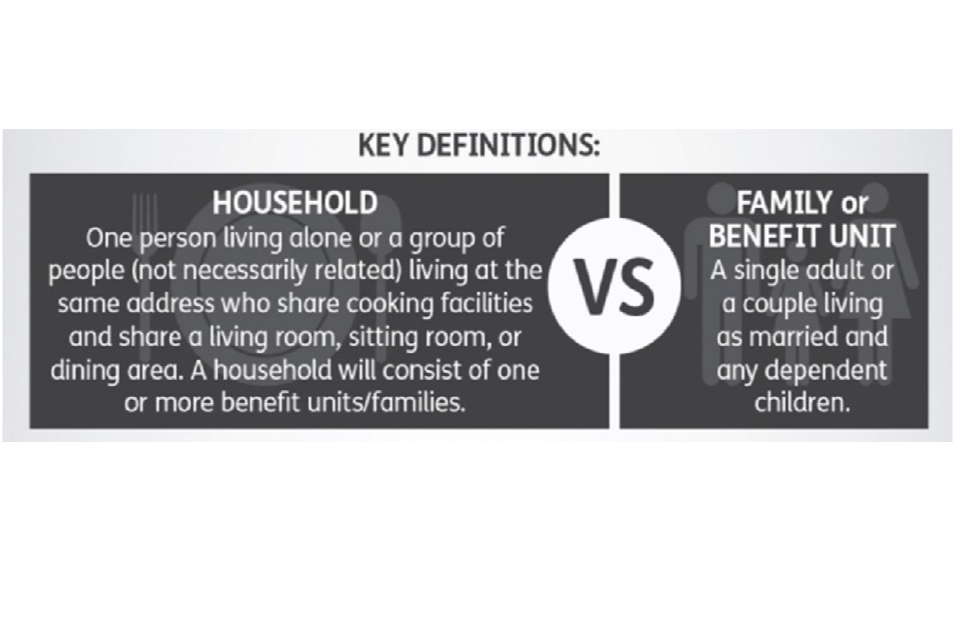

Households and families

ID presents information on an individual’s household income by various household and family (sometimes referred to as a ‘benefit unit’) characteristics. There are important differences between households and families.

A household is one person living alone or a group of people (not necessarily related) who either share living accommodation OR share one meal a day and who have the same address as their only or main residence. A household can consist of one or more families or ‘benefit units’, which are single adults or a married or cohabiting couple and any dependent children. For example, a group of students with a shared living room would be counted as a single household even if they did not eat together, but a group of bed-sits at the same address would not be counted as a single household because they do not share living space or eat together.

A husband and wife living with their young children and an elderly parent would be one household but two families or ‘benefit units’. The husband, wife and children would constitute one benefit unit and the elderly parent would constitute another. It should be noted that the term ‘benefit unit’ is used as a description of groups of individuals regardless of whether they are in receipt of any benefits or tax credits. A household will consist of one or more benefit units, which in turn will consist of one or more individuals (adults and children).

Data on state support

The Government pays money to individuals to support them financially under various circumstances. An individual is in receipt of state support if they receive one or more benefits or are in receipt of Tax Credits.

Most of these benefits are administered by DWP, with the exception of Housing Benefit and Council Tax Reduction which are administered by local authorities, some social security benefits which have been devolved to the Scottish Government, and Child Benefit and Tax Credits which are administered by HM Revenue and Customs.

Universal Credit (UC) is the primary working-age benefit. It has replaced income-based Jobseekers’ Allowance, income-related Employment and Support Allowance, Income Support, Working Tax Credit, Child Tax Credit and Housing Benefits for all new claims. Claimants with legacy benefits who have not since had a change in circumstances, remain on these benefits and will transfer to UC in future. For more information about the way in which information on state support is gathered and processed, please see the USoc Wave 13 questionnaire and ‘Understanding Society and its income data’.

Ethnicity

USoc includes detailed ethnicity classifications which are combined into the following publication splits:

White:

- British/English/Scottish/Welsh/Northern Irish

- Irish

- Gypsy or Irish Traveller resident in England, Scotland or Wales

- Any other White background

Mixed:

- White and Black Caribbean

- White and Black African

- White and Asian

- Any other mixed background

Asian:

- Asian/ Asian British: Indian

- Asian/ Asian British: Pakistani

- Asian/ Asian British: Bangladeshi

- Asian/ Asian British: Chinese

- Asian/ Asian British: Any other Asian background

Black:

- Black/ Black British: Caribbean

- Black/ Black British: African

- Black/ Black British: Any other Black Background

Other:

- Other Ethnic Group: Arab

- Other Ethnic Group: Gypsy or Irish Traveller resident in Northern Ireland

- Other Ethnic Group: Any other ethnic group.

Source: Understanding Society questionnaire documentation.

To ensure ID statistics are harmonised with GSS standards Gypsy or Irish Travellers resident in Northern Ireland are included in the Other ethnic group rather than the White ethnic group. Gypsy or Irish Travellers resident in England, Scotland or Wales are still included in the White ethnic group.

Long-standing illness or disability

The way in which information on long-standing illness or disability was gathered by the USoc survey changed over waves 7 to 9.

Up to and including Wave 7 (2015 to 2016)

USoc included two questions to determine the presence of a limiting or non-limiting long-standing illness or disability:

“Do you have any long-standing physical or mental impairment, illness or disability? By ‘long-standing’ I mean anything that has troubled you over a period of at least 12 months or that is likely to trouble you over a period of at least 12 months.”

If respondents reported having a long-standing illness or disability, a follow-up question asked:

“Does this / do these health problem(s) or disability(ies) mean that you have substantial difficulties with any of the following areas of your life?”

Twelve areas were listed:

- mobility (moving around at home and walking)

- lifting, carrying or moving objects

- manual dexterity (using your hands to carry out everyday tasks)

- continence (bladder and bowel control)

- hearing (apart from using a standard hearing aid)

- sight (apart from wearing standard glasses)

- communication or speech problems

- memory or ability to concentrate, learn or understand

- recognising when you are in physical danger

- your physical co-ordination (e.g. balance)

- difficulties with own personal care (e.g. getting dressed, taking a bath or shower)

- other health problem or disability

If a respondent answered that they had substantial difficulties with any of these areas, they were said to have a limiting long-standing illness or disability. If they identified none of these, then the long-standing illness or disability was said to be non-limiting. Prior to Wave 7, although the presence of a long-standing impairment, illness or disability was asked of all adult respondents, proxy respondents (i.e. where someone completes the survey on behalf of another individual) were not asked if any long-standing illness or disability was limiting or not. In Wave 7 (2015 and 2016), this changed, so that this information was also gathered via proxy interviews, resulting in a decrease in the amount of data coded as missing for this variable.

Changes in waves 8 and 9

In Wave 8 (2016 and 2017), USoc changed the way in which this information was captured, but only in the main (not the proxy) questionnaire. The change removed the link between the presence of a long-standing impairment, illness or disability and whether any such illness or disability was limiting or not: in Wave 8, all respondents to the main adult questionnaire were asked whether they had a limiting health problem or disability, regardless of whether they had reported a long-standing impairment, illness or disability.

Those who reported a long-standing impairment, illness or disability were asked:

“Do you have any health problems or disabilities that mean you have substantial difficulties with any of the following areas of your life?”

Those who did not report a long-standing impairment, illness or disability were asked:

“Even though you don’t have any long-standing health problems, do you have any health problems or disabilities that mean you have substantial difficulties with any of the following areas of your life?”

This question was followed by a list of the same twelve areas noted above.

While ID only derives its statistics on limiting and non-limiting illness or disability for those who report having a long-standing illness or disability it should, therefore, be noted that from Wave 8 (2016 and 2017), limiting conditions may not necessarily be linked to the long-standing illness or disability reported. Section 7 of the Summary report has been drafted to reflect these changes. See also USoc survey documentation for further details.

From Wave 9 (2017 and 2018) onwards, the new approach to the question regarding limiting health problems that had been implemented in the main questionnaire, was implemented in the proxy questionnaire.

Section 4: What to be aware of when interpreting ID statistics

Accurate interpretation of statistics produced using survey data relies upon understanding the way in which the data is collected. This section sets out some of the key factors that are relevant to ID.

Wave 1 (2009 to 2010) income information

There are known issues with the income information in the first USoc wave covering 2009 to 2010. See Dr Paul Fisher’s paper Does repeated measurement improve income data quality? (ISER Working Paper Series, 2016-11) for details of why income data on the first wave of USoc are not comparable with subsequent waves and are likely to be of lower quality. We have therefore excluded the first wave from any analysis presented in this publication.

Survey Data

The figures in ID come from USoc, a longitudinal survey. The Wave 13 longitudinal sample included data on over 25,000 individuals. In addition to capturing detailed information on incomes, USoc gathers rich contextual information on household and individual circumstances, such as employment, education level and disability.

Surveys gather information from a sample rather than from the whole population. The sample is designed carefully to allow for this, and to be as accurate as possible given practical limitations, such as time and cost constraints. Results from sample surveys are always estimates, not precise figures. This means that they are always subject to a margin of error, and this has implications for interpretation:

- Margins of error associated with survey estimates mean that small differences between survey estimates (e.g. when comparing rates of persistent low income across sub-groups or considering changes over time) may not reflect real differences in the wider population.

- Margins of error are often greater where statistics are based on smaller sample sizes. This may lead to a degree of instability in the statistics which is not based on similar levels of instability in the population.

In addition to sampling error, consideration should also be given to non-sampling error. Non-sampling error arises from the introduction of systematic errors in the sample compared to the population it is supposed to represent. As well as response bias, these errors include inappropriate definition of the population, misleading questions, data input errors or data handling problems – in fact any factor that might lead to the survey results systematically misrepresenting the population. There is no simple control or measurement for such non-sampling error, although the risk can be minimised through careful application of the appropriate survey techniques from the questionnaire and sample design stages through to analysis of results.

ID is based on data from a longitudinal household survey. It is subject to the following nuances of using survey data, with additional issues which specifically affect longitudinal surveys:

| Term | Definition |

|---|---|

| Attrition | Some respondents will inevitably drop out between interviews. To minimise attrition, the USoc team maintains a database of information on respondents so they can keep in touch with them. The database builds on contact information collected during the survey interviews, and is updated throughout the year. A between-wave-mailing is also used to help maintain contact with participants and update addresses. |

| Sampling error | Results from surveys are estimates and not precise figures. In general terms the smaller the sample size, the larger the uncertainty. |

| Non-response error | As with any survey, analysis based on USoc is at risk from systematic bias due to non-response. This is when households that had been selected for interview do not respond to the survey. Individuals within households may also be non-responders even if the rest of the household does respond. In an attempt to correct for this type of bias, results are weighted to adjust for non-response, taking account of previous responses. |

| Item non-response | Item non-response occurs where a respondent has given a full interview, but has refused or given a ‘don’t know’ answer to a particular question, which consequently leads to a missing value for that item. The USoc team use imputation to correct for item non-response in some variables, whereby a calculated value replaces the missing value. Imputation helps to reduce the potential bias associated with item non-response. |

| Survey coverage | The initial USoc survey only sampled private households in the United Kingdom. This meant that it excluded individuals living in institutions such as nursing or retirement homes, hostels for homeless people, or prison/young offender’s institutions. As a result, analysis for particular age bands, such as older people or younger people, may not be completely representative of all individuals in those age bands where the characteristics of people who live in private households (and who were included), differ in a fundamental way from those living in institutional settings (who were not included). |

| Sample size | Although USoc has a large sample size for a household survey, small sample sizes for some more detailed analyses may mean results are less stable. |

| Measurement error | Other social surveys underestimate incomes from certain sources when compared with administrative data. Like these surveys, it is likely that USoc also does not fully capture all income streams. However, the longitudinal nature of the survey means that this may improve over time with the use of dependent interviewing (where respondents can be reminded of previous responses) and panel conditioning (where familiarity with the questionnaire means that respondents respond more accurately to later waves of the survey). See Dr Paul Fisher’s paper Does repeated measurement improve income data quality? for further details. |

Reporting uncertainty

As noted above, survey results are always estimates and not precise figures, and so they are subject to a level of uncertainty. Two different random samples from one population, for example the UK, are unlikely to give the same survey result, and these results are likely to differ from those that would be obtained if the whole population was surveyed. We do not calculate sampling uncertainty for ID statistics.

Rounding and suppression

Figures are rounded to the nearest percentage point independently. As a result, some composition totals may not sum exactly to 100. Where categories are summed for descriptive purposes, rounding is implemented after summing, for accuracy.

Percentages based on a sample population of 100 or less are suppressed, as are statistics of below 0.5%. This is due to concerns around data quality and respondent anonymity.

Survey-based income data

The following issues need to be considered when using any survey-based income information:

| Term | Definition |

|---|---|

| Lowest incomes | Comparisons of household income and expenditure suggest that those households reporting the lowest incomes may not have the lowest living standards. |

| Benefit receipt | Relative to administrative records, surveys tend to under-report benefit receipt. |

| Self-employed | Almost all analyses in the ID publication include the self-employed (the exception is events associated with low income entry and exit which are based on changes to full-time work). A proportion of this group are believed to report incomes that do not reflect their living standards and there are also recognised difficulties in obtaining timely and accurate income information from this group. This may lead to an understatement of total income for some groups for whom this is a major income component, although this is likely to be more important for those at the top of the income distribution. |

| High incomes | Unlike in the HBAI series, no adjustment is made to correct for a likely undercount of ‘very rich’ households in survey data. However, this should not affect low income statistics based on median incomes. |

| Gender analysis | In any interpretation of ID statistics based on gender, it must be remembered that individual income is derived by the equivalisation of household income. Equivalisation assumes that all household members benefit equally from household income. Where the household includes a heterosexual couple, each of them is therefore placed at the same position in the income distribution. Research has suggested that this assumption is not always valid, as men sometimes benefit from shared household income at the expense of women. The lower-level gender disaggregation in the family type classification used by ID is therefore likely to be more informative than analysis based solely on gender. Evidence on the distribution of money within couple households, particularly those on low incomes, is discussed in this research briefing published by the Women’s Budget Group. |

| Students | All analyses in ID includes students. Information for students should be treated with some caution because they are often dependent on irregular flows of income. |

| Older people | The effect of the exclusion of some of the older people who live in residential homes is likely to be small overall except for results specific to those aged 80 and above. |

| Ethnicity analysis | The small sample sizes associated with some ethnic minority groups mean that statistics based on these groups can be unstable or are suppressed for quality or anonymity purposes. USoc includes an Ethnic Minority Boost (EMB) and an Immigrant and Ethnic Minority Boost (IEMB) which increase sample sizes for ethnic minorities. |

| Disability analysis | No adjustment is made to disposable household income to take into account any additional costs that may be incurred due to the illness or disability in question. This means that using income as a proxy for living standards for these groups may be somewhat upwardly biased. |

| Regional analysis | Although the USoc sample is large enough to allow some analysis to be performed at a regional level, it should be noted that no adjustment has been made for regional cost of living differences. It is therefore assumed that there is no difference in the cost of living between regions, although the After Housing Costs measure will partly take into account differences in housing costs. |

Section 5: ID and other statistics

Other measures of persistent low income

ID is a successor series to DWP’s Low Income Dynamics (LID) publication, the final issue of which was published in September 2010. LID was based on the British Household Panel Survey (BHPS). There are methodological differences between the two approaches and data sources which mean that direct comparisons are not possible.

Statistics on persistent low income have also been published by the Office for National Statistics (ONS): see Persistent Poverty in the UK and EU. These statistics were last published in 2019, and are based on the European Union Statistics on Income and Living Conditions (EU-SILC). As well as drawing on a different data source, these statistics use slightly different definitions, and count persistent low income differently i.e. individuals who are in low income households for at least three of the last four years, including the latest year. This difference means that UK estimates published using this method tend to be a little lower than those presented in ID. For details of SILC calculations see EU statistics on income and living conditions (EU-SILC) methodology - monetary poverty, while “The relationship between EU indicators of persistent and current poverty” by Stephen P. Jenkins and Philippe Van Kerm contains a commentary on the EU-SILC persistent low income methodology. Persistent low income data sourced from EU-SILC for other European countries is available via the eurostat website.

Other publications which use ID statistics

Poverty and Income Inequality in Scotland includes figures on persistent poverty for children and other population groups in Scotland. It also includes statistics on low income entry and exit rates for Scotland. These statistics are produced for the Scottish Government by the DWP.

Persistent poverty in Wales includes headline figures on persistent poverty for children, working-age adults, and pensioners in Wales. This release is published by the Welsh Government.

Ethnicity Facts and Figures: Persistent low income published by the Race Disparity Unit at the Cabinet Office presents ID data on persistent low income and low income entry and exit, by ethnic group.

Other statistics on income, wealth and economic wellbeing

ID is released alongside other government statistical publications focused on income and low income. The publications listed below can be considered alongside ID to give a more complete picture.

This is not intended to be an exhaustive list. More information on income data as well as sources of data on earnings can be found in the ONS Income and earnings statistics guide. ONS have also developed a new income and earnings interactive tool, which can be used to quickly identify sources of statistics on income and earnings, as well as information about their key features. See also ‘Explaining income and earnings: important questions answered’, also published by the ONS.

The Households Below Average Income (HBAI) series presents information on living standards in the UK based on household income measures for the financial year ending 2023. HBAI uses data from the FRS. Estimates are provided for average incomes, and for the number and percentage of people living in low income households. Tables M.8 and M.9 in the ID publication methodology tables compare single year income statistics derived from USoc with HBAI figures, and show a good level of coherence. HBAI remains the official source of poverty estimates.

The Family Resources Survey (FRS) is a continuous household survey. It publishes a range of annual statistics on household circumstances, including income, disability, tenure and pension participation.

Pensioners’ Incomes Statistics provide a more detailed analysis of pensioners’ incomes, based on data collected by the FRS.

Below Average Resources (BAR) is a new poverty measure which is currently being developed by DWP, based on the Social Metrics Commission approach to poverty measurement. Once fully developed, the BAR measure will sit alongside HBAI, providing a more expansive view of available resources (both savings and inescapable costs) than the income measurement adopted under HBAI.

European comparisons: statistics on levels of low income in other European countries is available via the eurostat website.

International Comparisons: the OECD provides international comparisons on trends and levels in Gini coefficients before and after taxes and transfers, average household disposable incomes, relative poverty rates and poverty gaps, before and after taxes and transfers.

The effect of taxes and benefits on household income: these ONS statistics provide a detailed breakdown of household income, including estimates of both direct and indirect taxes, cash benefits and in-kind benefits provided by the state by decile and quintile groups, ranked by equivalised disposable income.

Commentary on average household income is available via a separate bulletin, as is Household income inequality.

Personal Incomes statistics published by HMRC include data on UK taxpayers, their incomes and the income tax they are liable for, based on the annual Survey of Personal Incomes.

Information on state benefits including claims and caseload numbers on benefits administered by DWP can be found via the DWP benefits statistics collection.

Wealth in Great Britain:

The Wealth & Assets Survey (WAS) is a key source of information on how households in Great Britain are managing economically. WAS is a large-scale longitudinal survey with seven rounds currently published. The most recent publication available presents headline results from the seventh round (2018 to 2020), covering household debt, financial wealth, pension wealth, property wealth and physical wealth.

Personal and economic well-being in Great Britain:

Based on the ONS’s Opinions and Lifestyle Survey (OPN) which ran weekly during the course of the coronavirus pandemic, as well as the Survey on Living Conditions (SLC), this publication reported on how the pandemic affected people’s employment, income, savings and debt, as well as their well-being.

Improving Lives: Helping workless families indicators and evidence base:

Improving Lives is a compendium of nine indicators which tracks progress in tackling the disadvantages that affect families’ and children’s outcomes. It includes measures of worklessness and problem debt.

Estimates of income and low income for small areas

We do not publish data below the level of region, due to sample sizes. However, there are some related data sources that present information at smaller geographies:

Children in low income families: Local area statistics:

These statistics were first published in March 2020. They provide estimates of the number and proportion of children living in relative and absolute (before housing costs) low income by local area across the United Kingdom. They replaced Official Statistics previously published separately by DWP (children in out-of-work benefit households) and HMRC (children in low-income families local measure).

Income estimates for small areas, England and Wales: Financial Year Ending 2018:

ONS produce model-based estimates of income at Middle layer Super Output Area (MSOA) level.

Other sources of information on low income

Some non-government bodies also produce evidence on low income, including analysis of quantitative data as well as qualitative research on the experiences of people affected by low income. Such organisations include charities, campaign groups, academic research institutes, and think tanks.

Section 6: Revision to the statistics

As noted above, ID uses data produced by the longitudinal survey, Understanding Society (USoc), run by the University of Essex.

Each annual USoc data release provides a revised set of datasets for each wave of the survey. Revisions to previously released data are made where this improves data quality, for example where new information is gathered which was previously missing or incorrect. Statistics derived for a certain time period in this ID publication may therefore be different to those derived for the same time period in a previous ID publication, and may also be subject to future revisions. For this reason it is best to always refer to the most recent ID publication. Please refer to the USoc user guide and specific information on revisions for more information.

Section 7: Status of the statistics

Official statistics

ID is Official Statistics.

Our statistical practice is regulated by the Office for Statistics Regulation (OSR). OSR sets the standards of trustworthiness, quality, and value in the Code of Practice for Statistics that all producers of official statistics should adhere to.

You are welcome to contact us directly with any comments about how we meet these standards. Alternatively, you can contact OSR by emailing regulation@statistics.gov.uk or via the OSR website.

Quality statement

We have worked closely with the University of Essex to review their income derivations. We also compare single year income distribution and low income statistics with HBAI. While we would expect differences between these sources because of different survey vehicles, timings and definitions, as can be seen in the relevant tables, there is a good level of consistency between different data sources. See Table M.8 and M.9 in the ID methodology tables for comparisons between HBAI and ID income distribution and relative low income statistics.

We welcome feedback