Summary Statistics

Published 30 June 2022

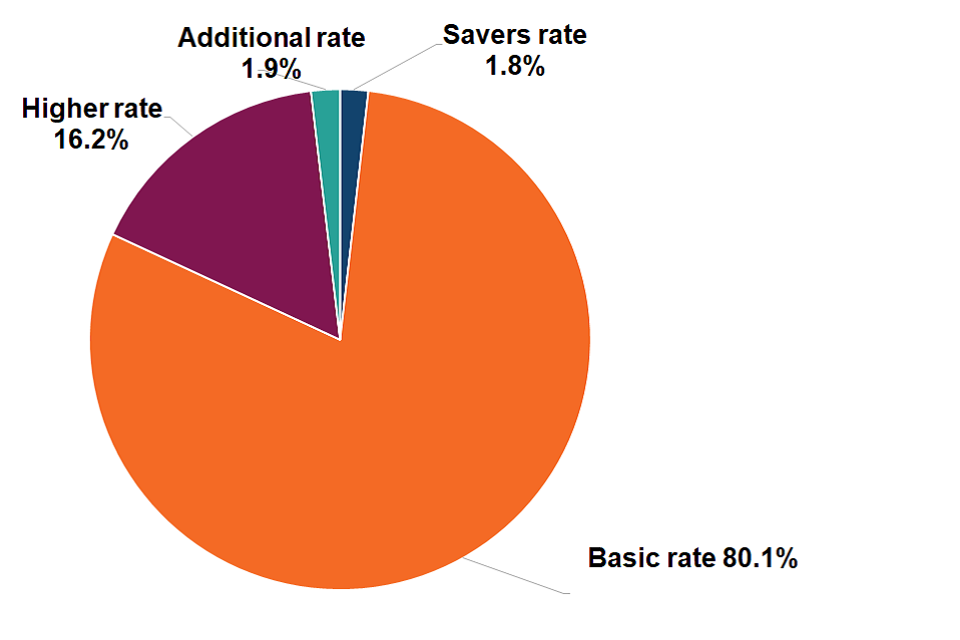

Income Tax payer numbers by type

-

there were 31.5 million Income Tax payers in tax year 2019 to 2020, which is projected to increase to 34.0 million in 2022 to 2023

-

there are a projected 27.8 million basic rate and savers rate Income Tax payers in tax year 2023 to 2023, of which, 611,000 are savers rate Income Tax payers and 27.2 million are basic rate Income Tax payers. There is a 2.1% increase in basic rate Income Tax payers and savers rate Income Tax payers in 2022 to 2023 from 2019 to 2020. Basic rate Income Tax payers make up a projected 80.1% , and savers rate Income Tax payers are projected to be 1.8% of the overall Income Tax paying population in 2022 to 2023.

-

there are a projected 5.5 million higher rate Income Tax payers in tax year 2022 to 2023, which is a 43.9% increase compared to 2019 to 2020. Higher rate Income Tax payers make up a projected 16.2% of the overall Income Tax paying population in 2022 to 2023

-

there are a projected 629,000 additional rate Income Tax payers in tax year 2022 to 2023, which is a 49.4% increase from 2019 to 2020. Additional rate Income Tax payers make up a projected 1.9% of the overall Income Tax paying population in 2022 to 2023

Estimates for 2022 to 2023 are projections based on the 2019 to 2020 Survey of Personal Incomes and the Office for Budget Responsibility’s March 2022 Economic and Fiscal Outlook. Basic rate includes savers rate Income Tax payers and both Scottish starter and intermediate rate Income Tax payers.

Summary Figure 1. The estimated number of Income Tax payers by marginal rate between 2019 to 2020 and 2022 to 2023

| Tax year | Total number of Income Tax payers | Basic rate Income Tax payers | Higher rate Income Tax payers | Additional rate Income Tax payers |

|---|---|---|---|---|

| 2019 to 2020 | 31,500,000 | 26,500,000 | 3,830,000 | 421,000 |

| 2020 to 2021 | 32,200,000 | 27,000,000 | 4,140,000 | 457,000 |

| 2021 to 2022 | 32,700,000 | 26,600,000 | 4,760,000 | 563,000 |

| 2022 to 2023 | 34,000,000 | 27,200,000 | 5,510,000 | 629,000 |

Summary Figure 2. The estimated proportion of Income Tax payers by marginal rate in 2022 to 2023

Income Tax payer numbers by UK region

-

Northern Ireland had the lowest number of Income Tax payers at 2.5% in 2019 to 2020, followed by the North East at 3.6%

-

the South East had the highest number of Income Tax payers at 14.8% in 2019 to 2020, while London had the second highest at 13.5%

Summary Figure 3. Regions with the highest and lowest number of UK Income Tax payers

Distribution of income and Income Tax liabilities

-

the top 50% of Income Tax payers received 74.4% of total income in 2019 to 2020, or £859 billion out of a total £1,160 billion. This resulted in a 48.8 percentage point income inequality between the top and bottom 50% of Income Tax payers (where 0 percentage points is completely equal).

-

however, the top 50% of Income Tax payers were liable for 90.5% of total Income Tax in 2019 to 2020, or £171 billion out of a total £189 billion, indicating the progressive nature of the Income Tax system

-

the top 1% of Income Tax payers make up the majority of additional rate Income Tax payers and received 12.3% of total income in 2019 to 2020

-

in addition, the top 1% of Income Tax payers were liable for 29.0% of total Income Tax in 2019 to 2020. This is projected to decrease to a 28.3% share of total Income Tax by 2022 to 2023

Summary Figure 4. Percentage share of income and Income Tax liabilities for the top 50% and top 1% of Income Tax payers

| Tax year | Top 50% - share of income | Top 50% - share of tax | Top 1% - share of income | Top 1% - share of tax |

|---|---|---|---|---|

| 2019 to 2020 | 74.4% | 90.5% | 12.3% | 29.0% |

| 2022 to 2023 | 76.2% | 91.7% | 13.0% | 28.3% |

Income Tax payer distributions are based on total income before tax. Projections for the top 1% of Income Tax payers are indicative.

Average Income Tax rates

-

basic rate Income Tax payers are projected to have an average tax rate of 9.5% in 2022 to 2023 which mirrors the average tax rate in 2019 to 2020, with a slight decrease in average tax rate to 9.4% in the years 2020 to 2021 through to 2021 to 2022.

-

higher rate Income Tax payers are projected to have an average tax rate of 22.2% in 2022 to 2023, an increase of 0.4 percentage points compared to 2019 to 2020

-

additional rate Income Tax payers are projected to have an average tax rate of 38.4% in 2022 to 2023, a slight increase of 0.2 percentage points compared to 2019 to 2020

Summary Table 1. Average rate of Income Tax by marginal rate

| Tax year | Savers rate Income Tax payers | Basic rate Income Tax payers | Higher rate Income Tax payers | Additional rate Income Tax payers |

|---|---|---|---|---|

| 2019 to 2020 | 4.0% | 9.5% | 21.8% | 38.2% |

| 2022 to 2023 | 4.4% | 9.5% | 22.2% | 38.4% |