National non-domestic rates collected by councils in England: forecast for 2023 to 2024

Updated 20 April 2023

Applies to England

This release provides data on the forecast of non-domestic rating income due to local authorities in 2023-24, including data relating to the amount of business rates reliefs forecast to be given to businesses. This release includes data from all 296 authorities. Due to the 2023 revaluation, it is inappropriate to make direct comparisons between the 2022-23 and 2023-24 data in this release. Since the original publication, the release includes data from one additional authority which was not included in the original release, and there have been further updates to figures for four other authorities. Changes to England-level figures are small.

1. In this release:

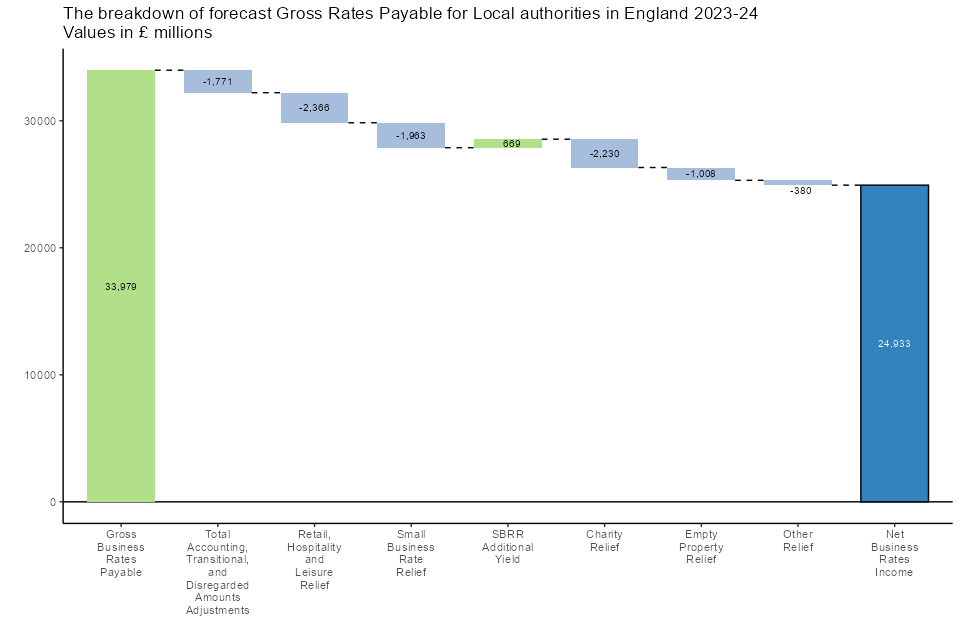

- Local authorities estimate the non-domestic rating income for 2023-24 will be £24.9 billion. This is what authorities estimate they will collect after all reliefs, accounting adjustments and sums retained outside the rates retention scheme are taken into consideration.

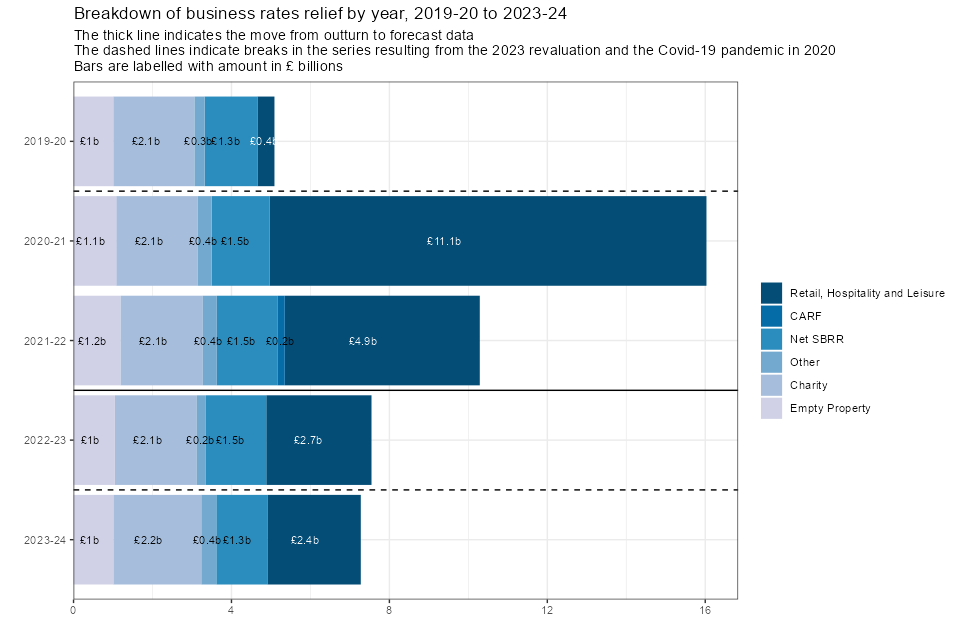

- Local authorities estimate that they will grant a total of £7.3 billion of relief from business rates in 2023-24. Of this £1.3 billion is the net cost of Small Business Rate Relief, £3.3 billion is the cost of other mandatory relief and £2.6 billion is the cost of discretionary relief. Of the discretionary relief, £2.4 billion is the cost of the retail, hospitality and leisure relief.

- The £1.3 billion Small Business Rate Relief cost is a net figure. Authorities estimate they will grant £2.0 billion relief under the Small Business Rate Relief scheme, but this is offset by other businesses contributing £669 million in the form of a supplement to cover some of the cost of this relief.

- Total relief provided to charitable occupations (that is both mandatory and discretionary relief) is expected to amount to £2.2 billion in respect of 2023-24.

Release date: 16 February 2023 (Revised 22 February 2023 and August 2024)

Date of next release: February 2024

Contact: 0303 444 8433 / nndr.statistics@levellingup.gov.uk (Responsible Statistician: Jo Coleman)

Media enquiries: 0303 444 1209 / NewsDesk@levellingup.gov.uk

2. Introduction

This release has been compiled by the Department for Levelling Up, Housing and Communities (DLUHC) and it provides information on national non-domestic rates and associated information for the financial year 2023-24. This information is derived from the national non-domestic rates (NNDR1) returns submitted by the 296 billing authorities in England that will be in existence from 1 April 2023.

The original release published 16 February 2023 included 295 out of 296 authorities. The revision published 22 February 2023 includes data from that one additional authority. A further revision published 22 March 2023 includes minor revisions to the data for three authorities. A further revision was published in August 2024 to include revised figures for one local authority. Changes to England-level figures are small.

The data in this release are not directly compared to 2022-23 because of the business rates revaluation taking effect from 1 April 2023. This means there is a change in the rateable value of all businesses in the country and hence on the collectible business rates and the amount of relief given by all billing authorities. Further details are in the technical notes shown below.

In addition, comparisons between years since 2020-21 are inappropriate because of the impact of the retail, hospitality and leisure relief on the amount of relief given by authorities. Further details on this relief are below.

Non-domestic rates, or business rates, are collected by billing authorities and are the way in which those that occupy a non-domestic property (or hereditament) contribute towards local services. Since 2013-14 local authorities are allowed to retain a proportion of the revenue that is generated in their area. The NNDR1 form collects data that estimates what authorities will collect and the outturn data (collected on the NNDR3) is what was collected.

Apart from properties that are exempt from business rates, such as agricultural land, parks and places of worship, each non-domestic property has a rateable value which is set by the Valuation Office Agency (VOA). Billing authorities work out the business rates liability for every hereditament by multiplying the rateable value of the property by the appropriate multiplier. There are two multipliers, the non-domestic multiplier and the small business non-domestic rate multiplier. The former is higher because it includes a supplement which is used to fund the Small Business Rate Relief scheme, which is designed to help small businesses meet the cost of their business rates.

The multipliers are set each financial year for England according to formula set by legislation, which, from 2018-19 have been determined by the increase in the previous September’s Consumer Price Index. Government can then cap the multiplier and compensate authorities for the loss of income through Section 31 grant.

In addition to the Small Business Rate Relief scheme, rateable properties may also be eligible for other discounts or reliefs on their business rates bills. Some of these are mandatory i.e. they are automatic entitlements in any billing authority area, and some are discretionary relief which are granted at a billing authority’s discretion. As new reliefs have been introduced since the start of this series, and some of these reliefs were time limited, changes across years are not strictly comparable. Further information about the types of reliefs available are presented in Table 2.

Further details about the business rates retention scheme and an explanation of hereditaments can be found in the Definitions section of the accompanying technical document.

2.1 Technical Information

Please see the accompanying technical notes document for further details.

Revaluation and transitional relief

Every few years, the government adjusts the rateable value of business properties to reflect changes in the property market. This is known as a revaluation. At revaluation, the Government also revises the non-domestic and small business non-domestic multipliers to reflect the aggregate change in rateable values.

The latest revaluation comes into effect on the 1 April 2023 and reflects the rental market as at 1 April 2021. The tables in this release therefore show a discontinuity between 2022-23 and 2023-24 because this affects gross business rates and the amount of relief granted.

At a Revaluation, the Government also puts in place a transitional scheme that protects small and medium business ratepayers from significant step-changes in bills, by phasing in increases over a number of years. The cost of the transitional scheme is shown in Table 1. From 2023-24, this reflects the revenue foregone because the rates bills of ratepayers are being phased down as a result of the transitional scheme. In previous years authorities reported a net cost, reflecting that the cost of revenue foregone by delaying increases to bills was offset by additional income raised by delaying reductions to bills.

Small business rates relief

Small business rates relief provides 100% relief to all businesses that have a rateable value of below £12,000, and a tapering relief for businesses with a rateable value between £12,000 and £15,000. The threshold at which a higher multiplier is applied is £51,000.

Prior to 2017-18, this was given as a temporary doubling that required and extension each year, and with different thresholds for the relief.

Multipliers

In the Autumn 2017 Budget, Government announced that the multipliers would increase in line with the Consumer Price Index rather than the Retail Price Index. Further details of the national multiplier and small business rate multiplier and the new reliefs can be found in the technical notes accompanying this release.

2.2 Special factors affecting 2023-24

Revaluation

The latest revaluation, described above, comes into effect on the 1 April 2023 and reflects the rental market as at 1 April 2021. The tables in this release therefore show a discontinuity between 2022-23 and 2023-24 to reflect the revaluation. This affects gross business rates and the amounts of relief granted because the rateable value of businesses change, transitional arrangements may reduce the amount of relief granted, and figures will also be affected by other changes to reliefs.

Business rates multiplier

The business rates multiplier was capped in the 2022 Spending Review for 2023-24 at the same level it was in 2022-23. This was at the same level as it was in 2021-22 , which was itself capped at the same level it was in 2020-21. The compensation for this cap is included in Table 3, and is affected by both the cumulative effect of capping the multiplier for the last three consecutive years, and the level of inflation in September 2022.

Additional reliefs

In the November 2022 budget, the Government announced the continuation of the Retail, Hospitality and Leisure Business Rates Relief Scheme into 2023-24. This relief, previously expanded in response to the coronavirus pandemic, was increased in 2023-24 to support businesses with significant inflationary pressures. In 2023-24, eligible properties will receive a 75% relief on business rates, up to a cash cap of £110,000 per business. This is an increase from 50% in 2022-23, which was itself a decrease from 100% in 2020-21 and the first three months of 2021-22 and 66% in the remaining months of 2021-22.

In the Spring Statement 2022, the Government announced the introduction of 100% relief for low-carbon heat networks that have their own rates bill. This relief applies from financial year 2022-23, but was announced after forecasts were made for 2022-23, so this is the first forecast where authorities reported the low-carbon heat networks relief.

In the March 2021 Budget, the Government announced 100% business rates relief for businesses in Freeports. This is included in ‘other ratepayers under s47’ in Table 2, but as authorities are reimbursed with section 31 grants for relief granted, Freeports relief is specifically included in Table 3. This is the first year that authorities have reported forecasts of Freeports relief.

3. National non-domestic rates to be collected by local authorities in England 2023-24

Table 1 gives details of the amount of national non-domestic rates local authorities estimate they will collect in 2023-24 and the reliefs they will grant. The multipliers used are also shown. The national non-domestic multiplier for 2023-24 includes a 1.3p supplement to fund the Small Business Rate Relief scheme. The cost of transitional arrangements shown in the table for 2023-24 reflects the revenue foregone because the rates bills of ratepayers are being phased down as a result of the transitional scheme. Previously this has been a net cost with the cost of revenue foregone by delaying increases to bills offset by additional income by delaying reductions to bills.

Chart 1 shows the flow from gross rates to net rates forecast in 2023-24. Chart 2 shows how gross and net rates have changed since 2013-14.

-

Local authorities estimate the non-domestic rating income for 2023-24 will be £24.9 billion. This is what authorities estimate they will collect after all reliefs, accounting adjustments and sums retained outside the rates retention scheme are taken into consideration.

-

Local authorities report they will grant a total of £7.3 billion of relief from business rates in 2023-24. Of this £1.3 billion is the net cost of Small Business Rate Relief, £3.3 billion is the cost of other mandatory relief and £2.6 billion is the cost of discretionary relief.

3.1 Appeals

As part of the NNDR1 process authorities are required to make an estimate of how much income they will forego as a result of changes to rating lists, including appeals by businesses against their valuations. This includes both income not collected in year and also refunds they have to make in respect of previous years.

- Local authorities estimate the appeals provision will be £956 million in 2023-24. The figure for 2023-24 represents authorities’ best estimate of the total future loss of non-domestic rates on the new 2023 Rating list.

Table 1: National non-domestic rates to be collected by local authorities 2019-20 to 2023-24

| 2019-20 Outturn | 2020-21 Outturn | 2021-22 Outturn | 2022-23 Forecast | 2023-24 Forecast | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Gross rates payable in year | 30,933 | 30,943 | 30,801 | || | 31,788 | || | 33,979 | (R) | ||

| Total cost of reliefs | 5,089 | 16,031 | || | 10,290 | || | 7,547 | || | 7,276 | (R) | |

| Of which net cost of Small Business Rate relief | 1,415 | 1,601 | 1,617 | || | 1,530 | || | 1,294 | (R) | ||

| Of which other mandatory relief | 3,071 | 3,127 | 3,389 | || | 3,196 | || | 3,337 | (R) | ||

| Of which discretionary relief(a),(b) | 603 | 11,303 | || | 5,284 | || | 2,821 | || | 2,645 | (R) | |

| Gross Rates Payable in year less total cost of reliefs | 25,844 | 14,912 | || | 20,512 | || | 24,241 | || | 26,704 | (R) | |

| Net cost of transitional arrangement(b) | 83 | 192 | 182 | || | – | || | – | |||

| Cost of transitional arrangement(c) | – | – | – | – | -1,795 | (R) | ||||

| Net Rates Yield (Gross Rates Payable plus net cost of Transition) | 25,927 | 15,104 | || | 20,694 | || | 24,241 | || | 24,909 | (R) | |

| Total cost of accounting adjustments | 280 | 1,831 | -289 | || | 1,378 | || | 1,406 | (R) | ||

| Of which losses in collection(d) | 300 | 860 | 147 | || | 500 | || | 449 | (R) | ||

| Of which net addition to appeals provision(e) | -20 | 970 | -436 | || | 878 | || | 956 | (R) | ||

| Of which interest payable | 0 | 0 | 0 | || | – | || | – | |||

| Other deductions from collectable rates(f) | 179 | 288 | 278 | || | 96 | || | -1,699 | (R) | ||

| Of which transitional protection payments made to authorities | 83 | 192 | 182 | || | – | || | -1,795 | (R) | ||

| Of which other deductions | 96 | 96 | 96 | || | 96 | || | 97 | (R) | ||

| Total Disregarded Amounts | 155 | 147 | 198 | || | 201 | || | 268 | |||

| Of which amounts retained in respect of Designated Areas | 83 | 63 | 106 | || | 109 | || | 153 | |||

| Of which amounts retained in respect of Renewable Energy schemes | 72 | 85 | 92 | || | 92 | || | 115 | |||

| Of which amounts retained in respect of Shale Gas | 0 | 0 | 0 | || | 0 | || | 0 |

| 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Small business rate multiplier (pence) | 49.1 | 49.9 | 49.9 | 49.9 | 49.9 | |||||

| National non-domestic rates multiplier (pence) | 50.4 | 51.2 | 51.2 | 51.2 | 51.2 | |||||

| Number of hereditaments on rating list as at 30 Sept (`000s)(g) | 1,942 | 1,976 | 1,996 | 2,006 | 2,015 | |||||

| Total aggregate rateable value of all hereditaments on rating list as at 30 Sept (million pounds)(g) | 63,637 | 64,045 | 63,910 | 63,634 | || | 67,877 |

Source: Outturn data are taken from NNDR3 forms, forecast data are taken from NNDR1 forms.

(R) Revised since the original publication of this release after data was received from East Staffordshire.

(a) The discretionary section 31 funded reliefs include the retail, hospitality and leisure relief. In 2019-20 the retail discount relief, was a discount of one third of the non-domestic rates bill for retail shops, restaurants pubs and cinemas with a rateable value of £51,000 or less. In 2020-21 this was expanded in response to the coronavirus pandemic to provide a 100% relief to all retail, hospitality and leisure businesses. In 2021-22 the relief gave a 100% discount for the first three months and then a 66% discount for the remaining months with a cap on the relief for each business. In 2022-23 it was a 50% discount with a cap on the relief, increasing to 75% in 2023-24. Some authorities have reported that in the 2022-23 forecast it was difficult to account for the cash cap as it was applied on a nationwide basis per business, whereas they have included it in the forecast for 2023-24. This explains in part why there is a decrease in forecast between 2022-23 and 2023-24.

(b) The transitional relief scheme from the 2017 revaluation expired in 2021-22. In 2022-23, authorities could give the same support to businesses using the supporting small business relief (a discretionary relief), and so what would normally be the cost of the transitional scheme is included in the Discretionary Reliefs figure.

(c) From 2023-24 onwards, the transitional relief scheme changed so that it was fully funded by central government. In previous years authorities reported a net cost with the cost of revenue foregone by delaying increases to bills offset by additional income by delaying reductions to bills. This is now shown on a separate line. From 2023-24 the cost only reflects the revenue foregone by delaying increases to bills. Figures are shown as negative as they are deducted from Net Rates Yield.

(d) Write offs to the allowance for non-collection are not included in the Total cost of Accounting Adjustments.

(e) The outturn data for net addition to appeals is systematically lower than the forecast data as local authorities do not forecast reductions in the appeals provision.

(f) Other deductions from collectable rates includes an allowance for cost of collection & legal costs, a special authority deduction for the City of London, and the cost of transitional protection payments made to authorities to reverse the effects of transitional arrangements.

(g) 2019-20 VOA data is as at 3 October 2018, 2020-21 VOA data is as at 3 October 2019, 2021-22 VOA data is at 7 October 2020, 2022-23 VOA data is as at 15 October 2021, 2023-24 VOA data is the draft 2023 list published on 17 November 2022.

3.2 Chart 1: Breakdown of gross rates payable

Chart 1 shows how reliefs and other adjustments are deducted from gross rates to arrive at the forecast net business rates income for 2021-22.

3.3 Chart 2: Business rates over time

Chart 2 shows gross rates collected increasing steadily until the pandemic, and increasing again after the 2023 revaluation. Net income was increasing steadily, then fell sharply due to the retail discount relief introduced in response to the pandemic but has increased steadily year on year since then.

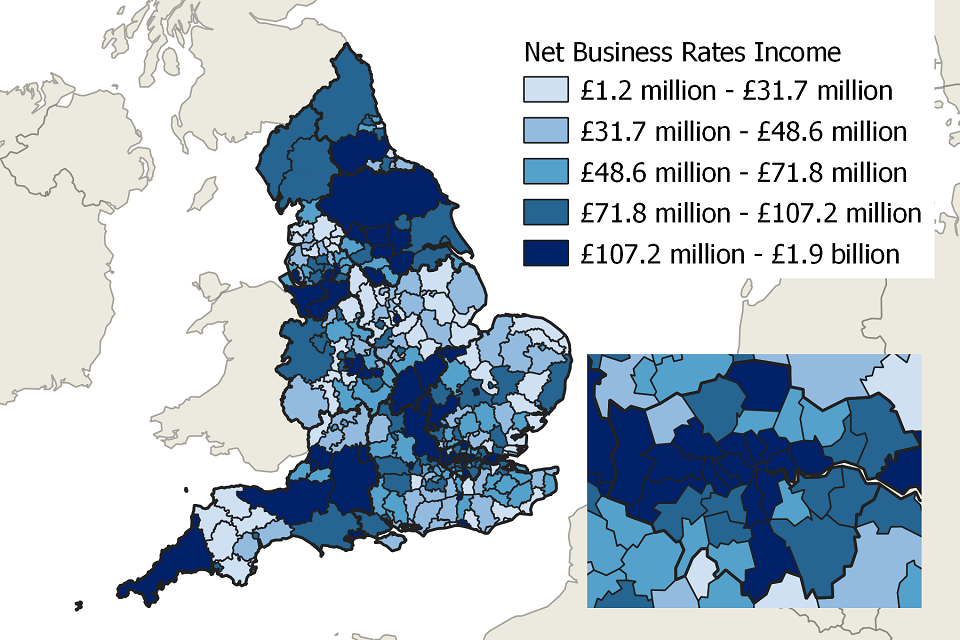

There are data for each local authority in England in the tables accompanying this release covering the amount of business rates income and reliefs granted. Map 1 provides an overview of how forecast net business rates income differs across England, with a zoomed-in box for the London boroughs.

3.4 Map 1: Net rates income in England

4. Reliefs to be granted by local authorities in 2023-24

Table 2 shows figures for mandatory and discretionary reliefs which billing authorities expect they will grant in 2023-24. Mandatory reliefs are automatic entitlements in any billing authority area whereas discretionary reliefs are granted at a billing authority’s discretion. Chart 3 shows how the largest reliefs have changed since 2019-20.

-

Of the estimated £7.3 billion relief to be granted from business rates, £3.3 billion is mandatory relief excluding Small Business Rate Relief, which consists primarily of charity and empty premises relief.

-

Authorities estimate they will grant £2.0 billion relief under the Small Business Rate relief scheme for 2023-24, whilst receipts from the supplement paid by some businesses to fund the Small Business Rate relief scheme in 2023-24 are expected to be £669 million. This gives a net cost of the scheme of £1.3 billion.

-

Authorities estimate the amount of relief to be granted to empty premises in 2023-24 will be £1.0 billion.

-

Total relief provided to charitable occupations (that is both mandatory and discretionary relief) is expected to amount to £2.2 billion in respect of 2023-24, and these reliefs account for 30% of the total relief to be granted.

-

Local authorities expect to grant a total of £2.6 billion discretionary relief in 2023-24 of which £2.4 billion is the cost of the retail, hospitality and leisure relief. The retail, hospitality and leisure relief accounts for 33% of the total relief to be granted.

Table 2: Cost of reliefs from national non-domestic rates: 2019-20 to 2023-24

| 2019-20 Outturn | 2020-21 Outturn | 2021-22 Outturn | 2022-23 Forecast | 2023-24 Forecast | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Total cost of mandatory relief | 4,486 | 4,728 | 5,005 | || | 4,726 | || | 4,630 | (R) | ||

| Of which net cost of small business rate relief | 1,415 | 1,601 | 1,617 | || | 1,530 | || | 1,294 | (R) | ||

| Of which net cost of small business rate relief in respect of current year | 1,338 | 1,470 | 1,535 | || | 1,530 | || | 1,294 | (R) | ||

| Of which relief provided in year | 1,970 | 2,100 | 2,161 | || | 2,159 | || | 1,963 | (R) | ||

| Of which relief on existing properties where a 2nd property is occupied | 4 | 5 | 5 | || | 3 | || | 3 | |||

| Of which additional yield generated from the small business supplement | 633 | 630 | 626 | || | 629 | || | 669 | |||

| Of which net cost of small business rate relief in respect of previous years | 77 | 131 | 82 | || | – | || | – | |||

| Of which total cost of other mandatory relief | 3,071 | 3,127 | 3,389 | || | 3,196 | || | 3,337 | (R) | ||

| Of which total other mandatory relief in respect of current year | 3,069 | 3,151 | 3,276 | || | 3,122 | || | 3,235 | (R) | ||

| Of which charitable occupation | 2,011 | 2,021 | 2,040 | || | 2,027 | || | 2,181 | (R) | ||

| Of which community Amateur Sports Clubs (CASCs) | 21 | 22 | 23 | || | 21 | || | 21 | (R) | ||

| Of which rural rate relief | 4 | 4 | 4 | || | 4 | || | 3 | |||

| Of which telecomms relief(a) | 0 | 0 | 2 | || | – | || | – | |||

| Of which Public Lavatories relief | – | – | 5 | || | 5 | || | 4 | (R) | ||

| Of which partially occupied hereditaments | 26 | 22 | 16 | || | 17 | || | 17 | (R) | ||

| Of which empty premises | 1,006 | 1,082 | 1,187 | || | 1,048 | || | 1,008 | (R) | ||

| Of which other mandatory relief in respect of previous years | 2 | -24 | 113 | || | – | || | – | |||

| Of which changes as a result of local estimates of growth or decline in mandatory relief | – | – | – | || | 74 | || | 102 | (R) | ||

| Total cost of discretionary relief | 603 | 11,303 | || | 5,284 | || | 2,821 | || | 2,645 | (R) | |

| Of which total discretionary relief in respect of current year | 112 | 98 | 101 | || | 102 | || | 101 | (R) | ||

| Of which charitable occupation | 48 | 42 | 45 | || | 47 | || | 48 | (R) | ||

| Of which Non-profit making bodies | 37 | 31 | 33 | || | 34 | || | 36 | |||

| Of which Community Amateur Sports Clubs (CASCs) | 1 | 1 | 1 | || | 1 | || | 2 | |||

| Of which rural rate relief(a) | 0 | 0 | 0 | || | 0 | || | 0 | |||

| Of which small rural businesses | 1 | 1 | 1 | || | 1 | || | 1 | |||

| Of which other ratepayers under s47 | 22 | 20 | 20 | || | 19 | || | 15 | |||

| Of which hardship relief | 2 | 3 | 1 | || | – | || | – | |||

| Of which discretionary relief in respect of previous years | 3 | 1 | 6 | || | – | || | – | |||

| Of which total cost of discretionary reliefs funded through S31 grant | 481 | 11,180 | || | 5,203 | || | 2,714 | || | 2,542 | (R) | |

| Of which Flooding relief | 2 | 1 | 0 | || | – | || | – | |||

| Of which Rural Rate relief | 4 | 4 | 4 | || | 5 | || | 3 | |||

| Of which Local Newspaper Temporary relief(a) | 0 | 0 | 0 | || | 0 | || | 0 | |||

| Of which Supporting Small Businesses relief(b),(c) | 13 | 13 | 11 | || | 45 | || | 173 | (R) | ||

| Of which Discretionary Scheme relief | 30 | 3 | – | || | – | || | – | |||

| Of which retail, hospitality and leisure relief(d) | 432 | 11,061 | || | 4,940 | || | 2,665 | || | 2,366 | (R) | |

| Of which nursery relief | – | 98 | 63 | || | – | || | – | |||

| Of which COVID-19 additional relief | – | – | 185 | || | – | || | – | |||

| Of which low carbon heat networks relief | – | – | – | || | – | || | 1 | |||

| Of which discretionary relief funded through S31 grants in respect of previous years | 7 | 25 | -25 | || | – | || | – | |||

| Of which changes as a result of local estimates of growth or decline in discretionary relief | – | – | – | || | 4 | || | 1 | |||

| TOTAL COST OF ALL RELIEFS | 5,089 | 16,031 | || | 10,290 | || | 7,547 | || | 7,276 | (R) |

Source: Outturn data are taken from NNDR3 forms, forecast data are taken from NNDR1 forms.

(R) Revised since the original publication of this release after data was received from East Staffordshire.

(a) 0 values are below £0.5 million.

(b) The transitional relief scheme from the 2017 revaluation expired in 2021-22. In 2022-23, authorities could give the same support to businesses using the supporting small business relief (a discretionary relief), and so what would normally be the cost of the transitional scheme is included in the Discretionary Reliefs figure.

(c) From 2023-24, supporting small business relief will cap bill increases at £600 per year for businesses losing eligibility for or seeing reductions in Small Business Rate Relief (SBRR) or Rural Rate Relief (RRR) as a result of the 2023 business rates revaluation. This means there is a large increase in 2023-24 as the scheme applies to the new revaluation.

(d) The discretionary section 31 funded reliefs include the retail, hospitality and leisure relief. In 2019-20 the retail discount relief, was a discount of one third of the non-domestic rates bill for retail shops, restaurants pubs and cinemas with a rateable value of £51,000 or less. In 2020-21 this was expanded in response to the coronavirus pandemic to provide a 100% relief to all retail, hospitality and leisure businesses. In 2021-22 the relief gave a 100% discount for the first three months and then a 66% discount for the remaining months with a cap on the relief for each business. In 2022-23 it was a 50% discount with a cap on the relief, increasing to 75% in 2023-24. Some authorities have reported that in the 2022-23 forecast it was difficult to account for the cash cap as it was applied on a nationwide basis per business, whereas they have included it in the forecast for 2023-24. This explains in part why there is a decrease in forecast between 2022-23 and 2023-24.

4.1 Chart 3: Business rates reliefs over time

Chart 3 shows that there is little change in the amount of the larger business rates reliefs granted since 2019-20, with the exception of the retail, hospitality and leisure relief which is a major driver of changes in the amount of relief.

5. Reliefs to be funded by Section 31 grants

Since 2013-14, a number of measures have been announced by the Chancellor in Autumn Statements and Budgets which have made changes to the national non-domestic rates scheme. Central government compensates local authorities for these changes and this compensation is made outside of the rate retention scheme by means of a Section 31 (S31) grant. The grants are given to local authorities to fund activities which are not covered by existing payment schedules or methods. Details on the measures in table 3 can be found in the technical notes published alongside this release.

The amounts shown in Table 3 are the Section 31 grant to be paid to local authorities to compensate them for the loss of income arising from the measures listed. They differ from the amounts shown in Table 2 which show the total amount of relief to be granted to business ratepayers under each of the measures as they exclude the central government share of the reliefs.

Since 2017-18, some authorities have been able to retain more than a 50% share of the income, and therefore will be compensated for more of the relief. Additionally, single year rate retention pilots took place in 2018-19 and 2019-20, where different authorities and different percentage shares were involved. Therefore, year-on-year changes in each measure are not directly comparable.

Table 3 shows the Section 31 grants paid to local authorities from 2019-20 to 2021-22 and what authorities expect to be paid in 2022-23 and 2023-24.

Table 3: Section 31 grants due to authorities for national non-domestic rates measures 2019-20 to 2023-24

| 2019-20 Outturn | 2020-21 Outturn | 2021-22 Outturn | 2022-23 Forecast | 2023-24 Forecast | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Capping the increase in the small business rates multiplier(a) | 582 | || | 326 | || | 671 | || | 1,445 | || | 2,662 | (R) |

| Cost of doubling SBRR and threshold changes | 1,054 | || | 1,014 | 1,030 | || | 1,041 | || | 1,007 | (R) | |

| Maintaining small business rates relief on “first” properties | 3 | || | 5 | 4 | || | 2 | || | 2 | ||

| Relief to newly built properties(b) | 0 | || | 0 | 0 | || | – | || | – | ||

| Relief awarded on the occupation of “long-term empty” properties(b) | 0 | || | 0 | 0 | || | – | || | – | ||

| Retail relief | 6 | || | 4 | 4 | || | – | || | – | ||

| Flooding relief | 1 | || | 1 | 0 | || | – | || | – | ||

| Rural Rate relief | 3 | || | 2 | 2 | || | 3 | || | 2 | ||

| Local Newspaper Temporary relief(b) | 0 | || | 0 | 0 | || | 0 | || | 0 | ||

| In Lieu of Transitional relief(b),(c) | 0 | || | 0 | 0 | || | – | || | – | ||

| Supporting Small Businesses relief(c),(d) | 9 | || | 8 | 7 | || | 29 | || | 123 | (R) | |

| Discretionary Scheme relief | 21 | || | -1 | -1 | || | – | || | – | ||

| Pub relief(b) | 0 | || | 0 | 0 | || | – | || | – | ||

| Enterprise Zone relief provided in 100% Pilot Areas | 5 | || | 3 | 3 | || | 2 | || | 1 | ||

| Telecomms relief(b) | 0 | || | 0 | 3 | || | – | || | – | ||

| Retail, hospitality and leisure relief(e) | 308 | || | 7,117 | || | 3,212 | || | 1,832 | || | 1,706 | (R) |

| Nursery Relief | – | || | 62 | || | 42 | || | – | || | – | |

| Public Lavatories relief | – | || | – | 5 | || | 3 | || | 3 | (R) | |

| COVID-19 Additional Relief | – | || | – | 109 | || | – | || | – | ||

| Freeports relief | – | || | – | – | || | – | || | 2 | ||

| Low carbon heat networks relief | – | || | – | – | || | – | || | 1 | ||

| Total amount of reliefs funded by Section 31 grants | 1,991 | || | 8,542 | || | 5,089 | || | 4,358 | || | 5,509 | (R) |

Source: Outturn data are taken from NNDR3 forms, forecast data are taken from NNDR1 forms.

Note: Since 2017-18 some authorities have been able to retain more than a 50% share of income. The amount of share and authorities involved have change from year to year, and so annual figures are not directly comparable.

(R) Revised since the original publication of this release after data was received from East Staffordshire.

(a) The relief in respect of capping the small business rates multiplier is particularly high in 2022-23 and 2023-24 as inflation increased more during 2022 than it did in the prior years. The cap was at the same level of 49.9p throughout these years. This means the difference between the multiplier and what it would have been without the cap increased more than usual in those years.

(b) 0 values are below £0.5 million.

(c) The transitional relief scheme from the 2017 revaluation expired in 2021-22. In 2022-23, authorities could give the same support to businesses using the supporting small business relief (a discretionary relief), and so what would normally be the cost of the transitional scheme is included in the Discretionary Reliefs figure.

(d) From 2023-24, supporting small business relief will cap bill increases at £600 per year for businesses losing eligibility for or seeing reductions in Small Business Rate Relief (SBRR) or Rural Rate Relief (RRR) as a result of the 2023 business rates revaluation. This means there is a large increase in 2023-24 as the scheme applies to the new revaluation.

(e) The discretionary section 31 funded reliefs include the retail, hospitality and leisure relief. In 2019-20 the retail discount relief, was a discount of one third of the non-domestic rates bill for retail shops, restaurants pubs and cinemas with a rateable value of £51,000 or less. In 2020-21 this was expanded in response to the coronavirus pandemic to provide a 100% relief to all retail, hospitality and leisure businesses. In 2021-22 the relief gave a 100% discount for the first three months and then a 66% discount for the remaining months with a cap on the relief for each business. In 2022-23 it was a 50% discount with a cap on the relief, increasing to 75% in 2023-24. Some authorities have reported that in the 2022-23 forecast it was difficult to account for the cash cap as it was applied on a nationwide basis per business, whereas they have included it in the forecast for 2023-24. This explains in part why there is a decrease in forecast between 2022-23 and 2023-24.

6. Accompanying tables and open data

6.1 Symbols used

(R) = Revised since the original publication

… = not available

0 = zero or negligible (usually less than 0.5 million)

- = not relevant

|| = a discontinuity in data between years

6.2 Rounding

Where figures have been rounded, there may be a slight discrepancy between the total and the sum of constituent parts.

7. Tables

Accompanying tables are available to download alongside this release. These include Tables 1 to 3 for England and local authority level data. Table 4 with the number of hereditaments in receipt of mandatory and discretionary rate relief and data for individual local authorities will be available in a later update in March.

8. Open data

These statistics are available in fully open and linkable data formats.

9. Technical notes

Please see the accompanying technical notes document for further details.

Information on Official Statistics is available via the UK Statistics Authority website.

Information about statistics at DLUHC is available via the Department’s website.