Non-domestic rating: stock of properties statistical commentary

Updated 5 February 2025

Applies to England and Wales

This is the first non-domestic rating stock of properties statistical release for the 2023 rating list. On 3 April 2023, the 2023 Revaluation statistical publication was released, showing the changes in the rateable value of non-domestic properties as a result of the 2023 revaluation, to reflect changes in the property market since the previous revaluation in 2017. A more detailed breakdown of non-domestic stock of properties at 1 April 2023 (the start of the 2023 rating list) was also provided as an ad hoc release. As the first publication of the 2023 rating list, most comparisons with the previous year will be compared to 1 April 2023, to remove the effect of the revaluation and show changes from the start of the 2023 rating list.

This release contains statistics relating to stock of non-domestic properties for England and Wales at 31 March 2024. The statistics provide information on the number and value of the stock of rateable properties (known as “hereditaments”), broken down by sector, geographic location, property type and rateable value band.

Responsible Statistician

Anna McReady

Statistical enquiries

Date of next publication

Spring 2025

1. Headline figures

1.1 Properties in England and Wales on the Local Rating List at 31 March 2024

The stock of properties at 31 March 2024 was 2.13 million, down from 2.15 million at 1 April 2023 (the start of the 2023 rating list).

Out of these properties, England accounted for 2 million (94%) of the total, and Wales accounted for the 127 thousand (6%) remaining properties.

The total rateable value of the properties at 31 March 2024 was £70.7 billion, up from £70.4 billion at 1 April 2023.

England accounted for £68.2 billion (97%), and Wales accounted for £2.5 billion (3%).

1.2 The Central Rating List in England and Wales

The central rating list contains the rating assessments of the network property of major transport, utility and telecommunications undertakings and cross-country pipelines.

Rates from central rating list rateable properties in England are paid directly to the Department of Levelling Up, Housing and Communities (DLUHC), and in Wales are paid to the Welsh Government.

- the total rateable value of properties on the central list at 31 March 2024 was £4.0 billion, the same level as at 1 April 2023 (the start of the 2023 rating list)

- the properties in England accounted for £3.8 billion (95%) of this total and in Wales accounted for the remaining £0.2 billion (5%)

The total rateable value of the central list reported in this publication is not directly comparable with the 2017 central list figures reported in the 2023 Revaluation statistical release published in April 2023.

For more information on the Central Rating List, please refer to the Background Information Note.

The remainder of this statistical commentary refers to the local rating list.

2. Changes to stock of property counts in England and Wales

The following section shows the changes to stock of property counts by the reason for the change. This includes changes from the start of the 2023 rating list on 1 April 2023 to 31 March 2024.

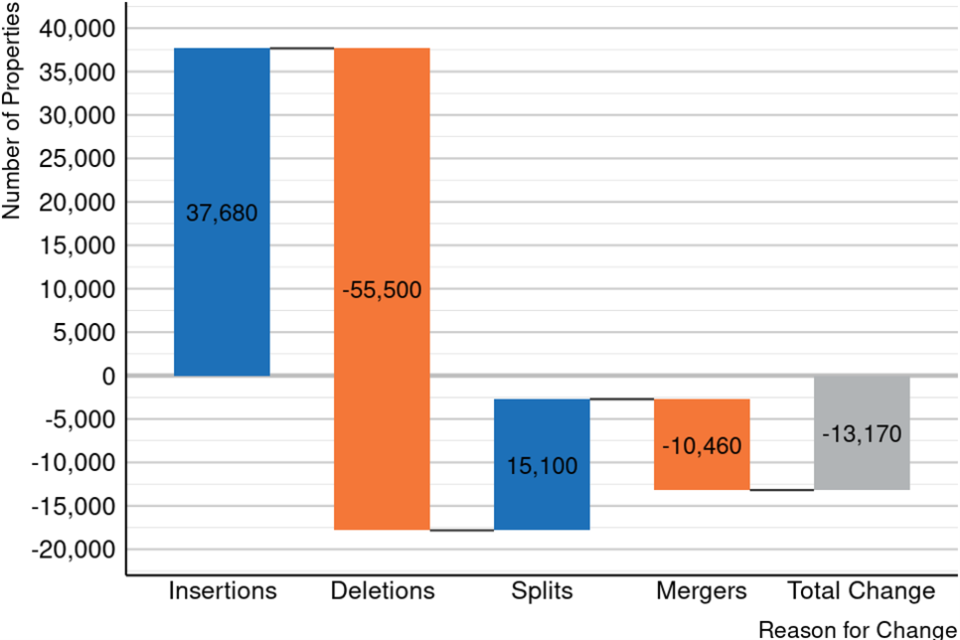

Figure 1: Changes to stock of property counts by the reason for the change in England and Wales.

Source: NDR Stock of Properties Changes (Table SOP8.1)

Figure 1 shows the changes to the stock of property counts in England and Wales between 1 April 2023 and 31 March 2024, broken down by the reason for change. Since the start of the 2023 rating list, 52,780 properties have been inserted into the rating list; 37,680 new properties and 15,100 as a result of properties being split into a greater number. There has also been 65,960 properties removed from the rating list; 55,500 deleted properties and 10,460 due to properties merging. This leads to an overall decrease of 13,170 to the total count of stock of properties.

Of the deleted properties, 11,870 (21%) are attributable to self-catering holiday homes moving from the non-domestic rating list to the council tax list following the introduction of the Non-Domestic Rating (Definition of Domestic Property) (England) Order 2022. See the Further Information section below for further explanation about statistics for holiday homes/lets.

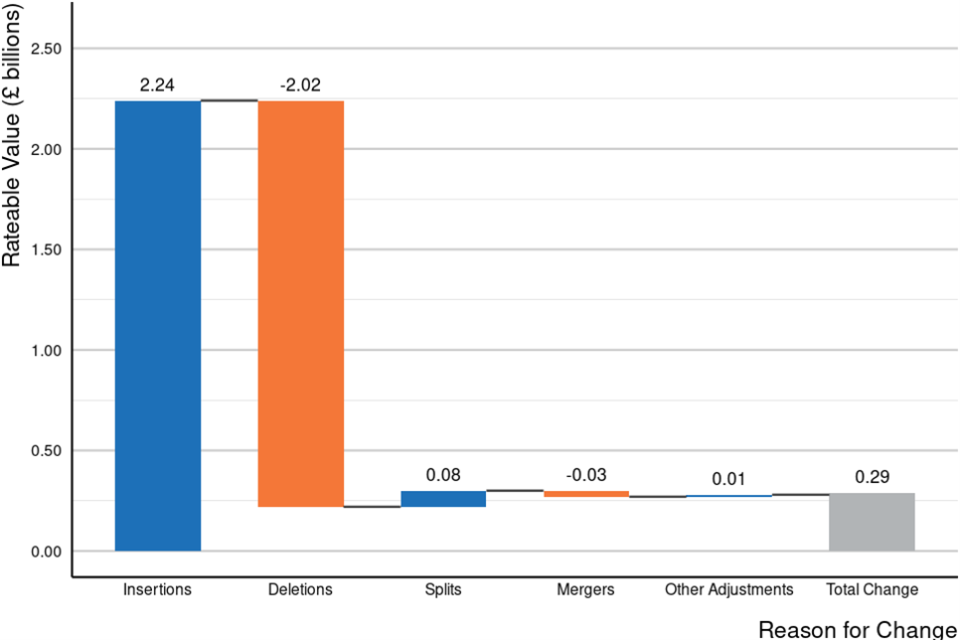

Figure 2: Changes to rateable value by the reason for the change in England and Wales.

Source: NDR Stock of Properties Changes (Table SOP8.2)

Figure 2 shows the changes to rateable value in England and Wales between 1 April 2023 and 31 March 2024, broken down by the reason for change. Since the start of the 2023 rating list, £2.33 billion of rateable value has been added; £2.24 billion due to insertions, £0.08 billion as a result of properties being split into a greater number, and £0.01 billion from other adjustments. There has also been £2.05 billion of rateable value removed from the rating list; £2.02 billion due to the deletion of properties and £0.03 billion due to properties merging. This leads to an overall increase of £0.29 billion to the total rateable value.

3. Time series of the stock of properties in England and Wales

The following section shows the changes to property counts and total rateable value (RV) over time. Each time series covers three distinct Rating Lists (2010, 2017, and 2023) and shows data at 31 March for each year.

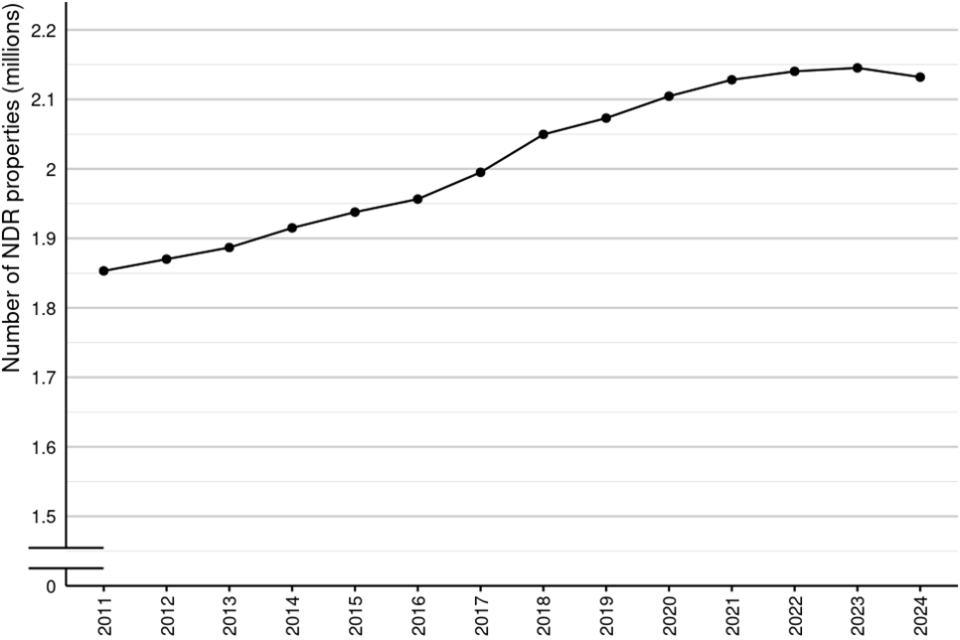

Figure 3: Number of rateable properties in England and Wales

Source: NDR Stock of Properties (Table SOP3.1)

Figure note: The y-axis has been zoomed in so that the change over time is visible

Figure 3 shows the total number of properties in England and Wales at 31 March of each year from 2011 to 2024. The number of properties has been steadily increasing since 31 March 2011; at 31 March 2024 it had increased from 1.85 million to 2.13 million (an increase of 15%). Between 31 March 2023 (the end of 2017 rating list) and 31 March 2024, the number decreased from 2.15 million by 13,270 (1%). A breakdown of the change to stock since the start of the 2023 rating list (1 April 2023) can be seen in figure 1.

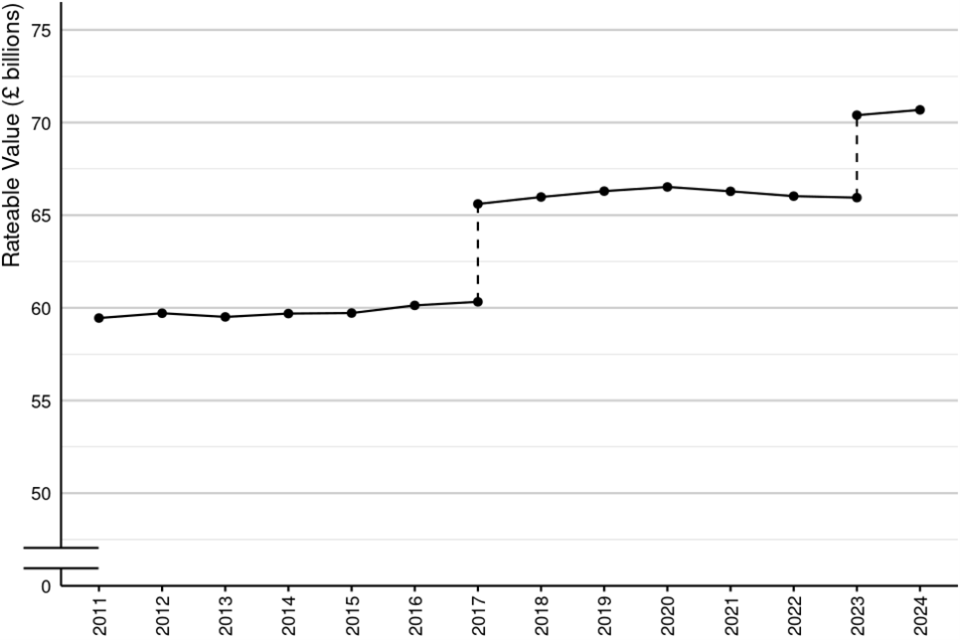

Figure 4: Total rateable value in England and Wales

Source: NDR Stock of Properties (Table SOP3.2)

Figure note: The y-axis has been zoomed in so that the trend over time is visible

Figure 4 shows total RV in England and Wales at 31 March of each year from 2011 to 2024. Each dotted line coincides with the end of a revaluation cycle and the introduction of a new Rating List. Between 31 March 2023 and 31 March 2024 (the end of the 2017 list), RV increased from £65.9 billion by £4.7 billion (7%). Since 1 April 2023 (the start of the 2023 Rating List), total RV has increased by £0.3 billion from £70.4 billion to £70.7 billion. A breakdown of the change to rateable value since the start of the 2023 rating list can been see in figure 2.

3.1 Distribution by sector

‘Sector’ consists of the following categories: Retail, Industrial and Office (RIO), which is a categorisation commonly used by those in the surveying profession. VOA statisticians have, in conjunction with operational colleagues, mapped each SCat code to one of the three categories. The ‘Other’ category was created to cover SCat codes which could not be readily assigned to ‘Retail’, ‘Office’ or ‘Industry’. This includes Assembly and Leisure, Education, Health, Hotels, and Utilities – for more details see Figure 13.

Further detail on sector composition is available in the Background Information document and Metadata files.

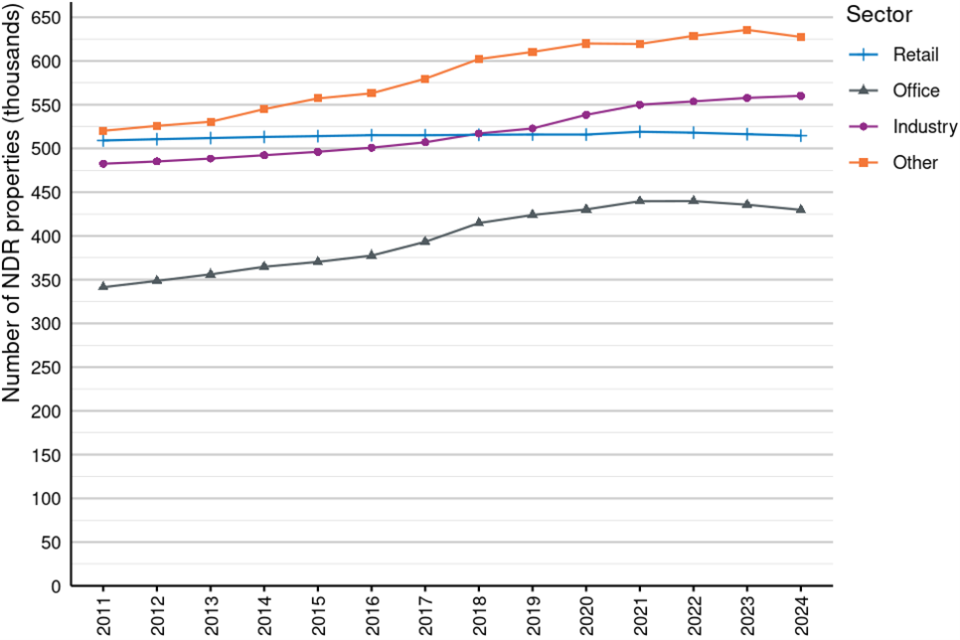

Figure 5: Number of rateable properties by sector in England and Wales

Source: NDR Stock of Properties (Tables SOP4.1, SOP5.1, SOP6.1, and SOP7.1)

Figure 5 shows the total number of properties in each sector in England and Wales at 31 March of each year from 2011 to 2024.

Since 31 March 2011:

- the number of properties in the Retail sector has increased by 1%, from 509,080 to 514,580

- the Office sector has increased by 26%, from 341,360 to 429,790 properties

- the Industry sector has increased by 16%, from 482,530 to 560,130

- the Other sector has increased by 21%, from 520,180 to 627,500

In the latest financial year, from the start of the 2023 list (1 April 2023 to 31 March 2024):

- the number of properties in the Retail sector has decreased by 1,870 (less than 1%)

- the Office sector has decreased by 4,750 (1%)

- the Industry sector has increased by 2,020 (less than 1%)

- the Other sector has decreased by 8,570 (1%)

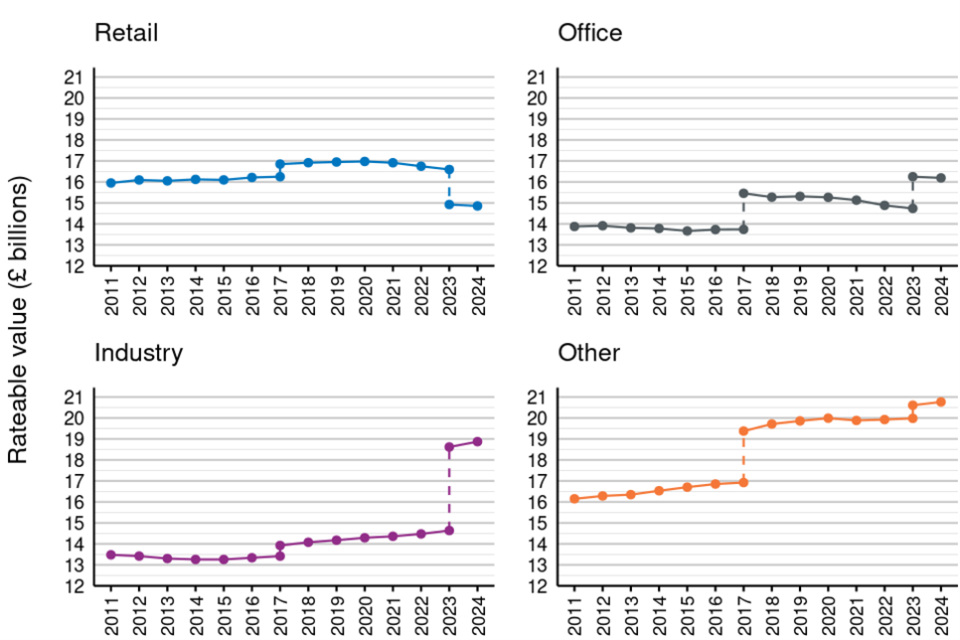

Figure 6: Total rateable value by sector in England and Wales

Source: NDR Stock of Properties (Tables SOP4.2, SOP5.2, SOP6.2, and SOP7.2)

Figure 6 shows total RV in each sector in England and Wales at 31 March of each year from 2011 to 2024. Each dotted line coincides with the end of a revaluation cycle and the introduction of a new Rating List. Since 31 March 2018 (the first full year of the 2017 Rating List):

- the total RV for the Retail sector has decreased by 12%, from £16.9 to £14.9 billion

- the Office sector has increased by 6%, from £15.3 to £16.2 billion

- the Industry sector has increased by 34%, from £14.1 to £18.9 billion

- the Other sector has increased by 5%, from £19.7 to £20.8 billion

In the latest financial year, from the start of the 2023 list (1 April 2023 to 31 March 2024):

- the total RV for the Retail sector has reduced by less than 1% from £14.9 billion to £14.8 billion

- the Office sector has reduced by less than 1% from £16.2 billion to £16.1 billion

- the Industry sector has increased by 2% from £18.6 billion to £18.9 billion

- the Other sector has increased by 1% from £20.6 billion to £20.8 billion

4. The Stock of Properties in England and Wales at 31 March 2024

The following section shows a more detailed view of property counts and total RV at 31 March 2024.

4.1 Distribution by sector

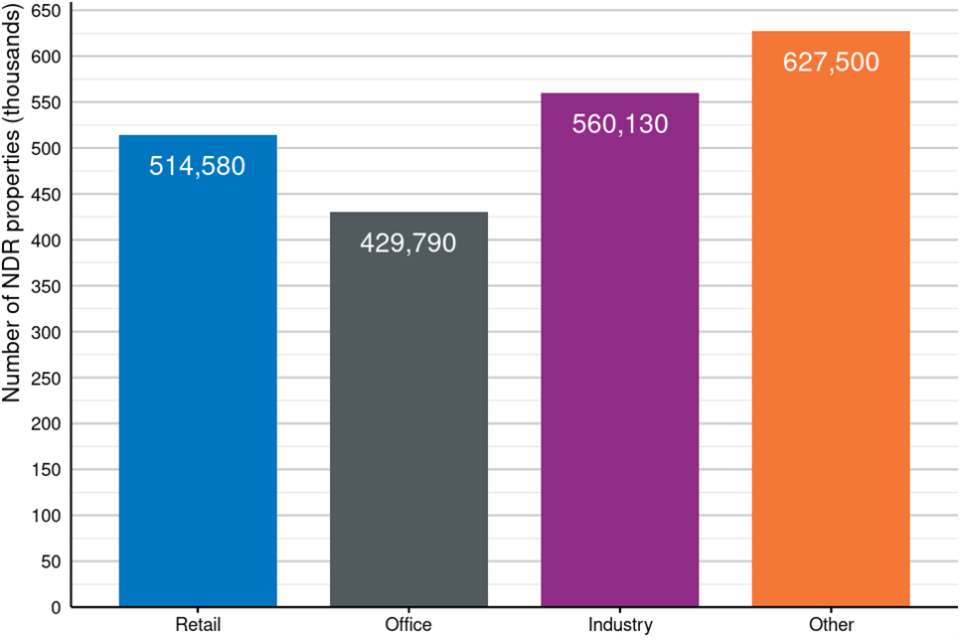

Figure 7: Number of rateable properties by sector in England and Wales

Source: NDR Stock of Properties (Tables SOP4.1, SOP5.1, SOP6.1, and SOP7.1)

Figure note: Counts are rounded to the nearest 10

Figure 7 shows property counts by sector at 31 March 2024. The Other sector had the highest count with 628,000 properties (29% of the total properties). The Office sector had the lowest count with 430,000 properties (20%).

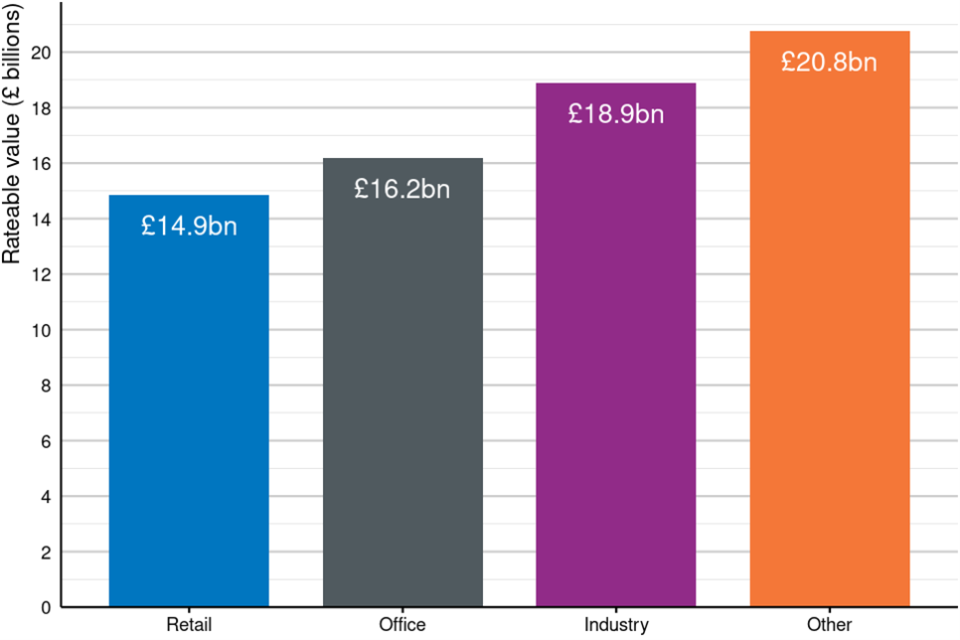

Figure 8: Total rateable value by sector in England and Wales

Source: NDR Stock of Properties (Tables SOP4.2, SOP5.2, SOP6.2, and SOP7.2)

Figure note: RV totals are rounded to the nearest £100 million

Figure 8 shows total RV by sector at 31 March 2024. The Other sector had the highest total RV with £20.8 billion (29% of the overall total RV). The Retail sector had the lowest total RV with £14.9 billion (21%).

4.2 Distribution by region

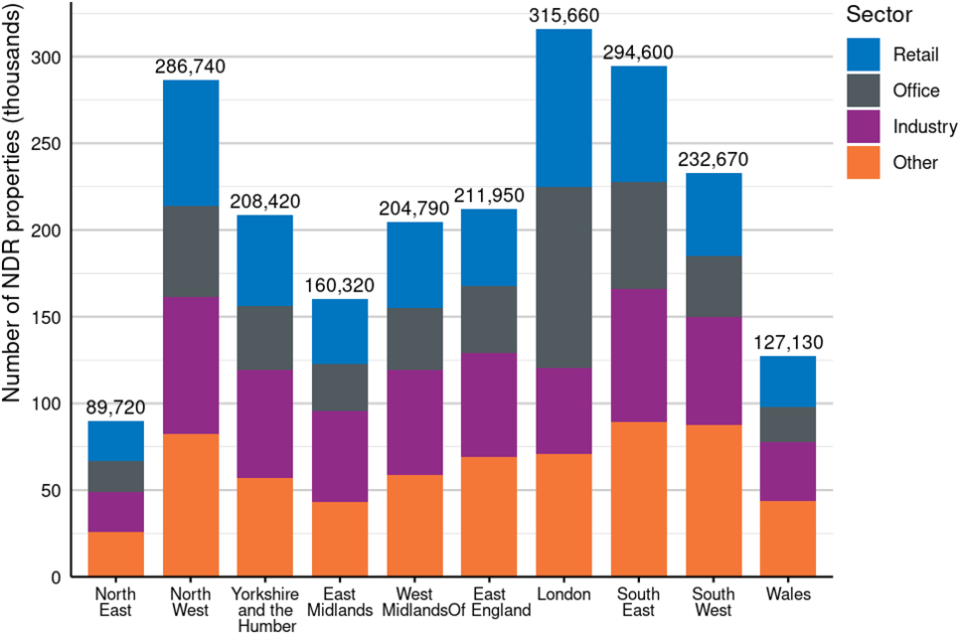

Figure 9: Number of rateable properties by region and sector

Source: NDR Stock of Properties (Tables SOP4.1, SOP5.1, SOP6.1, and SOP7.1)

Figure note: Counts are rounded to the nearest 10

Figure 9 shows property counts by region and sector at 31 March 2024. London had the highest count with 316,000 properties (15% of the total properties). The North East had the lowest count with 90,000 properties (4%).

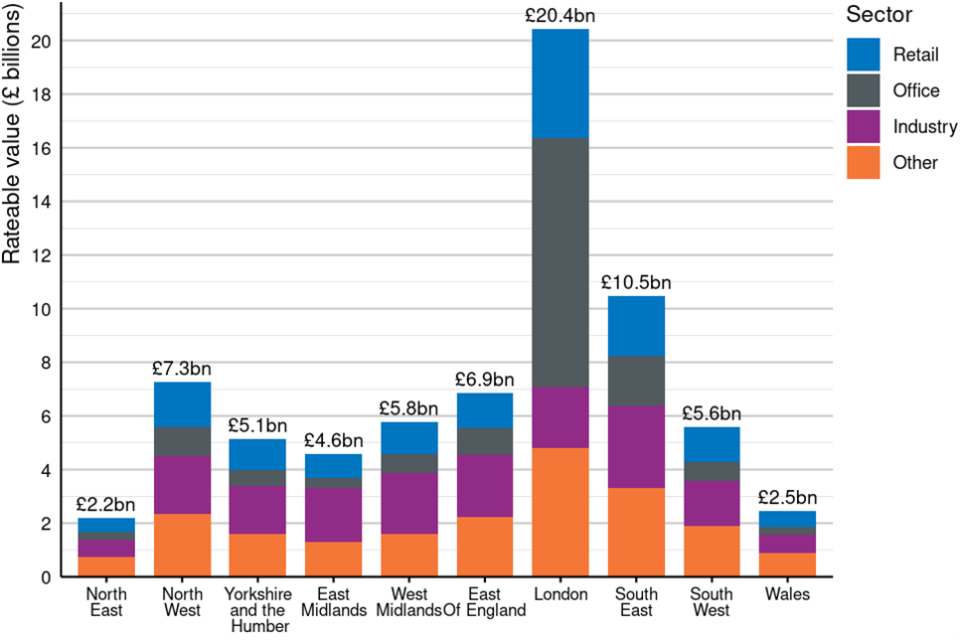

Figure 10: Total rateable value by region and sector

Source: NDR Stock of Properties (Tables SOP4.2, SOP5.2, SOP6.2 & SOP7.2)

Figure note: RV totals are rounded to the nearest £100 million

Figure 10 shows total RV by region and sector at 31 March 2024. London had the highest total RV with £20.4 billion (29% of the overall total RV). The North East had the lowest total RV with £2.2 billion (3%).

4.3 Distribution by rateable value band

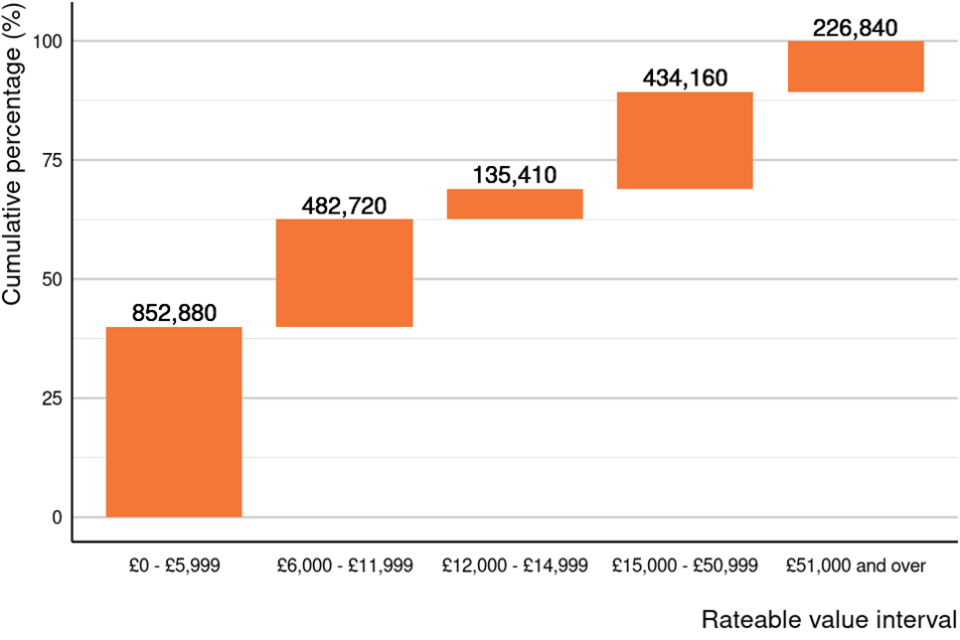

Figure 11: Number of rateable properties by rateable value band

Source: NDR Stock of Properties (Table SOP2.1)

Figure notes: Counts are rounded to the nearest 10. Totals may not sum due to rounding.

Figure 11 shows property counts by RV band in England and Wales at 31 March 2024. 63% of properties have a rateable value less than £12,000 while 37% of properties have a rateable value of £12,000 or over. The band ranges are not consistent sizes therefore band totals should not be compared directly.

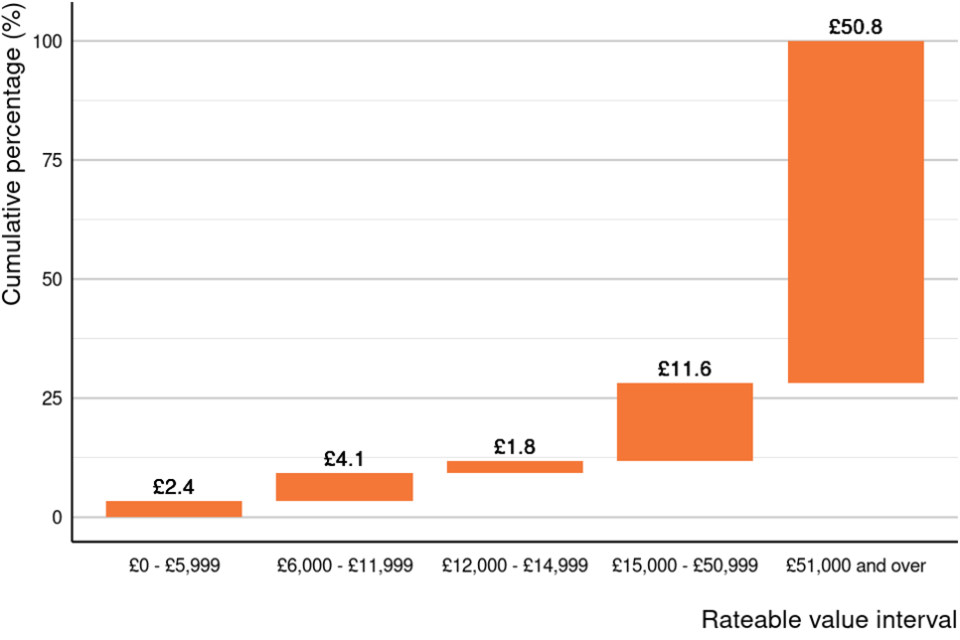

Figure 12: Total rateable value by rateable value band

Source: NDR Stock of Properties (Table SOP2.1)

Figure notes: Figures are presented in billions of pounds. Totals may not sum due to rounding.

Figure 12 shows rateable value by RV band in England and Wales at 31 March 2024. The majority of RV lies within the £51,000 and over RV band, which represents £50.8 billion of RV (72% of total RV). The remaining 28% of RV lies within the bands less than £51,000. The band ranges are not consistent sizes therefore band totals should not be compared directly.

4.4 Distribution by sub-sector

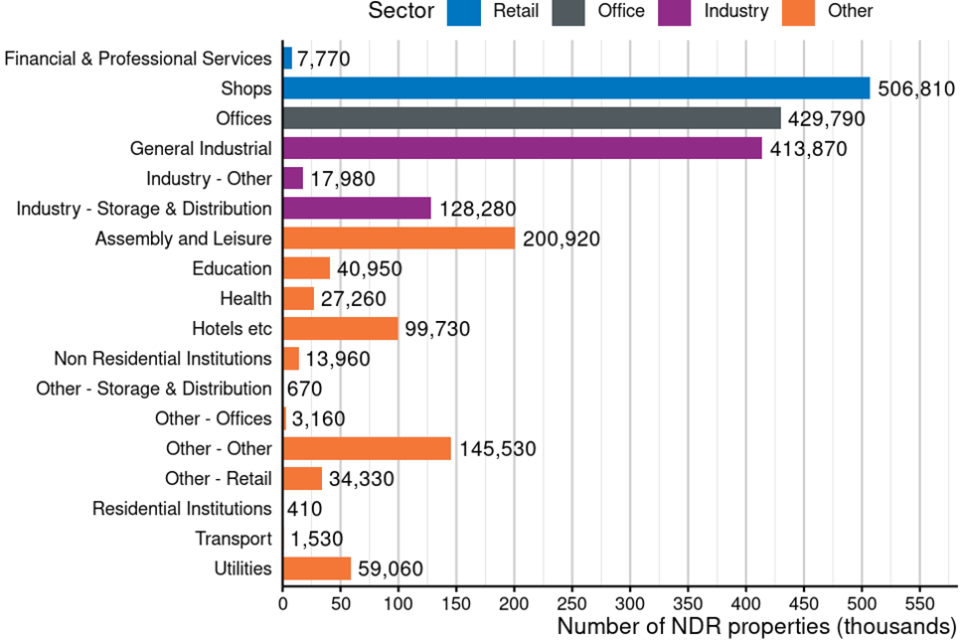

Figure 13: Number of rateable properties by sector and sub-sector in England and Wales

Source: Stock SCat, 2024 (Table SOP1.1)

Figure note: Counts are rounded to the nearest 10

Figure 13 shows property counts by sub-sector in England and Wales at 31 March 2024. The sub-sector with the most properties was Shops with 506,810. The sub-sector with the fewest properties was Residential Institutions with 410.

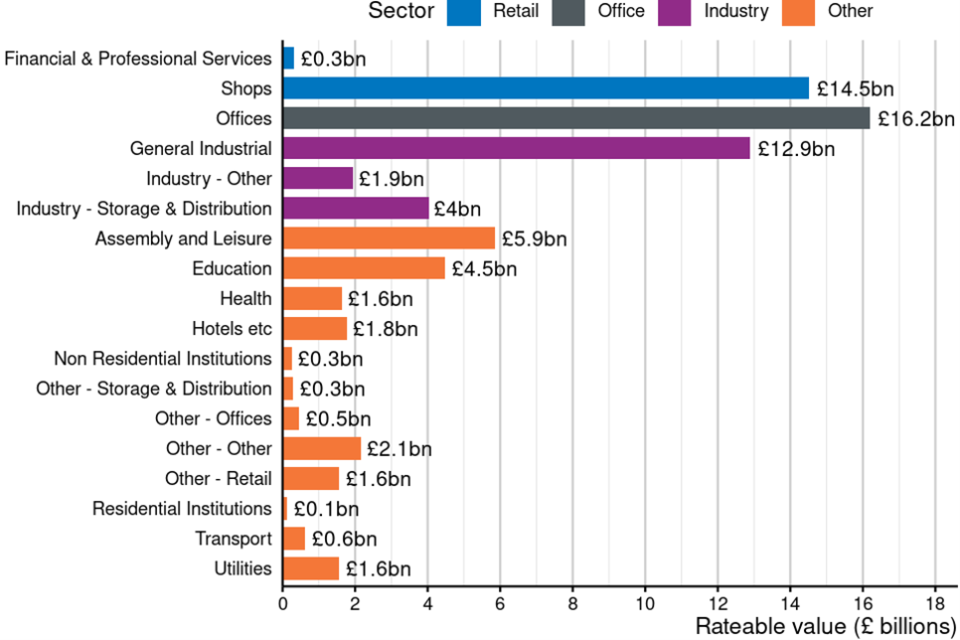

Figure 14: Total rateable value by sector and sub-sector in England and Wales

Source: Stock SCat, 2024 (Table SOP1.1)

Figure note: RV totals are rounded to the nearest £100 million

Figure 14 shows total RV by sub-sector in England and Wales at 31 March 2024. The sub-sector with the highest RV was Offices with £16.2 billion. The sub-sector with the lowest RV was Residential Institutions with £121.8 million.

5. Further Information

In Autumn 2024, VOA will publish an ad hoc release relating to holiday lets in England and Wales.

The analysis will not form part of our official statistics as it is not yet possible to establish a suitable assured methodology. However, we recognise this area is of interest to users of both our Council Tax and Non-domestic rates statistics so the analysis will provide an explanation and provisional best estimate of holiday let properties moving between the Council Tax and Non-domestic rating lists. Further information on this ad hoc release will be provided on our announcements page in due course.

More information about this release can be found in the Background Information document

Further information on the area codes used in this can be found on the ONS website

More information on statistics at the VOA can be found on the Agency’s website: About VOA statistics

Timings of future releases are regularly placed on the VOA research and statistics calendar

We will keep the format of this document under review to continue improving the presentation of our statistics, and welcome feedback from users on the value of the information provided in this commentary – please forward any comments to the Statistics Inbox