Pensioners' Incomes Series: background information and methodology

Updated 30 August 2023

1. Background information

Effect of the coronavirus (COVID-19) pandemic on these statistics

This Pensioners’ Incomes (PI) Series publication is the second survey year where data collection has been affected by the coronavirus (COVID-19) pandemic. Please see the Family Resources Survey (FRS) background information and methodology for the specific adjustments that have been made in light of the coronavirus (COVID-19) pandemic effects on the sample for financial year ending (FYE) 2022.

See the Households Below Average Income (HBAI) technical report which explains the effects of the coronavirus (COVID-19) pandemic in more detail. This should be considered alongside the interpretation of the PI statistics.

A. Purpose of the statistics

PI contains estimates of the levels, sources, and distribution of pensioners’ incomes. It also examines the position of single pensioners and pensioner couples, including any dependent children, within the income distribution of the population as a whole. This is different from HBAI. This is because PI only includes the income of pensioner units and excludes the income of other adults living in the same household.

This is a key source of information that is used to inform government thinking on relevant policies, as well as related programmes and projects. Researchers and analysts outside government use the statistics and data to examine topics such as ageing, distributional impacts of fiscal policies and the income profiles of pensioner groups. Estimates in PI (as well as in HBAI) are based on data from the FRS.

Read more about PI online.

Versions of the dataset are available from the UK Data Service.

PI data is available on the Stat-Xplore online tool which allows users to create their own PI analysis. The PI information is available at family (benefit unit) level.

B. Context of the statistics

Pensioners are an increasingly large and diverse group in the population. There are a number of recent reforms affecting current and future pensioners, including:

-

private pension reforms including automatic enrolment

This publication illustrates changes in pensioners’ incomes over time and puts the results in the context of both economic and policy changes.

Pensioner demographics

The Office for National Statistics (ONS) population estimates for mid-2021 found that people aged 65 and over represented nearly one in five people.

According to the ONS the UK’s age structure is shifting towards older ages because of declining fertility rates and people living longer. The number of people of pensionable age, relative to the size of those expected to be of working age, is increasing.

Home ownership continues to be higher for pensioners compared to those of working age. Around three-quarters of pensioners live in homes that are owned outright (compared to roughly one in five of the working-age population), so therefore face minimal housing costs, as explained in the HBAI report.

Considerations when interpreting average pensioner incomes’

PI finds that there are differences in average incomes between age groups as well as changes over time. There are several reasons for this which should be noted when interpreting these results:

- the ‘age’ effect: older pensioners are less likely to be in work and hence receive a smaller amount from earnings. Furthermore, they are less likely to have a partner who is in work. Any pension(s) they may be in receipt of are related to their earnings, years of scheme membership, and pension contributions (including National Insurance in the case of the State Pension) they made previously in their working lives

- the ‘cohort’ effect: the rapid rise in occupational pension coverage in the 1950s and 1960s will have been more beneficial to later cohorts. From the 1980s, coverage of high contribution defined benefit (DB) schemes started to decline with most private sector DB schemes now closed to new joiners. Only 10% of all schemes are open to new entrants. Coverage in private sector workplace pensions only started to increase from 2012 following the introduction of Automatic Enrolment (AE). However, contributions to defined contribution (DC) schemes are currently much lower than previous defined benefit schemes

- the length of time since retirement: pensions generally increase by less generous uprating measures after retirement. In addition, most annuities purchased with occupational or personal pensions are level annuities, which do not increase over time. Income in real terms is therefore decreasing for these annuities once inflation is considered

- uprating: the Basic and New State Pension increased by 2.5% in line with the ‘triple lock’. This was lower than inflation of around 4% and so was not an increase in real terms for those in receipt

- changing SPa over time: from 6 April 2010, the SPa has been increasing gradually for females, and since December 2018 has been increasing for both males and females. The FRS data contained in this report was collected throughout FYE 2022, during which the SPa for both males and females remained at 66 years. In this report, people are categorised as being above SPa based upon their reported birth date and the timetable for the legislated increases in SPa

C. Policy changes

Council Tax

The Department for Levelling Up, Housing and Communities estimated that the average band D tax set by local authorities in England for FYE 2022 represented an increase of 4.4% from FYE 2021 levels.

In Wales, the average band D council tax for FYE 2022 increased by 3.8% from FYE 2021 levels.

In Scotland, councillors had agreed not to increase Council Tax for FYE 2022.

In Northern Ireland, there were increases in rates (poundage) of no more than one per cent in some council areas, but in others the rates (poundage) remained as it was in FYE 2021.

Housing Support for private renters

In April 2020, Local Housing Allowance rates were made more generous, as they increased to the 30th percentile of market rents. These rates remained the same for FYE 2022.

National Living Wage

In April 2021, the National Living Wage increased to £8.91 per hour for employees aged 23 years and over.

State Pension

In October 2020, the State Pension age increased to 66 years for both males and females and has remained at 66 years for FYE 2022.

Pensioner TV licences

From 1 August 2020, anyone who was aged 75 years or over and received Pension Credit was entitled to a free TV licence.

Universal Credit (UC) £20 uplift

From April 2020, the government increased the standard allowance in UC by £1,040.04 per year and the basic element in Working Tax Credit by £1,045 per year. Both new and existing UC claimants and existing Working Tax Credit claimants received an additional £20 per week on top of annual uprating. This uplift ended in October 2021.

UC removal of Minimum Income Floor for self-employed people

Between April 2020 and July 2021, the government temporarily suspended the Minimum Income Floor so that a drop in a claimant’s earnings was reflected in their monthly UC payment.

Reducing the UC taper rate

At the Autumn 2021 Budget, it was announced that the UC taper rate would be reduced from 63% to 55%. The taper is a reduction to a claimant’s UC based on their earned income. This change was implemented from 1 December 2021.

Severe Disability Premium (SDP) transitional payments

From 27 January 2021, the SDP Gateway was removed.

The SDP transitional payments were introduced for those who were entitled to the SDP and migrated to UC before the SDP Gateway commenced on 16 January 2019. These payments comprised of the following:

-

£285 a month for single claimants who were not receiving the UC limited capability for work and work-related activity (LCWRA) addition

-

£120 a month for single claimants who were receiving the LCWRA addition

-

£405 a month for joint claimants who were receiving the higher couple rate SDP in their legacy benefit

-

£285 a month for joint claimants who were receiving the lower couple rate SDP and were not receiving the LCWRA addition in UC

-

£120 a month for joint claimants who were receiving the lower couple rate SDP and were receiving the LCWRA addition in UC

-

an additional lump-sum payment to encompass the time period since the claimant moved onto UC

Up-rating

In April 2021:

-

inflation-linked benefits and tax credits rose by 0.5% in line with the Consumer Prices Index (CPI)

-

the Basic and New State Pension increased by 2.5% in line with the ‘triple lock’. The ‘triple lock’ ensured that in FYE 2022 both the Basic and New State Pension increased by the highest of the increase in earnings, price inflation as measured by the CPI, or 2.5%. The Basic State Pension increased from £134.25 per week to £137.60 per week, a cash increase of £3.35 per week. The New State Pension increased from £175.20 per week to £179.60 per week, a cash increase of £4.40 per week

-

the Standard Minimum Guarantee (SMG) in Pension Credit increased by 1.9%. For those who were single, the SMG in Pension Credit increased from £173.75 per week to £177.10 per week, a cash increase of £3.35 per week. For couples, this increased from £265.20 per week to £270.30 per week, a cash increase of £5.10 per week

-

both the lower and higher UC work allowances rose broadly in line with the CPI

Rent and mortgage payments

On 17 March 2020, the government announced that anyone struggling to pay their mortgage or rent as a result of the coronavirus (COVID-19) pandemic, as well as landlords with buy-to-let mortgages whose tenants were unable to pay the rent could apply for a payment holiday. Mortgage holidays were initially set to run until October 2020 but were then extended to 31 July 2021. Payment holidays could either last up to three months or up to six months. For those continuing to struggle financially once their payment holiday had ended, lenders should have provided additional support through tailored forbearance options. Landlords and lenders were prevented from evicting those occupying their properties by the Coronavirus Act 2020. From March 2020 to September 2020, housing possession action was suspended in courts and a ban on repossessions was in place from November 2020 until the end of May 2021.

Self-Employment Income Support Scheme (SEISS)

The government introduced the SEISS to help self-employed individuals who were affected by the coronavirus (COVID-19) pandemic. SEISS is for people who are self-employed or a member of a partnership in the UK and have lost income because of the coronavirus (COVID-19) pandemic. The first round of the SEISS paid taxable grants worth 80% of the claimant’s average monthly trading profit, up to £7,500 in total, and covered a three-month period.

The government announced the second round of SEISS in May 2020 with taxable grants worth 70% of the claimant’s average monthly trading profit, up to £6,570 in total, and encompassing a three-month period.

In September 2020, the government announced an extension to the SEISS which firstly covered from November 2020 to January 2021 and then from February 2021 to April 2021. The first of these two grants was worth 80% of the claimant’s average monthly trading profit, up to £7,500 in total, and the second was partly determined by the amount that a claimant’s turnover had reduced from April 2020 to April 2021.

A fifth grant was announced to cover the period from May 2021 to September 2021 and was in part determined by the amount a claimant’s turnover had reduced between April 2020 and April 2021. This grant was worth 80% of three months’ average trading profits, up to £7,500 for those with a turnover reduction of 30% or more. For those with a turnover reduction of less than 30%, this grant was worth 30% of three months’ average trading profits, up to £2,850.

‘Furlough’ - Coronavirus Job Retention Scheme (CJRS)

In March 2020, the government announced the CJRS. Employers who were unable to maintain their workforce because of the coronavirus (COVID-19) pandemic could put their employees on furlough and apply for a grant. Government and employer contributions varied during the scheme to ensure that an employee received at least 80% of their monthly wage, up to £2,500 a month, including National Insurance and any pension contributions. This scheme was extended to September 2021 and the level of grant available to employers under the scheme remained the same until June 2021. From July 2021 the level of grant was reduced, and employers were asked to contribute towards the cost of furloughed employees’ wages. To be eligible for the grant employers had to pay furloughed employees 80% of their wages, up to a cap of £2,500 per month for the time they spend on furlough.

D. Source of the statistics

In FYE 2022 several factors affected FRS data collection, response rates and the distribution of characteristics among FRS survey respondents, including:

-

change in the mode of interviewing

-

changes in the methods used to contact survey participants

-

changes in people’s behaviours and circumstances during the coronavirus (COVID-19) pandemic

More details on the effects of the coronavirus (COVID-19) pandemic on the FRS as a whole are included in the FRS background information and methodology. These should help users in their use and interpretation of FRS FYE 2022 data.

The Households Below Average Income (HBAI) technical report which explains the effects of the coronavirus (COVID-19) pandemic in more detail. This should be considered alongside the interpretation of the PI statistics.

The FRS is the main underlying data source for PI. It is one of the largest cross-sectional household surveys in the UK. The focus of the FRS is on capturing information on household incomes, so it provides more detail on different income sources than other household surveys, making it the foremost source of income data. The FRS also captures contextual information on the household and individual circumstances, such as employment, education level and disability. Overall, it is a comprehensive data source that allows for a range of different analysis.

The PI publication is also based on the HBAI dataset, which is derived from the FRS. HBAI makes an adjustment for households with very high incomes, as the FRS under-records information about these households. The HBAI quality and methodology information report provides further details on this and other topics.

The FRS is an annual survey based on financial years. Data is available for every year since FYE 1995.

Sample size: From April 2011, the target achieved UK sample size for the FRS was reduced by 5,000 households from 25,000 to 20,000 households a year. A published assessment concluded that this reduced sample still allowed the core outputs from the FRS, such as the individual measure of income in PI, to be produced. It should be noted that due to the coronavirus (COVID-19) pandemic, there was a smaller achieved sample size in FYE 2021 and FYE 2022.

Disability: For those above State Pension age, the reduction seen between FYE 2020 and FYE 2021 may have been a consequence of the change in mode from face-to-face to telephone interviewing, as fewer participants reported impairments in hearing, memory, or vision. There is still evidence of a mode effect in the FYE 2022 disability sample, with visual, hearing, and memory impairments again under-represented compared to before the coronavirus (COVID-19) pandemic. This largely affects the pensioner disability sample.

Coverage: Until FYE 2002, the FRS covered Great Britain. Since FYE 2003, Northern Ireland has been included, meaning the whole of the United Kingdom is included in PI. Therefore, caution should be taken when comparing results across these years.

E. Strengths of the statistics

-

The FRS captures more detail on different income sources compared to other household surveys; this allows PI to analyse and report on the different income sources for pensioners.

-

The FRS provides information on components of income and housing costs which are unavailable in administrative data.

-

The relatively long time series available means that trends can be assessed going back to FYE 1995, allowing an analysis of the effects of policies and events on the incomes of pensioners over time.

-

The range of demographic breakdowns allows comparisons between the incomes of groups of pensioners based on age, gender, ethnicity, and marital status.

-

Confidence intervals are calculated for a wide range of estimates using a bootstrapping approach (see ‘Measuring the size of sampling error’ below). These measures of uncertainty indicate whether differences between demographic groups and changes between years are likely to be real differences or caused by sampling error.

-

PI provides information on the income of pensioner units in monetary terms, split by sources of income.

-

PI also includes a range of metrics to support a wide range of different research questions, as found in the methodology section of this document.

F. Limitations of the statistics

In summary in FYE 2022, several factors affected FRS data collection, response rates and the distribution of characteristics among FRS survey respondents. The changes made to the FRS as a result of the coronavirus (COVID-19) pandemic resulted in a smaller sample size with around 16,000 interviews in FYE 2022 (down from around 20,000 in a usual year). In addition, the composition of the FRS achieved sample changed significantly between FYE 2020 and FYE 2022. The grossing regime was adjusted to improve the representativeness of the sample but there remain some unknown biases. As the reliability of the results of sample surveys, including the FRS, is positively related to the unweighted sample size, the smaller sample in FYE 2022 may have contributed to some of the differences observed this year.

This publication is based on survey data. Therefore, it is subject to potential limitations inherent in all surveys, including:

-

sampling error: This will vary to a greater or lesser extent depending on the level of disaggregation at which results are presented

-

non-response error: Systematic bias due to non-response by households selected for interview in the FRS. The response rate for the FRS in the FYE 2022 was 26%. In an attempt to correct for differential non-response, estimates are weighted using population totals

-

survey coverage: The FRS covers private households in the UK. Therefore, individuals in nursing or retirement homes, for example, will not be included. This means that figures relating to the most elderly individuals may not be representative of the UK population, as some individuals in this age group will have moved into homes where they can receive more frequent help

-

survey design: The FRS uses a clustered sample design to produce robust regional estimates. Therefore, the FRS is not suitable for analysis below region level

-

sample size: Although the FRS has a relatively large sample size for a household survey, small sample sizes may require several years of data to be combined for some analysis

Furthermore, relative to administrative records, the FRS is known to under-report benefit receipt. However, the FRS is considered to be the best source for looking at benefit and tax credit receipt by characteristics not captured on administrative sources, and for looking at total benefit receipt on a benefit unit or household basis. It is often inappropriate to look at benefit receipt on an individual basis because means-tested benefits are paid on behalf of the benefit unit. For further information on the under-reporting of benefit receipt, see the FRS background information and methodology.

G. Alternative data sources

There are other data sources that can provide information on areas of interest similar to those in the PI publication. These are listed below:

-

a guide to sources of data on income and earnings produced by the ONS. This guide is for users of official statistics on earnings and income. It compares the main sources of data available and outlines which sources will best meet user needs

-

visit the income and earnings interactive tool where you can filter by government department and country of interest to find relevant statistics

-

HBAI presents the number and percentage of pensioners living in low-income households and material deprivation

-

the FRS publication includes pension participation for working-age individuals. This shows those who are saving for retirement and the type of pension they are saving in (occupational or personal)

-

Income Dynamics looks at changes in household income including a measure of persistent low income, based on Understanding Society data

-

the DWP Stat-Xplore Tool is a tool which provides users with access to administrative data, as well as data from FRS, HBAI and PI which allows users to conduct their own analysis. Users can download and analyse statistics on a range of different benefits, programmes, and other administrative information collected and stored by the department

-

the English Longitudinal Study of Ageing (ELSA) is a biennial longitudinal study of the health, social and economic circumstances of a sample of approximately 8,500 people aged over 50 in England. ELSA started in the early 2000s, with nine waves of data currently published. It provides longitudinal data on pensions, savings, and labour market participation, as well as information on employment, retirement interactions, and transitions over the life courses of respondents as they grow older. ELSA also provides information on health trajectories, disability, and healthy life expectancy

-

the Wealth and Assets Survey (WAS) is a large-scale longitudinal survey with seven rounds currently published. Round 7 (2018 to 2020) had a sample of around 18,000 private households or 39,000 individuals in GB. It is conducted by the ONS. The WAS dataset holds information about the economic status of households and individuals including their physical and financial assets, debts, and pension provision. WAS data is also used to understand how wealth is distributed and the factors which may affect financial planning, as well as respondents’ attitudes and behaviours towards saving. The Pension Wealth tables in WAS provides estimates of the types of private (non-state) pension wealth, split by a wide range of socio-demographic and economic breakdowns

-

the Occupational Pension Scheme Survey (OPSS) was an annual survey, conducted by ONS. It covered occupational pension schemes from the public and private sector and samples at the level of the scheme. The OPSS provided the UK’s longest consistent time series for estimates of pension scheme membership, with data from 1953 to 2018, and it provided estimates of the number of schemes, scheme members, and their level of contributions

-

the Financial Survey of Pension Schemes (FSPS) is a quarterly survey that gathers information about income and expenditure, transactions, assets, and liabilities of pension schemes

-

the Annual Survey of Hours and Earnings (ASHE) is published by the ONS. It has been in place since 1997 and can be used to provide information on earnings for individuals close to or over SPa. It also collects significant information on employee pension membership and contributions. 2020 and 2021 saw lower response rates and data collection disruption due to the coronavirus (COVID-19) pandemic, so ASHE estimates are subject to more uncertainty compared to previous years. They also provide a summary dataset of pensioner results

-

the Labour Force Survey (LFS) is a continuous, large scale sample survey conducted by the ONS which provides information on the labour market, including employment, unemployment, and economic activity rates. This source can be used to provide information on individuals close to or over SPa in the labour market

-

DWP benefit expenditure and caseload tables contain historic and forecast benefit expenditure and caseload data. These tables include long-term projections of pensioner benefit expenditure, as well as State Pension expenditure by country of residence

-

DWP benefit statistics provide a high-level summary of National and Official statistics available through Stat-Xplore on a range of benefits, including the State Pension and Pension Credit. The main statistical release document is published on a six-monthly basis, with some data also released quarterly via Stat-Xplore and data tables

-

personal incomes statistics as published by His Majesty’s Revenue and Customs (HMRC) shows summary information about individuals who are UK taxpayers, their income, and the income tax to which they are liable. The data comes from the annual Survey of Personal Incomes, which samples administrative data held by HMRC on people who could be liable to UK income tax for the income tax year. This source includes information on income and tax for taxpayers of pension age

-

explaining income and earnings provides information on income and earnings statistics published by government departments, including DWP. It contains information on gender, occupations, and the number of people living below the minimum wage

-

changing trends and recent shortages in the labour market looks at workers that have entered or left the workforce and how this has changed in recent years

-

overview of workers who were furloughed in the UK provides characteristics of those who have been furloughed in the UK and how the furlough scheme has affected labour market outcomes and skills

-

Early insights from the Over 50s Lifestyle Study, Great Britain: Attitudes and reasons behind those aged 50 to 70 years leaving the labour market at some point in 2021, in Great Britain between 8 to 13 February 2022

H. Definitions and terminology

More information can be found in the glossary, below.

Pensioner Units

PI provides analysis on pensioner benefit units (known as pensioner units), which include:

Age of pensioner units

For analysis of pensioner units by age, pensioner couples are categorised by the age of the head. The head of the pensioner unit is the Household Reference Person (HRP, see below) if they belong to the pensioner unit. In households with multiple benefit units, if the HRP is not part of the pensioner unit, the head of the pensioner unit is the first person from the pensioner unit named in the interview. In households where there is one person under SPa and one person over SPa, the younger person may be the HRP and therefore the head of a pensioner unit need not be over SPa.

The HRP is the householder with the highest income, regardless of gender.

-

in a single adult household, the HRP is the sole householder (i.e., the person in whose name the accommodation is owned or rented)

-

if there are two or more householders, the HRP is the householder with the highest personal income from all sources

-

if there are two or more householders who have the same income, the HRP is the eldest householder

In PI, pensioner units are classified as having recently reached State Pension age (SPa) if the head was within five years of SPa at the time of interview. See “recently reached State Pension age” in the glossary. Pensioner units who recently reached State Pension age are also included in the ‘Under 75’ age group.

It should be noted that due to the rising SPa, this definition classifies some pensioners as having “recently reached State Pension age” even if they reached their SPa more than five years ago.

For example, a woman born on 6 April 1951 will have reached SPa on 6 May 2012, aged 61 years 1 month. When interviewed on 6 July 2021, she is 70 years 3 months old and reached her SPa 9 years 2 months ago. However, because the SPa has risen to 66 years by the date of interview, she is still classed as having “recently reached State Pension age” because she is within five years of the current SPa.

Income

PI estimates do not reflect income from other adults and their dependent children in a household. For example, if a pensioner lives with their adult children, the younger adults’ incomes are not included in this analysis. While the benefit income of dependent children is included in estimates, this was only relevant for just over half a per cent of pensioner units in FYE 2022.

Estimates are based on unequivalised income, except when comparing to the overall population distribution in section 7 of the main publication and in tables 4.6 and 4.7 of the table pack. Equivalisation makes an adjustment to income to reflect household size and composition in order to compare income across households as a measure of living standards and is used in the HBAI publication. In most cases in PI, income is shown for single pensioners and pensioner couples separately.

Income measures

Gross income: In PI, gross income is generally separated into six components:

-

income from benefits, including tax credits. In some tables this is further divided into:

-

State Pension: Basic and Additional State Pensions, New State Pension, Bereavement Allowance (previously Widow’s Pension), and Widowed Parent’s Allowance

-

income-related benefits: Pension Credit, Housing Benefit, Council Tax Reduction, Social Fund Payments, and Universal Credit (for working-age partners of pensioners included within the dataset)

-

disability benefits: Disability Living Allowance, Personal Independence Payments, Armed Forces Compensation Scheme, Attendance Allowance, Industrial Injuries Disablement Benefit, and any remaining Severe Disablement Allowance cases

-

These three benefit types are not exhaustive: there are benefits, such as Winter Fuel Payments and Carers’ Allowance, which do not fit into any of these categories but are included in total benefit income.

-

income from occupational pensions: employee pensions associated with an employer and workplace

-

income from personal pensions: personal pensions, annuities bought with lump sums from personal pensions, trade union and friendly society pensions

Income from private pensions is the sum of income from occupational pensions and personal pensions.

-

income from investments: including interest from Individual Savings Accounts (ISAs) and other savings accounts, unit trusts, bonds, stocks, and shares

-

income from earnings: including employee earnings and profit and loss from self-employment, as well as income from dividends

-

other income: benefits from friendly societies, income received for dependent children, maintenance payments and, from November 2000, free TV licences for those aged 75 and over who receive Pension Credit

More information about the different income sources can be found in the glossary.

Net income Before Housing Costs (BHC) comprises total income from all sources for all members of the pensioner unit. Income is net of:

-

income tax payments

-

National Insurance contributions

-

contributions to pension schemes

-

local taxes (i.e., council tax or domestic rates)

-

maintenance and child support payments

-

student loan repayments, and

-

parental contributions to students living away from home.

Net income After Housing Costs (AHC) is derived by deducting a measure of housing costs from the overall income measure. Housing costs include:

-

rent (gross of housing benefits)

-

water rates, community water charges and council water charges

-

structural insurance premiums (for owner occupiers)

-

mortgage interest payments (net of any tax relief), and

-

ground rent and service charges

Income from Housing Benefit is included within gross income as an income-related benefit. Capital mortgage repayments are not deducted as a Housing Cost, as this is regarded as an asset being accrued and not a cost.

We use AHC figures throughout the PI publication unless otherwise stated, as this is a better reflection of pensioners’ disposable incomes.

I. National Statistics status

National Statistics status means that our statistics meet the highest standards of trustworthiness, quality, and public value, and it is our responsibility to maintain compliance with these standards.

The statistics underwent a full assessment against the Code of Practice for Statistics in 2011 and were confirmed as National Statistics in November 2012 by the Office for Statistics Regulation (OSR). The continued designation of these statistics as National Statistics was confirmed in September 2022 following a compliance check by the OSR.

Since this assessment by the OSR in 2011, we have continued to comply with the Code of Practice for Statistics, and have made a number of improvements including:

-

value has been added as, in line with DWP Statistics reporting practices, publications have been made significantly shorter to enable a focus on commentary and analysis that aids interpretation to increase clarity and insight

-

the timeliness of the publication has been improved so that reports are released within 12 months of the completion of the FRS, made possible by improvements to the suite of codes that are used to conduct analysis

-

by making our data available on Stat-Xplore and the UK Data Service, our statistics are more accessible and support new analysis for users not included in the publications themselves

-

the quality of statistics has improved as variants of the Consumer Price Index (CPI) have replaced the use of Retail Prices Index (RPI) when adjusting for inflation, in line with guidance from the UK Statistics Authority and National Statistician

-

introduced an improved methodology for measuring and reporting uncertainty around key PI estimates

-

amendments to our reporting of ethnic background to reflect fully that this is self-declared. Representation rates are now calculated from known declarations only and exclude ‘choose not to declare’ and ‘unknown’. Only a minimal number of interviews were affected by this change

It is DWP’s responsibility to maintain compliance with the standards expected of National Statistics. If DWP becomes concerned about whether these statistics are still meeting the appropriate standards, we will discuss any concerns with the OSR. National Statistics status can be removed at any point when the highest standards are not maintained and reinstated when standards are restored.

Read further information about National Statistics on the UK Statistics Authority website.

DWP considers that all PI statistics in this publication are “Fully Comparable at level A*” of the UK Countries Comparability Scale across countries.

J. Quality Statement

PI is based on the HBAI and FRS datasets. These datasets undergo substantial checking and verification both internally within DWP, and externally by the Institute for Fiscal Studies (IFS). When producing charts and tables for the publication, all content is independently quality assured by different members of the PI team to ensure methodology is robust. All commentary in the PI report is reviewed by the PI team and analysts from the relevant policy areas within DWP to ensure the information presented is accurate and meets user needs. The data quality assurance process can be seen in the flowchart below:

Suitable data sources

- The FRS is a well-designed survey whose data is designated as National Statistics by the OSR.

- FRS conducts stages of validation, editing, conversion, imputation, and grossing prior to publication.

- HBAI, which also uses the FRS dataset, is the UK’s official source of poverty estimates and is also the main and recommended source on household and individual incomes.

- The PI dataset draws on both the FRS and HBAI datasets to focus on pensioners.

Assured quality

- There is quality across the end-to-end process of the FRS. Questionnaire design, testing the questionnaire, and fieldwork processes such as interviewer briefing are all robust.

- The FRS requires a high threshold to accept interviews as being complete, before being included in the data process.

- There are several feedback loops between the FRS, HBAI, IFS, and PI, as shown via the arrows in the flowchart above.

- IFS provides additional quality assurance on the HBAI dataset.

- PI also receives input through working with DWP policy analysts who are subject matter experts.

K. Future Reporting

The statistical work programme outlines developments to DWP official statistics. Users of PI will be made aware of future changes to these statistics via the statistical work programme and PI collection page.

L. Feedback

If you have any comments or questions, please contact:

Joanne Burrage,

PI Team Leader, Surveys Branch

Email: pensioners incomes@dwp.gov.uk

DWP Press Office: 0115 965 8781

M. Acknowledgements

Publication Lead: Aliyah Simjee

2. Methodology

Points to note

| Use… | If… |

|---|---|

| Gross | Interested in how much income pensioners receive before any taxes are applied; Or interested in different sources of income. |

| Net | Interested in income available for pensioners to spend (excluding the income of other household members), either BHC or AHC. |

| Mean | Interested in all income available to pensioner units in a particular group; Do not consider the influence of the highest incomes to be a major problem; Or interested in breaking down income by source. |

| Median | Interested in the income of the ‘typical’ pensioner unit; Do not want the average distorted by a small number of high incomes; Or are looking at distributions of incomes. |

| Average (mean or median) for all | Interested in all income available to pensioner units; Or want to include those with no income from a particular source. |

| Average (mean or median) for those in receipt | Interested in the average ‘rate’ at which people receive income from a particular source; Or are interested in an individual source of income. |

| All pensioner units | Interested in broad trends in cash amounts for pensioners (both in couples and singles) as a whole. |

| Singles and couples separately | Comparing subgroups that contain different proportions of singles and couples; Or looking at distributions of income. |

| After housing costs | Interested in the income available for pensioners to spend after their housing costs have been met; Considering changes in this net income over time; Or for comparing pensioners’ incomes with working-age incomes. |

| Before housing costs | Interested in total net income. |

A. Rounding and accuracy

In the tables and publication, the following conventions have been used:

| 0 | Nil (none recorded in the sample) |

| [low] | Negligible (less than 0.5% or 50p) |

| [x] | Not available due to small sample size (fewer than 50 for averages, fewer than 100 for percentages) or as a result of less than three years of comparable data in three-year average tables. |

Figures have been rounded to the nearest pound or one per cent. Population sizes have been rounded to the nearest 0.1 million. Individual figures have been rounded independently, so the sum of component items does not necessarily equal the totals shown.

B. Measuring living standards

Incomes are often used as a measure of the ‘standard of living’ achieved by different groups. However, there are many other factors that can affect living standards, such as wealth, physical health, and expenditure. These factors are not considered in this report. Furthermore, estimates of incomes in PI only consider the income of the pensioner benefit unit.

Pensioners’ standards of living may also be affected by the income of other adult members of the household or their dependents. Also, no adjustment (equivalisation) is made for single pensioners compared to couples. Income estimates should therefore only be regarded as broadly indicative of pensioners’ overall living standards.

Material deprivation for pensioners, an additional indicator for measuring living standards, has been included in the HBAI publication since FYE 2010 and is derived from a suite of questions in the FRS. A final score is calculated from the set of questions and compared with a threshold score to determine whether a pensioner is in material deprivation.

For details of the material deprivation indicator, see: Department for Work and Pensions Working Paper Number 54. For the latest results on the percentage of pensioners in low-income households and material deprivation, see the HBAI publication.

Detailed information on the measuring and production of the FRS dataset can be found in this year’s FRS background information and methodology. This also includes information on the survey design, sampling, collection, and quality assurance processes.

C. Grossing

The grossing regime applied in FYE 2021 was adapted to try to control for the larger impacts of the coronavirus (COVID-19) pandemic upon the achieved sample. Whilst the existing FRS grossing regime brought estimates close to the age and tenure profile of the UK population, it retained a disproportionate number of respondents who had been educated to at least degree level. When preparing the FYE 2022 estimates, it was found that the weighted sample included a disproportionate number of respondents with education levels at first-degree level or above, and too few below degree level. Therefore, the use of educational grossing controls was maintained, using annual growth in the degree population measured in the Annual Population Survey (APS).

There has, however, been no change to the overall population basis for the estimates. These remain the population in private households, as estimated by ONS. ONS has not adjusted these figures in the light of the coronavirus (COVID-19) pandemic. More information on mid-year estimates the of population can be found on the ONS website.

The grossing regime in FYE 2022 has also been adapted to control for the differential level of response seen through the year: This reflects the introduction of the planned boost to the issued sample from 1 October 2021. Following this boost (in England and Wales) in the second half of the year, the achieved sample (for the UK as a whole) was approximately 10,000 for the period from October to March. This was significantly higher than the 6,000 achieved for the period from April to September. This step change was accounted for by introducing a biannual grossing control for GB so there were equal numbers of private households from each half of the survey year in the weighted sample.

Grossing-up is the term usually given to the process of applying factors to sample data so that they yield estimates of the overall population. Estimates in PI incorporates the 2011 Census based mid-year population estimates into the grossing regime from FYE 2013 onwards. A consistent back series has been produced from FYE 2003 to FYE 2012.

In addition to the use of 2011 Census data, a number of minor methodological changes have also been implemented in the FRS dataset. These methodological changes were made on the recommendation of the ONS Methodological Advisory Service during an Initial Review of the FRS weighting scheme. A report of the changes made to the grossing regime is available.

A software package called CALMAR, provided by the French National Statistics Institute, is used to reconcile control variables at different levels and estimate their joint population. This software makes the final weighted sample distributions match the population distributions through a process known as calibration weighting. It should be noted that if a few cases are associated with very small or very large grossing factors, grossed estimates will have relatively wide confidence intervals.

D. Adjusting for inflation

PI uses uprating factors to adjust for inflation, by bringing values from previous years into current price terms for the most recent year of the publication. As advised in a Statistical Notice published in May 2016, from FYE 2015 PI made a methodological change to use variants of the Consumer Prices Index (CPI) when adjusting for inflation. Prior to FYE 2015, variants of the Retail Prices Index (RPI) were used to adjust for inflation.

Read more information in the FYE 2015 PI publication’s background information and methodology.

E. Adjustment for individuals with very high incomes

An adjustment is made to sample cases at the top of the income distribution to correct for volatility in the highest incomes captured in the survey. This adjustment uses data from HM Revenue and Customs Survey of Personal Incomes (SPI) to control the numbers and income levels of the ‘very rich’ while retaining the FRS data on the characteristics of the households. For FYE 2022, pensioners in GB are subject to the SPI adjustment if their gross income exceeded £90,400 per year (£73,000 in Northern Ireland). Working-age adults (including the working-age partners of pensioners) are subject to the SPI adjustment if their gross income exceeded £343,700 per year (£180,600 per year in Northern Ireland). For more details on the SPI adjustment see the HBAI quality and methodology information report.

F. Negative incomes

Negative incomes are not thought to be indicative of standards of living. Pensioner units with negative net income BHC have the gross income components of income, and their net income BHC, set to zero. Net income AHC is set to zero minus housing costs, and so for a small number of cases will be negative. See the PI methodological paper number two for more information on negative incomes.

G. Output standards for ethnic groups

PI FYE 2022 has adopted the latest harmonised output standards for ethnic groups for the UK, however, ‘mixed’ and ‘other’ ethnic groups have been merged together due to small sample sizes. The latest harmonised standards were published in August 2011 and cover the ethnic group question in England, Wales, Scotland, and Northern Ireland. They also cover harmonised data presentation for ethnic group outputs. The standards were updated in February 2013 detailing how Gypsy, Traveller, and Irish Traveller should be recorded in the outputs, due to differences across the UK.

Reporting of ethnic background was amended in FYE 2021 to reflect fully that this ethnicity is self-declared. Representation rates are now calculated from known declarations only and exclude ‘choose not to declare’ and ‘unknown’. For the FRS and PI this has had a minimal effect on reporting.

For further details please see the Ethnicity harmonised standard.

H. Further information

A collection of methodological papers on PI are available which include papers on negative incomes, personal pension income, and definitions of pensioner units.

3. Reliability of estimates

The achieved FRS sample this year is larger than FYE 2021, though still around 20% smaller than a typical survey year. Whilst this still represents a large sample, confidence intervals are wider than in a normal FRS year, and this needs to be borne in mind when interpreting the estimates in this publication.

Given the reduced sample size in FYE 2022, confidence intervals around the main estimates are wider than in years prior to the coronavirus (COVID-19) pandemic, though not as wide as FYE 2021. The increase in variation does vary across the main estimates, but on average is around 20%. Therefore, the degree of change in the estimates needed to be larger before we can be confident it is statistically significant.

The figures in this publication come from the FRS. Like all surveys, it gathers information from a sample rather than from the whole population. The size of the sample and the way in which the sample is selected is carefully designed to ensure that it is representative of the UK as whole, whilst bearing in mind practical considerations like time and cost constraints. Survey results are always estimates, not precise figures. This means that they are subject to a level of uncertainty which can affect how changes, especially over the short term, should be interpreted.

A. Estimating and reporting uncertainty

Two different random samples from one population, for example the UK, are unlikely to give exactly the same survey results, which are likely to differ again from the results that would be obtained if the whole population was surveyed. This level of uncertainty around a survey estimate can be calculated and is commonly referred to as sampling error.

In addition to sampling error, the PI estimates can also be affected by other non-sampling errors. Some of these are:

-

reporting errors: Imperfect recall and respondents choosing to deliberately give incorrect answers are examples of reporting error. If these errors are systematic, they may lead to bias in the survey estimates

-

under-reporting: The FRS information on benefits relies on the respondent being able to accurately report the amount of benefit they receive. This reliance leads to under-reporting in receipt for many benefits. It is also thought that household surveys underestimate income from both self-employment and investments so these figures should be treated with caution. The under-reporting of income from investments is particularly likely to affect the estimates for pensioners

-

misreporting: The type of income received is self-reported by survey respondents and can consequently be misreported. For example, some survey respondents may not be able to distinguish between the State Pension and Pension Credit because these benefits can be paid jointly

-

systematic bias: This arises in the sample if certain groups are less likely to respond to a survey than others. This is corrected to some extent in the FRS by grossing to match subgroups of the population by age, sex, family status, tenure, council tax band, and broad geographic region. Nevertheless, it is difficult to account for all possible bias, so some results may still be affected

We can calculate the level of uncertainty around a survey estimate by exploring how that estimate would change if we were to draw many survey samples for the same time period, instead of just one. This process is called bootstrapping.

B. Measuring the size of sampling error

Bootstrapping allows us to define a range around the estimate (known as a “confidence interval”) and to state how likely it is that the real value that the survey is trying to measure lies within that range. Confidence intervals are used as a guide to the size of sampling error. These are typically set up so that we can be 95% sure that the true value lies within the range, in which case this range is referred to as a “95% confidence interval”. A wider confidence interval indicates a greater uncertainty around the estimate. Generally, a smaller sample size will lead to estimates that have a wider confidence interval. This is because a smaller sample is less likely than a larger sample to reflect the characteristics of the total population and therefore there will be more uncertainty around the estimate derived from the sample.

Statistical significance: Some changes in estimates between years will be the result of different samples being chosen, whilst other changes will reflect underlying changes in income across the population. Confidence intervals can be used to identify changes in the data that are statistically significant; that is, they are unlikely to have occurred by chance due to a particular sample being chosen. Confidence intervals can give a range around the difference in a result from one year to the next. If the range does not include zero it indicates this change is unlikely to be the result of chance.

Working with uncertain estimates: Some changes between years will be small in relation to sampling variation and other sources of error and may not be statistically significant. This is relevant for particular sub-groups, as these will have smaller sample sizes than the overall survey sample size. For these sub-groups it is important to look at long-term trends.

4. Estimating and interpreting uncertainty in PI

A. Calculating uncertainty in PI

Since the FYE 2014 publication, confidence intervals have been calculated using a bootstrapping approach, using the statistical package SAS. This has allowed confidence intervals to be calculated for a wider range of estimates.

Bootstrapping considers the design of the sample. It replicates the sampling design of the survey and takes re-samples with replacement from the dataset, creating 500 new samples of the dataset. Each new sample is different and contains multiple copies of some survey observations and none of some others. Exploring the range of results in these samples allows us to generate confidence intervals around the result obtained in the original sample.

From the FYE 2016 publication and onwards, new bootstrapping methodology has provided an improved measure of uncertainty around key PI estimates by creating resamples of the HBAI dataset by simulating stratified, cluster sampling for GB and stratified sampling for NI. It also creates a unique set of grossing factors for each resample using the HBAI grossing process to gross the GB and NI resamples to the UK population. For a more technical guide to the approach used to generate confidence intervals in this report, please see the statistical notice or the HBAI Quality and Methodology Information Report.

B. Interpreting estimates of uncertainty in PI

Table M1.1 provides confidence intervals for key estimates of pensioners’ incomes in FYE 2022. For example, in FYE 2022, weekly gross income for all pensioner units is estimated to be £588. We can be 95% confident that the true value of gross income per week, if we were to take a census of the population, would lie between £568 and £605.

The table shows that, while there is a degree of uncertainty about the estimates, it does not affect the broad conclusions drawn, such as the relative importance of different types of income, or the fact that single males on average had higher incomes than single females.

When comparing two or more estimates, we must factor in the uncertainty surrounding each of the estimates. Table M1.2 shows the growth in sources of income between FYE 2012 and FYE 2022, and FYE 2021 and FYE 2022.

Statistically significant results (at the 95% confidence level) are marked with an asterisk (*). As can be seen, the confidence intervals around the estimates of various different growth rates between FYE 2021 and FYE 2022 often include zero. This is particularly true for smaller components of income. This means that we cannot be confident that the growth rate is different from zero, and hence the change is not statistically significant.

Over short time periods, it is unlikely that an income measure will change dramatically, so the uncertainty is likely to be large compared with the change itself.

Users are advised to draw conclusions from long term trends rather than year on year changes.

Even some longer-term changes need to be interpreted with care. For income sources where the amount received per week varies greatly between pensioner units, such as investment income, even long-term comparisons may not be statistically significant. For example, income from investments has increased by three per cent for single pensioners from FYE 2012 to FYE 2022, but this increase is not statistically significant (see Table M1.2).

For more information about uncertainty around FRS derived estimates see the 2014 uncertainty in FRS based analysis report. There is also the 2017 statistical notice for the change implemented from FYE 2016 data onwards.

Table M1.1: Uncertainty surrounding estimates in PI FYE 2022

| Measure | Estimate | 95% confidence interval | ||

|---|---|---|---|---|

| £ p/w | Interval width | Relative width | Interval range | |

| All pensioner units | ||||

| Gross income | 588 | 36 | 6% | 568 to 605 |

| of which | ||||

| Benefit income | 257 | 11 | 4% | 252 to 263 |

| Occupational pension income | 195 | 28 | 14% | 180 to 207 |

| Personal pension income | 18 | 8 | 44% | 14 to 22 |

| Investment income | 41 | 9 | 23% | 35 to 45 |

| Earnings income | 74 | 19 | 26% | 64 to 83 |

| Other income | 3 | 2 | 67% | 2 to 4 |

| Net income BHC | ||||

| Mean | 494 | 29 | 6% | 478 to 507 |

| Median | 390 | 28 | 7% | 375 to 402 |

| Net income AHC | ||||

| Mean | 458 | 29 | 6% | 443 to 472 |

| Median | 349 | 27 | 8% | 331 to 358 |

| Pensioner couples | ||||

| Median net income BHC | 538 | 54 | 10% | 506 to 560 |

| Median net income AHC | 515 | 47 | 9% | 489 to 536 |

| Single pensioners | ||||

| Median net income BHC | 281 | 19 | 7% | 270 to 289 |

| Median net income AHC | 239 | 22 | 9% | 227 to 249 |

| Single male pensioners | ||||

| Median net income BHC | 298 | 42 | 14% | 276 to 318 |

| Median net income AHC | 254 | 48 | 19% | 224 to 272 |

| Single female pensioners | ||||

| Median net income BHC | 276 | 22 | 8% | 266 to 288 |

| Median net income AHC | 232 | 25 | 11% | 218 to 244 |

| Recently reached SPa pensioner units | ||||

| Median net income BHC | 339 | 30 | 9% | 323 to 353 |

| Median net income AHC | 392 | 80 | 20% | 351 to 432 |

| Not recently reached SPa pensioner units | ||||

| Median net income BHC | 376 | 31 | 8% | 358 to 390 |

| Median net income AHC | 389 | 48 | 12% | 364 to 413 |

| Pensioner units where the head is under 75 | ||||

| Median net income BHC | 429 | 46 | 11% | 401 to 447 |

| Median net income AHC | 389 | 48 | 12% | 364 to 413 |

| Pensioner units where the head is 75 or over | ||||

| Median net income BHC | 357 | 28 | 8% | 343 to 372 |

| Median net income AHC | 322 | 35 | 11% | 303 to 338 |

- The interval widths are calculated on unrounded numbers and therefore may not match the interval range.

Table M1.2 Growth in average incomes of pensioner units, FYE 2012 to FYE 2022, and FYE 2021 to FYE 2022

| Measure | FYE 2012 | FYE 2021 | FYE 2022 | % growth FYE 2012 to FYE 2022 | % growth FYE 2021 to FYE 2022 | 95% confidence interval FYE 2012 to FYE 2022 | 95% confidence interval FYE 2021 to FYE 2022 |

| All pensioner units | |||||||

| Gross income | 552 | 604 | 588 | 7%* | -3% | 1% to 12% | -7% to 2% |

| of which | |||||||

| Benefit income | 236 | 263 | 257 | 9%* | -2% | 5% to 12% | -5% to 1% |

| Occupational pension income | 150 | 197 | 195 | 30%* | -1% | 17% to 42% | -12% to 10% |

| Personal pension income | 21 | 21 | 18 | -13% | -14% | -44% to 8% | -50% to 9% |

| Investment income | 40 | 48 | 41 | 3% | -15% | -16% to 17% | -40% to 1% |

| Earnings income | 101 | 73 | 74 | -27%* | 2% | -42% to -14% | -21% to 23% |

| Other income | 4 | 3 | 3 | -32%* | -2% | -63% to -9% | -57% to 33% |

| Net income BHC | |||||||

|---|---|---|---|---|---|---|---|

| Mean | 459 | 508 | 494 | 8%* | -3% | 3% to 12% | -7% to 2% |

| Median | 361 | 409 | 390 | 8* | -5% | 1% to 12% | -10% to 2% |

| Net income AHC | |||||||

| Mean | 423 | 473 | 458 | 8%* | -3% | 3% to 13% | 0% to 9% |

| Median | 324 | 376 | 349 | 8%* | -7%* | 1% to 12% | -14% to -2% |

| Pensioner couples | |||||||

| Gross income | 746 | 817 | 791 | 6% | -3% | -1% to 13% | -9% to 3% |

| of which | |||||||

| Benefit income | 261 | 301 | 299 | 15%* | -1% | 10% to 19% | -5% to 4% |

| Occupational pension income | 214 | 282 | 280 | 31%* | -1% | 15% to 46% | -13% to 13% |

| Personal pension income | 33 | 32 | 27 | -18% | -14% | -50% to 6% | -58% to 12% |

| Investment income | 59 | 74 | 59 | 0% | -20% | -29% to 22% | -61% to 0% |

| Earnings income | 174 | 125 | 123 | -29%* | -1% | -47% to -14% | -30% to 22% |

| Other income | 4 | 4 | 3 | -37%* | -24% | -73% to -13% | -81% to 6% |

| Net income BHC | |||||||

| Mean | 608 | 679 | 657 | 8%* | -3% | 1% to 14% | -9% to 3% |

| Median | 496 | 562 | 538 | 9%* | -4% | 2% to 14% | -12% to 1% |

| Net income AHC | |||||||

| Mean | 577 | 650 | 627 | 9%* | -4% | 2% to 15% | -10% to 2% |

| Median | 467 | 533 | 515 | 10%* | -4% | 3% to 16% | -11% to 4% |

| Single pensioners | |||||||

| Gross income | 355 | 401 | 387 | 9%* | -3% | 0% to 17% | -13% to 6% |

| of which | |||||||

| Benefit income | 211 | 226 | 216 | 2% | -4% | -2% to 7% | -10% to 1% |

| Occupational pension income | 85 | 116 | 111 | 30%* | -4% | 5% to 48% | -25% to 12% |

| Personal pension income | 8 | 11 | 9 | 15% | -17% | -76% to 64% | -90% to 21% |

| Investment income | 20 | 23 | 23 | 17% | -1% | -56% to 56% | -83% to 36% |

| Earnings income | 26 | 23 | 26 | -2% | 12% | -70% to 37% | -98% to 63% |

| Other income | 4 | 2 | 3 | -27% | 36% | -90% to 13% | -115% to 108% |

| Net income BHC | |||||||

| Mean | 307 | 346 | 332 | 8%* | -4% | 1% to 14% | -12% to 4% |

| Median | 269 | 300 | 281 | 4% | -6% | -1% to 9% | -13% to 2% |

| Net income AHC | |||||||

| Mean | 267 | 304 | 293 | 10%* | -4% | 1% to 17% | -13% to 5% |

| Median | 224 | 256 | 239 | 7%* | -7% | 0% to 13% | -16% to 2% |

- Results that are statistically significant are denoted with an asterisk (*).

- Confidence intervals are calculated on unrounded numbers. Changes are indicated as statistically significant if the confidence interval before rounding does not include zero.

- The percentage changes are calculated on unrounded numbers and therefore may not match those calculated for the rounded numbers shown in the table.

5. Households Below Average Income (HBAI) and the Pensioners’ Incomes (PI) Series

While the HBAI data for FYE 2022 has undergone extensive quality assurance prior to publication, we recommend that users exercise additional caution when using the data for FYE 2022, particularly when making comparisons with previous years. This is especially recommended when interpreting larger changes observed in FYE 2022.

See the HBAI technical report which explains the effects of the coronavirus (COVID-19) pandemic in more detail. This should be considered alongside the interpretation of the PI statistics.

Two of the tables in the PI table pack (Tables 4.6 and 4.7) provide information on the position of pensioners within the overall income distribution. These tables define pensioners as adults in families where at least one member is over SPa, consistent with the rest of the PI table pack. This is different to the definition used in HBAI which defines pensioners as those over SPa.

Results from HBAI should not be directly compared to those from PI. The main differences between HBAI and PI methods of analysis are:

Income components: The PI results include analysis of the components of pensioner unit income (benefit income, occupational pension income, etc.). HBAI, with its broader span of interests, does not present detailed analysis of this sort.

Household or pensioner unit: PI is generally concerned with cash incomes directly received by pensioners. It measures the income of pensioner benefit units only (plus income for any dependent children within the pensioner unit), ignoring income received by any other members of the household. HBAI attempts to measure material living standards, so it includes all the income for the household in which the pensioner lives; the underlying HBAI assumption being that the total household income is shared amongst all household members.

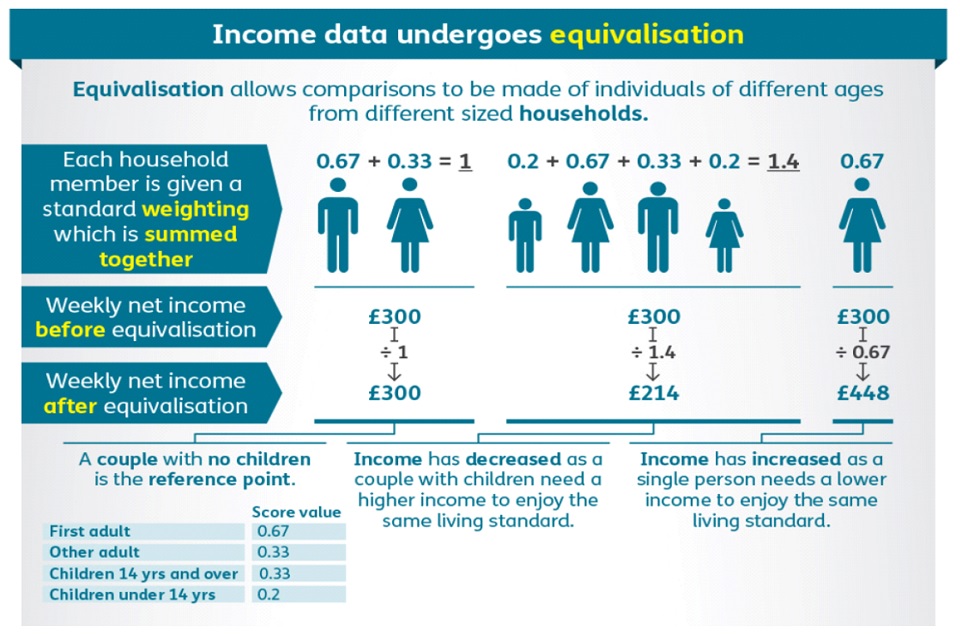

Equivalisation: To allow comparison of living standards of different households, the HBAI ‘equivalises’ household income; that is, adjusts it to take account of household size and composition. One of the main functions of PI is to provide information on the income of pensioner units in monetary terms, split by sources of income. This can only be done using unequivalised income. Equivalisation is not necessary for most results, which are presented separately for pensioner couples and single pensioners. To avoid unnecessary complexity, the main PI results are presented in monetary terms, at constant FYE 2022 prices, rather than equivalised income at FYE 2022 prices. PI does however use equivalised income to analyse pensioners’ position in the overall population income distribution.

Equivalisation Scales: HBAI historically used the McClements equivalisation scale. Following user consultation, the FYE 2006 edition of HBAI and subsequent HBAI publications have used Modified OECD equivalisation scales. The same change has been made to the relevant data in PI since the FYE 2006 edition of PI. Information on the effect of the change can be found in Appendix B of the FYE 2006 edition of PI.

6. Glossary

This glossary gives a brief explanation for each of the key terms used in PI. Further details on these definitions, including full derivations of variables, are available on request from the DWP PI Team at pensioners-incomes@dwp.gov.uk.

A glossary of income and earnings terms produced by the ONS is also available.

Adult

All individuals who are aged 16 and over are classified as an adult, unless the individual is defined as a dependent child (see Child). All adults in the household are interviewed as part of the FRS.

Age

Respondent’s age at last birthday (at the time of the interview).

Automatic enrolment

Automatic enrolment requires all employers to enrol their eligible workers into a workplace pension scheme if they are not already in one. The staged timetable began in October 2012 for larger firms and completed for all employers in 2018. To preserve individual responsibility for the decision to save, workers can opt out of the scheme. To be eligible for automatic enrolment, the jobholder must be at least 22 years old, under SPa, earn above the earnings trigger for automatic enrolment, and work or usually work in the UK. For more information see automatic enrolment.

Benefit unit or family

A benefit unit may consist of a single adult, or a married or cohabiting couple, plus any dependent children. Same-sex partners have been included in the same benefit unit since January 2006. Where a total for a benefit unit is presented (such as total benefit unit income) this includes income from adults plus any income from dependent children. There are various types of benefit unit:

-

pensioner couple: Benefit units where either adult in the couple is over SPa

-

pensioner couple, married or civil partnered: Benefit units headed by a couple in which at least one partner is over SPa and the couple are either married or in a civil partnership

-

pensioner couple, cohabiting: Benefit units headed by a couple in which at least one partner is over SPa and the couple are neither married nor in a civil partnership

-

single male pensioner: Benefit units headed by a single male adult over SPa

-

single female pensioner: Benefit units headed by a single female adult over SPa

It should be noted that ‘benefit unit’ is used as a description of groups of individuals regardless of whether they are in receipt of any state support.

Please also note that ‘pensioner unit’ is used within the publication to refer to a benefit unit.

Benefits

Financial support from the government. Most of these benefits are administered by DWP. The major exceptions are Housing Benefit and Council Tax Reduction, which are administered by local authorities. Child Benefit is administered by HMRC, who also administer Tax Credits. These are not treated as benefits, but both Tax Credits and benefits are included in the term State Support. Tax Credits will ultimately be replaced by UC.

Benefits are often divided into income-related benefits and non-income-related benefits. In assessing entitlement to the former, the claimant’s income and savings will be checked against the rules of the benefit. In contrast, eligibility for non-income-related benefits is instead dependent on the claimant’s circumstances (a recent bereavement, for example), rather than their income and savings. A list of the main state benefits divided into these two categories is below.

Disability-related benefits is the term used to describe all benefits paid on grounds of disability. These are: Disability Living Allowance, Personal Independence Payments, Armed Forces Compensation Scheme, Attendance Allowance, Industrial Injuries Disablement Benefit, and any remaining Severe Disablement Allowance cases. Before FYE 2009, Incapacity Benefit was also in this group. Numbers on Incapacity Benefit and Severe Disablement Allowance benefits have decreased over time, as both were replaced by Employment and Support Allowance from October 2008.

| Income-related benefits (UK) | Non-income-related benefits (UK) |

| Council Tax Reduction | Attendance Allowance |

| Employment and Support Allowance (income-related element) | Carer’s Allowance |

| Housing Benefit | Child Benefit |

| Income Support | Disability Living Allowance (both mobility and care components) |

| Pension Credit | Employment and Support Allowance (contributory element) |

| Universal Credit | Personal Independence Payment (Daily Living and Mobility components) |

| State Pension |

Child

A dependent child is defined as an individual aged under 16. A person is also defined as a child if they are 16 to 19 years old and they are all of the below:

-

not married nor in a civil partnership nor living with a partner

-

living with parents or a responsible adult

-

in full-time non-advanced education or in unwaged government training

Confidence interval

A measure of sampling error. A confidence interval is a range around an estimate which states how likely it is that the real value that the survey is trying to measure lies within that range. A wider confidence interval indicates a greater uncertainty around the estimate. Generally, a smaller sample size will lead to estimates that have a wider confidence interval than estimates from larger sample sizes. This is because a smaller sample is less likely than a larger sample to reflect the characteristics of the total population and therefore there will be more uncertainty around the estimate derived from the sample. Note that a confidence interval ignores any systematic errors which may be present in the survey and analysis processes.

Council tax

The tax is based on which, of a set of bands, a property’s value falls into. Its headline rate is based on two adults per household.

Read more information on council tax.

Equivalisation

Income measures used in HBAI consider variations in the size and composition of the households in which people live. This process is called equivalisation. Equivalisation reflects the fact that a family of several people needs a higher income than a single individual in order for them to enjoy a comparable standard of living. Equivalence scales conventionally take a couple with no children as the reference point. The process then relatively increases the income of single person households (since their incomes are divided by a value less than one) and relatively reduces the incomes of households with three or more persons, which have an equivalence value of greater than one.

We do not use equivalisation in PI, except in section 7 of the main publication and when comparing to the overall distribution in Tables 4.6 and 4.7 of the table pack.

Ethnic group

The ethnic group to which respondents consider that they belong. The FRS questions are in line with National Statistics’ harmonisation guidance. The categories are:

-

White

-

Mixed or Multiple ethnic groups

-

Asian or Asian British

-

Black or African or Caribbean or Black British

-

Other ethnic group

For Northern Ireland, ‘Irish Traveller’ is included in ‘Other ethnic group’. For England, Wales, and Scotland, ‘Gypsy or Irish Traveller’ is included in ‘White’.

‘Arab’ has been included in ‘Other ethnic group’ due to small sample sizes.

Ethnic background is self-declared; data is available for known declarations and excludes ‘choose not to declare’ and ‘unknown’.

Family Resources Survey (FRS)

The FRS is one of the largest cross-sectional household surveys in the country. From April 2011, the target achieved UK sample size for the FRS was reduced by 5,000 households from 25,000 to 20,000 households a year. The FRS sample size has been affected by the coronavirus (COVID-19) pandemic in FYE 2021 and FYE 2022. Prior to FYE 2003 the survey covered GB; from FYE 2003 the survey was extended to cover the UK.

Gross income

Total income a pensioner receives from all sources before any outgoings, tax, or housing costs.

Head of benefit unit

If the HRP does not belong to the benefit unit, then the Head of benefit unit is simply the first person from that benefit unit, in the order they were named in the interview. If the HRP does belong to the benefit unit, they are also the Head of that benefit unit.

Household

One person living alone or a group of people (not necessarily related) living at the same address who share cooking facilities and share a living room or sitting room or dining area. A household consists of one or more benefit units.

Household Reference Person (HRP)

The highest income person in a household.

-

in a single-adult household, the HRP is simply the sole householder (i.e., the person in whose name the accommodation is owned or rented)

-

if there are two or more householders, the HRP is the householder with the highest personal income, taking all sources of income into account

-

if there are two or more householders who have the same income, the HRP is the elder

Before April 2001, the HRP was known as the Head of Household. Where we refer to ‘Head’ in tables relating to households, this is the HRP. The Head of benefit unit will not necessarily be the HRP (see Head of benefit unit).

Housing costs

Housing costs are made up of rent (gross of housing benefit), water rates, community water charges and council water charges, mortgage interest payments (net of tax relief), structural insurance premiums (for owner occupiers); and ground rent and service charges.

Net incomes in PI are presented either on a BHC or AHC basis, the definitions of which are:

-

Before Housing Costs (BHC): Net income before the housing cost aspects listed above are taken away

-

After Housing Costs (AHC): Net income after the housing cost aspects listed above are taken away

Capital mortgage repayments are not deducted as a Housing Cost as this is regarded as an asset being accrued and not a cost.

In a multi-benefit unit household, housing costs are attributed to the first benefit unit (the benefit unit with the HRP). This means that for a minority of pensioner units, housing costs will not be attributed to them.

Income distribution

The spread of incomes across the population.

Marital status

This is the person’s marital status:

-

married or civil partnership: currently married or in a civil partnership, and not separated from spouse (excludes temporary absences)

-

cohabiting: not married nor in a civil partnership, but living as a couple

-

single: is not currently cohabiting and is not married nor in a civil partnership

Mixed-age pensioner couples

A couple where one member is above SPa and the other is below. Used in comparison with couples where both members are over SPa.

Net income

Net income is gross income with direct taxes including Council Tax payments deducted. Net income may be presented on a BHC or AHC basis. See ‘Housing costs’ for more detail.

Occupational pension

An occupational pension scheme is an arrangement an employer makes to give their employees a pension when they retire. Employees may become a member of an employer’s pension scheme on a voluntary basis. Until 6 April 2016, Defined Benefit occupational pension schemes could be contracted into or out of the Additional State Pension. This was abolished with the introduction of the New State Pension. The contracting out of Defined Contribution occupational pension schemes was abolished in 2012.

Pensioner benefit unit

Benefit units who are a pensioner couple, single male pensioner, or single female pensioner. Pensioner benefit units may also include any dependent children, but this is uncommon. In FYE 2022, just over half a per cent of pensioner units included dependent children.

Pension Credit

An income-related benefit made up of Guarantee Credit and Savings Credit. Guarantee Credit tops up the claimant’s income to a guaranteed level. Savings Credit is an extra amount for people who have made provision for their retirement above a certain threshold. Savings Credit was abolished for new claimants on 6 April 2016, so most people who reached SPa after 6 April 2016 are not eligible for Savings Credit. New claims for Savings Credit can still be made by benefit units who have reached SPa prior to 6 April 2016.

Personal pension

A pension provided through a contract between an individual and the pension provider. The pension which is produced will be based upon the level of contributions, investment returns and annuity rates. A personal pension can be either employer provided or privately purchased. Different forms of personal pension include:

-