Commentary for Personal pensions: Tables 7 and 8

Published 30 June 2021

Following the revisions in the previous release in 2019, further improvements to the supporting technology and reporting mechanisms have enabled the inclusion of late reporting and amendments.

As a result, this release includes substantial revisions to the Annual Allowance (AA) and Lifetime Allowance (LTA) figures. An example is in the tax year 2010 to 2011, the total value of Lump Sum LTA charges reported by the scheme through Accounting for Tax (AFT) returns has increased by 67%.

This does not impact statistics on individuals reporting pension savings in excess of the AA via their Self Assessment return.

1. Annual Allowance (AA)

Years refer to tax years, for example 2018 to 2019 refers to the dates between 6 April 2018 to 5 April 2019.

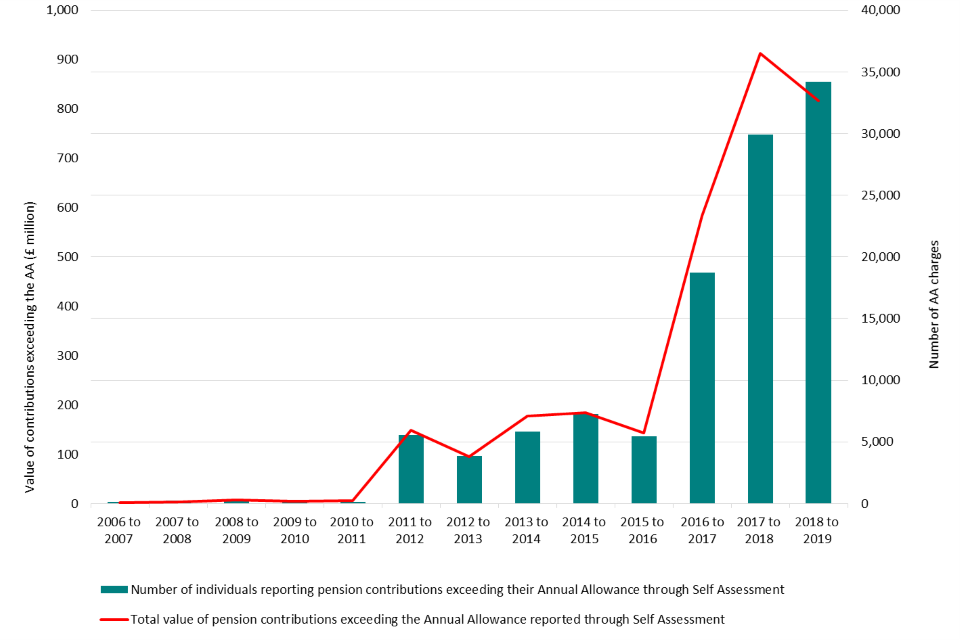

In 2018 to 2019, 34,220 tax payers reported pension contributions exceeding their AA through Self Assessment. The total value of contributions reported as exceeding the AA was £817 million in 2018 to 2019, decreasing from £912 million in 2017 to 2018 and £584 million in 2016 to 2017 (when the Tapered AA was introduced).

In 2018 to 2019, 13,660 AA charges were reported by schemes through AFT returns. The total value of AA charges reported by schemes in 2018 to 2019 was £209 million, a 71% increase from £122 million in 2017 to 2018.

Chart 1: Number of AA charges and value of contributions exceeding the AA

2. Lifetime Allowance (LTA)

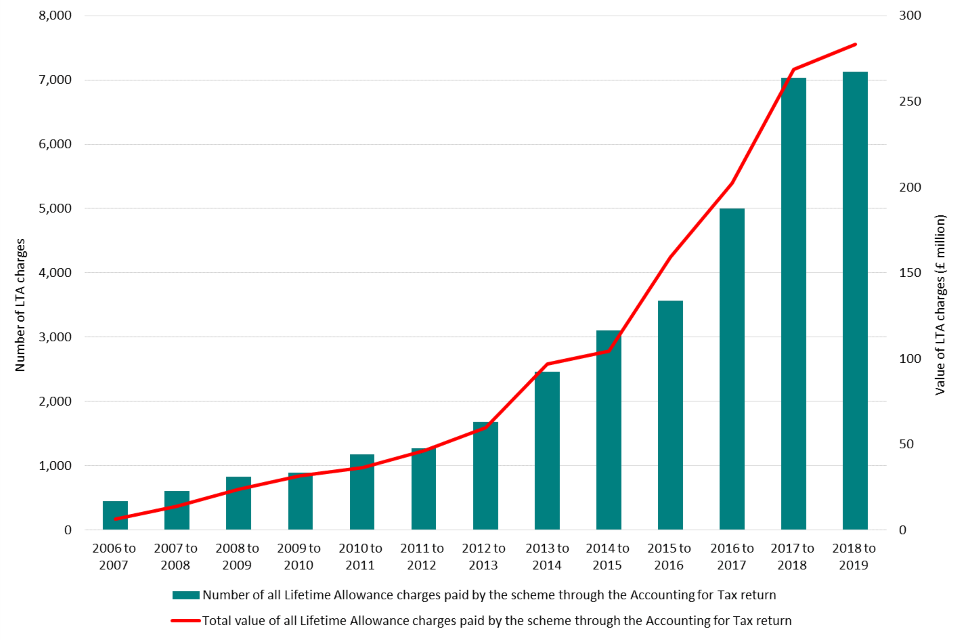

In 2018 to 2019, 7,130 LTA charges were reported by schemes through AFT returns. The total value of LTA charges reported by schemes in 2018 to 2019 was £283 million, a 6% increase from £269 million in 2017 to 2018.

Chart 2: Number and value of pension contributions exceeding the LTA reported through AFT returns

3. Scope of this product

HMRC will not publish Table 1: Personal pensions contributions by source, Table 2: The number of members and value of contributions by type and Table 6: The estimated cost of Pension Tax Relief for 2018 to 2019.

This is so we can work to ensure the data provided by pension schemes is correct and of a high standard. The figures for 2018 to 2019 will now be released in September 2021 alongside those for 2019 to 2020. HMRC apologise for this delay. HMRC recommend a cautious use of the figures in Table 1, Table 2 and Table 6 for 2017 to 2018 while the data provided by pension schemes is under investigation.

HMRC is committed to providing impartial quality statistics that meet our users’ needs. We encourage our users to engage with us so that we can improve our statistics and identify gaps in the statistics that we produce. Please see HMRC’s statistics continuous user engagement strategy

Former tables PEN 3, PEN4 and PEN5 are no longer available for 2017 to 2018 and onwards because of changes to the data we receive.

Previous tables will still be available on GOV.UK, but we will not be updating for 2017 to 2018 onwards. These tables can still be produced on individual contribution basis excluding all employer contributions. Please let us know if this would be useful for us to produce in future releases of this publication.

3.1 Contact information

If you have any comments on these tables or any enquiries on the statistics, please contact

- B Badaru

- K Kerr

- personaltax.statistics@hmrc.gov.uk

For press queries, please contact HMRC Press Office: news.desk@hmrc.gov.uk