UK House Price Index England: September 2023

Published 15 November 2023

1. Headline statistics for September 2023

The average price of a property in England was £310,000

The annual price change of a property in England was -0.5%

The monthly price change of a property in England was -0.5%

The index figure for England (January 2015 = 100) was 152.6

Estimates for the most recent months are provisional and are likely to be updated as more data is incorporated into the index. Read the revision policies.

Next publication of UK HPI

The October 2023 UK HPI will be published at 9.30am on Wednesday 20 December 2023. See the calendar of release dates for more information.

2. Economic statement

Average house prices in England decreased by 0.5% in the 12 months to September 2023 (provisional estimate). This was down from 0.6% (revised estimate) in the 12 months to August 2023 and lower than the average UK house price annual inflation of negative 0.1% (provisional estimate) in the 12 months to September 2023.

The fastest growing region was the North East, with annual percentage change at 1.6% in the 12 months to September 2023. The lowest annual percentage change was in the South West, where prices decreased by 1.6% in the 12 months to September 2023.

On a non-seasonally adjusted basis, average house prices in England decreased by 0.5% between August 2023 and September 2023, compared with an increase of 0.5% during the same period 12 months ago. On a seasonally adjusted basis, average house prices in England decreased by 0.4% between August 2023 and September 2023.

Comparing the provisional UK HPI volume estimate for July 2022 with the provisional UK HPI volume estimate for July 2023, the volume of transactions decreased by 23.6% in England and by 21.9% in the UK.

UK Property Transaction Statistics published by HM Revenue & Customs (which differ in coverage but are more complete for this period), report that on a non-seasonally adjusted basis, July 2023’s provisional transaction volume estimate for England was 23.2% lower than July 2022’s revised volume estimate.

In England, detached houses showed the highest annual percentage change out of all property types, increasing by 0.6% in the 12 months to September 2023 to £490,000. Terraced houses showed the lowest annual percentage change, which decreased by 1.5% in the 12 months to September 2023 to £252,000.

As with other indicators in the housing market, which typically fluctuate from month to month, it is important not to put too much weight on one month’s set of house price data.

3. Price change

3.1 Annual price change

Annual price change for England and London over the past 5 years

Download this chart’s data (CSV, 1KB)

Average house prices in England decreased by 0.5% in the 12 months to September 2023.

In London, average house prices decreased by 1.1% in the 12 months to September 2023, down from a decrease of 0.8% in the 12 months to August 2023.

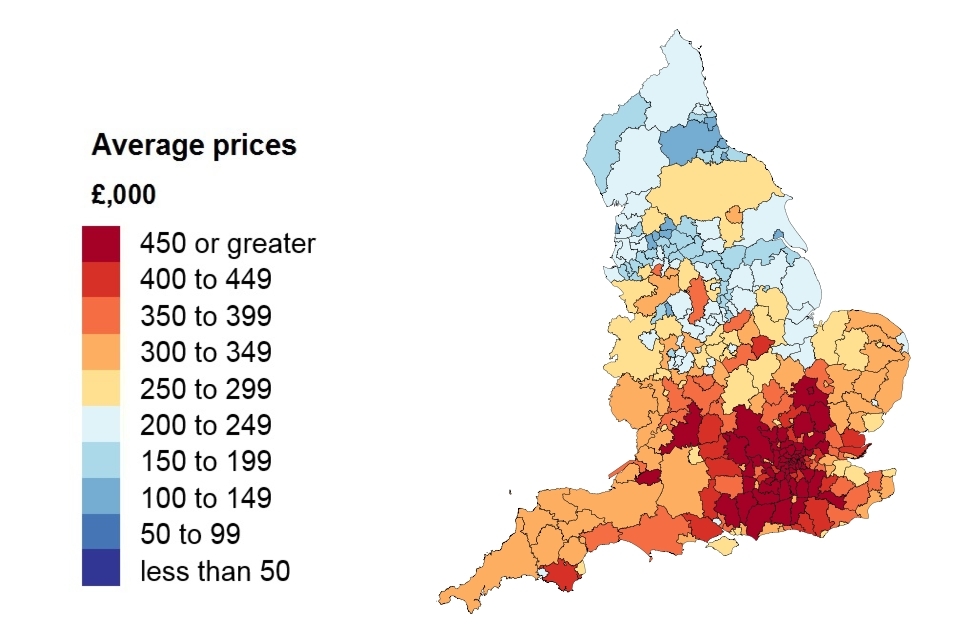

Annual price change by local authority for England

Low numbers of sales transactions in some local authorities and London boroughs, such as City of London, can lead to volatility in the series. While we make efforts to account for this volatility, the change in price in these local levels can be influenced by the type and number of properties sold in any given period. Geographies with low number of sales transactions should be analysed in the context of their longer-term trends rather than focusing on monthly movements.

Note: data for City of London for the months of July and August 2021 have been suppressed due to unusually low transaction numbers and the resulting impact on the quality of data.

| Local authorities | September 2023 | September 2022 | Difference |

|---|---|---|---|

| Adur | £368,000 | £388,000 | -5.1% |

| Amber Valley | £230,000 | £225,000 | 2.2% |

| Arun | £350,000 | £363,000 | -3.8% |

| Ashfield | £189,000 | £193,000 | -2.3% |

| Ashford | £379,000 | £364,000 | 4.2% |

| Babergh | £345,000 | £356,000 | -3.0% |

| Barking and Dagenham | £346,000 | £348,000 | -0.7% |

| Barnet | £585,000 | £601,000 | -2.8% |

| Barnsley | £171,000 | £165,000 | 3.9% |

| Basildon | £371,000 | £380,000 | -2.5% |

| Basingstoke and Deane | £356,000 | £359,000 | -0.7% |

| Bassetlaw | £210,000 | £206,000 | 2.2% |

| Bath and North East Somerset | £454,000 | £437,000 | 3.8% |

| Bedford | £357,000 | £353,000 | 1.0% |

| Bexley | £396,000 | £405,000 | -2.2% |

| Birmingham | £235,000 | £231,000 | 1.3% |

| Blaby | £299,000 | £299,000 | -0.1% |

| Blackburn with Darwen | £138,000 | £145,000 | -5.1% |

| Blackpool | £127,000 | £138,000 | -7.8% |

| Bolsover | £175,000 | £173,000 | 1.1% |

| Bolton | £188,000 | £188,000 | 0.2% |

| Boston | £201,000 | £199,000 | 1.3% |

| Bournemouth Christchurch and Poole | £340,000 | £348,000 | -2.4% |

| Bracknell Forest | £395,000 | £391,000 | 1.0% |

| Bradford | £178,000 | £176,000 | 0.7% |

| Braintree | £343,000 | £345,000 | -0.6% |

| Breckland | £289,000 | £290,000 | -0.2% |

| Brent | £566,000 | £576,000 | -1.8% |

| Brentwood | £465,000 | £475,000 | -2.2% |

| Brighton and Hove | £427,000 | £442,000 | -3.5% |

| Broadland | £334,000 | £338,000 | -1.3% |

| Bromley | £503,000 | £512,000 | -1.7% |

| Bromsgrove | £348,000 | £356,000 | -2.1% |

| Broxbourne | £392,000 | £395,000 | -0.8% |

| Broxtowe | £248,000 | £249,000 | -0.4% |

| Buckinghamshire | £489,000 | £480,000 | 1.9% |

| Burnley | £105,000 | £117,000 | -10.9% |

| Bury | £245,000 | £239,000 | 2.5% |

| Calderdale | £184,000 | £184,000 | 0.1% |

| Cambridge | £516,000 | £519,000 | -0.6% |

| Cambridgeshire | £359,000 | £360,000 | -0.2% |

| Camden | £811,000 | £860,000 | -5.8% |

| Cannock Chase | £243,000 | £225,000 | 8.1% |

| Canterbury | £390,000 | £364,000 | 6.9% |

| Castle Point | £378,000 | £385,000 | -1.9% |

| Central Bedfordshire | £366,000 | £378,000 | -3.1% |

| Charnwood | £286,000 | £288,000 | -0.6% |

| Chelmsford | £394,000 | £383,000 | 2.8% |

| Cheltenham | £341,000 | £344,000 | -0.9% |

| Cherwell | £364,000 | £368,000 | -1.3% |

| Cheshire East | £300,000 | £290,000 | 3.4% |

| Cheshire West and Chester | £275,000 | £265,000 | 3.9% |

| Chesterfield | £206,000 | £198,000 | 4.3% |

| Chichester | £465,000 | £484,000 | -3.8% |

| Chorley | £232,000 | £228,000 | 1.6% |

| City of Bristol | £351,000 | £360,000 | -2.4% |

| City of Derby | £208,000 | £201,000 | 3.4% |

| City of Kingston upon Hull | £135,000 | £138,000 | -1.8% |

| City of London | £807,000 | £958,000 | -15.7% |

| City of Nottingham | £193,000 | £190,000 | 1.7% |

| City of Peterborough | £249,000 | £240,000 | 3.6% |

| City of Plymouth | £224,000 | £226,000 | -0.5% |

| City of Westminster | £967,000 | £989,000 | -2.2% |

| Colchester | £312,000 | £318,000 | -1.9% |

| Cornwall | £316,000 | £322,000 | -1.7% |

| Cotswold | £503,000 | £513,000 | -2.0% |

| County Durham | £130,000 | £131,000 | -0.5% |

| Coventry | £227,000 | £232,000 | -2.0% |

| Crawley | £334,000 | £325,000 | 2.9% |

| Croydon | £431,000 | £432,000 | -0.3% |

| Cumberland | £166,000 | £169,000 | -1.9% |

| Dacorum | £474,000 | £475,000 | -0.2% |

| Darlington | £160,000 | £157,000 | 2.3% |

| Dartford | £366,000 | £359,000 | 2.0% |

| Derbyshire | £237,000 | £230,000 | 3.2% |

| Derbyshire Dales | £351,000 | £338,000 | 3.8% |

| Devon | £338,000 | £345,000 | -2.1% |

| Doncaster | £171,000 | £166,000 | 3.0% |

| Dorset | £361,000 | £370,000 | -2.6% |

| Dover | £324,000 | £324,000 | -0.2% |

| Dudley | £240,000 | £233,000 | 3.0% |

| Ealing | £554,000 | £538,000 | 3.1% |

| East Cambridgeshire | £351,000 | £353,000 | -0.5% |

| East Devon | £367,000 | £369,000 | -0.5% |

| East Hampshire | £462,000 | £462,000 | 0.0% |

| East Hertfordshire | £454,000 | £453,000 | 0.2% |

| East Lindsey | £235,000 | £228,000 | 3.3% |

| East Riding of Yorkshire | £228,000 | £224,000 | 1.8% |

| East Staffordshire | £238,000 | £234,000 | 1.7% |

| East Suffolk | £312,000 | £312,000 | -0.1% |

| East Sussex | £348,000 | £361,000 | -3.8% |

| Eastbourne | £295,000 | £306,000 | -3.5% |

| Eastleigh | £350,000 | £351,000 | -0.2% |

| Elmbridge | £705,000 | £723,000 | -2.5% |

| Enfield | £454,000 | £455,000 | -0.1% |

| Epping Forest | £531,000 | £538,000 | -1.2% |

| Epsom and Ewell | £554,000 | £555,000 | -0.1% |

| Erewash | £216,000 | £208,000 | 3.7% |

| Essex | £375,000 | £378,000 | -0.7% |

| Exeter | £315,000 | £327,000 | -3.5% |

| Fareham | £354,000 | £364,000 | -2.6% |

| Fenland | £245,000 | £243,000 | 0.6% |

| Folkestone and Hythe | £326,000 | £335,000 | -2.7% |

| Forest of Dean | £314,000 | £318,000 | -1.3% |

| Fylde | £239,000 | £239,000 | 0.0% |

| Gateshead | £157,000 | £152,000 | 3.9% |

| Gedling | £248,000 | £249,000 | -0.6% |

| Gloucester | £253,000 | £250,000 | 1.3% |

| Gloucestershire | £338,000 | £342,000 | -1.0% |

| Gosport | £258,000 | £261,000 | -1.2% |

| Gravesham | £327,000 | £331,000 | -1.5% |

| Great Yarmouth | £209,000 | £221,000 | -5.4% |

| Greenwich | £446,000 | £439,000 | 1.6% |

| Guildford | £540,000 | £537,000 | 0.6% |

| Hackney | £614,000 | £648,000 | -5.3% |

| Halton | £185,000 | £191,000 | -3.4% |

| Hammersmith and Fulham | £797,000 | £812,000 | -1.8% |

| Hampshire | £384,000 | £384,000 | -0.2% |

| Harborough | £382,000 | £357,000 | 7.1% |

| Haringey | £624,000 | £612,000 | 1.9% |

| Harlow | £312,000 | £328,000 | -4.8% |

| Harrow | £521,000 | £530,000 | -1.7% |

| Hart | £500,000 | £488,000 | 2.6% |

| Hartlepool | £136,000 | £134,000 | 1.0% |

| Hastings | £266,000 | £295,000 | -9.7% |

| Havant | £328,000 | £328,000 | 0.2% |

| Havering | £428,000 | £427,000 | 0.4% |

| Herefordshire | £303,000 | £306,000 | -1.0% |

| Hertfordshire | £462,000 | £463,000 | -0.3% |

| Hertsmere | £540,000 | £545,000 | -1.0% |

| High Peak | £271,000 | £257,000 | 5.4% |

| Hillingdon | £455,000 | £464,000 | -2.0% |

| Hinckley and Bosworth | £297,000 | £293,000 | 1.4% |

| Horsham | £456,000 | £450,000 | 1.5% |

| Hounslow | £476,000 | £454,000 | 4.9% |

| Huntingdonshire | £316,000 | £316,000 | -0.1% |

| Hyndburn | £123,000 | £130,000 | -6.0% |

| Ipswich | £237,000 | £235,000 | 0.7% |

| Isle of Wight | £284,000 | £287,000 | -1.1% |

| Islington | £719,000 | £734,000 | -2.1% |

| Kensington and Chelsea | £1,203,000 | £1,516,000 | -20.6% |

| Kent | £362,000 | £365,000 | -0.7% |

| King’s Lynn and West Norfolk | £281,000 | £275,000 | 2.1% |

| Kingston upon Thames | £542,000 | £565,000 | -4.0% |

| Kirklees | £194,000 | £192,000 | 1.3% |

| Knowsley | £181,000 | £176,000 | 2.9% |

| Lambeth | £580,000 | £559,000 | 3.7% |

| Lancashire | £189,000 | £188,000 | 0.6% |

| Lancaster | £209,000 | £198,000 | 5.4% |

| Leeds | £246,000 | £240,000 | 2.7% |

| Leicester | £232,000 | £227,000 | 2.2% |

| Leicestershire | £305,000 | £298,000 | 2.2% |

| Lewes | £426,000 | £409,000 | 4.1% |

| Lewisham | £483,000 | £463,000 | 4.3% |

| Lichfield | £312,000 | £315,000 | -1.1% |

| Lincoln | £179,000 | £185,000 | -3.0% |

| Lincolnshire | £234,000 | £236,000 | -0.8% |

| Liverpool | £187,000 | £180,000 | 4.0% |

| Luton | £282,000 | £285,000 | -1.3% |

| Maidstone | £362,000 | £352,000 | 3.1% |

| Maldon | £429,000 | £414,000 | 3.5% |

| Malvern Hills | £350,000 | £334,000 | 4.6% |

| Manchester | £244,000 | £233,000 | 4.8% |

| Mansfield | £186,000 | £184,000 | 0.8% |

| Medway | £299,000 | £301,000 | -0.5% |

| Melton | £305,000 | £309,000 | -1.3% |

| Merton | £588,000 | £584,000 | 0.6% |

| Mid Devon | £318,000 | £309,000 | 2.9% |

| Mid Suffolk | £319,000 | £327,000 | -2.5% |

| Mid Sussex | £477,000 | £457,000 | 4.3% |

| Middlesbrough | £140,000 | £146,000 | -3.8% |

| Milton Keynes | £326,000 | £321,000 | 1.6% |

| Mole Valley | £558,000 | £583,000 | -4.3% |

| New Forest | £409,000 | £421,000 | -2.9% |

| Newark and Sherwood | £250,000 | £238,000 | 5.1% |

| Newcastle upon Tyne | £201,000 | £194,000 | 3.5% |

| Newcastle-under-Lyme | £195,000 | £196,000 | -0.6% |

| Newham | £415,000 | £414,000 | 0.4% |

| Norfolk | £289,000 | £291,000 | -0.6% |

| North Devon | £329,000 | £337,000 | -2.1% |

| North East Derbyshire | £257,000 | £239,000 | 7.4% |

| North East Lincolnshire | £154,000 | £157,000 | -2.2% |

| North Hertfordshire | £405,000 | £392,000 | 3.4% |

| North Kesteven | £260,000 | £272,000 | -4.3% |

| North Lincolnshire | £187,000 | £185,000 | 1.3% |

| North Norfolk | £327,000 | £334,000 | -2.1% |

| North Northamptonshire | £271,000 | £273,000 | -0.8% |

| North Somerset | £333,000 | £334,000 | -0.2% |

| North Tyneside | £215,000 | £203,000 | 5.9% |

| North Warwickshire | £252,000 | £260,000 | -3.1% |

| North West Leicestershire | £291,000 | £274,000 | 6.1% |

| North Yorkshire | £285,000 | £280,000 | 2.0% |

| Northumberland | £207,000 | £196,000 | 5.3% |

| Norwich | £251,000 | £246,000 | 2.0% |

| Nottinghamshire | £238,000 | £235,000 | 1.0% |

| Nuneaton and Bedworth | £241,000 | £233,000 | 3.2% |

| Oadby and Wigston | £287,000 | £279,000 | 3.0% |

| Oldham | £193,000 | £186,000 | 3.6% |

| Oxford | £498,000 | £487,000 | 2.3% |

| Oxfordshire | £445,000 | £437,000 | 2.0% |

| Pendle | £129,000 | £136,000 | -4.6% |

| Portsmouth | £260,000 | £258,000 | 0.8% |

| Preston | £169,000 | £160,000 | 5.2% |

| Reading | £324,000 | £328,000 | -1.2% |

| Redbridge | £505,000 | £485,000 | 4.1% |

| Redcar and Cleveland | £162,000 | £156,000 | 3.4% |

| Redditch | £272,000 | £265,000 | 2.8% |

| Reigate and Banstead | £484,000 | £491,000 | -1.5% |

| Ribble Valley | £284,000 | £265,000 | 7.3% |

| Richmond upon Thames | £756,000 | £767,000 | -1.4% |

| Rochdale | £193,000 | £193,000 | 0.0% |

| Rochford | £430,000 | £423,000 | 1.5% |

| Rossendale | £192,000 | £190,000 | 1.1% |

| Rother | £363,000 | £383,000 | -5.5% |

| Rotherham | £181,000 | £181,000 | 0.4% |

| Rugby | £309,000 | £297,000 | 3.8% |

| Runnymede | £480,000 | £483,000 | -0.6% |

| Rushcliffe | £359,000 | £354,000 | 1.3% |

| Rushmoor | £329,000 | £338,000 | -2.5% |

| Rutland | £403,000 | £380,000 | 6.3% |

| Salford | £214,000 | £214,000 | -0.4% |

| Sandwell | £202,000 | £197,000 | 2.3% |

| Sefton | £218,000 | £212,000 | 2.7% |

| Sevenoaks | £496,000 | £523,000 | -5.2% |

| Sheffield | £224,000 | £213,000 | 4.9% |

| Shropshire | £281,000 | £279,000 | 0.8% |

| Slough | £313,000 | £319,000 | -2.0% |

| Solihull | £343,000 | £336,000 | 2.1% |

| Somerset | £308,000 | £307,000 | 0.3% |

| South Cambridgeshire | £452,000 | £454,000 | -0.3% |

| South Derbyshire | £248,000 | £248,000 | -0.2% |

| South Gloucestershire | £347,000 | £351,000 | -1.1% |

| South Hams | £422,000 | £428,000 | -1.5% |

| South Holland | £237,000 | £245,000 | -3.4% |

| South Kesteven | £280,000 | £278,000 | 0.7% |

| South Norfolk | £338,000 | £341,000 | -0.8% |

| South Oxfordshire | £531,000 | £522,000 | 1.8% |

| South Ribble | £215,000 | £215,000 | 0.2% |

| South Staffordshire | £301,000 | £302,000 | -0.1% |

| South Tyneside | £170,000 | £155,000 | 9.8% |

| Southampton | £244,000 | £248,000 | -1.5% |

| Southend-on-Sea | £332,000 | £343,000 | -3.3% |

| Southwark | £549,000 | £557,000 | -1.4% |

| Spelthorne | £422,000 | £419,000 | 0.6% |

| St Albans | £612,000 | £606,000 | 0.9% |

| St Helens | £169,000 | £175,000 | -3.6% |

| Stafford | £277,000 | £270,000 | 2.5% |

| Staffordshire | £250,000 | £249,000 | 0.5% |

| Staffordshire Moorlands | £221,000 | £237,000 | -6.9% |

| Stevenage | £331,000 | £340,000 | -2.4% |

| Stockport | £305,000 | £303,000 | 0.7% |

| Stockton-on-Tees | £166,000 | £162,000 | 2.1% |

| Stoke-on-Trent | £141,000 | £143,000 | -1.6% |

| Stratford-on-Avon | £373,000 | £393,000 | -4.9% |

| Stroud | £345,000 | £355,000 | -2.9% |

| Suffolk | £302,000 | £304,000 | -0.9% |

| Sunderland | £147,000 | £142,000 | 3.4% |

| Surrey | £525,000 | £532,000 | -1.4% |

| Surrey Heath | £440,000 | £474,000 | -7.2% |

| Sutton | £438,000 | £442,000 | -0.8% |

| Swale | £298,000 | £309,000 | -3.6% |

| Swindon | £272,000 | £269,000 | 1.1% |

| Tameside | £212,000 | £212,000 | 0.3% |

| Tamworth | £238,000 | £241,000 | -1.5% |

| Tandridge | £522,000 | £523,000 | -0.1% |

| Teignbridge | £327,000 | £328,000 | -0.3% |

| Telford and Wrekin | £230,000 | £221,000 | 3.9% |

| Tendring | £283,000 | £280,000 | 1.4% |

| Test Valley | £440,000 | £406,000 | 8.6% |

| Tewkesbury | £354,000 | £357,000 | -0.9% |

| Thanet | £295,000 | £319,000 | -7.6% |

| Three Rivers | £597,000 | £612,000 | -2.5% |

| Thurrock | £332,000 | £332,000 | 0.1% |

| Tonbridge and Malling | £426,000 | £443,000 | -3.7% |

| Torbay | £261,000 | £262,000 | -0.4% |

| Torridge | £304,000 | £323,000 | -6.0% |

| Tower Hamlets | £509,000 | £479,000 | 6.4% |

| Trafford | £366,000 | £368,000 | -0.7% |

| Tunbridge Wells | £467,000 | £471,000 | -0.8% |

| Uttlesford | £474,000 | £487,000 | -2.6% |

| Vale of White Horse | £443,000 | £430,000 | 3.2% |

| Wakefield | £205,000 | £198,000 | 3.4% |

| Walsall | £216,000 | £216,000 | 0.3% |

| Waltham Forest | £510,000 | £524,000 | -2.5% |

| Wandsworth | £638,000 | £655,000 | -2.6% |

| Warrington | £259,000 | £262,000 | -1.4% |

| Warwick | £377,000 | £361,000 | 4.6% |

| Warwickshire | £317,000 | £314,000 | 1.1% |

| Watford | £386,000 | £401,000 | -3.6% |

| Waverley | £578,000 | £565,000 | 2.5% |

| Wealden | £410,000 | £422,000 | -3.1% |

| Welwyn Hatfield | £435,000 | £438,000 | -0.7% |

| West Berkshire | £423,000 | £415,000 | 2.1% |

| West Devon | £308,000 | £334,000 | -7.8% |

| West Lancashire | £245,000 | £229,000 | 6.9% |

| West Lindsey | £214,000 | £217,000 | -1.6% |

| West Northamptonshire | £298,000 | £298,000 | -0.1% |

| West Oxfordshire | £415,000 | £395,000 | 4.9% |

| West Suffolk | £314,000 | £316,000 | -1.0% |

| West Sussex | £397,000 | £401,000 | -1.0% |

| Westmorland and Furness | £226,000 | £231,000 | -2.0% |

| Wigan | £186,000 | £186,000 | -0.3% |

| Wiltshire | £341,000 | £342,000 | -0.3% |

| Winchester | £493,000 | £503,000 | -2.0% |

| Windsor and Maidenhead | £542,000 | £553,000 | -2.1% |

| Wirral | £218,000 | £212,000 | 2.6% |

| Woking | £483,000 | £498,000 | -3.0% |

| Wokingham | £526,000 | £506,000 | 4.0% |

| Wolverhampton | £198,000 | £202,000 | -2.1% |

| Worcester | £271,000 | £263,000 | 3.2% |

| Worcestershire | £306,000 | £302,000 | 1.2% |

| Worthing | £345,000 | £357,000 | -3.6% |

| Wychavon | £351,000 | £348,000 | 0.8% |

| Wyre | £200,000 | £198,000 | 1.1% |

| Wyre Forest | £250,000 | £254,000 | -1.6% |

| York | £321,000 | £326,000 | -1.8% |

| England | £310,000 | £311,000 | -0.5% |

Download this table’s data (CSV, 12KB)

Average price by local authority for England

In September 2023, the most expensive area in England to purchase a property was Kensington and Chelsea, where the average cost was £1.2 million. In contrast, the cheapest area to purchase a property was Burnley, where the average cost was £105,000.

3.2 Annual price change by London borough

| London borough | September 2023 | September 2022 | Difference |

|---|---|---|---|

| Barking and Dagenham | £346,000 | £348,000 | -0.7% |

| Barnet | £585,000 | £601,000 | -2.8% |

| Bexley | £396,000 | £405,000 | -2.2% |

| Brent | £566,000 | £576,000 | -1.8% |

| Bromley | £503,000 | £512,000 | -1.7% |

| Camden | £811,000 | £860,000 | -5.8% |

| City of London | £807,000 | £958,000 | -15.7% |

| City of Westminster | £967,000 | £989,000 | -2.2% |

| Croydon | £431,000 | £432,000 | -0.3% |

| Ealing | £554,000 | £538,000 | 3.1% |

| Enfield | £454,000 | £455,000 | -0.1% |

| Greenwich | £446,000 | £439,000 | 1.6% |

| Hackney | £614,000 | £648,000 | -5.3% |

| Hammersmith and Fulham | £797,000 | £812,000 | -1.8% |

| Haringey | £624,000 | £612,000 | 1.9% |

| Harrow | £521,000 | £530,000 | -1.7% |

| Havering | £428,000 | £427,000 | 0.4% |

| Hillingdon | £455,000 | £464,000 | -2.0% |

| Hounslow | £476,000 | £454,000 | 4.9% |

| Islington | £719,000 | £734,000 | -2.1% |

| Kensington and Chelsea | £1,203,000 | £1,516,000 | -20.6% |

| Kingston upon Thames | £542,000 | £565,000 | -4.0% |

| Lambeth | £580,000 | £560,000 | 3.7% |

| Lewisham | £483,000 | £463,000 | 4.3% |

| Merton | £588,000 | £584,000 | 0.6% |

| Newham | £415,000 | £414,000 | 0.4% |

| Redbridge | £505,000 | £485,000 | 4.1% |

| Richmond upon Thames | £756,000 | £767,000 | -1.4% |

| Southwark | £549,000 | £557,000 | -1.4% |

| Sutton | £438,000 | £442,000 | -0.8% |

| Tower Hamlets | £509,000 | £479,000 | 6.4% |

| Waltham Forest | £510,000 | £524,000 | -2.5% |

| Wandsworth | £638,000 | £655,000 | -2.6% |

Download this table’s data (CSV, 2KB)

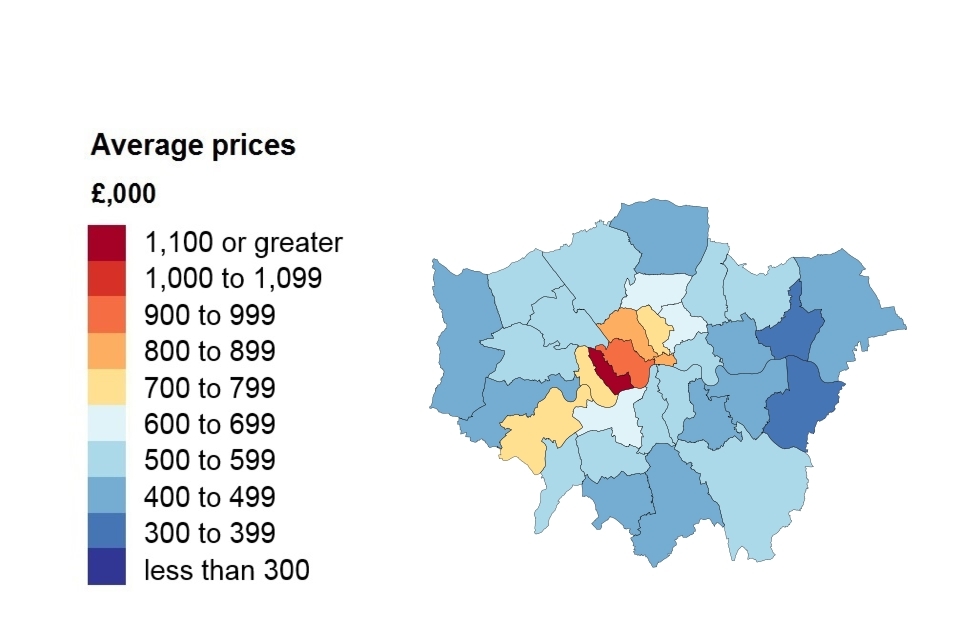

Average price by London borough

In September 2023, the most expensive London borough to purchase a property was Kensington and Chelsea, where the average cost was £1.2 million. In contrast, the cheapest borough to purchase a property was Barking and Dagenham, where the average cost was £346,000.

3.3 Average price change by property type

Average price change by property type for England

| Property type | September 2023 | September 2022 | Difference |

|---|---|---|---|

| Detached | £490,000 | £487,000 | 0.6% |

| Semi-detached | £297,000 | £298,000 | -0.2% |

| Terraced | £252,000 | £256,000 | -1.5% |

| Flat or maisonette | £252,000 | £254,000 | -0.6% |

| All | £310,000 | £311,000 | -0.5% |

Download this table’s data (CSV, 1KB)

4. Sales volumes

The amount of time between the sale of a property and the registration of this information varies. It typically ranges between 2 weeks and 2 months but can be longer. Volume figures for the most recent 2 months are not yet at a reliable level for reporting, so they are not included in the report. Published transactions for recent months will increase as later registered transactions are incorporated into the index.

Sales volume data is also available by property status (new build and existing property) and funding status (cash and mortgage) in our downloadable data tables. Transactions involving the creation of a new register, such as new builds, are more complex and require more time to process. Read Revisions to the UK HPI data for more information.

4.1 Sales volumes by local authority

Sales volumes for England by local authority

Comparing the provisional volume estimate for the current month with the revised volume estimate for the corresponding month in the previous year

| Local authorities | July 2023 | July 2022 |

|---|---|---|

| Adur | 59 | 93 |

| Amber Valley | 113 | 205 |

| Arun | 131 | 281 |

| Ashfield | 91 | 178 |

| Ashford | 91 | 147 |

| Babergh | 78 | 114 |

| Barking and Dagenham | 62 | 135 |

| Barnet | 183 | 333 |

| Barnsley | 199 | 320 |

| Basildon | 126 | 222 |

| Basingstoke and Deane | 132 | 205 |

| Bassetlaw | 93 | 180 |

| Bath and North East Somerset | 143 | 224 |

| Bedford | 126 | 211 |

| Bexley | 149 | 268 |

| Birmingham | 544 | 968 |

| Blaby | 64 | 113 |

| Blackburn with Darwen | 106 | 176 |

| Blackpool | 133 | 229 |

| Bolsover | 61 | 129 |

| Bolton | 197 | 353 |

| Boston | 42 | 88 |

| Bournemouth Christchurch and Poole | 332 | 587 |

| Bracknell Forest | 100 | 176 |

| Bradford | 384 | 538 |

| Braintree | 126 | 232 |

| Breckland | 131 | 166 |

| Brent | 89 | 185 |

| Brentwood | 76 | 139 |

| Brighton and Hove | 220 | 334 |

| Broadland | 99 | 191 |

| Bromley | 225 | 429 |

| Bromsgrove | 85 | 151 |

| Broxbourne | 63 | 148 |

| Broxtowe | 91 | 118 |

| Buckinghamshire | 373 | 652 |

| Burnley | 88 | 146 |

| Bury | 130 | 213 |

| Calderdale | 163 | 279 |

| Cambridge | 62 | 100 |

| Cambridgeshire | 418 | 777 |

| Camden | 100 | 166 |

| Cannock Chase | 79 | 110 |

| Canterbury | 89 | 204 |

| Castle Point | 58 | 116 |

| Central Bedfordshire | 174 | 495 |

| Charnwood | 145 | 197 |

| Chelmsford | 122 | 261 |

| Cheltenham | 97 | 203 |

| Cherwell | 112 | 223 |

| Cheshire East | 346 | 608 |

| Cheshire West and Chester | 320 | 500 |

| Chesterfield | 92 | 148 |

| Chichester | 86 | 166 |

| Chorley | 81 | 151 |

| City of Bristol | 398 | 530 |

| City of Derby | 163 | 296 |

| City of Kingston upon Hull | 168 | 324 |

| City of London | 11 | 17 |

| City of Nottingham | 196 | 296 |

| City of Peterborough | 126 | 260 |

| City of Plymouth | 210 | 375 |

| City of Westminster | 107 | 223 |

| Colchester | 159 | 253 |

| Cornwall | 420 | 719 |

| Cotswold | 77 | 116 |

| County Durham | 462 | 698 |

| Coventry | 185 | 369 |

| Crawley | 68 | 110 |

| Croydon | 216 | 387 |

| Cumberland | 230 | 351 |

| Dacorum | 140 | 185 |

| Darlington | 99 | 147 |

| Dartford | 71 | 138 |

| Derbyshire | 673 | 1,163 |

| Derbyshire Dales | 64 | 80 |

| Devon | 750 | 1,068 |

| Doncaster | 196 | 437 |

| Dorset | 372 | 544 |

| Dover | 84 | 167 |

| Dudley | 199 | 334 |

| Ealing | 173 | 293 |

| East Cambridgeshire | 51 | 119 |

| East Devon | 159 | 224 |

| East Hampshire | 97 | 174 |

| East Hertfordshire | 108 | 215 |

| East Lindsey | 110 | 186 |

| East Riding of Yorkshire | 315 | 539 |

| East Staffordshire | 88 | 205 |

| East Suffolk | 189 | 321 |

| East Sussex | 454 | 851 |

| Eastbourne | 98 | 170 |

| Eastleigh | 103 | 161 |

| Elmbridge | 112 | 209 |

| Enfield | 133 | 228 |

| Epping Forest | 91 | 153 |

| Epsom and Ewell | 65 | 83 |

| Erewash | 83 | 156 |

| Essex | 1,142 | 2,022 |

| Exeter | 111 | 140 |

| Fareham | 96 | 155 |

| Fenland | 58 | 144 |

| Folkestone and Hythe | 69 | 130 |

| Forest of Dean | 58 | 94 |

| Fylde | 65 | 149 |

| Gateshead | 181 | 242 |

| Gedling | 73 | 163 |

| Gloucester | 114 | 198 |

| Gloucestershire | 551 | 908 |

| Gosport | 64 | 120 |

| Gravesham | 59 | 90 |

| Great Yarmouth | 62 | 133 |

| Greenwich | 158 | 289 |

| Guildford | 115 | 212 |

| Hackney | 122 | 186 |

| Halton | 91 | 145 |

| Hammersmith and Fulham | 139 | 207 |

| Hampshire | 1,065 | 1,738 |

| Harborough | 69 | 149 |

| Haringey | 129 | 205 |

| Harlow | 46 | 78 |

| Harrow | 94 | 215 |

| Hart | 77 | 137 |

| Hartlepool | 85 | 118 |

| Hastings | 83 | 131 |

| Havant | 114 | 152 |

| Havering | 152 | 306 |

| Herefordshire | 141 | 196 |

| Hertfordshire | 810 | 1,453 |

| Hertsmere | 61 | 120 |

| High Peak | 73 | 120 |

| Hillingdon | 143 | 252 |

| Hinckley and Bosworth | 95 | 157 |

| Horsham | 83 | 191 |

| Hounslow | 101 | 186 |

| Huntingdonshire | 126 | 245 |

| Hyndburn | 46 | 131 |

| Ipswich | 102 | 158 |

| Isle of Wight | 126 | 223 |

| Islington | 127 | 173 |

| Kensington and Chelsea | 101 | 172 |

| Kent | 1,100 | 1,941 |

| King’s Lynn and West Norfolk | 100 | 199 |

| Kingston upon Thames | 112 | 194 |

| Kirklees | 298 | 517 |

| Knowsley | 64 | 161 |

| Lambeth | 220 | 341 |

| Lancashire | 1,000 | 1,740 |

| Lancaster | 113 | 217 |

| Leeds | 595 | 952 |

| Leicester | 125 | 232 |

| Leicestershire | 512 | 902 |

| Lewes | 70 | 126 |

| Lewisham | 187 | 335 |

| Lichfield | 88 | 143 |

| Lincoln | 76 | 113 |

| Lincolnshire | 552 | 1,077 |

| Liverpool | 276 | 495 |

| Luton | 88 | 177 |

| Maidstone | 136 | 212 |

| Maldon | 50 | 73 |

| Malvern Hills | 66 | 97 |

| Manchester | 250 | 484 |

| Mansfield | 82 | 159 |

| Medway | 208 | 279 |

| Melton | 39 | 83 |

| Merton | 144 | 260 |

| Mid Devon | 62 | 110 |

| Mid Suffolk | 81 | 163 |

| Mid Sussex | 113 | 222 |

| Middlesbrough | 79 | 161 |

| Milton Keynes | 175 | 343 |

| Mole Valley | 78 | 121 |

| New Forest | 159 | 204 |

| Newark and Sherwood | 101 | 192 |

| Newcastle upon Tyne | 190 | 323 |

| Newcastle-under-Lyme | 97 | 134 |

| Newham | 76 | 184 |

| Norfolk | 720 | 1,245 |

| North Devon | 83 | 127 |

| North East Derbyshire | 79 | 144 |

| North East Lincolnshire | 120 | 240 |

| North Hertfordshire | 106 | 174 |

| North Kesteven | 91 | 207 |

| North Lincolnshire | 158 | 196 |

| North Norfolk | 96 | 169 |

| North Northamptonshire | 271 | 474 |

| North Somerset | 222 | 348 |

| North Tyneside | 232 | 285 |

| North Warwickshire | 46 | 82 |

| North West Leicestershire | 69 | 131 |

| North Yorkshire | 563 | 916 |

| Northumberland | 275 | 488 |

| Norwich | 125 | 188 |

| Nottinghamshire | 638 | 1,153 |

| Nuneaton and Bedworth | 92 | 203 |

| Oadby and Wigston | 31 | 72 |

| Oldham | 132 | 245 |

| Oxford | 102 | 118 |

| Oxfordshire | 531 | 867 |

| Pendle | 75 | 114 |

| Portsmouth | 129 | 252 |

| Preston | 102 | 198 |

| Reading | 115 | 178 |

| Redbridge | 135 | 191 |

| Redcar and Cleveland | 110 | 181 |

| Redditch | 67 | 106 |

| Reigate and Banstead | 132 | 189 |

| Ribble Valley | 57 | 94 |

| Richmond upon Thames | 182 | 297 |

| Rochdale | 132 | 279 |

| Rochford | 83 | 118 |

| Rossendale | 60 | 87 |

| Rother | 80 | 184 |

| Rotherham | 180 | 314 |

| Rugby | 81 | 150 |

| Runnymede | 60 | 124 |

| Rushcliffe | 107 | 163 |

| Rushmoor | 54 | 94 |

| Rutland | 28 | 52 |

| Salford | 188 | 298 |

| Sandwell | 152 | 257 |

| Sefton | 213 | 339 |

| Sevenoaks | 93 | 149 |

| Sheffield | 372 | 573 |

| Shropshire | 256 | 382 |

| Slough | 38 | 110 |

| Solihull | 172 | 288 |

| Somerset | 432 | 711 |

| South Cambridgeshire | 121 | 169 |

| South Derbyshire | 108 | 181 |

| South Gloucestershire | 229 | 347 |

| South Hams | 93 | 130 |

| South Holland | 62 | 124 |

| South Kesteven | 119 | 200 |

| South Norfolk | 107 | 199 |

| South Oxfordshire | 128 | 202 |

| South Ribble | 108 | 174 |

| South Staffordshire | 65 | 122 |

| South Tyneside | 103 | 179 |

| Southampton | 183 | 284 |

| Southend-on-Sea | 125 | 237 |

| Southwark | 179 | 303 |

| Spelthorne | 65 | 167 |

| St Albans | 124 | 202 |

| St Helens | 127 | 185 |

| Stafford | 102 | 182 |

| Staffordshire | 664 | 1,111 |

| Staffordshire Moorlands | 83 | 105 |

| Stevenage | 58 | 76 |

| Stockport | 243 | 383 |

| Stockton-on-Tees | 177 | 267 |

| Stoke-on-Trent | 180 | 283 |

| Stratford-on-Avon | 94 | 225 |

| Stroud | 132 | 165 |

| Suffolk | 578 | 992 |

| Sunderland | 174 | 318 |

| Surrey | 945 | 1,659 |

| Surrey Heath | 66 | 140 |

| Sutton | 131 | 216 |

| Swale | 99 | 175 |

| Swindon | 194 | 323 |

| Tameside | 190 | 278 |

| Tamworth | 62 | 110 |

| Tandridge | 48 | 110 |

| Teignbridge | 117 | 151 |

| Telford and Wrekin | 105 | 195 |

| Tendring | 156 | 277 |

| Test Valley | 75 | 172 |

| Tewkesbury | 73 | 132 |

| Thanet | 110 | 179 |

| Three Rivers | 55 | 118 |

| Thurrock | 95 | 190 |

| Tonbridge and Malling | 106 | 185 |

| Torbay | 114 | 184 |

| Torridge | 75 | 91 |

| Tower Hamlets | 143 | 289 |

| Trafford | 165 | 284 |

| Tunbridge Wells | 93 | 165 |

| Uttlesford | 49 | 100 |

| Vale of White Horse | 99 | 185 |

| Wakefield | 238 | 442 |

| Walsall | 162 | 231 |

| Waltham Forest | 165 | 260 |

| Wandsworth | 346 | 469 |

| Warrington | 163 | 264 |

| Warwick | 124 | 206 |

| Warwickshire | 437 | 866 |

| Watford | 45 | 101 |

| Waverley | 112 | 156 |

| Wealden | 123 | 240 |

| Welwyn Hatfield | 50 | 114 |

| West Berkshire | 124 | 182 |

| West Devon | 50 | 95 |

| West Lancashire | 96 | 125 |

| West Lindsey | 52 | 159 |

| West Northamptonshire | 277 | 544 |

| West Oxfordshire | 90 | 139 |

| West Suffolk | 128 | 236 |

| West Sussex | 645 | 1,249 |

| Westmorland and Furness | 235 | 312 |

| Wigan | 225 | 433 |

| Wiltshire | 396 | 681 |

| Winchester | 94 | 164 |

| Windsor and Maidenhead | 121 | 197 |

| Wirral | 259 | 430 |

| Woking | 92 | 148 |

| Wokingham | 142 | 259 |

| Wolverhampton | 135 | 204 |

| Worcester | 78 | 131 |

| Worcestershire | 460 | 771 |

| Worthing | 105 | 186 |

| Wychavon | 101 | 159 |

| Wyre | 109 | 154 |

| Wyre Forest | 63 | 127 |

| York | 148 | 218 |

| England | 39,600 | 67,617 |

Note: The ‘Difference’ column has been removed from this table as the latest month’s data are not yet complete.

Note: The number of property transactions for July 2023 will increase as more transactions are incorporated into the UK HPI index. See our Revisions Policy for more information.

Comparing the provisional UK HPI volume estimate for July 2022 with the provisional UK HPI estimate for July 2023, volume transactions decreased by 23.6% in England.

UK Property Transaction Statistics published by HM Revenue & Customs (which differ in coverage but are more complete for this period), report that on a non-seasonally adjusted basis, HMRC volume transactions decreased by 23.2% in England in the 12 months to July 2023.

Download this table’s data (CSV, 10KB)

4.2 Sales volumes by London borough

Sales volumes by London borough

| London borough | July 2023 | July 2022 |

|---|---|---|

| Barking and Dagenham | 62 | 135 |

| Barnet | 183 | 333 |

| Bexley | 149 | 268 |

| Brent | 89 | 185 |

| Bromley | 225 | 429 |

| Camden | 100 | 166 |

| City of London | 11 | 17 |

| City of Westminster | 107 | 223 |

| Croydon | 216 | 387 |

| Ealing | 173 | 293 |

| Enfield | 133 | 228 |

| Greenwich | 158 | 289 |

| Hackney | 122 | 186 |

| Hammersmith and Fulham | 139 | 207 |

| Haringey | 129 | 205 |

| Harrow | 94 | 215 |

| Havering | 152 | 306 |

| Hillingdon | 143 | 252 |

| Hounslow | 101 | 186 |

| Islington | 127 | 173 |

| Kensington and Chelsea | 101 | 172 |

| Kingston upon Thames | 112 | 194 |

| Lambeth | 220 | 341 |

| Lewisham | 187 | 335 |

| Merton | 144 | 260 |

| Newham | 76 | 184 |

| Redbridge | 135 | 191 |

| Richmond upon Thames | 182 | 297 |

| Southwark | 179 | 303 |

| Sutton | 131 | 216 |

| Tower Hamlets | 143 | 289 |

| Waltham Forest | 165 | 260 |

| Wandsworth | 346 | 469 |

Note: The ‘Difference’ column has been removed from this table as the latest month’s data are not yet complete.

Note: The number of property transactions for July 2023 will increase as more transactions are incorporated into the index. See our Revisions Policy for more information.

Download this table’s data (CSV, 1KB)

4.3 Sales volumes for England

Sales volumes for England over the past five years

| Date | Sales volumes for England |

|---|---|

| July 2019 | 73,613 |

| July 2020 | 54,524 |

| July 2021 | 46,709 |

| July 2022 | 67,617 |

| July 2023 | 39,600 |

Comparing the provisional UK HPI volume estimate for July 2022 with the provisional UK HPI estimate for July 2023, volume transactions decreased by 23.6% in England.

UK Property Transaction Statistics published by HM Revenue & Customs (which differ in coverage but are more complete for this period), report that on a non-seasonally adjusted basis, HMRC volume transactions decreased by 23.2% in England in the 12 months to July 2023.

Download this chart’s data (CSV, 1KB)

4.4 Sales volumes for London

Sales volumes for London over the past 5 years

| Date | Sales volumes for London |

|---|---|

| July 2019 | 8,275 |

| July 2020 | 5,988 |

| July 2021 | 2,701 |

| July 2022 | 8,194 |

| July 2023 | 4,734 |

Download this chart’s data (CSV, 1KB)

5. Property status

Transactions involving the creation of a new register, such as new builds, are more complex and need more time to process. This means they can take longer to appear in the land registers. The volume of new build transactions for the most recent 2 months are not at a reliable level for reporting the breakdown between new build and existing resold property, so they are not included in the report.

New build and existing resold property for England by region

| Region | Average new build July 2023 | Average existing July 2023 | New build monthly change | Existing monthly change | New build annual change | Existing annual change |

|---|---|---|---|---|---|---|

| London | £594,000 | £531,000 | 1.2% | 1.6% | 11.6% | -1.6% |

| North East | £281,000 | £154,000 | 2.6% | 0.6% | 19.9% | 1.0% |

| East Midlands | £395,000 | £240,000 | 1.9% | 0.1% | 18.1% | 1.2% |

| East of England | £512,000 | £343,000 | 1.6% | 1.1% | 15.9% | -0.5% |

| North West | £336,000 | £209,000 | 2.0% | 0.9% | 17.8% | 0.2% |

| South East | £532,000 | £385,000 | 2.7% | 1.0% | 16.5% | -0.6% |

| South West | £444,000 | £317,000 | 1.0% | 0.7% | 14.4% | -1.5% |

| West Midlands Region | £391,000 | £244,000 | 1.5% | 1.2% | 15.8% | -0.1% |

| Yorkshire and The Humber | £312,000 | £206,000 | 2.7% | 1.6% | 18.1% | 1.4% |

| England | £438,000 | £301,000 | 1.9% | 1.0% | 16.3% | -0.2% |

Download this table’s data (CSV, 1KB)

Note: Since the October 2017 release, amendments have been made to our estimation model when calculating our provisional estimate. Find out further information and the impact of this change in methods used to produce the UK HPI.

6. Buyer status

First time buyer and former owner occupier for England by region

| Region | Average first time buyer price September 2023 | Average former owner occupier price September 2023 | First time buyer monthly change | Former owner occupier monthly change | First time buyer annual change | Former owner occupier annual change |

|---|---|---|---|---|---|---|

| London | £465,000 | £616,000 | 0.2% | -1.0% | -0.6% | -1.9% |

| North East | £139,000 | £188,000 | -2.0% | -2.0% | 1.2% | 2.1% |

| East Midlands | £210,000 | £284,000 | -0.4% | -0.9% | 0.5% | 0.3% |

| East of England | £290,000 | £402,000 | -0.3% | -0.5% | -1.4% | -1.4% |

| North West | £183,000 | £248,000 | 0.5% | 0.5% | 0.2% | 0.9% |

| South East | £310,000 | £460,000 | -0.3% | -0.8% | -1.3% | -1.4% |

| South West | £268,000 | £374,000 | 0.1% | -0.2% | -1.6% | -1.6% |

| West Midlands Region | £210,000 | £292,000 | -0.1% | -0.3% | 0.4% | 0.6% |

| Yorkshire and The Humber | £179,000 | £237,000 | -2.2% | -2.5% | -0.3% | 0.2% |

| England | £257,000 | £355,000 | -0.4% | -0.7% | -0.4% | -0.5% |

Download this table’s data (CSV, 1KB)

7. Funding status

Cash and mortgage indicator for England by region

| Region | Average cash price September 2023 | Average mortgage price September 2023 | Cash monthly change | Mortgage monthly change | Cash annual change | Mortgage annual change |

|---|---|---|---|---|---|---|

| London | £548,000 | £533,000 | -1.5% | 0.0% | -2.4% | -0.8% |

| North East | £148,000 | £172,000 | -2.0% | -2.0% | 1.0% | 1.9% |

| East Midlands | £239,000 | £257,000 | -0.9% | -0.5% | 0.0% | 0.6% |

| East of England | £333,000 | £362,000 | -0.4% | -0.4% | -1.8% | -1.3% |

| North West | £197,000 | £229,000 | 0.6% | 0.5% | 0.3% | 0.7% |

| South East | £371,000 | £402,000 | -0.8% | -0.5% | -1.9% | -1.2% |

| South West | £322,000 | £333,000 | -0.2% | 0.0% | -1.9% | -1.4% |

| West Midlands Region | £239,000 | £260,000 | -0.3% | -0.2% | 0.1% | 0.7% |

| Yorkshire and The Humber | £199,000 | £216,000 | -2.7% | -2.2% | -0.5% | 0.2% |

| England | £289,000 | £320,000 | -0.8% | -0.5% | -0.9% | -0.3% |

Download this table’s data (CSV, 1KB)

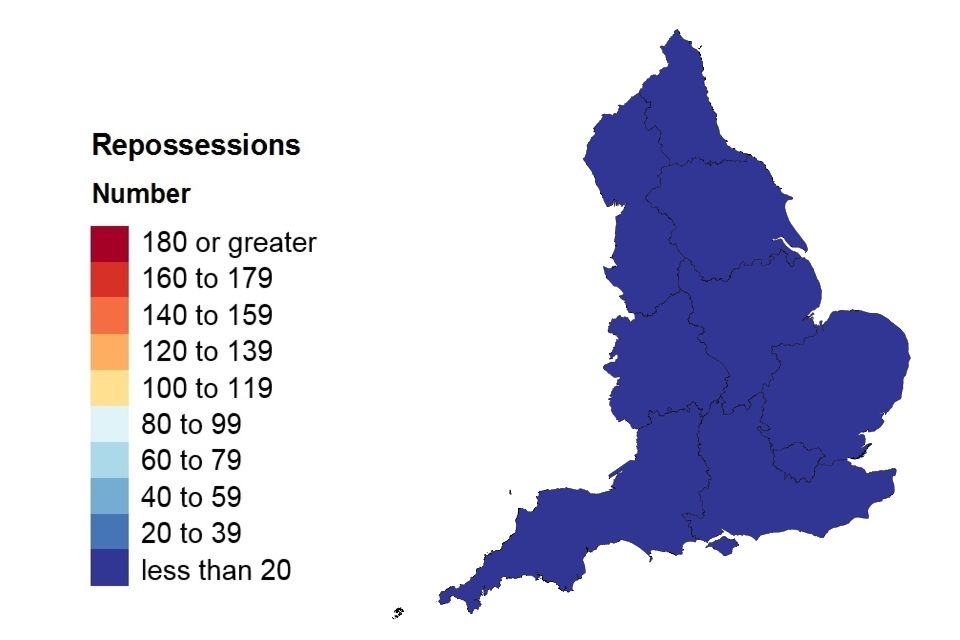

8. Repossession sales volumes

Due to a period of 2 weeks to 2 months between completion and registration of sales, volume figures for the most recent 2 months are not yet complete, so they are not included in the report.

Repossession sales volumes by government office region

| Region | Sales volume July 2023 |

|---|---|

| East Midlands | 5 |

| East of England | 1 |

| London | 9 |

| North East | 8 |

| North West | 16 |

| South East | 5 |

| South West | 1 |

| West Midlands Region | 2 |

| Yorkshire and The Humber | 5 |

| England | 52 |

Download the data for England and Wales (CSV, 7KB)

9. Access the data

Download the data as CSV files or access it with our UK HPI tool.

Data revisions

View any revisions to previously published data in the data downloads or find out more about revisions in our guidance About the UK HPI.

10. About the UK House Price Index

The UK House Price Index (UK HPI) is calculated by the Office for National Statistics and Land & Property Services Northern Ireland. Find out about the methodology used to create the UK HPI.

Data for the UK House Price Index is provided by HM Land Registry, Registers of Scotland, The Land & Property Services/Northern Ireland Statistics & Research Agency and the Valuation Office Agency.

Find out more about the UK House Price Index.

11. Contact for England queries

Eileen Morrison, Data Services Team Leader, HM Land Registry

Email eileen.morrison@landregistry.gov.uk

Telephone 0300 006 5288